Unit 3

Depreciation

Q1) What is the nature of Depreciation?

A1) Depreciation is a measure of the wearing out, consumption or other loss of value of a depreciable asset arising from use, passage of time or obsolescence through technology and market changes. Depreciation is allocated so as to charge a fair proportion of the depreciable amount in each accounting period during the expected useful life of the asset. Depreciation includes amortisation of assets whose useful life is predetermined.

Depreciation has been defined as 'the diminution in the utility or value of an asset, due to natural wear and tear, exhaustion of the subject-matter, effluxion of time accident, obsolescence or similar causes'. The words "accident", "obsolescence" and the phrase "effluxion of time" included in the definition, signify that when an asset held by a business cannot be employed for even one of the purposes for which it was acquired due to some damage suffered, the assets having become out of date or due to no occasion having arisen for it to be used, the loss caused to the business will be depreciation.

Q2) Give the accounting concept of depreciation.

A2) A firm requires fixed assets such as plant and machinery, building and furniture etc for its necessity which is purchased and it is recorded in the books of account at its original cost. A fixed asset is used to earn revenue for a number of accounting period in future with the same cost until the asset is sold or discarded.

Therefore, it is necessary that a part of the original cost of the fixed asset will be treated as an expense in each accounting year. A part of the original cost which will be treated as an expense is known as depreciation in accounting. Depreciation is an important expense for a firm which must be charged in the statement of profit and loss account before getting the net profit for that particular year.

The cost incurred of a fixed asset which is in the form of depreciation should be matched against the revenues which is earned from the use of an asset. In accounting, depreciation means distribution of the cost of a fixed asset for the years of its usage and charge the depreciation in statement of profit and loss account. Depreciation has no link with the market value of an asset.

Q3) What are the factors in the measurement of depreciation?

A3) The factors which affect measurement of depreciation are given below:

(i) The original cost of asset: The cost includes all cost incurred in acquiring the asset, i.e., purchase price including transportation and installation costs, if any.

(ii) The additions, if any, made to the assets during the year taking into consideration the date on which these additions were made.

(iii) The estimated useful life of the asset.

(iv) The scrap or the residual value of the asset.

(v) Obsolescence, i.e., the chance of the asset going out of fashion.

(vi) The working hours of the asset concerned.

(vii) The repairs and renewals.

(viii) The skill of the operators who handle the asset.

(ix) The legal provisions or other restrictions relating to depreciation.

Q4) Explain the Straight-line method of depreciation.

A4) Straight-line depreciation is the simplest and most often used method. The straight-line depreciation is calculated by dividing the difference between assets cost and its expected salvage value by the number of years for its expected useful life. (The salvage value may be zero, or even negative due to costs required to retire it; however, for depreciation purposes salvage value is not generally calculated at below zero.) The company will then charge the same amount to depreciation each year over that period, until the value shown for the asset has reduced from the original cost to the salvage value.

Straight-line method:

DE=(Cost-SL)/UL

For example, a vehicle that depreciates over 5 years is purchased at a cost of $17,000, and will have a salvage value of $2000. Then this vehicle will depreciate at $3,000 per year, i.e. (17-2)/5 = 3. This table illustrates the straight-line method of depreciation. Book value at the beginning of the first year of depreciation is the original cost of the asset. At any time, book value equals original cost minus accumulated depreciation.

Book value = original cost − accumulated depreciation Book value at the end of year becomes book value at the beginning of next year. The asset is depreciated until the book value equals scrap value.

Depreciation | Accumulated depreciation | Book value |

|

| (Original cost) $17,000 |

$3,000 | $3,000 | $14,000 |

3,000 | 6,000 | 11,000 |

3,000 | 9,000 | 8,000 |

3,000 | 12,000 | 5,000 |

3,000 | 15,000 | (Scrap value) 2,000 |

If the vehicle were to be sold and the sales price exceeded the depreciated value (net book value) then the excess would be considered a gain and subject to depreciation recapture. In addition, this gain above the depreciated value would be recognized as ordinary income by the tax office. If the sales price is ever less than the book value, the resulting capital loss is tax-deductible. If the sale price were ever more than the original book value, then the gain above the original book value is recognized as a capital gain.

If a company chooses to depreciate an asset at a different rate from that used by the tax office, then this generates a timing difference in the income statement due to the difference (at a point in time) between the taxation department's and company's view of the profit.

Q5) Explain the Diminishing balance method.

A5)

Depreciation | Depreciation | Accumulated | Book value at |

|

|

| Original cost $1,000.00 |

40% | 400.00 | 400.00 | 600.00 |

40% | 240.00 | 640.00 | 360.00 |

40% | 144.00 | 784.00 | 216.00 |

40% | 86.40 | 870.40 | 129.60 |

129.60 - 100.00 | 29.60 | 900.00 | Scrap value 100.00 |

The double-declining-balance method is used to calculate an assets accelerated rate of depreciation against its non-depreciated balance during earlier years of assets useful life. When using the double-declining-balance method, the salvage value is not considered in determining the annual depreciation, but the book value of the asset being depreciated is never brought below its salvage value, regardless of the method used. Depreciation ceases when either the salvage value or the end of the asset's useful life is reached.

Since double-declining-balance depreciation does not always depreciate an asset fully by its end of life, some methods also compute a straight-line depreciation each year, and apply the greater of the two. This has the effect of converting from declining-balance depreciation to straight-line depreciation at a midpoint in the asset's life. The double-declining-balance method is also a better representation of how vehicles depreciate and can more accurately match cost with benefit from asset use. The company in the future may want to allocate as little depreciation expenses as possible to help with additional expenses.

Accounting Entries under Straight Line and Reducing Balance Methods:

There are two alternative approaches for recording accounting entries for depreciation.

First Alternative

A provision for depreciation account is opened to accumulate the balance of depreciation and the assets are carried at historical cost.

Accounting entry

Profit and Loss Account Dr.

To Provision for Depreciation Account

Second Alternative:

Amount of Depreciation is credited to the Asset Account every year and the Asset Account is carried at historical cost less depreciation.

Accounting entries:

Depreciation Account Dr.

To Asset Account Profit and Loss Account Dr.

To Depreciation Account

Q6) In which sector depreciation accounting deals with?

A6) Depreciation Accounting deals with depreciation accounting and applies to all depreciable assets, except the following items to which special considerations apply:

(i) forests, plantations and similar regenerative natural resources;

(ii) wasting assets including expenditure on the exploration for and extraction of minerals, oils, natural gas and similar non-regenerative resources;

(iii) expenditure on research and development;

(iv) goodwill;

(v) live stock.

This statement also does not apply to land unless it has a limited useful life for the enterprise.

Q7) What are depreciable assets?

A7) Depreciable assets are assets which

(i) are expected to be used during more than one accounting period; and

(ii) have a limited useful life; and

(iii) are held by an enterprise for use in the production or supply of goods and services, for rental to others, or for administrative purposes and not for the purpose of sale in the ordinary course of business.

Q8) Different accounting policies for depreciation are adopted by different enterprises. Explain.

A8) Different accounting policies for depreciation are adopted by different enterprises. Disclosure of accounting policies for depreciation followed by an enterprise is necessary to appreciate the view presented in the financial statements of the enterprise.

The following terms are used in this Statement with the meanings specified:

Depreciation is a measure of the wearing out, consumption or other loss of value of a depreciable asset arising from use, passage of time or obsolescence through technology and market changes. Depreciation is allocated so as to charge a fair proportion of the depreciable amount in each accounting period during the expected useful life of the asset. Depreciation includes amortisation of assets whose useful life is predetermined.

Q9) What do you mean by Depreciation?

A9) Depreciation is a measure of the wearing out, consumption or other loss of value of a depreciable asset arising from use, passage of time or obsolescence through technology and market changes. Depreciation is allocated so as to charge a fair proportion of the depreciable amount in each accounting period during the expected useful life of the asset. Depreciation includes amortisation of assets whose useful life is predetermined.

Q10) Why the double-declining-balance method is used?

A10) The double-declining-balance method is used to calculate an asset accelerated rate of depreciation against its non-depreciated balance during earlier years of assets useful life. When using the double-declining-balance method, the salvage value is not considered in determining the annual depreciation, but the book value of the asset being depreciated is never brought below its salvage value, regardless of the method used. Depreciation ceases when either the salvage value or the end of the asset's useful life is reached.

Q11) What are the accounting Entries under Straight Line and Reducing Balance Methods?

A11) There are two alternative approaches for recording accounting entries for depreciation.

First Alternative

A provision for depreciation account is opened to accumulate the balance of depreciation and the assets are carried at historical cost.

Accounting entry

Profit and Loss Account Dr.

To Provision for Depreciation Account

Second Alternative:

Amount of Depreciation is credited to the Asset Account every year and the Asset Account is carried at historical cost less depreciation.

Accounting entries:

Depreciation Account Dr.

To Asset Account Profit and Loss Account Dr.

To Depreciation Account

Q12) How depreciation method selected should be applied consistently from period to period?

A12) The depreciation method selected should be applied consistently from period to period. A change from one method of providing depreciation to another should be made only if the adoption of the new method is required by statute or for compliance with an accounting standard or if it is considered that the change would result in a more appropriate preparation or presentation of the financial statements of the enterprise. When such a change in the method of depreciation is made, depreciation should be recalculated in accordance with the new method from the date of the asset coming into use. The deficiency or surplus arising from retrospective recomputation of depreciation in accordance with the new method should be adjusted in the accounts in the year in which the method of depreciation is changed. In case the change in the method results in deficiency in depreciation in respect of past years, the deficiency should be charged in the statement of profit and loss. In case the change in the method results in surplus, the surplus should be credited to the statement of profit and loss. Such a change should be treated as a change in accounting policy and its effect should be quantified and disclosed.

Q13) What happens in case the depreciable assets are revalued?

A13) In case the depreciable assets are revalued, the provision for depreciation is based on the revalued amount on the estimate of the remaining useful life of such assets. In case the revaluation has a material effect on the amount of depreciation, the same is disclosed separately in the year in which revaluation is carried out.

Q14) What are disposal of depreciable assets-change of method?

A14) The depreciation methods used, the total depreciation for the period for each class of assets, the gross amount of each class of depreciable assets and the related accumulated depreciation are disclosed in the financial statements along with the disclosure of other accounting policies. The depreciation rates or the useful lives of the assets are disclosed only if they are different from the principal rates specified in the statute governing the enterprise.

In case the depreciable assets are revalued, the provision for depreciation is based on the revalued amount on the estimate of the remaining useful life of such assets. In case the revaluation has a material effect on the amount of depreciation, the same is disclosed separately in the year in which revaluation is carried out.

A change in the method of depreciation is treated as a change in an accounting policy and is disclosed accordingly.

The depreciable amount of a depreciable asset should be allocated on a systematic basis to each accounting period during the useful life of the asset.

The depreciation method selected should be applied consistently from period to period. A change from one method of providing depreciation to another should be made only if the adoption of the new method is required by statute or for compliance with an accounting standard or if it is considered that the change would result in a more appropriate preparation or presentation of the financial statements of the enterprise. When such a change in the method of depreciation is made, depreciation should be recalculated in accordance with the new method from the date of the asset coming into use. The deficiency or surplus arising from retrospective recomputation of depreciation in accordance with the new method should be adjusted in the accounts in the year in which the method of depreciation is changed. In case the change in the method results in deficiency in depreciation in respect of past years, the deficiency should be charged in the statement of profit and loss. In case the change in the method results in surplus, the surplus should be credited to the statement of profit and loss. Such a change should be treated as a change in accounting policy and its effect should be quantified and disclosed.

Q15) What are the salient features of accounting standard AS 6 ICAI?

A15) Depreciation Accounting deals with depreciation accounting and applies to all depreciable assets, except the following items to which special considerations apply:

(i) forests, plantations and similar regenerative natural resources;

(ii) wasting assets including expenditure on the exploration for and extraction of minerals, oils, natural gas and similar non-regenerative resources;

(iii) expenditure on research and development;

(iv) goodwill;

(v) live stock.

This statement also does not apply to land unless it has a limited useful life for the enterprise.

Different accounting policies for depreciation are adopted by different enterprises. Disclosure of accounting policies for depreciation followed by an enterprise is necessary to appreciate the view presented in the financial statements of the enterprise.

The following terms are used in this Statement with the meanings specified:

Depreciation is a measure of the wearing out, consumption or other loss of value of a depreciable asset arising from use, passage of time or obsolescence through technology and market changes. Depreciation is allocated so as to charge a fair proportion of the depreciable amount in each accounting period during the expected useful life of the asset. Depreciation includes amortisation of assets whose useful life is predetermined.

Depreciable assets are assets which

(i) are expected to be used during more than one accounting period; and

(ii) have a limited useful life; and

(iii) are held by an enterprise for use in the production or supply of goods and services, for rental to others, or for administrative purposes and not for the purpose of sale in the ordinary course of business.

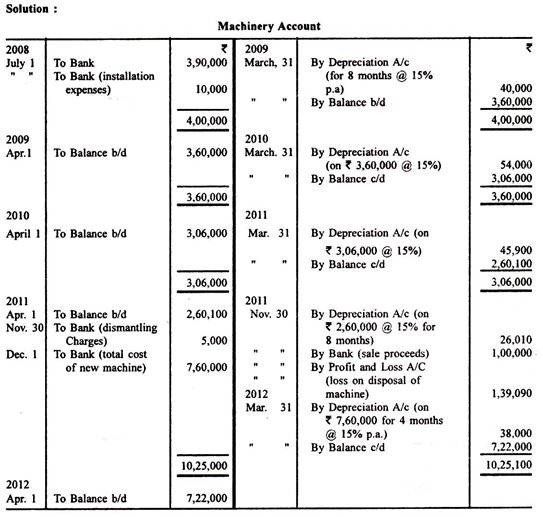

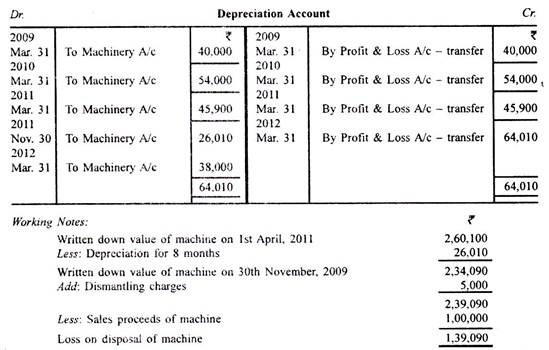

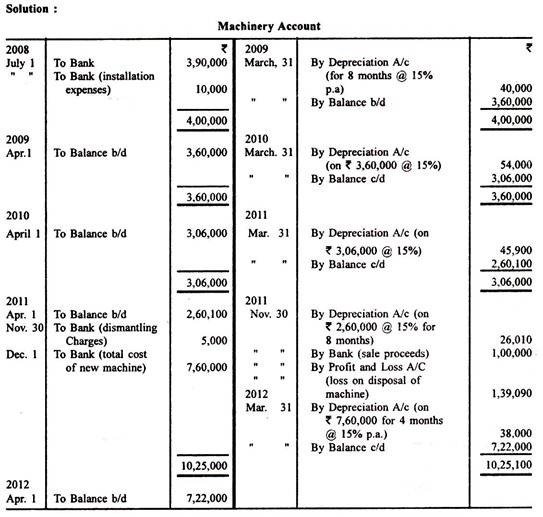

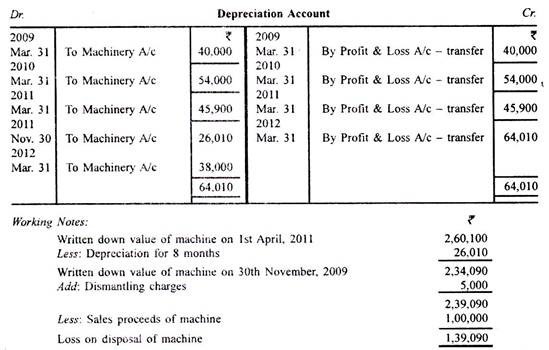

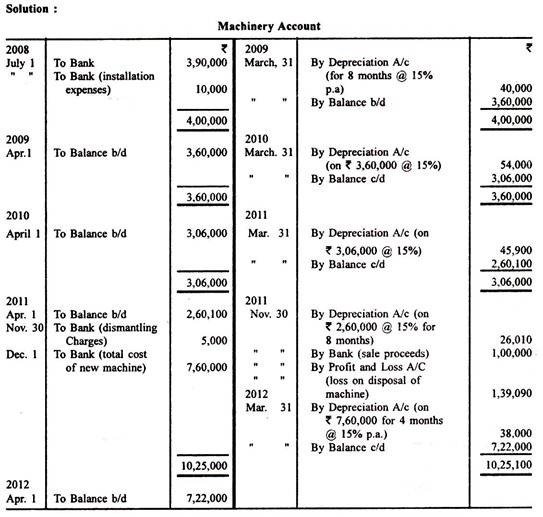

Q16) On 1st July, 2008 a company purchased a machine for Rs 3,90,000 and spent Rs 10,000 on its installation. It decided to provide depreciation @ 15% per annum, using written down value method. On 30th November, 2011 the machine was dismantled at a cost of Rs 5,000 and then sold for Rs 1,00,000.

On 1st December, 2011 the company acquired and put into operation a new machine at a total cost of Rs 7,60,000. Depreciation was provided on the new machine on the same basis as had been used in the case of the earlier machine. The company closes its books of account every year on 31st March.

Prepare Machinery Account and Depreciation Account for four accounting years ended 31st March. 2012:

A16)

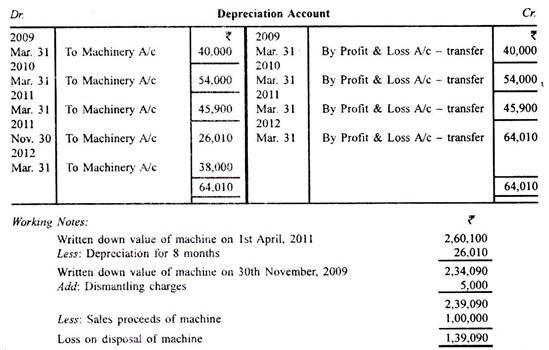

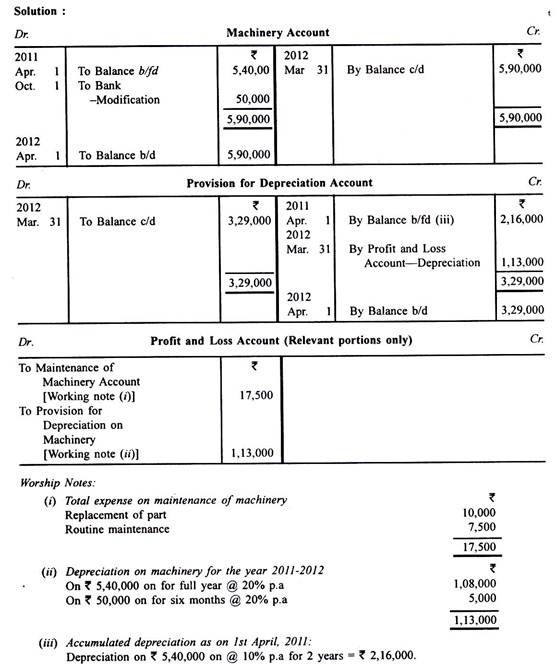

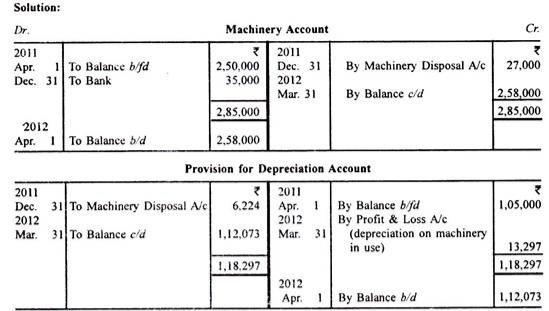

Q17) The cost of machinery in use with a firm on 1st April, 2011 was Rs 2,50,000 against which the depreciation provision stood at Rs 1,05,000 on that date; the firm provided depreciation at 10% of the diminishing value.

On 31st December, 2011 two machines costing Rs 15,000 and Rs 12,000 respectively, both purchased on 1st October, 2008, had to be discarded because of damage and had to be replaced by two new machines costing Rs 20,000 and Rs 15,000 respectively.

One of the discarded machines was sold for Rs 8,000; against the other it was expected that Rs 3,000 would be realisable.

Show the relevant accounts in the ledger on the firm for the year ended 31st March, 2012.

A17)

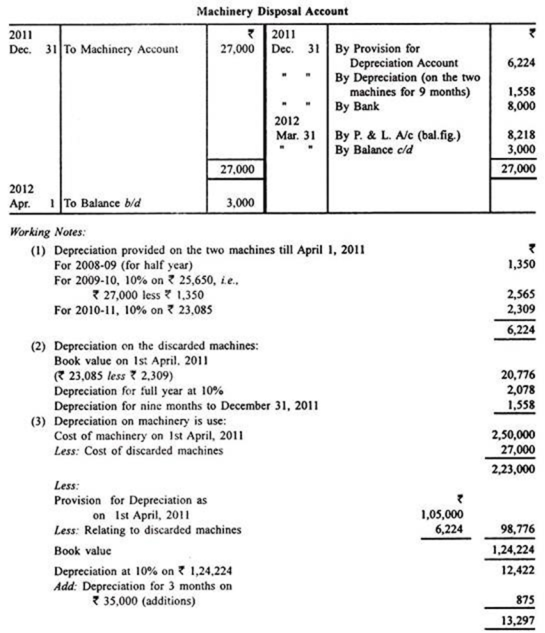

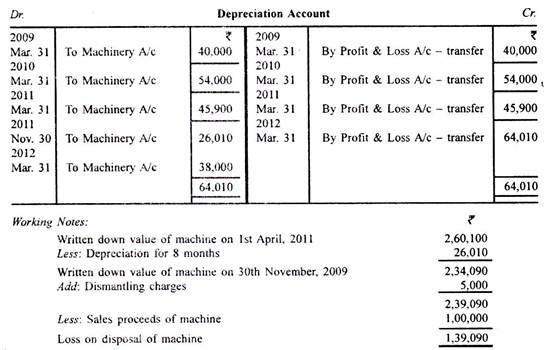

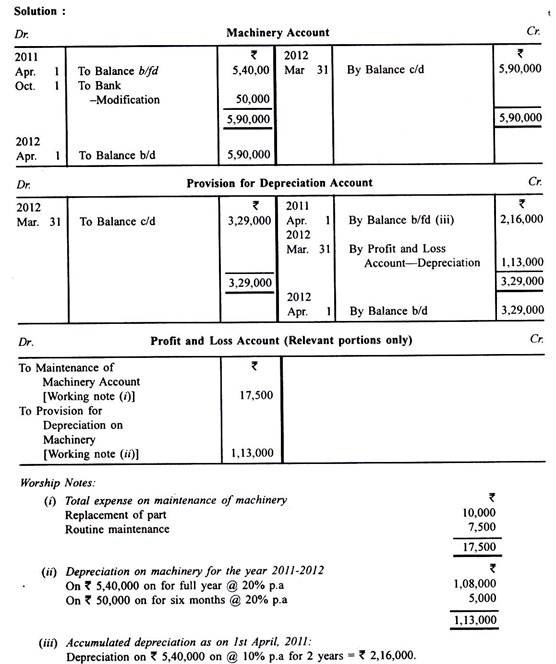

Q18) Metropol Ltd. Acquired a machine for Rs 5,40,000 on 1st April 2009. Depreciation was to be charged at 20% per annum on straight line method.

On 1st October, 2011 a modification was made to improve its technical efficiency at a cost of Rs 50,000 which it was considered would also extend the useful life of the machine by two years. At the same time, an important component of the machine was replaced at a cost of Rs 10,000 because of excessive wear and tear.

Routine maintenance during the accounting year ending 31st, March, 2012 cost Rs 7,500.

Show for the year ending 31st, March 2012:

(i) Machinery Account

(ii) Provision for depreciation account, and

(iii) Relevant portions of profit and loss account showing revenue charge relating to machinery.

A18)

Q19) For what purpose, a firm requires fixed assets?

A19) A firm requires fixed assets such as plant and machinery, building and furniture etc for its necessity which is purchased and it is recorded in the books of account at its original cost. A fixed asset is used to earn revenue for a number of accounting period in future with the same cost until the asset is sold or discarded.

Q20) What is Straight line depreciation?

A20) Straight-line depreciation is the simplest and most often used method. The straight-line depreciation is calculated by dividing the difference between assets cost and its expected salvage value by the number of years for its expected useful life. (The salvage value may be zero, or even negative due to costs required to retire it; however, for depreciation purposes salvage value is not generally calculated at below zero.) The company will then charge the same amount to depreciation each year over that period, until the value shown for the asset has reduced from the original cost to the salvage value.

Unit 3

Depreciation

Q1) What is the nature of Depreciation?

A1) Depreciation is a measure of the wearing out, consumption or other loss of value of a depreciable asset arising from use, passage of time or obsolescence through technology and market changes. Depreciation is allocated so as to charge a fair proportion of the depreciable amount in each accounting period during the expected useful life of the asset. Depreciation includes amortisation of assets whose useful life is predetermined.

Depreciation has been defined as 'the diminution in the utility or value of an asset, due to natural wear and tear, exhaustion of the subject-matter, effluxion of time accident, obsolescence or similar causes'. The words "accident", "obsolescence" and the phrase "effluxion of time" included in the definition, signify that when an asset held by a business cannot be employed for even one of the purposes for which it was acquired due to some damage suffered, the assets having become out of date or due to no occasion having arisen for it to be used, the loss caused to the business will be depreciation.

Q2) Give the accounting concept of depreciation.

A2) A firm requires fixed assets such as plant and machinery, building and furniture etc for its necessity which is purchased and it is recorded in the books of account at its original cost. A fixed asset is used to earn revenue for a number of accounting period in future with the same cost until the asset is sold or discarded.

Therefore, it is necessary that a part of the original cost of the fixed asset will be treated as an expense in each accounting year. A part of the original cost which will be treated as an expense is known as depreciation in accounting. Depreciation is an important expense for a firm which must be charged in the statement of profit and loss account before getting the net profit for that particular year.

The cost incurred of a fixed asset which is in the form of depreciation should be matched against the revenues which is earned from the use of an asset. In accounting, depreciation means distribution of the cost of a fixed asset for the years of its usage and charge the depreciation in statement of profit and loss account. Depreciation has no link with the market value of an asset.

Q3) What are the factors in the measurement of depreciation?

A3) The factors which affect measurement of depreciation are given below:

(i) The original cost of asset: The cost includes all cost incurred in acquiring the asset, i.e., purchase price including transportation and installation costs, if any.

(ii) The additions, if any, made to the assets during the year taking into consideration the date on which these additions were made.

(iii) The estimated useful life of the asset.

(iv) The scrap or the residual value of the asset.

(v) Obsolescence, i.e., the chance of the asset going out of fashion.

(vi) The working hours of the asset concerned.

(vii) The repairs and renewals.

(viii) The skill of the operators who handle the asset.

(ix) The legal provisions or other restrictions relating to depreciation.

Q4) Explain the Straight-line method of depreciation.

A4) Straight-line depreciation is the simplest and most often used method. The straight-line depreciation is calculated by dividing the difference between assets cost and its expected salvage value by the number of years for its expected useful life. (The salvage value may be zero, or even negative due to costs required to retire it; however, for depreciation purposes salvage value is not generally calculated at below zero.) The company will then charge the same amount to depreciation each year over that period, until the value shown for the asset has reduced from the original cost to the salvage value.

Straight-line method:

DE=(Cost-SL)/UL

For example, a vehicle that depreciates over 5 years is purchased at a cost of $17,000, and will have a salvage value of $2000. Then this vehicle will depreciate at $3,000 per year, i.e. (17-2)/5 = 3. This table illustrates the straight-line method of depreciation. Book value at the beginning of the first year of depreciation is the original cost of the asset. At any time, book value equals original cost minus accumulated depreciation.

Book value = original cost − accumulated depreciation Book value at the end of year becomes book value at the beginning of next year. The asset is depreciated until the book value equals scrap value.

Depreciation | Accumulated depreciation | Book value |

|

| (Original cost) $17,000 |

$3,000 | $3,000 | $14,000 |

3,000 | 6,000 | 11,000 |

3,000 | 9,000 | 8,000 |

3,000 | 12,000 | 5,000 |

3,000 | 15,000 | (Scrap value) 2,000 |

If the vehicle were to be sold and the sales price exceeded the depreciated value (net book value) then the excess would be considered a gain and subject to depreciation recapture. In addition, this gain above the depreciated value would be recognized as ordinary income by the tax office. If the sales price is ever less than the book value, the resulting capital loss is tax-deductible. If the sale price were ever more than the original book value, then the gain above the original book value is recognized as a capital gain.

If a company chooses to depreciate an asset at a different rate from that used by the tax office, then this generates a timing difference in the income statement due to the difference (at a point in time) between the taxation department's and company's view of the profit.

Q5) Explain the Diminishing balance method.

A5)

Depreciation | Depreciation | Accumulated | Book value at |

|

|

| Original cost $1,000.00 |

40% | 400.00 | 400.00 | 600.00 |

40% | 240.00 | 640.00 | 360.00 |

40% | 144.00 | 784.00 | 216.00 |

40% | 86.40 | 870.40 | 129.60 |

129.60 - 100.00 | 29.60 | 900.00 | Scrap value 100.00 |

The double-declining-balance method is used to calculate an assets accelerated rate of depreciation against its non-depreciated balance during earlier years of assets useful life. When using the double-declining-balance method, the salvage value is not considered in determining the annual depreciation, but the book value of the asset being depreciated is never brought below its salvage value, regardless of the method used. Depreciation ceases when either the salvage value or the end of the asset's useful life is reached.

Since double-declining-balance depreciation does not always depreciate an asset fully by its end of life, some methods also compute a straight-line depreciation each year, and apply the greater of the two. This has the effect of converting from declining-balance depreciation to straight-line depreciation at a midpoint in the asset's life. The double-declining-balance method is also a better representation of how vehicles depreciate and can more accurately match cost with benefit from asset use. The company in the future may want to allocate as little depreciation expenses as possible to help with additional expenses.

Accounting Entries under Straight Line and Reducing Balance Methods:

There are two alternative approaches for recording accounting entries for depreciation.

First Alternative

A provision for depreciation account is opened to accumulate the balance of depreciation and the assets are carried at historical cost.

Accounting entry

Profit and Loss Account Dr.

To Provision for Depreciation Account

Second Alternative:

Amount of Depreciation is credited to the Asset Account every year and the Asset Account is carried at historical cost less depreciation.

Accounting entries:

Depreciation Account Dr.

To Asset Account Profit and Loss Account Dr.

To Depreciation Account

Q6) In which sector depreciation accounting deals with?

A6) Depreciation Accounting deals with depreciation accounting and applies to all depreciable assets, except the following items to which special considerations apply:

(i) forests, plantations and similar regenerative natural resources;

(ii) wasting assets including expenditure on the exploration for and extraction of minerals, oils, natural gas and similar non-regenerative resources;

(iii) expenditure on research and development;

(iv) goodwill;

(v) live stock.

This statement also does not apply to land unless it has a limited useful life for the enterprise.

Q7) What are depreciable assets?

A7) Depreciable assets are assets which

(i) are expected to be used during more than one accounting period; and

(ii) have a limited useful life; and

(iii) are held by an enterprise for use in the production or supply of goods and services, for rental to others, or for administrative purposes and not for the purpose of sale in the ordinary course of business.

Q8) Different accounting policies for depreciation are adopted by different enterprises. Explain.

A8) Different accounting policies for depreciation are adopted by different enterprises. Disclosure of accounting policies for depreciation followed by an enterprise is necessary to appreciate the view presented in the financial statements of the enterprise.

The following terms are used in this Statement with the meanings specified:

Depreciation is a measure of the wearing out, consumption or other loss of value of a depreciable asset arising from use, passage of time or obsolescence through technology and market changes. Depreciation is allocated so as to charge a fair proportion of the depreciable amount in each accounting period during the expected useful life of the asset. Depreciation includes amortisation of assets whose useful life is predetermined.

Q9) What do you mean by Depreciation?

A9) Depreciation is a measure of the wearing out, consumption or other loss of value of a depreciable asset arising from use, passage of time or obsolescence through technology and market changes. Depreciation is allocated so as to charge a fair proportion of the depreciable amount in each accounting period during the expected useful life of the asset. Depreciation includes amortisation of assets whose useful life is predetermined.

Q10) Why the double-declining-balance method is used?

A10) The double-declining-balance method is used to calculate an asset accelerated rate of depreciation against its non-depreciated balance during earlier years of assets useful life. When using the double-declining-balance method, the salvage value is not considered in determining the annual depreciation, but the book value of the asset being depreciated is never brought below its salvage value, regardless of the method used. Depreciation ceases when either the salvage value or the end of the asset's useful life is reached.

Q11) What are the accounting Entries under Straight Line and Reducing Balance Methods?

A11) There are two alternative approaches for recording accounting entries for depreciation.

First Alternative

A provision for depreciation account is opened to accumulate the balance of depreciation and the assets are carried at historical cost.

Accounting entry

Profit and Loss Account Dr.

To Provision for Depreciation Account

Second Alternative:

Amount of Depreciation is credited to the Asset Account every year and the Asset Account is carried at historical cost less depreciation.

Accounting entries:

Depreciation Account Dr.

To Asset Account Profit and Loss Account Dr.

To Depreciation Account

Q12) How depreciation method selected should be applied consistently from period to period?

A12) The depreciation method selected should be applied consistently from period to period. A change from one method of providing depreciation to another should be made only if the adoption of the new method is required by statute or for compliance with an accounting standard or if it is considered that the change would result in a more appropriate preparation or presentation of the financial statements of the enterprise. When such a change in the method of depreciation is made, depreciation should be recalculated in accordance with the new method from the date of the asset coming into use. The deficiency or surplus arising from retrospective recomputation of depreciation in accordance with the new method should be adjusted in the accounts in the year in which the method of depreciation is changed. In case the change in the method results in deficiency in depreciation in respect of past years, the deficiency should be charged in the statement of profit and loss. In case the change in the method results in surplus, the surplus should be credited to the statement of profit and loss. Such a change should be treated as a change in accounting policy and its effect should be quantified and disclosed.

Q13) What happens in case the depreciable assets are revalued?

A13) In case the depreciable assets are revalued, the provision for depreciation is based on the revalued amount on the estimate of the remaining useful life of such assets. In case the revaluation has a material effect on the amount of depreciation, the same is disclosed separately in the year in which revaluation is carried out.

Q14) What are disposal of depreciable assets-change of method?

A14) The depreciation methods used, the total depreciation for the period for each class of assets, the gross amount of each class of depreciable assets and the related accumulated depreciation are disclosed in the financial statements along with the disclosure of other accounting policies. The depreciation rates or the useful lives of the assets are disclosed only if they are different from the principal rates specified in the statute governing the enterprise.

In case the depreciable assets are revalued, the provision for depreciation is based on the revalued amount on the estimate of the remaining useful life of such assets. In case the revaluation has a material effect on the amount of depreciation, the same is disclosed separately in the year in which revaluation is carried out.

A change in the method of depreciation is treated as a change in an accounting policy and is disclosed accordingly.

The depreciable amount of a depreciable asset should be allocated on a systematic basis to each accounting period during the useful life of the asset.

The depreciation method selected should be applied consistently from period to period. A change from one method of providing depreciation to another should be made only if the adoption of the new method is required by statute or for compliance with an accounting standard or if it is considered that the change would result in a more appropriate preparation or presentation of the financial statements of the enterprise. When such a change in the method of depreciation is made, depreciation should be recalculated in accordance with the new method from the date of the asset coming into use. The deficiency or surplus arising from retrospective recomputation of depreciation in accordance with the new method should be adjusted in the accounts in the year in which the method of depreciation is changed. In case the change in the method results in deficiency in depreciation in respect of past years, the deficiency should be charged in the statement of profit and loss. In case the change in the method results in surplus, the surplus should be credited to the statement of profit and loss. Such a change should be treated as a change in accounting policy and its effect should be quantified and disclosed.

Q15) What are the salient features of accounting standard AS 6 ICAI?

A15) Depreciation Accounting deals with depreciation accounting and applies to all depreciable assets, except the following items to which special considerations apply:

(i) forests, plantations and similar regenerative natural resources;

(ii) wasting assets including expenditure on the exploration for and extraction of minerals, oils, natural gas and similar non-regenerative resources;

(iii) expenditure on research and development;

(iv) goodwill;

(v) live stock.

This statement also does not apply to land unless it has a limited useful life for the enterprise.

Different accounting policies for depreciation are adopted by different enterprises. Disclosure of accounting policies for depreciation followed by an enterprise is necessary to appreciate the view presented in the financial statements of the enterprise.

The following terms are used in this Statement with the meanings specified:

Depreciation is a measure of the wearing out, consumption or other loss of value of a depreciable asset arising from use, passage of time or obsolescence through technology and market changes. Depreciation is allocated so as to charge a fair proportion of the depreciable amount in each accounting period during the expected useful life of the asset. Depreciation includes amortisation of assets whose useful life is predetermined.

Depreciable assets are assets which

(i) are expected to be used during more than one accounting period; and

(ii) have a limited useful life; and

(iii) are held by an enterprise for use in the production or supply of goods and services, for rental to others, or for administrative purposes and not for the purpose of sale in the ordinary course of business.

Q16) On 1st July, 2008 a company purchased a machine for Rs 3,90,000 and spent Rs 10,000 on its installation. It decided to provide depreciation @ 15% per annum, using written down value method. On 30th November, 2011 the machine was dismantled at a cost of Rs 5,000 and then sold for Rs 1,00,000.

On 1st December, 2011 the company acquired and put into operation a new machine at a total cost of Rs 7,60,000. Depreciation was provided on the new machine on the same basis as had been used in the case of the earlier machine. The company closes its books of account every year on 31st March.

Prepare Machinery Account and Depreciation Account for four accounting years ended 31st March. 2012:

A16)

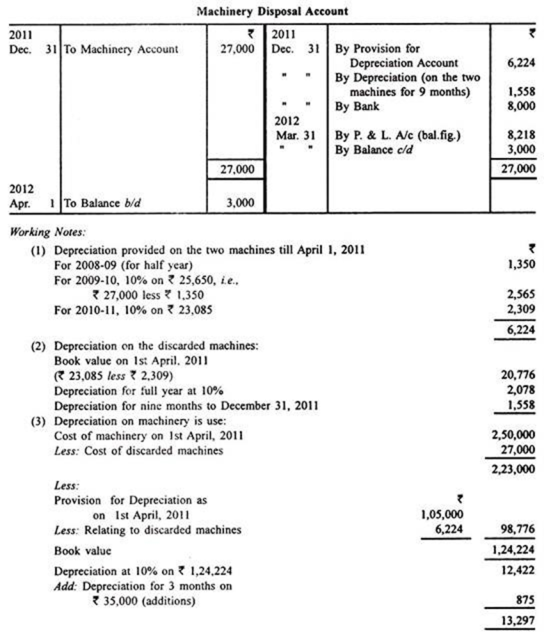

Q17) The cost of machinery in use with a firm on 1st April, 2011 was Rs 2,50,000 against which the depreciation provision stood at Rs 1,05,000 on that date; the firm provided depreciation at 10% of the diminishing value.

On 31st December, 2011 two machines costing Rs 15,000 and Rs 12,000 respectively, both purchased on 1st October, 2008, had to be discarded because of damage and had to be replaced by two new machines costing Rs 20,000 and Rs 15,000 respectively.

One of the discarded machines was sold for Rs 8,000; against the other it was expected that Rs 3,000 would be realisable.

Show the relevant accounts in the ledger on the firm for the year ended 31st March, 2012.

A17)

Q18) Metropol Ltd. Acquired a machine for Rs 5,40,000 on 1st April 2009. Depreciation was to be charged at 20% per annum on straight line method.

On 1st October, 2011 a modification was made to improve its technical efficiency at a cost of Rs 50,000 which it was considered would also extend the useful life of the machine by two years. At the same time, an important component of the machine was replaced at a cost of Rs 10,000 because of excessive wear and tear.

Routine maintenance during the accounting year ending 31st, March, 2012 cost Rs 7,500.

Show for the year ending 31st, March 2012:

(i) Machinery Account

(ii) Provision for depreciation account, and

(iii) Relevant portions of profit and loss account showing revenue charge relating to machinery.

A18)

Q19) For what purpose, a firm requires fixed assets?

A19) A firm requires fixed assets such as plant and machinery, building and furniture etc for its necessity which is purchased and it is recorded in the books of account at its original cost. A fixed asset is used to earn revenue for a number of accounting period in future with the same cost until the asset is sold or discarded.

Q20) What is Straight line depreciation?

A20) Straight-line depreciation is the simplest and most often used method. The straight-line depreciation is calculated by dividing the difference between assets cost and its expected salvage value by the number of years for its expected useful life. (The salvage value may be zero, or even negative due to costs required to retire it; however, for depreciation purposes salvage value is not generally calculated at below zero.) The company will then charge the same amount to depreciation each year over that period, until the value shown for the asset has reduced from the original cost to the salvage value.

Unit 3

Depreciation

Q1) What is the nature of Depreciation?

A1) Depreciation is a measure of the wearing out, consumption or other loss of value of a depreciable asset arising from use, passage of time or obsolescence through technology and market changes. Depreciation is allocated so as to charge a fair proportion of the depreciable amount in each accounting period during the expected useful life of the asset. Depreciation includes amortisation of assets whose useful life is predetermined.

Depreciation has been defined as 'the diminution in the utility or value of an asset, due to natural wear and tear, exhaustion of the subject-matter, effluxion of time accident, obsolescence or similar causes'. The words "accident", "obsolescence" and the phrase "effluxion of time" included in the definition, signify that when an asset held by a business cannot be employed for even one of the purposes for which it was acquired due to some damage suffered, the assets having become out of date or due to no occasion having arisen for it to be used, the loss caused to the business will be depreciation.

Q2) Give the accounting concept of depreciation.

A2) A firm requires fixed assets such as plant and machinery, building and furniture etc for its necessity which is purchased and it is recorded in the books of account at its original cost. A fixed asset is used to earn revenue for a number of accounting period in future with the same cost until the asset is sold or discarded.

Therefore, it is necessary that a part of the original cost of the fixed asset will be treated as an expense in each accounting year. A part of the original cost which will be treated as an expense is known as depreciation in accounting. Depreciation is an important expense for a firm which must be charged in the statement of profit and loss account before getting the net profit for that particular year.

The cost incurred of a fixed asset which is in the form of depreciation should be matched against the revenues which is earned from the use of an asset. In accounting, depreciation means distribution of the cost of a fixed asset for the years of its usage and charge the depreciation in statement of profit and loss account. Depreciation has no link with the market value of an asset.

Q3) What are the factors in the measurement of depreciation?

A3) The factors which affect measurement of depreciation are given below:

(i) The original cost of asset: The cost includes all cost incurred in acquiring the asset, i.e., purchase price including transportation and installation costs, if any.

(ii) The additions, if any, made to the assets during the year taking into consideration the date on which these additions were made.

(iii) The estimated useful life of the asset.

(iv) The scrap or the residual value of the asset.

(v) Obsolescence, i.e., the chance of the asset going out of fashion.

(vi) The working hours of the asset concerned.

(vii) The repairs and renewals.

(viii) The skill of the operators who handle the asset.

(ix) The legal provisions or other restrictions relating to depreciation.

Q4) Explain the Straight-line method of depreciation.

A4) Straight-line depreciation is the simplest and most often used method. The straight-line depreciation is calculated by dividing the difference between assets cost and its expected salvage value by the number of years for its expected useful life. (The salvage value may be zero, or even negative due to costs required to retire it; however, for depreciation purposes salvage value is not generally calculated at below zero.) The company will then charge the same amount to depreciation each year over that period, until the value shown for the asset has reduced from the original cost to the salvage value.

Straight-line method:

DE=(Cost-SL)/UL

For example, a vehicle that depreciates over 5 years is purchased at a cost of $17,000, and will have a salvage value of $2000. Then this vehicle will depreciate at $3,000 per year, i.e. (17-2)/5 = 3. This table illustrates the straight-line method of depreciation. Book value at the beginning of the first year of depreciation is the original cost of the asset. At any time, book value equals original cost minus accumulated depreciation.

Book value = original cost − accumulated depreciation Book value at the end of year becomes book value at the beginning of next year. The asset is depreciated until the book value equals scrap value.

Depreciation | Accumulated depreciation | Book value |

|

| (Original cost) $17,000 |

$3,000 | $3,000 | $14,000 |

3,000 | 6,000 | 11,000 |

3,000 | 9,000 | 8,000 |

3,000 | 12,000 | 5,000 |

3,000 | 15,000 | (Scrap value) 2,000 |

If the vehicle were to be sold and the sales price exceeded the depreciated value (net book value) then the excess would be considered a gain and subject to depreciation recapture. In addition, this gain above the depreciated value would be recognized as ordinary income by the tax office. If the sales price is ever less than the book value, the resulting capital loss is tax-deductible. If the sale price were ever more than the original book value, then the gain above the original book value is recognized as a capital gain.

If a company chooses to depreciate an asset at a different rate from that used by the tax office, then this generates a timing difference in the income statement due to the difference (at a point in time) between the taxation department's and company's view of the profit.

Q5) Explain the Diminishing balance method.

A5)

Depreciation | Depreciation | Accumulated | Book value at |

|

|

| Original cost $1,000.00 |

40% | 400.00 | 400.00 | 600.00 |

40% | 240.00 | 640.00 | 360.00 |

40% | 144.00 | 784.00 | 216.00 |

40% | 86.40 | 870.40 | 129.60 |

129.60 - 100.00 | 29.60 | 900.00 | Scrap value 100.00 |

The double-declining-balance method is used to calculate an assets accelerated rate of depreciation against its non-depreciated balance during earlier years of assets useful life. When using the double-declining-balance method, the salvage value is not considered in determining the annual depreciation, but the book value of the asset being depreciated is never brought below its salvage value, regardless of the method used. Depreciation ceases when either the salvage value or the end of the asset's useful life is reached.

Since double-declining-balance depreciation does not always depreciate an asset fully by its end of life, some methods also compute a straight-line depreciation each year, and apply the greater of the two. This has the effect of converting from declining-balance depreciation to straight-line depreciation at a midpoint in the asset's life. The double-declining-balance method is also a better representation of how vehicles depreciate and can more accurately match cost with benefit from asset use. The company in the future may want to allocate as little depreciation expenses as possible to help with additional expenses.

Accounting Entries under Straight Line and Reducing Balance Methods:

There are two alternative approaches for recording accounting entries for depreciation.

First Alternative

A provision for depreciation account is opened to accumulate the balance of depreciation and the assets are carried at historical cost.

Accounting entry

Profit and Loss Account Dr.

To Provision for Depreciation Account

Second Alternative:

Amount of Depreciation is credited to the Asset Account every year and the Asset Account is carried at historical cost less depreciation.

Accounting entries:

Depreciation Account Dr.

To Asset Account Profit and Loss Account Dr.

To Depreciation Account

Q6) In which sector depreciation accounting deals with?

A6) Depreciation Accounting deals with depreciation accounting and applies to all depreciable assets, except the following items to which special considerations apply:

(i) forests, plantations and similar regenerative natural resources;

(ii) wasting assets including expenditure on the exploration for and extraction of minerals, oils, natural gas and similar non-regenerative resources;

(iii) expenditure on research and development;

(iv) goodwill;

(v) live stock.

This statement also does not apply to land unless it has a limited useful life for the enterprise.

Q7) What are depreciable assets?

A7) Depreciable assets are assets which

(i) are expected to be used during more than one accounting period; and

(ii) have a limited useful life; and

(iii) are held by an enterprise for use in the production or supply of goods and services, for rental to others, or for administrative purposes and not for the purpose of sale in the ordinary course of business.

Q8) Different accounting policies for depreciation are adopted by different enterprises. Explain.

A8) Different accounting policies for depreciation are adopted by different enterprises. Disclosure of accounting policies for depreciation followed by an enterprise is necessary to appreciate the view presented in the financial statements of the enterprise.

The following terms are used in this Statement with the meanings specified:

Depreciation is a measure of the wearing out, consumption or other loss of value of a depreciable asset arising from use, passage of time or obsolescence through technology and market changes. Depreciation is allocated so as to charge a fair proportion of the depreciable amount in each accounting period during the expected useful life of the asset. Depreciation includes amortisation of assets whose useful life is predetermined.

Q9) What do you mean by Depreciation?

A9) Depreciation is a measure of the wearing out, consumption or other loss of value of a depreciable asset arising from use, passage of time or obsolescence through technology and market changes. Depreciation is allocated so as to charge a fair proportion of the depreciable amount in each accounting period during the expected useful life of the asset. Depreciation includes amortisation of assets whose useful life is predetermined.

Q10) Why the double-declining-balance method is used?

A10) The double-declining-balance method is used to calculate an asset accelerated rate of depreciation against its non-depreciated balance during earlier years of assets useful life. When using the double-declining-balance method, the salvage value is not considered in determining the annual depreciation, but the book value of the asset being depreciated is never brought below its salvage value, regardless of the method used. Depreciation ceases when either the salvage value or the end of the asset's useful life is reached.

Q11) What are the accounting Entries under Straight Line and Reducing Balance Methods?

A11) There are two alternative approaches for recording accounting entries for depreciation.

First Alternative

A provision for depreciation account is opened to accumulate the balance of depreciation and the assets are carried at historical cost.

Accounting entry

Profit and Loss Account Dr.

To Provision for Depreciation Account

Second Alternative:

Amount of Depreciation is credited to the Asset Account every year and the Asset Account is carried at historical cost less depreciation.

Accounting entries:

Depreciation Account Dr.

To Asset Account Profit and Loss Account Dr.

To Depreciation Account

Q12) How depreciation method selected should be applied consistently from period to period?

A12) The depreciation method selected should be applied consistently from period to period. A change from one method of providing depreciation to another should be made only if the adoption of the new method is required by statute or for compliance with an accounting standard or if it is considered that the change would result in a more appropriate preparation or presentation of the financial statements of the enterprise. When such a change in the method of depreciation is made, depreciation should be recalculated in accordance with the new method from the date of the asset coming into use. The deficiency or surplus arising from retrospective recomputation of depreciation in accordance with the new method should be adjusted in the accounts in the year in which the method of depreciation is changed. In case the change in the method results in deficiency in depreciation in respect of past years, the deficiency should be charged in the statement of profit and loss. In case the change in the method results in surplus, the surplus should be credited to the statement of profit and loss. Such a change should be treated as a change in accounting policy and its effect should be quantified and disclosed.

Q13) What happens in case the depreciable assets are revalued?

A13) In case the depreciable assets are revalued, the provision for depreciation is based on the revalued amount on the estimate of the remaining useful life of such assets. In case the revaluation has a material effect on the amount of depreciation, the same is disclosed separately in the year in which revaluation is carried out.

Q14) What are disposal of depreciable assets-change of method?

A14) The depreciation methods used, the total depreciation for the period for each class of assets, the gross amount of each class of depreciable assets and the related accumulated depreciation are disclosed in the financial statements along with the disclosure of other accounting policies. The depreciation rates or the useful lives of the assets are disclosed only if they are different from the principal rates specified in the statute governing the enterprise.

In case the depreciable assets are revalued, the provision for depreciation is based on the revalued amount on the estimate of the remaining useful life of such assets. In case the revaluation has a material effect on the amount of depreciation, the same is disclosed separately in the year in which revaluation is carried out.

A change in the method of depreciation is treated as a change in an accounting policy and is disclosed accordingly.

The depreciable amount of a depreciable asset should be allocated on a systematic basis to each accounting period during the useful life of the asset.

The depreciation method selected should be applied consistently from period to period. A change from one method of providing depreciation to another should be made only if the adoption of the new method is required by statute or for compliance with an accounting standard or if it is considered that the change would result in a more appropriate preparation or presentation of the financial statements of the enterprise. When such a change in the method of depreciation is made, depreciation should be recalculated in accordance with the new method from the date of the asset coming into use. The deficiency or surplus arising from retrospective recomputation of depreciation in accordance with the new method should be adjusted in the accounts in the year in which the method of depreciation is changed. In case the change in the method results in deficiency in depreciation in respect of past years, the deficiency should be charged in the statement of profit and loss. In case the change in the method results in surplus, the surplus should be credited to the statement of profit and loss. Such a change should be treated as a change in accounting policy and its effect should be quantified and disclosed.

Q15) What are the salient features of accounting standard AS 6 ICAI?

A15) Depreciation Accounting deals with depreciation accounting and applies to all depreciable assets, except the following items to which special considerations apply:

(i) forests, plantations and similar regenerative natural resources;

(ii) wasting assets including expenditure on the exploration for and extraction of minerals, oils, natural gas and similar non-regenerative resources;

(iii) expenditure on research and development;

(iv) goodwill;

(v) live stock.

This statement also does not apply to land unless it has a limited useful life for the enterprise.

Different accounting policies for depreciation are adopted by different enterprises. Disclosure of accounting policies for depreciation followed by an enterprise is necessary to appreciate the view presented in the financial statements of the enterprise.

The following terms are used in this Statement with the meanings specified:

Depreciation is a measure of the wearing out, consumption or other loss of value of a depreciable asset arising from use, passage of time or obsolescence through technology and market changes. Depreciation is allocated so as to charge a fair proportion of the depreciable amount in each accounting period during the expected useful life of the asset. Depreciation includes amortisation of assets whose useful life is predetermined.

Depreciable assets are assets which

(i) are expected to be used during more than one accounting period; and

(ii) have a limited useful life; and

(iii) are held by an enterprise for use in the production or supply of goods and services, for rental to others, or for administrative purposes and not for the purpose of sale in the ordinary course of business.

Q16) On 1st July, 2008 a company purchased a machine for Rs 3,90,000 and spent Rs 10,000 on its installation. It decided to provide depreciation @ 15% per annum, using written down value method. On 30th November, 2011 the machine was dismantled at a cost of Rs 5,000 and then sold for Rs 1,00,000.

On 1st December, 2011 the company acquired and put into operation a new machine at a total cost of Rs 7,60,000. Depreciation was provided on the new machine on the same basis as had been used in the case of the earlier machine. The company closes its books of account every year on 31st March.

Prepare Machinery Account and Depreciation Account for four accounting years ended 31st March. 2012:

A16)

Q17) The cost of machinery in use with a firm on 1st April, 2011 was Rs 2,50,000 against which the depreciation provision stood at Rs 1,05,000 on that date; the firm provided depreciation at 10% of the diminishing value.

On 31st December, 2011 two machines costing Rs 15,000 and Rs 12,000 respectively, both purchased on 1st October, 2008, had to be discarded because of damage and had to be replaced by two new machines costing Rs 20,000 and Rs 15,000 respectively.

One of the discarded machines was sold for Rs 8,000; against the other it was expected that Rs 3,000 would be realisable.

Show the relevant accounts in the ledger on the firm for the year ended 31st March, 2012.

A17)

Q18) Metropol Ltd. Acquired a machine for Rs 5,40,000 on 1st April 2009. Depreciation was to be charged at 20% per annum on straight line method.

On 1st October, 2011 a modification was made to improve its technical efficiency at a cost of Rs 50,000 which it was considered would also extend the useful life of the machine by two years. At the same time, an important component of the machine was replaced at a cost of Rs 10,000 because of excessive wear and tear.

Routine maintenance during the accounting year ending 31st, March, 2012 cost Rs 7,500.

Show for the year ending 31st, March 2012:

(i) Machinery Account

(ii) Provision for depreciation account, and

(iii) Relevant portions of profit and loss account showing revenue charge relating to machinery.

A18)

Q19) For what purpose, a firm requires fixed assets?

A19) A firm requires fixed assets such as plant and machinery, building and furniture etc for its necessity which is purchased and it is recorded in the books of account at its original cost. A fixed asset is used to earn revenue for a number of accounting period in future with the same cost until the asset is sold or discarded.

Q20) What is Straight line depreciation?

A20) Straight-line depreciation is the simplest and most often used method. The straight-line depreciation is calculated by dividing the difference between assets cost and its expected salvage value by the number of years for its expected useful life. (The salvage value may be zero, or even negative due to costs required to retire it; however, for depreciation purposes salvage value is not generally calculated at below zero.) The company will then charge the same amount to depreciation each year over that period, until the value shown for the asset has reduced from the original cost to the salvage value.

Unit 3

Depreciation

Q1) What is the nature of Depreciation?

A1) Depreciation is a measure of the wearing out, consumption or other loss of value of a depreciable asset arising from use, passage of time or obsolescence through technology and market changes. Depreciation is allocated so as to charge a fair proportion of the depreciable amount in each accounting period during the expected useful life of the asset. Depreciation includes amortisation of assets whose useful life is predetermined.

Depreciation has been defined as 'the diminution in the utility or value of an asset, due to natural wear and tear, exhaustion of the subject-matter, effluxion of time accident, obsolescence or similar causes'. The words "accident", "obsolescence" and the phrase "effluxion of time" included in the definition, signify that when an asset held by a business cannot be employed for even one of the purposes for which it was acquired due to some damage suffered, the assets having become out of date or due to no occasion having arisen for it to be used, the loss caused to the business will be depreciation.

Q2) Give the accounting concept of depreciation.

A2) A firm requires fixed assets such as plant and machinery, building and furniture etc for its necessity which is purchased and it is recorded in the books of account at its original cost. A fixed asset is used to earn revenue for a number of accounting period in future with the same cost until the asset is sold or discarded.

Therefore, it is necessary that a part of the original cost of the fixed asset will be treated as an expense in each accounting year. A part of the original cost which will be treated as an expense is known as depreciation in accounting. Depreciation is an important expense for a firm which must be charged in the statement of profit and loss account before getting the net profit for that particular year.

The cost incurred of a fixed asset which is in the form of depreciation should be matched against the revenues which is earned from the use of an asset. In accounting, depreciation means distribution of the cost of a fixed asset for the years of its usage and charge the depreciation in statement of profit and loss account. Depreciation has no link with the market value of an asset.

Q3) What are the factors in the measurement of depreciation?

A3) The factors which affect measurement of depreciation are given below:

(i) The original cost of asset: The cost includes all cost incurred in acquiring the asset, i.e., purchase price including transportation and installation costs, if any.

(ii) The additions, if any, made to the assets during the year taking into consideration the date on which these additions were made.

(iii) The estimated useful life of the asset.

(iv) The scrap or the residual value of the asset.

(v) Obsolescence, i.e., the chance of the asset going out of fashion.

(vi) The working hours of the asset concerned.

(vii) The repairs and renewals.

(viii) The skill of the operators who handle the asset.

(ix) The legal provisions or other restrictions relating to depreciation.

Q4) Explain the Straight-line method of depreciation.

A4) Straight-line depreciation is the simplest and most often used method. The straight-line depreciation is calculated by dividing the difference between assets cost and its expected salvage value by the number of years for its expected useful life. (The salvage value may be zero, or even negative due to costs required to retire it; however, for depreciation purposes salvage value is not generally calculated at below zero.) The company will then charge the same amount to depreciation each year over that period, until the value shown for the asset has reduced from the original cost to the salvage value.

Straight-line method:

DE=(Cost-SL)/UL

For example, a vehicle that depreciates over 5 years is purchased at a cost of $17,000, and will have a salvage value of $2000. Then this vehicle will depreciate at $3,000 per year, i.e. (17-2)/5 = 3. This table illustrates the straight-line method of depreciation. Book value at the beginning of the first year of depreciation is the original cost of the asset. At any time, book value equals original cost minus accumulated depreciation.

Book value = original cost − accumulated depreciation Book value at the end of year becomes book value at the beginning of next year. The asset is depreciated until the book value equals scrap value.

Depreciation | Accumulated depreciation | Book value |

|

| (Original cost) $17,000 |

$3,000 | $3,000 | $14,000 |

3,000 | 6,000 | 11,000 |

3,000 | 9,000 | 8,000 |

3,000 | 12,000 | 5,000 |

3,000 | 15,000 | (Scrap value) 2,000 |

If the vehicle were to be sold and the sales price exceeded the depreciated value (net book value) then the excess would be considered a gain and subject to depreciation recapture. In addition, this gain above the depreciated value would be recognized as ordinary income by the tax office. If the sales price is ever less than the book value, the resulting capital loss is tax-deductible. If the sale price were ever more than the original book value, then the gain above the original book value is recognized as a capital gain.

If a company chooses to depreciate an asset at a different rate from that used by the tax office, then this generates a timing difference in the income statement due to the difference (at a point in time) between the taxation department's and company's view of the profit.

Q5) Explain the Diminishing balance method.

A5)

Depreciation | Depreciation | Accumulated | Book value at |

|

|

| Original cost $1,000.00 |

40% | 400.00 | 400.00 | 600.00 |

40% | 240.00 | 640.00 | 360.00 |

40% | 144.00 | 784.00 | 216.00 |

40% | 86.40 | 870.40 | 129.60 |

129.60 - 100.00 | 29.60 | 900.00 | Scrap value 100.00 |

The double-declining-balance method is used to calculate an assets accelerated rate of depreciation against its non-depreciated balance during earlier years of assets useful life. When using the double-declining-balance method, the salvage value is not considered in determining the annual depreciation, but the book value of the asset being depreciated is never brought below its salvage value, regardless of the method used. Depreciation ceases when either the salvage value or the end of the asset's useful life is reached.

Since double-declining-balance depreciation does not always depreciate an asset fully by its end of life, some methods also compute a straight-line depreciation each year, and apply the greater of the two. This has the effect of converting from declining-balance depreciation to straight-line depreciation at a midpoint in the asset's life. The double-declining-balance method is also a better representation of how vehicles depreciate and can more accurately match cost with benefit from asset use. The company in the future may want to allocate as little depreciation expenses as possible to help with additional expenses.

Accounting Entries under Straight Line and Reducing Balance Methods:

There are two alternative approaches for recording accounting entries for depreciation.

First Alternative

A provision for depreciation account is opened to accumulate the balance of depreciation and the assets are carried at historical cost.

Accounting entry

Profit and Loss Account Dr.

To Provision for Depreciation Account

Second Alternative:

Amount of Depreciation is credited to the Asset Account every year and the Asset Account is carried at historical cost less depreciation.

Accounting entries:

Depreciation Account Dr.

To Asset Account Profit and Loss Account Dr.

To Depreciation Account

Q6) In which sector depreciation accounting deals with?

A6) Depreciation Accounting deals with depreciation accounting and applies to all depreciable assets, except the following items to which special considerations apply:

(i) forests, plantations and similar regenerative natural resources;

(ii) wasting assets including expenditure on the exploration for and extraction of minerals, oils, natural gas and similar non-regenerative resources;

(iii) expenditure on research and development;

(iv) goodwill;

(v) live stock.

This statement also does not apply to land unless it has a limited useful life for the enterprise.

Q7) What are depreciable assets?

A7) Depreciable assets are assets which

(i) are expected to be used during more than one accounting period; and

(ii) have a limited useful life; and

(iii) are held by an enterprise for use in the production or supply of goods and services, for rental to others, or for administrative purposes and not for the purpose of sale in the ordinary course of business.

Q8) Different accounting policies for depreciation are adopted by different enterprises. Explain.

A8) Different accounting policies for depreciation are adopted by different enterprises. Disclosure of accounting policies for depreciation followed by an enterprise is necessary to appreciate the view presented in the financial statements of the enterprise.

The following terms are used in this Statement with the meanings specified:

Depreciation is a measure of the wearing out, consumption or other loss of value of a depreciable asset arising from use, passage of time or obsolescence through technology and market changes. Depreciation is allocated so as to charge a fair proportion of the depreciable amount in each accounting period during the expected useful life of the asset. Depreciation includes amortisation of assets whose useful life is predetermined.

Q9) What do you mean by Depreciation?

A9) Depreciation is a measure of the wearing out, consumption or other loss of value of a depreciable asset arising from use, passage of time or obsolescence through technology and market changes. Depreciation is allocated so as to charge a fair proportion of the depreciable amount in each accounting period during the expected useful life of the asset. Depreciation includes amortisation of assets whose useful life is predetermined.

Q10) Why the double-declining-balance method is used?

A10) The double-declining-balance method is used to calculate an asset accelerated rate of depreciation against its non-depreciated balance during earlier years of assets useful life. When using the double-declining-balance method, the salvage value is not considered in determining the annual depreciation, but the book value of the asset being depreciated is never brought below its salvage value, regardless of the method used. Depreciation ceases when either the salvage value or the end of the asset's useful life is reached.

Q11) What are the accounting Entries under Straight Line and Reducing Balance Methods?

A11) There are two alternative approaches for recording accounting entries for depreciation.

First Alternative

A provision for depreciation account is opened to accumulate the balance of depreciation and the assets are carried at historical cost.

Accounting entry

Profit and Loss Account Dr.

To Provision for Depreciation Account

Second Alternative:

Amount of Depreciation is credited to the Asset Account every year and the Asset Account is carried at historical cost less depreciation.

Accounting entries:

Depreciation Account Dr.

To Asset Account Profit and Loss Account Dr.

To Depreciation Account

Q12) How depreciation method selected should be applied consistently from period to period?

A12) The depreciation method selected should be applied consistently from period to period. A change from one method of providing depreciation to another should be made only if the adoption of the new method is required by statute or for compliance with an accounting standard or if it is considered that the change would result in a more appropriate preparation or presentation of the financial statements of the enterprise. When such a change in the method of depreciation is made, depreciation should be recalculated in accordance with the new method from the date of the asset coming into use. The deficiency or surplus arising from retrospective recomputation of depreciation in accordance with the new method should be adjusted in the accounts in the year in which the method of depreciation is changed. In case the change in the method results in deficiency in depreciation in respect of past years, the deficiency should be charged in the statement of profit and loss. In case the change in the method results in surplus, the surplus should be credited to the statement of profit and loss. Such a change should be treated as a change in accounting policy and its effect should be quantified and disclosed.

Q13) What happens in case the depreciable assets are revalued?

A13) In case the depreciable assets are revalued, the provision for depreciation is based on the revalued amount on the estimate of the remaining useful life of such assets. In case the revaluation has a material effect on the amount of depreciation, the same is disclosed separately in the year in which revaluation is carried out.

Q14) What are disposal of depreciable assets-change of method?

A14) The depreciation methods used, the total depreciation for the period for each class of assets, the gross amount of each class of depreciable assets and the related accumulated depreciation are disclosed in the financial statements along with the disclosure of other accounting policies. The depreciation rates or the useful lives of the assets are disclosed only if they are different from the principal rates specified in the statute governing the enterprise.

In case the depreciable assets are revalued, the provision for depreciation is based on the revalued amount on the estimate of the remaining useful life of such assets. In case the revaluation has a material effect on the amount of depreciation, the same is disclosed separately in the year in which revaluation is carried out.

A change in the method of depreciation is treated as a change in an accounting policy and is disclosed accordingly.

The depreciable amount of a depreciable asset should be allocated on a systematic basis to each accounting period during the useful life of the asset.

The depreciation method selected should be applied consistently from period to period. A change from one method of providing depreciation to another should be made only if the adoption of the new method is required by statute or for compliance with an accounting standard or if it is considered that the change would result in a more appropriate preparation or presentation of the financial statements of the enterprise. When such a change in the method of depreciation is made, depreciation should be recalculated in accordance with the new method from the date of the asset coming into use. The deficiency or surplus arising from retrospective recomputation of depreciation in accordance with the new method should be adjusted in the accounts in the year in which the method of depreciation is changed. In case the change in the method results in deficiency in depreciation in respect of past years, the deficiency should be charged in the statement of profit and loss. In case the change in the method results in surplus, the surplus should be credited to the statement of profit and loss. Such a change should be treated as a change in accounting policy and its effect should be quantified and disclosed.

Q15) What are the salient features of accounting standard AS 6 ICAI?

A15) Depreciation Accounting deals with depreciation accounting and applies to all depreciable assets, except the following items to which special considerations apply:

(i) forests, plantations and similar regenerative natural resources;

(ii) wasting assets including expenditure on the exploration for and extraction of minerals, oils, natural gas and similar non-regenerative resources;

(iii) expenditure on research and development;

(iv) goodwill;

(v) live stock.

This statement also does not apply to land unless it has a limited useful life for the enterprise.

Different accounting policies for depreciation are adopted by different enterprises. Disclosure of accounting policies for depreciation followed by an enterprise is necessary to appreciate the view presented in the financial statements of the enterprise.

The following terms are used in this Statement with the meanings specified: