UNIT 4

Open Economy

Q1) Explain Open economy – Flows of goods and capital.

A1)

Open economy is an important concept of international macro economics. Openness is measured by the ratio of a country’s exports or imports to its GDP. In recent years all major market economies have increasingly opened their borders to foreign trade and foreign capital. The result is growing share of output and consumption involved in international trade.

Every country has its own choice that whether the economy will be opened or closed. Open economy indicates trade with a domestic country and with the rest of the world where as closed economy indicates trade barriers of a domestic country with rest of the world. In case of an open economy the national income accounts identify of a country can be expressed as

Y= C+I+G+X-M………………….(1)

Where, consumption refers to household expenditure on various goods and services. Goods are of three types: non durables, durables and services.

Investment refers to capital goods, which are purchased for producing mainly consumer goods in the economy. Government purchases are the various goods and services purchased by the central, state and local government. Transfer payment such as pension funds does not include in the GDP since they does not account for any production. In an open economy the national income identify includes the net export (NX) which is the difference between exports and imports. The national income accounts identify shows how the domestic output, domestic spending and net exports are related. In particular,

NX = Y – (C+I+G)………………..(2)

Net exports = output – domestic spending

This equation shows that domestic spending need not be equal the output of goods and services. If output exceeds domestic spending, we export the difference: net export are positive.

The income identify in equation 1 can also be expressed as

Y= C+S+T……………..(2)

Now from equation 1 and 2

We get,

C+S+T = C+I+G+X-M

Or, S+T = I+G+X-M

Or, S+T +M= I+G+X

This implies that the sum total of leakages from the circular flow of income = the sum total of injections in to the circular flow

Another interpretation of the above identity

The above equation can be expressed as :

I+G+X = S+T+M

Or, I = S+(T-G)+(M-X)

Total investment = household savings+ budget surplus + trade deficit

Q2) Explain saving and investment in a small and a large open economy.

A2)

A closed economy country does not have to bother about the BOP of the foreign countries and there is no favorable or unfavorable BOP. Where as an open economy such favorable and unfavorable BOP has considerable effect on the country as well as on the economy. Thus an open economy suffers from trade deficit if its imports exceeds its exports, in which case it can borrow financial capital from other countries or from the international capital markets.

A small open economy has been considered with perfect capital mobility. In the context of international capital flows, a small country is the one which has no influence over the world rate of interest. The term perfect mobility refers to the fact that the people of a country can borrow or lend freely in the absence of government intervention in the world capital markets.

Due to perfect capital mobility, the domestic rate of interest r is the same as that of the world rate of interest r*. Both the domestic and world rate of interest is determined by savings and investment.

Q3) Explain exchange rates.

A3)

Exchange rate is the rate at which the currency of one country is exchanged for the currency of another country. According to David Ricardo, international trade is a highly organized system of barter. In this theory of comparative cost advantage, the commodities and money is not used as a medium of exchange. However, in modern times the world has changed and thus the relevant concept is the exchange rate.

Nominal and real exchange rate: It is the exchange rate of a currency against any other. It is thus a bilateral concept.

Effective exchange rate (EER): It is weighted average of nominal rates, the weights being the shares of the respective countries in the trade of the country for which the EER is being calculated.

RER = NER(P*/P)

Real effective exchange rate: This is the overall RER for the economy. It is the weighted average of the RERs for all its trade partners, the weights being the shares of the respective countries in its foreign trade. It may be interpreted as the quantity of domestic goods which is to be given up to get one unit of a given basket of foreign goods.

The balance of trade is equal to net capital outflow, which in turn, equal S- I. Savings depends on C, G and T. Investment depends on both domestic and the world rate of interest. In a world of perfect capital mobility, there is only one rate of interest.

Types of Exchange Rates

Free-Floating

A free-floating exchange rate rises and falls due to changes in the foreign exchange market.

Restricted Currencies

Some countries have restricted currencies, limiting their exchange to within the countries' borders. Also, a restricted currency can have its value set by the government.

Currency Peg

Sometimes a country will peg its currency to that of another nation. For instance, the Hong Kong dollar is pegged to the U.S. Dollar in a range of 7.75 to 7.85. This means the value of the Hong Kong dollar to the U.S. Dollar will remain within this range.

Onshore Vs. Offshore

Exchange rates can also be different for the same country. In some cases, there is an onshore rate and an offshore rate. Generally, a more favourable exchange rate can often be found within a country’s border versus outside its borders. China is one major example of a country that has this rate structure. Additionally, China's yuan is a currency that is controlled by the government. Every day, the Chinese government sets a midpoint value for the currency, allowing the yuan to trade in a band of 2% from the midpoint.

Spot vs. Forward

Exchange rates can have what is called a spot rate, or cash value, which is the current market value. Alternatively, an exchange rate may have a forward value, which is based on expectations for the currency to rise or fall versus its spot price. Forward rate values may fluctuate due to changes in expectations for future interest rates in one country versus another. For example, let's say that traders have the view that the eurozone will ease monetary policy versus the U.S. In this case, traders could buy the dollar versus the euro, resulting in the value of the euro falling.

Quotation

Typically, an exchange rate is quoted using an acronym for the national currency it represents. For example, the acronym USD represents the U.S. Dollar, while EUR represents the euro. To quote the currency pair for the dollar and the euro, it would be EUR/USD. In this case, the quotation is euro to dollar, and translates to 1-euro trading for the equivalent of $1.13 if the exchange rate is 1.13. In the case of the Japanese yen, it's USD/JPY, or dollar to yen. An exchange rate of 100 would mean that 1 dollar equals 100 yen.

Q4) Explain Mundell – Fleming model.

A4)

The basic Mundell-Fleming model — like the IS-LM model — is based on the assumption of fixed price level and shows the interaction between the goods market and the money market.

The model explains the causes of short-run fluctuations in aggregate income (or, what comes to the same thing, shifts in the ad curve) in an open economy.

The Mundell-Fleming model is based on a very restrictive assumption. It considers a small open economy with perfect capital mobility.

This means that the economy can borrow or lend freely from the international capital markets at the prevailing rate of interest since its domestic rate of interest is determined by the world rate of interest. So, the rate of interest is not a policy variable in the small economy being studied.

This means that macroeconomic adjustment occurs only through exchange rate changes. In other words, the brunt of adjustment is borne by exchange rate movements in foreign exchange markets to maintain the officially determined exchange rate. The central bank permits the exchange rate to move up or down in response to changing economic conditions.

The basic assumption of this model is that the domestic rate of interest (r) is equal to the world rate of interest (r*) in a small open economy with perfect capital mobility. No doubt any change within the domestic economy may alter the domestic rate of interest, but the rate of interest cannot stay out of line with the world rate of interest for long.

The difference between the two, if any, is removed quickly through inflows and outflows of financial capital. It may be recalled that “smallness” of a country has no relation to its size. A small country is one which cannot alter the world rate of interest through its own borrowing and lending activities. In contrast, a large economy is one which has market (bargaining) power so that it can exert influence over the world rate of interest.

For such a country, either international capital mobility is far from perfect, or the country is so large that it can exert influence on world capital markets.

The main prediction from the Mundell-Fleming model is that the behaviour of an economy depends crucially on the exchange rate system it adopts, i.e., whether it operates a floating exchange rate system or a fixed exchange rate system. We start with adjustment under a floating exchange rate system, in which case there is no central bank intervention in the foreign exchange market.

In such a situation, if the domestic interest rate goes above the world rate, foreigners will start lending to the home country. This capital inflow will create excess supply of funds and the domestic rate of interest r again will fall to r*.

The converse is also true. If, for some reason, the domestic rate of interest (r) falls below r*, there will be capital outflow from the home country and the resulting shortage of funds will push up r to the level of r*. Thus, in a world of perfect capital mobility, r will quickly get adjusted to r*.

The Open Economy IS Curve:

In the Mundell-Fleming model, the market for goods and services is expressed by the following equation:

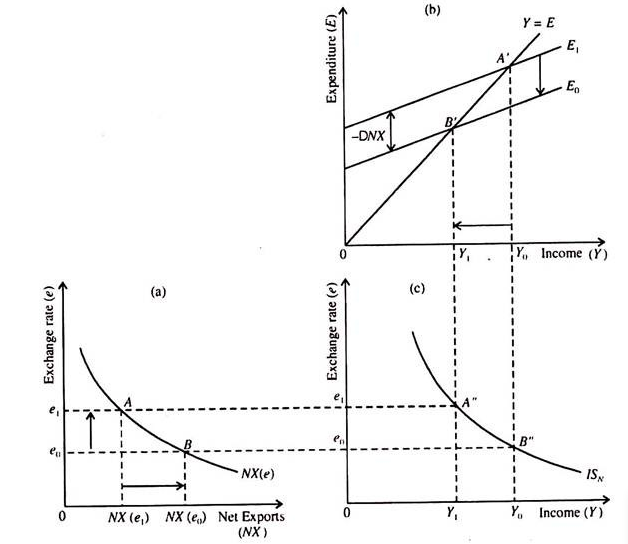

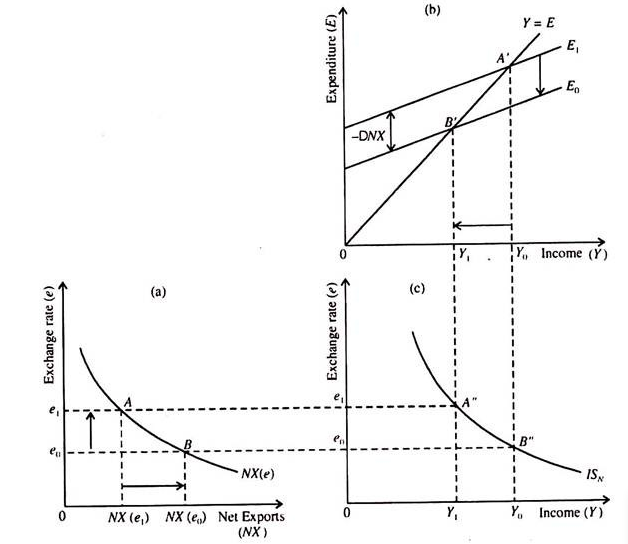

Y = C(Y – T) + I(r*) + G + NX(e) … (1)

Where all the terms have their usual meanings. Here investment depends on the world rate of interest r* since r = r* and NX depends on the exchange rate e which is the price of a foreign currency in terms of domestic currency.

In the Mundell-Fleming model, it is assumed that the price levels at home and abroad remain fixed. So, there is no difference between real exchange rate and nominal exchange rate. We now illustrate the equation of the goods market equilibrium in Fig. Given below.

In part (a), an increase in the rate from e0 to e1, lowers net exports from NX(e0) to NX(e1). As a result, the planned expenditure line E1 shifts downward to E0. Consequently, income falls from Y1 to Y0. In part (c), we show the new IS curve, which is the locus of points, indicating alternative combinations of e and Y which ensure equilibrium in the goods market.

The new IS curve is derived by following this sequence:

e rises → NX falls → Y falls

The Open Economy LM Curve:

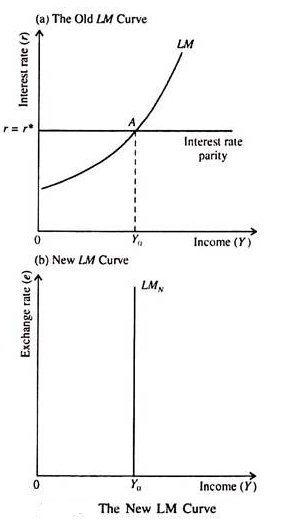

The equilibrium condition of the money market in the Mundell-Fleming model is:

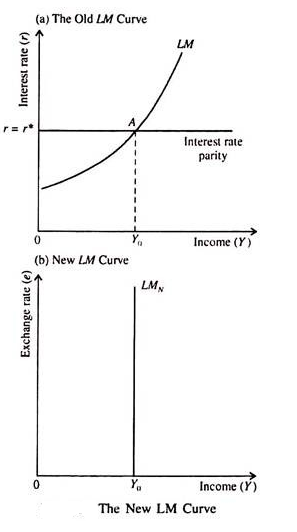

M = L(r*, Y) … (2)

Since r = r*.

Here the supply of money equals its demand and demand for money varies inversely with r* and the positively with Y. In this model, M remains exogenously fixed by the central bank.

The new LM curve, as shown in below Fig. (b), is vertical — since the equation (2) has no relation to the exchange rate. This equation determines only Y, whether e is high or low. In below Fig. (a), we draw the closed economy LM curve as also a horizontal line showing parity between r and r*.

The intersection of the two curves at the point A determines the equilibrium level of income Y0, which has no relation to e, shown on the vertical axis of below Fig. (b). This is why the new (open economy) LM curve is vertical. The LMN curve of below Fig. (b) is derived from r* and the closed economy LM curve, shown in below Fig. (a).

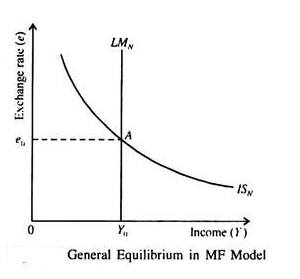

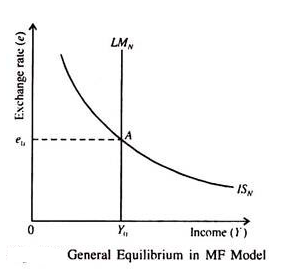

General Equilibrium:

In the below Fig. , we show the general equilibrium of goods market and the money market. The equilibrium income (Y0) and exchange rate (e0) are determined simultaneously at point A where the IS and LM curves intersect.

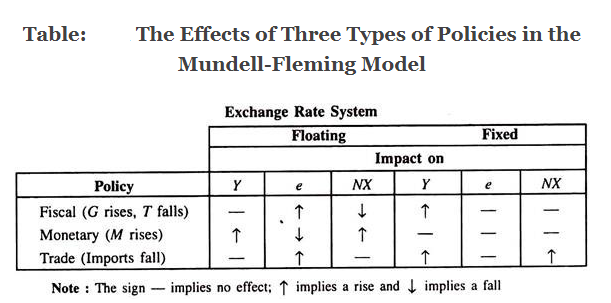

Main Message of Mundell-Flemming Model:

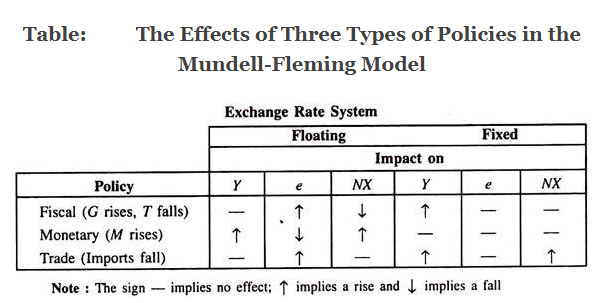

The main message of the Mundell-Fleming model is that the effect of any economic policy (fiscal, monetary or trade) depends on the exchange rate system of the country under consideration, i.e., whether the country is following a fixed or a floating exchange rate system. Table summarises the effects of three different policies in the Mundell-Fleming model.

The Mundell-Fleming model shows how to make appropriate use of monetary, fiscal and trade policies to achieve any desired macroeconomic objective. The influence of these policies depends on the exchange rate system. Under floating exchange rate system, only monetary policy can alter national income.

The effect of expansionary fiscal policy is totally neutralised by currency appreciation. Under fixed exchange rate system, only fiscal policy can alter Y. The central bank loses control over money supply since it has to be adjusted upward or downward for maintaining the exchange rate at a predetermined level.

Q5) Explain interest-rate differentials.

A5)

An interest rate differential is a difference in interest rate between two currencies in a pair. If one currency has an interest rate of 3% and the other has an interest rate of 1%, it has a 2% interest rate differential. The use of interest rate differentials is of particular concern in foreign exchange markets for pricing purpose.

If you were to buy the currency that pays 3% against the currency that pays 1%, you would be paid on the difference with daily interest payments. This simple definition is known as the carry trade, earning carry on the interest rate differential. Development in recent years has brought interest rate differentials to a new light that are worth investigating.

In general, interest rate differential weights the contrast in interest rate between two similar interest – bearing assets. Traders in the foreign exchange market use IRDs when pricing forward exchange rates.

Based on interest rate parity a trader can create an expectation of the future exchange rate between two currencies and set the premium, or discount, on the current market exchange rate future contracts.

IRD calculation are often used in fixed income trading, forex trading, and lending calculations.

Q6) Explain types of exchange rate.

A6)

Exchange rate is the rate at which the currency of one country is exchanged for the currency of another country. According to David Ricardo, international trade is a highly organized system of barter. In this theory of comparative cost advantage, the commodities and money is not used as a medium of exchange. However, in modern times the world has changed and thus the relevant concept is the exchange rate.

Nominal and real exchange rate: It is the exchange rate of a currency against any other. It is thus a bilateral concept.

Effective exchange rate (EER): It is weighted average of nominal rates, the weights being the shares of the respective countries in the trade of the country for which the EER is being calculated.

RER = NER(P*/P)

Real effective exchange rate: This is the overall RER for the economy. It is the weighted average of the RERs for all its trade partners, the weights being the shares of the respective countries in its foreign trade. It may be interpreted as the quantity of domestic goods which is to be given up to get one unit of a given basket of foreign goods.

The balance of trade is equal to net capital outflow, which in turn, equal S- I. Savings depends on C, G and T. Investment depends on both domestic and the world rate of interest. In a world of perfect capital mobility, there is only one rate of interest.

Types of Exchange Rates

Free-Floating

A free-floating exchange rate rises and falls due to changes in the foreign exchange market.

Restricted Currencies

Some countries have restricted currencies, limiting their exchange to within the countries' borders. Also, a restricted currency can have its value set by the government.

Currency Peg

Sometimes a country will peg its currency to that of another nation. For instance, the Hong Kong dollar is pegged to the U.S. Dollar in a range of 7.75 to 7.85. This means the value of the Hong Kong dollar to the U.S. Dollar will remain within this range.

Onshore Vs. Offshore

Exchange rates can also be different for the same country. In some cases, there is an onshore rate and an offshore rate. Generally, a more favourable exchange rate can often be found within a country’s border versus outside its borders. China is one major example of a country that has this rate structure. Additionally, China's yuan is a currency that is controlled by the government. Every day, the Chinese government sets a midpoint value for the currency, allowing the yuan to trade in a band of 2% from the midpoint.

Spot vs. Forward

Exchange rates can have what is called a spot rate, or cash value, which is the current market value. Alternatively, an exchange rate may have a forward value, which is based on expectations for the currency to rise or fall versus its spot price. Forward rate values may fluctuate due to changes in expectations for future interest rates in one country versus another. For example, let's say that traders have the view that the eurozone will ease monetary policy versus the U.S. In this case, traders could buy the dollar versus the euro, resulting in the value of the euro falling.

Quotation

Typically, an exchange rate is quoted using an acronym for the national currency it represents. For example, the acronym USD represents the U.S. Dollar, while EUR represents the euro. To quote the currency pair for the dollar and the euro, it would be EUR/USD. In this case, the quotation is euro to dollar, and translates to 1-euro trading for the equivalent of $1.13 if the exchange rate is 1.13. In the case of the Japanese yen, it's USD/JPY, or dollar to yen. An exchange rate of 100 would mean that 1 dollar equals 100 yen.

Q7) Explain Open economy – flows of goods and capital, saving and investment in a small and a large open economy?

A7)

Open economy – flows of goods and capital

Open economy is an important concept of international macro economics. Openness is measured by the ratio of a country’s exports or imports to its GDP. In recent years all major market economies have increasingly opened their borders to foreign trade and foreign capital. The result is growing share of output and consumption involved in international trade.

Every country has its own choice that whether the economy will be opened or closed. Open economy indicates trade with a domestic country and with the rest of the world where as closed economy indicates trade barriers of a domestic country with rest of the world. In case of an open economy the national income accounts identify of a country can be expressed as

Y= C+I+G+X-M………………….(1)

Where, consumption refers to household expenditure on various goods and services. Goods are of three types: non durables, durables and services.

Investment refers to capital goods, which are purchased for producing mainly consumer goods in the economy. Government purchases are the various goods and services purchased by the central, state and local government. Transfer payment such as pension funds does not include in the GDP since they does not account for any production. In an open economy the national income identify includes the net export (NX) which is the difference between exports and imports. The national income accounts identify shows how the domestic output, domestic spending and net exports are related. In particular,

NX = Y – (C+I+G)………………..(2)

Net exports = output – domestic spending

This equation shows that domestic spending need not be equal the output of goods and services. If output exceeds domestic spending, we export the difference: net export are positive.

The income identify in equation 1 can also be expressed as

Y= C+S+T……………..(2)

Now from equation 1 and 2

We get,

C+S+T = C+I+G+X-M

Or, S+T = I+G+X-M

Or, S+T +M= I+G+X

This implies that the sum total of leakages from the circular flow of income = the sum total of injections in to the circular flow

Another interpretation of the above identity

The above equation can be expressed as:

I+G+X = S+T+M

Or, I = S+(T-G)+(M-X)

Total investment = household savings+ budget surplus + trade deficit

Saving and investment in a small and a large open economy

A closed economy country does not have to bother about the BOP of the foreign countries and there is no favorable or unfavorable BOP. Where as an open economy such favorable and unfavorable BOP has considerable effect on the country as well as on the economy. Thus an open economy suffers from trade deficit if its imports exceeds its exports, in which case it can borrow financial capital from other countries or from the international capital markets.

A small open economy has been considered with perfect capital mobility. In the context of international capital flows, a small country is the one which has no influence over the world rate of interest. The term perfect mobility refers to the fact that the people of a country can borrow or lend freely in the absence of government intervention in the world capital markets.

Due to perfect capital mobility, the domestic rate of interest r is the same as that of the world rate of interest r*. Both the domestic and world rate of interest is determined by savings and investment.

Q8) Explain exchange rate and interest rate differential.

A8)

Exchange rates

Exchange rate is the rate at which the currency of one country is exchanged for the currency of another country. According to David Ricardo, international trade is a highly organized system of barter. In this theory of comparative cost advantage, the commodities and money is not used as a medium of exchange. However, in modern times the world has changed and thus the relevant concept is the exchange rate.

Nominal and real exchange rate: It is the exchange rate of a currency against any other. It is thus a bilateral concept.

Effective exchange rate (EER): It is weighted average of nominal rates, the weights being the shares of the respective countries in the trade of the country for which the EER is being calculated.

RER = NER(P*/P)

Real effective exchange rate: This is the overall RER for the economy. It is the weighted average of the RERs for all its trade partners, the weights being the shares of the respective countries in its foreign trade. It may be interpreted as the quantity of domestic goods which is to be given up to get one unit of a given basket of foreign goods.

The balance of trade is equal to net capital outflow, which in turn, equal S- I. Savings depends on C, G and T. Investment depends on both domestic and the world rate of interest. In a world of perfect capital mobility, there is only one rate of interest.

Types of Exchange Rates

Free-Floating

A free-floating exchange rate rises and falls due to changes in the foreign exchange market.

Restricted Currencies

Some countries have restricted currencies, limiting their exchange to within the countries' borders. Also, a restricted currency can have its value set by the government.

Currency Peg

Sometimes a country will peg its currency to that of another nation. For instance, the Hong Kong dollar is pegged to the U.S. Dollar in a range of 7.75 to 7.85. This means the value of the Hong Kong dollar to the U.S. Dollar will remain within this range.

Onshore Vs. Offshore

Exchange rates can also be different for the same country. In some cases, there is an onshore rate and an offshore rate. Generally, a more favourable exchange rate can often be found within a country’s border versus outside its borders. China is one major example of a country that has this rate structure. Additionally, China's yuan is a currency that is controlled by the government. Every day, the Chinese government sets a midpoint value for the currency, allowing the yuan to trade in a band of 2% from the midpoint.

Spot vs. Forward

Exchange rates can have what is called a spot rate, or cash value, which is the current market value. Alternatively, an exchange rate may have a forward value, which is based on expectations for the currency to rise or fall versus its spot price. Forward rate values may fluctuate due to changes in expectations for future interest rates in one country versus another. For example, let's say that traders have the view that the eurozone will ease monetary policy versus the U.S. In this case, traders could buy the dollar versus the euro, resulting in the value of the euro falling.

Quotation

Typically, an exchange rate is quoted using an acronym for the national currency it represents. For example, the acronym USD represents the U.S. Dollar, while EUR represents the euro. To quote the currency pair for the dollar and the euro, it would be EUR/USD. In this case, the quotation is euro to dollar, and translates to 1-euro trading for the equivalent of $1.13 if the exchange rate is 1.13. In the case of the Japanese yen, it's USD/JPY, or dollar to yen. An exchange rate of 100 would mean that 1 dollar equals 100 yen.

Interest-rate differentials case of a large economy

An interest rate differential is a difference in interest rate between two currencies in a pair. If one currency has an interest rate of 3% and the other has an interest rate of 1%, it has a 2% interest rate differential. The use of interest rate differentials is of particular concern in foreign exchange markets for pricing purpose.

If you were to buy the currency that pays 3% against the currency that pays 1%, you would be paid on the difference with daily interest payments. This simple definition is known as the carry trade, earning carry on the interest rate differential. Development in recent years has brought interest rate differentials to a new light that are worth investigating.

In general, interest rate differential weights the contrast in interest rate between two similar interest – bearing assets. Traders in the foreign exchange market use IRDs when pricing forward exchange rates.

Based on interest rate parity a trader can create an expectation of the future exchange rate between two currencies and set the premium, or discount, on the current market exchange rate future contracts.

IRD calculation are often used in fixed income trading, forex trading, and lending calculations

Q9) Explain saving and investment in a small and a large open economy, exchange rates?

A9)

Saving and investment in a small and a large open economy

A closed economy country does not have to bother about the BOP of the foreign countries and there is no favorable or unfavorable BOP. Where as an open economy such favorable and unfavorable BOP has considerable effect on the country as well as on the economy. Thus an open economy suffers from trade deficit if its imports exceeds its exports, in which case it can borrow financial capital from other countries or from the international capital markets.

A small open economy has been considered with perfect capital mobility. In the context of international capital flows, a small country is the one which has no influence over the world rate of interest. The term perfect mobility refers to the fact that the people of a country can borrow or lend freely in the absence of government intervention in the world capital markets.

Due to perfect capital mobility, the domestic rate of interest r is the same as that of the world rate of interest r*. Both the domestic and world rate of interest is determined by savings and investment.

Exchange rates

Exchange rate is the rate at which the currency of one country is exchanged for the currency of another country. According to David Ricardo, international trade is a highly organized system of barter. In this theory of comparative cost advantage, the commodities and money is not used as a medium of exchange. However, in modern times the world has changed and thus the relevant concept is the exchange rate.

Nominal and real exchange rate: It is the exchange rate of a currency against any other. It is thus a bilateral concept.

Effective exchange rate (EER): It is weighted average of nominal rates, the weights being the shares of the respective countries in the trade of the country for which the EER is being calculated.

RER = NER(P*/P)

Real effective exchange rate: This is the overall RER for the economy. It is the weighted average of the RERs for all its trade partners, the weights being the shares of the respective countries in its foreign trade. It may be interpreted as the quantity of domestic goods which is to be given up to get one unit of a given basket of foreign goods.

The balance of trade is equal to net capital outflow, which in turn, equal S- I. Savings depends on C, G and T. Investment depends on both domestic and the world rate of interest. In a world of perfect capital mobility, there is only one rate of interest.

Types of Exchange Rates

Free-Floating

A free-floating exchange rate rises and falls due to changes in the foreign exchange market.

Restricted Currencies

Some countries have restricted currencies, limiting their exchange to within the countries' borders. Also, a restricted currency can have its value set by the government.

Currency Peg

Sometimes a country will peg its currency to that of another nation. For instance, the Hong Kong dollar is pegged to the U.S. Dollar in a range of 7.75 to 7.85. This means the value of the Hong Kong dollar to the U.S. Dollar will remain within this range.

Onshore Vs. Offshore

Exchange rates can also be different for the same country. In some cases, there is an onshore rate and an offshore rate. Generally, a more favourable exchange rate can often be found within a country’s border versus outside its borders. China is one major example of a country that has this rate structure. Additionally, China's yuan is a currency that is controlled by the government. Every day, the Chinese government sets a midpoint value for the currency, allowing the yuan to trade in a band of 2% from the midpoint.

Spot vs. Forward

Exchange rates can have what is called a spot rate, or cash value, which is the current market value. Alternatively, an exchange rate may have a forward value, which is based on expectations for the currency to rise or fall versus its spot price. Forward rate values may fluctuate due to changes in expectations for future interest rates in one country versus another. For example, let's say that traders have the view that the eurozone will ease monetary policy versus the U.S. In this case, traders could buy the dollar versus the euro, resulting in the value of the euro falling.

Quotation

Typically, an exchange rate is quoted using an acronym for the national currency it represents. For example, the acronym USD represents the U.S. Dollar, while EUR represents the euro. To quote the currency pair for the dollar and the euro, it would be EUR/USD. In this case, the quotation is euro to dollar, and translates to 1-euro trading for the equivalent of $1.13 if the exchange rate is 1.13. In the case of the Japanese yen, it's USD/JPY, or dollar to yen. An exchange rate of 100 would mean that 1 dollar equals 100 yen.

Q10) Write about spot and forward exchange rate.

A10)

Exchange rates can have what is called a spot rate, or cash value, which is the current market value. Alternatively, an exchange rate may have a forward value, which is based on expectations for the currency to rise or fall versus its spot price. Forward rate values may fluctuate due to changes in expectations for future interest rates in one country versus another. For example, let's say that traders have the view that the eurozone will ease monetary policy versus the U.S. In this case, traders could buy the dollar versus the euro, resulting in the value of the euro falling.

UNIT 4

Open Economy

Q1) Explain Open economy – Flows of goods and capital.

A1)

Open economy is an important concept of international macro economics. Openness is measured by the ratio of a country’s exports or imports to its GDP. In recent years all major market economies have increasingly opened their borders to foreign trade and foreign capital. The result is growing share of output and consumption involved in international trade.

Every country has its own choice that whether the economy will be opened or closed. Open economy indicates trade with a domestic country and with the rest of the world where as closed economy indicates trade barriers of a domestic country with rest of the world. In case of an open economy the national income accounts identify of a country can be expressed as

Y= C+I+G+X-M………………….(1)

Where, consumption refers to household expenditure on various goods and services. Goods are of three types: non durables, durables and services.

Investment refers to capital goods, which are purchased for producing mainly consumer goods in the economy. Government purchases are the various goods and services purchased by the central, state and local government. Transfer payment such as pension funds does not include in the GDP since they does not account for any production. In an open economy the national income identify includes the net export (NX) which is the difference between exports and imports. The national income accounts identify shows how the domestic output, domestic spending and net exports are related. In particular,

NX = Y – (C+I+G)………………..(2)

Net exports = output – domestic spending

This equation shows that domestic spending need not be equal the output of goods and services. If output exceeds domestic spending, we export the difference: net export are positive.

The income identify in equation 1 can also be expressed as

Y= C+S+T……………..(2)

Now from equation 1 and 2

We get,

C+S+T = C+I+G+X-M

Or, S+T = I+G+X-M

Or, S+T +M= I+G+X

This implies that the sum total of leakages from the circular flow of income = the sum total of injections in to the circular flow

Another interpretation of the above identity

The above equation can be expressed as :

I+G+X = S+T+M

Or, I = S+(T-G)+(M-X)

Total investment = household savings+ budget surplus + trade deficit

Q2) Explain saving and investment in a small and a large open economy.

A2)

A closed economy country does not have to bother about the BOP of the foreign countries and there is no favorable or unfavorable BOP. Where as an open economy such favorable and unfavorable BOP has considerable effect on the country as well as on the economy. Thus an open economy suffers from trade deficit if its imports exceeds its exports, in which case it can borrow financial capital from other countries or from the international capital markets.

A small open economy has been considered with perfect capital mobility. In the context of international capital flows, a small country is the one which has no influence over the world rate of interest. The term perfect mobility refers to the fact that the people of a country can borrow or lend freely in the absence of government intervention in the world capital markets.

Due to perfect capital mobility, the domestic rate of interest r is the same as that of the world rate of interest r*. Both the domestic and world rate of interest is determined by savings and investment.

Q3) Explain exchange rates.

A3)

Exchange rate is the rate at which the currency of one country is exchanged for the currency of another country. According to David Ricardo, international trade is a highly organized system of barter. In this theory of comparative cost advantage, the commodities and money is not used as a medium of exchange. However, in modern times the world has changed and thus the relevant concept is the exchange rate.

Nominal and real exchange rate: It is the exchange rate of a currency against any other. It is thus a bilateral concept.

Effective exchange rate (EER): It is weighted average of nominal rates, the weights being the shares of the respective countries in the trade of the country for which the EER is being calculated.

RER = NER(P*/P)

Real effective exchange rate: This is the overall RER for the economy. It is the weighted average of the RERs for all its trade partners, the weights being the shares of the respective countries in its foreign trade. It may be interpreted as the quantity of domestic goods which is to be given up to get one unit of a given basket of foreign goods.

The balance of trade is equal to net capital outflow, which in turn, equal S- I. Savings depends on C, G and T. Investment depends on both domestic and the world rate of interest. In a world of perfect capital mobility, there is only one rate of interest.

Types of Exchange Rates

Free-Floating

A free-floating exchange rate rises and falls due to changes in the foreign exchange market.

Restricted Currencies

Some countries have restricted currencies, limiting their exchange to within the countries' borders. Also, a restricted currency can have its value set by the government.

Currency Peg

Sometimes a country will peg its currency to that of another nation. For instance, the Hong Kong dollar is pegged to the U.S. Dollar in a range of 7.75 to 7.85. This means the value of the Hong Kong dollar to the U.S. Dollar will remain within this range.

Onshore Vs. Offshore

Exchange rates can also be different for the same country. In some cases, there is an onshore rate and an offshore rate. Generally, a more favourable exchange rate can often be found within a country’s border versus outside its borders. China is one major example of a country that has this rate structure. Additionally, China's yuan is a currency that is controlled by the government. Every day, the Chinese government sets a midpoint value for the currency, allowing the yuan to trade in a band of 2% from the midpoint.

Spot vs. Forward

Exchange rates can have what is called a spot rate, or cash value, which is the current market value. Alternatively, an exchange rate may have a forward value, which is based on expectations for the currency to rise or fall versus its spot price. Forward rate values may fluctuate due to changes in expectations for future interest rates in one country versus another. For example, let's say that traders have the view that the eurozone will ease monetary policy versus the U.S. In this case, traders could buy the dollar versus the euro, resulting in the value of the euro falling.

Quotation

Typically, an exchange rate is quoted using an acronym for the national currency it represents. For example, the acronym USD represents the U.S. Dollar, while EUR represents the euro. To quote the currency pair for the dollar and the euro, it would be EUR/USD. In this case, the quotation is euro to dollar, and translates to 1-euro trading for the equivalent of $1.13 if the exchange rate is 1.13. In the case of the Japanese yen, it's USD/JPY, or dollar to yen. An exchange rate of 100 would mean that 1 dollar equals 100 yen.

Q4) Explain Mundell – Fleming model.

A4)

The basic Mundell-Fleming model — like the IS-LM model — is based on the assumption of fixed price level and shows the interaction between the goods market and the money market.

The model explains the causes of short-run fluctuations in aggregate income (or, what comes to the same thing, shifts in the ad curve) in an open economy.

The Mundell-Fleming model is based on a very restrictive assumption. It considers a small open economy with perfect capital mobility.

This means that the economy can borrow or lend freely from the international capital markets at the prevailing rate of interest since its domestic rate of interest is determined by the world rate of interest. So, the rate of interest is not a policy variable in the small economy being studied.

This means that macroeconomic adjustment occurs only through exchange rate changes. In other words, the brunt of adjustment is borne by exchange rate movements in foreign exchange markets to maintain the officially determined exchange rate. The central bank permits the exchange rate to move up or down in response to changing economic conditions.

The basic assumption of this model is that the domestic rate of interest (r) is equal to the world rate of interest (r*) in a small open economy with perfect capital mobility. No doubt any change within the domestic economy may alter the domestic rate of interest, but the rate of interest cannot stay out of line with the world rate of interest for long.

The difference between the two, if any, is removed quickly through inflows and outflows of financial capital. It may be recalled that “smallness” of a country has no relation to its size. A small country is one which cannot alter the world rate of interest through its own borrowing and lending activities. In contrast, a large economy is one which has market (bargaining) power so that it can exert influence over the world rate of interest.

For such a country, either international capital mobility is far from perfect, or the country is so large that it can exert influence on world capital markets.

The main prediction from the Mundell-Fleming model is that the behaviour of an economy depends crucially on the exchange rate system it adopts, i.e., whether it operates a floating exchange rate system or a fixed exchange rate system. We start with adjustment under a floating exchange rate system, in which case there is no central bank intervention in the foreign exchange market.

In such a situation, if the domestic interest rate goes above the world rate, foreigners will start lending to the home country. This capital inflow will create excess supply of funds and the domestic rate of interest r again will fall to r*.

The converse is also true. If, for some reason, the domestic rate of interest (r) falls below r*, there will be capital outflow from the home country and the resulting shortage of funds will push up r to the level of r*. Thus, in a world of perfect capital mobility, r will quickly get adjusted to r*.

The Open Economy IS Curve:

In the Mundell-Fleming model, the market for goods and services is expressed by the following equation:

Y = C(Y – T) + I(r*) + G + NX(e) … (1)

Where all the terms have their usual meanings. Here investment depends on the world rate of interest r* since r = r* and NX depends on the exchange rate e which is the price of a foreign currency in terms of domestic currency.

In the Mundell-Fleming model, it is assumed that the price levels at home and abroad remain fixed. So, there is no difference between real exchange rate and nominal exchange rate. We now illustrate the equation of the goods market equilibrium in Fig. Given below.

In part (a), an increase in the rate from e0 to e1, lowers net exports from NX(e0) to NX(e1). As a result, the planned expenditure line E1 shifts downward to E0. Consequently, income falls from Y1 to Y0. In part (c), we show the new IS curve, which is the locus of points, indicating alternative combinations of e and Y which ensure equilibrium in the goods market.

The new IS curve is derived by following this sequence:

e rises → NX falls → Y falls

The Open Economy LM Curve:

The equilibrium condition of the money market in the Mundell-Fleming model is:

M = L(r*, Y) … (2)

Since r = r*.

Here the supply of money equals its demand and demand for money varies inversely with r* and the positively with Y. In this model, M remains exogenously fixed by the central bank.

The new LM curve, as shown in below Fig. (b), is vertical — since the equation (2) has no relation to the exchange rate. This equation determines only Y, whether e is high or low. In below Fig. (a), we draw the closed economy LM curve as also a horizontal line showing parity between r and r*.

The intersection of the two curves at the point A determines the equilibrium level of income Y0, which has no relation to e, shown on the vertical axis of below Fig. (b). This is why the new (open economy) LM curve is vertical. The LMN curve of below Fig. (b) is derived from r* and the closed economy LM curve, shown in below Fig. (a).

General Equilibrium:

In the below Fig. , we show the general equilibrium of goods market and the money market. The equilibrium income (Y0) and exchange rate (e0) are determined simultaneously at point A where the IS and LM curves intersect.

Main Message of Mundell-Flemming Model:

The main message of the Mundell-Fleming model is that the effect of any economic policy (fiscal, monetary or trade) depends on the exchange rate system of the country under consideration, i.e., whether the country is following a fixed or a floating exchange rate system. Table summarises the effects of three different policies in the Mundell-Fleming model.

The Mundell-Fleming model shows how to make appropriate use of monetary, fiscal and trade policies to achieve any desired macroeconomic objective. The influence of these policies depends on the exchange rate system. Under floating exchange rate system, only monetary policy can alter national income.

The effect of expansionary fiscal policy is totally neutralised by currency appreciation. Under fixed exchange rate system, only fiscal policy can alter Y. The central bank loses control over money supply since it has to be adjusted upward or downward for maintaining the exchange rate at a predetermined level.

Q5) Explain interest-rate differentials.

A5)

An interest rate differential is a difference in interest rate between two currencies in a pair. If one currency has an interest rate of 3% and the other has an interest rate of 1%, it has a 2% interest rate differential. The use of interest rate differentials is of particular concern in foreign exchange markets for pricing purpose.

If you were to buy the currency that pays 3% against the currency that pays 1%, you would be paid on the difference with daily interest payments. This simple definition is known as the carry trade, earning carry on the interest rate differential. Development in recent years has brought interest rate differentials to a new light that are worth investigating.

In general, interest rate differential weights the contrast in interest rate between two similar interest – bearing assets. Traders in the foreign exchange market use IRDs when pricing forward exchange rates.

Based on interest rate parity a trader can create an expectation of the future exchange rate between two currencies and set the premium, or discount, on the current market exchange rate future contracts.

IRD calculation are often used in fixed income trading, forex trading, and lending calculations.

Q6) Explain types of exchange rate.

A6)

Exchange rate is the rate at which the currency of one country is exchanged for the currency of another country. According to David Ricardo, international trade is a highly organized system of barter. In this theory of comparative cost advantage, the commodities and money is not used as a medium of exchange. However, in modern times the world has changed and thus the relevant concept is the exchange rate.

Nominal and real exchange rate: It is the exchange rate of a currency against any other. It is thus a bilateral concept.

Effective exchange rate (EER): It is weighted average of nominal rates, the weights being the shares of the respective countries in the trade of the country for which the EER is being calculated.

RER = NER(P*/P)

Real effective exchange rate: This is the overall RER for the economy. It is the weighted average of the RERs for all its trade partners, the weights being the shares of the respective countries in its foreign trade. It may be interpreted as the quantity of domestic goods which is to be given up to get one unit of a given basket of foreign goods.

The balance of trade is equal to net capital outflow, which in turn, equal S- I. Savings depends on C, G and T. Investment depends on both domestic and the world rate of interest. In a world of perfect capital mobility, there is only one rate of interest.

Types of Exchange Rates

Free-Floating

A free-floating exchange rate rises and falls due to changes in the foreign exchange market.

Restricted Currencies

Some countries have restricted currencies, limiting their exchange to within the countries' borders. Also, a restricted currency can have its value set by the government.

Currency Peg

Sometimes a country will peg its currency to that of another nation. For instance, the Hong Kong dollar is pegged to the U.S. Dollar in a range of 7.75 to 7.85. This means the value of the Hong Kong dollar to the U.S. Dollar will remain within this range.

Onshore Vs. Offshore

Exchange rates can also be different for the same country. In some cases, there is an onshore rate and an offshore rate. Generally, a more favourable exchange rate can often be found within a country’s border versus outside its borders. China is one major example of a country that has this rate structure. Additionally, China's yuan is a currency that is controlled by the government. Every day, the Chinese government sets a midpoint value for the currency, allowing the yuan to trade in a band of 2% from the midpoint.

Spot vs. Forward

Exchange rates can have what is called a spot rate, or cash value, which is the current market value. Alternatively, an exchange rate may have a forward value, which is based on expectations for the currency to rise or fall versus its spot price. Forward rate values may fluctuate due to changes in expectations for future interest rates in one country versus another. For example, let's say that traders have the view that the eurozone will ease monetary policy versus the U.S. In this case, traders could buy the dollar versus the euro, resulting in the value of the euro falling.

Quotation

Typically, an exchange rate is quoted using an acronym for the national currency it represents. For example, the acronym USD represents the U.S. Dollar, while EUR represents the euro. To quote the currency pair for the dollar and the euro, it would be EUR/USD. In this case, the quotation is euro to dollar, and translates to 1-euro trading for the equivalent of $1.13 if the exchange rate is 1.13. In the case of the Japanese yen, it's USD/JPY, or dollar to yen. An exchange rate of 100 would mean that 1 dollar equals 100 yen.

Q7) Explain Open economy – flows of goods and capital, saving and investment in a small and a large open economy?

A7)

Open economy – flows of goods and capital

Open economy is an important concept of international macro economics. Openness is measured by the ratio of a country’s exports or imports to its GDP. In recent years all major market economies have increasingly opened their borders to foreign trade and foreign capital. The result is growing share of output and consumption involved in international trade.

Every country has its own choice that whether the economy will be opened or closed. Open economy indicates trade with a domestic country and with the rest of the world where as closed economy indicates trade barriers of a domestic country with rest of the world. In case of an open economy the national income accounts identify of a country can be expressed as

Y= C+I+G+X-M………………….(1)

Where, consumption refers to household expenditure on various goods and services. Goods are of three types: non durables, durables and services.

Investment refers to capital goods, which are purchased for producing mainly consumer goods in the economy. Government purchases are the various goods and services purchased by the central, state and local government. Transfer payment such as pension funds does not include in the GDP since they does not account for any production. In an open economy the national income identify includes the net export (NX) which is the difference between exports and imports. The national income accounts identify shows how the domestic output, domestic spending and net exports are related. In particular,

NX = Y – (C+I+G)………………..(2)

Net exports = output – domestic spending

This equation shows that domestic spending need not be equal the output of goods and services. If output exceeds domestic spending, we export the difference: net export are positive.

The income identify in equation 1 can also be expressed as

Y= C+S+T……………..(2)

Now from equation 1 and 2

We get,

C+S+T = C+I+G+X-M

Or, S+T = I+G+X-M

Or, S+T +M= I+G+X

This implies that the sum total of leakages from the circular flow of income = the sum total of injections in to the circular flow

Another interpretation of the above identity

The above equation can be expressed as:

I+G+X = S+T+M

Or, I = S+(T-G)+(M-X)

Total investment = household savings+ budget surplus + trade deficit

Saving and investment in a small and a large open economy

A closed economy country does not have to bother about the BOP of the foreign countries and there is no favorable or unfavorable BOP. Where as an open economy such favorable and unfavorable BOP has considerable effect on the country as well as on the economy. Thus an open economy suffers from trade deficit if its imports exceeds its exports, in which case it can borrow financial capital from other countries or from the international capital markets.

A small open economy has been considered with perfect capital mobility. In the context of international capital flows, a small country is the one which has no influence over the world rate of interest. The term perfect mobility refers to the fact that the people of a country can borrow or lend freely in the absence of government intervention in the world capital markets.

Due to perfect capital mobility, the domestic rate of interest r is the same as that of the world rate of interest r*. Both the domestic and world rate of interest is determined by savings and investment.

Q8) Explain exchange rate and interest rate differential.

A8)

Exchange rates

Exchange rate is the rate at which the currency of one country is exchanged for the currency of another country. According to David Ricardo, international trade is a highly organized system of barter. In this theory of comparative cost advantage, the commodities and money is not used as a medium of exchange. However, in modern times the world has changed and thus the relevant concept is the exchange rate.

Nominal and real exchange rate: It is the exchange rate of a currency against any other. It is thus a bilateral concept.

Effective exchange rate (EER): It is weighted average of nominal rates, the weights being the shares of the respective countries in the trade of the country for which the EER is being calculated.

RER = NER(P*/P)

Real effective exchange rate: This is the overall RER for the economy. It is the weighted average of the RERs for all its trade partners, the weights being the shares of the respective countries in its foreign trade. It may be interpreted as the quantity of domestic goods which is to be given up to get one unit of a given basket of foreign goods.

The balance of trade is equal to net capital outflow, which in turn, equal S- I. Savings depends on C, G and T. Investment depends on both domestic and the world rate of interest. In a world of perfect capital mobility, there is only one rate of interest.

Types of Exchange Rates

Free-Floating

A free-floating exchange rate rises and falls due to changes in the foreign exchange market.

Restricted Currencies

Some countries have restricted currencies, limiting their exchange to within the countries' borders. Also, a restricted currency can have its value set by the government.

Currency Peg

Sometimes a country will peg its currency to that of another nation. For instance, the Hong Kong dollar is pegged to the U.S. Dollar in a range of 7.75 to 7.85. This means the value of the Hong Kong dollar to the U.S. Dollar will remain within this range.

Onshore Vs. Offshore

Exchange rates can also be different for the same country. In some cases, there is an onshore rate and an offshore rate. Generally, a more favourable exchange rate can often be found within a country’s border versus outside its borders. China is one major example of a country that has this rate structure. Additionally, China's yuan is a currency that is controlled by the government. Every day, the Chinese government sets a midpoint value for the currency, allowing the yuan to trade in a band of 2% from the midpoint.

Spot vs. Forward

Exchange rates can have what is called a spot rate, or cash value, which is the current market value. Alternatively, an exchange rate may have a forward value, which is based on expectations for the currency to rise or fall versus its spot price. Forward rate values may fluctuate due to changes in expectations for future interest rates in one country versus another. For example, let's say that traders have the view that the eurozone will ease monetary policy versus the U.S. In this case, traders could buy the dollar versus the euro, resulting in the value of the euro falling.

Quotation

Typically, an exchange rate is quoted using an acronym for the national currency it represents. For example, the acronym USD represents the U.S. Dollar, while EUR represents the euro. To quote the currency pair for the dollar and the euro, it would be EUR/USD. In this case, the quotation is euro to dollar, and translates to 1-euro trading for the equivalent of $1.13 if the exchange rate is 1.13. In the case of the Japanese yen, it's USD/JPY, or dollar to yen. An exchange rate of 100 would mean that 1 dollar equals 100 yen.

Interest-rate differentials case of a large economy

An interest rate differential is a difference in interest rate between two currencies in a pair. If one currency has an interest rate of 3% and the other has an interest rate of 1%, it has a 2% interest rate differential. The use of interest rate differentials is of particular concern in foreign exchange markets for pricing purpose.

If you were to buy the currency that pays 3% against the currency that pays 1%, you would be paid on the difference with daily interest payments. This simple definition is known as the carry trade, earning carry on the interest rate differential. Development in recent years has brought interest rate differentials to a new light that are worth investigating.

In general, interest rate differential weights the contrast in interest rate between two similar interest – bearing assets. Traders in the foreign exchange market use IRDs when pricing forward exchange rates.

Based on interest rate parity a trader can create an expectation of the future exchange rate between two currencies and set the premium, or discount, on the current market exchange rate future contracts.

IRD calculation are often used in fixed income trading, forex trading, and lending calculations

Q9) Explain saving and investment in a small and a large open economy, exchange rates?

A9)

Saving and investment in a small and a large open economy

A closed economy country does not have to bother about the BOP of the foreign countries and there is no favorable or unfavorable BOP. Where as an open economy such favorable and unfavorable BOP has considerable effect on the country as well as on the economy. Thus an open economy suffers from trade deficit if its imports exceeds its exports, in which case it can borrow financial capital from other countries or from the international capital markets.

A small open economy has been considered with perfect capital mobility. In the context of international capital flows, a small country is the one which has no influence over the world rate of interest. The term perfect mobility refers to the fact that the people of a country can borrow or lend freely in the absence of government intervention in the world capital markets.

Due to perfect capital mobility, the domestic rate of interest r is the same as that of the world rate of interest r*. Both the domestic and world rate of interest is determined by savings and investment.

Exchange rates

Exchange rate is the rate at which the currency of one country is exchanged for the currency of another country. According to David Ricardo, international trade is a highly organized system of barter. In this theory of comparative cost advantage, the commodities and money is not used as a medium of exchange. However, in modern times the world has changed and thus the relevant concept is the exchange rate.

Nominal and real exchange rate: It is the exchange rate of a currency against any other. It is thus a bilateral concept.

Effective exchange rate (EER): It is weighted average of nominal rates, the weights being the shares of the respective countries in the trade of the country for which the EER is being calculated.

RER = NER(P*/P)

Real effective exchange rate: This is the overall RER for the economy. It is the weighted average of the RERs for all its trade partners, the weights being the shares of the respective countries in its foreign trade. It may be interpreted as the quantity of domestic goods which is to be given up to get one unit of a given basket of foreign goods.

The balance of trade is equal to net capital outflow, which in turn, equal S- I. Savings depends on C, G and T. Investment depends on both domestic and the world rate of interest. In a world of perfect capital mobility, there is only one rate of interest.

Types of Exchange Rates

Free-Floating

A free-floating exchange rate rises and falls due to changes in the foreign exchange market.

Restricted Currencies

Some countries have restricted currencies, limiting their exchange to within the countries' borders. Also, a restricted currency can have its value set by the government.

Currency Peg

Sometimes a country will peg its currency to that of another nation. For instance, the Hong Kong dollar is pegged to the U.S. Dollar in a range of 7.75 to 7.85. This means the value of the Hong Kong dollar to the U.S. Dollar will remain within this range.

Onshore Vs. Offshore

Exchange rates can also be different for the same country. In some cases, there is an onshore rate and an offshore rate. Generally, a more favourable exchange rate can often be found within a country’s border versus outside its borders. China is one major example of a country that has this rate structure. Additionally, China's yuan is a currency that is controlled by the government. Every day, the Chinese government sets a midpoint value for the currency, allowing the yuan to trade in a band of 2% from the midpoint.

Spot vs. Forward

Exchange rates can have what is called a spot rate, or cash value, which is the current market value. Alternatively, an exchange rate may have a forward value, which is based on expectations for the currency to rise or fall versus its spot price. Forward rate values may fluctuate due to changes in expectations for future interest rates in one country versus another. For example, let's say that traders have the view that the eurozone will ease monetary policy versus the U.S. In this case, traders could buy the dollar versus the euro, resulting in the value of the euro falling.

Quotation

Typically, an exchange rate is quoted using an acronym for the national currency it represents. For example, the acronym USD represents the U.S. Dollar, while EUR represents the euro. To quote the currency pair for the dollar and the euro, it would be EUR/USD. In this case, the quotation is euro to dollar, and translates to 1-euro trading for the equivalent of $1.13 if the exchange rate is 1.13. In the case of the Japanese yen, it's USD/JPY, or dollar to yen. An exchange rate of 100 would mean that 1 dollar equals 100 yen.

Q10) Write about spot and forward exchange rate.

A10)

Exchange rates can have what is called a spot rate, or cash value, which is the current market value. Alternatively, an exchange rate may have a forward value, which is based on expectations for the currency to rise or fall versus its spot price. Forward rate values may fluctuate due to changes in expectations for future interest rates in one country versus another. For example, let's say that traders have the view that the eurozone will ease monetary policy versus the U.S. In this case, traders could buy the dollar versus the euro, resulting in the value of the euro falling.