Unit 1

Basic concept

Q1) What is Income tax? What are its features?

A1) Income tax refers to direct tax imposed by the government on income of the citizens of India. It is levied on income of individuals from salary, business, business, profession and other income.

Some of the features of income tax are-

- It is a direct tax.

- It is charged on the total income of a person.

- It is charged on the income of the income year at the rate applicable in assessment year.

- It is payable in the year following the income year.

- It is generally charged on revenue income of a person.

- It is a tax charged on a person for income that comes within the preview of relevant income tax law.

- Whether the income is permanent or temporary, it is immaterial from the tax point of view. Even temporary income is taxable.

If a person receives tax—free income on which tax is paid by the person making payment on behalf of the recipient, it has to be grossed up for inclusion in his total income.

Q2) What is Agriculture income?

A2) AGRICULTURE INCOME [SECTION 2(1A)]

Agricultural income means—

(a) any rent or revenue derived from land which is situated in India and is used for agricultural purposes;

(b) any income derived from such land by—

(i) agriculture; or

(ii) the performance by a cultivator or receiver of rent-in-kind of any process ordinarily employed by a cultivator or receiver of rent-in-kind to render the produce raised or received by him fit to be taken to market; or

(iii) the sale by a cultivator or receiver of rent-in-kind of the produce raised or received by him, in respect of which no process has been performed other than a process of the nature described in paragraph (ii) of this sub-clause;

(c) any income derived from any building owned and occupied by the receiver of the rent or revenue of any such land, or occupied by the cultivator or the receiver of rent-in-kind, of any land with respect to which, or the produce of which, any process mentioned in paragraphs (ii) and (iii) of sub-clause (b) is carried on.

Q3) What is Gross total Income?

A3) Gross Total Income is the aggregate of all the income earned by the individuals during a specified period. According to Section 14 of the Income Tax Act 1961, the income of a person or an assessee can be categorised under these five heads,

- Income from Salaries

- Income from House Property

- Profits and Gains of Business and Profession

- Capital Gains

- Income from Other Sources

Specimen of calculation of gross total income

Income From Salary | Xx |

Add: Income Under the Head House Property | Xx |

Add: Profits and Gains of Business and Profession | Xx |

Add: capital gains Income | Xx |

Add: Income from Other Sources | Xx |

Gross Total Income | Xxx |

Less: Deductions under Section 80C to 80U | Xx |

Total Income | Xxx |

Q4) What do you mean by Total income?

A4) According to section 2(45) total income means the total amount of income referred to in section 5, computed in the manner laid down in this Act. Section 5 of the act provides scope of total Income-

(1) Subject to the provisions of this Act, the total income of any previous year of a person who is a resident includes all income from whatever source derived which-

(a) is received or is deemed to be received in India in such year by or on behalf of such person; or

(b) accrues or arises or is deemed to accrue or arise to him in India during such year; or

(c) accrues or arises to him outside India during such year:

Provided that, in the case of a person not ordinarily resident in India within the meaning of sub-section (6) of section 6, the income which accrues or arises to him outside India shall not be so included unless it is derived from a business controlled in or a profession set up in India.

(2) Subject to the provisions of this Act, the total income of any previous year of a person who is a non-resident includes all income from whatever source derived which—

(a) is received or is deemed to be received in India in such year by or on behalf of such person; or

(b) accrues or arises or is deemed to accrue or arise to him in India during such year.

Q5) What is Maximum Marginal rate of tax.

A5) Marginal Tax Rate is applicable for all the brackets of income of a taxpayer. This is also applicable on any other taxable income for which the taxpayer qualifies. Knowing about Marginal Tax Rates is important when you doing financial planning.

Marginal Tax Rate is the tax rate that is applicable for each tax bracket of a taxpayer’s income or other taxable income for which he or she qualifies. It is the percentage taken from the taxpayer’s next rupee of taxable income over and above a set income threshold.

As an individual’s income rises so will his or her marginal tax rate. The main objective of marginal tax rates is to tax individuals on the basis of what they earn, where people with lower income are taxed at lower rates as compared to people with higher income.

Q6) What is PAN?

A6) A permanent account number (PAN) is a ten-character alphanumeric identifier, issued in the form of a laminated "PAN card", by the Indian Income Tax Department, to any "person" who applies for it or to whom the department allots the number without an application. It can also be obtained in the form of a PDF file.

A PAN is a unique identifier issued to all judicial entities identifiable under the Indian Income Tax Act, 1961. The income tax PAN and its linked card are issued under Section 139A of the Income Tax Act. It is issued by the Indian Income Tax Department under the supervision of the Central Board for Direct Taxes (CBDT) and it also serves as an important proof of identification.

It is also issued to foreign nationals (such as investors) subject to a valid visa, and hence a PAN card is not acceptable as proof of Indian citizenship. A PAN is necessary for filing income tax returns.

The PAN (or PAN number) is a ten-character long alpha-numeric unique identifier.

Q7) What are the uses of PAN?

A7) The primary purpose of the PAN is to bring a universal identification to all financial transactions and to prevent tax evasion by keeping track of monetary transactions, especially those of high-net-worth individuals who can impact the economy.

Quoting the PAN is mandatory when filing income tax returns, tax deduction at source, or any other communication with the Income Tax Department. PAN is also steadily becoming a mandatory document for opening a new bank account, a demat account, a new landline telephone connection / a mobile phone connection, purchase of foreign currency, bank deposits above ₹50,000, purchase and sale of immovable properties, vehicles etc.

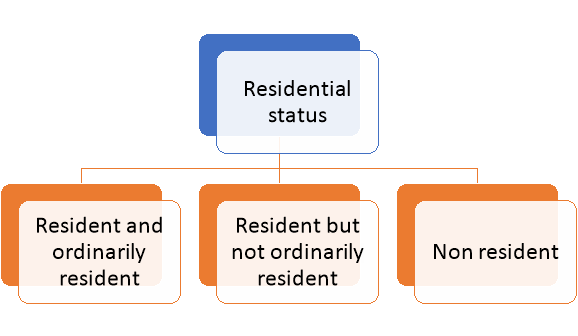

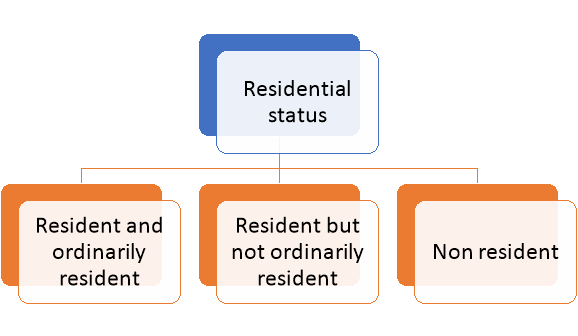

Q8) What is Residential status?

A8) Section 4(6) of the income tax act provides provisions for residential status of person in India. According to the Income Tax Act, 1961, residential status of a person is one of the important criteria in determining the tax implications. The residential status of a person can be categorised into-

a) Resident and Ordinarily Resident (ROR)

b) Resident but Not Ordinarily Resident (RNOR)

c) Non- Resident (NR)

Such types are discussed below-

a)Resident and Ordinarily Resident (ROR)

A resident taxpayer is an individual who satisfies any one of the following conditions:

- Resides in India for a minimum of 182 days in a year, or

- Resided in India for a minimum of 365 days in the immediately preceding four years and for a minimum of 60 days in the current financial year.

b) Resident but Not Ordinarily Resident (RNOR)

If an individual qualifies as a resident, the next step is to determine if he/she is a Resident ordinarily resident (ROR) or an RNOR. He will be a ROR if he meets both of the following conditions:

- Has been a resident of India in at least 2 out of 10 years immediately previous years and

- Has stayed in India for at least 730 days in 7 immediately preceding years

c) Non- Resident (NR)

An individual satisfying neither of the conditions stated above conditions would be a non-resident for the year.

Q9) Explain the tax liability of persons according to residential status?

A9) The tax liability of persons according to residential status are discussed below-

- Resident:

A resident will be charged to tax in India on his global income i.e. income earned in India as well as income earned outside India.

2. Non-resident and Resident but not ordinarily resident:

Their tax liability in India is restricted to the income they earn in India. They need not pay any tax in India on their foreign income. Also note that in a case of double taxation of income where the same income is getting taxed in India as well as abroad, one may resort to the Double Taxation Avoidance Agreement (DTAA) that India would have entered into with the other country in order to eliminate the possibility of paying taxes twice

Q10) What are the exempted income under section 10?

A10) Exempted income is that income on which income tax is not chargeable. Such

Incomes are classified as under:

i) Incomes which do not form part of total income nor is income tax payable on them. They are called fully exempted incomes.

Ii) Incomes which are included in the total income but are exempt from income tax at the average rate of income tax applicable to the total income. They are called partially exempted incomes.

Iii) Incomes of certain Institutions or authorities are exempted subject to fulfilment of the required conditions.

Q11) What are the objectives of Income Tax?

A11) Some of the objectives of income tax are highlighted below-

1. To reduce inequalities in the distribution of income and wealth.

2. To bring out a greater measure of equity between different classes of tax payers.

3. To achieve the twin objectives of higher yields with reduction in inequalities.

4. To accelerate the temp of economic growth and development of the country.

5. To maintain reasonable economic stability in the force of long run inflationary pressure and short run international price movements.

6. To make available of funds for economic development.

7. To reduce extreme inequalities in wealth, income and consumptions standards with undetermined productive efficiency, offence, justice and political stability.

8. To encourage investment in new capital goods.

9. To channelize investment into those sectors which contribute the most of economic growth.

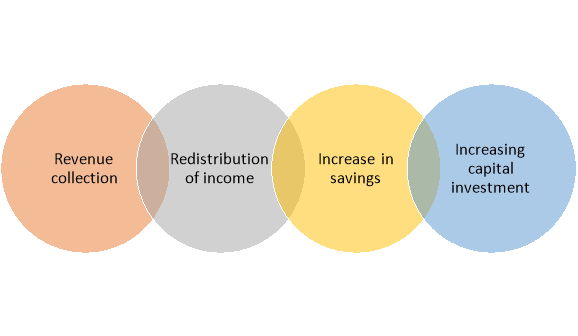

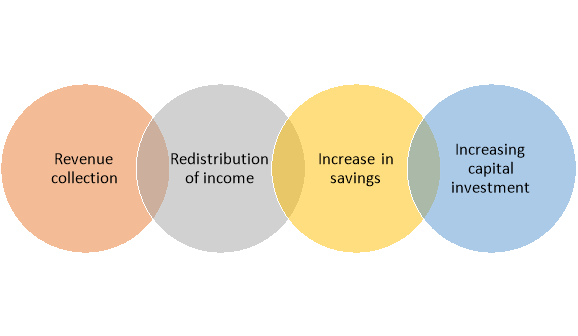

Q12) What are the importance of Income tax?

A12) Some of the importance of income tax is highlighted below-

- Revenue Collection:

Government collects nearly 18% of revenue from this source of tax. Therefore the most and significant source of revenue is income tax.

2. Redistribution of Income:

An efficient and fair tax system can reduce the inequality of wealth and income. This is possible by imposing tax rich people heavily and to confer a benefit to poorer through progressive income tax.

3. Increase in Savings:

An effective and efficient tax system encourages people to save through providing tax credit facilities on investment allowances.

4. Increasing Capital Investment:

This income tax revenue can be used by the government to ensure the economic development of the country. It can be used to build up the infrastructure to invest in some social security programs in various poverty alleviation programs, like, Social Justice, Economical Control. Increase Public Awareness.

Q13) What is the assessment of Association of Persons (AOP) or Body of Individuals (BOI) with regards to Marginal Tax Rate?

A13) The assessment of the members of AOP or BOI depends on whether they are eligible to be charged tax at the maximum marginal rate or not at all.

If an AOP or BOI is chargeable to tax at a maximum marginal rate or any higher rate, the share of profit of a member is exempt from tax. Therefore, it is not to be included in the total income of the member as per Section 86(a)

The rate of 30.9% charged is the maximum marginal rate of tax and if such rate is applied then the share of profit of the member is exempt from tax

Q14) What is the structure of PAN?

A14) The PAN structure is as follows: Fourth character [P — Individual or Person] Example: AAAPZ1234C

- The first five characters are letters (in uppercase by default), followed by four numerals, and the last (tenth) character is a letter.

- The first three characters of the code are three letters forming a sequence of alphabetical letters from AAA to ZZZ

- The fourth character identifies the type of holder of the card. Each holder type is uniquely defined by a letter from the list below:

A — AOP (Association of persons)

B — BOI (Body of individuals)

C — Company

F — Firm

G — Government

H — HUF (Hindu Undivided Family)

L — Local authority

J — Artificial juridical person

P — Person (Individual)

T — Trust (AOP)

- The fifth character of the PAN is the first character of either:

- Of the first name, surname or last name of the person, in the case of a "personal" PAN card, where the fourth character is "P" or

- Of the name of the entity, trust, society, or organisation in the case of a company/HUF/firm/AOP/trust/BOI/local authority/artificial judicial person/government, where the fourth character is "C", "H", "F", "A", "T", "B", "L", "J", "G".

- The last (tenth) character is an alphabetic digit used as a check-sum to verify the validity of that current code.

Q15) Why PAN is necessary?

A15) Under the existing law, it is absolutely necessary for all income- tax assessees to quote PAN in the following documents:

(i) in the income-tax return and in all other correspondences with the income-tax department.

(ii) in all challans for payment of any tax, interest and penalty due under the Income-tax Act.

(iii) in all documents related with the following transactions:

- Sale or purchase of any immovable property in excess of Rs. 10 lakhs

- Properties valued by Stamp Valuation authority at amount exceeding Rs.10 lakh.

- Sale or purchase of a motor vehicle other than a two-wheeler.

- Time deposit exceeding Rs. 50,000/- with a bank.

-Deposits with Co-op Banks, Post Office, Nidhi, NBFC companies will also need PAN;

-Deposits aggregating to more than Rs.5 lakh during the year will also need PAN

e. sale or purchase of shares, stocks and other securities in excess of Rs. 1,00,000/-.

f. opening of a bank account.

g. payment to hotels and restaurants in excess of Rs. 25,000 at a time, but in case of cash payment exceeding Rs. 50,000 PAN is required.

h. Cash deposit with banking company of Rs. 50,000 or above in a day.

i. Payment exceeding Rs.50,000/- to RBI for acquiring its bonds.

j. Purchase/ sale of any goods or services exceeding Rs.2 lakh per transaction.

k. Payment exceeding Rs.50,000/- to a company/ institution for acquiring its debentures/ bonds.

l. Payment exceeding Rs.50,000/- for purchase of mutual fund units.

Further, if any part of the income of the assessee is liable to deduction of tax at source, the assessee is required to intimate his PAN to the person responsible for deducting tax at source.

Q16) Highlight the list of exempted income?

A16) The list of exempted income is highlighted below-

1) Agricultural income [Sec.10 (1)]

Agricultural income from the land situated in India is fully exempted from

Income tax (Agricultural income definition given under Income Tax Act.)

2) Sum received by a member from Hindu undivided family [Sec.10 (2)]

Any sum received by a member of Hindu undivided family at the time of division is tax free.

3) Share of a partner in firm’s income [Sec.10 (2A)]

The share of a partner in firms’ profit is fully tax free.

4) Profit of newly established industrial undertaking in free trade zone [Sec.10AA].

5) Compensation received by victims of Bhopal gas leak disaster [Sec.10

(10BB)]

Any compensation paid under any Plan of Bhopal Gas Leak Disaster (Processing of claims Act, 1985) is exempted from tax.

6) Sum received from life insurance [Sec.10 (10D)]

Any sum received from life insurance Corporation as the maturity of insurance policy is fully exempt from tax, even bonus received is also fully exempted. But, Keyman Insurance Policy and any sum received under u/s 80DD(3) will not be exempted.

7) Sum received from Public Provident Fund [Sec.10 (11)]

Any sum received from public provident fund (in state bank and head offices) is fully exempted.

8) Payment from Sukanya Samridhi account [Sec.10 (11A)]

Any sum received from Sukanya Samridhi Account rules, 2014 made under Government saving bank Act, 1873 is fully exempt from tax.

9) Payment from National Payment System Trust [Sec.10 (12A)] Exempted Incomes

Any payment from national payment system trust u/s 80(CCD), if it does not exceed 40% of total amount, payable to assessee at time of closure of the scheme is exempt from tax.

10) Partial withdrawal from National Pension System Trust [Sec.10 (12B)]

Any withdrawal by the assessee from national pension system trust, up to 25% of it is tax free.

11) Interest, premium or bonus on specified investments [Sec.10(15)]

Like Annuity certificates, National Saving Certificates, Post Office Savings, Bank Account, Interest on relief Bonds, Post office cash certificates etc. are fully exempt from tax.

12) Scholarships [Sec.10 (16)]

Any fellowship or scholarship granted by Government for education and research work will be exempted.

13) Allowances of M. Ps and MLA’s [Sec.10 (17)]

For example, daily allowances, constituency allowance, shall be exempt fully.

14) Award or reward [Sec.10 (17A)]

Any award in form of cash or kind granted by Central or State Government for work of literature or scientific shall be exempted. Any award from any other institution apart from Government, shall be exempted from tax provided, such exemption is approved by Central Government.

15) Pension to an individual awarded by ‘Vir Chakra’ [Sec.10 (18)]

Any amount in form of pension received by an individual or family who had been a central or state Government employee and was awarded ‘PARAM Veer Chakra, Vir Chakra, Mahavir Chakra, shall be exempted.

16) Family pension to family members of armed forces [Sec.10 (19)]

Family pension to widow or children or nominated pension of a member of the armed forces died during operational duty shall be exempted.

17) Annual value of a palace of the Ex-rulers [Sec.10 (19A)]

18) Incomes of scheduled tribes [Sec.10 (26)]

Any income accrued to scheduled tribes living in tribal areas (as given in VI schedule of constitution) of State of Manipur, Sikkim, Tripura, Mizoram, Nagaland and Arunachal Pradesh shall be exempted.

19) Subsidy received from tea board [Sec.10(30)]

Any subsidy from tea Board, to the assessee, carrying on the business of growing and manufacturing tea in India, received shall be exempt from tax, provided, the certificate of exemption, has been presented to Income Tax officers.

20) Subsidy received by planters [Sec.10(31)]

Any subsidy from Rubber Board office or spice board, to the assessee, under any scheme for replantation of rubber plants or coffee plants etc. shall be exempt.

21) Income of minor child [Sec.10 (32)]

Income up to Rs.1,500/- in respect of minor is exempt from tax and any excess of that amount is included in parent’s income whose income is greater.

22) Capital gain on transfer of units of US-64 [Sec.10(33)]

Any capital gain on transfer of units US-64 shall be exempted provided such transfer is done on or after 1/4/2002.

23) Dividend from domestic company [Sec.10 (34)]

Any dividend declared by a domestic company is exempt from tax (with effect from AY 2004-05). It does not include dividend u/s 2(22) (e).

24) Any income received in respect of units of a mutual fund, Units from the administrator of the specified undertaking or units from the specified company [Sec.10 (35)]

This income is exempt with effect from AY 2004-05.

25) Long term capital gain on eligible equity shares [Sec.10(36)]

This exemption is applicable only when shares have been held for at least 12 months and when investment have been made on or after 1/3/2003 and not later on 31st March, 2004.

26) Exemption of capital gains on compensation received on compulsory acquisition of agricultural land situated within specified urban cities [Sec.10 (37)].

Such exemption is available to an individual or Hindu undivided family, on short- or long-term capital gain, provided such compensation should be received on or after 1/4/2004 and land is used in agriculture preceding 2 years from compulsory acquisition.

27) Exemption of long-term capital gain arising from sale of shares and units (With effect from 1-10-2004) [Not applicable W.e.f. AY 2019-20] [Sec.10 (38)].

28) Exemption of specified income from international sporting event held in India (with effect from assessment year 2006-07) [Sec.10 (39)].

29) Exemption in respect of grant etc. received by a subsidiary company from its holding company engaged in business of distribution of power [Sec.10 (40)] (with effect from AY 2006-07).

30) Exemption of capital gain to undertakings engaged in business of generation of power (with effect from assessment year 2006-07) [Sec.10 (41)].

31) Exemption of specified income of certain bodies or authorities (with Exempted Incomes effect from assessment year 2006-07) [Sec.10 (42)].

32) Exemption of amount received by an individual as loan under reserve mortgage scheme [Sec.10 (43)]

Such exemption is available to senior citizen, who does not make payment of principal amount and interest throughout his life under the scheme.

33) Exemption of sum received by an individual on behalf of new pension scheme trust [Sec.10 (44)].

34) Perquisites and allowances to chairman and members of Union Public

Service Commission [Sec.10 (45)]

If chairman and members of UPSC have not been retired, then the following allowances and perquisites are exempted, rent free official residence, transport allowance, and leave travel concession. If retired, then Rs.14, 000 pm for meeting expenses and Rs.1,500 pm for residential telephone.

35) Exemption of a specified income of notified body or authority or trust or board or commission [Sec.10 (46)].

36) Income of infrastructure debt fund [Sec.10 (47)]

Such exemption can be availed, only if return of income is filed as per section 139.

37) Income of foreign company [Sec.10 (48)]

Such exemption is allowed to a foreign company in India, only if any income is received by sale of crude oil (in Indian currency).

38) Income of foreign company on account of storage of crude oil [Sec.10 (48A)].

39) Income of National Financial Holdings Company Limited [Sec.10 (49)].

Such company must have been set up by central Government relating to the AY on or before 1st April, 2014.

Q17) What are the Marginal tax rates in India?

A17) The Corporate marginal Tax Rate for domestic companies in India for 2020 is 25.17% with surcharges and cess for such domestic companies.

The corporate marginal tax rates in India from 2006 - 2020 are as follows:

Year | Corporate Marginal Tax Rates |

2006 | 33.66% |

2007 | 33.99% |

2008 | 33.99% |

2009 | 33.99% |

2010 | 33.99% |

2011 | 32.44% |

2012 | 32.45% |

2013 | 33.99% |

2014 | 33.99% |

2015 | 34.61% |

2016 | 34.61% |

2017 | 34.61% |

2018 | 34.61% |

2019 | 25.17% |

2020 | 25.17% |

Q18) What is the importance of Marginal tax rate?

A18) Marginal tax rates are important when it comes to financial planning. For taxpayers, knowing about marginal tax rates is necessary in order to ascertain what amount of their raises or bonuses they get to keep after deduction of taxes. It is also helping taxpayers determine how much they can contribute to their retirement accounts, which yield them tax benefits.

Q19) What is the Maximum Marginal Tax Rate?

A19) In certain cases, like in the case of a Trust of an Association of Person (AOP), income is required to be taxed at the maximum marginal rate, which means there will be no exception limit or slab rate.

As per Section 2(29C) of the Income Tax Act, 1961, the term “maximum marginal rate” means the rate of income-tax (including surcharge on income tax, if any) applicable in relation to the highest slab of income in the case of an individual, association of persons or body of individuals as specified in the Finance Act of the relevant year.

Q20) What is Assessment year and Previous year?

A20) ASSESSMENT YEAR

According to section 2(9), assessment year means the period of twelve months commencing on the 1st day of April every year.

Previous Year

Section 2(3) previous year means the financial year immediately preceding the assessment year:

Provided that, in the case of a business or profession newly set up, or a source of income newly coming into existence, in the said financial year, the previous year shall be the period beginning with the date of setting up of the business or profession or, as the case may be, the date on which the source of income newly comes into existence and ending with the said financial year.

Unit 1

Basic concept

Q1) What is Income tax? What are its features?

A1) Income tax refers to direct tax imposed by the government on income of the citizens of India. It is levied on income of individuals from salary, business, business, profession and other income.

Some of the features of income tax are-

- It is a direct tax.

- It is charged on the total income of a person.

- It is charged on the income of the income year at the rate applicable in assessment year.

- It is payable in the year following the income year.

- It is generally charged on revenue income of a person.

- It is a tax charged on a person for income that comes within the preview of relevant income tax law.

- Whether the income is permanent or temporary, it is immaterial from the tax point of view. Even temporary income is taxable.

If a person receives tax—free income on which tax is paid by the person making payment on behalf of the recipient, it has to be grossed up for inclusion in his total income.

Q2) What is Agriculture income?

A2) AGRICULTURE INCOME [SECTION 2(1A)]

Agricultural income means—

(a) any rent or revenue derived from land which is situated in India and is used for agricultural purposes;

(b) any income derived from such land by—

(i) agriculture; or

(ii) the performance by a cultivator or receiver of rent-in-kind of any process ordinarily employed by a cultivator or receiver of rent-in-kind to render the produce raised or received by him fit to be taken to market; or

(iii) the sale by a cultivator or receiver of rent-in-kind of the produce raised or received by him, in respect of which no process has been performed other than a process of the nature described in paragraph (ii) of this sub-clause;

(c) any income derived from any building owned and occupied by the receiver of the rent or revenue of any such land, or occupied by the cultivator or the receiver of rent-in-kind, of any land with respect to which, or the produce of which, any process mentioned in paragraphs (ii) and (iii) of sub-clause (b) is carried on.

Q3) What is Gross total Income?

A3) Gross Total Income is the aggregate of all the income earned by the individuals during a specified period. According to Section 14 of the Income Tax Act 1961, the income of a person or an assessee can be categorised under these five heads,

- Income from Salaries

- Income from House Property

- Profits and Gains of Business and Profession

- Capital Gains

- Income from Other Sources

Specimen of calculation of gross total income

Income From Salary | Xx |

Add: Income Under the Head House Property | Xx |

Add: Profits and Gains of Business and Profession | Xx |

Add: capital gains Income | Xx |

Add: Income from Other Sources | Xx |

Gross Total Income | Xxx |

Less: Deductions under Section 80C to 80U | Xx |

Total Income | Xxx |

Q4) What do you mean by Total income?

A4) According to section 2(45) total income means the total amount of income referred to in section 5, computed in the manner laid down in this Act. Section 5 of the act provides scope of total Income-

(1) Subject to the provisions of this Act, the total income of any previous year of a person who is a resident includes all income from whatever source derived which-

(a) is received or is deemed to be received in India in such year by or on behalf of such person; or

(b) accrues or arises or is deemed to accrue or arise to him in India during such year; or

(c) accrues or arises to him outside India during such year:

Provided that, in the case of a person not ordinarily resident in India within the meaning of sub-section (6) of section 6, the income which accrues or arises to him outside India shall not be so included unless it is derived from a business controlled in or a profession set up in India.

(2) Subject to the provisions of this Act, the total income of any previous year of a person who is a non-resident includes all income from whatever source derived which—

(a) is received or is deemed to be received in India in such year by or on behalf of such person; or

(b) accrues or arises or is deemed to accrue or arise to him in India during such year.

Q5) What is Maximum Marginal rate of tax.

A5) Marginal Tax Rate is applicable for all the brackets of income of a taxpayer. This is also applicable on any other taxable income for which the taxpayer qualifies. Knowing about Marginal Tax Rates is important when you doing financial planning.

Marginal Tax Rate is the tax rate that is applicable for each tax bracket of a taxpayer’s income or other taxable income for which he or she qualifies. It is the percentage taken from the taxpayer’s next rupee of taxable income over and above a set income threshold.

As an individual’s income rises so will his or her marginal tax rate. The main objective of marginal tax rates is to tax individuals on the basis of what they earn, where people with lower income are taxed at lower rates as compared to people with higher income.

Q6) What is PAN?

A6) A permanent account number (PAN) is a ten-character alphanumeric identifier, issued in the form of a laminated "PAN card", by the Indian Income Tax Department, to any "person" who applies for it or to whom the department allots the number without an application. It can also be obtained in the form of a PDF file.

A PAN is a unique identifier issued to all judicial entities identifiable under the Indian Income Tax Act, 1961. The income tax PAN and its linked card are issued under Section 139A of the Income Tax Act. It is issued by the Indian Income Tax Department under the supervision of the Central Board for Direct Taxes (CBDT) and it also serves as an important proof of identification.

It is also issued to foreign nationals (such as investors) subject to a valid visa, and hence a PAN card is not acceptable as proof of Indian citizenship. A PAN is necessary for filing income tax returns.

The PAN (or PAN number) is a ten-character long alpha-numeric unique identifier.

Q7) What are the uses of PAN?

A7) The primary purpose of the PAN is to bring a universal identification to all financial transactions and to prevent tax evasion by keeping track of monetary transactions, especially those of high-net-worth individuals who can impact the economy.

Quoting the PAN is mandatory when filing income tax returns, tax deduction at source, or any other communication with the Income Tax Department. PAN is also steadily becoming a mandatory document for opening a new bank account, a demat account, a new landline telephone connection / a mobile phone connection, purchase of foreign currency, bank deposits above ₹50,000, purchase and sale of immovable properties, vehicles etc.

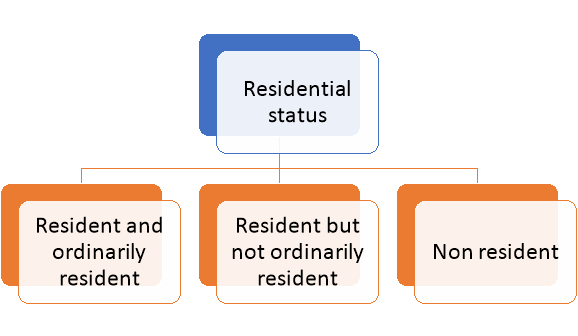

Q8) What is Residential status?

A8) Section 4(6) of the income tax act provides provisions for residential status of person in India. According to the Income Tax Act, 1961, residential status of a person is one of the important criteria in determining the tax implications. The residential status of a person can be categorised into-

a) Resident and Ordinarily Resident (ROR)

b) Resident but Not Ordinarily Resident (RNOR)

c) Non- Resident (NR)

Such types are discussed below-

a)Resident and Ordinarily Resident (ROR)

A resident taxpayer is an individual who satisfies any one of the following conditions:

- Resides in India for a minimum of 182 days in a year, or

- Resided in India for a minimum of 365 days in the immediately preceding four years and for a minimum of 60 days in the current financial year.

b) Resident but Not Ordinarily Resident (RNOR)

If an individual qualifies as a resident, the next step is to determine if he/she is a Resident ordinarily resident (ROR) or an RNOR. He will be a ROR if he meets both of the following conditions:

- Has been a resident of India in at least 2 out of 10 years immediately previous years and

- Has stayed in India for at least 730 days in 7 immediately preceding years

c) Non- Resident (NR)

An individual satisfying neither of the conditions stated above conditions would be a non-resident for the year.

Q9) Explain the tax liability of persons according to residential status?

A9) The tax liability of persons according to residential status are discussed below-

- Resident:

A resident will be charged to tax in India on his global income i.e. income earned in India as well as income earned outside India.

2. Non-resident and Resident but not ordinarily resident:

Their tax liability in India is restricted to the income they earn in India. They need not pay any tax in India on their foreign income. Also note that in a case of double taxation of income where the same income is getting taxed in India as well as abroad, one may resort to the Double Taxation Avoidance Agreement (DTAA) that India would have entered into with the other country in order to eliminate the possibility of paying taxes twice

Q10) What are the exempted income under section 10?

A10) Exempted income is that income on which income tax is not chargeable. Such

Incomes are classified as under:

i) Incomes which do not form part of total income nor is income tax payable on them. They are called fully exempted incomes.

Ii) Incomes which are included in the total income but are exempt from income tax at the average rate of income tax applicable to the total income. They are called partially exempted incomes.

Iii) Incomes of certain Institutions or authorities are exempted subject to fulfilment of the required conditions.

Q11) What are the objectives of Income Tax?

A11) Some of the objectives of income tax are highlighted below-

1. To reduce inequalities in the distribution of income and wealth.

2. To bring out a greater measure of equity between different classes of tax payers.

3. To achieve the twin objectives of higher yields with reduction in inequalities.

4. To accelerate the temp of economic growth and development of the country.

5. To maintain reasonable economic stability in the force of long run inflationary pressure and short run international price movements.

6. To make available of funds for economic development.

7. To reduce extreme inequalities in wealth, income and consumptions standards with undetermined productive efficiency, offence, justice and political stability.

8. To encourage investment in new capital goods.

9. To channelize investment into those sectors which contribute the most of economic growth.

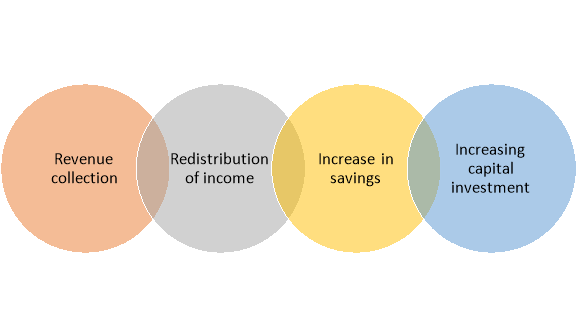

Q12) What are the importance of Income tax?

A12) Some of the importance of income tax is highlighted below-

- Revenue Collection:

Government collects nearly 18% of revenue from this source of tax. Therefore the most and significant source of revenue is income tax.

2. Redistribution of Income:

An efficient and fair tax system can reduce the inequality of wealth and income. This is possible by imposing tax rich people heavily and to confer a benefit to poorer through progressive income tax.

3. Increase in Savings:

An effective and efficient tax system encourages people to save through providing tax credit facilities on investment allowances.

4. Increasing Capital Investment:

This income tax revenue can be used by the government to ensure the economic development of the country. It can be used to build up the infrastructure to invest in some social security programs in various poverty alleviation programs, like, Social Justice, Economical Control. Increase Public Awareness.

Q13) What is the assessment of Association of Persons (AOP) or Body of Individuals (BOI) with regards to Marginal Tax Rate?

A13) The assessment of the members of AOP or BOI depends on whether they are eligible to be charged tax at the maximum marginal rate or not at all.

If an AOP or BOI is chargeable to tax at a maximum marginal rate or any higher rate, the share of profit of a member is exempt from tax. Therefore, it is not to be included in the total income of the member as per Section 86(a)

The rate of 30.9% charged is the maximum marginal rate of tax and if such rate is applied then the share of profit of the member is exempt from tax

Q14) What is the structure of PAN?

A14) The PAN structure is as follows: Fourth character [P — Individual or Person] Example: AAAPZ1234C

- The first five characters are letters (in uppercase by default), followed by four numerals, and the last (tenth) character is a letter.

- The first three characters of the code are three letters forming a sequence of alphabetical letters from AAA to ZZZ

- The fourth character identifies the type of holder of the card. Each holder type is uniquely defined by a letter from the list below:

A — AOP (Association of persons)

B — BOI (Body of individuals)

C — Company

F — Firm

G — Government

H — HUF (Hindu Undivided Family)

L — Local authority

J — Artificial juridical person

P — Person (Individual)

T — Trust (AOP)

- The fifth character of the PAN is the first character of either:

- Of the first name, surname or last name of the person, in the case of a "personal" PAN card, where the fourth character is "P" or

- Of the name of the entity, trust, society, or organisation in the case of a company/HUF/firm/AOP/trust/BOI/local authority/artificial judicial person/government, where the fourth character is "C", "H", "F", "A", "T", "B", "L", "J", "G".

- The last (tenth) character is an alphabetic digit used as a check-sum to verify the validity of that current code.

Q15) Why PAN is necessary?

A15) Under the existing law, it is absolutely necessary for all income- tax assessees to quote PAN in the following documents:

(i) in the income-tax return and in all other correspondences with the income-tax department.

(ii) in all challans for payment of any tax, interest and penalty due under the Income-tax Act.

(iii) in all documents related with the following transactions:

- Sale or purchase of any immovable property in excess of Rs. 10 lakhs

- Properties valued by Stamp Valuation authority at amount exceeding Rs.10 lakh.

- Sale or purchase of a motor vehicle other than a two-wheeler.

- Time deposit exceeding Rs. 50,000/- with a bank.

-Deposits with Co-op Banks, Post Office, Nidhi, NBFC companies will also need PAN;

-Deposits aggregating to more than Rs.5 lakh during the year will also need PAN

e. sale or purchase of shares, stocks and other securities in excess of Rs. 1,00,000/-.

f. opening of a bank account.

g. payment to hotels and restaurants in excess of Rs. 25,000 at a time, but in case of cash payment exceeding Rs. 50,000 PAN is required.

h. Cash deposit with banking company of Rs. 50,000 or above in a day.

i. Payment exceeding Rs.50,000/- to RBI for acquiring its bonds.

j. Purchase/ sale of any goods or services exceeding Rs.2 lakh per transaction.

k. Payment exceeding Rs.50,000/- to a company/ institution for acquiring its debentures/ bonds.

l. Payment exceeding Rs.50,000/- for purchase of mutual fund units.

Further, if any part of the income of the assessee is liable to deduction of tax at source, the assessee is required to intimate his PAN to the person responsible for deducting tax at source.

Q16) Highlight the list of exempted income?

A16) The list of exempted income is highlighted below-

1) Agricultural income [Sec.10 (1)]

Agricultural income from the land situated in India is fully exempted from

Income tax (Agricultural income definition given under Income Tax Act.)

2) Sum received by a member from Hindu undivided family [Sec.10 (2)]

Any sum received by a member of Hindu undivided family at the time of division is tax free.

3) Share of a partner in firm’s income [Sec.10 (2A)]

The share of a partner in firms’ profit is fully tax free.

4) Profit of newly established industrial undertaking in free trade zone [Sec.10AA].

5) Compensation received by victims of Bhopal gas leak disaster [Sec.10

(10BB)]

Any compensation paid under any Plan of Bhopal Gas Leak Disaster (Processing of claims Act, 1985) is exempted from tax.

6) Sum received from life insurance [Sec.10 (10D)]

Any sum received from life insurance Corporation as the maturity of insurance policy is fully exempt from tax, even bonus received is also fully exempted. But, Keyman Insurance Policy and any sum received under u/s 80DD(3) will not be exempted.

7) Sum received from Public Provident Fund [Sec.10 (11)]

Any sum received from public provident fund (in state bank and head offices) is fully exempted.

8) Payment from Sukanya Samridhi account [Sec.10 (11A)]

Any sum received from Sukanya Samridhi Account rules, 2014 made under Government saving bank Act, 1873 is fully exempt from tax.

9) Payment from National Payment System Trust [Sec.10 (12A)] Exempted Incomes

Any payment from national payment system trust u/s 80(CCD), if it does not exceed 40% of total amount, payable to assessee at time of closure of the scheme is exempt from tax.

10) Partial withdrawal from National Pension System Trust [Sec.10 (12B)]

Any withdrawal by the assessee from national pension system trust, up to 25% of it is tax free.

11) Interest, premium or bonus on specified investments [Sec.10(15)]

Like Annuity certificates, National Saving Certificates, Post Office Savings, Bank Account, Interest on relief Bonds, Post office cash certificates etc. are fully exempt from tax.

12) Scholarships [Sec.10 (16)]

Any fellowship or scholarship granted by Government for education and research work will be exempted.

13) Allowances of M. Ps and MLA’s [Sec.10 (17)]

For example, daily allowances, constituency allowance, shall be exempt fully.

14) Award or reward [Sec.10 (17A)]

Any award in form of cash or kind granted by Central or State Government for work of literature or scientific shall be exempted. Any award from any other institution apart from Government, shall be exempted from tax provided, such exemption is approved by Central Government.

15) Pension to an individual awarded by ‘Vir Chakra’ [Sec.10 (18)]

Any amount in form of pension received by an individual or family who had been a central or state Government employee and was awarded ‘PARAM Veer Chakra, Vir Chakra, Mahavir Chakra, shall be exempted.

16) Family pension to family members of armed forces [Sec.10 (19)]

Family pension to widow or children or nominated pension of a member of the armed forces died during operational duty shall be exempted.

17) Annual value of a palace of the Ex-rulers [Sec.10 (19A)]

18) Incomes of scheduled tribes [Sec.10 (26)]

Any income accrued to scheduled tribes living in tribal areas (as given in VI schedule of constitution) of State of Manipur, Sikkim, Tripura, Mizoram, Nagaland and Arunachal Pradesh shall be exempted.

19) Subsidy received from tea board [Sec.10(30)]

Any subsidy from tea Board, to the assessee, carrying on the business of growing and manufacturing tea in India, received shall be exempt from tax, provided, the certificate of exemption, has been presented to Income Tax officers.

20) Subsidy received by planters [Sec.10(31)]

Any subsidy from Rubber Board office or spice board, to the assessee, under any scheme for replantation of rubber plants or coffee plants etc. shall be exempt.

21) Income of minor child [Sec.10 (32)]

Income up to Rs.1,500/- in respect of minor is exempt from tax and any excess of that amount is included in parent’s income whose income is greater.

22) Capital gain on transfer of units of US-64 [Sec.10(33)]

Any capital gain on transfer of units US-64 shall be exempted provided such transfer is done on or after 1/4/2002.

23) Dividend from domestic company [Sec.10 (34)]

Any dividend declared by a domestic company is exempt from tax (with effect from AY 2004-05). It does not include dividend u/s 2(22) (e).

24) Any income received in respect of units of a mutual fund, Units from the administrator of the specified undertaking or units from the specified company [Sec.10 (35)]

This income is exempt with effect from AY 2004-05.

25) Long term capital gain on eligible equity shares [Sec.10(36)]

This exemption is applicable only when shares have been held for at least 12 months and when investment have been made on or after 1/3/2003 and not later on 31st March, 2004.

26) Exemption of capital gains on compensation received on compulsory acquisition of agricultural land situated within specified urban cities [Sec.10 (37)].

Such exemption is available to an individual or Hindu undivided family, on short- or long-term capital gain, provided such compensation should be received on or after 1/4/2004 and land is used in agriculture preceding 2 years from compulsory acquisition.

27) Exemption of long-term capital gain arising from sale of shares and units (With effect from 1-10-2004) [Not applicable W.e.f. AY 2019-20] [Sec.10 (38)].

28) Exemption of specified income from international sporting event held in India (with effect from assessment year 2006-07) [Sec.10 (39)].

29) Exemption in respect of grant etc. received by a subsidiary company from its holding company engaged in business of distribution of power [Sec.10 (40)] (with effect from AY 2006-07).

30) Exemption of capital gain to undertakings engaged in business of generation of power (with effect from assessment year 2006-07) [Sec.10 (41)].

31) Exemption of specified income of certain bodies or authorities (with Exempted Incomes effect from assessment year 2006-07) [Sec.10 (42)].

32) Exemption of amount received by an individual as loan under reserve mortgage scheme [Sec.10 (43)]

Such exemption is available to senior citizen, who does not make payment of principal amount and interest throughout his life under the scheme.

33) Exemption of sum received by an individual on behalf of new pension scheme trust [Sec.10 (44)].

34) Perquisites and allowances to chairman and members of Union Public

Service Commission [Sec.10 (45)]

If chairman and members of UPSC have not been retired, then the following allowances and perquisites are exempted, rent free official residence, transport allowance, and leave travel concession. If retired, then Rs.14, 000 pm for meeting expenses and Rs.1,500 pm for residential telephone.

35) Exemption of a specified income of notified body or authority or trust or board or commission [Sec.10 (46)].

36) Income of infrastructure debt fund [Sec.10 (47)]

Such exemption can be availed, only if return of income is filed as per section 139.

37) Income of foreign company [Sec.10 (48)]

Such exemption is allowed to a foreign company in India, only if any income is received by sale of crude oil (in Indian currency).

38) Income of foreign company on account of storage of crude oil [Sec.10 (48A)].

39) Income of National Financial Holdings Company Limited [Sec.10 (49)].

Such company must have been set up by central Government relating to the AY on or before 1st April, 2014.

Q17) What are the Marginal tax rates in India?

A17) The Corporate marginal Tax Rate for domestic companies in India for 2020 is 25.17% with surcharges and cess for such domestic companies.

The corporate marginal tax rates in India from 2006 - 2020 are as follows:

Year | Corporate Marginal Tax Rates |

2006 | 33.66% |

2007 | 33.99% |

2008 | 33.99% |

2009 | 33.99% |

2010 | 33.99% |

2011 | 32.44% |

2012 | 32.45% |

2013 | 33.99% |

2014 | 33.99% |

2015 | 34.61% |

2016 | 34.61% |

2017 | 34.61% |

2018 | 34.61% |

2019 | 25.17% |

2020 | 25.17% |

Q18) What is the importance of Marginal tax rate?

A18) Marginal tax rates are important when it comes to financial planning. For taxpayers, knowing about marginal tax rates is necessary in order to ascertain what amount of their raises or bonuses they get to keep after deduction of taxes. It is also helping taxpayers determine how much they can contribute to their retirement accounts, which yield them tax benefits.

Q19) What is the Maximum Marginal Tax Rate?

A19) In certain cases, like in the case of a Trust of an Association of Person (AOP), income is required to be taxed at the maximum marginal rate, which means there will be no exception limit or slab rate.

As per Section 2(29C) of the Income Tax Act, 1961, the term “maximum marginal rate” means the rate of income-tax (including surcharge on income tax, if any) applicable in relation to the highest slab of income in the case of an individual, association of persons or body of individuals as specified in the Finance Act of the relevant year.

Q20) What is Assessment year and Previous year?

A20) ASSESSMENT YEAR

According to section 2(9), assessment year means the period of twelve months commencing on the 1st day of April every year.

Previous Year

Section 2(3) previous year means the financial year immediately preceding the assessment year:

Provided that, in the case of a business or profession newly set up, or a source of income newly coming into existence, in the said financial year, the previous year shall be the period beginning with the date of setting up of the business or profession or, as the case may be, the date on which the source of income newly comes into existence and ending with the said financial year.

Unit 1

Basic concept

Q1) What is Income tax? What are its features?

A1) Income tax refers to direct tax imposed by the government on income of the citizens of India. It is levied on income of individuals from salary, business, business, profession and other income.

Some of the features of income tax are-

- It is a direct tax.

- It is charged on the total income of a person.

- It is charged on the income of the income year at the rate applicable in assessment year.

- It is payable in the year following the income year.

- It is generally charged on revenue income of a person.

- It is a tax charged on a person for income that comes within the preview of relevant income tax law.

- Whether the income is permanent or temporary, it is immaterial from the tax point of view. Even temporary income is taxable.

If a person receives tax—free income on which tax is paid by the person making payment on behalf of the recipient, it has to be grossed up for inclusion in his total income.

Q2) What is Agriculture income?

A2) AGRICULTURE INCOME [SECTION 2(1A)]

Agricultural income means—

(a) any rent or revenue derived from land which is situated in India and is used for agricultural purposes;

(b) any income derived from such land by—

(i) agriculture; or

(ii) the performance by a cultivator or receiver of rent-in-kind of any process ordinarily employed by a cultivator or receiver of rent-in-kind to render the produce raised or received by him fit to be taken to market; or

(iii) the sale by a cultivator or receiver of rent-in-kind of the produce raised or received by him, in respect of which no process has been performed other than a process of the nature described in paragraph (ii) of this sub-clause;

(c) any income derived from any building owned and occupied by the receiver of the rent or revenue of any such land, or occupied by the cultivator or the receiver of rent-in-kind, of any land with respect to which, or the produce of which, any process mentioned in paragraphs (ii) and (iii) of sub-clause (b) is carried on.

Q3) What is Gross total Income?

A3) Gross Total Income is the aggregate of all the income earned by the individuals during a specified period. According to Section 14 of the Income Tax Act 1961, the income of a person or an assessee can be categorised under these five heads,

- Income from Salaries

- Income from House Property

- Profits and Gains of Business and Profession

- Capital Gains

- Income from Other Sources

Specimen of calculation of gross total income

Income From Salary | Xx |

Add: Income Under the Head House Property | Xx |

Add: Profits and Gains of Business and Profession | Xx |

Add: capital gains Income | Xx |

Add: Income from Other Sources | Xx |

Gross Total Income | Xxx |

Less: Deductions under Section 80C to 80U | Xx |

Total Income | Xxx |

Q4) What do you mean by Total income?

A4) According to section 2(45) total income means the total amount of income referred to in section 5, computed in the manner laid down in this Act. Section 5 of the act provides scope of total Income-

(1) Subject to the provisions of this Act, the total income of any previous year of a person who is a resident includes all income from whatever source derived which-

(a) is received or is deemed to be received in India in such year by or on behalf of such person; or

(b) accrues or arises or is deemed to accrue or arise to him in India during such year; or

(c) accrues or arises to him outside India during such year:

Provided that, in the case of a person not ordinarily resident in India within the meaning of sub-section (6) of section 6, the income which accrues or arises to him outside India shall not be so included unless it is derived from a business controlled in or a profession set up in India.

(2) Subject to the provisions of this Act, the total income of any previous year of a person who is a non-resident includes all income from whatever source derived which—

(a) is received or is deemed to be received in India in such year by or on behalf of such person; or

(b) accrues or arises or is deemed to accrue or arise to him in India during such year.

Q5) What is Maximum Marginal rate of tax.

A5) Marginal Tax Rate is applicable for all the brackets of income of a taxpayer. This is also applicable on any other taxable income for which the taxpayer qualifies. Knowing about Marginal Tax Rates is important when you doing financial planning.

Marginal Tax Rate is the tax rate that is applicable for each tax bracket of a taxpayer’s income or other taxable income for which he or she qualifies. It is the percentage taken from the taxpayer’s next rupee of taxable income over and above a set income threshold.

As an individual’s income rises so will his or her marginal tax rate. The main objective of marginal tax rates is to tax individuals on the basis of what they earn, where people with lower income are taxed at lower rates as compared to people with higher income.

Q6) What is PAN?

A6) A permanent account number (PAN) is a ten-character alphanumeric identifier, issued in the form of a laminated "PAN card", by the Indian Income Tax Department, to any "person" who applies for it or to whom the department allots the number without an application. It can also be obtained in the form of a PDF file.

A PAN is a unique identifier issued to all judicial entities identifiable under the Indian Income Tax Act, 1961. The income tax PAN and its linked card are issued under Section 139A of the Income Tax Act. It is issued by the Indian Income Tax Department under the supervision of the Central Board for Direct Taxes (CBDT) and it also serves as an important proof of identification.

It is also issued to foreign nationals (such as investors) subject to a valid visa, and hence a PAN card is not acceptable as proof of Indian citizenship. A PAN is necessary for filing income tax returns.

The PAN (or PAN number) is a ten-character long alpha-numeric unique identifier.

Q7) What are the uses of PAN?

A7) The primary purpose of the PAN is to bring a universal identification to all financial transactions and to prevent tax evasion by keeping track of monetary transactions, especially those of high-net-worth individuals who can impact the economy.

Quoting the PAN is mandatory when filing income tax returns, tax deduction at source, or any other communication with the Income Tax Department. PAN is also steadily becoming a mandatory document for opening a new bank account, a demat account, a new landline telephone connection / a mobile phone connection, purchase of foreign currency, bank deposits above ₹50,000, purchase and sale of immovable properties, vehicles etc.

Q8) What is Residential status?

A8) Section 4(6) of the income tax act provides provisions for residential status of person in India. According to the Income Tax Act, 1961, residential status of a person is one of the important criteria in determining the tax implications. The residential status of a person can be categorised into-

a) Resident and Ordinarily Resident (ROR)

b) Resident but Not Ordinarily Resident (RNOR)

c) Non- Resident (NR)

Such types are discussed below-

a)Resident and Ordinarily Resident (ROR)

A resident taxpayer is an individual who satisfies any one of the following conditions:

- Resides in India for a minimum of 182 days in a year, or

- Resided in India for a minimum of 365 days in the immediately preceding four years and for a minimum of 60 days in the current financial year.

b) Resident but Not Ordinarily Resident (RNOR)

If an individual qualifies as a resident, the next step is to determine if he/she is a Resident ordinarily resident (ROR) or an RNOR. He will be a ROR if he meets both of the following conditions:

- Has been a resident of India in at least 2 out of 10 years immediately previous years and

- Has stayed in India for at least 730 days in 7 immediately preceding years

c) Non- Resident (NR)

An individual satisfying neither of the conditions stated above conditions would be a non-resident for the year.

Q9) Explain the tax liability of persons according to residential status?

A9) The tax liability of persons according to residential status are discussed below-

- Resident:

A resident will be charged to tax in India on his global income i.e. income earned in India as well as income earned outside India.

2. Non-resident and Resident but not ordinarily resident:

Their tax liability in India is restricted to the income they earn in India. They need not pay any tax in India on their foreign income. Also note that in a case of double taxation of income where the same income is getting taxed in India as well as abroad, one may resort to the Double Taxation Avoidance Agreement (DTAA) that India would have entered into with the other country in order to eliminate the possibility of paying taxes twice

Q10) What are the exempted income under section 10?

A10) Exempted income is that income on which income tax is not chargeable. Such

Incomes are classified as under:

i) Incomes which do not form part of total income nor is income tax payable on them. They are called fully exempted incomes.

Ii) Incomes which are included in the total income but are exempt from income tax at the average rate of income tax applicable to the total income. They are called partially exempted incomes.

Iii) Incomes of certain Institutions or authorities are exempted subject to fulfilment of the required conditions.

Q11) What are the objectives of Income Tax?

A11) Some of the objectives of income tax are highlighted below-

1. To reduce inequalities in the distribution of income and wealth.

2. To bring out a greater measure of equity between different classes of tax payers.

3. To achieve the twin objectives of higher yields with reduction in inequalities.

4. To accelerate the temp of economic growth and development of the country.

5. To maintain reasonable economic stability in the force of long run inflationary pressure and short run international price movements.

6. To make available of funds for economic development.

7. To reduce extreme inequalities in wealth, income and consumptions standards with undetermined productive efficiency, offence, justice and political stability.

8. To encourage investment in new capital goods.

9. To channelize investment into those sectors which contribute the most of economic growth.

Q12) What are the importance of Income tax?

A12) Some of the importance of income tax is highlighted below-

- Revenue Collection:

Government collects nearly 18% of revenue from this source of tax. Therefore the most and significant source of revenue is income tax.

2. Redistribution of Income:

An efficient and fair tax system can reduce the inequality of wealth and income. This is possible by imposing tax rich people heavily and to confer a benefit to poorer through progressive income tax.

3. Increase in Savings:

An effective and efficient tax system encourages people to save through providing tax credit facilities on investment allowances.

4. Increasing Capital Investment:

This income tax revenue can be used by the government to ensure the economic development of the country. It can be used to build up the infrastructure to invest in some social security programs in various poverty alleviation programs, like, Social Justice, Economical Control. Increase Public Awareness.

Q13) What is the assessment of Association of Persons (AOP) or Body of Individuals (BOI) with regards to Marginal Tax Rate?

A13) The assessment of the members of AOP or BOI depends on whether they are eligible to be charged tax at the maximum marginal rate or not at all.

If an AOP or BOI is chargeable to tax at a maximum marginal rate or any higher rate, the share of profit of a member is exempt from tax. Therefore, it is not to be included in the total income of the member as per Section 86(a)

The rate of 30.9% charged is the maximum marginal rate of tax and if such rate is applied then the share of profit of the member is exempt from tax

Q14) What is the structure of PAN?

A14) The PAN structure is as follows: Fourth character [P — Individual or Person] Example: AAAPZ1234C

- The first five characters are letters (in uppercase by default), followed by four numerals, and the last (tenth) character is a letter.

- The first three characters of the code are three letters forming a sequence of alphabetical letters from AAA to ZZZ

- The fourth character identifies the type of holder of the card. Each holder type is uniquely defined by a letter from the list below:

A — AOP (Association of persons)

B — BOI (Body of individuals)

C — Company

F — Firm

G — Government

H — HUF (Hindu Undivided Family)

L — Local authority

J — Artificial juridical person

P — Person (Individual)

T — Trust (AOP)

- The fifth character of the PAN is the first character of either:

- Of the first name, surname or last name of the person, in the case of a "personal" PAN card, where the fourth character is "P" or

- Of the name of the entity, trust, society, or organisation in the case of a company/HUF/firm/AOP/trust/BOI/local authority/artificial judicial person/government, where the fourth character is "C", "H", "F", "A", "T", "B", "L", "J", "G".

- The last (tenth) character is an alphabetic digit used as a check-sum to verify the validity of that current code.

Q15) Why PAN is necessary?

A15) Under the existing law, it is absolutely necessary for all income- tax assessees to quote PAN in the following documents:

(i) in the income-tax return and in all other correspondences with the income-tax department.

(ii) in all challans for payment of any tax, interest and penalty due under the Income-tax Act.

(iii) in all documents related with the following transactions:

- Sale or purchase of any immovable property in excess of Rs. 10 lakhs

- Properties valued by Stamp Valuation authority at amount exceeding Rs.10 lakh.

- Sale or purchase of a motor vehicle other than a two-wheeler.

- Time deposit exceeding Rs. 50,000/- with a bank.

-Deposits with Co-op Banks, Post Office, Nidhi, NBFC companies will also need PAN;

-Deposits aggregating to more than Rs.5 lakh during the year will also need PAN

e. sale or purchase of shares, stocks and other securities in excess of Rs. 1,00,000/-.

f. opening of a bank account.

g. payment to hotels and restaurants in excess of Rs. 25,000 at a time, but in case of cash payment exceeding Rs. 50,000 PAN is required.

h. Cash deposit with banking company of Rs. 50,000 or above in a day.

i. Payment exceeding Rs.50,000/- to RBI for acquiring its bonds.

j. Purchase/ sale of any goods or services exceeding Rs.2 lakh per transaction.

k. Payment exceeding Rs.50,000/- to a company/ institution for acquiring its debentures/ bonds.

l. Payment exceeding Rs.50,000/- for purchase of mutual fund units.

Further, if any part of the income of the assessee is liable to deduction of tax at source, the assessee is required to intimate his PAN to the person responsible for deducting tax at source.

Q16) Highlight the list of exempted income?

A16) The list of exempted income is highlighted below-

1) Agricultural income [Sec.10 (1)]

Agricultural income from the land situated in India is fully exempted from

Income tax (Agricultural income definition given under Income Tax Act.)

2) Sum received by a member from Hindu undivided family [Sec.10 (2)]

Any sum received by a member of Hindu undivided family at the time of division is tax free.

3) Share of a partner in firm’s income [Sec.10 (2A)]

The share of a partner in firms’ profit is fully tax free.

4) Profit of newly established industrial undertaking in free trade zone [Sec.10AA].

5) Compensation received by victims of Bhopal gas leak disaster [Sec.10

(10BB)]

Any compensation paid under any Plan of Bhopal Gas Leak Disaster (Processing of claims Act, 1985) is exempted from tax.

6) Sum received from life insurance [Sec.10 (10D)]

Any sum received from life insurance Corporation as the maturity of insurance policy is fully exempt from tax, even bonus received is also fully exempted. But, Keyman Insurance Policy and any sum received under u/s 80DD(3) will not be exempted.

7) Sum received from Public Provident Fund [Sec.10 (11)]

Any sum received from public provident fund (in state bank and head offices) is fully exempted.

8) Payment from Sukanya Samridhi account [Sec.10 (11A)]

Any sum received from Sukanya Samridhi Account rules, 2014 made under Government saving bank Act, 1873 is fully exempt from tax.

9) Payment from National Payment System Trust [Sec.10 (12A)] Exempted Incomes

Any payment from national payment system trust u/s 80(CCD), if it does not exceed 40% of total amount, payable to assessee at time of closure of the scheme is exempt from tax.

10) Partial withdrawal from National Pension System Trust [Sec.10 (12B)]

Any withdrawal by the assessee from national pension system trust, up to 25% of it is tax free.

11) Interest, premium or bonus on specified investments [Sec.10(15)]

Like Annuity certificates, National Saving Certificates, Post Office Savings, Bank Account, Interest on relief Bonds, Post office cash certificates etc. are fully exempt from tax.

12) Scholarships [Sec.10 (16)]

Any fellowship or scholarship granted by Government for education and research work will be exempted.

13) Allowances of M. Ps and MLA’s [Sec.10 (17)]

For example, daily allowances, constituency allowance, shall be exempt fully.

14) Award or reward [Sec.10 (17A)]

Any award in form of cash or kind granted by Central or State Government for work of literature or scientific shall be exempted. Any award from any other institution apart from Government, shall be exempted from tax provided, such exemption is approved by Central Government.

15) Pension to an individual awarded by ‘Vir Chakra’ [Sec.10 (18)]

Any amount in form of pension received by an individual or family who had been a central or state Government employee and was awarded ‘PARAM Veer Chakra, Vir Chakra, Mahavir Chakra, shall be exempted.

16) Family pension to family members of armed forces [Sec.10 (19)]

Family pension to widow or children or nominated pension of a member of the armed forces died during operational duty shall be exempted.

17) Annual value of a palace of the Ex-rulers [Sec.10 (19A)]

18) Incomes of scheduled tribes [Sec.10 (26)]

Any income accrued to scheduled tribes living in tribal areas (as given in VI schedule of constitution) of State of Manipur, Sikkim, Tripura, Mizoram, Nagaland and Arunachal Pradesh shall be exempted.

19) Subsidy received from tea board [Sec.10(30)]

Any subsidy from tea Board, to the assessee, carrying on the business of growing and manufacturing tea in India, received shall be exempt from tax, provided, the certificate of exemption, has been presented to Income Tax officers.

20) Subsidy received by planters [Sec.10(31)]

Any subsidy from Rubber Board office or spice board, to the assessee, under any scheme for replantation of rubber plants or coffee plants etc. shall be exempt.

21) Income of minor child [Sec.10 (32)]

Income up to Rs.1,500/- in respect of minor is exempt from tax and any excess of that amount is included in parent’s income whose income is greater.

22) Capital gain on transfer of units of US-64 [Sec.10(33)]

Any capital gain on transfer of units US-64 shall be exempted provided such transfer is done on or after 1/4/2002.

23) Dividend from domestic company [Sec.10 (34)]

Any dividend declared by a domestic company is exempt from tax (with effect from AY 2004-05). It does not include dividend u/s 2(22) (e).

24) Any income received in respect of units of a mutual fund, Units from the administrator of the specified undertaking or units from the specified company [Sec.10 (35)]

This income is exempt with effect from AY 2004-05.

25) Long term capital gain on eligible equity shares [Sec.10(36)]

This exemption is applicable only when shares have been held for at least 12 months and when investment have been made on or after 1/3/2003 and not later on 31st March, 2004.

26) Exemption of capital gains on compensation received on compulsory acquisition of agricultural land situated within specified urban cities [Sec.10 (37)].

Such exemption is available to an individual or Hindu undivided family, on short- or long-term capital gain, provided such compensation should be received on or after 1/4/2004 and land is used in agriculture preceding 2 years from compulsory acquisition.

27) Exemption of long-term capital gain arising from sale of shares and units (With effect from 1-10-2004) [Not applicable W.e.f. AY 2019-20] [Sec.10 (38)].

28) Exemption of specified income from international sporting event held in India (with effect from assessment year 2006-07) [Sec.10 (39)].

29) Exemption in respect of grant etc. received by a subsidiary company from its holding company engaged in business of distribution of power [Sec.10 (40)] (with effect from AY 2006-07).

30) Exemption of capital gain to undertakings engaged in business of generation of power (with effect from assessment year 2006-07) [Sec.10 (41)].

31) Exemption of specified income of certain bodies or authorities (with Exempted Incomes effect from assessment year 2006-07) [Sec.10 (42)].

32) Exemption of amount received by an individual as loan under reserve mortgage scheme [Sec.10 (43)]

Such exemption is available to senior citizen, who does not make payment of principal amount and interest throughout his life under the scheme.

33) Exemption of sum received by an individual on behalf of new pension scheme trust [Sec.10 (44)].

34) Perquisites and allowances to chairman and members of Union Public

Service Commission [Sec.10 (45)]

If chairman and members of UPSC have not been retired, then the following allowances and perquisites are exempted, rent free official residence, transport allowance, and leave travel concession. If retired, then Rs.14, 000 pm for meeting expenses and Rs.1,500 pm for residential telephone.

35) Exemption of a specified income of notified body or authority or trust or board or commission [Sec.10 (46)].

36) Income of infrastructure debt fund [Sec.10 (47)]

Such exemption can be availed, only if return of income is filed as per section 139.

37) Income of foreign company [Sec.10 (48)]

Such exemption is allowed to a foreign company in India, only if any income is received by sale of crude oil (in Indian currency).

38) Income of foreign company on account of storage of crude oil [Sec.10 (48A)].

39) Income of National Financial Holdings Company Limited [Sec.10 (49)].

Such company must have been set up by central Government relating to the AY on or before 1st April, 2014.

Q17) What are the Marginal tax rates in India?

A17) The Corporate marginal Tax Rate for domestic companies in India for 2020 is 25.17% with surcharges and cess for such domestic companies.

The corporate marginal tax rates in India from 2006 - 2020 are as follows:

Year | Corporate Marginal Tax Rates |

2006 | 33.66% |

2007 | 33.99% |

2008 | 33.99% |

2009 | 33.99% |

2010 | 33.99% |

2011 | 32.44% |

2012 | 32.45% |

2013 | 33.99% |

2014 | 33.99% |

2015 | 34.61% |

2016 | 34.61% |

2017 | 34.61% |

2018 | 34.61% |

2019 | 25.17% |

2020 | 25.17% |

Q18) What is the importance of Marginal tax rate?

A18) Marginal tax rates are important when it comes to financial planning. For taxpayers, knowing about marginal tax rates is necessary in order to ascertain what amount of their raises or bonuses they get to keep after deduction of taxes. It is also helping taxpayers determine how much they can contribute to their retirement accounts, which yield them tax benefits.

Q19) What is the Maximum Marginal Tax Rate?

A19) In certain cases, like in the case of a Trust of an Association of Person (AOP), income is required to be taxed at the maximum marginal rate, which means there will be no exception limit or slab rate.

As per Section 2(29C) of the Income Tax Act, 1961, the term “maximum marginal rate” means the rate of income-tax (including surcharge on income tax, if any) applicable in relation to the highest slab of income in the case of an individual, association of persons or body of individuals as specified in the Finance Act of the relevant year.

Q20) What is Assessment year and Previous year?

A20) ASSESSMENT YEAR

According to section 2(9), assessment year means the period of twelve months commencing on the 1st day of April every year.

Previous Year

Section 2(3) previous year means the financial year immediately preceding the assessment year:

Provided that, in the case of a business or profession newly set up, or a source of income newly coming into existence, in the said financial year, the previous year shall be the period beginning with the date of setting up of the business or profession or, as the case may be, the date on which the source of income newly comes into existence and ending with the said financial year.

Unit 1

Basic concept

Q1) What is Income tax? What are its features?

A1) Income tax refers to direct tax imposed by the government on income of the citizens of India. It is levied on income of individuals from salary, business, business, profession and other income.

Some of the features of income tax are-

- It is a direct tax.

- It is charged on the total income of a person.

- It is charged on the income of the income year at the rate applicable in assessment year.

- It is payable in the year following the income year.

- It is generally charged on revenue income of a person.

- It is a tax charged on a person for income that comes within the preview of relevant income tax law.

- Whether the income is permanent or temporary, it is immaterial from the tax point of view. Even temporary income is taxable.

If a person receives tax—free income on which tax is paid by the person making payment on behalf of the recipient, it has to be grossed up for inclusion in his total income.

Q2) What is Agriculture income?

A2) AGRICULTURE INCOME [SECTION 2(1A)]

Agricultural income means—