Unit 4

Methods of Costing

Q1) What is Contract costing?

A1) Contract costing, unlike short-term jobs, is a special system of job costing that applies to long-term contracts. Contract costing applies primarily to civil engineering and engineering projects, shipbuilding, road and rail contracts, bridge construction, and more.

Contract costing may be a sort of specific order costing. This applies to contracts that take a considerable amount of time to complete and fall into different accounting periods. However, periods longer than one year are not an essential feature of long-term contracts. Some contracts with a term shorter than one year should be accounted for as long-term contracts if they are significant enough for the activity of that term.

Q2) What are the features of Contract costing?

A2) Contracts to which contract costing applies have the following features:

(A) The contract is based on the special requirements of the customer.

(B) The contract period is relatively long.

(C) Contract work is done on-site, unlike manufacturing under the roof.

(D) Contract work mainly consists of construction activities.

Q3) What is the accounting procedure for contract costing?

A3) If there are many contracts, an identification number and name are given to each contract for accounting and management reasons. A separate contract account is maintained for every contract.

All costs associated with the contract will be charged to each contract account. In the contract cost structure, the majority of spending is of a direct nature in the form of materials, wages, plant and store use, direct costs, etc., and only a small portion is charged as allocated overheads.

Q4) What are the accounting treatment of costs?

A4) The accounting treatment of costs are

1.Material:

(A) All materials purchased for the contract or sent to the site will be charged for the contract.

(B) If the material is returned to the store, or is on an unused site, or if the material is transferred to another contract site, it will be credited to the contract account.

(C) If the material is not needed immediately, the material will be stored and its costs will be debited to the stock account.

2. Labour:

All labour employed or worked in the field is treated as direct labour and all costs associated with them are charged to the contract account. Salaries and incentives for management and supervisory staff of a particular contract are also charged for that particular contract.

3. Plants:

(A) If the plant is hired, the employment fee will be charged to the contract account.

(B) If the plant was specially purchased for a contract or the plant was sent to the site, the value of the plant is debited to the contract account. The value of the returned or remaining on-site plant will be credited to the contract account. The balance between the debited amount and the credited amount in the contract represents the value of the plant used in the field.

(C) The depreciation amount provided by the plant may be debited to the contract account instead of displaying the value of the plant issued to the site and remaining on the site.

4. Subcontract fee:

Part of the contract work may be provided on a subcontract basis and payments made in the subcontract work may be debited to the contract account.

5. Overhead:

General overhead and head office expenses are fairly distributed to different contracts, and some overhead is charged to the contract account.

6. Difficulty of cost control:

Contracts are generally large and contract work is done on-site. This causes some problems with material use, labour utilization, labour supervision, plant and work damage, material and tool theft, and more. This site-based work makes it difficult to control the cost of contracts.

7. Surveyor Certificate and Deposit:

In contract work, surveyors, architects, and civil engineers visit the site on a regular basis to inspect the completed work. He issues a certificate stating the completion stage of the work and the value of the work completed by the certificate issuance date. Payment will be released to the contractor by the contractor based on the certificate.

Payments are typically released only up to a certain percentage, for example 80% of certified work. The balance of certified work is retained by the contractor until the entire contract is successfully completed.

The amount of money so reserved is called a "reservation". The contractor does so to protect itself from the risks that may arise from the contractor. Generally, the percentage of retained earnings is up to 20% of the amount of certified work.

8. Work in progress:

The amount of work in process includes the value of certified and uncertified work in process as it appears in your contract account.

9. Cost of running contract:

Due to the long-term nature of the contract, it was necessary to determine the profit attributable to each accounting period. For long-term contracts, it is believed that the results can be evaluated with reasonable certainty before they are signed, and imputed profits should be carefully calculated and included in the current account.

The profits taken up should be based on the principles of standard costing. For completed contracts, all profits arising from the contract can be transferred to the income statement.

However, in the case of an incomplete contract, preparations are made to deal with unforeseen circumstances and unexpected losses, so depending on the scope of work completed in the contract, only part of the profit is reflected in the income statement Will be done. There are no strict rules for calculating profits reflected in the income statement.

Q5) What are the principles followed in case of accounting treatment of cost?

A5) The following principles are followed:

(1) If an incomplete contract causes a loss, the entire loss will be debited to the income statement.

(2) Profit should only be considered for certified jobs. Uncertified work should be evaluated at cost.

(3) Contract completion is less than 25% of the contract price – no profit should be recorded on the income statement and the entire amount is retained as a reserve for contingencies.

(4) Contract completion up to 25% or more, less than 50% of the contract price – in this case, one-third of the profit, a decrease in the ratio of cash received to the certified work will be reflected in the profit and loss. Account. The balance remains as a reserve in case of contingency.

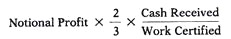

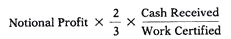

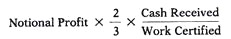

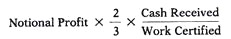

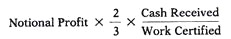

(5) Contract completions up to 50% or more and less than 90% – in this case, two-thirds of the profit is reduced by the percentage of cash received for the work authorized to be brought into the income statement, leaving the rest Keep up. The amount of reserve.

The formula is given below:

Q6) What is Process costing?

A6) Process costing is a way of costing adopted to seek out the value of these goods which are manufactured in stages. Each stage is called a process. The output of every process becomes the input for subsequent process and so on.

Q7) What are the features of Abnormal loss?

A7) The features of Abnormal loss are-

1. Loss due to external factors such as natural disasters, loss due to fire or theft, strike, failure, Machines, etc.

2. Unexpected loss.

3. Somewhat avoidable and therefore controllable.

4. Credited to process A / c as a balance number in the quantity column.

The 5-amount column is calculated using the following formula:

Abnormal loss (amount) =

Dr – Cr (% from quantity)

Dr – Cr (Amt Col.)

× Abnormal loss (quantity)

Q8) What are the features of Abnormal profit?

A8) The features of Abnormal profit are-

1. If the actual loss is less than the expected loss, it is called anomalous gain.

2. Due to the large amount of R / M, efficient workforce, advanced technology, etc.

3. Recorded as the balance number in the quantity column on the debit side of process A / c.

4. A monetary column calculated using the following formula.

Abnormal gain (amount) =

Dr – Cr (quantity column)

Dr – Cr (Amt column)

× Abnormal gain (quantity) the next process.

Example: Process costing is applicable to product like sugar industry, refining industry, paper industry. Etc. There are two types of losses in process costing.

Example: Input 20 Kgs

(–) Output 18 Kgs

= Loss 2 Kgs

Q9) What are the features of Normal loss?

A9) The features of Normal loss are-

1. It's a loss thanks to internal factors like heating, boiling, evaporation,

2. Expected loss.

3. A given percentage of the input amount.

4. It is an unavoidable loss and an unmanageable loss.

5. There are usually two types: (A) Scrap: It has feasible value. (B) Weight Loss: No Realizable value because it is an invisible process.

6. Credited to process A / c and calculated as% of the input quantity.

Q10) Give the specimen of Process Account when there are normal loss and abnormal losses.

A10) Dr. Process A/c. Cr.

Particulars | Units | Rs. | Particulars | Units | Rs. |

To Basic Material | Xxx | Xx | By Normal Loss | Xx | Xx |

To Direct Material |

| Xx | By Abnormal Loss | Xx | Xx |

To Direct Wages |

| Xx | By Process II A/c. | Xx | Xx |

To Direct Expenses |

| Xx | (Output transferred to |

|

|

To Production Overheads |

| Xx | Next process) |

|

|

To Cost of Rectification of Normal Defects |

| Xx | By Process Stock A/c. | Xx | Xx |

|

|

|

|

|

|

To Abnormal Gains |

| Xx |

|

|

|

| Xx | Xxx |

| Xx | Xx |

Q11) What is Cost of process?

A11) The cost of the output of the process (Total Cost less Sales value of scrap) is transferred to the next process. The cost of each process is thus made up to cost brought forward from the previous process and net cost of material, labour and overhead added in that process after reducing the sales value of scrap. The net cost of the finished process is transferred to the finished goods account. The net cost is divided by the number of units produced to determine the average cost per unit in that process.

Q12) What are the items on the Debit side of Process A/c?

A12) Each process account is debited with

a) Cost of materials used in that process.

b) Cost of labor incurred in that process.

c) Direct expenses incurred in that process.

d) Overheads charged to that process on some pre-determined.

e) Cost of ratification of normal defectives.

f) Cost of abnormal gain (if any arises in that process)

Q13) What are the items on the Credit side of Process A/c?

A13) Each process account is credited with

a) Scrap value of Normal Loss (if any) occurs in that process.

b) Cost of Abnormal Loss (if any occurs in that process)

Q14) What are the limitations of process costing?

A14) The limitations of process costing are-

1.Cost obtained at each process is only historical cost and are not very useful for effective control.

2.Process costing is based on average cost method, which is not that suitable for performance analysis, evaluation and managerial control.

3.Work-in-progress is generally done on estimated basis which leads to inaccuracy in total cost calculations.

4.The computation of average cost is more difficult in those cases where more than one type of products is manufactured and a division of the cost element is necessary.

5.Where different products arise in the same process and common costs are prorated to various costs units. Such individual products costs may be taken as only approximation and hence not reliable.

Q15) What are the advantages of process costing?

A15) The advantages of process costing are-

- Costs are be computed periodically at the end of a particular period

- It is simple and involves less clerical work that job costing

- It is easy to allocate the expenses to processes in order to have accurate costs.

- Use of standard costing systems in very effective in process costing situations.

- Process costing helps in preparation of tender, quotations

- Since cost data is available for each process, operation and department, good managerial control impossible.

Q16) What are the features of Process Costing?

A16) The features of process costing are-

- The production is continuous.

- The product is homogeneous.

- The process is standardized.

- Output of one process become raw material of another process.

- The output of the last process is transferred to finished stock.

- Costs are collected process-wise.

- Both direct and indirect costs are accumulated in each process.

- If the revise stock of semi-finished goods, it is expressed in terms of equal units.

- The total cost of each process is divided by the normal output of that process to find out cost per unit of that process.

Q17) What is the accounting procedure of costing?

A17) For each process an individual process account is prepared. Each process of production is treated as a distinct cost center.

Q18) According to CIMA London, what is process costing?

A18) CIMA London defines process costing as “that form of operation costing which applies where standardize goods are produced”

Q19) According to CIMA, what is contract costing?

A19) CIMA defines contract costs and contract costs as follows:

“The total price related to one contract specified as a price unit."

Q20) What will be the accounting treatment of cost in case of plants?

A20) The accounting treatment of cost in case of plants will be-

(A) If the plant is hired, the employment fee will be charged to the contract account.

(B) If the plant was specially purchased for a contract or the plant was sent to the site, the value of the plant is debited to the contract account. The value of the returned or remaining on-site plant will be credited to the contract account. The balance between the debited amount and the credited amount in the contract represents the value of the plant used in the field.

(C) The depreciation amount provided by the plant may be debited to the contract account instead of displaying the value of the plant issued to the site and remaining on the site.

Unit 4

Methods of Costing

Q1) What is Contract costing?

A1) Contract costing, unlike short-term jobs, is a special system of job costing that applies to long-term contracts. Contract costing applies primarily to civil engineering and engineering projects, shipbuilding, road and rail contracts, bridge construction, and more.

Contract costing may be a sort of specific order costing. This applies to contracts that take a considerable amount of time to complete and fall into different accounting periods. However, periods longer than one year are not an essential feature of long-term contracts. Some contracts with a term shorter than one year should be accounted for as long-term contracts if they are significant enough for the activity of that term.

Q2) What are the features of Contract costing?

A2) Contracts to which contract costing applies have the following features:

(A) The contract is based on the special requirements of the customer.

(B) The contract period is relatively long.

(C) Contract work is done on-site, unlike manufacturing under the roof.

(D) Contract work mainly consists of construction activities.

Q3) What is the accounting procedure for contract costing?

A3) If there are many contracts, an identification number and name are given to each contract for accounting and management reasons. A separate contract account is maintained for every contract.

All costs associated with the contract will be charged to each contract account. In the contract cost structure, the majority of spending is of a direct nature in the form of materials, wages, plant and store use, direct costs, etc., and only a small portion is charged as allocated overheads.

Q4) What are the accounting treatment of costs?

A4) The accounting treatment of costs are

1.Material:

(A) All materials purchased for the contract or sent to the site will be charged for the contract.

(B) If the material is returned to the store, or is on an unused site, or if the material is transferred to another contract site, it will be credited to the contract account.

(C) If the material is not needed immediately, the material will be stored and its costs will be debited to the stock account.

2. Labour:

All labour employed or worked in the field is treated as direct labour and all costs associated with them are charged to the contract account. Salaries and incentives for management and supervisory staff of a particular contract are also charged for that particular contract.

3. Plants:

(A) If the plant is hired, the employment fee will be charged to the contract account.

(B) If the plant was specially purchased for a contract or the plant was sent to the site, the value of the plant is debited to the contract account. The value of the returned or remaining on-site plant will be credited to the contract account. The balance between the debited amount and the credited amount in the contract represents the value of the plant used in the field.

(C) The depreciation amount provided by the plant may be debited to the contract account instead of displaying the value of the plant issued to the site and remaining on the site.

4. Subcontract fee:

Part of the contract work may be provided on a subcontract basis and payments made in the subcontract work may be debited to the contract account.

5. Overhead:

General overhead and head office expenses are fairly distributed to different contracts, and some overhead is charged to the contract account.

6. Difficulty of cost control:

Contracts are generally large and contract work is done on-site. This causes some problems with material use, labour utilization, labour supervision, plant and work damage, material and tool theft, and more. This site-based work makes it difficult to control the cost of contracts.

7. Surveyor Certificate and Deposit:

In contract work, surveyors, architects, and civil engineers visit the site on a regular basis to inspect the completed work. He issues a certificate stating the completion stage of the work and the value of the work completed by the certificate issuance date. Payment will be released to the contractor by the contractor based on the certificate.

Payments are typically released only up to a certain percentage, for example 80% of certified work. The balance of certified work is retained by the contractor until the entire contract is successfully completed.

The amount of money so reserved is called a "reservation". The contractor does so to protect itself from the risks that may arise from the contractor. Generally, the percentage of retained earnings is up to 20% of the amount of certified work.

8. Work in progress:

The amount of work in process includes the value of certified and uncertified work in process as it appears in your contract account.

9. Cost of running contract:

Due to the long-term nature of the contract, it was necessary to determine the profit attributable to each accounting period. For long-term contracts, it is believed that the results can be evaluated with reasonable certainty before they are signed, and imputed profits should be carefully calculated and included in the current account.

The profits taken up should be based on the principles of standard costing. For completed contracts, all profits arising from the contract can be transferred to the income statement.

However, in the case of an incomplete contract, preparations are made to deal with unforeseen circumstances and unexpected losses, so depending on the scope of work completed in the contract, only part of the profit is reflected in the income statement Will be done. There are no strict rules for calculating profits reflected in the income statement.

Q5) What are the principles followed in case of accounting treatment of cost?

A5) The following principles are followed:

(1) If an incomplete contract causes a loss, the entire loss will be debited to the income statement.

(2) Profit should only be considered for certified jobs. Uncertified work should be evaluated at cost.

(3) Contract completion is less than 25% of the contract price – no profit should be recorded on the income statement and the entire amount is retained as a reserve for contingencies.

(4) Contract completion up to 25% or more, less than 50% of the contract price – in this case, one-third of the profit, a decrease in the ratio of cash received to the certified work will be reflected in the profit and loss. Account. The balance remains as a reserve in case of contingency.

(5) Contract completions up to 50% or more and less than 90% – in this case, two-thirds of the profit is reduced by the percentage of cash received for the work authorized to be brought into the income statement, leaving the rest Keep up. The amount of reserve.

The formula is given below:

Q6) What is Process costing?

A6) Process costing is a way of costing adopted to seek out the value of these goods which are manufactured in stages. Each stage is called a process. The output of every process becomes the input for subsequent process and so on.

Q7) What are the features of Abnormal loss?

A7) The features of Abnormal loss are-

1. Loss due to external factors such as natural disasters, loss due to fire or theft, strike, failure, Machines, etc.

2. Unexpected loss.

3. Somewhat avoidable and therefore controllable.

4. Credited to process A / c as a balance number in the quantity column.

The 5-amount column is calculated using the following formula:

Abnormal loss (amount) =

Dr – Cr (% from quantity)

Dr – Cr (Amt Col.)

× Abnormal loss (quantity)

Q8) What are the features of Abnormal profit?

A8) The features of Abnormal profit are-

1. If the actual loss is less than the expected loss, it is called anomalous gain.

2. Due to the large amount of R / M, efficient workforce, advanced technology, etc.

3. Recorded as the balance number in the quantity column on the debit side of process A / c.

4. A monetary column calculated using the following formula.

Abnormal gain (amount) =

Dr – Cr (quantity column)

Dr – Cr (Amt column)

× Abnormal gain (quantity) the next process.

Example: Process costing is applicable to product like sugar industry, refining industry, paper industry. Etc. There are two types of losses in process costing.

Example: Input 20 Kgs

(–) Output 18 Kgs

= Loss 2 Kgs

Q9) What are the features of Normal loss?

A9) The features of Normal loss are-

1. It's a loss thanks to internal factors like heating, boiling, evaporation,

2. Expected loss.

3. A given percentage of the input amount.

4. It is an unavoidable loss and an unmanageable loss.

5. There are usually two types: (A) Scrap: It has feasible value. (B) Weight Loss: No Realizable value because it is an invisible process.

6. Credited to process A / c and calculated as% of the input quantity.

Q10) Give the specimen of Process Account when there are normal loss and abnormal losses.

A10) Dr. Process A/c. Cr.

Particulars | Units | Rs. | Particulars | Units | Rs. |

To Basic Material | Xxx | Xx | By Normal Loss | Xx | Xx |

To Direct Material |

| Xx | By Abnormal Loss | Xx | Xx |

To Direct Wages |

| Xx | By Process II A/c. | Xx | Xx |

To Direct Expenses |

| Xx | (Output transferred to |

|

|

To Production Overheads |

| Xx | Next process) |

|

|

To Cost of Rectification of Normal Defects |

| Xx | By Process Stock A/c. | Xx | Xx |

|

|

|

|

|

|

To Abnormal Gains |

| Xx |

|

|

|

| Xx | Xxx |

| Xx | Xx |

Q11) What is Cost of process?

A11) The cost of the output of the process (Total Cost less Sales value of scrap) is transferred to the next process. The cost of each process is thus made up to cost brought forward from the previous process and net cost of material, labour and overhead added in that process after reducing the sales value of scrap. The net cost of the finished process is transferred to the finished goods account. The net cost is divided by the number of units produced to determine the average cost per unit in that process.

Q12) What are the items on the Debit side of Process A/c?

A12) Each process account is debited with

a) Cost of materials used in that process.

b) Cost of labor incurred in that process.

c) Direct expenses incurred in that process.

d) Overheads charged to that process on some pre-determined.

e) Cost of ratification of normal defectives.

f) Cost of abnormal gain (if any arises in that process)

Q13) What are the items on the Credit side of Process A/c?

A13) Each process account is credited with

a) Scrap value of Normal Loss (if any) occurs in that process.

b) Cost of Abnormal Loss (if any occurs in that process)

Q14) What are the limitations of process costing?

A14) The limitations of process costing are-

1.Cost obtained at each process is only historical cost and are not very useful for effective control.

2.Process costing is based on average cost method, which is not that suitable for performance analysis, evaluation and managerial control.

3.Work-in-progress is generally done on estimated basis which leads to inaccuracy in total cost calculations.

4.The computation of average cost is more difficult in those cases where more than one type of products is manufactured and a division of the cost element is necessary.

5.Where different products arise in the same process and common costs are prorated to various costs units. Such individual products costs may be taken as only approximation and hence not reliable.

Q15) What are the advantages of process costing?

A15) The advantages of process costing are-

- Costs are be computed periodically at the end of a particular period

- It is simple and involves less clerical work that job costing

- It is easy to allocate the expenses to processes in order to have accurate costs.

- Use of standard costing systems in very effective in process costing situations.

- Process costing helps in preparation of tender, quotations

- Since cost data is available for each process, operation and department, good managerial control impossible.

Q16) What are the features of Process Costing?

A16) The features of process costing are-

- The production is continuous.

- The product is homogeneous.

- The process is standardized.

- Output of one process become raw material of another process.

- The output of the last process is transferred to finished stock.

- Costs are collected process-wise.

- Both direct and indirect costs are accumulated in each process.

- If the revise stock of semi-finished goods, it is expressed in terms of equal units.

- The total cost of each process is divided by the normal output of that process to find out cost per unit of that process.

Q17) What is the accounting procedure of costing?

A17) For each process an individual process account is prepared. Each process of production is treated as a distinct cost center.

Q18) According to CIMA London, what is process costing?

A18) CIMA London defines process costing as “that form of operation costing which applies where standardize goods are produced”

Q19) According to CIMA, what is contract costing?

A19) CIMA defines contract costs and contract costs as follows:

“The total price related to one contract specified as a price unit."

Q20) What will be the accounting treatment of cost in case of plants?

A20) The accounting treatment of cost in case of plants will be-

(A) If the plant is hired, the employment fee will be charged to the contract account.

(B) If the plant was specially purchased for a contract or the plant was sent to the site, the value of the plant is debited to the contract account. The value of the returned or remaining on-site plant will be credited to the contract account. The balance between the debited amount and the credited amount in the contract represents the value of the plant used in the field.

(C) The depreciation amount provided by the plant may be debited to the contract account instead of displaying the value of the plant issued to the site and remaining on the site.

Unit 4

Methods of Costing

Q1) What is Contract costing?

A1) Contract costing, unlike short-term jobs, is a special system of job costing that applies to long-term contracts. Contract costing applies primarily to civil engineering and engineering projects, shipbuilding, road and rail contracts, bridge construction, and more.

Contract costing may be a sort of specific order costing. This applies to contracts that take a considerable amount of time to complete and fall into different accounting periods. However, periods longer than one year are not an essential feature of long-term contracts. Some contracts with a term shorter than one year should be accounted for as long-term contracts if they are significant enough for the activity of that term.

Q2) What are the features of Contract costing?

A2) Contracts to which contract costing applies have the following features:

(A) The contract is based on the special requirements of the customer.

(B) The contract period is relatively long.

(C) Contract work is done on-site, unlike manufacturing under the roof.

(D) Contract work mainly consists of construction activities.

Q3) What is the accounting procedure for contract costing?

A3) If there are many contracts, an identification number and name are given to each contract for accounting and management reasons. A separate contract account is maintained for every contract.

All costs associated with the contract will be charged to each contract account. In the contract cost structure, the majority of spending is of a direct nature in the form of materials, wages, plant and store use, direct costs, etc., and only a small portion is charged as allocated overheads.

Q4) What are the accounting treatment of costs?

A4) The accounting treatment of costs are

1.Material:

(A) All materials purchased for the contract or sent to the site will be charged for the contract.

(B) If the material is returned to the store, or is on an unused site, or if the material is transferred to another contract site, it will be credited to the contract account.

(C) If the material is not needed immediately, the material will be stored and its costs will be debited to the stock account.

2. Labour:

All labour employed or worked in the field is treated as direct labour and all costs associated with them are charged to the contract account. Salaries and incentives for management and supervisory staff of a particular contract are also charged for that particular contract.

3. Plants:

(A) If the plant is hired, the employment fee will be charged to the contract account.

(B) If the plant was specially purchased for a contract or the plant was sent to the site, the value of the plant is debited to the contract account. The value of the returned or remaining on-site plant will be credited to the contract account. The balance between the debited amount and the credited amount in the contract represents the value of the plant used in the field.

(C) The depreciation amount provided by the plant may be debited to the contract account instead of displaying the value of the plant issued to the site and remaining on the site.

4. Subcontract fee:

Part of the contract work may be provided on a subcontract basis and payments made in the subcontract work may be debited to the contract account.

5. Overhead:

General overhead and head office expenses are fairly distributed to different contracts, and some overhead is charged to the contract account.

6. Difficulty of cost control:

Contracts are generally large and contract work is done on-site. This causes some problems with material use, labour utilization, labour supervision, plant and work damage, material and tool theft, and more. This site-based work makes it difficult to control the cost of contracts.

7. Surveyor Certificate and Deposit:

In contract work, surveyors, architects, and civil engineers visit the site on a regular basis to inspect the completed work. He issues a certificate stating the completion stage of the work and the value of the work completed by the certificate issuance date. Payment will be released to the contractor by the contractor based on the certificate.

Payments are typically released only up to a certain percentage, for example 80% of certified work. The balance of certified work is retained by the contractor until the entire contract is successfully completed.

The amount of money so reserved is called a "reservation". The contractor does so to protect itself from the risks that may arise from the contractor. Generally, the percentage of retained earnings is up to 20% of the amount of certified work.

8. Work in progress:

The amount of work in process includes the value of certified and uncertified work in process as it appears in your contract account.

9. Cost of running contract:

Due to the long-term nature of the contract, it was necessary to determine the profit attributable to each accounting period. For long-term contracts, it is believed that the results can be evaluated with reasonable certainty before they are signed, and imputed profits should be carefully calculated and included in the current account.

The profits taken up should be based on the principles of standard costing. For completed contracts, all profits arising from the contract can be transferred to the income statement.

However, in the case of an incomplete contract, preparations are made to deal with unforeseen circumstances and unexpected losses, so depending on the scope of work completed in the contract, only part of the profit is reflected in the income statement Will be done. There are no strict rules for calculating profits reflected in the income statement.

Q5) What are the principles followed in case of accounting treatment of cost?

A5) The following principles are followed:

(1) If an incomplete contract causes a loss, the entire loss will be debited to the income statement.

(2) Profit should only be considered for certified jobs. Uncertified work should be evaluated at cost.

(3) Contract completion is less than 25% of the contract price – no profit should be recorded on the income statement and the entire amount is retained as a reserve for contingencies.

(4) Contract completion up to 25% or more, less than 50% of the contract price – in this case, one-third of the profit, a decrease in the ratio of cash received to the certified work will be reflected in the profit and loss. Account. The balance remains as a reserve in case of contingency.

(5) Contract completions up to 50% or more and less than 90% – in this case, two-thirds of the profit is reduced by the percentage of cash received for the work authorized to be brought into the income statement, leaving the rest Keep up. The amount of reserve.

The formula is given below:

Q6) What is Process costing?

A6) Process costing is a way of costing adopted to seek out the value of these goods which are manufactured in stages. Each stage is called a process. The output of every process becomes the input for subsequent process and so on.

Q7) What are the features of Abnormal loss?

A7) The features of Abnormal loss are-

1. Loss due to external factors such as natural disasters, loss due to fire or theft, strike, failure, Machines, etc.

2. Unexpected loss.

3. Somewhat avoidable and therefore controllable.

4. Credited to process A / c as a balance number in the quantity column.

The 5-amount column is calculated using the following formula:

Abnormal loss (amount) =

Dr – Cr (% from quantity)

Dr – Cr (Amt Col.)

× Abnormal loss (quantity)

Q8) What are the features of Abnormal profit?

A8) The features of Abnormal profit are-

1. If the actual loss is less than the expected loss, it is called anomalous gain.

2. Due to the large amount of R / M, efficient workforce, advanced technology, etc.

3. Recorded as the balance number in the quantity column on the debit side of process A / c.

4. A monetary column calculated using the following formula.

Abnormal gain (amount) =

Dr – Cr (quantity column)

Dr – Cr (Amt column)

× Abnormal gain (quantity) the next process.

Example: Process costing is applicable to product like sugar industry, refining industry, paper industry. Etc. There are two types of losses in process costing.

Example: Input 20 Kgs

(–) Output 18 Kgs

= Loss 2 Kgs

Q9) What are the features of Normal loss?

A9) The features of Normal loss are-

1. It's a loss thanks to internal factors like heating, boiling, evaporation,

2. Expected loss.

3. A given percentage of the input amount.

4. It is an unavoidable loss and an unmanageable loss.

5. There are usually two types: (A) Scrap: It has feasible value. (B) Weight Loss: No Realizable value because it is an invisible process.

6. Credited to process A / c and calculated as% of the input quantity.

Q10) Give the specimen of Process Account when there are normal loss and abnormal losses.

A10) Dr. Process A/c. Cr.

Particulars | Units | Rs. | Particulars | Units | Rs. |

To Basic Material | Xxx | Xx | By Normal Loss | Xx | Xx |

To Direct Material |

| Xx | By Abnormal Loss | Xx | Xx |

To Direct Wages |

| Xx | By Process II A/c. | Xx | Xx |

To Direct Expenses |

| Xx | (Output transferred to |

|

|

To Production Overheads |

| Xx | Next process) |

|

|

To Cost of Rectification of Normal Defects |

| Xx | By Process Stock A/c. | Xx | Xx |

|

|

|

|

|

|

To Abnormal Gains |

| Xx |

|

|

|

| Xx | Xxx |

| Xx | Xx |

Q11) What is Cost of process?

A11) The cost of the output of the process (Total Cost less Sales value of scrap) is transferred to the next process. The cost of each process is thus made up to cost brought forward from the previous process and net cost of material, labour and overhead added in that process after reducing the sales value of scrap. The net cost of the finished process is transferred to the finished goods account. The net cost is divided by the number of units produced to determine the average cost per unit in that process.

Q12) What are the items on the Debit side of Process A/c?

A12) Each process account is debited with

a) Cost of materials used in that process.

b) Cost of labor incurred in that process.

c) Direct expenses incurred in that process.

d) Overheads charged to that process on some pre-determined.

e) Cost of ratification of normal defectives.

f) Cost of abnormal gain (if any arises in that process)

Q13) What are the items on the Credit side of Process A/c?

A13) Each process account is credited with

a) Scrap value of Normal Loss (if any) occurs in that process.

b) Cost of Abnormal Loss (if any occurs in that process)

Q14) What are the limitations of process costing?

A14) The limitations of process costing are-

1.Cost obtained at each process is only historical cost and are not very useful for effective control.

2.Process costing is based on average cost method, which is not that suitable for performance analysis, evaluation and managerial control.

3.Work-in-progress is generally done on estimated basis which leads to inaccuracy in total cost calculations.

4.The computation of average cost is more difficult in those cases where more than one type of products is manufactured and a division of the cost element is necessary.

5.Where different products arise in the same process and common costs are prorated to various costs units. Such individual products costs may be taken as only approximation and hence not reliable.

Q15) What are the advantages of process costing?

A15) The advantages of process costing are-

- Costs are be computed periodically at the end of a particular period

- It is simple and involves less clerical work that job costing

- It is easy to allocate the expenses to processes in order to have accurate costs.

- Use of standard costing systems in very effective in process costing situations.

- Process costing helps in preparation of tender, quotations

- Since cost data is available for each process, operation and department, good managerial control impossible.

Q16) What are the features of Process Costing?

A16) The features of process costing are-

- The production is continuous.

- The product is homogeneous.

- The process is standardized.

- Output of one process become raw material of another process.

- The output of the last process is transferred to finished stock.

- Costs are collected process-wise.

- Both direct and indirect costs are accumulated in each process.

- If the revise stock of semi-finished goods, it is expressed in terms of equal units.

- The total cost of each process is divided by the normal output of that process to find out cost per unit of that process.

Q17) What is the accounting procedure of costing?

A17) For each process an individual process account is prepared. Each process of production is treated as a distinct cost center.

Q18) According to CIMA London, what is process costing?

A18) CIMA London defines process costing as “that form of operation costing which applies where standardize goods are produced”

Q19) According to CIMA, what is contract costing?

A19) CIMA defines contract costs and contract costs as follows:

“The total price related to one contract specified as a price unit."

Q20) What will be the accounting treatment of cost in case of plants?

A20) The accounting treatment of cost in case of plants will be-

(A) If the plant is hired, the employment fee will be charged to the contract account.

(B) If the plant was specially purchased for a contract or the plant was sent to the site, the value of the plant is debited to the contract account. The value of the returned or remaining on-site plant will be credited to the contract account. The balance between the debited amount and the credited amount in the contract represents the value of the plant used in the field.

(C) The depreciation amount provided by the plant may be debited to the contract account instead of displaying the value of the plant issued to the site and remaining on the site.

Unit 4

Unit 4

Unit 4

Methods of Costing

Q1) What is Contract costing?

A1) Contract costing, unlike short-term jobs, is a special system of job costing that applies to long-term contracts. Contract costing applies primarily to civil engineering and engineering projects, shipbuilding, road and rail contracts, bridge construction, and more.

Contract costing may be a sort of specific order costing. This applies to contracts that take a considerable amount of time to complete and fall into different accounting periods. However, periods longer than one year are not an essential feature of long-term contracts. Some contracts with a term shorter than one year should be accounted for as long-term contracts if they are significant enough for the activity of that term.

Q2) What are the features of Contract costing?

A2) Contracts to which contract costing applies have the following features:

(A) The contract is based on the special requirements of the customer.

(B) The contract period is relatively long.

(C) Contract work is done on-site, unlike manufacturing under the roof.

(D) Contract work mainly consists of construction activities.

Q3) What is the accounting procedure for contract costing?

A3) If there are many contracts, an identification number and name are given to each contract for accounting and management reasons. A separate contract account is maintained for every contract.

All costs associated with the contract will be charged to each contract account. In the contract cost structure, the majority of spending is of a direct nature in the form of materials, wages, plant and store use, direct costs, etc., and only a small portion is charged as allocated overheads.

Q4) What are the accounting treatment of costs?

A4) The accounting treatment of costs are

1.Material:

(A) All materials purchased for the contract or sent to the site will be charged for the contract.

(B) If the material is returned to the store, or is on an unused site, or if the material is transferred to another contract site, it will be credited to the contract account.

(C) If the material is not needed immediately, the material will be stored and its costs will be debited to the stock account.

2. Labour:

All labour employed or worked in the field is treated as direct labour and all costs associated with them are charged to the contract account. Salaries and incentives for management and supervisory staff of a particular contract are also charged for that particular contract.

3. Plants:

(A) If the plant is hired, the employment fee will be charged to the contract account.

(B) If the plant was specially purchased for a contract or the plant was sent to the site, the value of the plant is debited to the contract account. The value of the returned or remaining on-site plant will be credited to the contract account. The balance between the debited amount and the credited amount in the contract represents the value of the plant used in the field.

(C) The depreciation amount provided by the plant may be debited to the contract account instead of displaying the value of the plant issued to the site and remaining on the site.

4. Subcontract fee:

Part of the contract work may be provided on a subcontract basis and payments made in the subcontract work may be debited to the contract account.

5. Overhead:

General overhead and head office expenses are fairly distributed to different contracts, and some overhead is charged to the contract account.

6. Difficulty of cost control:

Contracts are generally large and contract work is done on-site. This causes some problems with material use, labour utilization, labour supervision, plant and work damage, material and tool theft, and more. This site-based work makes it difficult to control the cost of contracts.

7. Surveyor Certificate and Deposit:

In contract work, surveyors, architects, and civil engineers visit the site on a regular basis to inspect the completed work. He issues a certificate stating the completion stage of the work and the value of the work completed by the certificate issuance date. Payment will be released to the contractor by the contractor based on the certificate.

Payments are typically released only up to a certain percentage, for example 80% of certified work. The balance of certified work is retained by the contractor until the entire contract is successfully completed.

The amount of money so reserved is called a "reservation". The contractor does so to protect itself from the risks that may arise from the contractor. Generally, the percentage of retained earnings is up to 20% of the amount of certified work.

8. Work in progress:

The amount of work in process includes the value of certified and uncertified work in process as it appears in your contract account.

9. Cost of running contract:

Due to the long-term nature of the contract, it was necessary to determine the profit attributable to each accounting period. For long-term contracts, it is believed that the results can be evaluated with reasonable certainty before they are signed, and imputed profits should be carefully calculated and included in the current account.

The profits taken up should be based on the principles of standard costing. For completed contracts, all profits arising from the contract can be transferred to the income statement.

However, in the case of an incomplete contract, preparations are made to deal with unforeseen circumstances and unexpected losses, so depending on the scope of work completed in the contract, only part of the profit is reflected in the income statement Will be done. There are no strict rules for calculating profits reflected in the income statement.

Q5) What are the principles followed in case of accounting treatment of cost?

A5) The following principles are followed:

(1) If an incomplete contract causes a loss, the entire loss will be debited to the income statement.

(2) Profit should only be considered for certified jobs. Uncertified work should be evaluated at cost.

(3) Contract completion is less than 25% of the contract price – no profit should be recorded on the income statement and the entire amount is retained as a reserve for contingencies.

(4) Contract completion up to 25% or more, less than 50% of the contract price – in this case, one-third of the profit, a decrease in the ratio of cash received to the certified work will be reflected in the profit and loss. Account. The balance remains as a reserve in case of contingency.

(5) Contract completions up to 50% or more and less than 90% – in this case, two-thirds of the profit is reduced by the percentage of cash received for the work authorized to be brought into the income statement, leaving the rest Keep up. The amount of reserve.

The formula is given below:

Q6) What is Process costing?

A6) Process costing is a way of costing adopted to seek out the value of these goods which are manufactured in stages. Each stage is called a process. The output of every process becomes the input for subsequent process and so on.

Q7) What are the features of Abnormal loss?

A7) The features of Abnormal loss are-

1. Loss due to external factors such as natural disasters, loss due to fire or theft, strike, failure, Machines, etc.

2. Unexpected loss.

3. Somewhat avoidable and therefore controllable.

4. Credited to process A / c as a balance number in the quantity column.

The 5-amount column is calculated using the following formula:

Abnormal loss (amount) =

Dr – Cr (% from quantity)

Dr – Cr (Amt Col.)

× Abnormal loss (quantity)

Q8) What are the features of Abnormal profit?

A8) The features of Abnormal profit are-

1. If the actual loss is less than the expected loss, it is called anomalous gain.

2. Due to the large amount of R / M, efficient workforce, advanced technology, etc.

3. Recorded as the balance number in the quantity column on the debit side of process A / c.

4. A monetary column calculated using the following formula.

Abnormal gain (amount) =

Dr – Cr (quantity column)

Dr – Cr (Amt column)

× Abnormal gain (quantity) the next process.

Example: Process costing is applicable to product like sugar industry, refining industry, paper industry. Etc. There are two types of losses in process costing.

Example: Input 20 Kgs

(–) Output 18 Kgs

= Loss 2 Kgs

Q9) What are the features of Normal loss?

A9) The features of Normal loss are-

1. It's a loss thanks to internal factors like heating, boiling, evaporation,

2. Expected loss.

3. A given percentage of the input amount.

4. It is an unavoidable loss and an unmanageable loss.

5. There are usually two types: (A) Scrap: It has feasible value. (B) Weight Loss: No Realizable value because it is an invisible process.

6. Credited to process A / c and calculated as% of the input quantity.

Q10) Give the specimen of Process Account when there are normal loss and abnormal losses.

A10) Dr. Process A/c. Cr.

Particulars | Units | Rs. | Particulars | Units | Rs. |

To Basic Material | Xxx | Xx | By Normal Loss | Xx | Xx |

To Direct Material |

| Xx | By Abnormal Loss | Xx | Xx |

To Direct Wages |

| Xx | By Process II A/c. | Xx | Xx |

To Direct Expenses |

| Xx | (Output transferred to |

|

|

To Production Overheads |

| Xx | Next process) |

|

|

To Cost of Rectification of Normal Defects |

| Xx | By Process Stock A/c. | Xx | Xx |

|

|

|

|

|

|

To Abnormal Gains |

| Xx |

|

|

|

| Xx | Xxx |

| Xx | Xx |

Q11) What is Cost of process?

A11) The cost of the output of the process (Total Cost less Sales value of scrap) is transferred to the next process. The cost of each process is thus made up to cost brought forward from the previous process and net cost of material, labour and overhead added in that process after reducing the sales value of scrap. The net cost of the finished process is transferred to the finished goods account. The net cost is divided by the number of units produced to determine the average cost per unit in that process.

Q12) What are the items on the Debit side of Process A/c?

A12) Each process account is debited with

a) Cost of materials used in that process.

b) Cost of labor incurred in that process.

c) Direct expenses incurred in that process.

d) Overheads charged to that process on some pre-determined.

e) Cost of ratification of normal defectives.

f) Cost of abnormal gain (if any arises in that process)

Q13) What are the items on the Credit side of Process A/c?

A13) Each process account is credited with

a) Scrap value of Normal Loss (if any) occurs in that process.

b) Cost of Abnormal Loss (if any occurs in that process)

Q14) What are the limitations of process costing?

A14) The limitations of process costing are-

1.Cost obtained at each process is only historical cost and are not very useful for effective control.

2.Process costing is based on average cost method, which is not that suitable for performance analysis, evaluation and managerial control.

3.Work-in-progress is generally done on estimated basis which leads to inaccuracy in total cost calculations.

4.The computation of average cost is more difficult in those cases where more than one type of products is manufactured and a division of the cost element is necessary.

5.Where different products arise in the same process and common costs are prorated to various costs units. Such individual products costs may be taken as only approximation and hence not reliable.

Q15) What are the advantages of process costing?

A15) The advantages of process costing are-

- Costs are be computed periodically at the end of a particular period

- It is simple and involves less clerical work that job costing

- It is easy to allocate the expenses to processes in order to have accurate costs.

- Use of standard costing systems in very effective in process costing situations.

- Process costing helps in preparation of tender, quotations

- Since cost data is available for each process, operation and department, good managerial control impossible.

Q16) What are the features of Process Costing?

A16) The features of process costing are-

- The production is continuous.

- The product is homogeneous.

- The process is standardized.

- Output of one process become raw material of another process.

- The output of the last process is transferred to finished stock.

- Costs are collected process-wise.

- Both direct and indirect costs are accumulated in each process.

- If the revise stock of semi-finished goods, it is expressed in terms of equal units.

- The total cost of each process is divided by the normal output of that process to find out cost per unit of that process.

Q17) What is the accounting procedure of costing?

A17) For each process an individual process account is prepared. Each process of production is treated as a distinct cost center.

Q18) According to CIMA London, what is process costing?

A18) CIMA London defines process costing as “that form of operation costing which applies where standardize goods are produced”

Q19) According to CIMA, what is contract costing?

A19) CIMA defines contract costs and contract costs as follows:

“The total price related to one contract specified as a price unit."

Q20) What will be the accounting treatment of cost in case of plants?

A20) The accounting treatment of cost in case of plants will be-

(A) If the plant is hired, the employment fee will be charged to the contract account.

(B) If the plant was specially purchased for a contract or the plant was sent to the site, the value of the plant is debited to the contract account. The value of the returned or remaining on-site plant will be credited to the contract account. The balance between the debited amount and the credited amount in the contract represents the value of the plant used in the field.

(C) The depreciation amount provided by the plant may be debited to the contract account instead of displaying the value of the plant issued to the site and remaining on the site.

Unit 4

Unit 4

Methods of Costing

Q1) What is Contract costing?

A1) Contract costing, unlike short-term jobs, is a special system of job costing that applies to long-term contracts. Contract costing applies primarily to civil engineering and engineering projects, shipbuilding, road and rail contracts, bridge construction, and more.

Contract costing may be a sort of specific order costing. This applies to contracts that take a considerable amount of time to complete and fall into different accounting periods. However, periods longer than one year are not an essential feature of long-term contracts. Some contracts with a term shorter than one year should be accounted for as long-term contracts if they are significant enough for the activity of that term.

Q2) What are the features of Contract costing?

A2) Contracts to which contract costing applies have the following features:

(A) The contract is based on the special requirements of the customer.

(B) The contract period is relatively long.

(C) Contract work is done on-site, unlike manufacturing under the roof.

(D) Contract work mainly consists of construction activities.

Q3) What is the accounting procedure for contract costing?

A3) If there are many contracts, an identification number and name are given to each contract for accounting and management reasons. A separate contract account is maintained for every contract.

All costs associated with the contract will be charged to each contract account. In the contract cost structure, the majority of spending is of a direct nature in the form of materials, wages, plant and store use, direct costs, etc., and only a small portion is charged as allocated overheads.

Q4) What are the accounting treatment of costs?

A4) The accounting treatment of costs are

1.Material:

(A) All materials purchased for the contract or sent to the site will be charged for the contract.

(B) If the material is returned to the store, or is on an unused site, or if the material is transferred to another contract site, it will be credited to the contract account.

(C) If the material is not needed immediately, the material will be stored and its costs will be debited to the stock account.

2. Labour:

All labour employed or worked in the field is treated as direct labour and all costs associated with them are charged to the contract account. Salaries and incentives for management and supervisory staff of a particular contract are also charged for that particular contract.

3. Plants:

(A) If the plant is hired, the employment fee will be charged to the contract account.

(B) If the plant was specially purchased for a contract or the plant was sent to the site, the value of the plant is debited to the contract account. The value of the returned or remaining on-site plant will be credited to the contract account. The balance between the debited amount and the credited amount in the contract represents the value of the plant used in the field.

(C) The depreciation amount provided by the plant may be debited to the contract account instead of displaying the value of the plant issued to the site and remaining on the site.

4. Subcontract fee:

Part of the contract work may be provided on a subcontract basis and payments made in the subcontract work may be debited to the contract account.

5. Overhead:

General overhead and head office expenses are fairly distributed to different contracts, and some overhead is charged to the contract account.

6. Difficulty of cost control:

Contracts are generally large and contract work is done on-site. This causes some problems with material use, labour utilization, labour supervision, plant and work damage, material and tool theft, and more. This site-based work makes it difficult to control the cost of contracts.

7. Surveyor Certificate and Deposit:

In contract work, surveyors, architects, and civil engineers visit the site on a regular basis to inspect the completed work. He issues a certificate stating the completion stage of the work and the value of the work completed by the certificate issuance date. Payment will be released to the contractor by the contractor based on the certificate.

Payments are typically released only up to a certain percentage, for example 80% of certified work. The balance of certified work is retained by the contractor until the entire contract is successfully completed.

The amount of money so reserved is called a "reservation". The contractor does so to protect itself from the risks that may arise from the contractor. Generally, the percentage of retained earnings is up to 20% of the amount of certified work.

8. Work in progress:

The amount of work in process includes the value of certified and uncertified work in process as it appears in your contract account.

9. Cost of running contract:

Due to the long-term nature of the contract, it was necessary to determine the profit attributable to each accounting period. For long-term contracts, it is believed that the results can be evaluated with reasonable certainty before they are signed, and imputed profits should be carefully calculated and included in the current account.

The profits taken up should be based on the principles of standard costing. For completed contracts, all profits arising from the contract can be transferred to the income statement.

However, in the case of an incomplete contract, preparations are made to deal with unforeseen circumstances and unexpected losses, so depending on the scope of work completed in the contract, only part of the profit is reflected in the income statement Will be done. There are no strict rules for calculating profits reflected in the income statement.

Q5) What are the principles followed in case of accounting treatment of cost?

A5) The following principles are followed:

(1) If an incomplete contract causes a loss, the entire loss will be debited to the income statement.

(2) Profit should only be considered for certified jobs. Uncertified work should be evaluated at cost.

(3) Contract completion is less than 25% of the contract price – no profit should be recorded on the income statement and the entire amount is retained as a reserve for contingencies.

(4) Contract completion up to 25% or more, less than 50% of the contract price – in this case, one-third of the profit, a decrease in the ratio of cash received to the certified work will be reflected in the profit and loss. Account. The balance remains as a reserve in case of contingency.

(5) Contract completions up to 50% or more and less than 90% – in this case, two-thirds of the profit is reduced by the percentage of cash received for the work authorized to be brought into the income statement, leaving the rest Keep up. The amount of reserve.

The formula is given below:

Q6) What is Process costing?

A6) Process costing is a way of costing adopted to seek out the value of these goods which are manufactured in stages. Each stage is called a process. The output of every process becomes the input for subsequent process and so on.

Q7) What are the features of Abnormal loss?

A7) The features of Abnormal loss are-

1. Loss due to external factors such as natural disasters, loss due to fire or theft, strike, failure, Machines, etc.

2. Unexpected loss.

3. Somewhat avoidable and therefore controllable.

4. Credited to process A / c as a balance number in the quantity column.

The 5-amount column is calculated using the following formula:

Abnormal loss (amount) =

Dr – Cr (% from quantity)

Dr – Cr (Amt Col.)

× Abnormal loss (quantity)

Q8) What are the features of Abnormal profit?

A8) The features of Abnormal profit are-

1. If the actual loss is less than the expected loss, it is called anomalous gain.

2. Due to the large amount of R / M, efficient workforce, advanced technology, etc.

3. Recorded as the balance number in the quantity column on the debit side of process A / c.

4. A monetary column calculated using the following formula.

Abnormal gain (amount) =

Dr – Cr (quantity column)

Dr – Cr (Amt column)

× Abnormal gain (quantity) the next process.

Example: Process costing is applicable to product like sugar industry, refining industry, paper industry. Etc. There are two types of losses in process costing.

Example: Input 20 Kgs

(–) Output 18 Kgs

= Loss 2 Kgs

Q9) What are the features of Normal loss?

A9) The features of Normal loss are-

1. It's a loss thanks to internal factors like heating, boiling, evaporation,

2. Expected loss.

3. A given percentage of the input amount.

4. It is an unavoidable loss and an unmanageable loss.

5. There are usually two types: (A) Scrap: It has feasible value. (B) Weight Loss: No Realizable value because it is an invisible process.

6. Credited to process A / c and calculated as% of the input quantity.

Q10) Give the specimen of Process Account when there are normal loss and abnormal losses.

A10) Dr. Process A/c. Cr.

Particulars | Units | Rs. | Particulars | Units | Rs. |

To Basic Material | Xxx | Xx | By Normal Loss | Xx | Xx |

To Direct Material |

| Xx | By Abnormal Loss | Xx | Xx |

To Direct Wages |

| Xx | By Process II A/c. | Xx | Xx |

To Direct Expenses |

| Xx | (Output transferred to |

|

|

To Production Overheads |

| Xx | Next process) |

|

|

To Cost of Rectification of Normal Defects |

| Xx | By Process Stock A/c. | Xx | Xx |

|

|

|

|

|

|

To Abnormal Gains |

| Xx |

|

|

|

| Xx | Xxx |

| Xx | Xx |

Q11) What is Cost of process?

A11) The cost of the output of the process (Total Cost less Sales value of scrap) is transferred to the next process. The cost of each process is thus made up to cost brought forward from the previous process and net cost of material, labour and overhead added in that process after reducing the sales value of scrap. The net cost of the finished process is transferred to the finished goods account. The net cost is divided by the number of units produced to determine the average cost per unit in that process.

Q12) What are the items on the Debit side of Process A/c?

A12) Each process account is debited with

a) Cost of materials used in that process.

b) Cost of labor incurred in that process.

c) Direct expenses incurred in that process.

d) Overheads charged to that process on some pre-determined.

e) Cost of ratification of normal defectives.

f) Cost of abnormal gain (if any arises in that process)

Q13) What are the items on the Credit side of Process A/c?

A13) Each process account is credited with

a) Scrap value of Normal Loss (if any) occurs in that process.

b) Cost of Abnormal Loss (if any occurs in that process)

Q14) What are the limitations of process costing?

A14) The limitations of process costing are-

1.Cost obtained at each process is only historical cost and are not very useful for effective control.

2.Process costing is based on average cost method, which is not that suitable for performance analysis, evaluation and managerial control.

3.Work-in-progress is generally done on estimated basis which leads to inaccuracy in total cost calculations.

4.The computation of average cost is more difficult in those cases where more than one type of products is manufactured and a division of the cost element is necessary.

5.Where different products arise in the same process and common costs are prorated to various costs units. Such individual products costs may be taken as only approximation and hence not reliable.

Q15) What are the advantages of process costing?

A15) The advantages of process costing are-

- Costs are be computed periodically at the end of a particular period

- It is simple and involves less clerical work that job costing

- It is easy to allocate the expenses to processes in order to have accurate costs.

- Use of standard costing systems in very effective in process costing situations.

- Process costing helps in preparation of tender, quotations

- Since cost data is available for each process, operation and department, good managerial control impossible.

Q16) What are the features of Process Costing?

A16) The features of process costing are-

- The production is continuous.

- The product is homogeneous.

- The process is standardized.

- Output of one process become raw material of another process.

- The output of the last process is transferred to finished stock.

- Costs are collected process-wise.

- Both direct and indirect costs are accumulated in each process.

- If the revise stock of semi-finished goods, it is expressed in terms of equal units.

- The total cost of each process is divided by the normal output of that process to find out cost per unit of that process.

Q17) What is the accounting procedure of costing?

A17) For each process an individual process account is prepared. Each process of production is treated as a distinct cost center.

Q18) According to CIMA London, what is process costing?

A18) CIMA London defines process costing as “that form of operation costing which applies where standardize goods are produced”

Q19) According to CIMA, what is contract costing?

A19) CIMA defines contract costs and contract costs as follows:

“The total price related to one contract specified as a price unit."

Q20) What will be the accounting treatment of cost in case of plants?

A20) The accounting treatment of cost in case of plants will be-

(A) If the plant is hired, the employment fee will be charged to the contract account.

(B) If the plant was specially purchased for a contract or the plant was sent to the site, the value of the plant is debited to the contract account. The value of the returned or remaining on-site plant will be credited to the contract account. The balance between the debited amount and the credited amount in the contract represents the value of the plant used in the field.

(C) The depreciation amount provided by the plant may be debited to the contract account instead of displaying the value of the plant issued to the site and remaining on the site.