Unit 4

Registration

Q1) Define registration under GST. Also state the advantages of registration. 5

A1) Registration of any business entity under the GST Law implies obtaining a unique number from the concerned tax authorities for the purpose of collecting tax on behalf of the government and to avail Input tax credit for the taxes on his inward supplies. Without registration, a person can neither collect tax from his customers nor claim any input tax credit of tax paid by him.

Registration will confer the following advantages to a taxpayer:

• He is legally recognized as supplier of goods or services.

• He is legally authorized to collect tax from his customers and pass on the credit of the taxes paid on the goods or services supplied to the purchasers/ recipients. • He can claim input tax credit of taxes paid and can utilize the same for payment of taxes due on supply of goods or services.

• Seamless flow of Input Tax Credit from suppliers to recipients at the national level.

Q2) Define operational registration and compulsory registration. 8

A2) Optional registration

Voluntary/optional registration under GST has several advantages such as more freedom in inter-state sales, passing on of input tax credit, good ratings, etc. However, it is important to also have the technology ready for online payments.

The following businesses are mandated to register under the Goods and Services Tax:

- Businesses that engage in inter-state selling

- Businesses that engage in online sales

- Businesses whose turnover exceeds Rs.20 lakh.

Compulsory registration (Section 24)

The following categories of persons shall be required to be registered under this Act,––

(i) persons making any inter-State taxable supply;

(ii) casual taxable persons making taxable supply;

(iii) persons who are required to pay tax under reverse charge;

(iv) person who are required to pay tax under sub-section (5) of section 9;

(v) non-resident taxable persons making taxable supply;

(vi) persons who are required to deduct tax under section 51, whether or not separately registered under this Act;

(vii) persons who make taxable supply of goods or services or both on behalf of other taxable persons whether as an agent or otherwise;

(viii) Input Service Distributor, whether or not separately registered under this Act;

(ix) persons who supply goods or services or both, other than supplies specified under sub-section (5) of section 9, through such electronic commerce operator who is required to collect tax at source under section 52;

(x) every electronic commerce operator;

(xi) every person supplying online information and database access or retrieval services from a place outside India to a person in India, other than a registered person; and

(xii) such other person or class of persons as may be notified by the Government on the recommendations of the Council.

Q3) State the procedure for new registration. 10

A3) Section 25 of the GST act provides for the procedure for new registration-

(1) Every person who is liable to be registered under section 22 or section 24 shall apply for registration in every such State or Union territory in which he is so liable within thirty days from the date on which he becomes liable to registration, in such manner and subject to such conditions as may be prescribed:

Provided that a casual taxable person or a non-resident taxable person shall apply for registration at least five days prior to the commencement of business.

(2) A person seeking registration under this Act shall be granted a single registration in a State or Union territory:

Provided that a person having multiple business verticals in a State or Union territory may be granted a separate registration for each business vertical, subject to such conditions as may be prescribed.

(3) A person, though not liable to be registered under section 22 or section 24 may get himself registered voluntarily, and all provisions of this Act, as are applicable to a registered person, shall apply to such person

(4) A person who has obtained or is required to obtain more than one registration, whether in one State or Union territory or more than one State or Union territory shall, in respect of each such registration, be treated as distinct persons for the purposes of this Act.

(5) Where a person who has obtained or is required to obtain registration in a State or Union territory in respect of an establishment, has an establishment in another State or Union territory, then such establishments shall be treated as establishments of distinct persons for the purposes of this Act.

(6) Every person shall have a Permanent Account Number issued under the Income tax Act, 1961 in order to be eligible for grant of registration:

Provided that a person required to deduct tax under section 51 may have, in lieu of a Permanent Account Number, a Tax Deduction and Collection Account Number issued under the said Act in order to be eligible for grant of registration.

(7) Notwithstanding anything contained in sub-section (6), a non-resident taxable person may be granted registration under sub-section (1) on the basis of such other documents as may be prescribed.

(8) Where a person who is liable to be registered under this Act fails to obtain registration, the proper officer may, without prejudice to any action which may be taken under this Act or under any other law for the time being in force, proceed to register such person in such manner as may be prescribed.

(9) Notwithstanding anything contained in sub-section (1),––

a. Any specialised agency of the United Nations Organisation or any Multilateral Financial Institution and Organisation notified under the United Nations (Privileges and Immunities) Act, 1947, Consulate or Embassy of foreign countries; and

b. Any other person or class of persons, as may be notified by the Commissioner, shall be granted a Unique Identity Number in such manner and for such purposes, including refund of taxes on the notified supplies of goods or services or both received by them, as may be prescribed.

(10) The registration or the Unique Identity Number shall be granted or rejected after due verification in such manner and within such period as may be prescribed.

(11) A certificate of registration shall be issued in such form and with effect from such date as may be prescribed.

(12) A registration or a Unique Identity Number shall be deemed to have been granted after the expiry of the period prescribed under sub-section (10), if no deficiency has been communicated to the applicant within that period.

Q4) State the procedure for amendment of registration. 4

A4) Section 28 of the GST act provides for the procedure for amendment of registration-

(1) Every registered person and a person to whom a Unique Identity Number has been assigned shall inform the proper officer of any changes in the information furnished at the time of registration or subsequent thereto, in such form and manner and within such period as may be prescribed.

(2) The proper officer may, on the basis of information furnished under sub-section (1) or as ascertained by him, approve or reject amendments in the registration particulars in such manner and within such period as may be prescribed:

Provided that approval of the proper officer shall not be required in respect of amendment of such particulars as may be prescribed:

Provided further that the proper officer shall not reject the application for amendment in the registration particulars without giving the person an opportunity of being heard.

(3) Any rejection or approval of amendments under the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act, as the case may be, shall be deemed to be a rejection or approval under this Act.

Q5) State the provisions regarding cancellation of registration. 8

A5) Section 29 of the GST act provides provisions regarding cancellation of registration-

(1) The proper officer may, either on his own motion or on an application filed by the registered person or by his legal heirs, in case of death of such person, cancel the registration, in such manner and within such period as may be prescribed, having regard to the circumstances where,––

a) the business has been discontinued, transferred fully for any reason including death of the proprietor, amalgamated with other legal entity, demerged or otherwise disposed of; or

b) there is any change in the constitution of the business; or

c) the taxable person, other than the person registered under sub-section (3) of section 25, is no longer liable to be registered under section 22 or section 24.

(2) The proper officer may cancel the registration of a person from such date, including any retrospective date, as he may deem fit, where,––

a registered person has contravened such provisions of the Act or the rules made thereunder as may be prescribed; or

- a person paying tax under section 10 has not furnished returns for three consecutive tax periods; or

- Any registered person, other than a person specified in clause (b), has not furnished returns for a continuous period of six months; or

- Any person who has taken voluntary registration under sub-section (3) of section 25 has not commenced business within six months from the date of registration; or

- Registration has been obtained by means of fraud, wilful misstatement or suppression of facts:

Provided that the proper officer shall not cancel the registration without giving the person an opportunity of being heard.

(3) The cancellation of registration under this section shall not affect the liability of the person to pay tax and other dues under this Act or to discharge any obligation under this Act or the rules made thereunder for any period prior to the date of cancellation whether or not such tax and other dues are determined before or after the date of cancellation.

(4) The cancellation of registration under the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act, as the case may be, shall be deemed to be a cancellation of registration under this Act.

(5) Every registered person whose registration is cancelled shall pay an amount, by way of debit in the electronic credit ledger or electronic cash ledger, equivalent to the credit of input tax in respect of inputs held in stock and inputs contained in semi-finished or finished goods held in stock or capital goods or plant and machinery on the day immediately preceding the date of such cancellation or the output tax payable on such goods, whichever is higher, calculated in such manner as may be prescribed:

Provided that in case of capital goods or plant and machinery, the taxable person shall pay an amount equal to the input tax credit taken on the said capital goods or plant and machinery, reduced by such percentage points as may be prescribed or the tax on the transaction value of such capital goods or plant and machinery under section 15, whichever is higher

(6) The amount payable under sub-section (5) shall be calculated in such manner as may be prescribed.

Q6) Define composite scheme. Also state the conditions for composite scheme. 5

A6) Composition Scheme is a simple and easy scheme under GST for taxpayers. Small taxpayers can get rid of tedious GST formalities and pay GST at a fixed rate of turnover. This scheme can be opted by any taxpayer whose turnover is less than Rs. 1.5 crore.

The following people cannot opt for the scheme-

- Manufacturer of ice cream, pan masala, or tobacco

- A person making inter-state supplies

- A casual taxable person or a non-resident taxable person

- Businesses which supply goods through an e-commerce operator

The following conditions must be satisfied in order to opt for composition scheme:

1. No Input Tax Credit can be claimed by a dealer opting for composition scheme

2. The dealer cannot supply goods not taxable under GST such as alcohol.

3. The taxpayer has to pay tax at normal rates for transactions under the Reverse Charge Mechanism

4. If a taxable person has different segments of businesses (such as textile, electronic accessories, groceries, etc.) under the same PAN, they must register all such businesses under the scheme collectively or opt out of the scheme.

5. The taxpayer has to mention the words ‘composition taxable person’ on every notice or signboard displayed prominently at their place of business.

6. The taxpayer has to mention the words ‘composition taxable person’ on every bill of supply issued by him.

7. As per the CGST (Amendment) Act, 2018, a manufacturer or trader can now also supply services to an extent of ten percent of turnover, or Rs.5 lakhs, whichever is higher. This amendment will be applicable from the 1st of Feb, 2019.

Q7) State the restrictions under composite scheme of GST. 5

A7) The restrictions of composite scheme are-

- The person opting for the scheme must neither be a casual taxable person nor a non-resident taxable person.

- The goods held by him in stock on the appointed date must not be purchased from a place outside his state. The goods should therefore not be classified as:

- Interstate purchase

- Imported Goods

- Branch situated outside the State

- Agents or Principal situated outside the State

3. Where the taxpayers deal with unregistered person, tax must be paid or no stock must be held

4. Mandatory display of invoices of the words ” composition taxable person, not eligible to collect tax on supplies”

5. Mandatory display of the words “Composition Taxable Person” on every notice and signboard displayed at a prominent place.

6. He is not a manufacturer of such goods as may be notified by the Government during the preceding financial year.

Q8) State the provisions regarding manner of maintenance of accounts under GST. 8

A8) The provisions regarding maintenance of accounts under GST are provided under section 35-

(1) Every registered person shall keep and maintain, at his principal place of business, as mentioned in the certificate of registration, a true and correct account of—

a) production or manufacture of goods;

b) inward and outward supply of goods or services or both;

c) stock of goods;

d) input tax credit availed;

e) output tax payable and paid; and

f) such other particulars as may be prescribed:

Provided that where more than one place of business is specified in the certificate of registration, the accounts relating to each place of business shall be kept at such places of business:

Provided further that the registered person may keep and maintain such accounts and other particulars in electronic form in such manner as may be prescribed.

(2) Every owner or operator of warehouse or godown or any other place used for storage of goods and every transporter, irrespective of whether he is a registered person or not, shall maintain records of the consigner, consignee and other relevant details of the goods in such manner as may be prescribed.

(3) The Commissioner may notify a class of taxable persons to maintain additional accounts or documents for such purpose as may be specified therein.

(4) Where the Commissioner considers that any class of taxable person is not in a position to keep and maintain accounts in accordance with the provisions of this section, he may, for reasons to be recorded in writing, permit such class of taxable persons to maintain accounts in such manner as may be prescribed.

(5) Every registered person whose turnover during a financial year exceeds the prescribed limit shall get his accounts audited by a chartered accountant or a cost accountant and shall submit a copy of the audited annual accounts, the reconciliation statement under sub-section (2) of section 44 and such other documents in such form and manner as may be prescribed.

(6) Subject to the provisions of clause (h) of sub-section (5) of section 17, where the registered person fails to account for the goods or services or both in accordance with the provisions of sub-section (1), the proper officer shall determine the amount of tax payable on the goods or services or both that are not accounted for, as if such goods or services or both had been supplied by such person and the provisions of section 73 or section 74, as the case may be, shall, mutatis mutandis, apply for determination of such tax.

Q9) Write a small note on voucher under GST. 4

A9) Vouchers are not defined in the Act but its general definition is “a small printed piece of paper that entitles the holder to a discount or that may be exchanged for goods or services”. Examples of vouchers are coupon, token, ticket, license, permit, pass.

‘Voucher’, for the purposes of GST, necessarily means that instrument which should be accepted as consideration (wholly or partly) for a supply. Therefore, a voucher is an asset for the recipient, and without a recipient, a ‘voucher’ would lose its meaning.

Therefore, in a case of a supplier issuing a voucher to a recipient of goods, on his making a purchase from the supplier, the voucher is not being viewed as an additional outcome of the supply made to the recipient. Rather, it is an instrument that can be used in place of money (or other consideration) which can be used on effecting yet another inward supply.

Time of supply in case of vouchers:

In case of supply of vouchers by a supplier, the time of supply shall be—

(a) the date of issue of voucher, if the supply is identifiable at that point; or

(b) the date of redemption of voucher, in all other cases.

Q10) State the provisions related to audit under GST. 5

A10) (1) The Commissioner or any officer authorised by him, by way of a general or a specific order, may undertake audit of any registered person for such period, at such frequency and in such manner as may be prescribed.

(2) The officers referred to in sub-section (1) may conduct audit at the place of business of the registered person or in their office.

(3) The registered person shall be informed by way of a notice not less than fifteen working days prior to the conduct of audit in such manner as may be prescribed.

(4) The audit under sub-section (1) shall be completed within a period of three months from the date of commencement of the audit:

Provided that where the Commissioner is satisfied that audit in respect of such registered person cannot be completed within three months, he may, for the reasons to be recorded in writing, extend the period by a further period not exceeding six months.

(5) During the course of audit, the authorised officer may require the registered person,—

(i) to afford him the necessary facility to verify the books of account or other documents as he may require;

(ii) to furnish such information as he may require and render assistance for timely completion of the audit.

(6) On conclusion of audit, the proper officer shall, within thirty days, inform the registered person, whose records are audited, about the findings, his rights and obligations and the reasons for such findings.

(7) Where the audit conducted under sub-section (1) results in detection of tax not paid or short paid or erroneously refunded, or input tax credit wrongly availed or utilised, the proper officer may initiate action under section 73 or section 74.

Q11) Write a note on departmental audit. 5

A11) Due to the nature and complexity of the case and the interest of revenue, officer not below the rank of Assistant Commissioner may direct registered person for Audit & examination of books of accounts by a chartered accountant or a cost accountant as nominated by the Commissioner. Such nominated auditor shall submit his report to the commissioner within 90 days. Further 90 days period can be extended on application made by the auditor. If Audit results in tax not paid or shortly paid, wrongly claimed input tax credits or erroneously refunded, the proper officer may initiate action under Section 73 or Section 74.

Issues in departmental audit:

- Reconciliation: It is a major issue for taxpayers with multiple state registrations to reconcile the audited financial statements with the Annual GST returns.

- Decentralized Audit under GST: Management of information as GST audit under different states can be initiated at the same time unlike earlier regime where audit was centralised.

- Request for numerous documents: No uniform list of documents prescribed by the government for audit purpose.

- Inconsistency: Inconsistent tax positions adopted by different jurisdictional authorities leading to unwanted notices and litigations.

- Data Management: In case of onsite audit, there is difficulty in providing and managing documents as generally information maintained at central level.

Q12) State the provisions related to special audit. 5

A12) The provisions related to special audit is provided under section 66 of the GST act.

(1) If at any stage of scrutiny, inquiry, investigation or any other proceedings before him, any officer not below the rank of Assistant Commissioner, having regard to the nature and complexity of the case and the interest of revenue, is of the opinion that the value has not been correctly declared or the credit availed is not within the normal limits, he may, with the prior approval of the Commissioner, direct such registered person by a communication in writing to get his records including books of account examined and audited by a chartered accountant or a cost accountant as may be nominated by the Commissioner.

(2) The chartered accountant or cost accountant so nominated shall, within the period of ninety days, submit a report of such audit duly signed and certified by him to the said Assistant Commissioner mentioning therein such other particulars as may be specified:

Provided that the Assistant Commissioner may, on an application made to him in this behalf by the registered person or the chartered accountant or cost accountant or for any material and sufficient reason, extend the said period by a further period of ninety days.

(3) The provisions of sub-section (1) shall have effect notwithstanding that the accounts of the registered person have been audited under any other provisions of this Act or any other law for the time being in force.

(4) The registered person shall be given an opportunity of being heard in respect of any material gathered on the basis of special audit under sub-section (1) which is proposed to be used in any proceedings against him under this Act or the rules made thereunder.

(5) The expenses of the examination and audit of records under sub-section (1), including the remuneration of such chartered accountant or cost accountant, shall be determined and paid by the Commissioner and such determination shall be final.

(6) Where the special audit conducted under sub-section (1) results in detection of tax not paid or short paid or erroneously refunded, or input tax credit wrongly availed or utilised, the proper officer may initiate action under section 73 or section 74.

Q13) State the provisions related to penalty for certain offences provided under section 122. 12

A13) Penalty for certain offences (Section 122) are stated below-

(1) Where a taxable person who––

(i) supplies any goods or services or both without issue of any invoice or issues an incorrect or false invoice with regard to any such supply;

(ii) issues any invoice or bill without supply of goods or services or both in violation of the provisions of this Act or the rules made thereunder;

(iii) collects any amount as tax but fails to pay the same to the Government beyond a period of three months from the date on which such payment becomes due;

(iv) collects any tax in contravention of the provisions of this Act but fails to pay the same to the Government beyond a period of three months from the date on which such payment becomes due;

(v) fails to deduct the tax in accordance with the provisions of sub-section (1) of section 51, or deducts an amount which is less than the amount required to be deducted under the said sub-section, or where he fails to pay to the Government under sub-section (2) thereof, the amount deducted as tax;

(vi) fails to collect tax in accordance with the provisions of sub-section (1) of section 52, or collects an amount which is less than the amount required to be collected under the said sub-section or where he fails to pay to the Government the amount collected as tax under sub-section (3) of section 52;

(vii) takes or utilises input tax credit without actual receipt of goods or services or both either fully or partially, in contravention of the provisions of this Act or the rules made thereunder;

(viii) fraudulently obtains refund of tax under this Act;

(ix) takes or distributes input tax credit in contravention of section 20, or the rules made thereunder;

(x) falsifies or substitutes financial records or produces fake accounts or documents or furnishes any false information or return with an intention to evade payment of tax due under this Act;

(xi) is liable to be registered under this Act but fails to obtain registration;

(xii) furnishes any false information with regard to registration particulars, either at the time of applying for registration, or subsequently;

(xiii) obstructs or prevents any officer in discharge of his duties under this Act;

(xiv) transports any taxable goods without the cover of documents as may be specified in this behalf;

(xv) suppresses his turnover leading to evasion of tax under this Act;

(xvi) fails to keep, maintain or retain books of account and other documents in accordance with the provisions of this Act or the rules made thereunder;

(xvii) fails to furnish information or documents called for by an officer in accordance with the provisions of this Act or the rules made thereunder or furnishes false information or documents during any proceedings under this Act;

(xviii) supplies, transports or stores any goods which he has reasons to believe are liable to confiscation under this Act;

(xix) issues any invoice or document by using the registration number of another registered person;

(xx) tampers with, or destroys any material evidence or document;

(xxi) disposes off or tampers with any goods that have been detained, seized, or attached under this Act.

Q14) Write a short note on E-way bill. 5

A14) E-Way Bill is an Electronic Way bill for movement of goods to be generated on the eWay Bill Portal. A GST registered person cannot transport goods in a vehicle whose value exceeds Rs. 50,000 (Single Invoice/bill/delivery challan) without an e-way bill that is generated on ewaybillgst.gov.in. Alternatively, Eway bill can also be generated or cancelled through SMS, Android App and by site-to-site integration through API. When an eway bill is generated, a unique Eway Bill Number (EBN) is allocated and is available to the supplier, recipient, and the transporter.

EWay bill will be generated when there is a movement of goods in a vehicle/ conveyance of value more than Rs. 50,000 (either each Invoice or in aggregate of all invoices in a vehicle/conveyance):

- In relation to a ‘supply’

- For reasons other than a ‘supply’ ( say a return)

- Due to inward ‘supply’ from an unregistered person

For this purpose, a supply may be either of the following:

- A supply made for a consideration (payment) in the course of business

- A supply made for a consideration (payment) which may not be in the course of business

- A supply without consideration (without payment)In simpler terms, the term ‘supply’ usually means a:

- Sale – sale of goods and payment made

- Transfer – branch transfers for instance

- Barter/Exchange – where the payment is by goods instead of in money

Q15) Write a small note on registration. 5

A15) Registration of any business entity under the GST Law implies obtaining a unique number from the concerned tax authorities for the purpose of collecting tax on behalf of the government and to avail Input tax credit for the taxes on his inward supplies. Without registration, a person can neither collect tax from his customers nor claim any input tax credit of tax paid by him.

Registration will confer the following advantages to a taxpayer:

• He is legally recognized as supplier of goods or services.

• He is legally authorized to collect tax from his customers and pass on the credit of the taxes paid on the goods or services supplied to the purchasers/ recipients. • He can claim input tax credit of taxes paid and can utilize the same for payment of taxes due on supply of goods or services.

• Seamless flow of Input Tax Credit from suppliers to recipients at the national level.

Q16) What categories of persons are required to register compulsory registration? 12

A16) The following categories of persons shall be required to be registered under this Act,––

(i) persons making any inter-State taxable supply;

(ii) casual taxable persons making taxable supply;

(iii) persons who are required to pay tax under reverse charge;

(iv) person who are required to pay tax under sub-section (5) of section 9;

(v) non-resident taxable persons making taxable supply;

(vi) persons who are required to deduct tax under section 51, whether or not separately registered under this Act;

(vii) persons who make taxable supply of goods or services or both on behalf of other taxable persons whether as an agent or otherwise;

(viii) Input Service Distributor, whether or not separately registered under this Act;

(ix) persons who supply goods or services or both, other than supplies specified under sub-section (5) of section 9, through such electronic commerce operator who is required to collect tax at source under section 52;

(x) every electronic commerce operator;

(xi) every person supplying online information and database access or retrieval services from a place outside India to a person in India, other than a registered person; and

(xii) such other person or class of persons as may be notified by the Government on the recommendations of the Council.

Q17) Who can opt for composite scheme under GST? 2

A17) The following people cannot opt for the scheme-

- Manufacturer of ice cream, pan masala, or tobacco

- A person making inter-state supplies

- A casual taxable person or a non-resident taxable person

- Businesses which supply goods through an e-commerce operator

Q18) Write a note on period of retention of relevant record. 4

A18) Every registered person required to keep and maintain books of account or other records in accordance with the provisions of sub-section (1) of section 35 shall retain them until the expiry of seventy-two months from the due date of furnishing of annual return for the year pertaining to such accounts and records:

Provided that a registered person, who is a party to an appeal or revision or any other proceedings before any Appellate Authority or Revisional Authority or Appellate Tribunal or court, whether filed by him or by the Commissioner, or is under investigation for an offence under Chapter XIX, shall retain the books of account and other records pertaining to the subject matter of such appeal or revision or proceedings or investigation for a period of one year after final disposal of such appeal or revision or proceedings or investigation, or for the period specified above, whichever is later.

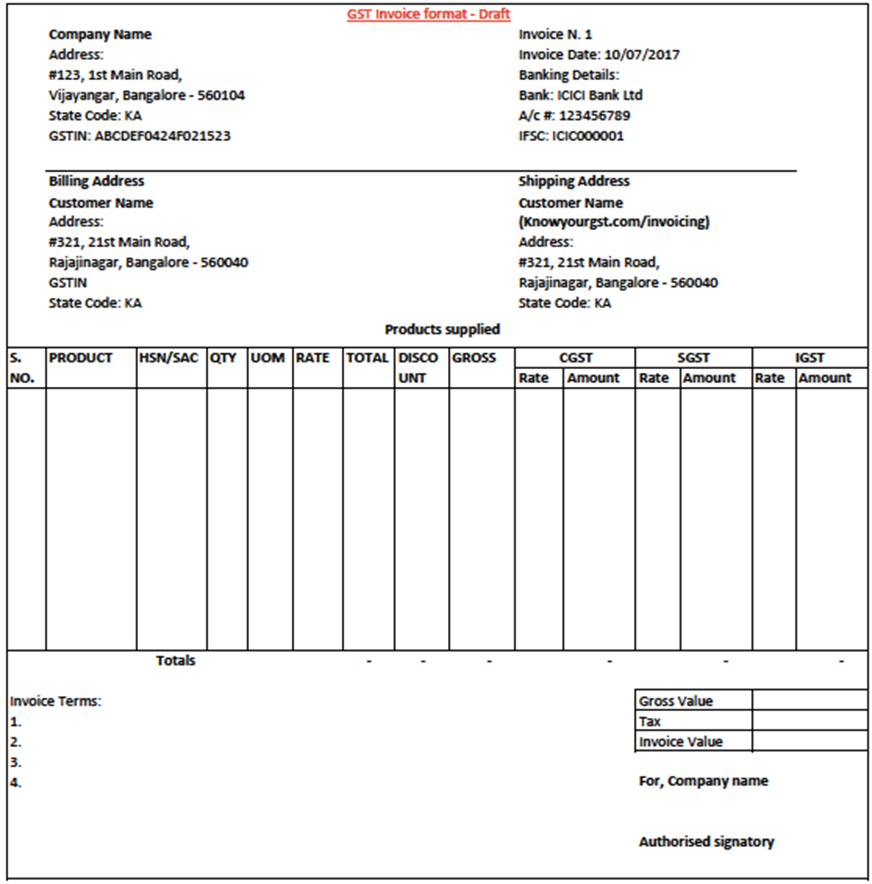

Q19) Draw a specimen format of GST. 5

A19)

Q20) State the provisions related to debit note and credit note. 4

A20) The provisions related to debit and credit note are provided under section 34 of the GST act-

(1) Where a tax invoice has been issued for supply of any goods or services or both and the taxable value or tax charged in that tax invoice is found to exceed the taxable value or tax payable in respect of such supply, or where the goods supplied are returned by the recipient, or where goods or services or both supplied are found to be deficient, the registered person, who has supplied such goods or services or both, may issue to the recipient a credit note containing such particulars as may be prescribed.

(2) Any registered person who issues a credit note in relation to a supply of goods or services or both shall declare the details of such credit note in the return for the month during which such credit note has been issued but not later than September following the end of the financial year in which such supply was made, or the date of furnishing of the relevant annual return, whichever is earlier, and the tax liability shall be adjusted in such manner as may be prescribed:

Provided that no reduction in output tax liability of the supplier shall be permitted, if the incidence of tax and interest on such supply has been passed on to any other person.

(3) Where a tax invoice has been issued for supply of any goods or services or both and the taxable value or tax charged in that tax invoice is found to be less than the taxable value or tax payable in respect of such supply, the registered person, who has supplied such goods or services or both, shall issue to the recipient a debit note containing such particulars as may be prescribed.

(4) Any registered person who issues a debit note in relation to a supply of goods or services or both shall declare the details of such debit note in the return for the month during which such debit note has been issued and the tax liability shall be adjusted in such manner as may be prescribed.