Unit 2

Economic Trends

Q1) Define income. State the concepts associated with income.

Q2) Write a note on different concept of income.

A) to Q 1& 2

Income is the flow of money to an individual at a point of time. Thus, income can be expressed as Real income=Money income/price level.

Some concepts of income are-

GDP=C+I+G+(X-M)

Where, C=consumption

I=income

G=Govt. expenditure

X= export

M=import

2. Gross national product (GNP): It is market price of all goods and services produced in a year by residents of a country within the domestic territory as well as abroad.

GNP=GDP+NFIA

3. Net national product at market price (NNP): it is the market value of net output of final goods and services produces by an economy during a year and net factor income from abroad.

NNP=GNP-Depriciation

4. Personal income (PI): It refers to the total money income received by individuals and households of a country from all possible sources before direct taxes.

PI= NI-Corporate income taxes-undistributed corporate profits-social security contribution+ Transfer payments.

5. Disposable income (DI): It is the income left with individuals after payment of direct taxes from personal income.

DI= PI- direct taxes.

6. Per capital income: It is calculated by dividing the national income of the country by the total population of a country.

Per capital income= Total national income/total national population.

Q3) Define savings and investment.

A3) Savings

Savings is that part of income that is not consumed. In other words,

S =Y – C

Where, S= Savings

Y= Income

C= Consumption

Investment

Investment is defined as addition to the stock of physical capital (such as machines, buildings, roads etc., i.e. anything that adds to the future productive capacity of the economy) and changes in the inventory (or the stock of finished goods) of a producer. Investment decisions by producers, such as whether to buy a new machine, depend, to a large extent, on the market rate of interest. However, for simplicity, we assume here that firms plan to invest the same amount every year. We can write the ex-ante investment demand as

I = I/

I/

Where I/ is a positive constant which represents the autonomous (given or exogenous) investment in the economy in a given year.

Q4) Define industry. What are the types of industry.

Q5) “Industry is classified on the basis of size, materials and ownership.” Discuss.

A) to Q4 & 5-

Industry refers to all economic activity that is concerned with primary, secondary and tertiary activities production of goods, extraction of minerals or the provision of services. Industries can be classified on the basis of raw materials, size and ownership. For example, textile industry, automobile industry, food processing industry etc.

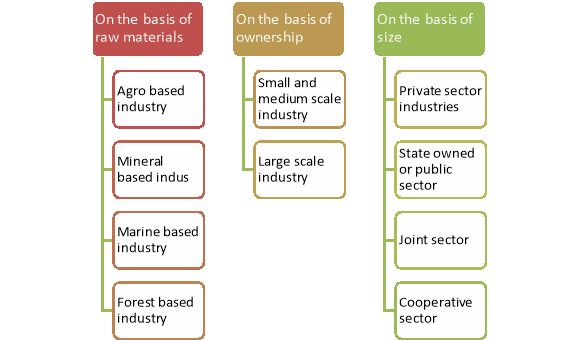

On the basis of raw materials, ownership and size the industry is classified as depicted in figure

Figure : Classification of industry

a) On the basis of raw materials

b) On the basis of size

c) On the basis of ownership

Q6) Discuss the factors that effect on location of an industry.

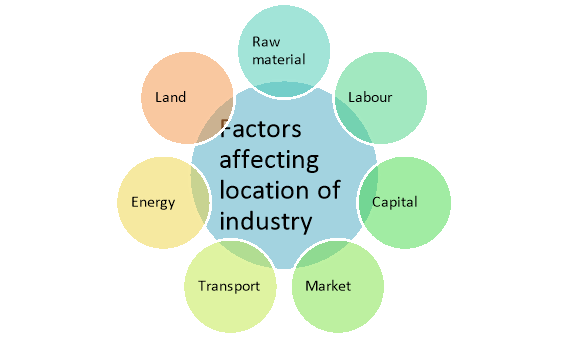

A6) Some of the important factors that affect the location of industry are highlighted in figure -

Figure: Factors affecting location of industry

Availability and access to raw materials influences on location of an industry. Labour industries industries are located where cheap labour is available, Iron and Steel industries are located Jamshedpur because of rich in iron ore.

2. Availability of labour

It influences on location of labour intensive industry because the industry can get large number of labour at low cost. For example, Bangladesh, India etc. has many labour intensive industries.

3. Accessibility to capital

Easy and convenient accessibility to credit for start-ups and existing industries leads to promotion of more industries. Govt. of India started to launch many schemes for promotion of industries. For example, MUDRA loan, start-up India, make in India etc.

4. Market access

Industry will localise in those areas it can easily access the market. It will help them to survive and grow in the market.

5. Transport

There should be good communication and transportation link for transporting the products to the market place from the place of production.

6. Availability of energy

Energy like electricity, gas, internet etc. should be available in the place where the industry is located.

7. Availability of land

An industry needs large estate to set up its production unit. Thus an industry will locate in those areas where large area of land is available.

Q7) Define BOP and BOT.

Q8) Write a note on BOP and BOT.

A) to Q7&8

Balance of payment (BOP)

The balance of payments (BoP) records the transactions in goods, services and assets between residents of a country with the rest of the world for a specified time period typically a year. There are two main accounts in the BoP — the current account and the capital account. The classification of BOP is shown in figure

Figure : Classification of BOP

a) Current account transactions:

It refers to those foreign exchange transactions which does not cause changes in the asset and liability position of the country. Current Account is the record of trade in goods and services and transfer payments. A surplus current account means that the nation is a lender to other countries and a deficit current account means that the nation is a borrower from other countries.

a) Trade in goods includes exports and imports of goods.

b) Trade in services includes factor income and non-factor income transactions.

c) Transfer payments are the receipts which the residents of a country get for ‘free’, without having to provide any goods or services in return. They consist of gifts, remittances and grants.

b) Capital account transactions:

It refers to those foreign exchange transactions which cause changes in the asset and liability position of the country. For example, purchase of asset in foreign country, return of loan, External commercial borrowings etc. It consist of the components-

a) Foreign direct investment and foreign portfolio investment.

b) External borrowings through debt, loan from other countries, international financial companies.

c) External aids like Govt. aid, intergovernmental loan, bilateral loan etc.

Balance of Trade (BOT)

It indicates the difference between a country's imports and its exports of visible/merchandised items. Balance of trade is the largest component of a country's balance of payments. Debit items of BOT include imports, foreign aid, domestic spending abroad and domestic investments abroad. Credit items of BOT includes exports, foreign spending in the domestic economy and foreign investments in the domestic economy. When exports are greater than imports than the BOT is favourable and if imports are greater than exports then it is unfavourable.

Q9) Define BOP. Distinguish between BOP and BOT.

A9) The balance of payments (BoP) records the transactions in goods, services and assets between residents of a country with the rest of the world for a specified time period typically a year.

Sl No. | BOP | BOT |

It is a broad term as it covers BOT. | It is a narrow term as it is a part of BOP. | |

2. | It includes all transactions related to visible, invisible and capital transfers. | It includes only visible items. |

3. | It is always balances itself. | It can be favourable or unfavourable |

4. | BOP = Current Account + Capital Account + or - Balancing item (Errors and omissions) | BOT = Net Earning on Export - Net payment for imports. |

5. | Following are main factors which affect BOP a)Conditions of foreign lenders. b)Economic policy of Govt. c) all the factors of BOT | Following are main factors which affect BOT a) cost of production b) availability of raw materials c) Exchange rate d) Prices of goods manufactured at home |

6. | It causes change in asset or liability position of the country. | It does not cause change in asset or liability position of the country. |

|

|

|

Q10) Write a brief note on concept of money.

A10) Money is a medium of exchange. In earlier time barter system was prevailed for where goods are exchanged with gods. But later on money is considered as a medium of exchange for its convenience. The function/features of money are-

a) It acts as a medium of exchange.

b) It acts as a convenient unit of account.

c) It can act as a store of value for individuals.

Demand for money

People desire to hold money balance broadly from two motives-

The principal motive for holding money is to carry out transactions. Suppose you earn Rs 100 on the first day of every month and run down this balance evenly over the rest of the month. Thus your cash balance at the beginning and end of the month are Rs 100 and 0, respectively. Your average cash holding can then be calculated as (Rs 100 + Rs 0) ÷ 2 = Rs 50, with which you are making transactions worth Rs 100 per month. Hence your average transaction demand for money is equal to half your monthly income, or, in other words, half the value of your monthly transactions. Consider, next, a two-person economy consisting of two entities – a firm (owned by one person) and a worker. The firm pays the worker a salary of Rs 100 at the beginning of every month. The worker, in turn, spends this income over the month on the output produced by the firm – the only good available in this economy. Thus, at the beginning of each month the worker has a money balance of Rs 100 and the firm a balance of Rs 0. On the last day of the month the picture is reversed – the firm has gathered a balance of Rs 100 through its sales to the worker. The average money holding of the firm as well as the worker is equal to Rs 50 each. Thus the total transaction demand for money in this economy is equal to Rs 100. The total volume of monthly transactions in this economy is Rs 200 – the firm has sold its output worth Rs 100 to the worker and the latter has sold her services worth Rs 100 to the firm. The transaction demand for money of the economy is again a fraction of the total volume of transactions in the economy over the unit period of time. In general, therefore, the transaction demand for money in an economy, MdT,

can be written in the following form

MdT = k.T

Where, T is the total value of (nominal) transactions in the economy over unit period and k is a positive fraction.

2. The Speculative Motive:

An individual may hold her wealth in the form of landed property, bullion, bonds, money etc. For simplicity, let us club all forms of assets other than money together into a single category called ‘bonds’. Typically, bonds are papers bearing the promise of a future stream of monetary returns over a certain period of time. These papers are issued by governments or firms for borrowing money from the public and they are tradable in the market. The price of a bond is inversely related to the market rate of interest. Different people have different expectations regarding the future movements in the market rate of interest based on their private information regarding the economy.

Speculations regarding future movements in interest rate and bond prices give rise to the speculative demand for money. When the interest rate is very high everyone expects it to fall in future and hence anticipates capital gains from bond-holding. Hence people convert their money into bonds. Thus, speculative demand for money is low. When interest rate comes down, more and more people expect it to rise in the future and anticipate capital loss. Thus they convert their bonds into money giving rise to a high speculative demand for money. Hence speculative demand for money is inversely related to the rate of interest. Assuming a simple form, the speculative demand for money can be written as

MdS=

Where r is the market rate of interest and rmax and rmin are the upper and lower limits of r, both positive constants. It is evident from equation that as r decreases from rmax to rmin, the value of MdS increases from 0 to α.

Q11) Define finance. What are the types of finance?

A11) Finance may be defined as the art and science of managing money. It includes financial service and financial instruments. Finance also is referred as the provision of money at the time when it is needed.

According to Khan and Jain, “Finance is the art and science of managing money”.

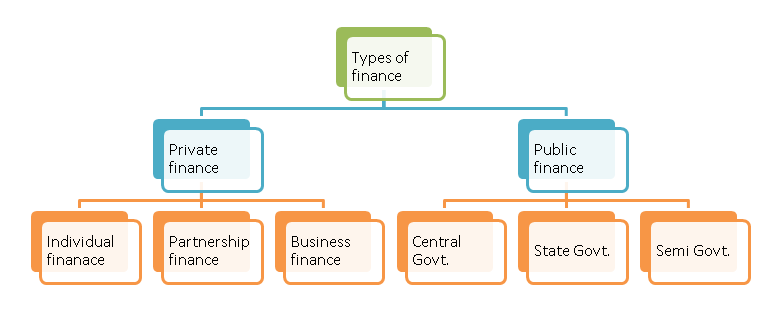

The figure 4 shows that finance can be classified into two major parts:

Figure 4: Types of finance

a) Private finance:

Private finance includes the individual, firms, business or corporate financial activities to meet the requirements.

a) Individual/personal finance is concerned managing one’s savings and investment. It covers budgeting, banking, insurance, mortgages, investment, tax, retirement planning etc. of an individual.

b) Partnership firm finance refers to the managing of savings and investment of partnership firm.

c) Business finance is concerned with planning, acquisition and control of funds/capital of business concern. Different sources of business finance are shares, debentures, bonds, borrowings from financial institutions etc.

b) Public finance:

Public Finance which concerns with revenue and disbursement of Government such as Central Government, State Government and Semi-Government Financial matters.

a) Government revenues are income of government earned from income tax, corporate tax, GST, non-tax items like fees, fines, royalty etc.

Public expenditure is the money spent by government entities on infrastructure, defence, education, health, housing, administration etc.