Unit 4

The Reserve Bank of India

Q1) Write a small note on RBI. 4

A1) The Reserve Bank of India (RBI) is the Central Bank of India, established on April 1, 1935, under the Reserve Bank of India Act. The Reserve Bank of India uses monetary policy to stabilize India's finances and is responsible for regulating the national currency and credit system.

RBI in Mumbai serves financial markets in a variety of ways. Banks set overnight interbank lending rates. The Mumbai Interbank Offer Rate (MIBOR) serves as a benchmark for interest rate related financial products in India.

The main purpose of the RBI is to provide integrated oversight of the Indian financial sector, which consists of commercial banks, financial institutions, and non-bank financial companies. Initiatives adopted by the RBI include rebuilding bank inspections, implementing off-site monitoring of banks and financial institutions, and strengthening the role of auditors.

First and foremost, RBI develops implements and monitors India's monetary policy. The bank's business goal is to keep prices stable and ensure that credit flows into the productive economic sector. RBI also controls all foreign exchange under the Foreign Exchange Control Act of 1999. The law allows the RBI to promote foreign trade and payments and promote the development and soundness of India's foreign exchange market.

The RBI acts as a regulatory and supervisory authority for the entire financial system. It injects public trust into the country's financial system, protects interest rates and provides the public with a positive banking alternative. Finally, the RBI acts as the issuer of your home currency. For India, this means that the currency will be issued or destroyed depending on its suitability for current distribution. It provides the Indian people with a supply of currency in the form of reliable banknotes and coins. This is a long-standing problem in India. In 2018, the RBI banned the use of crypto currencies by regulated financial institutions and banks.

Q2) Discuss the functions of RBI. 8

A2) The functions of RBI is discussed below-

1. Exclusive note issuance:

Like other central banks, the RBI acts as the country's only monetary authority. Through the issuing department of the bank, we issue 1 rupee banknote and banknotes of all denominations except coins and coins.

1 rupee banknotes and coins and coins are issued by the Government of India. In fact, RBI also issues these coins on behalf of the Government of India. Currently, RBI issues rupees 2, 5, 10, 20, 50 and 150 banknotes.

Prior to 1956, RBI's bond issuance principles were based on the proportional reserve system. This system was replaced in 1956 with a minimum reserve system that required the RBI to hold at least Rs. Gold equivalent to 115 crores as support for the issued currency.

The rest (Rs. 85crores) must be foreign securities and the minimum of these assets, along with gold and foreign exchange reserves, is Rs. 200 rolls.

2. Banker's bank:

As a banker's bank, RBI holds part of the cash reserves of commercial banks and lends funds in a short period of time. All banks need to maintain a certain percentage of their total debt (between 3% and 15%). The main purpose of the RBI to change this reserve requirement ratio is to manage credit.

The RBI provides financial support to commercial banks and state co-operative banks through the re-discount of bills of exchange. RBI acts as a last resort bid as it meets the financial needs of commercial banks.

The RBI is authorized by law to oversee, regulate and control the activities of commercial and co-operative banks. RBI regularly inspects the bank and asks the bank for returns and required information.

3. Banker to the government:

The RBI acts as a banker for the Government of India and the state governments (excluding Jammu and Kashmir). As such, it trades all banking operations of these governments.

These are:

RBI:

(I) Receive and pay money on behalf of the government.

(II) Perform exchange remittances and other banking operations.

As a government banker, RBI provides short-term credit to the Government of India. This short-term credit can be obtained through the sale of Treasury securities. Not only this, the RBI also provides state governments with a way and means of progress (repayment in 90 days). It should be noted that the central government can borrow any amount from RBI.

The RBI also acts as a government agent for membership in the IMF and the World Bank.

In addition, RBI covers a wide range of economic issues (financing patterns, resource mobilization, institutional arrangements on banking and credit issues, banking and credit issues, international finance) as well as banking and financial issues.

4. Credit admin:

The RBI manages the total money supply and bank credit to cover the interests of the country. RBI manages credits to ensure price and exchange rate stability.

To achieve this, RBI uses all types of quantitative, qualitative, and selective credit management measures. The most widely used credit product at RBI is the bank interest rate. The RBI also relies heavily on selective methods of credit management. This feature is so important that it requires special treatment.

5. Exchange management and control:

One of the important central banking functions we perform is to maintain the external value of the rupee. The external stability of a currency is closely related to its internal stability, the country's inherent economic power, and the way the currency conducts its economic and financial operations.

Therefore, domestic, fiscal and monetary policy plays an important role in maintaining the external value of a currency. The Reserve Bank of India has a very important role to play in this area.

RBI has the authority to trade forex on behalf of its own account and government.

The country's official foreign reserves consist of gold coins and reserve banks' foreign exchange reserves, in addition to holding SDRs. As the administrator of the country's Forex reserves, the Reserve Bank is obliged to control the investment and use of reserves in the most lucrative managers.

6. Other features:

RBI collects and collates all financial and banking data on a regular basis and publishes it in weekly statements in the RBI Bulletin (monthly) and currency and financial reports (annual).

7. Promotion and development features:

Apart from these traditional features, RBI carries out various activities of the nature of promotion and development. It seeks to mobilize savings for productive purposes. This is done in a variety of ways. For example, RBI has helped build the huge financial infrastructure we are seeing today.

'This is the Deposit Insurance Corporation (to protect depositors' interests from bank failures), the Agricultural Refinancing Development Corporation (to meet the needs of farmers), IFCI, SFC, IDBI, and UTI (for long-term support). It is composed of institutions such as. And the medium-term needs of the industry) and so on.

When it comes to co-operative credit transfers, RBI's performance really deserves praise. This curtailed money lending activity in rural economies.

Therefore, as traditionally understood, it is clear that RBI is not a typical central bank. It's more than a central bank. In addition to regulating currencies and credits, we also support the development of the Indian economy by conducting various types of promotional activities. As a result, many activities are combined in one at RBI.

Q3) Explain the methods of monetary policy. 5

A3) Central banks use a variety of tools to implement monetary policy. The most widely used policy tools are:

1. Interest rate adjustment

Central banks can influence interest rates by changing the discount rate. The discount rate (basic interest rate) is the interest rate that the central bank charges the bank for short-term loans. For example, if the central bank raises the discount rate, the cost of borrowing the bank will increase. The bank then raises the interest rate charged to the customer. Therefore, the cost of borrowing in the economy will increase and the money supply will decrease.

2. Change Reserve Requirements

Central banks usually set a minimum reserve that a commercial bank must hold. By changing the amount required, central banks can influence the money supply of the economy. As financial authorities increase the required reserves, commercial banks can lend less money to their customers, reducing the money supply.

Commercial banks cannot use reserves to take out loans or fund investments in new businesses. Central banks pay them reserve interest because it constitutes a lost opportunity for commercial banks. Interest is known as IOR or IORR (reserve interest or required reserve interest).

3. Open Market Operations

Central banks can buy or sell government-issued securities to influence the money supply. For example, central banks can buy government bonds. As a result, banks will get more money to increase lending and the money supply in the economy. Expanded monetary policy and contracted monetary policy. Monetary policy can be expanding or contracting, depending on its purpose.

4. Expanded Monetary Policy

This is a monetary policy aimed at increasing the money supply in the economy by lowering interest rates, central banks buying government bonds, and lowering the reserve requirement ratio of banks. Expansion policies reduce unemployment and stimulate business activities and consumer spending. The overall goal of expanded monetary policy is to promote economic growth. However, it can also lead to higher inflation.

5. Contractive Monetary Policy

The goal of contractile monetary policy is to reduce the money supply in the economy. This can be achieved by raising interest rates, selling government bonds, and raising the reserve requirement ratio of banks. Contraction policies are used when the government wants to curb inflation levels.

Q4) Discuss the methods of credit control of RBI. 5

A4) In India, the Reserve Bank of India Act of 1934 and the Banking Regulation Act of 1949 provide a legal framework for the management of credit structures by the RBI. Quantitative credit management is used to maintain the right amount of credit for funding in the market. Some of the important common credit management methods are:

- Bank interest rate policy

The bank interest rate is the interest rate at which the central bank lends funds according to the liquidity requirements of commercial banks. Bank interest rates are also known as discount rates. In other words, the bank interest rate is the rate at which the central bank redistributes eligible documents held by commercial banks (approved securities, bills of exchange, commercial paper, etc.). Bank interest rates are important because they are pacesetters against other market interest rates. Bank interest rates have been changed several times by the RBI to control inflation and recession. The bank interest rate is 8.25% w.e.f. March 5, 2013.

2. Open market operations

This refers to buying and selling government bonds in the open market to increase or decrease the amount of money in the banking system. This method is superior to the bank interest rate policy. Buying injects money into the banking system, while selling securities is the opposite. For the last 20 years, RBI has been switching. These include buying one loan for the sale of another loan and vice versa. This policy aims to prevent an unlimited increase in liquidity.

3. Reserve requirement ratio (CRR)

The reserve requirement ratio (CRR) is an effective means of credit management. Under the RB1 Act of 1934, all commercial banks are required to maintain a certain minimum cash reserve at RBI. The RBI is empowered to vary the CRR between 3% and 15%. A high CRR reduces cash on the loan and a low CRR increases cash on the loan. The CRR was reduced from 15% in 1991 to 7.5% in May 2001. In December 2001, it was further reduced to 5.5%. It was 5% in January 2009. In January 2010, RBI raised the CRR from 5% to 5.75. %. Inflationary pressures on the economy began to rise, rising to another 6% in April 2010. As of March 2011, the CRR was 6% and is now 4% w.e.f.09 / 02/2013.

4. Legal liquidity ratio (SLR)

Under the SLR, the government imposed the following obligations on banks: Maintain a certain ratio to RBI's total deposits in the form of liquid assets such as cash, gold and other securities. The RBI had the power to modify the SLR in the range of 25% to 40 between 1990 and 1992, with the SLR reaching 38.5%. The Narasimham Commission did not support maintaining a high SLR. The SLR has been reduced to 25% from October 10, 1997. In November 2008, it was further reduced to 24%. Currently, it is 23% on November 8, 2012.

5. Credit management function

Domestic commercial banks create credits according to the demands of the economy. But if this credit creation is unchecked or unregulated, it leads the economy into an inflation cycle. Credit creation, on the other hand, is below the required limits and has a negative impact on economic growth. As the country's central bank, RBI must look for growth with price stability. Therefore, we use a variety of credit management tools to regulate the credit-creating capabilities of commercial banks.

6. Repo rate and reverse repo rate

Repo rate and reverse repo rate are becoming important in determining interest rate trends. A repo means a sales contract. A repo transaction is a swap transaction that involves the immediate sale of securities and the simultaneous purchase of those securities at a given price on a future date. Repo rate helps commercial banks raise funds from RBI by agreeing to sell their securities and buy them back at a later date.

The reverse repo rate is the rate that a bank obtains from RBI to deposit short-term excess funds with RBI. Repo and reverse repo operations are used in the RBI's liquidity adjustment facility. RBI contracts credits by increasing repo rates and reverse repo rates, and increases credits by decreasing them. In March 2011, the repo rate was 6.75% and the reverse repo rate was 5.75%. In May 2011, RBI announced its 2011-12 monetary policy. To reduce inflation, we raised the repo rate to 7.25% and the reverse repo to 6.25%. w.e.f March 5, 2013

Q5) Discuss the main features of monetary policy. 8

A5) The main characteristics of the Reserve Bank of India's monetary policy are as follows.

1. Active policy:

Prior to the introduction of the plan in India in 1951, the Reserve Bank's monetary policy was passive, cheap and easy. That means that the Reserve Bank did not use monetary policy measures to regulate the economy.

For example, from 1935 to 1951, bank interest rates were stable at 3%. But since 1951, Reserve Banks have followed aggressive monetary policy. It has used all means of credit management.

2. Overall expansion:

An important feature of Reserve Bank's monetary policy is the overall expansion of the money supply. In S.L.N.'s words, Shinha's "reserve bank" responsibility is more than just a credit limit.

In a growing economy, the money supply and bank credit need to be continuously expanded, and central banks are obliged to ensure that legitimate credit requirements are met. In fact, the overall trend of the money supply has become one of the expansions with almost continuous rises in price levels.

3. Seasonal variation:

Monetary policy is characterized by behavioural changes during busy and slow periods. These seasons are tied to the agricultural season. During the busy season, funding expands due to seasonal needs for production financing and inventory building of agricultural products.

On the other hand, the slack season is characterized by a reduction in funds due to return flow. It may be pointed out that the total contraction of funds during the slack season tends to be far below the expansion of the previous busy season.

The main reason behind this changing pattern is the need for additional funding from the industrial sector. Therefore, during the busy season, reserve banks will adopt an extended credit policy to tighten liquidity pressure during the slack season.

4. Strict and dear monetary policy:

To curb inflation, reserve banks often employ strict and dear monetary policy. Monetary tightening policies mean that the growth rate of the money supply will slow down. Dear monetary policy, refers to raising bank interest rates. This rise in bank interest rates leads to higher interest rates charged by banks.

5. Investment and savings orientation:

The monetary policy adopted by the Reserve Bank emphasizes both investment and savings. Appropriate funds are now available for productive purposes at reasonable interest rates to facilitate investment. Reserve banks also maintain interest on deposits at reasonable rates to attract savings.

6. Credit distribution imbalance:

Monetary policy is biased towards the industrial sector. Agriculture has not obtained the necessary institutional finances. As a result, it has to rely to a large extent on money lending because of its credit needs.

The agricultural sector has to pay high interest rates and still cannot get the capital it needs. Most of the money goes to large industries. Even small industries suffer from financial insufficiency. Therefore, monetary policy has resulted in imbalances in credit distribution.

7. Wide range of credit management methods:

Reserve banks have used a wide range of credit management methods. We employ all means of quantitative and qualitative credit management to meet the needs of complex and changing economic conditions.

Monetary policy has gone beyond traditional regulatory functions because its goal was to achieve stable economic growth. It takes a more proactive role in directing credit to the desired sector.

8. Leading factors:

According to Shri. C. Langerjan- The following three factors have essentially led to the implementation of monetary policy.

(I) Monetary policy measures were generally in response to fiscal policy.

(II) Monetary policy has acted primarily through the availability of credit, but credit costs have also been revised upwards, sometimes very sharply, to effectively respond to inflation.

(III) Monetary policy operations remain limited to areas related to the regulation of financial authorities in credit allocation to the non-government sector, especially due to important elements of post-nationalization national economic policy of banks.

Q6) What is interest rate? What are the types of interest rate? 5

A6) The interest rate is the amount the lender charges the borrower and is the percentage of the principal, that is, the amount lent. Loan interest rates are usually recorded on an annual basis known as the annual rate (APR).Interest rates also apply to amounts earned from savings accounts and certificates of deposit (CDs) at banks and credit unions. Annual Interest (APY) refers to the interest earned on these deposit accounts.

Various rates in India

- Bond rate

The bond price is the present discounted value of the future cash stream generated by the bond. This is the sum of the present value of all possible coupon payments and the present value of par value at maturity. To calculate the bond price, you simply need to discount the known future cash flows.

2. Bill rate

Billing rate definition: The amount that the company or professional charges for each hour of work. In other words, the billing rate is the amount that an independent expert charges the client for pre-tax, fees, and discounts. It takes into account the costs you need to cover in order to make your target income. This rate is the foundation for building a business.

3. Deposit rates

The deposit hobby price is the hobby price paid with the aid of using a business financial institution or economic group to the coins deposit of the account holder. Deposit money owed consists of certificate of deposit (CD), financial savings money owed, and different funding money owed.

Q7) Write a note on deposit rate. 5

A7) The deposit hobby price is the hobby price paid with the aid of using a business financial institution or economic group to the coins deposit of the account holder. Deposit money owed consists of certificate of deposit (CD), financial savings money owed, and different funding money owed.

For example, deposit hobby prices are frequently paid on coins deposited in financial savings or cash marketplace money owed. Interest on financial savings money owed within reason low, however banks and economic establishments additionally pay hobby on coins deposited in sure different sorts of money owed. Deposit hobby prices may be constant or fluctuating on the minimal deposit quantity for a time frame and are typically now no longer issue to early withdrawal penalties.

Deposit money owed is appealing to buyers as a secure manner to preserve liquid coins, earn small constant hobby prices and take out insurance. Banks typically provide higher prices for money owed with large balances. It is used as an incentive to draw excessive cost customers with sizable assets. By accomplishing better hobby prices, of course, the extra money you deposit the greater earnings you'll earn over time.

Fixed prices assured on sure deposit money owed have a tendency to be small in comparison to the variable returns of different economic instruments. The trade-off is that account holders are confident of the slow profits of deposits and the capacity for surprising profits or losses on a bigger scale. For sure self-controlled pension money owed, the distinctive sorts of investments made consist of actual estate, funding trusts, stocks, bonds, and bills.

Banks opt to provide aggressive hobby prices on those deposits to draw customers. Depending at the product, the top class deposit hobby price can also additionally simplest be to be had beneath sure conditions, including the minimal and, in a few cases, the most stability. Also, sure money owed require a hard and fast length of six months, one year, or more than one years, and that cash need to be left in deposit and now no longer handy to the account owner. Early get right of entry to deposits can bring about fines and fees, which include the lack of agreed hobby prices if the stability last on your account falls under the minimal quantity.

How to calculate deposit rate?

The Fixed Deposit Calculator calculates the maturity amount along with compound interest earned either monthly, quarterly, semi-annually, or annually.

Fixed deposit interest rate

P x (1 + r / N) nxN

Wherein,

P is the Principal amount that is invested initially

R is the fixed rate of interest

N is the frequency of interest being paid

N is the number of periods for which investment shall be made

Q8) Write a note on administered rates. 5

A8) Instead of comparing interest rates on small savings schemes to match market interest rates, governments need to lock incremental investments in them to appropriate benchmarks, such as yields on government securities. Whenever there is a downward bias in interest rates, there are protests about interest rates in small savings schemes.

High managed interest rates act as floors, preventing banks from lowering deposit prices below the interest rates available for small savings for fear of reduced deposit mobilization. This stickiness of deposit rates means that they cannot lower lending rates, even if the system is sufficiently liquid. Indeed, the collection of small savings schemes has skyrocketed between 2008 and late 2009 since deposit rates fell above their recent high of 10%.

Most of these schemes are now as much as bank deposits, earning about 8% annually. This makes schemes such as Public Provident Funds (PPFs) particularly attractive. Not only are PPF contributions subject to income tax exemption under Section 80C, but the interest earned is also tax exempt. Therefore, banks are now demanding lower management rates when lowering lending rates.

However, the total reduction that applies to the entire accumulated corpus is unfair. Contributions to these schemes are made on the assumption that interest rates will remain strong until maturity. Reducing the overall cumulative investment can disrupt investors' financial goals, most of which are small savers.

Therefore, interest rate adjustments should only be applied to incremental contributions. Anyway, it is the rate applied when making a deposit that influences the investment decision. It is best to benchmark interest rates on new contributions to small savings schemes for government securities yields of comparable maturity, adjusted to the appropriate liquidity premium.

This allows savers to get higher returns when interest rates rise. The government missed the opportunity to lock returns to a benchmark when interest rates were rising. When we have to lower interest rates, we now have to make the difficult decision to do so.

Q9) Write a note market determined rate. 5

A9) Market determined rate refers to those interest rates which are determined on the basis of market supply i.e, demand and supply. There is no interference from the side of the government regarding control of such rates. Market-determined interest rates need to be sub-divided under two heads:

(a) Interest rates on marketable government debt and

(b) Interest rates on other marketable debt For present purposes, the marketable government debt should be defined broadly to include not only the market debt of the Central and state governments (as is usual), but also that of local authorities, of development banks as the IDBI and the IFCI, and of such semi-official agencies as port trusts and state electricity boards.

The reasons for adopting such a broader definition are:

(i) The market debts of agencies other than the government listed above are guaranteed by the government both respect of principal and interest so as to make them default-risk free; and

(ii) The statutory investment requirements imposed on various financial institutions have created a large and growing captive market for such debt along with the government debt. The net consequence is artificially lower rates of interest on such debts. Though they are not administered rates, they partake very much of administered rates due to the two features listed above and strong market support to the government debt by the RBI. As a result, fluctuations in these rates are relatively small.

Q10) What are the different types of interest rate sources? 5

A10) The following points highlight the seven main causes of interest rate differentials. The causes are as follows:

1. Difference in risk:

The total interest rate depends on the difference between risk and inconvenience, the cost of maintaining the borrower's account, and the labour and trouble associated with lending operations. The greater the risk and inconvenience, the higher the interest rate. Kabriwara usually charges higher interest rates than banks. This is because the former sanctions lend without requiring collateral.

2. Loan period:

In general, the longer the loan period, the higher the interest rate. Long-term licensed loans usually have high interest rates because money and capital are locked for a long time. Short-term loans have low interest rates.

3. Loan amount:

The interest rate also depends on the amount of the loan. Usually, when a borrower borrows a large amount of money, the borrower pays a low interest rate. Small loans may be available if high interest rates are paid.

4. Security nature:

Interest rates depend on the nature of the securities offered by the borrower. Loans for gold and government bond collateral have less interest because lenders can easily convert these securities into cash. However, loans are also sanctioned by giving real estate securities such as land and homes. Interest rates on these securities tend to be higher because these securities cannot be easily converted into cash.

5. Borrower's financial position:

Interest rates may vary depending on the lender's beliefs about financial strength and creditworthiness.

Borrowers who know their integrity and reputation can get loans at low interest rates. If the borrower's credibility is questionable, the opposite is true. Generally, whenever a government receives a loan from its own people, it pays a low interest rate because it does not question its ability to repay money on time.

6. Market imperfections:

Market flaws seem to be another reason for interest rate fluctuations. There are various institutions that run the money lending business. For example, banks, insurance companies, housing construction banks, etc. specialize in different types of loans that charge different interest rates. Village money lenders enjoy a certain degree of monopoly and therefore impose high interest rates.

7. Fluctuations in supply and demand of money:

Finally, the difference in interest rates can also be due to the difference in supply and demand of money in different markets. The nature of agricultural loans is different from industrial and commercial loans. Obviously, the supply and demand conditions of money are different, which causes a difference in interest rates.

Q11) Write a small note on inflation. 4

A11) Inflation is the rate at which the general price level of goods and services rises, resulting in a decline in the purchasing power of the currency. Central banks are trying to limit inflation and avoid deflation in order to keep the economy running smoothly.

Inflation is the continuous rise in the general price level of goods and services in the economy over a period of time. As price levels rise, less goods and services are purchased by each unit of currency. As a result, inflation reflects a decline in purchasing power per unit amount. This is a loss of real value in exchange media and unit accounts within the economy. The main indicator of price inflation is the inflation rate. This is the annual rate of change of the general price index (usually the consumer price index). The opposite of inflation is deflation.

Inflation affects the economy in a variety of positive and negative ways. The negative effects of inflation include increased opportunity costs for holding money and uncertainty about future inflation that can discourage investment and savings. If inflation is fast enough, consumers are in the future. The positive effects are reducing the real burden of public and private debt, keeping the nominal interest rate above zero so that the central bank can adjust interest rates to stabilize the economy, and unemployment due to nominal wage rigidity. Economists generally believe that high inflation and hyperinflation are caused by the overgrowth of the money supply. There are more diverse views on the factors that determine low to moderate inflation. Low or moderate inflation can result from fluctuations in the actual demand for goods and services, or changes in available supplies such as shortages. However, the consensus is that the long-term duration of inflation is driven by the money supply, which grows faster than economic growth.

Inflation is a quantitative measure of the speed at which the average price level of a basket of selected goods and services in an economy increases over a period of time. It’s the constant rise within the general level of prices where a unit of currency buys but it did in prior periods. Often expressed as a percentage, inflation indicates a decrease within the purchasing power of a nation’s currency.

According to A.C. Pigou (Cambridge University), inflation comes in existence “when money income is expanding more than in proportion to income activity”. An increase in general price level takes place when people have more money income to spend against less goods and services.

G. Crowther (British economists) brings out the meaning precisely when he says, “inflation is a state in which the value of money is falling i.e., prices rising”.

Inflation, according to Harry G. Johnson (Canadian economist), “is a sustained rise in prices”.

Paul Samuelson (American economist) defines inflation as “a rise in the general level of prices”.

According to Milton Friedman (American economists), ‘inflation is taxation without representation’.

Q12) State the different causes of inflation. 5

A12) This is a general explanation given by the Keynesians. Inflation occurs when the aggregate demand for goods and services in the economy rises faster than the economy's capacity. Inflation, in the opinion of monetarists, is simply caused by the money supply, which controls all other factors that determine inflation. The economy is such a big theme that there is no absolute explanation for how inflation is being injected into the world economy. I've read an article about Forbes and I think the author has a very good explanation for this topic.

Inflation is primarily caused by either the demand-pull factor or the value push factor. Aside from supply and demand factors, inflation also can be caused by structural bottlenecks and policies of governments and central banks. Therefore, the most causes of inflation are:

- Monetary policy: It determines the availability of currency within the market. Excessive funds results in inflation. Therefore, it reduces the worth of the currency.

- Fiscal Policy: Monitor economic borrowing and spending. As borrowing (debt) increases, taxes increase and extra currency printing is completed to repay the debt.

- Demand-pull inflation: Price increases thanks to the gap between supply (high) and provide (low).

- Cost-push inflation: inflation of products and services thanks to rising production costs.

- Exchange rates: Exposure to foreign markets is predicated on dollar value. Rate of exchange fluctuations affect inflation.

- Structural bottlenecks (fluctuations in agricultural prices, weak infrastructure, etc.)

- Monetary policy intervention by the financial institution.

- Expanded economic policy by the govt.

Q13) How to find inflation expectations? 5

A13) There are usually two ways to find the expected inflation.

1. Survey-based method

2. Market-based method

1. Survey-based method

Central banks in many countries, whether expanding or conservative, continue to identify future inflation expectations for their countries by conducting surveys that enable them to adopt appropriate strategies.

Example:

For example, the Federal Bank of New York has been conducting a survey of consumer expectations every year since June 2013.

This is done through a national representative body of rotating panels consisting of heads of approximately 1,300 households.

It will be held for 12 months with the same number of panels coming and going frequently.

It revolves around the economic outcomes associated with it in the labor market, Inflation, households, etc.

The survey will continue to track respondents' age, education, income, home ownership, employment history, and more.

Some of the questions asked as part of a survey to measure consumer sentiment and inflation expectations are listed below.

Do you think your family is better than 12 months ago?

Do you think your family will get better in the next 12 months?

What do you think will be your interest in SB accounts 12 years from now?

Do you think the stock price will be higher than it is now?

Do you think inflation and deflation will occur in the coming months?

What do you think inflation will be in the next 12 months?

How is your current employment situation?

In addition, another example of a survey-based measurement is a Survey of Expert Predictors (SPF) measurement that tends to be a group that keeps track of the entire economy.

SPF provides a specific forecast of inflation based on the consumer price index

Also about that of the (CPI) and Consumer Price Index (PCE).

2. Market-based method

In this method, the measurement of economic inflation is done by understanding TIPS (Treasury Inflated Protected Securities).

This increases the principal of the bond as much as inflation. This method continues to understand the price difference between Treasury securities and the actual inflation-protected securities traded on the market.

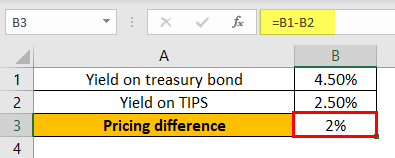

For example, given that a country's 10-year bond yields 4.5% and the same country's 10-year inflation-protected bongo yields 2.5%, the market is currently 4.5% – 2.5% = average year over the next 10 years. Inflation rate 2% pricing

The TIPS method can be considered beneficial as it tends to react more to all incoming information.

Q14) State the advantages and limitations of inflation. 5

A14)

Advantage of inflation are-

- Business decision making:

Business takes into account expected inflation. Make specific decisions regarding fixed pricing, negotiate specific contracts, or even wage negotiations. They may make certain changes to their products in terms of quantity or price to accommodate the expected future price increases brought about by inflation.

b. Household Decision Making:

By taking into account the necessary price increases for all important household items, groceries, and consumer goods, households can reasonably determine their next budget, such as the stock market to prevent inflation from being eroded. The real value of money over time trying to save money on a means of increasing wealth.

c. Inflation targeting by central banks: By being able to measure the necessary sentiments and expectations of households and businesses, central banks can adopt the expansion / contraction monetary policy necessary to target inflation according to a set framework. May be able to stir

Limitations of inflation are-

- Time-consuming: Inflation research methods conducted by interviewing multiple households are often a very time-consuming problem and certainly require painstaking efforts from the research team.

- Deviation from reality: We often find that the expected inflation deviates from the actual inflation of the economy.

- Self-reliant personality: Usually, when inflation is incorporated into a country, businesses, consumers, workers, and all kinds of agents are sure to start expecting it, and thus put those expectations into their actions. Notice the incorporation.

Q15) What do you mean by bankers bank? 2

A15) As a banker's bank, RBI holds part of the cash reserves of commercial banks and lends funds in a short period of time. All banks need to maintain a certain percentage of their total debt (between 3% and 15%). The main purpose of the RBI to change this reserve requirement ratio is to manage credit.

The RBI provides financial support to commercial banks and state co-operative banks through the re-discount of bills of exchange. RBI acts as a last resort bid as it meets the financial needs of commercial banks.

The RBI is authorized by law to oversee, regulate and control the activities of commercial and co-operative banks. RBI regularly inspects the bank and asks the bank for returns and required information.

Q16) What do you mean by monetary policy? 2

A16) Monetary policy is a policy of Reserve Bank of India to control the money supply in the economy. RBI used qualitative and quantitative techniques to control the money supply in the economy. Qualitative techniques are moral suasion, directives, margin requirements etc. The quantitative techniques are CRR, SLR, open market operation, bank rate.

Q17) Explain the quantitative credit control techniques. 5

A17) The quantitative credit control techniques are-

- Bank interest rate policy

The bank interest rate is the interest rate at which the central bank lends funds according to the liquidity requirements of commercial banks. Bank interest rates are also known as discount rates. In other words, the bank interest rate is the rate at which the central bank redistributes eligible documents held by commercial banks (approved securities, bills of exchange, commercial paper, etc.). Bank interest rates are important because they are pacesetters against other market interest rates. Bank interest rates have been changed several times by the RBI to control inflation and recession.

- Open market operations

This refers to buying and selling government bonds in the open market to increase or decrease the amount of money in the banking system. This method is superior to the bank interest rate policy. Buying injects money into the banking system, while selling securities is the opposite. For the last 20 years, RBI has been switching. These include buying one loan for the sale of another loan and vice versa. This policy aims to prevent an unlimited increase in liquidity.

2. Reserve requirement ratio (CRR)

The reserve requirement ratio (CRR) is an effective means of credit management. Under the RB1 Act of 1934, all commercial banks are required to maintain a certain minimum cash reserve at RBI. The RBI is empowered to vary the CRR between 3% and 15%. A high CRR reduces cash on the loan and a low CRR increases cash on the loan.

3. Legal liquidity ratio (SLR)

Under the SLR, the government imposed the following obligations on banks: Maintain a certain ratio to RBI's total deposits in the form of liquid assets such as cash, gold and other securities.

Q18) Define repo and reverse repo. 2

A18) Repo rate and reverse repo rate are becoming important in determining interest rate trends. A repo means a sales contract. A repo transaction is a swap transaction that involves the immediate sale of securities and the simultaneous purchase of those securities at a given price on a future date. Repo rate helps commercial banks raise funds from RBI by agreeing to sell their securities and buy them back at a later date.

The reverse repo rate is the rate that a bank obtains from RBI to deposit short-term excess funds with RBI. Repo and reverse repo operations are used in the RBI's liquidity adjustment facility. RBI contracts credits by increasing repo rates and reverse repo rates, and increases credits by decreasing them.

Q19) What is a multiplier? 2

A19) A multiplier is a number that is multiplied by an employee's hourly wage to cover expenses or profits. For example, suppose you have an employee who earns an hourly wage of $ 57 an hour. Multiply the hourly wage by a multiplier. This new fee indicates what to charge the client. Including the multiplier allows the invoice to the client to cover more than the employee's direct hourly wage.

Q20) How to calculate deposit rate? 2

A20) The Fixed Deposit Calculator calculates the maturity amount along with compound interest earned either monthly, quarterly, semi-annually, or annually.

Fixed deposit interest rate

P x (1 + r / N) nxN

Wherein,

P is the Principal amount that is invested initially

R is the fixed rate of interest

N is the frequency of interest being paid

N is the number of periods for which investment shall be made