Unit III

Role of government

Question bank

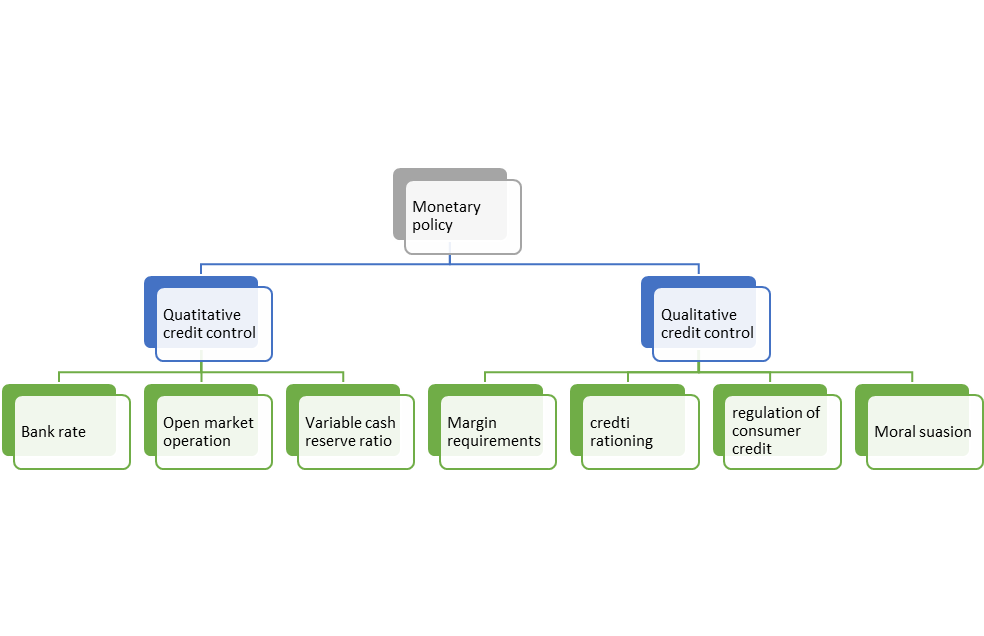

Q1) Write a note on monetary policy. 5

A1) Monetary policy refers to the actions undertaken by monetary authority of a country to control money supply and achieve sustainable growth. In India it is issued by the RBI to control the credit capacity of commercial banks. The objectives of monetary policy are-

a) To control inflation.

b) To reduce unemployment.

c) To promote moderate long term interest rate.

The structure of monetary policy is highlighted in figure 1

Figure 1: Monetary policy

a) Quantitative credit control

- Bank rate: It is the rate at which commercial banks discounts and rediscounts the commercial bills with the RBI.

- Open market operation: Under this method, the RBI purchase and sells treasury bills in the money market on behalf of the Government to control the short term liquidity of the country.

- Variable cash reserve ratio: It is of two types-

a) Cash reserve ratio: It is the proportion of time and demand liabilities of commercial banks kept with RBI in the cash form.

b) Statutory liquidity ratio: It is the proportion of time and demand liabilities of commercial banks kept with RBI in other than cash form like gold, silver, precious metal, government securities etc.

b) Qualitative methods

- Margin requirements: It is the difference between loan amount and market rate of securities provided against the loan.

- Credit rationing: Under this method, RBI limits the credit to commercial banks depending on their area of lending.

- Regulation of consumer credit: Under this method, RBI directs the commercial banks to carefully verify the borrowers’ financial background before granting any loan and advances.

- Moral suasion: It is request to the commercial banks by the RBI to follow the rules, regulations, policies and directions of RBI.

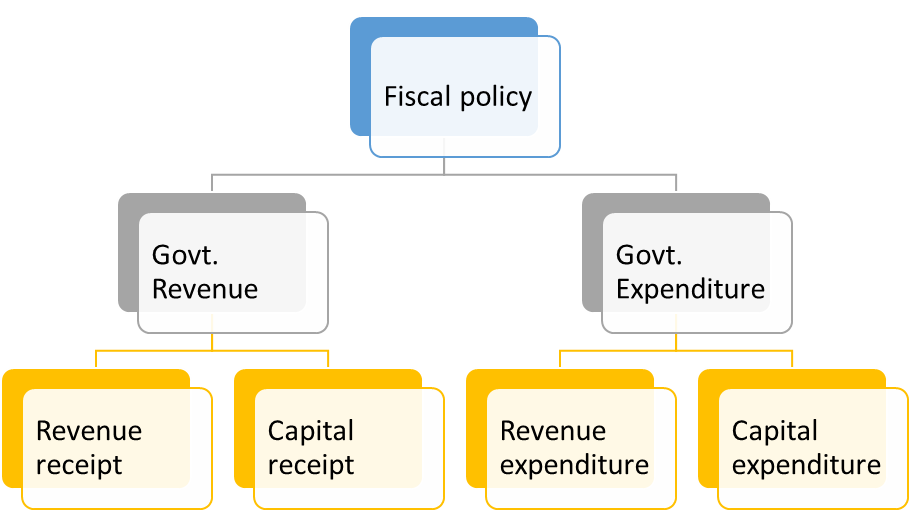

Q2) Write a note on fiscal policy. 5

A2) Fiscal policy is related to Govt. Revenue and Govt. Expenditure. Government annually determine fiscal policy under the Govt. Budget. The sources of Government revenue and Govt. Expenditure are-

- Government revenue

a) Revenue receipts: Revenue receipts are those receipts that do not lead to a claim on the government. They are divided into tax and non-tax revenues. Tax revenues, an important component of revenue receipts, have for long been divided into direct taxes (personal income tax) and firms (corporation tax), and indirect taxes like excise taxes (duties levied on goods produced within the country), customs duties (taxes imposed on goods imported into and exported out of India) and service tax1. Other direct taxes like wealth tax, gift tax and estate duty (now abolished) have never brought in large amount of revenue and thus have been referred to as ‘paper taxes’.

b) Capital Receipts: All those receipts of the government which create liability or reduce financial assets are termed as capital receipts. The government also receives money by way of loans or from the sale of its assets. Loans will have to be returned to the agencies from which they have been borrowed. Thus they create liability. Sale of government assets, like sale of shares in Public Sector Undertakings (PSUs) which is referred to as PSU disinvestment, reduce the total amount of financial assets of the government.

2. Government expenditure

a) Revenue expenditure: Revenue Expenditure is expenditure incurred for purposes other than the creation of physical or financial assets of the central government. It relates to those expenses incurred for the normal functioning of the government departments and various services, interest payments on debt incurred by the government, and grants given to state governments and other parties (even though some of the grants may be meant for creation of assets). Budget documents classify total expenditure into plan and non-plan expenditure. According to this classification, plan revenue expenditure relates to central Plans (the Five-Year Plans) and central assistance for State and Union Territory plans. Non-plan expenditure, the more important component of revenue expenditure, covers a vast range of general, economic and social services of the government. The main items of non-plan expenditure are interest payments, defence services, subsidies, salaries and pensions.

b) Capital expenditure: There are expenditures of the government which result in creation of physical or financial assets or reduction in financial liabilities. This includes expenditure on the acquisition of land, building, machinery, equipment, investment in shares, and loans and advances by the central government to state and union territory governments, PSUs and other parties. Capital expenditure is also categorised as plan and non-plan in the budget documents. Plan capital expenditure, like its revenue counterpart, relates to central plan and central assistance for state and union territory plans. Non-plan capital expenditure covers various general, social and economic services provided by the government.

Q3) What is industrial policy and what is its importance? 5

A3) Industrial policy is a formal declaration by the government, which outlines general policy for industry. There are two main parts to industrial policy. The first part generally deals with the ideology of current political power, while the other part provides a framework for specific rules / principles. The main purpose of industrial policy is to increase industrial production, thereby promoting industrial growth, which leads to economic growth through optimal use of resources. Modernization; Balanced industrial development; balanced regional development (by providing concessions to the industrial development of underdeveloped regions); balanced development of basic and consumer industries. Coordinated development of large, small and cottage companies. Determining business areas under the private and public sector. Strengthen the heartfelt relationship between workers and managers and the proper use of domestic / foreign capital. Figure 2 shows fiscal policy-

Importance of industrialization

Some of the industrial policies-

1. Industrialization is the first requirement for the country's rapid economic development.

2. Industrialization not only contributes to the development of industry, but also promotes the social sector of agriculture, trade, transportation, foreign trade, services and economy.

3. It improves employment opportunities, national income, per capita income, and the standard of living of the masses.

4. It is necessary to establish a healthy tradition of industrialization and to guide, regulate and manage it (if necessary).

5. Industrial policy helps the country to prosper in a self-sufficient manner by laying the structure and foundation of industrial development.

Need, purpose and importance of industrial policy

The necessity, purpose and importance of industrial policy can be explained in the following points.

1. Development of natural resources:

Industrial policy helps to fully develop the country's natural resources. This helps you properly identify, collect, and use resources. It promotes an increase in the national income of the country.

2. To increase industrial production:

The main purpose of industrial policy is to increase the country's industrial production. It provides the impetus for the rapid development of the industry and the growth of the industry.

3. Modernization:

Industrial policy encourages modernization to increase the productivity and productivity of industry. It envisions the use of modems and the latest production technology in the industrial sector. Promote maximum production with minimum production cost.

4. Balanced industrial development:

Industrial policy envisions a country's balanced industrial development. It also promotes balanced development in various sectors of the economy.

5. Balanced regional development

Industrial policy helps the country to develop a balanced region. Industrial policy may include provisions regarding the provision of facilities or concessions for the rapid development of an industrially backward region / region of a country.

6. Coordination between basic industry and consumer industry

Balanced development of basic and consumer industries is essential for economic growth. Industrial policy, on the one hand, encourages the development of basic and major industries, and on the other hand, attention is also paid to the development of the consumer industry. Therefore, with balanced and collaborative development of both types of industries, it provides a pace for economic growth.

7. Coordination between small and large industries

Industrial policy plays an important role in the coordinated development of small or domestic and large industries. These industries can help each other through the provisions of industrial policy.

8. Determining the area

Industrial policy determines the areas of business under the public and private sectors. Through national industrial policy, we can set the right direction for the private sector.

9. Heartfelt labour-management relations

Comprehensive industrial policy is needed to establish a heartfelt relationship between workers and managers. Heartfelt labour-management relations are essential for rapid and sustainable industrialization.

10. Appropriate use of foreign aid / investment

Appropriate industrial policy is supposed to attract foreign capital and entrepreneurs. It helps the country's rapid industrialization. If you think carefully about industrial policy, the disadvantages of "foreign aid" will be confirmed. Foreign aid can be used for national interests if the country implements appropriate industrial policies.

Q4) Write a brief note on industrial licensing. 5

A4) The industrial policy reforms have reduced the industrial licensing requirements, removed restrictions on investment and expansion, and facilitated easy access to foreign technology and foreign direct investment. Under the Industries (Development & Regulation) Act, 1951, an industrial licence is required in respect of the following:

i. Items of manufacture falling under the list of compulsory licensing (only 5 industries are in the list)

Ii. If a non SSI unit intends to manufacture items reserved exclusively for the Small Scale Sector.

In addition certain industries are reserved exclusively for the Public Sector (presently Atomic Energy and Railway Transport come under this category). With progressive delicensing of industries, only 5 industries have been retained under compulsory licensing under the Industries (D&R) Act, 1951 viz.

(i) Distillation and brewing of alcoholic drinks;

(ii) Cigars and cigarettes of tobacco and manufactured tobacco substitutes;

(iii) Electronic aerospace and Defence equipment: all types;

(iv) Industrial explosives including detonating fuses, Safety Fuses, gun powder, nitrocellulose and matches;

(v) Hazardous chemicals: viz. (a) Hydrocyanic acid and its Derivatives; (b) Phosgene and its derivatives; (c) Isocyanates and diisocyanates of hydrocarbon, not elsewhere specified (example: Methyl Isocyanate)

At present there are 20 items which are exclusively reserved for manufacture in the small scale sector (SSI). Any non-SSI unit desirous of manufacturing these items needs an industrial licence which is issued with an obligation to export 50% of annual production.

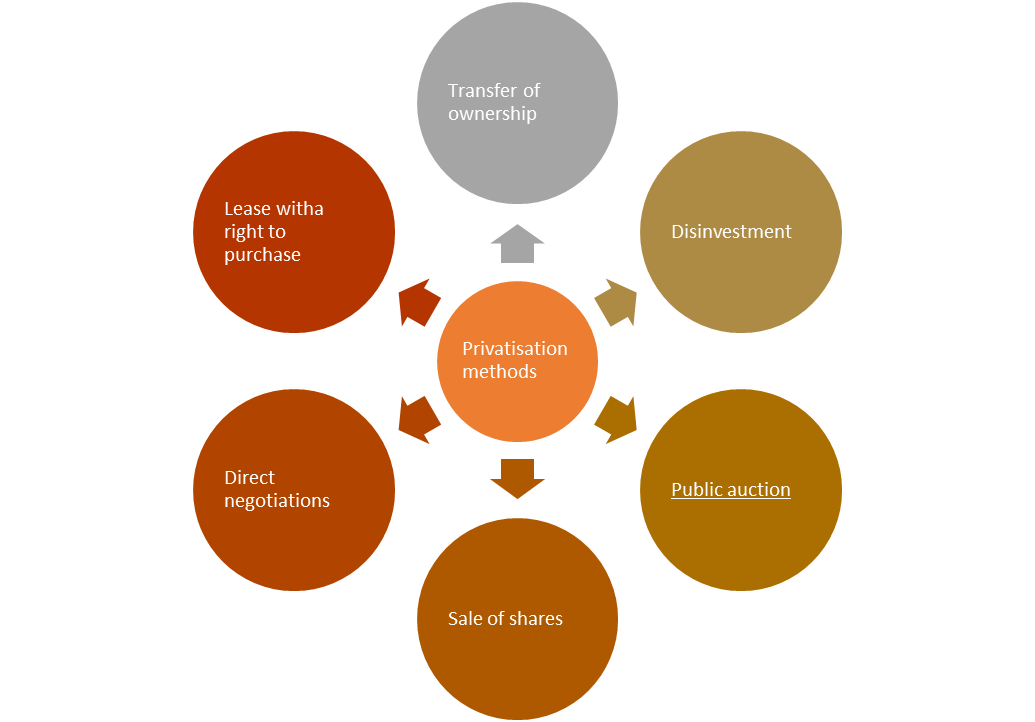

Q5) Define privatization. What are the methods of privatization? 8

A5) Privatization refers to the transfer of ownership, control, and control of a public sector company to the private sector. In India, the concept of privatization was introduced in 1993 under the LPG policy. This will allow private companies to enter the banking sector, insurance sector, production companies, etc., which were not permitted before the introduction of the LPG policy. For example, the privatization of the Bharat Aluminum Company in 2006 and the privatization of Delhi and Mumbai airports in 2006. Its main purpose is to:

a) Increase the influx of FDI into India.

b) To improve the financial strength of the company.

c) Improve the efficiency of PSUs by giving decision autonomy.

d) Promote government dynamism because there is no government interference.

T he methods of privatisation of companies are-

he methods of privatisation of companies are-

Figure 1: Methods of privatisation

1. Transfer of ownership:

This method transfers ownership, control, and control of a public sector company to the private sector.

2. Investment reduction:

When the government withdraws an investment from the PSU and sells it to the public, it is known as an investment withdrawal.

3. Public auction:

Public company stock or long-term assets are sold in this way to raise the maximum amount of government-owned assets.

4. Sale of shares:

This method allows you to sell PSU shares through the stock exchange.

5. Direct negotiation:

In this way, the government deals directly with certain private organizations for PSU private property.

6. Leases right to buy:

This method also envisions private companies owning and using state-owned enterprises, or meetings by specific standards. Private companies can later choose to exercise the option of converting a real estate lease into ownership.

Q6) Discuss devaluation. State its advantages. 8

A6) Devaluation is the planned downward revision of the fee of cashes in a single US in comparison to some other foreign money, organization of currencies, or foreign money standards. Countries with constant or semi-constant change charges use this economic coverage tool. This is frequently pressured with depreciation and is the alternative of revaluation, which refers to foreign exchange charge readjustments.

Devaluation happens while the authorities desire to growth its alternate balance (exports minus imports) via way of means of decreasing the relative fee of the foreign money. Government does this via way of means of adjusting constant or semi-constant change charges among its very own foreign money and the currencies of different nations. By making their foreign money cheaper, nations can growth their exports. At the equal time, overseas merchandise can be greater steeply-priced and imports will decrease. In a few cases, a rustic may also take the alternative movement via way of means of growing the fee of the foreign money. It is referred to as reassessment. Devaluation isn't like depreciation and deflation. Depreciation happens while floating change charge foreign money loses its fee withinside the global foreign money market. Deflation happens while the overall rate of home merchandise is going down.

Advantages of devaluation

Devaluation helps bring perfect quality to international market demand and reduce monetary value to some extent of competitiveness. Therefore, it is not easy for Pakistan to sell goods produced by France, Germany, or the Netherlands when the monetary value is high, as both developed and developing countries are mapped to one international market. .. But we are in conflict with developing countries. Therefore, in order to function in the market, it is really necessary to set the monetary value and monetary value of rivals.

Every new product has four phases, the first of which is the implementation phase. The debut phase requires a series of attempts to evolve the product and raise buyer awareness. At this stage, it's important to sell at a price that is below cost. As such, the authorities provide certain liability drawbacks for a specified period of time, until the product becomes self-sufficient.

Each state maintains a history of the entire import / export agenda, along with a balance of payments chart. When imports from exports are added or the balance of payments deteriorates, it is important to increase exports immediately. Declining monetary value is one of the fastest ways to increase exports.

When people tend to buy imported goods and the local industry begins to suffer, they need to reduce spending on foreign purchases and discourage people from going directly to local goods. Devaluation is one of the ways to reduce imports and promote local industry.

The decline in monetary value due to devaluation has long-term implications, which can be seen over the duration of the clip.

All of the above conditions are currently predominant in Pakistan. But the question arises as to why all these conditions have a relatively dramatic impact on our economic system. The answer to this question pertains to our policy on forecasting and receiving income from foreign donors and states. Previously it was used to pull budget spreads apart with the help of AIDS and debt. However, the situation was different for this clip, and it was not possible to start income abroad. The IMF was used to expand financing for last year's development plan. However, during the current 12 months, the IMF has suspended the ESAF-approved $ 300 million trench. The results are fairly clear: devaluation and the impact of new obligations / taxes

Q7) Define devaluation. What are its disadvantages? 5

A7) Devaluation is the planned downward revision of the fee of cashes in a single US in comparison to some other foreign money, organization of currencies, or foreign money standards. Countries with constant or semi-constant change charges use this economic coverage tool. This is frequently pressured with depreciation and is the alternative of revaluation, which refers to foreign exchange charge readjustments.

Devaluation happens while the authorities desire to growth its alternate balance (exports minus imports) via way of means of decreasing the relative fee of the foreign money. Government does this via way of means of adjusting constant or semi-constant change charges among its very own foreign money and the currencies of different nations. By making their foreign money cheaper, nations can growth their exports. At the equal time, overseas merchandise can be greater steeply-priced and imports will decrease. In a few cases, a rustic may also take the alternative movement via way of means of growing the fee of the foreign money. It is referred to as reassessment. Devaluation isn't like depreciation and deflation. Depreciation happens while floating change charge foreign money loses its fee withinside the global foreign money market. Deflation happens while the overall rate of home merchandise is going down.

Disadvantages of devaluation

The devaluation with all the disadvantages is an irregular policy. This has been evaluated as an extraordinary agreement to reduce demand. Alternatively, incomplete planning is essential for future calculations where the degree of original monetary value is maintained again.

The devaluation involves a high risk of price increases in the state. For example, if exports do not increase as a result of a decline in monetary value, the state will tolerate the losses due to the increased costs of all imports. Losses were incurred due to the decline in monetary value in the international market.

Devaluation automatically increases the value of external debt and accordingly increases the total required for debt repayment

The devaluation of the currency is considered the last step taken after all other financial and monetary measures have failed.

Other factors need to be evaluated before devaluing the currency to raise the economic system through increased exports. For example, a decline in exports can be due to unfortunate product quality, trade barriers, low value products, and inaccessibility to export points.

Continued depreciation of the currency can lead to improper imports of goods within the state. Such improper imports and exports could create an improper "parallel economic system" within the state, which would be completely out of our control.

Devaluation is supported by specific incentive bundles to reduce the points generated internally for export.

Q8) Highlight key measures of foreign trade policy. 8

A8) The Exim policy/trade policy of India from 2009-14 are as follows-

- Merchandise Exports from India Scheme (MEIS)

a) The 5 different schemes (Focus Product Scheme, Market Linked Focus Product Scheme, Focus Market Scheme, Agri, Infrastructure Incentive Scrip, VKGUY) for rewarding merchandise exports with different kinds of duty scripts have been merged into a single scheme, namely Merchandise Export from India Scheme (MEIS) and there would be no conditionality attached to the scripts issued under the scheme.

b) Rewards for export of notified goods to notified markets under ‘Merchandise Exports from India Scheme (MEIS) shall be payable as percentage of realized FOB value (in free foreign exchange). The debits towards basic customs duty in the transferable reward duty credit scrips would also be allowed adjustment as duty drawback. At present, only the additional duty of customs / excise duty / service tax is allowed adjustment as CENVAT credit or drawback, as per Department of Revenue rules.

2. Service Exports from India Scheme (SEIS)

(a) Served from India Scheme (SFIS) has been replaced with Service Exports from India Scheme (SEIS). SEIS shall apply to ‘Service Providers located in India’ instead of ‘Indian Service Providers’.

(b) The rate of reward under SEIS would be based on net foreign exchange earned. The reward issued as duty credit scrip, would no longer be with actual user condition and will no longer be restricted to usage for specified types of goods but be freely transferable and usable for all types of goods and service tax debits on procurement of services / goods. Debits would be eligible for CENVAT credit or drawback.

3. Chapter -3 Incentives (MEIS & SEIS) to be available for SEZs

It is now proposed to extend Chapter -3 Incentives (MEIS & SEIS) to units located in SEZs also.

4. Duty credit scrips to be freely transferable and usable for payment of custom duty, excise duty and service tax.

(a) All scrips issued under MEIS and SEIS and the goods imported against these scrips would be fully transferable.

(b) Scrips issued under Exports from India Schemes can be used for the following:-

(i) Payment of customs duty for import of inputs / goods including capital goods, except items listed in Appendix 3A.

(ii) Payment of excise duty on domestic procurement of inputs or goods, including capital goods as per DoR notification.

5. Status Holders

(a) Business leaders who have excelled in international trade and have successfully contributed to country’s foreign trade are proposed to be recognized as Status Holders and given special treatment and privileges to facilitate their trade transactions, in order to reduce their transaction costs and time.

(b) The nomenclature of Export House, Star Export House, Trading House, Star Trading House, Premier Trading House certificate has been changed to One, Two, Three, Four, Five Star Export House.

5. Boost to "MAKE IN INDIA"

Reduced Export Obligation (EO) for domestic procurement under EPCG scheme:

a) Specific Export Obligation under EPCG scheme, in case capital goods are procured from indigenous manufacturers, which is currently 90% of the normal export obligation (6 times at the duty saved amount) has been reduced to 75%, in order to promote domestic capital goods manufacturing industry.

b) Higher level of rewards under MEIS for export items with high domestic content and value addition.

6. Trade facilitation & ease of doing business

Online filing of documents/ applications and Paperless trade in 24x7 environments:

a) DGFT already provides facility of Online filing of various applications under FTP by the exporters/importers. However, certain documents like Certificates issued by Chartered Accountants/ Company Secretary / Cost Accountant etc. have to be filed in physical forms only. In order to move further towards paperless processing of reward schemes, it has been decided to develop an online procedure to upload digitally signed documents by Chartered Accountant / Company Secretary / Cost Accountant. In the new system, it will be possible to upload online documents like annexure attached to ANF 3B, ANF 3C and ANF 3D, which are at present signed by these signatories and submitted physically.

b) As a measure of ease of doing business, landing documents of export consignment as proofs for notified market can be digitally uploaded in the following manner:-

(i) Any exporter may upload the scanned copy of Bill of Entry under his digital signature.

(ii) Status holders falling in the category of Three Star, Four Star or Five Star Export House may upload scanned copies of documents.

7. Online inter-ministerial consultations:

It is proposed to have online inter-ministerial consultations for approval of export of SCOMET items, Norms fixation, Import Authorisations, Export Authorisation, in a phased manner, with the objective to reduce time for approval. As a result, there would not be any need to submit hard copies of documents for these purposes by the exporters.

8. Forthcoming e-Governance Initiatives

(a) DGFT is currently working on the following EDI initiatives:

(i) Message exchange for transmission of export reward scrips from DGFT to Customs.

(ii) Message exchange for transmission of Bills of Entry (import details) from Customs to DGFT.

(iii) Online issuance of Export Obligation Discharge Certificate (EODC).

(iv) Message exchange with Ministry of Corporate Affairs for CIN & DIN.

(v) Message exchange with CBDT for PAN.

(vi) Facility to pay application fee using debit card / credit card.

(vii) Open API for submission of IEC application.

(viii) Mobile applications for FTP

9. Other initiatives

New initiatives for EOUs, EHTPs and STPs

(a) EOUs, EHTPs, STPs have been allowed to share infrastructural facilities among themselves. This will enable units to utilize their infrastructural facilities in an optimum way and avoid duplication of efforts and cost to create separate infrastructural facilities in different units.

(b) Inter unit transfer of goods and services have been allowed among EOUs, EHTPs, STPs, and BTPs. This will facilitate group of those units which source inputs centrally in order to obtain bulk discount. This will reduce cost of transportation, other logistic costs and result in maintaining effective supply chain.

(c) EOUs have been allowed facility to set up Warehouses near the port of export. This will help in reducing lead time for delivery of goods and will also address the issue of un-predictability of supply orders.

(d) STP units, EHTP units, software EOUs have been allowed the facility to use all duty free equipment/goods for training purposes. This will help these units in developing skills of their employees.

Q9) Discuss briefly the foreign investment regulation. 5

A9) Regulation of foreign investment at the international level is scarce. Hundreds of bilateral and multilateral treaties attempt to regulate that behaviour, either exclusively or in combination with other matters, typically trade relations. The provisions of these treaties apply equally to the treatment of investment by nationals of either party in the territory of the other party or parties. The regulatory measures of foreign investment in India are-

- Regulation in Inward-Looking Economies

Restrictive policies in the first group are expressed in strict controls over the entry and establishment of foreign investment, the levels of capital which foreign investors are permitted to invest and a myriad of performance requirements. Under such controls, the admission of foreign investment is typically subject to various “screening” procedures, licensing requirements and several approvals by the host state’s central and local authorities. The procedures are frequently cumbersome and based on rules that are vaguely formulated, allowing for significant measure of administrative discretion. Transfer of capital and earnings is subject to general currency controls and the employment of foreign labour is tightly restricted. Performance requirements usually include minimum local inputs, export ratios and/or local employment ratios. The legal approach to attracting foreign investments in certain sectors is incentive-based. Statutes of this kind emphasize fiscal (tax exemption) or other incentives to attract and channel foreign investments to certain areas or predefined sectors of the national economy. Such approaches have been proven to distort global flows of foreign investment, while bringing little or no benefits to the economic development of the host country.

2. Regulation in Outward-Looking Economies

The foreign investment statutes in this group of countries reflect market-oriented approaches to foreign investment, allowing in principle for open admission of foreign investment, subject to specified exceptions. In some of these statutes, the exceptions have been framed in broad terms to assure protection of the host state’s fundamental interests such as national security, public order, protection of the environment, public health and the like. In other statutes, the exceptions have been listed in so-called “negative lists” of areas of the national economy where the foreign investment is either absolutely prohibited or only partially permitted under specified circumstances. Some statutes also provide for a one-stop shop where all approvals required, including for tax exemptions, are obtained through one agency.

3) Bilateral investment treaties

The first modern bilateral investment treaty (BIT) was concluded in 1959 between Germany and Pakistan. Over the decades that followed an increasing number of European countries concluded such treaties with developing countries. By the mid- to late-1980s, BITs came to be universally accepted instruments for the promotion and legal protection of foreign investments. BITs are no longer concluded exclusively between capital-exporting and capital-importing countries; an increasing number of them began to be concluded among developing, normally capital-importing countries (and transition economy countries). The consolidation of certain core provisions in BITs points to what may be called the “first generation” of BITs. The greatly expanded treaty practice since the late1980s, however, has led to refinement in the drafting of BIT provisions and in some cases to their reformulation as instruments of investment liberalization policies.

Q10) What changes have been seen in the role of public sector? 5

A10) In the 1991 review of economic policy and reform, the Government of India made four major changes in the public sector. These four changes have changed the role of the public sector in our country forever.

1] Reduction of industry reserved for the public sector

In the first five-year plan, the government reserved 17 industries for the public sector. This meant that only the government could operate in these industries and no private capital was involved. However, by 1991 this number had dropped to eight. And now there are only three, including railroads and nuclear power.

The public sector must contribute to the development of these industries, but now the private sector can move them forward. Today, in these industries, such as mining and air transportation, private and public companies coexist and complement each other.

2] Reduction of investment

Withdrawing from the public sector means selling the shares of a public company to the private sector and the general public. In addition, reduced investment will enable new capital inflows and improved personal efficiency and financial discipline. It also ensures that governments secure additional funding to invest in social programs and objectives such as public health and hygiene.

Investment cuts also transfer commercial and financial risks to the private sector. This puts the company within corporate governance and reduces the amount of public debt. In some cases, such as in the telecommunications industry, withdrawal of investment has intensified competition and has also benefited consumers by lowering prices.

3] Closure of sick unit

After the policy change, all public sector units will be reviewed by the Industrial Finance Reconstruction Commission. This committee reviews the condition of the unit and decides whether the unit can be rehabilitated or shut down permanently. However, this upset the workers and employees of the closed sick unit.

They had to be shut down because the government was unable to maintain such sick units. Workers were provided with a safety net regarding loss of income. A National Renewal Fund was established to fund voluntary separation and retirement programs for such workers. But in the end, they were inadequate measures.

4] Memorandum of Understanding

This was a system to give public sector units the opportunity to revive. Government authorities associated with the unit's manager will sign a memorandum of understanding. It gives you clear criteria for your company to meet. If the goal is achieved, the company will continue. Otherwise, the shutdown or investment will be discontinued.