UNIT V

Accounting of Dissolution of Partnership firm

Q1) How do we prepare Final Accounting in Partnership Account?

A1) The final closing of a partnership company is similar to that of a sole proprietor. The only difference is that in a sole proprietorship, the profit is added to the business owner's capital, whereas the profit is distributed among the partners. First, prepare a trial balance from all debit and credit balances for all ledger accounts. This will generate a trading account and a profit and loss account. Finally, a balance sheet is created that reflects your position at the end of the period. The trading account shows gross profit or total loss, and the profit and loss account reflect the net position.

- Manufacturing Account

This is provided only for manufacturing concerns. The production cost is displayed.

II. Trading Account

The trading account is prepared for the transaction and is part of the income statement. Record all transactions

Related to goods and direct costs. If the credit side is larger than the debit side, the gross profit thus obtained is

It will be credited to the income statement. On the other hand, if the debit is greater than the gross loss

It will be debited on the income statement.

a. Debit side of trading account

- Opening stock

- Purchases after deducting the amount of burnt items, partner withdrawn items, and items

Distributed as a free sample

Direct costs mean costs that are directly related to the production or purchase of goods, such as wages.

Manufacturing costs for inward freight, factory rent, octroi, import taxes, tariffs, electricity, etc. Factories, etc.

b. Credit side of Trading Account

- Sale of goods

- Closed stock

- Items that have been burnt down, items that have been withdrawn by a partner, items that have been distributed as free samples, etc. may appear here instead of being deducted from your purchase.

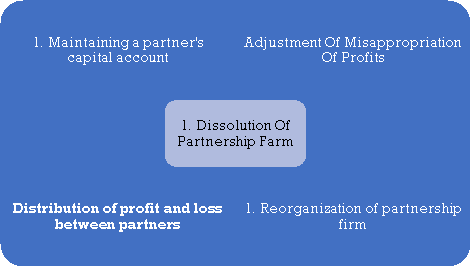

Partnership-style business organizations are very similar to sole proprietorship-style businesses, but there are certain exceptions to this form of business organization that must be taken into account when preparing a partnership company account.

These exceptions, called special aspects of partnership accounts, are:

Maintaining a Partner's Capital Account

In partnership operations, capital accounts are maintained in two different ways: (a) fixed capital and (b) variable capital.

The fixed capital method maintains two accounts, the capital account and the current account, while the variable capital method maintains only the capital account.

Distribution of Profit and Loss Between Partners

Since multiple individuals are involved in the partnership business, care must be taken in the distribution of profit and loss. A profit and loss account is provided for this purpose.

Adjustment of Misappropriation of Profits

One of the special aspects of partnership is to coordinate your partnership account whenever you need to adjust or modify past events. In the past, the profit-sharing ratio between partners may have been incorrect, in which case the company will make adjustments to correct the error.

Reorganization of Partnership Firm

Restructuring is referred to as changes that occur with respect to partnerships or in partnership actions that lead to the creation of new terms and conditions between partners.

The following situations lead to the restructuring of the partnership company.

- Admission of a new partner

- Partner Retirement / Partner Death

- Dissolution of partner

Q2) Write note on what Admission of Partnership means.

A2) Joining a partner means getting a new partner into a partnership company for a portion of the profit and paying back his or their share of the company's goodwill and capital. If a company needs more money or services / knowledge to grow its business, they will approach the new partner against the company's share of profits with the consent of all old partners.

Admission of Partner

Partner admission refers to the situation in which an individual joins an existing partnership company and the old partner agrees to sacrifice a share of profits. This is the mode of partnership rebuilding. This is because with the addition of a new partner, all partners, including the new partner, must create new contracts / contracts and terminate existing contracts / contracts.

All (smallest) old partners sacrifice some of the company's profits, and new partners receive some of their profits according to their transactions with the old partners, resulting in a new profit-sharing ratio among all partners.

According to Article 31 of the Indian Partnership Act of 1932

- A person is recognized as a new partner:

- If so, agreed in the partnership certificate, or

- Without the above, if all partners agree to enrol.

- After joining, the new partner will acquire her two rights:

- The right to share the company's future interests, and

- The right to share company assets.

- At the same time, he is responsible for the business incurred after enrolment and for the losses suffered by the company.

Impact of Partner Admission:

There are many effects that affect the partnership, some of which appear as follows:

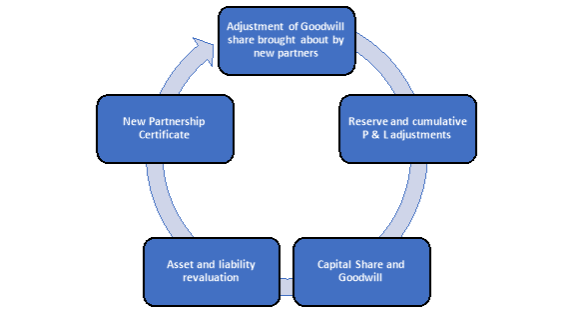

1. New Partnership Certificate:

The new partnership agreement / agreement between all partners must include the new partner, along with all new terms and conditions accepted by all partners. The old contract will be abolished.

2. Capital Share and Goodwill:

According to the contract between the new partner and the old partner, the new partner must bring in a share of the company's capital and good faith, depending on his share of the company's profits.

3. Reserve and cumulative P & L adjustments: –

Older partners will need to adjust their reserves and cumulative P & L with the old profit-sharing ratio as these items are related to the partner's pre-enrolment period.

4. Asset and liability revaluation: –

If, at the time of joining a partner, the old partner decides to know the true financial position of the company, all assets and liabilities of the company must be revalued.

5. Adjustment of Goodwill share brought about by new partners: –

The old partner adjusts the goodwill share of the new partner at the sacrifice ratio.

Adjustments Required for Partner Admission: –

The adjustments required after joining a new partner are displayed as follows:

- Changes in Profit Sharing Rate

- Evaluation of Goodwill

- Adjustments for reserves, cumulative gains / losses, and deferred revenue costs.

- Revaluation of Assets and Liabilities

- Adjustment of Capital in Partnership

Q3) Define Partnership.

A3) A partnership is when two or more people work together and comply with share the profits / losses of the business in equal or already specified proportions. Within the case of a corporation restructuring, there's a change within the share ratio between existing partners consistent with the transactions between the partners.

"A partnership may be a connection between those that have agreed to share the interests of the business they are doing, or who act for everybody."

Partnership means two or more people do business together and comply with share the profits / losses of that business in equal or already specified proportions. Within the case of a corporation restructuring, there's a change within the share ratio between existing partners consistent with the transactions between the partners.

Changes in share between existing partners: –

Changing the share ratio between existing partners means if one or more of her existing partners want to share more of the business profit, the share ratio are going to be mutually determined from the predetermined share ratio. Means to vary . This process is understood as company restructuring.

In this process, those that want more share will earn an equivalent amount as another victim. Therefore, to calculate the quantity of additional capital required to earn more profits, you would like to calculate the partner acquisition / sacrifice ratio. To calculate the gain / sacrifice ratio, you would like to use the subsequent formula:

Share Sacrifice / Acquisition = Old Share – New Share

(Both shares are related to the partner for whom the sacrifice / gain share is calculated)

The results obtained from the above calculations are treated as sacrifices or acquisitions, as shown below.

- If the result's positive, it's a Sacrificing Share.

- If the result's negative, it's the earned share.

Q4) What adjustments are made in order to vary profit share?

A4) Five adjustments are made to vary the profit share. These are shown below, and every one the tweaks are illustrated during a separate article.

1. Determining the sacrifice ratio and acquisition ratio

2. Goodwill accounting

3. Reserve account, accounting for cumulative profit and loss,

4. Asset revaluation and liability revaluation, and

5. Capital Adjustment

1. Determining sacrifice ratio and acquisition ratio: –

First of all, to form all kinds of adjustments, you would like to calculate the sacrifice / profit ratio. With the assistance of this ratio, calculate the entire amount of other adjustments. These ratios are going to be discussed in additional detail within the next article.

- What is the sacrifice ratio?

- What is the speed of return?

2. Goodwill Accounting: –

Goodwill means one business acquires all or a number of the shares of another business for an amount that exceeds the entire assets of that business. The extra difference paid is named goodwill. It's a tangible asset.

Therefore, the winning partner must pay a well-meaning amount to sacrifice the partner. To pay this amount, create an adjustment entry or pay the victim in cash.

The winning partner brings a share of goodwill adequate to the share earned within the company's profits.

3. Reserve Account, Accounting for Cumulative Profit And Loss,

Reserve may be a proportional amount of net or surplus reserved for future payments. In other words, it's a reservation of known non-responsible interests.

This amount has been relevant for the past year and therefore the victim is entitled thereto. Therefore, reserves and cumulative P & L are split by the old profit share.

4. Asset revaluation and liability revaluation: –

According to accounting standards, all assets within the books are presented at their original (cost) value, but some assets are valuable compared to their value , while others have a lower market price .

Therefore, you would like to calculate truth / market price of your assets and liabilities and distribute the difference between your partners.

5. Capital Adjustment: –

Capital adjustments are essential because profitable partners must invest more so as to urge more share within the company. Therefore, partners bring the specified amount of capital consistent with their rate of return.

The selling partner will withdraw capital from the business because it will share less profit after the restructuring.

Q5) What is Goodwill Accounting?

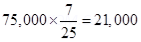

A5) The amount of compensation paid by the winning partner to the sacrificial partner will be treated as determined by all older partners. They can record the amount of premium they receive in good faith in their books or personally distribute this amount to all partners through their partner's capital account. The premium amount of goodwill is calculated by the following formula.

Premium amount for goodwill = Value of corporate goodwill X Profit sharing

(i) When goodwill is adjusted through the partner's capital account: -

If goodwill processing is adjusted through a partner's equity / checking account, the following adjustment (journal) entry will be made.

A and B are partners of AB Co. Ltd. They shared the company's profits in her 3: 2 ratios. But now they want to share their profits equally in the future. That is, A sacrifices a tenth share and B gets a tenth share. The amount of goodwill of the company is Rs 1,75,000.

(a) If the variable capital account is maintained: –

| |||||

Date | Particulars | L.F. | Debit | Credit | |

|

|

|

|

|

|

| Gaining Partners’ Capital, A/c | Dr. |

| XXXX |

|

| To Sacrificing Partners’ Capital A/c |

|

| XXXX | |

| (Being adjustment of premium for goodwill.) |

|

|

| |

(b) If a fixed capital account is maintained: –

For variable capital, pass the journal through your partner's checking account. This is shown as: – –

| |||||

Date | Particulars | L.F. | Debit | Credit | |

|

|

|

|

|

|

| Gaining Partners’ Current A/c | Dr. |

| XXXX |

|

| To Sacrificing Partners’ Current A/c |

|

| XXXX | |

| (Being adjustment of premium for goodwill.) |

|

|

| |

(ii) When good intentions are solicited and cancelled: -

If goodwill is processed, it will be adjusted by creating accounting books, which will be fully amortized through the partner's capital / checking account and then adjusted.

Q6) Describe accounting transactions for the amount of Goodwill.

A6) The accounting for the amount of goodwill above is described in different ways:

(a) If the variable capital account is maintained: –

For variable capital, we pass the journal through the partner's capital account. This is shown as: – –

Date | Particulars | L.F. | Debit | Credit | |

|

|

|

|

|

|

| Goodwill A/c | Dr. |

| XXXX |

|

| To Partners’ Capital A/c |

|

| XXXX | |

| (Being Credited the full amount of goodwill among the partners’ capital account in the old profit sharing ratio) |

|

|

| |

|

|

|

|

| |

| Partners’ Capital A/c | Dr. |

| XXXX |

|

| To Goodwill A/c |

|

| XXXX | |

| (Being Credited the full amount of goodwill among the partners’ capital account in the New profit sharing ratio) |

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

(b) If a fixed capital account is maintained: –

For variable capital, pass the journal through your partner's checking account. This is shown as: – –

Date | Particulars | L.F. | Debit | Credit | |

|

|

|

|

|

|

| Goodwill A/c | Dr. |

| XXXX |

|

| To Partners’ Current A/c |

|

| XXXX | |

| (Being Credited the full amount of goodwill among the partners’ Current account in the old profit-sharing ratio) |

|

|

| |

|

|

|

|

| |

| Partners’ Current A/c | Dr. |

| XXXX |

|

| To Goodwill A/c |

|

| XXXX | |

| (Being Credited the full amount of goodwill among the partners’ Current account in the new profit-sharing ratio) |

|

|

| |

Q7) Define Hidden or Guessed Credit with an example.

A7) At times, the value of Favor may not be given when a new partner enrolls. In these situations, goodwill is calculated based on the net worth of the business. Hidden goodwill is when the company's desired total capital exceeds the actual total capital of all partners.

For example

The capital of L and M is Rs. 2,00,000 and Rs. 1,50,000 each. They recognize N as a partner with a 1/5 share of Rs. 1,00,000 as his capital.

Based on N's capital, the company's total capital must be Rs. 5,00,000 (1,00,000 x 5/1). However, the actual capital of the company is Rs. 4,50,000 (2,00,000 +1,50,000 +1,00,000). Therefore, the hidden good intentions:

= Rs. 5,00,000 --Rs 4,50,000

= Rs. 50,000

Q8) What is Asset Revaluation and Debt Revaluation? Pass necessary entries to show how changes in the value of assets and liabilities are recorded in the books.

A8) Revaluing an asset means comparing the book value of the asset to the current market value of the asset. In the event of a company restructuring, such as a change in profit sharing, the assets will need to be revalued. The difference is credited to the partner's capital / current account if it increases and debited to the partner's capital / current account with the old profit-sharing ratio if it decreases.

The process of revaluing liabilities is the same as the process of revaluing assets above, but the processing of liabilities is the opposite of the asset account. Therefore, if the difference increases, it will be debited to the partner's capital / current account, and if it decreases, it will be credited to the partner's capital / current account with the old profit-sharing ratio.

Accounting for Revaluation of Assets and Liabilities: –

Partners must first decide whether to record asset and liability revaluations in their books. The accounting treatment in both cases is different and is explained as follows:

1. When changes in the value of assets and liabilities are recorded in the books: –

One account revaluation account or profit and loss adjustment account was opened when the partner decided to record all changes at the account booth. An increase in asset value and a decrease in liability value are debited to the revaluation account, and a decrease in asset value and an increase in liability value are debited to the revaluation account. It is then debited to the partner's capital or checking if the revaluation account balance is debited, and debited to the partner's capital or checking if the revaluation account balance is debited.

Accounting journal entries are passed: –

Date | Particulars | L. F. | Debit | Credit |

| |

|

|

|

|

|

|

|

(i) For an increase in the value of assets: |

| |||||

| Asset A/c (Individually) | Dr. |

| XXXX |

|

|

| To Revaluation A/c |

|

| XXXX |

| |

| (Being adjustment made for the increase in the value of assets) |

|

|

|

| |

|

|

|

|

|

| |

(ii) For a decrease in the value of assets: |

| |||||

| Revaluation A/c | Dr. |

| XXXX |

|

|

| To Asset A/c (Individually) |

|

| XXXX |

| |

| (Being adjustment made for the Decrease in the value of assets.) |

|

|

|

| |

|

|

|

|

|

| |

(iii) For an increase in the value of Liability: |

| |||||

| Revaluation A/c | Dr. |

| XXXX |

|

|

| To Liability A/c (Individually) |

|

| XXXX |

| |

| (Being adjustment made for the increase in the value of assets) |

|

|

|

| |

|

|

|

|

|

| |

(iv) For a decrease in the value of Liability: |

| |||||

| Liability A/c (Individually) | Dr. |

| XXXX |

|

|

| To Revaluation A/c |

|

| XXXX |

| |

| (Being adjustment made for the Decrease in the value of the liability .) |

|

|

|

| |

|

|

|

|

|

| |

(v) For the recording of unrecorded assets: |

| |||||

| Unrecorded Asset A/c | Dr. |

| XXXX |

|

|

| To Revaluation A/c |

|

| XXXX |

| |

| (Being adjustment made for the recording of the value of assets.) |

|

|

|

| |

|

|

|

|

|

| |

Vi) For the recording of unrecorded liability: |

| |||||

| Revaluation A/c | Dr. |

| XXXX |

|

|

| To Unrecorded Liability A/c |

|

| XXXX |

| |

| (Being adjustment made for the recording of the value of liabilities) |

|

|

|

| |

|

|

|

|

|

| |

(vii) For the balance of Revaluation Account: – |

| |||||

(i) if there is the Credit balance (Net Gain) |

| |||||

| Revaluation A/c | Dr. |

| XXXX |

|

|

| To Partners’ Capital/Current A/c |

|

| XXXX |

| |

| (Being adjustment made for transfer the balance of revaluation a/c to partners’ capital/current a/c) |

|

|

|

| |

|

|

|

|

|

| |

(ii) if there is the Debit balance (net loss) |

| |||||

| Partners’ Capital/Current A/c | Dr. |

| XXXX |

|

|

| To Revaluation a/c |

|

| XXXX |

| |

| (Being adjustment made for transfer the balance of revaluation a/c to partners’ capital/current a/c) |

|

|

|

| |

Q9) What is Capital Adjustment in Partnership?

A9) Adjusting capital in a partnership means creating a share of capital according to the new profit-sharing ratio determined by the partner. If more or less capital is needed than is already invested in the partnership, the partner will introduce or withdraw each capital in cash.

The required balance of the partner's capital account is calculated as the new profit-sharing rate is calculated during the restructuring of the partner company and the difference between all old reserves or cumulative P & L, asset and liability revaluations is split among all partners Will be changed (old partner if new partner enrolled) at the old rate. If one of her partners sacrifices a share of profits, it will be paid by all other profitable partners. Therefore, the balance of his capital account will increase and will be greater than the balance required according to his share of the company's profits, and he will withdraw the share of capital to the extent that it meets the capital requirements.

Journal for Capital Adjustment: –

Revaluation of assets and liabilities with the journal of reserve balance or cumulative income statement already described above. Capital Adjustment journals such as:

Date | Particulars | L. F. | Debit | Credit | |

(i) For excess capital withdrawn by the partner | |||||

| Partners’ Capital A/c | Dr. |

| XXXX |

|

| To Cash/Bank A/c |

|

| XXXX | |

| (Being excess capital withdrawn by the partners) |

|

|

| |

(ii) For the amount of capital introduced by the partner | |||||

| Cash/Bank A/c | Dr. |

| XXXX |

|

| To Partners’ Capital A/c |

|

| XXXX | |

| (Being adjustment made for transfer the balance of revaluation a/c to retiring partners’ capital/current a/c) |

|

|

| |

Adjustment of Surplus / Deficit by Partner's Current Account:

(a) If the existing capital is greater than his required capital (surplus)

Partner Capital A / c Dr.

To The Partner's Current A / c

(b) If the existing capital is less than his required capital (deficiency)

Partner's current A / c Dr.

To Partner Capital A / c

However, if the checking account shows a debit balance, it will be placed on the asset side of the balance sheet.

Q10) What is the death of a partner?

A10) If one of her partners dies in an accident or medical problem, the partnership agreement / contract between all partners will be terminated. This situation is called the death of the partner. The partnership certificate ends, but if the remaining partners want to continue the partnership, the partnership can continue its activities.

Retirement Partner Responsibilities: –

The responsibilities of a retired partner are explained in her two situations:

Pre-retirement Act Debt: –

The retiring partner will be liable for any actions taken by the company prior to the retirement date, equally or in accordance with the certificate of partnership with all other partners. The remaining partner or other third party (who has some kind of contract with the retiring partner) exempts the retiring partner from liability by means of a written contract.

According to Section 32 (2): –

The retiring partner will continue to be responsible for all laws prior to the retirement date. However, the retiring partner may be exempt from liability by agreement with himself, a third party, and the continuing partner.

2. Debt for actions after retirement date: –

A retiring partner is a certificate of partnership with all remaining partners, equal to or with all other partners, for any actions taken by the company after his retirement date until the retirement notice of the retiring partner is not issued. We will take responsibility accordingly.

According to Section 32 (3): –

After retirement, the retiring partner will continue to be liable to third parties for the company's conduct until the retirement notice is given.

Impact of partner retirement: –

There are many effects that affect the partnership, some of which appear as follows:

1. New Partnership Certificate:

A new partnership agreement / agreement with the rest of the partners is required with all new terms and conditions accepted by all partners. The old contract will be abolished.

2. Capital share and goodwill:

According to the contract between the remaining partners, the remaining partners are required to pay a share of the company's capital and goodwill in order to retire the partner, depending on his share of the company's profits.

3. Reserve and cumulative P & L adjustments: –

Reserves and cumulative P & L are also paid to retired partners. Cumulative P / L at the old profit-sharing rate because these items are related to the pre-retirement period.

4. Asset and liability revaluation: –

At retirement, if the remaining partners decide to know the company's true financial position, they will need to revalue all of the company's assets and liabilities.

- Necessary adjustments for Partnership Certificates: –

Partner Retirement The following adjustments are taken into account, all of which were described in previous articles, so click on the name to review all of these articles one at a time.

- Changes in profit sharing rate

- Evaluation of goodwill

- Adjustments for reserves, cumulative gains / losses, and deferred revenue costs.

- Revaluation of assets and liabilities

- Adjustment of capital in partnership

Q11_ R, S and M are partners sharing profits in the ratio of 2/5, 2/5 and 1/5. M decides to retire from the business and his share is taken by R and S in the ratio of 1: 2. Calculate the new profit-sharing ratio.

A11) Old Ratio R, S and M = 2: 2: 1

M retires from the firm.

His profit share | = | 1 |

5 |

M’s share taken by R and S in ratio of 1: 2

Share taken by R | = | 1 | X | 1 |

5 | 3 |

Share taken by S | = | 1 | X | 2 |

5 | 3 |

| = | 1 |

| 15 |

| = | 2 |

| 15 |

| = | 6 + 1 |

15 |

New Ratio = Old Ratio + Share acquired from M

R’s New Share | = | 2 | + | 1 |

5 | 15 |

| = | 7 |

| 15 |

S’s New Share | = | 2 | + | 2 |

5 | 15 |

| = | 6 + 2 |

15 |

| = | 8 |

| 15 |

Q11) Amit, Balan, and Chander were partners in a firm sharing profits in the proportion of 1/2, 1/3, and 1/6 respectively. Chander retired on 1st April 2014. The Balance Sheet of the firm on the date of Chander’s retirement was as follows

Liabilities | Amount | Assets | Amount | ||

Sundry Creditors | 12,600 | Bank |

| 50,000 | |

Provident Fund | 3,000 | Debtors | 30,000 |

| |

General Reserve | 9,000 | Less: Provision | 1,000 | 29,000 | |

Partner’s Capital A/cs: | Stock |

| 25,000 | ||

Amit’s Capital | 40,000 |

| Investments | 10,000 | |

Balan’s Capital | 36,500 |

| Patents |

| 5,000 |

Chander’s Capital | 20,000 | 96,500 | Machinery | 48,000 | |

|

| 1,21,100 |

|

| 1,21,100 |

It was agreed that:

- Goodwill will be valued at 27,000.

- Depreciation of 10% was to be provided on Machinery.

- Patents were to be reduced by 20%.

- Liability on account of Provident Fund was estimated at 2,400.

- Chander took over Investments for 15,800.

- Amit and Balan decided to adjust their capitals in a proportion to their profit-sharing ratio by opening Current Accounts.

Prepare Revaluation Account and Partners’ Capital Accounts on Chander’s retirement.

A12) Revaluation Account | |||||

| |||||

Particular | Amount | Particular | Amount | ||

To Machinery A/c | 4,800 | By Investments A/c | 5,800 | ||

To Patents | 1,000 | By Provident Fund A/c | 600 | ||

|

|

|

| ||

To Profit transferred to: |

|

|

| ||

Amit’s Capital A/c | 300 |

|

|

|

|

Balan’s Capital A/c | 200 |

|

|

|

|

Chander’s Capital A/c | 100 | 600 |

|

|

|

|

| 6,400 |

|

| 6,400 |

Partners’ Capital Account | |||||||

Part. | Amit | Balan | Chander | Part. | Amit | Balan | Chander |

To Investments A/c | – | – | 15,800 | By Balance B/d | 40,000 | 36,500 | 20,000 |

To Chander’s Capital A/c | 2,700 | 1,800 | – | By Revaluation (Profit)A/c | 300 | 200 | 100 |

To Chander’s Loan A/c | – | – | 10,300 | By General Reserve A/c | 4,500 | 3,000 | 1,500 |

To Balan’s Current A/c | – | 5,900 | – | By Amit’s Capital A/c | – | – | 2,700 |

|

|

|

| By Balan’s Capital A/c | – | – | 1,800 |

|

|

|

| By Current A/c | 5,900 | – | – |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 50,700 | 39,700 | 26,100 |

| 50,700 | 39,700 | 26,100 |

Working Note: -

Calculation of Gaining Ratio

Old Ratio of Amit, Balan, and Chander = 1/2: 1/3: 1/6

= 3/6:2/6:1/6 (make base equal)

Chander retires from the firm.

New or Gaining Ratio of Amit and Balan, = 3:2 (as per old ratio)

Adjustment of Goodwill

Goodwill of the firm = Rs 27,000

Chander’s Share of Goodwill | = | Firm’s Goodwill | X | Chander’s share |

|

|

|

|

|

| = | 27,000 | X | 1 |

6 | ||||

|

|

|

|

|

| = | Rs 4,500 |

|

|

Amit will pay | = | Chander’s Goodwill | X | Share of Amit |

|

|

|

|

|

| = | 4,500 | X | 3 |

5 | ||||

|

|

|

|

|

| = | Rs 2,700 |

|

|

Balan will pay | = | Chander’s Goodwill | X | Share of Balan |

|

|

|

|

|

| = | 4,500 | X | 2 |

5 | ||||

|

|

|

|

|

| = | Rs 1,800 |

|

|

Calculation of Addition/withdrawal of Capital by the Amit and Balan

Balance of Capital Amount after all adjustments | = | Opening Balance of Capital Account | + | All Credits | – | All Debits |

Balance of Amit’s Capital Amount after all adjustments | = | 40,000 | + | 300 | + | 4,500 | – | 2,700 |

| = | 42,100/- |

|

|

|

|

|

|

Balance of Balan’s Capital Amount after all adjustments | = | 36,500 | + | 200 | + | 3,000 | – | (1,800) |

|

|

|

|

|

|

|

|

|

| = | 37,900 |

|

|

|

|

|

|

Total Capital of the firm | = | Amit’s Capital Balance | + | Balan’s Capital Balance |

|

|

|

|

|

| = | 42,100 | + | 37,900 |

|

|

|

|

|

| = | 80,000 |

|

|

Calculation of Total Capital

The total capital of the Firm= Rs 80,000

Amit’s New Capital | = | Firm’s new Capital | X | Share of Amit |

|

|

|

|

|

| = | 80,000 | X | 3 |

5 | ||||

|

|

|

|

|

| = | Rs 48,000 |

|

|

Balan New Capital | = | Firm’s new Capital | X | Share of Balan |

|

|

|

|

|

| = | 80,000 | X | 2 |

| 5 | |||

|

|

|

|

|

| = | Rs 32,000 |

|

|

Calculation of Addition/withdrawal of Capital by the Amit and Balan

Addition/withdrawal by Amit’s in/from Capital A/c | = | New Capital Amount | – | Balance of Capital Amount after all adjustments |

|

|

|

|

|

| = | 48,000 | – | 42,100 |

|

|

|

|

|

| = | 5,900/- |

|

|

Addition/withdrawal by Balan’s in/from Capital A/c | = | New Capital Amount | – | Balance of Capital Amount after all adjustments |

|

|

|

|

|

| = | 32,000 | – | 37,900 |

|

|

|

|

|

| = | 5,900/- |

|

|

Q12) A B and C were partners sharing profits in the ratio of 3: 2: 1. The firm closes its books on 31st March every year. B died on 30th June 2018. On his death, Goodwill of the firm was valued at 6,00,000. B’s share in profit or loss till the date of death was to be calculated on the basis of the previous year’s profit which was 15,00,000 Loss. Pass necessary Journal entries for goodwill and his share of loss.

A13)

Date | Particulars | L.F. | Debit | Credit | |

| A’s Capital A/c 2,00,000 × 3/4 | Dr. |

| 1,50,000 |

|

| C’s Capital A/c 2,00,000 × 1/4 | Dr. |

| 50,000 |

|

| To B’s Capital A/c |

|

|

| 2,00,000 |

| (Being B’s share of goodwill adjusted in gaining ratio 3: 1) |

|

|

| |

| B’s Capital A/c | Dr. |

| 1,25,000 |

|

| To Profit & Loss Suspense A/c |

|

|

| 1,25,000 |

| (Being B’s Share of loss debited to his Capital) |

|

|

|

|

Working Notes:

Calculation of Gaining Ratio:

Calculation of B’s Share of Goodwill

Goodwill = 6,00,000

B’s Share of Goodwill | = | 6,00,000 | X | 2 |

6 | ||||

| = | Rs 2,00,000 |

|

|

Calculation of B’s Share of Loss till the date of his death i.e., 30 th June 2018: –

Previous year’s loss = 15,00,000

B’s share of loss till the date of death = Previous year’s loss × B’s Share of Loss × Months till the date of his death/12

B’s share of loss till the date of death | = | 15,00,000 | X | 2 | X | 3 |

6 | 12 | |||||

|

|

|

|

|

|

|

B’s share of loss till the date of death | = | Rs 1,25,000 |

|

|

|

|

Q13) The Balance Sheet of X, Y and Z as at 31st March, 2018 was

Liabilities |

| Amount | Assets | Amount |

Bills Payable |

| 2,000 | Cash at Bank | 5,800 |

Employees’ Provident Fund |

| 5,000 | Bills Receivable | 800 |

Workmen Compensation Reserve |

| 6,000 | Stock | 9,000 |

General Reserve |

| 6,000 | Sundry Debtors | 16,000 |

Loans |

| 7,100 | Furniture | 2,000 |

Capital A/cs: |

|

| Plant and Machinery | 6,500 |

X | 22,750 |

| Building | 30,000 |

Y | 15,250 |

| Advertising Suspense | 6,000 |

Z | 12,000 | 50,000 |

|

|

|

| 76,100 |

| 76,100 |

The profit-sharing ratio was 3 : 2 : 1. Z died on 31st July, 2018. The Partnership Deed provides that:

a Goodwill is to be calculated on the basis of three years’ purchase of the five years’ average profit. The profits were: 2017-18: 24,000; 2016-17: 16,000; 2015-16: 20,000 and 2014- 15: 10,000 and 2013-14: 5,000.

b The deceased partner to be given a share of profits till the date of death on the basis of profits for the previous year.

c The Assets have been revalued as: Stock 10,000; Debtors 15,000; Furniture 1,500; Plant and Machinery 5,000; Building 35,000. A Bill Receivable for 600 was found worthless. d A Sum of 12,233 was paid immediately to Z’s Executors and the balance to be paid in two equal annual instalments together with interest @ 10% p.a. On the amount outstanding. Give Journal entries and show the Z’s Executors’ Account till it is finally settled.

A14)

Date | Particulars | L.F. | Debit | Credit | |

| Workmen’s Compensation Reserve | Dr. |

| 6,000 |

|

| To X’s Capital A/c |

|

|

| 3,000 |

| To Y’s Capital A/c |

|

|

| 2,000 |

| To Z’s Capital A/c |

|

|

| 1,000 |

| (Being Workmen’s Compensation Reserve distributed among partners in their old ratio) |

|

|

| |

| General Reserve A/c | Dr. |

| 6,000 |

|

| To Z’s Capital A/c |

|

|

| 3,000 |

| To Y’s Capital A/c |

|

|

| 2,000 |

| To Z’s Capital A/c |

|

|

| 1,000 |

| (Being General Reserve distributed among partners in their old ratio) |

|

|

|

|

| X’ Capital A/c | Dr. |

| 3,000 |

|

| Y’s Capital A/c | Dr. |

| 2,000 |

|

| Z’s Capital A/c | Dr. |

| 1,000 |

|

| To Advertisement Suspense A/c |

|

|

| 6,000 |

| (Being Goodwill written off among partners in their old ratio) |

|

|

|

|

| X’s Capital A/c | Dr. |

| 4,500 |

|

| Y’s Capital A/c | Dr. |

| 3,000 |

|

| To Z’s Capital A/c |

|

|

| 7,500 |

| (Being T’s share of goodwill adjusted) |

|

|

|

|

| Revaluation A/c | Dr. |

| 3,600 |

|

| To Sundry debtors A/c |

|

|

| 1,000 |

| To Furniture A/c |

|

|

| 500 |

| To Plant and Machinery A/c |

|

|

| 1,500 |

| To Bills Receivable A/c |

|

|

| 600 |

| (Being Decrease in value of Assets transferred to Revaluation Account) |

|

|

|

|

| Stock A/c | Dr. |

| 1,000 |

|

| Building A/c | Dr. |

| 5,000 |

|

| To Revaluation A/c |

|

|

| 6,000 |

| (Being Increase in value of Assets transferred to Revaluation Account) |

|

|

|

|

| Revaluation A/c | Dr. |

| 2,400 |

|

| To X’ Capital A/c |

|

|

| 1,200 |

| To Y’s Capital A/c |

|

|

| 800 |

| To Z’s Capital A/c |

|

|

| 400 |

| (Being Revaluation profit distributed among partners in their old ratio ) |

|

|

|

|

| Profit and Loss Suspense A/c | Dr. |

| 1,333 |

|

| To Z’s Capital A/c |

|

|

| 1,333 |

| (Being Z’s share of profit transferred his capital account) |

|

|

|

|

| Z’s Capital A/c | Dr. |

| 22,233 |

|

| To Z’s Executor’s A/c |

|

|

| 22,233 |

| (Being Amount due to Z transferred to his Executor’s Account) |

|

|

|

|

| (Being Amount due to Z transferred to his Executor’s Account) |

|

|

|

|

| Z’s Executor’s A/c | Dr. |

| 12,333 |

|

| To Bank A/c |

|

|

| 12,333 |

| (Being Amount paid to Z’s Executor) |

|

|

|

|

Z’s Executor’s Account | ||||||

Date | Particular | Amount | Date | Particular | Amount | |

2018 |

|

|

|

|

| |

July 31 | To Bank A/c | 12,233 | July 31 | By Z’s Capital A/c | 22,233 | |

2019 |

|

|

|

|

| |

Mar. 31 | To Cash A/c 25,000 + 5,000 | 10,667 | Mar. 31 | By Interest 10,000 × 10% for 8 months |

| 5,000 |

|

| 22,900 |

|

|

| 22,900 |

2019 |

|

|

|

|

|

|

July. 01 | To Bank A/c 5,000 + 667 + 333 | 6,000 | Aug. 01 | By Balance b/d |

| 10,667 |

2020 |

|

|

|

|

|

|

Mar. 31 | To Balance c/d | 5,333 | Aug. 01 | By Interest 75,000 × 10% for 4 months |

| 333 |

|

|

| Mar. 31 | By Interest 5,000 × 10% for 8 month |

| 333 |

|

| 11,333 |

|

|

| 11,333 |

2020 |

|

|

|

|

|

|

Aug. 01 | To Bank A/c 5,000 + 333 + 167 | 5,500 | Aug. 01 | By Balance b/d |

| 5,333 |

|

|

| Aug. 01 | By Interest 25,000 × 10% for 4 months |

| 167 |

|

| 5,500 |

|

|

| 5,500 |

Working Notes:

Calculation of Goodwill

Goodwill = Average Profit × Number of Year’s Purchase

Average Profit | = | 24,000 + 16,000 + 20,000 + 10,000 + 5,000 |

5 | ||

|

|

|

| = | Rs 15,000 |

∴ Goodwill = Average Profit × Number of Years’ Purchase

=15,000 × 3 = Rs 45,000

Adjustment of Goodwill

Old Ratio = 3 : 2 : 1

Z died.

∴ New Ratio X and Y = 3 : 1

Gaining Ratio = 3 : 2

Z’s Share in Goodwill | = | 45,000 | X | 1 |

6 | ||||

|

|

|

|

|

| = | Rs 7,500 |

|

|

This share of goodwill is to be distributed between X and Y in their gaining ratio i.e. 3 : 1.

X’s Share in Goodwill | = | 7,500 | X | 3 |

5 | ||||

|

|

|

|

|

| = | Rs 4,500 |

|

|

Y’s Share in Goodwill | = | 7,500 | X | 2 |

5 | ||||

|

|

|

|

|

| = | Rs 3,000 |

|

|

Calculation Z’s Share of Prof

Profit for 2017-18 Immediate Previous Year = Rs 24,000

∴ Z’s Profit Share | = | 24,000 | X | 1 | X | 4 |

6 | 12 | |||||

|

|

|

|

|

|

|

| = | Rs 1,333 |

|

|

|

|

Revaluation Account | ||||

Particular | Amount | Particular | Amount | |

To Sundry Debtors | 1,000 | By Balance b/d | 80,000 | |

To Furniture | 500 | By Interest on Capital A/c | 1,600 | |

To Plant and Machinery | 1,500 |

|

|

|

To Bills Receivable | 600 |

|

|

|

Profit transferred to: |

|

|

|

|

X’s Capital A/c | 1,200 |

|

|

|

Y’s Capital A/c | 800 |

|

|

|

Z’s Capital A/c | 400 |

|

|

|

| 6,000 |

|

| 6,000 |

Q14) X, Y and Z were partners in a firm sharing profits in the ratio of 2: 2: 1. On 31st March 2018, their Balance Sheet was as follows:

Liabilities |

| Amount | Assets | Amount |

Trade Creditors |

| 1,20,000 | Cash at Bank | 1,80,000 |

Bills Payable |

| 80,000 | Stock | 1,40,000 |

General Reserve |

| 60,000 | Sundry Debtors | 80,000 |

Capital A/cs: |

|

| Building | 3,00,000 |

X | 7,00,000 |

| Advance to Y | 7,00,000 |

Y | 7,00,000 |

| Profit and Loss A/c | 3,20,000 |

Z | 60,000 | 14,60,000 |

|

|

|

| 17,20,000 |

| 17,20,000 |

Y died on 30th June 2018. The Partnership Deed provided for the following on the death of a partner:

i Goodwill of the business was to be calculated on the basis of 2 times the average profit of the past 5 years. Profits for the years ended 31st March, 2018, 31st March, 2017, 31st March, 2016, 31st March, 2015 and 31st March, 2014 were 3,20,000 Loss; 1,00,000; 1,60,000; 2,20,000 and 4,40,000 respectively.

ii Y’s share of profit or loss from 1st April 2018 till his death was to be calculated on the basis of the profit or loss for the year ended 31st March 2018. You are required to calculate the following:

a Goodwill of the firm and Y’s share of goodwill at the time of his death.

b Y’s share in the profit or loss of the firm till the date of his death.

c Prepare Y’s Capital Account at the time of his death to be presented to his executors.

A15)

Y’s Capital Account | |||||

Particular | Amount | Particular | Amount | ||

Profit & Loss A/c | 1,28,000 | Balance b/d | 7,00,000 | ||

Profit & Loss Suspense Share of Loss | 32,000 | General Reserve | 24,000 | ||

Advance to Y | 7,00,000 | X’s Capital A/c |

| 64,000 | |

|

|

| Z’s Capital A/c |

| 32,000 |

|

| 8,20,000 |

|

| 8,20,000 |

Working Notes:

Calculation of Share in General Reserve

Reserve | = | 60,000 | X | 2 |

5 | ||||

|

|

|

|

|

| = | Rs 24,000 |

|

|

Q15) X, Y and Z are partners in firm sharing profits and losses in the ratio of 5: 3 : 2. Their Balance Sheet as at 31st March 2018 was as follows:

Liabilities |

| Amount | Assets |

| Amount |

Sundry Creditors |

| 18,000 | Goodwill |

| 12,000 |

Investments Fluctuation Reserve |

| 7,000 | Patents |

| 52,000 |

Workmen Compensation Reserve |

| 7,000 | Machinery |

| 62,400 |

Capital A/cs: |

|

| Investment |

| 6,000 |

X | 1,35,000 |

| Stock |

| 20,000 |

Y | 95,000 |

| Sundry Debtors | 24,000 |

|

Z | 74,000 | 3,04,000 | Less: Provision for Doubtful Debts | 4,000 | 20,000 |

|

|

| Loan to Z |

| 1,000 |

|

|

| Cash at Bank |

| 600 |

|

|

| Profit and Loss A/c |

| 1,50,000 |

|

|

| Z’s Drawings |

| 12,000 |

|

| 3,36,000 |

|

| 3,36,000 |

Z died on 1st April 2018, X and Y decide to share future profits and losses in the ratio of 3: 5. It was agreed that:

i Goodwill of the firm be valued 212 years’ purchase of average of four completed years’ profits which were: 2014-15— 1,00,000; 2015-16— 80,000; 2016-17— 82,000.

ii Stock is undervalued by 14,000 and machinery is overvalued by 13,600.

iii All debtors are good. A debtor whose dues of 400 were written off as bad debts paid 50% in full settlement.

iv Out of the amount of insurance premium debited to Profit and Loss Account, 2,200 be carried forward as prepaid insurance premium.

v 1,000 included in Sundry Creditors is not likely to arise.

vi A claim of 1,000 on account of Workmen Compensation to be provided for. Vii Investment is sold for 8,200 and a sum of 11,200 be paid to executors of Z immediately. The balance to be paid in four equal half-yearly instalments together with interest @ 8% p.a. At half-year rest.

Show Revaluation Account, Capital Accounts of Partners and the Balance Sheet of the new firm.

A16)

Revaluation Account | |||||

Particular | Amount | Particular | Amount | ||

Machinery | 13,600 | Creditors | 1,000 | ||

|

| Stock | 14,000 | ||

|

| Provision for Doubtful Debts |

| 4,000 | |

Profit transferred to: |

|

| Investment |

| 2,200 |

X’s Capital A/c | 5,000 |

| Bad Debts Recovered |

| 200 |

Y’s Capital A/c | 3,000 |

| Prepaid Insurance |

| 2,200 |

Z’s Capital A/c | 2,000 | 10,000 |

|

|

|

|

| 23,600 |

|

| 23,600 |

Partners’ Capital Account | |||||||

Part. | X | Y | Z | Part. | X | Y | Z |

To Goodwill A/c | 6,000 | 3,600 | 2,400 | By Balance B/d | 1,35,000 | 95,000 | 74,000 |

To Drawing A/c | – | – | 12,000 | By Revaluation A/c | 5,000 | 3,000 | 2,000 |

To Profit & Loss A/c | 75,000 | 45,000 | 30,000 | By IFR | 3,500 | 2,100 | 1,400 |

To X’s Capital A/c | – | 8,750 | – | By Y’s Capital A/c | 8,750 | – | 14,000 |

To Z ’s Capital A/c | – | 14,000 | – | By WFC | 3,000 | 1,800 | 1,200 |

To Loan to Z |

|

| 1,000 | By P & L Suspense A/c | – | – | 35,000 |

To Executors A/c |

|

| 47,200 |

|

|

|

|

To Balance c/d | 74,250 | 30,550 | – |

|

|

|

|

| 1,55,250 | 1,01,900 | 92,600 |

| 1,55,250 | 1,01,900 | 92,600 |

Z’s Executors Account | ||||

Particular | Amount | Particular | Amount | |

Bank A/c | 11,200 | Z’s Capital A/c | 47,200 | |

Z’s Executors Loan Account | 36,000 |

|

| |

| 47,200 |

|

| 47,200 |

Balance Sheet | |||||

Liabilities | Amount | Assets | Amount | ||

Creditors | 17,000 | Patents |

| 52,000 | |

Z’s Executors Loan A/c | 36,000 | Machinery |

| 48,800 | |

Workmen Compensation Claim |

| 1,000 | Stock |

| 34,000 |

Capital: |

|

| Debtors |

| 24,000 |

X | 74,250 |

| Prepaid Insurance |

| 2,200 |

Y | 30,550 | 30,550 |

|

| |

Bank Overdraft 600 + 8,200- 11,200 + 200 |

| 2,200 |

|

| |

|

| 1,61,000 |

|

| 1,61,000 |

Q16) Ram, Manohar and Joshi were partners in a firm. Joshi died on 31st May 2018. His share of profit from the closure of the last accounting year till the date of death was to be calculated on the basis of the average of three completed financial years of profits before death. Profits for the years ended 31st March 2016, 2017 and 2018 were 7,000; 8,000 and 9,000 respectively. Calculate Joshi’s share of profit till the date of his death and pass necessary Journal entry for the same.

A17)

Average Profit | = | Profit of last 3 year |

3 | ||

|

|

|

| = | 7,000 + 8,000 +9,000 |

| 3 | |

|

|

|

| = | Rs 8,000 |

Joshi’s Profit Share from April 01, 2018 to May 31, 2018 | = | 8,000 | X | 2 | X | 1 |

12 | 3 | |||||

|

|

|

|

|

|

|

| = | Rs 444 |

|

|

|

|

Journal Entries

Date | Particulars | L.F. | Debit | Credit | |

| Profit and Loss Suspense A/c | Dr. |

| 444 |

|

| To Joshi’s Capital A/c |

|

|

| 444 |

| (Being Joshi’s profit share credited to his capital account) |

|

|

| |

|

|

|

|

|

|

Q17) A B and C were partners in a firm sharing profits in the ratio of 5 : 3: 2. On 31st March 2018, their Balance Sheet was as follows:

Liabilities |

| Amount | Assets | Amount |

Creditors |

| 11,000 | Building | 20,000 |

Reserves |

| 6,000 | Machinery | 30,000 |

A’s Loan A/c |

| 5,000 | Stock | 10,000 |

Capital A/cs: |

|

| Patents | 11,000 |

A | 25,000 |

| Debtors | 8,000 |

B | 25,000 |

| Cash | 8,000 |

C | 15,000 |

|

|

|

|

| 87,000 |

| 87,000 |

A died-on 1st October 2018. It was agreed among his executors and the remaining partners that:

i Goodwill to be valued at 212 years’ purchase of the average profit of the previous 4 years, which were 2014-15: 13,000; 2015-16: 12,000; 2016-17: 20,000 and 2017-18: 15,000.

ii Patents be valued at 8,000; Machinery at 28,000; and Building at 25,000.

iii Profit for the year 2017-18 be taken as having accrued at the same rate as that of the previous year.

iv Interest on capital be provided @ 10% p.a.

v Half of the amount due to A to be paid immediately to the executors and the balance transferred to his Executors’ Loan Account. Prepare A’s Capital Account and A’s Executors’ Account as on 1st October 2018.

A18)

A’s Capital Account | |||||

Particular | Amount | Particular | Amount | ||

To Bank A/c | 28,450 | By Balance b/d | 25,000 | ||

To A’s Executors A/c | 28,450 | By Reserve | 3,000 | ||

|

| By B’s Capital A/c Goodwill | 11,250 | ||

|

|

| By C’s Capital A/c Goodwill |

| 7,500 |

|

|

| By Profit & Loss Suspense |

| 3,750 |

|

|

| By Interest on Capital WN2 |

| 1,250 |

|

|

| By A’s Loan A/c WN6 |

| 5,150 |

|

| 56,900 |

|

| 56,900 |

A’s Executors Account | |||||

Particular | Amount | Particular | Amount | ||

To Bank A/c | 28,450 | By Balance b/d | 56,900 | ||

To A’s Executors A/c | 28,450 |

|

| ||

|

|

|

|

|

|

|

| 56,900 |

|

| 56,900 |

Working Notes:

Calculation of Share in Reserve

| = | 6,000 | X | 5 |

10 | ||||

|

|

|

|

|

| = | Rs 3,000 |

|

|

Calculation of Interest on Capital

| = | 25,000 | X | 6 | X | 10 |

100 | 12 | |||||

|

|

|

|

|

|

|

| = | Rs 1,250 |

|

|

|

|

Calculation of Profit & Loss Suspense

Profit & loss Suspense | = | 15,000 | X | 5 | X | 6 |

100 | 12 | |||||

|

|

|

|

|

|

|

| = | Rs 3,750 |

|

|

|

|

Calculation of Share in Revaluation Profit/Loss

Revaluation=Nil(−3,000−2,000+5,000)

Q18) X, Y and Z were partners in a firm sharing profits and losses in the ratio of 3 : 2: 1. Z died on 30th June 2018. The Balance Sheet of the firm as at that 31st March 2018 is as follows:

Liabilities |

| Amount | Assets | Amount |

X’s Capital A/c | 2,40,000 |

| Machinery | 2,40,000 |

Y’s Capital A/c | 1,60,000 |

| Furniture | 1,50,000 |

Z’s Capital A/c | 80,000 | 4,80,000 | Investments | 40,000 |

X’s Current A/c |

| 16,000 | Stock | 64,000 |

Y’s Current A/c |

| 5,000 | Sundry Debtors | 50,000 |

Reserve |

| 60,000 | Bills Receivable | 22,000 |

Bills Payable |

| 34,000 | Cash at Bank | 37,000 |

Sundry Creditors |

| 40,000 | Cash in Hand | 22,000 |

|

|

| Z’s Current A/c | 10,000 |

|

| 6,35,000 |

| 6,35,000 |

The following decisions were taken by the remaining partners:

- A Provision for Doubtful Debts is to be raised at 5% on Debtors.

b While Machinery to be decreased by 10%, Furniture and Stock are to be appreciated by 5% and 10% respectively. - Advertising Expenses 4,200 are to be carried forward to the next accounting year and, therefore, it is to be adjusted through the Revaluation Account.

- Goodwill of the firm is valued at 60,000.

- X and Y are to share profits and losses equally in future.

f Profit for the year ended 31st March 2018 was 8,16,000 and Z’s share of profit till the date of death is to be determined on the basis of profit for the year ended 31st March 2018. - The Fixed Capital Method is to be converted into the Fluctuating Capital Method by transferring the Current Account balances to the respective Partners’ Capital Accounts. Prepare the Revaluation Account, Partners’ Capital Accounts and prepare C’s Executors’ Account to show that C’s Executors were paid in two half-yearly instalments plus interest of 10% p.a. On the unpaid balance.

The first instalment was paid on 31st December 2018.

A19)

Revaluation Account | |||||

Particular | Amount | Particular | Amount | ||

Machinery | 1,00,000 | Furniture | 7,500 | ||

Provision for Doubtful Debts | 2,500 | Stock | 6,400 | ||

|

| Prepaid Advertisement Expenses |

| 4,200 | |

|

|

| Loss transferred to |

|

|

|

|

| X’s Capital A/c | 4,200 |

|

|

|

| Y’s Capital A/c | 2,800 |

|

|

|

| Z’s Capital A/c | 1,400 | 8,400 |

|

| 26,500 |

|

| 26,500 |

Partners’ Capital Account | |||||||

Part. | X | Y | Z | Part. | X | Y | Z |

To Current A/c | – | – | 10,000 | By Balance B/d | 2,40,000 | 1,60,000 | 80,000 |

To Revaluation A/c | 4,200 | 2,800 | 1,400 | By Current A/c | 16,000 | 5,000 | – |

To Z’s Capital A/c | – | 10,000 | – | By Reserve | 30,000 | 20,000 | 10,000 |

To Z’s Capital A/c | – | 34,000 | – | By Y’s Capital A/c | – | – | 34,000 |

To Executors A/c | – | – | 1,22,600 | By Y’s Capital A/c | – | – | 10,000 |

|

|

|

|

| – | – |

|

To Balance c/d | 2,81,800 | 1,38,200 | – |

|

|

|

|

| 2,86,000 | 1,85,00 | 1,34,000 |

| 2,86,000 | 1,85,00 | 1,34,000 |

T’s Executor’s Account | ||||||

Date | Particular | Amount | Date | Particular | Amount | |

2018 |

|

|

|

|

| |

Dec. 31 | To Bank A/c 61,300 + 6,130 | 67,430 | Jun. 30 | By Z’s Capital A/c | 1,22,600 | |

2019 |

|

|

|

|

| |

Mar. 31 | To Balance c/d | 62,832.5 | Dec. 31 | By Interest (1,22,600×10100×612 |

| 6,130 |

|

|

| Mar. 31 | By Interest (61,300×10100×312) |

| 1,532.5 |

|

| 1,30,262.5 |

|

|

| 1,30,262.5 |

2019 |

|

|

|

|

|

|

Jun. 30 | To Bank 61,300 + 3,065 | 28,750 | April 01 | By Balance b/d |

| 62,832.5 |

2020 |

|

|

|

|

|

|

Jan. 31 | To Cash A/c 25,000 + 2,500 | 27,500 | Jun. 30 | By Interest (61,300×10100×312 |

| 1,532.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 64,365 |

|

|

| 64,365 |

Working Notes:

Calculation of Profit & Loss Suspense

Profit & loss Suspense | = | 8,16,000 | X | 1 | X | 6 |

3 | 12 | |||||

|

|

|

|

|

|

|

| = | Rs 34,000 |

|

|

|

|

Q19) On 31st March 2014, the Balance Sheet of Pooja, Qureshi and Ross, who were partners in a firm was as under:

Liabilities |

| Amount | Assets | Amount |

Sundry Creditors |

| 2,50,000 | Building | 2,60,000 |

Reserve Fund |

| 2,00,000 | Investment | 1,10,000 |

Capital A/c |

|

| Qureshi’s Loan | 1,00,000 |

Pooja | 1,50,000 |

| Debtors | 1,50,000 |

Qureshi | 1,00,000 |

| Stock | 1,20,000 |

Ross | 1,00,000 | 3,50,000 | Cash | 60,000 |

|

| 8,00,000 |

| 8,00,000 |

Qureshi died on 1st July 2014. The profit-sharing ratio of the partners was 2 : 1: 1. On the death of a partner, the partnership deed provided for the following:

- His share in the profits of the firm till the date of his death will be calculated on the basis of average profits of the last three completed years.

- Goodwill of the firm will be calculated on the basis of the total profit for the last two years.

- Interest on loan given by the firm to a partner will be charged at the rate of 6% p.a. Or 4,000, whichever is more.

iv Profits for the last three years were 45,000; 48,000 and 33,000.

Prepare Qureshi’s Capital Account to be rendered to his executors. A20)

Qureshi’s Capital A/c | |||||

Particular | Amount | Particular | Amount | ||

To Drawings A/c | 1,04,000 | By Balance b/d | 1,00,000 | ||

To Executor’s A/c | 68,875 | By Pooja’s Capital A/c WN1 | 13,500 | ||

|

| By Ross’s Capital A/c WN1 | 6,750 | ||

|

|

| By Profit & Loss Suspense A/c WN2 |

| 2,625 |

|

|

| By Reserve Fund A/c 2,00,000 × 1/4 |

| 50,000 |

|

| 1,72,875 |

|

| 1,72,875 |

Working Notes:

Calculation of Qureshi’s Share of Goodwill

Goodwill = 48,000 + 33,000 = 81,000

Qureshi’s Share of Goodwill = 81,000 × 1/4 = 20,250

Gaining Ratio = Pooja: Ross = 2: 1

Amount debited to Pooja’s Capital A/c | = | 20,250 | X | 2 |

3 | ||||

|

|

|

|

|

| = | Rs 13,500 |

|

|

Amount debited to Ross’s Capital A/c | = | 20,250 | X | 1 |

3 | ||||

|

|

|

|

|

| = | Rs 6,750 |

|

|

Calculation of Qureshi’s Share of Loss till the date of his death

Average Profit of the last three years = 45,000 + 48,000 + 33,000/3 = 42,000

Qureshi’s share of loss till the date of death = Previous year’s loss × Qureshi’s Share of Loss × Months till the date of his death/12

| = | 42,000 | X | 1 | X | 3 |

4 | 12 | |||||

|

|

|

|

|

|

|

| = | Rs 2,625 |

|

|

|

|

Calculation of Amount due on account of Loan given to Qureshi

Loan given to Qureshi by a firm = 1,00,000

Amount of interest till 1st July, 2014 | = | 1,00,000 | X | 6 | X | 3 |

100 | 12 | |||||

|

|

|

|

|

|

|

| = | Rs 1,500 |

|

|

|

|

Total Amount due to firm on 1st July | = | Loan amount | + | Amount of Interest |

|

|

|

|

|

| = | 1,00,000 | + | 4,000 |

| = | Rs 1,04,000 |

|

|

Adjustment of Goodwill

Q21) From the following Trial Balance of Ajit and Sujit, you are required to prepare a Trading and Profit & Loss A/c for the year ended 31st December 2003 and a Balance Sheet as on that date:

Trial Balance Sheet as on 31st December 2003

Particulars | Debit Rs. | Credit Rs. | Particulars | Debit Rs. | Credit Rs. |

Capital A/c: Ajit Sujit Drawing A/c Ajit Sujit Stock on 1-1-2003 Bills Receivable Purchases and Sales Return Salaries |

2,000 1,000 44,000 1,800 1,90,000

6,000 10,000 |

60,000 40,000

3,02,000

2,000 | Carriage Outward Wages Insurance Discount Received Postage (Debtors and Creditors) Furniture Cash in Hand Machinery Rent & Taxes (Printing & Stationery) |

1,400 24,000 1,600

800

70,400

24,000 9,800 80,000 1,200

400 4,68,400 |

200

64,200

4,68,400 |

Adjustments:

- The closing stock on 31st December 2003 was valued at Rs. 56,000.

- The outstanding expenses were: (a) Wages Rs. 2,000 and (b) Salaries Rs. 930.

- Goods of Rs. 2,000 were distributed as free samples.

- Interest on partner’s capital was to be provided at 7% p.a.

- Prepaid Insurance was Rs. 100.

- Depreciation was to be provided on furniture at 10% and on machinery at 5%.

- A reserve for bad and doubtful debts was to be created at 5% of sundry debtors.

A21)

In the books of Ajit & Sujit

Trading, Profit & Loss A/c for the year ended 31st Dec, 2003

Particulars | Amount (Rs) | Amount (Rs) | Particulars | Amount (Rs) | Amount (Rs) |

To Opening stock |

| 44,000 | By Sales Less : Return Inwards | 3,02,000 6,000 |

2,96,000 |

To Purchase Less : Return Outwards | 1,90,000 (2,000) |

1,88,000 | By Goods Given as Samples (3) |

| 2,000 |

To Wages Add : Outstanding (2) | 24,000 2,000 |

26,000 | By Closing Stock (1) |

| 56,000 |

To Gross Profit c/d |

| 96,000 |

|

|

|

|

|

|

|

|

|

Total |

| 3,54,000 | Total |

| 3,54,000 |

|

|

|

|

|

|

To Salaries | 10,000 |

| By Gross Profit b/d |

| 96,000 |

Add : Outstanding (2) | 930 | 10,930 | By discount Received |

| 200 |

To Insurance Less : Prepaid (5) | 1,600 (100) |

1,500 |

|

|

|

To Postage |

| 800 |

|

|

|

To Rent & Taxes |

| 1,200 |

|

|

|

To Printing & stationery |

| 400 |

|

|

|

To Carriage Outwards |

| 1,400 |

|

|

|

To free Samples Given (3) |

| 2,000 |

|

|

|

To Reserve for Doubtful Debt (5% of 70,400) (7) |

| 3,520 |

|

|

|

To Depreciation : (6) Machinery (5% of 80,000) Furniture (10% of 24,000) |

4,000 2,400 | 6,400 |

|

|

|

To Net Profit c/d |

| 68,050 |

|

|

|

|

|

|

|

|

|

Total |

| 96,200 | Total |

| 96,200 |

|

|

|

|

|

|

To Interest on Capitals : (4) Ajit (7% of 60,000) Sujit (7% of 40,000) |

4,200 2,800 |

7,000 | By Net Profit b/d |

| 68,050 |

To Net profit transferred: Ajit Sujit |

30,525 30,525 |

61,050 |

|

|

|

|

|

|

|

|

|

Total |

| 68,050 | Total |

| 68,050 |

Balance Sheet as on 31st Dec, 2003

Liabilities | Amount (Rs) | Amount (Rs) | Assets | Amount (Rs) | Amount (Rs) |

Capital Account of Ajit: |

|

| Machinery | 80,000 |

|

Balance b/d | 60,000 |

| Less : Depreciation (6) | (4,000) | 76,000 |

Add : Interest (4) | 4,200 |

| Furniture | 24,000 |

|

Add : Net Profit | 30,525 |

| Less : Depreciation (6) | (2,400) | 21,600 |

| 94,725 |

|

|

|

|

Less : Drawings | (2,000) | 92,725 |

|

|

|

|

|

|

|

|

|

Capital Account of Sujit: |

|

| Prepaid Insurance (5) |

|

|

Balance b/d | 40,000 |

| Stock (1) |

|

|

Add : Interest (4) | 2,800 |

| Debtors | 70,400 |

|

Add : Profit | 30,525 |

| Less : Reserve for D.D (7) | (3,520) | 66,880 |

| 73,325 |

| Bills Receivable |

| 1,800 |

Less : Drawings | (1,000) | 72,325 | Cash in Hand |

| 9,800 |

Sundry Creditors |

| 64,200 |

|

|

|

Outstanding Expenses : (2) |

|

|

|

|

|

Wages | 2,000 |

|

|

|

|

Salaries | 930 | 2,930 |

|

|

|

|

|

|

|

|

|

Total |

| 2,32,180 | Total |

| 2,32,180 |

Notes:

- In absence of information, partner’s share is assumed to be equal.

- Numbers written in brackets are effect of adjustment numbers.

Q20) A, B and C carried on business in partnership as Ready Made Cloth Dealers. The partnership agreement provided that –

- The partners were to be credited at the end of each year with interest at 5% per annum on Opening Balance of Capital.

- No Interest was to be charged on drawings.

- Profits and Losses were to be shared as to A5, B 3 and C2. It was agreed that C’s Share of profit in any should not be less than Rs. 10,000 and any deficiency in such share was to be borne by the other two partners in their profit sharing ratio.

Trial Balance of the Partnership as on 31stDecember 2003

Account | Debit Rs. | Credit Rs. |

Shop Fittings (at cost) Freehold Premises Leasehold Premises Purchased During the year Additions and Alterations to Leasehold Premises Purchases Stock as at 1-1-2003 Salaries and wages Office and Trade Expenses Rent, Rates and Insurance Professional Charges Debtors Balance at Central Bank Ltd. Partners Capital Account: A B C Partners Current Account: A B C Sales Trade Creditors Depreciation Reserve Reserve for Doubtful Debts Drawings Other Than Monthly Payments: A B C

| 36,000 60,000 45,000 25,000 2,80,000 42,000 64,000 45,200 10,500 3,500 20,600 43,700

- - -

- - - - - - -

7,000 6,000 4,000 6,92,500 | - - - - - - - - - - - -

80,000 50,000 30,000

16,000 8,000 12,000 4,45,000 37,000 14,000 500

- - - 6,92,500 |

You are given the following additional information:

- Stock on December 31, 2003 was valued at the market value of Rs. 35,000 but if valued at cost it was Rs. 42,000.

- Goods worth Rs. 1,000 were destroyed by fire and the Insurance Company has admitted claim for Rs. 700 only.

- A debt of Rs. 600 is to be written off and provision for doubtful debts is to be at 5%.

- Salaries and wages include the following monthly drawings by the partners: A: Rs. 500; B: Rs. 300 and C: Rs. 250.

- Partners had during the year been supplied with goods worth Rs. 600 to A and Rs. 400 to B

- On December 31, 2003 rates paid in advance and office and trade expenses owing were Rs. 2,500 and Rs. 2,100 respectively.

- Depreciation of shop fittings to be provided at 5% p.a. On cost.

- Professional Charges include Rs. 2,500 fees paid in respect of the acquisition of leasehold premises.

- The cost of addition and alterations to the leasehold premises were to be written off over 25 years commencing from 1-1-2003.

You are requested to prepare the Trading Account and Profit & Loss Account for the year ending. 31st December, 2001 and Balance Sheet as at 31st December 2003.

A22)

In the books of A, B & C

Profit & Loss A/c for the year ended 31 Dec, 2003

Particulars | Amount (Rs) | Amount (Rs) | Particulars | Amount (Rs) | Amount (Rs) | |

To Salaries & Wages Less : Salaries to Partners | 64,000 (12,600) | 51,400 | By Gross Profit b/d |

| 1,60,000 | |

To Office/ Trade Expenses Add: Outstanding | 45, 200 2,100 | 47,300 |

|

|

| |

To Rent, Rates & Insurance Less : Prepaid Rates | 10,500 (2,500) |

|

|

|

| |

To Professional Charges Less: Expenses on acquisition of Leasehold Premises | 3,500

(2,500) | 1,000 |

|

|

| |

To Bad Debts Add: RDD (New) | 600 1,000 |

|

|

|

| |

| 1,600 |

|

|

|

| |

Less : RDD (Old) | (500) | 1,100 |

|

|

| |

To Depreciation on : Leasehold Premises Shop Fitting | 2,900 1,800 | 4,700 |

|

|

| |

To Goods Destroyed by Fire (Cost Less Insurance claim) |

| 300 |

|

|

| |

To Net Profit c/d |

| 46, 200 |

|

|

| |

Total |

| 1,60,000 | Total |

| 1,60,000 | |

Profit & Loss Appropriation A/c | ||||||

Particulars | Amount (Rs) | Amount (Rs) | Particulars | Amount (Rs) | Amount (Rs) | |

To Interest on Partner’s Capitals |

| 8,000 | By Net Profit b/d |

| 46,200 | |

To Net Profit transferred to Current A/c - A (28,200 x 5/8) - B (28,200 x 3/8) - C (minimum guaranteed) | 17,625 10,575

10,000 | 38,200 |

|

|

| |

Total |

| 46,200 | Total |

| 46,200 | |

Balance Sheet as on 31 Dec, 2003

Liabilities | Amount (Rs) | Amount (Rs) | Assets | Amount (Rs) | Amount (Rs) |

Capital Accounts: - A - B - C | 80,000 50,000 30,000 | 1,60,000 | Fixed Assets: Shop fitting (at Cost)

Less: Dep. Upto Current year (14,000 + 1,800) | 36,000 15,800 | 20,200 |

Current Accounts: - A - B - C | 24,025 11,075 16,500 | 51,600 | Freehold Premises |

| 60,000 |

Trade Creditors |

| 37,000 | Leasehold Premises Add: Addition during the Year Add: Expenses on acquisition of Leasehold Premises | 45,000

25,000

2,500 72,500 |

|

Outstanding office & Trade Expenses |

| 2,100 | Less: Depreciation (1/25) | (2,900) | 69,600 |

|

|

| Debtors Less Bad Debts | 20,600 (600) |

|

|

|

|

| 20,000 |

|

|

|

| Less : Provision for bad debts | (1,000) | 19,000 |

|

|

| Balance at Central bank Ltd. |

| 43,700 |

|

|

| Insurance Claim Receivable |

| 700 |

|

|

| Prepaid Rates |

| 2,500 |

|

|

| Closing stock |

| 35,000 |

|

|

|

|

|

|

Total |

| 2,50,700 | Total |

| 2,50,700 |

Partner’s Current Accounts

Particulars | A (Rs) | B (Rs) | C (Rs) | Particulars | A (Rs) | B (Rs) | C (Rs) |

To Drawing | 7,000 | 6,000 | 4,000 | By Balance b/d | 16,000 | 8,000 | 12,000 |

To Drawing (salary) | 6,000 | 3,600 | 3,000 | By Interest on capital | 4,000 | 2,500 | 1,500 |

To Drawing (goods) | 600 | 400 |

| By Profit & Loss A/c | 17,625 | 10,575 | 10,000 |

To Balance c/d | 24,025 | 11,075 | 16,500 |

|

|

|

|

Total | 37,625 | 21,075 | 23,500 | Total | 37,625 | 21,075 | 23,500 |

Q21) A and B were partners sharing profits and losses in the ratio of 3:2. With effect from 1-10-2002, C joins as a third partner. The new profit sharing ratio was 2:2:1.

The following is their trial balance as on 31st March, 2003:

Particulars | Dr. Rs. | Cr. Rs. |

A’s Drawings and Capital B’s Drawings and Capital C’s Drawings and Capital Opening Stock (1-4-2002) Purchases and Sales Wages Furniture General Expenses Selling Expenses Debtors and Creditors Cash and Bank Balance Amount brought by C (for his share of Goodwill) | 15,000 10,000 5,000 30,000 9,00,000 1,40,000 2,00,000 60,000 14,000 6,26,000 3,50,000 - 23,50,000 | 3,00,000 2,00,000 1,50,000 - 14,00,000 - - - - 2,50,000 - 50,000 23,50,000 |

Other Information:

- Stock on 31-3-2003 was Rs. 1,80,000.

- Purchases from 1-4-2002 to 30-9-2002 were Rs. 4,00,000.

- Sales from 1-4-2002 to 30-9-2002 were Rs. 6,00,000.

- Wages from 1-4-2002 to 30-9-2002 were Rs. 60,000.

- Stock on 30-9-2002 was Rs. 80,000.

- Furniture worth Rs. 1, 00,000 was purchased 1-1-2003. Write off depreciation on furniture at 20% p.a.

- Interest on partner’s capital is to be provided at 12% p.a.

- No Interest is to be charged on partners drawings.

You are required to prepare:

- Trading A/c containing the columns for: 1-4-2002 to 30-9-2002 and 1-10-2002 to 31-3-2003.

- Profit & Loss A/c containing the columns for: 1-4-2002 to 30-9-2002 and 1-10-2002 to 31-3-2003.

- Balance sheet as on 31st March, 2003.

A23)

M/s A, B, C

Trading, Profit & Loss A/c for the year ended 31st March, 2003

Particulars | Apr-Sep (Rs) | Oct-Mar (Rs) | Particulars | Apr-Sep (Rs) | Oct-Mar (Rs) |

To Opening Stock | 30,000 | 80,000 | By Sales | 6,00,000 | 8,00,000 |

To Purchases | 4,00,000 | 5,00,000 |

|

|

|

To Wages | 60,000 | 80,000 | By Closing Stock | 80,000 | 1,80,000 |

|

|

|

|

|

|

To Gross Profit c/d | 1,90,000 | 3,20,000 |

|

|

|

|

|

|

|

|

|

Total | 6,80,000 | 9,80,000 | Total | 6,80,000 | 9,80,000 |

|

|

|

|

|

|

To General Expenses (WN2) | 30,000 | 30,000 | By Gross Profit b/d | 1,90,000 | 3,20,000 |

To Selling Expenses (WN2) | 6,000 | 8,000 |

|

|

|

To Depreciation on Furniture (WN 3) | 10,000 | 15,000 |

|

|

|

|

|

|

|

|

|

To Net Profit c/d | 1,44,000 | 2,67,000 |

|

|

|

|

|

|

|

|

|

Total | 1,90,000 | 3,20,000 | Total | 1,90,000 | 3,20,000 |

|

|

|

|

|

|

To Interest on Capital |

|

| By Net Profit b/d | 1,44,000 | 2,67,000 |

A(3 L x 12% x 1/2) | 18,000 | 18,000 |

|

|

|

B(2 L x 12% x 1/2) | 12,000 | 12,000 |

|

|

|

C(1.5 L x 12% x 1/2) | - | 9,000 |

|

|

|

|

|

|

|

|

|

To Net Profit trfd to Partner’s capital |

|

|

|

|

|

A (3/5) (2/5) | 68,400 | 91,200 |

|

|

|

B (2/5) (2/5) | 45,600 | 91,200 |

|

|

|

C ( - ) (1/5) | - | 45,600 |

|

|

|

|

|

|

|

|

|

Total | 1,44,000 | 2,67,000 | Total | 1,44,000 | 2,67,000 |

Partner’s Capital A/c

Particulars | A | B | C | Particulars | A | B | C |

To Drawings | 15,000 | 10,000 | 5,000 | By Balance b/d | 3,00,000 | 2,00,000 | - |

To Balance c/d | 5,30,600 | 3,50,800 | 1,99,600 | By Bank | - | - | 1,50,000 |

|

|

|

| By Interest | 36,000 | 24,000 | 9,000 |

|

|

|

| By Goodwill (WN1) | 50,000 | - | - |

|

|

|

| By Net Profit | 1,59,600 | 1,36,800 | 45,600 |

Total | 5,45,600 | 3,60,800 | 2,04,600 | Total | 5,45,600 | 3,60,800 | 2,04,600 |

Balance Sheet as on 31st March, 2003

Liabilities | Amount (Rs) | Amount (Rs) | Assets | Amount (Rs) | Amount (Rs) |

Partner’s capitals |

|

| Furniture | 2,00,000 |

|

A | 5,30,600 |

| Less: Depreciation | (25,000) | 1,75,000 |

B | 3,50,800 |

| Debtors |

| 6,26,000 |

C | 1,99,600 | 10,81,000 | Stock |

| 1,80,000 |

|

|

| Cash & Bank |

| 3,50,000 |

Creditors |

| 2,50,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

| 13,31,000 | Total |

| 13,31,000 |

Working Notes:

- Sacrifice by partners

SR = OR – NR

A = (3/5) - (2/5) = 1/5

B = (2/5) - (2/5) = NIL

2. General Expenses: Time Basis & Selling Expenses: Sales Basis.

3. Depreciation on Furniture

Particulars | Total | Before Admission | After Admission |

Opening (1,00,000 x 20%) | 20,000 | 10,000 | 10,000 |

Purchases (1,00,000 x 20% x 3/12) | 5,000 | - | 5,000 |