Unit 3

Economic development

Q1) What is Harrod-Domer’s Economic Growth model?

A1)

These models address and emphasise the various aspects of developed economies' development. They are, in a sense, alternate stylized depictions of a growing economy.

They all have one thing in common: they're all focused on Keynesian saving-investment research. The Harrod-Domar Model, the first and most basic model of development, is the direct result of projecting short-run Keynesian analysis into the long-run.

This model assumes that capital is the most important factor in economic development. It focuses on the probability of steady growth through capital supply and demand adjustments. Mrs. Joan Robinson's model, on the other hand, recognises technological development, as well as capital accumulation, as a source of economic growth. The neoclassical growth model is the third form of growth model.

It implies that capital and labour are substituted, and that technological innovation is neutral in the sense that it neither saves nor absorbs labour or capital. And when neutral technical is used, both variables are used in the same proportion. Here, we'll look at some of the more well-known growth models.

Although the Harrod and Domar models vary in certain details, they are fundamentally the same. Harrod's model may be considered the English equivalent of Domar's model. Both of these models emphasise the importance of achieving and sustaining consistent development. Capital accumulation plays a critical role in the growth process, according to Harrod and Domar. In reality, they emphasise capital accumulation's dual function. New expenditure, on the one hand, produces revenue (due to the multiplier effect); on the other hand, it

expands the economy's productive potential (due to the efficiency effect) by increasing its capital stock. It's worth noting that classical economics placed a premium on the investment's efficiency while ignoring the income factor. Keynes had paid close attention to the issue of income generation but had overlooked the issue of increasing productive ability. Harrod and Domar took great care to address both of the issues that arise as a result of investment in their models.

Q2) What are the general assumptions of Harrod-Domar’s model?

A2)

The following are the core assumptions of the Harrod-Domar models:

(i) There is already a full-employment standard of wages.

(ii) The government should not intervene with the economy's operation.

(iii) The model is based on the “closed economy” premise. To put it another way, government trade sanctions and the problems that come with foreign trade are ruled out.

(iv) There are no lags in variable change, i.e., economic variables such as savings, investment, revenue, and expenditure all adjust in the same amount of time.

(v) The marginal propensity to save (MPS) and the average propensity to save (APS) are equivalent. S/Y=S/Y (vi) Both the tendency to save and the “capital coefficient” (i.e., capital-output ratio) are given constant values. Since the capita-output ratio is fixed, this amounts to assuming that the law of constant returns operates in the economy.

(vii) Income, expenditure, and savings are all represented in a net sense, that is, they are taken into account after depreciation. As a result, depreciation rates are excluded from these factors.

(viii) Saving and investment are equal in ex-ante and ex-post senses, i.e., accounting and practical equality exists between saving and investment.

Q3) Which three issues are there in Harrod’s expansion strategy? Explain it.

A3)

Harrod's expansion strategy posed three issues:

(i) How can an economy with a fixed (capital-output ratio) (capital-coefficient) and a fixed saving-income ratio achieve steady growth?

(ii) How can the constant rate of growth be maintained? Or, to put it another way, what are the requirements for continuing to expand at a steady rate?

(iii) How do natural forces impose a limit on the economy's growth rate?

Harrod had introduced three separate growth rate principles in order to address these issues: I G, the real growth rate; (ii) Gw, the warranted growth rate (iii) the natural growth rate, Gn.

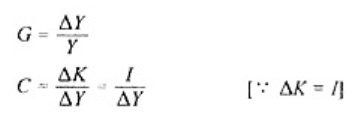

The Actual Growth Rate is the rate of growth dictated by the country's actual savings and expenditure rates. In other words, it can be defined as the ratio of change in income (AT) to the total income (Y) in the given period. G = Y/Y if real growth rate is denoted by G.

The saving-income ratio and the capital-output ratio decide the real growth rate (G). Both variables have been assumed to be constant over the time span. The following is the relationship between the real growth rate and its determinants:

GC = s …(1)

Because

Substituting value of G, C and s in the equation (1), we get,

Q4) What is Schumpetarian Growth model? Explain in detail.

A4)

The Schumpeter model of economic growth moves round the inventions and innovations. This model is explained with the followings:

(1) Production Process,

(2) Dynamic Analysis of the Economy,

(3) Growth Trends, and

(4) Capitalism's Demise

Production Process in the Schumpeter Model:

The development process depicts the interaction of productive forces that result in the creation of products. Material and immaterial influences combine to shape these active forces. Land, labour, and resources are physical or material factors, while technological facts and social structure are non-physical or immaterial factors.

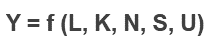

As a result, the Schumpeter output structure is as follows:

Where Y denotes economic growth, K denotes generated means of production, L denotes labour, N denotes natural resources, S denotes technology, and U denotes social set-up or social organisation.

By dividing the total differential of the output function by dt.

The rate of change of productive forces (dK/dt, dN/dt, dL/dt), the rate of change of technology (dS/dt), and the rate of change of social set-up (dU/dt) are all factors in the economy's productivity.

Q5) Write and Explain the dynamic Evalution of Economy in Schumpeter Model.

A5)

We present two forms of effects in the context of complex economic analysis.

(i) The results of changes in output factors such as K, L, and N, which he refers to as "Growth Components."

(ii) The effects of technological and social change, which he refers to as "Evolution Components," as well as the effects of changes in S and U.

He leaves the land as it is in terms of development components. Assume that dN/dt = 0.

The remaining two factors are the shift in population (dL/dt) and the change in output means (dK/dt). dL/dt: He considers population to be an exogenous variable. In other words, population in the economy is determined by exogenous factors. He goes on to claim that population growth is a slow and steady process with few sharp fluctuations. As a result, the population function will be L = f. (t).

dK/dt:

According to Schumpeter, the shift in capital goods or manufactured means of production is determined by savings. Savings, on the other hand, are determined by the benefit rate. However, profits cannot be obtained without growth, and development cannot be achieved without profits. According to him, a product's worth is equal to its costs due to the circular flow of NI. Profits would not be accrued in this manner. However, according to Schumpeter, as new techniques are implemented, they will produce profits. It means that in a capitalist society, profits are determined by technological advancements. In other words, improvements in applied technological expertise affect the stock of resources. It's as follows:

dK/dt = k (dS/dt)

This demonstrates how, in Schumpeter's model, capital accumulation is linked to technological changes. The accumulation of capital increases as technological advances increase.

In terms of institutional and social shifts, dU/dt According to Schumpeter, it is a complicated situation that is linked to a country's social, psychological, technical, and political environment. As a result, it is as follows:

dU/dt = u (K, L, N, S, U)

As a result, we can see that in Schumpeter's model, changes in the economy's productivity are influenced by technological change and the socio-cultural setting of the economy.

Q6) What are the five predections on Decline of Capatalism?

A6)

(i) As capitalism progresses, entrepreneurs and their manufacturing processes will become obsolete. In lieu of entrepreneurs, salaried administrators would be in charge of industrial units.

(ii) On the one hand, technological advancements generate economies. On the other hand, as the manufacturing network expands in tandem with capitalism's rise, labour unions and other bargaining practises will thrive.

(iii) 'Liberalism' will evolve in tandem with capitalism's expansion. The system of 'Monarchy' would be weakened as a result of this. The ruling class would become poorer, reliant on the civil and military bureaucracies. Unrest can grow in society as a result of this.

(iv) Emaciation and women's rights would be promoted by patriarchy. It will cause havoc in the home.

(v) The freedom to speak and write is guaranteed by capitalism. In teahouses, parks, hotels, and journals and newspapers, people will express their frustration with capitalism.

Q7) What do you mean by critism in economic growth and planning? Explain with the help of points.

A7)

(i)The 'Inventor and Innovator' has been designated as a 'Ideal Man' in the Schumpeter Model. Inventions and improvements, on the other hand, are now regular practises of industrial concerns. Economic fluctuations, according to Schumpeter, are caused by inventions and developments. However, this is not the case. They emerge as a result of monetary and fiscal policies, as well as market preferences and psychological behaviour.

(i) Again, in terms of economic growth, Schumpeter places a premium on technologies and innovations. However, innovations cannot be produced in Pakistan or other countries where funds and resources are scarce.

(ii) For the sake of inventions, Schumpeter relies on credit production. However, it is countered by the argument that, in the short term, bank credit may be beneficial to industrial growth. However, in the long run, bank loans would be insufficient to fund such growth. In such a scenario, economic growth would be contingent on the selling of shares, among other things.

(iii) It is incorrect, according to Meir and Baldwin, to assume that society will inevitably shift toward socialism. Europe and America, when analysed as capitalist nations, have a higher level of industrial growth. They have the freedom to express themselves verbally and in writing. However, no viable option for a rich capitalist country to convert to socialism has emerged to date. Following the disintegration of the Soviet Union, the socialist countries have begun to turn themselves into 'Market Economies.'

Q8) Explain Schumpeter’s Model and UDCs in brief.

A8)

(i)Schumpeter's model is based on the specific social and economic system that existed in Europe and the United States during the 18th and 19th centuries. However, in the case of Pakistan, as in other developing countries, such a paradigm is less applicable. Our socioeconomic system is not the same as theirs. We lack the required prerequisites for development.

(ii) The Schumpeterian model is built on the concept of 'Entrepreneurs.' However, there is a scarcity of these individuals in UDCs. Profit margins are poor in this region. The state of technology is deplorable. As a result, the need to invent and reinvent is still lacking. In addition, a shortage of funding, inadequate transportation, and testing facilities deter future entrepreneurs.

(iii) Governments control a large number of projects in UDCs; since they have low earnings, the costs are higher; and they are managed by bureaucrats and managers who seldom participate in inventions and developments.

(iv) There are numerous economic and non-economic factors that influence economic growth. Schumpeter, on the other hand, associates economic growth solely with inventions and technologies.

(v) Rather than inventing, entrepreneurs in UDCs follow and copy strategies and goods that have become obsolete in DCs.

(vi) According to Schumpeter, an economy's internal circumstances would drive economic growth. However, UDCs are surrounded by centuries of sufferings, difficulties, anguish, rituals, practises, and development techniques, among other things. In such a case, Schumpeter's model would be made ineffective.

(vii) Population development is a major concern in UDCs. The effects of population growth are often distorted. What would Schumpeter's inventions do in such a situation?

(viii) For economic growth, Schumpeter relies on 'Credit.' However, in UDCs where demand cannot be increased, inflation will rise, halting the growth process.

Q9) What do you understand from Balanced and unbalanced development ?

Explain in detail.

A9)

After objectively examining the comparative study of balanced and unbalanced growth strategies, the logical question is: which of these two strategies stimulates economic growth more effectively?

The neutral and objective opinion is that a discussion on the controversy is unnecessary.

It is based entirely on scientific evidence and political inspiration. Though Paul Streeten claims that the option between balanced and unbalanced growth can be reformulated.

However, according to Ashok Mathur, "balanced and unbalanced growth should not be mutually exclusive, and an optimal development plan can combine certain elements of both balance and unbalance."

Both theories are based on the Big Push principle, which calls for investment to break the poverty cycle. Balanced growth tends to improve all sectors at the same time, while unbalanced growth suggests that investments should be made only in the economy's leading sectors.

Underdeveloped countries lack the human, material, and financial capital to invest in a variety of complementary industries at the same time. New investment opportunities arise as a result of investments made in specific sectors. Through sustaining tensions and disproportions, the aim is to keep the disequilibrium alive rather than to destroy it.

Unbalanced growth implies the formation of disharmony, inconsistency, and disequilibrium, while balanced growth strives for peace, consistency, and equilibrium. The introduction of sustainable growth necessitates a significant investment of resources.

Unbalanced growth, on the other hand, necessitates a smaller amount of capital, as it focuses on only the most profitable sectors. Balanced growth is a long-term strategy since the expansion of all economic sectors is only feasible over time. Unbalanced development, on the other hand, is a short-term strategy because only a few leading sectors can develop in a short period of time.

The doctrines of balanced and unbalanced growth have two common issues relating to the position of the state and the role of supply constraints and inelastic supply. In underdeveloped nations, private industry is only capable of making investment decisions. As a result, healthy development necessitates forethought. States play a leading role in promoting SOC investments in an unbalanced growth plan, generating disequilibrium.

If growth begins with DPA investment, political pressures push the government to invest in SOC. The lack of demand is the primary concern of the balanced growth theory, which ignores the position of supply constraints.

This is not true since underdeveloped countries lack access to finance, expertise, infrastructure, and other inelastic resources. Similarly, the unbalanced growth doctrine overlooks the importance of supply constraints and supply elasticity. In such circumstances, a careful balance must be struck between the benefits of balanced and unbalanced growth.

There is no doubt that developing countries are committed to democracy and should strive to manage the twin evils of inflation and a negative balance of payments when implementing any economic growth strategy.

It is imperative that something be done to strengthen and vigorize the doctrine's effectiveness as a tool for economic growth.

“From the debate, we can now understand that the phrases balanced growth and unbalanced growth initially caught on too readily, and that each solution has been overdrawn,” Prof. Meier correctly observes. After much deliberation, each solution has become so highly qualified that the debate has effectively died out.

Rather than attempting to generalise either method, we should focus on the circumstances under which each can be considered legitimate. Although a newly developed country should strive for balance in an investment criterion, this goal can most likely be achieved only by initially pursuing an unbalanced investment policy.”

Q10) Write down the summary of Harrod-Domar’s analysis.

A10)

The following are the key points of the Harrod-Domar analysis:

1. Investment is the most important variable in achieving steady growth because it serves a dual purpose: it produces revenue while also creating productive potential.

2. Depending on how income behaves, increased ability from investment will result in higher production or higher unemployment.

3. Income behaviour can be expressed in terms of growth rates, such as G, Gw, and Gn, with equality between the three growth rates ensuring full employment of labour and full utilisation of capital stock.

4. These conditions, on the other hand, only define steady-state growth. The actual rate of growth may vary from the forecasted rate. The economy would experience accumulated inflation if the real growth rate exceeds the warranted rate of growth. The economy would slide into cumulative inflation if the real growth rate is lower than the warranted growth rate. The economy would slide into accumulated deflation if the real growth rate is lower than the warranted growth rate.

5. Business cycles are seen as detours from a steady growth direction. These alterations aren't going to work forever. Upper and lower limits constrain these; the ‘full employment ceiling' serves as an upper limit, while effective demand, which includes autonomous expenditure and consumption, serves as a lower limit. Under these two thresholds, the real growth rate fluctuates.

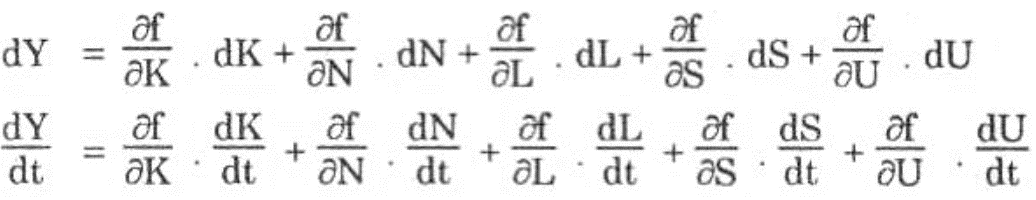

The horizontal axis represents profits, while the vertical axis represents savings and investment. The line S(Y) drawn through the origin depicts the levels of saving that correspond to various income levels. The average and median tendency to save is measured by the slope of this line (tangent). The acceleration co-efficient v, which remains constant at each income level of Y0, Y1, and Y2, is calculated by the slopes of lines Y0I0, Y1I1, and Y2I2.

The saving is S0Y0 at an initial income level of Y0. When this money is put to use, the income jumps from Y0 to Y1. Savings rise to S1Y1 as a result of the higher wages. When this sum of money is saved and reinvested, the percentage of income rises to Y2. Savings would rise to S2Y2 as a result of the higher wages. The acceleration effect on production growth can be seen in this phase of rising wages, saving, and expenditure.