UNIT 2

Preparation and Presentation of Financial Statement

Q1) Explain preparation of financial statement.

A1)

Financial statement is a formal record of the financial activities and position of the business, person or other entity. Relevant financial information are presented in a structured manner and in a form easy to understand.

The objective of financial statements is to provide information about the financial position, performance and changes in financial position of an enterprise that is useful to a wide range of users in making economic decisions.

Financial statement should be understandable, relevant, reliable and comparable.

Financial statements as per Indian Company law comprise of

- Balance sheet or statement of financial position or net worth statement

- Income statement or profit and loss report

- Cash flow statement or fund flow statement

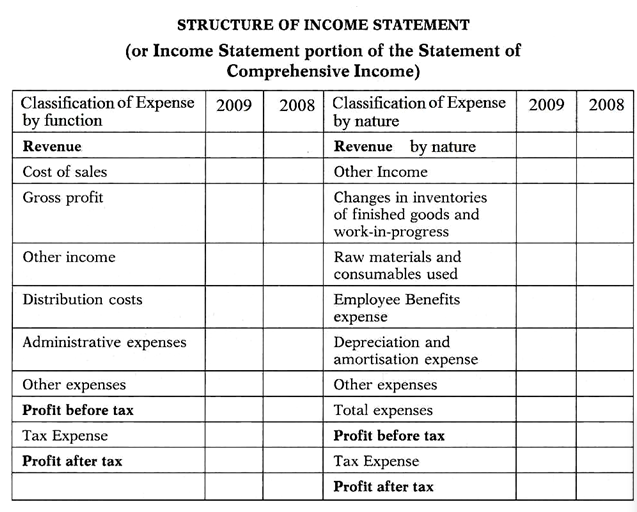

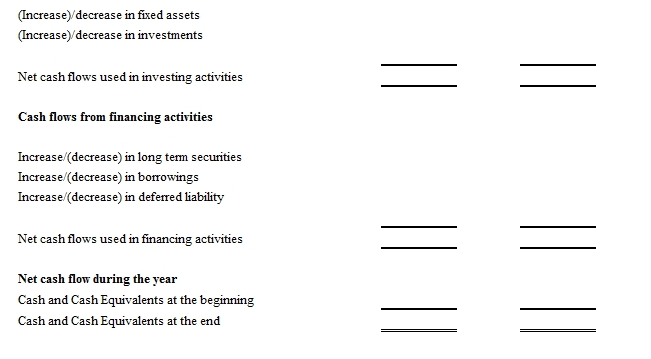

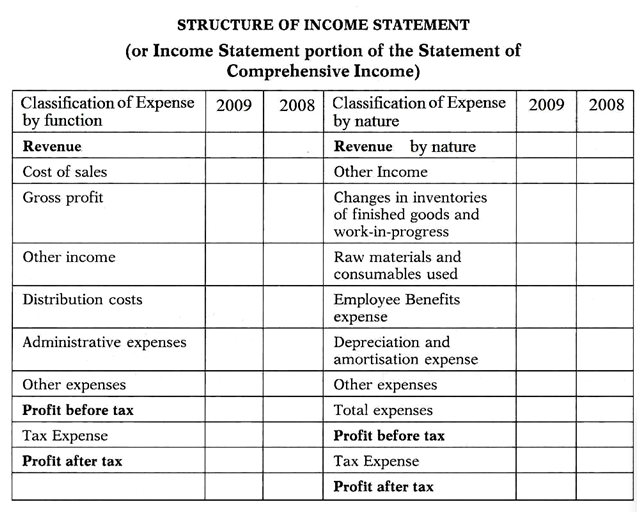

Income statement

- IAS 1 has defined the term comprehensive income comprises of all components of profit or loss’ and of other comprehensive income.

- The income statement is one of the financial statements of an entity that reports three main financial information revenues, expenses, and profit or loss of an entity for a specific period of time.

- Profit or Loss = Income minus expenses recognized in accordance with the Framework or a specific IFRS.

- Profit or loss is the total of income less expenses, excluding the components of other comprehensive income.

Balance sheet

IFRSs based Statement of Financial Position (Balance Sheet) is a classified presentation of assets and liabilities. It shows the balance of assets, liabilities, and equity at the end of the period of time.

Assets include anything that is owned by the equity that has monetary value. Assets have to be valued on a cost basis or on the basis of market value. Assets are categorized into current assets, intermediate assets and long term assets

Current assets include cash or assets that can and will be turned into cash within a year. Example cash, marketable securities, etc.

Intermediate assets cannot be converted or sold for cash in a short period of time. These assets are not consumed within a year. Ex small equipment

Long term assets support production activities and are considered to have a life greater than aayear. Ex building, land, etc

Liabilities are financial obligation of the business such as money owned to lender, suppliers, employees, etc.

Owners equity is the difference between total assets and total liabilities. It reflects the owners stake in the business and includes investment capital and retained profits.

FORMAT OF BALANCE SHEET

Name of the Company

Balance Sheet as at

| Notes | Current Year | Previous Year |

(in Rs.) | (in Rs.) | ||

EQUITY AND LIABILITIES |

|

|

|

Shareholders Fund |

|

|

|

Share Capital | 1 |

|

|

Reserves & Surplus | 2 |

|

|

Money Received against Warrants |

|

|

|

|

|

|

|

|

|

|

|

Share Application Money pending allotment |

|

|

|

|

|

|

|

Non-current Liabilities |

|

|

|

Long Term Borrowings | 3 |

|

|

Deferred Tax Liabilities (Net) | 4 |

|

|

Other Long Term Liabilities | 5 |

|

|

Long Term Provisions | 6 |

|

|

|

|

|

|

Current Liabilities |

|

|

|

Short Term Borrowings | 7 |

|

|

Trade Payables | 8 |

|

|

Other Current Liabilities | 9 |

|

|

Short Term Provisions | 10 |

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

ASSETS |

|

|

|

Non-current Assets |

|

|

|

Fixed Assets | 11 |

|

|

Tangible Assets |

|

|

|

Intangible Assets |

|

|

|

Capital Work-in-Progress |

|

|

|

Intangible Assets under development |

|

|

|

Non-current Investments | 12 |

|

|

Deferred Tax Assets (Net) |

|

|

|

Long Term Loans & Advances | 13 |

|

|

Other Non-current Assets | 14 |

|

|

|

|

|

|

Current Assets |

|

|

|

Current Investments | 15 |

|

|

Inventories | 16 |

|

|

Trade Receivables | 17 |

|

|

Cash and Cash Equivalents | 18 |

|

|

Short Term Loans & Advances | 19 |

|

|

Other Current Assets | 20 |

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

Significant Accounting Policies |

|

|

|

The accompanying notes are an integral part of the financial statements |

|

|

|

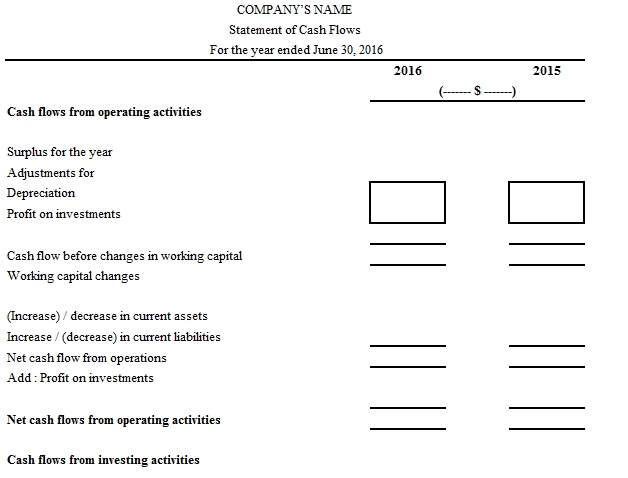

Statement of cashflow

It is also called sources and uses of funds or flow of funds statements. In cash flow statement both the cash inflows and outflows are summarized over a given period of time. In cash flow statement the total cash inflows must be equal to the total cash outflows

Q2) Explain income statement.

A2)

Income statement

- IAS 1 has defined the term comprehensive income comprises of all components of profit or loss’ and of other comprehensive income.

- The income statement is one of the financial statements of an entity that reports three main financial information revenues, expenses, and profit or loss of an entity for a specific period of time.

- Profit or Loss = Income minus expenses recognized in accordance with the Framework or a specific IFRS.

- Profit or loss is the total of income less expenses, excluding the components of other comprehensive income.

Q3) Explain balance sheet.

A3)

Balance sheet

IFRSs based Statement of Financial Position (Balance Sheet) is a classified presentation of assets and liabilities. It shows the balance of assets, liabilities, and equity at the end of the period of time.

Assets include anything that is owned by the equity that has monetary value. Assets have to be valued on a cost basis or on the basis of market value. Assets are categorized into current assets, intermediate assets and long term assets

Current assets include cash or assets that can and will be turned into cash within a year. Example cash, marketable securities, etc.

Intermediate assets cannot be converted or sold for cash in a short period of time. These assets are not consumed within a year. Ex small equipment

Long term assets support production activities and are considered to have a life greater than aayear. Ex building, land, etc

Liabilities are financial obligation of the business such as money owned to lender, suppliers, employees, etc.

Owners equity is the difference between total assets and total liabilities. It reflects the owners stake in the business and includes investment capital and retained profits.

FORMAT OF BALANCE SHEET

Name of the Company

Balance Sheet as at

| Notes | Current Year | Previous Year |

(in Rs.) | (in Rs.) | ||

EQUITY AND LIABILITIES |

|

|

|

Shareholders Fund |

|

|

|

Share Capital | 1 |

|

|

Reserves & Surplus | 2 |

|

|

Money Received against Warrants |

|

|

|

|

|

|

|

|

|

|

|

Share Application Money pending allotment |

|

|

|

|

|

|

|

Non-current Liabilities |

|

|

|

Long Term Borrowings | 3 |

|

|

Deferred Tax Liabilities (Net) | 4 |

|

|

Other Long Term Liabilities | 5 |

|

|

Long Term Provisions | 6 |

|

|

|

|

|

|

Current Liabilities |

|

|

|

Short Term Borrowings | 7 |

|

|

Trade Payables | 8 |

|

|

Other Current Liabilities | 9 |

|

|

Short Term Provisions | 10 |

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

ASSETS |

|

|

|

Non-current Assets |

|

|

|

Fixed Assets | 11 |

|

|

Tangible Assets |

|

|

|

Intangible Assets |

|

|

|

Capital Work-in-Progress |

|

|

|

Intangible Assets under development |

|

|

|

Non-current Investments | 12 |

|

|

Deferred Tax Assets (Net) |

|

|

|

Long Term Loans & Advances | 13 |

|

|

Other Non-current Assets | 14 |

|

|

|

|

|

|

Current Assets |

|

|

|

Current Investments | 15 |

|

|

Inventories | 16 |

|

|

Trade Receivables | 17 |

|

|

Cash and Cash Equivalents | 18 |

|

|

Short Term Loans & Advances | 19 |

|

|

Other Current Assets | 20 |

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

Significant Accounting Policies |

|

|

|

The accompanying notes are an integral part of the financial statements |

|

|

|

Q4) Explain accounting concepts and convention.

A4)

Accounting concepts defines the assumption on the basis of which financial statement of a business entity is prepared. Concepts are those basic assumption and condition which for the basis upon which the accountancy has been laid.

Accounting principles

- They should be based on real assumption

- They must be simple, understandable and explanatory

- They must be followed consistently

- They should be able to reflect future predictions

- They should be informational to users

Accounting convention emerges out of accounting practices, commonly known as accounting principle, adopted by various organizations over a period of time. Accounting bodies may change any of the convention to improve the quality of accounting information.

Accounting concepts

- Entity concept – Entity concept states that the business enterprise and its owner are two separate independent entities. Thus, the business and personal transaction of its owner are separate.

For example, when owner invests money in the business, it is recorded as liability of the business to the owner. Similarly, when owner takes money from business for personal use, it is not treated as business expenses.

2. Money measurement concept – This concept assumes that all business transaction must be in terms of money. Thus transactions expressed in terms of money are recorded in the books of account.

For example – sale of good, rent paid are expressed in money so recorded in books of account. Whereas sincerity, loyalty are not recorded in books of account because they cannot be measured in monetary terms.

3. Going concern concept - This concept states that a business firm will continue to carry on its activities for an indefinite period of time. It means every business entity has continuity of life and will not be resolved in the near future.

4. Accounting period concept –All transaction are recorded in the books of account on the assumption that profits on these transaction are to be ascertained for a specific period. Thus, this concept states that a balance sheet and profit and loss account should be prepared at regular interval

5. Accounting cost concept – It states that all assets are recorded in the books of account at their purchase price which include cost of acquisition, transportation and installation and not at its market price.

For example – fixed assets like building, machinery are recorded at purchase price

6. Dual aspect concept – Dual aspect is the basic principle of accounting. It provides the basis of recording accounting transactions. For every credit, a corresponding debit is made. Therefore the transaction should be recorded in two places.

7. Matching concept – This concept states that revenue and expenses incurred to earn profit must belong to the same accounting period. So once the revenue is realized, the next step is to allocate it to the relevant accounting period. It is very helpful for the investors to know the exact amount of profit and loss in the business

8. Realization concept – The concept states that, revenue is realized at the time when goods and services are actually delivered.An advance or fee paid is not considered a profit until the goods or services are delivered to the buyer.

9. Accrual concept – Accrual concept means the amount of money is yet to be paid or received at the end of the accounting period. It means cash received or not and expenses paid or not, both the transaction will be recorded in the books of account in that accounting period

Accounting convention

- Consistency –Consistency means same accounting principles should be uses year after year, so that same standards are applied to calculate profit and loss. While comparing over a period of time a meaningful conclusion can be drawn. If a different accounting principles are used , then it cannot be comparable

2. Full disclosure – It includes all material and relevant facts concerning financial statements should be fully disclosed. Full disclosure means full, fair, adequate disclosure of accounting information. Parties like investor, lender, etc are interested in the financial information, so the business entity should disclose full and fair information.

3. Materiality – It means all material fact should be recorded in accounting. Accountant should record important data and leave insignificant data. Material fact influence the decision of the users.

4. Conservatism – The conservatism is based on the principle that “Anticipate no profit, but provide all the possible losses”. The main objective is to show minimum profit. Profit should not be over estimated. It is an unfair convention, it will lead to reduction in the capital of an enterprise

Q5) Explain accounting concepts.

A5)

Accounting concepts

1. Entity concept – Entity concept states that the business enterprise and its owner are two separate independent entities. Thus, the business and personal transaction of its owner are separate.

For example, when owner invests money in the business, it is recorded as liability of the business to the owner. Similarly, when owner takes money from business for personal use, it is not treated as business expenses.

2. Money measurement concept – This concept assumes that all business transaction must be in terms of money. Thus transactions expressed in terms of money are recorded in the books of account.

For example – sale of good, rent paid are expressed in money so recorded in books of account. Whereas sincerity, loyalty are not recorded in books of account because they cannot be measured in monetary terms.

3. Going concern concept - This concept states that a business firm will continue to carry on its activities for an indefinite period of time. It means every business entity has continuity of life and will not be resolved in the near future.

4. Accounting period concept –All transaction are recorded in the books of account on the assumption that profits on these transaction are to be ascertained for a specific period. Thus, this concept states that a balance sheet and profit and loss account should be prepared at regular interval

5. Accounting cost concept – It states that all assets are recorded in the books of account at their purchase price which include cost of acquisition, transportation and installation and not at its market price.

For example – fixed assets like building, machinery are recorded at purchase price

6. Dual aspect concept – Dual aspect is the basic principle of accounting. It provides the basis of recording accounting transactions. For every credit, a corresponding debit is made. Therefore the transaction should be recorded in two places.

7. Matching concept – This concept states that revenue and expenses incurred to earn profit must belong to the same accounting period. So once the revenue is realized, the next step is to allocate it to the relevant accounting period. It is very helpful for the investors to know the exact amount of profit and loss in the business

8. Realization concept – The concept states that, revenue is realized at the time when goods and services are actually delivered.An advance or fee paid is not considered a profit until the goods or services are delivered to the buyer.

9. Accrual concept – Accrual concept means the amount of money is yet to be paid or received at the end of the accounting period. It means cash received or not and expenses paid or not, both the transaction will be recorded in the books of account in that accounting period

Q6) Explain accounting convention.

A6)

Accounting convention

5. Consistency – Consistency means same accounting principles should be uses year after year, so that same standards are applied to calculate profit and loss. While comparing over a period of time a meaningful conclusion can be drawn. If a different accounting principles are used , then it cannot be comparable

6. Full disclosure – It includes all material and relevant facts concerning financial statements should be fully disclosed. Full disclosure means full, fair, adequate disclosure of accounting information. Parties like investor, lender, etc are interested in the financial information, so the business entity should disclose full and fair information.

7. Materiality – It means all material fact should be recorded in accounting. Accountant should record important data and leave insignificant data. Material fact influence the decision of the users.

8. Conservatism – The conservatism is based on the principle that “Anticipate no profit, but provide all the possible losses”. The main objective is to show minimum profit. Profit should not be over estimated. It is an unfair convention, it will lead to reduction in the capital of an enterprise

Q7) Explain the limitation of financial statements.

A7)

Limitation

- Based on historical costs: the current worth of the company are not disclosed in the financial statement of the company. Initially the transactions are recorded at their cost. The value of assets and liabilities changes over time. Thus, if we present a large part of the amount which is based on historical costs the balance sheet could be misleading.

2. Based on Personal judgment: in the statement the value of assets depends on the standards of the person who deals with it. For example, the method of depreciation, mode of amortization of assets etc, depends on the personal judgment of the accountant.

3. Inflationary effects: If the inflation rate is relatively high, the amounts of assets and liabilities in the balance sheet will appear low, as we cannot adjust it for inflation. This mostly applies to long-term assets.

4. Intangible assets not recorded: the intangible assets are not recorded as assets. But we charge any expenditure created to make an intangible asset as an expense. This policy underestimates the value of a business, especially when large amount is spend to build a brand image or new product.

5. Interim reports are produced: As we know financial statements are interim reports, thus these are not final reports. Therefore, a user can gain an incorrect view of financial results by only looking at one reporting period. We can only compute final gain or loss of the business at the time of termination of business.

6. Not always comparable across companies: different companies use different accounting practices. Thus a company finds difficulty in comparing the results of its company with different companies.

7. False figures: The management team of a company may change the results to report excellent results, for example when a bonus plan calls for payouts only if the sales level increases.

8. Lack of non-financial factors: only the financial factors are taken into consideration to prepare the financial statements and they do not address non-financial issues, such as the environmental attentiveness of a company’s operations, or how well it works with the local community.

9. Figures are distorted: Financial statements provide information about either historical results or the financial status of a business as of a specific date. The statements do not provide any value in predicting what will happen in the future.

Q8) Explain interpretation and analysis of financial statement.

A8)

Analysis and interpretation of financial statement determines the significance and meaning of financial statement. The main function of financial analysis is to analyze the figures contained in financial statement to determine the strength and weakness of the business.

Definition

“Analyzing financial statements,” according to Metcalf and Titard, “is a process of evaluating the relationship between component parts of a financial statement to obtain a better understanding of a firm’s position and performance.”

In the words of Myers, “Financial statement analysis is largely a study of relationship among the various financial factors in a business as disclosed by a single set-of statements and a study of the trend of these factors as shown in a series of statements.”

The purpose of financial analysis is to judge the profitability and financial soundness of the firm by diagnose the information contained in financial statements. Analyst uses various tools to analyze the financial statement of the company before commenting upon the financial health or weaknesses of an enterprise.

The term ‘financial statement analysis’ includes both ‘analysis’, and ‘interpretation’. The term ‘analysis’ means the simplification of financial data by methodical classification of the data given in the financial statements, ‘interpretation’ means, ‘explaining the meaning and significance of the data so simplified.’

Objectives of financial statement analysis

- To assess the earning capacity or profitability of the firm.

- To assess the operational efficiency and managerial effectiveness.

- To assess the short term as well as long term solvency position of the firm.

- To identify the reasons for change in profitability and financial position of the firm.

- To provide inter firm comparison

- To forecast about future prospects of the firm

- To help in decision making and control

Parties interested in financial analysis

- Investors or potential investors

- Management

- Creditors and suppliers

- Bankers and financial institution

- Employees

Types of financial analysis

- On the basis of information used - external analysis are information made available to the outsiders of the business, like creditors, investors, government. These parties obtained data for analysis from the published financial statements. Thus an analysis done by outsiders is known as external analysis.

On the basis of information obtained from the internal and unpublished records and books internal analysis is done. Internal type of analysis refers to analysis for managerial purpose.

2. On the basis of modus operandi - Horizontal analysis is also known as ‘dynamic analysis’ or ‘trend analysis’. This analysis is done by analyzing the statements over a period of time. Vertical analysis is also known as ‘static analysis’ or ‘structural analysis’. It is made by analyzing a single set of financial statement prepared at a particular date.

Preliminaries Required for Analysis and Interpretation of Financial Statements:

- The presentation of data should be in a logical way

- The information should be analysed for preparing comparative statements

- The objective and extent of analysis and interpretation should be determined.

- While interpretation economic facts should be taken into account

- Interpreted data and information should be in a report form.

- All data shown in financial statements should be studied just to understand their significance.

Techniques of analysis and interpretation

- Ratio analysis - Ratio analysis is used to evaluate relationships among financial statement items. It is used to identify trends over time for one company or to compare two or more companies at one point in time. Financial statement ratio analysis focuses on three key aspects of a business: liquidity, profitability, and solvency.

2. Fund flow analysis – fund flow analysis provides only some information about financial activities of a business in a limited manner. Fund flow analysis is also known as Application of Funds Statement, Statement of Sources and Applications of Funds, Statement of Funds Supplied and Applied, Where Got and Where Gone Statement, Statement of Resources Provided and Applied

3. Cash flow analysis – the cash flow analysis shows the movement of cash or cash equivalents during the period. This analysis demonstrates the changes in the accounts of balance sheet on cash and cash equivalents.

Q9) Explain techniques of analysis and interpretation of financial statement.

A9)

Techniques of analysis and interpretation

- Ratio analysis - Ratio analysis is used to evaluate relationships among financial statement items. It is used to identify trends over time for one company or to compare two or more companies at one point in time. Financial statement ratio analysis focuses on three key aspects of a business: liquidity, profitability, and solvency.

2. Fund flow analysis – fund flow analysis provides only some information about financial activities of a business in a limited manner. Fund flow analysis is also known as Application of Funds Statement, Statement of Sources and Applications of Funds, Statement of Funds Supplied and Applied, Where Got and Where Gone Statement, Statement of Resources Provided and Applied

3. Cash flow analysis – the cash flow analysis shows the movement of cash or cash equivalents during the period. This analysis demonstrates the changes in the accounts of balance sheet on cash and cash equivalents.

Q10) Draw the format of balance sheet.

A10)

FORMAT OF BALANCE SHEET

Name of the Company

Balance Sheet as at

| Notes | Current Year | Previous Year |

(in Rs.) | (in Rs.) | ||

EQUITY AND LIABILITIES |

|

|

|

Shareholders Fund |

|

|

|

Share Capital | 1 |

|

|

Reserves & Surplus | 2 |

|

|

Money Received against Warrants |

|

|

|

|

|

|

|

|

|

|

|

Share Application Money pending allotment |

|

|

|

|

|

|

|

Non-current Liabilities |

|

|

|

Long Term Borrowings | 3 |

|

|

Deferred Tax Liabilities (Net) | 4 |

|

|

Other Long Term Liabilities | 5 |

|

|

Long Term Provisions | 6 |

|

|

|

|

|

|

Current Liabilities |

|

|

|

Short Term Borrowings | 7 |

|

|

Trade Payables | 8 |

|

|

Other Current Liabilities | 9 |

|

|

Short Term Provisions | 10 |

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

ASSETS |

|

|

|

Non-current Assets |

|

|

|

Fixed Assets | 11 |

|

|

Tangible Assets |

|

|

|

Intangible Assets |

|

|

|

Capital Work-in-Progress |

|

|

|

Intangible Assets under development |

|

|

|

Non-current Investments | 12 |

|

|

Deferred Tax Assets (Net) |

|

|

|

Long Term Loans & Advances | 13 |

|

|

Other Non-current Assets | 14 |

|

|

|

|

|

|

Current Assets |

|

|

|

Current Investments | 15 |

|

|

Inventories | 16 |

|

|

Trade Receivables | 17 |

|

|

Cash and Cash Equivalents | 18 |

|

|

Short Term Loans & Advances | 19 |

|

|

Other Current Assets | 20 |

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

Significant Accounting Policies |

|

|

|

The accompanying notes are an integral part of the financial statements |

|

|

|