Unit 1

Management of Working Capital

Q1) What is the meaning of Working capital?

A1) The term Working Capital also called gross working capital refers to the firm’s aggregate of current assets and current assets are these assets which can be convertible into cash within an accounting period, generally a year. Accounting Standards Board, The Institute of Chartered Accountants of India defines, “Working capital means the funds available for day-to-day operations of an enterprise. It also represents the excess of current assets over current liabilities including short-term loans.”

Q2) How many concepts working capital has? Explain in brief.

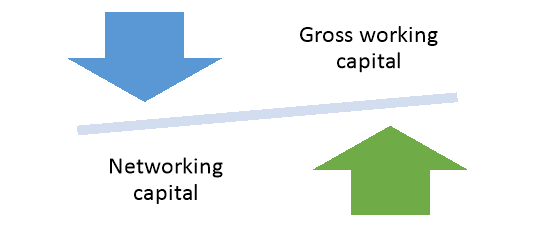

A2) Working capital has two concepts:

Figure: Concept of working capital

i) Gross working capital

Gross Working capital refers to the total of the current assets. Gross working capital is more helpful to the management in managing each individual current assets for day-to-day operations.

Ii) Net working capital

Net working capital refers to the excess of the current assets over current liabilities. In the long run, it is the net working capital that is useful for the purpose.

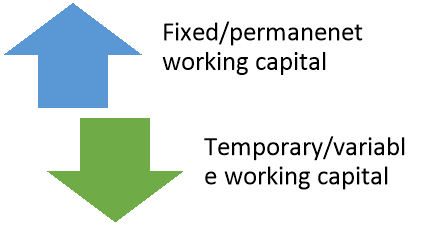

Q3) How many types of Working capital are there?

A3) There are two types of working capital-

Figure: Working capital classification

(a) Rigid, fixed, regular or permanent working capital

Every business concern has to maintain certain minimum amount of current assets at all times to carry on its activities efficiently and effectively. It is indispensable for any business concern to keep some material as stocks, some in the shape of work-in-progress and some in the form of finished goods. Permanent Working Capital is the irreducible minimum amount of working capital necessary to carry on its activities without any interruptions. It is that minimum amount necessary to outlays its fixed assets effectively.

(b) Variable, seasonal, temporary or flexible working capital

Temporary working capital is that amount of current assets which is not permanent and fluctuating from time to time depending upon the company’s requirements and it is generally financed out of short-term funds. It may also high due to seasonal character of the industry as such it is also called seasonal working capital.

Q4) Give the importance of Working capital.

A4) Working capital works as breath of the company without which an organisation cannot survive. Some of the features of working capital are-

- It is of two types- gross working capital and net working capital.

- It is permanent and temporary nature. Permanent working capital is needed for long term and short-term working capital is needed for short term.

- It is used for purchase of raw materials, payment of wages and expenses.

iv. It changes form constantly to keep the wheels of business moving.

v. Working capital enhances liquidity, solvency, creditworthiness and reputation of the enterprise.

vi. It generates the elements of cost namely: Materials, wages and expenses.

vii. It enables the enterprise to avail the cash discount facilities offered by its suppliers.

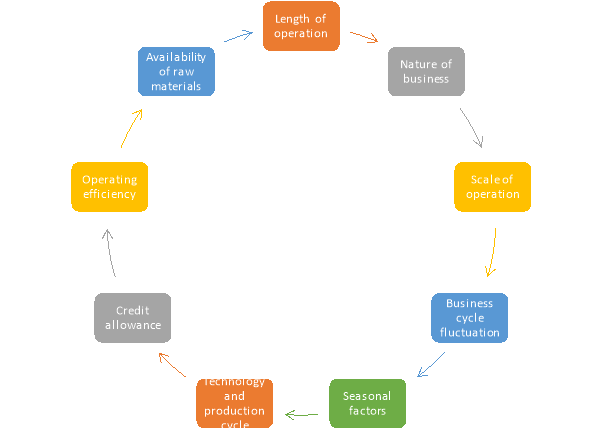

Q5) What are the factors affecting working capital?

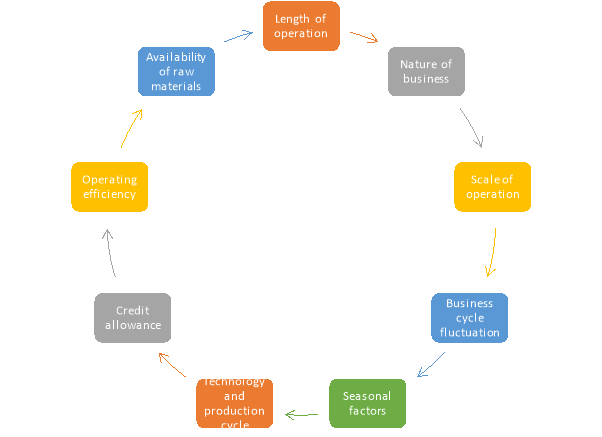

A5) The finance manager must keep in mind following factors before estimating the amount of working capital.

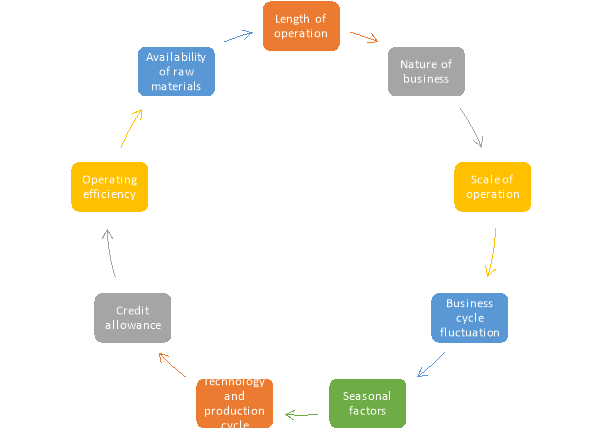

Figure: Factors affecting working capital

1. Length of Operating Cycle:

The amount of working capital directly depends upon the length of operating cycle. Operating cycle refers to the time period involved in production. It starts right from acquisition of raw material and ends till payment is received after sale. The working capital is very important for the smooth flow of operating cycle. If operating cycle is long then more working capital is required whereas for companies having short operating cycle, the working capital requirement is less.

2. Nature of Business:

The type of business, firm is involved in, is the next consideration while deciding the working capital. In case of trading concern or retail shop the requirement of working capital is less because length of operating cycle is small. The wholesalers as compared to retail shop require more working capital as they have to maintain large stock and generally sell goods on credit which increases the length of operating cycle. The manufacturing company requires huge amount of working capital because they have to convert raw material into finished goods, sell on credit, maintain the inventory of raw material as well as finished goods.

3. Scale of Operation:

The firms operating at large scale need to maintain more inventory, debtors, etc. So, they generally require large working capital whereas firms operating at small scale require less working capital.

4. Business Cycle Fluctuation:

During boom period the market is flourishing so more demand, more production, more stock, and more debtors which mean more amount of working capital is required. Whereas during depression period low demand less inventories to be maintained, less debtors, so less working capital will be required.

5. Seasonal Factors:

The working capital requirement is constant for the companies which are selling goods throughout the season whereas the companies which are selling seasonal goods require huge amount during season as more demand, more stock has to be maintained and fast supply is needed whereas during off season or slack season demand is very low so less working capital is needed.

6. Technology and Production Cycle:

If a company is using labour intensive technique of production, then more working capital is required because company needs to maintain enough cash flow for making payments to labour whereas if company is using machine-intensive technique of production then less working capital is required because investment in machinery is fixed capital requirement and there will be less operative expenses. In case of production cycle, if production cycle is long then more working capital will be required because it will take long time for converting raw material into finished goods whereas when production cycle is small lesser funds are tied up in inventory and raw materials so less working capital is required.

7. Credit Allowed:

Credit policy refers to average period for collection of sale proceeds. It depends on number of factors such as creditworthiness, of clients, industry norms etc. If company is following liberal credit policy, then it will require more working capital whereas if company is following strict or short-term credit policy, then it can manage with less working capital also.

8. Credit Avail:

Another factor related to credit policy is how much and for how long period company is getting credit from its suppliers. If suppliers of raw materials are giving long term credit, then company can manage with less amount of working capital whereas if suppliers are giving only short period credit, then company will require more working capital to make payments to creditors.

9. Operating Efficiency:

The firm having high degree of operating efficiency requires less amount of working capital as compared to firm having low degree of efficiency which requires more working capital. Firms with high degree of efficiency have low wastage and can manage with low level of inventory also and during operating cycle also these firms bear less expense so they can manage with less working capital also.

10. Availability of Raw Materials:

If raw materials are easily available and there is ready supply of raw materials and inputs then firms can manage with less amount of working capital also as they need not maintain any stock of raw materials or they can manage with very less stock.

Q6) What are the advantages of working capital?

A6) The advantages of working capital are as follows-

1.Working capital is helpful in attracting new customers, refreshing the brand, increasing online presence, creating marketing capital for event sponsorship, direct marketing campaigns, etc.

2.It helps prevent payment delays and manages cash flow for significant operating expenses such as payroll, keeping utility current, payments of leases or mortgages, and more.

3.It is useful to purchase additional inventory needed to fill future orders, restock your inventory, buy new products, etc, and expand the business infrastructure.

4.Useful in advance payment when you want to take advantage of wholesale pricing for the update tool.

5.Ideal for seasonal businesses to restore inventory in the off-season, hire temporary employees, promote accurate marketing, cover expenses such as rent, insurance, taxes, salaries, and more.

6.It is especially useful to meet unexpected and unforeseen expenses.

Q7) What is Factoring?

A7) Factoring is one of the sources of working capital. Banks have been given more freedom of borrowing and lending both internally and externally and facilitated the free functioning in lending and investment operations. From 1994, banks are allowed to enter directly leasing, hire purchasing and factoring services, instead through their subsidiaries. In other words, banks are free to enter or exit in any field depending on their profitability, but subject to some RBI guidelines. Banks provide working capital finance through financing receivables, which is known as “factoring”. A “Factor” is a financial institution, which renders services relating to the management and financing of sundry debtors that arises from credit sales.

Q8) What are Commercial banks?

A8) Commercial banks are the major source of working capital finance to industries and commerce. Granting loan to business is one of their primary functions. Getting bank loan is not an easy task since the lending bank may ask a number of questions about the prospective borrower’s financial position and its plans for the future.

At the same time the bank will want to monitor borrower’s business progress. But there is a good side to this, that is borrower’s share price tends to rise, because investor knows that convincing banks is very difficult. The different types or forms of loans are:

(i) Loans,

(ii) Overdrafts,

(iii) Cash credits,

(iv) Purchasing or discounting of bills and

(v) Letter of Credit.

Q9) What are Inter-Corporate Deposits (ICDs)?

A9) A deposit made by one firm with another firm is known as Inter-Corporate Deposit (ICD). Generally, these deposits are made for a period up to six months.

Such deposits may be of three types:

(a) Call Deposits:

These deposits are those expected to be payable on call/on just one day notice. But, in actual practice, the lender has to wait for at least 2 or 3 days to get back the amount. Inter-corporate deposits generally have 12 per cent interest per annum.

(b) Three Months Deposits:

These deposits are more popular among companies for investing the surplus funds. The borrower takes this type of deposits for meeting short-term cash inadequacy. The interest rate on these types of deposits is around 14 per cent per annum.

(c) Six months Deposits:

Inter-corporate deposits are made for a maximum period of six months. These types of deposits are usually given to ‘A’ category borrowers only and they carry an interest rate of around 16 per cent per annum.

Q10) What are Public Deposits?

A10) Public deposits or term deposits are in the nature of unsecured deposits, are solicited by the firms (both large and small) from general public primarily for the purpose of financing their working capital requirements.

Q11) What are Commercial paper?

A11) Commercial paper represents a short-term unsecured promissory note issued by firms that have a fairly high credit (standing) rating. It was first introduced in the USA and it is an important money market instrument. In India, Reserve Bank of India introduced CP on the recommendations of the Vaghul Working Group on Money Market. CP is a source of short-term finance to only large firms with sound financial position.

Q12) What are Deferred Income?

A12) Deferred income is income received in advance by the firm for supply of goods or services in future period. This income increases the firm’s liquidity and constitutes an important source of short-term finance. These payments are not showed as revenue till the supply of goods or services, but showed in the balance sheet as income received in advance.

Advance payment can be demanded by firms which are having monopoly power, great demand for its products and services and if the firm is manufacturing a special product on a special order.

Q13) What are Accruals?

A13) Accrued expenses are those expenses which the company owes to the other, but not yet due and not yet paid the amount. Accruals represent a liability that a firm has to pay for the services or goods, it has received. It is spontaneous and interest-free source of financing. Salaries and wages, interest and taxes are the major constituents of accruals. Salaries and wages are usually paid on monthly and weekly base, respectively. The amounts of salaries and wages are owed but not yet paid and shown them as accrued salaries and wages on the balance sheet at the end of the financial year. The longer the time lag in–payment of these expenses, the greater is the amount of funds provided by the employees. Similarly, interest and tax are accruals, as source of short-term finance. Tax will be paid on earnings.

Q14) What is Trade Credit?

A14) Trade credit refers to the credit extended by the supplier of goods or services to his/her customer in the normal course of business. It occupies a very important position in short-term financing due to the competition. Almost all the traders and manufacturers are required to extend credit facility (a portion), without which there is no business. Trade credit is a spontaneous source of finance that arises in the normal business transactions without specific negotiation, (automatic source of finance).

Q15) What are the sources of Working capital?

A15) The two segments of working capital viz., regular or fixed or permanent and variable are financed by the long-term and the short-term sources of funds respectively. The main sources of long-term funds are shares, debentures, term- loans, retained earnings etc.

Short-term financing is aimed to meet the demand of current assets and pay the current liabilities of the organization. In other words, it helps in minimizing the gap between current assets and current liabilities. There are different means to raise capital from the market for small duration. Various agencies, such as commercial banks, co-operative banks, financial institutions, and NABARD provide the financial assistance to organizations.

Q16) Explain the Credit Policy determinant of working capital.

A16) If a business offers easy credit terms to its customers, the company is investing in accounts receivable that may be outstanding for a long time. This investment can be reduced by tightening the credit policy, but doing so may drive away some customers.

Q17) Explain the Growth Rate determinant of working capital.

A17) If a business is growing at a rapid rate, it is likely increasing its investments in receivables and inventory. Unless profits are extremely high, it is unlikely that the entity can generate sufficient cash to pay for these receivables and inventory, resulting in a steady increase in working capital. Conversely, if a business is shrinking, its working capital requirements will also decline, which spins off excess cash.

Q18) Explain the Payables Payment Terms determinant of working capital.

A18) If a company can negotiate longer payment terms with its suppliers, it can reduce the amount of investment needed in working capital, essentially by obtaining a free loan from its suppliers. Conversely, short payment terms reduce this source of cash, which increases the working capital balance.

Q19) Explain the Production Process Flow determinant of working capital.

A19) If a company estimates its production needs, what it manufactures will likely vary somewhat from actual demand, resulting in an excess amount of inventory on hand. Conversely, a just-in-time system produces goods only to order, so the investment in inventory is reduced.

Q20) Explain the Seasonality determinant of working capital.

A20) If a company sells most of its goods at one time of the year, it may need to build its inventory asset in advance of the selling season. This investment in inventory can be reduced by outsourcing work or paying overtime to manufacture goods at the last minute.

Unit 1

Management of Working Capital

Q1) What is the meaning of Working capital?

A1) The term Working Capital also called gross working capital refers to the firm’s aggregate of current assets and current assets are these assets which can be convertible into cash within an accounting period, generally a year. Accounting Standards Board, The Institute of Chartered Accountants of India defines, “Working capital means the funds available for day-to-day operations of an enterprise. It also represents the excess of current assets over current liabilities including short-term loans.”

Q2) How many concepts working capital has? Explain in brief.

A2) Working capital has two concepts:

Figure: Concept of working capital

i) Gross working capital

Gross Working capital refers to the total of the current assets. Gross working capital is more helpful to the management in managing each individual current assets for day-to-day operations.

Ii) Net working capital

Net working capital refers to the excess of the current assets over current liabilities. In the long run, it is the net working capital that is useful for the purpose.

Q3) How many types of Working capital are there?

A3) There are two types of working capital-

Figure: Working capital classification

(a) Rigid, fixed, regular or permanent working capital

Every business concern has to maintain certain minimum amount of current assets at all times to carry on its activities efficiently and effectively. It is indispensable for any business concern to keep some material as stocks, some in the shape of work-in-progress and some in the form of finished goods. Permanent Working Capital is the irreducible minimum amount of working capital necessary to carry on its activities without any interruptions. It is that minimum amount necessary to outlays its fixed assets effectively.

(b) Variable, seasonal, temporary or flexible working capital

Temporary working capital is that amount of current assets which is not permanent and fluctuating from time to time depending upon the company’s requirements and it is generally financed out of short-term funds. It may also high due to seasonal character of the industry as such it is also called seasonal working capital.

Q4) Give the importance of Working capital.

A4) Working capital works as breath of the company without which an organisation cannot survive. Some of the features of working capital are-

- It is of two types- gross working capital and net working capital.

- It is permanent and temporary nature. Permanent working capital is needed for long term and short-term working capital is needed for short term.

- It is used for purchase of raw materials, payment of wages and expenses.

iv. It changes form constantly to keep the wheels of business moving.

v. Working capital enhances liquidity, solvency, creditworthiness and reputation of the enterprise.

vi. It generates the elements of cost namely: Materials, wages and expenses.

vii. It enables the enterprise to avail the cash discount facilities offered by its suppliers.

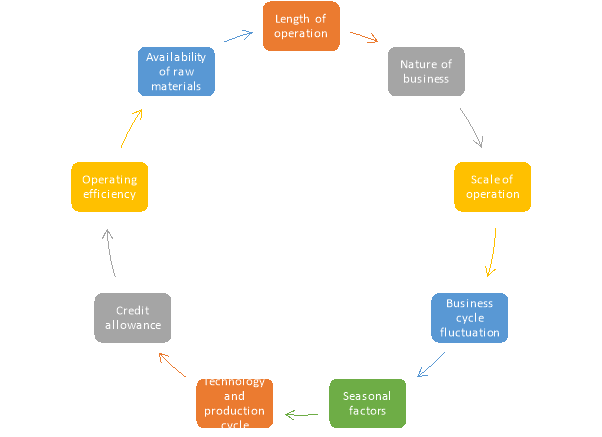

Q5) What are the factors affecting working capital?

A5) The finance manager must keep in mind following factors before estimating the amount of working capital.

Figure: Factors affecting working capital

1. Length of Operating Cycle:

The amount of working capital directly depends upon the length of operating cycle. Operating cycle refers to the time period involved in production. It starts right from acquisition of raw material and ends till payment is received after sale. The working capital is very important for the smooth flow of operating cycle. If operating cycle is long then more working capital is required whereas for companies having short operating cycle, the working capital requirement is less.

2. Nature of Business:

The type of business, firm is involved in, is the next consideration while deciding the working capital. In case of trading concern or retail shop the requirement of working capital is less because length of operating cycle is small. The wholesalers as compared to retail shop require more working capital as they have to maintain large stock and generally sell goods on credit which increases the length of operating cycle. The manufacturing company requires huge amount of working capital because they have to convert raw material into finished goods, sell on credit, maintain the inventory of raw material as well as finished goods.

3. Scale of Operation:

The firms operating at large scale need to maintain more inventory, debtors, etc. So, they generally require large working capital whereas firms operating at small scale require less working capital.

4. Business Cycle Fluctuation:

During boom period the market is flourishing so more demand, more production, more stock, and more debtors which mean more amount of working capital is required. Whereas during depression period low demand less inventories to be maintained, less debtors, so less working capital will be required.

5. Seasonal Factors:

The working capital requirement is constant for the companies which are selling goods throughout the season whereas the companies which are selling seasonal goods require huge amount during season as more demand, more stock has to be maintained and fast supply is needed whereas during off season or slack season demand is very low so less working capital is needed.

6. Technology and Production Cycle:

If a company is using labour intensive technique of production, then more working capital is required because company needs to maintain enough cash flow for making payments to labour whereas if company is using machine-intensive technique of production then less working capital is required because investment in machinery is fixed capital requirement and there will be less operative expenses. In case of production cycle, if production cycle is long then more working capital will be required because it will take long time for converting raw material into finished goods whereas when production cycle is small lesser funds are tied up in inventory and raw materials so less working capital is required.

7. Credit Allowed:

Credit policy refers to average period for collection of sale proceeds. It depends on number of factors such as creditworthiness, of clients, industry norms etc. If company is following liberal credit policy, then it will require more working capital whereas if company is following strict or short-term credit policy, then it can manage with less working capital also.

8. Credit Avail:

Another factor related to credit policy is how much and for how long period company is getting credit from its suppliers. If suppliers of raw materials are giving long term credit, then company can manage with less amount of working capital whereas if suppliers are giving only short period credit, then company will require more working capital to make payments to creditors.

9. Operating Efficiency:

The firm having high degree of operating efficiency requires less amount of working capital as compared to firm having low degree of efficiency which requires more working capital. Firms with high degree of efficiency have low wastage and can manage with low level of inventory also and during operating cycle also these firms bear less expense so they can manage with less working capital also.

10. Availability of Raw Materials:

If raw materials are easily available and there is ready supply of raw materials and inputs then firms can manage with less amount of working capital also as they need not maintain any stock of raw materials or they can manage with very less stock.

Q6) What are the advantages of working capital?

A6) The advantages of working capital are as follows-

1.Working capital is helpful in attracting new customers, refreshing the brand, increasing online presence, creating marketing capital for event sponsorship, direct marketing campaigns, etc.

2.It helps prevent payment delays and manages cash flow for significant operating expenses such as payroll, keeping utility current, payments of leases or mortgages, and more.

3.It is useful to purchase additional inventory needed to fill future orders, restock your inventory, buy new products, etc, and expand the business infrastructure.

4.Useful in advance payment when you want to take advantage of wholesale pricing for the update tool.

5.Ideal for seasonal businesses to restore inventory in the off-season, hire temporary employees, promote accurate marketing, cover expenses such as rent, insurance, taxes, salaries, and more.

6.It is especially useful to meet unexpected and unforeseen expenses.

Q7) What is Factoring?

A7) Factoring is one of the sources of working capital. Banks have been given more freedom of borrowing and lending both internally and externally and facilitated the free functioning in lending and investment operations. From 1994, banks are allowed to enter directly leasing, hire purchasing and factoring services, instead through their subsidiaries. In other words, banks are free to enter or exit in any field depending on their profitability, but subject to some RBI guidelines. Banks provide working capital finance through financing receivables, which is known as “factoring”. A “Factor” is a financial institution, which renders services relating to the management and financing of sundry debtors that arises from credit sales.

Q8) What are Commercial banks?

A8) Commercial banks are the major source of working capital finance to industries and commerce. Granting loan to business is one of their primary functions. Getting bank loan is not an easy task since the lending bank may ask a number of questions about the prospective borrower’s financial position and its plans for the future.

At the same time the bank will want to monitor borrower’s business progress. But there is a good side to this, that is borrower’s share price tends to rise, because investor knows that convincing banks is very difficult. The different types or forms of loans are:

(i) Loans,

(ii) Overdrafts,

(iii) Cash credits,

(iv) Purchasing or discounting of bills and

(v) Letter of Credit.

Q9) What are Inter-Corporate Deposits (ICDs)?

A9) A deposit made by one firm with another firm is known as Inter-Corporate Deposit (ICD). Generally, these deposits are made for a period up to six months.

Such deposits may be of three types:

(a) Call Deposits:

These deposits are those expected to be payable on call/on just one day notice. But, in actual practice, the lender has to wait for at least 2 or 3 days to get back the amount. Inter-corporate deposits generally have 12 per cent interest per annum.

(b) Three Months Deposits:

These deposits are more popular among companies for investing the surplus funds. The borrower takes this type of deposits for meeting short-term cash inadequacy. The interest rate on these types of deposits is around 14 per cent per annum.

(c) Six months Deposits:

Inter-corporate deposits are made for a maximum period of six months. These types of deposits are usually given to ‘A’ category borrowers only and they carry an interest rate of around 16 per cent per annum.

Q10) What are Public Deposits?

A10) Public deposits or term deposits are in the nature of unsecured deposits, are solicited by the firms (both large and small) from general public primarily for the purpose of financing their working capital requirements.

Q11) What are Commercial paper?

A11) Commercial paper represents a short-term unsecured promissory note issued by firms that have a fairly high credit (standing) rating. It was first introduced in the USA and it is an important money market instrument. In India, Reserve Bank of India introduced CP on the recommendations of the Vaghul Working Group on Money Market. CP is a source of short-term finance to only large firms with sound financial position.

Q12) What are Deferred Income?

A12) Deferred income is income received in advance by the firm for supply of goods or services in future period. This income increases the firm’s liquidity and constitutes an important source of short-term finance. These payments are not showed as revenue till the supply of goods or services, but showed in the balance sheet as income received in advance.

Advance payment can be demanded by firms which are having monopoly power, great demand for its products and services and if the firm is manufacturing a special product on a special order.

Q13) What are Accruals?

A13) Accrued expenses are those expenses which the company owes to the other, but not yet due and not yet paid the amount. Accruals represent a liability that a firm has to pay for the services or goods, it has received. It is spontaneous and interest-free source of financing. Salaries and wages, interest and taxes are the major constituents of accruals. Salaries and wages are usually paid on monthly and weekly base, respectively. The amounts of salaries and wages are owed but not yet paid and shown them as accrued salaries and wages on the balance sheet at the end of the financial year. The longer the time lag in–payment of these expenses, the greater is the amount of funds provided by the employees. Similarly, interest and tax are accruals, as source of short-term finance. Tax will be paid on earnings.

Q14) What is Trade Credit?

A14) Trade credit refers to the credit extended by the supplier of goods or services to his/her customer in the normal course of business. It occupies a very important position in short-term financing due to the competition. Almost all the traders and manufacturers are required to extend credit facility (a portion), without which there is no business. Trade credit is a spontaneous source of finance that arises in the normal business transactions without specific negotiation, (automatic source of finance).

Q15) What are the sources of Working capital?

A15) The two segments of working capital viz., regular or fixed or permanent and variable are financed by the long-term and the short-term sources of funds respectively. The main sources of long-term funds are shares, debentures, term- loans, retained earnings etc.

Short-term financing is aimed to meet the demand of current assets and pay the current liabilities of the organization. In other words, it helps in minimizing the gap between current assets and current liabilities. There are different means to raise capital from the market for small duration. Various agencies, such as commercial banks, co-operative banks, financial institutions, and NABARD provide the financial assistance to organizations.

Q16) Explain the Credit Policy determinant of working capital.

A16) If a business offers easy credit terms to its customers, the company is investing in accounts receivable that may be outstanding for a long time. This investment can be reduced by tightening the credit policy, but doing so may drive away some customers.

Q17) Explain the Growth Rate determinant of working capital.

A17) If a business is growing at a rapid rate, it is likely increasing its investments in receivables and inventory. Unless profits are extremely high, it is unlikely that the entity can generate sufficient cash to pay for these receivables and inventory, resulting in a steady increase in working capital. Conversely, if a business is shrinking, its working capital requirements will also decline, which spins off excess cash.

Q18) Explain the Payables Payment Terms determinant of working capital.

A18) If a company can negotiate longer payment terms with its suppliers, it can reduce the amount of investment needed in working capital, essentially by obtaining a free loan from its suppliers. Conversely, short payment terms reduce this source of cash, which increases the working capital balance.

Q19) Explain the Production Process Flow determinant of working capital.

A19) If a company estimates its production needs, what it manufactures will likely vary somewhat from actual demand, resulting in an excess amount of inventory on hand. Conversely, a just-in-time system produces goods only to order, so the investment in inventory is reduced.

Q20) Explain the Seasonality determinant of working capital.

A20) If a company sells most of its goods at one time of the year, it may need to build its inventory asset in advance of the selling season. This investment in inventory can be reduced by outsourcing work or paying overtime to manufacture goods at the last minute.

Unit 1

Management of Working Capital

Q1) What is the meaning of Working capital?

A1) The term Working Capital also called gross working capital refers to the firm’s aggregate of current assets and current assets are these assets which can be convertible into cash within an accounting period, generally a year. Accounting Standards Board, The Institute of Chartered Accountants of India defines, “Working capital means the funds available for day-to-day operations of an enterprise. It also represents the excess of current assets over current liabilities including short-term loans.”

Q2) How many concepts working capital has? Explain in brief.

A2) Working capital has two concepts:

Figure: Concept of working capital

i) Gross working capital

Gross Working capital refers to the total of the current assets. Gross working capital is more helpful to the management in managing each individual current assets for day-to-day operations.

Ii) Net working capital

Net working capital refers to the excess of the current assets over current liabilities. In the long run, it is the net working capital that is useful for the purpose.

Q3) How many types of Working capital are there?

A3) There are two types of working capital-

Figure: Working capital classification

(a) Rigid, fixed, regular or permanent working capital

Every business concern has to maintain certain minimum amount of current assets at all times to carry on its activities efficiently and effectively. It is indispensable for any business concern to keep some material as stocks, some in the shape of work-in-progress and some in the form of finished goods. Permanent Working Capital is the irreducible minimum amount of working capital necessary to carry on its activities without any interruptions. It is that minimum amount necessary to outlays its fixed assets effectively.

(b) Variable, seasonal, temporary or flexible working capital

Temporary working capital is that amount of current assets which is not permanent and fluctuating from time to time depending upon the company’s requirements and it is generally financed out of short-term funds. It may also high due to seasonal character of the industry as such it is also called seasonal working capital.

Q4) Give the importance of Working capital.

A4) Working capital works as breath of the company without which an organisation cannot survive. Some of the features of working capital are-

- It is of two types- gross working capital and net working capital.

- It is permanent and temporary nature. Permanent working capital is needed for long term and short-term working capital is needed for short term.

- It is used for purchase of raw materials, payment of wages and expenses.

iv. It changes form constantly to keep the wheels of business moving.

v. Working capital enhances liquidity, solvency, creditworthiness and reputation of the enterprise.

vi. It generates the elements of cost namely: Materials, wages and expenses.

vii. It enables the enterprise to avail the cash discount facilities offered by its suppliers.

Q5) What are the factors affecting working capital?

A5) The finance manager must keep in mind following factors before estimating the amount of working capital.

Figure: Factors affecting working capital

1. Length of Operating Cycle:

The amount of working capital directly depends upon the length of operating cycle. Operating cycle refers to the time period involved in production. It starts right from acquisition of raw material and ends till payment is received after sale. The working capital is very important for the smooth flow of operating cycle. If operating cycle is long then more working capital is required whereas for companies having short operating cycle, the working capital requirement is less.

2. Nature of Business:

The type of business, firm is involved in, is the next consideration while deciding the working capital. In case of trading concern or retail shop the requirement of working capital is less because length of operating cycle is small. The wholesalers as compared to retail shop require more working capital as they have to maintain large stock and generally sell goods on credit which increases the length of operating cycle. The manufacturing company requires huge amount of working capital because they have to convert raw material into finished goods, sell on credit, maintain the inventory of raw material as well as finished goods.

3. Scale of Operation:

The firms operating at large scale need to maintain more inventory, debtors, etc. So, they generally require large working capital whereas firms operating at small scale require less working capital.

4. Business Cycle Fluctuation:

During boom period the market is flourishing so more demand, more production, more stock, and more debtors which mean more amount of working capital is required. Whereas during depression period low demand less inventories to be maintained, less debtors, so less working capital will be required.

5. Seasonal Factors:

The working capital requirement is constant for the companies which are selling goods throughout the season whereas the companies which are selling seasonal goods require huge amount during season as more demand, more stock has to be maintained and fast supply is needed whereas during off season or slack season demand is very low so less working capital is needed.

6. Technology and Production Cycle:

If a company is using labour intensive technique of production, then more working capital is required because company needs to maintain enough cash flow for making payments to labour whereas if company is using machine-intensive technique of production then less working capital is required because investment in machinery is fixed capital requirement and there will be less operative expenses. In case of production cycle, if production cycle is long then more working capital will be required because it will take long time for converting raw material into finished goods whereas when production cycle is small lesser funds are tied up in inventory and raw materials so less working capital is required.

7. Credit Allowed:

Credit policy refers to average period for collection of sale proceeds. It depends on number of factors such as creditworthiness, of clients, industry norms etc. If company is following liberal credit policy, then it will require more working capital whereas if company is following strict or short-term credit policy, then it can manage with less working capital also.

8. Credit Avail:

Another factor related to credit policy is how much and for how long period company is getting credit from its suppliers. If suppliers of raw materials are giving long term credit, then company can manage with less amount of working capital whereas if suppliers are giving only short period credit, then company will require more working capital to make payments to creditors.

9. Operating Efficiency:

The firm having high degree of operating efficiency requires less amount of working capital as compared to firm having low degree of efficiency which requires more working capital. Firms with high degree of efficiency have low wastage and can manage with low level of inventory also and during operating cycle also these firms bear less expense so they can manage with less working capital also.

10. Availability of Raw Materials:

If raw materials are easily available and there is ready supply of raw materials and inputs then firms can manage with less amount of working capital also as they need not maintain any stock of raw materials or they can manage with very less stock.

Q6) What are the advantages of working capital?

A6) The advantages of working capital are as follows-

1.Working capital is helpful in attracting new customers, refreshing the brand, increasing online presence, creating marketing capital for event sponsorship, direct marketing campaigns, etc.

2.It helps prevent payment delays and manages cash flow for significant operating expenses such as payroll, keeping utility current, payments of leases or mortgages, and more.

3.It is useful to purchase additional inventory needed to fill future orders, restock your inventory, buy new products, etc, and expand the business infrastructure.

4.Useful in advance payment when you want to take advantage of wholesale pricing for the update tool.

5.Ideal for seasonal businesses to restore inventory in the off-season, hire temporary employees, promote accurate marketing, cover expenses such as rent, insurance, taxes, salaries, and more.

6.It is especially useful to meet unexpected and unforeseen expenses.

Q7) What is Factoring?

A7) Factoring is one of the sources of working capital. Banks have been given more freedom of borrowing and lending both internally and externally and facilitated the free functioning in lending and investment operations. From 1994, banks are allowed to enter directly leasing, hire purchasing and factoring services, instead through their subsidiaries. In other words, banks are free to enter or exit in any field depending on their profitability, but subject to some RBI guidelines. Banks provide working capital finance through financing receivables, which is known as “factoring”. A “Factor” is a financial institution, which renders services relating to the management and financing of sundry debtors that arises from credit sales.

Q8) What are Commercial banks?

A8) Commercial banks are the major source of working capital finance to industries and commerce. Granting loan to business is one of their primary functions. Getting bank loan is not an easy task since the lending bank may ask a number of questions about the prospective borrower’s financial position and its plans for the future.

At the same time the bank will want to monitor borrower’s business progress. But there is a good side to this, that is borrower’s share price tends to rise, because investor knows that convincing banks is very difficult. The different types or forms of loans are:

(i) Loans,

(ii) Overdrafts,

(iii) Cash credits,

(iv) Purchasing or discounting of bills and

(v) Letter of Credit.

Q9) What are Inter-Corporate Deposits (ICDs)?

A9) A deposit made by one firm with another firm is known as Inter-Corporate Deposit (ICD). Generally, these deposits are made for a period up to six months.

Such deposits may be of three types:

(a) Call Deposits:

These deposits are those expected to be payable on call/on just one day notice. But, in actual practice, the lender has to wait for at least 2 or 3 days to get back the amount. Inter-corporate deposits generally have 12 per cent interest per annum.

(b) Three Months Deposits:

These deposits are more popular among companies for investing the surplus funds. The borrower takes this type of deposits for meeting short-term cash inadequacy. The interest rate on these types of deposits is around 14 per cent per annum.

(c) Six months Deposits:

Inter-corporate deposits are made for a maximum period of six months. These types of deposits are usually given to ‘A’ category borrowers only and they carry an interest rate of around 16 per cent per annum.

Q10) What are Public Deposits?

A10) Public deposits or term deposits are in the nature of unsecured deposits, are solicited by the firms (both large and small) from general public primarily for the purpose of financing their working capital requirements.

Q11) What are Commercial paper?

A11) Commercial paper represents a short-term unsecured promissory note issued by firms that have a fairly high credit (standing) rating. It was first introduced in the USA and it is an important money market instrument. In India, Reserve Bank of India introduced CP on the recommendations of the Vaghul Working Group on Money Market. CP is a source of short-term finance to only large firms with sound financial position.

Q12) What are Deferred Income?

A12) Deferred income is income received in advance by the firm for supply of goods or services in future period. This income increases the firm’s liquidity and constitutes an important source of short-term finance. These payments are not showed as revenue till the supply of goods or services, but showed in the balance sheet as income received in advance.

Advance payment can be demanded by firms which are having monopoly power, great demand for its products and services and if the firm is manufacturing a special product on a special order.

Q13) What are Accruals?

A13) Accrued expenses are those expenses which the company owes to the other, but not yet due and not yet paid the amount. Accruals represent a liability that a firm has to pay for the services or goods, it has received. It is spontaneous and interest-free source of financing. Salaries and wages, interest and taxes are the major constituents of accruals. Salaries and wages are usually paid on monthly and weekly base, respectively. The amounts of salaries and wages are owed but not yet paid and shown them as accrued salaries and wages on the balance sheet at the end of the financial year. The longer the time lag in–payment of these expenses, the greater is the amount of funds provided by the employees. Similarly, interest and tax are accruals, as source of short-term finance. Tax will be paid on earnings.

Q14) What is Trade Credit?

A14) Trade credit refers to the credit extended by the supplier of goods or services to his/her customer in the normal course of business. It occupies a very important position in short-term financing due to the competition. Almost all the traders and manufacturers are required to extend credit facility (a portion), without which there is no business. Trade credit is a spontaneous source of finance that arises in the normal business transactions without specific negotiation, (automatic source of finance).

Q15) What are the sources of Working capital?

A15) The two segments of working capital viz., regular or fixed or permanent and variable are financed by the long-term and the short-term sources of funds respectively. The main sources of long-term funds are shares, debentures, term- loans, retained earnings etc.

Short-term financing is aimed to meet the demand of current assets and pay the current liabilities of the organization. In other words, it helps in minimizing the gap between current assets and current liabilities. There are different means to raise capital from the market for small duration. Various agencies, such as commercial banks, co-operative banks, financial institutions, and NABARD provide the financial assistance to organizations.

Q16) Explain the Credit Policy determinant of working capital.

A16) If a business offers easy credit terms to its customers, the company is investing in accounts receivable that may be outstanding for a long time. This investment can be reduced by tightening the credit policy, but doing so may drive away some customers.

Q17) Explain the Growth Rate determinant of working capital.

A17) If a business is growing at a rapid rate, it is likely increasing its investments in receivables and inventory. Unless profits are extremely high, it is unlikely that the entity can generate sufficient cash to pay for these receivables and inventory, resulting in a steady increase in working capital. Conversely, if a business is shrinking, its working capital requirements will also decline, which spins off excess cash.

Q18) Explain the Payables Payment Terms determinant of working capital.

A18) If a company can negotiate longer payment terms with its suppliers, it can reduce the amount of investment needed in working capital, essentially by obtaining a free loan from its suppliers. Conversely, short payment terms reduce this source of cash, which increases the working capital balance.

Q19) Explain the Production Process Flow determinant of working capital.

A19) If a company estimates its production needs, what it manufactures will likely vary somewhat from actual demand, resulting in an excess amount of inventory on hand. Conversely, a just-in-time system produces goods only to order, so the investment in inventory is reduced.

Q20) Explain the Seasonality determinant of working capital.

A20) If a company sells most of its goods at one time of the year, it may need to build its inventory asset in advance of the selling season. This investment in inventory can be reduced by outsourcing work or paying overtime to manufacture goods at the last minute.

Unit 1

Management of Working Capital

Q1) What is the meaning of Working capital?

A1) The term Working Capital also called gross working capital refers to the firm’s aggregate of current assets and current assets are these assets which can be convertible into cash within an accounting period, generally a year. Accounting Standards Board, The Institute of Chartered Accountants of India defines, “Working capital means the funds available for day-to-day operations of an enterprise. It also represents the excess of current assets over current liabilities including short-term loans.”

Q2) How many concepts working capital has? Explain in brief.

A2) Working capital has two concepts:

Figure: Concept of working capital

i) Gross working capital

Gross Working capital refers to the total of the current assets. Gross working capital is more helpful to the management in managing each individual current assets for day-to-day operations.

Ii) Net working capital

Net working capital refers to the excess of the current assets over current liabilities. In the long run, it is the net working capital that is useful for the purpose.

Q3) How many types of Working capital are there?

A3) There are two types of working capital-

Figure: Working capital classification

(a) Rigid, fixed, regular or permanent working capital

Every business concern has to maintain certain minimum amount of current assets at all times to carry on its activities efficiently and effectively. It is indispensable for any business concern to keep some material as stocks, some in the shape of work-in-progress and some in the form of finished goods. Permanent Working Capital is the irreducible minimum amount of working capital necessary to carry on its activities without any interruptions. It is that minimum amount necessary to outlays its fixed assets effectively.

(b) Variable, seasonal, temporary or flexible working capital

Temporary working capital is that amount of current assets which is not permanent and fluctuating from time to time depending upon the company’s requirements and it is generally financed out of short-term funds. It may also high due to seasonal character of the industry as such it is also called seasonal working capital.

Q4) Give the importance of Working capital.

A4) Working capital works as breath of the company without which an organisation cannot survive. Some of the features of working capital are-

- It is of two types- gross working capital and net working capital.

- It is permanent and temporary nature. Permanent working capital is needed for long term and short-term working capital is needed for short term.

- It is used for purchase of raw materials, payment of wages and expenses.

iv. It changes form constantly to keep the wheels of business moving.

v. Working capital enhances liquidity, solvency, creditworthiness and reputation of the enterprise.

vi. It generates the elements of cost namely: Materials, wages and expenses.

vii. It enables the enterprise to avail the cash discount facilities offered by its suppliers.

Q5) What are the factors affecting working capital?

A5) The finance manager must keep in mind following factors before estimating the amount of working capital.

Figure: Factors affecting working capital

1. Length of Operating Cycle:

The amount of working capital directly depends upon the length of operating cycle. Operating cycle refers to the time period involved in production. It starts right from acquisition of raw material and ends till payment is received after sale. The working capital is very important for the smooth flow of operating cycle. If operating cycle is long then more working capital is required whereas for companies having short operating cycle, the working capital requirement is less.

2. Nature of Business:

The type of business, firm is involved in, is the next consideration while deciding the working capital. In case of trading concern or retail shop the requirement of working capital is less because length of operating cycle is small. The wholesalers as compared to retail shop require more working capital as they have to maintain large stock and generally sell goods on credit which increases the length of operating cycle. The manufacturing company requires huge amount of working capital because they have to convert raw material into finished goods, sell on credit, maintain the inventory of raw material as well as finished goods.

3. Scale of Operation:

The firms operating at large scale need to maintain more inventory, debtors, etc. So, they generally require large working capital whereas firms operating at small scale require less working capital.

4. Business Cycle Fluctuation:

During boom period the market is flourishing so more demand, more production, more stock, and more debtors which mean more amount of working capital is required. Whereas during depression period low demand less inventories to be maintained, less debtors, so less working capital will be required.

5. Seasonal Factors:

The working capital requirement is constant for the companies which are selling goods throughout the season whereas the companies which are selling seasonal goods require huge amount during season as more demand, more stock has to be maintained and fast supply is needed whereas during off season or slack season demand is very low so less working capital is needed.

6. Technology and Production Cycle:

If a company is using labour intensive technique of production, then more working capital is required because company needs to maintain enough cash flow for making payments to labour whereas if company is using machine-intensive technique of production then less working capital is required because investment in machinery is fixed capital requirement and there will be less operative expenses. In case of production cycle, if production cycle is long then more working capital will be required because it will take long time for converting raw material into finished goods whereas when production cycle is small lesser funds are tied up in inventory and raw materials so less working capital is required.

7. Credit Allowed:

Credit policy refers to average period for collection of sale proceeds. It depends on number of factors such as creditworthiness, of clients, industry norms etc. If company is following liberal credit policy, then it will require more working capital whereas if company is following strict or short-term credit policy, then it can manage with less working capital also.

8. Credit Avail:

Another factor related to credit policy is how much and for how long period company is getting credit from its suppliers. If suppliers of raw materials are giving long term credit, then company can manage with less amount of working capital whereas if suppliers are giving only short period credit, then company will require more working capital to make payments to creditors.

9. Operating Efficiency:

The firm having high degree of operating efficiency requires less amount of working capital as compared to firm having low degree of efficiency which requires more working capital. Firms with high degree of efficiency have low wastage and can manage with low level of inventory also and during operating cycle also these firms bear less expense so they can manage with less working capital also.

10. Availability of Raw Materials:

If raw materials are easily available and there is ready supply of raw materials and inputs then firms can manage with less amount of working capital also as they need not maintain any stock of raw materials or they can manage with very less stock.

Q6) What are the advantages of working capital?

A6) The advantages of working capital are as follows-

1.Working capital is helpful in attracting new customers, refreshing the brand, increasing online presence, creating marketing capital for event sponsorship, direct marketing campaigns, etc.

2.It helps prevent payment delays and manages cash flow for significant operating expenses such as payroll, keeping utility current, payments of leases or mortgages, and more.

3.It is useful to purchase additional inventory needed to fill future orders, restock your inventory, buy new products, etc, and expand the business infrastructure.

4.Useful in advance payment when you want to take advantage of wholesale pricing for the update tool.

5.Ideal for seasonal businesses to restore inventory in the off-season, hire temporary employees, promote accurate marketing, cover expenses such as rent, insurance, taxes, salaries, and more.

6.It is especially useful to meet unexpected and unforeseen expenses.

Q7) What is Factoring?

A7) Factoring is one of the sources of working capital. Banks have been given more freedom of borrowing and lending both internally and externally and facilitated the free functioning in lending and investment operations. From 1994, banks are allowed to enter directly leasing, hire purchasing and factoring services, instead through their subsidiaries. In other words, banks are free to enter or exit in any field depending on their profitability, but subject to some RBI guidelines. Banks provide working capital finance through financing receivables, which is known as “factoring”. A “Factor” is a financial institution, which renders services relating to the management and financing of sundry debtors that arises from credit sales.

Q8) What are Commercial banks?

A8) Commercial banks are the major source of working capital finance to industries and commerce. Granting loan to business is one of their primary functions. Getting bank loan is not an easy task since the lending bank may ask a number of questions about the prospective borrower’s financial position and its plans for the future.

At the same time the bank will want to monitor borrower’s business progress. But there is a good side to this, that is borrower’s share price tends to rise, because investor knows that convincing banks is very difficult. The different types or forms of loans are:

(i) Loans,

(ii) Overdrafts,

(iii) Cash credits,

(iv) Purchasing or discounting of bills and

(v) Letter of Credit.

Q9) What are Inter-Corporate Deposits (ICDs)?

A9) A deposit made by one firm with another firm is known as Inter-Corporate Deposit (ICD). Generally, these deposits are made for a period up to six months.

Such deposits may be of three types:

(a) Call Deposits:

These deposits are those expected to be payable on call/on just one day notice. But, in actual practice, the lender has to wait for at least 2 or 3 days to get back the amount. Inter-corporate deposits generally have 12 per cent interest per annum.

(b) Three Months Deposits:

These deposits are more popular among companies for investing the surplus funds. The borrower takes this type of deposits for meeting short-term cash inadequacy. The interest rate on these types of deposits is around 14 per cent per annum.

(c) Six months Deposits:

Inter-corporate deposits are made for a maximum period of six months. These types of deposits are usually given to ‘A’ category borrowers only and they carry an interest rate of around 16 per cent per annum.

Q10) What are Public Deposits?

A10) Public deposits or term deposits are in the nature of unsecured deposits, are solicited by the firms (both large and small) from general public primarily for the purpose of financing their working capital requirements.

Q11) What are Commercial paper?

A11) Commercial paper represents a short-term unsecured promissory note issued by firms that have a fairly high credit (standing) rating. It was first introduced in the USA and it is an important money market instrument. In India, Reserve Bank of India introduced CP on the recommendations of the Vaghul Working Group on Money Market. CP is a source of short-term finance to only large firms with sound financial position.

Q12) What are Deferred Income?

A12) Deferred income is income received in advance by the firm for supply of goods or services in future period. This income increases the firm’s liquidity and constitutes an important source of short-term finance. These payments are not showed as revenue till the supply of goods or services, but showed in the balance sheet as income received in advance.

Advance payment can be demanded by firms which are having monopoly power, great demand for its products and services and if the firm is manufacturing a special product on a special order.

Q13) What are Accruals?

A13) Accrued expenses are those expenses which the company owes to the other, but not yet due and not yet paid the amount. Accruals represent a liability that a firm has to pay for the services or goods, it has received. It is spontaneous and interest-free source of financing. Salaries and wages, interest and taxes are the major constituents of accruals. Salaries and wages are usually paid on monthly and weekly base, respectively. The amounts of salaries and wages are owed but not yet paid and shown them as accrued salaries and wages on the balance sheet at the end of the financial year. The longer the time lag in–payment of these expenses, the greater is the amount of funds provided by the employees. Similarly, interest and tax are accruals, as source of short-term finance. Tax will be paid on earnings.

Q14) What is Trade Credit?

A14) Trade credit refers to the credit extended by the supplier of goods or services to his/her customer in the normal course of business. It occupies a very important position in short-term financing due to the competition. Almost all the traders and manufacturers are required to extend credit facility (a portion), without which there is no business. Trade credit is a spontaneous source of finance that arises in the normal business transactions without specific negotiation, (automatic source of finance).

Q15) What are the sources of Working capital?

A15) The two segments of working capital viz., regular or fixed or permanent and variable are financed by the long-term and the short-term sources of funds respectively. The main sources of long-term funds are shares, debentures, term- loans, retained earnings etc.

Short-term financing is aimed to meet the demand of current assets and pay the current liabilities of the organization. In other words, it helps in minimizing the gap between current assets and current liabilities. There are different means to raise capital from the market for small duration. Various agencies, such as commercial banks, co-operative banks, financial institutions, and NABARD provide the financial assistance to organizations.

Q16) Explain the Credit Policy determinant of working capital.

A16) If a business offers easy credit terms to its customers, the company is investing in accounts receivable that may be outstanding for a long time. This investment can be reduced by tightening the credit policy, but doing so may drive away some customers.

Q17) Explain the Growth Rate determinant of working capital.

A17) If a business is growing at a rapid rate, it is likely increasing its investments in receivables and inventory. Unless profits are extremely high, it is unlikely that the entity can generate sufficient cash to pay for these receivables and inventory, resulting in a steady increase in working capital. Conversely, if a business is shrinking, its working capital requirements will also decline, which spins off excess cash.

Q18) Explain the Payables Payment Terms determinant of working capital.

A18) If a company can negotiate longer payment terms with its suppliers, it can reduce the amount of investment needed in working capital, essentially by obtaining a free loan from its suppliers. Conversely, short payment terms reduce this source of cash, which increases the working capital balance.

Q19) Explain the Production Process Flow determinant of working capital.

A19) If a company estimates its production needs, what it manufactures will likely vary somewhat from actual demand, resulting in an excess amount of inventory on hand. Conversely, a just-in-time system produces goods only to order, so the investment in inventory is reduced.

Q20) Explain the Seasonality determinant of working capital.

A20) If a company sells most of its goods at one time of the year, it may need to build its inventory asset in advance of the selling season. This investment in inventory can be reduced by outsourcing work or paying overtime to manufacture goods at the last minute.