Unit 6

Marginal Costing and Break –Even Analysis

Q1) What is Marginal costing?

A1) Marginal cost refers to the increase or decrease in the cost of producing one more unit or serving one more customer. It is also known as incremental cost.

Marginal costs are based on production expenses that are variable or direct – labour, materials, and equipment, for example – and not fixed costs the company will have whether it increases production or not. Fixed costs might include administrative overhead and marketing efforts – expenses that are the same no matter how many pieces are produced.

Q2) Why Marginal costing is very important?

A2) Marginal Costing is very important technique in solving managerial problems and contributing in various areas of decisions. In this context profitability of two or more alternative options is compared and such options is selected which offers maximum profitability along with fulfilment of objectives of the enterprise. Marginal costing - definition Marginal costing distinguishes between fixed costs and variable costs as convention ally classified. The marginal cost of a product –―is its variable cost‖. This is normally taken to be; direct labour, direct material, direct expenses and the variable part of overheads. Marginal costing is formally defined as: ‗the accounting system in which variable costs are charged to cost units and the fixed costs of the period are written-off in full against the aggregate contribution. Its special value is in decision making ‘. (Terminology.) The term contribution ‘mentioned in the formal definition is the term given to the difference between Sales and marginal cost.

Q3) What are the assumptions of marginal costing?

A3) The assumptions of marginal costing are-

1. All Elements of cost can be segregated into fixed and variable cost.

2. Variable cost remains constant per unit of output irrespective of the level of output and thus fluctuates directly in proportion to changes in the volume of output.

3. The selling price remains unchanged at all levels of activity.

4. Fixed costs remain unchanged for entire volume of production.

5. The volume of production is the only factor which influences the costs.

6. The state of technology process of production and quality of output will remain unchanged.

7. There will be no significant change in the level of opening and closing inventory.

8. The company manufactures a single product. In the case of a multi-product company, the sales-mix remains unchanged.

9. Both revenue and cost functions are linear over the range of activity under considerations.

Q4) What are the advantages of Marginal costing?

A4) The advantages of Marginal costing are-

1. The marginal costing technique is very simple to understand and easy to operate. The reason is that the fixed costs are not included in the cost of production and there is no arbitrary apportionment of fixed costs.

2. The current year fixed costs is not carried forward to the next year. As such, cost and profit are not vitiated. Cost comparisons become meaningful.

3. The contribution is used as a tool in managerial decision-making. It provides a more reliable measure for decision-making.

4. Marginal costing shows more clearly the impact on profit of fluctuations in the volume of sales.

5. Under absorption and over absorption of overheads problems are not arisen under marginal costing.

6. The marginal costing technique can be combined with standard costing.

7. The prevailing relationship between cost, selling price and volume are properly explained in clear terms.

8. It shows the relative contributions to profit that are made by each of a number of products and show where the sales effort should be contracted.

9. The management can take short run tactical decisions with the help of marginal costing information.

10. Marginal cost pricing method is highly useful for public utility undertakings. It helps them in maximizing output or better capacity utilization. This is possible only when lowest possible price is charged. The lowest limit is set by marginal cost of the product. When public utility concerns adopt marginal cost pricing, it helps in maximizing social welfare.

11. This method enables the firms to face competition. This is the reason why export prices are based on marginal costs since international market is highly competitive.

12. This method helps in optimum allocation of resources and as such it is the most efficient and effective pricing technique and it is useful when demand conditions are slack.

13. Marginal cost pricing is suitable for pricing over the life-cycle of a product. Each stage of the life-cycle has separate fixed cost and short-run marginal cost.

Q5) What are the disadvantages of Marginal costing?

A5) The disadvantages, demerits or limitations of marginal costing are briefly explained below.

1. The total costs cannot be easily segregated into fixed costs and variable costs.

2. Moreover, it is also very difficult to per-determine the degree of variability of semi-variable costs.

3. Under marginal costing, the fixed costs remain constant and variable costs are varying according to level of output. In reality, the fixed costs do not remain constant and the variable costs are not varying according to level of output.

4. There is no meaning in the exclusion of fixed costs from the valuation of finished goods since the fixed costs are incurred for the purpose of manufacture of products.

5. In the case of loss by fire, the full amount of loss cannot be recovered from the insurance company since the stocks are undervalued.

6. Tax authorities do not accept the valuation of stock since the shock does not show true value.

7. The calculation of variable overheads does not include all the variable overheads.

8. The profit fluctuates as per the fluctuation of sales volume. Hence, the preparation of periodic operating statements becomes unrealistic.

9. The elimination of fixed costs renders cost comparison of jobs difficult.

10. The management cannot take a quality decision with the help of contribution alone. The contribution may vary if new techniques followed in the production process.

11. The fixed costs are constant only for short period. In the long run, all the costs are variable.

12. Firms may find it difficult to cover up costs and earn a fair return on capital employed when they follow marginal cost principle in times of recession when demand is slack and price reduction becomes inevitable to retain business.

13. Marginal cost pricing requires a better understanding of marginal cost technique. Some accountants are not fully conversant with the marginal techniques themselves. Therefore, they are not capable of explaining their use to the management.

In spite of its advantages, due to its inherent weakness of not ensuring the coverage of fixed costs, marginal pricing has not been adopted extensively. It is confined to cases of special orders only.

Q6) What is Break-even analysis?

A6) Break-even analysis entails calculating and examining the margin of safety for an entity based on the revenues collected and associated costs. In other words, the analysis shows how many sales it takes to pay for the cost of doing business. Analysing different price levels relating to various levels of demand, the break-even analysis determines what level of sales are necessary to cover the company's total fixed costs. A demand-side analysis would give a seller significant insight into selling capabilities.

Q7) How Break-Even Analysis Works?

A7) Break-even analysis is useful in determining the level of production or a targeted desired sales mix. The study is for a company's management’s use only, as the metric and calculations are not used by external parties, such as investors, regulators, or financial institutions. This type of analysis involves a calculation of the break-even point (BEP). The break-even point is calculated by dividing the total fixed costs of production by the price per individual unit less the variable costs of production. Fixed costs are costs that remain the same regardless of how many units are sold.

Break-even analysis looks at the level of fixed costs relative to the profit earned by each additional unit produced and sold. In general, a company with lower fixed costs will have a lower break-even point of sale. For example, a company with $0 of fixed costs will automatically have broken even upon the sale of the first product assuming variable costs do not exceed sales revenue.

Q8) What is Break-even point?

A8) The breakeven point (break-even price) for a trade or investment is determined by comparing the market price of an asset to the original cost; the breakeven point is reached when the two prices are equal.

In corporate accounting, the breakeven point formula is determined by dividing the total fixed costs associated with production by the revenue per individual unit minus the variable costs per unit. In this case, fixed costs refer to those which do not change depending upon the number of units sold. Put differently, the breakeven point is the production level at which total revenues for a product equal total expense.

Q9) Where Breakeven points can be applied?

A9) Breakeven points can be applied to a wide variety of contexts. For instance, the breakeven point in a property would be how much money the homeowner would need to generate from a sale to exactly offset the net purchase price, inclusive of closing costs, taxes, fees, insurance, and interest paid on the mortgage—as well as costs related to maintenance and home improvements. At that price, the homeowner would exactly break even, neither making nor losing any money.

Traders also apply BEPs to trades, figuring out what price a security must reach to exactly cover all costs associated with a trade including taxes, commissions, management fees, and so on. A company's breakeven is likewise calculated by taking fixed costs and dividing that figure by the gross profit margin percentage.

Q10) How Do You Calculate a Breakeven Point?

A10) Generally, to calculate the breakeven point in business, fixed costs are divided by the gross profit margin. This produces a dollar figure that a company needs to break even. When it comes to stocks, if a trader bought a stock at $200, and nine months later it reached $200 again after falling from $250, it would have reached the breakeven point.

Q11) How Do You Calculate a Breakeven Point in Options Trading?

A11) Consider the following example in which an investor pays a $10 premium for a stock call option, and the strike price is $100. The breakeven point would equal the $10 premium plus the $100 strike price, or $110. On the other hand, if this were applied to a put option, the breakeven point would be calculated as the $100 strike price minus the $10 premium paid, amounting to $90.

Q12) What is Margin of safety?

A12) Margin of safety is a principle of investing in which an investor only purchases securities when their market price is significantly below their intrinsic value. In other words, when the market price of a security is significantly below your estimation of its intrinsic value, the difference is the margin of safety. Because investors may set a margin of safety in accordance with their own risk preferences, buying securities when this difference is present allows an investment to be made with minimal downside risk.

Alternatively, in accounting, the margin of safety, or safety margin, refers to the difference between actual sales and break-even sales. Managers can utilize the margin of safety to know how much sales can decrease before the company or a project becomes unprofitable.

Q13) Who popularize the margin of safety principle?

A13) The margin of safety principle was popularized by famed British-born American investor Benjamin Graham (known as the father of value investing) and his followers, most notably Warren Buffett. Investors utilize both qualitative and quantitative factors, including firm management, governance, industry performance, assets and earnings, to determine a security's intrinsic value. The market price is then used as the point of comparison to calculate the margin of safety. Buffett, who is a staunch believer in the margin of safety and has declared it one of his "cornerstones of investing," has been known to apply as much as a 50% discount to the intrinsic value of a stock as his price target.

Q14) How to Calculate the Margin of Safety

A14) To calculate the margin of safety, subtract the current breakeven point from sales, and divide by sales. The formula is:

(Current Sales Level – Breakeven Point) ÷ Current Sales Level = Margin of safety

The amount of this buffer is expressed as a percentage.

Q15) What are the two alternative versions of the margin of safety?

A15) The two alternative versions of the margin of safety are-

- Budget based. A company may want to project its margin of safety under a budget for a future period. If so, replace the current sales level in the formula with the budgeted sales level.

- Unit based. If you want to translate the margin of safety into the number of units sold, then use the following formula instead (though note that this version works best if a company only sells one product):

(Current Sales Level - Breakeven Point) ÷ Selling Price Per Unit

Q16) Where the margin of safety concept is applied?

A16) The margin of safety concept is also applied to investing, where it refers to the difference between the intrinsic value of a company's share price and its current market value. An investor wants to see a large variance between the two figures (which is the margin of safety) before buying stock. This implies that there is substantial upside potential for the stock price - or at least, it means any error in deriving the intrinsic value must be a big one in order to erase the margin of safety.

Q17) How to calculate break even formula?

A17) The breakeven formula for a business provides a dollar figure they need to break even. This can be converted into units by calculating the contribution margin (unit sale price fewer variable costs). Dividing the fixed costs by the contribution margin will provide how many units are needed to break even.

Business Breakeven= Fixed cost/ Gross Profit Margin

The information required to calculate a business's BEP can be found in its financial statements. The first pieces of information required are the fixed costs and the gross margin percentage.

Assume a company has $1 million in fixed costs and a gross margin of 37%. Its breakeven point is $2.7 million ($1 million / 0.37). In this breakeven point example, the company must generate $2.7 million in revenue to cover its fixed and variable costs. If it generates more sales, the company will have a profit. If it generates fewer sales, there will be a loss.

It is also possible to calculate how many units need to be sold to cover the fixed costs, which will result in the company breaking even. To do this, calculate the contribution margin, which is the sale price of the product less variable costs.

Assume a company has a $50 sale price for their product and variable costs of $10. The contribution margin is $40 ($50 - $10). Divide the fixed costs by the contribution margin to determine how many units the company has to sell: $1 million / $40 = 25,000 units. If the company sells more units than this it will show a profit. If it sells less, there will be a loss.

Q18) How marginal costing is calculated?

A18) Marginal costing is often calculated when enough items have been produced to cover the fixed costs and production is at a break-even point, where the only expenses going forward are variable or direct costs. When average costs are constant, as opposed to situations where material costs fluctuate because of scarcity issues, marginal cost is usually the same as average cost.

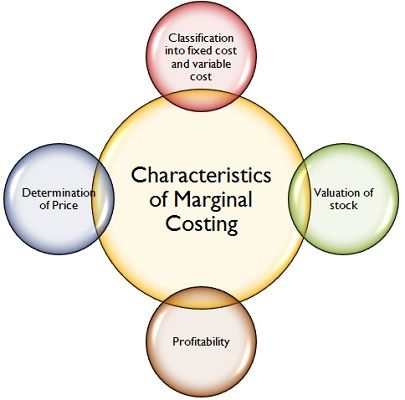

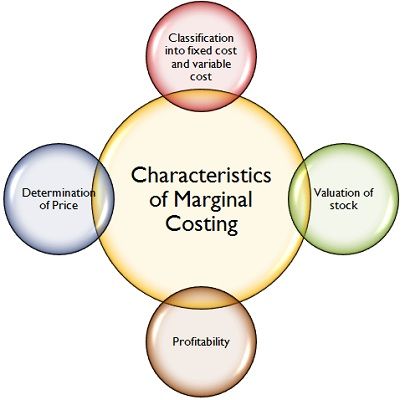

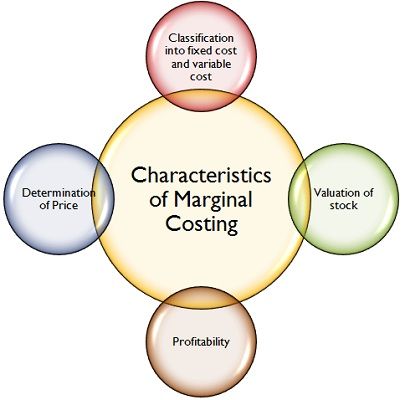

Q19) Mention with diagram the characteristics of Marginal costing?

A19) The characteristics of marginal costing are-

Q20) Where traders apply Break-even point?

A20) Traders also apply BEPs to trades, figuring out what price a security must reach to exactly cover all costs associated with a trade including taxes, commissions, management fees, and so on. A company's breakeven is likewise calculated by taking fixed costs and dividing that figure by the gross profit margin percentage.

Unit 6

Marginal Costing and Break –Even Analysis

Q1) What is Marginal costing?

A1) Marginal cost refers to the increase or decrease in the cost of producing one more unit or serving one more customer. It is also known as incremental cost.

Marginal costs are based on production expenses that are variable or direct – labour, materials, and equipment, for example – and not fixed costs the company will have whether it increases production or not. Fixed costs might include administrative overhead and marketing efforts – expenses that are the same no matter how many pieces are produced.

Q2) Why Marginal costing is very important?

A2) Marginal Costing is very important technique in solving managerial problems and contributing in various areas of decisions. In this context profitability of two or more alternative options is compared and such options is selected which offers maximum profitability along with fulfilment of objectives of the enterprise. Marginal costing - definition Marginal costing distinguishes between fixed costs and variable costs as convention ally classified. The marginal cost of a product –―is its variable cost‖. This is normally taken to be; direct labour, direct material, direct expenses and the variable part of overheads. Marginal costing is formally defined as: ‗the accounting system in which variable costs are charged to cost units and the fixed costs of the period are written-off in full against the aggregate contribution. Its special value is in decision making ‘. (Terminology.) The term contribution ‘mentioned in the formal definition is the term given to the difference between Sales and marginal cost.

Q3) What are the assumptions of marginal costing?

A3) The assumptions of marginal costing are-

1. All Elements of cost can be segregated into fixed and variable cost.

2. Variable cost remains constant per unit of output irrespective of the level of output and thus fluctuates directly in proportion to changes in the volume of output.

3. The selling price remains unchanged at all levels of activity.

4. Fixed costs remain unchanged for entire volume of production.

5. The volume of production is the only factor which influences the costs.

6. The state of technology process of production and quality of output will remain unchanged.

7. There will be no significant change in the level of opening and closing inventory.

8. The company manufactures a single product. In the case of a multi-product company, the sales-mix remains unchanged.

9. Both revenue and cost functions are linear over the range of activity under considerations.

Q4) What are the advantages of Marginal costing?

A4) The advantages of Marginal costing are-

1. The marginal costing technique is very simple to understand and easy to operate. The reason is that the fixed costs are not included in the cost of production and there is no arbitrary apportionment of fixed costs.

2. The current year fixed costs is not carried forward to the next year. As such, cost and profit are not vitiated. Cost comparisons become meaningful.

3. The contribution is used as a tool in managerial decision-making. It provides a more reliable measure for decision-making.

4. Marginal costing shows more clearly the impact on profit of fluctuations in the volume of sales.

5. Under absorption and over absorption of overheads problems are not arisen under marginal costing.

6. The marginal costing technique can be combined with standard costing.

7. The prevailing relationship between cost, selling price and volume are properly explained in clear terms.

8. It shows the relative contributions to profit that are made by each of a number of products and show where the sales effort should be contracted.

9. The management can take short run tactical decisions with the help of marginal costing information.

10. Marginal cost pricing method is highly useful for public utility undertakings. It helps them in maximizing output or better capacity utilization. This is possible only when lowest possible price is charged. The lowest limit is set by marginal cost of the product. When public utility concerns adopt marginal cost pricing, it helps in maximizing social welfare.

11. This method enables the firms to face competition. This is the reason why export prices are based on marginal costs since international market is highly competitive.

12. This method helps in optimum allocation of resources and as such it is the most efficient and effective pricing technique and it is useful when demand conditions are slack.

13. Marginal cost pricing is suitable for pricing over the life-cycle of a product. Each stage of the life-cycle has separate fixed cost and short-run marginal cost.

Q5) What are the disadvantages of Marginal costing?

A5) The disadvantages, demerits or limitations of marginal costing are briefly explained below.

1. The total costs cannot be easily segregated into fixed costs and variable costs.

2. Moreover, it is also very difficult to per-determine the degree of variability of semi-variable costs.

3. Under marginal costing, the fixed costs remain constant and variable costs are varying according to level of output. In reality, the fixed costs do not remain constant and the variable costs are not varying according to level of output.

4. There is no meaning in the exclusion of fixed costs from the valuation of finished goods since the fixed costs are incurred for the purpose of manufacture of products.

5. In the case of loss by fire, the full amount of loss cannot be recovered from the insurance company since the stocks are undervalued.

6. Tax authorities do not accept the valuation of stock since the shock does not show true value.

7. The calculation of variable overheads does not include all the variable overheads.

8. The profit fluctuates as per the fluctuation of sales volume. Hence, the preparation of periodic operating statements becomes unrealistic.

9. The elimination of fixed costs renders cost comparison of jobs difficult.

10. The management cannot take a quality decision with the help of contribution alone. The contribution may vary if new techniques followed in the production process.

11. The fixed costs are constant only for short period. In the long run, all the costs are variable.

12. Firms may find it difficult to cover up costs and earn a fair return on capital employed when they follow marginal cost principle in times of recession when demand is slack and price reduction becomes inevitable to retain business.

13. Marginal cost pricing requires a better understanding of marginal cost technique. Some accountants are not fully conversant with the marginal techniques themselves. Therefore, they are not capable of explaining their use to the management.

In spite of its advantages, due to its inherent weakness of not ensuring the coverage of fixed costs, marginal pricing has not been adopted extensively. It is confined to cases of special orders only.

Q6) What is Break-even analysis?

A6) Break-even analysis entails calculating and examining the margin of safety for an entity based on the revenues collected and associated costs. In other words, the analysis shows how many sales it takes to pay for the cost of doing business. Analysing different price levels relating to various levels of demand, the break-even analysis determines what level of sales are necessary to cover the company's total fixed costs. A demand-side analysis would give a seller significant insight into selling capabilities.

Q7) How Break-Even Analysis Works?

A7) Break-even analysis is useful in determining the level of production or a targeted desired sales mix. The study is for a company's management’s use only, as the metric and calculations are not used by external parties, such as investors, regulators, or financial institutions. This type of analysis involves a calculation of the break-even point (BEP). The break-even point is calculated by dividing the total fixed costs of production by the price per individual unit less the variable costs of production. Fixed costs are costs that remain the same regardless of how many units are sold.

Break-even analysis looks at the level of fixed costs relative to the profit earned by each additional unit produced and sold. In general, a company with lower fixed costs will have a lower break-even point of sale. For example, a company with $0 of fixed costs will automatically have broken even upon the sale of the first product assuming variable costs do not exceed sales revenue.

Q8) What is Break-even point?

A8) The breakeven point (break-even price) for a trade or investment is determined by comparing the market price of an asset to the original cost; the breakeven point is reached when the two prices are equal.

In corporate accounting, the breakeven point formula is determined by dividing the total fixed costs associated with production by the revenue per individual unit minus the variable costs per unit. In this case, fixed costs refer to those which do not change depending upon the number of units sold. Put differently, the breakeven point is the production level at which total revenues for a product equal total expense.

Q9) Where Breakeven points can be applied?

A9) Breakeven points can be applied to a wide variety of contexts. For instance, the breakeven point in a property would be how much money the homeowner would need to generate from a sale to exactly offset the net purchase price, inclusive of closing costs, taxes, fees, insurance, and interest paid on the mortgage—as well as costs related to maintenance and home improvements. At that price, the homeowner would exactly break even, neither making nor losing any money.

Traders also apply BEPs to trades, figuring out what price a security must reach to exactly cover all costs associated with a trade including taxes, commissions, management fees, and so on. A company's breakeven is likewise calculated by taking fixed costs and dividing that figure by the gross profit margin percentage.

Q10) How Do You Calculate a Breakeven Point?

A10) Generally, to calculate the breakeven point in business, fixed costs are divided by the gross profit margin. This produces a dollar figure that a company needs to break even. When it comes to stocks, if a trader bought a stock at $200, and nine months later it reached $200 again after falling from $250, it would have reached the breakeven point.

Q11) How Do You Calculate a Breakeven Point in Options Trading?

A11) Consider the following example in which an investor pays a $10 premium for a stock call option, and the strike price is $100. The breakeven point would equal the $10 premium plus the $100 strike price, or $110. On the other hand, if this were applied to a put option, the breakeven point would be calculated as the $100 strike price minus the $10 premium paid, amounting to $90.

Q12) What is Margin of safety?

A12) Margin of safety is a principle of investing in which an investor only purchases securities when their market price is significantly below their intrinsic value. In other words, when the market price of a security is significantly below your estimation of its intrinsic value, the difference is the margin of safety. Because investors may set a margin of safety in accordance with their own risk preferences, buying securities when this difference is present allows an investment to be made with minimal downside risk.

Alternatively, in accounting, the margin of safety, or safety margin, refers to the difference between actual sales and break-even sales. Managers can utilize the margin of safety to know how much sales can decrease before the company or a project becomes unprofitable.

Q13) Who popularize the margin of safety principle?

A13) The margin of safety principle was popularized by famed British-born American investor Benjamin Graham (known as the father of value investing) and his followers, most notably Warren Buffett. Investors utilize both qualitative and quantitative factors, including firm management, governance, industry performance, assets and earnings, to determine a security's intrinsic value. The market price is then used as the point of comparison to calculate the margin of safety. Buffett, who is a staunch believer in the margin of safety and has declared it one of his "cornerstones of investing," has been known to apply as much as a 50% discount to the intrinsic value of a stock as his price target.

Q14) How to Calculate the Margin of Safety

A14) To calculate the margin of safety, subtract the current breakeven point from sales, and divide by sales. The formula is:

(Current Sales Level – Breakeven Point) ÷ Current Sales Level = Margin of safety

The amount of this buffer is expressed as a percentage.

Q15) What are the two alternative versions of the margin of safety?

A15) The two alternative versions of the margin of safety are-

- Budget based. A company may want to project its margin of safety under a budget for a future period. If so, replace the current sales level in the formula with the budgeted sales level.

- Unit based. If you want to translate the margin of safety into the number of units sold, then use the following formula instead (though note that this version works best if a company only sells one product):

(Current Sales Level - Breakeven Point) ÷ Selling Price Per Unit

Q16) Where the margin of safety concept is applied?

A16) The margin of safety concept is also applied to investing, where it refers to the difference between the intrinsic value of a company's share price and its current market value. An investor wants to see a large variance between the two figures (which is the margin of safety) before buying stock. This implies that there is substantial upside potential for the stock price - or at least, it means any error in deriving the intrinsic value must be a big one in order to erase the margin of safety.

Q17) How to calculate break even formula?

A17) The breakeven formula for a business provides a dollar figure they need to break even. This can be converted into units by calculating the contribution margin (unit sale price fewer variable costs). Dividing the fixed costs by the contribution margin will provide how many units are needed to break even.

Business Breakeven= Fixed cost/ Gross Profit Margin

The information required to calculate a business's BEP can be found in its financial statements. The first pieces of information required are the fixed costs and the gross margin percentage.

Assume a company has $1 million in fixed costs and a gross margin of 37%. Its breakeven point is $2.7 million ($1 million / 0.37). In this breakeven point example, the company must generate $2.7 million in revenue to cover its fixed and variable costs. If it generates more sales, the company will have a profit. If it generates fewer sales, there will be a loss.

It is also possible to calculate how many units need to be sold to cover the fixed costs, which will result in the company breaking even. To do this, calculate the contribution margin, which is the sale price of the product less variable costs.

Assume a company has a $50 sale price for their product and variable costs of $10. The contribution margin is $40 ($50 - $10). Divide the fixed costs by the contribution margin to determine how many units the company has to sell: $1 million / $40 = 25,000 units. If the company sells more units than this it will show a profit. If it sells less, there will be a loss.

Q18) How marginal costing is calculated?

A18) Marginal costing is often calculated when enough items have been produced to cover the fixed costs and production is at a break-even point, where the only expenses going forward are variable or direct costs. When average costs are constant, as opposed to situations where material costs fluctuate because of scarcity issues, marginal cost is usually the same as average cost.

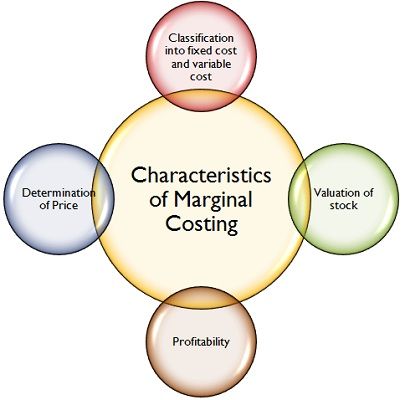

Q19) Mention with diagram the characteristics of Marginal costing?

A19) The characteristics of marginal costing are-

Q20) Where traders apply Break-even point?

A20) Traders also apply BEPs to trades, figuring out what price a security must reach to exactly cover all costs associated with a trade including taxes, commissions, management fees, and so on. A company's breakeven is likewise calculated by taking fixed costs and dividing that figure by the gross profit margin percentage.

Unit 6

Unit 6

Marginal Costing and Break –Even Analysis

Q1) What is Marginal costing?

A1) Marginal cost refers to the increase or decrease in the cost of producing one more unit or serving one more customer. It is also known as incremental cost.

Marginal costs are based on production expenses that are variable or direct – labour, materials, and equipment, for example – and not fixed costs the company will have whether it increases production or not. Fixed costs might include administrative overhead and marketing efforts – expenses that are the same no matter how many pieces are produced.

Q2) Why Marginal costing is very important?

A2) Marginal Costing is very important technique in solving managerial problems and contributing in various areas of decisions. In this context profitability of two or more alternative options is compared and such options is selected which offers maximum profitability along with fulfilment of objectives of the enterprise. Marginal costing - definition Marginal costing distinguishes between fixed costs and variable costs as convention ally classified. The marginal cost of a product –―is its variable cost‖. This is normally taken to be; direct labour, direct material, direct expenses and the variable part of overheads. Marginal costing is formally defined as: ‗the accounting system in which variable costs are charged to cost units and the fixed costs of the period are written-off in full against the aggregate contribution. Its special value is in decision making ‘. (Terminology.) The term contribution ‘mentioned in the formal definition is the term given to the difference between Sales and marginal cost.

Q3) What are the assumptions of marginal costing?

A3) The assumptions of marginal costing are-

1. All Elements of cost can be segregated into fixed and variable cost.

2. Variable cost remains constant per unit of output irrespective of the level of output and thus fluctuates directly in proportion to changes in the volume of output.

3. The selling price remains unchanged at all levels of activity.

4. Fixed costs remain unchanged for entire volume of production.

5. The volume of production is the only factor which influences the costs.

6. The state of technology process of production and quality of output will remain unchanged.

7. There will be no significant change in the level of opening and closing inventory.

8. The company manufactures a single product. In the case of a multi-product company, the sales-mix remains unchanged.

9. Both revenue and cost functions are linear over the range of activity under considerations.

Q4) What are the advantages of Marginal costing?

A4) The advantages of Marginal costing are-

1. The marginal costing technique is very simple to understand and easy to operate. The reason is that the fixed costs are not included in the cost of production and there is no arbitrary apportionment of fixed costs.

2. The current year fixed costs is not carried forward to the next year. As such, cost and profit are not vitiated. Cost comparisons become meaningful.

3. The contribution is used as a tool in managerial decision-making. It provides a more reliable measure for decision-making.

4. Marginal costing shows more clearly the impact on profit of fluctuations in the volume of sales.

5. Under absorption and over absorption of overheads problems are not arisen under marginal costing.

6. The marginal costing technique can be combined with standard costing.

7. The prevailing relationship between cost, selling price and volume are properly explained in clear terms.

8. It shows the relative contributions to profit that are made by each of a number of products and show where the sales effort should be contracted.

9. The management can take short run tactical decisions with the help of marginal costing information.

10. Marginal cost pricing method is highly useful for public utility undertakings. It helps them in maximizing output or better capacity utilization. This is possible only when lowest possible price is charged. The lowest limit is set by marginal cost of the product. When public utility concerns adopt marginal cost pricing, it helps in maximizing social welfare.

11. This method enables the firms to face competition. This is the reason why export prices are based on marginal costs since international market is highly competitive.

12. This method helps in optimum allocation of resources and as such it is the most efficient and effective pricing technique and it is useful when demand conditions are slack.

13. Marginal cost pricing is suitable for pricing over the life-cycle of a product. Each stage of the life-cycle has separate fixed cost and short-run marginal cost.

Q5) What are the disadvantages of Marginal costing?

A5) The disadvantages, demerits or limitations of marginal costing are briefly explained below.

1. The total costs cannot be easily segregated into fixed costs and variable costs.

2. Moreover, it is also very difficult to per-determine the degree of variability of semi-variable costs.

3. Under marginal costing, the fixed costs remain constant and variable costs are varying according to level of output. In reality, the fixed costs do not remain constant and the variable costs are not varying according to level of output.

4. There is no meaning in the exclusion of fixed costs from the valuation of finished goods since the fixed costs are incurred for the purpose of manufacture of products.

5. In the case of loss by fire, the full amount of loss cannot be recovered from the insurance company since the stocks are undervalued.

6. Tax authorities do not accept the valuation of stock since the shock does not show true value.

7. The calculation of variable overheads does not include all the variable overheads.

8. The profit fluctuates as per the fluctuation of sales volume. Hence, the preparation of periodic operating statements becomes unrealistic.

9. The elimination of fixed costs renders cost comparison of jobs difficult.

10. The management cannot take a quality decision with the help of contribution alone. The contribution may vary if new techniques followed in the production process.

11. The fixed costs are constant only for short period. In the long run, all the costs are variable.

12. Firms may find it difficult to cover up costs and earn a fair return on capital employed when they follow marginal cost principle in times of recession when demand is slack and price reduction becomes inevitable to retain business.

13. Marginal cost pricing requires a better understanding of marginal cost technique. Some accountants are not fully conversant with the marginal techniques themselves. Therefore, they are not capable of explaining their use to the management.

In spite of its advantages, due to its inherent weakness of not ensuring the coverage of fixed costs, marginal pricing has not been adopted extensively. It is confined to cases of special orders only.

Q6) What is Break-even analysis?

A6) Break-even analysis entails calculating and examining the margin of safety for an entity based on the revenues collected and associated costs. In other words, the analysis shows how many sales it takes to pay for the cost of doing business. Analysing different price levels relating to various levels of demand, the break-even analysis determines what level of sales are necessary to cover the company's total fixed costs. A demand-side analysis would give a seller significant insight into selling capabilities.

Q7) How Break-Even Analysis Works?

A7) Break-even analysis is useful in determining the level of production or a targeted desired sales mix. The study is for a company's management’s use only, as the metric and calculations are not used by external parties, such as investors, regulators, or financial institutions. This type of analysis involves a calculation of the break-even point (BEP). The break-even point is calculated by dividing the total fixed costs of production by the price per individual unit less the variable costs of production. Fixed costs are costs that remain the same regardless of how many units are sold.

Break-even analysis looks at the level of fixed costs relative to the profit earned by each additional unit produced and sold. In general, a company with lower fixed costs will have a lower break-even point of sale. For example, a company with $0 of fixed costs will automatically have broken even upon the sale of the first product assuming variable costs do not exceed sales revenue.

Q8) What is Break-even point?

A8) The breakeven point (break-even price) for a trade or investment is determined by comparing the market price of an asset to the original cost; the breakeven point is reached when the two prices are equal.

In corporate accounting, the breakeven point formula is determined by dividing the total fixed costs associated with production by the revenue per individual unit minus the variable costs per unit. In this case, fixed costs refer to those which do not change depending upon the number of units sold. Put differently, the breakeven point is the production level at which total revenues for a product equal total expense.

Q9) Where Breakeven points can be applied?

A9) Breakeven points can be applied to a wide variety of contexts. For instance, the breakeven point in a property would be how much money the homeowner would need to generate from a sale to exactly offset the net purchase price, inclusive of closing costs, taxes, fees, insurance, and interest paid on the mortgage—as well as costs related to maintenance and home improvements. At that price, the homeowner would exactly break even, neither making nor losing any money.

Traders also apply BEPs to trades, figuring out what price a security must reach to exactly cover all costs associated with a trade including taxes, commissions, management fees, and so on. A company's breakeven is likewise calculated by taking fixed costs and dividing that figure by the gross profit margin percentage.

Q10) How Do You Calculate a Breakeven Point?

A10) Generally, to calculate the breakeven point in business, fixed costs are divided by the gross profit margin. This produces a dollar figure that a company needs to break even. When it comes to stocks, if a trader bought a stock at $200, and nine months later it reached $200 again after falling from $250, it would have reached the breakeven point.

Q11) How Do You Calculate a Breakeven Point in Options Trading?

A11) Consider the following example in which an investor pays a $10 premium for a stock call option, and the strike price is $100. The breakeven point would equal the $10 premium plus the $100 strike price, or $110. On the other hand, if this were applied to a put option, the breakeven point would be calculated as the $100 strike price minus the $10 premium paid, amounting to $90.

Q12) What is Margin of safety?

A12) Margin of safety is a principle of investing in which an investor only purchases securities when their market price is significantly below their intrinsic value. In other words, when the market price of a security is significantly below your estimation of its intrinsic value, the difference is the margin of safety. Because investors may set a margin of safety in accordance with their own risk preferences, buying securities when this difference is present allows an investment to be made with minimal downside risk.

Alternatively, in accounting, the margin of safety, or safety margin, refers to the difference between actual sales and break-even sales. Managers can utilize the margin of safety to know how much sales can decrease before the company or a project becomes unprofitable.

Q13) Who popularize the margin of safety principle?

A13) The margin of safety principle was popularized by famed British-born American investor Benjamin Graham (known as the father of value investing) and his followers, most notably Warren Buffett. Investors utilize both qualitative and quantitative factors, including firm management, governance, industry performance, assets and earnings, to determine a security's intrinsic value. The market price is then used as the point of comparison to calculate the margin of safety. Buffett, who is a staunch believer in the margin of safety and has declared it one of his "cornerstones of investing," has been known to apply as much as a 50% discount to the intrinsic value of a stock as his price target.

Q14) How to Calculate the Margin of Safety

A14) To calculate the margin of safety, subtract the current breakeven point from sales, and divide by sales. The formula is:

(Current Sales Level – Breakeven Point) ÷ Current Sales Level = Margin of safety

The amount of this buffer is expressed as a percentage.

Q15) What are the two alternative versions of the margin of safety?

A15) The two alternative versions of the margin of safety are-

- Budget based. A company may want to project its margin of safety under a budget for a future period. If so, replace the current sales level in the formula with the budgeted sales level.

- Unit based. If you want to translate the margin of safety into the number of units sold, then use the following formula instead (though note that this version works best if a company only sells one product):

(Current Sales Level - Breakeven Point) ÷ Selling Price Per Unit

Q16) Where the margin of safety concept is applied?

A16) The margin of safety concept is also applied to investing, where it refers to the difference between the intrinsic value of a company's share price and its current market value. An investor wants to see a large variance between the two figures (which is the margin of safety) before buying stock. This implies that there is substantial upside potential for the stock price - or at least, it means any error in deriving the intrinsic value must be a big one in order to erase the margin of safety.

Q17) How to calculate break even formula?

A17) The breakeven formula for a business provides a dollar figure they need to break even. This can be converted into units by calculating the contribution margin (unit sale price fewer variable costs). Dividing the fixed costs by the contribution margin will provide how many units are needed to break even.

Business Breakeven= Fixed cost/ Gross Profit Margin

The information required to calculate a business's BEP can be found in its financial statements. The first pieces of information required are the fixed costs and the gross margin percentage.

Assume a company has $1 million in fixed costs and a gross margin of 37%. Its breakeven point is $2.7 million ($1 million / 0.37). In this breakeven point example, the company must generate $2.7 million in revenue to cover its fixed and variable costs. If it generates more sales, the company will have a profit. If it generates fewer sales, there will be a loss.

It is also possible to calculate how many units need to be sold to cover the fixed costs, which will result in the company breaking even. To do this, calculate the contribution margin, which is the sale price of the product less variable costs.

Assume a company has a $50 sale price for their product and variable costs of $10. The contribution margin is $40 ($50 - $10). Divide the fixed costs by the contribution margin to determine how many units the company has to sell: $1 million / $40 = 25,000 units. If the company sells more units than this it will show a profit. If it sells less, there will be a loss.

Q18) How marginal costing is calculated?

A18) Marginal costing is often calculated when enough items have been produced to cover the fixed costs and production is at a break-even point, where the only expenses going forward are variable or direct costs. When average costs are constant, as opposed to situations where material costs fluctuate because of scarcity issues, marginal cost is usually the same as average cost.

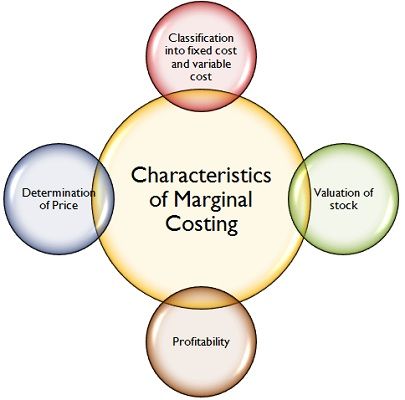

Q19) Mention with diagram the characteristics of Marginal costing?

A19) The characteristics of marginal costing are-

Q20) Where traders apply Break-even point?

A20) Traders also apply BEPs to trades, figuring out what price a security must reach to exactly cover all costs associated with a trade including taxes, commissions, management fees, and so on. A company's breakeven is likewise calculated by taking fixed costs and dividing that figure by the gross profit margin percentage.

Unit 6

Marginal Costing and Break –Even Analysis

Q1) What is Marginal costing?

A1) Marginal cost refers to the increase or decrease in the cost of producing one more unit or serving one more customer. It is also known as incremental cost.

Marginal costs are based on production expenses that are variable or direct – labour, materials, and equipment, for example – and not fixed costs the company will have whether it increases production or not. Fixed costs might include administrative overhead and marketing efforts – expenses that are the same no matter how many pieces are produced.

Q2) Why Marginal costing is very important?

A2) Marginal Costing is very important technique in solving managerial problems and contributing in various areas of decisions. In this context profitability of two or more alternative options is compared and such options is selected which offers maximum profitability along with fulfilment of objectives of the enterprise. Marginal costing - definition Marginal costing distinguishes between fixed costs and variable costs as convention ally classified. The marginal cost of a product –―is its variable cost‖. This is normally taken to be; direct labour, direct material, direct expenses and the variable part of overheads. Marginal costing is formally defined as: ‗the accounting system in which variable costs are charged to cost units and the fixed costs of the period are written-off in full against the aggregate contribution. Its special value is in decision making ‘. (Terminology.) The term contribution ‘mentioned in the formal definition is the term given to the difference between Sales and marginal cost.

Q3) What are the assumptions of marginal costing?

A3) The assumptions of marginal costing are-

1. All Elements of cost can be segregated into fixed and variable cost.

2. Variable cost remains constant per unit of output irrespective of the level of output and thus fluctuates directly in proportion to changes in the volume of output.

3. The selling price remains unchanged at all levels of activity.

4. Fixed costs remain unchanged for entire volume of production.

5. The volume of production is the only factor which influences the costs.

6. The state of technology process of production and quality of output will remain unchanged.

7. There will be no significant change in the level of opening and closing inventory.

8. The company manufactures a single product. In the case of a multi-product company, the sales-mix remains unchanged.

9. Both revenue and cost functions are linear over the range of activity under considerations.

Q4) What are the advantages of Marginal costing?

A4) The advantages of Marginal costing are-

1. The marginal costing technique is very simple to understand and easy to operate. The reason is that the fixed costs are not included in the cost of production and there is no arbitrary apportionment of fixed costs.

2. The current year fixed costs is not carried forward to the next year. As such, cost and profit are not vitiated. Cost comparisons become meaningful.

3. The contribution is used as a tool in managerial decision-making. It provides a more reliable measure for decision-making.

4. Marginal costing shows more clearly the impact on profit of fluctuations in the volume of sales.

5. Under absorption and over absorption of overheads problems are not arisen under marginal costing.

6. The marginal costing technique can be combined with standard costing.

7. The prevailing relationship between cost, selling price and volume are properly explained in clear terms.

8. It shows the relative contributions to profit that are made by each of a number of products and show where the sales effort should be contracted.

9. The management can take short run tactical decisions with the help of marginal costing information.

10. Marginal cost pricing method is highly useful for public utility undertakings. It helps them in maximizing output or better capacity utilization. This is possible only when lowest possible price is charged. The lowest limit is set by marginal cost of the product. When public utility concerns adopt marginal cost pricing, it helps in maximizing social welfare.

11. This method enables the firms to face competition. This is the reason why export prices are based on marginal costs since international market is highly competitive.

12. This method helps in optimum allocation of resources and as such it is the most efficient and effective pricing technique and it is useful when demand conditions are slack.

13. Marginal cost pricing is suitable for pricing over the life-cycle of a product. Each stage of the life-cycle has separate fixed cost and short-run marginal cost.

Q5) What are the disadvantages of Marginal costing?

A5) The disadvantages, demerits or limitations of marginal costing are briefly explained below.

1. The total costs cannot be easily segregated into fixed costs and variable costs.

2. Moreover, it is also very difficult to per-determine the degree of variability of semi-variable costs.

3. Under marginal costing, the fixed costs remain constant and variable costs are varying according to level of output. In reality, the fixed costs do not remain constant and the variable costs are not varying according to level of output.

4. There is no meaning in the exclusion of fixed costs from the valuation of finished goods since the fixed costs are incurred for the purpose of manufacture of products.

5. In the case of loss by fire, the full amount of loss cannot be recovered from the insurance company since the stocks are undervalued.

6. Tax authorities do not accept the valuation of stock since the shock does not show true value.

7. The calculation of variable overheads does not include all the variable overheads.

8. The profit fluctuates as per the fluctuation of sales volume. Hence, the preparation of periodic operating statements becomes unrealistic.

9. The elimination of fixed costs renders cost comparison of jobs difficult.

10. The management cannot take a quality decision with the help of contribution alone. The contribution may vary if new techniques followed in the production process.

11. The fixed costs are constant only for short period. In the long run, all the costs are variable.

12. Firms may find it difficult to cover up costs and earn a fair return on capital employed when they follow marginal cost principle in times of recession when demand is slack and price reduction becomes inevitable to retain business.

13. Marginal cost pricing requires a better understanding of marginal cost technique. Some accountants are not fully conversant with the marginal techniques themselves. Therefore, they are not capable of explaining their use to the management.

In spite of its advantages, due to its inherent weakness of not ensuring the coverage of fixed costs, marginal pricing has not been adopted extensively. It is confined to cases of special orders only.

Q6) What is Break-even analysis?

A6) Break-even analysis entails calculating and examining the margin of safety for an entity based on the revenues collected and associated costs. In other words, the analysis shows how many sales it takes to pay for the cost of doing business. Analysing different price levels relating to various levels of demand, the break-even analysis determines what level of sales are necessary to cover the company's total fixed costs. A demand-side analysis would give a seller significant insight into selling capabilities.

Q7) How Break-Even Analysis Works?

A7) Break-even analysis is useful in determining the level of production or a targeted desired sales mix. The study is for a company's management’s use only, as the metric and calculations are not used by external parties, such as investors, regulators, or financial institutions. This type of analysis involves a calculation of the break-even point (BEP). The break-even point is calculated by dividing the total fixed costs of production by the price per individual unit less the variable costs of production. Fixed costs are costs that remain the same regardless of how many units are sold.

Break-even analysis looks at the level of fixed costs relative to the profit earned by each additional unit produced and sold. In general, a company with lower fixed costs will have a lower break-even point of sale. For example, a company with $0 of fixed costs will automatically have broken even upon the sale of the first product assuming variable costs do not exceed sales revenue.

Q8) What is Break-even point?

A8) The breakeven point (break-even price) for a trade or investment is determined by comparing the market price of an asset to the original cost; the breakeven point is reached when the two prices are equal.

In corporate accounting, the breakeven point formula is determined by dividing the total fixed costs associated with production by the revenue per individual unit minus the variable costs per unit. In this case, fixed costs refer to those which do not change depending upon the number of units sold. Put differently, the breakeven point is the production level at which total revenues for a product equal total expense.

Q9) Where Breakeven points can be applied?

A9) Breakeven points can be applied to a wide variety of contexts. For instance, the breakeven point in a property would be how much money the homeowner would need to generate from a sale to exactly offset the net purchase price, inclusive of closing costs, taxes, fees, insurance, and interest paid on the mortgage—as well as costs related to maintenance and home improvements. At that price, the homeowner would exactly break even, neither making nor losing any money.

Traders also apply BEPs to trades, figuring out what price a security must reach to exactly cover all costs associated with a trade including taxes, commissions, management fees, and so on. A company's breakeven is likewise calculated by taking fixed costs and dividing that figure by the gross profit margin percentage.

Q10) How Do You Calculate a Breakeven Point?

A10) Generally, to calculate the breakeven point in business, fixed costs are divided by the gross profit margin. This produces a dollar figure that a company needs to break even. When it comes to stocks, if a trader bought a stock at $200, and nine months later it reached $200 again after falling from $250, it would have reached the breakeven point.

Q11) How Do You Calculate a Breakeven Point in Options Trading?

A11) Consider the following example in which an investor pays a $10 premium for a stock call option, and the strike price is $100. The breakeven point would equal the $10 premium plus the $100 strike price, or $110. On the other hand, if this were applied to a put option, the breakeven point would be calculated as the $100 strike price minus the $10 premium paid, amounting to $90.

Q12) What is Margin of safety?

A12) Margin of safety is a principle of investing in which an investor only purchases securities when their market price is significantly below their intrinsic value. In other words, when the market price of a security is significantly below your estimation of its intrinsic value, the difference is the margin of safety. Because investors may set a margin of safety in accordance with their own risk preferences, buying securities when this difference is present allows an investment to be made with minimal downside risk.

Alternatively, in accounting, the margin of safety, or safety margin, refers to the difference between actual sales and break-even sales. Managers can utilize the margin of safety to know how much sales can decrease before the company or a project becomes unprofitable.

Q13) Who popularize the margin of safety principle?

A13) The margin of safety principle was popularized by famed British-born American investor Benjamin Graham (known as the father of value investing) and his followers, most notably Warren Buffett. Investors utilize both qualitative and quantitative factors, including firm management, governance, industry performance, assets and earnings, to determine a security's intrinsic value. The market price is then used as the point of comparison to calculate the margin of safety. Buffett, who is a staunch believer in the margin of safety and has declared it one of his "cornerstones of investing," has been known to apply as much as a 50% discount to the intrinsic value of a stock as his price target.

Q14) How to Calculate the Margin of Safety

A14) To calculate the margin of safety, subtract the current breakeven point from sales, and divide by sales. The formula is:

(Current Sales Level – Breakeven Point) ÷ Current Sales Level = Margin of safety

The amount of this buffer is expressed as a percentage.

Q15) What are the two alternative versions of the margin of safety?

A15) The two alternative versions of the margin of safety are-

- Budget based. A company may want to project its margin of safety under a budget for a future period. If so, replace the current sales level in the formula with the budgeted sales level.

- Unit based. If you want to translate the margin of safety into the number of units sold, then use the following formula instead (though note that this version works best if a company only sells one product):

(Current Sales Level - Breakeven Point) ÷ Selling Price Per Unit

Q16) Where the margin of safety concept is applied?

A16) The margin of safety concept is also applied to investing, where it refers to the difference between the intrinsic value of a company's share price and its current market value. An investor wants to see a large variance between the two figures (which is the margin of safety) before buying stock. This implies that there is substantial upside potential for the stock price - or at least, it means any error in deriving the intrinsic value must be a big one in order to erase the margin of safety.

Q17) How to calculate break even formula?

A17) The breakeven formula for a business provides a dollar figure they need to break even. This can be converted into units by calculating the contribution margin (unit sale price fewer variable costs). Dividing the fixed costs by the contribution margin will provide how many units are needed to break even.

Business Breakeven= Fixed cost/ Gross Profit Margin

The information required to calculate a business's BEP can be found in its financial statements. The first pieces of information required are the fixed costs and the gross margin percentage.

Assume a company has $1 million in fixed costs and a gross margin of 37%. Its breakeven point is $2.7 million ($1 million / 0.37). In this breakeven point example, the company must generate $2.7 million in revenue to cover its fixed and variable costs. If it generates more sales, the company will have a profit. If it generates fewer sales, there will be a loss.

It is also possible to calculate how many units need to be sold to cover the fixed costs, which will result in the company breaking even. To do this, calculate the contribution margin, which is the sale price of the product less variable costs.

Assume a company has a $50 sale price for their product and variable costs of $10. The contribution margin is $40 ($50 - $10). Divide the fixed costs by the contribution margin to determine how many units the company has to sell: $1 million / $40 = 25,000 units. If the company sells more units than this it will show a profit. If it sells less, there will be a loss.

Q18) How marginal costing is calculated?

A18) Marginal costing is often calculated when enough items have been produced to cover the fixed costs and production is at a break-even point, where the only expenses going forward are variable or direct costs. When average costs are constant, as opposed to situations where material costs fluctuate because of scarcity issues, marginal cost is usually the same as average cost.

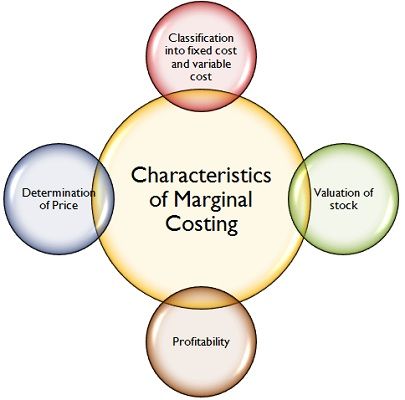

Q19) Mention with diagram the characteristics of Marginal costing?

A19) The characteristics of marginal costing are-

Q20) Where traders apply Break-even point?

A20) Traders also apply BEPs to trades, figuring out what price a security must reach to exactly cover all costs associated with a trade including taxes, commissions, management fees, and so on. A company's breakeven is likewise calculated by taking fixed costs and dividing that figure by the gross profit margin percentage.

Unit 6

Marginal Costing and Break –Even Analysis

Q1) What is Marginal costing?

A1) Marginal cost refers to the increase or decrease in the cost of producing one more unit or serving one more customer. It is also known as incremental cost.

Marginal costs are based on production expenses that are variable or direct – labour, materials, and equipment, for example – and not fixed costs the company will have whether it increases production or not. Fixed costs might include administrative overhead and marketing efforts – expenses that are the same no matter how many pieces are produced.

Q2) Why Marginal costing is very important?

A2) Marginal Costing is very important technique in solving managerial problems and contributing in various areas of decisions. In this context profitability of two or more alternative options is compared and such options is selected which offers maximum profitability along with fulfilment of objectives of the enterprise. Marginal costing - definition Marginal costing distinguishes between fixed costs and variable costs as convention ally classified. The marginal cost of a product –―is its variable cost‖. This is normally taken to be; direct labour, direct material, direct expenses and the variable part of overheads. Marginal costing is formally defined as: ‗the accounting system in which variable costs are charged to cost units and the fixed costs of the period are written-off in full against the aggregate contribution. Its special value is in decision making ‘. (Terminology.) The term contribution ‘mentioned in the formal definition is the term given to the difference between Sales and marginal cost.

Q3) What are the assumptions of marginal costing?

A3) The assumptions of marginal costing are-

1. All Elements of cost can be segregated into fixed and variable cost.

2. Variable cost remains constant per unit of output irrespective of the level of output and thus fluctuates directly in proportion to changes in the volume of output.

3. The selling price remains unchanged at all levels of activity.

4. Fixed costs remain unchanged for entire volume of production.

5. The volume of production is the only factor which influences the costs.

6. The state of technology process of production and quality of output will remain unchanged.

7. There will be no significant change in the level of opening and closing inventory.

8. The company manufactures a single product. In the case of a multi-product company, the sales-mix remains unchanged.

9. Both revenue and cost functions are linear over the range of activity under considerations.

Q4) What are the advantages of Marginal costing?

A4) The advantages of Marginal costing are-

1. The marginal costing technique is very simple to understand and easy to operate. The reason is that the fixed costs are not included in the cost of production and there is no arbitrary apportionment of fixed costs.

2. The current year fixed costs is not carried forward to the next year. As such, cost and profit are not vitiated. Cost comparisons become meaningful.

3. The contribution is used as a tool in managerial decision-making. It provides a more reliable measure for decision-making.

4. Marginal costing shows more clearly the impact on profit of fluctuations in the volume of sales.

5. Under absorption and over absorption of overheads problems are not arisen under marginal costing.

6. The marginal costing technique can be combined with standard costing.

7. The prevailing relationship between cost, selling price and volume are properly explained in clear terms.

8. It shows the relative contributions to profit that are made by each of a number of products and show where the sales effort should be contracted.

9. The management can take short run tactical decisions with the help of marginal costing information.

10. Marginal cost pricing method is highly useful for public utility undertakings. It helps them in maximizing output or better capacity utilization. This is possible only when lowest possible price is charged. The lowest limit is set by marginal cost of the product. When public utility concerns adopt marginal cost pricing, it helps in maximizing social welfare.

11. This method enables the firms to face competition. This is the reason why export prices are based on marginal costs since international market is highly competitive.

12. This method helps in optimum allocation of resources and as such it is the most efficient and effective pricing technique and it is useful when demand conditions are slack.

13. Marginal cost pricing is suitable for pricing over the life-cycle of a product. Each stage of the life-cycle has separate fixed cost and short-run marginal cost.

Q5) What are the disadvantages of Marginal costing?

A5) The disadvantages, demerits or limitations of marginal costing are briefly explained below.

1. The total costs cannot be easily segregated into fixed costs and variable costs.

2. Moreover, it is also very difficult to per-determine the degree of variability of semi-variable costs.

3. Under marginal costing, the fixed costs remain constant and variable costs are varying according to level of output. In reality, the fixed costs do not remain constant and the variable costs are not varying according to level of output.

4. There is no meaning in the exclusion of fixed costs from the valuation of finished goods since the fixed costs are incurred for the purpose of manufacture of products.

5. In the case of loss by fire, the full amount of loss cannot be recovered from the insurance company since the stocks are undervalued.

6. Tax authorities do not accept the valuation of stock since the shock does not show true value.

7. The calculation of variable overheads does not include all the variable overheads.

8. The profit fluctuates as per the fluctuation of sales volume. Hence, the preparation of periodic operating statements becomes unrealistic.

9. The elimination of fixed costs renders cost comparison of jobs difficult.

10. The management cannot take a quality decision with the help of contribution alone. The contribution may vary if new techniques followed in the production process.

11. The fixed costs are constant only for short period. In the long run, all the costs are variable.

12. Firms may find it difficult to cover up costs and earn a fair return on capital employed when they follow marginal cost principle in times of recession when demand is slack and price reduction becomes inevitable to retain business.

13. Marginal cost pricing requires a better understanding of marginal cost technique. Some accountants are not fully conversant with the marginal techniques themselves. Therefore, they are not capable of explaining their use to the management.

In spite of its advantages, due to its inherent weakness of not ensuring the coverage of fixed costs, marginal pricing has not been adopted extensively. It is confined to cases of special orders only.

Q6) What is Break-even analysis?

A6) Break-even analysis entails calculating and examining the margin of safety for an entity based on the revenues collected and associated costs. In other words, the analysis shows how many sales it takes to pay for the cost of doing business. Analysing different price levels relating to various levels of demand, the break-even analysis determines what level of sales are necessary to cover the company's total fixed costs. A demand-side analysis would give a seller significant insight into selling capabilities.

Q7) How Break-Even Analysis Works?

A7) Break-even analysis is useful in determining the level of production or a targeted desired sales mix. The study is for a company's management’s use only, as the metric and calculations are not used by external parties, such as investors, regulators, or financial institutions. This type of analysis involves a calculation of the break-even point (BEP). The break-even point is calculated by dividing the total fixed costs of production by the price per individual unit less the variable costs of production. Fixed costs are costs that remain the same regardless of how many units are sold.

Break-even analysis looks at the level of fixed costs relative to the profit earned by each additional unit produced and sold. In general, a company with lower fixed costs will have a lower break-even point of sale. For example, a company with $0 of fixed costs will automatically have broken even upon the sale of the first product assuming variable costs do not exceed sales revenue.

Q8) What is Break-even point?

A8) The breakeven point (break-even price) for a trade or investment is determined by comparing the market price of an asset to the original cost; the breakeven point is reached when the two prices are equal.

In corporate accounting, the breakeven point formula is determined by dividing the total fixed costs associated with production by the revenue per individual unit minus the variable costs per unit. In this case, fixed costs refer to those which do not change depending upon the number of units sold. Put differently, the breakeven point is the production level at which total revenues for a product equal total expense.

Q9) Where Breakeven points can be applied?

A9) Breakeven points can be applied to a wide variety of contexts. For instance, the breakeven point in a property would be how much money the homeowner would need to generate from a sale to exactly offset the net purchase price, inclusive of closing costs, taxes, fees, insurance, and interest paid on the mortgage—as well as costs related to maintenance and home improvements. At that price, the homeowner would exactly break even, neither making nor losing any money.

Traders also apply BEPs to trades, figuring out what price a security must reach to exactly cover all costs associated with a trade including taxes, commissions, management fees, and so on. A company's breakeven is likewise calculated by taking fixed costs and dividing that figure by the gross profit margin percentage.

Q10) How Do You Calculate a Breakeven Point?

A10) Generally, to calculate the breakeven point in business, fixed costs are divided by the gross profit margin. This produces a dollar figure that a company needs to break even. When it comes to stocks, if a trader bought a stock at $200, and nine months later it reached $200 again after falling from $250, it would have reached the breakeven point.

Q11) How Do You Calculate a Breakeven Point in Options Trading?

A11) Consider the following example in which an investor pays a $10 premium for a stock call option, and the strike price is $100. The breakeven point would equal the $10 premium plus the $100 strike price, or $110. On the other hand, if this were applied to a put option, the breakeven point would be calculated as the $100 strike price minus the $10 premium paid, amounting to $90.

Q12) What is Margin of safety?

A12) Margin of safety is a principle of investing in which an investor only purchases securities when their market price is significantly below their intrinsic value. In other words, when the market price of a security is significantly below your estimation of its intrinsic value, the difference is the margin of safety. Because investors may set a margin of safety in accordance with their own risk preferences, buying securities when this difference is present allows an investment to be made with minimal downside risk.

Alternatively, in accounting, the margin of safety, or safety margin, refers to the difference between actual sales and break-even sales. Managers can utilize the margin of safety to know how much sales can decrease before the company or a project becomes unprofitable.

Q13) Who popularize the margin of safety principle?