Unit VI

Cash Flow Statement

Question Bank:

Q1). Define Cash flow.

A1). Cash flows are recorded on the company's cash flow statement. This statement (one of the company's key statements) shows the actual inflows and outflows of cash (or cash-like assets) from its investment activities. This is a mandatory report under generally accepted accounting principles (GAAP)

This is different from the income statement, which records data and transactions that may not be fully realized, such as uncollected income and unpaid income. On the other hand, this information is already entered in the cash flow statement, which gives you a more accurate picture of how much cash your company is generating.

Q2). Classify cash flow statement.

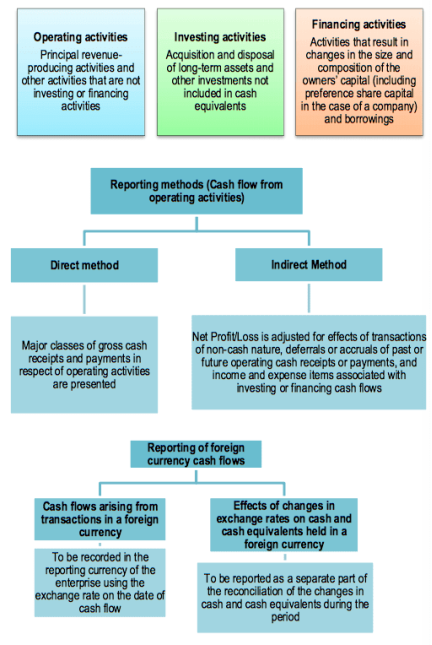

A2). The cash flow statement allows you to classify cash flow sources into three different categories:

- Cash Flow from Operating Activities: Cash generated from the general or core business of the business is listed in this category.

- Cash Flows from Investing Activities: This section describes the cash flows spent on investments such as new equipment.

- Cash Flows from Financing Activities: This category includes all transactions involving the debtor, such as income from new debt and dividends paid to investors.

Q3). Draw the specimen of Cash flow

A3). Specimen of Cash Flow

Cash flow statement for XYZ business

For the year ended 31st December 2020

CASH FLOW FROM OPERATING ACTIVITIES

Cash receipts from customer

Cash paid to supplier

Cash paid to employees

Cash paid for other operating expenses

Cash generated from operations

Dividend received *

Interest received

Interest paid

Tax paid

Net cash flow from operating activities

CASH FLOW FROM INVESTING ACTIVITIES

Proceeds from capital contributed

Proceeds from loan

Payment of loan

Net cash flow from financing activities

CASH FLOW FROM FINANCING ACTIVITIES

Proceeds from capital contributed

Proceeds from loan

Payment of loan

Net cash flow from financing activities

NET INCREASE /DECREASE IN CASH

Cash at the beginning of the period

Cash at the end of period

A company receives an inflow of cash income from selling goods, providing services, selling assets, earning interest on investments, renting, acquiring loans, or issuing new shares. Cash outflows can result from purchases, loan repayments, business expansions, payroll payments, or dividend distributions.

Investors and lenders have liquidity and cash on hand because the Securities and Exchange Commission (SEC) requires all listed companies to use accrual accounting and largely ignores the actual balance of cash on hand. It relies on cash flow statements to evaluate flow management. It's a more reliable tool than the metrics companies use to dress up their earnings, such as interest, taxes, depreciation, and earned before interest (EBITDA)

Q4). Define Cash and cash equivalents

A4). Cash equivalents are held by a corporation to satisfy its short-term cash commitment on behalf of an investment or other such purpose. For investments that qualify as cash equivalents:

1. The investment must be easily convertible to cash

2. Must be exposed to a really low level of risk regarding changes in its value

Therefore, an investment is taken into account a debt instrument as long as such investment features a short maturity within 3 months from the date of acquisition.

The AS 3 income statement states that movements between items that form a part of cash or cash equivalents should be excluded because they are part of a company's cash management, not business, financing, and investment activities. Cash management consists of investing surplus take advantage cash equivalents.

Q5). What is Investment activities. Give some examples.

A5) Cash flows from investing activities represent outflows for cash flows and resources aimed toward generating future income. For example:

- Cash purchased the acquisition of fixed assets

- Cash received from the disposal of fixed assets (including intangible assets)

- Cash paid to accumulate shares, warrants or debt certificates of other companies and equity interests in joint ventures

Q6). Explain Income from investment and financing activities.

A6). An entity must separately record all major classes of money receipts and payments resulting from financial and investment activities, except people who got to be reported on a net basis.

- Net-based income

Cash flows from any of the subsequent operating, financing or investing activities could also be reported in net form.

- Cash income and payments on behalf of the client if the cash flows reflect the activities of such clients instead of the activities of the corporate itself.

- Revenue and cash payments for products with large amounts, fast sales and short maturities

Cash flows from each of the subsequent activities of a financial company could also be reported in net form.

- Cash income and payments for receipt and repayment of fixed-maturity deposits

- Placement and withdrawal of deposits from other financial companies

- Loans and cash advance payments are provided to Customer / Customer and repayment of such loans and advance payments.

B. Foreign currency cash flow

Cash flows from transactions in foreign currencies should be recorded in the company's reporting currency using the following methods:

Foreign currency amount * FX rates the exchange rate between the cash flow date report and the foreign currency.

If the result is similar to using the cash flow date rate, you can use a rate that is close to the actual rate.

The impact of exchange rate fluctuations on cash and cash equivalents held in foreign currencies must be reported as a separate and separate part of the adjustment of changes in cash and cash equivalents during the period.

Q7). Write short note on Acquisition and disposal of business divisions including subsidiaries.

A7). Total cash flows from acquisitions and disposals of business units, including subsidiaries, must be viewed as investment activity and reported separately.

An entity must provide a complete of the subsequent for both acquisitions and disposals of other business units, including subsidiaries, within the subsequent period:

(A) Total purchase or disposal

(B) Purchase or disposal price discharged as cash and cash equivalents

Q8). Explain Cash flow as per accounting standards.

A8). Cash flow as per accounting standards:

- Applicability of AS3 income Statement

The applicability of the income statement is defined under the businesses Act 2013. As defined by the law, financial statements include:

I. Record

Ii. Profit and Loss Account / Balance Account

Iii. Income statement

Iv. Statement of changes in shareholders' equity, etc.

v. Annotation

Therefore, the income statement must be prepared by all companies, but the law also specifies certain categories of companies that are exempt from an equivalent.

For eg: One Person Company (OPC), Small Company, and Dormant Company.

- OPC means a corporation with just one member.

- SMEs are private companies with a maximum paid-up capital of Rupees. The utmost sales are 500,000 rupees. 2 rolls.

- A dormant company is an inactive company that's established for future projects or simply to carry assets and has no significant transactions.

2. Cash and cash equivalents

Cash equivalents are held by a corporation to satisfy its short-term cash commitment on behalf of an investment or other such purpose. For investments that qualify as cash equivalents:

1. The investment must be easily convertible to cash

2. Must be exposed to a really low level of risk regarding changes in its value

Therefore, an investment is taken into account a debt instrument as long as such investment features a short maturity within 3 months from the date of acquisition.

The AS 3 income statement states that movements between items that form a part of cash or cash equivalents should be excluded because these are a part of a company's cash management, not business, financing, and investment activities.

Cash management consists of investing surplus take advantage cash equivalents.

3. View income

The income statement must represent the cash flows within the amount during which they're categorized as follows:

A. Sales activities

B. Investment

C. Financing activities

Companies got to prepare and present cash flows from operations, financing, and investment activities during a way that suits their business.

Grouping activities provides information that permits users to assess the impact of such activities on the company's overall financial position and to assess the worth of money and cash equivalents.

A. Sales activities

Cash flow from operating activities comes primarily from activities that generate the company's main revenue. For example:

- Cash received from the sale of products and services

- Cash received in fees, royalties, commissions, and various other sorts of revenue

- Cash paid to suppliers of products and services

B. Investment activities

Cash flows from investing activities represent outflows for cash flows and resources aimed toward generating future income. For example:

- Cash purchased the acquisition of fixed assets

- Cash received from the disposal of fixed assets (including intangible assets)

- Cash paid to accumulate shares, warrants or debt certificates of other companies and equity interests in joint ventures

C. Financing activities

Financing activities are activities that change the composition and size of the owner's capital and therefore the company's debt. For example:

- Cash received from the issuance of shares or other similar securities

- Cash received from the issuance of loans, corporate bonds, bonds, bills, and other short-term or long-term debt

- Repayment of debt

4. Income from operating activities

Companies should report cash flows from operating activities using:

1. Direct method-if all major classes of money receipt and payment are presented. Or

2. Indirect method – If net or loss is adjusted as follows:

a) Impact of non-cash transactions like depreciation, deferred taxes and provisions.

b) Income or deferral of future or past operating cash income or payments

c) Expenses or income related to income financing or investment

5. Income from investment and financing activities

An entity must separately record all major classes of money receipts and payments resulting from financial and investment activities, except people who got to be reported on a net basis.

C. Net-based income

Cash flows from any of the subsequent operating, financing or investing activities could also be reported in net form.

- Cash income and payments on behalf of the client if the cash flows reflect the activities of such clients instead of the activities of the corporate itself.

- Revenue and cash payments for products with large amounts, fast sales and short maturities

Cash flows from each of the subsequent activities of a financial company could also be reported in net form.

d. Cash income and payments for receipt and repayment of fixed-maturity deposits

e. Placement and withdrawal of deposits from other financial companies

f. Loans and cash advance payments are provided to Customer / Customer and repayment of such loans and advance payments.

D. Foreign currency cash flow

Cash flows from transactions in foreign currencies should be recorded in the company's reporting currency using the following methods:

Foreign currency amount * FX rates the exchange rate between the cash flow date report and the foreign currency.

If the result is similar to using the cash flow date rate, you can use a rate that is close to the actual rate.

The impact of exchange rate fluctuations on cash and cash equivalents held in foreign currencies must be reported as a separate and separate part of the adjustment of changes in cash and cash equivalents during the period.

6. Special items, dividends and profits

Cash flows related to special items should be categorized as originating from operating, financing, or investing activities, as appropriate and clearly disclosed.

Cash flows from receiving and paying dividends and interest must be disclosed separately. For financial companies, cash flows from receiving and paying dividends and interest should be categorized as cash flows from operating activities.

For other companies, cash flows from interest expense should be categorized as cash flows from financing activities, while dividends and interest received should be categorized as cash flows from investing activities.

7. Tax on income

Income tax cash flows must be disclosed separately and reported as cash flows from operating activities unless they may be explicitly related to investment and financing activities.

8. Acquisition and disposal of business divisions including subsidiaries

Total cash flows from acquisitions and disposals of business units, including subsidiaries, must be viewed as investment activity and reported separately.

An entity must provide a complete of the subsequent for both acquisitions and disposals of other business units, including subsidiaries, within the subsequent period:

(A) Total purchase or disposal

(B) Purchase or disposal price discharged as cash and cash equivalents

9. Non-cash transaction

Financing and investment transactions that do not require cash or cash equivalents should not be included in the cash flow statement. These transactions must be presented elsewhere in the financial statements in a way that provides relevant information regarding such financing and investment activities.

10. Disclosure

An entity must disclose the amount of substantial unusable cash and cash equivalents it holds, along with management commentary. Commitments that may result from discounted bills of exchange and other similar obligations undertaken by an entity are usually disclosed in the financial statements by note, even if the likelihood of loss is low.

Q9). Differentiate between AS3 and IndAS7

A9). Main differences between AS3 and IndAS7

Details

| AS3 Cash Flow Statement

| Ind AS7 Cash Flow Statement |

Bank Overdrafts

| AS3 does not have such a requirement

| Ind AS 7 explicitly includes bank overdraft as a part of cash and cash equivalents to be repaid for the asking |

Cash Flows from Extracurricular Activities.

| AS3 requires that cash flows related to extracurricular activities be classified as cash flows from operating activities, financing activities, and investing activities. | IndAS7 does not include such a requirement |

Changes in ownership of subsidiary | There are no such requirements for cash flows from changes in ownership of subsidiary AS3

| Ind AS 7 requires a classification of cash flows resulting from changes in ownership of subsidiaries. This will not lose your control as cash. Flow from financial activities |

Accounting for investments in subsidiaries or affiliates .

| AS 3 does not have such a requirement | Ind AS 7 requires the use of the cost method or equity method when accounting for investments in subsidiaries or affiliates |

Disclosure Requirements | AS3 requires less disclosure requirements compared to Ind AS 7. | Ind AS 7 requires more disclosure requirements.

|

Q10). Show the Specimen of Cash Flow Statement.

A10) The Specimen of Cash Flow Statement:

Q11). From the overview of the Cash Account of x INC., we have finished using the 31st March2007 direct method of preparing the cash flow statement of the year according to AS-3. We have no cash equivalents.

Summary (cash account ) 31.3.2007

Summary (cash account ) 31.3.2007

| Rs |

| Rs |

To balance b/d 1.4.2006 | 50 | By payment to supplier | 2,000 |

To equity shares | 300 | By purchase of fixed asset | 200 |

To receipt from customer | 2,800 | By overheard expenses | 200 |

To sale of fixed asset | 100 | By wages & salaries | 100 |

|

| By taxation | 250 |

|

| By dividend | 50 |

|

| By repayment of loan | 300 |

|

| By balance c/d | 150 |

| 3,250 |

| 3,250 |

A11)

Cash flow statement

For the year ended 31st march 2007

(A) Cash flow from operating activities |

|

|

Cash from customer | 2800 |

|

Cash payment to suppliers | (2,000) |

|

Cash paid for overhead expenses | (200) |

|

Cash paid for salaries | (100) |

|

Cash generated from operations | 500 |

|

Income tax paid | (250) |

|

Net cash from operating activities |

| 250 |

(B) Cash flows from investing activities |

|

|

Purchase of fixed assets | (200) |

|

Cash from sale of fixed assets | 100 |

|

Net cash used in investing activities |

| (100) |

© cash flow from financing activities |

|

|

Issue of equity shares | 300 |

|

Repayment of loan | (300) |

|

Payment of dividends | (50) |

|

Net cash used in financing activities |

| (50) |

Net increase in cash & cash equivalent |

| 100 |

Cash and cash equivalent (1.4.06) |

| 50 |

Cash and cash equivalent (31.3 .07) |

| 150 |

Q12). Create a cash flow statement for Suryan Corporation. From: additional information:

Balance sheet

Liabilities | 1.1.06 Rs | 31.12.06 Rs | Assets | 1.1.06 Rs | 31.12.06 Rs |

Share capital | 1,00,000 | 4,00,000 | Goodwill | - | 20,000 |

8% debenture | - | 2,00,000 | Machinery | 1,25,000 | 4,75,000 |

Retained earnings | 60,000 | 90,000 | Stock | 20,000 | 80,000 |

Creditors | 40,000 | 1,00,000 | Debtor | 30,000 | 1,00,000 |

Bills payable | 20,000 | 40,000 | Cash at bank | 50,000 | 1,50,000 |

Provision for tax | 30,000 | 40,000 | Cash in hand | 25,000 | 45,000 |

| 2,50,000 | 8,70,000 |

| 2,50,000 | 8,70,000 |

Other information:

(a) During 2006, the sole trader's business was purchased by issuing shares of Rs. 2, 00,000. The assets acquired from him were: goodwill Rs. 20,000, machine Rs. 1, 00,000, 50,000 and debtors Rs. 30,000.

(b) The provision for the tax imposed in 2006 was Rs. 35,000.

(c) Corporate bonds were issued at a 5% premium included in retained earnings.

(d) The depreciation levied on the machine was Rs. 30,000.

A12)

Cash flow statement of suryan Ltd.,

For the year 2006

Particular | Rs | Rs |

|

|

|

Profit before tax and extraordinary items | 55,000 |

|

Adjustment for: |

|

|

Depreciation on machinery | 30,000 |

|

Operating profit before working capital changes | 85,000 |

|

Increase in creditors ( 1,00,000-40,000) | 60,000 |

|

Increase in bills payable (40,000-20,000) | 20,000 |

|

Increase in stock (excluding stock bought by issue of shares) (80,000-50,000-20,000) | (10,000) |

|

Increase in debtors (excluding debtors acquired by issue of shares) (1,00,000-30,000-30,000) | (40,000) |

|

Cash outflow from operations | 1,15,000 |

|

Income tax paid |  |

|

Net cash from operating activities |

| 90,000 |

II. Cash flow from investing activities |

|

|

Machinery purchased for cash |  |

|

|

| 2,80,000 |

III. Cash flow from financing activities : |

|

|

Cash proceeds from issue of shares |  |

|

Cash proceeds from issue of debenture |  |

|

Net cash flow from financing activities |

|  |

Net increase in cash and cash equivalets |

| 1,20,000 |

Add: cash and cash equivalent at the beginning of the year |

| 75,000 |

Cash and cash equivalent at the end of the year |

| 1,95,000 |

Working:-

| Rs |

Closing retained earning | 90,000 |

Less: opening retained earning | 60,000 |

| 30,000 |

Add: provision made for tax | 35,000 |

| 65,000 |

Less: premium on issue of debenture ( 2,00,000*5%) | 10,000 |

Net profit before tax and extraordinary items | 55,000 |

2. Provision for tax account

| Rs |

| Rs |

To bank ( tax paid) (balancing figure) | 25,000 | By balance b/d | 30,000 |

To balance c/d | 40,000 | By profit & loss (provision) | 35,000 |

| 65,000 |

| 65,000 |

3. Machinery account

| Rs |

| Rs |

To balance b/d | 1,25,000 | By depreciation | 30,000 |

To bank (purchase ) (balancing fig.) | 2,80,000 | By balance c/d | 4,75,000 |

To vendor (business purchase) | 1,00,000 |

|

|

| 5,05,000 |

| 5,05,000 |

4. Share capital account

| Rs |

| Rs |

To balance c/d | 4,00,000 | By balance b/d | 1,00,000 |

|

| By vendor A/c (business purchase) | 2,00,000 |

|

| By bank (issue for cash) | 1,00,000 |

| 4,00,000 |

| 4,00,000 |

5.

Debenture issue (face value) | 2,00,0,00 |

Add: premium on issue at 5% | 10,000 |

Total proceeds | 2,10,000 |

Q13). Make-out cash flow statement from the following balance sheet of Executive Corporation:

Liabilities | 2003 Rs | 2004 Rs | Assets | 2003 Rs | 2004 Rs |

Equity share capital | 3,00,000 | 4,00,000 | Goodwill | 1,15,000 | 90,000 |

8% redeemable preference share capital | 1,50,000 | 1,00,000 | Land & building | 2,00,000 | 1,70,000 |

General reserve | 40,000 | 70,000 | Plant | 80,000 | 2,00,000 |

Profit & loss | 30,000 | 48,000 | Debtors | 1,60,000 | 2,00,000 |

Proposed dividend | 42,000 | 50,000 | Stock | 77,000 | 1,09,000 |

Creditors | 55,000 | 83,000 | Bills receivable | 20,000 | 30,000 |

Bills payable | 20,000 | 16,000 | Cash in hand | 15,000 | 10,000 |

Provision for taxation | 40,000 | 50,000 | Cash at bank | 10,000 | 8,000 |

| 6,77,000 | 8,17,000 |

| 6,77,000 | 8,17,000 |

Other information:

(A) Depreciation of Rs. 10,000 and Rs. 20,000 were filled with plants and land and buildings in 2004.

(B) Interim dividend of Rs. 20,000 has been paid in 2004.

(C) Rs. 35,000 income tax paid between 2004

A13)

Cash flow statement

For the year ended 31st December 2004

| Rs | Rs |

(A) Cash flow from operating activities |

|

|

Net profit before tax and extraordinary item | 1,88,000 |

|

Adjustment for depreciation | 30,000 |

|

Profit from trading operations | 2,18,000 |

|

Increase in creditors | 28,000 |

|

Increase in debtors | (40,000) |

|

Increase in stock | (32,000) |

|

Increase in B/R | (10,000) |

|

Decrease in B/P | (4,000) |

|

Payment of tax | (35,000) |

|

Net cash provided from financial activities |

| 1,25,000 |

|

|

|

(B) Cash flow from investing activities |

|

|

Sale of land & building | 10,000 |

|

Purchase of plant | (1,30,000) |

|

Net cash used in investing activities |

| 1,20,000 |

© Cash flow from financial activities |

|

|

Issue of share capital | 1,00,000 |

|

Redemption of pref. Shares | (50,000) |

|

Payment of interim dividend | (20,000) |

|

Payment of dividend | (42,000) |

|

|

| (12,000) |

Net decrease in cash and cash equivalent |

| (7,000) |

Cash and cash equivalent as on 31. 3 . 2003 |

| 25,000 |

Cash and cash equivalent as on 31.3.2004 |

| 18,000 |

- Plant account

| Rs |

| Rs |

To balance b/d | 80,000 | By P&L account (Dep.) | 10,000 |

To bank ( purchase of plant ) | 1,30,000 | By balance c/d | 2,00,000 |

| 2,10,000 |

| 2,10,000 |

2. Land and building account

| Rs |

| Rs |

To balance b/d | 2,00,000 | By P&L. Account (Dep) | 20,000 |

|

| By bank (sale of land and building ) | 10,000 |

|

| By balance c/d | 1,70,000 |

| 2,00,000 |

| 2,00,000 |

3. Adjusted profit and loss account

| Rs |

| Rs |

To general reserve | 30,000 | By balance b/d | 30,000 |

To interim dividend | 20,000 | By profit before tax and extraordinary item | 1,88,000 |

To provision for taxation | 45,000 |

|

|

To goodwill | 25,000 |

|

|

To proposed dividend | 50,000 |

|

|

To balance c/d | 48,000 |

|

|

| 2,18,000 |

| 2,18,000 |

4. Proposed dividend account

| Rs |

| Rs |

To bank | 42,000 | By balance b/d | 42,000 |

To balance b/d | 50,000 | By profit and loss | 50,000 |

| 92,000 |

| 92,000 |

5. Provision for taxation account

| Rs |

| Rs |

To bank | 35,000 | By bank b/d | 40,000 |

To balance c/d | 50,000 | By profit &loss account | 45,000 |

| 85,000 |

| 85,00 |

Q14). The bank statement of the business company has increased during the last financial year by Rs.1, 50,000. In the same period it issued shares of Rs. Redeemed bonds of 2, 00,000 and Rs.1, 50,000. It purchased fixed assets for Rs. Charge depreciation of 40,000 and Rs.20, 000. The working capital of the company, other than the bank balance, was increased by Rs. Calculates the company's profit during the year of 1,15,000 transactions.

A14)

1, 50,000=profit+ 2, 00,000 – 1, 50,000 – 40,000 + 20,000 – 1,15,000

Profit=Rs.2, 35,000

Q15). The chemical company has a turnover of Rs. Cash costs of 50 lakh, Rs (including taxes).Depreciation of 35lakhs and rs.5 if the lax debtor is reduced over the period by Rs.6lakhs, what is the cash from the operation?

A15)

Cash from Operation = Rs.50 lakh-Rs 35 lakhs+Rs.6 Lakh = rupees.21 lax

There are two ways to convert net income from operating activities into net cash flow:

- Direct method, and

- Indirect methods.

Q16). The following information is available from the Exclusive Ltd books. For the year ended 31st March, 2016:

(a) This year's cash turnover was Rs.10, 00,000 and account Rs turnover.12, 00,000.

(b) Accounts payable payments for inventory totaled Rs.7, 80,000.

(c) The collection for accounts receivable was Rs.7, 60,000.

(d) The rent is paid in cash Rs.2, 20,000, excellent rent that has been rs.20, 000.

(e) 4, 00,000 shares of Rs.10 face value were issued for Rs.48, 00,000.

(f) The equipment was purchased for cash Rs.16, 80,000.

(g) Dividends equivalent to Rs.10, 00,000 were declared but still not paid.

(h) Rs.4, 00,000 of the dividends declared the previous year were paid.

(i) Equipment whose book value is Rs. It sold for 1, 60,000 rupees.2, 40,000.

(j) Cash accounts increased by Rs.37, 20,000.

Prepare an income statement using the direct method.

A16)

Cash flows from operating activities |

|

|

Cash receipts from customer (10,00,000+7,60,000) | 17,60,000 |

|

Cash paid to suppliers and for rent | (10,00,000) |

|

Net cash flows from operating activities |

| 7,60,000 |

Cash flows from investing activities |

|

|

Sale of equipment | 2,40,000 |

|

Purchase of equipment | (16,80,000) |

|

Net cash used in investing activities |

| (14,40,000) |

Cash flow from financing activities |

|

|

Issue of equity shares ( including premium) | 48,00,000 |

|

Dividend paid | (4,00,000) |

|

Net cash flows from financing activities (B) |

| 44,00,000 |

Net increase in cash and cash equivalents (A)+(B)+(C) |

| 37,20,000 |

Q17). Maduri Co., Ltd. Gives you the following information for the year that ended 31st March, 2016:

- Annual sales totaled Rs.96, 00,000. The company sells goods for cash only.

- The cost of the goods sold was 60% of sales.

- Closed stocks were higher than closed stocks by Rs.43, 000.

- Trade on 31st March, 2016 surpassed those on 31st March, 2015 by Rs.23, 000.

- The taxes paid amounted to Rs.7, 00,000.

- The depreciation of fixed assets in that year was Rs. For 3, 15,000 rupees, the other costs totaled Rs.21,45,000. Unpaid costs for the 31st March, 2015 and 31st March, 2016 totaled Rs.82,000 yen each,91,000

- New machine and furniture costing Rs.10,27,500 yen

- The issue of Rights was made from 50,000 shares of Rs.10 each at a premium of Rs. Received 3 whole monies per share.

- Dividends to sum Rs. 4, 00,000 were distributed among shareholders.

- Cash at hand and in the bank as of 31st March, 2015 totaled Rs.2,13,800.

You are required to organize an income statement using the direct method.

A17)

Cost of sales (60% of Rs 96,00,000) |

| 57,60,000 |

Add: expenses incurred |

| 21,45,000 |

Outstanding expenses on 31st march , 2015 |

| 82,000 |

Excess of closing inventory |

| 43,000 |

|

| 80,30,000 |

Less: excess of closing creditors over opening creditors | 23,000 |

|

Outstanding expenses on 31st march , 2016 | 91,000 | 1,14,000 |

|

| 79,16,000 |

Income from issuance of share capital:

Issue price of one share=Rs. 10 + Rs.3 = Rs.13

Income from the issuance of 50,000 shares=Rs. 13x50, 000 = Rs. 6, 50,000

Cash flow statement of Madhuri Ltd. For the year ended 31st march,2016

(A) Cash flow from operating activities |

|

|

Cash receipt from customer | 96,00,000 |

|

Cash paid to supplier and employees | (79,16,000) |

|

Cash inflow from operations | 16,84,000 |

|

Tax paid | (7,00,000) |

|

Net cash from operating activities |

| 9,84,000 |

(B) Cash flow from investing activities |

|

|

Purchase of fixed assets | (10,27,500) |

|

Net cash used in investing activities |

| (10,27,500) |

© cash flow from financing activities |

|

|

Proceeds from issue of share capital | 6,50,000 |

|

Dividend paid | (4,00,000) |

|

Net cash from financing activities |

| 2,50,000 |

Net increase in cash and cash equivalents (A+B+C) |

| 2,06,500 |

Cash and cash equivalent as on 31st march ,2015 |

| 2,13,800 |

Cash and cash equivalents as on 31st march ,2016 |

| 4,20,300 |

Q18). A summary of the caching extracted from the book of happy Co., Ltd.:

You should prepare the company's cash flow statement for the period ended in accordance with Indian Accounting Standards-31st March, 2016-3 (revised).

A18)

(A) Cash flow from operating activities |

|

|

Receipts from customer | 11,132 |

|

Payment to suppliers | (8,188) |

|

Payment of wages and salaries | (276) |

|

Payment of overheads | (460) |

|

Payment of taxes | (972) |

|

Net cash from operating activities |

| 1,236 |

(B) Cash flow from investing activities |

|

|

Proceeds on sale of fixed assets | 512 |

|

Acquisition of (payment) fixed assets | 920 |

|

Net cash used in investing activities |

| (408) |

© cash flow from financing activities |

|

|

Proceeds in issue of shares | 1,200 |

|

Payment of dividends | (320) |

|

Repayment of bank loans | (1,000) |

|

Net cash used in financing activities |

| (120) |

Net increase in cash and cash equivalent |

| 708 |

Cash and cash equivalent at the beginning of the period |

| 140 |

Cash and cash equivalent at the end of period |

| 848 |

Q19). The following information is available from the books of Standard Company Ltd.:

This is a calculated cash flow business.

Particular | 2015 | 2016 |

Profit made during the year |

| 2,50,000 |

Income received in advance | 500 | 600 |

Prepaid expenses | 1,600 | 1,400 |

Debtors | 80,000 | 95,000 |

Bills receivable | 25,000 | 20,000 |

Creditors | 45,000 | 40,000 |

Bills payable | 13,000 | 15,000 |

Outstanding expenses | 2,500 | 2,000 |

Accured income | 1,500 | 1,200 |

A19)

Profit made during the year |

| 2,50,000 |

Add: decrease in debtors | 15,000 |

|

Increase in creditors | 5,000 |

|

Increase in outstanding expenses | 500 | 20,500 |

|

| 2,70,500 |

Less: decrease in income received in advance | 100 |

|

Increase in prepaid expenses | 200 |

|

Increase in bills payable | 5,000 |

|

Decrease in bills payable | 2,000 |

|

Increase in accrued income | 300 | 7,600 |

Cash generated from operations |

| 2,62,900 |