Unit 2

EDP

Q1) Write a short note on bank. 5

A1) Finance is the lifeline of trade, commerce and industry. Today, the banking sector serves as the backbone of modern business. The development of any country relies primarily on the banking system.

The term bank is derived from the Old Italian banca or French banque, both meaning benches and money changer tables. In the olden days, money changers and money changers in Europe used to display coins from various countries on benches and tables in large piles (quantities) for the purpose of lending and exchanging.

Banks are financial institutions that handle deposits, prepayments and other related services. Receive money from people who want to save in the form of deposits and lend money to those who need it.

The Oxford Dictionary defines a bank as "a facility for storing money paid on customer orders."

Simply put, a bank can be defined as a business activity that receives, protects, and lends money owned by other individuals or groups for profit. However, over time, the activities covered by banking have expanded, and banks offer a variety of other services. Recent banking services include debit and credit card issuance, secure storage of valuables, lockers, ATM services, and online money transfers in countries and around the world.

Banks are often said to play a quiet yet important role in our daily lives. Banks perform financial intermediaries by pooling savings and directing them to investments through maturity and risk transformations, thereby continuing to drive the growth engine of the economy.

Q2) What is a commercial bank? What are its types? 5

A2) A commercial bank is a type of financial institution that does everything from depositing and withdrawing money to the general public and providing loans for investment. These banks are commercial institutions and operate solely for commercial purposes.

The two main characteristics of commercial banks are lending and borrowing. Banks receive deposits and give money to various projects to earn interest (profit). The interest rate that a bank provides to depositors is called the borrowing interest rate, and the interest rate that a bank lends money to is called the lending interest rate.

Types of commercial banks:

There are three different types of commercial banks.

Private Bank –: A type of commercial bank in which an individual or company owns a majority of the equity capital. All private banks are recorded as limited liability companies. Banks such as Housing Development Finance Corporation (HDFC) Bank, India Industrial Credit Investment Corporation (ICICI) Bank, Yes Bank, etc.

Public Banks –: A type of nationalized bank in which the government holds important shares. For example, Bank of Baroda, State Bank of India (SBI), Dena Bank, Corporation Bank, Punjab National Bank.

Foreign Banks –: These banks are established abroad and have branches in other countries. For example, banks such as American Express Bank, Hongkong and Shanghai Banking Corporation (HSBC), Standard & Chartered Bank, and Citibank.

Commercial Bank Example

Here are some examples of commercial banks in India:

- State Bank of India (SBI)

- Housing Development Finance Corporation (HDFC) Bank

- Indian Industrial Credit Investment Corporation (ICICI) Bank

- Dena Bank

Q3) Explain the functions of commercial bank. 5

A3) The functions of commercial banks fall into two major divisions.

(A) Main functions

Accept Deposits: Banks receive deposits in the form of savings, current and fixed deposits. Surplus balances collected from companies and individuals are lent out as a temporary requirement for commercial transactions.

Providing Loans and Prepaid: Another important function of this bank is to provide entrepreneurs and businessmen with loans and prepayments and collect interest. For all banks, it is a major source of profit. In this process, the bank holds a small number of deposits as reserves and provides (lends) the remaining amount to the borrower at banks such as demand loans, overdrafts, cash credits and short-term loans.

Credit Cash: When a customer is offered a credit or loan, no liquid cash is offered. First, a bank account is opened for the customer and then the money is transferred to that account. This process allows banks to make money

(B) Secondary function

Bill of exchange discount: This is a written agreement approving the amount to be paid for goods purchased at a particular point in the future. You can also settle the amount before the estimated time by using the discount method of the commercial bank.

Overdraft Facility: A prepayment given to a customer by overdrawing the overdraft to a certain limit.

Buying and Selling Securities: Banks provide the ability to sell and buy securities.

Locker Equipment: Banks provide locker equipment to their customers to keep valuables and documents safe. The bank charges a minimum annual fee for this service.

Use various means such as promissory notes, checks, and bills of exchange.

Q4) Discuss the importance of commercial bank. 5

A4) Banks in growing international locations now no longer best carry out their everyday industrial banking functions, however additionally play powerful positions in monetary improvement. The enormous majority of human beings in such international locations are poor, unemployed and engaged in conventional agriculture.

There is a pointy scarcity of capital. People lack tasks and businesses. The approach of transportation is undeveloped. The enterprise is depressed. Commercial banks assist conquer those limitations and sell monetary improvement. The position of industrial banks in growing international locations is defined as follows.

1. Mobilization of financial savings for capital formation:

Commercial banks assist mobilize financial savings via a community of department banks. People in growing international locations have low incomes, however banks inspire them to shop via way of means of introducing one of a kind deposit schemes to healthy the desires of man or woman depositors. They additionally mobilize some wealthy idol financial savings. By mobilizing financial savings, banks direct their financial savings to effective investments. Therefore, they assist the capital formation of growing international locations.

2. Financial enterprise:

Commercial banks fund the economic area in a number of ways. They provide short-time period, medium-time period and long-time period loans to the enterprise. In India, they provide short-time period loans. Revenues from Latin American international locations like Guatemala permit them to pursue medium-time period loans for one to 3 years. However, in South Korea, industrial banks also are selling long-time period loans to enterprise.

In India, industrial banks boost short-time period and medium-time period investment for small industries and additionally offer employment buy investment. What's more, they underwrite big-scale business shares and company bonds. Therefore, they now no longer best fund the enterprise, however additionally assist broaden the undeveloped capital markets in such international locations.

3. Financial change:

Commercial banks aid the financing of home and overseas change. Banks offer outlets and wholesalers with loans to inventory the products they change. We additionally aid the motion of products from one place to any other via way of means of providing all kinds of centers, inclusive of reductions and receipts of payments of exchange, overdraft centers, and draft issuance. The Forex market centers for importers and exporters of products.

4. Agricultural financing:

Commercial banks aid big agricultural sectors in growing international locations in a number of ways. They offer loans to agricultural traders. They open a community of branches in rural regions to offer agricultural credit score. They without delay fund farmers for the sale of produce, modernization and mechanization of farms, the supply of irrigation centers, land improvement and more.

We additionally offer monetary aid for livestock, dairy, sheep breeding, hen farming, fish farming and horticulture. Small, restrained farmers and landless agricultural workers, craftsmen, and trivial shopkeepers in rural regions are furnished with monetary help via neighbourhood banks in rural India. These nearby banks function below industrial banks. Therefore, industrial banks meet the credit score necessities of all kinds of neighbourhood human beings.

5. Financing patron sports:

People in growing international locations are poor; low-profits and do now no longer have enough monetary sources to shop for long lasting patron items. Commercial banks lend to clients to shop for items together with homes, scooters, enthusiasts and refrigerators. In this way, industrial banks additionally assist enhance the same old of residing of human beings in growing international locations via way of means of presenting financing for patron sports.

6. Financing for task introduction sports:

Commercial banks fund task introduction sports in growing international locations. They offer financing for the schooling of younger human beings reading in engineering, scientific and different better schooling institutions. They prepay loans to younger entrepreneurs, scientific and engineering graduates, and different technically skilled human beings to set up their very own business. Such credit score traces are furnished via way of means of many industrial banks in India. Therefore, banks now no longer best aid inhumane capital formation, however additionally make contributions to expanded entrepreneurial interest in growing international locations.

7. Monetary coverage aid:

Commercial banks aid the country's monetary improvement via way of means of adhering to the primary bank's economic coverage. In fact, primary banks depend upon industrial banks for the fulfilment of monetary control rules in step with the necessities of growing economies.

In this way, industrial banks make contributions considerably to the increase of the growing financial system via way of means of lending to agriculture, change and enterprise, helping the formation of bodily and human capital, and following countrywide economic coverage.

Q5) Write the structure of commercial bank. 5

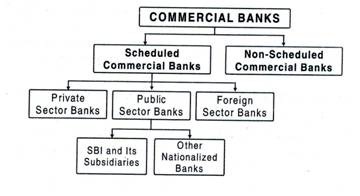

A5) The commercial banks can be broadly classified under two heads:

1. Scheduled bank:

Scheduled banks are the ones covered withinside the Second Schedule of the Reserve Bank of India Act of 1934.

In India, there are 3 varieties of business banks planned:

(i) Public zone banks:

These banks are owned and managed with the aid of using the government. The foremost motive of those banks isn't to make a profit, however to serve society. The State Bank of India, the Bank of India, the Punjab National Bank, the Bank of Canada, and the Corporation Bank are examples of public zone banks.

There are varieties of public zone banks.

(A) SBI and its subsidiaries.

(B) Other state-owned banks.

(ii) Private Banks:

These banks are owned and controlled with the aid of using personal businessmen. Their foremost motive is to make a profit. ICICI Bank, HDFC Bank and IDBI Bank are examples of personal banks.

(iii) Foreign banks:

These banks are owned and managed with the aid of using overseas promoters. The range has grown hastily seeing that 1991, whilst the method of monetary liberalization commenced in India. Bank of America, American Express Bank and Standard Chartered Bank are examples of overseas banks.

2. Unplanned bank:

Unplanned banks are banks that aren't covered withinside the Second Schedule of the Reserve Bank of India Act of 1934.

Q6) Explain balance sheet of a bank. 5

A6) A financial institution's stability sheet may be described as a part of a financial institution's economic statements that constitute its economic function. That is, it represents the economic function of a banking entity at a specific factor in time, commonly on the quit of the accounting period (quarterly, yearly, and as follows). Applicable Regulations) Created in strict compliance with relevant banking policies and countrywide policies that offer insights into banking property, liabilities and capital.

Banks do now no longer function like everyday companies. Therefore, a financial institution's stability sheet isn't like different non-economic institutions. A financial institution's stability sheet includes 3 parts: property, liabilities, and fairness. The predominant feature of a financial institution is to draw buyers and lend credit or loans to certified customers.

Assets: Therefore, withinside the banking world, property are commonly cash granted via way of means of banks, loans, or different means.

Debt: Where does debt now pass into the financial institution? Most frequently it's miles cash along with savers / depositors. Therefore, the quantity deposited via way of means of the saver withinside the financial institution is the obligation of the financial institution. Both property and liabilities are pondered at the financial institution's stability sheet. Assets consist of 3 categories: worthwhile property, non-worthwhile property, coins and coins equivalents.

Capital: Capital fairness is a financial institution's very own useful resource together with shareholder-funded capital and retained income of the financial institution.

Q7) Write the importance of assets and liabilities. 8

A7) Importance of main Liabilities and Assets.

- Assets-Use of funds

Balance sheet assets consist of the assets available to a company, that is, the goods and other means that the company uses to perform its business functions. The assets are displayed on the left side of the balance sheet. Here's how they are categorized:

- Fixed asset

- Current assets

- Accrual and deferral

- Deferred tax asset

- Asset difference from asset offset

- Fixed asset

Fixed assets include all assets and other products that are permanently available to the company and used to operate its business. This includes, for example, production machinery, vehicles, land and buildings, as well as intangible assets such as patents, licenses and brands, long-term financial assets and investments in companies.

b. Current assets

Liquid assets, on the other hand, consist of funds and goods that the company can freely use in the short term for investment purposes. These are, for example, raw materials, components, or intermediate products that are then consumed, sold, or converted to other products. A company's current assets also include bank balances, cash on hand, accounts receivable from debtors, and short-term financial assets.

c. Accrual and deferral

Prepaid expenses are paid in one accounting period but will not be used until a future accounting period. On the balance sheet asset side, the item includes expenses that were incurred before the balance sheet but represent costs only at a later date, such as prepaid.

d. Deferred tax asset

Deferred tax assets can be included on the asset side of the balance sheet if the commercial balance sheet and the tax balance sheet are different so that tax cuts can be expected in the next fiscal year. Through the loss carried forward.

e. Active difference from asset offset

For pension obligations to employees and similar long-term obligations, the current fair value of assets that serve this purpose is important (rather than the principle of acquisition). These liabilities are set off against the assets, contrary to the set-off prohibitions that apply otherwise. If the asset is higher than the liability, an active difference will occur. The amount must also be displayed on the asset side of the balance sheet.

2. Debt – Source of Funding

The liabilities are displayed on the right side of the balance sheet. They show where the company's money came from. Balance sheet liabilities are broadly categorized as follows:

- Equity

- In anticipation

- Liabilities

- Accrual and deferral

- Deferred tax liability

All balance sheet items except equity are summarized here by the term "borrowed capital". These are the values available to the company, but they must be repaid (safely or perhaps) in the foreseeable future. It also includes provisions for expected liabilities.

- Equity

Equity includes subscribed capital. Depending on the legal form of the company, this is called a capital increase in addition to the usual stock capital. In addition, capital consists of reserves. A company's capital reserve is created, for example, when shares are issued in excess of their normal value. This reserve is, so to speak, externally funded, but the revenue reserve may come from the company itself and need to be formed from the company's performance. Profit or loss carried forward is also counted as capital. This is the residual profit / loss from the previous year. Finally, the net income or loss for the year also belongs to capital.

b. In anticipation

Anticipation is obligatory. There are uncertainties regarding future pension payments or taxes regarding the actual amount and when it will occur.

c. Liabilities

All specific company liabilities also appear on the liabilities side of the balance sheet. Corresponding funds are still available, but must be repaid on a known date. Therefore, they are included in the debt.

d. Accrual and deferral

Services provided by the entity after the balance sheet date but pre-billed will appear as deferred income on the balance sheet (for example, rental income for the following year).

e. Deferred tax liability

Like deferred tax assets, there are deferred tax liabilities. These are the expected future payment obligations to the tax office due to various asset valuations, liabilities, and deferred income in accordance with commercial law and tax standards. They belong to debt capital and must be presented on the debt side of the balance sheet.

Assets and liabilities are at the proper and left facets of the company's stability sheet. This stability sheet is a crucial manner to offer data approximately a company's monetary situation. If your commercial enterprise is a dwelling thing, those might be its critical signs. Assets and liabilities are crucial factors of your company's monetary position. Revenues and costs constitute the waft of budget thru a company's commercial enterprise. Balance sheets are organized in line with suitable accounting principles, that is, the guidelines that marketers who're obliged to put together stability sheets should follow whilst recording commercial enterprise transactions in the modern-day accounting framework.

Q8) What is a regional rural bank? 5

A8) Local regional banks are Indian fixed-term commercial banks that carry out local banking operations at the state level.

It was founded with the aim of providing easy access to rural people with banking and credit services and mobilizing financial resources from urban to rural areas of India. Therefore, the RRB forms an important element of India's financial services sector.

RRB operates at the district level in the state and may cover multiple districts in the state.

Like other commercial banks, the Regional Rural Bank's organization consists of a board of directors, chairman, managing director, manager, regional manager, and assistant staff.

The Narasimhan Commission on Rural Credit under Prime Minister Indira Gandhi has made certain recommendations on the formation of RRBs that are beneficial to rural residents compared to commercial banks.

The Local Bank Establishment Ordinance was passed on September 26, 1975, which is the date of establishment of RRB.

The Local and Regional Banking Act (RRB Act) was passed in 1976.

The first five RRBs were established on the anniversary of Gandhi Jayanti on October 2, 1975. Since then, many RRBs have been established by the Government of India and their respective state governments.

The RRB Act of 1976 describes the function of the RRB to provide financial assistance to farmers, small and medium-sized enterprises (MSMEs), local artisans and artisans for agriculture, industry, trade, commerce and their economic development. .. Within a year of the enactment of this law, 25 RRBs were established.

Q9) Write the function of regional rural bank. 8

A9) Local banks are fixed-term commercial banks, so their main function is to accept deposits and pay loans. The important functions of regional banks are explained below.

1. Accept deposits

RRB accepts deposits from members who have an account at the bank.

Deposits can be made in your current account or savings account.

Depositors can also be created in fixed or recurring format.

2. Loan extension

The RRB Act of 1975 states that RRB can provide loans and credit services to priority sectors (PS). Loans to this sector are classified as PSL or preferred sector loans. RBI announced that it will cover RBB with PSL from 1997.

Priority sectors consist of small and marginal farmers, craftsmen and artisans, local traders, small and medium-sized enterprises, education, housing and renewable energy that require development and financial investment.

75% of total bank credit must be provided to the preferred lending sector. Of this total credit, 10% must be given to the economically weak section.

Therefore, low interest rate short-term loans are provided by these banks to the preferred sector. However, RRB cannot offer large or long-term loans to its customers.

3. Payment of wages

Local banks in India play an important role in wage distribution under MGNREGA (Mahatma Gandhi National Local Employment Guarantee Act), Pradan Mantri Gram Sadak Yojana (PMGSY).

Pensions offered under India's poverty reduction and pension schemes are also distributed through these banks.

4. RRB secondary function

Similar to commercial banks, the secondary function of Indian regional banks is to provide their clients with agency services and general utility services.

Agency services such as foreign exchange, bill payments and wire transfers are performed by RRB.

Utility services such as ATMs, UPIs, debit card issuance and locker facilities are also provided by RRB in India.

Q10) Cooperative banking in India. Explain 8

A10) Co-operative banks are establishments which are installed on the idea of co-operatives and perform regular banking operations. Like different banks, co-operative banks are installed via way of means of elevating budget via stocks, accepting deposits and supplying loans.

However, cooperative banks fluctuate from joint-inventory corporations withinside the following points.

(i) Cooperative banks problem restrained legal responsibility stocks, and joint-inventory corporations’ problem restrained legal responsibility stocks.

(ii) At a credit score cooperative bank, one shareholder casts one vote irrespective of the range of stocks held. In a joint-inventory company, the vote casting rights of shareholders are decided via way of means of the range of stocks held.

(iii) Co-operative banks are commonly inquisitive about nearby credit score and offer monetary help to agricultural and nearby activities. Ltds are normally inquisitive about exchange and business credit score requirements.

(iv) India's co-operatives have a federal shape. The number one credit score affiliation is withinside the lowest rung. Next are district-degree critical co-operative banks and nation-degree nation co-operative banks. The organization does now no longer have this sort of federal shape.

(v) Cooperative Credit Unions are placed in villages in the course of the country. Co., Ltd. And its branches are specifically focused in city areas, especially in massive cities

History of Indian Cooperatives:

The Indian co-operative motion becomes initiated normally to deal with nearby credit score issues. The records of Indian credit score cooperatives started out with the passage of the Cooperative Law in 1904. The motive of this regulation becomes to set up a co-operative credit score union that "promotes savings, self-assist and cooperation amongst farmers, craftsmen and those of restrained means".

Many co-operative credit score unions had been installed below this regulation. The Cooperative Act of 1912 diagnosed the want to set up a brand new employer for the supervision, auditing and deliver of co-operative credit score. These companies had been: (A) A union along with a number one society. (B) Central bank; (c) Regional bank.

It started out with the route of organising co-operatives and increasing co-operative credit score, however development remained insufficient at some stage in the pre-independence period. Even after working for 1/2 of a century, co-operative credit score shaped handiest 3.1 percentage of general nearby credit score among 1951 and 1952.

Q11) What is State Cooperative Bank? Explain its functions. 3

A11) A co-operative bank is a type of bank that provides financial services to co-operatives and organizations that its members own. When the state runs these banks they are called state co-operative banks.

Co-operative banks also perform the basic banking functions of banking but they differ from commercial banks in the following respects

1. Commercial banks are joint-stock companies under the companies’ act of 1956, or public sector bank under a separate act of a parliament whereas co-operative banks were established under the co-operative society’s acts of different states.

2. Commercial bank structure is branch banking structure whereas co-operative banks have a three tier setup, with state co-operative bank at apex level, central / district co-operative bank at district level, and primary co-operative societies at rural level.

3. Only some of the sections of banking regulation act of 1949 (fully applicable to commercial banks), are applicable to co-operative banks, resulting only in partial control by RBI of co-operative banks and

4. Co-operative banks function on the principle of cooperation and not entirely on commercial parameters.

Q12) Explain the structure of Cooperative bank. 8

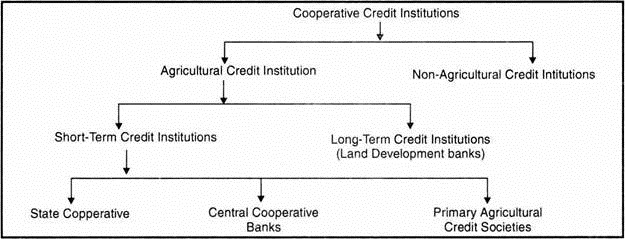

A12) In rural India, there may be a three-tiered short-time period rural co-operative shape. Tier-I consists of nation-degree nation co-operative banks (SCBs). Tier-II consists of the district-degree Central Cooperative Bank (CCB). Tier-III consists of the Primary Agricultural Credit Association (PACS)

Nineteen states have a three-tiered short-time period co-operative credit score shape along with SCB, CCB, and PACS. There also are degrees of short-time period co-operative shape withinside the 12 states. In the north - eastern states, inclusive of Sikkim, the shape is -tiered and is composed handiest of SCB and PACS.

As of March 31, 2013, there had been 31 SCBs, 370 CCBs, and 92432 PACSs. As of March 31, 2012, the mortgage loaned with the aid of using SCB become Rupees. The 75600 crore with the aid of using CCB become Rs. It become Rs in step with 14400 rupees and PACS. 91200 Crore.

1. State Cooperative Bank (SCB):

Function and organization:

The nation co-operative financial institution is the top of the 3-tiered co-operative credit score shape working on the nation degree. Every nation has a nation co-operative financial institution.

State co-operative banks occupy a completely unique role withinside the co-operative credit score shape with 3 essential functions:

(A) They offer a hyperlink for the Reserve Bank of India to offer credit score to co-operatives and consequently to take part in rural finance.

(B) Act as a balancing middle for significant co-operative banks with the aid of using making the excess price range of a few significant co-operative banks available. Central Cooperative Banks aren't allowed to borrow or lend among them.

(C) They fund, control and supervise Central Cooperative Banks and, thru them, fundamental credit score societies.

Capital:

State co-operative banks acquire operating capital from their personal price range, deposits, borrowings and different reassets of funding.

(i) Own price range encompass fairness capital and diverse forms of reserves. Most of the fairness capital is procured from member co-operatives and significant co-operative banks, and the relaxation is contributed with the aid of using the nation authorities. Individual contributions to fairness capital are very small.

(ii) The predominant reassets of deposits also are co-operatives and significant co-operative banks. The final deposits are from people, neighbourhood organizations, etc.

(iii) State co-operative financial institution borrowings are on the whole from reserve banks, with the relaxation coming from nation governments and the like.

Loans and prepayments:

State co-operative banks are on the whole interested by presenting loans and prepayments to co-operatives. Over 98% of those societies are financed, of which approximately 75% are short-term. In maximum cases, loans are supplied for agricultural purposes.

The quantity of nation co-operative banks improved from 15 in 1950-fifty one to 21 in 1960-sixty one and 28 in 1991-ninety two. Loans made with the aid of using those banks improved from the rupee. Forty two rupees in 1950-fifty one. From 1960-sixty one to 26 billion rupees or even rupees. Rs 768 five billion in 1991-ninety two.

2. Central Cooperative Bank (CCB):

Function and organization:

The Central Cooperative Bank is withinside the center of a 3-tiered co-operative credit score shape.

There are forms of significant co-operative banks.

(A) There can be co-operative banking unions whose individuals are open handiest to co-operatives. Such co-operatives exist in Haryana, Punjab, Rajasthan, Orissa and Kerala.

(B) There can be a mixture of significant co-operative banks whose individuals are open to each people and co-operatives. Central co-operative banks withinside the final states are of this type. The predominant characteristic of the Central Cooperative Bank is to offer loans to fundamental co-operatives. However, a few loans also are supplied to people and others.

Capital:

Central Cooperative Banks increase operating capital from their personal price range, deposits, borrowings and different reassets of funding. Self-financing is composed in general of fairness capital contributed with the aid of using co-operatives and nation governments, with the relaxation such as reserves.

Deposits come on the whole from people and co-operatives. Some deposits are acquired from neighbourhood organizations. Deposit mobilization with the aid of using significant co-operative banks varies from nation to nation.

For example, it's far lots better in Gujarat, Punjab, Maharashtra and Himachal Pradesh, however very low in Assam, Bihar, West Bengal and Orissa. Borrowings are especially from reserve banks and pinnacle banks.

Loans and prepayments:

The quantity of significant co-operative banks in 1991-ninety two becomes 361, and the entire quantity of loans made with the aid of using them in 1991-ninety two become rupees. 14226 Crore. Co-operatives get hold of approximately 98% of loans, and approximately 75% of loans are short-term. In maximum cases, loans are supplied for agricultural purposes.

Approximately 80% of loans to co-operatives are unsecured and the final loans are to securities including commodities, agricultural products, actual estate, authorities and different securities.

Overdue issues:

The maximum disastrous function of the functioning of Central Cooperative Banks is the growth in heavy and antisocial loans. In 1997-98, the ratio of delinquency to call for on the significant co-operative degree becomes 34.

According to a evaluate of the Reserve Bank of India's 1974-seventy six Indian Cooperative Movement, the principle reasons of those delinquency are:

(A) Natural failures including floods and droughts that have an effect on the borrower's capacity to repay.

(B) Inadequate and inefficient supervision with the aid of using banks.

(C) Poor excellent and control of society and banks.

D) There isn't any any credit score and advertising and marketing hyperlink.

(E) Resistance to obligatory measures.

(F) If obligatory measures are taken, the device will now no longer be capable of put into effect the decree promptly.

A relevant quarter making plans scheme has been evolved for the rehabilitation of vulnerable relevant co-operative banks. This scheme gives semi-monetary guide to offset non-appearing loans, losses, and irreparable delinquency for small and marginal farmers.

3. Primary Agricultural Credit Association (PACS):

Function and organization:

Primary agricultural credit score unions shape the idea of a three-tiered co-operative credit score structure. A village-stage group that offers at once with rural humans. It encourages financial savings amongst farmers, accepts deposits from them, offers loans to terrible borrowers, and collects repayments.

It serves because the very last hyperlink among the remaining borrower, the locals on the only hand, and the better establishments, the Central Cooperative Bank, the State Cooperative Bank, and the Reserve Bank of India, on the alternative hand.

A principal agricultural credit score society can begin with extra than 10 humans’ withinside the village. The club rate is small, so even the poorest agronomist can emerge as a member.

Members of society have limitless liability. In different words, withinside the occasion of a social collapse, every member is completely accountable for the lack of society as a whole. Social manage is beneath the manager of the elected group.

Capital:

The operating capital of principal credit score societies comes from their personal finances, deposits, borrowings and different reassets of funding. Own finances include fairness capital, club charges and reserves. Deposits are acquired from each individuals and non-individuals. Borrowings are especially from Central Cooperative Banks.

In fact, borrowing bureaucracy a chief supply of operating capital for society. People normally do now no longer deposit their financial savings in co-operatives due to the fact higher belongings aren't to be had to savers in phrases of poverty, low financial savings habits, and the fee of go back and threat from those societies.

Coverage:

From 1999 to 2000, there had been 88,000 principal agricultural societies overlaying extra than 96% of rural areas. The variety of individuals of those societies changed into 868 million rupees. Over the beyond few decades, Reserve Banks have laboured with kingdom governments to reorganize possible number one credit score societies and take diverse steps to combine infeasible societies with large-scale multipurpose societies.

These paintings of reorganizing principal societies into effective and possible devices has been finished in nearly each kingdom besides Gujarat, Maharashtra and Jammu and Kashmir. The variety of number one societies, which accelerated from 105,000 in 1950-fifty one to 212,000 in 1960-sixty one, reduced from 1999 to 2000 to 92,000 because of the reorganization.

Advanced loan:

Loans loaned through the Primary Credit Association have proven a fashion of three non-stop growths. They were given up from the rupee. 23 rupees in 1950-51. Rupees 20.2 billion in 1960-61 or even rupees. 13600 crores in 1999-2000.

Only individuals of society are entitled to loans from them. Most of the loans are short-time period loans and are for agricultural purposes. Loans are difficulty to low hobby rates.

Society is anticipated to growth lending to weaker elements of rural communities, in particular small and confined farmers. However, there are critical troubles with social delinquency loans growing from Rs. Rupees from 6 crores in 1950-fifty one. Forty four rupees to 1960-sixty one and rupees. Rupees 287.five billion in 1991-92.

Land Development Bank (LDB) or Cooperative Agricultural and Rural Development Bank (CARDB):

In addition to short-time period credit score, farmers additionally want long-time period credit score for everlasting development of land, compensation of vintage debt, and buy of agricultural equipment and different tools. Traditionally, the long-time period necessities of farmers were met basically through cash creditors and numerous different establishments. However, this supply of credit score grew to become out to be wrong and changed into accountable for the exploitation of the farmers.

Cooperative banks and industrial banks aren't in a function to offer long-time period loans through their nature, as their deposits are basically demand (short-time period) deposits. Therefore, there has been a splendid want for specialised establishments to offer long-time period credit score to farmers. The established order of the Land Development Bank, now called the Cooperative and the Rural Development Bank (CARDB), is an attempt on this direction.

Structure:

The Land Development Bank is registered as a co-operative; however its duties are confined.

These banks have a two-tier structure.

(A) At the state level, there is a state or central land development bank, now known as the State Cooperative Agriculture and Rural Development Bank (SCARDB). They were formerly known as Central Land Mortgage Bank,

(B) At the local level, there are branches of the State Land Development Bank or SCARDB and the Primary Land Development Bank, now known as the Primary Cooperative Agricultural and Rural Development Bank (PCARDB).

Some states do not have a primary land development bank, but they do have a branch of the state land development bank. In Madhya Pradesh, the state co-operative bank itself functions as the state's land development bank. Other states, such as Andhra Pradesh, Kerala, and Maharashtra, have land development banks in several states.

Similarly, primary land development banks vary systematically from state to state. At the national level, the Land Development Bank has also formed a union called the All India Land Development Banking Union.

Capital:

Land Development Banks raise funds from equity capital, reserves, deposits, loans, and corporate bonds. Bonds form the largest source of funding. Bonds are issued by the state land development bank.

They have fixed interest rates, variable maturities from 20 to 25 years, and are guaranteed by the state government. These bonds are subscribed to by Cooperative Banks, Commercial Banks, State Bank of India and Reserve Bank of India.

In addition to regular corporate bonds, the Land Development Bank also floats local corporate bonds for up to 7 years. These bonds are subscribed to by farmers, Panchayat, and Reserve Banks. The Reserve Bank has contributed significantly to the Land Development Bank's financing by funding state governments to contribute to the equity capital of these banks and by joining regular and local corporate bonds.

Growth:

In India, the first joint land mortgage bank was formed in 1920 in Chang, Punjab. However, the Central Land Development Bank was founded in 1929 and had an effective beginning in Madras. Later, other states also established such institutions.

The number of state co-operative agricultural and rural development banks (SCARDB), which was 5 in 1950-51, increased to 20 in 2013. The number of primary cooperative agricultural and rural development banks (PCARDB) was 697 in 2013.

Loans and prepayments:

Land Development Banks or SCARDBs provide long-term loans to farmers-(a) redemption of old debt, (b) improvement of land and cultivation methods, (c) purchase of expensive machinery, (d) special if you want to buy land. These banks offer loans for land mortgages, with loan durations ranging from 15 to 30 years.

From 1999 to 2000, the loans approved by these banks were 2520 rupees and the loan balance was rupees. 11670 Crore. The loan balance at the end of March 2012 was rupees. 19400 crores by SCARDB, Rs.12000 crores by PCARDB.

Land Development Bank Defects:

Land development banks have grown numerically over the years, but have made little progress in providing long-term loans to farmers.

The following are the factors that cause the land development bank's unsatisfactory performance.

i. Heterogeneous growth:

There was uneven growth in the Land Development Bank. These show some progress in states such as Andhra Pradesh, Tamil Nadu, Karnataka, Maharashtra and Gujarat. Other states have made little progress. About half of the states do not have land development banks.

Ii. Overdue issues:

The main problem facing land development banks is the presence of heavy delinquency. In addition, delinquency has continued to increase over the years. From 1991 to 1992, the land development bank's delinquency rate went from 42 to 44 percent.

Inadequate lending policies, inadequate supervision, overuse of loans, ineffective measures for recovery, and deliberate defaults are the main causes of inadequate levels of delinquency. Given the seriousness of the problem, the state government is advised to create and implement a time-limited program for a special recovery drive.

Iii. Lack of trained staff:

Although the Land Development Bank is growing quantitatively, there has been little qualitative improvement in the lending sector, primarily due to the lack of technical and supervisory staff. Necessary changes to the legislation of co-operative agencies are also needed to diversify lending activities for non-traditional development purposes and on the basis of non-landing security.

Iv. Other defects:

Other deficiencies of land development banks can be summarized below:

(A) These banks impose very high interest rates on the loans they offer.

(B) There are many delays and bureaucratic principles in granting loans.

(C) The second loan will not be prepaid unless the first loan is repaid.

(D) Instalments and loan terms are not fixed based on the borrower's ability to repay.

(E) The process of obtaining loans from these banks is so complex that agronomists are forced to seek help from money lenders.

(F) Weak parts of rural societies, such as landless workers, village craftsmen, and marginal farmers, are for production activities simply because they do not have sufficient security to provide land and loans. I can't get a loan from the bank.

(G) In most cases, loans are provided for the purpose of repayment and development of old loans.

v. Local Credit Survey Report:

A report by the All India Rural Credit Research Commission points out the inadequate performance of the Land Mortgage Bank (now called the Land Development Bank):

(A) These banks rise inadequate funding in an improper manner to meet demand and typically lend them in a manner that is not developed and coordinated.

(B) They behave as if previous debt, not production, claimed its attention. When

(C) They reach only the big cultivator and arrive late to him.

Credit Cooperative Evaluation:

Cooperative Credit Progress:

As a result of effective measures taken by the government and the Reserve Bank of India, India's co-operative banking system has made remarkable progress since independence. Co-operative credit, which was only 3.1% of total local credit in 1951-52, rose to 15.5% in 1961-62 and 22.7% in 1970-71.

The total amount of short-term credit granted by co-operatives increased from rupees. 23 rupees from 1951 to 1952. From 1961 to 1962, it was 20.3 billion rupees, and even rupees. The 1425 Crore of 1979-80. Therefore, during about 20 years (i.e., 1960-61 to 1979-80), short-term and medium-term lending increased more than seven-fold.

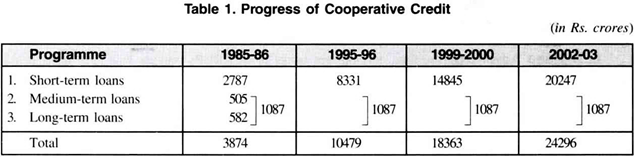

Table 1 shows that cooperative credit increased significantly from Rs. 3874 crore in 1985-86 to Rs. 10479 crore in 1995-96, and further to Rs. 24296 crore in 2002-03. Short-term cooperative credit increased from Rs. 2787 crore in 1985-86 to Rs. 8331 crore in 1995-96 and to Rs. 20247 crore in 2002-03. Medium-term and long-term cooperative loans increased from Rs. 1087 crore in 1985-86 to Rs. 2148 crore in 1995-96 and to Rs. 4049 crore in 2002-03.

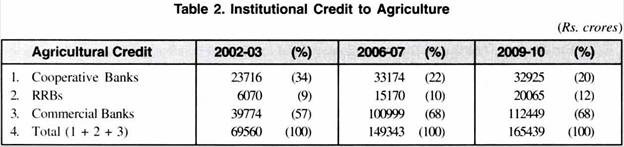

Table-2 shows that during 10th Five Year Plan (2002-03 to 2006-07), agricultural credit from cooperative banks increased from Rs. 23716 crore (34%) to Rs. 33174 crore (22%). In 2009-10, it was Rs. 32925 crore (20%).

Q13) Write the importance of cooperative bank. 5

A13) The co-operative system must play an important role in promoting local finance and is particularly suitable for the situation in India.

The various benefits of co-operative credit institutions are listed below.

I. Alternative Credit Source:

The main purpose of the co-operative credit movement is to provide an effective alternative to the traditional flawed credit system of village money lending. Cooperatives tend to protect local people out of the control of money lenders. Money lending has traditionally dominated rural areas, imposing very high interest rates and exploiting the poor by manipulating accounts.

II. Cheap Country Credits:

The co-operative credit system has cheapened local credit, both directly and indirectly.

(A) Directly because co-operatives impose relatively low interest rates

(B) Indirectly, the existence of co-operatives as an alternative institution broke the money lending monopoly, thereby forcing him to lower interest rates.

III. Productive borrowing:

An important advantage of the Cooperative Credit System is that it changes the nature of the loan. Previously, cultivators were rented for consumption and other unproductive purposes. But now they are renting primarily for productive purposes. Co-operatives discourage unproductive borrowing.

IV. Encouragement for savings and investment:

Co-operative credit movements have encouraged savings and investment by developing frugal habits among farmers. Rural people tend to deposit their savings in co-operatives and other banking institutions instead of saving them.

V. Improvement of farming method:

Co-operatives have also been very helpful in introducing better agricultural methods. Cooperative credits can be used to purchase improved seeds, fertilizers, the latest tools and more. The Marketing and Processing Association has helped members buy inputs cheaply and sell produce at affordable prices.

VI. The role of co-operative banks before 1969:

Until the nationalization of major commercial banks in 1969, co-operatives were virtually the only institutional source of local credit. Commercial banks and other financial institutions provided little credit for agriculture and other rural activities. Cooperative credit to farmers as a percentage of total agricultural credit increased from 3.1 percent in 1951-52 to 15.5 percent in 1961-62 and to 22.7 percent in 1970-71.

On the other hand, agricultural credit provided by commercial banks as a percentage of total agricultural credit is almost negligible, dropping from 0.9% in 1951-52 to 0.6% in 1961-62 and in 1970-71.

VII. Role of Cooperatives since 1969:

After the commercial bank was nationalized in 1969, the government adopted a multi-institutional approach. Under this approach, both co-operative banks and commercial banks (including local regional banks) are being developed to fund the local sector.

However, this new approach also recognized the key role that co-operative credit institutions should play in lending to rural areas for the following reasons:

(A) Co-operative credit associations are best suited for the socio-economic situation of Indian villages.

(B) Cooperatives A vast network of co-operatives has been built over the years across the length and breadth of the country. This network cannot be duplicated or easily crossed.

(C) Co-operative institutions have acquired in-depth knowledge of local situations and local issues.

VIII. Appropriate Federal Structure of Cooperative Banking System:

The co-operative banking system consists of (a) major agricultural credit associations at the village level, (b) higher financial institutions in the form of central co-operatives and state co-operative banks, and (c) land development to provide long-term credit. It has a federal structure with banks. For agriculture. Such a banking structure is essential and is particularly well suited to effectively meet the financial requirements of the country's vast rural areas.

"Co-operatives are still in the countryside of India."

Q14) Explain the process of credit creation by bank. 3

A14) Credit creation is an extension of deposits. Bank credit creation is always based on the suspicion that a small percentage of users really need money. Similarly, banks expect that not all users will demand money from their deposits at any given time, as expected. There are two ways to analyze credit creation indicators.

1. Credit creation by a single bank

In a single banking framework, one bank handles all deposits and checks. The process of creating credits is clarified by the following theoretical model.

If the bank is expected to need to maintain a CRR of 20%.

If (Individual A) deposits 1,000 rupees in the bank, at that point the bank holds only 200 rupees and lends the remaining 800 rupees to someone else (Individual B). They open a credit account in the name of the borrower for the equivalent.

Banks also hold 20% of Rs. Promote 800 (e.g. Rs. 160) and the remaining Rs. 640 for personal C.

In addition, banks hold 20% of Rs. Advance 640 (e.g. Rs. 128) and the remaining Rs. 512 for personal D.

This cycle continues to the mandatory deposits that underlie Rs. An additional hold that underlies 1,000 rupees. This will lead to an additional 800 rupees or a sub-deposit. 4,000 (800 + 640 + 512 +…).

Adding the first deposit will give you a full deposit of Rs. 5,000. In this situation, the credit multiplier is 5 (a complement to the CRR) and the credit creation is a multiple of the first excess deposit of Rs. 800.

2. Credit creation through the entire banking system

There are many banks in the banking system and you cannot give more credit than you earn. When a bank makes a derivative deposit, you lose money to another bank.

A shortage of deposits at one bank is the addition of deposits at another bank. This exchange within the financial framework creates mandatory deposits and expands opportunities for additional formation of sub-deposits. [4] To make this cycle clearer:

Bank A makes an initial deposit of Rs 1,000, maintains a CRR of 20% and lends the remaining Rs 800 to another Bank B.

Again, we will hold 20% of 800 rupees (i.e. Rs .160 /-) and lend the remaining 640 rupees to Bank C.

This cycle continues until the first excess deposit of Rs 1,000 leads to a sub deposit of Rs 4,000. Adding the first deposit will give you a full deposit of Rs. 5,000. In this situation, the credit multiplier is 5 (a complement to the CRR) and the credit creation is a multiple of the first excess deposit of Rs. 800.

Q15) Discuss the determinants of general financial institution credit score.5

A15) The following factors spotlight 8 key determinants of general financial institution credit score. The determinants are:

1. Excessive preparation:

A financial institution's cap potential to create credit score relies upon on the whole quantity of extra reserves held via way of means of the whole banking machine over duration of time. The quantity of deposits created relies upon at once on the quantity of extra reserve.

2. Reserve rate:

The most quantity of credit score a financial institution can create additionally relies upon at the reserve necessities maintained during the banking machine. As the principal financial institution increases the minimal reserve requirement, the quantity of deposits generated during the banking machine will decrease. The opposite is likewise true.

3. People’s banking conduct:

The credit score-growing cap potential of business banks additionally relies upon on humans’ banking conduct. In industrialized international locations, humans’ banking conduct is properly advanced and maximum transactions are settled via way of means of check. Obviously, the credit score-growing potential of business banks is better in such international locations.

In growing international locations like India, the alternative is true. Banking centers aren't to be had in maximum rural regions wherein 70% of humans live. Moreover, banking practices aren't properly advanced in such international locations. In fact, the significant use of barter structures and absence of monetization in maximum growing international locations in Asia, Latin America and Africa has hampered more than one credit score expansions via way of means of the banking machine.

4. Availability of collateral securities:

Banks generally require securities to make a loan. If the borrower does now no longer have sufficient proper securities to offer, the whole quantity of deposits made via way of means of the banking machine can be small. Even if a financial institution is obsessed with lending, it can't boom the quantity of lending.

5. Existing enterprise conditions:

The quantity of credit score that may be created throughout the banking machine relies upon at the country of the financial system, and extra specially the prevailing enterprise situation. If the financial system is expanding, the call for items and offerings will boom. As a result, the earnings outlook can be bright.

Therefore, businessmen can promote extra and are obsessed with generating extra. Therefore, they take extra loans and the call for financial institution loans increases. This will assist banks boom the quantity of credit score. In contrast, banks can't generate a whole lot credit score while the financial system is in recession. At such times, there's little call for financial institution loans.

6. Banking machine growth:

The general quantity of credit score a financial institution could make relies upon at the growth of the country's banking machine. If the banking machine is properly advanced and there are numerous banks withinside the country, the credit score-growing cap potential of the banks can be high.

This is due to the fact the whole quantity of credit that may be created throughout the banking machine is a more than one of the whole extra reserves of the banking machine. However, a single (exclusive) financial institution withinside the machine can't create credit (deposits) that exceed its very own extra reserves.

7. Legal reserve:

If the statutory reserve is 10% however the business financial institution holds 20% reserve, the deposit (credit score) multiplier can be five rather than 10. So if the financial institution's coins deposits boom first, as an example Rs. 1,000, the whole boom withinside the final financial institution deposit can be handiest rupees. Not 5,000 rupees. 10,000. This is what's going on in international locations like India wherein cash markets are underdeveloped.

8. Cash leak:

When a depositor withdraws a positive quantity for the reason of spending (transaction), much less coins is left withinside the financial institution. Therefore, as humans’ call for cash transactions increases, so does the quantity of coins with humans out of doors the financial institution. This reduces the credit score-growing potential of business banks.

In short, the cap potential of business banks to generate credit score relies upon now no longer handiest on their very own coins necessities, however additionally at the coins necessities of public or non-banking structures. Their very own coins necessities rely broadly speaking at the principal financial institution's financial (credit score) policy.

Central banks regularly restrict the boom of the cash deliver so as to sluggish the financial system and reduce inflation. However, the coins necessities of the overall public depend upon the call for transactions on cash, that is, the quantity of cash humans call for spending purposes.

Q16) What do you mean by bank credit? 5

A16) The term bank credit refers to the amount of credit available to a business or individual in the form of a loan from a banking institution. Therefore, bank credit is the total amount that an individual or company can borrow from a bank or other financial institution. The borrower's bank credit depends on his or her ability to repay the loan and the total amount of credit the bank can lend. Bank credit types include car loans, personal loans, and mortgages.

Understand bank credit

Banks and financial institutions make money from the money they lend to their customers. These funds come from money that customers deposit in checks and savings accounts or invest in specific investment instruments such as certificates of deposit (CDs). Banks pay customers a small amount of interest on their deposits in return for using the service. As mentioned earlier, this money is lent to others and is known as bank credit.

Bank credit consists of the total amount of total funds that a financial institution provides to an individual or company. This is an agreement between the bank and the borrower that the bank lends to the borrower. By expanding credit, banks basically rely on the borrower to repay the principal balance and interest at a later date. Whether someone is authorized for credit and the amount they receive is based on their credit rating.

Approval is determined by the borrower's credit rating and income or other considerations. This includes the amount of collateral, assets, or debt you already have. There are several ways to ensure approval, such as reducing the total debt-to-revenue (DTI) ratio. The acceptable DTI ratio is 36%, but 28% is ideal. Borrowers are generally advised to keep their card balance below 20% of their credit limit and pay off all late accounts. Banks typically provide credit to borrowers who have an unfavourable credit history under conditions that benefit the bank itself (higher interest rates, lower lines of credit, and more restrictive terms).

Q17) State the types of bank credit. 5

A17) Bank credit is the total amount that a financial institution (that is, a bank) has the willingness and ability to provide a loan or prepayment to an individual or organization.

Bank credit can be divided into many sections by different criteria.

Depends on the purpose of credit

Ruse and Hudgins categorize loans into seven major categories and show their purpose.

Real estate loans are secured by real estate such as land, buildings and other structures, raising short-term loans for construction and land development and purchasing funds for farmland, housing, apartments, commercial structures and foreign real estate. Includes a long-term loan to do. ..

Financial institution loans include loans to banks, insurance companies, financial companies and other financial institutions.

Agricultural loans are extended to farms and ranches to support crop planting and harvesting, and to support livestock raising and care.

Commercial and industrial loans are granted to businesses to cover inventory purchases, tax payments, and salary payments.

Loans to individuals can be funded to purchase cars, mobile homes, appliances and other retail products, home repair and modernization, medical and other personal costs, directly to individuals or through retailers.

Other loans include all other loans, including securities loans.

A lease receivable in which a lender purchases equipment or vehicles and leases them to a customer.

By credit period

Loans can be divided into three categories, depending on how long the loan is offered.

Short-term credits will be repaid within a year. Companies use short-term loans to meet their working capital needs. Short-term loans are typically made to inventory and accounts receivable. These loans may also be unsecured, such as credit lines or revolving credits.

Medium-term credit will be repaid over a period of 1 to 5 years. Banks usually grant such loans to real estate. Interest rates on medium-term loans are higher than on short-term loans.

Long-term credit is a loan with a repayment period of more than 5 years. Long-term loans are used to build factories and factories, build homes, buy land, equipment and machinery. Real estate is used as securities for such loans.

Depends on the nature of the credit

Funded or non-documentary credits are provided from bank funds to individuals and organizations through their current or loan accounts. Loan credits include loans, cash credits and bank overdrafts.

Credits or documentary credits funded by the son are given by issuing various documents. This form of credit bank offers loans by lending reputation and fame rather than expanding cash. Examples of non-funded credits include letters of credit (LC) and bank guarantees.

These are the standard types of bank credits.

Q18) Write the problems of cooperative banks. 8

A18) Various committees, committees, and individual investigations reviewing the functioning of the Indian co-operative banking system point out many weaknesses in the system and make suggestions for improving the system.

The main weaknesses are listed below.

I. General Weaknesses of Primary Credit Society:

The organizational and financial restrictions of major credit societies significantly reduce the ability to provide adequate credit to local people.

The All India Rural Credit Review Board has pointed out the following weaknesses of major credit societies:

(A) Co-operative credit still accounts for a small proportion of farmers' total borrowings.

(B) The needs of tenants and smallholders are not fully met.

(C) More major credit societies are financially weak and unable to meet production-oriented credit needs.

(D) Overdue is surprisingly increasing at all levels.

(E) The Primary Credit Association was unable to provide appropriate and timely credit to the borrowing farmers.

II. Insufficient coverage:

Despite the fact that co-operatives currently cover almost every rural area of the country, the number of members in that rural household is only about 45 percent. Therefore, 55% of rural households are still not covered by the co-operative credit system.

In fact, the number of borrowing members of the Primary Credit Association is very small and is limited to several states such as Maharashtra, Gujarat, Punjab, Haryana and Tamil Nadu and relatively wealthy landowners.

The criteria for determining borrowing membership are as follows:

(A) Borrowing members as a percentage of rural households,

(B) Average amount of loans issued by each borrowing member, and

(C) Percentage of loans going to weak sections.

The Banking Commission of 1972 clarified the following reasons to low-borrowing member co-operatives:

(A) People are unable to provide the required security.

(B) Lack of up-to-date land records.

(C) Eligibility for a particular purpose of the loan.

(D) Insufficient credit limits specified.

(E) Troublesome conditions stipulated for loans such as equity capital contributions and compulsory savings deposits of 10% or 20% of the loan balance.

(F) Member defaults for repayment of loans.

III. Inefficient society:

Despite the fact that the major agricultural credit associations in most states have been reorganized into viable units, their lending operations have not improved. In Plan 7, it was observed that from 1982 to 1983, only 66,000 of the 94089 major agricultural credit associations in the country paid full-time secretaries. About 34,000 societies were at a loss.

IV. Overdue issues:

A serious problem with co-operative credit is the ever-increasing delinquency of co-operative institutions over the years. In 1991-92, the ratio of delinquency to demand at the Land Development Bank level was 57, at the Central Cooperative Bank level 41, and at the Primary Agricultural Credit Association level 39.

Overdue short-term credit structures are the most alarming in the north-eastern states. In the long-term lending sector, nine land development banks in Maharashtra, Gujarat, Madhya Pradesh, Bihar, Karnataka, Assam, West Bengal, Orissa and Nadu, Tamil are mostly functioning due to delinquency issues. I'm in trouble.

Large amounts of delinquency limit the recycling of funds and adversely affect the co-operative's lending capacity.

The Banking Commission of 1972 pointed out the following reasons for overdue loans:

(A) Indifferent or mismanagement of the primary society.

(B) Unhealthy lending policies that result in over-lending or lending unrelated to actual needs, or diversion of lending for other purposes.

(C) Vested interests and collective politics in society and willful defaulters.

(D) Inadequate supervision and inadequate recovery efforts on loan use.

(E) Lack of proper control of central co-operative banks over the primary community.

(F) Lack of proper links between credit and marketing agencies.

(G) If you do not take prompt action against the intentional defaulter. When

(H) Uncertain agricultural prices.

V. Regional disparity:

There was a large regional disparity in the distribution of co-operative credit. According to Plan 7, eight states, Andhra Pradesh, Gujarat, Haryana, Kerala, Madhya Pradesh, Maharashtra, Punjab and Rajasthan, account for about 80% of all credits paid. Short-term credits per hectare paid are different from rupees. 4 rupees at Assam , 718 in Kerala.

VI. Benefits for Big Land Owners:

Most of the benefits from co-operatives have been covered by large landowners because of their strong socio-economic status. For example, between 1984 and 1985, farmers with less than 2 hectares received only 38.8% of the total loan from major agricultural credit associations, while 55 landowners with more than 2 hectares. The proportion of the poorest rural population (i.e., peasants, peasants, landless workers) was only 6.2%.

VII. Lack of other facilities:

In addition to providing adequate and timely credit, small and limited farmers also need other facilities in the form of input supply (i.e. better seeds, fertilizers, pesticides, etc.), dissemination and marketing services.

These facilities will ensure that you can properly use the credits you have borrowed. Therefore, credit unions should be reorganized into multipurpose co-operatives.