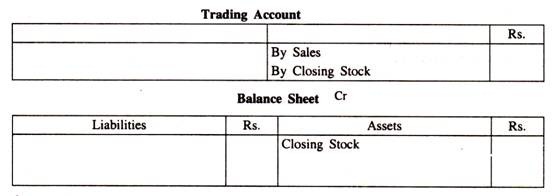

Particulars | Amount | Particulars | Amount |

To opening stock | xxx | By sales | xxx |

To purchase | xxx | Less: Returns | xxx |

Less: returns | xxx | By Closing stock | xxx |

To direct expenses: | xxx | By Gross loss c/d |

|

Freight & carriage | xxx |

|

|

Custom & insurance | xxx |

|

|

Wages | xxx |

|

|

Gas, water & fuel | xxx |

|

|

Factory expenses | xxx |

|

|

Royalty on production | xxx |

|

|

To Gross profit c/d | xxx |

|

|

Particulars | Amount | Particulars | Amount |

To Gross loss b/d | xxx | To Gross profit b/d | xxx |

Management expenses: | xxx | Income: | xxx |

To salaries | xxx | By Discount received | xxx |

To office rent, rates, and taxes | xxx | By Commission received | xxx |

To printing and stationery | xxx | Non-trading income: | xxx |

To Telephone charges | xxx | By Bank interest | xxx |

To Insurance | xxx | By Rent received | xxx |

To Audit fees | xxx | By Dividend received | xxx |

To Legal charges | xxx | By Bad debts recovered | xxx |

To Electricity charges | xxx | Abnormal gains: | xxx |

To Maintenance expenses | xxx | By Profit on sale of machinery | xxx |

To Repairs and renewals | xxx | By Profit on sale of investments | xxx |

To Depreciation | xxx | By Net Loss(transferred to Capital A/c) | xxx |

Selling distribution expenses: |

|

|

|

To Salaries | xxx |

|

|

To Advertisement | xxx |

|

|

To Godown | xxx |

|

|

To Carriage outward | xxx |

|

|

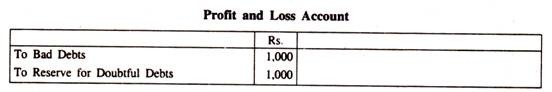

To Bad debts | xxx |

|

|

To Provision for bad debts | xxx |

|

|

To Selling commission | xxx |

|

|

Financial expenses: |

|

|

|

To Bank charges | xxx |

|

|

To Interest on loan | xxx |

|

|

To Discount allowed | xxx |

|

|

Abnormal losses: | xxx |

|

|

To Loss on sale of machinery | xxx |

|

|

To Loss on sale of investments | xxx |

|

|

To Loss by fire | xxx |

|

|

To Net Profit(transferred to capital a/c) | xxx |

|

|

TOTAL |

| TOTAL |

|

|

Balance sheet

|

|

|

|

|

|

|

|

Particulars | Rs | Particulars | Rs |

Stock (1-4-2015) Purchase Wages Carriage inwards Freight inward | 10,000 1,60,000 30,000 10,000 8,000 | Sales Returns inward Return outward Gas and Fuel | 3,00,000 16,000 10,000 8,000 |

Particulars | Rs | RS | Particulars | Rs | Rs |

To Opening Stock To purchase Less: Return outwards To wages Add: Outstanding To carriage inwards To freight inwards To Gas and fuel Less: Prepaid To Gross profit c/d |

1,60,000 10,000 | 10,000

1,50,000

34,000 10,000 8,000

7,000 85,000

| By Sales Less: Returns inward BY Closing Stock | 30,00,000 16,000 |

2.84,000 20,000

|

| |||||

30,000 4,000 | |||||

8,000 1,000 | |||||

| |||||

3,04,00 | |||||

3,04,00 | |||||

|

|

Particulars | Rs | Particulars | Rs |

Gross profit Rent paid Salaries Commissions (Cr.) Discount received Insurance Premium paid | 1,00,000 22,000 10,000 12,000 2,000 8,000 | Interest received Bad debts Provisions for bad debts(1-4-2016) Sundry debtors Buildings | 6,000 2,000 4,000 40,000 80,000 |

Particulars | Rs | RS | Particulars | Rs | Rs |

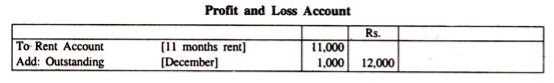

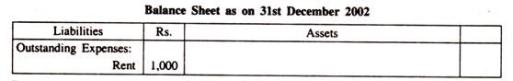

To Rent Add: Outstanding (22,000x1/11) To Salaries Add: Outstanding To Insurance premium

Less: Prepaid insurance To Provision for bad and doubtful debts(closing)

Add: Bad debts Add: Further bad debts

Less: Opening provisions for bad and doubtful debts To Depreciate on building (80,000 x 10%)

To Net profit (transferred to capital A/c)

| 22,000 2,000 |

24,000

14,000

6,000

2,900 8,000 | By Gross profit b/d By Commission

Less: Received in advance By Discount received By interest received Add: Accrued | - 12,000 2,000 | 1,00,000

10,000 2,000

8,000

|

10,000 4,000 | 6,000

2,000 | ||||

8,000 2,000 | |||||

1,900 2,000 3,000

| |||||

6,900

4,000 | |||||

| |||||

65,100 | |||||

1,20,000 | |||||

1,20,000 |

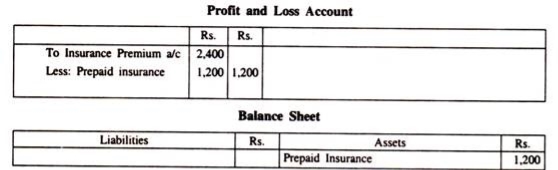

Particulars | Rs | Particulars | Rs |

Gross profit Salaries Office rent paid Advertisement | 50,000 18,000 12,000 8,000 | Rent received Discount received Carriage outwards Fire insurance premium | 2,000 3,000 2,500 6,500 |

Particulars | Rs | RS | Particulars | Rs | Rs |

To Salaries To Office rent To Advertisement To Carriage outwards To Fire insurance premium Less: Prepaid To Manager’s commission To Net profit (transferred to capital account) |

6,500 1,500 | 18,000 12,000 8,000 2,500

5,000 1,000

9,000 | By Gross profit b/d By Rent received Add: Rent accrued By Discount received |

2,000 500 | 50,000

2,500 3,000

55,500 |

| |||||

55,500 |

Particulars | Rs | Rs | Particulars | Rs | Rs |

To Salaries To Office Rent To Advertisement To Carriage outwards To Fire insurance premium Less: Prepaid TO Manager’s commission To Net profit (transferred to capital account) |

6,500 1,500 | 18,000 12,000 8,000 2,500

5,000 1,000

9,000

55,500 | By Gross profit/d By Rent received Add: Rent accrued By Discount received |

2,000 500 | 50,000

2,500 3,000

55,500 |

| |||||

|

Particulars | Rs | Particulars | Rs |

Stock on 01.01.2016 Purchase Sales Expenses on purchase Bank charges paid | 9,000 22,000 42,000 1,500 3,500 | Bad debts Sundry expenses Discount allowed Expenses on sale Repairs on office furniture | 1,200 1,800 1,700 1,000 600 |

Particulars | Rs. | Particulars | Rs |

To Opening stock To Purchase To Expense’s on purchase To Gross profit c/d

To Bank charges To Bad debts To Sundry expenses To Discount allowed TO Expense on sale To Repairs on office furniture TO Manager’s commission To Net profit (transferred to capital A/c) | 9,000 22,000 1,500 14,000 | By Sales By Closing stock

By Gross profit b/d | 42,000 4,500

|

46,500 | 46,500 | ||

3,500 1,200 1,800 1,700 1,000 600 200 4,000

| 14,000

| ||

14,000 | 14,000 |

Particulars | Rs | Particulars | Rs |

Capital Drawings Cash in hand Loan from Bank Bank over draft Investment Bills receivables | 2,00,000 40,000 15,000 40,000 20,000 20,000 10,000 | Sundry creditors Bill payable Goodwill Sundry debtor Land and Building Vehicles Cash at bank | 40,000 20,000 60,000 80,000 50,000 80,000 25,000 |

Particulars | Rs | Rs | Particulars | Rs | Rs |

Capital Add: Net profit Add: Interest on capital

Less: Drawings Loan from bank

Add: Interest outstanding Bills payable Sundry creditors Bank overdraft Add: Interest outstanding

Outstanding liabilities Salaries Wages | 2,00,000 96,000 20,000 |

2,76,000

46,000 20,000 40,000

23,000

30,000

| Good will Land and Building Vehicles Less: Depreciation

Investment Stock in trade Sundry debtors Less: Bad debts

Less: Provision for bad and doubtful debts

Bills receivable Cash at bank Cash in hand |

80,000 8,000 | 60,000 50,000

72,000 20,000 1,20,000

63,000

10,000 25,000 15,000

|

3,16,000 40,000 | |||||

80,000 10,000 | |||||

40,000

6,000 | |||||

20,000 3,000 | 70,000

7,000 | ||||

10,000 20,000 |

| ||||

4,35,000 | |||||

| 4,35,000 |

Particular | Rs | Paricular | Rs |

Purchase Return inward Opening stock Freight inwards Wages Investments Bank Charges Land Machinery Buildings Cash at bank Cash in hand | 75,000 2,000 10,000 4,000 2,000 10,000 1,000 30,000 30,000 25,000 18,000 4,000 2,11,000 | Capital Creditors Sales Return outwards | 60,000 30,000 1,20,000 1,000

2,11,000 |

Particulars | RS | Rs | Particulars | Rs | Rs |

To Opening stock TO Purchase Less: Return outward To Freight inwards To wages To Gross profit c/d

To Depreciation on machinery To Bank charges To Net profit (transferred to a/c) |

75,000 1,000 | 10,000

74,000 4,000 2,000 37,000 | By Sales Less: Return inward

By Closing stock

By Gross profit b/d BY Accrued interest on investment | 1,20,000 2,000 |

1,18,000

9,000

|

| |||||

| |||||

1,27,000 | 1,27,000 | ||||

3,000 1,000 35,000 |

37,000 2,000

| ||||

39,000 | |||||

39,000 |

Particulars | RS | Rs | Particulars | Rs | Rs |

Capital Add: Net profit Creditors | 60,000 35,000

|

95,000 30,000

| Land Building Machinery Less Depreciation Investment Add: Accrued interest Stock in trade Cash at bank Cash in hand

|

30,000 3,000 | 30,000 25,000

27,000

12,000 9,000 18,000 4,000

|

10,000 2,000 |

Particulars | Rs | Particulars | Rs |

Purchase Wages Freight inwards Advertisement Carriage outwards Cash Machinery Debtors Bills receivable Stock on 1st January, 2016 | 10,000 600 750 500 400 1,200 8000 2,250 300 1,000 25,000 | Sales Commission received Rent received Creditors Capital | 15,100 1,900 600 2,400 5,000

25,000 |

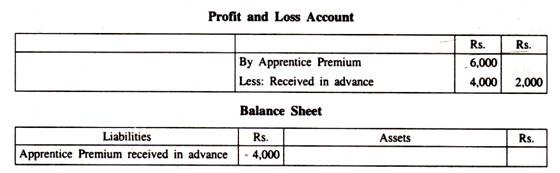

Particulars | Rs | Rs | Particulars | Rs | Rs |

To Opening stock To Purchase TO Wages Add: Outstanding To Freight inwards To Gross profit c/d

TO Advertisement Less: Prepaid advertisement To Carriage outwards TO Net profit (transferred to capital a/c) |

600 200 | 1,000 10,000

800 750 4,650 | By Sales By Closing stock

By Gross profit b/d By Commission received Less: Received in advance By Rent received |

1,900 400 | 15,100 2,100

|

500 150 | |||||

17,200 | 17,200 4,650 | ||||

350 400

6,000

|

1,500 600

| ||||

| |||||

| |||||

6,750 | 6,750 |

Capital Debtors Creditors Purchase Sales Income tax of Jain paid Opening stock | 20,000 8,000 10,500 60,00 80,000 500 12,000 | Offices Salaries Establishment expenses Selling expense Furniture Cash at bank Miscellaneous receipt Drawings | 6,600 4,500 2,300 10,000 2,400 600 4,800 |

Particular | Rs | Rs | Particular | Rs | Rs |

To Opening Stock To Purchase To Gross Profit c/d

To Office salaries Add: Outstanding To Establish expenses To Selling expenses To Depreciation on furniture (10,000 x 10%) To interest on capital (20,000 x 5%) To Net profit (transferred to capital a/c) |

6,600 600 | 12,000 60,000 22,000 | By sales By closing stock

By Gross Profit b/d By miscellaneous receipt |

| 80,000 4,000 |

94,000 |

94,000 | ||||

72,00 4,500 2,300 1,000

1000

6,600

| 22,000

600

| ||||

| |||||

22,600 | 22,600 |

Liabilities | Rs | Rs | Assets | Rs | Rs |

Capital Add: Net profit Add: Interest on capital

Less: Drawings 4,800 Income tax 500 Creditors Office salaries outstanding

| 20,000 6,600 1,100 27,600

5,300 |

22,300 10,500 600 | Furniture Less: Depreciation Stock in trade Debtors

Cash at bank | 10,000 1,000 |

9,000 14,000 8,000 2,400 |

| |||||

| |||||

33,400 |

Debit balances | Rs | Credit balances | Rs |

Drawings Sundry debtors Coal, gas and water Return inward Purchase Stock on 1-11-2016 Travelling expenses Interest on loan paid Petty cash Repairs Investment | 5,000 60,000 10,500 2,500 2,56,500 89,700 51,250 300 710 4,090 70,000 | Capital Loan at 6% p.a. Sales Interest on investment Sundry creditors | 1,31,500 20,000 3,56,500 2,550 40,000

|

5,50,550 | 5,50,550 |

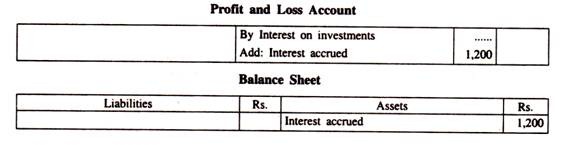

Particulars | ₹ | ₹ | Particulars | ₹ | ₹ |

To opening stock To purchase To Coal, gas and water To Gross profit c/d

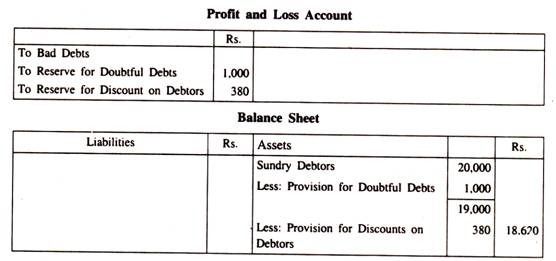

To travelling expenses To interest on loan paid To Repair To Provide Provision for bad and doubtful debts To Provision for Discount on debtors Net Profit (transferred to capital a/c)

|

300

900 | 89,000 2,56,500 10,500 1,27,300 | By sales Less: Returns inward By Closing stock

By Gross profit b/d By Interest on Investment | 3,56,00 2,500 |

3,54,500 1,30,000 |

| |||||

4,84,000 | |||||

4,84,000 | |||||

51,250

1,200

4,090 3,000

1,140

69,170

|

1,23,300 2,550

| ||||

1,29,850 |

|

| 1,29,850 |

Liabilities | ₹ | ₹ | Assets | ₹ | ₹ |

Capital Add: Net profit

Less: Drawings 6% Loan Add interest outstanding Sundry creditors

| 1,31,500 69,170 2,00,000 5,000 20,000 900 |

1,95,670

20,900 40,000 | Investments Stock in trade Sundry debtors Less: Provision for bad and doubtful debts( 60,000* 5/100) Less: Provision for discount on debtors (57,000*2/100) Pretty cash |

60,000

3,000

57,000 1,140

| 70,000 1,30,000

55,860 710 |

2,56,570 |

Particulars | Debit Rs | Credit Rs |

Stock as on 01-012015 Purchase and Sales Returns Carriage inwards Salaries Insurance Wages Bad Debts Furniture Capital Printing and stationery Cash at bank Petty cash Commissions | 2,00,000 22,00,000 1,00,000 50,000 2,60,000 1,20,000 80,000 10,000 7,00,000

80,000 3,15,000 5,000 10,000 |

33,00,000 80,000

7,50,000 |

| 41,30,000 | 41,30,000 |

Particulars | Rs | Rs | Particulars | Rs | Rs |

To Opening Stock |

| 2,00,000 | By Sales Less: Returns | 33,00,000 1,00,000 |

32,00,000 |

To Purchase Less: Returns | 22,00,000 80,000 |

21,20,000 | By Closing Stock |

| 4,00,000 |

To Carriage inwards |

| 50,000 |

|

|

|

To Wages |

| 80,000 |

|

|

|

To Gross profit c/d |

| 11,50,000 |

|

|

3,60,000 |

36,00,000 | |||||

To Salaries |

| 2,60,000 | By Gross Profit b/d |

| 11,50,000 |

To Insurance Less: Prepaid | 1,20,000 60,000 |

60,000 | By Commissions receivable |

|

50,000 |

To Bad debts |

| 10,000 |

|

|

|

To Printing and stationery |

| 80,000 |

|

|

|

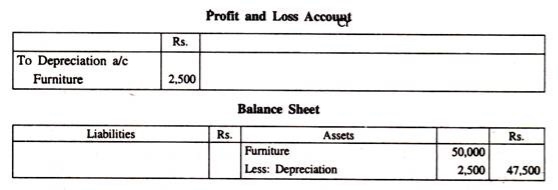

To Depreciation on furniture (7,00,000 x 10/100) |

|

70,000 |

|

|

|

To Commissions |

| 10,000 |

|

|

|

To Net profit (transferred to capital A/c) |

| 7,10,000

|

|

|

|

12,00,00 | |||||

12,00,000 |