Unit 5

Service Costing

Q1) What is Service costing?

A1) The term service costing or operating costing refers to the computation of the total operational cost incurred on each unit of the intangible product. These intangible products or services can be either in the form of internal services that are carried out by industries as supporting activities for the manufacturing of goods. Or in the way of external services that are offered as a significant product to the customers by the service sector companies.

Definition: The term service costing or operating costing refers to the computation of the total operational cost incurred on each unit of the intangible product. These intangible products or services can be either in the form of internal services that are carried out by industries as supporting activities for the manufacturing of goods. Or in the way of external services that are offered as a significant product to the customers by the service sector companies.

Service costing is an essential concept since every service organization needs to ascertain its business overheads. It is to ensure fair pricing of the products, i.e., services; and for keeping a control over its fixed and variable costs.

Service costing is an essential concept since every service organization needs to ascertain its business overheads. It is to ensure fair pricing of the products, i.e., services; and for keeping a control over its fixed and variable costs.

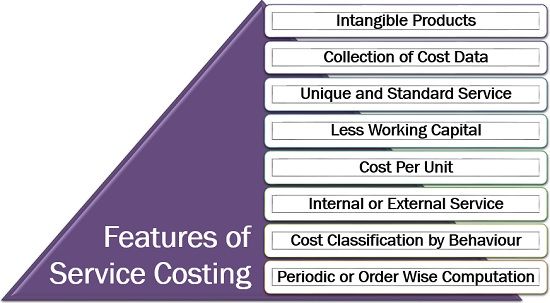

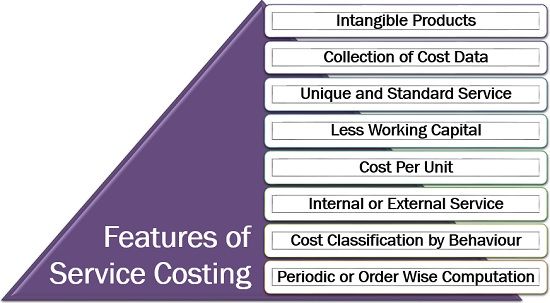

Q2) What are the features of Service costing?

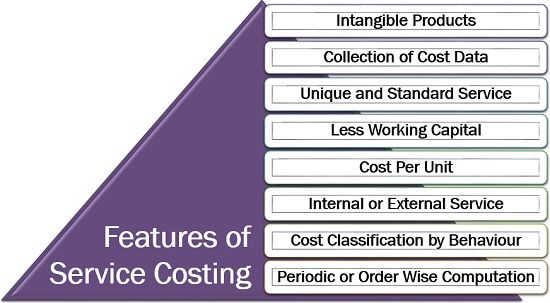

A2) The costing in a service industry can be better understood with the help of the following characteristics:

Intangible Products: Service costing deals with the operating cost of products which does not have any physical form but satisfies consumer needs and wants.

Collection of Cost Data: The documents used for service costing of products include cost sheet, bills payables, daily log sheet, etc.

Unique and Standard Service: The services so offered by such organizations are specialized and exclusive

Less Working Capital: The service costing involves less working capital since the direct cost of raw material and other direct expenses is comparatively low.

Cost Per Unit: The cost per unit is mainly calculated in service costing. Here, the cost unit is determined by the type of service industry the business belongs to, and it usually differs from company to company. Like, in the case of goods transport it is ‘tonne-miles’; whereas, in boilers, it is ‘per cubic centimetre-litre’.

Internal or External Service: The service costing can be performed internally, to determine the operating cost of the supporting activities in manufacturing industries. Else, it can be carried out externally, by the companies dedicated to rendering such services.

Cost classification by behaviour- In the operating cost sheet format, all the business costs are classified according to their behaviour, i.e., fixed costs, semi-variable costs and variable costs.

Periodic or Order Wise Computation: The service costing records the overheads at regular intervals, i.e., monthly or yearly but for operating cost of vehicles like tractors and JCB machines, order wise computation is adopted.

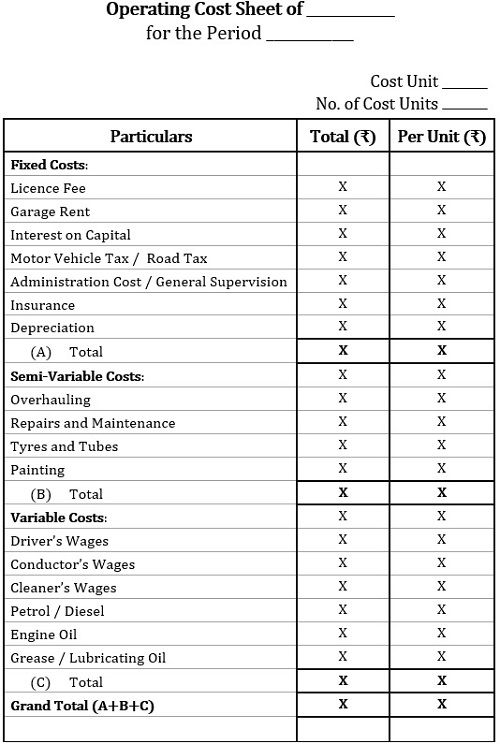

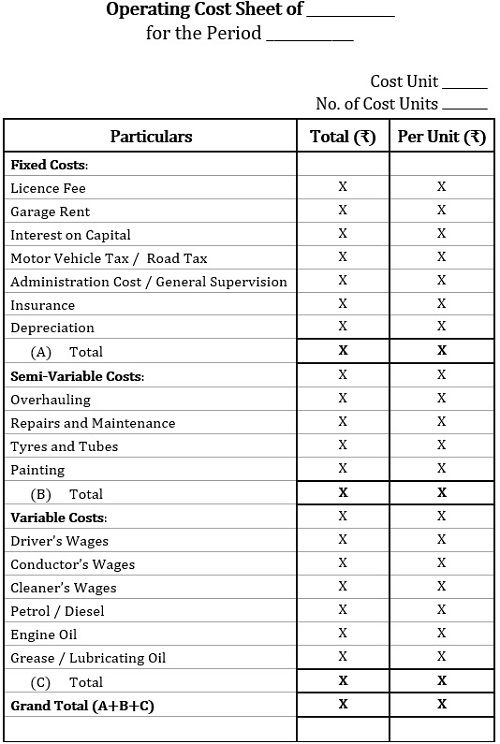

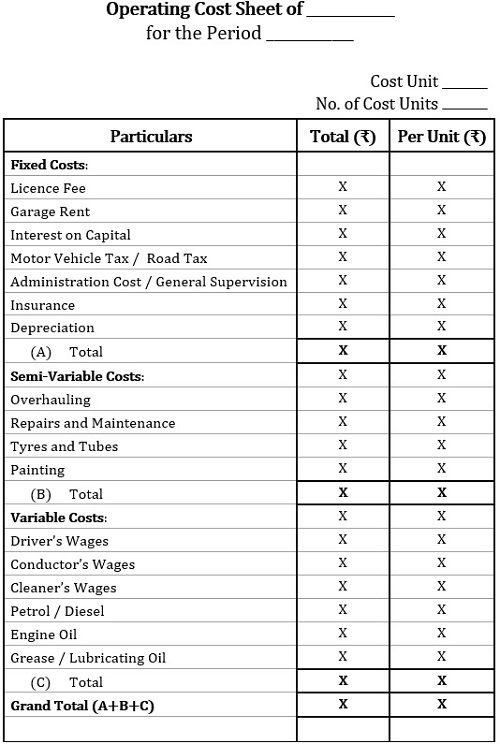

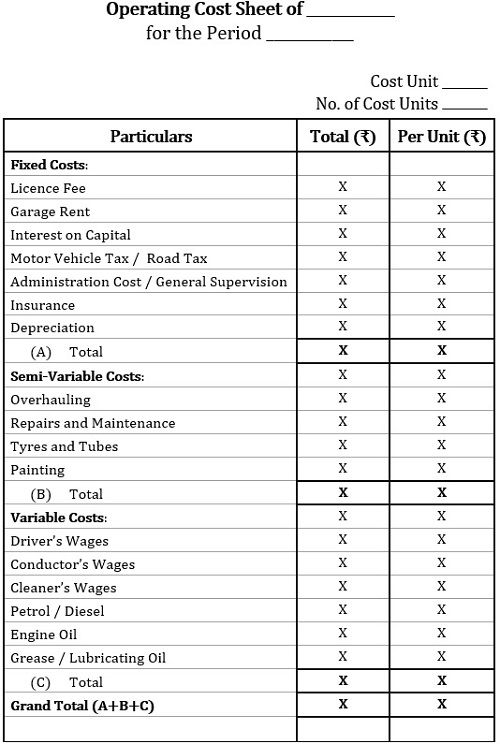

Q3) Show the format of service costing.

A3) We are going to view the computation of transport costing in this section.

Transport is one of the significant service industry these days, and it is essential to have an insight of the proforma for determining the operating costing of such organizations:

Q4) What is the procedure when there is a difference between the profits disclosed by cost accounts and financial accounts?

A4) When there is a difference between the profits disclosed by cost accounts and financial accounts, the following steps shall be taken to prepare a Reconciliation Statement: (I) Ascertain the various reasons of disagreement (as discussed above) between the profits disclosed by two sets of books of accounts. (II) If profit as per cost account (or loss as per financial accounts) is taken as the base: Add: (i) Items of income included in financial accounts but not in cost accounts. (ii) Items of expenditure (as interest on capital, rent on owned premises etc.) included in cost accounts but not in financial accounts. (iii) Amounts by which items of expenditure have been shown in excess in cost accounts as compared to the corresponding entries in financial accounts. (iv) Amounts by which items of income have been shown in excess in financial accounts as compared to the corresponding entries in cost accounts. (v) Over-absorption of overheads in cost accounts. (vi) The amount by which closing stock of inventory is undervalued in cost accounts. (vii) The amount by which the opening stock of inventory is overvalued in cost accounts. (viii) Over charge of depreciation in cost accounts.

Deduct:

(i)Items of income included in cost accounts but not in financial accounts.

(ii) Items of expenditure included in financial accounts but not in cost accounts. (iii) Amounts by which items of income have been shown in excess in cost accounts over the corresponding entries in financial accounts.

(iv) Amounts by which items of expenditure have been shown in excess in financial accounts over the corresponding entries in cost accounts.

(v) Under-absorption of overheads in cost accounts.

(vi) The amount by which closing stock of inventory is overvalued in cost accounts.

(vii) The amount by which the opening stock of inventory is undervalued in cost accounts.

(viii) Under charge of depreciation in cost accounts.

(ix) After making all the above additions and deductions, the resulting figure will be profit as per financial accounts (or loss as per cash accounts).

Q5) Why reconciliation between the results of the two sets of books is necessary?

A5) Reconciliation between the results of the two sets of books is necessary due to the following reasons:

1. To find out the reasons for the difference in the profit or loss in cost and financial accounts and to indicate the position clearly and to be sure that no mistakes pertaining to accounts have been committed.

2. To ensure the mathematical accuracy and reliability of cost accounts in order to have cost ascertainment, cost control and to have a check on the financial accounts.

3. To contribute to the standardisation of policies regarding stock valuation, depreciation and overheads.

4. To facilitate coordination and promote better cooperation between the activities of financial and cost sections of the accounting department.

5. To place management in better position to acquaint itself with the reasons for the variation in profits paving the way to more effective internal control.

Q6) How Reconciliation of costing and financial profits can be attempted?

A6) Reconciliation of costing and financial profits can be attempted:

(a) By preparing a Reconciliation Statement or

(b) By preparation a Memorandum Reconciliation Account. Reconciliation Statement: When reconciliation is attempted by preparing a reconciliation statement, profit shown by one set of accounts is taken as base profit and items of difference are either added to it or deducted from it to arrive at the figure of profit shown by other set of accounts.

Q7) What is Reconciliation of Cost and Financial Accounts?

A7) Reconciliation of Cost and Financial Accounts is process to find all the reasons behind disagreement in profit which is calculated as per cost accounts and as per financial accounts. There are lots of items which are shown in the profit and loss account only when we make it as per financial accounting rules. There are lots of items which are shown in costing profit and loss account only when we calculate profit as per cost accounting. Suppose, we have taken the profit or loss as per financial accounts, we adjust it as per cost accounts. In the end of adjustments, we see same profit as per cost accounts. If we have taken profit as per cost account, we have to adjust items as per financial accounts.

Q8) How reconciliation Statement is made in case of cost and financial accounts?

A8) (a) Items included only in financial accounts- There are number of items which appear only in financial accounts, and not in cost accounts, since they neither do not relate to the manufacturing activities, such as, purely financial charges, reducing financial profit Losses on capital assets Stamp duty and expenses on issue and transfer of stock, shares and bonds Loss on investments. Discount on debentures, bonds, etc. Fines and penalties, Interest on bank loans. Purely financial income, increasing financial profit Rent received Profit on sale of assets Share transfer fee Share premium Interest on investment, bank deposits. Dividends received. Appropriation of profit – donations and charities. (b) Items included only in the cost accounts -There are very few items which appear in cost accounts, but not in financial accounts. Because, all expenditure incurred, whether for cash or credit, passes though the financial accounts, and only relevant expenses are incorporated in cost accounts. Hence, only item which can appear in cost accounts but not in financial accounts is a notional charge, such as, (i) interest on capital, which is not paid but included in cost accounts to show the notional cost of employing capital, or (ii) rent i.e., charging a notional rent of premises owned by the proprietor. (c) Items accounted for differently in cost accounting and financial accounting Overhead – In cost accounts, overheads are applied to cost units at predetermined rates based on estimates, and the amount recovered may differ from actual expenses incurred. If such under-or over-recovery of overheads are not charged off to costing profit and loss account, the profits on two sets of books will differ.

Q9) In financial accounts, how stock is valued?

A9) In financial accounts, stock is valued at lower of cost or market value. In cost accounts, stock is valued at cost adoption one of the methods, such as FIFO, LIFO, average etc., which is suitable to the unit. Thus, there may be difference in stock valuation, which will reflect difference in profit between the two sets of books. Depreciation – If different basis is adopted for charging depreciation in cost accounts as compared to financial accounts, the profits will vary. Need for Reconciliation: In those concerns where there are no separate cost and financial accounts, the problem of reconciliation does not arise. But where cost and financial accounts are maintained independent of each other, it is imperative that periodically two accounts are reconciled. Though both sets of books are concerned with the same basic transactions but the figure of profit disclosed by the former does not agree with that disclosed by the latter.

Q10) Explain the reconciliation of cost and financial accounts.

A10) Reconciliation of Cost and Financial Accounts is process to find all the reasons behind disagreement in profit which is calculated as per cost accounts and as per financial accounts. There are lots of items which are shown in the profit and loss account only when we make it as per financial accounting rules. There are lots of items which are shown in costing profit and loss account only when we calculate profit as per cost accounting. Suppose, we have taken the profit or loss as per financial accounts, we adjust it as per cost accounts. In the end of adjustments, we see same profit as per cost accounts. If we have taken profit as per cost account, we have to adjust items as per financial accounts. For this purpose, we make reconciliation Statement. (a) Items included only in financial accounts There are number of items which appear only in financial accounts, and not in cost accounts, since they neither do not relate to the manufacturing activities, such as, purely financial charges, reducing financial profit Losses on capital assets Stamp duty and expenses on issue and transfer of stock, shares and bonds Loss on investments. Discount on debentures, bonds, etc. Fines and penalties, Interest on bank loans. Purely financial income, increasing financial profit Rent received Profit on sale of assets Share transfer fee Share premium Interest on investment, bank deposits. Dividends received. Appropriation of profit – donations and charities. (b) Items included only in the cost accounts There are very few items which appear in cost accounts, but not in financial accounts. Because, all expenditure incurred, whether for cash or credit, passes though the financial accounts, and only relevant expenses are incorporated in cost accounts. Hence, only item which can appear in cost accounts but not in financial accounts is a notional charge, such as, (i) interest on capital, which is not paid but included in cost accounts to show the notional cost of employing capital, or (ii) rent i.e., charging a notional rent of premises owned by the proprietor. (c) Items accounted for differently in cost accounting and financial accounting Overhead – In cost accounts, overheads are applied to cost units at predetermined rates based on estimates, and the amount recovered may differ from actual expenses incurred. If such under-or over-recovery of overheads are not charged off to costing profit and loss account, the profits on two sets of books will differ. Stock valuation – In financial accounts, stock is valued at lower of cost or market value. In cost accounts, stock is valued at cost adoption one of the methods, such as FIFO, LIFO, average etc., which is suitable to the unit. Thus, there may be difference in stock valuation, which will reflect difference in profit between the two sets of books. Depreciation – If different basis is adopted for charging depreciation in cost accounts as compared to financial accounts, the profits will vary. Need for Reconciliation: In those concerns where there are no separate cost and financial accounts, the problem of reconciliation does not arise. But where cost and financial accounts are maintained independent of each other, it is imperative that periodically two accounts are reconciled. Though both sets of books are concerned with the same basic transactions but the figure of profit disclosed by the former does not agree with that disclosed by the latter.

Thus, reconciliation between the results of the two sets of books is necessary due to the following reasons:

1. To find out the reasons for the difference in the profit or loss in cost and financial accounts and to indicate the position clearly and to be sure that no mistakes pertaining to accounts have been committed.

2. To ensure the mathematical accuracy and reliability of cost accounts in order to have cost ascertainment, cost control and to have a check on the financial accounts.

3. To contribute to the standardisation of policies regarding stock valuation, depreciation and overheads.

4. To facilitate coordination and promote better cooperation between the activities of financial and cost sections of the accounting department.

5. To place management in better position to acquaint itself with the reasons for the variation in profits paving the way to more effective internal control. Methods of Reconciliation: Reconciliation of costing and financial profits can be attempted either:

(a) By preparing a Reconciliation Statement or

(b) By preparation a Memorandum Reconciliation Account. Reconciliation Statement: When reconciliation is attempted by preparing a reconciliation statement, profit shown by one set of accounts is taken as base profit and items of difference are either added to it or deducted from it to arrive at the figure of profit shown by other set of accounts.

Q11) What are the principal financial ledgers under non-integral accounts?

A11) The principal financial ledgers are:

(i) General Ledger:

It contains all real, nominal and personal accounts except trade debtors and trade creditors account.

(ii) Debtors Ledger:

It has personal accounts of trade debtors.

(iii) Creditors Ledger:

It has personal accounts of trade creditors.

Q12) What are the principal cost ledgers under non-integral accounts?

A12) The principal cost ledgers are:

(i) Cost Ledger:

It is the principal ledger in cost books which controls all other ledgers in the costing department. It contains all impersonal accounts and is similar to General Ledger of financial accounts.

(ii) Stores Ledger:

It is a subsidiary ledger. It contains all stores accounts.

(iii) Work-in-Progress Ledger:

It is a subsidiary ledger. It contains a separate account for each job in progress. Each such account is debited with the materials costs, wages and overheads chargeable to the jobs and credited with the cost of work completed. The balance in this account shows the cost of uncertified work.

Iv) Finished Goods Ledger:

It is a subsidiary ledger. It contains accounts of completely finished goods and jobs. The cost ledger is made self-balancing by opening a control account for each of the above subsidiary ledgers.

Q13) What are the basic features of non-integral system?

A13) The basic features of non-integral system are-

(i) Separate ledgers are maintained for cost and financial accounts.

(ii) Like financial accounting, it is also based on double entry system.

(iii) There are no personal accounts because cost accounts do not show relationship with outsiders.

Iv) Cost accounts are concerned with impersonal accounts i.e., real and nominal accounts.

(v) In real accounts, only stocks are shown in cost accounts.

(vi) Transactions affecting the nominal accounts are recorded separately in detail. Thus, cost accounting department is concerned mainly with the ascertainment of income and expenditure of business,

(vii) Under this system one main ledger (i.e., Cost Ledger) and various subsidiary ledgers are maintained,

(viii) Since the system is not properly integrated, some items may appear in financial ledgers only, while some other items appear only in cost ledger,

(ix) The profit or loss disclosed by the two sets of accounts for a particular period will never be the same and as such a reconciliation of costing profit or loss with that of financial accounts is essential.

Q14) What is non-integral system?

A14) Non-integral system is a system of accounting under which two separate sets of account books are maintained—one for cost accounts and the other for financial accounts. In other words, cost accounts are maintained separately from financial accounts.

Since separate ledgers are maintained for cost and financial accounts in this system, the cost accountant is responsible for recording of the cost accounting transactions and the financial accountant is responsible for financial transactions.

Non-integral system of accounting is also known as non-integrated system or Inter-locking system or Cost Ledger Accounting system. CIMA, London defines non-integral system as a system in which the cost accounts are distinct from financial accounts, the two sets of accounts being kept continuously in agreement by the use of control accounts or made readily reconcilable by other means.

Q15) What are the essential Prerequisites for Integrated Accounting System?

A15) The essential prerequisites for integrated system include the following: (a) Degree of Integration: The degree of integration of the two sets of accounts should be determined. It is the management which has to decide on full or partial integration. Full integration changes the entire accounting records. (b) Suitable Coding System: A suitable coding system must be developed to serve the accounting purposes of both financial and cost accounts. (c) Accounting Policy: An agreed routine with regard to the treatment of provision for accruals, pre-paid expenses, other adjustments necessary for the preparation of interim accounts.

(d) Co-ordination: Prefect co-ordination should exist between the staff responsible for the financial and cost aspects of the accounts and an efficient processing of various accounting documents should be ensured.

Q16) What are the basic Features of Integral System?

A16) The basic features of Integral system are-

(a) There is no need for cost ledger because all control accounts are maintained in the financial ledger.

(b) There is no need to open a Cost Ledger Control Account because both the aspects (i.e., debit and credit) of all transactions are recorded in respective accounts.

(c) Subsidiary ledgers i.e., Stores Ledger, Work-in-Progress Ledger and Finished goods ledger are maintained as is done in non-integrated accounting. In addition, a Sales Ledger (containing personal accounts for each customer) and a Purchase Ledger (containing personal accounts for each supplier) are also maintained. Overhead ledger is maintained to contain separate accounts for factory, administration and selling and distribution overhead.

(d) A control account for each subsidiary ledger is maintained in the general ledger.

Q17) What is Integrated system?

A17) Under integrated accounting, profit or loss is calculated by making profit and loss account only at the end of the accounting period. Therefore, it is not necessary to prepare a cost reconciliation statement to reconcile the profit as per financial account and cost account. The integrated accounting also helps in bringing co-ordination between the activities between costing and financial department.

Integral or Integrated system is a system of accounting under which only one set of account books is maintained to record both the Cost and Financial transactions. The system implies the merger of both cost and financial accounts in one set of books. The two sets of account books merge into a composite system. CIMA, London defines Integral system as a system in which the financial and cost accounts are interlocked to ensure that all relevant expenditure is absorbed into the cost accounts.

Q18) What are the advantages of Integrated system?

A18) The advantages of Integrated system are-

(i) There is no need for reconciliation because there will be only one figure of profit or loss as there is only one set of books.

(ii) This system is economical because it avoids duplication of recording the transactions in two separate set of books.

(iii) Accounting information is readily available and the correctness of the data is automatically checked.

(iv) It enables the introduction of mechanised accounting.

(v) A better understanding exists among the staff.

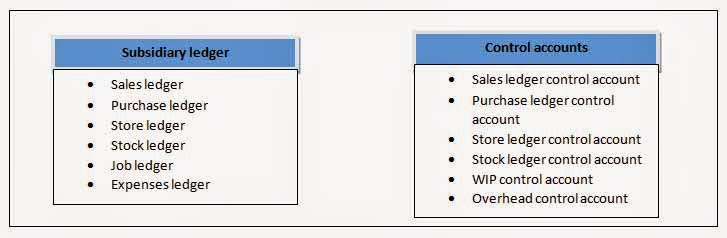

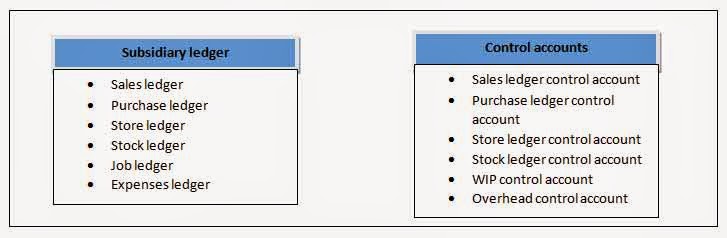

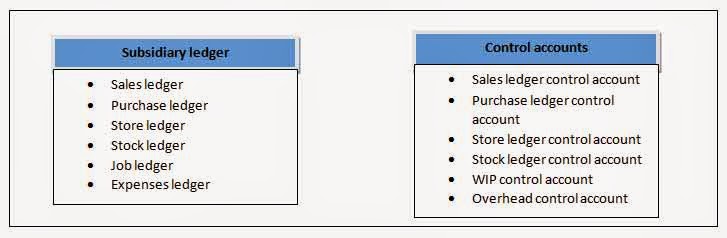

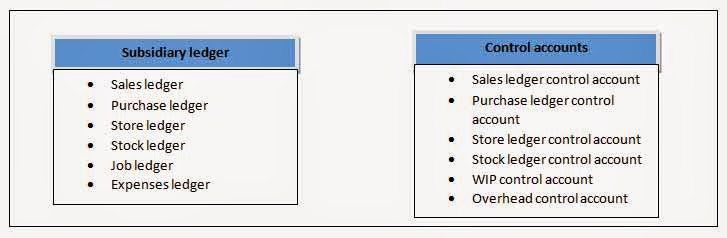

Q19) What are the subsidiary and control ledger prepared under integrated accounting?

A19) The subsidiary and control ledger prepared under integrated accounting are mentioned below:

Q20) What are the types of Service Costing?

A20) When we talk about services, our mind recalls the multiple intangible products we use on a day-to-day basis. But do you know that all these services have different cost units and elements during computation?

This is because each of these services is unique and involves a variety of different type of overheads. Thus, the service costing for each kind of service organization varies and can be classified as follows:

Transport Costing

The costing in the transport industry meets multiple objectives. These objectives can be segregated as follows by the type of transport service an organization provides:

- Private Transport: When the vehicle is hired individually for private tours, service costing is used to determine the hiring charges to be applied.

- Passenger Transport: It also ascertains the cost of conveyance, per passenger up to a certain distance in case of public or passenger transport companies.

- Goods Transport: When we talk about goods transport services, the cost of carrying a defined quantity of goods up to a particular distance is also decided through service costing.

The common objectives of transport costing include a comparison between two different vehicles or group of vehicles and; whether to use an alternative source of transport or own vehicle, in terms of cost involved.

Unit 5

Service Costing

Q1) What is Service costing?

A1) The term service costing or operating costing refers to the computation of the total operational cost incurred on each unit of the intangible product. These intangible products or services can be either in the form of internal services that are carried out by industries as supporting activities for the manufacturing of goods. Or in the way of external services that are offered as a significant product to the customers by the service sector companies.

Definition: The term service costing or operating costing refers to the computation of the total operational cost incurred on each unit of the intangible product. These intangible products or services can be either in the form of internal services that are carried out by industries as supporting activities for the manufacturing of goods. Or in the way of external services that are offered as a significant product to the customers by the service sector companies.

Service costing is an essential concept since every service organization needs to ascertain its business overheads. It is to ensure fair pricing of the products, i.e., services; and for keeping a control over its fixed and variable costs.

Service costing is an essential concept since every service organization needs to ascertain its business overheads. It is to ensure fair pricing of the products, i.e., services; and for keeping a control over its fixed and variable costs.

Q2) What are the features of Service costing?

A2) The costing in a service industry can be better understood with the help of the following characteristics:

Intangible Products: Service costing deals with the operating cost of products which does not have any physical form but satisfies consumer needs and wants.

Collection of Cost Data: The documents used for service costing of products include cost sheet, bills payables, daily log sheet, etc.

Unique and Standard Service: The services so offered by such organizations are specialized and exclusive

Less Working Capital: The service costing involves less working capital since the direct cost of raw material and other direct expenses is comparatively low.

Cost Per Unit: The cost per unit is mainly calculated in service costing. Here, the cost unit is determined by the type of service industry the business belongs to, and it usually differs from company to company. Like, in the case of goods transport it is ‘tonne-miles’; whereas, in boilers, it is ‘per cubic centimetre-litre’.

Internal or External Service: The service costing can be performed internally, to determine the operating cost of the supporting activities in manufacturing industries. Else, it can be carried out externally, by the companies dedicated to rendering such services.

Cost classification by behaviour- In the operating cost sheet format, all the business costs are classified according to their behaviour, i.e., fixed costs, semi-variable costs and variable costs.

Periodic or Order Wise Computation: The service costing records the overheads at regular intervals, i.e., monthly or yearly but for operating cost of vehicles like tractors and JCB machines, order wise computation is adopted.

Q3) Show the format of service costing.

A3) We are going to view the computation of transport costing in this section.

Transport is one of the significant service industry these days, and it is essential to have an insight of the proforma for determining the operating costing of such organizations:

Q4) What is the procedure when there is a difference between the profits disclosed by cost accounts and financial accounts?

A4) When there is a difference between the profits disclosed by cost accounts and financial accounts, the following steps shall be taken to prepare a Reconciliation Statement: (I) Ascertain the various reasons of disagreement (as discussed above) between the profits disclosed by two sets of books of accounts. (II) If profit as per cost account (or loss as per financial accounts) is taken as the base: Add: (i) Items of income included in financial accounts but not in cost accounts. (ii) Items of expenditure (as interest on capital, rent on owned premises etc.) included in cost accounts but not in financial accounts. (iii) Amounts by which items of expenditure have been shown in excess in cost accounts as compared to the corresponding entries in financial accounts. (iv) Amounts by which items of income have been shown in excess in financial accounts as compared to the corresponding entries in cost accounts. (v) Over-absorption of overheads in cost accounts. (vi) The amount by which closing stock of inventory is undervalued in cost accounts. (vii) The amount by which the opening stock of inventory is overvalued in cost accounts. (viii) Over charge of depreciation in cost accounts.

Deduct:

(i)Items of income included in cost accounts but not in financial accounts.

(ii) Items of expenditure included in financial accounts but not in cost accounts. (iii) Amounts by which items of income have been shown in excess in cost accounts over the corresponding entries in financial accounts.

(iv) Amounts by which items of expenditure have been shown in excess in financial accounts over the corresponding entries in cost accounts.

(v) Under-absorption of overheads in cost accounts.

(vi) The amount by which closing stock of inventory is overvalued in cost accounts.

(vii) The amount by which the opening stock of inventory is undervalued in cost accounts.

(viii) Under charge of depreciation in cost accounts.

(ix) After making all the above additions and deductions, the resulting figure will be profit as per financial accounts (or loss as per cash accounts).

Q5) Why reconciliation between the results of the two sets of books is necessary?

A5) Reconciliation between the results of the two sets of books is necessary due to the following reasons:

1. To find out the reasons for the difference in the profit or loss in cost and financial accounts and to indicate the position clearly and to be sure that no mistakes pertaining to accounts have been committed.

2. To ensure the mathematical accuracy and reliability of cost accounts in order to have cost ascertainment, cost control and to have a check on the financial accounts.

3. To contribute to the standardisation of policies regarding stock valuation, depreciation and overheads.

4. To facilitate coordination and promote better cooperation between the activities of financial and cost sections of the accounting department.

5. To place management in better position to acquaint itself with the reasons for the variation in profits paving the way to more effective internal control.

Q6) How Reconciliation of costing and financial profits can be attempted?

A6) Reconciliation of costing and financial profits can be attempted:

(a) By preparing a Reconciliation Statement or

(b) By preparation a Memorandum Reconciliation Account. Reconciliation Statement: When reconciliation is attempted by preparing a reconciliation statement, profit shown by one set of accounts is taken as base profit and items of difference are either added to it or deducted from it to arrive at the figure of profit shown by other set of accounts.

Q7) What is Reconciliation of Cost and Financial Accounts?

A7) Reconciliation of Cost and Financial Accounts is process to find all the reasons behind disagreement in profit which is calculated as per cost accounts and as per financial accounts. There are lots of items which are shown in the profit and loss account only when we make it as per financial accounting rules. There are lots of items which are shown in costing profit and loss account only when we calculate profit as per cost accounting. Suppose, we have taken the profit or loss as per financial accounts, we adjust it as per cost accounts. In the end of adjustments, we see same profit as per cost accounts. If we have taken profit as per cost account, we have to adjust items as per financial accounts.

Q8) How reconciliation Statement is made in case of cost and financial accounts?

A8) (a) Items included only in financial accounts- There are number of items which appear only in financial accounts, and not in cost accounts, since they neither do not relate to the manufacturing activities, such as, purely financial charges, reducing financial profit Losses on capital assets Stamp duty and expenses on issue and transfer of stock, shares and bonds Loss on investments. Discount on debentures, bonds, etc. Fines and penalties, Interest on bank loans. Purely financial income, increasing financial profit Rent received Profit on sale of assets Share transfer fee Share premium Interest on investment, bank deposits. Dividends received. Appropriation of profit – donations and charities. (b) Items included only in the cost accounts -There are very few items which appear in cost accounts, but not in financial accounts. Because, all expenditure incurred, whether for cash or credit, passes though the financial accounts, and only relevant expenses are incorporated in cost accounts. Hence, only item which can appear in cost accounts but not in financial accounts is a notional charge, such as, (i) interest on capital, which is not paid but included in cost accounts to show the notional cost of employing capital, or (ii) rent i.e., charging a notional rent of premises owned by the proprietor. (c) Items accounted for differently in cost accounting and financial accounting Overhead – In cost accounts, overheads are applied to cost units at predetermined rates based on estimates, and the amount recovered may differ from actual expenses incurred. If such under-or over-recovery of overheads are not charged off to costing profit and loss account, the profits on two sets of books will differ.

Q9) In financial accounts, how stock is valued?

A9) In financial accounts, stock is valued at lower of cost or market value. In cost accounts, stock is valued at cost adoption one of the methods, such as FIFO, LIFO, average etc., which is suitable to the unit. Thus, there may be difference in stock valuation, which will reflect difference in profit between the two sets of books. Depreciation – If different basis is adopted for charging depreciation in cost accounts as compared to financial accounts, the profits will vary. Need for Reconciliation: In those concerns where there are no separate cost and financial accounts, the problem of reconciliation does not arise. But where cost and financial accounts are maintained independent of each other, it is imperative that periodically two accounts are reconciled. Though both sets of books are concerned with the same basic transactions but the figure of profit disclosed by the former does not agree with that disclosed by the latter.

Q10) Explain the reconciliation of cost and financial accounts.

A10) Reconciliation of Cost and Financial Accounts is process to find all the reasons behind disagreement in profit which is calculated as per cost accounts and as per financial accounts. There are lots of items which are shown in the profit and loss account only when we make it as per financial accounting rules. There are lots of items which are shown in costing profit and loss account only when we calculate profit as per cost accounting. Suppose, we have taken the profit or loss as per financial accounts, we adjust it as per cost accounts. In the end of adjustments, we see same profit as per cost accounts. If we have taken profit as per cost account, we have to adjust items as per financial accounts. For this purpose, we make reconciliation Statement. (a) Items included only in financial accounts There are number of items which appear only in financial accounts, and not in cost accounts, since they neither do not relate to the manufacturing activities, such as, purely financial charges, reducing financial profit Losses on capital assets Stamp duty and expenses on issue and transfer of stock, shares and bonds Loss on investments. Discount on debentures, bonds, etc. Fines and penalties, Interest on bank loans. Purely financial income, increasing financial profit Rent received Profit on sale of assets Share transfer fee Share premium Interest on investment, bank deposits. Dividends received. Appropriation of profit – donations and charities. (b) Items included only in the cost accounts There are very few items which appear in cost accounts, but not in financial accounts. Because, all expenditure incurred, whether for cash or credit, passes though the financial accounts, and only relevant expenses are incorporated in cost accounts. Hence, only item which can appear in cost accounts but not in financial accounts is a notional charge, such as, (i) interest on capital, which is not paid but included in cost accounts to show the notional cost of employing capital, or (ii) rent i.e., charging a notional rent of premises owned by the proprietor. (c) Items accounted for differently in cost accounting and financial accounting Overhead – In cost accounts, overheads are applied to cost units at predetermined rates based on estimates, and the amount recovered may differ from actual expenses incurred. If such under-or over-recovery of overheads are not charged off to costing profit and loss account, the profits on two sets of books will differ. Stock valuation – In financial accounts, stock is valued at lower of cost or market value. In cost accounts, stock is valued at cost adoption one of the methods, such as FIFO, LIFO, average etc., which is suitable to the unit. Thus, there may be difference in stock valuation, which will reflect difference in profit between the two sets of books. Depreciation – If different basis is adopted for charging depreciation in cost accounts as compared to financial accounts, the profits will vary. Need for Reconciliation: In those concerns where there are no separate cost and financial accounts, the problem of reconciliation does not arise. But where cost and financial accounts are maintained independent of each other, it is imperative that periodically two accounts are reconciled. Though both sets of books are concerned with the same basic transactions but the figure of profit disclosed by the former does not agree with that disclosed by the latter.

Thus, reconciliation between the results of the two sets of books is necessary due to the following reasons:

1. To find out the reasons for the difference in the profit or loss in cost and financial accounts and to indicate the position clearly and to be sure that no mistakes pertaining to accounts have been committed.

2. To ensure the mathematical accuracy and reliability of cost accounts in order to have cost ascertainment, cost control and to have a check on the financial accounts.

3. To contribute to the standardisation of policies regarding stock valuation, depreciation and overheads.

4. To facilitate coordination and promote better cooperation between the activities of financial and cost sections of the accounting department.

5. To place management in better position to acquaint itself with the reasons for the variation in profits paving the way to more effective internal control. Methods of Reconciliation: Reconciliation of costing and financial profits can be attempted either:

(a) By preparing a Reconciliation Statement or

(b) By preparation a Memorandum Reconciliation Account. Reconciliation Statement: When reconciliation is attempted by preparing a reconciliation statement, profit shown by one set of accounts is taken as base profit and items of difference are either added to it or deducted from it to arrive at the figure of profit shown by other set of accounts.

Q11) What are the principal financial ledgers under non-integral accounts?

A11) The principal financial ledgers are:

(i) General Ledger:

It contains all real, nominal and personal accounts except trade debtors and trade creditors account.

(ii) Debtors Ledger:

It has personal accounts of trade debtors.

(iii) Creditors Ledger:

It has personal accounts of trade creditors.

Q12) What are the principal cost ledgers under non-integral accounts?

A12) The principal cost ledgers are:

(i) Cost Ledger:

It is the principal ledger in cost books which controls all other ledgers in the costing department. It contains all impersonal accounts and is similar to General Ledger of financial accounts.

(ii) Stores Ledger:

It is a subsidiary ledger. It contains all stores accounts.

(iii) Work-in-Progress Ledger:

It is a subsidiary ledger. It contains a separate account for each job in progress. Each such account is debited with the materials costs, wages and overheads chargeable to the jobs and credited with the cost of work completed. The balance in this account shows the cost of uncertified work.

Iv) Finished Goods Ledger:

It is a subsidiary ledger. It contains accounts of completely finished goods and jobs. The cost ledger is made self-balancing by opening a control account for each of the above subsidiary ledgers.

Q13) What are the basic features of non-integral system?

A13) The basic features of non-integral system are-

(i) Separate ledgers are maintained for cost and financial accounts.

(ii) Like financial accounting, it is also based on double entry system.

(iii) There are no personal accounts because cost accounts do not show relationship with outsiders.

Iv) Cost accounts are concerned with impersonal accounts i.e., real and nominal accounts.

(v) In real accounts, only stocks are shown in cost accounts.

(vi) Transactions affecting the nominal accounts are recorded separately in detail. Thus, cost accounting department is concerned mainly with the ascertainment of income and expenditure of business,

(vii) Under this system one main ledger (i.e., Cost Ledger) and various subsidiary ledgers are maintained,

(viii) Since the system is not properly integrated, some items may appear in financial ledgers only, while some other items appear only in cost ledger,

(ix) The profit or loss disclosed by the two sets of accounts for a particular period will never be the same and as such a reconciliation of costing profit or loss with that of financial accounts is essential.

Q14) What is non-integral system?

A14) Non-integral system is a system of accounting under which two separate sets of account books are maintained—one for cost accounts and the other for financial accounts. In other words, cost accounts are maintained separately from financial accounts.

Since separate ledgers are maintained for cost and financial accounts in this system, the cost accountant is responsible for recording of the cost accounting transactions and the financial accountant is responsible for financial transactions.

Non-integral system of accounting is also known as non-integrated system or Inter-locking system or Cost Ledger Accounting system. CIMA, London defines non-integral system as a system in which the cost accounts are distinct from financial accounts, the two sets of accounts being kept continuously in agreement by the use of control accounts or made readily reconcilable by other means.

Q15) What are the essential Prerequisites for Integrated Accounting System?

A15) The essential prerequisites for integrated system include the following: (a) Degree of Integration: The degree of integration of the two sets of accounts should be determined. It is the management which has to decide on full or partial integration. Full integration changes the entire accounting records. (b) Suitable Coding System: A suitable coding system must be developed to serve the accounting purposes of both financial and cost accounts. (c) Accounting Policy: An agreed routine with regard to the treatment of provision for accruals, pre-paid expenses, other adjustments necessary for the preparation of interim accounts.

(d) Co-ordination: Prefect co-ordination should exist between the staff responsible for the financial and cost aspects of the accounts and an efficient processing of various accounting documents should be ensured.

Q16) What are the basic Features of Integral System?

A16) The basic features of Integral system are-

(a) There is no need for cost ledger because all control accounts are maintained in the financial ledger.

(b) There is no need to open a Cost Ledger Control Account because both the aspects (i.e., debit and credit) of all transactions are recorded in respective accounts.

(c) Subsidiary ledgers i.e., Stores Ledger, Work-in-Progress Ledger and Finished goods ledger are maintained as is done in non-integrated accounting. In addition, a Sales Ledger (containing personal accounts for each customer) and a Purchase Ledger (containing personal accounts for each supplier) are also maintained. Overhead ledger is maintained to contain separate accounts for factory, administration and selling and distribution overhead.

(d) A control account for each subsidiary ledger is maintained in the general ledger.

Q17) What is Integrated system?

A17) Under integrated accounting, profit or loss is calculated by making profit and loss account only at the end of the accounting period. Therefore, it is not necessary to prepare a cost reconciliation statement to reconcile the profit as per financial account and cost account. The integrated accounting also helps in bringing co-ordination between the activities between costing and financial department.

Integral or Integrated system is a system of accounting under which only one set of account books is maintained to record both the Cost and Financial transactions. The system implies the merger of both cost and financial accounts in one set of books. The two sets of account books merge into a composite system. CIMA, London defines Integral system as a system in which the financial and cost accounts are interlocked to ensure that all relevant expenditure is absorbed into the cost accounts.

Q18) What are the advantages of Integrated system?

A18) The advantages of Integrated system are-

(i) There is no need for reconciliation because there will be only one figure of profit or loss as there is only one set of books.

(ii) This system is economical because it avoids duplication of recording the transactions in two separate set of books.

(iii) Accounting information is readily available and the correctness of the data is automatically checked.

(iv) It enables the introduction of mechanised accounting.

(v) A better understanding exists among the staff.

Q19) What are the subsidiary and control ledger prepared under integrated accounting?

A19) The subsidiary and control ledger prepared under integrated accounting are mentioned below:

Q20) What are the types of Service Costing?

A20) When we talk about services, our mind recalls the multiple intangible products we use on a day-to-day basis. But do you know that all these services have different cost units and elements during computation?

This is because each of these services is unique and involves a variety of different type of overheads. Thus, the service costing for each kind of service organization varies and can be classified as follows:

Transport Costing

The costing in the transport industry meets multiple objectives. These objectives can be segregated as follows by the type of transport service an organization provides:

- Private Transport: When the vehicle is hired individually for private tours, service costing is used to determine the hiring charges to be applied.

- Passenger Transport: It also ascertains the cost of conveyance, per passenger up to a certain distance in case of public or passenger transport companies.

- Goods Transport: When we talk about goods transport services, the cost of carrying a defined quantity of goods up to a particular distance is also decided through service costing.

The common objectives of transport costing include a comparison between two different vehicles or group of vehicles and; whether to use an alternative source of transport or own vehicle, in terms of cost involved.

Unit 5

Service Costing

Q1) What is Service costing?

A1) The term service costing or operating costing refers to the computation of the total operational cost incurred on each unit of the intangible product. These intangible products or services can be either in the form of internal services that are carried out by industries as supporting activities for the manufacturing of goods. Or in the way of external services that are offered as a significant product to the customers by the service sector companies.

Definition: The term service costing or operating costing refers to the computation of the total operational cost incurred on each unit of the intangible product. These intangible products or services can be either in the form of internal services that are carried out by industries as supporting activities for the manufacturing of goods. Or in the way of external services that are offered as a significant product to the customers by the service sector companies.

Service costing is an essential concept since every service organization needs to ascertain its business overheads. It is to ensure fair pricing of the products, i.e., services; and for keeping a control over its fixed and variable costs.

Service costing is an essential concept since every service organization needs to ascertain its business overheads. It is to ensure fair pricing of the products, i.e., services; and for keeping a control over its fixed and variable costs.

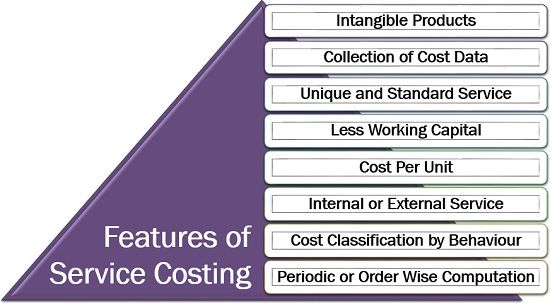

Q2) What are the features of Service costing?

A2) The costing in a service industry can be better understood with the help of the following characteristics:

Intangible Products: Service costing deals with the operating cost of products which does not have any physical form but satisfies consumer needs and wants.

Collection of Cost Data: The documents used for service costing of products include cost sheet, bills payables, daily log sheet, etc.

Unique and Standard Service: The services so offered by such organizations are specialized and exclusive

Less Working Capital: The service costing involves less working capital since the direct cost of raw material and other direct expenses is comparatively low.

Cost Per Unit: The cost per unit is mainly calculated in service costing. Here, the cost unit is determined by the type of service industry the business belongs to, and it usually differs from company to company. Like, in the case of goods transport it is ‘tonne-miles’; whereas, in boilers, it is ‘per cubic centimetre-litre’.

Internal or External Service: The service costing can be performed internally, to determine the operating cost of the supporting activities in manufacturing industries. Else, it can be carried out externally, by the companies dedicated to rendering such services.

Cost classification by behaviour- In the operating cost sheet format, all the business costs are classified according to their behaviour, i.e., fixed costs, semi-variable costs and variable costs.

Periodic or Order Wise Computation: The service costing records the overheads at regular intervals, i.e., monthly or yearly but for operating cost of vehicles like tractors and JCB machines, order wise computation is adopted.

Q3) Show the format of service costing.

A3) We are going to view the computation of transport costing in this section.

Transport is one of the significant service industry these days, and it is essential to have an insight of the proforma for determining the operating costing of such organizations:

Q4) What is the procedure when there is a difference between the profits disclosed by cost accounts and financial accounts?

A4) When there is a difference between the profits disclosed by cost accounts and financial accounts, the following steps shall be taken to prepare a Reconciliation Statement: (I) Ascertain the various reasons of disagreement (as discussed above) between the profits disclosed by two sets of books of accounts. (II) If profit as per cost account (or loss as per financial accounts) is taken as the base: Add: (i) Items of income included in financial accounts but not in cost accounts. (ii) Items of expenditure (as interest on capital, rent on owned premises etc.) included in cost accounts but not in financial accounts. (iii) Amounts by which items of expenditure have been shown in excess in cost accounts as compared to the corresponding entries in financial accounts. (iv) Amounts by which items of income have been shown in excess in financial accounts as compared to the corresponding entries in cost accounts. (v) Over-absorption of overheads in cost accounts. (vi) The amount by which closing stock of inventory is undervalued in cost accounts. (vii) The amount by which the opening stock of inventory is overvalued in cost accounts. (viii) Over charge of depreciation in cost accounts.

Deduct:

(i)Items of income included in cost accounts but not in financial accounts.

(ii) Items of expenditure included in financial accounts but not in cost accounts. (iii) Amounts by which items of income have been shown in excess in cost accounts over the corresponding entries in financial accounts.

(iv) Amounts by which items of expenditure have been shown in excess in financial accounts over the corresponding entries in cost accounts.

(v) Under-absorption of overheads in cost accounts.

(vi) The amount by which closing stock of inventory is overvalued in cost accounts.

(vii) The amount by which the opening stock of inventory is undervalued in cost accounts.

(viii) Under charge of depreciation in cost accounts.

(ix) After making all the above additions and deductions, the resulting figure will be profit as per financial accounts (or loss as per cash accounts).

Q5) Why reconciliation between the results of the two sets of books is necessary?

A5) Reconciliation between the results of the two sets of books is necessary due to the following reasons:

1. To find out the reasons for the difference in the profit or loss in cost and financial accounts and to indicate the position clearly and to be sure that no mistakes pertaining to accounts have been committed.

2. To ensure the mathematical accuracy and reliability of cost accounts in order to have cost ascertainment, cost control and to have a check on the financial accounts.

3. To contribute to the standardisation of policies regarding stock valuation, depreciation and overheads.

4. To facilitate coordination and promote better cooperation between the activities of financial and cost sections of the accounting department.

5. To place management in better position to acquaint itself with the reasons for the variation in profits paving the way to more effective internal control.

Q6) How Reconciliation of costing and financial profits can be attempted?

A6) Reconciliation of costing and financial profits can be attempted:

(a) By preparing a Reconciliation Statement or

(b) By preparation a Memorandum Reconciliation Account. Reconciliation Statement: When reconciliation is attempted by preparing a reconciliation statement, profit shown by one set of accounts is taken as base profit and items of difference are either added to it or deducted from it to arrive at the figure of profit shown by other set of accounts.

Q7) What is Reconciliation of Cost and Financial Accounts?

A7) Reconciliation of Cost and Financial Accounts is process to find all the reasons behind disagreement in profit which is calculated as per cost accounts and as per financial accounts. There are lots of items which are shown in the profit and loss account only when we make it as per financial accounting rules. There are lots of items which are shown in costing profit and loss account only when we calculate profit as per cost accounting. Suppose, we have taken the profit or loss as per financial accounts, we adjust it as per cost accounts. In the end of adjustments, we see same profit as per cost accounts. If we have taken profit as per cost account, we have to adjust items as per financial accounts.

Q8) How reconciliation Statement is made in case of cost and financial accounts?

A8) (a) Items included only in financial accounts- There are number of items which appear only in financial accounts, and not in cost accounts, since they neither do not relate to the manufacturing activities, such as, purely financial charges, reducing financial profit Losses on capital assets Stamp duty and expenses on issue and transfer of stock, shares and bonds Loss on investments. Discount on debentures, bonds, etc. Fines and penalties, Interest on bank loans. Purely financial income, increasing financial profit Rent received Profit on sale of assets Share transfer fee Share premium Interest on investment, bank deposits. Dividends received. Appropriation of profit – donations and charities. (b) Items included only in the cost accounts -There are very few items which appear in cost accounts, but not in financial accounts. Because, all expenditure incurred, whether for cash or credit, passes though the financial accounts, and only relevant expenses are incorporated in cost accounts. Hence, only item which can appear in cost accounts but not in financial accounts is a notional charge, such as, (i) interest on capital, which is not paid but included in cost accounts to show the notional cost of employing capital, or (ii) rent i.e., charging a notional rent of premises owned by the proprietor. (c) Items accounted for differently in cost accounting and financial accounting Overhead – In cost accounts, overheads are applied to cost units at predetermined rates based on estimates, and the amount recovered may differ from actual expenses incurred. If such under-or over-recovery of overheads are not charged off to costing profit and loss account, the profits on two sets of books will differ.

Q9) In financial accounts, how stock is valued?

A9) In financial accounts, stock is valued at lower of cost or market value. In cost accounts, stock is valued at cost adoption one of the methods, such as FIFO, LIFO, average etc., which is suitable to the unit. Thus, there may be difference in stock valuation, which will reflect difference in profit between the two sets of books. Depreciation – If different basis is adopted for charging depreciation in cost accounts as compared to financial accounts, the profits will vary. Need for Reconciliation: In those concerns where there are no separate cost and financial accounts, the problem of reconciliation does not arise. But where cost and financial accounts are maintained independent of each other, it is imperative that periodically two accounts are reconciled. Though both sets of books are concerned with the same basic transactions but the figure of profit disclosed by the former does not agree with that disclosed by the latter.

Q10) Explain the reconciliation of cost and financial accounts.

A10) Reconciliation of Cost and Financial Accounts is process to find all the reasons behind disagreement in profit which is calculated as per cost accounts and as per financial accounts. There are lots of items which are shown in the profit and loss account only when we make it as per financial accounting rules. There are lots of items which are shown in costing profit and loss account only when we calculate profit as per cost accounting. Suppose, we have taken the profit or loss as per financial accounts, we adjust it as per cost accounts. In the end of adjustments, we see same profit as per cost accounts. If we have taken profit as per cost account, we have to adjust items as per financial accounts. For this purpose, we make reconciliation Statement. (a) Items included only in financial accounts There are number of items which appear only in financial accounts, and not in cost accounts, since they neither do not relate to the manufacturing activities, such as, purely financial charges, reducing financial profit Losses on capital assets Stamp duty and expenses on issue and transfer of stock, shares and bonds Loss on investments. Discount on debentures, bonds, etc. Fines and penalties, Interest on bank loans. Purely financial income, increasing financial profit Rent received Profit on sale of assets Share transfer fee Share premium Interest on investment, bank deposits. Dividends received. Appropriation of profit – donations and charities. (b) Items included only in the cost accounts There are very few items which appear in cost accounts, but not in financial accounts. Because, all expenditure incurred, whether for cash or credit, passes though the financial accounts, and only relevant expenses are incorporated in cost accounts. Hence, only item which can appear in cost accounts but not in financial accounts is a notional charge, such as, (i) interest on capital, which is not paid but included in cost accounts to show the notional cost of employing capital, or (ii) rent i.e., charging a notional rent of premises owned by the proprietor. (c) Items accounted for differently in cost accounting and financial accounting Overhead – In cost accounts, overheads are applied to cost units at predetermined rates based on estimates, and the amount recovered may differ from actual expenses incurred. If such under-or over-recovery of overheads are not charged off to costing profit and loss account, the profits on two sets of books will differ. Stock valuation – In financial accounts, stock is valued at lower of cost or market value. In cost accounts, stock is valued at cost adoption one of the methods, such as FIFO, LIFO, average etc., which is suitable to the unit. Thus, there may be difference in stock valuation, which will reflect difference in profit between the two sets of books. Depreciation – If different basis is adopted for charging depreciation in cost accounts as compared to financial accounts, the profits will vary. Need for Reconciliation: In those concerns where there are no separate cost and financial accounts, the problem of reconciliation does not arise. But where cost and financial accounts are maintained independent of each other, it is imperative that periodically two accounts are reconciled. Though both sets of books are concerned with the same basic transactions but the figure of profit disclosed by the former does not agree with that disclosed by the latter.

Thus, reconciliation between the results of the two sets of books is necessary due to the following reasons:

1. To find out the reasons for the difference in the profit or loss in cost and financial accounts and to indicate the position clearly and to be sure that no mistakes pertaining to accounts have been committed.

2. To ensure the mathematical accuracy and reliability of cost accounts in order to have cost ascertainment, cost control and to have a check on the financial accounts.

3. To contribute to the standardisation of policies regarding stock valuation, depreciation and overheads.

4. To facilitate coordination and promote better cooperation between the activities of financial and cost sections of the accounting department.

5. To place management in better position to acquaint itself with the reasons for the variation in profits paving the way to more effective internal control. Methods of Reconciliation: Reconciliation of costing and financial profits can be attempted either:

(a) By preparing a Reconciliation Statement or

(b) By preparation a Memorandum Reconciliation Account. Reconciliation Statement: When reconciliation is attempted by preparing a reconciliation statement, profit shown by one set of accounts is taken as base profit and items of difference are either added to it or deducted from it to arrive at the figure of profit shown by other set of accounts.

Q11) What are the principal financial ledgers under non-integral accounts?

A11) The principal financial ledgers are:

(i) General Ledger:

It contains all real, nominal and personal accounts except trade debtors and trade creditors account.

(ii) Debtors Ledger:

It has personal accounts of trade debtors.

(iii) Creditors Ledger:

It has personal accounts of trade creditors.

Q12) What are the principal cost ledgers under non-integral accounts?

A12) The principal cost ledgers are:

(i) Cost Ledger:

It is the principal ledger in cost books which controls all other ledgers in the costing department. It contains all impersonal accounts and is similar to General Ledger of financial accounts.

(ii) Stores Ledger:

It is a subsidiary ledger. It contains all stores accounts.

(iii) Work-in-Progress Ledger:

It is a subsidiary ledger. It contains a separate account for each job in progress. Each such account is debited with the materials costs, wages and overheads chargeable to the jobs and credited with the cost of work completed. The balance in this account shows the cost of uncertified work.

Iv) Finished Goods Ledger:

It is a subsidiary ledger. It contains accounts of completely finished goods and jobs. The cost ledger is made self-balancing by opening a control account for each of the above subsidiary ledgers.

Q13) What are the basic features of non-integral system?

A13) The basic features of non-integral system are-

(i) Separate ledgers are maintained for cost and financial accounts.

(ii) Like financial accounting, it is also based on double entry system.

(iii) There are no personal accounts because cost accounts do not show relationship with outsiders.

Iv) Cost accounts are concerned with impersonal accounts i.e., real and nominal accounts.

(v) In real accounts, only stocks are shown in cost accounts.

(vi) Transactions affecting the nominal accounts are recorded separately in detail. Thus, cost accounting department is concerned mainly with the ascertainment of income and expenditure of business,

(vii) Under this system one main ledger (i.e., Cost Ledger) and various subsidiary ledgers are maintained,

(viii) Since the system is not properly integrated, some items may appear in financial ledgers only, while some other items appear only in cost ledger,

(ix) The profit or loss disclosed by the two sets of accounts for a particular period will never be the same and as such a reconciliation of costing profit or loss with that of financial accounts is essential.

Q14) What is non-integral system?

A14) Non-integral system is a system of accounting under which two separate sets of account books are maintained—one for cost accounts and the other for financial accounts. In other words, cost accounts are maintained separately from financial accounts.

Since separate ledgers are maintained for cost and financial accounts in this system, the cost accountant is responsible for recording of the cost accounting transactions and the financial accountant is responsible for financial transactions.

Non-integral system of accounting is also known as non-integrated system or Inter-locking system or Cost Ledger Accounting system. CIMA, London defines non-integral system as a system in which the cost accounts are distinct from financial accounts, the two sets of accounts being kept continuously in agreement by the use of control accounts or made readily reconcilable by other means.

Q15) What are the essential Prerequisites for Integrated Accounting System?

A15) The essential prerequisites for integrated system include the following: (a) Degree of Integration: The degree of integration of the two sets of accounts should be determined. It is the management which has to decide on full or partial integration. Full integration changes the entire accounting records. (b) Suitable Coding System: A suitable coding system must be developed to serve the accounting purposes of both financial and cost accounts. (c) Accounting Policy: An agreed routine with regard to the treatment of provision for accruals, pre-paid expenses, other adjustments necessary for the preparation of interim accounts.

(d) Co-ordination: Prefect co-ordination should exist between the staff responsible for the financial and cost aspects of the accounts and an efficient processing of various accounting documents should be ensured.

Q16) What are the basic Features of Integral System?

A16) The basic features of Integral system are-

(a) There is no need for cost ledger because all control accounts are maintained in the financial ledger.

(b) There is no need to open a Cost Ledger Control Account because both the aspects (i.e., debit and credit) of all transactions are recorded in respective accounts.

(c) Subsidiary ledgers i.e., Stores Ledger, Work-in-Progress Ledger and Finished goods ledger are maintained as is done in non-integrated accounting. In addition, a Sales Ledger (containing personal accounts for each customer) and a Purchase Ledger (containing personal accounts for each supplier) are also maintained. Overhead ledger is maintained to contain separate accounts for factory, administration and selling and distribution overhead.

(d) A control account for each subsidiary ledger is maintained in the general ledger.

Q17) What is Integrated system?

A17) Under integrated accounting, profit or loss is calculated by making profit and loss account only at the end of the accounting period. Therefore, it is not necessary to prepare a cost reconciliation statement to reconcile the profit as per financial account and cost account. The integrated accounting also helps in bringing co-ordination between the activities between costing and financial department.

Integral or Integrated system is a system of accounting under which only one set of account books is maintained to record both the Cost and Financial transactions. The system implies the merger of both cost and financial accounts in one set of books. The two sets of account books merge into a composite system. CIMA, London defines Integral system as a system in which the financial and cost accounts are interlocked to ensure that all relevant expenditure is absorbed into the cost accounts.

Q18) What are the advantages of Integrated system?

A18) The advantages of Integrated system are-

(i) There is no need for reconciliation because there will be only one figure of profit or loss as there is only one set of books.

(ii) This system is economical because it avoids duplication of recording the transactions in two separate set of books.

(iii) Accounting information is readily available and the correctness of the data is automatically checked.

(iv) It enables the introduction of mechanised accounting.

(v) A better understanding exists among the staff.

Q19) What are the subsidiary and control ledger prepared under integrated accounting?

A19) The subsidiary and control ledger prepared under integrated accounting are mentioned below:

Q20) What are the types of Service Costing?

A20) When we talk about services, our mind recalls the multiple intangible products we use on a day-to-day basis. But do you know that all these services have different cost units and elements during computation?

This is because each of these services is unique and involves a variety of different type of overheads. Thus, the service costing for each kind of service organization varies and can be classified as follows:

Transport Costing

The costing in the transport industry meets multiple objectives. These objectives can be segregated as follows by the type of transport service an organization provides:

- Private Transport: When the vehicle is hired individually for private tours, service costing is used to determine the hiring charges to be applied.

- Passenger Transport: It also ascertains the cost of conveyance, per passenger up to a certain distance in case of public or passenger transport companies.

- Goods Transport: When we talk about goods transport services, the cost of carrying a defined quantity of goods up to a particular distance is also decided through service costing.

The common objectives of transport costing include a comparison between two different vehicles or group of vehicles and; whether to use an alternative source of transport or own vehicle, in terms of cost involved.

Unit 5

Service Costing

Q1) What is Service costing?

A1) The term service costing or operating costing refers to the computation of the total operational cost incurred on each unit of the intangible product. These intangible products or services can be either in the form of internal services that are carried out by industries as supporting activities for the manufacturing of goods. Or in the way of external services that are offered as a significant product to the customers by the service sector companies.

Definition: The term service costing or operating costing refers to the computation of the total operational cost incurred on each unit of the intangible product. These intangible products or services can be either in the form of internal services that are carried out by industries as supporting activities for the manufacturing of goods. Or in the way of external services that are offered as a significant product to the customers by the service sector companies.

Service costing is an essential concept since every service organization needs to ascertain its business overheads. It is to ensure fair pricing of the products, i.e., services; and for keeping a control over its fixed and variable costs.

Service costing is an essential concept since every service organization needs to ascertain its business overheads. It is to ensure fair pricing of the products, i.e., services; and for keeping a control over its fixed and variable costs.

Q2) What are the features of Service costing?

A2) The costing in a service industry can be better understood with the help of the following characteristics:

Intangible Products: Service costing deals with the operating cost of products which does not have any physical form but satisfies consumer needs and wants.

Collection of Cost Data: The documents used for service costing of products include cost sheet, bills payables, daily log sheet, etc.

Unique and Standard Service: The services so offered by such organizations are specialized and exclusive

Less Working Capital: The service costing involves less working capital since the direct cost of raw material and other direct expenses is comparatively low.

Cost Per Unit: The cost per unit is mainly calculated in service costing. Here, the cost unit is determined by the type of service industry the business belongs to, and it usually differs from company to company. Like, in the case of goods transport it is ‘tonne-miles’; whereas, in boilers, it is ‘per cubic centimetre-litre’.

Internal or External Service: The service costing can be performed internally, to determine the operating cost of the supporting activities in manufacturing industries. Else, it can be carried out externally, by the companies dedicated to rendering such services.

Cost classification by behaviour- In the operating cost sheet format, all the business costs are classified according to their behaviour, i.e., fixed costs, semi-variable costs and variable costs.

Periodic or Order Wise Computation: The service costing records the overheads at regular intervals, i.e., monthly or yearly but for operating cost of vehicles like tractors and JCB machines, order wise computation is adopted.

Q3) Show the format of service costing.

A3) We are going to view the computation of transport costing in this section.

Transport is one of the significant service industry these days, and it is essential to have an insight of the proforma for determining the operating costing of such organizations:

Q4) What is the procedure when there is a difference between the profits disclosed by cost accounts and financial accounts?

A4) When there is a difference between the profits disclosed by cost accounts and financial accounts, the following steps shall be taken to prepare a Reconciliation Statement: (I) Ascertain the various reasons of disagreement (as discussed above) between the profits disclosed by two sets of books of accounts. (II) If profit as per cost account (or loss as per financial accounts) is taken as the base: Add: (i) Items of income included in financial accounts but not in cost accounts. (ii) Items of expenditure (as interest on capital, rent on owned premises etc.) included in cost accounts but not in financial accounts. (iii) Amounts by which items of expenditure have been shown in excess in cost accounts as compared to the corresponding entries in financial accounts. (iv) Amounts by which items of income have been shown in excess in financial accounts as compared to the corresponding entries in cost accounts. (v) Over-absorption of overheads in cost accounts. (vi) The amount by which closing stock of inventory is undervalued in cost accounts. (vii) The amount by which the opening stock of inventory is overvalued in cost accounts. (viii) Over charge of depreciation in cost accounts.

Deduct:

(i)Items of income included in cost accounts but not in financial accounts.

(ii) Items of expenditure included in financial accounts but not in cost accounts. (iii) Amounts by which items of income have been shown in excess in cost accounts over the corresponding entries in financial accounts.

(iv) Amounts by which items of expenditure have been shown in excess in financial accounts over the corresponding entries in cost accounts.

(v) Under-absorption of overheads in cost accounts.

(vi) The amount by which closing stock of inventory is overvalued in cost accounts.

(vii) The amount by which the opening stock of inventory is undervalued in cost accounts.

(viii) Under charge of depreciation in cost accounts.

(ix) After making all the above additions and deductions, the resulting figure will be profit as per financial accounts (or loss as per cash accounts).

Q5) Why reconciliation between the results of the two sets of books is necessary?

A5) Reconciliation between the results of the two sets of books is necessary due to the following reasons: