Unit 4

Analysis and Intepretation of Financial Statements

Q1) The company's balance sheet for December 31 is as follows:

Liabilities | Rs | Assets | Rs |

Share capital | 2,00,000 | Land and building | 1.,40,000 |

Profit & loss account | 30,000 | Plant and machinery | 3,50,000 |

General reserve | 40,000 | Stock | 2,00,000 |

12% debenture | 4,20,000 | Sundry debtor | 1,00,000 |

Sundry creditor | 1,00,000 | Bills receivable | 10,000 |

Bills payable | 50,000 | Cash at bank | 40,000 |

| 8,40,000 |

| 8,40,000 |

Calculate :-

A1)

=2.33:1

=2.33:1

2. Quick ratio =

3. Inventory to working capital =

working capital= current assets – current liabilities

Rs 3,50,000 - Rs 1,50,000= Rs 2,00,000

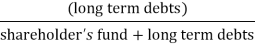

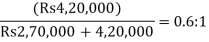

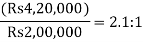

4. Debt to equity ratio=

(or)

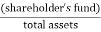

5. Proprietary ratio=

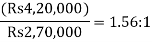

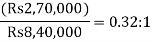

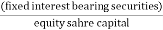

6. Capital gearing ratio =

7. Current assets to fixed assets =

Q2) From the following items listed in the trading and profit and loss accounts of the corporation.Working out, business concerns occupancy rate:

Trading account of a account LTD.

For the period ending December 21

Dr. Cr.

Expenses | Rs | Income | Rs |

To opening stock | 1,400 | By net sales | 10,000 |

To purchase | 6,400 | By closing stock. | 600 |

To direct expenses | 300 |

|

|

To gross profit | 2,500 |

|

|

| 10,600 |

| 10,600 |

Profit and loss account of a company LTD.

For the period ending December 31

Dr. Cr.

Expenses | Rs | Income | Rs |

To operating expenses |

| By gross profit | 2,500 |

| 1,600 |

|

|

b. Selling and distribution expenses | 300 |

|

|

To financial expenses | 100 |

|

|

To net profit | 500 |

|

|

| 2,500 |

| 2,500 |

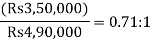

A2)

cost of good sold | Rs |

Opening stock | 1,400 |

purchases | 6,400 |

Direct expenses | 300 |

| 8,100 |

Less closing stock | 600 |

Cost of good sold | 7,500 |

Operating expenses | Rs |

| 1,600 |

b. Selling and distribution expenses | 300 |

c. Financial expenses | 100 |

Operating expenses | 2,000 |

Q3) Below is a summary profit and loss account of Taj Products Ltd. Published January 31-4:

Profit and loss account

| Rs |

| Rs |

Opening stock of market | 99,500 | Sales | 8,50,0000 |

Purchase of material | 3,20,000 | Stock of material (closing) | 89,000 |

Direct wages | 2,25,000 | Stock of finished goods ( closing ) | 60,0000 |

Manufacturing expenses | 14,250 | Non- operating income interest | 3,0000 |

Selling & distribution |

| Profit on sale of shares | 6,000 |

Expenses | 30,000 |

|

|

Administrative expenses | 1,50,000 |

|

|

Finance charges | 15,000 |

|

|

Non- operating expenses |

|

|

|

Loss on scale of assets | 4,000 |

|

|

Net profit | 1,50,000 |

|

|

| 10,08,000 |

| 10,08,000 |

Work out following ratios:-

A3)

Gross sales (a) |

| 8,50,000 |

Less: cost of good sold: | Rs |

|

Opening stock of material | 99,500 |

|

Add: material purchased | 3,20,000 |

|

| 4,19,500 |

|

Less: stock of material (closing) | 89,000 |

|

Material consumed ; (b) | 3,30,500 |

|

Direct wages | 2,25,000 |

|

Manufacturing expenses | 14,250 |

|

Cost of production | 5,70,000 |

|

Less: closing stock of finished products | 60,000 |

|

Cost of good sold |

|

|

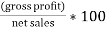

Gross profit (e) |

|

|

Less: administrative expenses | 1,50,000 | 5,10,000 |

selling and distribution | 30,000 | 1,80,000 |

Net operating profit before interest and taxation |

| 1,60,000 |

Add: non- operating income (g) |

|

|

Interest | 3,000 |

|

Profit on sales of shares | 6,000 | 9,000 |

|

| 1,69,000 |

Less: loss on sale of assets | 4,000 |

|

Finance charges | 15,000 | 19,000 |

Income before taxation |

| 1,50,000 |

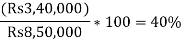

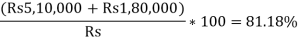

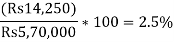

2. Net profit ratio=

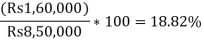

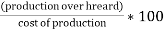

3.

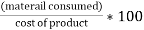

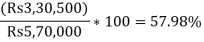

4. i. material consumed ratio=

Q4) You need to calculate from the following balance sheet and additional information:

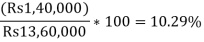

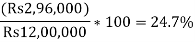

(i)Total Return on resources

(ii)Return on employment capital

(iii) Shareholder fund return

Balance sheet as on 31stdec

| Rs |

| Rs |

Share capital (Rs10) | 8,00,000 | Fixed assets | 10,00,000 |

Reserve | 2,00,000 | Current assets | 3,60,000 |

8% debenture | 2,00,000 |

|

|

Creditors | 1,60,000 |

|

|

| 13,60,000 |

| 13,60,000 |

Net operating profit before tax is Rs 2,80,000. Assume tax rate at 50% . dividend declared amount to Rs 1,20,000

A4)

ii. return on capital employed =

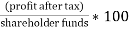

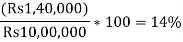

iii. return on shareholder’s fund=

Q5) The company has Rs capital. 10, 00,000; its turnover is 3 times the capital, and the margin of turnover is 6%. What is the return on investment?

Solution :-

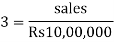

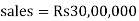

Capital turnover ratio=

rate of return on investment =

Gross profit =6% of Rs 30,00,000

Rs= 1,80,000

Q6) From the following income statement,prepare a general size income statement for Jayant Ltd which ended 31st March, 2011.

Particular | Amount |

revenue from operations | 25,38,000 |

(+) other income | 38,000 |

Total income | 25,76,000 |

Expenses |

|

Cost of revenue from operations | 14,00,000 |

Operating expenses | 5, 00,000 |

Total expenses | 19,00,000 |

profit before tax | 6,76,000 |

(-) income tax | 3,38,000 |

profit after tax |

|

A6)

Common size statement of profit and loss

for the year ended 31st March, 2011

Particular | Amt | Amt |

| 25,38,000 | 100.00 |

II. Other income | 38,000 | 1.50 |

III. Total revenue (I+II) | 25, 76, 000 | 101.50 |

IV. Expenses |

|

|

(a). cost of revenue from operations. (b). operations expenses | 14,00,000 5,00,000 | 55.16 19.70 |

Total expenses | 19,00,000 | 74.86 |

V. Profit before tax (III-IV) | 6,76,000 | 26.64 |

VI. Tax | 3,38,000 | 13.32 |

VII. Profit after tax ( V-VI) | 3,38,000 | 13.32 |

Q7) Below is Raj Ltd's income statement for the year ended 31st March, 2011.

Particular | Amount |

Revenue from operations | 2,00,000 |

(+) other income | 15,000 |

Total income | 2,15,000 |

Expenses |

|

Cost of revenue from operations . | 1,10,000 |

Operating expenses | 5,000 |

Total expenses | 1,15000 |

Profit before tax | 1,00,000 |

(-) income tax | 40,000 |

profit after tax | 60,000 |

Preparing a statement of the general size of Raj Ltd's profit and loss for the year ended 31st March, 2011.(Delhi 2012, fix)

A7)

Common size income statement

For the year ended 31st march, 2011

Particular | Amt. | Percentage of sales |

| 2,00,000 | 100.00 |

II. Other income | 15,000 | 7.50 |

III. Total revenue (I+II) | 2,15,000 | 107.50 |

IV. Expenses (a) Cost of revenue from operations (b) Operating expenses |

1,10,000 5,000 |

55.00 2.50 |

Total expenses | 1,15,000 | 57.50 |

V. profit before tax ( III-IV) | 1,00,,000 | 50.00 |

VI. Tax | 40,000 | 20.00 |

VII. Profit after tax (V-VI) | 60,000 | 30.00 |

Q8) Create a comparative statement of profit and loss from the following information.

Particular | 31st march, 2009 | 31st march 2010 |

Revenue from operations | 40,000 | 50,000 |

Cost of revenue from operations | 30,000 | 35,000 |

Wage paid | 16,000 | 14,000 |

Operating expenses | 2,500 | 3,000 |

Other income | 2,000 | 3,000 |

Income tax | 4,750 | 7,500 |

A8)

Comparative statement of profit and loss

For the year ended 31stmarch , 2009 and 2010

Particular | 31st march 2009 | 31st march 2010 | Absolute change ( increase or decrease) | Percentage change ( increase or decrease )(%) |

| 40,000 | 50,000 | 10,000 | 25.00 |

II. Other income | 2,000 | 3,000 | 1,000 | 50.00 |

III. Total revenue (I+II) | 42,000 | 53,000 | 11,000 | 26.19 |

IV. Expenses (a) Cost of revenue from operations. (b) Operating expenses Total expenses |

30,000 2,500 32,500 |

35,000 3,000 38,000 |

5,000 500 5,500 |

16.67 20.00 16.92 |

V. Profit before tax ( III-IV) | 9,500 | 15,000 | 5,500 | 57.89 |

VI. Tax | 4,750 | 7,500 | 2,750 | 57.89 |

VII. Profit after tax (V-VI) | 4,750 | 7,500 | 2,750 | 57.89 |

Note the paid wages are part of the direct costs and are included in the cost of goods already sold.

Q9) Create a comparative statement of profit and loss from the following information.

Particular | 2009 | 2010 |

Revenue from operations | 10,00,000 | 12,50,000 |

Cost of revenue from operations | 5,00,000 | 6,50,000 |

Carriage inwards | 30,000 | 50,000 |

Operating expenses | 50,000 | 60,000 |

Income tax | 50% | 50% |

A9)

Comparative statement of profit and loss

For the year ended 31st march, 2009 and 2010

Particulars | 31st march 2009 | 31st march 2010 | Absolute change(increases or decreases) | Percentage change (increase or decrease) |

| 10,00000 | 12,50,000 | 2,50,000 | 25.0 |

II. Other income | - | - | - | - |

III. Total revenue (I+II) | 10,00000 | 12,50,000 | 2,50,000 | 25.0 |

IV. Expenses (a) Cost of revenue from operations (b) Operating expenses Total expense |

5,00,000 50,000 5,50,0000 |

6,50,000 60,000 7,10,000 |

1,50,000 10,000 1,60,000 |

30.00 20.00 29.09 |

V. Profit before tax ( III-IV) | 4,50,000 | 5,40,000 | 90,000 | 20.00 |

VI. Tax @ 50% | 2,25,000 | 2,70,000 | 45,000 | 20.00 |

VII. Profit and tax (V-VI) | 2,25,000

| 2,70,000 | 45,000 | 20.00 |

Note: inward carriage is part of the direct cost and is included in the cost of goods already sold.

Q10) Use the following information to create a comparative statement of profit and loss.

Particular | 31st march, 2008 | 31st march, 2009 |

Revenue from operations | 2,00,000 | 3,50,000 |

Purchase | 1,00,000 | 2,00,000 |

Cost of revenue | 60% of revenue from operations | 70% of revenue from operations |

Administrative expenses | 5% on gross profit | 7% on gross profit |

Income tax | 45% | 45% |

A10)

Comparative statement of profit and loss

For the year ended 31st march, 2008 and 2009

Particular | 31st march 2008 | 31st march 2009 | Absolute change | Percentage change |

| 2,00,000 | 3,50,000 | 1,50,000 | 75.00 |

II. Other income | - | - | - | - |

III. Total revenue (I+II) | 2,00,000 | 3,50,000 | 1,50,000 | 75.00 |

IV. Expense

|

1,20,000 4,000 1,24,000 |

2,45,000 7,350 2,52,000 |

1,25,000 3,350 1,28,350 |

104.17 83.75 103.51 |

V. Profit before tax (III-IV) | 76,000 | 97,650 | 21,650 | 28.49 |

VI. Tax @45% | 34,200 | 43,943 | 9,743 | 28.49 |

VII. Profit after tax | 41,800 | 53,707 | 11,970 | 28.49 |

Note purchases are not indicated individually, as they are part of the cost of the goods sold.

Working note

| 2008 | 2009 |

Revenue from operational (sales) | 2,00,000 | 3,50,000 |

(-) cost of revenue from operations | 1,20,000 | 2,45,000 |

Gross profit | 80,000 | 1,05,000 |

administrative expenses | 5% on gross profit i.e 4,000 | 7% on gross profit i.e 7,350 |

Q11) Create a comparative income statement for profit and loss from the following information

Particular | 31stmarch , 2008 | 31st , march 2009 |

revenue from operations | 3,00,000 | 4,00,000 |

Sales return | 1,00,000 | 2,00,000 |

Cost of revenue from operations | 60% of revenue operations | 50% of revenue from operations |

Administrative expense | 20% gross profit | 10% on gross profit |

Income tax | 40% | 40% |

A11)

Comparative statement of profit and loss

For the year ended 31st march, 2008 and 2009

Particular | 31st march 2008 | 31st march 2009 | Absolute change (increase or decrease) | Percentage change( increase or decrease) |

| 2,00,000 | 2,00,000 | - | - |

II. Other income | - | - | - | - |

III. Total revenue ( I+II) | 2,00,000 | 2,00,000 | - | - |

IV. Expenses

Total expense |

1,20,000 16,000 1,36,000 |

1,00,000 10,000 1,10,000 |

(20,000) (6,000) (26,000) |

(16.67) (37.50) (19.12) |

V. Profit before tax ( III-IV) | 64,000 | 90,000 | 26,000 | 40.63 |

VI. Tax @40% | 25,600 | 36,000 | 10,400 | 40.63 |

VII. Profit after tax (V-VI) | 38,400 | 54,000 | 15,600 | 40.63 |

Working note

| 2008 | 2009 |

Revenue from operations | 3,00,000 | 4,00,000 |

(-) sales return | 1,00,000 | 2,00,000 |

Revenue from operations | 2,00,000 | 2,00,000 |

(-) cost of revenue from operations | 1,20,000 | 1,00,000 |

Gross profit | 80,000 | 1,00,000 |

Administrative expenses | 20% on gross profit i.e 16,000 | 10% on gross profit i.e 10,000 |

Q12) Create a comparative statement of profit and loss from the following

Particular | 31st march 2008 | 31st march , 2009 |

Revenue from operations | 140% of cost of revenue from operations | 160% of cost of revenue from operations |

Purchases | 2,50,000 | 4,50,000 |

Cost of revenue from operations | 3,00,000 | 5,00,000 |

Administrative expenses | 10% of cost of revenue from operations | 8% of cost of revenue from operations |

Income tax | 40% | 50% |

A12)

Comparative statement of profit and loss

For the year ended 31st march, 2008 and 2009

Particular | 31st march 2008 | 31st march 2009 | Absolute change | Percentage change |

| 4,20,000 | 8,00,000 | 3,80,000 | 90.48 |

II. Other income | - | - | - | - |

III. Total revenue (I+II) | 4,20,000 | 8,00,000 | 3,80,000 | 90.48 |

IV. Expenses

Total expenses |

3,00,000 30,000 3,30,000 |

5,00,000 40,000 5,40,000 |

2,00,000 10,000 2,10,000 |

66.67 33.33 63.64 |

V. Profit before tax ( III-IV) | 90,000 | 2,60,000 | 1,70,000 | 188.89 |

VI. Tax @ 40% and 50% | 36,000 | 1,30,000 | 94,000 | 261.11 |

VII. Profit after tax (V-VI) | 54,000 | 1,30,000 | 76,000 | 140.74 |

Note purchases are not indicated individually, as they are part of the cost of the goods sold.

Q13) Create a comparative statement of profit and loss from the following

Particular | 31st march, 2008 | 31st march, 2009 |

Revenue from operations | 140% of cost of revenue from operations | 150% of cost of revenue from operations |

Purchases | 1,50,000 | 2,50,000 |

Cost of revenue from operations | 2,00,000 | 3,00,000 |

Operating expenses | 10,000 | 15,000 |

Income tax | 40% | 40% |

A13)

Particular | 31st march 2008 | 31st march 2009 | Absolute change | Percentage change | |

| 2,80,000 | 4,50,000 | 1,70,000 | 60.71 | |

II. Other income | - | - | - | - | |

III. Total revenue (I+II) | 2,80,000 | 4,50,000 | 1,70,000 | 60.71 | |

IV. Expenses c. Cost of revenue from operations d. Administrative expenses Total expenses |

2,00,000 10,000 2,10,000 |

3,00,000 15,000 3,15,000 |

1,00,000 5,000 1,05,000 |

50.00 50.00 50.00 | |

V. Profit before tax ( III-IV) | 70,000 | 1,35,000 | 65,000 | 92.86 | |

VI. Tax @ 40% and 50% | 28,000 | 54,000 | 26,000 | 92.86 | |

VII. Profit after tax (V-VI) | 42,000 | 81,000 | 39,000 | 92.86 |

|

Note the purchase is part of the cost of the goods sold and therefore does not appear separately.

Q14) Explain Analysis and interpretation of Financial Statements.

A14)

What are financial statements?

The term financial statement refers to a statement of change in financial condition, statement of retained earnings, balance sheet, income statement, and so on. But in general, financial statements contain only two statements; they are profit and loss accounts and balance sheets. It is observed that the mere presentation of these statements does not serve anyone's purpose anyway. The importance of these statements lies in their analysis and interpretation. Initially, the analysis was carried out only to extend credit, but now it is used as the most important function of management accountants to provideinformation.

Hampton J.J. "A statement disclosing the status of an investment is known as a balance sheet and a statement indicating the result is known as a profit and loss account, “the statement said.

Some of the schedules are prepared and submitted alongside financial statements for meaningful presentation. Such a schedule is based on the schedule of fixed assets, the schedule of debtors, the schedule of creditors, the schedule of investments.

Meaning of analysis

Analysis means the process of splitting or splitting the content of financial statements into many parts to obtain maximum meaningful information.

Meaning of interpretation

Explaining the meaning and significance of the rearrangement and/or modified data of the financial statements is called Interpretation

F.Wood:Putting the meaning of a press release in simple words for the advantage of a person is called "Interpretation

Procedures for analysis and interpretation

In order to conduct an effective analysis and interpretation of financial statements, it is necessary to complete the following basics:

Purpose of analysis and interpretation

Many stakeholders of financial statements are analysed and interpreted according to their various purposes. Despite the variability of the purposes of analysis and interpretation by different classes of people, there are several common purposes of interpretation, which are given below.

1. To find out the income capacity and efficiency of various business activities with the help of the income statement.

2. Measure management efficiency under different business situations.

3. Estimate the performance ratings of different departments over a period of time.

4. With the help of the balance sheet, measure the short-and long-term solvency position of the business organization.

5. To find out the source of Finance and how to utilize available finance.

6. To determine the future prospects of earnings capacity and business concerns.

7. Identify the role of fixed assets in maintaining revenue capacity for how they are utilized and business concerns.

8. Investigate the future potential of business concerns.

9. Compare the operational efficiency of similar concerns engaged in the same industry.

10. Identify the growth trend of the business organization.

The importance of analysis and interpretation

All quantitative information i.e. financial accounting information is comprehensively analysed and interpreted so that important facts and relationships regarding various aspects of financial life of business concerns are known to everyone. Thus, various factors increase the importance of analysing and interpreting financial statements.

1. Wrong and incomplete decisions are taken by the management team in the absence of analysis and interpretation.

2. Sometimes, decisions are also taken by various responsible executives in haste.

3. Everyone has limited experience in business activities. Therefore, the complexity of business activities can be easily understood through analysis and interpretation.

4. If a decision is made based on intuition or conclusions, then the decision has no meaning, and no one understands the decision. In other words, if the decision is based on scientific analysis and interpretation, then everyone understands the decision very easily.

5. Analysis and interpretation are necessary to verify and consider the correctness and correctness of selections already made on the idea of intuition.

Q15) Explain ratio analysis.

A15)

Ratio analysis is used to evaluate relationships among financial statement items. It is used to identify trends over time for one company or to compare two or more companies at one point in time. Financial statement ratio analysis focuses on three key aspects of a business: liquidity, profitability, and solvency.

Ratio analysis is concerned with the calculation of relationship to provide indicators of past performance in terms of critical success factors of a business. This is an accounting ratio. The accounting ratio offer quick ways to evaluate a business's financial condition.

According to Accounting Scholar, ratios are the most frequently used accounting formulas in regard to business analysis. Analyzing your finances with these ratios helps you identify trends and other data that inform important business decisions.

Different types of accounting ratio

These ratios are used to evaluate the company ability in paying its debts, usually by measuring current liabilities and liquid assets. This determines the ability of the company to pay off short-term debts. These are some common liquidity ratios:

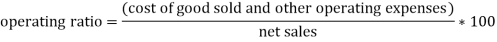

It is also known as working capital ratio. The purpose of this ratio is to measure the company ability to pay off short-term debts by liquidating the assets. Current assets includes stock, debtors, cash and bank balances, bills receivable, etc. current liabilities includes creditors, bank overdrafts, outstanding expenses, etc. The ideal ratio is considered to be 2:1

This ratio is similar to the current ratio above, except that to measure "quick" assets, which includes Cash + Cash Equivalents + Short Term Investments + Accounts Receivables. The ideal ratio is 1:1.

By calculating the net working capital ratio, the company is calculating the liquidity of the assets. An increasing net working capital ratio indicates that the business is investing more in liquid assets than fixed assets.

This ratio tells the ability of business in covering its debts using only cash.

The cash coverage ratio is similar to the cash ratio, but it calculates the business ability to pay interest on its debts.

2. Profitability ratios

This ratio is used by accountant to measure a business's earnings versus its expenses. Profitability is the ability of a business to earn profit over a period of time. The profitability ratios show the combined effects of liquidity, asset management and debt management on operating results. These are some common profitability ratios:

This ratio determines the basic profitability of the firm. The ratio is represented as a percentage of sales. Higher the ratio, the higher is the profit earned on sales

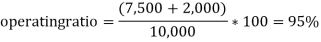

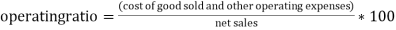

This ratio measures the equation between the cost of operating activities and the net sales, or revenue from operations. This ratio expresses the cost of goods sold as a percentage of the net sales. Lower the ratio, lower the expense related to the sales

This ratio measures the ultimate profitability. Higher the ratio, the more profitable are the sales.

The return on assets ratio indicates how much profit businesses make compared to their assets. Higher the return, the more efficient is the management in utilizing its asset base

It measures how much the shareholders earned for their investment in the company. Higher percentage indicates better return to investors.

This ratio measures the overall efficiency of the utilization of the firm’s funds. It indicates the productivity of capital employed.

The earnings-per-share ratio is similar to the return-on-equity ratio, except that this ratio indicates the company profitability from the outstanding shares at the end of a given period.

3. Leverage ratios

A leverage ratio is a important indicator of financial strength, it sees how much of the company's capital comes from debt and how the company can meet its financial obligations.

This ratio compares the company’s total debt to its total assets. The higher the debt ratio the more difficult it becomes for the firm to raise debt.

This ratio measures the strength of the financial structure of the company. A high equity ratio reflects a strong financial structure of the company.

This ratio measures the debt component of a company’s capital structure. A low level of debt and a healthy proportion of equity in a company’s capital structure is an indication of financial strength.

4. Turnover ratios

Turnover ratios are used to measure the company's income against its assets. There are many different types of turnover ratios. Here are some common turnover ratios:

5. Market value ratios

Market value ratios deal entirely with stocks and shares. Many investors use these ratios to determine if your stocks are overpriced or underpriced. These are a couple of common market value ratios: