Unit – 3

ROYALTY, HIRE PURCHASE SYSTEM AND INSTALMENT PAYMENT SYSTEM OF ACCOUNTS

Q1) Explain the concept of Hire Purchase System.

A1)

Hire Purchase System is a special arrangement of purchase – sale, where the ownership in asset is not transferred to the hirer (hire purchaser); only property in goods are transferred.

The biggest advantage of this system is that the hirer can immediately start to use the goods purchased without paying the full amount.

If the hirer does not want to continue the use the assets or goods due to any reason, he can return them any time and is not required to pay any instalment that are still remaining. However, amount paid till then cannot be claimed back from the seller.

In addition to the above, the hirer cannot sell or mortgage the asset acquired under the system.

He cannot even modify the asset according to his requirement before the payment of last instalment.

Nevertheless, Depreciation is provided by the hire purchaser on such assets since:

(a) It is used for the business and

(b) It is likely to be owned in near future on payment of the last instalment.

Depreciation may be charged either under the Straight Line Method or the Written Down Method. It should be noted that Depreciation is charged with reference to the cost of the asset i.e. its cash price and not its hire purchase price.

Q2) What is Instalment Payment System? What are its features?

A2)

Under the Instalment Payment System, the ownership is transferred by the seller to the buyer at the time of sale (at the time of signing the contract), unlike Hire Purchase System, where the ownership is transferred only upon the payment of last instalment.

This is just another method of credit system, where the buyer have the facility of paying the amount of goods in instalments.

The features of this system are:

Under instalment purchase system, the buyer gets the immediate possession as well as the ownership of goods.

Under instalment system, the buyer can sell or mortgage the goods even before clearing all the instalments.

Under instalment system, the buyer can sell or mortgage the goods even before clearing all the instalments.

The buyer of the goods under instalment purchase system has no right to return the goods to the seller.

In case of default in the payment of instalment, the total amount of instalments which is already paid by the buyer cannot be forfeited.

Q3) Distinguish Between:

Hire Purchase System v/s Instalment Payment System

A3)

Under Hire Purchase System, Ownership of goods is transferred after the payment of final instalment. On the other hand, Ownership of the goods passes to the buyer just signing the agreement under Instalment Payment System.

When goods are purchased Hire Purchase System, the buyer cannot sell, destroy or transfer the goods. While in Instalment Payment System, the buyer can sell, destroy or mortgage or transfer as his/her wish.

The buyer can return the goods before making the final instalment, in Hire Purchase System. While, the buyer cannot return the goods to the seller when the goods are purchased in Instalment Payment System.

Under Hire Purchase System, the liability of repair and maintenance lies with the seller provided that the buyer takes the utmost good care and in Instalment Payment System, the buyer is responsible for repair and maintenance.

Q4) Mr. G of Patna acquired a plant from Mr. C of Ranchi to be delivered on April 1, 2018 on the following terms:

a) Initial payment Rs. 40,000 immediately and

b) 4 half-yearly instalments of Rs. 30,000 commencing from September 30,2018.

c) Interest is 10% per year.

What is the Cash Price of the asset?

A4)

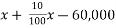

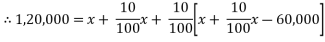

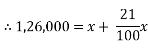

If  is the cash price less down payment, then the interest for the first year will be

is the cash price less down payment, then the interest for the first year will be  and the amount due will be

and the amount due will be

Next year, the interest will be

Total amounts paid by way of instalments in respect of Cash Price if the total of instalments is Rs. 1,20,000.

=

=

Answer: The Present Value of the instalments is Rs. 1,04,132 and adding the cash down payment of Rs. 40,000, the total cash price is Rs. 1,44,132.

Q5) A trader fixes Hire purchase price of his goods b adding 60% to the cost of the goods. Prepare Hire Purchase Trading Account to ascertain profit earned by the trader from his following Hire Purchase transactions:

Stock with customers in the beginning of the year Goods sold during the year Cash received from customers during the year Stock with customers at the end of the year | 64,800 2,61,360 84,000 2,26,960 |

A5)

Dr. Hire Purchase Trading A/c Cr.

Particulars | Amount | Particulars | Amount |

To Hire Purchase Stock

To Goods sold on H.P. A/c

To H.P Stock Reserve A/c (on Closing Stock) (2,26,960×60/160)

To Profit and Loss A/c (Profit) | 64,800

2,61,360

85,110

37,200 | By H.P. Stock Reserve (64,800×60/160)

By Goods sold on H.P. A/c (Loading) (2,61,360×60/160)

By Bank (Instalment)

By H.P. Stock (Closing)

By Instalments due (W.N. 1) | 24,300

98,010

84,000

2,26,960

15,200 |

| 4,48,750 |

| 4,48,750 |

W.N. 1)

Opening Balance of H.P. Stock 64,800

Add: Goods sold during the year 2,61,360

3,26,160

Less: Closing Stock 2,26,960

Instalments falling due during the year 99,200

Less: Instalments received during the year 84,000

Instalments at the end of the year 15,200