Unit - 5

Control

Q1) Explain the concept of Controlling with its definition.

A1) Concept

Therefore, management can be defined as a management function to ensure that activities within an organization are performed according to plan. Control also ensures the efficient and effective use of organizational resources to achieve goals. Therefore, it is a goal-oriented function.

Control and management control are often considered the same. They both are different from each other. Control is one of the management functions, but management control can be defined as the process that an administrator follows to perform a control function.

Management control refers to setting established standards, comparing actual performance with these standards, and taking corrective actions to ensure that the organization's goals are achieved, if necessary.

Definition of control:

Business management means measuring achievement against standards and correcting deviations to ensure that goals are achieved according to the plan. Koontz and Koontz

Control functions are performed at all levels, top, middle, and supervision levels, at all types of organizations, whether commercial or non-commercial. Therefore, it is a popular feature. Management should not be considered the last function of management.

The control function compares the actual performance with a given standard, finds deviations, and attempts to take corrective action. Ultimately, this process also helps in developing future plans. Therefore, control functions help bring the management cycle back to plan.

Q2) What is the importance of administrative functions in an organization?

A2) The importance of administrative functions in an organization is as follows:

1. Achievement of organizational goals:

Control helps you compare actual performance to certain criteria, find deviations, and take corrective action to ensure that your activities perform as planned. Therefore, it helps to achieve the goals of the organization.

2. Judgment of standard accuracy:

An efficient control system helps determine standard accuracy. In addition, it helps us review and revise our standards as our organization and environment change.

3. Use resources efficiently:

Management checks the work of employees at all stages of operation. Therefore, you can effectively and efficiently use all resources in your organization while minimizing waste and corruption.

4. Improving employee motivation:

Employees know the criteria by which their performance is judged. A systematic assessment of performance and the resulting rewards in the form of increments, bonuses, promotions, etc. motivate employees to do their best.

5. Ensuring order and discipline:

By managing it, you can closely check the activities of employees. Therefore, it helps reduce fraudulent behaviour of employees and creates order and discipline in the organization.

6. Promote ongoing coordination:

Management helps provide a common direction for all activities and individual efforts of different departments to achieve organizational goals.

Q3) Define Control Process.

A3) Its main purpose is to ensure that the activities of the organization are proceeding as planned. The control process that every manager needs to implement consists of several steps. Each of these is equally important and plays a major role in effective management.

The management control process ensures that all activities in the business are driving that goal. This process basically helps managers assess the performance of their organization. By making good use of it, you can decide whether to change the plan or continue.

Q4) What all elements does control process consist of?

A4) The control process consists of the following basic elements and procedures:

1. Establish goals and standards

The task of modifying goals and criteria is done during planning, but it also plays a major role in control. This is because the main purpose of management is to direct business behaviour towards that goal. If members of an organization have a clear understanding of their goals, they will do their utmost to achieve them.

It is very important for managers to communicate their organization's goals, standards and objectives as clearly as possible. There should be no ambiguity among employees in this regard. When everyone works towards a common goal, it helps the organization to thrive.

The goals that administrators need to set and work on are either tangible / concrete or intangible / abstract. A tangible goal is a goal that can be easily quantified numerically. For example, achieving sales equivalent to rupees. Within a year, 100 chores is a concrete goal.

Intangible goals, on the other hand, are goals that cannot be quantified numerically. For example, company may be aiming to win a prestigious award for corporate social responsibility activities.

2. Measure actual performance against goals and criteria

Once the manager knows what his goals are, he then needs to measure and compare the actual performance. This step basically helps you know if your plan is working as intended.

After implementing the plans, the administrator should constantly monitor and evaluate them. If things aren't working properly, they should always be ready to take corrective action. To do this, you need to keep comparing actual performance to your ultimate goal.

This step of process control not only helps managers perform corrective actions, but also helps managers anticipate future problems. In this way, they can take immediate action and save their business from loss.

To compare the actual performance, the manager should measure it first. You can do this by measuring the results financially, seeking customer feedback, or appointing a financial expert. This is often difficult when managers want to measure intangible criteria such as labor relations and market reputation.

3. Take corrective action

If there is a discrepancy between actual performance and goals, managers should take immediate corrective action. Timely corrective actions can not only reduce losses, but also prevent them from happening again in the future.

In some cases, the corporate organization develops default corrective actions in the form of policies. However, for complex issues, this can be difficult to do.

In such cases, the administrator must first quantify the defect and prepare a series of actions to fix it. At times, special measures may need to be taken for unpredictable problems.

4. Follow-up of corrective actions

Taking corrective action is not enough. Administrators also need to draw them to logical conclusions. Even this step requires a thorough evaluation and comparison.

Administrators should stick to the issue until it is resolved. If they refer to it to their subordinates, they must stay around and see him complete the task. They may guide him personally so that he can later solve such problems himself.

Q5) Explain the principle of control.

A5) The following are the principles of control.

1. Purpose:

Controls must actively contribute to the achievement of Group goals by quickly and accurately detecting deviations from the plan to enable corrective action.

2. Interdependence between planning and management:

The principle of interdependence is that the more plans are clearer, complete, and integrated, and the controls are designed to reflect such plans, the more effectively the controls meet the needs of managers. He says he will respond.

3. Management responsibility:

According to this principle, the main responsibility for exercising control lies with the manager responsible for executing the particular plan involved.

4. Control principles that adhere to organizational patterns:

Controls should be designed to reflect the nature and structure of the plan. If the organization is clear and the responsibilities for the work done are clearly defined, management will be more effective and it will be easier to isolate the person responsible for the deviation.

5. Control efficiency:

Control techniques and approaches effectively detect deviations from the plan and enable corrective action with minimal unsolicited consequences.

6. Future-oriented control:

It emphasizes that controls should be positive. Effective management should be aimed at preventing current and future deviations from the plan.

7. Control personality:

Management should be designed to meet the individual requirements of administrators within the organization. Some control techniques and information are available to different types of businesses and administrators in the same format, but as a general rule, controls should be tailored to meet specific requirements.

8. Strategic point control:

Effective and efficient management requires attention to strategic factors in assessing performance.

9. Exceptional principle:

You should adopt the exception principle of notifying standard exceptions. You should be aware of the various properties of exceptions, as "small" exceptions in a particular area can be more important than "large" exceptions elsewhere.

10. Review Principle:

The control system should be reviewed on a regular basis. Review exercises can cover some or all of the points highlighted in the above principles. Moreover, flexibility and economic nature or control should not be lost while reviewing the control.

Q6) What is ratio analysis? Explain its uses.

A6) Ratio analysis refers to the analysis of financial information that is contained in a company's financial statement. These are primarily used by external analysts to determine various aspects of the business, such as profitability, liquidity and solvency.

Ratio analysis

Analysts obtain data to assess a company's financial performance based on current and historical financial statements. They use the data to determine if a company's financial position is on the rise or down and compare it to other competitors.

Use of ratio analysis

1. Comparison

One use of ratio analysis is to compare a company's financial performance to similar companies in the industry to understand its position in the market. By obtaining financial ratios such as price-earnings ratios from known competitors and comparing them to company ratios, management can identify market gaps and explore competitive advantages, strengths and weaknesses. I can do it. Management can then use that information to make decisions aimed at improving the company's position in the market.

2. Trend line

Companies can also use ratios to see if they are prone to financial performance. Established companies collect data from financial statements over a number of reporting periods. The trends obtained can be used to predict the direction of future financial performance. It can also be used to identify financial disruptions that are expected to be impossible to predict using a single reporting period ratio.

3. Operational efficiency

Company owners can also use financial ratio analysis to determine the degree of efficiency in managing assets and liabilities. Inefficient use of assets such as automobiles, land and buildings bring unnecessary costs to be eliminated. The financial ratio also helps determine if the financial resources are overused or underused.

Q7) How can you classify ratios?

A7) This relationship can be represented as a percentage or quotient. The ratio is simple to calculate and easy to understand. Those interested in analysing financial statements can be grouped under three heads,

i) Owner or investor

Ii) Creditors and

Iii) Financial executives

All these three groups are interested in the financial situation and performance of the company, but each of them is the main objective to try to get from these statements.

Investors primarily want a basis for estimating income capacity. Creditors are primarily concerned with liquidity and the ability to pay interest and redeem the loan within the specified period. Management is interested in the evolution of analytical tools that measure cost, efficiency, liquidity and profitability to make intelligent decisions.

Classification of ratios:

Financial ratios can be divided into the following five groups:

- Structure

- Fluidity

- Profitability

- Sales

- Other.

1. Structure Group: the ratio of structure groups is as follows:

A. Liabilities funded by total capitalization:

The term "total" capitalization refers to the term of the loan, consisting of debt, capital stock and reserves and surpluses. The ratio of funding debt to total capitalization is calculated by dividing funding debt by total capitalization. It can also be expressed as a percentage of the provident debt to the total capitalization.

B. Long term loans

Total capital (share capital +reserve and surplus + long-term borrowings) II) debt to capital:

It is necessary to pay close attention to the calculation and interpretation of this ratio. The definition of debt takes two first. One includes current liabilities and the other includes current liabilities. Therefore, the ratio is calculated by the following two methods:

Long-term loans term credits + total liabilities on capital=current liabilities and reserves share capital + reserves and surplus (or)

Long-term debt on shares = long-term debt / equity capital + reserve and surplus

C. Net fixed assets to funded liabilities:

This ratio acts as a complementary measure to determine the security for the lender. A 2: 1 ratio means that for all rupees of long-term debt, there is a book value of two rupees of net fixed assets:

Fixed assets net assets Reserve debt

D. Reserve (long-term) debt on net working capital:

This ratio is calculated by dividing long-term debt by the amount of net working capital. It helps to find out the creditor's contribution to the company's current assets.

Long-term loans net working capital

2. Liquidity group:

It includes current ratio and acid test ratio

i) Current Ratio:

It is measured by dividing current assets by current liabilities. This ratio indicates the extent to which the receivables of short-term creditors are covered by assets that may be converted into cash in the period corresponding to the maturity of the receivables, so short-term credit to general current assets/current liabilities and reserves+ Inventory

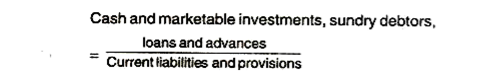

Ii) Acid test ratio:

It is also termed as fast ratio. It is determined by dividing the "quick assets", that is, cash, marketable investments and sundries debtors by current liabilities. This ratio is the most bitter of financial strength than the current ratio, as it does not give consideration to stocks that can move very low.

Liquidity group

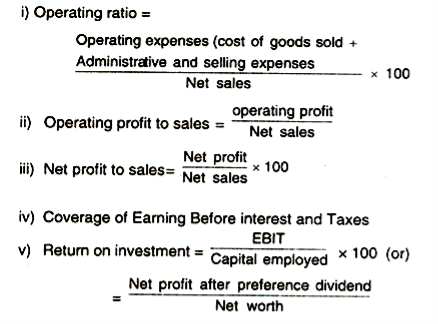

3. Profitability group:

It has five ratios and that they are calculated as follows:

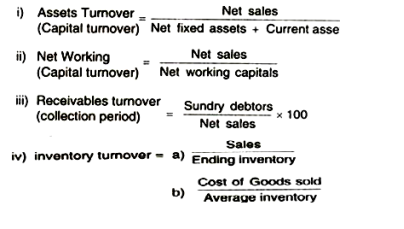

4. Sales group:

It has four ratios, and that they are calculated as follows:

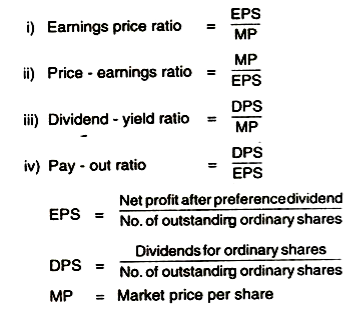

5. Other group:

It contains four ratios, and they are:

Q8)What is the Criteria for comparison of ratio?

A8) For proper use of proportions, it is essential to fix the criteria for comparison. As long as the ratio itself is not very meaningful, it is also suitable as compared to. The choice of the right criteria for comparison is the most important factor in the ratio analysis. The four most common criteria used in ratio analysis are absolute, historical, horizontal and budgetary.

Absolute standards are those that are generally perceived as desirable, regardless of the company, Time, stage of the business cycle or the purpose of the analyst. Past standards include comparing the company's own past performance as a present or future standard.

On a horizontal basis, one enterprise is compared with another or with the average of other enterprises of the same nature. Budget standards arrive after preparing the budget for the period ratio developed from the actual performance, and to find out the degree of achievement of the expected goals of the enterprise, the planning of the budget is carried out.

Q9) What are the benefits of ratio analysis?

A9) Ratio analysis is widely used as a powerful tool for financial table analysis. It is a numerical or quantitative relationship between the two figures of the financial statements to confirm the strengths and weaknesses of the company, as well as its current financial situation and past performance. It assists various stakeholders to make an assessment of certain aspects of the company's performance. The main advantages of ratio analysis are:

1. Forecasting and planning:

The trend of costs, turnover, profit and other facts can be known by calculating the ratio of the relevant accounting figures for the past few years. With the help of ratios, this trend analysis may help to predict and plan future business activities.

2. Budgeting:

A budget is an estimate of future activities based on past experience. Accounting ratios help to estimate budget figures. For example, the sales budget can be prepared with the help of an analysis of past sales.

3. Measurement of operating efficiency:

The ratio analysis shows the degree of efficiency in the management and use of that asset. Different activity ratios show operational efficiency. In fact, the solvency of the enterprise depends on the sales income generated by utilizing its assets.

4. Communication:

The ratio is an effective means of communication and is important in informing the owner or other party of the position and progress made by the business concern.

5. Performance and cost control:

Ratios may also be used for controlling the performance of different departments or departments of a project as well as controlling costs. Management always concerns the overall profitability of the company. They want to know if the company has the capacity to meet its short-term and long-term obligations to Creditors, ensure a reasonable return to the owner and ensure the optimal use of the company's assets. This is possible if all the proportions are taken into account together.

6. Enterprise-to-enterprise comparison:

Comparing the performance of multiple companies reveals efficient and inefficient companies, and inefficient companies adopt appropriate measures to improve efficiency the best way of enterprise-to-enterprise comparison is to compare the relevant ratio of the organization to the average ratio of the industry.

7. Displaying liquidity positions:

Ratio analysis helps to assess the liquidity position i.e., the short-term debt that pays the company's ability. The liquidity ratio shows the ability to pay and support credit analysis by banks, creditors, and other suppliers of short-term loans.

8. Displaying long-term solvency positions:

Ratio analysis is also used to assess the long-term debt solvency of the enterprise. This is measured by the ratio of leverage/capital structure to profitability, which indicates profitability and operational efficiency. Ratio analysis shows the strength and weakness of the enterprise in this regard.

9. Indicators of overall profitability

Management always concerns the overall profitability of the company. They want to know if the company has the capacity to meet its short-term and long-term obligations to Creditors, ensure a reasonable return to the owner and ensure the optimal use of the company's assets. This is possible if all the proportions are taken into account together.

10. Signals of corporate illness:

Companies are sick when they are unable to continuously generate profits and are suffering from a serious liquidity crisis. Proper ratio analysis can give industry disease signals in advance so that timely measures can be taken to prevent the occurrence of such diseases.

11. Assistance in decision making:

Ratio analysis helps to make decisions such as whether to supply the enterprise with goods on credit, whether bank loans will be available.

12. Simplify financial statements:

Ratio analysis makes it easy to understand the relationships between various items and helps to understand the financial statements.

Q10) Discuss the Limitations of ratios.

A10) Limitations of ratios are:

1. Restrictions on financial statements:

The ratio is calculated from the information recorded in the financial statements. However, the financial statements suffer from many limitations and, therefore, can affect the quality of the ratio analysis.

2. Historical information: financial statements provide historical information. They do not reflect the current situation. Therefore, it is not useful to predict the future.

3. Different accounting policies:

Different accounting policies regarding the valuation of inventories, charges depreciation, etc prevents you from comparing accounting data and accounting ratios for both companies.

4. Lack of criteria for comparison:

No fixed standard can be set for the ideal ratio. For example, it is said that the current ratio is ideal if current assets are twice the current liabilities. But this conclusion is justifiable in the case of these concerns, which have sufficient arrangements with their bankers to fund when they need it.

5. Quantitative analysis:

Ratios are a quantitative analysis only tool, and qualitative factors are ignored when calculating ratios. For example, if a liquid asset contains a large inventory consisting mainly of obsolete items, a high current ratio does not necessarily mean a healthy liquid position.

6. Window-dressing:

The term "window dressing" means presenting a financial statement in such a way that it displays a better position than what it actually is. For example, if a low depreciation rate is charged, the revenue expense field is treated as a capital investment, for example. The position of concern can be made to appear on the balance sheet much better than what it is. The ratio calculated from such a balance sheet cannot be used to scan the financial situation of the business.

7. Price level changes:

For fixed assets, the system displays the position statement at the cost only. Therefore, it does not reflect changes in the price level. Therefore, it makes the comparison difficult.

8. Causality is necessary:

Proper care should be taken to study only such figures that have causality.

9. The ratio occupies one variable.

Since the ratio occupies only one variable, they cannot always give the correct picture, since some other variables such as government policy, economic situation, availability of resources, etc. You should keep in mind while interpreting the ratio.

10. Seasonal factors affect financial data:

Proper care should be taken when interpreting the accounting ratios calculated for seasonal operations. For example, an umbrella company maintains high inventory during the rainy season, and the inventory level for the rest of the year will be 25% of the seasonal inventory level. Therefore, the liquidity ratio and inventory turnover will give a biased picture.

Q11) What is DuPont analysis? Explain its components.

A11) In simple terms, we break down ROE to analyze how companies can increase shareholder profits.

Equity margin=net profit margin*asset turnover*financial leverage = (net income/turnover)*(net sales/total assets) * (total assets/total capital) the company can increase the equity margin if it has.-

1. Generate a higher net profit margin.

2. Use assets effectively to generate more sales

3. High financial leverage

Components of DuPont analysis

3 factors are considered for this analysis;

1. Profit margin-this is a very basic ratio of profitability. It is calculated by dividing the net profit by the total revenue. This is similar to the profit generated after deducting all expenses. The main factors remain to derive a way to keep it growing by maintaining a healthy profit margin and reducing the costs that affect Roe, price increases, etc.

For example; Company X has annual net profit of Rs1000 and annual sales of Rs10000. So, net profit is calculated as follows

Net profit margin=net profit/total revenue=1000/10000=10%

2. Total assets turnover-this ratio indicates the efficiency of the company when using its assets. It is calculated by dividing the income by the average asset. This ratio varies from industry to industry, but it helps to compare companies in the same industry. If the company's asset turnover increases, this will positively affect the company’s ROE.

For example; Company X has an income of Rs10000 and an average asset of Rs200. So, the turnover of assets is as follows

Asset turnover=revenue/average asset = 1000/200=5

3. Financial leverage-this refers to the amount of debt used to finance assets. Companies should strike a balance on debt usage. Debt should be used to fund the operation and growth of the company. However, the use of excessive leverage to push up eggs can prove harmful to the health of the company. For example; Company X has an average asset of Rs1000 and equity of Rs400. Therefore, the leverage of the company is

Financial leverage=average assets/average shares=1000/400=2.5

Q12) What is Capital gearing ratio?

A12) The capital gearing ratio is the ratio of capital with fixed returns (i.e. preferred stock capital plus long-term liabilities) and capital with variable returns (i.e. common stock capital).

The total capital of the company consists of three main segments: Shares, Preferred Stock capital and long-term loans. Share holders (i.e., common shareholders) are paid dividends, which vary annually depending on the amount of profit. Returns a variable that common shareholders can see everywhere. On the other hand, both preferred shareholders and long-term lenders are paid a fixed rate of return regardless of the level of the company's profits. The funding is being advanced everywhere seen fixed returns.

Formula:

The formula for capital gearing ratio is as follows:

Capital gearing ratio=common shareholders ' equity/fixed expenses bearing fund gearing level

The gear level arrives by representing the capital with a fixed return (CWFR) as a percentage of the adopted capital. Companies where CWFR exceeds 60% of the total capital employed are said to be high geared. Companies where CWFR is between 30% to 50% of the total capital are said to be medium-sized geared. Companies where CWFR is below 25% of the total capital employed are said to be low-geared. It is said that companies that do not have CWFR do not show up or are fully capital-funded.

A slight reduction in RoCE in a high geared company can cause a large reduction in Roe. On the other hand, even a slight improvement in ROCE for such a company can lead to a significant increase in ROCE.

Q13) Explain Ratio Combined Ratio with its types.

A13) Combined ratio—the sum of two ratios, calculated by dividing the losses incurred and the loss adjustment expense (LAE) by the earned premium (calendar year loss rate) and all other expenses by the written or earned premium (i.e., trade-based or statutory base expense ratio). When applied to the overall results of a company, the combined ratio is also referred to as composite or statutory ratio. Used in both insurance and reinsurance, the combined ratio below 100 percent represents underwriting profits.

- Return on Capital employed (Including Long Term Borrowings)

Adopted capital refers to the quantity of capital investment a business uses to work and provides an indicator of how a corporation is investing that cash .

Capitals adopted are often defined in several contexts, but it generally refers to the capital employed by a corporation to get profit. This figure is usually utilized in the return on capital (ROCE) ratio to live a company's profitability and efficiency of capital use.

Formula

This metric are often calculated in two ways:

Adopted capital=total assets and current liabilities

Where

Total assets is that the sum of the value of all assets.

Current liabilities are liabilities that are paid within a year.

Or,

Employed capital=fixed assets + capital

Where

Fixed assets, also referred to as capital assets, are purchased for long-term use and are essential assets within the operation of the corporate.

Examples are properties, plants, and equipment (PP&E).

Working capital is that the capital available for daily operations and is calculated as current assets minus current liabilities.

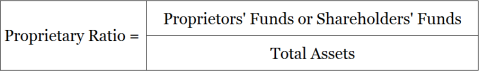

2. Return on proprietor’s Fund (Shareholders Fund and Preference Capital)

This ratio indicates the percentage of total assets of the company, which is financed by the funds of the owners. The unique ratio is also known as the capital adequacy ratio. It helps to determine the financial strength of the company & helps creditors to assess the ratio of shareholder funds adopted from the total assets of the company.

The word "owner" is a synonym for “owner of the business", and the owner's funds, in this case, are only those funds that belong to the owner/shareholder of the business. Owners 'funds are also known as owners' Funds, shareholders ' funds, net assets, etc.

Owner's fund or shareholder's fund=share capital+reserves and surplus

Total assets = includes total assets according to the balance sheet

3. Return on Equity Capital

The return on equity (ROE) is a measure of the company's annual profit margin (net profit) divided by the value of the total shareholders ' equity, expressed as a percentage (for example, 12%). Alternatively, ROE can be derived by dividing the company's dividend growth rate by the revenue retention rate (1 payout ratio).

The return on equity is a two-part ratio in its derivation because it brings together the Income Statement and balance sheet, net profit or profit compared with shareholders ' equity this figure represents the total return on equity and shows the ability of a company to turn equity investment into profit. Put another way, it measures the profit of each dollar from shareholders ' equity.

Share rate of return formula

Below is the Roe equation:

ROE=net income/shareholders ' equity

ROE provides a simple indicator for assessing return on investment. By comparing the company’s ROE to the industry average, something may be identified about the company's competitive advantage. Roe may also provide insight into how company management is using financing from equity to grow a business.

A sustainable and increasing ROE over time could mean companies are better at generating shareholder value because they know how to reinvest revenue wisely, in order to increase productivity and profits. In contrast, a drop in ROE could mean that management is making poor decisions about reinvesting capital into unproductive assets.

4. Dividend Payout Ratio

Dividend payout ratio is the ratio of the company's net income to the total dividend paid to shareholders. This is the percentage of profits paid to shareholders in dividends. The amount that is not paid to shareholders is held by the company to repay the debt or reinvest in its core business. It is sometimes simply called “payout ratio".'

Dividend payout ratio provides an indicator of how much money a company is returning to shareholders it is a calculation formula and calculation of dividend payout ratio.

The payout ratio can be calculated as the annual dividend divided by earnings per share, or equally the dividend divided by net income (as shown below).

Dividend Payout Ratio= Dividends Paid

Net Income

Dividend Payout Ratio= 1−Retention Ratio

Alternatively, the dividend payout ratio can also be calculated as:

Retention Ratio= EPS

EPS−DPS

Where:

EPS=Earnings per share

DPS=Dividends per share

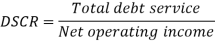

5. Debt Service Ratio

Debt service coverage rates apply to businesses, governments, and personal finance. In the context of corporate finance, the debt service coverage ratio (DSCR) is a measure of a company's available cash flow to pay its current debt obligations. The DSCR shows investors whether a company has enough income to pay its debt. In the context of government finance, DSCR is the amount of export income required by a country to meet annual interest and principal payments on external debt. In a personal financial context, it is the ratio used by bank lenders to determine income property loans. DSCR expressions and calculations

The calculation formula for the debt service coverage rate requires net operating income and therefore the total debt repayment of the entity. Net operating income is the company's revenue minus operating expenses and does not include taxes and interest payments. This is often thought to be equivalent to earnings before interest and tax (EBIT).

Where

Operating income = revenue-COE

COE=constant operating expenses

Total debt=current debt

6. Debtors Turnover

A debtor's turnover rate of 6 times means that on average; the debtor buys and recalls 6 times a year. So, we can assume that 6 times a year means once every two months, and this is only an average collection period of 60 days.

Debtor turnover=net credit turnover: average debtor

Net credit sales: Debtors + bill receivables

Standard norm of proportions

The higher the ratio, the position of the company in collecting arrears means the effectiveness of the collection department, and vice versa rd norm of proportions

7. Creditors Turnover

It shows the effectiveness of the company in taking advantage of the credit period allowed by the creditor during the time of credit purchase.

Credit turnover=credit purchase: average creditor

Or

Credit purchases:

Handprint + general store

Standard norm of proportions

The fewer ratios are better, which means that the company's position in liquidity management will enjoy more credit periods from creditors and vice versa.

Creditor rate= 365 days/52 weeks/12 months

Creditor turnover

Standard norm of proportions

The greater duration is better than company liquidity management in availing creditors and reverse credit periods.

Q14) Write note on budgetary control.

A14) Meaning and definition:

Budgetary management is the process of preparing budgets for various activities, comparing budget figures, and achieving any deviations that will be eliminated in the future. Therefore, budget is a means and budget management is the end result. Budget management is an ongoing process that helps you plan and coordinate. It also provides a control method.

Budget management is a cost that includes budget preparation, coordination of departmental work, establishment of responsibilities, comparison of actual performance with budget, and results-based actions to achieve maximum profitability. It's a system of coordination. Brown and Howard

Weldon characterizes budget management as planning ahead of various functions of the business so that the entire business is managed.

ICMA defines budget control as follows: “Continuing actual and budget results to set budgets, associate executive responsibilities with policy requirements, and ensure the objectives of the policy through individual actions, or provide the basis for the policy. Its revision to compare with. "

The budget management features as defined above are:

1. A prerequisite for budget management is to set different types of budgets and modify the responsibility of the person responsible for the successful implementation of the policy.

2 Compare actual performance to budget and reveal deviations for cost control purposes.

3. Corrective action will be initiated to correctly set the unwanted deviations.

The budget management process includes:

- Preparing various budgets.

- A continuous comparison of actual performance and budget performance.

- Budget revision based on changes in the situation.

- Budget management systems should not be strict.

You need a flexible personal initiative and a good range of momentum. Budgetary control is an important tool for making an organization an important tool for cost control and achieving overall goals.

Q15) What is Budget Control?

A15) Budgeting is the process in which budgets are prepared for future periods and, if there are differences, are compared with actual performance to find differences. Comparison of budget figures with actual figures will help management to find out the differences and take corrective actions without delay. Objectives of Budget Control

The main objectives of Budget Control are:

- Define the purpose of the enterprise

- So provide a plan for achieving a defined goal

- Increasing profitability by eliminating waste.

- Centralization of the control system.

- Correction of differences from the Sit standard.

- Fixing the responsibilities of various individuals in the enterprise.

- Coordinate the activities of different departments.

- Sales departments and cost centers economically and efficiently

Q16) What are the Disadvantages or limitations of Budget Control?

A16) The limits of Budget Control are as follows:

1. It is really difficult to accurately prepare the budget under inflation.

2. The budget involves heavy spending that small business care cannot afford.

3. The budget is always prepared for future periods that are uncertain. In the future, the conditions that disrupt the budget may change. Therefore, uncertainty in the future minimizes the usefulness of the Budget Control System.

4. Budget Control is just an administrative tool. Management cannot be replaced in decision-making because it is not a substitute for management.

5. The success of Budget Control depends on the support of top management. This will fail if there is insufficient support from top management.

Q17)Explain Fixed budget.

A17) Fixed budget:

This budget is employed for one level of activity and one set of conditions. It’s defined as a budget designed to stay unchanged no matter the quantity of production or sales achieved. This is often a decent budget and is drawn on the idea that the budgeted activity level won't change. Changes in spending thanks to changes in activity levels aren't taken under consideration.

Therefore, changes in spending resulting from changes in expected conditions and activities aren't specified. Therefore, a hard and fast budget is merely useful if the particular activity level corresponds to the budget activity level.

A typical example of a hard and fast budget may be a master budget tailored to one output level of (for example) 20,000 sales units. However, actually , the extent of activity and set conditions change as a results of internal and external factors like changes in supply and demand, shortages of materials and electricity, and fierce competition.

It is almost useless as a budget management mechanism because it doesn't distinguish between fixed costs, variable costs, and semi-variable costs, and there's no adjustment of the budget amount thanks to changes in costs thanks to changes in levels activity. It doesn't provide a meaningful basis for comparison and control. It also does nothing to repair prices or violate submissions.