Unit 3

International pricing

Q1) What are the factors influencing international price

A1) The following are the main factors to be considered while fixing prices in international market:

1. International Marketing Objectives:

Mostly price is decided with a view to capture international market, e.g., when a company wants to enter in the market the product is sold at lower rates. When it intends to maximise use of its additional production capacity, marginal cost of production is considered. When an export target is to be achieved then in that context price is determined. Other motives like getting entry in market, to get a certain share in market, to get definite return on investment, etc., are also of special importance.

2. Cost of Product:

Price in international marketing cannot be determined without considering the cost of the product. Fixed and variable costs of production, marketing and transport expenses are included in the cost of production. Sometimes a company sells at a price lower than cost and increases its share in market. It aims to recover production cost in long run. Price depends on production cost. Hence, it is necessary to analyse the cost and to consider the fixed and variable costs while fixing the price.

3. Demand:

Demand is another factor that determines the prices in the international markets. The demand in international markets is also affected by a number of factors which are different from those operating in domestic market. Customs and tastes of foreign customers may differ widely.

Elasticity of demand is another factor which affects the pricing. If the demand of the product is elastic, a reduction in price may increase the sales volume. On the other hand, higher price may be fixed if the demand is inelastic and the supply is limited.

4. Business Competition:

Competition in the foreign market is also an important factor. Competition in foreign market may be so severe that the exporter has no other option except to follow the market leader. In monopoly an exporter can fix high price of its patented product. Greater competition reduces freedom for fixing the price. Price cannot be determined without considering the strategy of competitors.

5. Exchange Rate:

Foreign exchange rate plays a vital role in the price fixing in international marketing. For example, when rupee falls against dollar an importer hesitates in filling tender. An importer has to pay more rupees per dollar. In such circumstances rupee is considered to have become weaker against dollar.

6. Product Differentiation:

This factor plays a vital role in price fixing. When a product has specialities or is totally different compared to those of its competitors, the company is more-free to decide price. Usually prices of such products are quoted higher than that of others up to certain extent.

7. Prestige:

Prestige of the producer and of the country is reflected in the price of the product. Prestigious companies determine higher price for their products. Underdeveloped countries cannot quote high price, even if their product is better than that of the developed country. In foreign markets, as a developing country India finds it difficult to keep prices high though our many items like H.M.T. Watches, woollen garments, readymade wear, leather bags and Ayurvedic medicines are of superb quality.

8. Market Characteristics:

In addition to competition the following are some other factors which also affect price:

(i) Trend of demand

(ii) Consumer income levels

(iii) Importance of the product to the consumer, and

(iv) Margins of profit.

9. Government Factors:

Government’s policy and laws affect pricing as under:

(i) Ceiling and Floor Prices:

Some countries fix top and bottom prices of their products. When government regulates the price, one has to keep its price between them. India had fixed minimum export prices of cotton cloth and other products. Normally, such a policy may be applied for national development, industries position, stock of goods, and protection of industries.

(ii) Regulation of Margins:

Sometimes government decides the profit margin or percentage of mark-up for producers or distributors. As a result, marketer loses most of the freedom of pricing.

(iii) Taxes:

While deciding price of an exportable product, custom duties and other taxes have to be considered. When import duties are levied, an exporter has to reduce his price. In foreign markets price has to be kept up because of such taxes.

(iv) Tax Concessions, Exemptions and Subsidies:

To promote exports many countries give tax reliefs or freedom. Products can be exported at lower prices in such cases. For example, under Duty Draw Back Scheme, if raw-materials are imported for production of export goods, the import duty or excise duty paid for this is refundable. To promote export, Govt., gives financial subsidies also. Such subsidies also affect price determination in export market.

(v) Other Incentives:

To promote export the government gives many incentives. Among these, supply of raw-materials, electricity and water supply at lower rates, aid in selling etc. are main incentives. While fixing prices of export goods these factors are kept in view.

(vi) Government Competition:

Sometimes the government enters in market to keep control on international prices. For example, the American Government sells aluminium from its stock at a fixed price to American companies. The companies are unable to increase prices in such circumstances. Hence, while fixing price Government competition should also be considered.

(vii) International Agreement:

Prices of some products are controlled by international agreements about stock, buffer stock agreement, bilateral or multilateral agreements. In view of such agreements companies have to fix prices in international market.

Q2) What is pricing process?

A2) (A) Cost-Oriented Export Pricing Methods:

The cost-oriented pricing methods are based on costs incurred in the production of the products. Total costs include fixed costs and variable costs. Thus export pricing may be based on full cost (fixed and variable) or only on variable costs. A reasonable profit will be added to the base cost to arrive at the export pricing.

Thus cost-oriented export pricing methods may be divided into the following two methods:

1. Full Cost Methods or Cost-Plus Method:

The most frequently used pricing method in exports is cost-plus method. This method is based on the full cost or total cost approach. In arriving at the export pricing under this method, the total cost of production of the article (fixed and variable) is taken into account.

Over and above the fixed and variable costs incurred in the production of exportable articles, all direct and indirect expenses incurred for the development of product such as research and development expenses and other expenses necessary for the export of the articles such as transportation cost, freight, customs duties, insurance etc., are included.

Then a reasonable profit margin is added to the costs and the value of the subsidy and assistance from the Government or other bodies of the country, if any, is deducted. The net result is the total export price for the commodities produced. Price per unit may be calculated by dividing the total price, thus arrived, by the number of units manufactured.

The various elements of cost, forming part of the total cost are:

(i) Direct Costs:

(a) Variable Costs:

Direct materials, direct labour, variable production overheads, variable administrative overheads.

(b) Other Costs Directly Related to Exports:

Selling costs—Advertising support to importers abroad, special packing, labelling, etc., commission to overseas agent, export credit insurance, bank charges, inland freight, forward charges, inland insurance, port charges, export duties, warehousing at port, documentation and incidentals, interests on funds involved, costs of after-sale service.

(ii) Fixed Costs or Common Costs:

It includes production overheads, administration overheads, publicity and advertising (general), travel abroad and after-sale service minus Govt., assistance, duty drawback and import subsidy etc., received and then freight and insurance are added to arrive at the final cost.

Advantages:

The main benefits of this system are as under:

(i) Under this method the exporter realises the total cost in marketing the product in a foreign market.

(ii) Marginal targets are thought of.

(iii) No chances of loss.

(iv) This is logical and universally accepted method.

(v) It is easier to understand and calculate.

Disadvantages:

Main limitations are as under:

(i) Cost is considered in advance. But there is difference between estimated and real cost. So this method does not give exact result.

(ii) When a company’s cost is higher than its competitors, this method is of no help.

(iii) In this method only cost and expected profit are considered. Hence, chances of increasing price are often lost.

(iv) Change in demand and supply is not taken care of.

(v) It does not help in competition.

(vi) There is little scope for change according to time and circumstances and hence, this method of pricing is not useful.

2. Marginal Cost Pricing:

Another cost oriented method of pricing in international market is to determine the price on the basis of variable cost or direct cost. In this method fixed cost element in the total cost of production is totally ignored and the firm is concerned only with the marginal or incremental cost of producing the goods which are sold in foreign markets.

We know that the fixed cost remains fixed up to a certain level of output irrespective of the volume of output. Variable costs, on the other hand, vary in proportion to the volume of production. Thus, it is the variable or direct or marginal costs that set the price after a certain level of output is achieved, that is, output at Break-Even Point (BEP).

This method is based on the assumption that the export sales are bonus sales and any return over the variable costs contributes to the net profit. Under this system it is assumed that the firm has been producing the goods for home consumption and the fixed costs have already been met or in other words, Break-Even Point has been achieved.

Thus, if the manufacturers are able to realise the direct costs, including those involved in export operations specifically, they would not affect the profitability of their firms. The profitability of firms should be assessed with reference to marginal cost which should normally constitute the basis for export pricing. Other elements in calculating price will remain the same.

Advantages:

There are a number of advantages by the use of this method:

(i) Export sales are additional sales hence these should not be burdened with overhead costs which are ordinarily met from the domestic trade.

(ii) This method is advocated for firms from developing countries who are not well-known in foreign markets as compared to their competitors from developed countries, and therefore, lower prices based on variable costs may help them enter a market. Price may be used as a technique for securing market acceptance for products newly introduced into the market.

(iii) Since the buyers of products from developing countries usually are in countries with low national income, it is advisable for the firm to serve a large segment of the market at low prices.

(iv) When fixed cost can be gained from domestic market, total profit can be raised by exporting at a price higher than marginal cost price.

(v) An order which may be refused on the basis of total cost can be accepted on the basis of marginal cost and profit can be increased.

Disadvantages:

Following are the main disadvantages:

(i) Generally, this method is applied only when a company has idle production capacity in addition to optional cost.

(ii) Developing countries might be charged for dumping their products in foreign markets because they would be selling their products below net prices and thus may attract anti-dumping provisions which will take away their competitive advantage.

(iii) The use of this method may give rise to cut-throat competition among exporting firms from developing countries resulting in loss in valuable foreign exchange to the exporting countries.

(iv) Marginal cost pricing is not advisable in the following cases:

(a) If the importers are regularly purchasing the product at a low price, it will be difficult for exporters to increase the price of the commodities later on. It may result in loss of market.

(b) This policy is not useful or is of limited use to industries which are mainly dependent upon export markets and where overheads or fixed costs are insignificant.

Feasibility:

The system of marginal cost pricing is feasible in the following circumstances:

(i) There must be a large domestic market for the product so that the overheads may be charged from products manufactured for domestic market.

(ii) Mass production techniques must have been adopted so that the gap between the full and marginal costs may be reduced.

(iii) The home market has a capacity to bear the higher prices.

(iv) Additional production for exports is possible without increasing overhead costs and within permissible production capacity.

Marginal Cost Sets the Lower Limit:

It is generally advocated that marginal cost should be the basis for export pricing. This method based on marginal cost only sets the lower limit up to which a firm can sell its product without affecting its overall profitability. It does not follow that one should invariably charge the variable cost.

The situation in different markets may be different and in many a case, contribution towards fixed cost might be possible and all efforts should be made to take advantage of this possibility. Even in cases where only marginal cost is possible to realise, the long-term objective of the firm should be to recover direct costs plus some contribution towards overhead costs as well.

(B) Market-Oriented Export Pricing:

Both the methods are based on cost considerations, while under market- oriented pricing, price is changed in accordance with market changes. The costs are, no doubt, important but the competitive prices should also be considered before fixing the export price. Competitive prices mean the prices that are charged by the competitors for the same product or for the substitute of the product in the target market. Once this price level is established, the base price or what the buyer can afford, should be determined.

The base price can be determined by following the three basic steps:

(i) First, relevant demand schedules (quantities to be bought) at various prices should be estimated over the planning period;

(ii) Then, relevant costs (total and incremental) of production and marketing should be estimated to achieve the target sales volume as per demand schedules prepared; and

(iii) Lastly, the price that offers the highest profit contribution, i.e., sales revenues minus ‘all fixed and variable costs.

The final determination of base price should be made after considering all other elements of marketing mix. Within these elements, the nature and length of channel of distribution is the most important factor affecting the final cost of the product?

The above three steps, though appear to be very simple, is actually not so because there are various other factors that should be considered. The most appropriate method to estimate the demand of the product shall be the judgemental analysis of company and trade executives. One other way may be the extrapolation of demand estimates for target markets from actual sales in identical markets in terms of basic factors.

Advantages:

The main advantages of this method are as follows:

(i) This method is more flexible, hence benefits of market opportunity can be obtained.

(ii) Business unit can face competition as price is fixed as per market position.

(iii) When product life is short, this method is most suitable.

(iv) Capital is regained quickly.

(v) We make sales quickly and cash flow can be maintained.

(vi) Risk of product becoming out of date decreases.

Disadvantages:

(i) It is not easy to estimate market changes.

(ii) It is possible to overlook relation between price and demand.

(iii) If demand is less in a market compared to others, it may mislead.

Q3) What is cost oriented pricing method?

A3) The cost-oriented pricing methods are based on costs incurred in the production of the products. Total costs include fixed costs and variable costs. Thus export pricing may be based on full cost (fixed and variable) or only on variable costs. A reasonable profit will be added to the base cost to arrive at the export pricing.

Thus cost-oriented export pricing methods may be divided into the following two methods:

1. Full Cost Methods or Cost-Plus Method:

The most frequently used pricing method in exports is cost-plus method. This method is based on the full cost or total cost approach. In arriving at the export pricing under this method, the total cost of production of the article (fixed and variable) is taken into account.

Over and above the fixed and variable costs incurred in the production of exportable articles, all direct and indirect expenses incurred for the development of product such as research and development expenses and other expenses necessary for the export of the articles such as transportation cost, freight, customs duties, insurance etc., are included.

Then a reasonable profit margin is added to the costs and the value of the subsidy and assistance from the Government or other bodies of the country, if any, is deducted. The net result is the total export price for the commodities produced. Price per unit may be calculated by dividing the total price, thus arrived, by the number of units manufactured.

The various elements of cost, forming part of the total cost are:

(i) Direct Costs:

(a) Variable Costs:

Direct materials, direct labour, variable production overheads, variable administrative overheads.

(b) Other Costs Directly Related to Exports:

Selling costs—Advertising support to importers abroad, special packing, labelling, etc., commission to overseas agent, export credit insurance, bank charges, inland freight, forward charges, inland insurance, port charges, export duties, warehousing at port, documentation and incidentals, interests on funds involved, costs of after-sale service.

(ii) Fixed Costs or Common Costs:

It includes production overheads, administration overheads, publicity and advertising (general), travel abroad and after-sale service minus Govt., assistance, duty drawback and import subsidy etc., received and then freight and insurance are added to arrive at the final cost.

Advantages:

The main benefits of this system are as under:

(i) Under this method the exporter realises the total cost in marketing the product in a foreign market.

(ii) Marginal targets are thought of.

(iii) No chances of loss.

(iv) This is logical and universally accepted method.

(v) It is easier to understand and calculate.

Disadvantages:

Main limitations are as under:

(i) Cost is considered in advance. But there is difference between estimated and real cost. So this method does not give exact result.

(ii) When a company’s cost is higher than its competitors, this method is of no help.

(iii) In this method only cost and expected profit are considered. Hence, chances of increasing price are often lost.

(iv) Change in demand and supply is not taken care of.

(v) It does not help in competition.

(vi) There is little scope for change according to time and circumstances and hence, this method of pricing is not useful.

Q4) What is marginal cost pricing?

A4) Another cost oriented method of pricing in international market is to determine the price on the basis of variable cost or direct cost. In this method fixed cost element in the total cost of production is totally ignored and the firm is concerned only with the marginal or incremental cost of producing the goods which are sold in foreign markets.

We know that the fixed cost remains fixed up to a certain level of output irrespective of the volume of output. Variable costs, on the other hand, vary in proportion to the volume of production. Thus, it is the variable or direct or marginal costs that set the price after a certain level of output is achieved, that is, output at Break-Even Point (BEP).

This method is based on the assumption that the export sales are bonus sales and any return over the variable costs contributes to the net profit. Under this system it is assumed that the firm has been producing the goods for home consumption and the fixed costs have already been met or in other words, Break-Even Point has been achieved.

Thus, if the manufacturers are able to realise the direct costs, including those involved in export operations specifically, they would not affect the profitability of their firms. The profitability of firms should be assessed with reference to marginal cost which should normally constitute the basis for export pricing. Other elements in calculating price will remain the same.

Advantages:

There are a number of advantages by the use of this method:

(i) Export sales are additional sales hence these should not be burdened with overhead costs which are ordinarily met from the domestic trade.

(ii) This method is advocated for firms from developing countries who are not well-known in foreign markets as compared to their competitors from developed countries, and therefore, lower prices based on variable costs may help them enter a market. Price may be used as a technique for securing market acceptance for products newly introduced into the market.

(iii) Since the buyers of products from developing countries usually are in countries with low national income, it is advisable for the firm to serve a large segment of the market at low prices.

(iv) When fixed cost can be gained from domestic market, total profit can be raised by exporting at a price higher than marginal cost price.

(v) An order which may be refused on the basis of total cost can be accepted on the basis of marginal cost and profit can be increased.

Disadvantages:

Following are the main disadvantages:

(i) Generally, this method is applied only when a company has idle production capacity in addition to optional cost.

(ii) Developing countries might be charged for dumping their products in foreign markets because they would be selling their products below net prices and thus may attract anti-dumping provisions which will take away their competitive advantage.

(iii) The use of this method may give rise to cut-throat competition among exporting firms from developing countries resulting in loss in valuable foreign exchange to the exporting countries.

(iv) Marginal cost pricing is not advisable in the following cases:

(a) If the importers are regularly purchasing the product at a low price, it will be difficult for exporters to increase the price of the commodities later on. It may result in loss of market.

(b) This policy is not useful or is of limited use to industries which are mainly dependent upon export markets and where overheads or fixed costs are insignificant.

Feasibility:

The system of marginal cost pricing is feasible in the following circumstances:

(i) There must be a large domestic market for the product so that the overheads may be charged from products manufactured for domestic market.

(ii) Mass production techniques must have been adopted so that the gap between the full and marginal costs may be reduced.

(iii) The home market has a capacity to bear the higher prices.

(iv) Additional production for exports is possible without increasing overhead costs and within permissible production capacity.

Marginal Cost Sets the Lower Limit:

It is generally advocated that marginal cost should be the basis for export pricing. This method based on marginal cost only sets the lower limit up to which a firm can sell its product without affecting its overall profitability. It does not follow that one should invariably charge the variable cost.

The situation in different markets may be different and in many a case, contribution towards fixed cost might be possible and all efforts should be made to take advantage of this possibility. Even in cases where only marginal cost is possible to realise, the long-term objective of the firm should be to recover direct costs plus some contribution towards overhead costs as well.

Q5) What are the advantages and disadvantages of marginal cost pricing?

A5) Another cost oriented method of pricing in international market is to determine the price on the basis of variable cost or direct cost. In this method fixed cost element in the total cost of production is totally ignored and the firm is concerned only with the marginal or incremental cost of producing the goods which are sold in foreign markets.

We know that the fixed cost remains fixed up to a certain level of output irrespective of the volume of output. Variable costs, on the other hand, vary in proportion to the volume of production. Thus, it is the variable or direct or marginal costs that set the price after a certain level of output is achieved, that is, output at Break-Even Point (BEP).

This method is based on the assumption that the export sales are bonus sales and any return over the variable costs contributes to the net profit. Under this system it is assumed that the firm has been producing the goods for home consumption and the fixed costs have already been met or in other words, Break-Even Point has been achieved.

Thus, if the manufacturers are able to realise the direct costs, including those involved in export operations specifically, they would not affect the profitability of their firms. The profitability of firms should be assessed with reference to marginal cost which should normally constitute the basis for export pricing. Other elements in calculating price will remain the same.

Advantages:

There are a number of advantages by the use of this method:

(i) Export sales are additional sales hence these should not be burdened with overhead costs which are ordinarily met from the domestic trade.

(ii) This method is advocated for firms from developing countries who are not well-known in foreign markets as compared to their competitors from developed countries, and therefore, lower prices based on variable costs may help them enter a market. Price may be used as a technique for securing market acceptance for products newly introduced into the market.

(iii) Since the buyers of products from developing countries usually are in countries with low national income, it is advisable for the firm to serve a large segment of the market at low prices.

(iv) When fixed cost can be gained from domestic market, total profit can be raised by exporting at a price higher than marginal cost price.

(v) An order which may be refused on the basis of total cost can be accepted on the basis of marginal cost and profit can be increased.

Disadvantages:

Following are the main disadvantages:

(i) Generally, this method is applied only when a company has idle production capacity in addition to optional cost.

(ii) Developing countries might be charged for dumping their products in foreign markets because they would be selling their products below net prices and thus may attract anti-dumping provisions which will take away their competitive advantage.

(iii) The use of this method may give rise to cut-throat competition among exporting firms from developing countries resulting in loss in valuable foreign exchange to the exporting countries.

(iv) Marginal cost pricing is not advisable in the following cases:

(a) If the importers are regularly purchasing the product at a low price, it will be difficult for exporters to increase the price of the commodities later on. It may result in loss of market.

(b) This policy is not useful or is of limited use to industries which are mainly dependent upon export markets and where overheads or fixed costs are insignificant.

Feasibility:

The system of marginal cost pricing is feasible in the following circumstances:

(i) There must be a large domestic market for the product so that the overheads may be charged from products manufactured for domestic market.

(ii) Mass production techniques must have been adopted so that the gap between the full and marginal costs may be reduced.

(iii) The home market has a capacity to bear the higher prices.

(iv) Additional production for exports is possible without increasing overhead costs and within permissible production capacity.

Marginal Cost Sets the Lower Limit:

It is generally advocated that marginal cost should be the basis for export pricing. This method based on marginal cost only sets the lower limit up to which a firm can sell its product without affecting its overall profitability. It does not follow that one should invariably charge the variable cost.

The situation in different markets may be different and in many a case, contribution towards fixed cost might be possible and all efforts should be made to take advantage of this possibility. Even in cases where only marginal cost is possible to realise, the long-term objective of the firm should be to recover direct costs plus some contribution towards overhead costs as well.

Q6) What is market oriented export pricing?

A6) Both the methods are based on cost considerations, while under market- oriented pricing, price is changed in accordance with market changes. The costs are, no doubt, important but the competitive prices should also be considered before fixing the export price. Competitive prices mean the prices that are charged by the competitors for the same product or for the substitute of the product in the target market. Once this price level is established, the base price or what the buyer can afford, should be determined.

The base price can be determined by following the three basic steps:

(i) First, relevant demand schedules (quantities to be bought) at various prices should be estimated over the planning period;

(ii) Then, relevant costs (total and incremental) of production and marketing should be estimated to achieve the target sales volume as per demand schedules prepared; and

(iii) Lastly, the price that offers the highest profit contribution, i.e., sales revenues minus ‘all fixed and variable costs.

The final determination of base price should be made after considering all other elements of marketing mix. Within these elements, the nature and length of channel of distribution is the most important factor affecting the final cost of the product?

The above three steps, though appear to be very simple, is actually not so because there are various other factors that should be considered. The most appropriate method to estimate the demand of the product shall be the judgemental analysis of company and trade executives. One other way may be the extrapolation of demand estimates for target markets from actual sales in identical markets in terms of basic factors.

Advantages:

The main advantages of this method are as follows:

(i) This method is more flexible, hence benefits of market opportunity can be obtained.

(ii) Business unit can face competition as price is fixed as per market position.

(iii) When product life is short, this method is most suitable.

(iv) Capital is regained quickly.

(v) We make sales quickly and cash flow can be maintained.

(vi) Risk of product becoming out of date decreases.

Disadvantages:

(i) It is not easy to estimate market changes.

(ii) It is possible to overlook relation between price and demand.

(iii) If demand is less in a market compared to others, it may mislead

Q7) What are the advantages and disadvantages of market oriented export pricing?

A7) Both the methods are based on cost considerations, while under market- oriented pricing, price is changed in accordance with market changes. The costs are, no doubt, important but the competitive prices should also be considered before fixing the export price. Competitive prices mean the prices that are charged by the competitors for the same product or for the substitute of the product in the target market. Once this price level is established, the base price or what the buyer can afford, should be determined.

The base price can be determined by following the three basic steps:

(i) First, relevant demand schedules (quantities to be bought) at various prices should be estimated over the planning period;

(ii) Then, relevant costs (total and incremental) of production and marketing should be estimated to achieve the target sales volume as per demand schedules prepared; and

(iii) Lastly, the price that offers the highest profit contribution, i.e., sales revenues minus ‘all fixed and variable costs.

The final determination of base price should be made after considering all other elements of marketing mix. Within these elements, the nature and length of channel of distribution is the most important factor affecting the final cost of the product?

The above three steps, though appear to be very simple, is actually not so because there are various other factors that should be considered. The most appropriate method to estimate the demand of the product shall be the judgemental analysis of company and trade executives. One other way may be the extrapolation of demand estimates for target markets from actual sales in identical markets in terms of basic factors.

Advantages:

The main advantages of this method are as follows:

(i) This method is more flexible, hence benefits of market opportunity can be obtained.

(ii) Business unit can face competition as price is fixed as per market position.

(iii) When product life is short, this method is most suitable.

(iv) Capital is regained quickly.

(v) We make sales quickly and cash flow can be maintained.

(vi) Risk of product becoming out of date decreases.

Disadvantages:

(i) It is not easy to estimate market changes.

(ii) It is possible to overlook relation between price and demand.

(iii) If demand is less in a market compared to others, it may mislead

Q8) What is international price quotation?

A8) Export price quotations and Inco terms plays vital role in international marketing. Buyer in international trade inquires from number of foreign companies regarding product or goods foreign companies who are interest to export provide full details of desired product along with price quotation. Purchasing decision is significantly affected by price quotation. The details of widely used price quotations in international marketing is as under –

1) Ex-works/Ex-factory (EXW) – This price quotation refers to floor cost of seller.

2) Free carrier (FCA) – This price quotation the exporter’s obligation to deliver the goods is over when he delivers it.

3) Free alongside ship (FAS) – This price quotation the exporter delivers the goods by placing it alongside the ship at the specified poll.

4) Free on board (FOB) – In this price, if the loading expenditure is added into FAS the new price quotation will be FOD.

5) Cost and freight (C&F) – This price quotation refers that exporters has added the amount of foreign firm is country’s port to the port of importer.

6) Cost, Insurance & freight (CIF) – In this price, if the amount of insurance premium is added in the C&F. The new quotation will be C/F.

7) Delivered Ex-ship (DES) – This price quotation indicates that the exporter will deliver the goods by placing it at the disposal of importer’s port the exporter bears all the risk & cost involved in briniging the goods.

8) Delivered at frontier (DAF) – Under this price quotation exporter delivers the goods at the disposal of importer on means of transport not unloaded, cleared for exports but cleared for import at the specified destination at the frontier, but before the custom post of the adjoining country.

9) Delivered Ex quay (DEQ) – In this price quotation the importer clears the goods for import and he has to pay all the taxes, duties and for other formalities, imposed by the government of his country.

10) Delivered duty unpaid (DDU) – In this price quotation the exporter delivers the goods, which is not cleared for import but not unloaded from at any destination. The exporter bears the risks and cost of transportation of goods, excluding the import duty.

11) Delivered duty paid (DDP) – In this price quotation the exporter delivers the goods to the importer cleared for import but is to be loaded from at any desitnation. In the price quotation obligation of exporter become grater & importer’s becomes grater & importer’s become minimum.

Q9) What are the promotion methods?

A9) The following are the tools/elements of product promotion in export markets.

(a) Advertising- Advertising is one popular and extensively used tool of product promotion in domestic and foreign markets. Advertising as a promotion strategy is used in every country of the world irrespective of its economic, political or social development. A manufacturer advertises his products/goods in overseas market to make the target buyers aware of the attributes of the product so that they may be induced to purchase it.

(b) Sales Promotion- Sales promotion includes activities that seek to directly induce, or indirectly serve as incentives to motivate, a desired response on the part of target customers, and intermediaries. The various sales promotion techniques include free samples, consumer contests, money-refund offers, free gifts, quantity discount and installment selling.

(c) Personal Selling- Personal selling is face to face communication with one or more prospective buyers/users and influencing the buyer with the aim of motivating the prospect toward a purchase decision. It is one of the four tools of marketing communication. The other tools are public relations and publicity, sales promotion and advertising. Arrange of top executives meetings with the top executives of a potential buying company. In foreign markets personal selling is possible in trade fairs and exhibitions and also at stores level.

(d) Public Relations- Modern firms are concerned about the effects of their actions on the public. The firm should understand concerns of the public and communicate to them its goals and interests, otherwise, they may misinterpret, distort or be openly hostile to the firms actions. The firm needs to communicate to correct erroneous impressions of the company in the minds of general public, to maintain goodwill, and explain the firm‟s goals and interests.

(e) Direct mailing - Direct mailing is the sending of sales literature through mail to select or perspective customers. Advertising is costly in overseas markets. For industrial products, such advertising in national newspapers, T.V., and commercial radio is not required. One of the most cost efficient methods of product promotion in foreign markets is the direct mailing method. This method is selective and also personal in nature.

(f) Publicity - Publicity is news carried in the mass media about a firm and its products, policies, personnel, or actions. A newspaper or a magazine publishing an article on the company about its products or activities is publicity. It can be either favourable reporting or an unfavourable reporting in the media.

(g) Packaging - An attractively designed packaging can influence or induce the prospects to buy the product. A well designed packaging can communicate the type and quality of the product. Packaging often has attention attracting value.

(h) Sales Promotion - Sales promotion technique communicates with the audience through a variety of non-personal media to supplement advertising. Sales promotion technique is used extensively in domestic and overseas markets. In sales promotion, various vehicles like free samples, gifts, coupons and contests are used for the information of buyers.

(i) Trade Fairs and Exhibitions- Participation in trade fairs and exhibitions in one more method of approaching large number of foreign buyers easily, quickly and economically. Here, the exporter attracts customers to his product or products. Trade fair acts as valuable marketing communication tool for exporters from developing countries.

(j) Internet - Now a day, internet can be used to communicate export marketing information. Internet can be referred as electronic yellow pages. The exporter can provide information of the product on the internet. Importers can get the information on the internet and contact the exporter.

Q10) Explain direct mail?

A10) Direct mail encompasses a wide variety of marketing materials, including brochures, catalogs, postcards, newsletters and sales letters. Major corporations know that direct-mail advertising is one of the most effective and profitable ways to reach out to new and existing clients.

Direct mail is the most heavily used direct marketing medium, and its popularity continues to grow despite postage increases. While most advertisers use third class mail, a significant number of mailings are sent first class, making it difficult to arrive at accurate statistics about the volume of advertising mail being sent.

The primary application of direct mail is to reach consumers with offers of traditional goods and services. Some of the earliest examples of direct mail were seed catalogs sent to American colonists before the Revolutionary War. More recently, direct mail has been used to offer consumers a range of financial services, coupons for discounts on packaged goods, and requests for donations to a variety of nonprofit organizations.

Direct mail is also an effective medium in business-to-business marketing. Since business orders are usually of larger value than consumer purchases, it often takes more than one mailing to make a sale. Imaginative packages are often used to get through to hard-to-reach executives whose mail is screened by their secretaries. In addition to making sales, business-to-business direct mail can be used to generate sales leads and reinforce the personal selling effort.

Sales literature includes brochures, price lists, and customer testimonials, that a company uses to promote its goods, products, or services to the public.

Q11) What is advertising?

A11) The word advertising comes from the latin word "advertere meaning” to turn the minds of towards".

Advertising can be defined as a non personal presentation and promotion of ideas, goods or services paid by an identified sponsor. It is non personal mass communication which has become a potent means of education and mass selling. It consist of all the advertisements involved in presenting product information targeting audiences through media such as newspaper, magazines, catalogs, booklets, posters, television, radios, cards, calendars, transport, etc.

Advertising is used for communicating business information to the present and prospective customers. It usually provides information about the advertising firm, its product qualities, place of availability of its products, etc. Advertisement is indispensable for both the sellers and the buyers. However, it is more important for the sellers. In the modern age of large scale production, producers cannot think of pushing sale of their products without advertising them. Advertisement supplements personal selling to a great extent.

Definition

According to W.J Stanton, “advertising consist of all activities involved in presenting to an audience a non – personal, sponsor – identified, paid for a message about a product or organization.

According to American marketing association, “Advertising is a paid form of non personal presentation and promotion of ideas, goods, and services of an identified sponsor”.

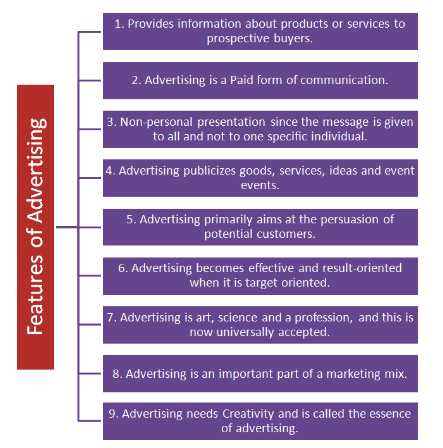

Features of advertisement

The main features of advertising:

- Provides information: Advertising's primary purpose is to provide information about products or services to prospective buyers. The details of products such as features, uses, prices, benefits, manufacturer's name, etc; and also the key message and brand name are in the advertisements. The information supplied through advertising educate and guide consumers and facilitate them to make a correct choice while buying a product.

2. Paid communication: Advertising is a form of paid communication. The advertiser pays to the media for giving publicity to his advertising message to inform or persuade an audience regarding a product, organization, or idea. He also decides the size, slogan, etc. given in the advertisement.

3. Non-personal presentation: Advertising is non-personal in character as against salesmanship, which is a personal or face to face communication. Here, the message is given to all and not to one specific individual. This rule is applicable to all media including the press.

4. Publicity: Advertising publicizes goods, services, ideas and event events. It is primarily for giving information to consumers. This primary purpose is to provide information related to the features and benefits of goods and services of different types. It offers new ideas to customers as its contents are meaningful. The aim is to make the popularize ideas and thereby promote sales.

5. Primarily for Persuasion: Advertising aims at the persuasion of potential customers. It attracts attention towards a particular product, creates a desire to have it, and finally persuade the consumers to visit the market and purchase the same. It has a psychological impact on consumers. It influences their buying decisions.

6. Target oriented: when advertising is target oriented it becomes effective and result-oriented. A targeted advertisement intensively focuses on a specific market or particular groups of customers (like teenagers, housewives, infants, children, etc.). Thus, the selection of a particular market is called a target market.

7. Art, science and profession: Advertising is universally accepted as art, science and a profession. It is an art as it needs creativity for raising its effectiveness. It is a science as it has its principles or rules. It is also a profession as it has a code of conduct for its members and operates within standards set by its organized bodies.

8. The element of a marketing mix: Advertising is an important part of a marketing mix. It supports the sales promotion efforts of the manufacturer. It makes a positive contribution to sales promotion provided other elements in the marketing mix are reasonably favorable. Many companies spend huge funds on advertisements and public relations.

9. Creativity: Advertising is a method of presenting a product in an artistic, attractive and agreeable manner. It is possible through the element of creativity. The creative people introduce creativity in advertisements. The Ads won't succeed without creativity. Therefore, creativity is called the ‘Essence of Advertising.’

Q12) State personal selling?

A12) “Personal selling is an ancient art. Effective sales persons have more than instinct; they are trained in a method of analysis and customer management. Selling today is a profession that involves mastering and applying a whole set of principles”. (P. Kotler).

Personal selling is a part of promotional- mix and it is an art of person-to-person communication for persuading prospects or consumers in the sales process. For introducing effective marketing system, balancing of other marketing elements like, product development, pricing, distribution system, advertising etc. should be organised along with implementation of personal selling methodology.

Objectives

- To enhance the sales volume of the different products of the company

- To ensure the there is a proper mix of products in the total sales volume

- To ensure that the market share of the company is increased

- To ensure that the profits of the company have improved

- To bring down or reduce the overall selling expenses of the company

- To gain new accounts and ensure that there is growth of the business

- It helps in the appointment of dealers and expansion of the distribution channel.

- To secure channel members co-operation in stocking as well as selling the products of the company.

- To achieve the desired proportion of cash and credit sales.

- To provide pre-sale and after-sale services.

- To train the dealers and customers.

- To assist and support other promotional measures.

- To help in collecting the amounts due from the market.

- To help in gathering and reporting marketing intelligence.

Q13) What is trade fair and exhibition?

A13) Fairs and exhibitions constitute the means of presenting goods and services in an attractive manner with the aid of colour, light and motion in order to catch the imagination of the visitor, attract his attention and get him interested in the goods or products displayed. They help in reaching the public who may not be reached in any other way or who by nature would disregard other media of publicity.

In other words, exhibition is a congregation of showrooms of different manufacturers under one roof. Exhibition is a huge gathering of businessmen and manufacturers from different parts for the purpose of display, demonstration and booking orders. Trade fairs are also huge fairs where the display and demonstrations are combined generally with entertainment.

Trade fairs and exhibitions play an important role not only in domestic markets but in international marketing too by bringing potential buyers and suppliers/ manufacturers in contact and imparting information about the relevant developments around the world. In certain cases they have a special significance. For example, in Libya where media advertisement for products is not permitted, the annual Tripoli International Trade Fair is very important and popular means to promote products and business.

Organising international trade fairs and exhibitions is not new to humanity but they are now becoming increasingly popular. Basically, these are the publicity tools where goods are displayed by the manufacturers in an attractive manner in order to catch the imagination of the visiting public and attract them with a view to get them interested in the objects or goods displayed.

In trade fairs and exhibitions, generally, the goods are displayed and their working is demonstrated, if the goods are of technical nature with a view to create the demand in the market. Generally, goods are not offered for sale, they are only displayed but very often consumer goods of small value are sold there on cash terms.

Fairs and exhibitions are of following two types:

1. General or Horizontal Fairs and Exhibitions:

In general fairs, almost all types of goods—consumer as well as industrial—are exhibited. The participants in the fairs come from domestic and international markets. The general fairs attract visitors of all ages, tastes and types and therefore require good place to show consumer goods or new products. Separate pavilions may be set up for each nation or domestic manufacturers or for a group of national or international manufacturers.

Exhibits of one group may also be displayed in one pavilion. Such exhibitions and trade fairs are generally visited by business firms as well as general public. This is a good medium of disseminating information or to make the public aware of the newly manufactured product which is about to enter the market. The examples of such fairs are India International Trade Fair organised every year in Delhi and Milan Trade Fair, Milan.

2. Specialised or Vertical Fairs and Exhibitions:

These fairs and exhibitions are highly specialised in the sense that only specific products are displayed there. For example, the leather fair in Paris or the Book Fair in Frankfurt, International Book Fair, New Delhi, Auto Expo, New Delhi, Mumbai Sea Food Fair, Hanover Engineering Fair etc. These fairs are intended only for trade and industry and not for the general public.

The main purpose of organising such fairs and exhibitions is not only to conclude deals immediately but also to have first-hand knowledge of technical developments in that field in various countries or to identify business partners on a long term basis or to get ideas for product development and planning. Such fairs and exhibitions may be organised by the government company or specialised promotion institutions.

Specialised fairs and exhibitions may be classified into following two categories:

(i) Solo Exhibition:

‘Solo’ exhibitions are organised by the government of a country in another country where the market prospects of its export products are bright. Generally the Commodity Boards, the Export Promotion Councils or other government agencies organise such exhibitions.

The exhibition may be a specialised one where only a limited number of products are displayed or it may be a general exhibition to display all the important export products of the country organising the exhibition. Indee-79 is the best example of a specialised ‘solo’ or ‘national’ exhibition. It was organised by the Engineering Export Promotion Council in 1979 in Indonesia to exhibit Indian engineering products.

(ii) Company Exhibition:

Such an exhibition is organised by an exporting firm in another country to exhibit its own products. The exhibition may be open for traders or for both traders and consumers.

Q14) How cost of product influence international pricing?

A14) Price in international marketing cannot be determined without considering the cost of the product. Fixed and variable costs of production, marketing and transport expenses are included in the cost of production. Sometimes a company sells at a price lower than cost and increases its share in market. It aims to recover production cost in long run. Price depends on production cost. Hence, it is necessary to analyse the cost and to consider the fixed and variable costs while fixing the price.

Q15) How demand influence international pricing?

A15) Demand is another factor that determines the prices in the international markets. The demand in international markets is also affected by a number of factors which are different from those operating in domestic market. Customs and tastes of foreign customers may differ widely.

Elasticity of demand is another factor which affects the pricing. If the demand of the product is elastic, a reduction in price may increase the sales volume. On the other hand, higher price may be fixed if the demand is inelastic and the supply is limited.

Q16) How competition influence international pricing?

A16) Competition in the foreign market is also an important factor. Competition in foreign market may be so severe that the exporter has no other option except to follow the market leader. In monopoly an exporter can fix high price of its patented product. Greater competition reduces freedom for fixing the price. Price cannot be determined without considering the strategy of competitors.

Q17) What is fixed cost?

A17) It includes production overheads, administration overheads, publicity and advertising (general), travel abroad and after-sale service minus Govt., assistance, duty drawback and import subsidy etc., received and then freight and insurance are added to arrive at the final cost.

Advantages:

The main benefits of this system are as under:

(i) Under this method the exporter realises the total cost in marketing the product in a foreign market.

(ii) Marginal targets are thought of.

(iii) No chances of loss.

(iv) This is logical and universally accepted method.

(v) It is easier to understand and calculate.

Disadvantages:

Main limitations are as under:

(i) Cost is considered in advance. But there is difference between estimated and real cost. So this method does not give exact result.

(ii) When a company’s cost is higher than its competitors, this method is of no help.

(iii) In this method only cost and expected profit are considered. Hence, chances of increasing price are often lost.

(iv) Change in demand and supply is not taken care of.

(v) It does not help in competition.

(vi) There is little scope for change according to time and circumstances and hence, this method of pricing is not useful.

Q18) Write the disadvantage of marginal costing pricicng?

A18) (i) Generally, this method is applied only when a company has idle production capacity in addition to optional cost.

(ii) Developing countries might be charged for dumping their products in foreign markets because they would be selling their products below net prices and thus may attract anti-dumping provisions which will take away their competitive advantage.

(iii) The use of this method may give rise to cut-throat competition among exporting firms from developing countries resulting in loss in valuable foreign exchange to the exporting countries.

(iv) Marginal cost pricing is not advisable in the following cases:

(a) If the importers are regularly purchasing the product at a low price, it will be difficult for exporters to increase the price of the commodities later on. It may result in loss of market.

(b) This policy is not useful or is of limited use to industries which are mainly dependent upon export markets and where overheads or fixed costs are insignificant.

Q19) State the steps determine market oriented export pricing?

A19) (i) First, relevant demand schedules (quantities to be bought) at various prices should be estimated over the planning period;

(ii) Then, relevant costs (total and incremental) of production and marketing should be estimated to achieve the target sales volume as per demand schedules prepared; and

(iii) Lastly, the price that offers the highest profit contribution, i.e., sales revenues minus ‘all fixed and variable costs.

Q20) Define DAF?

A20) Under this price quotation exporter delivers the goods at the disposal of importer on means of transport not unloaded, cleared for exports but cleared for import at the specified destination at the frontier, but before the custom post of the adjoining country