Unit 5

Process Costing

It is a way of costing adopted to seek out the value of these goods which are manufactured in stages. Each stage is called a process. The output of every process becomes the input for subsequent process and so on.

The staple introduced within the first process loses its identity and therefore the output is transferred to

A. Abnormal loss

1. Loss due to external factors such as natural disasters, loss due to fire or theft, strike, failure, Machines, etc.

2. Unexpected loss.

3. Somewhat avoidable and therefore controllable.

4. Credited to process A / c as a balance number in the quantity column.

The 5-amount column is calculated using the following formula:

Abnormal loss (amount) =

Dr – Cr (% from quantity)

Dr – Cr (Amt Col.)

× Abnormal loss (quantity)

B. Abnormal profit / profit

1. If the actual loss is less than the expected loss, it is called anomalous gain.

2. Due to the large amount of R / M, efficient workforce, advanced technology, etc.

3. Recorded as the balance number in the quantity column on the debit side of process A / c.

4. A monetary column calculated using the following formula.

Abnormal gain (amount) =

Dr – Cr (quantity column)

Dr – Cr (Amt column)

× Abnormal gain (quantity) the next process.

Example: Process costing is applicable to product like sugar industry, refining industry, paper industry. Etc... There are two types of losses in process costing.

Example: Input 20 Kgs

(–) Output 18 Kgs

= Loss 2 Kgs

Abnormal loss Normal loss

A. Normal Loss

1. It's a loss thanks to internal factors like heating, boiling, evaporation,

2. Expected loss.

3. A given percentage of the input amount.

4. It is an unavoidable loss and an unmanageable loss.

5. There are usually two types: (A) Scrap: It has feasible value. (B) Weight Loss: No Realizable value because it is an invisible process.

6. Credited to process A / c and calculated as% of the input quantity.

Process Costing- Meaning

Process costing is a method of costing under which all costs are accumulated for each stage of production or process, and the cost per unit of product is ascertained at each stage of production by dividing the cost of each process by the normal output of that process.

Definition:

CIMA London defines process costing as “that form of operation costing which applies where standardize goods are produced”

Features of Process Costing:

a) The production is continuous

b) The product is homogeneous

c) The process is standardized

d) Output of one process become raw material of another process

e) The output of the last process is transferred to finished stock

f) Costs are collected process-wise

g) Both direct and indirect costs are accumulated in each process

h) If the revise stock of semi-finished goods, it is expressed in terms of equal units

i) The total cost of each process is divided by the normal output of that process to find out cost per unit of that process.

Advantages of process costing:

- Costs are be computed periodically at the end of a particular period

- It is simple and involves less clerical work that job costing

- It is easy to allocate the expenses to processes in order to have accurate costs.

- Use of standard costing systems in very effective in process costing situations.

- Process costing helps in preparation of tender, quotations

- Since cost data is available for each process, operation and department, good managerial control impossible.

Limitations:

- Cost obtained at each process is only historical cost and are not very useful for effective control.

- Process costing is based on average cost method, which is not that suitable for performance analysis, evaluation and managerial control.

- Work-in-progress is generally done on estimated basis which leads to inaccuracy in total cost calculations.

- The computation of average cost is more difficult in those cases where more than one type of products is manufactured and a division of the cost element is necessary.

- Where different products arise in the same process and common costs are prorated to various costs units. Such individual products costs may be taken as only approximation and hence not reliable.

Accounting procedure of costing

For each process an individual process account is prepared.

Each process of production is treated as a distinct cost center.

Items on the Debit side of Process A/c.

Each process account is debited with

a) Cost of materials used in that process.

b) Cost of labor incurred in that process.

c) Direct expenses incurred in that process.

d) Overheads charged to that process on some pre-determined.

e) Cost of ratification of normal defectives.

f) Cost of abnormal gain (if any arises in that process)

Items on the Credit side:

Each process account is credited with

a) Scrap value of Normal Loss (if any) occurs in that process.

b) Cost of Abnormal Loss (if any occurs in that process)

Cost of Process:

The cost of the output of the process (Total Cost less Sales value of scrap) is transferred to the next process. The cost of each process is thus made up to cost brought forward from the previous process and net cost of material, labor and overhead added in that process after reducing the sales value of scrap. The net cost of the finished process is transferred to the finished goods account. The net cost is divided by the number of units produced to determine the average cost per unit in that process. Specimen of Process Account when there are normal loss and abnormal losses.

Dr. Process A/c. Cr.

Particulars | Units | Rs. | Particulars | Units | Rs. |

To Basic Material | Xxx | Xx | By Normal Loss | Xx | Xx |

To Direct Material |

| Xx | By Abnormal Loss | Xx | Xx |

To Direct Wages |

| Xx | By Process II A/c. | Xx | Xx |

To Direct Expenses |

| Xx | (output transferred to |

|

|

To Production Overheads |

| Xx | Next process) |

|

|

To Cost of Rectification of Normal Defects |

| Xx | By Process I Stock A/c. | Xx | Xx |

|

|

|

|

|

|

To Abnormal Gains |

| Xx |

|

|

|

| Xx | Xxx |

| Xx | Xx |

Inter process profit

Normally the output of one process is transferred to another process at cost but sometimes at a price showing a profit to the transfer process. The transfer price may be made at a price corresponding to current wholesale market price or at cost plus an agreed percentage. The advantage of the method is to find out whether the particular Process is making profit (or) loss. This will help the management whether to process the product or to buy the product from the market. If the transfer price is higher than the cost price then the process account will show a profit. The complexity brought into the accounting arises from the fact that the inter process profits introduced remain a part of the prices of process stocks, finished stocks and work-in-progress. The balance cannot show the stock with profit. To avoid the complication a provision must be created to reduce the stock at actual cost prices. This problem arises only in respect of stock on hand at the end of the period because goods sold must have realized the internal profits. The unrealized profit in the closing stock is eliminated by creating a stock reserve. The amount of stock reserve is calculated by the following formula.

Stock Reserve = (Transfer Value of stock X Profit included in transfer price)/ (Transfer Price)

Joint and By-Products

Co-costs are costs that benefit multiple products, and by-products are minor consequences of the manufacturing process and are low-selling products. Joint costing or by-product costing is used when there is a production process in which the final product is split at a later stage in production. The point at which a company can determine the final product is called the split point. There may be some dividing points. Each can clearly identify another product, is physically separated from the manufacturing process, and in some cases is further refined into a finished product. If manufacturing costs are incurred before the split point, you need to specify how these costs are distributed to the final product. If an entity bears any costs after the split point, those costs are likely to be related to a particular product and can be more easily allocated to them.

In addition to the dividing points, there may be one or more by-products. Given the importance of by-product revenue and cost, by-product accounting tends to be a minor issue.

If a company bears costs before the split point, it must be assigned to the product under the direction of both generally accepted accounting principles and International Financial Reporting Standards. If you do not assign these costs to a product, you will have to treat them as period costs and will charge them as costs for the current period. This can be a mishandling of costs, as if the related product is not sold until some point in the future, it will charge a portion of the product cost as an expense before the offset sale transaction is realized.

Co-cost allocations are not administratively useful, as the resulting information is essentially based on arbitrary allocations. Therefore, the best allocation method does not have to be particularly accurate, but it should be easy to calculate and easy to defend if reviewed by the auditor.

How to allocate joint costs

There are two common ways to allocate joint costs. The calculation method is as follows.

Allocate based on sales. Sum all manufacturing costs up to the split point, determine the sales value of all joint products at the same split point, and assign costs based on the sales price. If there are by-products, do not allocate costs to them. Instead, you charge the cost of goods sold as revenue from the sale. This is the simpler of the two methods.

Allocate based on gross profit. Sum the costs of all processing costs incurred by each joint product after the split point and deduct this amount from the total revenue each product ultimately earns. This approach requires additional cost accumulation work, but may be the only viable alternative if the selling price of each product at the point of split cannot be determined (of the calculation method described above).

Pricing for joint products and by-products

The costs allocated to joint products and by-products should not be related to the pricing of these products, as they are not related to the value of the items sold. Prior to the split point, all costs incurred are sunk costs and do not affect future decisions such as product prices.

The situation is quite different when it comes to costs incurred after the split point. Do not set the product price below the total cost incurred after the split point, as these costs can be attributed to a particular product.

If the lower limit of the price of a product is only the total cost incurred after the split point, this may result in a lower price than the total cost incurred (including the cost incurred before the split point). A strange scenario occurs. Obviously, charging such a low price is not a viable alternative in the long run, as companies will continue to suffer losses. This offers two alternative prices.

Short-term price

If market prices cannot be raised to sustainable levels in the long run, it may be necessary to allow very low product prices in the short run, even if they are close to the sum of costs incurred after the split point.

Long-term price

In the long run, companies need to set prices to achieve revenue levels that exceed total production costs. Otherwise, there is a risk of bankruptcy.

That is, if the individual product price cannot be set high enough than to offset the production cost, and the customer does not want to accept the higher price, then the different co-products can be set.

An important point to remember about cost allocation related to joint products and by-products is that the allocation is simply an expression, not related to the value of the product to which the cost is allocated. The only reason to use these allocations is to achieve valid sales costs and inventory valuations under the requirements of various accounting standards.

Key takeaways:

- The output of every process becomes the input for subsequent process and so on.

- The staple introduced within the first process loses its identity and therefore the output

- Process costing is a method of costing under which all costs are accumulated for each stage of production or process

- Normally the output of one process is transferred to another process at cost but sometimes at a price showing a profit to the transfer process.

- The point at which a company can determine the final product is called the split point.

- How to allocate joint costs.

- Pricing for joint products and by-products

Introduction

It is generally assumed that the profits of a business for a particular period are provided by the income statement prepared for that period.

Imagine the surprise when the income statement prepared by a financial accountant at X Ltd. Showed a profit of Rs.4,56,000 in the fiscal year ending March 31, 2009. The cost accountant created a cost statement for the same period and reached the profit of Rs. 5,12,000. You feel that one of the reported numbers should be wrong.

However, there is a logical explanation for the difference in profit numbers, and both may be correct. This is because the basic assumptions of her two accountants for preparing the income statement are different. For example, interest on a loan is debited in the financial income statement, but the costing person does not consider this interest expense to be a cost item and therefore ignores this item. Naturally, in this case, the coster reports a higher profit than financial accounting.

The next section describes the types of differences and the items that cause these differences.

Preparation of adjustment statement or memorandum adjustment account:

You need to create an adjustment statement or memorandum adjustment account to adjust the profits shown in the two sets of books. You can use the results shown by any set of books as a base and make the necessary adjustments to reach the results shown by any set of books. Reconciliation Statements and Memorandums The techniques for creating reconciliation accounts are described below.

Preparing the adjustment statement involves the following steps:

(1) It can be used based on the profit of each set of books (cost or finance). This is actually the starting point for determining profits, as shown in the other series of books, after making appropriate adjustments considering the causes of the differences.

(2) It is necessary to investigate the effect of a particular cause of difference on the benefits presented by other series of books.

(3) If the profits shown by another set of books increase due to the cause, the increase must be added to the profits of the previous set used as the base.

(4) If it causes a decrease in the displayed profit of other books, it is necessary to deduct the decrease from the profit based on the previous books.

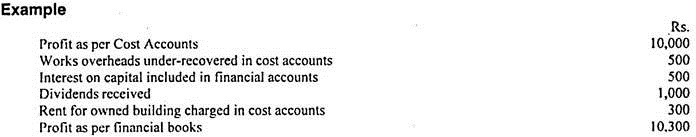

There is a difference in Rs. 300 between the profits shown on the financial books and the profits shown on the cost books.

Adjustment statements can be made to adjust the profits presented by the two sets of books on the following criteria:

1. It may be based on costing profit. In other words, if you take into account the causes of the above differences and adjust this profit figure appropriately, you will be able to find the profit shown in your financial books.

2. Overhead costs are charged more in the financial account than in the cost account. This means that the profits shown in financial accounting are less than the profits shown in costing in Rs. 500 (amount of under recovery). The amount of Rs because it is based on the profit from cost accounting. You must deduct 500 from this base profit to reach the profit shown in financial accounting.

3. Inclusion of interest on capital as an expense reduced profits as shown in the financial books. In other words, the profits shown on the cost books are greater than the profits shown on Rupee's financial books. 500 (amount of interest). Therefore, that amount must be deducted from the base profit.

4. Dividends received are credited to the financial books. This means that the profits shown on the financial books are greater than the profits shown on the Rs cost books. 1,000. Therefore, that amount should be added to the profit as shown in the cost book.

5. The rent of the building you own is listed free of charge in your financial books. However, that amount is charged on the cost statement. This means that the profits shown on the financial books are this amount higher than the profits shown on the cost books. Therefore, you need to add the amount to your profit, as shown in the cost book.

Adjustment statements can now be conveniently displayed in the following formats:

In the example above, the cost account shows a loss of Rs. For 10,000, you should enter the amount of loss in the "Minus" column instead of profit. Next, the adjustment statement should be written in the same pattern, assuming that there is a profit instead of a loss.

Creating a memorandum adjustment account:

Memorandum reconciliation accounts can be created on the same line as the reconciliation statement. Difference says “Dr. Means “-" and "Cr." means "+".

Taking the above example, the memo adjustment account would look like this:

Importance of Reconciliation Statement:

- If separate books are maintained for costing and financial transactions, there is usually a difference between the profits shown in costing and the profits shown in financial accounting. However, by chance, it is possible that the overall benefits of the two books are the same. Nevertheless, in all cases, the results presented by both sets of books should be adjusted to identify the cause of the difference (if any) and establish the accuracy of both sets of books.

- For business concerns, costing and financial accounting can be maintained on the basis of non-integrated or integrated accounting systems. In a non-integrated accounting system, costing and financial accounting are managed separately. Costing is maintained by costing personnel in accordance with costing principles and reviews the total cost per unit of products and jobs at various stages of production or execution.

- Financial accounting is maintained by a financial accountant in accordance with the principles of financial accounting and records the day-to-day transactions of a business with the aim of finding the net impact on the profitability and financial position of the business.

- Therefore, the objectives, objectives, principles, and methods of maintaining costing and financial accounting are not the same. Therefore, the profits shown in costing may not match the profits shown in financial accounting. The inconsistent information provided by these two sets of accounts may not help you make the right policy decisions.

- Therefore, the costing system must be able to coordinate with financial accounting. Costing is unreliable unless such an analysis is coordinated with financial accounting, as costing relies primarily on estimates and constitutes a detailed analysis of financial expenditures. In this regard, H.J. "

Meaning of Reconciliation:

Adjustments can be represented as a process of aggregating performance or profits, as shown in Costing and Financial Accounting. The arithmetic accuracy of profits revealed by two different books. Efforts have also been made to determine this. "

Therefore, costing and financial accounting adjustment involves the process of identifying and accounting for the items that led to the difference in performance, as shown in Costing and Financial Accounting. Adjustments are made in the form of analytics presented in the form of statements (called adjustment statements) or memo accounts (called memorandum adjustment accounts).

Need for reconciliation:

The need to collate cost and financial accounts arises for the following reasons:

(I) Adjustments help ensure the accuracy and reliability of the various accounting books maintained by business concerns.

(II) Analytical disclosure of reasons for fluctuations in profits or losses facilitates internal control.

(III) We support cooperation and coordination between cost accounting firms and accounting firms.

(IV) Helps develop appropriate policies regarding overhead absorption, depreciation and stock valuation.

Causes of discrepancies between costing and results shown in financial accounts:

In a non-integrated accounting system, if you manage costing and financial accounting separately, the documents used to see the amount of expenses charged for some items are the same (for example, the cost of the materials used).

The labor costs paid must be confirmed with the help of material invoices and wages, respectively), but for one or more of the following reasons –

1. Overhead under / over absorption:

Financial accounting constitutes actual expenditures for factory, office, administration, sales and distribution overheads, while costing provides estimated charges for these items based on historical records or pre-determined absorption rates. Configure. As a result, overhead costs are generally under / over absorbed in costing.

2. Receipt / income items displayed only in financial accounts:

The following receipt and income items are shown or included in financial accounting but are excluded from costing –

(A) Interest and discounts received.

(B) Rent received.

(C) Dividends received.

(D) Commission received.

(E) The transfer fee received.

(F) Take advantage of the sale of fixed assets and investments.

3. Expense / loss items displayed only in the financial account:

The following cost and loss items are billed to the financial account but do not appear in the cost account –

(A) Interest allowed on the loan.

(B) Interest on capital.

(C) Cash discounts are allowed.

(D) Interest paid on corporate bonds.

(E) Expenses and losses associated with the issuance of shares and bonds.

(F) Loss on transaction of fixed assets and investments.

(G) Profit appropriation items, that is, income tax paid or provision for income tax, transfer to reserve

+

(H) Reserve costs are amortized.

(I) Goodwill has been amortized.

(J) Donations and charity payments.

4. Unusual profit / loss items included only in financial accounts:

There are various items of extraordinary profit and loss that are included in financial accounting but excluded from costing.

These items are:

(A) Cost of extraordinary loss of material.

(B) The cost of unusual idle time for workers.

(C) The cost of extraordinary savings in materials.

(D) Exceptional non-performing loans.

(E) Fines and fines paid for violating government rules and regulations.

5. Expense items included only in costing:

The following expense items are only recorded in the cost account and are not considered in the financial account –

(A) Estimated rent of owned facilities.

(B) Depreciation of assets that do not have book values in their financial accounts.

6. Differences in billing standards for asset depreciation:

Costing and depreciation of fixed assets in the financial account may be calculated differently, which can lead to different results. In financial accounting, depreciation is typically based on the depreciation (devaluation) method or the original cost method. However, costing may follow machine time rates or unit of measure depreciation methods.

7. Differences in stock valuation criteria:

Raw material inventories in financial accounting are valued at cost or market price, whichever is lower, while costing is valued using one of the methods, FIFO, LIFO, or AVERAGE pricing. Amounts in progress for costing purposes may be valued based on prime or factory costs, but financial accounting considers some of the administrative and administrative costs.

In financial accounting, finished product inventory is valued based on cost or market price, whichever is lower, while in costing, it is valued based on actual cost.

Costing and adjustment of financial results:

If there is a difference between the work results disclosed in costing and the work results disclosed in financial accounting, you need to perform the following steps to determine the reason for the difference.

1. You need to check the degree of difference between the actual overhead recorded in financial accounting and the cost recorded in costing.

2. You need to schedule all costs and losses that are included in your trading and profit and loss accounts but not in your cost accounts.

3. You need to schedule all revenues and profits that are credited to the P & L account but excluded from the cost account.

4. You need to schedule all items that are included in costing but excluded from financial accounting.

5. You need to review the criteria by which raw material, work in process, and finished product inventories were valued for balance sheet purposes and compare them to the value shown in costing to see their differences.

6. Finally, you need to see all the items that are included in the cost and finance accounts but have different values.

If you find a discrepancy, you should create an adjustment statement starting with the profit disclosed in costing.

Next, you need to add the following items to your profit according to costing:

(I) Overhead costs (factories, offices, management, sales and distribution) are either over-absorbed or over-recovered in cost accounting or under-absorbed in financial accounting.

(II) Receipt items that appear in the financial books but not in costing.

(III) Overvaluation of starting inventory (of raw materials, work in process, or finished products) in costing.

(IV) Undervaluation of end-of-term inventory (of raw materials, work in process, or finished products) in costing.

(V) An item of unusual efficiency (abnormal savings) that appears in the financial books but not in costing.

The following items should be deducted from your profit according to costing.

(I) Underabsorption of overhead costs in the cost account or overabsorption in the financial account,

(II) The item of expense that appears in the financial account, not the cost account.

(III) Undervaluation of starting inventory (of raw materials, work in process, or finished products) in costing,

(IV) Overvaluation of closing inventory in cost accounts.

After making the above adjustments, the costing profit will match the financial accounting profit.

Below shown are the performa of reconciliation and memorandum reconciliation staement:

Particulars | Amount (Rs) | Amount (Rs) |

Financial Profit (as per the financial books) |

| XX |

Add: Expenses, losses and appropriation debited in financial books only Closing stock under valued in Financial Books Opening Stock over valued in Financial books Excess depreciation charged in Financial Books Expenses under recovered in Cost Books Income credited only in Cost Books

Less: Income credited only in Financial Books Closing stock over valued in Financial Books Opening Stock under valued in Financial books Short depreciation charged in Financial Books Expenses over recovered in Cost Books |

XX XX XX XX

XX

XX XX XX XX |

XX

XX |

Costing Profit (as per Costing books) |

| XX |

Starting with financial profit- Statement of Reconciliation between Financial Profit and Cost Profit for the Year ended

Particulars | Amount (Rs) | Amount (Rs) |

Costing Profit (as per Costing books) |

| XX |

Add: Income credited only in Financial Books Closing stock over valued in Financial Books Opening Stock under valued in Financial books Short depreciation charged in Financial Books Expenses over recovered in Cost Books

Less: Expenses, losses and appropriation debited in financial books only Closing stock under valued in Financial Books Opening Stock over valued in Financial books Excess depreciation charged in Financial Books Expenses under recovered in Cost Books Income credited only in Cost Books

|

XX XX XX XX

XX XX XX XX

XX |

XX

XX |

Financial Profit (as per the financial books) |

| XX |

Key takeaways:

- Preparation of adjustment statement or memorandum adjustment account.

- Importance of Reconciliation Statement

- Adjustments can be represented as a process of aggregating performance or profits, as shown in Costing and Financial Accounting.

- Specimen of Reconciliation Statement

Solved Examples:

Q.1. From the following particulars reconciliation statement

Particulars | Rs. |

Net Profit as per financial records | 1,54,506 |

Net Profit as per costing records | 2,06,880 |

Works overheads under recovered in costing | 3,744 |

Administrative Overheads recovered in excess in costing | 2,040 |

Deprecation charged in financial accounts | 13,440 |

Depreciation recovered in Cost Accounts | 15,000 |

Interest received but not included in Cost Accounting | 9,600 |

Obsolescence loss charged in financial records | 6,840 |

Income tax provided in financial books | 48,360 |

Bank interest credited in financial books | 900 |

Stores adjustment credited in financial books | 570 |

Depreciation of stock charged in financial books | 8,100 |

Solution:

RECONCILIATION STATEMENT | |||

Particulars | Rs. | Rs. | |

Net Profit as per costing records Add: Administrative Overheads over absorbed Depreciation excess charged Income not credited in costing – Interest received Bank interest Stores adjustment |

15,000 900 570 |

| 2,06,880 |

2,040 1,560 |

| ||

16,470 |

| ||

Total Less: Works overheads under recovered Expenses not charged in costing books 9,600 Income tax provided in Financial Book 48,360 Depreciation of Stock charged in Financial Book 8,100 Net Profit as per financial books |

| 20,070 | |

3,744

66,060 | 2,26,950

(69,804) | ||

| 1,57,146 | ||

Q.2. Following is the Trading and Profit and loss account of a factory producing a particular unit of a product of which the actual output is 1,00,000 units.

Trading & Profit and Loss A/c for the year ended 31/12/09

| Rs |

| Rs. |

To Material | 200000 | By Sales | 400000 |

To Wages | 100000 |

|

|

To Works Exp. | 60000 |

|

|

To Office rent | 18000 |

|

|

To Selling & Dist. Exit | 12000 |

|

|

To Net Profit | 10000 |

|

|

| 400000 |

| 400000 |

The normal output of the factory is 1,50,000 units. Works expenses are fixed to the extent of Rs. 36,000. Office expenses for all practical purposes are constant, Selling and distribution expenses are variable to the extent of Rs.6000/- Prepare a cost sheet and reconciliation statement.

Solution:

Cost Sheet

Actual output 1,00,000 units Normal output 1,50,000 units

Particulars | Per Unit | Amount (Rs) |

Material | 2.00 | 2,00,000 |

Wages | 1.00 | 1,00,000 |

PRIME COST | 3.00 | 3,00,000 |

Add: Works expenses |

|

|

Fixed (2/3 of 36000) = 24000 |

|

|

Variable = 24000 | 0.48 | 48,000 |

WORKS COST | 3.48 | 3,48,000 |

Add: Office Expenses (2/3 * 36000) (Actual output/ Normal output = 2/3 Proportionate fixed cost are considered) | 0.12 | 12,000 |

COST OF PRODUCTION | 3.60 | 3,60,000 |

Add: Selling and Distribution Expenses |

|

|

Fixed (2/3) = 4000 |

|

|

Variable = 6000 | 0.10 | 10,000 |

COST OF SALES | 3.70 | 3,70,000 |

Add: Profit | 0.30 | 30,000 |

SALES | 4.00 | 4,00,000 |

Reconciliation statement

Particulars | Amount (Rs) | Amount (Rs) |

Profit shown by Cost Accounts |

| 30,000 |

Add: |

|

|

Less: |

|

|

Under recovery of Work Expenses | 12,000 |

|

Under recovery of Office Expenses | 6,000 |

|

Under recovery of Selling Expenses | 2,000 | (20,000) |

Profits shown by Financial Accounts |

| 10,000 |

Q.3. The Trading & Profit & Loss account of “A’ Ltd. Is as follows:

To Purchases | 25120 | By Sales (50000 units |

|

|

| @ of Rs.1.50 each) | 75000 |

Less : Closing Stock | 4050 |

|

|

To Gross Profit | 53870 |

|

|

| ------------ |

| --------- |

To Net Profit | 75000 |

| 75000 |

To Direct Wages | 10500 |

|

|

To Works Expenses | 12130 | By Gross Profit | 43870 |

To Selling Expenses | 7100 | By Discount received | 260 |

To Administrative | 5340 | By Profit on sale of |

|

Expenses |

| Land | 2340 |

To Depreciation | 1100 |

|

|

To Net Profit | 20300 |

|

|

| ------------ |

| --------- |

| 56470 |

| 56470 |

The profit as per cost accounts was only Rs.19,770. Reconcile the financial and costing profits using the following information:

a) Cost accounts valued closing stock at Rs. 4280

b) The work expenses in the cost accounts were taken at 100% of direct wages.

c) Selling & administration expenses were charged in the cost accounts at 10% of sales and 0.10 per unit respectively.

d) Depreciation in the cost accounts was Rs.800.

Solution:

RECONCILIATION STATEMENT | ||

Particulars | Rs. | Rs. |

Profit as per Cost Accounts |

| 19,770 |

Add: 1. Over absorption of selling expenses | 400 |

|

2. Discount received | 260 |

|

3. Profit on sale of land | 2,340 | 3,000 |

|

| 22,770 |

Less 1. Difference in valuation of closing | 200 |

|

2. Under absorption of Administrative | 340 |

|

Exp. |

|

|

3. Under absorption of Works Exps. | 1,630 |

|

4. Depreciation under changed | 300 | (2,470) |

Profit as per Financial Accounts |

| 20,300 |

Q.4. From the following Profit & loss account draw up a Reconciliation statement showing the Profit as per Cost Accounts:

To Office Salaries | 11282 | By Gross Profit | 54648 |

To Office Expenses | 6514 | By Dividend received | 400 |

To Salary to Salesmen | 4922 | By Interest on Bank FD | 150 |

To Sales Expenses | 9304 |

|

|

To Distribution Exp. | 2990 |

|

|

To Loss on Sale of Machinery | 1950 |

|

|

To Fines | 200 |

|

|

To Discount | 100 |

|

|

To Net Profit c/d | 17936 |

|

|

55198 |

| 55198 | |

To Income Tax | |||

To Transfer to Reserves | 8000 | By Net Profit b/d | 17936 |

To Dividend | 1000 |

|

|

To Balance c/d | 4800 |

|

|

| 4136 |

|

|

| 17936 |

| 17936 |

The cost accountant has ascertained a Profit of Rs. 19636 as per his books.

Solution:

RECONCILIATION STATEMENT | ||

Particulars | Rs. | Rs. |

Profit as per cost accounts |

| 19,636 |

Add: |

|

|

Income not credited in cost accounts |

|

|

Dividend | 400 |

|

Interest on Bank FD | 150 | 550 |

|

| 20,186 |

Less: |

|

|

Expenses not debited in cost accounts |

|

|

Fines | 200 |

|

Discount | 100 |

|

Loss on sale of machinery | 1,950 |

|

Income Tax | 8,000 |

|

Trf to reserves | 1,000 |

|

Dividend | 4,800 | (15,500) |

Profit as per Financial Account(P&L A/c) |

| 4,136 |

Q.5. M/s ESVEE Ltd. Has furnished you the following information from the financial books for the year ended 31st December, 2009.

Particulars | Rs. |

Materials consumed | 260000 |

Wages | 150000 |

Factory overheads | 94750 |

Administration Overheads | 106000 |

Selling and Distribution overheads | 55000 |

Bad Debts | 4000 |

Preliminary expenses | 5000 |

Opening Stock (500 units at Rs.35/- each) | 17500 |

Closing stock (250 units at Rs.50/- each) | 12500 |

Sales (10250 units) | 717500 |

Interest Received | 250 |

Rent Received | 10000 |

The cost sheet shows the following:

Cost of materials Rs. 26 per unit.

Labour cost Rs. 15 per unit

Factory overheads 60% of Labour cost

Administration overheads 20% of Factory cost

Selling expenses Rs. 6 per unit

Opening Stock Rs. 45 per unit

You are required to prepare:

- Financial Profit & Loss Account

- Costing Profit & Loss Account

- Statement of Reconciliation

Solution:

Financial Profit & Loss A/c

| Rs |

| Rs. |

To Opening Stock | 17,500 | By Sales (10250 units )

By Closing stock (250 units

At Rs.50 each)

By Gross Profit b/d By Interest received By Rent Provided | 7,17,500 |

(500 Units at Rs.35 each) |

|

| |

To Materials consumed | 2,60,000 |

| |

(10000 units) |

|

| |

To Wages | 1,50,000 |

| |

To Gross Profit c/d | 3,02,500 | 12,500 | |

|

|

| |

| 7,30,000 | 7,30,000 | |

To Factory overheads | 94,750 | 3,02,500 | |

To Administration c/d | 1,06,000 | 250 | |

To Selling Expenses | 55,000 | 10,000 | |

To Bad Debts | 4,000 |

| |

To Preliminary Expenses | 5,000 |

| |

To Net Profit | 48,000 |

| |

|

|

| |

| 3,12,750 | 3,12,750 |

Cost Sheet for the year ended 31.12.2009

(Production 10,000 units)

Particulars | Cost per Unit Rs. | Total Cost Rs. |

Material Consumed | 26 | 2,60,000 |

Labour | 15 | 1,50,000 |

| ------------- | -------------- |

PRIME COST | 41 | 4,10,000 |

Factory Overheads (60% of Labour cost) | 9 | 90,000 |

| ------------ | --------------- |

WORKS COST | 50 | 5,00,000 |

Administration overheads |

|

|

(20% of work cost) | 10 | 1,00,000 |

COST OF PRODUCTION | 60. | 6,00,000 |

Add : Opening Stock of finished goods |

|

|

(500 units at (Rs.45/- each) |

| 22,500 |

|

| --------------- |

|

| 6,22,500 |

Less: Closing stock of finished goods |

|

|

(250 units) |

| 15,000 |

| ------------- | --------------- |

|

| 6,07,500 |

Selling Expenses | 6 | 61,500 |

| ------------ | --------------- |

COST OF SALES | 66 | 669000 |

PROFIT | 4 | 48500 |

| ------------- | --------------- |

SALES | 70 | 717500 |

Statement of Reconciliation

Particulars | Rs. | Rs. |

Profit as per Cost Accounts |

| 48,500 |

Add: Over recovery of overheads: |

|

|

Selling expenses | 6,500 |

|

Over valuation of stock: |

|

|

Opening stock | 5,000 |

|

Purely financial income: |

|

|

Interest | 250 |

|

Rent | 10,000 | 31,750 |

| ----------- | ------------ |

|

| 70,250 |

Less: Under recovery of overheads- |

|

|

Factory overheads | 4,750 |

|

Administrative overheads | 6,000 |

|

Over valuation of stock: | 2,500 |

|

Closing Stock |

|

|

Purely financial expenses: | 4,000 |

|

Bad Debts |

|

|

Preliminary expenses | 5,000 | (22,250) |

| ----------- | ------------ |

Profit as per Financial Accounts |

| 48,000 |

References:

- Arora M.N.: Cost Accounting - Principles and Practice; Vikas, New Delhi.

- Jain S.P. And Narang K.L.: Cost Accounting; Kalyani New Delhi.

- Anthony Robert, Reece, et al: Principles of Management Accounting; Richard D. Irwin Inc. Illinois.

- Horngren, Charles, Foster and Datar; Cost Accounting - A Managerial Emphasis; Prentice – Hall of India, New Delhi.

- Khan M.Y. And Jain P.K.: Management Accounting; Tata McGraw Hill.