Unit 2

Management of Cash

Q1) What is Cash management?

A1) Cash management is the process of collecting and managing cash flows. Cash management can be important for both individuals and companies. In business, it is a key component of a company's financial stability. For individuals, cash is also essential for financial stability while also usually considered as part of a total wealth portfolio. Individuals and businesses have a wide range of offerings available across the financial marketplace to help with all types of cash management needs. Banks are typically a primary financial service provider for the custody of cash assets. There are also many different cash management solutions for individuals and businesses seeking to obtain the best return on cash assets or the most efficient use of cash comprehensively.

Q2) What are the objectives of Cash management?

A2) The objectives of cash management are discussed below-

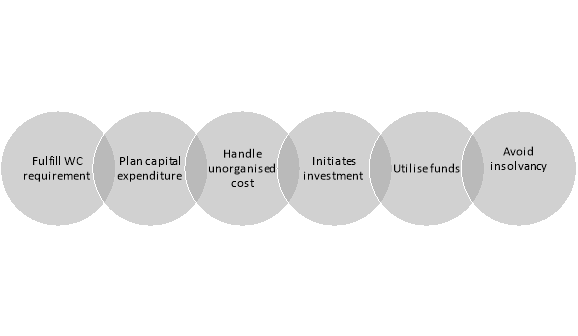

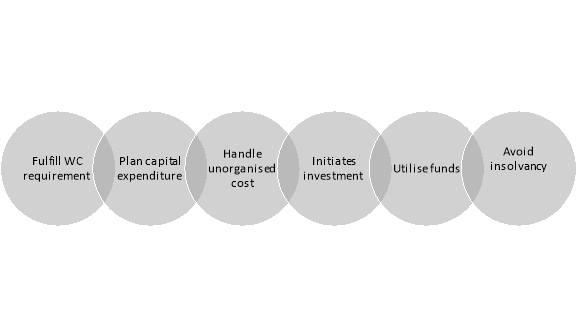

Figure: Objectives of cash management

1. Fulfil Working Capital Requirement: The organization needs to maintain ample liquid cash to meet its routine expenses which possible only through effective cash management.

2. Planning Capital Expenditure: It helps in planning the capital expenditure and determining the ratio of debt and equity to acquire finance for this purpose.

3. Handling Unorganized Costs: There are times when the company encounters unexpected circumstances like the breakdown of machinery. These are unforeseen expenses to cope up with; cash surplus is a lifesaver in such conditions.

4. Initiates Investment: The other aim of cash management is to invest the idle funds in the right opportunity and the correct proportion.

5. Better Utilization of Funds: It ensures the optimum utilization of the available funds by creating a proper balance between the cash in hand and investment.

6. Avoiding Insolvency: If the business does not plan for efficient cash management, the situation of insolvency may arise. It is either due to lack of liquid cash or not making a profit out of the money available.

Q3) Explain the Miller – Orr’ Model?

A3) According to Merton H. Miller and Daniel Orr, Baumol’s model only determines the cash withdrawal; however, cash is the most uncertain element of the business. There may be times when the organization will have surplus cash, thus discouraging withdrawals; instead, it may require to make investments. Therefore, the company needs to decide the return point or the level of money to be maintained, instead of determining the withdrawal amount. This model emphasizes on withdrawing the cash only if the available fund is below the return point of money whereas investing the surplus amount exceeding this level.

Q4) Explain the Baumol’s EOQ Model.

A4) Based on the Economic Order Quantity (EOQ), in the year 1952, William J. Baumol gave the Baumol’s EOQ model, which influences the cash management of the company. This model emphasizes on maintaining the optimum cash balance in a year to meet the business expenses on the one hand and grab the profitable investment opportunities on the other side. The following formula of the Baumol’s EOQ Model determines the level of cash which is to be maintained by the organization:

Where,

‘C’ is the optimum cash balance;

‘F’ is the fixed transaction cost;

‘T’ is the total cash requirement for that period;

‘i’ is the rate of interest during the period

Q5) What are the methods of cash management?

A5) All big and small businesses needs to have enough cash to pay the bills. Focusing solely on sales and profits could create issues when invoices arrive and you find that there aren’t enough funds available to pay them. Below are five ways you can be proactive and improve cash management for your business:

1. Create a cash flow statement and analyse it monthly. The primary objective of a cash flow statement is to help you budget for future periods and identify potential financial problems before they get out of hand. This doesn’t have to be a complicated procedure. Simply prepare a schedule that shows the cash balance at the beginning of the month and add cash you receive (from things like cash sales, collections on receivables, and asset dispositions). Then, subtract cash you spend to calculate the ending cash balance. If your cash balance is decreasing month to month, you have negative cash flow and you may need to make adjustments to your operations. If it’s climbing, your cash flow is positive.

Note that once you have a cash flow statement that works for you, you can automate the report in your accounting software. Or, you can create a more traditional cash flow statement that begins with your net income, then make adjustments for non-cash items and changes in your balance sheet accounts.

2. Create a history of your cash flow. Build a cash flow history by using historical financial records over the course of the past few of years. This will help you discover if there is a particular time of year which needs more attention.

3. Forecast your cash flow needs. Use your historic cash flow and project the next 12 to 24 months. This process will help identify how much excess cash is required in the good months to cover payroll costs and other expenses during the low-cash months. To smooth out cash flow, you might consider establishing a line of credit that can be paid back as cash becomes available.

4. Implement ideas to improve cash flow. Now that you know your cash needs, consider ideas to help improve your cash position. For example:

- Reduce the lag time between shipping and invoicing.

- Re-examine credit and collection policies.

- Consider offering discounts for early payment.

- Charge interest on delinquent balances.

- Convert excess and unsold inventory back into cash.

5. Manage your growth. Be cautious when expanding into new markets, developing new product lines, hiring employees, or ramping up your marketing budget. All of these activities require cash and you don’t want to travel too far down that road before generating accurate cash forecasts.

Q6) Explain the determination of optimum level of cash.

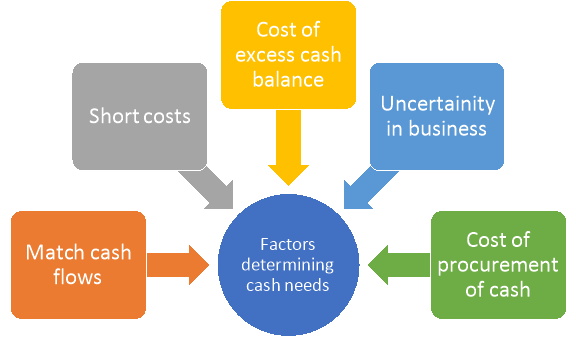

A6) Maintenance of optimum level of cash is the main problem of cash management. The level of cash holding differs from industry to industry, organisation to organisation. The factors determining the cash needs of the industry is explained as follows:

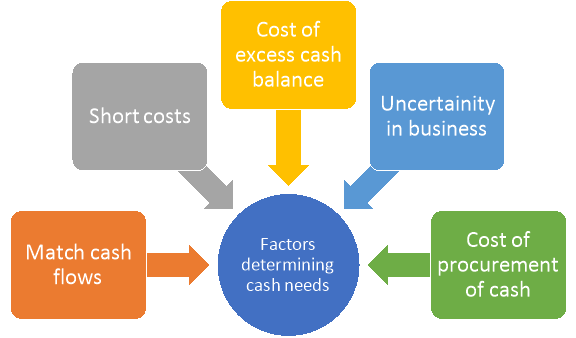

Figure: Factors determining cash needs

- Matching of cash flows:

The first and very important factor determining the level of cash requirement is matching cash inflows with cash outflows. If the receipts and payments are perfectly coinciding or balance each other, there would be no need for cash balances. The need for cash management therefore due to the non-synchronisation of cash receipts and disbursements.

Ii. Short costs:

Short costs are defined as the expenses incurred as a result of shortfall of cash. The short costs include, transaction costs associated with raising cash to overcome the shortage, borrowing costs associated with borrowing to cover the shortage i.e., interest on loan, loss of trade-discount, penalty rates by banks to meet a shortfall in cash balances and costs associated with deterioration of the firm’s credit rating etc. which is reflected in higher bank charges on loans, decline in sales and profits.

Iii. Cost of excess cash balances:

One of the important factors determining the cash needs is the cost of maintaining cash balances i.e., excess or idle cash balances. The cost of maintaining excess cash balance is called excess cash balance cost.

Iv. Uncertainty in business:

The first requirement of cash management is a precautionary cushion to cope with irregularities in cash flows, unexpected delays in collections and disbursements and defaults. The uncertainty can be overcome through accurate forecasting of tax payments, dividends, capital expenditure etc. and ability of the firm to borrow funds through over draft facility.

v. Cost of procurement and management of cash:

The costs associated with establishing and operating cash management staff and activities determining the cash needs of a business firm. These costs are generally fixed and are accounted for by salary, storage and handling of securities etc. The above factors are considered to determine the cash needs of a business firm.

Q7) What are Motives for holding cash?

A7) The Motives for Holding Cash is easy, the cash inflows and outflows are not well accompanied, i.e., sometimes the cash inflows are more than the cash outflows while sometimes the cash outflows could be more than the cash inflows. Hence, the cash is held by the firms to meet the certain as well as uncertain situations.

Q8) What are Transaction Motive?

A8) The transaction motive refers to the cash required by a firm to meet the day to day needs of its business operations. In an ordinary course of business, the firm requires cash to make the payments in the form of salaries, wages, interests, dividends, goods purchased, etc.

Likewise, it also receives cash from its sales, debtors, investments. Often the firm’s cash inflows and outflows do not match, and hence, the cash is held up to meet its routine commitments.

Q9) What are Precautionary Motive?

A9) The precautionary motive refers to the tendency of a firm to hold cash, to meet the contingencies or unforeseen circumstances arising in the course of business.

Since the future is uncertain, a firm may have to face contingencies such as an increase in the price of raw materials, labour strike, lockouts, change in the demand, etc. Thus, in order to meet with these uncertainties, the cash is held by the firms to have an uninterrupted business operation.

Q10) What are Speculative Motive?

A10) The firms hold cash for the speculative purposes to avail the benefit of bargain purchases that may arise in the future. For example, if the firm feels the prices of raw material are likely to fall in the future, it will hold cash and wait till the prices actually fall.

Thus, a firm holds cash to exploit the possible opportunities that are out of the normal course of business. These opportunities could be in the form of the low-interest rate charged on the borrowed funds, expected fall in the raw material prices or favourable change in the government policies.

Thus, the cash is the most significant and liquid asset that the firm holds. It is significant as it is used to pay off the firm’s obligations and helps in the expansion of business operations.

Q11) How Matching of cash flows determine cash needs?

A11) The first and very important factor determining the level of cash requirement is matching cash inflows with cash outflows. If the receipts and payments are perfectly coinciding or balance each other, there would be no need for cash balances. The need for cash management therefore due to the non-synchronisation of cash receipts and disbursements.

Q12) How Short costs determine cash needs?

Short costs are defined as the expenses incurred as a result of shortfall of cash. The short costs include, transaction costs associated with raising cash to overcome the shortage, borrowing costs associated with borrowing to cover the shortage i.e., interest on loan, loss of trade-discount, penalty rates by banks to meet a shortfall in cash balances and costs associated with deterioration of the firm’s credit rating etc. which is reflected in higher bank charges on loans, decline in sales and profits.

Q13) How Cost of excess cash balances determine cash needs?

A13) One of the important factors determining the cash needs is the cost of maintaining cash balances i.e., excess or idle cash balances. The cost of maintaining excess cash balance is called excess cash balance cost.

Q14) How Uncertainty in business determine cash needs?

A14) The first requirement of cash management is a precautionary cushion to cope with irregularities in cash flows, unexpected delays in collections and disbursements and defaults. The uncertainty can be overcome through accurate forecasting of tax payments, dividends, capital expenditure etc. and ability of the firm to borrow funds through over draft facility.

Q15) How Cost of procurement and management of cash determine cash needs?

A15) The costs associated with establishing and operating cash management staff and activities determining the cash needs of a business firm. These costs are generally fixed and are accounted for by salary, storage and handling of securities etc. The above factors are considered to determine the cash needs of a business firm.

Q16) How can you Create a cash flow statement and analyse it monthly?

A16) The primary objective of a cash flow statement is to help you budget for future periods and identify potential financial problems before they get out of hand. This doesn’t have to be a complicated procedure. Simply prepare a schedule that shows the cash balance at the beginning of the month and add cash you receive (from things like cash sales, collections on receivables, and asset dispositions). Then, subtract cash you spend to calculate the ending cash balance. If your cash balance is decreasing month to month, you have negative cash flow and you may need to make adjustments to your operations. If it’s climbing, your cash flow is positive.

Note that once you have a cash flow statement that works for you, you can automate the report in your accounting software. Or, you can create a more traditional cash flow statement that begins with your net income, then make adjustments for non-cash items and changes in your balance sheet accounts.

Q17) How can you Create a history of your cash flow?

A17) Build a cash flow history by using historical financial records over the course of the past few of years. This will help you discover if there is a particular time of year which needs more attention.

Q18) How can you forecast your cash flow needs?

A18) Use your historic cash flow and project the next 12 to 24 months. This process will help identify how much excess cash is required in the good months to cover payroll costs and other expenses during the low-cash months. To smooth out cash flow, you might consider establishing a line of credit that can be paid back as cash becomes available.

Q19) How can you implement ideas to improve cash flow?

A19) Now that you know your cash needs, consider ideas to help improve your cash position. For example:

- Reduce the lag time between shipping and invoicing.

- Re-examine credit and collection policies.

- Consider offering discounts for early payment.

- Charge interest on delinquent balances.

- Convert excess and unsold inventory back into cash.

Q20) How can you Manage your growth to improve cash management for your business?

A20) Be cautious when expanding into new markets, developing new product lines, hiring employees, or ramping up your marketing budget. All of these activities require cash and you don’t want to travel too far down that road before generating accurate cash forecasts.

Unit 2

Management of Cash

Q1) What is Cash management?

A1) Cash management is the process of collecting and managing cash flows. Cash management can be important for both individuals and companies. In business, it is a key component of a company's financial stability. For individuals, cash is also essential for financial stability while also usually considered as part of a total wealth portfolio. Individuals and businesses have a wide range of offerings available across the financial marketplace to help with all types of cash management needs. Banks are typically a primary financial service provider for the custody of cash assets. There are also many different cash management solutions for individuals and businesses seeking to obtain the best return on cash assets or the most efficient use of cash comprehensively.

Q2) What are the objectives of Cash management?

A2) The objectives of cash management are discussed below-

Figure: Objectives of cash management

1. Fulfil Working Capital Requirement: The organization needs to maintain ample liquid cash to meet its routine expenses which possible only through effective cash management.

2. Planning Capital Expenditure: It helps in planning the capital expenditure and determining the ratio of debt and equity to acquire finance for this purpose.

3. Handling Unorganized Costs: There are times when the company encounters unexpected circumstances like the breakdown of machinery. These are unforeseen expenses to cope up with; cash surplus is a lifesaver in such conditions.

4. Initiates Investment: The other aim of cash management is to invest the idle funds in the right opportunity and the correct proportion.

5. Better Utilization of Funds: It ensures the optimum utilization of the available funds by creating a proper balance between the cash in hand and investment.

6. Avoiding Insolvency: If the business does not plan for efficient cash management, the situation of insolvency may arise. It is either due to lack of liquid cash or not making a profit out of the money available.

Q3) Explain the Miller – Orr’ Model?

A3) According to Merton H. Miller and Daniel Orr, Baumol’s model only determines the cash withdrawal; however, cash is the most uncertain element of the business. There may be times when the organization will have surplus cash, thus discouraging withdrawals; instead, it may require to make investments. Therefore, the company needs to decide the return point or the level of money to be maintained, instead of determining the withdrawal amount. This model emphasizes on withdrawing the cash only if the available fund is below the return point of money whereas investing the surplus amount exceeding this level.

Q4) Explain the Baumol’s EOQ Model.

A4) Based on the Economic Order Quantity (EOQ), in the year 1952, William J. Baumol gave the Baumol’s EOQ model, which influences the cash management of the company. This model emphasizes on maintaining the optimum cash balance in a year to meet the business expenses on the one hand and grab the profitable investment opportunities on the other side. The following formula of the Baumol’s EOQ Model determines the level of cash which is to be maintained by the organization:

Where,

‘C’ is the optimum cash balance;

‘F’ is the fixed transaction cost;

‘T’ is the total cash requirement for that period;

‘i’ is the rate of interest during the period

Q5) What are the methods of cash management?

A5) All big and small businesses needs to have enough cash to pay the bills. Focusing solely on sales and profits could create issues when invoices arrive and you find that there aren’t enough funds available to pay them. Below are five ways you can be proactive and improve cash management for your business:

1. Create a cash flow statement and analyse it monthly. The primary objective of a cash flow statement is to help you budget for future periods and identify potential financial problems before they get out of hand. This doesn’t have to be a complicated procedure. Simply prepare a schedule that shows the cash balance at the beginning of the month and add cash you receive (from things like cash sales, collections on receivables, and asset dispositions). Then, subtract cash you spend to calculate the ending cash balance. If your cash balance is decreasing month to month, you have negative cash flow and you may need to make adjustments to your operations. If it’s climbing, your cash flow is positive.

Note that once you have a cash flow statement that works for you, you can automate the report in your accounting software. Or, you can create a more traditional cash flow statement that begins with your net income, then make adjustments for non-cash items and changes in your balance sheet accounts.

2. Create a history of your cash flow. Build a cash flow history by using historical financial records over the course of the past few of years. This will help you discover if there is a particular time of year which needs more attention.

3. Forecast your cash flow needs. Use your historic cash flow and project the next 12 to 24 months. This process will help identify how much excess cash is required in the good months to cover payroll costs and other expenses during the low-cash months. To smooth out cash flow, you might consider establishing a line of credit that can be paid back as cash becomes available.

4. Implement ideas to improve cash flow. Now that you know your cash needs, consider ideas to help improve your cash position. For example:

- Reduce the lag time between shipping and invoicing.

- Re-examine credit and collection policies.

- Consider offering discounts for early payment.

- Charge interest on delinquent balances.

- Convert excess and unsold inventory back into cash.

5. Manage your growth. Be cautious when expanding into new markets, developing new product lines, hiring employees, or ramping up your marketing budget. All of these activities require cash and you don’t want to travel too far down that road before generating accurate cash forecasts.

Q6) Explain the determination of optimum level of cash.

A6) Maintenance of optimum level of cash is the main problem of cash management. The level of cash holding differs from industry to industry, organisation to organisation. The factors determining the cash needs of the industry is explained as follows:

Figure: Factors determining cash needs

- Matching of cash flows:

The first and very important factor determining the level of cash requirement is matching cash inflows with cash outflows. If the receipts and payments are perfectly coinciding or balance each other, there would be no need for cash balances. The need for cash management therefore due to the non-synchronisation of cash receipts and disbursements.

Ii. Short costs:

Short costs are defined as the expenses incurred as a result of shortfall of cash. The short costs include, transaction costs associated with raising cash to overcome the shortage, borrowing costs associated with borrowing to cover the shortage i.e., interest on loan, loss of trade-discount, penalty rates by banks to meet a shortfall in cash balances and costs associated with deterioration of the firm’s credit rating etc. which is reflected in higher bank charges on loans, decline in sales and profits.

Iii. Cost of excess cash balances:

One of the important factors determining the cash needs is the cost of maintaining cash balances i.e., excess or idle cash balances. The cost of maintaining excess cash balance is called excess cash balance cost.

Iv. Uncertainty in business:

The first requirement of cash management is a precautionary cushion to cope with irregularities in cash flows, unexpected delays in collections and disbursements and defaults. The uncertainty can be overcome through accurate forecasting of tax payments, dividends, capital expenditure etc. and ability of the firm to borrow funds through over draft facility.

v. Cost of procurement and management of cash:

The costs associated with establishing and operating cash management staff and activities determining the cash needs of a business firm. These costs are generally fixed and are accounted for by salary, storage and handling of securities etc. The above factors are considered to determine the cash needs of a business firm.

Q7) What are Motives for holding cash?

A7) The Motives for Holding Cash is easy, the cash inflows and outflows are not well accompanied, i.e., sometimes the cash inflows are more than the cash outflows while sometimes the cash outflows could be more than the cash inflows. Hence, the cash is held by the firms to meet the certain as well as uncertain situations.

Q8) What are Transaction Motive?

A8) The transaction motive refers to the cash required by a firm to meet the day to day needs of its business operations. In an ordinary course of business, the firm requires cash to make the payments in the form of salaries, wages, interests, dividends, goods purchased, etc.

Likewise, it also receives cash from its sales, debtors, investments. Often the firm’s cash inflows and outflows do not match, and hence, the cash is held up to meet its routine commitments.

Q9) What are Precautionary Motive?

A9) The precautionary motive refers to the tendency of a firm to hold cash, to meet the contingencies or unforeseen circumstances arising in the course of business.

Since the future is uncertain, a firm may have to face contingencies such as an increase in the price of raw materials, labour strike, lockouts, change in the demand, etc. Thus, in order to meet with these uncertainties, the cash is held by the firms to have an uninterrupted business operation.

Q10) What are Speculative Motive?

A10) The firms hold cash for the speculative purposes to avail the benefit of bargain purchases that may arise in the future. For example, if the firm feels the prices of raw material are likely to fall in the future, it will hold cash and wait till the prices actually fall.

Thus, a firm holds cash to exploit the possible opportunities that are out of the normal course of business. These opportunities could be in the form of the low-interest rate charged on the borrowed funds, expected fall in the raw material prices or favourable change in the government policies.

Thus, the cash is the most significant and liquid asset that the firm holds. It is significant as it is used to pay off the firm’s obligations and helps in the expansion of business operations.

Q11) How Matching of cash flows determine cash needs?

A11) The first and very important factor determining the level of cash requirement is matching cash inflows with cash outflows. If the receipts and payments are perfectly coinciding or balance each other, there would be no need for cash balances. The need for cash management therefore due to the non-synchronisation of cash receipts and disbursements.

Q12) How Short costs determine cash needs?

Short costs are defined as the expenses incurred as a result of shortfall of cash. The short costs include, transaction costs associated with raising cash to overcome the shortage, borrowing costs associated with borrowing to cover the shortage i.e., interest on loan, loss of trade-discount, penalty rates by banks to meet a shortfall in cash balances and costs associated with deterioration of the firm’s credit rating etc. which is reflected in higher bank charges on loans, decline in sales and profits.

Q13) How Cost of excess cash balances determine cash needs?

A13) One of the important factors determining the cash needs is the cost of maintaining cash balances i.e., excess or idle cash balances. The cost of maintaining excess cash balance is called excess cash balance cost.

Q14) How Uncertainty in business determine cash needs?

A14) The first requirement of cash management is a precautionary cushion to cope with irregularities in cash flows, unexpected delays in collections and disbursements and defaults. The uncertainty can be overcome through accurate forecasting of tax payments, dividends, capital expenditure etc. and ability of the firm to borrow funds through over draft facility.

Q15) How Cost of procurement and management of cash determine cash needs?

A15) The costs associated with establishing and operating cash management staff and activities determining the cash needs of a business firm. These costs are generally fixed and are accounted for by salary, storage and handling of securities etc. The above factors are considered to determine the cash needs of a business firm.

Q16) How can you Create a cash flow statement and analyse it monthly?

A16) The primary objective of a cash flow statement is to help you budget for future periods and identify potential financial problems before they get out of hand. This doesn’t have to be a complicated procedure. Simply prepare a schedule that shows the cash balance at the beginning of the month and add cash you receive (from things like cash sales, collections on receivables, and asset dispositions). Then, subtract cash you spend to calculate the ending cash balance. If your cash balance is decreasing month to month, you have negative cash flow and you may need to make adjustments to your operations. If it’s climbing, your cash flow is positive.

Note that once you have a cash flow statement that works for you, you can automate the report in your accounting software. Or, you can create a more traditional cash flow statement that begins with your net income, then make adjustments for non-cash items and changes in your balance sheet accounts.

Q17) How can you Create a history of your cash flow?

A17) Build a cash flow history by using historical financial records over the course of the past few of years. This will help you discover if there is a particular time of year which needs more attention.

Q18) How can you forecast your cash flow needs?

A18) Use your historic cash flow and project the next 12 to 24 months. This process will help identify how much excess cash is required in the good months to cover payroll costs and other expenses during the low-cash months. To smooth out cash flow, you might consider establishing a line of credit that can be paid back as cash becomes available.

Q19) How can you implement ideas to improve cash flow?

A19) Now that you know your cash needs, consider ideas to help improve your cash position. For example:

- Reduce the lag time between shipping and invoicing.

- Re-examine credit and collection policies.

- Consider offering discounts for early payment.

- Charge interest on delinquent balances.

- Convert excess and unsold inventory back into cash.

Q20) How can you Manage your growth to improve cash management for your business?

A20) Be cautious when expanding into new markets, developing new product lines, hiring employees, or ramping up your marketing budget. All of these activities require cash and you don’t want to travel too far down that road before generating accurate cash forecasts.

Unit 2

Management of Cash

Q1) What is Cash management?

A1) Cash management is the process of collecting and managing cash flows. Cash management can be important for both individuals and companies. In business, it is a key component of a company's financial stability. For individuals, cash is also essential for financial stability while also usually considered as part of a total wealth portfolio. Individuals and businesses have a wide range of offerings available across the financial marketplace to help with all types of cash management needs. Banks are typically a primary financial service provider for the custody of cash assets. There are also many different cash management solutions for individuals and businesses seeking to obtain the best return on cash assets or the most efficient use of cash comprehensively.

Q2) What are the objectives of Cash management?

A2) The objectives of cash management are discussed below-

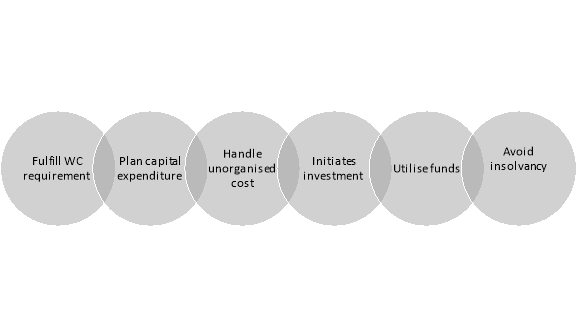

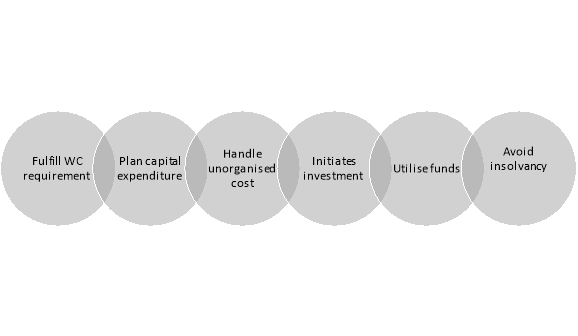

Figure: Objectives of cash management

1. Fulfil Working Capital Requirement: The organization needs to maintain ample liquid cash to meet its routine expenses which possible only through effective cash management.

2. Planning Capital Expenditure: It helps in planning the capital expenditure and determining the ratio of debt and equity to acquire finance for this purpose.

3. Handling Unorganized Costs: There are times when the company encounters unexpected circumstances like the breakdown of machinery. These are unforeseen expenses to cope up with; cash surplus is a lifesaver in such conditions.

4. Initiates Investment: The other aim of cash management is to invest the idle funds in the right opportunity and the correct proportion.

5. Better Utilization of Funds: It ensures the optimum utilization of the available funds by creating a proper balance between the cash in hand and investment.

6. Avoiding Insolvency: If the business does not plan for efficient cash management, the situation of insolvency may arise. It is either due to lack of liquid cash or not making a profit out of the money available.

Q3) Explain the Miller – Orr’ Model?

A3) According to Merton H. Miller and Daniel Orr, Baumol’s model only determines the cash withdrawal; however, cash is the most uncertain element of the business. There may be times when the organization will have surplus cash, thus discouraging withdrawals; instead, it may require to make investments. Therefore, the company needs to decide the return point or the level of money to be maintained, instead of determining the withdrawal amount. This model emphasizes on withdrawing the cash only if the available fund is below the return point of money whereas investing the surplus amount exceeding this level.

Q4) Explain the Baumol’s EOQ Model.

A4) Based on the Economic Order Quantity (EOQ), in the year 1952, William J. Baumol gave the Baumol’s EOQ model, which influences the cash management of the company. This model emphasizes on maintaining the optimum cash balance in a year to meet the business expenses on the one hand and grab the profitable investment opportunities on the other side. The following formula of the Baumol’s EOQ Model determines the level of cash which is to be maintained by the organization:

Where,

‘C’ is the optimum cash balance;

‘F’ is the fixed transaction cost;

‘T’ is the total cash requirement for that period;

‘i’ is the rate of interest during the period

Q5) What are the methods of cash management?

A5) All big and small businesses needs to have enough cash to pay the bills. Focusing solely on sales and profits could create issues when invoices arrive and you find that there aren’t enough funds available to pay them. Below are five ways you can be proactive and improve cash management for your business:

1. Create a cash flow statement and analyse it monthly. The primary objective of a cash flow statement is to help you budget for future periods and identify potential financial problems before they get out of hand. This doesn’t have to be a complicated procedure. Simply prepare a schedule that shows the cash balance at the beginning of the month and add cash you receive (from things like cash sales, collections on receivables, and asset dispositions). Then, subtract cash you spend to calculate the ending cash balance. If your cash balance is decreasing month to month, you have negative cash flow and you may need to make adjustments to your operations. If it’s climbing, your cash flow is positive.

Note that once you have a cash flow statement that works for you, you can automate the report in your accounting software. Or, you can create a more traditional cash flow statement that begins with your net income, then make adjustments for non-cash items and changes in your balance sheet accounts.

2. Create a history of your cash flow. Build a cash flow history by using historical financial records over the course of the past few of years. This will help you discover if there is a particular time of year which needs more attention.

3. Forecast your cash flow needs. Use your historic cash flow and project the next 12 to 24 months. This process will help identify how much excess cash is required in the good months to cover payroll costs and other expenses during the low-cash months. To smooth out cash flow, you might consider establishing a line of credit that can be paid back as cash becomes available.

4. Implement ideas to improve cash flow. Now that you know your cash needs, consider ideas to help improve your cash position. For example:

- Reduce the lag time between shipping and invoicing.

- Re-examine credit and collection policies.

- Consider offering discounts for early payment.

- Charge interest on delinquent balances.

- Convert excess and unsold inventory back into cash.

5. Manage your growth. Be cautious when expanding into new markets, developing new product lines, hiring employees, or ramping up your marketing budget. All of these activities require cash and you don’t want to travel too far down that road before generating accurate cash forecasts.

Q6) Explain the determination of optimum level of cash.

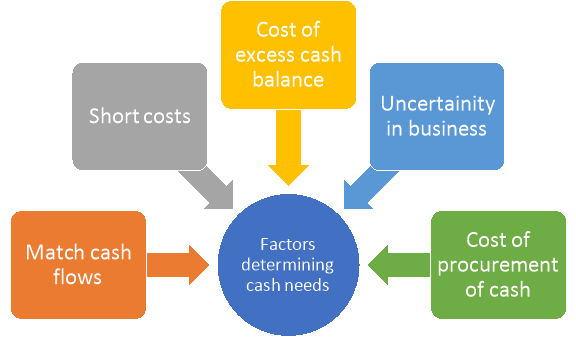

A6) Maintenance of optimum level of cash is the main problem of cash management. The level of cash holding differs from industry to industry, organisation to organisation. The factors determining the cash needs of the industry is explained as follows:

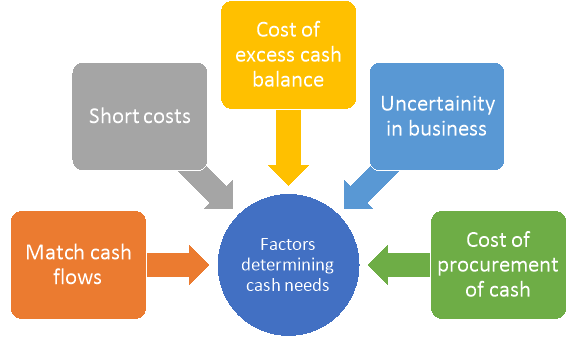

Figure: Factors determining cash needs

- Matching of cash flows:

The first and very important factor determining the level of cash requirement is matching cash inflows with cash outflows. If the receipts and payments are perfectly coinciding or balance each other, there would be no need for cash balances. The need for cash management therefore due to the non-synchronisation of cash receipts and disbursements.

Ii. Short costs:

Short costs are defined as the expenses incurred as a result of shortfall of cash. The short costs include, transaction costs associated with raising cash to overcome the shortage, borrowing costs associated with borrowing to cover the shortage i.e., interest on loan, loss of trade-discount, penalty rates by banks to meet a shortfall in cash balances and costs associated with deterioration of the firm’s credit rating etc. which is reflected in higher bank charges on loans, decline in sales and profits.

Iii. Cost of excess cash balances:

One of the important factors determining the cash needs is the cost of maintaining cash balances i.e., excess or idle cash balances. The cost of maintaining excess cash balance is called excess cash balance cost.

Iv. Uncertainty in business:

The first requirement of cash management is a precautionary cushion to cope with irregularities in cash flows, unexpected delays in collections and disbursements and defaults. The uncertainty can be overcome through accurate forecasting of tax payments, dividends, capital expenditure etc. and ability of the firm to borrow funds through over draft facility.

v. Cost of procurement and management of cash:

The costs associated with establishing and operating cash management staff and activities determining the cash needs of a business firm. These costs are generally fixed and are accounted for by salary, storage and handling of securities etc. The above factors are considered to determine the cash needs of a business firm.

Q7) What are Motives for holding cash?

A7) The Motives for Holding Cash is easy, the cash inflows and outflows are not well accompanied, i.e., sometimes the cash inflows are more than the cash outflows while sometimes the cash outflows could be more than the cash inflows. Hence, the cash is held by the firms to meet the certain as well as uncertain situations.

Q8) What are Transaction Motive?

A8) The transaction motive refers to the cash required by a firm to meet the day to day needs of its business operations. In an ordinary course of business, the firm requires cash to make the payments in the form of salaries, wages, interests, dividends, goods purchased, etc.

Likewise, it also receives cash from its sales, debtors, investments. Often the firm’s cash inflows and outflows do not match, and hence, the cash is held up to meet its routine commitments.

Q9) What are Precautionary Motive?

A9) The precautionary motive refers to the tendency of a firm to hold cash, to meet the contingencies or unforeseen circumstances arising in the course of business.

Since the future is uncertain, a firm may have to face contingencies such as an increase in the price of raw materials, labour strike, lockouts, change in the demand, etc. Thus, in order to meet with these uncertainties, the cash is held by the firms to have an uninterrupted business operation.

Q10) What are Speculative Motive?

A10) The firms hold cash for the speculative purposes to avail the benefit of bargain purchases that may arise in the future. For example, if the firm feels the prices of raw material are likely to fall in the future, it will hold cash and wait till the prices actually fall.

Thus, a firm holds cash to exploit the possible opportunities that are out of the normal course of business. These opportunities could be in the form of the low-interest rate charged on the borrowed funds, expected fall in the raw material prices or favourable change in the government policies.

Thus, the cash is the most significant and liquid asset that the firm holds. It is significant as it is used to pay off the firm’s obligations and helps in the expansion of business operations.

Q11) How Matching of cash flows determine cash needs?

A11) The first and very important factor determining the level of cash requirement is matching cash inflows with cash outflows. If the receipts and payments are perfectly coinciding or balance each other, there would be no need for cash balances. The need for cash management therefore due to the non-synchronisation of cash receipts and disbursements.

Q12) How Short costs determine cash needs?

Short costs are defined as the expenses incurred as a result of shortfall of cash. The short costs include, transaction costs associated with raising cash to overcome the shortage, borrowing costs associated with borrowing to cover the shortage i.e., interest on loan, loss of trade-discount, penalty rates by banks to meet a shortfall in cash balances and costs associated with deterioration of the firm’s credit rating etc. which is reflected in higher bank charges on loans, decline in sales and profits.

Q13) How Cost of excess cash balances determine cash needs?

A13) One of the important factors determining the cash needs is the cost of maintaining cash balances i.e., excess or idle cash balances. The cost of maintaining excess cash balance is called excess cash balance cost.

Q14) How Uncertainty in business determine cash needs?

A14) The first requirement of cash management is a precautionary cushion to cope with irregularities in cash flows, unexpected delays in collections and disbursements and defaults. The uncertainty can be overcome through accurate forecasting of tax payments, dividends, capital expenditure etc. and ability of the firm to borrow funds through over draft facility.

Q15) How Cost of procurement and management of cash determine cash needs?

A15) The costs associated with establishing and operating cash management staff and activities determining the cash needs of a business firm. These costs are generally fixed and are accounted for by salary, storage and handling of securities etc. The above factors are considered to determine the cash needs of a business firm.

Q16) How can you Create a cash flow statement and analyse it monthly?

A16) The primary objective of a cash flow statement is to help you budget for future periods and identify potential financial problems before they get out of hand. This doesn’t have to be a complicated procedure. Simply prepare a schedule that shows the cash balance at the beginning of the month and add cash you receive (from things like cash sales, collections on receivables, and asset dispositions). Then, subtract cash you spend to calculate the ending cash balance. If your cash balance is decreasing month to month, you have negative cash flow and you may need to make adjustments to your operations. If it’s climbing, your cash flow is positive.

Note that once you have a cash flow statement that works for you, you can automate the report in your accounting software. Or, you can create a more traditional cash flow statement that begins with your net income, then make adjustments for non-cash items and changes in your balance sheet accounts.

Q17) How can you Create a history of your cash flow?

A17) Build a cash flow history by using historical financial records over the course of the past few of years. This will help you discover if there is a particular time of year which needs more attention.

Q18) How can you forecast your cash flow needs?

A18) Use your historic cash flow and project the next 12 to 24 months. This process will help identify how much excess cash is required in the good months to cover payroll costs and other expenses during the low-cash months. To smooth out cash flow, you might consider establishing a line of credit that can be paid back as cash becomes available.

Q19) How can you implement ideas to improve cash flow?

A19) Now that you know your cash needs, consider ideas to help improve your cash position. For example:

- Reduce the lag time between shipping and invoicing.

- Re-examine credit and collection policies.

- Consider offering discounts for early payment.

- Charge interest on delinquent balances.

- Convert excess and unsold inventory back into cash.

Q20) How can you Manage your growth to improve cash management for your business?

A20) Be cautious when expanding into new markets, developing new product lines, hiring employees, or ramping up your marketing budget. All of these activities require cash and you don’t want to travel too far down that road before generating accurate cash forecasts.

Unit 2

Management of Cash

Q1) What is Cash management?

A1) Cash management is the process of collecting and managing cash flows. Cash management can be important for both individuals and companies. In business, it is a key component of a company's financial stability. For individuals, cash is also essential for financial stability while also usually considered as part of a total wealth portfolio. Individuals and businesses have a wide range of offerings available across the financial marketplace to help with all types of cash management needs. Banks are typically a primary financial service provider for the custody of cash assets. There are also many different cash management solutions for individuals and businesses seeking to obtain the best return on cash assets or the most efficient use of cash comprehensively.

Q2) What are the objectives of Cash management?

A2) The objectives of cash management are discussed below-

Figure: Objectives of cash management

1. Fulfil Working Capital Requirement: The organization needs to maintain ample liquid cash to meet its routine expenses which possible only through effective cash management.

2. Planning Capital Expenditure: It helps in planning the capital expenditure and determining the ratio of debt and equity to acquire finance for this purpose.

3. Handling Unorganized Costs: There are times when the company encounters unexpected circumstances like the breakdown of machinery. These are unforeseen expenses to cope up with; cash surplus is a lifesaver in such conditions.

4. Initiates Investment: The other aim of cash management is to invest the idle funds in the right opportunity and the correct proportion.

5. Better Utilization of Funds: It ensures the optimum utilization of the available funds by creating a proper balance between the cash in hand and investment.

6. Avoiding Insolvency: If the business does not plan for efficient cash management, the situation of insolvency may arise. It is either due to lack of liquid cash or not making a profit out of the money available.

Q3) Explain the Miller – Orr’ Model?

A3) According to Merton H. Miller and Daniel Orr, Baumol’s model only determines the cash withdrawal; however, cash is the most uncertain element of the business. There may be times when the organization will have surplus cash, thus discouraging withdrawals; instead, it may require to make investments. Therefore, the company needs to decide the return point or the level of money to be maintained, instead of determining the withdrawal amount. This model emphasizes on withdrawing the cash only if the available fund is below the return point of money whereas investing the surplus amount exceeding this level.

Q4) Explain the Baumol’s EOQ Model.

A4) Based on the Economic Order Quantity (EOQ), in the year 1952, William J. Baumol gave the Baumol’s EOQ model, which influences the cash management of the company. This model emphasizes on maintaining the optimum cash balance in a year to meet the business expenses on the one hand and grab the profitable investment opportunities on the other side. The following formula of the Baumol’s EOQ Model determines the level of cash which is to be maintained by the organization:

Where,

‘C’ is the optimum cash balance;

‘F’ is the fixed transaction cost;

‘T’ is the total cash requirement for that period;

‘i’ is the rate of interest during the period

Q5) What are the methods of cash management?

A5) All big and small businesses needs to have enough cash to pay the bills. Focusing solely on sales and profits could create issues when invoices arrive and you find that there aren’t enough funds available to pay them. Below are five ways you can be proactive and improve cash management for your business:

1. Create a cash flow statement and analyse it monthly. The primary objective of a cash flow statement is to help you budget for future periods and identify potential financial problems before they get out of hand. This doesn’t have to be a complicated procedure. Simply prepare a schedule that shows the cash balance at the beginning of the month and add cash you receive (from things like cash sales, collections on receivables, and asset dispositions). Then, subtract cash you spend to calculate the ending cash balance. If your cash balance is decreasing month to month, you have negative cash flow and you may need to make adjustments to your operations. If it’s climbing, your cash flow is positive.

Note that once you have a cash flow statement that works for you, you can automate the report in your accounting software. Or, you can create a more traditional cash flow statement that begins with your net income, then make adjustments for non-cash items and changes in your balance sheet accounts.

2. Create a history of your cash flow. Build a cash flow history by using historical financial records over the course of the past few of years. This will help you discover if there is a particular time of year which needs more attention.

3. Forecast your cash flow needs. Use your historic cash flow and project the next 12 to 24 months. This process will help identify how much excess cash is required in the good months to cover payroll costs and other expenses during the low-cash months. To smooth out cash flow, you might consider establishing a line of credit that can be paid back as cash becomes available.

4. Implement ideas to improve cash flow. Now that you know your cash needs, consider ideas to help improve your cash position. For example:

- Reduce the lag time between shipping and invoicing.

- Re-examine credit and collection policies.

- Consider offering discounts for early payment.

- Charge interest on delinquent balances.

- Convert excess and unsold inventory back into cash.

5. Manage your growth. Be cautious when expanding into new markets, developing new product lines, hiring employees, or ramping up your marketing budget. All of these activities require cash and you don’t want to travel too far down that road before generating accurate cash forecasts.

Q6) Explain the determination of optimum level of cash.

A6) Maintenance of optimum level of cash is the main problem of cash management. The level of cash holding differs from industry to industry, organisation to organisation. The factors determining the cash needs of the industry is explained as follows:

Figure: Factors determining cash needs

- Matching of cash flows:

The first and very important factor determining the level of cash requirement is matching cash inflows with cash outflows. If the receipts and payments are perfectly coinciding or balance each other, there would be no need for cash balances. The need for cash management therefore due to the non-synchronisation of cash receipts and disbursements.

Ii. Short costs:

Short costs are defined as the expenses incurred as a result of shortfall of cash. The short costs include, transaction costs associated with raising cash to overcome the shortage, borrowing costs associated with borrowing to cover the shortage i.e., interest on loan, loss of trade-discount, penalty rates by banks to meet a shortfall in cash balances and costs associated with deterioration of the firm’s credit rating etc. which is reflected in higher bank charges on loans, decline in sales and profits.

Iii. Cost of excess cash balances:

One of the important factors determining the cash needs is the cost of maintaining cash balances i.e., excess or idle cash balances. The cost of maintaining excess cash balance is called excess cash balance cost.

Iv. Uncertainty in business:

The first requirement of cash management is a precautionary cushion to cope with irregularities in cash flows, unexpected delays in collections and disbursements and defaults. The uncertainty can be overcome through accurate forecasting of tax payments, dividends, capital expenditure etc. and ability of the firm to borrow funds through over draft facility.

v. Cost of procurement and management of cash:

The costs associated with establishing and operating cash management staff and activities determining the cash needs of a business firm. These costs are generally fixed and are accounted for by salary, storage and handling of securities etc. The above factors are considered to determine the cash needs of a business firm.

Q7) What are Motives for holding cash?

A7) The Motives for Holding Cash is easy, the cash inflows and outflows are not well accompanied, i.e., sometimes the cash inflows are more than the cash outflows while sometimes the cash outflows could be more than the cash inflows. Hence, the cash is held by the firms to meet the certain as well as uncertain situations.

Q8) What are Transaction Motive?

A8) The transaction motive refers to the cash required by a firm to meet the day to day needs of its business operations. In an ordinary course of business, the firm requires cash to make the payments in the form of salaries, wages, interests, dividends, goods purchased, etc.

Likewise, it also receives cash from its sales, debtors, investments. Often the firm’s cash inflows and outflows do not match, and hence, the cash is held up to meet its routine commitments.

Q9) What are Precautionary Motive?

A9) The precautionary motive refers to the tendency of a firm to hold cash, to meet the contingencies or unforeseen circumstances arising in the course of business.

Since the future is uncertain, a firm may have to face contingencies such as an increase in the price of raw materials, labour strike, lockouts, change in the demand, etc. Thus, in order to meet with these uncertainties, the cash is held by the firms to have an uninterrupted business operation.

Q10) What are Speculative Motive?

A10) The firms hold cash for the speculative purposes to avail the benefit of bargain purchases that may arise in the future. For example, if the firm feels the prices of raw material are likely to fall in the future, it will hold cash and wait till the prices actually fall.

Thus, a firm holds cash to exploit the possible opportunities that are out of the normal course of business. These opportunities could be in the form of the low-interest rate charged on the borrowed funds, expected fall in the raw material prices or favourable change in the government policies.

Thus, the cash is the most significant and liquid asset that the firm holds. It is significant as it is used to pay off the firm’s obligations and helps in the expansion of business operations.

Q11) How Matching of cash flows determine cash needs?

A11) The first and very important factor determining the level of cash requirement is matching cash inflows with cash outflows. If the receipts and payments are perfectly coinciding or balance each other, there would be no need for cash balances. The need for cash management therefore due to the non-synchronisation of cash receipts and disbursements.

Q12) How Short costs determine cash needs?

Short costs are defined as the expenses incurred as a result of shortfall of cash. The short costs include, transaction costs associated with raising cash to overcome the shortage, borrowing costs associated with borrowing to cover the shortage i.e., interest on loan, loss of trade-discount, penalty rates by banks to meet a shortfall in cash balances and costs associated with deterioration of the firm’s credit rating etc. which is reflected in higher bank charges on loans, decline in sales and profits.

Q13) How Cost of excess cash balances determine cash needs?

A13) One of the important factors determining the cash needs is the cost of maintaining cash balances i.e., excess or idle cash balances. The cost of maintaining excess cash balance is called excess cash balance cost.

Q14) How Uncertainty in business determine cash needs?

A14) The first requirement of cash management is a precautionary cushion to cope with irregularities in cash flows, unexpected delays in collections and disbursements and defaults. The uncertainty can be overcome through accurate forecasting of tax payments, dividends, capital expenditure etc. and ability of the firm to borrow funds through over draft facility.

Q15) How Cost of procurement and management of cash determine cash needs?

A15) The costs associated with establishing and operating cash management staff and activities determining the cash needs of a business firm. These costs are generally fixed and are accounted for by salary, storage and handling of securities etc. The above factors are considered to determine the cash needs of a business firm.

Q16) How can you Create a cash flow statement and analyse it monthly?

A16) The primary objective of a cash flow statement is to help you budget for future periods and identify potential financial problems before they get out of hand. This doesn’t have to be a complicated procedure. Simply prepare a schedule that shows the cash balance at the beginning of the month and add cash you receive (from things like cash sales, collections on receivables, and asset dispositions). Then, subtract cash you spend to calculate the ending cash balance. If your cash balance is decreasing month to month, you have negative cash flow and you may need to make adjustments to your operations. If it’s climbing, your cash flow is positive.

Note that once you have a cash flow statement that works for you, you can automate the report in your accounting software. Or, you can create a more traditional cash flow statement that begins with your net income, then make adjustments for non-cash items and changes in your balance sheet accounts.

Q17) How can you Create a history of your cash flow?

A17) Build a cash flow history by using historical financial records over the course of the past few of years. This will help you discover if there is a particular time of year which needs more attention.

Q18) How can you forecast your cash flow needs?

A18) Use your historic cash flow and project the next 12 to 24 months. This process will help identify how much excess cash is required in the good months to cover payroll costs and other expenses during the low-cash months. To smooth out cash flow, you might consider establishing a line of credit that can be paid back as cash becomes available.

Q19) How can you implement ideas to improve cash flow?

A19) Now that you know your cash needs, consider ideas to help improve your cash position. For example:

- Reduce the lag time between shipping and invoicing.

- Re-examine credit and collection policies.

- Consider offering discounts for early payment.

- Charge interest on delinquent balances.

- Convert excess and unsold inventory back into cash.

Q20) How can you Manage your growth to improve cash management for your business?

A20) Be cautious when expanding into new markets, developing new product lines, hiring employees, or ramping up your marketing budget. All of these activities require cash and you don’t want to travel too far down that road before generating accurate cash forecasts.