Unit II

Final Accounts

Question Bank:

Q1). What is the purpose of preparing Final Accounts?

A1). The final account is the account prepared by the Joint Stock Company at the end of the fiscal year. The purpose of creating a final account is to provide a clear picture of the financial situation of the organization to its management, owners or other users of such accounting information.

Final account preparation involves preparing a set of accounts and statements at the end of the fiscal year.

- Trading and profit and loss accounts

- Balance sheet

- Profit and loss appropriation account

- Purpose of Final Account preparation

The final account is prepared for the following purposes:

- To determine the profit and loss incurred by the company within a certain financial period

- To determine the financial status of the company

- To serve as a source of information to inform users of accounting information (owners, creditors, investors and other stakeholders) about the solvency of the company.

Trading account

The results of the purchase and sale of goods are known as the trading account. This sheet is provided to show the difference between the sales price and the cost price. It is prepared to show the trading results of the business i.e. The total profit or total loss maintained by the business. It records the direct costs of the business company.

J.R. According to Batlibboi

The trading account shows the results of buying and selling goods. When we prepare this account, the general establishment costs are not taken into account and only the trAaction of goods is included."

Profit and loss accounts

This account is prepared to check the net profit/loss and fiscal year expenses of the business during the fiscal year. It records the indirect expenses of the business company like rent, salary, and advertising expenses. Profit and loss a/C includes expenses and losses and gains and losses incurred in business other than the production of goods and services.

Balance sheet

The balance statement shows the financial status of the business at a specific date. The financial status of a business is discovered by aggregating its assets and liabilities on a specific date. The excess of assets over liabilities represents the capital sunk into the business and reflects the financial health of the enterprise.

Now it is known as a statement of the financial status of the company.

Q2). What all expenses come under the head of trading A/C?

A2). Trade and manufacturing operating companies deal with the sale and purchase of goods. Therefore, only the manufacturing and trading entities prepare the trading account. Service providers do not prepare for this.

Advantages of preparing a trading account format

- It is a very important statement from the point of view of the cost of goods. By preparing a trading account, an entity may take a decision to continue or discontinue a particular product, which helps to obtain maximum profit or reduce losses.

- With the help of a trading account, the sales tax authority can, in accordance with the sales tax declaration filed by the business,. It also helps the excise duty authorities to assess the excise duty of a business enterprise.

- The management, having in mind the market competition, determines the price of the product with the help of a trading account.

Items in trading account format

The trading account contains the following details:

- Details of raw materials, semi-finished goods and finished products, opening stock.

- Close inventory details of raw materials, semi-finished products, and finished products.

- Total purchase of goods less purchase return.

- Total sales of goods less sales return.

- All direct costs associated with the purchase or sale or manufacture of goods.

Item of income (Cr.Side)

- Less sales return than total sales of goods

- Close the stock of the product.

- Expenditure item (Doctor) side

Item of expenditure (Dr.Side)

- Opening stock

- Total purchase of goods less purchase return

- All the direct cost like carriage interior & freight cost, rent, electricity and power cost, wages for godown or factory, packing cost, etc. for workers and supervisors.

Notes

- The trial count will not be displayed on the close. But, firstly, we need to show the amount of closing shares on the income side of the trading account, and secondly, on the balance sheet under current assets.

- We value closing inventory at either lower cost or market price.

- On the day of preparation of the trading account, we value the physically available closed shares.

- However, the trading account can also be prepared in horizontal form, but the content remains the same.

Trading Account Format

Particulars | Amount | Particulars | Amount |

To opening stock | Xxx | By sales | Xxx |

To purchase | Xxx | Less: Returns | Xxx |

Less: returns | Xxx | By Closing stock | Xxx |

To direct expenses: | Xxx | By Gross loss c/d |

|

Freight & carriage | Xxx |

|

|

Custom & insurance | Xxx |

|

|

Wages | Xxx |

|

|

Gas, water & fuel | Xxx |

|

|

Factory expenses | Xxx |

|

|

Royalty on production | Xxx |

|

|

To Gross profit c/d | Xxx |

|

|

Q3). Draw the format of P/LA/C.

A3). All companies generally prepare profit and loss accounts/statements at the end of the year to gain visibility of income, revenue, expenses, and losses incurred in a certain range of periods. It is important to prepare a profit and loss statement because this information helps organizations make the right business decisions, such as where to cut costs, from where the business can generate more profit, and which parts of the business are suffering from losses.

- Profit and loss accounts / statements

- Types of profit and loss

- Gross profit/gross loss

- Profit / loss

Trading account is prepared to check gross profit/loss while profit and loss account is created to check profit and loss/net loss.

Profit and loss accounts are made to check the annual profit or loss of a business. This account only shows overhead. All items of income and expenses, whether cash or non-cash, are considered in this account.

Only revenue or expenses related to the current period are debited or credited to the profit and loss account. The profit and loss account starts with gross profit on the credit side and, if there is a total loss, appears on the debit side. Items not displayed in the profit and loss account format

Drawing: the drawing is not the company's expense. Therefore, we debit it to capital a/c, and not to profit and loss a/c.

Income tax: for a company, income tax is an expense, but for a sole proprietor, it is his personal expense. Therefore, we debit it to the capital A/C.

Discounts: as we know, discounts are of two types–trade discounts and cash discounts. We deduct the trade discount from the amount charged and therefore do not show it in the account books. On the other hand, if the customer pays the amount on a certain date, a cash discount will be possible. We view cash discounts in account books. Therefore, we debit it to the profit and loss account.

Bad debt: it is because of the customer and the amount he does not pay it. We debit this amount to profit and loss a/c in the event that preparations have already been made for a bet that is worse than it is initially written off from it. When bad loA are recovered, it is again. Now it is not credited to the account of the party, but recovered account should be credited to the bad debt and is written on the credit side of the profit and loss account

Profit and Loss Account Format

Particulars | Amount | Particulars | Amount |

To Gross loss b/d | Xxx | To Gross profit b/d | Xxx |

Management expenses: | Xxx | Income: | Xxx |

To salaries | Xxx | By Discount received | Xxx |

To office rent, rates, and taxes | Xxx | By Commission received | Xxx |

To printing and stationery | Xxx | Non-trading income: | Xxx |

To Telephone charges | Xxx | By Bank interest | Xxx |

To Insurance | Xxx | By Rent received | Xxx |

To Audit fees | Xxx | By Dividend received | Xxx |

To Legal charges | Xxx | By Bad debts recovered | Xxx |

To Electricity charges | Xxx | Abnormal gains: | Xxx |

To Maintenance expenses | Xxx | By Profit on sale of machinery | Xxx |

To Repairs and renewals | Xxx | By Profit on sale of investments | Xxx |

To Depreciation | Xxx | By Net Loss(trAferred to Capital A/c) | Xxx |

Selling distribution expenses: |

|

|

|

To Salaries | Xxx |

|

|

To Advertisement | Xxx |

|

|

To Godown | Xxx |

|

|

To Carriage outward | Xxx |

|

|

To Bad debts | Xxx |

|

|

To Provision for bad debts | Xxx |

|

|

To Selling commission | Xxx |

|

|

Financial expenses: |

|

|

|

To Bank charges | Xxx |

|

|

To Interest on loan | Xxx |

|

|

To Discount allowed | Xxx |

|

|

Abnormal losses: | Xxx |

|

|

To Loss on sale of machinery | Xxx |

|

|

To Loss on sale of investments | Xxx |

|

|

To Loss by fire | Xxx |

|

|

To Net Profit(trAferred to capital a/c) | Xxx |

|

|

TOTAL |

| TOTAL |

|

Q4). What is meant by Grouping and Marshalling of assets and liabilities? Explain the ways in which a balance sheet may be marshalled.

A4). The rationale behind preparing financial statements is to present a summarised version of all financial activities in such a manner that all users can interpret and understand the information easily, appropriately and also take decisions accordingly.

Grouping of assets and liabilities: Grouping meA showing similar assets and liabilities under a single head. For example, all assets that can be used for more than a year are clubbed together under the heading ‘fixed assets’, for example, building, furniture, machinery, etc.

Marshalling of asset and liabilities: When assets and liabilities are shown in a particular order of liquidity or permanence, they are said to be marshalled.

1. In order of liquidity: Liquidity meA convertibility into cash. Assets that can be converted into cash in least possible time, i.e., more liquid assets are recorded first, followed by the lesser liquid assets. In a balance sheet, cash in hand is recorded at first and goodwill at last. In the same way, liabilities that are to be paid first, i.e., high priority liabilities are recorded first, followed by the lower priority ones. In a balance sheet, current liabilities are recorded first and then the long term liabilities and capital at the last.

Balance Sheet of.................., as on................ | ||||||

|

|

|

|

|

|

|

Liabilities | Amount Rs | Assets | Amount Rs | |||

Current Liabilities: |

| Current Assets: |

|

| ||

Bills Payable |

| – | Cash in Hand |

| – | |

Sunday Creditors | – | Cash at Bank |

| – | ||

Bank Overdraft |

| – | Bills Receivable |

| – | |

Long Term LoA |

| – | Debtors |

| – | |

Capital: |

|

| Closing Stock |

| – | |

Opening balance | – |

| Long Term Investments |

| ||

| Add: Net Profit | – |

| Fixed Assets: |

|

|

| Less: Drawings | – | – | Furniture |

| – |

|

|

|

| Plant and Machinery | – | |

|

|

|

| Land and Building | – | |

|

|

|

| Goodwill |

| – |

|

|

| – |

|

| – |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. In order of permanence: It is just the reverse of the above method. In this, assets and liabilities are arranged in their reducing level of permanence. The assets with higher degree of permanence are recorded first, followed by the assets with lower degree of permanence. For example, goodwill, land and building have the highest degree of permanence and hence are recorded at the top, whereas, cash at bank and cash in hand are recorded at the bottom. In the same way, liabilities are shown according to their life in the business. Liabilities with higher level of permanence like, capital is recorded at the top and other liabilities with lower permanence are recorded at the bottom.

Balance Sheet of.................., as on................ | ||||||||

|

|

|

|

|

|

|

| |

Liabilities |

| Amount Rs | Assets |

| Amount Rs | |||

Capital: |

|

| Fixed assets: |

|

| |||

Opening Balance | – |

| Goodwill |

| – | |||

| Add: Net profit | – |

| Land and Building |

| – | ||

| Less: Drawings | – | – | Plant and Machinery |

| – | ||

|

|

|

| Furniture |

| – | ||

Long Term LoA |

| – | Long Term Investments |

|

| |||

Current Liabilities: |

|

| Current Assets: |

|

| |||

Bank Overdraft |

| – | Closing Stock |

| – | |||

Sunday Creditors |

| – | Debtors |

| – | |||

Bill Payable |

| – | Bills Receivable |

| – | |||

|

|

| Cash at Bank |

| – | |||

|

|

| Cash in Hand |

| – | |||

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

| |

|

|

| – |

|

|

| – | |

Q5). A merchant has earned a Net Profit of ₹ 57,200 for the year ended 31st March, 2017. Other balances in his Ledger are as under:-

Dr. Balances | (₹) | Cr. Balances | (₹) |

Cash at Bank | 4,800 | Bills Payable | 3,200 |

Cash in Hand | 1,200 | Creditors | 61,300 |

Furniture and Fixtures | 7,500 | Loan | 50,000 |

Debtors | 80,100 | Capital | 3,32,300 |

Closing Stock | 70,000 |

|

|

Motor Car | 40,000 |

|

|

Building | 1,50,000 |

|

|

Plant and Machinery | 1,20,000 |

|

|

Bills Receivable | 4,400 |

|

|

Investments | 20,000 |

|

|

Drawings | 6,000 |

|

|

Prepare his Balance Sheet as at 31st March, 2017.

A5)

Balance Sheet As on March 31, 2017 | ||||

Liabilities | Amount (Rs) | Assets | Amount (Rs) | |

Capital | 3,32,300 |

| Fixed Assets |

|

Add: Net Profit | 57,200 |

| Furniture & Fixtures | 7,500 |

Less: Drawings | 6,000 | 3,83,500 | Motor Car | 40,000 |

Loan | 50,000 | Building | 1,50,000 | |

|

| Plant & Machinery | 1,20,000 | |

Current Liabilities |

| Current Assets |

| |

Creditors | 61,300 | Closing Stock | 70,000 | |

Bills Payable | 3,200 | Debtors | 80,100 | |

|

| Bills Receivable | 4,400 | |

|

| Investments | 20,000 | |

|

| Cash at Bank | 4,800 | |

|

| Cash in Hand | 1,200 | |

| 4,98,000 |

| 4,98,000 | |

Q6). What is a balance sheet? What are its characteristics? Arrange assets in the order of permanence:

Sundry Debtors, Stock, Investment, Land and Building, Cash in Hand, Motor Vehicle, Cash at Bank, Goodwill, Plant and Machinery, Furniture, Loose Tools, Marketable Securities.

A6). Balance Sheet is a statement prepared to ascertain values of assets and liabilities of a business on a particular date. It is called Balance Sheet as it contain balances of real and personal accounts, which are not closed on a particular date.

Characteristics of Balance Sheet

1. It is a statement of assets and liabilities.

2. The total of Assets side must be equal to Liabilities sides.

3. It is prepared at a particular date.

4. It helps in ascertaining the financial position of the business.

Assets in the order of Permanence:

- Goodwill

- Land and Building

- Plant and Machinery

- Motor Vehicle

- Loose Tools

- Furniture

- Investment (Long-term)

- Stock

- Sundry Debtors

- Marketable Securities (Short-term)

- Cash at Bank

- Cash in Hand

Q7). What is the purpose of preparing trading and profit and loss account?

A7). The purposes of preparing Trading Account are:

1. To calculate gross profit earned or gross loss incurred during an accounting period

2. To estimate the cost of goods sold

3. To record direct expenses (i.e., expenses incurred on the purchases and manufacturing of goods)

4. To measure the adequacy and reasonability of direct expenses incurred by comparing purchases with direct expenses incurred

5. To compare the realised efficiency and performance with the desired or proposed targets

The purposes of preparing Profit and Loss Account are:

1. To calculate net profit or net loss

2. To ascertain net profit ratio and to compare this year’s net profit ratio with that of the desired and proposed target in order to assess the efficiency and effectiveness

3. To measure the adequacy and reasonability of indirect expenses incurred by ascertaining ratio between indirect expenses and net profit

4. To compare current year’s actual performance with desired and planned performance

5. To provide various provisions and reserves to meet unforeseen future conditions and to toughen the financial position of the business

Q8). Calculate operating profit from the following:

| ₹ |

Net Profit 5,00,000

Dividend Received 6,000

Loss on sale of Furniture 12,000

Loss by Fire 50,000

Salaries 1,20,000

Interest on Loan from Bank 10,000

Rent Received 24,000

Donation 5,100

A8). Operating Profit = Net Profit − Non-Operating Income + Non-Operating ExpensesNon-Operating Income = Dividend Received + Rent Received

= 6,000 + 24,000 = 30,000Non-Operating Expenses = Loss on Sale of Furniture + Loss by Fire + Interest on Loan + Donation

= 12,000 + 50,000 + 10,000 + 5,100

= Rs 77,100

∴ Operating Profit = 5,00,000 − 30,000 + 77,100

= Rs 5,47,100 Operating Profit = Net Profit − Non-Operating Income + Non-Operating Expenses Non-Operating Income = Dividend Received + Rent Received

= 6,000 + 24,000

= 30,000 NonOperating Expenses = Loss on Sale of Furniture + Loss by Fire + Interest on Loan + Donation

= 12,000 +50,000 + 10,000 + 5,100

= Rs 77,100∴ Operating Profit = 5,00,000 − 30,000 + 77,100

= Rs 5,47,100

Note: Salary being an operating expense was already taken into account while determining net profit, thus, it will be ignored now.

Q9) What are financial statements? What information do they provide?

A9). Every business firm wants to know its financial position at the end of an accounting period. In order to assess its financial position, profit earned or loss incurred during an accounting period, the book value of its assets and liabilities is to be ascertained. In order to serve this purpose, financial statements are prepared. Financial statements are the statements showing profitability and financial position of a business at the end of the year. It includes:

1. Income statements, viz., Trading and Profit and Loss Account, which represents direct and indirect expenses incurred to generate revenues. On one hand, trading account discloses either gross profit or gross loss, on the other hand, profit and loss account discloses either net profit or net loss.

2. Statement of financial position, viz., Balance Sheet, which enlists the book value of all the assets and liabilities of the firm. Balance Sheet discloses the true financial position, solvency and credit worthiness of the business.

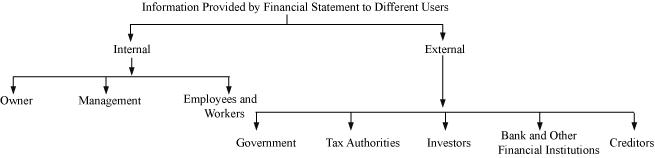

The information provided by the financial statements is in the form of gross profit or gross loss, net profit or net loss and book value of the assets and their liabilities. The value and relevance of the information provided by the financial statements varies from one user of accounting information to another. Various users of accounting information can be explained graphically as below.

1. Internal: Internal users are those persons who are directly related to the business. For example, owners, management, employees, workers, etc.

a. Owners: The information required by owners about profit earned or loss incurred during an accounting period. This information is provided by the financial statements in form of gross (net) profit or gross (net) loss.

b. Management: Financial statements provide vital information to the management for decision making, designing policies and future plA. There are various parameters such as ratio of direct (indirect) expenses to gross (net) profit, by the help of which management can check the adequacy, control and relevance of various expenses incurred and plA and policies implemented.

c. Employees and workers: They expect bonus at the year end, which is directly related to the profit of that particular period. The net profit as disclosed by the profit and loss account forms the basis of this expectation.

2. External: External users are those persons and institutions that are indirectly related to the business. For example, government, tax authorities, investors, etc.

a. Government: Government needs information in order to ascertain various macroeconomic variables, such as national income, GDP, employment opportunities generated, etc.

b. Tax authorities: Tax department is interested in knowing the actual sales, production, turnovers and exports and imports by the business. Tax department levies various taxes, such as income tax, VAT, excise tax, etc. The information disclosed by the financial statements form the basis of estimation of the tax dues of the business.

c. Investors: Financial statements help to know about the earning capacity, scope and potential to grow and to assess financial position of the business. It also helps in knowing various investments made by the business and also investments made by the organisations and individuals in the business. This information helps the investors to assess and determine whether investments by them will be fruitful or not.

d. Bank and other financial institutions: Financial statements provide information to banks and other financial institutions, such as LIC, GIC, etc., about the credit worthiness, solvency and repaying capacity of the business.

e. Creditors: Financial statements provide information to the creditors about the goodwill of the business and its credit worthiness and repaying capacity.

Q10). What are the objectives of preparing financial statements?

A10). The following are the objectives of preparing financial statements.

1. To ascertain profit earned or loss incurred by a business during an accounting period. This is estimated by preparing Trading and Profit and Loss Account.

2. To ascertain the true financial position of a business. This is reflected by the Balance Sheet.

3. To enable comparison of current year’s performance with that of the previous year’s, i.e., intra-firm comparisons. Also, to compare own performance with that of the other firms in the same industry, i.e., inter-firm comparisons.

4. To assess the solvency and credit worthiness of the business

5. To provide various provisions and reserves to meet unforeseen future conditions and to toughen the financial position of the business

6. To provide vital information to facilitate various users of accounting information in decision making process.

Q11). From the following ledger balance presented by Sen. On 31st March, 2016 prepare a trading account:

Particulars | Rs | Particulars | Rs |

Stock (1-4-2015) Purchase Wages Carriage inwards Freight inward | 10,000 1,60,000 30,000 10,000 8,000 | Sales Returns inward Return outward Gas and Fuel | 3,00,000 16,000 10,000 8,000 |

Other information:

- Closing value of stock for 31st March, 2016. 20,000

- Unpaid wages reached Rs. 4,000

- Gas and fuel were paid in advance for Rs. 1,000

A11)

Trading account for the year ended 31st March, 2016

Dr Cr

Particulars | Rs | RS | Particulars | Rs | Rs |

To Opening Stock To purchase Less: Return outwards To wages Add: Outstanding To carriage inwards To freight inwards To Gas and fuel Less: Prepaid To Gross profit c/d |

1,60,000 10,000 | 10,000

1,50,000

34,000 10,000 8,000

7,000 85,000

| By Sales Less: Returns inward BY Closing Stock | 30,00,000 16,000 |

2.84,000 20,000

|

| |||||

30,000 4,000 | |||||

8,000 1,000 | |||||

| |||||

3,04,00 | |||||

3,04,00 | |||||

|

|

Q12). From the following details presented by Thilak for the year 31st March, 2017, we will prepare a profit and loss account.

Particulars | Rs | Particulars | Rs |

Gross profit Rent paid Salaries Commissions (Cr.) Discount received Insurance Premium paid | 1,00,000 22,000 10,000 12,000 2,000 8,000 | Interest received Bad debts Provisions for bad debts(1-4-2016) Sundry debtors Buildings | 6,000 2,000 4,000 40,000 80,000 |

Adjustment:

- The unpaid salary reached Rs. 4,000

- The rent was paid for 11 months

- Interest expense reached Rs but was not received. 2,000.

- Prepaid insurance has reached Rs. 2,000

- Depreciating buildings by 10%

- Further bad debts reached Rs. Over 3,000 of 5%、

- The fee received in advance reached Rs. 2,000

A12):

Profit and Loss Account for the year ended 31st March, 2017

Dr. Cr.

Particulars | Rs | RS | Particulars | Rs | Rs |

To Rent Add: Outstanding (22,000x1/11) To Salaries Add: Outstanding To Insurance premium

Less: Prepaid insurance To Provision for bad and doubtful debts(closing)

Add: Bad debts Add: Further bad debts

Less: Opening provisions for bad and doubtful debts To Depreciate on building (80,000 x 10%)

To Net profit (trAferred to capital A/c)

| 22,000 2,000 |

24,000

14,000

6,000

2,900 8,000 | By Gross profit b/d By Commission

Less: Received in advance By Discount received By interest received Add: Accrued | - 12,000 2,000 | 1,00,000

10,000 2,000

8,000

|

10,000 4,000 | 6,000

2,000 | ||||

8,000 2,000 | |||||

1,900 2,000 3,000

| |||||

6,900

4,000 | |||||

| |||||

65,100 | |||||

1,20,000 | |||||

1,20,000 |

Working notes:

Debtors: 40,000

Less: further bad loA: 2,000: 38,000

Allowance for bad and bad debt of 5%: 38,000x5 % =Rs. 1,900

Q13). As of 31st December, 2017, from the balance below, prepare a profit and loss account.

Particulars | Rs | Particulars | Rs |

Gross profit Salaries Office rent paid Advertisement | 50,000 18,000 12,000 8,000 | Rent received Discount received Carriage outwards Fire insurance premium | 2,000 3,000 2,500 6,500 |

Adjustment:

- Rent accrued, but not yet received Rs. 500

- Fire insurance premiums are prepaid in the range of Rs. 1,500

- Offer the manager's Commission at 10% of the profit before meeting such a commission.

A13):

Dr. Trading and P/L Ac Cr.

Particulars | Rs | RS | Particulars | Rs | Rs |

To Salaries To Office rent To Advertisement To Carriage outwards To Fire insurance premium Less: Prepaid To Manager’s commission To Net profit (trAferred to capital account) |

6,500 1,500 | 18,000 12,000 8,000 2,500

5,000 1,000

9,000 | By Gross profit b/d By Rent received Add: Rent accrued By Discount received |

2,000 500 | 50,000

2,500 3,000

55,500 |

| |||||

55,500 |

Profit and Loss Account for the year ended 31st December, 2017

Dr. Cr.

Particulars | Rs | Rs | Particulars | Rs | Rs |

To Salaries To Office Rent To Advertisement To Carriage outwards To Fire insurance premium Less: Prepaid TO Manager’s commission To Net profit (trAferred to capital account) |

6,500 1,500 | 18,000 12,000 8,000 2,500

5,000 1,000

9,000

55,500 | By Gross profit/d By Rent received Add: Rent accrued By Discount received |

2,000 500 | 50,000

2,500 3,000

55,500 |

| |||||

|

Working notes:

Manager’s Commission= Net profit before charging commission x Rate of Commission/100

Net profit = 55,500 – (18,000 + 12,000 + 8,000 + 2,500 + 5,000) = Rs. 10,000

Manager’s commission = 10,000x 10/100 = 1,000

Q14). Prepare a trading and profit and loss account from the following balances obtained from Siva books:

Particulars | Rs | Particulars | Rs |

Stock on 01.01.2016 Purchase Sales Expenses on purchase Bank charges paid | 9,000 22,000 42,000 1,500 3,500 | Bad debts Sundry expenses Discount allowed Expenses on sale Repairs on office furniture | 1,200 1,800 1,700 1,000 600 |

Adjustment:

- Closing value of the stock on 31st December, 2016 Rs 4,500

- The manager is entitled to receive a commission@5% of the net profit after providing such a commission.

A14):

Dr. Trading and Profit and Loss Account for the year 31st December, 2016 Cr.

Particulars | Rs. | Particulars | Rs |

To Opening stock To Purchase To Expense’s on purchase To Gross profit c/d

To Bank charges To Bad debts To Sundry expenses To Discount allowed TO Expense on sale To Repairs on office furniture TO Manager’s commission To Net profit (trAferred to capital A/c) | 9,000 22,000 1,500 14,000 | By Sales By Closing stock

By Gross profit b/d | 42,000 4,500

|

46,500 | 46,500 | ||

3,500 1,200 1,800 1,700 1,000 600 200 4,000

| 14,000

| ||

14,000 | 14,000 |

Working Note:

Commission = Net profit before charging commissions x Rate of commissions/(100+ Rate of commissions) x 100

Net profit = 14,000 – (3,500 + 1,000+1,200+1,800+1,700+600) = Rs 4,200

Manager’s commission = 4,200 x 5/105 = Rs 200

Q15). From the following details, we have prepared Madhu's balance sheet and finished 31st March, 2018. During the final account creation, the following adjustments were made:

Particulars | Rs | Particulars | Rs |

Capital Drawings Cash in hand Loan from Bank Bank over draft Investment Bills receivables | 2,00,000 40,000 15,000 40,000 20,000 20,000 10,000 | Sundry creditors Bill payable Goodwill Sundry debtor Land and Building Vehicles Cash at bank | 40,000 20,000 60,000 80,000 50,000 80,000 25,000 |

- Unpaid debt: salary Rs. 10,000; pay Rupees. 20,000; interest on bank overdraft Rs. Bank loan Rs 3,000 and interest. 6,000

- Provide interest on capital@10%p.a.

- Bad debts reached Rs. Make provisions for bad debts of 10,000 and @10% to sundry debtors.

- Closing stock reached Rs. 1,20,000

- Provide depreciation on car @10%p.a.

- Net profit for the year reached Rs. 96,000 after considering all the above adjustments.

A15):

In the book of Madhu

Balance Sheet as on 31st March, 2018

Particulars | Rs | Rs | Particulars | Rs | Rs |

Capital Add: Net profit Add: Interest on capital

Less: Drawings Loan from bank

Add: Interest outstanding Bills payable Sundry creditors Bank overdraft Add: Interest outstanding

Outstanding liabilities Salaries Wages | 2,00,000 96,000 20,000 |

2,76,000

46,000 20,000 40,000

23,000

30,000

| Good will Land and Building Vehicles Less: Depreciation

Investment Stock in trade Sundry debtors Less: Bad debts

Less: Provision for bad and doubtful debts

Bills receivable Cash at bank Cash in hand |

80,000 8,000 | 60,000 50,000

72,000 20,000 1,20,000

63,000

10,000 25,000 15,000

|

3,16,000 40,000 | |||||

80,000 10,000 | |||||

40,000

6,000 | |||||

20,000 3,000 | 70,000

7,000 | ||||

10,000 20,000 |

| ||||

4,35,000 | |||||

| 4,35,000 |

Q16). The following balance was extracted from Thomas's book as of 31st March, 2018 additional information:

Particular | Rs | Paricular | Rs |

Purchase Return inward Opening stock Freight inwards Wages Investments Bank Charges Land Machinery Buildings Cash at bank Cash in hand | 75,000 2,000 10,000 4,000 2,000 10,000 1,000 30,000 30,000 25,000 18,000 4,000 2,11,000 | Capital Creditors Sales Return outwards | 60,000 30,000 1,20,000 1,000

2,11,000 |

- Close the stock by Rs. 9,000

- Provide depreciation@10% on machinery

- Interest accrued on the investment Rs. 2,000

Prepare a trading account, a profit and loss account and a balance sheet.

A16):In the book of Thomas

Dr.Trading and Profit and Loss Account for the year ended 31st March, 2018 Cr.

Particulars | RS | Rs | Particulars | Rs | Rs |

To Opening stock TO Purchase Less: Return outward To Freight inwards To wages To Gross profit c/d

To Depreciation on machinery To Bank charges To Net profit (trAferred to a/c) |

75,000 1,000 | 10,000

74,000 4,000 2,000 37,000 | By Sales Less: Return inward

By Closing stock

By Gross profit b/d BY Accrued interest on investment | 1,20,000 2,000 |

1,18,000

9,000

|

| |||||

| |||||

1,27,000 | 1,27,000 | ||||

3,000 1,000 35,000 |

37,000 2,000

| ||||

39,000 | |||||

39,000 |

Balance Sheet as on 31st March, 2018

Particulars | RS | Rs | Particulars | Rs | Rs |

Capital Add: Net profit Creditors | 60,000 35,000

|

95,000 30,000

| Land Building Machinery Less Depreciation Investment Add: Accrued interest Stock in trade Cash at bank Cash in hand

|

30,000 3,000 | 30,000 25,000

27,000

12,000 9,000 18,000 4,000

|

10,000 2,000 |

Q17). Below is a balance extracted from Nagarajan's book as of 31st March, 2016.

Particulars | Rs | Particulars | Rs |

Purchase Wages Freight inwards Advertisement Carriage outwards Cash Machinery Debtors Bills receivable Stock on 1st January, 2016 | 10,000 600 750 500 400 1,200 8000 2,250 300 1,000 25,000 | Sales Commission received Rent received Creditors Capital | 15,100 1,900 600 2,400 5,000

25,000 |

After adjusting for the following, we will prepare trading and profit and loss accounts for the year ending 31st March, 2016 and balance sheet as of that date:

- Fees received Rs in advance. 400

- Ads paid Rs in advance. 150

- Unpaid wages Rs. 200

- Stock at the end was Rs. 2,100

A17):

In the book of Nagrajan

Dr. Trading and Profit and Loss Account for the year ended 31st March, 2016 Cr.

Particulars | Rs | Rs | Particulars | Rs | Rs |

To Opening stock To Purchase TO Wages Add: Outstanding To Freight inwards To Gross profit c/d

TO Advertisement Less: Prepaid Advertisement To Carriage outwards TO Net profit (trAferred to capital a/c) |

600 200 | 1,000 10,000

800 750 4,650 | By Sales By Closing stock

By Gross profit b/d By Commission received Less: Received in advance By Rent received |

1,900 400 | 15,100 2,100

|

500 150 | |||||

17,200 | 17,200 4,650 | ||||

350 400

6,000

|

1,500 600

| ||||

| |||||

| |||||

6,750 | 6,750 |

Q18). Consider the following balance extracted from Jain's book, as of 31st December, 2016. Prepare the final account.

Capital Debtors Creditors Purchase Sales Income tax of Jain paid Opening stock | 20,000 8,000 10,500 60,00 80,000 500 12,000 | Offices Salaries Establishment expenses Selling expense Furniture Cash at bank Miscellaneous receipt Drawings | 6,600 4,500 2,300 10,000 2,400 600 4,800 |

Adjustment

- Unpaid salaries for January, 2016 amounted to Rs. 600

- Furniture depreciate by 10% p.a.

- 5% p.a on interest on capital

- Stock for 31st December, 2016 Rs 14,000

A18):

In the book of Jain

Dr. Trading and profit and Loss Account for the year ended 31st Dec,2016 Cr.

Particular | Rs | Rs | Particular | Rs | Rs |

To Opening Stock To Purchase To Gross Profit c/d

To Office salaries Add: Outstanding To Establish expenses To Selling expenses To Depreciation on furniture (10,000 x 10%) To interest on capital (20,000 x 5%) To Net profit (trAferred to capital a/c) |

6,600 600 | 12,000 60,000 22,000 | By sales By closing stock

By Gross Profit b/d By miscellaneous receipt |

| 80,000 4,000 |

94,000 |

94,000 | ||||

72,00 4,500 2,300 1,000

1000

6,600

| 22,000

600

| ||||

| |||||

22,600 | 22,600 |

Balance Sheet as on 31st December, 2016

Liabilities | Rs | Rs | Assets | Rs | Rs |

Capital Add: Net profit Add: Interest on capital

Less: Drawings 4,800 Income tax 500 Creditors Office salaries outstanding

| 20,000 6,600 1,100 27,600

5,300 |

22,300 10,500 600 | Furniture Less: Depreciation Stock in trade Debtors

Cash at bank | 10,000 1,000 |

9,000 14,000 8,000 2,400 |

| |||||

| |||||

33,400 |

Q19). Edward's books include: We will prepare his trading and profit and loss a/c for the year to 31st December, 2016 and ended the balance sheet for the day.

Debit balances | Rs | Credit balances | Rs |

Drawings Sundry debtors Coal, gas and water Return inward Purchase Stock on 1-11-2016 Travelling expenses Interest on loan paid Petty cash Repairs Investment | 5,000 60,000 10,500 2,500 2,56,500 89,700 51,250 300 710 4,090 70,000 | Capital Loan at 6% p.a. Sales Interest on investment Sundry creditors | 1,31,500 20,000 3,56,500 2,550 40,000

|

5,50,550 | 5,50,550 |

Adjustment:

- The closing price of stock was Rs. 1, 30,000 on 31th December, 2016.

- Create a 5% allowance for bad debt and bad debt to sundries debtor

- Create a provision at 2% for debtors discount

- Interest on the loan is postponed for 9 months.

A19):

In the books of Edward

Dr. Trading and Profit and Loss Account for the year ended 31st Dec, 2016 Cr.

Particulars | ₹ | ₹ | Particulars | ₹ | ₹ |

To opening stock To purchase To Coal, gas and water To Gross profit c/d

To travelling expenses To interest on loan paid To Repair To Provide Provision for bad and doubtful debts To Provision for Discount on debtors Net Profit (trAferred to capital a/c)

|

300

900 | 89,000 2,56,500 10,500 1,27,300 | By sales Less: Returns inward By Closing stock

By Gross profit b/d By Interest on Investment | 3,56,00 2,500 |

3,54,500 1,30,000 |

| |||||

4,84,000 | |||||

4,84,000 | |||||

51,250

1,200

4,090 3,000

1,140

69,170

|

1,23,300 2,550

| ||||

1,29,850 |

|

| 1,29,850 |

Balance Sheet as on 31st December, 2016

|

Liabilities | ₹ | ₹ | Assets | ₹ | ₹ |

Capital Add: Net profit

Less: Drawings 6% Loan Add interest outstanding Sundry creditors

| 1,31,500 69,170 2,00,000 5,000 20,000 900 |

1,95,670

20,900 40,000 | Investments Stock in trade Sundry debtors Less: Provision for bad and doubtful debts( 60,000* 5/100) Less: Provision for discount on debtors (57,000*2/100) Pretty cash |

60,000

3,000

57,000 1,140

| 70,000 1,30,000

55,860 710 |

2,56,570 |

|

Q20). Prepare a Trading Account from the following particulars for the year ended 31st March 2017: -

Particulars | (₹) | Particulars | (₹) |

Opening Stock | 2,50,000 | Purchases Returns | 22,000 |

Purchases | 7,00,000 | Sales Return | 36,000 |

Sales | 18,00,000 | Gas, Fuel and Power | 75,000 |

Wages | 2,06,000 | Dock Charges | 8,000 |

Carriage Inward | 34,000 | Factory Lighting | 96,000 |

Carriage Outward | 20,000 | Office Lighting | 5,000 |

Manufacturing Expenses | 2,48,000 |

|

|

Closing Stock is valued at ₹ 6,00,000.

A20).

Trading Account | |||||||

Dr. |

| Cr. | |||||

Particulars | Amount (Rs) | Particulars | Amount (Rs) | ||||

Opening Stock | 2,50,000 | Sales | 18,00,000 |

| |||

Purchases | 7,00,000 |

| Less: Sales Returns | 36,000 | 17,64,000 | ||

Less: Purchases Returns | 22,000 | 6,78,000 | Closing Stock | 6,00,000 | |||

Carriage Inward | 34,000 |

|

| ||||

Wages | 2,06,000 |

|

| ||||

Custom Duty | 15,000 |

|

| ||||

Gas, Fuel & Power | 60,000 |

|

| ||||

Dock Charges | 8,000 |

|

| ||||

Manufacturing Expenses | 2,48,000 |

|

| ||||

Factory Lighting | 96,000 |

|

| ||||

Gross Profit (Balancing Figure) | 7,69,000 |

|

| ||||

| 23,64,000 |

| 23,64,000 | ||||

|

|

|

|

|

| ||

Q21). Prepare Profit and Loss Account for the year ended 31st March, 2017 from the following particulars:-

| |||

Particulars | (₹) | Particulars | (₹) |

General expenses | 12,000 | Gross profit | 7,69,000 |

Charity | 3,000 | Carriage Outwards | 20,000 |

Office Lighting | 5,000 | Office Expenses | 16,000 |

Law Charges | 5,800 | Fire Insurance Premium | 18,000 |

Advertisement | 14,200 | Telephone Expenses | 13,500 |

Bank charges | 1,200 | Establishment expenses | 2,500 |

Commission | 7,000 | Miscellaneous Expenses | 7,100 |

Rent, Rates and Taxes | 30,000 | Discount Received | 6,200 |

Interest on investments | 12,000 | Traveller's salary | 60,000 |

Sundry Receipts | 6,000 | Repair | 4,300 |

Indirect expenses | 2,100 | Commission Cr. | 2,000 |

Printing and Stationery | 1,500 |

|

|

A21).

Profit and Loss Account For the year ended March 31, 2017 | |||||

Dr. |

| Cr. | |||

Particulars | Amount | Particulars | Amount (Rs) | ||

General Expenses | 12,000 | Gross Profit | 7,69,000 | ||

Charity | 3,000 | Interest on Investments | 12,000 | ||

Office Lighting | 5,000 | Sundry Receipts | 6,000 | ||

Law Charges | 5,800 | Discount Received | 6,200 | ||

Advertisement | 14,200 | Commission Received | 2,000 | ||

Bank Charges | 1,200 |

|

| ||

Commission | 7,000 |

|

| ||

Rent, Rates and Taxes | 30,000 |

|

| ||

Indirect Expenses | 2,100 |

|

| ||

Printing & Stationery | 1,500 |

|

| ||

Carriage Outwards | 20,000 |

|

| ||

Office Expenses | 16,000 |

|

| ||

Fire Insurance Premium | 18,000 |

|

| ||

Telephone Expenses | 13,500 |

|

| ||

Establishment Expenses | 2,500 |

|

| ||

Miscellaneous Expenses | 7,100 |

|

| ||

Traveler’s Salary | 60,000 |

|

| ||

Repair | 4,300 |

|

| ||

Net Profit | 5,72,000 |

|

| ||

| 7,95,200 |

| 7,95,200 | ||

Q22). Calculate the amount of gross profit, operating profit and net profit on the basis of the following balances extracted from the books of M/s Rajiv & Sons for the year ended March 31, 2017.

| ₹ |

Opening Stock | 50,000 |

Net Sales | 11,00,000 |

Net Purchases | 6,00,000 |

Direct Expenses | 60,000 |

Administration Expenses | 45,000 |

Selling and Distribution Expenses | 65,000 |

Loss due to Fire | 20,000 |

Closing Stock | 70,000 |

A22).

Financial Statement of M/s Rajiv & Sons | |||||

Trading Account | |||||

Dr. |

| Cr. | |||

Particulars | Amount | Particulars | Amount (Rs) | ||

Opening Stock | 50,000 | Net Sales | 11,00,000 | ||

Net Purchases | 6,00,000 | Closing Stock | 70,000 | ||

Direct Expenses | 60,000 |

|

| ||

Gross Profit (Balancing Figure) | 4,60,000 |

|

| ||

| 11,70,000 |

| 11,70,000 | ||

|

|

|

| ||

Profit and Loss Account For the year ended March 31, 2017 | |||||

Dr. |

| Cr. | |||

Particulars | Amount | Particulars | Amount (Rs) | ||

Administration Expenses | 45,000 | Gross Profit | 4,60,000 | ||

Selling & Distribution Expenses | 65,000 |

|

| ||

Loss by Fire | 20,000 |

|

| ||

Net Profit | 3,30,000 |

|

| ||

| 4,60,000 |

| 4,60,000 | ||

|

|

|

| ||

Working Notes:

Operating Profit = Net Profit − Non-Operating Income + Non-Operating Expenses = 3,30,000 − 0 + 20,000 = Rs 3,50,000 Operating Profit = Net Profit − Non-Operating Income + Non-Operating Expenses = 3,30,000 − 0 + 20,000 = Rs 3,50,000

Loss by Fire is a non-operating expense, thus, added to the net profit to arrive at operating profit.