Unit 4

Capital Formation of foreign and economic growth

Q1) Explain in detail Capital formation and growth?

A1)

The term "capital creation" is used in both a narrow and a wider context.

In a strict sense, however, it applies to physical capital stock, which includes computers, machinery, and other equipment.

Non-physical capital or human resources, such as public health, performance, craft, visible and intangible capital, are included in a wider context.

Capital goods, according to Prof. Colin Clark, are "reproducible wealth used for the purpose of development." Capital formation, on the other hand, refers to the net addition to the current stock of capital over a period of time.” As a result, capital formation is described as the sacrificing of immediate consumption in order to acquire more consumable products in the future, while ‘capital' is the portion of the current commodity that is used for further output rather than being consumed immediately.

We must distinguish between "keeping capital intact" and "capital formation" in this case. When resources are used to replace worn out properties, such as wear and tear on equipment, rather than adding to the economy's productive potential, the practise is known as keeping capital intact.

Capital accumulation, on the other hand, refers to the process of growing the stock of real capital, which obviously aids in increasing the level of output of goods and services. As a result, the core of the capital accumulation mechanism is the allocation of a portion of society's currently available resources toward the possibility of potential increases in consumable output.

The definition may thus be expanded to include human capital creation. In reality, only real physical assets such as stocks, bonds, currency notes, and bank deposits are included in capital creation because they increase the economy's productive potential.

“The meaning of capital formation is that society directs a portion of its productive activity to make capital goods, tools and instruments, machines and transport facilities plant and equipment—all the various forms of real capital that can so greatly increase the efficiency of productive effots,” Prof. Nurkse says.

“Domestic capital formation will involve not only additions to construction, machinery, and inventories within the nation, but also other expenditures, excluding those needed to maintain production at existing lands,” says Prof. Simon Kuznets.

It will include expenditures on schooling, leisure, and material luxuries that contribute to an individual's wellbeing and efficiency, as well as all societal expenditures that help to raise the morale of the workforce.”

Q2)What are the significance of Capital Formation in Economic Development?

A2)

Capital production or accumulation is regarded as the most important element in an economy's economic growth. Prof. Nurkse believes that capital accumulation will easily break the vicious cycle of poverty in developing countries. Capital creation quickens the speed of growth by maximising the use of available resources. In reality, it causes an increase in the size of national jobs, wages, and output, resulting in severe inflation and balance of payment problems.

The most important aspect of capital accumulation, especially in its early stages, is that it encourages the establishment of social overheads in poor countries, which are in desperate need of these infrastructures. In this way, capital accumulation contributes significantly to the growth of basic capital goods in developing economies.

2. Use of Round-about Methods of Production:

In a developing world, the capital formation process allows for the use of complicated or roundabout production processes, which allows for the division of labour into stages using modern techniques, and the production process contributes to specialisation. This leads to a rapid increase in demand.

3. Maximum Utilisation of Natural Resources:

In developing countries, risk-taking ability is increasing as a result of capital accumulation, which makes new natural resources available. It is made possible by careful and methodical exploitation.

4. Proper Use of Human Capital Formation:

In the qualitative growth of human resources, capital creation is extremely important. The formation of human capital is dependent on people's education, training, health, social and economic security, freedom, and welfare services, all of which require adequate capital. The labour force requires modern implements and instruments in sufficient quantities such that, as the population grows, demand increases optimally and additional labour is easily absorbed.

5. Improvement in Technology:

Capital creation provides overhead capital and the requisite environment for economic growth in developing countries. This aids in the instigation of technological advancement, which makes the use of more capital in the field of production difficult, and as capital in the field of production increases, the abstract type of capital shifts. It is clear that current capital structure developments lead to changes in technique structure and scale, and the public is thus more affected.

6. High Rate of Economic Growth:

A country's economic growth rate is proportional to its rate of capital creation. In contrast to advanced countries, the rate of capital creation or accumulation is generally very low. The rate of capital accumulation in poor and underdeveloped countries ranges from 1% to 5%, while it can even reach 20% in the latter.

7. Agricultural and Industrial Development:

Adequate funds are needed for the adoption of modern mechanised techniques, input, and the establishment of various heavy and light industries in modern agricultural and industrial growth. Lack of capital results in a lower rate of growth and, as a result, capital formation. In reality, the growth of these two industries is impossible without the accumulation of capital.

8. Increase in National Income:

Capital formation strengthens a country's manufacturing conditions and processes. As a result, national income and per capita income have increased significantly. This leads to an increase in output quantity, which in turn leads to an increase in national income. The rate of capital accumulation is inextricably linked to the rate of growth and the quantity of national income. As a result, increasing national income requires the proper implementation of various development methods and their efficient application.

9. Expansion of Economic Activities:

Productivity rises rapidly as the rate of capital accumulation rises, and available capital is used in more productive and comprehensive ways. Complicated processes and procedures are used by the economy in this way.

This leads to an increase in economic activity. Capital formation boosts productivity, which has two effects on economic growth. To begin with, it raises per capita income and increases buying power, resulting in more efficient demand. Second, increased investment contributes to increased production. Business activities can be expanded in underdeveloped countries as a result of capital accumulation, which helps to alleviate poverty and achieve economic growth.

10. Less Dependence on Foreign Capital:

The phase of capital accumulation in developing countries increases reliance on internal resources and domestic savings while decreasing reliance on foreign capital. Economic growth imposes a burden on foreign capital; as a result, in order to pay interest on foreign capital and cover the costs of foreign scientists, the nation must impose an unfair tax burden on the general public. Internal savings suffer a setback as a result of this. As a result of capital accumulation, a country can achieve self-sufficiency and become independent of foreign capital.

11. Increase in Economic Welfare:

The public is having more facilities as the pace of capital accumulation rises. As a result, the average person benefits economically. Their standard of living increases as a result of capital accumulation, which leads to an unexpected rise in their productivity and profits. This improves and increases the probability of finding jobs. This contributes to improving people's well-being in general. As a result, capital formation is the primary solution to poor countries' complex problems.

Q3) Explain the Process of Capital Formation?

A3)

Capital formation or accumulation undergoes three main stages:

(I)Savings creation;

(ii) Savings mobilisation; and

(iii) Savings investment.

The first stage of capital accumulation is the production of savings. It means that the amount of real savings must increase in order for the sources to be used for the manufacture of consumption goods and then released for other purposes. As a result, some existing consumption must be sacrificed in order to achieve a greater share of the flow of consumer products in the near future for capital accumulation.

For example, if a society saves nothing and spends all it creates, no new capital will be created, resulting in a decrease in consumer goods production in the future due to the wear and tear on current capital assets. As a result, it is important that people save from their current consumption. Savings are based on the ability to save, the desire to save, and the ability to save.

2. Mobilisation of Saving:

The next step in the saving process is to turn the funds into investable ones. The presence of banking and other financial institutions is needed for this reason. Banking facilities play an important role in promoting a high rate of savings mobilisation and channelization. In summary, a sound and effective banking system allows investors to increase their investment.

3. Investment of Saving:

Savings are then invested in capital goods as the final step. It requires a new breed of entrepreneurs who are effective, dynamic, bold, and professional. An astute and successful businessperson is often prepared to invest in the production of capital goods. In a nutshell, saving and investing are both essential for capital accumulation.

As a result, the mechanism of capital accumulation requires that national income (Y) surpass consumption in a specified period of time (c). Y = C + S divides the income (Y) between spending and saving. We also understand that revenue equals expenditure (Y + E). Consumption expenditure (c) and investment expenditure I are two types of expenditure (I). Since Y = E and C = S, the answer is C + I. To put it another way, S + I.

The difference between national income and consumption, on the other hand, is community saving, which is savings. The relationship between investment (I) and capital formation (C) is as follows: investment (I) refers to investible surplus, while capital formation (C) refers to the net addition to the existing stock of capital. If some portion of the investible surplus is used to produce consumer products, capital accumulation is hampered.

As a result, the value of capital formation in a given era might not be equal to the value of investible surplus. As a result, positive investment value is a prerequisite for capital accumulation. However, it is important to note that it does not guarantee capital accumulation. Even so, it can be increased by switching investible resources from consumer goods to capital goods output.

Q4) Explain in Detail Foreign capital and growth?

A4)

Capital deficiency is a problem in developing countries. Their capital creation rate is poor. Savings rates are also poor. As a result, these countries must depend on foreign capital to some degree in order to meet their developmental needs.

Foreign capital can be accessed in a variety of ways.

International assistance, private foreign investment, and public foreign investment are the three types of foreign investment.

Foreign aid is reliant on the generosity of developed countries in providing grants to developing countries. Its availability is determined by international political relations. Excessive dependence on foreign assistance puts a country's stability in jeopardy.

Capital inflows result from private foreign investment. It brings technological expertise as well as entrepreneurial skills. However, the availability of foreign capital from private investment is determined by the country's government policy. Private foreign investment would be discouraged if nationalisation is a possibility.

When two countries form a joint economic venture, there could be public foreign investment.

External finance can help accelerate growth, but relying on it too heavily can prevent a country from being self-sufficient. As a result, international assistance should be used first. However, once the development process has gotten off the ground, the country can focus on international trade rather than foreign aid.

Trade is always political, while aid is always economic. “Today, much of what is referred to as international assistance is in the form of bribes... The primary justification for these bribes is international funding for economic development.”

When aid for economic development is disguised as military assistance, however, “the goals of aid for economic development are likely to suffer.” As a result, true development is essentially dependent on trade, which involves rising exports in order to import real resources.

Q5) What are the Human resource and economic growth. Explain in Brief?

A5)

There is a direct connection between human capital and economic development. Human capital has an effect on economic growth and can aid in the development of an economy by increasing people's knowledge and skills.

In an economy, human capital refers to the skills, skill sets, and experience that workers possess. Since a skilled workforce will contribute to improved efficiency, the skills have economic value. Human capital refers to the recognition that not everyone has the same skill sets or skills. Investing in people's education will also increase the quality of jobs.

Economic growth refers to a rise in an economy's ability to generate products and services as opposed to previous times. The improvement in a country's gross domestic product (GDP) is used to calculate economic growth. The gross domestic product (GDP) is a measure of an economy's overall production of goods and services. For example, a GDP rate of 2.5 percent for the year indicates that the country's economic growth increased by 2.5 percent from the previous year. We must first examine two main drivers of economic growth in order to assess how human capital affects growth.

Consumers are thought to be responsible for more than two-thirds of the economic development in the United States. Consumers tend to increase their purchases of clothing, vehicles, technology, houses, and home products such as appliances as they gain employment or see their wages rise. All of this spending has a positive ripple effect, resulting in more jobs in a variety of sectors, including supermarkets, car dealers, technology shops, and home builders, to name a few. Additionally, increased consumption contributes to higher GDP growth across the economy.

2. Business Investment:

Consumer spending contributes to increased GDP growth, which improves business conditions. Companies have to invest more capital into their businesses as they become more profitable in order to generate potential growth. New machinery and technology acquisitions are examples of business investments. Capital investments are the investments made by companies. Capital investments, which necessitate large sums of money or capital, are intended to increase a company's productivity and income over time.

In a rising economy, businesses borrow more money from banks to expand production in response to increased market demand. The funds from the loan are typically used to make major purchases, such as manufacturing plants and machinery. Higher salaries and jobs are also a result of increased output, as more employees are needed to meet increased market demand for a company's goods.

When businesses look to recruit staff to assist with increased revenue, new job opportunities in a variety of fields emerge. Companies are forced to train employees for the skillsets required if the labour market becomes too tight as a result of an expanding economy because there aren't enough qualified skilled workers.

Companies become more profitable as a result of business investment, and GDP growth increases as a result of business investment, which is a key component of growth. Both consumer spending and business investment not only contribute to increased economic growth, but they also have a significant impact on job training and development.

Q6) Write short note on Human capital and Economic Growth?

A6)

Since investment appears to improve productivity, human capital is positively associated with economic growth. The process of educating a workforce is a form of investment, but it is a human capital investment rather than a capital investment such as machinery.

1. The Government's Role:

Governments play a critical role in expanding a country's population's skill sets and educational levels. Some governments are actively working to improve human resources by providing free higher education to citizens. These governments recognise that education contributes to the development of a country's economy and growth. Workers with more education or stronger skills prefer to gain more money, which boosts economic growth by increasing consumer spending.

2. The Corporate Sector's Role:

Human capital is also invested by businesses to increase income and productivity. Take, for example, an employee at a technology firm who receives computer programming training through on-site training and in-house seminars. A part of the tuition for higher education is covered by the corporation. If the worker remains at Following the completion of the training, she can develop new ideas and products for the business. Later in her career, the employee could leave the company and use the skills she gained to start a new business. If the employee stays with the company or begins a new one, the initial investment in human capital would lead to economic growth in the long run.

Q7) Define Human Capital Investments?

A7)

Investing in jobs has a history of improving working opportunities in economies all over the world. Consumer spending increases as jobs improves, resulting in increased sales for businesses and additional business investment. As a consequence, employment is a crucial indicator or metric for forecasting GDP growth.

The Organisation for Economic Co-operation and Development (OECD) is a coalition of over thirty countries that collaborate to form and improve economic and social policies around the world.

The OECD examines the effect of education levels on jobs and, eventually, economic development on a regular basis. The OECD's annual Education at a Glance study for 2020 looked at how educational programmes work, how much money is spent, and who benefits or participates. The OECD also tracks how men and women's education levels affect job development.

According to the OECD, countries with citizens who had grammar and high school educations had an employment rate of 72 percent for men and 45 percent for women among 25-34 year-olds in 2020. Those with a bachelor's or master's degree, on the other hand, had an employment rate of 89 percent for men and 81 percent for women.

While investing in human capital appears to result in higher growth, this does not always imply that jobs for newly educated employees are available. When it comes to job opportunities and labour movement, geography also plays a part. If job opportunities are in the north but skilled labour is in the south, development could be hampered due to the high cost of relocation or a lack of willingness to relocate.

Q8) What are the Key takeaway For Human capital Investments?

A8)

Q9) Explain Technology and Economic growth with diagrams in Brief?

A9)

Technology can be considered a primary source of economic growth, and technological advancements have a direct impact on the development of developing countries.

Economic growth and technological innovation are inextricably linked.

Economic development is often influenced by technological advancements. A high level of technology can be used to achieve a rapid rate of growth. According to Schumpeter, the only determinant of economic success is creativity or technological progress. However, if the degree of technology remains unchanged, the development process will come to a halt. As a result, technological advancement is what keeps the economy going. In developing countries, inventions and technologies have been primarily responsible for rapid economic development.

The increase in net national income in developed countries cannot be attributed solely to money. According to Kindleberger, technical advancements are responsible for a large portion of this improved efficiency. After accounting for labour force and capital stock inflation, Robert Solow estimated that technological change accounted for about 2/3 of the growth of the US economy.

In reality, technology can be considered a primary source of economic growth, and numerous technological advancements have a major impact on the development of developing countries. The effect of technological transition on production functions can be visualised using the diagrams below.

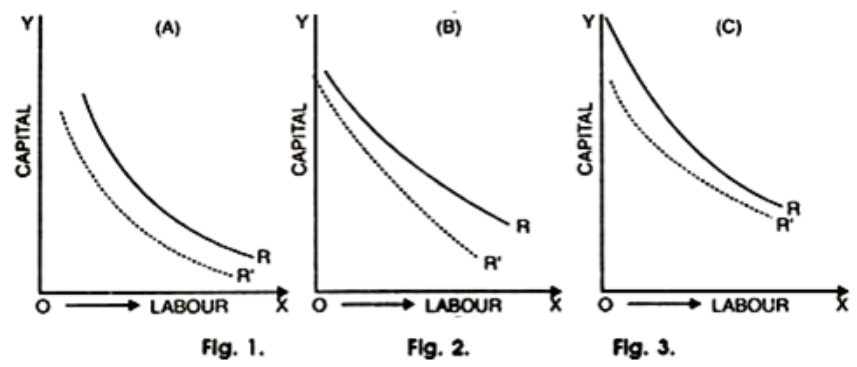

R' is an isoquant of the production feature before technological transition in Figures 1 to 3, and R' represents the same quantities output after the breakthrough in Figure 1. In terms of labour and money, the invention is unaffected. After technological development, the latest production function R shows that the same output can be achieved with less labour and capital.

The second graph shows that creativity saves labour, and R' shows that the same production can be achieved with less inputs, but labour saves more than money. The third figure shows that the invention is capital saving, and R' shows that after technological transition, the same production can be achieved with less inputs, but capital saving is greater than labour saving.

The general consensus is that technological progress is more critical than capital formation. However, capital formation alone will only bring about minimal economic growth, and progress can halt if there is no technological reform. A nation cannot continue to rely on technology imports. A country that invests more in science and technology will expand faster than one that accumulates more resources but spends less on technological research.

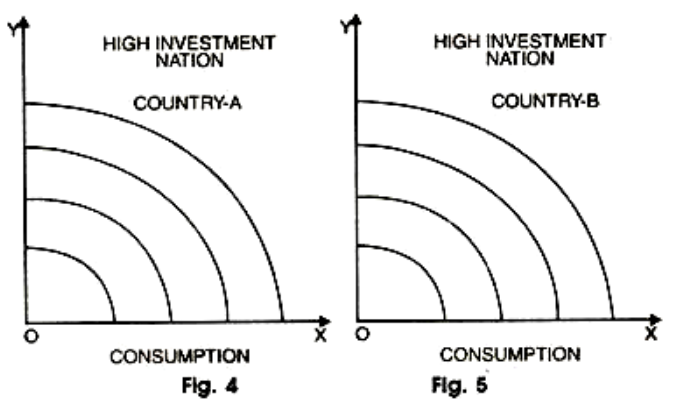

Country A focuses on accumulating more capital resources in the first figure (4), while country B focuses on technical aspects but does not control capital accumulation in the second figure 5. Because of the high rates of technological growth, it is obvious that country B is progressing faster than country A. The output role in diagram 6 illustrates the idea that technological innovation is more critical than capital accumulation.

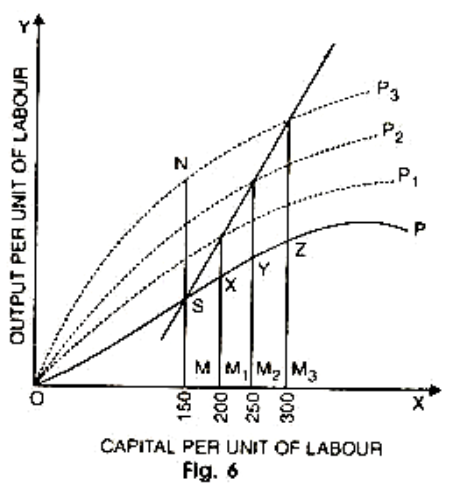

Figure 6 depicts the output function, which progresses from OP to OP, OP2, and OP. as technology advances. When the capital per worker is increased from Rs. 150 to Rs. 200, the output per worker of labour is increased from SM to XM1. When the capital per unit of labour is increased to Rs. 300, the output per labour is ZM. The main goal of technological development is to make efficient use of labour and other resources, because the production function moves upward, meaning that for the same amount of capital per worker, more output can be produced.

Although the amount of capital per worker remains constant at Rs. 150, output per worker continues to rise from SM to NM. This is due to the output function moving upward. Similarly, at different levels of capital intensity, more production can be made. As a result of technical advancement, the production function shifts upward, allowing for more output per worker with the same amount of capital per worker.