Unit 1

Money

Q1) How money has evolved?

A1) The history of money is enchanting and goes back thousands of years. From the early days of bartering to the first metal coins and eventually the first paper money, money has always had an important impact on the way we function as a society.

Before money was discovered, people bartered for goods and services. It wasn’t until about 5,000 years ago that the Mesopotamian people created the shekel, which is considered the first known form of currency. Gold and silver coins date back to around 650 to 600 B.C. When stamped coins were used to pay armies. Some evidence suggests that metal coins may be as old as 1250 B.C.

Money is the most important invention of modern times. It has undergone a long process of historical evolution. Human beings passed through a stage when money was not in use and goods were exchanged directly for one another. Such exchange of goods for goods was called Barter Exchange.

The inconveniences and drawbacks of barter led to the gradual use of a medium of exchange. If we study history of money, we shall find that all sorts of commodities like seashells, pearls, precious stones, tea, tobacco, cow, leather, cloth, salt, wine, etc. have been used as a medium of exchange (i.e., money).

Q2) Write a short note on money.

A2) Money is a medium of exchange. It acts a legal tender for any type of exchange and transactions. Buyers can purchase goods or a service from the seller in exchange for money. It is a commodity accepted by general consent as a medium of economic exchange. It is the medium in which prices and values are expressed.

It circulates from person to person and country to country, facilitating trade, and it is the principal measure of wealth.

Money, in simple terms, is a medium of exchange. It is instrumental in the exchange of goods and/or services.

Further, money is the most liquid assets among all our assets. It also has general acceptability as a means of payment along with its liquid nature.

Usually, the Central Bank or Government of a country creates and issues money. Also called cash money, this is a legal tender and hence there is a legal compulsion on citizens to accept it.

Money is an economic unit that functions as a generally recognized medium of exchange for transactional purposes in an economy. Money provides the service of reducing transaction cost, namely the double coincidence of wants. Money originates in the form of a commodity, having a physical property to be adopted by market participants as a medium of exchange. Money can be: market-determined, officially issued legal tender or fiat moneys, money substitutes and fiduciary media, and electronic cryptocurrencies.

Money is commonly referred to as currency. Economically, each government has its own money system. Cryptocurrencies are also being developed for financing and international exchange across the world.

Money is a liquid asset used in the settlement of transactions. It functions based on the general acceptance of its value within a governmental economy and internationally through foreign exchange. The current value of monetary currency is not necessarily derived from the materials used to produce the note or coin. Instead, value is derived from the willingness to agree to a displayed value and rely on it for use in future transactions. This is money's primary function: a generally recognized medium of exchange that people and global economies intend to hold, and are willing to accept as payment for current or future transactions.

Economic money systems began to be developed for the function of exchange. The use of money as currency provides a centralized medium for buying and selling in a market. This was first established to replace bartering. Monetary currency helps to provide a system for overcoming the double coincidence of wants. The double coincidence of wants is a ubiquitous problem in a barter economy, where in order to trade, each party must have something that the other party wants. When all parties use and willingly accept an agreed-upon monetary currency, they can avoid this problem.

In order to be most useful as money, a currency should be: 1) fungible, 2) durable, 3) portable, 4) recognizable, and 5) stable. These properties ensure that the benefit of reducing or eliminating the transaction cost of the double coincidence of wants is not outweighed by other types of transaction costs associated with that specific good.

Q3) What are the functions of money?

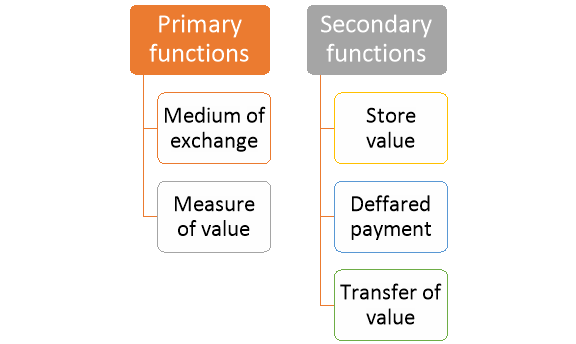

A3) Functions of money can be broadly categorised into two parts –

Figure: Functions of money

- Primary functions of money

Primary functions can be further divided into two subcategories.

- Exchange Medium

One of the primary functions of money is as a medium of exchange as it can be used for any or all transactions wherein goods or services are purchased or sold. Therefore, one can buy or sell products in exchange for money.

b. Measure of Value

Money can be treated as the parameter of measuring the value of a product or service. To put simply, the value of every product or service can be expressed in monetary form. The money also follows a standard and is accepted worldwide even though the currency does differ from one country to another.

For instance, the value of each product is determined in monetary terms. Value of 1 egg is supposedly Rs.5 in India, and the value of a pack of bread is around Rs.15. So, money is a measure of the value of all products (and services) and is the amount which is required to be paid/received while transacting. Therefore, it is one of the essential four functions of money.

Subsequently, these primary and secondary functions of money are some important uses of money in any economic market.

II. Secondary Functions of Money

The secondary function can be further segregated into three parts as mentioned below –

- Store of Value

Being crucial functions of money, it can be stored or conserved. One can store it for future purpose, and it is economical as well as convenient to store money.

b. Standard of Deferred Payments

Money can be used conveniently for deferred payments which need to be paid by individuals. It has become the standard for payments made presently or in future. For instance, if someone borrows a certain amount from another individual, they need to repay the amount with interest. With money in purview, it is convenient to pay the interest or make deferred payments.

This has led to the popularity of lending and borrowing transactions and has contributed a big part in the formation of financial institutions.

c. Transfer of Value

The utility of money stretches to the transfer of value as it can be used to purchase goods not only within the country but beyond the domestic line. One can sell or purchase goods in the domestic or international market with money as a standard tool.

Q4) What are the forms of money?

A4) There are many forms of money. Following are the main forms of money.

1. Metallic Money

2. Paper Money

3. Bank Money

4. Legal Money

5. Plastic Money

6. Near Money

Q5) Explain the significance of money.

A5) Money is the life blood of a modern tycoon economy. Without money this economy cannot function smoothly. Just as the strength and vitality of a human body is judged by the amount of blood and its proper circulation, in, the same way the strength and extent of development of the economy can be judged by the requisite supply and proper circulation of money in the economy. The significance of money, to a great extent, depends upon and is derived from the various functions it performs. These are given below:

1) Significance of money in consumption: Nowadays people receive their incomes in terms of money. This facilitates in exercising Free choice of consumption. Though, given their limited money income the consumers cannot buy each and everything that they desire yet money income gives them freedom to buy such goods and in such quantities which can yield them maximum satisfaction within that income-limit Besides, money gives the consumers liberty to choose between the present and the future consumption, i.e., how much to be spent on present consumption and how enrich to be saved from the given present income for Future consumption.

2) Significance of money in production: Money is not a factor of production, yet it facilitates production Use of money has led to expansion of market of goods and services. This has resulted in large scale production and technological improvements, thus minimising the cost of production. I- ow ever, large scale production requires division of labour a11d specialisation which is impossible under a barter-system. Besides, money (through price mechanism) indicates to producers the type and quantity of goods they should produce.

3) Significance of money in trade: Being a medium of exchange, money facilitates trade as well. Money constitutes basis of price-mechanism and, thus, helps in determining prices of goods and services through the forces of demand and supply. Besides by equalising marginal cost will1 marginal revenue of each ' product (measured in terms of money), the sellers can arrive at profit-maximising level of sales of their products.

4) Significance of money and economic progress: Introduction of money has led to the emergence of large-scale production resulting in constant urge to accumulate capital and develop new techniques of production. Thus, the role of money in encouraging material progress is significant.

5) Significance of money in public finance: Governments require resources to run the administration smoothly for which they levy taxes and also charge fees, fines, etc. Without money, taxes received will be in the form of goods which may or, may not be useful from government's point of view, e.g., shoemaker paying tax in the form of shoes and green-grocer in the form of vegetables. But taxes received in money give freedom to government regarding choice of things which government needs for the developmental purposes.

6) Money and foreign trade: Money have helped in the expansion of foreign trade; would thereby raise the levels of consumption the world over. It is because with the help of money we can transact not only those goods which are produced domestically but also those which are produced by other countries. The possibilities of exports and imports with the help of money has resulted in expansion of international trade and co-operation. The significance of money in all walks of life is so immense that modem life without money cannot even be imagined. It has rightly been remarked that 'money is a pivot around which all economic activities cluster'.

Q6) Explain the stages of evolution of money.

A6) Some of the major stages through which money has evolved are as follows: (i) Commodity Money (ii) Metallic Money (iii) Paper Money (iv) Credit Money (v) Plastic Money.

Money has evolved through different stages according to the time, place and circumstances.

(i) Commodity Money:

In the earliest period of human civilization, any commodity that was generally demanded and chosen by common consent was used as money.

Goods like furs, skins, salt, rice, wheat, utensils, weapons etc. were commonly used as money. Such exchange of goods for goods was known as ‘Barter Exchange’.

(ii) Metallic Money:

With progress of human civilization, commodity money changed into metallic money. Metals like gold, silver, copper, etc. were used as they could be easily handled and their quantity can be easily ascertained. It was the main form of money throughout the major portion of recorded history.

(iii) Paper Money:

It was found inconvenient as well as dangerous to carry gold and silver coins from place to place. So, invention of paper money marked a very important stage in the development of money. Paper money is regulated and controlled by Central bank of the country (RBI in India). At present, a very large part of money consists mainly of currency notes or paper money issued by the central bank.

(iv) Credit Money:

Emergence of credit money took place almost side by side with that of paper money. People keep a part of their cash as deposits with banks, which they can withdraw at their convenience through cheques. The cheque (known as credit money or bank money), itself, is not money, but it performs the same functions as money.

(v) Plastic Money:

The latest type of money is plastic money in the form of Credit cards and Debit cards. They aim at removing the need for carrying cash to make transactions.

Q7) What is Metallic money?

A7) The money made of any metal such as gold, silver etc is called metallic money. It exists in the form of coins. In our country the coins of Rs. 1, 2 and 5 are the current examples of metallic money. Due to its weight, it is difficult to use this money in large quantity.

Therefore, coins are used in small amounts only the metallic money has the following two types:

A) Full Bodied Coins

B) Token Money

A) Full Bodied Coins

When the face value of the coin is equal to the value of metal contained in the coin, the coin is called a full-bodied coin. The gold and silver coins of old times are examples of full-bodied coins.

B) Token Money

When the face value of a coin is greater than the value of the metal it contains, it is called token money. In our country, all the coins are token money.

Q8) What is Paper Money?

A8) Paper money refers to notes of different value made of paper which issued by the central bank or government of the country.

The paper money can be classified into following types:

A) Representative Money

B) Convertible Money

C) Inconvertible Money/fiat Money

A) Representative Money

Representative money is that money which is fully backed by equal metallic reserve. The holder of a bank note can easily get it converted into metallic (gold & silver) form on demand

B) Convertible Money

It is the form of money which can be converted into gold, silver i.e., metallic reserves. But all these notes issued by the government are not fully backed by gold. The amount of gold kept by the government is a particular proportion of the notes issued.

C) Inconvertible/Fiat Money

Inconvertible or fiat money is one that we have in our pocket and use in daily business. The face value of such money is more than the value of the paper. e.g., the value of the paper of 100-rupee note is almost nil but its purchasing power is equal to Rs.100. It has this value because it has been declared as legal money by the government, so it is generally accepted as a medium of exchange.

Q9) What is Bank Money?

A9) This is the most modern form of money this money is also called credit. It only consists of cheques, bill of exchange and drafts.

A) Cheques

A cheque is an unconditional order by the client on his bank to pay a certain sum of money to him or to any other party.

B) Bills of Exchange

A bill of exchange is an order by the drawer to the drawee to pay a sum of money to the drawer or to any other party.

C) Draft: Draft is a cheque drawn by a bank on its own branch or the branches of another bank requesting it to pay on demand a specific amount to a person named on it.

Q10) What is Legal Tender Money?

A10) The money that a person accepts as a means of payment and in discharge of debt is called legal tender notice. All the notes and coins issued by the govt. And the central bank are legal tender money. Legal tender money is of two types:

A) Limited Legal Tender Money

The money which can be used a means of payment up to a certain limit is called limited tender money e.g., coins.

B) Un-limited Legal Tender Money

The money that can be used a mean of payment up to any limit or amount e.g., all the notes issued by SBP.

Q11) What is Non legal tender money?

A11) Bank money is the form of cheques, bills of exchange, a promissory note is not legal tender money. Robertson says it “optional money”. So non legal tender money is money which a person may or may not accept as a mean of payment.

Q12) What is Plastic Money?

A12) Plastic money means the credit cards, smart cards. Plastic cards which have specially printed set of characters. Recently the use of this money has increase.

Q13) What is Near Money?

A13) A type of money which can easily be converted into money. It included deposits, government bonds, printed bonds etc.

Q14) Explain the significance of money in consumption.

A14) Nowadays people receive their incomes in terms of money. This facilitates in exercising Free choice of consumption. Though, given their limited money income the consumers cannot buy each and everything that they desire yet money income gives them freedom to buy such goods and in such quantities which can yield them maximum satisfaction within that income-limit Besides, money gives the consumers liberty to choose between the present and the future consumption, i.e., how much to be spent on present consumption and how enrich to be saved from the given present income for Future consumption.

Q15) Explain the significance of money in production.

A15) Money is not a factor of production, yet it facilitates production Use of money has led to expansion of market of goods and services. This has resulted in large scale production and technological improvements, thus minimising the cost of production. I- ow ever, large scale production requires division of labour a11d specialisation which is impossible under a barter-system. Besides, money (through price mechanism) indicates to producers the type and quantity of goods they should produce.

Q16) Explain the significance of money in trade.

A16) Being a medium of exchange, money facilitates trade as well. Money constitutes basis of price-mechanism and, thus, helps in determining prices of goods and services through the forces of demand and supply. Besides by equalising marginal cost will1 marginal revenue of each ' product (measured in terms of money), the sellers can arrive at profit-maximising level of sales of their products.

Q17) Explain the significance of money and economic progress.

A17) Introduction of money has led to the emergence of large-scale production resulting in constant urge to accumulate capital and develop new techniques of production. Thus, the role of money in encouraging material progress is significant.

Q18) Explain the significance of money in public finance?

A18) Governments require resources to run the administration smoothly for which they levy taxes and also charge fees, fines, etc. Without money, taxes received will be in the form of goods which may or, may not be useful from government's point of view, e.g., shoemaker paying tax in the form of shoes and green-grocer in the form of vegetables. But taxes received in money give freedom to government regarding choice of things which government needs for the developmental purposes.

Q19) Explain the significance of money and foreign trade.

A19) Money have helped in the expansion of foreign trade; would thereby raise the levels of consumption the world over. It is because with the help of money we can transact not only those goods which are produced domestically but also those which are produced by other countries. The possibilities of exports and imports with the help of money has resulted in expansion of international trade and co-operation. The significance of money in all walks of life is so immense that modem life without money cannot even be imagined. It has rightly been remarked that 'money is a pivot around which all economic activities cluster'.

Q20) What do you mean by secondary functions of money?

A20) The secondary function can be further segregated into three parts as mentioned below –

- Store of Value

Being crucial functions of money, it can be stored or conserved. One can store it for future purpose, and it is economical as well as convenient to store money.

2. Standard of Deferred Payments

Money can be used conveniently for deferred payments which need to be paid by individuals. It has become the standard for payments made presently or in future. For instance, if someone borrows a certain amount from another individual, they need to repay the amount with interest. With money in purview, it is convenient to pay the interest or make deferred payments.

This has led to the popularity of lending and borrowing transactions and has contributed a big part in the formation of financial institutions.

3. Transfer of Value

The utility of money stretches to the transfer of value as it can be used to purchase goods not only within the country but beyond the domestic line. One can sell or purchase goods in the domestic or international market with money as a standard tool.

Unit 1

Money

Q1) How money has evolved?

A1) The history of money is enchanting and goes back thousands of years. From the early days of bartering to the first metal coins and eventually the first paper money, money has always had an important impact on the way we function as a society.

Before money was discovered, people bartered for goods and services. It wasn’t until about 5,000 years ago that the Mesopotamian people created the shekel, which is considered the first known form of currency. Gold and silver coins date back to around 650 to 600 B.C. When stamped coins were used to pay armies. Some evidence suggests that metal coins may be as old as 1250 B.C.

Money is the most important invention of modern times. It has undergone a long process of historical evolution. Human beings passed through a stage when money was not in use and goods were exchanged directly for one another. Such exchange of goods for goods was called Barter Exchange.

The inconveniences and drawbacks of barter led to the gradual use of a medium of exchange. If we study history of money, we shall find that all sorts of commodities like seashells, pearls, precious stones, tea, tobacco, cow, leather, cloth, salt, wine, etc. have been used as a medium of exchange (i.e., money).

Q2) Write a short note on money.

A2) Money is a medium of exchange. It acts a legal tender for any type of exchange and transactions. Buyers can purchase goods or a service from the seller in exchange for money. It is a commodity accepted by general consent as a medium of economic exchange. It is the medium in which prices and values are expressed.

It circulates from person to person and country to country, facilitating trade, and it is the principal measure of wealth.

Money, in simple terms, is a medium of exchange. It is instrumental in the exchange of goods and/or services.

Further, money is the most liquid assets among all our assets. It also has general acceptability as a means of payment along with its liquid nature.

Usually, the Central Bank or Government of a country creates and issues money. Also called cash money, this is a legal tender and hence there is a legal compulsion on citizens to accept it.

Money is an economic unit that functions as a generally recognized medium of exchange for transactional purposes in an economy. Money provides the service of reducing transaction cost, namely the double coincidence of wants. Money originates in the form of a commodity, having a physical property to be adopted by market participants as a medium of exchange. Money can be: market-determined, officially issued legal tender or fiat moneys, money substitutes and fiduciary media, and electronic cryptocurrencies.

Money is commonly referred to as currency. Economically, each government has its own money system. Cryptocurrencies are also being developed for financing and international exchange across the world.

Money is a liquid asset used in the settlement of transactions. It functions based on the general acceptance of its value within a governmental economy and internationally through foreign exchange. The current value of monetary currency is not necessarily derived from the materials used to produce the note or coin. Instead, value is derived from the willingness to agree to a displayed value and rely on it for use in future transactions. This is money's primary function: a generally recognized medium of exchange that people and global economies intend to hold, and are willing to accept as payment for current or future transactions.

Economic money systems began to be developed for the function of exchange. The use of money as currency provides a centralized medium for buying and selling in a market. This was first established to replace bartering. Monetary currency helps to provide a system for overcoming the double coincidence of wants. The double coincidence of wants is a ubiquitous problem in a barter economy, where in order to trade, each party must have something that the other party wants. When all parties use and willingly accept an agreed-upon monetary currency, they can avoid this problem.

In order to be most useful as money, a currency should be: 1) fungible, 2) durable, 3) portable, 4) recognizable, and 5) stable. These properties ensure that the benefit of reducing or eliminating the transaction cost of the double coincidence of wants is not outweighed by other types of transaction costs associated with that specific good.

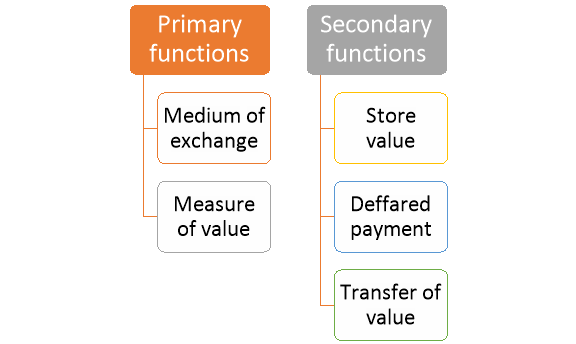

Q3) What are the functions of money?

A3) Functions of money can be broadly categorised into two parts –

Figure: Functions of money

- Primary functions of money

Primary functions can be further divided into two subcategories.

- Exchange Medium

One of the primary functions of money is as a medium of exchange as it can be used for any or all transactions wherein goods or services are purchased or sold. Therefore, one can buy or sell products in exchange for money.

b. Measure of Value

Money can be treated as the parameter of measuring the value of a product or service. To put simply, the value of every product or service can be expressed in monetary form. The money also follows a standard and is accepted worldwide even though the currency does differ from one country to another.

For instance, the value of each product is determined in monetary terms. Value of 1 egg is supposedly Rs.5 in India, and the value of a pack of bread is around Rs.15. So, money is a measure of the value of all products (and services) and is the amount which is required to be paid/received while transacting. Therefore, it is one of the essential four functions of money.

Subsequently, these primary and secondary functions of money are some important uses of money in any economic market.

II. Secondary Functions of Money

The secondary function can be further segregated into three parts as mentioned below –

- Store of Value

Being crucial functions of money, it can be stored or conserved. One can store it for future purpose, and it is economical as well as convenient to store money.

b. Standard of Deferred Payments

Money can be used conveniently for deferred payments which need to be paid by individuals. It has become the standard for payments made presently or in future. For instance, if someone borrows a certain amount from another individual, they need to repay the amount with interest. With money in purview, it is convenient to pay the interest or make deferred payments.

This has led to the popularity of lending and borrowing transactions and has contributed a big part in the formation of financial institutions.

c. Transfer of Value

The utility of money stretches to the transfer of value as it can be used to purchase goods not only within the country but beyond the domestic line. One can sell or purchase goods in the domestic or international market with money as a standard tool.

Q4) What are the forms of money?

A4) There are many forms of money. Following are the main forms of money.

1. Metallic Money

2. Paper Money

3. Bank Money

4. Legal Money

5. Plastic Money

6. Near Money

Q5) Explain the significance of money.

A5) Money is the life blood of a modern tycoon economy. Without money this economy cannot function smoothly. Just as the strength and vitality of a human body is judged by the amount of blood and its proper circulation, in, the same way the strength and extent of development of the economy can be judged by the requisite supply and proper circulation of money in the economy. The significance of money, to a great extent, depends upon and is derived from the various functions it performs. These are given below:

1) Significance of money in consumption: Nowadays people receive their incomes in terms of money. This facilitates in exercising Free choice of consumption. Though, given their limited money income the consumers cannot buy each and everything that they desire yet money income gives them freedom to buy such goods and in such quantities which can yield them maximum satisfaction within that income-limit Besides, money gives the consumers liberty to choose between the present and the future consumption, i.e., how much to be spent on present consumption and how enrich to be saved from the given present income for Future consumption.

2) Significance of money in production: Money is not a factor of production, yet it facilitates production Use of money has led to expansion of market of goods and services. This has resulted in large scale production and technological improvements, thus minimising the cost of production. I- ow ever, large scale production requires division of labour a11d specialisation which is impossible under a barter-system. Besides, money (through price mechanism) indicates to producers the type and quantity of goods they should produce.

3) Significance of money in trade: Being a medium of exchange, money facilitates trade as well. Money constitutes basis of price-mechanism and, thus, helps in determining prices of goods and services through the forces of demand and supply. Besides by equalising marginal cost will1 marginal revenue of each ' product (measured in terms of money), the sellers can arrive at profit-maximising level of sales of their products.

4) Significance of money and economic progress: Introduction of money has led to the emergence of large-scale production resulting in constant urge to accumulate capital and develop new techniques of production. Thus, the role of money in encouraging material progress is significant.

5) Significance of money in public finance: Governments require resources to run the administration smoothly for which they levy taxes and also charge fees, fines, etc. Without money, taxes received will be in the form of goods which may or, may not be useful from government's point of view, e.g., shoemaker paying tax in the form of shoes and green-grocer in the form of vegetables. But taxes received in money give freedom to government regarding choice of things which government needs for the developmental purposes.

6) Money and foreign trade: Money have helped in the expansion of foreign trade; would thereby raise the levels of consumption the world over. It is because with the help of money we can transact not only those goods which are produced domestically but also those which are produced by other countries. The possibilities of exports and imports with the help of money has resulted in expansion of international trade and co-operation. The significance of money in all walks of life is so immense that modem life without money cannot even be imagined. It has rightly been remarked that 'money is a pivot around which all economic activities cluster'.

Q6) Explain the stages of evolution of money.

A6) Some of the major stages through which money has evolved are as follows: (i) Commodity Money (ii) Metallic Money (iii) Paper Money (iv) Credit Money (v) Plastic Money.

Money has evolved through different stages according to the time, place and circumstances.

(i) Commodity Money:

In the earliest period of human civilization, any commodity that was generally demanded and chosen by common consent was used as money.

Goods like furs, skins, salt, rice, wheat, utensils, weapons etc. were commonly used as money. Such exchange of goods for goods was known as ‘Barter Exchange’.

(ii) Metallic Money:

With progress of human civilization, commodity money changed into metallic money. Metals like gold, silver, copper, etc. were used as they could be easily handled and their quantity can be easily ascertained. It was the main form of money throughout the major portion of recorded history.

(iii) Paper Money:

It was found inconvenient as well as dangerous to carry gold and silver coins from place to place. So, invention of paper money marked a very important stage in the development of money. Paper money is regulated and controlled by Central bank of the country (RBI in India). At present, a very large part of money consists mainly of currency notes or paper money issued by the central bank.

(iv) Credit Money:

Emergence of credit money took place almost side by side with that of paper money. People keep a part of their cash as deposits with banks, which they can withdraw at their convenience through cheques. The cheque (known as credit money or bank money), itself, is not money, but it performs the same functions as money.

(v) Plastic Money:

The latest type of money is plastic money in the form of Credit cards and Debit cards. They aim at removing the need for carrying cash to make transactions.

Q7) What is Metallic money?

A7) The money made of any metal such as gold, silver etc is called metallic money. It exists in the form of coins. In our country the coins of Rs. 1, 2 and 5 are the current examples of metallic money. Due to its weight, it is difficult to use this money in large quantity.

Therefore, coins are used in small amounts only the metallic money has the following two types:

A) Full Bodied Coins

B) Token Money

A) Full Bodied Coins

When the face value of the coin is equal to the value of metal contained in the coin, the coin is called a full-bodied coin. The gold and silver coins of old times are examples of full-bodied coins.

B) Token Money

When the face value of a coin is greater than the value of the metal it contains, it is called token money. In our country, all the coins are token money.

Q8) What is Paper Money?

A8) Paper money refers to notes of different value made of paper which issued by the central bank or government of the country.

The paper money can be classified into following types:

A) Representative Money

B) Convertible Money

C) Inconvertible Money/fiat Money

A) Representative Money

Representative money is that money which is fully backed by equal metallic reserve. The holder of a bank note can easily get it converted into metallic (gold & silver) form on demand

B) Convertible Money

It is the form of money which can be converted into gold, silver i.e., metallic reserves. But all these notes issued by the government are not fully backed by gold. The amount of gold kept by the government is a particular proportion of the notes issued.

C) Inconvertible/Fiat Money

Inconvertible or fiat money is one that we have in our pocket and use in daily business. The face value of such money is more than the value of the paper. e.g., the value of the paper of 100-rupee note is almost nil but its purchasing power is equal to Rs.100. It has this value because it has been declared as legal money by the government, so it is generally accepted as a medium of exchange.

Q9) What is Bank Money?

A9) This is the most modern form of money this money is also called credit. It only consists of cheques, bill of exchange and drafts.

A) Cheques

A cheque is an unconditional order by the client on his bank to pay a certain sum of money to him or to any other party.

B) Bills of Exchange

A bill of exchange is an order by the drawer to the drawee to pay a sum of money to the drawer or to any other party.

C) Draft: Draft is a cheque drawn by a bank on its own branch or the branches of another bank requesting it to pay on demand a specific amount to a person named on it.

Q10) What is Legal Tender Money?

A10) The money that a person accepts as a means of payment and in discharge of debt is called legal tender notice. All the notes and coins issued by the govt. And the central bank are legal tender money. Legal tender money is of two types:

A) Limited Legal Tender Money

The money which can be used a means of payment up to a certain limit is called limited tender money e.g., coins.

B) Un-limited Legal Tender Money

The money that can be used a mean of payment up to any limit or amount e.g., all the notes issued by SBP.

Q11) What is Non legal tender money?

A11) Bank money is the form of cheques, bills of exchange, a promissory note is not legal tender money. Robertson says it “optional money”. So non legal tender money is money which a person may or may not accept as a mean of payment.

Q12) What is Plastic Money?

A12) Plastic money means the credit cards, smart cards. Plastic cards which have specially printed set of characters. Recently the use of this money has increase.

Q13) What is Near Money?

A13) A type of money which can easily be converted into money. It included deposits, government bonds, printed bonds etc.

Q14) Explain the significance of money in consumption.

A14) Nowadays people receive their incomes in terms of money. This facilitates in exercising Free choice of consumption. Though, given their limited money income the consumers cannot buy each and everything that they desire yet money income gives them freedom to buy such goods and in such quantities which can yield them maximum satisfaction within that income-limit Besides, money gives the consumers liberty to choose between the present and the future consumption, i.e., how much to be spent on present consumption and how enrich to be saved from the given present income for Future consumption.

Q15) Explain the significance of money in production.

A15) Money is not a factor of production, yet it facilitates production Use of money has led to expansion of market of goods and services. This has resulted in large scale production and technological improvements, thus minimising the cost of production. I- ow ever, large scale production requires division of labour a11d specialisation which is impossible under a barter-system. Besides, money (through price mechanism) indicates to producers the type and quantity of goods they should produce.

Q16) Explain the significance of money in trade.

A16) Being a medium of exchange, money facilitates trade as well. Money constitutes basis of price-mechanism and, thus, helps in determining prices of goods and services through the forces of demand and supply. Besides by equalising marginal cost will1 marginal revenue of each ' product (measured in terms of money), the sellers can arrive at profit-maximising level of sales of their products.

Q17) Explain the significance of money and economic progress.

A17) Introduction of money has led to the emergence of large-scale production resulting in constant urge to accumulate capital and develop new techniques of production. Thus, the role of money in encouraging material progress is significant.

Q18) Explain the significance of money in public finance?

A18) Governments require resources to run the administration smoothly for which they levy taxes and also charge fees, fines, etc. Without money, taxes received will be in the form of goods which may or, may not be useful from government's point of view, e.g., shoemaker paying tax in the form of shoes and green-grocer in the form of vegetables. But taxes received in money give freedom to government regarding choice of things which government needs for the developmental purposes.

Q19) Explain the significance of money and foreign trade.

A19) Money have helped in the expansion of foreign trade; would thereby raise the levels of consumption the world over. It is because with the help of money we can transact not only those goods which are produced domestically but also those which are produced by other countries. The possibilities of exports and imports with the help of money has resulted in expansion of international trade and co-operation. The significance of money in all walks of life is so immense that modem life without money cannot even be imagined. It has rightly been remarked that 'money is a pivot around which all economic activities cluster'.

Q20) What do you mean by secondary functions of money?

A20) The secondary function can be further segregated into three parts as mentioned below –

- Store of Value

Being crucial functions of money, it can be stored or conserved. One can store it for future purpose, and it is economical as well as convenient to store money.

2. Standard of Deferred Payments

Money can be used conveniently for deferred payments which need to be paid by individuals. It has become the standard for payments made presently or in future. For instance, if someone borrows a certain amount from another individual, they need to repay the amount with interest. With money in purview, it is convenient to pay the interest or make deferred payments.

This has led to the popularity of lending and borrowing transactions and has contributed a big part in the formation of financial institutions.

3. Transfer of Value

The utility of money stretches to the transfer of value as it can be used to purchase goods not only within the country but beyond the domestic line. One can sell or purchase goods in the domestic or international market with money as a standard tool.

Unit 1

Money

Q1) How money has evolved?

A1) The history of money is enchanting and goes back thousands of years. From the early days of bartering to the first metal coins and eventually the first paper money, money has always had an important impact on the way we function as a society.

Before money was discovered, people bartered for goods and services. It wasn’t until about 5,000 years ago that the Mesopotamian people created the shekel, which is considered the first known form of currency. Gold and silver coins date back to around 650 to 600 B.C. When stamped coins were used to pay armies. Some evidence suggests that metal coins may be as old as 1250 B.C.

Money is the most important invention of modern times. It has undergone a long process of historical evolution. Human beings passed through a stage when money was not in use and goods were exchanged directly for one another. Such exchange of goods for goods was called Barter Exchange.

The inconveniences and drawbacks of barter led to the gradual use of a medium of exchange. If we study history of money, we shall find that all sorts of commodities like seashells, pearls, precious stones, tea, tobacco, cow, leather, cloth, salt, wine, etc. have been used as a medium of exchange (i.e., money).

Q2) Write a short note on money.

A2) Money is a medium of exchange. It acts a legal tender for any type of exchange and transactions. Buyers can purchase goods or a service from the seller in exchange for money. It is a commodity accepted by general consent as a medium of economic exchange. It is the medium in which prices and values are expressed.

It circulates from person to person and country to country, facilitating trade, and it is the principal measure of wealth.

Money, in simple terms, is a medium of exchange. It is instrumental in the exchange of goods and/or services.

Further, money is the most liquid assets among all our assets. It also has general acceptability as a means of payment along with its liquid nature.

Usually, the Central Bank or Government of a country creates and issues money. Also called cash money, this is a legal tender and hence there is a legal compulsion on citizens to accept it.

Money is an economic unit that functions as a generally recognized medium of exchange for transactional purposes in an economy. Money provides the service of reducing transaction cost, namely the double coincidence of wants. Money originates in the form of a commodity, having a physical property to be adopted by market participants as a medium of exchange. Money can be: market-determined, officially issued legal tender or fiat moneys, money substitutes and fiduciary media, and electronic cryptocurrencies.

Money is commonly referred to as currency. Economically, each government has its own money system. Cryptocurrencies are also being developed for financing and international exchange across the world.

Money is a liquid asset used in the settlement of transactions. It functions based on the general acceptance of its value within a governmental economy and internationally through foreign exchange. The current value of monetary currency is not necessarily derived from the materials used to produce the note or coin. Instead, value is derived from the willingness to agree to a displayed value and rely on it for use in future transactions. This is money's primary function: a generally recognized medium of exchange that people and global economies intend to hold, and are willing to accept as payment for current or future transactions.

Economic money systems began to be developed for the function of exchange. The use of money as currency provides a centralized medium for buying and selling in a market. This was first established to replace bartering. Monetary currency helps to provide a system for overcoming the double coincidence of wants. The double coincidence of wants is a ubiquitous problem in a barter economy, where in order to trade, each party must have something that the other party wants. When all parties use and willingly accept an agreed-upon monetary currency, they can avoid this problem.

In order to be most useful as money, a currency should be: 1) fungible, 2) durable, 3) portable, 4) recognizable, and 5) stable. These properties ensure that the benefit of reducing or eliminating the transaction cost of the double coincidence of wants is not outweighed by other types of transaction costs associated with that specific good.

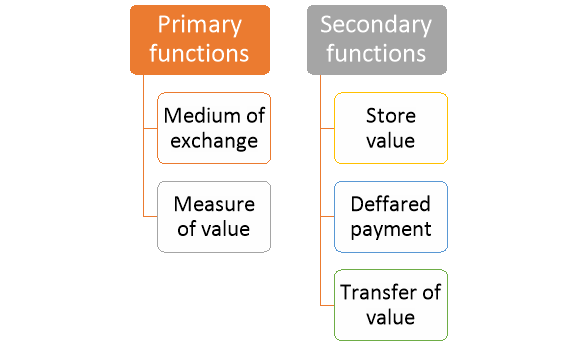

Q3) What are the functions of money?

A3) Functions of money can be broadly categorised into two parts –

Figure: Functions of money

- Primary functions of money

Primary functions can be further divided into two subcategories.

- Exchange Medium

One of the primary functions of money is as a medium of exchange as it can be used for any or all transactions wherein goods or services are purchased or sold. Therefore, one can buy or sell products in exchange for money.

b. Measure of Value

Money can be treated as the parameter of measuring the value of a product or service. To put simply, the value of every product or service can be expressed in monetary form. The money also follows a standard and is accepted worldwide even though the currency does differ from one country to another.

For instance, the value of each product is determined in monetary terms. Value of 1 egg is supposedly Rs.5 in India, and the value of a pack of bread is around Rs.15. So, money is a measure of the value of all products (and services) and is the amount which is required to be paid/received while transacting. Therefore, it is one of the essential four functions of money.

Subsequently, these primary and secondary functions of money are some important uses of money in any economic market.

II. Secondary Functions of Money

The secondary function can be further segregated into three parts as mentioned below –

- Store of Value

Being crucial functions of money, it can be stored or conserved. One can store it for future purpose, and it is economical as well as convenient to store money.

b. Standard of Deferred Payments

Money can be used conveniently for deferred payments which need to be paid by individuals. It has become the standard for payments made presently or in future. For instance, if someone borrows a certain amount from another individual, they need to repay the amount with interest. With money in purview, it is convenient to pay the interest or make deferred payments.

This has led to the popularity of lending and borrowing transactions and has contributed a big part in the formation of financial institutions.

c. Transfer of Value

The utility of money stretches to the transfer of value as it can be used to purchase goods not only within the country but beyond the domestic line. One can sell or purchase goods in the domestic or international market with money as a standard tool.

Q4) What are the forms of money?

A4) There are many forms of money. Following are the main forms of money.

1. Metallic Money

2. Paper Money

3. Bank Money

4. Legal Money

5. Plastic Money

6. Near Money

Q5) Explain the significance of money.

A5) Money is the life blood of a modern tycoon economy. Without money this economy cannot function smoothly. Just as the strength and vitality of a human body is judged by the amount of blood and its proper circulation, in, the same way the strength and extent of development of the economy can be judged by the requisite supply and proper circulation of money in the economy. The significance of money, to a great extent, depends upon and is derived from the various functions it performs. These are given below:

1) Significance of money in consumption: Nowadays people receive their incomes in terms of money. This facilitates in exercising Free choice of consumption. Though, given their limited money income the consumers cannot buy each and everything that they desire yet money income gives them freedom to buy such goods and in such quantities which can yield them maximum satisfaction within that income-limit Besides, money gives the consumers liberty to choose between the present and the future consumption, i.e., how much to be spent on present consumption and how enrich to be saved from the given present income for Future consumption.

2) Significance of money in production: Money is not a factor of production, yet it facilitates production Use of money has led to expansion of market of goods and services. This has resulted in large scale production and technological improvements, thus minimising the cost of production. I- ow ever, large scale production requires division of labour a11d specialisation which is impossible under a barter-system. Besides, money (through price mechanism) indicates to producers the type and quantity of goods they should produce.

3) Significance of money in trade: Being a medium of exchange, money facilitates trade as well. Money constitutes basis of price-mechanism and, thus, helps in determining prices of goods and services through the forces of demand and supply. Besides by equalising marginal cost will1 marginal revenue of each ' product (measured in terms of money), the sellers can arrive at profit-maximising level of sales of their products.

4) Significance of money and economic progress: Introduction of money has led to the emergence of large-scale production resulting in constant urge to accumulate capital and develop new techniques of production. Thus, the role of money in encouraging material progress is significant.

5) Significance of money in public finance: Governments require resources to run the administration smoothly for which they levy taxes and also charge fees, fines, etc. Without money, taxes received will be in the form of goods which may or, may not be useful from government's point of view, e.g., shoemaker paying tax in the form of shoes and green-grocer in the form of vegetables. But taxes received in money give freedom to government regarding choice of things which government needs for the developmental purposes.

6) Money and foreign trade: Money have helped in the expansion of foreign trade; would thereby raise the levels of consumption the world over. It is because with the help of money we can transact not only those goods which are produced domestically but also those which are produced by other countries. The possibilities of exports and imports with the help of money has resulted in expansion of international trade and co-operation. The significance of money in all walks of life is so immense that modem life without money cannot even be imagined. It has rightly been remarked that 'money is a pivot around which all economic activities cluster'.

Q6) Explain the stages of evolution of money.

A6) Some of the major stages through which money has evolved are as follows: (i) Commodity Money (ii) Metallic Money (iii) Paper Money (iv) Credit Money (v) Plastic Money.

Money has evolved through different stages according to the time, place and circumstances.

(i) Commodity Money:

In the earliest period of human civilization, any commodity that was generally demanded and chosen by common consent was used as money.

Goods like furs, skins, salt, rice, wheat, utensils, weapons etc. were commonly used as money. Such exchange of goods for goods was known as ‘Barter Exchange’.

(ii) Metallic Money:

With progress of human civilization, commodity money changed into metallic money. Metals like gold, silver, copper, etc. were used as they could be easily handled and their quantity can be easily ascertained. It was the main form of money throughout the major portion of recorded history.

(iii) Paper Money:

It was found inconvenient as well as dangerous to carry gold and silver coins from place to place. So, invention of paper money marked a very important stage in the development of money. Paper money is regulated and controlled by Central bank of the country (RBI in India). At present, a very large part of money consists mainly of currency notes or paper money issued by the central bank.

(iv) Credit Money:

Emergence of credit money took place almost side by side with that of paper money. People keep a part of their cash as deposits with banks, which they can withdraw at their convenience through cheques. The cheque (known as credit money or bank money), itself, is not money, but it performs the same functions as money.

(v) Plastic Money:

The latest type of money is plastic money in the form of Credit cards and Debit cards. They aim at removing the need for carrying cash to make transactions.

Q7) What is Metallic money?

A7) The money made of any metal such as gold, silver etc is called metallic money. It exists in the form of coins. In our country the coins of Rs. 1, 2 and 5 are the current examples of metallic money. Due to its weight, it is difficult to use this money in large quantity.

Therefore, coins are used in small amounts only the metallic money has the following two types:

A) Full Bodied Coins

B) Token Money

A) Full Bodied Coins

When the face value of the coin is equal to the value of metal contained in the coin, the coin is called a full-bodied coin. The gold and silver coins of old times are examples of full-bodied coins.

B) Token Money

When the face value of a coin is greater than the value of the metal it contains, it is called token money. In our country, all the coins are token money.

Q8) What is Paper Money?

A8) Paper money refers to notes of different value made of paper which issued by the central bank or government of the country.

The paper money can be classified into following types:

A) Representative Money

B) Convertible Money

C) Inconvertible Money/fiat Money

A) Representative Money

Representative money is that money which is fully backed by equal metallic reserve. The holder of a bank note can easily get it converted into metallic (gold & silver) form on demand

B) Convertible Money

It is the form of money which can be converted into gold, silver i.e., metallic reserves. But all these notes issued by the government are not fully backed by gold. The amount of gold kept by the government is a particular proportion of the notes issued.

C) Inconvertible/Fiat Money

Inconvertible or fiat money is one that we have in our pocket and use in daily business. The face value of such money is more than the value of the paper. e.g., the value of the paper of 100-rupee note is almost nil but its purchasing power is equal to Rs.100. It has this value because it has been declared as legal money by the government, so it is generally accepted as a medium of exchange.

Q9) What is Bank Money?

A9) This is the most modern form of money this money is also called credit. It only consists of cheques, bill of exchange and drafts.

A) Cheques

A cheque is an unconditional order by the client on his bank to pay a certain sum of money to him or to any other party.

B) Bills of Exchange

A bill of exchange is an order by the drawer to the drawee to pay a sum of money to the drawer or to any other party.

C) Draft: Draft is a cheque drawn by a bank on its own branch or the branches of another bank requesting it to pay on demand a specific amount to a person named on it.

Q10) What is Legal Tender Money?

A10) The money that a person accepts as a means of payment and in discharge of debt is called legal tender notice. All the notes and coins issued by the govt. And the central bank are legal tender money. Legal tender money is of two types:

A) Limited Legal Tender Money

The money which can be used a means of payment up to a certain limit is called limited tender money e.g., coins.

B) Un-limited Legal Tender Money

The money that can be used a mean of payment up to any limit or amount e.g., all the notes issued by SBP.

Q11) What is Non legal tender money?

A11) Bank money is the form of cheques, bills of exchange, a promissory note is not legal tender money. Robertson says it “optional money”. So non legal tender money is money which a person may or may not accept as a mean of payment.

Q12) What is Plastic Money?

A12) Plastic money means the credit cards, smart cards. Plastic cards which have specially printed set of characters. Recently the use of this money has increase.

Q13) What is Near Money?

A13) A type of money which can easily be converted into money. It included deposits, government bonds, printed bonds etc.

Q14) Explain the significance of money in consumption.

A14) Nowadays people receive their incomes in terms of money. This facilitates in exercising Free choice of consumption. Though, given their limited money income the consumers cannot buy each and everything that they desire yet money income gives them freedom to buy such goods and in such quantities which can yield them maximum satisfaction within that income-limit Besides, money gives the consumers liberty to choose between the present and the future consumption, i.e., how much to be spent on present consumption and how enrich to be saved from the given present income for Future consumption.

Q15) Explain the significance of money in production.

A15) Money is not a factor of production, yet it facilitates production Use of money has led to expansion of market of goods and services. This has resulted in large scale production and technological improvements, thus minimising the cost of production. I- ow ever, large scale production requires division of labour a11d specialisation which is impossible under a barter-system. Besides, money (through price mechanism) indicates to producers the type and quantity of goods they should produce.

Q16) Explain the significance of money in trade.

A16) Being a medium of exchange, money facilitates trade as well. Money constitutes basis of price-mechanism and, thus, helps in determining prices of goods and services through the forces of demand and supply. Besides by equalising marginal cost will1 marginal revenue of each ' product (measured in terms of money), the sellers can arrive at profit-maximising level of sales of their products.

Q17) Explain the significance of money and economic progress.

A17) Introduction of money has led to the emergence of large-scale production resulting in constant urge to accumulate capital and develop new techniques of production. Thus, the role of money in encouraging material progress is significant.

Q18) Explain the significance of money in public finance?

A18) Governments require resources to run the administration smoothly for which they levy taxes and also charge fees, fines, etc. Without money, taxes received will be in the form of goods which may or, may not be useful from government's point of view, e.g., shoemaker paying tax in the form of shoes and green-grocer in the form of vegetables. But taxes received in money give freedom to government regarding choice of things which government needs for the developmental purposes.

Q19) Explain the significance of money and foreign trade.

A19) Money have helped in the expansion of foreign trade; would thereby raise the levels of consumption the world over. It is because with the help of money we can transact not only those goods which are produced domestically but also those which are produced by other countries. The possibilities of exports and imports with the help of money has resulted in expansion of international trade and co-operation. The significance of money in all walks of life is so immense that modem life without money cannot even be imagined. It has rightly been remarked that 'money is a pivot around which all economic activities cluster'.

Q20) What do you mean by secondary functions of money?

A20) The secondary function can be further segregated into three parts as mentioned below –

- Store of Value

Being crucial functions of money, it can be stored or conserved. One can store it for future purpose, and it is economical as well as convenient to store money.

2. Standard of Deferred Payments

Money can be used conveniently for deferred payments which need to be paid by individuals. It has become the standard for payments made presently or in future. For instance, if someone borrows a certain amount from another individual, they need to repay the amount with interest. With money in purview, it is convenient to pay the interest or make deferred payments.

This has led to the popularity of lending and borrowing transactions and has contributed a big part in the formation of financial institutions.

3. Transfer of Value

The utility of money stretches to the transfer of value as it can be used to purchase goods not only within the country but beyond the domestic line. One can sell or purchase goods in the domestic or international market with money as a standard tool.

Unit 1

Unit 1

Money

Q1) How money has evolved?

A1) The history of money is enchanting and goes back thousands of years. From the early days of bartering to the first metal coins and eventually the first paper money, money has always had an important impact on the way we function as a society.

Before money was discovered, people bartered for goods and services. It wasn’t until about 5,000 years ago that the Mesopotamian people created the shekel, which is considered the first known form of currency. Gold and silver coins date back to around 650 to 600 B.C. When stamped coins were used to pay armies. Some evidence suggests that metal coins may be as old as 1250 B.C.

Money is the most important invention of modern times. It has undergone a long process of historical evolution. Human beings passed through a stage when money was not in use and goods were exchanged directly for one another. Such exchange of goods for goods was called Barter Exchange.

The inconveniences and drawbacks of barter led to the gradual use of a medium of exchange. If we study history of money, we shall find that all sorts of commodities like seashells, pearls, precious stones, tea, tobacco, cow, leather, cloth, salt, wine, etc. have been used as a medium of exchange (i.e., money).

Q2) Write a short note on money.

A2) Money is a medium of exchange. It acts a legal tender for any type of exchange and transactions. Buyers can purchase goods or a service from the seller in exchange for money. It is a commodity accepted by general consent as a medium of economic exchange. It is the medium in which prices and values are expressed.

It circulates from person to person and country to country, facilitating trade, and it is the principal measure of wealth.

Money, in simple terms, is a medium of exchange. It is instrumental in the exchange of goods and/or services.

Further, money is the most liquid assets among all our assets. It also has general acceptability as a means of payment along with its liquid nature.

Usually, the Central Bank or Government of a country creates and issues money. Also called cash money, this is a legal tender and hence there is a legal compulsion on citizens to accept it.

Money is an economic unit that functions as a generally recognized medium of exchange for transactional purposes in an economy. Money provides the service of reducing transaction cost, namely the double coincidence of wants. Money originates in the form of a commodity, having a physical property to be adopted by market participants as a medium of exchange. Money can be: market-determined, officially issued legal tender or fiat moneys, money substitutes and fiduciary media, and electronic cryptocurrencies.

Money is commonly referred to as currency. Economically, each government has its own money system. Cryptocurrencies are also being developed for financing and international exchange across the world.

Money is a liquid asset used in the settlement of transactions. It functions based on the general acceptance of its value within a governmental economy and internationally through foreign exchange. The current value of monetary currency is not necessarily derived from the materials used to produce the note or coin. Instead, value is derived from the willingness to agree to a displayed value and rely on it for use in future transactions. This is money's primary function: a generally recognized medium of exchange that people and global economies intend to hold, and are willing to accept as payment for current or future transactions.

Economic money systems began to be developed for the function of exchange. The use of money as currency provides a centralized medium for buying and selling in a market. This was first established to replace bartering. Monetary currency helps to provide a system for overcoming the double coincidence of wants. The double coincidence of wants is a ubiquitous problem in a barter economy, where in order to trade, each party must have something that the other party wants. When all parties use and willingly accept an agreed-upon monetary currency, they can avoid this problem.

In order to be most useful as money, a currency should be: 1) fungible, 2) durable, 3) portable, 4) recognizable, and 5) stable. These properties ensure that the benefit of reducing or eliminating the transaction cost of the double coincidence of wants is not outweighed by other types of transaction costs associated with that specific good.

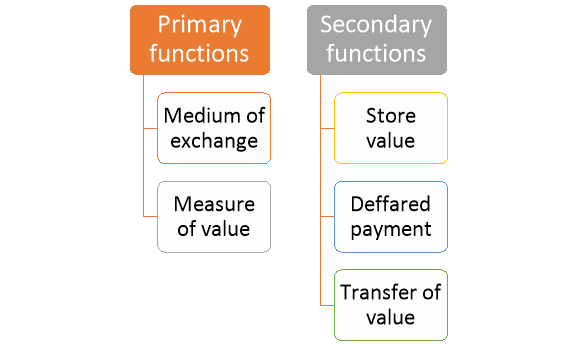

Q3) What are the functions of money?

A3) Functions of money can be broadly categorised into two parts –

Figure: Functions of money

- Primary functions of money

Primary functions can be further divided into two subcategories.

- Exchange Medium

One of the primary functions of money is as a medium of exchange as it can be used for any or all transactions wherein goods or services are purchased or sold. Therefore, one can buy or sell products in exchange for money.

b. Measure of Value

Money can be treated as the parameter of measuring the value of a product or service. To put simply, the value of every product or service can be expressed in monetary form. The money also follows a standard and is accepted worldwide even though the currency does differ from one country to another.

For instance, the value of each product is determined in monetary terms. Value of 1 egg is supposedly Rs.5 in India, and the value of a pack of bread is around Rs.15. So, money is a measure of the value of all products (and services) and is the amount which is required to be paid/received while transacting. Therefore, it is one of the essential four functions of money.

Subsequently, these primary and secondary functions of money are some important uses of money in any economic market.

II. Secondary Functions of Money

The secondary function can be further segregated into three parts as mentioned below –

- Store of Value

Being crucial functions of money, it can be stored or conserved. One can store it for future purpose, and it is economical as well as convenient to store money.

b. Standard of Deferred Payments

Money can be used conveniently for deferred payments which need to be paid by individuals. It has become the standard for payments made presently or in future. For instance, if someone borrows a certain amount from another individual, they need to repay the amount with interest. With money in purview, it is convenient to pay the interest or make deferred payments.

This has led to the popularity of lending and borrowing transactions and has contributed a big part in the formation of financial institutions.

c. Transfer of Value

The utility of money stretches to the transfer of value as it can be used to purchase goods not only within the country but beyond the domestic line. One can sell or purchase goods in the domestic or international market with money as a standard tool.

Q4) What are the forms of money?

A4) There are many forms of money. Following are the main forms of money.

1. Metallic Money

2. Paper Money

3. Bank Money

4. Legal Money

5. Plastic Money

6. Near Money

Q5) Explain the significance of money.

A5) Money is the life blood of a modern tycoon economy. Without money this economy cannot function smoothly. Just as the strength and vitality of a human body is judged by the amount of blood and its proper circulation, in, the same way the strength and extent of development of the economy can be judged by the requisite supply and proper circulation of money in the economy. The significance of money, to a great extent, depends upon and is derived from the various functions it performs. These are given below:

1) Significance of money in consumption: Nowadays people receive their incomes in terms of money. This facilitates in exercising Free choice of consumption. Though, given their limited money income the consumers cannot buy each and everything that they desire yet money income gives them freedom to buy such goods and in such quantities which can yield them maximum satisfaction within that income-limit Besides, money gives the consumers liberty to choose between the present and the future consumption, i.e., how much to be spent on present consumption and how enrich to be saved from the given present income for Future consumption.

2) Significance of money in production: Money is not a factor of production, yet it facilitates production Use of money has led to expansion of market of goods and services. This has resulted in large scale production and technological improvements, thus minimising the cost of production. I- ow ever, large scale production requires division of labour a11d specialisation which is impossible under a barter-system. Besides, money (through price mechanism) indicates to producers the type and quantity of goods they should produce.

3) Significance of money in trade: Being a medium of exchange, money facilitates trade as well. Money constitutes basis of price-mechanism and, thus, helps in determining prices of goods and services through the forces of demand and supply. Besides by equalising marginal cost will1 marginal revenue of each ' product (measured in terms of money), the sellers can arrive at profit-maximising level of sales of their products.

4) Significance of money and economic progress: Introduction of money has led to the emergence of large-scale production resulting in constant urge to accumulate capital and develop new techniques of production. Thus, the role of money in encouraging material progress is significant.

5) Significance of money in public finance: Governments require resources to run the administration smoothly for which they levy taxes and also charge fees, fines, etc. Without money, taxes received will be in the form of goods which may or, may not be useful from government's point of view, e.g., shoemaker paying tax in the form of shoes and green-grocer in the form of vegetables. But taxes received in money give freedom to government regarding choice of things which government needs for the developmental purposes.

6) Money and foreign trade: Money have helped in the expansion of foreign trade; would thereby raise the levels of consumption the world over. It is because with the help of money we can transact not only those goods which are produced domestically but also those which are produced by other countries. The possibilities of exports and imports with the help of money has resulted in expansion of international trade and co-operation. The significance of money in all walks of life is so immense that modem life without money cannot even be imagined. It has rightly been remarked that 'money is a pivot around which all economic activities cluster'.

Q6) Explain the stages of evolution of money.

A6) Some of the major stages through which money has evolved are as follows: (i) Commodity Money (ii) Metallic Money (iii) Paper Money (iv) Credit Money (v) Plastic Money.

Money has evolved through different stages according to the time, place and circumstances.

(i) Commodity Money:

In the earliest period of human civilization, any commodity that was generally demanded and chosen by common consent was used as money.

Goods like furs, skins, salt, rice, wheat, utensils, weapons etc. were commonly used as money. Such exchange of goods for goods was known as ‘Barter Exchange’.

(ii) Metallic Money:

With progress of human civilization, commodity money changed into metallic money. Metals like gold, silver, copper, etc. were used as they could be easily handled and their quantity can be easily ascertained. It was the main form of money throughout the major portion of recorded history.

(iii) Paper Money:

It was found inconvenient as well as dangerous to carry gold and silver coins from place to place. So, invention of paper money marked a very important stage in the development of money. Paper money is regulated and controlled by Central bank of the country (RBI in India). At present, a very large part of money consists mainly of currency notes or paper money issued by the central bank.

(iv) Credit Money:

Emergence of credit money took place almost side by side with that of paper money. People keep a part of their cash as deposits with banks, which they can withdraw at their convenience through cheques. The cheque (known as credit money or bank money), itself, is not money, but it performs the same functions as money.

(v) Plastic Money:

The latest type of money is plastic money in the form of Credit cards and Debit cards. They aim at removing the need for carrying cash to make transactions.

Q7) What is Metallic money?

A7) The money made of any metal such as gold, silver etc is called metallic money. It exists in the form of coins. In our country the coins of Rs. 1, 2 and 5 are the current examples of metallic money. Due to its weight, it is difficult to use this money in large quantity.

Therefore, coins are used in small amounts only the metallic money has the following two types:

A) Full Bodied Coins

B) Token Money

A) Full Bodied Coins

When the face value of the coin is equal to the value of metal contained in the coin, the coin is called a full-bodied coin. The gold and silver coins of old times are examples of full-bodied coins.

B) Token Money

When the face value of a coin is greater than the value of the metal it contains, it is called token money. In our country, all the coins are token money.

Q8) What is Paper Money?

A8) Paper money refers to notes of different value made of paper which issued by the central bank or government of the country.

The paper money can be classified into following types:

A) Representative Money

B) Convertible Money

C) Inconvertible Money/fiat Money

A) Representative Money

Representative money is that money which is fully backed by equal metallic reserve. The holder of a bank note can easily get it converted into metallic (gold & silver) form on demand

B) Convertible Money

It is the form of money which can be converted into gold, silver i.e., metallic reserves. But all these notes issued by the government are not fully backed by gold. The amount of gold kept by the government is a particular proportion of the notes issued.

C) Inconvertible/Fiat Money

Inconvertible or fiat money is one that we have in our pocket and use in daily business. The face value of such money is more than the value of the paper. e.g., the value of the paper of 100-rupee note is almost nil but its purchasing power is equal to Rs.100. It has this value because it has been declared as legal money by the government, so it is generally accepted as a medium of exchange.

Q9) What is Bank Money?

A9) This is the most modern form of money this money is also called credit. It only consists of cheques, bill of exchange and drafts.

A) Cheques

A cheque is an unconditional order by the client on his bank to pay a certain sum of money to him or to any other party.

B) Bills of Exchange

A bill of exchange is an order by the drawer to the drawee to pay a sum of money to the drawer or to any other party.

C) Draft: Draft is a cheque drawn by a bank on its own branch or the branches of another bank requesting it to pay on demand a specific amount to a person named on it.

Q10) What is Legal Tender Money?