Unit-II

Cost Accounting

Question and answers

Q1. Write the Composition of elements of cost.

Ans. Composition of elements of cost are:

The manufacturing organization converts raw materials into finished products. To that end, it employs labour and provides other facilities. It is necessary to check the amount spent on all this, while aggregating the cost of production. For this purpose, the cost is mainly classified into various factors. This classification is necessary for accounting and management. The cost elements are

(i) Direct material

(II) Direct labour

(iii) Direct expenses and

(iv) Overhead.

The following chart shows the wide heading of the cost and these acts as the basis for preparing the cost sheet.

Elements of cost

Elements of cost

MaterialsLabourOther Expenses

DirectIndirectDirectIndirectDirectIndirect

Overheads

FactoryAdministrativeSelling & Distribution

Q2. Define Stores Ledger.

Ans. Stores Ledger is managed by the costing department (and possibly the unit price) to record the issuance of materials, including all receipts, quantities, and values. Ledger is similar to a bin card, except that receipts, issues, and balances are displayed along with the amount. The ledger contains accounts for receipts, issues, and all items in the store whose balances are recorded in both quantity and amount.

Matching store ledger with bin card:

Stores Ledger of Krishna Engineering Ltd. | |||||||||||

Material Code: | Minimum Qty: | ||||||||||

Bin No: | Maximum Qty: | ||||||||||

Material Description: | Ordering Qty: | ||||||||||

Location: |

| ||||||||||

|

| ||||||||||

Date | Receipts | Issues | Balance | ||||||||

| GR No | Qty | Rate | Amount | SR No | Qty | Rate | Amount | Qty | Rate | Amount |

|

|

|

|

|

|

|

|

|

|

|

|

Generally, there is no difference between the quantity displayed on the bin card and the store ledger. However, in reality, the difference is mainly due to the following reasons.

a. Arithmetic error when calculating balance.

b. If the document wasn't posted to either your bin card or your store ledger, it could be because the document wasn't received.

c. Post to the wrong bin card or the wrong sheet (code) in your store ledger.

d. Posting of the receipt being issued and vice versa.

e. Materials issued or received for loan or approval may be entered on the bin card, but not on the store's ledger.

The difference between a store ledger and a bin card invalidates the purpose of maintaining two separate sets and invalidates the physical inventory because the correct book balance is not available for comparison with the physical balance. I will. Therefore, various methods are used to control or reduce discrepancies between the store's ledger and bin card and maintain the correct balance of the books.

s

Q3. Draw a diagram to show Bin card with its definition.

Ans A bin card is a quantitative record of receipts, issuance, and closing balances of store items. A separate bin card is maintained for each item and placed on a shelf or bin. This card is debited with the quantity of the store received, the quantity of the issued store is credited, and the balance of the quantity of the store is taken each time it is received or issued. You can easily find out the balance of an item at any time. To keep the store up-to-date balance, the principle is that you must touch the bin card before you can touch the item. For each item in the store, the material code, minimum quantity, maximum quantity, order quantity, and balance quantity are printed on the bin card. Bin cards are also known as "bin tags" or "stock cards."

Ledger storage

BIN CARD OF A LTD | |||||||

Material Code: |

|

|

| Maximum Level: |

| ||

Mat. Description: |

|

|

| Minimum Level: |

| ||

Location: |

|

|

| Re-ordering level: |

| ||

Unit of Measurement: | |||||||

Date | Doc No. | Received from / Issued to | Receipts | Issue | Balance | Verification with Stores Ledger Date & Verified by | |

|

|

|

|

|

|

|

|

Q4.How can be overhead subdivided into the groups?

Ans. Overhead can be subdivided into the following main groups:

Factory or work overhead: Also known as manufacturing or production overhead it consists of all the costs of indirect materials, indirect labor and other overhead incurred in the factory.

Example: Factory rent and insurance. Depreciation of factory buildings and machinery.

Office or management overhead: All indirect costs incurred by the office for the management and management of the enterprise.

Examples: Rent, fees, taxes and insurance for office buildings, audit fees, director fees.

Sales and distribution overhead: These are overhead related to marketing and sales.

Examples: Advertising of distributors, salaries and fees, travel expenses of salesmen.

Q5. Define inventory.

Ans. A material is a substance (physical term) that is part of a finished product or is composed of a finished product. In other words, a material is a product that is supplied to a business for the purpose of consuming it in the process of manufacturing or providing services, or for the purpose of converting it into a product. The term "store" is often used as a synonym for material, but store has a broader meaning, not only the raw materials consumed or used in production, but also miscellaneous goods, maintenance stores, processed parts, components. Also includes items such as tools. Jigs, other items, consumables, lubricants, etc. Finished and partially finished products are also often included in the term "store". Materials are also called inventory. The term material / inventory include not only raw materials, but also components; work in process, finished products, and scrap.

Material costs are an important component of the total cost of a product. It accounts for 40% to 80% of the total cost. Percentages may vary from industry to industry. But for the manufacturing sector, material costs are paramount. Inventory is also an important component of working capital. Therefore, it is treated the same as cash. Therefore, analysis and control of material costs is very important.

Q6.What is the purpose of material management system?

Ans. Material management: The ability to ensure sufficient inventory of goods to meet all requirements without carrying unnecessarily large amounts of inventory.

The purpose of the material management system is to:

1. Make the material available continuously so that the flow of material for production is uninterrupted. Production cannot be postponed due to lack of materials.

2. Purchase the required amount of materials to avoid working capital locks and minimize the risk of surplus or obsolete stores.

3. Make competitive and wise purchases at the most economical prices so that you can reduce material costs.

4. Purchase the right quality material to minimize the waste of material.

5. Acts as an information centre for material knowledge about prices, suppliers, lead times, quality and specifications.

Q7.Write short notes on Centralized and Decentralized purchases.

Ans. Centralized purchase: Centralized purchase means the purchase of materials by one specialized department. The purchasing department has personnel with expertise in all aspects of the material. The purchasing department has the authority to make purchases for the entire organization.

In this system, the requirements of the entire organization are confirmed through the creation of purchasing budget, the purchasing department makes purchases according to the accepted principle, and the materials are distributed to each production department according to the requirements.

In most cases, the purchasing department purchases materials based on the requisition form issued by the store. The supplier delivers the material to the Material Receipt section. Individual departments are not allowed to purchase their own materials when centralized purchases are made.

Decentralized purchase: Decentralized purchases mean that each department can purchase materials according to their needs. Therefore, the authority to make purchases rests with the individual departments.

(A) Advantages of local purchase: If the production unit is far from the body, it is beneficial to have the unit available for purchase locally. You can enjoy the benefits of basic low price and seasonal price, and reduce the cost.

(B) Reduction of transportation costs: By supplying materials locally, transportation costs will be significantly reduced.

(C) Quick resolution of the problem: Disputes caused by refusals, shortages and returns can be resolved easily and quickly.

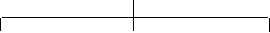

Q8.What do you mean by Purchase requisition?

Ans. The decision to purchase the material is made by the purchasing department after receiving the purchase request from the authorized department. A purchase request is made from an approved department to the purchasing department in a prescribed form called a purchase request.

Requisitions provide three basic pieces of information that help buyers perform their purchasing functions efficiently.

The information is as follows:

- What materials to buy (purchasing the right quality).

- When to buy (appropriate time).

- Amount to purchase (appropriate quantity).

Purchase requisitions are received by the purchaser from:

(I) Shopkeepers of all standard materials.

(II) Production control department of non-standard materials required for production.

(III) Plant and maintenance engineers for special maintenance and capital investment.

(IV) Head of special items such as office supplies.

The requisition is created three times. Two copies will be sent to the purchasing department, one copy will be retained as proof of approval and the other copy will be returned to the inventor after quoting the order details. Purchasing department. A third copy is kept by the store for office records and future references.

Material specifications or bill of materials:

The requisition contains details and specifications of the materials to purchase. Material specifications are known as bills of material. This starts in the production control department or the plant and maintenance engineer department. The BUI of Material is a complete schedule of materials or parts required for a particular job or work order created by a drafting office. A bill of materials is created for every job and a copy is sent to the storekeeper.

Q9.Define Purchase order.

Ans. A purchase order is an agreement between a material buyer and a supplier. It is a requirement from the purchaser to the supplier to supply goods of a specific quantity and quality in accordance with the terms set forth in the contract. It also means the buyer's commitment to deliver and pay for the goods according to the terms and conditions stated on the purchase order.

After carefully determining the purchase quantity, the purchasing department should place an order with the supplier of choice. You need to choose a supplier that can deliver the products you need at a competitive price and at the right time. We are looking for a quote from our supplier.

Quotations received from different suppliers are compared and an acceptable supplier is selected. After completing the above procedure, a purchase order will be issued to the supplier to supply the required quantity of goods at the specified time.

Purchase order i is issued in the prescribed format, produced in quadruples (4 copies), and sent to the next department for reference and coordination.

(I) the first copy will be sent to the supplier.

(Ii) One copy will be sent to the department that sent the purchase requisition.

(Iii) One copy will be sent to the store or the internal department of the product.

(Iv) One copy will be kept in the purchasing department as a permanent record.

(V) A copy will be sent to your account department.

Q10. What are the important methods to follow in pricing material issuance ?

Ans. The important methods to follow in pricing material issuance are: -

1. Actual cost method

2. First-in first-out (FIFO) method

3. Last-in first-out (LIFO) method

4. Maximum first-in first-out method (HIFO) method

5. Simple average cost method

6. Weighted average cost method

7. Periodic average cost method

8. Standard Cost method

9. Exchange cost method

10. Last-in first-out (NIFO) method

11. Base stock method.

1. Actual cost method:

If you purchase a material specifically for a particular job, the actual cost of the material will be charged to that job. Such materials are usually kept separately and published only for that particular job.

2. First-in first-out (FIFO) method:

CIMA defines FIFO as "a method of setting the price of material issuance using the purchase price of the oldest unit in stock." With this method, the materials are issued out of stock in the order in which they were first stocked. It is assumed that the material that opens first is the material that is used first.

Advantage:

(A) Easy to understand and easy to price in question.

(B) It is a good store management practice to ensure that raw materials leave stores in chronological order based on age.

(C) This is an easy method with less administrative costs than other pricing methods.

(D) This inventory valuation method is accepted under standard accounting practices.

(E) Consistent and realistic practices in inventory and finished product valuation.

(F) Inventory is valued at the latest market price, close to the value based on replacement costs.

Cons: Disadvantages:

(A) If confused with other materials purchased at a different price at a later date, it is uncertain whether the material with the longest stock will be used.

(B) If the price of the purchased material fluctuates significantly, there will be more clerical work and errors may occur.

(C) Manufacturing costs are modest in situations where prices are rising.

(D) Inflationary markets tend to lower prices for key issues. The deflationary market tends to set higher prices for these issues.

(E) Generally, it is necessary to adopt multiple prices for the publication of a single document.

(F) This method makes it difficult to compare costs for different jobs when billed for the same material at different prices.

3. Last in first out (LIFO) method:

With this method, the latest purchase is issued first. Issues are priced on the latest batch you receive and will continue to be billed until the new batch you receive arrives in stock. This is a way to set the issue price of a material using the purchase price of the latest unit in stock.

Advantage:

(A) Shares issued at more recent prices represent the current market value based on exchange costs.

(B) Easy to understand and apply.

(C) Product costs tend to be more realistic as material costs are billed at more recent prices.

(D) When the price is rising, the issue pricing will be the more recent current market price.

(E) It tends to show modest profit figures by minimizing unrealized inventory gains and valuing inventory at its pre-price value, providing a hedge against inflation.

Cons: Disadvantages:

(A) Valuation of inventory in this way is not accepted in the creation of financial accounting.

(B) This is an assumption of a cash flow pattern and is not intended to represent the actual physical flow of material from the store.

(C) It may be necessary to adopt multiple prices for one problem.

(D) It becomes difficult to compare costs between jobs.

(E) It involves more clerical work and sometimes the evaluation may go wrong.

(F) During inflation, the valuation of inventory in this way does not represent the current market price.

4. Highest in first out (HIFO) method:

With this method, the most expensive material is published first, regardless of the date of purchase. The basic assumption is that in a fluctuating inflation market, material costs are quickly absorbed into product costs, hedging the risk of inflation. This method is used when the material is in short supply and when you are running a contract with costs. This method is uncommon and is not accepted by standard accounting practices.

5. Simple average cost method:

In this way, all the materials received are merged into the inventory of existing materials and their identities are lost. The simple average price is calculated regardless of the quantity involved. The simple average cost is obtained by dividing the number of batches and adding the various prices paid during the period to the batches purchased. For example, three batches of material received in Rs. 10, rupees 12 and Rs. 14 per unit each.

The simple average price is calculated as follows:

Rs. 10+ rupees 12+ rupees 14/3 batch = Rs. 36/3 batch = 12 rupees per unit

This method takes into account the prices of different batches, but is not common because it does not take into account the quantity purchased in different batches. Use this method when the price is less volatile and the stock price is small.

6. Weighted average cost method:

This is a permanent weighted averaging system in which the issue price is recalculated each time after each receipt, taking into account both the total quantity and the total cost when calculating the weighted average price. For example, three batches of material received in a quantity of 1,000 units @ Rs. 15, 1,300 units @ Rupee 16 and 800 units @ Rs. 14.14.

The weighted average price is calculated as follows:

(1,000 units x Rs .15) + (1,300 units x Rs .16) + (800 units x Rs .14) / 1,000 units + 1,300 units + 800 units

= Rs. 15,000+ rupees 20,800 + rupees 11,200 / 3,100 units = rupees 47,000 / 3,100 units = 15.16 per rupee unit

This method tends to smooth out price fluctuations and reduce the number of calculations because each issue is billed at the same price until you receive a new batch of material.

This method is easier than FIFO and LIFO because you do not have to identify each batch individually. However, this method adds more clerical work in calculating the new average price each time you receive a new batch. The calculated issue price rarely represents the actual purchase price.

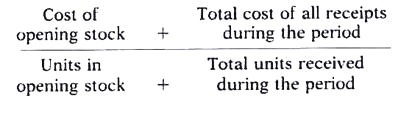

7. Periodic average cost method:

With this method, instead of recalculating the simple or weighted average cost each time you have a receipt, the average for the entire accounting period is calculated.

The average price of all materials published during the period is calculated as follows:

8. Standard cost method:

In this way, important issues are priced at a given standard issue price. The difference between the actual purchase price and the standard issue price is amortized on the income statement. The standard cost is a predetermined cost set by management before the actual material cost is known, and the standard issue price is used for all issuance to production and valuation of final stock.

Careful setting of standard prices first significantly reduces all clerical work and errors and simplifies inventory recording procedures. Eliminating cost fluctuations due to material price fluctuations makes it easier to compare realistic manufacturing costs. This method is not suitable in situations where prices fluctuate.

9. Exchange fee method:

The replacement cost is the cost of replacing the same material by purchasing it on the pricing date of the material issue. It is different from the actual cost on the purchase date. The exchange price is the exchange price of the material at the time the material is issued or on the valuation date of the end-of-term inventory.

This method is unacceptable to standard accounting practices as it reflects costs that are not actually paid. If the shares are held at exchange costs and are purchased at a lower price for balance sheet purposes, an element of profit that has not yet been realized will be included in the income statement.

This method is advocated by charging the job or process for the market price of the material, making it easier to determine the profitability of the job or process. This method is especially suitable for inflationary trends in material market prices. Without the exact market for a particular material, it is difficult to ascertain the replacement price for a material problem.

10. Next Inn First Out (NIFO) Method:

This method is a variant of the exchange cost method. In this way, the price quoted in the latest purchase order or contract is used for all issuance until a new order is placed.

11. Basic stock method:

With this method, the specified quantity of material is always kept in stock and priced as a buffer or base stock at its original cost. In addition, issuance of materials that exceed the basic stock quantity is priced using one of the above methods.

This method shows how prices fluctuate over time. However, this method is uncommon and makes stock valuation completely unrealistic and is not accepted by standard accounting practices.