Unit 1

Introduction

Q1) Define Cost Accounting and how did it evolve?

A1) Costing:

The Society of cost control accountants (ICMA) London defines costing as a confirmation of costs, and costing includes the technology and process of confirming costs.

Cost accounting:

The Society of cost management accountants (ICMA) in London defines cost accounting as"the science, art and application of the principles, methods and techniques of cost accounting and cost accounting to the practice of cost management and confirmation of profitability, as well as the presentation of information for the purpose of management decision making". Therefore, cost accounting includes costing, costing, Budget Control, cost control, and cost audit. Costing refers to the process of determining and accounting for the cost of a particular product or activity. It also includes classification, analysis and guessing the production of costs.

Costing:

I.C.M.A.London defines costing as"the process of accounting for costs from the time when expenditures occur or from the time when they are committed to establishing the ultimate relationship with cost centers and cost units."

In practice, costing, costing, and cost accounting are often used interchangeably. Cost accounting refers to the confirmation of costs, the accumulation and measurement of costs of activities, processes, products or services. Cost data is used to create costing sheets or cost sheets. Costing is a professional Department of accounting that helps manage costs to control and create awareness of the importance of costs to the well of the business organization. Managing a business to achieve its objectives requires systematic and useful cost data and reporting.

Evolution of Cost

Widespread interest in the subject of costing can be said to have developed in the Industrial Revolution, which began in 1760. As the factory system was followed by mechanization, simplification, standardization and mass production, costing had to keep up with these developments. Until the 18th century, costing was in the area of Engineers. Integration with financial accounting began when accountants began to audit cost records. Under the influence of financial accountants, costing came to be seen almost exclusively as a meA of inventory valuation and profit measurement.

Costing has been found to assist in managing when compiling and providing the required statistical data. It has developed rapidly and assisted management of providing valuable information to take appropriate decisions in time. Costing sheds light on excessive waste of materials, inefficient labor operations, idle machinery and many other similar factors that are responsible for the reduction of profits in business activities. Management has found that costing can provide valuable assistance in planning, managing and coordinating activities.

Q2) Write short note on Cost Center and Cost units.

A2) Cost center: A cost center is a place, person or asset that can be checked for costs and used for cost management purposes. This is an organizational segment or area of activity that is used to accumulate costs. The different types of cost centers used in manufacturing organizations are personal cost Cantor, impersonal cost center, work cost center and process Center.

Cost units: A cost unit is a unit of the quantity of a product or service for which the cost is likely to be confirmed. There should be a unit of activity for proper confirmation of costs. Every organization has its own units for the measurement of raw materials and finished products. When the unit of activity is determined, it becomes the cost unit of the cost accountant. The cost unit must be suitable for your organization. The following is an example of cost units in different industries:

Nature of Industry | Cost Unit |

Cement

| Tonne |

Cable | Metre

|

Power | Kilowatt/ hour |

Hospital | Per bed

|

Q3) What are the Objectives of Cost Accounting?

A3) Cost accounting goals are usually used to indicate activities in which costs must be determined individually. Activities can be functions for which data is required,sub-divisions of the organization, contracts or other units of work. There is a direct relationship between the information needs of management, the purpose of costing, the technologies and tools used for analysis in costing. Therefore, costing has the following purposes-

- Determine the cost of the product.

- To facilitate the planning and management of regular business activities.

- Provide information for short-term and long-term decisions.

Q4) When you install,how does the costing system looks ?

A4) When you install, the costing system looks like this:-

1 Costing reveals areas where materials were overused, Labor ran inefficiently and expenses incurred exorbitantly.

2 We propose a cost reduction program. Continuous costs in collaboration with technical personnel seeking areas for introducing cost savings bring beneficial results.

3 Cost accounts find specific causes for profit fluctuations. It points out that you lose products and operations. This indicates the reason for the loss and suggests corrective actions in time.

4 Provide management with the right data to choose the best option. You can decide whether to buy or manufacture parts, operate the Machine X or Y, accept or reject orders below the cost

5 The cost account gives the actual costs for price fixing. True supply and demand play an important role in fixing prices. But the cost is an essential guide here.

6 It provides important data up to in the bid. Bids filled with the help of marginal costing technology are successful.

7 Standard Costing and Budget Control help maximum efficiency.

8 Cost comparison helps cost control. Such comparisons can be between different periods of the same department or equivalent operations of different units.

9 Cost data is useful for external institutions such as governments,courts, etc.To make decisions on tariff regulation,settlement of disputes,fluctuations in wage levels, etc.

10 It can play with capacity costs to help overcome operational crises.

11 Marginal costing technology helps to make appropriate short-term decisions in times of trade recession.

12 Costing lays cost center and responsibility center to ensure proper organizational structure.

13 Costing provides a permanent inventory system. This enables inventory management and the creation of short-term profit and loss accounts.

14 The cost of closing the stock of raw materials, work in progress and finished products is readily available in the cost record.

Q5) What are the Methods of costing?

A5) Several methods or types of costing have been designed to suit the needs of individual business requirements. These are job costing and process costing.

All other costing methods are either variants of these two methods or techniques designed for specific purposes, specific opportunities, and specific conditions.

Job costing:this method is good for checking the cost of a job, a specific order, or a batch of finished products.

Where the cost unit is a job consisting of a specific quantity manufactured according to the order. The work can be small or large. It may be as per customer order for stock for final sale. Other variations of job costing are given below: -

- Contract costing:this method is used by contractors for construction of architectural bridges etc. Where the unit of cost is the contract. The term of this contract usually extends beyond the current fiscal year.

- Batch costing: this method produces economical batches of parts for subsequent assembling manufacturers large engineering companies use this method. Here, costing is done for batches of components, not for a single component.

- Multiple costing:this is used in large industries such as automobile, aircraft flat industry etc.Here the cost of parts is calculated separately. Each component is a job sheet. These are then assembled to complete the cost of an airplane or other finished product.

Q6) What are the essentials of a good costing system?

A6) The essentials of a good costing system are:

- The costing system must conform to the General Organization of the business. Usually no component alternation should be made to facilitate the costing system. However, unavoidable changes can be made in the establishment of the position of holding, and proper costing system.

- All relevant technical aspects (nature and method of production, product varieties, etc.) should be properly considered in order to adopt appropriate cost control ingenuity.

- The size, placement and configuration of the factory should be fully described for the advantages of those operating costing systems.

- It is necessary to clearly specify the procedures that must be followed for the purchase, receipt, storage and issuance of materials.

- It is necessary to specify the method of payment of wages and the system of labor management.

- It is necessary to specify the norms of appointment and assignment of overhead.

- Economics to ensure that the original record can be proper.

- Form should be obtained printed. It should contain full instructions. Those who use them should be properly trained to ensure the correctness and relevance of the data written on the form.

- The Examiner must check and sign all entries in the form.

- Responsibility for preparing and sending cost reports to various levels of management at regular intervals should be fixed and the necessary instructions in this regard be issued.

- Full cooperation from everyone involved in management should be enlisted. Resistance from employees should be minimal.

- The cost of managing a costing system must be commensurate with the profit available from it.

- Design the system appropriately to effectively perform cost control.

- Cost accounts and financial accounts must be linked. Or the results of two sets of accounts should be adjusted.

- Frequency, regularity and speed in the presentation of cost reports should be guaranteed.

Q7) Explain the term Cost Accounting.

A7) Overview of Cost Accounting: In the initial, the road was thought of as a value accounting technique of goods or services backed by historical knowledge. Thanks to the character of the market has recognized that crucial prices don't seem to be as vital as dominant prices. Therefore the prices compared to clerking, clerking was seen additional as a price management technique. Due to the areas of technological development altogether, value | the worth reduction} is presently put together inside the worth space Accounting. Therefore, it's the road of registration, classification and outline of the prices of Identify the worth of any product or service, plan, manage and cut back those prices and see from information to management to come to a decision.

Line meanings and definitions

“Cost accounting are often a way by that info consists, apportion summed up and understood for three main purposes: (in) elaboration and operational management, (ii) specific decision; and (iii) product Decision. "Charles T. Horngren

“Cost accounting is the strategy of the road from the aim that the unit of expenses incurs of committed to manufacturing your final relationship with value units. Inside the broadest sense, it includes the production of mathematical knowledge, the dear device management strategies and, moreover, the identification of

The profitableness of the activities assigned or planned is written as results of the appliance of accounting and equity accounting Principles, strategies and techniques for crucial prices and to investigate savings and / or surpluses as compared to previous expertise or standards. "- Institute of prices and Management contain the presentation of the info that has therefore been derived for the aim of decision-making in social control positions. –Wheldon

Cost accounting therefore provides management with info for elections of every kind. This is why the functions have invariably been indistinguishable from management accounting or alleged accounting internal accounting. Wilmot has adopted the road kind as "scan, record, Standardization, Prediction, Comparison, News and suggestions “and the role of a price account itself from "a scholar, news agent and Rophet"

Costing, called the form of management accounting that companies use to classify, summarize, and analyze different costs, helps management make better decisions for cost control and cost savings. The main function of costing is said to be to adjust, record, and identify investment allocations that are appropriate for the investment in determining the cost of goods and services. It also helps present relevant data to administrators involved in searching for services, contracts, or shipping costs.

It also contains information related to production, distribution and sales costs.

Q8) What are the benefits of Cost Auditing.

A8) Benefits of cost auditing:

The main advantage of cost auditing is that it ensures that management has reliable data for price-fixing, decision-making, control, and other purposes. The existence of such an audit system is additionally very helpful in maintaining internal checks. It's also very useful for accounting audits. However, it's important to know that financial and price audits have different purposes.

The former aims to stop fraud and errors, and by presenting the earnings report and record , it's possible to understand things (profit obtained during the year and economic condition at the top of the year) during a true and fair manner. Is aimed toward .

It's not about functional analysis, it's about spending and revenue as an entire . Cost audits are involved within the proper analysis and estimation of data in order that management can quickly obtain the knowledge they have , establishing cost accuracy for every product, job, activity, and so on. Aside from data reliability, cost auditing has certain incidental benefits. Rather, it must be said that cost audits help integrate and realize the advantages expected from costing systems. Following a press release by Minister of Justice HR Go Curry, judicial and company issues highlight the social benefits of cost auditing.

The reasonableness of the worth charged is to properly determine the prices and margins charged by producers and their retailers. Guaranteed only by. Another purpose underlying this step is cheap to take care and efficient for the industries subject to such rules and to scale back costs the maximum amount as possible. Informing about the value . Therefore, counting on this method protects the interests of consumers and may be a clear step towards eliminating social injustice.

Advantages of Cost Audit

(I) Thoroughly check all waste (in-store materials, workers, etc.), promptly identify and report.

(II) Production inefficiencies (or efficiencies) are identified and converted into financial terms.

(III) Exceptional management is possible by establishing individual responsibilities.

(IV) The budget control and standard costing system is greatly facilitated by cost audits by qualified costing personnel.

(V) Records are up to date and information is available for a variety of purposes.

(VI) Cost audits can uncover many errors and frauds that may not otherwise be revealed. This is because cost auditors take a closer look at spending and compare it to criteria to see the exact reason for the discrepancy.

Q9) Mention the importance of Cost Accounting.

A9) Importance of Cost Accounting

Costing is very important for commercial organizations. It also helps other organizations. One of such areas is the presentation of information in the most useful way. Costing is used to measure, analyze, or estimate costs. Reporting to stakeholders on the profitability and performance of individual products, departments and other segments of an organization, internal or external, or both costing concerns the synthesis and analysis of costs. Its purpose in modern times is to support management in the twin functions of decision-making and control. Therefore, costing is not just about finding costs, but advises on the management, planning and management of organizations and business operations. The Companies Act also stipulates that certain companies must maintain cost accounting records and accounts and conduct audits of cost accounts.

Q10) What are the advantages of Cost Accounting?

A10) Advantages of Cost Accounting are:

- Costing reveals areas where materials were overused, Labor ran inefficiently and expenses incurred exorbitantly.

- We propose a cost reduction program. Continuous costs in collaboration with technical personnel seeking areas for introducing cost savings bring beneficial results.

- Cost accounts find specific causes for profit fluctuations. It points out that you lose products and operations. This indicates the reason for the loss and suggests corrective actions in time.

- Provide management with the right data to choose the best option. You can decide whether to buy or manufacture parts, operate the Machine X or Y, accept or reject orders below the cost

- The cost account gives the actual costs for price fixing. True supply and demand play an important role in fixing prices. But the cost is an essential guide here.

- It provides important data up to in the bid. Bids filled with the help of marginal costing technology are successful.

- Standard Costing and Budget Control help maximum efficiency.

- Cost comparison helps cost control. Such comparisons can be between different periods of the same department or equivalent operations of different units.

- Cost data is useful for external institutions such as governments,courts, etc.To make decisions on tariff regulation,settlement of disputes,fluctuations in wage levels, etc.

- It can play with capacity costs to help overcome operational crises.

- Marginal costing technology helps to make appropriate short-term decisions in times of trade recession.

- Costing lays cost center and responsibility center to ensure proper organizational structure.

- Costing provides a permanent inventory system. This enables inventory management and the creation of short-term profit and loss accounts.

- The cost of closing the stock of raw materials, work in progress and finished products is readily available in the cost record.

- Not all organizations get all the advantages mentioned above.

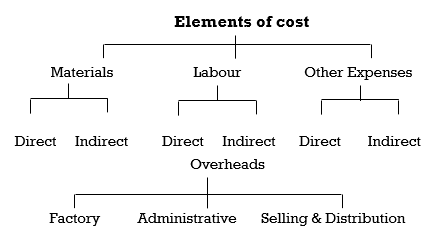

Q11) Write the Composition of elements of cost.

A11) A classification has to be made to arrive at the detailed costs of departments, production orders, jobs or other cost units. The total cost of production can be found without such analysis, and in many instances an average unit cost could be obtained but none of the advantages of an analysed cost would be available”. Harold. J. Wheldon.

Simple ascertainment of total cost cannot satisfy the various requirements of decision making. For effective control and managerial decision making, data is to be provided on the basis of analysed and classified costs. In order to satisfy this objective, cost is analysed by elements of cost i.e., by nature of expenditure.

Composition of elements of cost are:

The manufacturing organization converts raw materials into finished products. To that end, it employs labour and provides other facilities. It is necessary to check the amount spent on all this, while aggregating the cost of production. For this purpose, the cost is mainly classified into various factors. This classification is necessary for accounting and management. The cost elements are

(i) Direct material

(II) Direct labour

(iii) Direct expenses and

(iv) Overhead.

The following chart shows the wide heading of the cost and these acts as the basis for preparing the cost sheet.

Q12) Define Process costing.

A12) Process costing:this method is used in industry to manufacture products by continuous process. The cost is confirmed over the period by the process or department, but time is given more importance here as it is clear from the costing of the work. Therefore, this is also called period costing. Examples of industries that use process costing are the chemical industry, papermaking and refineries. The process costing can also be changed without:

- Work costing:work costing is applied to places where production goes through multiple operations in succession before the final product is manufactured. Wear and tear may occur in each operation. Work costing is used in industries such as Box manufacturing, shoe manufacturing and toy manufacturing. Where the cost unit is the work on which costs are accumulated.

- Single or output or individual costing: examples of industries applying this method are mining, quarry and steel production where the production is of a continuous nature and the final product is only one or different grades of the same product.

- Behavior costing:this method applies not to figure out the cost of drawing. Examples of industries using this method are trAport services, electrical and boiler houses. In trAport services, the unit of cost is passenger kilometers, or kilometers kilometers.

Q13) Explain the composition of Cost elements.

A13) (i) Direct Materials Cost:

Direct material cost is “The cost of materials entering into and becoming constituent elements of a product or saleable service”. Thus, materials which can be identified with units of output or service are known as direct materials.

Cotton used in production of cloth, leather used in the case of production of leather goods and lime in the production of chalk, etc., are the examples of direct materials. Any materials purchased and used for a specific job are also direct materials.

(ii) Indirect Materials:

Materials used for the product other than the direct materials are called indirect materials. In other words, materials cost which cannot be identified with a specific product, job, process is known as indirect material cost.

Small tools, stationery used in works, office stationery, advertising posters, and materials used in maintenance of plant and machinery are a few examples of indirect materials.

Element # 2 Labour:

Labour is the remuneration paid for physical or mental effort expended in production and distribution.

“The labour cost is the cost of remuneration (wages, salaries, commissions, bonus, etc.) of the employees of an undertaking” – I.C.M.A

Labour cost is also divided into direct and indirect portions:

(i) Direct Labour Cost:

It is also called ‘Direct-wages’. Direct labour cost is the cost of labour directly engaged in production operations. E.g., workmen engaged in assembling parts, carpenters engaged in furniture making, etc.

(ii) Indirect Labour Cost:

Indirect labour cost is the remuneration paid for labour engaged to help the production operations, e.g., inspectors, watchmen, sweepers, store keepers, etc. The remuneration paid to these persons cannot be traced to a job, process or production order. The labour costs of idle time, overtime, holidays, etc., are also taken as indirect costs. Similarly, clerical and managerial staff, salesmen, distribution employees are also included in the orbit of ‘indirect labour’.

Element # 3 Expenses:

Expenditure other than material and labour is the third element of cost.

It is defined by I.C.M.A. As- “The cost of service provided to an undertaking and the notional cost of the use of owned assets”.

Expenses are of two types:

(i) Direct expenses, and

(ii) Indirect expenses.

(i) Direct Expenses:

These are the expenses which can be directly identified with a unit of output, job, process or operation. They are specifically incurred for a job, or unit or process and in no way they are connected with other jobs or processes. The direct expenses are also known as chargeable expenses.

Some examples are:

(a) Hire charges of special plant used for a job.

(b) Royalty on products.

(c) Cost of special patterns, designs or plans for a particular job or work order, etc.

(ii) Indirect Expenses:

Indirect expenses are expenses other than indirect material and indirect labour, which cannot be directly identified with units of output, job, process or operation. These expenses are incurred commonly for jobs and processes. E.g., rent, power, lighting, depreciation, bank charges, advertising, etc.

Direct Cost or Prime Cost:

The aggregate of all the direct costs i.e., Direct Materials, Direct Labour or wages and Direct expenses is termed as- ‘Prime Cost’ or ‘Direct cost’. Thus prime cost or direct cost is the sum of all the elements of costs which can be specifically identified with particular products or jobs and allocated to such output.

Indirect Cost or ‘Overhead’ or ‘On Cost’ or ‘Burden’:

The aggregate of all the indirect costs i.e., Indirect Material, Indirect labour and Indirect expenses is variously termed as ‘On cost’ or ‘overhead’ or ‘Burden’. Over heads or on cost or indirect cost cannot be identified with specific products or jobs. So it is apportioned to the output on some reasonable basis.

I.C.M.A., defines overheads as follows:

“The aggregate of indirect materials cost, indirect wages cost (indirect labour cost) and indirect expenses”. I.C.M.A. Has stated in the note appended to this definition – ‘on cost’ and “Burden” as synonymous terms which are not recommended.

Elements # 4. Overhead:

On the basis of functions overhead is classified as:

(i) Factory overhead

(ii) Administration or office overhead, and

(iii) Selling and Distribution overhead.

(i) Factory Overhead:

This is the aggregate of indirect material, indirect wages and indirect expenses incurred in the factory. Examples of indirect factory expenses are rent, power, depreciation lighting and heating incurred in the factory.

(ii) Administration or Office Overhead:

All the indirect administration expenses, come under this category. Salaries of office staff, accountants, directors’ fees, rent of office building, stationery expenses incurred in the office lighting and bank charges, etc., are the examples.

(iii) Selling and Distribution Overhead:

This includes indirect selling and distribution expenses. Examples are salaries of salesmen, selling commission, advertising, warehouse rent, maintenance of delivery vans, warehouse staff expenses, warehouse lighting, etc.

Expenses Excluded from Costing:

The following items are excluded from computation of total cost:

(a) Capital Costs and Capital Losses- Purchase of fixed assets, plant and machinery, building, etc. Loss on sale of fixed assets, abnormal losses, preliminary expenses, patents written off, etc.

(b) Transfer to reserves, income tax, dividend, bonus to shareholders, etc.

(c) Financial items like, cash discount, interest on debentures, interest on loans, interest on own capital, etc.

Q14) How do managers use cost behavior patterns to make better decisions?

A14) Accurately predicting what costs will be in the future can help managers answer several important questions. For example, managers at Bikes Unlimited might ask the following:

We expect to see a 5 percent increase in unit sales next year. How will this affect revenues and costs?

We are applying for a loan with a bank, and bank managers think our sales estimates are high. What happens to our revenues and costs if we lower estimates by 20 percent?

1. Fixed costs remain static or constant no matter changes in output. Fixed costs are associated with time.

Theoretically, variable costs remain constant per output unit, and glued costs remain constant per total or unit time. Within the end of the day , these concepts don't apply. A comprehensive definition of variable costs should include costs that tend to fluctuate with output, or costs that have a serious relationship with output, and glued costs tend to be constant across production volumes. With output that ought to include costs, or costs that aren't significantly related.

2. Semi-variable costs don't change proportionally or remain static. For instance . i will be able to repair it.

3. Step cost is that the cost of jumping to a replacement level because the activity changes, fixed over the scope of the activity.

Based on features: Enterprises got to perform many features and see the value of every of those features. The subsequent may be a brief description of every feature cost.

The Chartered Institute of Management Accountants (CIMA), London defines various functional costs as follows:

(i) Manufacturing / cost. the value of operating a company's manufacturing department is that the manufacturing cost. This includes costs from the availability of materials, labor and services to the first packaging of the merchandise. Therefore, it includes direct material costs, direct labor costs, direct costs and factory overhead costs.

(ii) Management fee. Management costs are the prices of policymaking, organizational command, and operational management that aren't directly associated with production, sales, distribution, research, or development activities or functions.

(iii) Selling expenses. the value of pursuing demand generation and stimulus (sometimes called marketing) and securing orders.

(iv) Distribution costs. the value incurred from having the ability to ship the packaged product to having the ability to use the readjusted returned empty package, if any. Distribution costs also include expenses incurred to maneuver goods to and from prospects, as within the case of sales or returns.

(v) Research expenses. The value of checking out new or improved products, new applications of materials, or new or improved methods.

(vi) Development cost. the value of creating a choice to supply a replacement or improved product, or the choice to adopt a replacement or improved method by that method, until the formal production of that product begins, is that the cost of development.

(vii) Pre-manufacturing cost. Of the event costs from prototype to production, that part is that the prototype cost. This is often treated as a deferred revenue expense and is recorded in future production costs.

Q15) Narrate the objectives of Cost Accounting. (8 marks)

A15) Widespread interest in the subject of costing can be said to have developed in the Industrial Revolution, which began in 1760. As the factory system was followed by mechanization, simplification, standardization and mass production, costing had to keep up with these developments. Until the 18th century, costing was in the area of Engineers. Integration with financial accounting began when accountants began to audit cost records. Under the influence of financial accountants, costing came to be seen almost exclusively as a means of inventory valuation and profit measurement.

Costing has been found to assist in managing when compiling and providing the required statistical data. It has developed rapidly and assisted management of providing valuable information to take appropriate decisions in time. Costing sheds light on excessive waste of materials, inefficient labor operations, idle machinery and many other similar factors that are responsible for the reduction of profits in business activities. Management has found that costing can provide valuable assistance in planning, managing and coordinating activities.

Definitions

Costing:

The Society of cost control accountants (ICMA) London defines costing as a confirmation of costs, and costing includes the technology and process of confirming costs.

Cost accounting:

The Society of cost management accountants (ICMA) in London defines cost accounting as "the science, art and application of the principles, methods and techniques of cost accounting and cost accounting to the practice of cost management and confirmation of profitability, as well as the presentation of information for the purpose of management decision making". Therefore, cost accounting includes costing, costing, Budget Control, cost control, and cost audit. Costing refers to the process of determining and accounting for the cost of a particular product or activity. It also includes classification, analysis and guessing the production of costs.

Costing:

I.C.M.A. London defines costing as "the process of accounting for costs from the time when expenditures occur or from the time when they are committed to establishing the ultimate relationship with cost centers and cost units."

In practice, costing, costing, and cost accounting are often used interchangeably. Cost accounting refers to the confirmation of costs, the accumulation and measurement of costs of activities, processes, products or services. Cost data is used to create costing sheets or cost sheets. Costing is a professional Department of accounting that helps manage costs to control and create awareness of the importance of costs to the well of the business organization. Managing a business to achieve its objectives requires systematic and useful cost data and reporting.

Cost center:

A cost center is a place, person or asset that can be checked for costs and used for cost management purposes. This is an organizational segment or area of activity that is used to accumulate costs. The different types of cost centers used in manufacturing organizations are personal cost Cantor, impersonal cost center, work cost center and process Center.

Cost accounting goals are usually used to indicate activities in which costs must be determined individually. Activities can be functions for which data is required, sub-divisions of the organization, contracts or other units of work. There is a direct relationship between the information needs of management, the purpose of costing, the technologies and tools used for analysis in costing. Therefore, costing has the following purposes-

The main objectives of introduction of a Cost Accounting System in a manufacturing organization are as follows:

(i) Ascertainment of cost: The main objective of a Cost Accounting system is to ascertain cost for cost objects. Costing may be post completion or continuous but the aim is to arrive at a complete and accurate cost figure to assist the users to compare, control and make various decisions.

(ii) Determination of selling price: Cost Accounting System in a manufacturing organization enables to determine desired selling price after adding expected profit margin with the cost of the goods manufactured.

(iii) Cost control and Cost reduction: Cost Accounting System equips the cost controller to adhere and control the cost estimate or cost budget and assist them to identify the areas of cost reduction.

(iv) Ascertainment of profit of each activity: Cost Accounting System helps to classify cost on the basis of activity to ascertain activity wise profitability.

(v) Assisting in managerial decision making: Cost Accounting System provides relevant cost information and assists managers to make various decisions.