Unit - 3

Accounting for Overheads

Q1) What are the Methods of Overhead Absorption?

A1) Methods of Overhead Absorption

- Direct Material Cost Method

- Actual overhead / direct material costs X100

- Direct labor cost method

- Actual overhead / direct labor costs X100

- Prime cost method

- Budget Expenses / Expected Prime Costs

- Direct working hours law

- Overhead / direct working hours

- Rate per unit of production method

- Budget overhead / budget production unit

- Selling price method

- Budget overhead / sales of production units

- Machine hour rate method • Total overhead / total machine Hours

Q2) What is overhead departmentalization?

A2) Organizations include production, finance, human resources, accounting, sales, research, Efficient work, collection allocation, development for cost absorption, etc. Therefore, the overhead collected is allocated or allocated to each department on an appropriate basis. This process is called overhead division.

This process assists in managing costs and managing expenses for each department. In addition, the production cost of goods and services is confirmed, the department is passed through, and the services provided by the department are performed.

Q3) Explain overhead classification.

A3) The process of grouping overheads according to common characteristics is known as overhead classification. It provides managers with information that allows them to effectively manage their business. Overhead can be categorized as follows:

a. Elements: indirect materials, labor costs;

b. Function: Expenses for production, management, sales and distribution.

c. Behavior: Fixed, variable, and semi-variable overhead.

1. Fixed overhead remains fixed and is not affected by changes in production levels. For example, rent, fees, salaries, statutory expenses, etc.

2. Variable overhead costs change in direct proportion to changes in production, such as indirect materials, fuel, electricity, stationery, and sales staff commissions.

3. Semi-variable overhead costs are partially fixed and partially variable costs. They remain fixed to production volume and change when production exceeds a certain volume. For example, telephone charges include machine depreciation, repair and maintenance, and supervision costs.

Collection of expenses and codification

Overhead is collected and systematized under the appropriate head. Similar overhead items should be grouped. Overhead grouping is done by a technique called "Codification". This is a way to identify and describe various expenses with numbers, letters, or a combination of both, making it easy to collect cost data. The coding of the entire item is done through a proper coding system. Expenses are collected through store requests, financial accounting, wage tables, registries, and report sources.

Q4) Define Overhead allocation.

A4) Overhead allocation is the allocation of all items of costs to cost centers or costs to units. This refers to the billing of overhead costs to the cost center. This means that overhead was incurred due to the existence of that cost center. If a company offers multiple products, factory overhead is allocated to different production departments or cost centers. Appropriate overhead allocation is very important because incorrect allocations can distort income decisions, asset valuations, and performance valuations. The overhead allocation process is as follows:

i. Accumulate overhead costs based on department or product.

Ii. Identify cost targets for assigned costs

Iii. Choose how to associate such accumulated costs with cost goals.

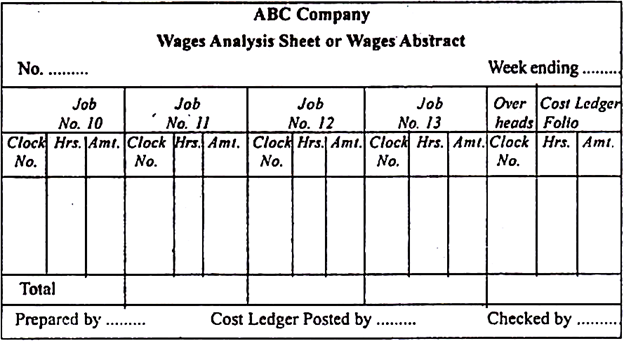

Q5) Explain with the help of diagram the Wage analysis.

A5) The wages charged for various jobs are shown on an analysis sheet called the Wage Analysis Sheet. This is suitable if your company is small and the number of jobs running is small. If you have a lot of work, as in a large company, the timesheet will pre-list the total labor costs and agree with a payroll overview.

The wage summary decisions are as follows:

The analysis sheet shows the labor costs for various jobs and the overhead costs charged as overhead costs.

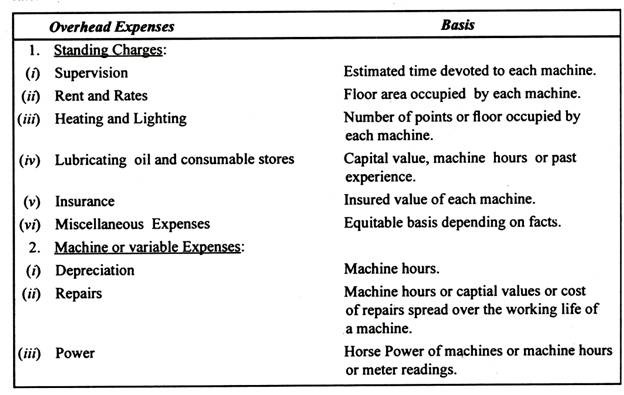

Q6) What are the criteria used to allocate costs for calculating the time rate of a machine?

A6) The following are the criteria used to allocate costs for calculating the time rate of a machine.

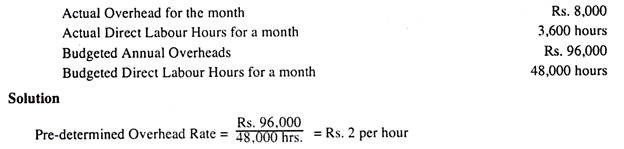

Q7) Calculate the predetermined overhead costs using the direct working hours of the budget period and the overhead charges charged for production for the month from the following details

A7)

The actual time in a month was 3,600 hours, so the overhead charged to production Rs. 7,200 (that is, 3600 x Rs. 2). However, the actual overhead for the month was only Rs. 8,000.

Q8) What are the causes of over-absorption?

A8) Overhead absorption is the name given to the process of absorbing the overhead of a business into the cost of its products. The process allows the total product cost to be used by the business in making decisions about pricing, profitability and inventory valuations.

Difference Between Overhead Absorption, Allocation and Apportionment

In order to understand cost absorption, it is necessary to distinguish it from overhead allocation, and apportionment. Overhead allocation is used to allocate overhead that is specifically identified with a cost center to that cost center, apportionment is used to apportion overhead costs between cost centers, and absorption is used to absorb the overhead into the total cost of its products.

The process of overhead absorption involves four steps.

Estimate overhead using a budget for the accounting period.

Choose an appropriate absorption base. An overhead absorption base is the basis used by a business to absorb its overhead costs into the cost of its products.

The absorption base is usually a quantity such as direct labor hours, direct labor cost, machine hours or material cost. The base used should be appropriate for the overhead cost to ensure that the cost is fairly absorbed between products.

Determine the overhead rate using the absorption rate formula. Having decided on an appropriate base, using the budgeted overhead, a predetermined overhead rate can be calculated using the absorption rate formula below.

- Overhead rate = Overhead cost / Total base quantity

- Apply the overhead Finally, the overhead is applied to the product cost by multiplying the base quantity used to manufacture the product by the calculated overhead rate.

Overhead absorbed = Product base quantity x Overhead rate

Overhead Absorption Example

Suppose a business budgets its annual overhead at 75,000 for the accounting period. The business applies overhead to its products using direct labor hours as the absorption base, and budgets for 30,000 direct labor hours for the same accounting period.

The business makes two products A and B. Product A uses 3.50 direct labor hours and product B uses 8.50 direct labor hours during manufacture.

- Estimate overhead

The overhead to be allocated is estimated using the budget as 75,000

2. Choose an appropriate absorption base

The absorption base in this case is direct labor hours. For the accounting period the total base quantity is 30,000 direct labor hours.

Determine the overhead rate

Using the overhead rate formula, the overhead rate is calculated as follows.

Reasons for overhead over or under absorption

The reasons for over absorption or under absorption of overhead are as follows:

1. Actual working hours are more or less than budget hours.

2. Actual overhead costs are different from budget overhead costs.

3. Both actual overhead costs and actual activity levels differ from budget costs and levels.

4. The overhead absorption method may be incorrect.

5. Unexpected costs may be incurred during the fiscal year end.

6. Overhead costs may be included in the calculation of overhead absorption rates.

7. Major changes, such as changing from manual to mechanical. This leads to increased capacity levels.

8. Seasonal variation of overhead costs over time.

Q9) Explain the concept of under and over absorption of overheads. Also describe the reasons of under and over absorption of overheads.

A9) Overhead is absorbed over a period of accounting or a specific period, depending on the actual production of the product, based on a given overhead absorption rate. Budgeted overhead and budgeted output are used to determine overhead rates. If the budget overhead and budget output differ between the actual overhead and the actual output, then 3 is the difference between the given overhead rate and the actual overhead rate.

If the overhead absorbed is greater than the overhead actually incurred, it is called overabsorption. If the overhead absorbed is less than the actual overhead incurred during the accounting period, it is said to be absorbed.

Reasons for overhead over or under absorption

The reasons for overabsorption or under absorption of overhead are as follows:

1. Actual working hours are more or less than budget hours.

2. Actual overhead costs are different from budget overhead costs.

3. Both actual overhead costs and actual activity levels differ from budget costs and levels.

4. The overhead absorption method may be incorrect.

5. Unexpected costs may be incurred during the fiscal year end.

6. Overhead costs may be included in the calculation of overhead absorption rates.

7. Major changes, such as changing from manual to mechanical. This leads to increased capacity levels.

8. Seasonal variation of overhead costs over time.

Handling of over or under absorption overhead

Overhead or shortage overhead is treated in the cost account in one of the following ways:

1. Application of additional charges

The subsidy rate is calculated by dividing the amount of under absorption or overabsorption by the actual basis. In the case of overabsorption, the compensation rate is applied to adjust the over recovery amount and vice versa.

2. Cost of sales adjustment

Over- or under-absorbed overhead costs are closed and transferred to the cost of goods sold account. This is done by the cost accountant at the end of each month or at the end of the accounting period. If a transfer is made at the end of the accounting period, excess / unabsorbed expenses will be treated as deferred income in the case of over-application and deferred expense in the case of under-application and will be carried forward monthly.

3. Amortization to costing profit and loss account

If the overhead or under absorption overhead is small, it is amortized by transferring it to the costing profit and loss account. If so, the closing inventory valuation is overvalued or undervalued.

4. Adjust to gross profit

Under-absorbed or over-absorbed overhead balances are closed by adjusting gross profit.

5. Carry over to the next year

Over-absorbed or over-absorbed overhead costs can be carried forward to the next fiscal year. It may be transferred to an overhead suspense account or an overhead reserve account. This overhead suspense account or overhead reserve account appears on your balance sheet.

Debit and credit balances that represent absorbed overhead or absorbed overhead that appear on the asset or liability side of the balance sheet. The basic idea is that he offsets the under absorption overhead in one year and the over absorbed overhead in another year. However, many accountants disagree with this idea. The reason is that the balance of unabsorbed / over absorbed overhead must not be carried over from one year to another. This method is also known as the use of reserve accounts.

Q10) What are the advantages and disadvantages of direct labour method?

A10) Direct labor cost is wages that are incurred in order to produce goods or provide services to customers. The total amount of direct labor cost is much more than wages paid. It also includes the payroll taxes associated with those wages, plus the cost of company-paid medical insurance, life insurance, workers' compensation insurance, any company-matched pension contributions, and other company benefits.

Direct labor costs are most commonly associated with products in a job costing environment, where the production staff is expected to record the time they spend working on various jobs. This can be a substantial chore if employees work on a multitude of different products. In the services industries, such as auditing, tax preparation, and consulting, employees are expected to track their hours by job, so their employer can bill customers based on direct labor hours worked. These are also considered to be direct labor costs. In a process costing environment, where the same product is created in very large quantities, direct labor cost is included in a general pool of conversion costs, which are then allocated equally to all of the products manufactured.

A strong case can be made in some production environments that direct labor does not really exist, and should be categorized as indirect labor, because production employees will not be sent home (and therefore not be paid) if one less unit of product is manufactured - instead, direct labor hours tend to be incurred at the same steady rate, irrespective of production volume levels, and so should be considered part of the general overhead costs associated with running a production operation.

The advantages of this method are:

(i) Wages paid are usually proportional to working hours, so the time factor is automatically taken into account.

(ii) The labor rate is more stable than the material price.

(iii) Certain variable overhead costs vary to some extent depending on the number of workers employed, so costs for production are related to wage payments proportional to the number of workers.

(iv) The basic data needed to calculate this rate is readily available from the wage statement and there is no additional labor cost.

Disadvantage:

The main drawbacks are:

(i) There is no distinction between skilled and unskilled labor and the difference in wage rates. Jobs carried out by high-paying workers cost more than jobs involving low-paying workers. This is unreasonable because unskilled workers incur more costs in the form of material waste, depreciation, and so on.

(ii) If the worker is paid on a piece-by-piece basis, the time element is completely ignored.

(iii) There is no distinction between the production of manual workers and the production of mechanical workers.

(iv) Overtime pays higher hourly wages, so this method has inaccurate results when workers are paid extra overtime wages. However, overhead costs increase at the same rate. In fact, many costs remain unchanged.

(v) There is no distinction between fixed and variable costs.

(vi) Absorption of overhead costs is unfair if labor is not an important factor in production. Ignore important factors such as widespread use of plants and equipment.

(vii) For pay-as-you-go workers, both efficient and time-consuming workers and inefficient and time-consuming workers apply the same rate to absorb the indirect costs of all workers. This is not appropriate.

Q11) What is prime cost method? What are its limitations?

A11) Prime cost method are all of the costs that are directly attributed to the production of each product. Prime costs are direct costs, meaning they include the costs of direct materials and direct labor involved in manufacturing an item. Companies use prime costs to price their products.

Examples of Prime Costs

Direct Materials

Direct materials are one of the main components of prime costs and include raw materials and supplies that are consumed directly during the production of goods.

Raw materials are the physical components of the product. In manufacturing, raw materials might include metals, plastics, hardware, fabric, and paint. The types of raw materials vary greatly depending on the industry. For a furniture manufacturer, the raw materials might be lumber, hardware, paint, and varnish.

Businesses in the restaurant industry need to strike a balance between profitability and the need to create unique, mouth-watering meals with high-quality ingredients. In this industry, the various food and beverage items that a restaurant uses to build its menu are its raw materials.

Direct Labor

Direct labor includes only wages paid to workers who directly contribute to the formation, assembly, or creation of the product. Direct labor would not include, for example, salaries for factory managers or fees paid to engineers or designers. These employees are involved in the creation of the product concept and the day-to-day operation of the business rather than the hands-on assembly of items for sale. However, commissions paid to salespeople who act as intermediaries between the manufacturer and the consumer are included in the prime cost equation.

The cost of labor and payroll taxes used directly in the production process are part of prime costs. Labor that is used to service and consult the production of goods is also included in prime costs. Direct labor examples might include assembly line workers, welders, carpenters, glass workers, painters, and cooks.

Defining Labor

Labor is sometimes a little more complicated to define because, for many companies, the contributions of several different types of employees are crucial to the creation of the end product. However, the definition of a labor expense used in the prime cost formula includes wages paid only to those employees who directly participate in the building, formation, or assembly of an item for sale.

The definition of direct labor can depend on the product itself. A garment manufacturing company, for example, would include the wages paid to the workers who cut, stitch, and dye the clothing, but not to the employee who designs them. In a restaurant, the cooks, servers, busboys, and other staff are included in labor because the end product consists of the dining experience as well as the prepared meal.

Any materials or labor whose direct association in the production process cannot be established must be excluded from the prime costs. For example, factory overhead and administrative costs are not part of prime costs.

Cost Object and Prime Costs

Prime costs can vary depending on the cost subject under consideration. For instance, if a customer is the cost object, then any expenses associated with serving the customer are considered prime costs, including shipping, returns, and warranty. If the cost subject is a particular geographic area, then the costs associated with serving that area are part of prime costs, including wages of sales staff and maintenance of warehouses assigned for that area.

Under the prime cost method, recovery is calculated by dividing budgeted overhead costs by the sum of direct material costs and direct labor costs for all products in the cost center.

If the budget overhead is Rs 50,000 and the estimated costs of direct materials and labor are Rs 30,000 and Rs 20,000, then the overhead recovery is 100%, or Rs 50,000 / Rs 30,000 + Rs 20,000 x 20,000 x 20,000. Suppose.

This method is simple and easy to operate. The data needed to calculate this rate is easily available from the record. This can be adopted when standard products are produced that require a certain amount of material and the number of hours it takes to manufacture it.

Limitations:

This method is not typically used due to the following limitations:

I. When material cost is the main item of the main cost and the time factor is not fully considered.

Ii. There is no distinction between manual labor and mechanical worker production.

Iii. There is no distinction between fixed and variable costs.

Iv. Combines the shortcomings of both direct materials and direct labor law.

v. In the calculation of overhead costs, both direct materials and direct labor are equally important. Overhead is, of course, more related to labor than material.

Q12) What are the causes of Under and Over Absorption of Overhead?

A12) Causes of Under and Over Absorption of Overhead

Under absorbed factory overheads: this situation arises if the overheads absorbed are less than the actual overheads. It arises when the amount of overhead that has been incurred exceeds the amount of overhead that has been absorbed. It is also termed as ‘under-recovery’. Following factors would create tinder absorbed factory overheads:

- Actual overheads being more than the estimated overheads,

- The actual output is less than those estimated.

For example; if the overheads absorbed on a predetermined basis are $ 10,000 and the actual overheads incurred are $ 12,000, there is under-absorption to the extent of $ 2000.

Over absorbed factory overheads: this situation arises if the overheads absorbed are more than the actual overheads. It arises when the amount of overhead that has been absorbed exceeds the amount of overhead that has been incurred. Following factors would create over absorbed factory overheads:

- Actual overheads being less than the estimated overheads,

- The actual output is more than the estimated.

For example, the overheads recovered are $ 30,000 and the actual production overheads are $ 27,500 then there will be over-absorption of $ 2500. ($30,000 – $27,500).

Methods for disposal of under or over-absorption of factory overheads:

- Apportionment through supplementary rates.

- Transfer to Costing Profit and Loss Account

- Carryover to next year’s Accounts.

When the actual output considerably differs from the probable output, it leads to under or over-absorption of overheads. When the cause is abnormal the amount of under or over-absorption should be treated as an abnormal loss and transferred to costing profit and loss accent.

Where the actual overhead of a period is absorbed at an absorption rate based on actual production during that period, the overhead absorbed must, if all calculations have been correctly made, exactly equal the overhead incurred. This is not so, however, when a predetermined rate is used. The amount absorbed in cost accounts may not be equal to actual overhead relating to an accounting period.

The use of a predetermined rate may, therefore, result in under-absorption or over-absorption. When the amount absorbed is less than the actual overhead, there is under-absorption. Over absorption arises when the amount absorbed is more than the actual overhead.

Where the absorption of overhead is made by a rate based on actual data, the overhead absorbed must be equal to the actual overhead incurred. But where a pre-determined rate is employed, there is generally a difference between the overhead absorbed and the overhead incurred. If the absorbed amount is less than the actual overhead, there is said to be under-absorption of overhead. For example, if during the month of March, 2019, overheads absorbed are $9,500 and the actual overheads are $10,000, there is an under-absorption of overheads to the extent of $500. In the case of under-absorption, the cost of production is deflated to the extent of amount under-absorbed.

On the other hand, if the absorbed amount is in excess of the actual overhead, there is said to be over-absorption of overhead. For the example, if during April, 2019, overheads absorbed are $10,800 and the actual overhead are $10,000, there is an over-absorption of overhead to the extent of $800. In the case of over-absorption, the cost of production is inflated to the extent of over-absorption.

Q13) What is the Treatment of under-absorbed and over-absorbed overhead?

A13) Treatment of under-absorbed and over-absorbed overhead

The under-absorbed and over-absorbed overhead costs may be disposed of in any of the following manners:

(1). Use of Supplementary Rate

Under this method, under-absorbed or over-absorbed overhead is apportioned to work-in-progress inventory, finished goods inventory and cost of sales by means of supplementary overhead rate. The amount of under-absorbed overhead is adjusted by adding it back to the cost of production by applying a positive supplementary rate while over-absorbed overhead is deducted through a negative supplementary rate. The supplementary rate is obtained by applying the following formula:

Supplementary Overhead Rate = (Overhead Incurred – Overhead Absorbed) /

Quantum of Base

This method has the ultimate effect of charging actual overhead to the cost of production and thus the distinction between the recovery at pre-determined rates and at actual rates no longer exist. The use of this method is generally recommended in the following cases:

(i). When there is a serious error in anticipating or estimating the overhead cost or quantum or value of base and the extent of under-absorption or over-absorption is considerable.

(ii). When there is a major change in the method of production leading to a significant difference between the overhead incurred and the overhead absorbed.

(iii). When there is a change in the working capacity of the manufacturing concern disturbing the estimates of overhead and quantum of the base.

(iv). When contracts or work-orders are undertaken on a cost-plus basis.

(2). Carry Forward to the Next Year’s Accounts

Under this method, the amount of overhead remaining under-absorbed or over-absorbed at the end of the year is transferred to an Overhead Reserve of Suspense Account to be carried forward to the next year’s accounts for absorption. This method can be applied when the normal business cycle extends over more than one year and overhead rates are pre-determined on a long term basis. This method is not commonly used.

(3). Transfer to Costing Profit and Loss Account

Under this method, which is applied in case of unusual circumstances causing an abnormal increase or decrease in actual overhead costs, the amount of overhead under-absorbed or over-absorbed is transferred to the Costing Profit and Loss Account. If the predetermined overhead rate is applicable for a year, there will be no problem in transferring the differences between overhead absorbed and overhead incurred to Costing Profit and Loss Account but if the same is applicable to a shorter period, the work of comparison between actual and estimated overhead will have to be done at frequent intervals. The other main disadvantage of this method is that the stocks of work-in-progress and finished goods remain under- or over-valued and are carried forward at the same values to the next period.

Example

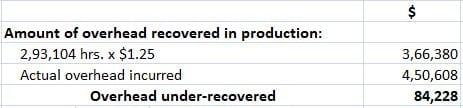

The total overhead expenses of a factory are $4,50,608. Taking into account the normal working of the factory, overhead was recovered in production at $1.25 per hour. The actual hours worked were 2,93,104. How would you proceed to close the account of works assuming that besides 7,800 units produced of which 7,000 were sold, there were 200 equivalent units in work-in-progress. On investigation, it was found that 50 percent of the unabsorbed overhead was on account of increase in the cost of indirect material and indirect labour and the other 50 percent was due to factory inefficiency.

Solution

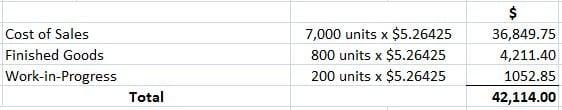

50% of unabsorbed overheads is due to increase in cost of indirect material and indirect labour. So, 50% of $84,228 i.e., $42,114 be recovered by a supplementary rate.

Total number of units produced or in work-in-progress = 7,800 + 200 = 8,000 units

Supplementary rate = 42,114 / 8,000 = $5.26425 per unit

So this amount of $42,114 be apportioned as follows:

The balance 50% difference caused due to factory inefficiency should be transferred to Costing Profit and Loss Account as it is an abnormal loss.