Unit - 2

Capital budgeting

Q1) What is capital budgeting? State the significance of capital budgeting. 5

A1) Capital Budgeting is one of the appraising techniques of investment decisions. Capital Budgeting is defined as the firm’s decision to invest its current funds most efficiently in long term activities in anticipation of an expected flow of future benefits over a series of years.

Charles. T. Horngreen defined capital budgeting as ― “Long term planning for making and financing proposed capital out lay”.

Capital Budgeting decisions are considered important for a variety of reasons. Some of them are the following:

1) Crucial decisions: Capital budgeting decisions are crucial, affecting all the departments of the firm. So, the capital budgeting decisions should be taken very carefully.

2) Long-run decisions: The implications of capital budgeting decisions extend to a longer period in the future. The consequences of a wrong decision will be disastrous for the survival of the firm.

3) Large amount of funds: Capital budgeting decisions involve spending large amount of funds. As such proper care should be exercised to see that these funds are invested in productive purchases.

4) Rigid: Capital budgeting decision cannot be altered easily to suit the purpose. Because of this reason, when once funds are committed in a project, they are to be continued till the end, loss or profit no matter.

Q2) Define capital budgeting. Discuss the significance of capital budgeting in financial management. 5

A2) Capital Budgeting is one of the appraising techniques of investment decisions. Capital Budgeting is defined as the firm’s decision to invest its current funds most efficiently in long term activities in anticipation of an expected flow of future benefits over a series of years.

Charles. T. Horngreen defined capital budgeting as ― “Long term planning for making and financing proposed capital out lay”.

Capital budgeting decisions may be generally needed for the following purposes:

a) Expansion: The firm requires additional funds to invest in fixed assets when it intends to expand the production facilities in view of the increase in demand for their product in near future. Accordingly, the current assets will increase. In case of expansion the existing infrastructure – like plant, machinery and other fixed assets is inadequate, to carry out the increased production volume. Thus, the firm needs funds for such project. This will include not only expenditure on fixed assets (infrastructure) but also an increase in working capital (current assets).

b) Replacement: The machines and equipment used in production may either wear out or may be rendered obsolete due to new technology. The productive capacity and competitive ability of the firm may be adversely affected. The firm needs funds or modernisation of a certain machines or for renovation of the entire plant etc., to make them more efficient and productive. Modernization and renovation will be a substitute for total replacement, where renovation or modernization is not desirable or feasible, funds will be needed for replacement.

c) Diversification: If the management of the firm decided to diversify its production into other lines by adding a new line to its original line, the process of diversification would require large funds for long-term investment. For example, ITC and Philips company for their diversification.

d) Buy or Lease: This is a most important decision area in Financial Management whether the firm acquire the desired equipment and building on lease or buy it‖. If the asset is acquired on lease, there have to be made a series of annual or monthly rental payments. If the asset is purchased, there will be a large initial commitment of funds, but not further payments. The decision – making area is which course of action will be better to follow? The costs and benefits of the two alternative methods should be matched and compared to arrive at a conclusion.

e) Research and Development: The existing production and operations can be improved by the application of new and more sophisticated production and operations management techniques. New technology can be borrowed or developed in the laboratories. There is a greater need of funds for continuous research and development of new technology for future benefits or returns from such investments.

Q3) What are the different techniques of capital budgeting. 8

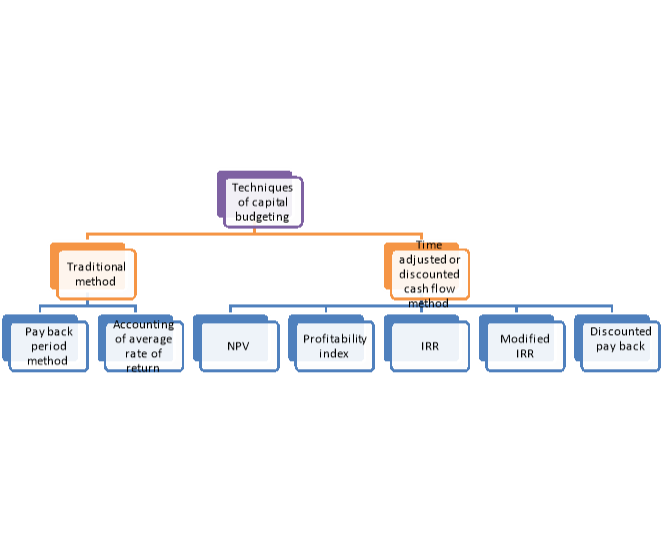

A3) The capital budgeting appraisal methods or techniques for evaluation of investment proposals will help the company to decide the desirability of an investment proposal, depending upon their relative income generating capacity and rank them in order if their desirability. These methods provide the company a set of normal method should enable to measure the real worth of the investment proposal. The appraisal methods should possess several good characteristics, which are mentioned as under. The capital budgeting techniques are highlighted in figure

Figure: Capital budgeting techniques

Payback Period

It is the most popular and widely recognized traditional methods of evaluating the investment proposals. It can be defined as the number of years to recover the original capital invested in a project. The payback period can be used as an accept or reject criterion as well as a method of ranking projects. The payback period is the number of years to recover the investment made in a project. If the payback period calculated for a project is less than the maximum payback period set-up by the company, it can be accepted. As a ranking method it gives the highest rank to a project which has the lowest payback period, and the lowest rank to a project with the highest payback period. Whenever a company faces the problem of choosing among two or more mutually exclusive projects, it can select a project on the basis of payback period, which has shorter period than the other projects.

Accounting Rate of Return

This technique uses the accounting information revealed by the financial statements to measure the profitability of an investment proposal. It can be determined by dividing the average income after taxes by the average investment. According to Soloman, Accounting Rate of Return can be calculated as the ratio, of average net income to the initial investment. On the basis of this method, the company can select all those projects whose ARR is higher than the minimum rate established by the company. It can reject the projects with an ARR lower than the expected rate of return. This method also helps the management to rank the proposal on the basis of ARR.

Accounting Rate of Return (ARR) = Original Investment Average Net Income

OR

Accounting Rate of Return (ARR) = Average Investment Average Net Income

Net Present Value

The net present value method is a classic method of evaluating the investment proposals. It is one of the methods of discounted cash flow techniques, which recognizes the importance of time value of money. It correctly postulates that cash flows arising at time periods differ in value and are comparable only with their equivalents i.e., present values. It is a method of calculating the present value of cash flows (inflows and outflows) of an investment proposal using the cost of capital as an appropriate discounting rate. The net present value will be arrived at by subtracting the present value of cash outflows from the present value of cash inflows. Steps to compute net present value:

(i) Estimation of future cash inflows

(ii) An appropriate rate of interest should be selected to discount the cash flows. Generally, this will be the ―cost of capital‖ of the company, or required rate of return.

(iii) The present value of inflows and outflows of an investment proposal has to be computed by discounting them with an appropriate cost of capital.

(iv) The net value is the difference between the present value of cash inflows and the present value of cash outflows.

The formula for the net present value can be written as:

NPV= C1 /(1+k)1 + C2 / (1+K)2 +C3 /(1+k)3 +…………. Cn /(1+K)n – I

Where,

C = Annual Cash inflows,

Cn = Cash inflow in the year n

K = Cost of Capital

I = Initial Investment

The Profitability Index

This method is also known as Benefit Cost Ratio ‘. According to Van Horne, the profitability Index of a project is ―the ratio of the present value of future net cash inflows to the present value of cash outflows. If the Profitability Index is greater than or equal to one, the project should be accepted otherwise reject. It can be calculated as follows-

Profitability Index = Present value of cash inflows/Present value of cash outflows

Discounted Payback

Under this method the discounted cash inflows are calculated and where the discounted cash flows are equal to original investment then the period which is required is called discounting payback period. While calculating discounting cash inflows the firm’s cost of capital has been used. It is calculated as-

Discounted payback period (DPP) = Investment/Discounted Annual cash in flow

Internal Rate of Return (IRR)

The internal rate of return method is also a modern technique of capital budgeting that takes into account the time value of money. It is also known as ‘time adjusted rate of return’ discounted cash flow’ ‘discounted rate of return,’ ‘yield method,’ and ‘trial and error yield method’.

In the net present value method, the net present value is determined by discounting the future cash flows of a project at a predetermined or specified rate called the cut-off rate. But under the internal rate of return method, the cash flows of a project are discounted at a suitable rate by hit and trial method, which equates the net present value so calculated to the amount of the investment.

Under this method, since the discount rate is determined internally, this method is called as the internal rate of return method. The internal rate of return can be defined as that rate of discount at which the present value of cash-inflows is equal to the present value of cash outflows.

Internal Rate of Return (IRR)

The internal rate of return method is also a modern technique of capital budgeting that takes into account the time value of money. It is also known as ‘time adjusted rate of return’ discounted cash flow’ ‘discounted rate of return,’ ‘yield method,’ and ‘trial and error yield method’.

In the net present value method, the net present value is determined by discounting the future cash flows of a project at a predetermined or specified rate called the cut-off rate. But under the internal rate of return method, the cash flows of a project are discounted at a suitable rate by hit and trial method, which equates the net present value so calculated to the amount of the investment.

Under this method, since the discount rate is determined internally, this method is called as the internal rate of return method. The internal rate of return can be defined as that rate of discount at which the present value of cash-inflows is equal to the present value of cash outflows.

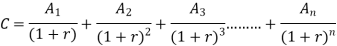

Where, C = Initial Outlay at time zer0.

A1, A2,………An = Future net cash flows at different periods.

2, 3,…., = number of years

r = rate of discount of internal rate of return.

Q4) Write a note on Payback period method. 5

A4) It is the most popular and widely recognized traditional methods of evaluating the investment proposals. It can be defined as the number of years to recover the original capital invested in a project. The payback period can be used as an accept or reject criterion as well as a method of ranking projects. The payback period is the number of years to recover the investment made in a project. If the payback period calculated for a project is less than the maximum payback period set-up by the company, it can be accepted. As a ranking method it gives the highest rank to a project which has the lowest payback period, and the lowest rank to a project with the highest payback period. Whenever a company faces the problem of choosing among two or more mutually exclusive projects, it can select a project on the basis of payback period, which has shorter period than the other projects.

The following are the merits of the payback period method:

(i) Easy to calculate: It is one of the easiest methods of evaluating the investment projects. It is simple to understand and easy to compute.

(ii) Knowledge: The knowledge of payback period is useful in decision-making, the shorter the period better the project.

(iii) Protection from loss due to obsolescence: This method is very suitable to such industries where mechanical and technical changes are routine practice and hence, shorter payback period practice avoids such losses.

(iv) Easily availability of information: It can be computed on the basis of accounting information, what is available from the books.

The payback period method has certain demerits:

(i) Failure in taking cash flows after payback period: This method is not taking into account the cash flows received by the company after the payback period.

(ii) Not considering the time value of money: It does not take into account the time value of money.

(iii) Non-considering of interest factor: It does not take into account the interest factor involved in the capital outlay.

(iv) Maximisation of market value not possible: It is not consistent with the objective of maximizing the market value of share.

(v) Failure in taking magnitude and timing of cash inflows: It fails to consider the pattern of cash inflows i.e., the magnitude and timing of cash inflows.

Q5) Write a note on ARR. 5

A5) This technique uses the accounting information revealed by the financial statements to measure the profitability of an investment proposal. It can be determined by dividing the average income after taxes by the average investment. According to Soloman, Accounting Rate of Return can be calculated as the ratio, of average net income to the initial investment. On the basis of this method, the company can select all those projects whose ARR is higher than the minimum rate established by the company. It can reject the projects with an ARR lower than the expected rate of return. This method also helps the management to rank the proposal on the basis of ARR.

Accounting Rate of Return (ARR) = Original Investment Average Net Income

OR

Accounting Rate of Return (ARR) = Average Investment Average Net Income

The following are the merits of ARR method:

(i) It is very simple to understand and calculate;

(ii) It can be readily computed with the help of the available accounting data;

(iii) It uses the entire stream of earnings to calculate the ARR.

This method has the following demerits:

(i) It is not based on cash flows generated by a project;

(ii) This method does not consider the objective of wealth maximization;

(iii) It ignores the length of the projects useful life;

(iv) If does not take into account the fact that the profile can be re-invested; and

(v) It ignores the time value of money.

Q6) Write a note on Net Present Value. 5

A6) The net present value method is a classic method of evaluating the investment proposals. It is one of the methods of discounted cash flow techniques, which recognizes the importance of time value of money. It correctly postulates that cash flows arising at time periods differ in value and are comparable only with their equivalents i.e., present values. It is a method of calculating the present value of cash flows (inflows and outflows) of an investment proposal using the cost of capital as an appropriate discounting rate. The net present value will be arrived at by subtracting the present value of cash outflows from the present value of cash inflows. Steps to compute net present value:

(i) Estimation of future cash inflows

(ii) An appropriate rate of interest should be selected to discount the cash flows. Generally, this will be the ―cost of capital‖ of the company, or required rate of return.

(iii) The present value of inflows and outflows of an investment proposal has to be computed by discounting them with an appropriate cost of capital.

(iv) The net value is the difference between the present value of cash inflows and the present value of cash outflows.

The formula for the net present value can be written as:

NPV= C1 /(1+k)1 + C2 / (1+K)2 +C3 /(1+k)3 +…………. Cn /(1+K)n – I

Where,

C = Annual Cash inflows,

Cn = Cash inflow in the year n

K = Cost of Capital

I = Initial Investment

The following are the merits of the net present value (NPV) methods:

(i) Consideration to total Cash Inflows: The NPV methods considers the total cash inflows of investment opportunities over the entire life-time of the projects unlike the payback period methods.

(ii) Recognition to the Time Value of Money: This method explicitly recognizes the time value of money, which is investable for making meaningful financial decisions.

(iii) Changing Discount Rate: Due to change in the risk pattern of the investor different discount rates can be used.

(iv) Best decision criteria for Mutually Exclusive Projects: This Method is particularly useful for the selection of mutually exclusive projects. It serves as the best decision criteria for mutually exclusive choice proposals.

(v) Maximisation of the Shareholders Wealth: Finally, the NPV method is instrumental in achieving the objective of the maximization of the shareholders’ wealth. This method is logically consistent with the company’s objective of maximizing shareholders’ wealth in terms of maximizing market value of shares, and theoretically correct for the selections of investment proposals.

The following are the demerits of the net present value method:

(i) It is difficult to understand and use.

(ii) The NPV is calculated by using the cost of capital as a discount rate. But the concept of cost of capital itself is difficult to understand and determine.

(iii) It does not give solutions when the comparable projects are involved in different amounts of investment.

(iv) It does not give correct answer to a question when alternative projects of limited funds are available, with unequal lives.

Q7) What is capital budgeting technique? Write a note on Profitability Index method. 5

A7) The capital budgeting appraisal methods or techniques for evaluation of investment proposals will help the company to decide the desirability of an investment proposal, depending upon their relative income generating capacity and rank them in order if their desirability. These methods provide the company a set of normal method should enable to measure the real worth of the investment proposal. The appraisal methods should possess several good characteristics, which are mentioned as under

Profitability index method is also known as Benefit Cost Ratio ‘. According to Van Horne, the profitability Index of a project is ―the ratio of the present value of future net cash inflows to the present value of cash outflows. If the Profitability Index is greater than or equal to one, the project should be accepted otherwise reject. It can be calculated as follows-

Profitability Index = Present value of cash inflows/Present value of cash outflows

The merits of this method are:

(i) It takes into account the time value of money

(ii) It helps to accept / reject investment proposal on the basis of value of the index.

(iii) It is useful to rank the proposals on the basis of the highest /lowest value of the index.

(iv) It takes into consideration the entire stream of cash flows generated during the life of the asset.

This technique suffers from the following limitations:

(i) It is somewhat difficult to compute.

(ii) It is difficult to understand the analytical of the decision on the basis of profitability index.

Q8) Why pay back period is considered as significant in long term decision making process. 5

A8) It is the most popular and widely recognized traditional methods of evaluating the investment proposals. The payback period can be used as an accept or reject criterion as well as a method of ranking projects. The payback period is the number of years to recover the investment made in a project. If the payback period calculated for a project is less than the maximum payback period set-up by the company, it can be accepted. Whenever a company faces the problem of choosing among two or more mutually exclusive projects, it can select a project on the basis of payback period, which has shorter period than the other projects.

The following are the merits of the payback period method:

(i) Easy to calculate: It is one of the easiest methods of evaluating the investment projects. It is simple to understand and easy to compute.

(ii) Knowledge: The knowledge of payback period is useful in decision-making, the shorter the period better the project.

(iii) Protection from loss due to obsolescence: This method is very suitable to such industries where mechanical and technical changes are routine practice and hence, shorter payback period practice avoids such losses.

(iv) Easily availability of information: It can be computed on the basis of accounting information, what is available from the books.

The payback period method has certain demerits:

(i) Failure in taking cash flows after payback period: This method is not taking into account the cash flows received by the company after the payback period.

(ii) Not considering the time value of money: It does not take into account the time value of money.

(iii) Non-considering of interest factor: It does not take into account the interest factor involved in the capital outlay.

(iv) Maximisation of market value not possible: It is not consistent with the objective of maximizing the market value of share.

(v) Failure in taking magnitude and timing of cash inflows: It fails to consider the pattern of cash inflows i.e., the magnitude and timing of cash inflows.

Q9) State the method of calculation NPV. Also highlight its merits. 5

A9) The formula for the net present value can be written as:

NPV= C1 /(1+k)1 + C2 / (1+K)2 +C3 /(1+k)3 +…………. Cn /(1+K)n – I

Where,

C = Annual Cash inflows,

Cn = Cash inflow in the year n

K = Cost of Capital

I = Initial Investment

The following are the merits of the net present value (NPV) methods:

(i) Consideration to total Cash Inflows: The NPV methods considers the total cash inflows of investment opportunities over the entire life-time of the projects unlike the payback period methods.

(ii) Recognition to the Time Value of Money: This method explicitly recognizes the time value of money, which is investable for making meaningful financial decisions.

(iii) Changing Discount Rate: Due to change in the risk pattern of the investor different discount rates can be used.

(iv) Best decision criteria for Mutually Exclusive Projects: This Method is particularly useful for the selection of mutually exclusive projects. It serves as the best decision criteria for mutually exclusive choice proposals.

(v) Maximisation of the Shareholders Wealth: Finally, the NPV method is instrumental in achieving the objective of the maximization of the shareholders’ wealth. This method is logically consistent with the company’s objective of maximizing shareholders’ wealth in terms of maximizing market value of shares, and theoretically correct for the selections of investment proposals.

Q10) State the formula of Profitability index. Also state its merits. 5

A10) The profitability index is calculated as follows-

Profitability Index = Present value of cash inflows/Present value of cash outflows

The merits of this method are:

(i) It takes into account the time value of money

(ii) It helps to accept / reject investment proposal on the basis of value of the index.

(iii) It is useful to rank the proposals on the basis of the highest /lowest value of the index.

(iv) It takes into consideration the entire stream of cash flows generated during the life of the asset.

This technique suffers from the following limitations:

(i) It is somewhat difficult to compute.

(ii) It is difficult to understand the analytical of the decision on the basis of profitability index.

Q11) What is capital budgeting. Also discuss the capital budgeting process. 8

A11) Capital Budgeting is one of the appraising techniques of investment decisions. Capital Budgeting is defined as the firm’s decision to invest its current funds most efficiently in long term activities in anticipation of an expected flow of future benefits over a series of years.

Charles. T. Horngreen defined capital budgeting as ― “Long term planning for making and financing proposed capital out lay”.

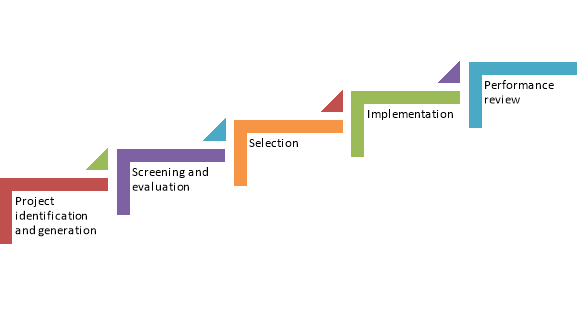

Capital budgeting involves long term decision making. The process of capital budgeting is discussed below-

Figure: capital budgeting process

A) Project identification and generation:

The first step towards capital budgeting is to generate a proposal for investments. There could be various reasons for taking up investments in a business. It could be addition of a new product line or expanding the existing one. It could be a proposal to either increase the production or reduce the costs of outputs.

B) Project Screening and Evaluation:

This step mainly involves selecting all correct criteria to judge the desirability of a proposal. This has to match the objective of the firm to maximize its market value. The tool of time value of money comes handy in this step. Also, the estimation of the benefits and the costs needs to be done. The total cash inflow and outflow along with the uncertainties and risks associated with the proposal has to be analysed thoroughly and appropriate provisioning has to be done for the same.

C) Project Selection:

There is no such defined method for the selection of a proposal for investments as different businesses have different requirements. That is why, the approval of an investment proposal is done based on the selection criteria and screening process which is defined for every firm keeping in mind the objectives of the investment being undertaken. Once the proposal has been finalized, the different alternatives for raising or acquiring funds have to be explored by the finance team. This is called preparing the capital budget. The average cost of funds has to be reduced. A detailed procedure for periodical reports and tracking the project for the lifetime needs to be streamlined in the initial phase itself. The final approvals are based on profitability, Economic constituents, viability and market conditions.

D) Implementation:

Money is spent and thus proposal is implemented. The different responsibilities like implementing the proposals, completion of the project within the requisite time period and reduction of cost are allotted. The management then takes up the task of monitoring and containing the implementation of the proposals.

E) Performance review:

The final stage of capital budgeting involves comparison of actual results with the standard ones. The unfavourable results are identified and removing the various difficulties of the projects helps for future selection and execution of the proposals.

Q12) Write note on any two modern techniques of capital budgeting. 8

A12) The two modern methods of capital budgeting are discussed below-

Net Present Value

The net present value method is a classic method of evaluating the investment proposals. It is one of the methods of discounted cash flow techniques, which recognizes the importance of time value of money. It correctly postulates that cash flows arising at time periods differ in value and are comparable only with their equivalents i.e., present values. It is a method of calculating the present value of cash flows (inflows and outflows) of an investment proposal using the cost of capital as an appropriate discounting rate. The net present value will be arrived at by subtracting the present value of cash outflows from the present value of cash inflows. Steps to compute net present value:

(i) Estimation of future cash inflows

(ii) An appropriate rate of interest should be selected to discount the cash flows. Generally, this will be the ―cost of capital‖ of the company, or required rate of return.

(iii) The present value of inflows and outflows of an investment proposal has to be computed by discounting them with an appropriate cost of capital.

(iv) The net value is the difference between the present value of cash inflows and the present value of cash outflows.

The formula for the net present value can be written as:

NPV= C1 /(1+k)1 + C2 / (1+K)2 +C3 /(1+k)3 +…………. Cn /(1+K)n – I

Where,

C = Annual Cash inflows,

Cn = Cash inflow in the year n

K = Cost of Capital

I = Initial Investment

The following are the merits of the net present value (NPV) methods:

(i) Consideration to total Cash Inflows: The NPV methods considers the total cash inflows of investment opportunities over the entire life-time of the projects unlike the payback period methods.

(ii) Recognition to the Time Value of Money: This method explicitly recognizes the time value of money, which is investable for making meaningful financial decisions.

(iii) Changing Discount Rate: Due to change in the risk pattern of the investor different discount rates can be used.

(iv) Best decision criteria for Mutually Exclusive Projects: This Method is particularly useful for the selection of mutually exclusive projects. It serves as the best decision criteria for mutually exclusive choice proposals.

(v) Maximisation of the Shareholders Wealth: Finally, the NPV method is instrumental in achieving the objective of the maximization of the shareholders’ wealth. This method is logically consistent with the company’s objective of maximizing shareholders’ wealth in terms of maximizing market value of shares, and theoretically correct for the selections of investment proposals.

The following are the demerits of the net present value method:

(i) It is difficult to understand and use.

(ii) The NPV is calculated by using the cost of capital as a discount rate. But the concept of cost of capital itself is difficult to understand and determine.

(iii) It does not give solutions when the comparable projects are involved in different amounts of investment.

(iv) It does not give correct answer to a question when alternative projects of limited funds are available, with unequal lives.

The Profitability Index

This method is also known as Benefit Cost Ratio ‘. According to Van Horne, the profitability Index of a project is ―the ratio of the present value of future net cash inflows to the present value of cash outflows. If the Profitability Index is greater than or equal to one, the project should be accepted otherwise reject. It can be calculated as follows-

Profitability Index = Present value of cash inflows/Present value of cash outflows

The merits of this method are:

(i) It takes into account the time value of money

(ii) It helps to accept / reject investment proposal on the basis of value of the index.

(iii) It is useful to rank the proposals on the basis of the highest /lowest value of the index.

(iv) It takes into consideration the entire stream of cash flows generated during the life of the asset.

This technique suffers from the following limitations:

(i) It is somewhat difficult to compute.

(ii) It is difficult to understand the analytical of the decision on the basis of profitability index.

Q13) Write a note on cash flow estimation. 5

A13) Cash flow estimation is necessary to estimate the cash flow in analysing the investment proposal. While analysing the cash flow, it is also necessary to estimate the cash outflow as well as cash inflow. Estimation of the net cash flow in an investment project should cover the following procedures:

Figure: Process of cash flow estimation

Step 1: Determination of Net Investment or Net Cash Outlay or Initial Cash Outlay.

Initial investment or start-up costs are net cash outflows at present cost. It refers to the sum of all cash outflows and cash inflows occurring at zero time periods. Net investment refers to the amount of which will be required for the acquisition of fixed assets. Thus, initial investment of a new fixed assets or project comprises cost, freight, installation charges, custom duty etc. Determination of net investment in replacement case is different than investment of new proposal

Step 2: Determination of annual net cash inflow or cash inflow after tax:

It is second step of capital budgeting which is determined after the determination of net cash outflow of investment proposal. In this step, net cash inflow is determined during the life of the project. It is called net cash inflow or cash flow after tax. It is determined on the basis of accounting for cash flow concept. To determine the net cash inflow, interest amount is not included.

Step 3: Determination of net cash inflow for the final year:

Final year net cash flow may be different due to course of working capital and salvage value of assets. If working capital is invested in initial stage, less in net cash outflow and plus in final year net cash inflow. It is called release of working capital. If working capital is reduced in initial year, Plus in net cash outflow and less is final year net cash inflow. Similarly, final year net cash inflow is affected by salvage value of assets. If salvage value of assets is not given, CFAT is effected only by working capital. The tax is adjusted on profit or loss on sales of assets.