Unit 4

Banking Growth

Q1) Explain the growth of banking industry in India.

A1) The banking industry in India seems to be unaffected from the global financial crises which started from U.S in the last quarter of 2008. Despite the fallout and nationalization of banks across developed economies, banks in India seems to be on the strong fundamental base and seems to be well insulated from the financial turbulence emerging from the western economies. The Indian banking industry is well placed as compare to their banking industries western counterparts which are depending upon government bailout and stimulus packages. The strong economic growth in the past, low defaulter ratio, absence of complex financial products, regular intervention by central bank, proactive adjustment of monetary policy and so-called close banking culture has favoured the banking industry in India in recent global financial turmoil. Although there will no impact on the Indian banking system similar to that in west but the banks in India will adopt for more of defensive approach in credit disbursal in coming period. In order to safe guard their interest, banks will follow stringent norms for credit disbursal. There will be more focus on analysing borrower financial health.

A nation with 1 billion plus, India is the fastest growing country in terms of population and soon to overtake China as world’s largest populated country. The discerning impact on the over-stretched limited resources explains why India always tends to be deficient in infrastructure and opportunity. The largest economy of the world often frustrated researchers, as there was no single predictable pattern of the market; the multiplicity of government regulations and widespread government ownership had always kept investors away from exploring the vast Indian market. However, with India being liberalised today, banking intermediation has been playing a crucial role in economic development through its credit channel. Foreign banks have entered the soil but that has not yet posed a threat to the vast network of public sector banks that still conduct 92% of banking business in India.

Banking in India has undergone a major revamp. It has come a long way since its creation which dates back to the British era. The present banking systems has come into place after many transformations from the older systems. Against this background the present chapter deals with the evolution of the Indian Banking systems, the various reforms that has been made to make banks more effective, the role of private and foreign sector banks and last the challenges the Indian banks faces in the New Millennium.

The banking system is central to a nation’s economy. Banks are special as they not only accept and deploy large amounts of uncollateralised public funds in a fiduciary capacity, but also leverage such funds through credit creation. In India, prior to nationalisation, banking was restricted mainly to the urban areas and neglected in the rural and semi-urban areas. Large industries and big business houses enjoyed major portion of the credit facilities. Agriculture, small-scale industries and exports did not receive the deserved attention. Therefore, inspired by a larger social purpose, 14 major banks were nationalised in 1969 and six more in 1980. Since then, the banking system in India has played a pivotal role in the Indian economy, acting as an instrument of social and economic change. The rationale behind bank nationalisation has been succinctly put forth by eminent bankers:

‘Many bank failures and crises over two centuries, and the damage they did under laissez faire conditions; the needs of planned growth and equitable distribution of credit, which in privately owned banks was concentrated mainly on the controlling industrial houses and influential borrowers; the needs of growing small scale industry and farming regarding finance, equipment and inputs; from all these there emerged an inexorable demand for banking legislation, some government control and a central banking authority, adding up, in the final analysis, to social control and nationalisation’ (Tandon, 1989).

Post nationalisation, the Indian banking system registered tremendous growth in volume. Despite the undeniable and multifield gains of bank nationalization, it may be noted that the important financial institutions were all state owned and were subject to central direction and control. Banks enjoyed little autonomy as both lending and deposit rates were controlled until the end of the 1980s. Although nationalisation of banks helped in the spread of banking to the rural and hitherto uncovered areas, the monopoly granted to the public sector and lack of competition led to overall inefficiency and low productivity. By 1991, the country’s financial system was saddled with an inefficient and financially unsound banking sector. Some of the reasons for this were (i) high reserve requirements, (ii) administered interest rates, (iii) directed credit and (iv) lack of competition (v) political interference and corruption. As recommended by the Narasimham Committee Report (1991) several reform measures were introduced which included reduction of reserve requirements, de-regulation of interest rates, introduction of prudential norms, strengthening of bank supervision and improving the competitiveness of the system, particularly by allowing entry of private sector banks. With a view to adopting the Basel Committee (1988) framework on capital adequacy norms, the Reserve Bank introduced a risk

Weighted asset ratio system for banks in India as a capital adequacy measure in 1992. Banks were asked to maintain risk-weighted capital adequacy ratio initially at the lower level of 4 per cent, which was gradually increased to 9 per cent. Banks were also directed to identify problem loans on their balance sheets and make provisions for bad loans and bring down the burgeoning problem of non-performing assets. The period 1992-97 laid the foundations for reform in the banking system (Rangarajan, 1998). The second Narasimham Committee Report (1998) focussed on issues like strengthening of the banking system, upgrading of technology and human resource development. The report laid emphasis on two aspects of banking regulation, viz., capital adequacy and asset classification and resolution of NPA-related problems.

Commercial banks in India are expected to start implementing Basel II norms with effect from March 31, 2007. They are expected to adopt the standardised approach for credit risk and the basic indicator approach for operational risk initially. After adequate skills are developed, both at the banks and at the supervisory levels, some banks may be allowed to migrate to the internal rating based (IRB) approach (Reddy 2005).

At present, banks in India are venturing into non-traditional areas and generating income through diversified activities other than the core banking activities. Strategic mergers and acquisitions are being explored and implemented. With this, the banking sector is currently on the threshold of an exciting phase. Against this backdrop, this paper endeavours to study the important banking indicators for the last 25-year period from 1981 to 2005. These indicators have been broadly grouped into different categories, viz., (i) number of banks and offices (ii) deposits and credit (iii) investments (iv) capital to risk-weighted assets ratio (CRAR) (v) non-performing assets (NPAs) (vi) Income composition (vii) Expenditure composition (viii) return on assets (ROAs) and (ix) some select ratios. Accordingly, the paper discusses these banking indicators in nine sections in the same order as listed above. The paper concludes in section X by drawing important inferences from the trends of these different banking parameters.

The number of offices of all scheduled commercial banks almost doubled from 29,677 in 1980 to 55,537 in 2005. This rapid increase in the number of bank offices is observed in the case of all the bank groups. However, the number of banks in the case of foreign bank group and domestic private sector bank group decreased from 42 in 2000 to 31 in 2005 and from 33 in 2000 to 29 in 2005, respectively. This fall in the number of banks is reflective of the consolidation process and, in particular, the mergers and acquisitions that are the order of the banking system at present.

Q2) How was banking in the older days?

A2) Banking is believed to be a part of Indian society from as early as Vedic age; transition from mere money lending to banking must have happened before Manu, the great Hindu jurist, who had devoted a large section of his work to “deposits” and “advances” and also formulated rules for calculating interest on both 1. During the Mogul period indigenous bankers (rich individuals or families) helped foreign trades and commerce by lending money to the business. It was during the East Indian period when agency houses started managing the banking business.

The first Joint Stock bank India saw came in 1786 named the General Bank of India followed by the Bank of Hindustan and the Bengal Bank. Only the Bank of Hindustan continued to be in the show until 1906 while the other two disappeared in the meantime. East India Company established three banks in first half of 19th century: the Bank of Bengal in 1809, the Bank of Bombay in 1840, and the Bank of Madras in 1843. Eventually these three banks (which used to be referred to as Presidency Banks) were made independent units and they really did well for almost a century. In 1920, these three were amalgamated and a new Imperial Bank of India was established in 1921. Reserve Bank of India Act was passed in 1934 and finally in 1935, the Central Bank was created and christened as Reserve Bank of India. Imperial Bank was undertaken as State Bank of India after passing the State Bank of India Act in 1955. During the last phase of freedom fighting (Swadeshi Movement) few banks with purely Indian management were established like Punjab National bank (PNB), Bank of India (BOI) Ltd, Canara Bank Ltd, Indian Bank Ltd, the Bank of Baroda Ltd, the Central Bank of India Ltd, etc. July 19, 1969 was an important day in the history of Indian banking industry. Fourteen major banks of the country were nationalised and on April 15, 1980 six more commercial private banks were taken over by the Indian government.

In the wake of liberalisation that started in the last decade a few foreign banks entered the foray of commercial banks. To date there are around 40 banks of foreign origin that are operating in the market, like ABN AMRO Bank, ANZ Grindlays Bank, American Express Bank, HSBC Bank, Barclays Bank and Citibank groups to name a few major of them.

Q3) What is Banking?

A3) Banking is an industry that handles cash, credit, and other financial transactions. Banks provide a Safe place to Store extra cash and credit. They offer savings accounts, Certificates of Deposit, and checking accounts. Banks use these deposits to make loans. These loans include home mortgages, business loans, and car loans.

A Bank is a financial institution licensed to receive deposits and make loans. Two of the most common types of banks are commercial/retail and investment banks. Depending on type, a bank may also provide various financial services ranging from providing safe deposit boxes and currency exchange to retirement and wealth management.

Banking is defined as “Accepting of deposits of money from public for the purpose of Lending or Investment, repayable on demand or otherwise and withdrawal by cheque, draft, or otherwise”

Banking can be defined as the business activity of accepting and safeguarding money owned by other individuals and entities, and then lending out this money in order to earn a profit. However, with the passage of time, the activities covered by banking business have widened and now various other services are also offered by banks. The banking services these days include issuance of debit and credit cards, providing safe custody of valuable items, lockers, ATM services and online transfer of funds across the country / world.

Q4) Explain the Indian Banking system.

A4) The Indian banking can be broadly categorized into nationalized (government owned), private banks and specialized banking institutions 2. The Reserve Bank of India acts a centralized body monitoring any discrepancies and shortcoming in the system. Since the nationalization of banks in 1969, the public sector banks or the nationalized banks have acquired a place of prominence and has since then seen tremendous progress. The need to become highly customer focused has forced the slow-moving public sector banks to adopt a fast-track approach. The unleashing of products and services through the net has galvanized players at all levels of the banking and financial institutions market grid to look into their existing portfolio offering. Conservative banking practices allowed Indian banks to be insulated partially from the Asian currency crisis. Indian banks are now quoting al higher valuation when compared to banks in other Asian countries (viz. Hong Kong, Singapore, Philippines etc.) that have major problems linked to huge Non-Performing Assets (NPAs) and payment defaults. Co-operative banks are nimble footed in approach and armed with efficient branch networks focus primarily on the ‘high revenue’ niche retail segments. The Indian banking has come from a long way from being a sleepy business institution to a highly proactive and dynamic entity. This transformation has been largely brought about by the large dose of liberalization and economic reforms that allowed banks to explore new business opportunities rather than generating revenues from conventional streams (i.e., borrowing and lending). The banking in India is highly fragmented with 30 banking units contributing to almost 50% of deposits and 60% of advances. Indian nationalized banks (banks owned by the government) continue to be the major lenders in the economy due to their sheer size and penetrative networks which assures them high deposit mobilization.

The banking system has three tiers. These are the scheduled commercial banks; the Regional rural banks which operate in rural areas not covered by the scheduled banks;

And the cooperative and special purpose rural banks. Under the ambit of the nationalized banks come the specialized banking institutions. These co-operatives, rural banks focus on areas of agriculture, rural development etc., unlike commercial banks these co-operative banks do not lend on the basis of a prime lending rate. They also have various tax sops because of their holding pattern and lending structure and hence have lower overheads. This enables them to give a marginally higher percentage on savings deposits. Many of these cooperative banks diversified into specialized areas (catering to the vast retail audience) like car finance, housing loans, truck finance etc. In order to keep pace with their public sector and private counterparts, the co-operative banks too have invested heavily in information technology to offer high-end computerized banking services to its clients.

Q5) What are the classification of banks?

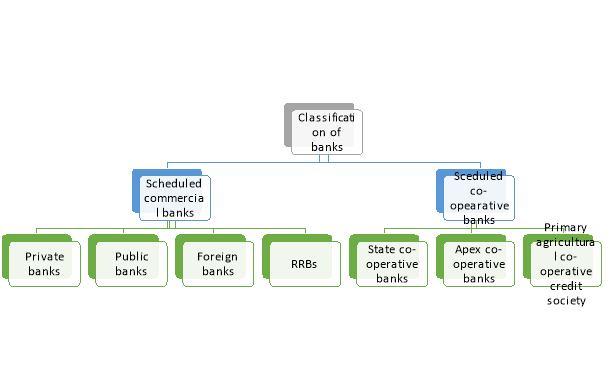

A5) Structure/Classification of banking system in India

Depending on the nature of activities performed and ownership, the classification of banks is discussed below-

Figure: Classification of banks

A) Scheduled Commercial banks: It refers to the banks established to facilitate trade and industry. It is again sub-divided as follow-

i) Public sector bank: It refers to the commercial banks where more than 50 per cent shares are held by the government. At present there are 12 public sector banks in India. It is again grouped as-

- SBI and its associates

- Other nationalised banks.

Some examples of public sector banks are State Bank of India, Punjab National bank, Union Bank of India etc.

Ii) Private sector bank: It refers to the commercial banks where more than 50 per cent shares are owned by the private individuals. Some examples of private sector bans are Yes bank, ICICI, City bank, Federal bank etc.

Iii) Foreign bank: It refers to the commercial bank which is operating in India but their head office is situated outside India. For example, HSBC ban Ltd. Standard Chartered etc.

Iv) Regional Rural Bank: RRBs are commercial banks established to operate at regional level of different states and to focus on the banking needs of rural masses. For example, Maharashtra Garmin bank, Assam Gramin Vikash bank etc.

B) Scheduled Co-operative bank: It refers to the bank established according to the co-operative principle and consumers are the owners of the bank. It provides normal banking services to its customers but it mainly focuses on the agriculture and allied activities. It operates under three tier structure-

- State Co-operative banks operate at the State level

- Apex Co-operative banks operate at the district level

- Primary Agricultural Co-operative Credit Society operates at the village level.

Q6) Explain the organisation of Indian Banking system.

A6) The Banking system of a country is an important pillar holding up the financial system of the country’s economy. The major role of banks in a financial system is the mobilization of deposits and disbursement of credit to various sectors of the economy. The existing, elaborate banking structure of India has evolved over several decades.

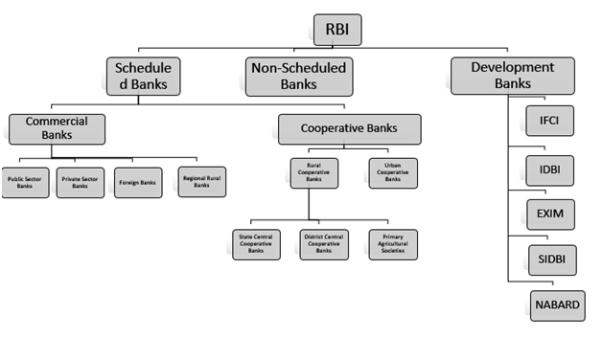

Reserve Bank of India is the central bank of the country and regulates the banking system of India. The structure of the banking system of India can be broadly divided into scheduled banks, non-scheduled banks and development banks.

Banks that are included in the second schedule of the Reserve Bank of India Act, 1934 are considered to be scheduled banks.

All scheduled banks enjoy the following facilities:

- Such a bank becomes eligible for debts/loans on bank rate from the RBI

- Such a bank automatically acquires the membership of a clearing house.

All banks which are not included in the second section of the Reserve Bank of India Act, 1934 are Non-scheduled Banks. They are not eligible to borrow from the RBI for normal banking purposes except for emergencies.

Scheduled banks are further divided into commercial and cooperative banks.

Scheduled, Non-Scheduled Banks and Development Banks

Commercial Banks

The institutions that accept deposits from the general public and advance loans with the purpose of earning profits are known as Commercial Banks.

Commercial banks can be broadly divided into public sector, private sector, foreign banks and RRBs.

- In Public Sector Banks the majority stake is held by the government. After the recent amalgamation of smaller banks with larger banks, there are 12 public sector banks in India as of now. An example of Public Sector Bank is State Bank of India.

- Private Sector Banks are banks where the major stakes in the equity are owned by private stakeholders or business houses. A few major private sector banks in India are HDFC Bank, Kotak Mahindra Bank, ICICI Bank etc.

- A Foreign Bank is a bank that has its headquarters outside the country but runs its offices as a private entity at any other location outside the country. Such banks are under an obligation to operate under the regulations provided by the central bank of the country as well as the rule prescribed by the parent organization located outside India. An example of Foreign Bank in India is Citi Bank.

- Regional Rural Banks were established under the Regional Rural Banks Ordinance, 1975 with the aim of ensuring sufficient institutional credit for agriculture and other rural sectors. The area of operation of RRBs is limited to the area notified by the Government. RRBs are owned jointly by the Government of India, the State Government and Sponsor Banks. An example of RRB in India is Arunachal Pradesh Rural Bank.

Cooperative Banks

A Cooperative Bank is a financial entity that belongs to its members, who are also the owners as well as the customers of their bank. They provide their members with numerous banking and financial services. Cooperative banks are the primary supporters of agricultural activities, some small-scale industries and self-employed workers. An example of a Cooperative Bank in India is Mehsana Urban Co-operative Bank.

At the ground level, individuals come together to form a Credit Co-operative Society. The individuals in the society include an association of borrowers and non-borrowers residing in a particular locality and taking interest in the business affairs of one another. As membership is practically open to all inhabitants of a locality, people of different status are brought together into the common organization. All the societies in an area come together to form a Central Co-operative Banks.

Cooperative banks are further divided into two categories - urban and rural.

- Rural cooperative Banks are either short-term or long-term.

- Short-term cooperative banks can be subdivided into State Co-operative Banks, District Central Co-operative Banks, Primary Agricultural Credit Societies.

- Long-term banks are either State Cooperative Agriculture and Rural Development Banks (SCARDBs) or Primary Cooperative Agriculture and Rural Development Banks (PCARDBs).

- Urban Co-operative Banks (UCBs) refer to primary cooperative banks located in urban and semi-urban areas.

Development Banks

Financial institutions that provide long-term credit in order to support capital-intensive investments spread over a long period and yielding low rates of return with considerable social benefits are known as Development Banks. The major development banks in India are; Industrial Finance Corporation of India (IFCI Ltd), 1948, Industrial Development Bank of India' (IDBI) 1964, Export-Import Banks of India (EXIM) 1982, Small Industries Development Bank of India (SIDBI) 1989, National Bank for Agriculture and Rural Development (NABARD) 1982.

The banking system of a country has the capability to heavily influence the development of a country’s economy. It is also instrumental in the development of rural and suburban regions of a country as it provides capital for small businesses and helps them to grow their business. The organized financial system comprises Commercial Banks, Regional Rural Banks (RRBs), Urban Co-operative Banks (UCBs), Primary Agricultural Credit Societies (PACS) etc. caters to the financial service requirement of the people. The initiatives taken by the Reserve Bank and the Government of India in order to promote financial inclusion have considerably improved the access to the formal financial institutions. Thus, the banking system of a country is very significant not only for economic growth but also for promoting economic equality.

Q7) Explain Nationalization and social control of banks.

A7) Nationalization refers to the situation where the government takes over a private organization. Through this action, government bodies end up having ownership and control over these bodies leading to the previous owners or shareholders losing their investment.

Bank nationalization in India started with the government nationalizing the 14 largest commercial banks on 19 July 1969 through the Banking Companies (Acquisition and Transfer of Undertakings) Ordinance, 1969. These banks held about 80% of the entire bank deposits in the country. In 1980 another six private banks were nationalized. Until 1969, the State Bank of India was the only bank not privately owned. It was called the Imperial Bank before its nationalization in 1955. Currently, India has 19 nationalized banks.

There are various reasons for the occurrence of such nationalization. One of the major reasons is to energize priority sectors. The agricultural sector was ignored for a very long time by commercial banks. These banks were seen as catering to only large industries and businesses. Approx. 2.3% of the bank loans were channelled to farmers, in 1950, with the figure declining to 2.2% by in next 17 years. The government also wanted to open new branches in the rural and backward areas. The government also wanted to mobilize savings through nationalization and utilize them for better and productive purposes leading to efficiency. There were various economic and political reasons as well Bank nationalization was one of her responses to the economic and political challenges of the time. E.g., the wars with China in 1962 and Pakistan in 1965—that put pressure on public finances.

Impact of Nationalization

Bank nationalization has both a negative and positive effect.

Positive effects include; firstly, an increase in financial savings since the lenders are opening branches without any banking branch. Secondly, there was an increase in gross domestic savings in the 1970s.

There also was an improvement in banking efficiency, which consequently lead to a boost in the confidence of the public in banks. It also gave a boost to the small-scale industries and other small sector businesses that were held back including agriculture. This resulted in the overall growth of the economy. There was a major increase in the penetration of the banks, especially in rural areas. Further, financial inclusion was witnessed due to the growth of financial intermediation. The share of bank deposits to GDP rose from 13% in 1969 to 38% in 1991. The gross savings rate rose from 12.8% in 1969 to 21.7% in 1990. The share of advances to GDP rose from 10% in 1969 to 25% in 1991. The gross investment rate rose from 13.9% in 1969 to 24.1% in 1990. Nationalization also demonstrated the utility of monetary policy in furthering redistributionist goals. The bank branches had reached from every urban area to almost all the remote areas. An increase in the public deposit because of nationalization was triggered which led to rapid growth in all classes of business. This was also the golden times of the Green Revolution, which Indian history considers to be the period of rapid India’s growth.

However, along with all these positive impacts, there were also some negative impacts. Although nationalization was able to help small scale businesses, it was incapable of eradicating poverty from India. The entire process of nationalization did not surpass the number of private banks i.e., private banks still held a dominant place in the market. Nationalization alone was also unable to achieve financial inclusion, Jan Dhan Yogna had a role to play in it because it was after the launch of this scheme that financial inclusion was increased.

The need for Banks and the Banking Sector

Financial institutions are a vital clog in the development of a country, they help in economic development by financing development projects (private and public) and they facilitate social growth by providing savings and investment options or facilitate loans to the masses to help improve their living standard.

A well-administered banking system can help in stabilizing the economy and build investments in the country. Banks play a major role in the planning and implementation of financial policies. The prioritizing of goals can help achieve the targets set by economists. The banking system can help attain the goal of higher profits by improving the purchasing power of the individual or the organization.

History of Nationalization

The story behind the nationalization of banks can be credited to the Indira Gandhi government, a move which was considered by many as one to invigorate the national spirit of the masses and to discard the capitalistic mindset of the capitalist banks, the critics saw this move as one to deviate from the problems faced by the country at the time with prolonged droughts hampering the economy of the country and the growth rate plummeting into the negatives.

Another reason for nationalization was the banks themselves. There was heavy criticism on banks that they were corporate-friendly and did not provide credit to agriculture and loaned to an industrialist who was involved with the banks. This accusation was backed by data that showed that agriculture received 2 percent of the credit in 1951 and this remained unchanged till 1967, whereas the share of industries had increased from 34 percent in 1951 to 64.3 percent in 1967.

The nationalization of banks finally capped the socialist policies that the Indian Constitution had envisaged.

Social impact of banks- Pre and Post nationalization

As mentioned above the banks were notorious for not lending credit to agriculture, the government then came up with the Banking Laws Amendment in 1968 which prohibited the directors from acquiring loans from the banks. Also, a National Credit Council was created and the major task of the NCC was to align the objectives of the banks to that of the nation and help in the development of all the sectors of the economy particularly the agriculture and small-scale industries. Such policies alarmed the banks which then in the fear of nationalization advertised their wholesome approach in helping the rural and semi-urban regions of the country. This move was initiated a little too late and the nationalization of banks was imminent.

Only major banks were selected for the nationalization process and the criteria had been set to any bank which was not foreign and had deposits of over 50 crore rupees. The Banking Companies (Acquisition and Transfer of Undertakings) Act, 1969 was passed and it laid down the criteria for nationalization. The objective of the Act was “to serve better the needs of the development of the economy in conformity with national policy and objectives”.

In the first phase, in 1969, 14 banks were nationalized and in the second phase of 1980, further 6 more banks were brought under government control thereby bringing the government-controlled over the banking sector up to 91 percent.

Post nationalization, the banks were expected to set up 4 rural branches for one branch established in an urban location and agriculture lending saw a drastic increase with the mandatory minimum credit of 18 percent set by the government on the banks.

Transformation of the Banking System

The post-nationalization banking regime had 27 banks under the Public Sector Banks (PSBs) which now were providing credit and allowing people to deposit their savings in the banks, thereby ushering a new era for the residents of rural and semi-urban regions of the country. The venture of providing banking services in remote locations was not cost-effective in the short term and was among the major barriers for private banks, but the RBI along with the Public sector banks devised a model to steadily grow the banking infrastructure in the rural and semi-urban locations with schemes such as Lead Bank Scheme (LBS) in 1969, the State Level Bankers’ Committee (SLBC), district credit plans, priority sector lending (PSL) norms in 1974, branch expansion policy and the formation of Regional Rural Banks in 1975. These schemes helped in the attainment of the outreach plans of the Reserve Bank of India and the Public Sector Banks.

The Public sector Banks also helped in the implementation of welfare schemes in coordination with the State, district, and taluka level administrations. Individuals in the rural regions were dependent on the PSBs for their subsidies and the welfare schemes allotted by the state and central governments. The government-sponsored debt-waiver schemes and agricultural subsidies provided through the PSBs had an impact on the rural regions of the country and helped finance rural business enterprises and helped increase the economy of the rural regions.

In the process, the number of bank branches increased from 8,187 in 1969 to 59,752 in 1990 to 1,41,756 in March 2019. The share of rural and semi-urban branches varied from 58.4% to 77.2% to 62.89% during this period. The total network of rural and semi-urban branches stands at 89,144 in March 2019 compared to 4,781 in 1969 and 46,128 in 1990. In addition, 1.26 lakh bank Mitra’s (business correspondents) provide branchless banking in villages.

Q8) What is Indian Banking Legislation?

A8) The Banking Regulation Act, 1949 is a legislation in India that regulates all banking firms in India. Passed as the Banking Companies Act 1949, it came into force from 16 March 1949 and changed to Banking Regulation Act 1949 from 1 March 1966. It is applicable in Jammu and Kashmir from 1956. Initially, the law was applicable only to banking companies. But, 1965 it was amended to make it applicable to cooperative banks and to introduce other changes. In 2020 it was amended to bring the cooperative banks under the supervision of the Reserve Bank of India.

The banking system in India is regulated by the Reserve Bank of India (RBI), through the provisions of the Banking Regulation Act, 1949. Some important aspects of the regulations that govern banking in this country, as well as RBI circulars that relate to banking in India, will be explored below.

Banks in India comprise of:

- Scheduled commercial banks (i.e., commercial banks performing all banking functions, which will include both government-owned banks and private banks, and branches or subsidiaries of foreign banks);

- Cooperative banks (set up by cooperative societies to provide financing to small borrowers);

- Regional rural banks (RRBs) (these are government banks set up at local levels to provide credit to rural and agricultural areas);

- Small finance banks (these banks have been set up to undertake basic banking activities with a focus on lending to sectors and geographical areas which are not being serviced by other banks); and

- Payments banks (these banks have been set up to undertake payment and remittance-related activities and accepting small deposits).

- Government oversight: In the past, the government has nationalised a number of major commercial banks. While the government has not made any moves for further nationalisation of banks, the government has the power to acquire undertakings of an Indian bank in certain situations, including for breach of applicable regulations. The government has also been (and is in the process) of merging various public sector banks to strengthen the balance sheets of the banks, and also has plans to reduce government stakes in the public sector banks as part of its disinvestment plans.

- Foreign banks: There are about 45 foreign banks that have already set up banking operations in India. While foreign banks are currently operating through branch models in India, guidelines have been issued in the year 2013, which require foreign banks to operate through either a wholly-owned subsidiary (WOS) incorporated in India or through branches set up in India. Further, foreign banks which have been set up in India after August 2010 would be required to operate in India through a WOS incorporated in India in the event that the ownership structure of the foreign bank was complex, or the business of the said bank was significant, or the host country regulations were not satisfactory. Under these guidelines, foreign banks were also incentivised to operate through a WOS located in India, as they would be treated on par with Indian banks.

Q9) Write a short note on IMF.

A9) The International Monetary Fund (IMF) is an international organization that promotes global economic growth and financial stability, encourages international trade, and reduces poverty. Quotas of member countries are a key determinant of the voting power in IMF decisions. Votes comprise one vote per 100,000 special drawing right (SDR) of quota plus basic votes. SDRS are an international type of monetary reserve currency created by the IMF as a supplement to the existing money reserves of member countries.

The International Monetary Fund (IMF) is based in Washington, D.C. The organization is currently composed of 189 member countries, each of which has representation on the IMF's executive board in proportion to its financial importance. Quotas are a key determinant of the voting power in IMF decisions. Votes comprise one vote per SDR100,000 of quota plus basic votes (same for all members).

The IMF's website describes its mission as "to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world."

Q10) Write a short note on IBRD.

A10) The International Bank for Reconstruction and Development (IBRD) is a global development cooperative owned by 189 member countries. As the largest development bank in the world, it supports the World Bank Group’s mission by providing loans, guarantees, risk management products, and advisory services to middle-income and creditworthy low-income countries, as well as by coordinating responses to regional and global challenges.

Created in 1944 to help Europe rebuild after World War II, IBRD joins with IDA, our fund for the poorest countries, to form the World Bank. They work closely with all institutions of the World Bank Group and the public and private sectors in developing countries to reduce poverty and build shared prosperity.

The International Bank for Reconstruction and Development (IBRD) is an international financial institution, established in 1944 and headquartered in Washington, D.C., United States, that is the lending arm of World Bank Group. The IBRD offers loans to middle-income developing countries. The IBRD is the first of five member institutions that compose the World Bank Group. The initial mission of the IBRD in 1944, was to finance the reconstruction of European nations devastated by World War II. The IBRD and its concessional lending arm, the International Development Association (IDA), are collectively known as the World Bank as they share the same leadership and staff.

Following the reconstruction of Europe, the Bank's mandate expanded to advancing worldwide economic development and eradicating poverty. The IBRD provides commercial-grade or concessional financing to sovereign states to fund projects that seek to improve transportation and infrastructure, education, domestic policy, environmental consciousness, energy investments, healthcare, access to food and potable water, and access to improved sanitation.

The IBRD is owned and governed by its 189 member states, with each country represented on the Board of Governors. The IBRD has its own executive leadership and staff which conduct its normal business operations. The Bank's member governments are shareholders which contribute and have the right to vote on its matters. In addition to contributions from its member nations, the IBRD acquires most of its capital by borrowing on international capital markets through bond issues at a preferred rate because of its AAA credit rating.

Q11) Explain in brief about post nationalisation of banks.

A11) Post nationalisation, the Indian banking system registered tremendous growth in volume. Despite the undeniable and multifield gains of bank nationalization, it may be noted that the important financial institutions were all state owned and were subject to central direction and control. Banks enjoyed little autonomy as both lending and deposit rates were controlled until the end of the 1980s. Although nationalisation of banks helped in the spread of banking to the rural and hitherto uncovered areas, the monopoly granted to the public sector and lack of competition led to overall inefficiency and low productivity. By 1991, the country’s financial system was saddled with an inefficient and financially unsound banking sector. Some of the reasons for this were (i) high reserve requirements, (ii) administered interest rates, (iii) directed credit and (iv) lack of competition (v) political interference and corruption. As recommended by the Narasimham Committee Report (1991) several reform measures were introduced which included reduction of reserve requirements, de-regulation of interest rates, introduction of prudential norms, strengthening of bank supervision and improving the competitiveness of the system, particularly by allowing entry of private sector banks. With a view to adopting the Basel Committee (1988) framework on capital adequacy norms, the Reserve Bank introduced a risk

Weighted asset ratio system for banks in India as a capital adequacy measure in 1992. Banks were asked to maintain risk-weighted capital adequacy ratio initially at the lower level of 4 per cent, which was gradually increased to 9 per cent. Banks were also directed to identify problem loans on their balance sheets and make provisions for bad loans and bring down the burgeoning problem of non-performing assets. The period 1992-97 laid the foundations for reform in the banking system (Rangarajan, 1998). The second Narasimham Committee Report (1998) focussed on issues like strengthening of the banking system, upgrading of technology and human resource development. The report laid emphasis on two aspects of banking regulation, viz., capital adequacy and asset classification and resolution of NPA-related problems.

Commercial banks in India are expected to start implementing Basel II norms with effect from March 31, 2007. They are expected to adopt the standardised approach for credit risk and the basic indicator approach for operational risk initially. After adequate skills are developed, both at the banks and at the supervisory levels, some banks may be allowed to migrate to the internal rating based (IRB) approach (Reddy 2005).

At present, banks in India are venturing into non-traditional areas and generating income through diversified activities other than the core banking activities. Strategic mergers and acquisitions are being explored and implemented. With this, the banking sector is currently on the threshold of an exciting phase. Against this backdrop, this paper endeavours to study the important banking indicators for the last 25-year period from 1981 to 2005. These indicators have been broadly grouped into different categories, viz., (i) number of banks and offices (ii) deposits and credit (iii) investments (iv) capital to risk-weighted assets ratio (CRAR) (v) non-performing assets (NPAs) (vi) Income composition (vii) Expenditure composition (viii) return on assets (ROAs) and (ix) some select ratios. Accordingly, the paper discusses these banking indicators in nine sections in the same order as listed above. The paper concludes in section X by drawing important inferences from the trends of these different banking parameters.

The number of offices of all scheduled commercial banks almost doubled from 29,677 in 1980 to 55,537 in 2005. This rapid increase in the number of bank offices is observed in the case of all the bank groups. However, the number of banks in the case of foreign bank group and domestic private sector bank group decreased from 42 in 2000 to 31 in 2005 and from 33 in 2000 to 29 in 2005, respectively. This fall in the number of banks is reflective of the consolidation process and, in particular, the mergers and acquisitions that are the order of the banking system at present.

Q12) What are the functions of Banking?

A12) FUNCTIONS

- Deals with money

The bank accepts deposits from the public and advancing them as loans to the needy people. The deposits may be current, fixed saving etc.

- Provide loans

The banks are the institutions that can create credit i.e., creation of additional money for lending. Thus ‘creation of credit is the unique features of banking.

Banks make extra money by providing loans for different Product to the loan. The bank makes the extra money by lending money to the eligible person at certain rates. Nowadays, banks provide loans for various requirements such as study loan, car loan, home loan, personal loans, etc. Different banks provide different loans at different interest rates. You can compare the interest rates of different banks to get a loan at minimum interest rates

- Middle man

Banks serve as a middle man from the money surplus unit to be money deficit unit. They are intermediaries, who transfer funds from savers to investors through grants for business, commerce, education, housing etc.

- Deposits must be withdrawal

The deposits are usually withdrawal on demand. It may be withdrawal by cheque, draft or otherwise.

- Internet Services

Bank is that modern banks are also providing internet services. The development of the internet and its inclusion in the banking sector has made it even more easy for people to carry out various transactions.

Banks are providing online services through their apps. You can pay bills, buy food, go shopping without having cash with you. With the help of banking apps, you can pay for everything online.

Nowadays, more and more banks are taking their business online. It helps in making safe and risks free transactions, and there are fewer chances of stealing taxes. There are specific terms for these types of transactions, such as internet banking and mobile banking.

- Commercial in nature

Since all the banking activities of Commercial banks are carried on with the aim of Making profit, it is regarded as a commercial institution.

The bank uses our money to lend it to others or by investing it in profitable businesses to make profits. If you think your money is sitting in a bank’s locker, then you are wrong.

You might have digits of the money mentioned in your passbook, but you might be rotating between one person to another to make more money to the investor.

- Size transformation

Bank Create a reservoir of fund from the numerous small deposits collect from customer and then provide large loan to Investor.

- Nature of agent

Beside the basic function of accepting deposits and lending money as a loan bank possess the characteristics of an agent because of its various agency services.

Q13) Give the total list of banks operating in India.

A13) Scheduled and Non-Scheduled Banks

There are approximately Eighty scheduled commercial banks, Indian and foreign; almost Two Hundred regional rural banks; more than Three Hundred Fifty central cooperative banks, Twenty land development banks; and a number of primary agricultural credit societies. In terms of business, the public sector banks, namely the State Bank of India and the nationalized banks, dominate the banking sector. India had a fairly well-developed commercial banking system in existence at the time of independence in 1947. The Reserve Bank of India (RBI) was established in 1935. While the RBI became a state-owned institution from January 1, 1949, the Banking Regulation Act was enacted in 1949 providing a framework for regulation and supervision of commercial banking activity.

The first step towards the nationalisation of commercial banks was the result of a report (under the aegis of RBI) by the Committee of Direction of All India Rural Credit Survey (1951) which till today is the locus classicus on the subject. The Committee recommended one strong integrated state partnered commercial banking institution to stimulate banking development in general and rural credit in particular. Thus, the Imperial Bank was taken over by the Government and renamed as the State Bank of India (SBI) on July 1, 1955 with the RBI acquiring overriding substantial holding of shares. A number of erstwhile banks owned by princely states were made subsidiaries of SBI in 1959. Thus, the beginning of the Plan era also saw the emergence of public ownership of one of the most prominent of the commercial banks.

The All-India Rural Credit Survey Committee Report, 1954 recommended an integrated approach to cooperative credit and emphasised the need for viable credit cooperative societies by expanding their area of operation, encouraging rural savings and diversifying business. The Committee also recommended for Government participation in the share capital of the cooperatives. The report subsequently paved the way for the present structure and composition of the Cooperative Banks in the country

There was a feeling that though the Indian banking system had made considerable progress in the ’50s and ’60s, it established close links between commercial and industry houses, resulting in cornering of bank credit by these segments to the exclusion of agriculture and small industries. To meet these concerns, in 1967, the Government introduced the concept of social control in the banking industry. The scheme of social control was aimed at bringing some changes in the management and distribution of credit by the commercial banks. The close link between big business houses and big banks was intended to be snapped or at least made ineffective by the reconstitution of the Board of Directors to the effect that 51 per cent of the directors were to have special knowledge or practical experience. Appointment of whole-time Chairman with special knowledge and practical experience of working of commercial banks or financial or economic or business administration was intended to professionalise the top management. Imposition of restrictions on loans to be granted to the directors’ concerns was another step towards avoiding undesirable flow of credit to the units in which the directors were interested. The scheme also provided for the take-over of banks under certain circumstances.

Political compulsion then partially attributed to inadequacies of the social control, led to the Government of India nationalising, in 1969, fourteen major scheduled commercial banks which had deposits above a cut-off size. The objective was to serve better the needs of development of the economy in conformity with national priorities and objectives. In a somewhat repeat of the same experience, eleven years after nationalisation, the Government announced the nationalisation of seven more scheduled commercial banks above the cut-off size. The second round of nationalisation gave an impression that if a private sector bank grew to the cut-off size it would be under the threat of nationalisation.

From the fifties a number of exclusively state-owned development financial institutions (DFIs) were also set up both at the national and state level, with a lone exception of Industrial Credit and Investment Corporation (ICICI) which had a minority private shareholding. The mutual fund activity was also a virtual monopoly of Government owned institution, viz., the Unit Trust of India. Refinance institutions in agriculture and industry sectors were also developed, similar in nature to the DFIs. Insurance, both Life and General, also became state monopolies.

Q14) Give the impact of Nationalization.

A14) Bank nationalization has both a negative and positive effect.

Positive effects include; firstly, an increase in financial savings since the lenders are opening branches without any banking branch. Secondly, there was an increase in gross domestic savings in the 1970s.

There also was an improvement in banking efficiency, which consequently lead to a boost in the confidence of the public in banks. It also gave a boost to the small-scale industries and other small sector businesses that were held back including agriculture. This resulted in the overall growth of the economy. There was a major increase in the penetration of the banks, especially in rural areas. Further, financial inclusion was witnessed due to the growth of financial intermediation. The share of bank deposits to GDP rose from 13% in 1969 to 38% in 1991. The gross savings rate rose from 12.8% in 1969 to 21.7% in 1990. The share of advances to GDP rose from 10% in 1969 to 25% in 1991. The gross investment rate rose from 13.9% in 1969 to 24.1% in 1990. Nationalization also demonstrated the utility of monetary policy in furthering redistributionist goals. The bank branches had reached from every urban area to almost all the remote areas. An increase in the public deposit because of nationalization was triggered which led to rapid growth in all classes of business. This was also the golden times of the Green Revolution, which Indian history considers to be the period of rapid India’s growth.

However, along with all these positive impacts, there were also some negative impacts. Although nationalization was able to help small scale businesses, it was incapable of eradicating poverty from India. The entire process of nationalization did not surpass the number of private banks i.e., private banks still held a dominant place in the market. Nationalization alone was also unable to achieve financial inclusion, Jan Dhan Yogna had a role to play in it because it was after the launch of this scheme that financial inclusion was increased.

Q15) Explain the history of Nationalization.

A15) The story behind the nationalization of banks can be credited to the Indira Gandhi government, a move which was considered by many as one to invigorate the national spirit of the masses and to discard the capitalistic mindset of the capitalist banks, the critics saw this move as one to deviate from the problems faced by the country at the time with prolonged droughts hampering the economy of the country and the growth rate plummeting into the negatives.

Another reason for nationalization was the banks themselves. There was heavy criticism on banks that they were corporate-friendly and did not provide credit to agriculture and loaned to an industrialist who was involved with the banks. This accusation was backed by data that showed that agriculture received 2 percent of the credit in 1951 and this remained unchanged till 1967, whereas the share of industries had increased from 34 percent in 1951 to 64.3 percent in 1967.

The nationalization of banks finally capped the socialist policies that the Indian Constitution had envisaged.

Social impact of banks- Pre and Post nationalization

As mentioned above the banks were notorious for not lending credit to agriculture, the government then came up with the Banking Laws Amendment in 1968 which prohibited the directors from acquiring loans from the banks. Also, a National Credit Council was created and the major task of the NCC was to align the objectives of the banks to that of the nation and help in the development of all the sectors of the economy particularly the agriculture and small-scale industries. Such policies alarmed the banks which then in the fear of nationalization advertised their wholesome approach in helping the rural and semi-urban regions of the country. This move was initiated a little too late and the nationalization of banks was imminent.

Only major banks were selected for the nationalization process and the criteria had been set to any bank which was not foreign and had deposits of over 50 crore rupees. The Banking Companies (Acquisition and Transfer of Undertakings) Act, 1969 was passed and it laid down the criteria for nationalization. The objective of the Act was “to serve better the needs of the development of the economy in conformity with national policy and objectives”.

In the first phase, in 1969, 14 banks were nationalized and in the second phase of 1980, further 6 more banks were brought under government control thereby bringing the government-controlled over the banking sector up to 91 percent.

Post nationalization, the banks were expected to set up 4 rural branches for one branch established in an urban location and agriculture lending saw a drastic increase with the mandatory minimum credit of 18 percent set by the government on the banks.

Q16) Give the transformation of banking system.

A16) The post-nationalization banking regime had 27 banks under the Public Sector Banks (PSBs) which now were providing credit and allowing people to deposit their savings in the banks, thereby ushering a new era for the residents of rural and semi-urban regions of the country. The venture of providing banking services in remote locations was not cost-effective in the short term and was among the major barriers for private banks, but the RBI along with the Public sector banks devised a model to steadily grow the banking infrastructure in the rural and semi-urban locations with schemes such as Lead Bank Scheme (LBS) in 1969, the State Level Bankers’ Committee (SLBC), district credit plans, priority sector lending (PSL) norms in 1974, branch expansion policy and the formation of Regional Rural Banks in 1975. These schemes helped in the attainment of the outreach plans of the Reserve Bank of India and the Public Sector Banks.

The Public sector Banks also helped in the implementation of welfare schemes in coordination with the State, district, and taluka level administrations. Individuals in the rural regions were dependent on the PSBs for their subsidies and the welfare schemes allotted by the state and central governments. The government-sponsored debt-waiver schemes and agricultural subsidies provided through the PSBs had an impact on the rural regions of the country and helped finance rural business enterprises and helped increase the economy of the rural regions.

In the process, the number of bank branches increased from 8,187 in 1969 to 59,752 in 1990 to 1,41,756 in March 2019. The share of rural and semi-urban branches varied from 58.4% to 77.2% to 62.89% during this period. The total network of rural and semi-urban branches stands at 89,144 in March 2019 compared to 4,781 in 1969 and 46,128 in 1990. In addition, 1.26 lakh bank Mitra’s (business correspondents) provide branchless banking in villages.

Q17) Explain in brief the history of IMF.

A17) The IMF was originally created in 1945 as part of the Bretton Woods Agreement, which attempted to encourage international financial cooperation by introducing a system of convertible currencies at fixed exchange rates. The dollar was redeemable for gold at $35 per ounce at the time. The IMF oversaw the system: for example, a country was free to readjust its exchange rate by up to 10% in either direction, but larger changes required the IMF's permission.

The IMF also acted as a gatekeeper: Countries were not eligible for membership in the International Bank for Reconstruction and Development (IBRD)—a World Bank forerunner that the Bretton Woods agreement created in order to fund the reconstruction of Europe after World War II—unless they were members of the IMF.

Since the Bretton Woods system collapsed in the 1970s, the IMF has promoted the system of floating exchange rates, meaning that market forces determine the value of currencies relative to one another. This system continues to be in place today.

Q18) Explain IBRD’s services.

A18) Through its partnership with MICs and creditworthy poorer countries, IBRD offers innovative financial solutions, including financial products (loans, guarantees, and risk management products) and knowledge and advisory services (including on a reimbursable basis) to governments at the national and subnational levels.

IBRD finances investments across all sectors and provides technical support and expertise at each stage of a project. IBRD’s resources not only supply borrowing countries with needed financing, but also serve as a vehicle for global knowledge transfer and technical assistance.

Advisory services in public debt and asset management help governments, official sector institutions, and development organizations build institutional capacity to protect and expand financial resources.

IBRD supports government efforts to strengthen public financial management as well as improve the investment climate, address service delivery bottlenecks, and strengthen policies and institutions.

Q19) How many banks comprises the banks in India?

A19) Banks in India comprise of:

- Scheduled commercial banks (i.e., commercial banks performing all banking functions, which will include both government-owned banks and private banks, and branches or subsidiaries of foreign banks);

- Cooperative banks (set up by cooperative societies to provide financing to small borrowers);

- Regional rural banks (RRBs) (these are government banks set up at local levels to provide credit to rural and agricultural areas);

- Small finance banks (these banks have been set up to undertake basic banking activities with a focus on lending to sectors and geographical areas which are not being serviced by other banks); and

- Payments banks (these banks have been set up to undertake payment and remittance-related activities and accepting small deposits).

- Government oversight: In the past, the government has nationalised a number of major commercial banks. While the government has not made any moves for further nationalisation of banks, the government has the power to acquire undertakings of an Indian bank in certain situations, including for breach of applicable regulations. The government has also been (and is in the process) of merging various public sector banks to strengthen the balance sheets of the banks, and also has plans to reduce government stakes in the public sector banks as part of its disinvestment plans.

- Foreign banks: There are about 45 foreign banks that have already set up banking operations in India. While foreign banks are currently operating through branch models in India, guidelines have been issued in the year 2013, which require foreign banks to operate through either a wholly-owned subsidiary (WOS) incorporated in India or through branches set up in India. Further, foreign banks which have been set up in India after August 2010 would be required to operate in India through a WOS incorporated in India in the event that the ownership structure of the foreign bank was complex, or the business of the said bank was significant, or the host country regulations were not satisfactory. Under these guidelines, foreign banks were also incentivised to operate through a WOS located in India, as they would be treated on par with Indian banks.

Q20) What is the need for banks and banking sector?

A20) Financial institutions are a vital clog in the development of a country, they help in economic development by financing development projects (private and public) and they facilitate social growth by providing savings and investment options or facilitate loans to the masses to help improve their living standard.

A well-administered banking system can help in stabilizing the economy and build investments in the country. Banks play a major role in the planning and implementation of financial policies. The prioritizing of goals can help achieve the targets set by economists. The banking system can help attain the goal of higher profits by improving the purchasing power of the individual or the organization.