S.N. | Particulars | Amount (Rs.) | Amount (Rs.) |

1. | Bank A / C (Dr) To Repay The Investment A / C (investment sold) | xxx | xxx |

2. | Use of profit And loss a / C (Dr) To For Debt Repayment A / C (The amount of the transferred profit) | xxx | xxx |

Debt Redemption Fund A / C (Dr) To The General Reserve A / C To The Capital Reserve A / C (Profit from the sale of investments) | xxx | xxx |

a) When buying a premium

S.N. | Particulars | Amount (Rs.) | Amount (Rs.) |

1. | Bond A/c Dr Loss on repayment A/c Dr To Bank A/c | xxx

| xxx |

2. | Profit & Loss A / C (Dr) To Loss on redemption A / C | xxx | xxx |

b) When buying with a discount

S.N. | Particulars | Amount (Rs.) | Amount (Rs.) |

1. | Debenture A / C (Dr) To benefit from repayment A / C (Dr)) To Bank A / C | xxx | xxx |

2. | Profit on redemption A / C (Dr) To the capital reserve a / c | xxx | xxx |

Year | Amount of debentures used(Rs) | Ratio | Discount to be written |

1 2 3 4 | 1,00,000 75,000 50,000 25,000 | 4 3 2 1 | 10,000 x 4/10 = 4,000 10,000 x 3/10 = 3,000 10,000 x 2/10 = 2,000 10,000 x 1/10 = 1,000 |

10 | 10,000 |

Year | Debenture Outstanding | Ratio | Discount written off |

1st year 2nd year 3rd year | 1,00,000 80,000 60,000 | 5 4 3

| 5/15 x Rs 6,000 = 2,000 4/15 x Rs 6,000 = 1,600 3/15 x Rs 6,000 = 1,200 |

Year | Debenture Outstanding | Ratio | Discount written off |

4th year 5th year | 40,000 20,000 | 2 1 | 2/15 x Rs 6,000 = 800 1/15 x Rs 6,000 = 400 |

|

| 15 | 6,000 |

Date | Particular | Rs | Date | Particular | Rs |

1st year Jan. 1 | To debenture | 6,000 | 1st Dec.31 | By Profit and Loss By closing balance | 2,000 4,000 |

6,000 | |||||

6,000 | |||||

| |||||

2nd year Jan. 1 | To Opening balance | 4,000 | 2nd Dec. 3 | By Profit and Loss By closing balance | 1,600 2,400 |

4,000 | |||||

4,000 | |||||

3rd year Jan. 1 | To Opening Balance | 2,400 | 3rd year Dec. 31 | By Profit and Loss By closing balance | 1,200 1,200 |

2,400 | |||||

2,400 | |||||

4th year Jan. 1 | To Opening Balance | 1,200 | 4th year Dec. 31 | By Profit and Loss By closing balance | 800 400 |

1,200 | |||||

1,200 | |||||

5th year Jan. 1 | To Opening Balance | 400 | 5th year Dec. 31 | By Profit and Loss | 400 |

4,00 | |||||

400 |

Sundry Assets Account) Dr. Goodwill (Bal, figure) Dr. To Liabilities Account To Vendor Account (Being purchase of business for a consideration of Rs. 6,40,000) |

| Rs 6,80,000 40,000 | Rs

80,000 6,40,000 |

Vendor Account ) Dr. To Debenture Account To Premium on Issue of Debenture Account To Bank Account (Being the purchase consideration) |

| 6,40,000 |

4,00,000

40,000 2,00,000 |

(a) |

Bank Account Dr. Discount on issue of Debentures Account ) Dr. To 10% Debentures Account (Being the receipt of money on issue of 120 10% Debentures at a discount of 5%) |

| Rs 1,14,000 6,000 | Rs

1,20,000 |

(b) | Bank Account Dr. Loss on Issue of Debentures Account Dr. Top 7% Debentures Account TO Premium on Redemption of Debentures Account (Being the receipt of money on issue of 150 7% Debentures at 5% discount and repayable at a premium of 10%) |

| 1,42,500 22,500 |

1,50,000

15,000 |

(c) | Bank Account Dr. To 9% Debentures Account To Premium on Issue of Debentures Account (Being the receipt of money on issue of 80 9% Debentures) |

| 84,000 |

80,000 4,000 |

(d) | Debentures Suspense Account Dr. To 8% Debentures Account (Being issue of 400 8% Debentures as collateral security against a loan of Rs. 40,000) |

| 40,000 |

40,000 |

|

Bank Account Dr. To 10% Debenture Application Account (Being issue of debentures and receipt of application money) |

| Rs 20,000 | Rs

20,000 |

| 10% Debentures Application Account Dr. To 10% Debenture Account (Being application money transferred to Debenture Account on allotment) |

| 20,000 |

200,000 |

| 10% Debenture Allotment Account Dr. Discount on Issue of Debentures Account Dr. To 10% Debenture Account (Being allotment money due to debentures) |

| 75.,000 5,000 |

80,000 |

| Bank Account Dr. To 10% Debenture Allotment Account (Being money received on allotment) |

| 75,000 |

75,000 |

| Expenses on Subscription Account Dr. To Bank Account (being expenses paid on issue of debentures) |

| 500 |

500 |

Liabilities | Rs | Assets | Rs |

Secured Loans: 10% Debentures |

1,00,000

| Current Assets: Bank Misc. Expenses: Expenses on Subscription 500 Discount on Debentures 5,000 |

94,500

5,500 |

1,00,000 | 1,00,000 |

Asset Side | Rs | Rs |

Misc. Expenditure: Discount on Debentures Less: Charged to Profit and Loss Account |

15,000 5,000 |

10,000 |

Balance Sheet (Second Year) | ||

Asset Side | Rs | Rs |

Misc. Expenditure: Discount on Debentures Less: Charged to Profit and Loss |

10,000 5,000 |

5,000 |

1st year Jan. 1 |

Bank Account Dr Loss on Issue of Debenture Account Dr To 10% Debenture Account To Premium on Redemption Account |

| Rs 2,00,000 10,000 | Rs

2,00,000 10,000 |

Dec 31 | Profit and Loss Appropriation A/c Dr To Sinking Find Account Sinking Fund Investment Account Dr To Bank Account |

| 38,005

38,005 |

38,005

38,005 |

|

| 2nd year | 3rd year | 4th year | 5th year | ||||

Dec 31. | Bank Account To Interest on S.F.I Account | Rs 1,900 | Rs 1,900 | Rs 3,896 | Rs 3,896 | Rs 5,991 | Rs 5,991 | Rs 8,190 | Rs 8,190 |

| Interest on S.F.I A/c To Sinking Fund | 19,000 | 1900 | 3,896 | 3,896 | 5,991 | 5,991 | 8,190 | 8,190 |

| P & L Appropriation Account To Sinking fund A/c | 38,005 | 38,005 | 38,005 | 38,005 | 38,005 | 38,005 | 38,005 | 38,005 |

| S.F.I. Account To Bank A/c | 39,905 | 39,905 | 41,901 | 41,901 | 43,996 | 43,996 |

| Nil |

V Year Dec.31 | Bank Account To Sinking Fund Investment Account Dr |

| Rs 1,63,805 | Rs 1,63,805 |

“ | Sinking Fund Account Dr To Sinking Fund Investment A/c |

| 2 | 2 |

“ | 10% Debenture Account Dr Premium on Redemption Account Dr To Debenture-holder’s Account |

| 2,00,000 10,000 | 2,10,000 |

Dec.31 | Debenture holder’s Account Dr To Bank Account |

| 2,10,000 | 2,10,000 |

“ | Sinking Fund Account Dr To General Reserve Account |

| 2,00,000 | 2,00,000 |

2004 Oct. 1 |

6% Debentures Account Dr. Premium on Redemption Account Dr. To Debentures-holders Account (Being amount payable on redemption of debentures including premium 4%) |

| Rs 10,00,000 40,000 | Rs

10,40,000 |

Oct. 1 | Debenture holder’s Account (4,000 x Rs 104) Dr. To 8% Preference Share Capital Account (4,16,000 x 100/130) To Share Premium Account (4,16,000 x 30/ 130) (Being Debenture holders are satisfied by allotment or preference shares of Rs. 100 each at a premium of Rs 30 per share) |

| 4,16,000 |

3,20,000 96,000 |

Oct. 1 | Debenture holder’s Accoutn (4,800 x Rs 104) Dr. Discount on Issue of Debentures Account . (4,99,200 x 4/96) Dr. To 7% Second Debentures Account (Being Debentures holders are satisfied by allotment of debentures of Rs 100 each at a discount of 4% |

| 4,99,200

20,800

|

5,20,000 |

Oct. 1 | Debenture holder’s Account Dr. To Bank Account (Being amount due to Debenture holders paid off) |

| 1,24,800 |

1,24,800 |

Oct. 1 | Share Premium Account (40,000 + 20,800) Dr. To Premium on Redemption Account To Discount o Issue of Debenture Account (Being Premium on Redemption and Discount on Issue of debentures are written off against Share Premium Account) |

| 60,800 |

40,000 20,800 |

Dr. | Debentureholder’s Account | Cr. | |||

2004 Ocr. 1 |

8% Preference Share Capital Account To Share Premium A/c To 7% Second Debenture Account (5,20,000 – 20,800) To Bank Account | Rs

3,20,000 96,000

4,99,200 1,24,800 | 2004 Oct. 1

“ “ |

By 6% Debentureholder’s Account By Premium on Redemption A/c | Rs

10,00,000 40,00,000

|

10,40,000 |

|

| 10,40,000 | ||

On recepipt pplication money | Bank Account Dr To Debenture Application A/c |

On allotment of debentures

| Debentures Application A/c Dr. To Debenture Account |

On making allotment or calls

| Debentures Allotment/ Call A/c Dr. To Debentures Account |

On receipt of money | Bank Account To Debenture Allotment / Call A/c Dr. |

Allotment money along with premium is due | Debenture Allotment A/c Dr To Debenture Account To Debenture Premium A/c |

When cash received | Bank Accoutn Dr. To Debenture Allotment/Call A/c |

Allotment money is due and discount allowed | Debenture Allotment A/c Dr. Discount on Issue of Debentures A/c Dr. TO Debenture Account |

When cash received | Bank Account Dr. Debenture Allotment A/c |

|

Debenture redeemable at par (i) Issued at par:- Bank Dr. To 12% Debentures Issue of 10,000 12% Debentures of Rs 100 each at a par |

| Rs

10,00,000 | Rs

10,00,000 |

| (ii) Issued at a discount:- Bank Dr. Discount on Issue of Debentures Account Dr, TO 12% Debentures Issue of 10,000 12% Debentures of Rs100 each at a discount 12% |

| 9,80,000 20,000 |

10,00,000 |

| (iii) Issued at a premium :- Bank Dr. To 12% Debentures TO Premium on Issue of Debentures Account / Securities Premium Account Issue 10,000 12% Debentures of Rs 100 each at a premium 3%. |

| 10,30,000 |

10,00,000 30,000 |

| (i ) Debentures issued at apar but redeemable at a premium of 50% Bank Dr. Loss on Issue of Debentures Account Dr. To 12% Debentures TO premium on Redemption of Debenture Account at par but redeemable at a premium of 5%

|

| 10,00,000 50,000 |

10,00,000 50,000 |

| (ii ) Debentures issued at a discount of 12% but redeemable at a premium of 5%:- Bank Dr. Loss on Issue of Debenture Account Dr. TO 12% Debentures TO Premium on Redemption of Debentures Account Issue of 10,000 12% Debentures issued at a discount of 2% but redeemable at a premium of 5% |

|

9,80,000 70,000 |

10,00,000 50,000 |

Particulars | Note No | Rs |

Non-current liabilities Long-term borrowings |

1 |

10,00,000 |

II. Assets Current Assets Cash and Cash equivalence |

2 |

10,00,000 |

Particulars | Note No | Rs |

Shareholder’s Funds Reserve and surplus Non-current liabilities Long-term borrowings |

1

2 |

(20,000)

10,00,000 |

9,80,000 | ||

II. Assets Current Assets Cash and Cash equivalence |

3 |

9,80,000 |

Particulars | Note No | Rs |

Shareholder’s Funds Reserve and surplus Non-current liabilities Long-term borrowings |

1

2 |

(30,000)

|

10,00,000 | ||

10,30,000 | ||

II. Assets Current Assets Cash and Cash equivalence |

3 |

10,30,000 |

Particulars | Note No | Rs |

Shareholder’s Funds Reserve and surplus Non-current liabilities Long-term borrowings |

1

2 |

(50,000)

|

10,50,000 | ||

10,00,000 | ||

II. Assets Current Assets Cash and Cash equivalence |

3 |

10,00,000 |

Particulars | Note No | Rs |

Shareholder’s Funds Reserve and surplus Non-current liabilities Long-term borrowings |

1

2 |

(70,000)

|

10,50,000 | ||

9,80,000 | ||

II. Assets Current Assets Cash and Cash equivalence |

3 |

980,000 |

To 12% Debentures Applications and Allotment Account (Application money on 9,000 12% Debentures @ Rs 35 each) | Rs

3,15,000 |

|

By Balance c/d | Rs 8,82,000 |

To 12% Debentures Applications and Allotment Account (Allotment money on 9,000 12% Debentures@ Rs 23 each) |

2,07,000 |

|

|

|

To 12% First and Final Call Account (Final and final call @ Rs 40 each)

To Balance b/d |

3,60,000 |

|

|

|

8,82,000 | 8,82,000 | |||

8,82,000 |

|

Fixed Assets Dr. To Liquidator of Tee Ltd Purchase of fixed Assets for an agreed value of Rs 3,15,000 |

| Rs 3,15,000 | Rs

3,15,000 |

Liquidator of Tee Ltd. Dr. To 13% Debentures To Premium on Issue of Debentures / Securities Premium Issue of 3,000 13% Debentures of Rs 100 each at a premium of 5% in discharge of consideration.

12% Debenture Application and Allotment Account Dr. |

| 3,15,000

5,22,000 |

3,00,000 15,000 |

2008 April 1 |

Bank Dr. Discount on Issue of Debentures Account Dr. To 14%, Debentures The issue of 1,000 14% debentures of Rs 1,000 each at Rs 950 |

| Rs 9,50,000 50,000 | Rs

10,00,00 |

“ “ | Debenture Issue Expense Account Dr. To Bank The Expense of Rs 8,000 incurred on issue of the debentures. |

| 8,000 |

8,000 |

2009 Mar.31 |

Interest on Debentures Account Dr. To Bank Payment of interest for the year on debentures |

| 1,40,000 |

1,40,000 |

“ “ | Profit and Loss Account To Interest on Debentures Account To Debenture Issue Expenses Account To Discount on Issue of Debentures Account Transfer of Interest on Debentures Account and Debentures Issue Expense Account to Profit and Loss Account and writing off Rs 10,000 of discount on Issue of Debentures |

| 1,58,000 |

1,40,000 8,000 10,000 |

“ “ | Profit and Loss Appropriation Account Dr. TO Debentures Redemption Reserve Creation of Debentures Redemption Reserve for redemption of debentures |

| 2,50,000 |

2,50,000 |

2010 Mar.31

|

Interest on Debentures Account Dr. TO Bank Payment of interest for the year on debentures |

| 1,40,000 |

1,40,000 |

“ “ | Profit and Loss Account Dr TO Interest on Debentures Account TO Discount on Issue of Debentures Account Transfer of Interest on Debentures Account to Profit and Loss account and writing off Rs 10,000 of Discount of Issue of Debentures. |

| 1,50,000 |

3,40,000 10,000 |

2010 May. 31 |

Profit and Loss Appropriation Account Dr. To Debentures Redemption Reserve Bringing up Debentures Redemption Reserve equal to 50% of the amount of Debentures to facilitate part redemption of debentures to |

| 2,50,000 |

2,50,000 |

2011 Mar.31 |

Interest on debentures Account Dr. 14% Debentures Dr. To Bank Payment of yearly interest on debentures and redemption of debentures of the paid up value of Rs50,000 at par by draw of lots. |

| Rs 1,40,000 50,000 | Rs

1,90,000 |

“ “ | Profit and Loss Account Dr. To Interest on Debentures Account To Discount on Issue of Debentures Account Transfer of Interest on Debentures Account to Profit And Loss Account and writing off Rs 10,00 of Discount on Issue of Debentures |

| 1,50,000 |

1,40,000 10,000 |

“ “ | Profit and Loss application Account Dr. To Debentures Redemption Reserve Increase made in Debenture Redemption Reserve to General Reserve |

| 2,50,000 |

2,50,000 |

“ “ | Debenture Redemption Reserve Dr. To General Reserve Transfer of the par value of debentures redeemed this year from Debenture Redemption Reserve to General Reserve |

| 50,000 |

50,000 |

2012 Mar. 31 |

Interest on Debentures Account Dr. To Bank Payment of yearly interest on debentures for Rs 9,50,000 |

| 1,33,000 |

1,33,000 |

“ “ | 14% Debentures Dr. To Bank To Profit on Redemption of Debentures Purchase of 50 Debentures in the Debentures market for cancellation @ Rs 980 plus expense Rs 500 |

| 50,000 |

49,500 500 |

“ “ | Profit on Redemption of Dr. To Discount on Issue of Debentures Account Use of Profit on redemption of debentures to partly write off discount o issue of debentures. |

| 500 |

500 |

“ “ | Profit and Loss Account Dr. To Interest on Debentures Account To Discount on Issue of Debentures Account Transfer of Interest on Debentures Account to Profit and Loss Account and writing off Rs9,500 of discount on Issue of Debentures, making total write off for the year equal to Rs 10,000 |

| 1,42,500 |

1,33,500 9,500 |

“ “ | Profit and Loss Appropriation Account Dr. To Debenture Redemption Reserve |

| 2,50,000 |

2,50,000 |

“ “ | Debenture Redemption Reserve Dr. Transfer from Debenture Redemption Reserve to General Reserve, the face value of debentures redeemed during the year. |

| 50,000 |

50,000 |

Reserve and Surplus Long term borrowings | Note No. 1 2 | Rs 9,90,000 9,00,000 |

|

Bank Dr. To Bank Loan Amount of bank loan raised |

| Rs 2,50,000 | Rs 2,50,000 |

| 14% Debentures Suspense Account Dr. To 14% Debentures Account Issue of 14% Debentures in favour of bank by way of a collateral security |

| 2,50,000 |

2,50,000 |

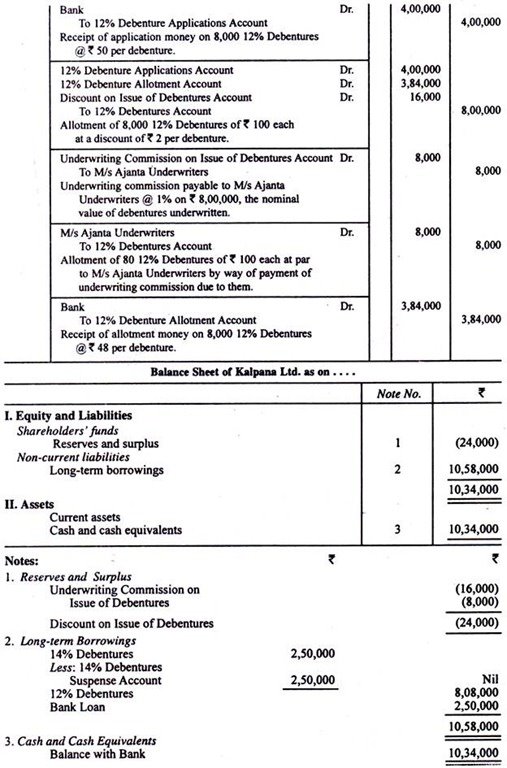

| Bank To 12% Debentures Application Account Receipt of application money on 8,000 12% Debentures @ Rs 50 per debenture. |

| 4,00,000 |

4,00,000 |

| 12% Debentures Application Account Dr. 12% Debentures Allotment Account Dr. Discount on Issue of Debentures Account Dr. To 12% Debentures Account Allotment of 8,000 12% Debenture of Rs 100 each at a discount of Rs 2 per debentures. |

| 4,00,000 3,84,000 16,000 |

8,00,000 |

| Underwriting Commission on Issue of Debentures Account Dr. To M/c Ajanta Underwriters Underwriting commissions payable to M/s Ajanta Underwriters @ 1% on Rs 8,00,000, the nominal value of debentures underwritten |

| 8,000 |

8,000 |

| M/s Ajanta Underwriters Dr. To 12% Debentures Account Allotment of 80 12% Debentures of Rs 100 each at par to M/c Ajanta Underwriters by way of payment of underwriting commission due to them |

| 8,000 |

8,000 |

| Bank Dr. To 12% Debenture Allotment Account Receipt of allotment money on 8,000 12% Debentures @ Rs 48 per debenture. |

| 3,84,000 |

3,84,000 |

Balance Sheet of Kalpan Ltd. as on …. |

|

|

| Note No | Rs |

Shareholder’s fund’s Reserve and surplus

Non-Current liabilities Long-term borrowings |

1

2 |

(24,000)

10,58,000 |

10,34,000 | ||

2. Assets Current assets Cash and cash equivalents |

3 |

10,34,000 |

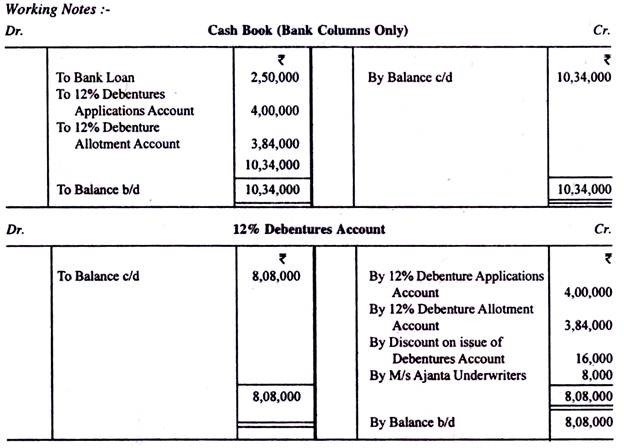

To Bank Loan To 12% Debentures Application Account To 12% Debenture Allotment Account

To Balance b/d | Rs 2,50,000

4,00,000 3,84,00 10,34,000 10,34,000 |

|

By Balance c/d | Rs 10,34,000 |

To Balance c/d | Rs 8,08,000

|

|

By 12% Debenture Application Account By 12% Debenture Allotment Account By Discount on issue of Debenture Account By M/s Ajanta Underwriters

By Balance b/d | Rs 4,00,000 3,84,000 16,000

8,000 |

8,08,000 | ||||

8,08,000 |

| 8,08,000 |

|

|