Unit 3

Management of Receivables

Q1) What are Receivables?

A1) Receivables, also regarded as accounts receivable, are debts owed to a firm by its customers for goods or services used or delivered but not yet paid for.

Receivables are created by expanding the line of credit to customers and are listed as current assets on the company's balance sheet. They are considered as liquid assets since they can be used as collateral to secure a loan to help meet short-term obligations.

Receivables are part of the working capital of a company. Effectively handling receivables means promptly following up with any consumers who have not paid and eventually reviewing payment plans if necessary. This is critical as it provides additional capital to fund operations and reduces the net debt of the organisation.

Receivables are assets accounts representing amounts owed to the firm as a result of sale of goods / services in the ordinary course of business.

They, therefore, represent the claims of a firm against its customers and are carried to the “assets side” of the balance sheet under titles such as accounts receivables, customer receivables or book debts. They are, as stated earlier, the result of extension of credit facility to then customers a reasonable period of time in which they can pay for the goods purchased by them.

Q2) What are the nature of Receivables?

A2) The nature of receivable management is discussed below-

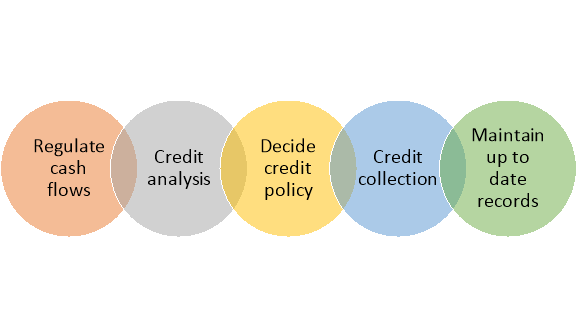

Figure: Nature of receivable management

- Regulate Cash Flow

Receivable management regulates all cash flows in an organization. It controls all inflow and outflow of funds and ensures that an efficient amount of cash is always available. Proper management of receivables enables organizations in efficient functioning at all the times.

2. Credit Analysis

It performs proper analysis of customer credentials for determining their credit ratings. Monitoring and scanning of customers before provide them any credit facility helps in minimizing the credit risk.

3. Decide Credit Policy

Receivable management decides the credit policy and standards as per which credit facility should be extended to customers. A company may have a lenient credit policy where customer credit-worthiness is not at all considered or a stringent policy where credit-worthiness is considered for providing credit.

4. Credit Collection

Receivable management focuses on efficient and timely collection of business payments from its customers. It works towards reducing the time gap in between the moments when bills are raised and payment is collected.

5. Maintain Up-To-Date Records

Receivable management maintains a systematic record of all business transactions on a regular basis. All transactions are maintained fairly in the form of proper billing and invoices which helps in avoiding any confusion or settling of disputes arising later.

Q3) What are the benefits of Receivables?

A3) The benefits of receivables are-

- Evaluates Customer Credit Ratings

Receivable management evaluates its customers borrowing capacity and repaying ability for determining their credit ratings. It approves any credit facility to its customers after analysing their information both qualitatively and quantitatively. Proper investigation of client details helps in reducing the credit risk.

2. Minimizes Investment in Receivables

It reduces investment in receivable by ensuring optimum funds are available within organization at all the times. Receivable management decides proper credit limit and credit period for avoiding any bankruptcy situations. Attempts are made to collect account receivable as soon as they become due for payment which reduces the overall investment in receivables.

3. Optimize Sales

Efficient receivable management assist business in raising their sales volume. Business is able to attract more and more customers by providing them credit facilities. They are able to properly decide and monitor credit facilities with the help of a receivable management.

4. Reduce Risk of Bad Debts

It takes all steps to avoid any instances of bad debts. Receivable management notify all customers for the payment as soon as the amount gets due. It charges interest on delay payments and aims at optimum collection of all payment timely.

5. Maintain Efficient Cash

Maintenance of efficient cash is crucial for the survival of every organization. Receivables management properly records all cash inflows and outflows of a business. All credit facilities are extended after analysing the capability of organization and due payments are collected timely. This results in steady cash flow within the organization.

6. Lower Cost of Credit

Receivable management helps business in lowering its cost of credit by limiting the credit amount and credit period for its customers. It performs all processes such as acquiring credit information of clients and collecting all due payments in an efficient way which lower the overall cost associated with credit facilities.

Q4) What are the meaning of Receivables management?

A4) Account receivables refer to the outstanding invoices or money which is yet to be paid by your customers. Until it is paid, such invoices or money is accounted as accounts receivables. It is also known as bills receivables. Business need cash all the time to keep the business running smoothly and ensuring the accounts receivables are paid on time is essential to manage cash flow efficiently. Management of the accounts receivable is called receivable management. Basically, the entire process of defining the credit policy, setting payment terms, sending payment follow ups and timely collection of the due payments can be defined as receivables management. Management of Receivables is also known as:

1.Payment Collection

2.Collection Management

3. Accounts Receivables

Q5) What are Control of Receivables?

A5) Managing receivables does not end with granting of credit as dictated by the credit policy. It is necessary to ensure that customers make payment as per the credit term and in the event of any deviation, corrective actions are required. Thus, monitoring the payment behaviour of the customers assumes importance. There are several possible reasons for customers to deviate from the payment terms. Three of these possible reasons and their implications in credit management are discussed below:

1.Changing Customer Business Characteristics: The customers, who have earlier agreed to make payment within a certain period of time, may deviate from their acceptance and delay the payment. For example, economic slowdown or slowdown in the industry of the customers business may force the customers to delay the payment. In fact, the bills payable become discretionary cash outflow item in economic recession. Thus, a close watch on the performance of customer’s industry is required.

2. Inaccurate Policy Forecasts: A wide deviation from the credit terms and actual flow of cash flows show inaccurate forecast and defective credit policy. It is quite possible that a firm uses defective credit rating model or wrongly assesses the credit variable. For example, it is quite possible to overestimate the collateral value and then lend more credit. If this is the reason for wide deviation, it requires updating the model or training the employees.

3.Improper Policy Implementation: Often wide deviation is noticed in practice while implementing credit policy. This may not be intentional but frequently in the form of accommodating special requests of the customers. For example, a customer may not be eligible for credit or higher credit as per the model in force. The customer may personally see the concerned manager and request her/him to relax the credit restriction. If there is no policy in place to deal with these types of request and ad hoc decisions are made, then wide deviation is possible. Often these deviations become costly for the firm. Intervention of top officials and ad hoc decisions are cited as major reasons for widespread defaults in many public financial institutions. Thus, it is necessary to ensure that policies are implemented in letter and spirit. Monitoring provides signals of deviation from expectations. There are several 17 monitoring techniques available to the credit managers. The monitoring system begins with aggregate analysis and then move down to account-specific analysis.

Q6) What is Credit Period?

A6) Decision on credit period is determined by several factors. It is important to check the credit period given by other firms in the industry. It would be difficult to sustain by adopting a completely different credit policy as compared to that of industry. For example, if the industry practice is 30 days of credit period, a firm which offers 120 days credit would certainly attract more business but the cost associated with managing longer credit period also increases simultaneously. On the other hand, if the firm reduces the credit period to 10 days, it would certainly reduce the cost of carrying receivables but volume would also decline because many customers would prefer other firms, which offer 30 days credit. In other words, granting trade credit is an aspect of price. The time that the buyer gets before payment is due, is one of the dimensions of the product (like quality, service, etc.) which determine the attractiveness of the product. Like other aspects of price, the firm’s terms of credit affect its volume. All other things being equal, longer credit period and more liberal credit-granting policies increase sales, while shorter credit period and more stringent credit granting policies decrease sales. These policies also affect the level and timing of certain costs. Evaluation of credit policy changes must compare with the changes in sales and additional revenues generated by the sales as a result of this policy change and costs effects. While additional volume and revenue associated with such additional volume are clear and measurable, the cost effects require further analysis.

Q7) What is Discount?

A7) When a firm pursues aggressive credit policy, it affects cash flows in the form of delayed collection and bad debts. Discounts are offered to the customers, who purchased the goods on credit, as an incentive to give up the credit period and pay much earlier. For example, suppose the terms of credit is “3/10 net 60”. It means if the customer, who gets 60 days credit period can pay within 10 days from the date of purchase and get a discount of 3% on the value of order. Since the customer uses the opportunity cost of funds and availability of cash in taking decision, the cash discount should be set attractive. The discount quantum should be greater than interest rate of short-term borrowings.

Q8) What is Credit Eligibility?

A8) Having designed credit period and discount rate, the next logical step is to define the customers, who are eligible for the credit terms. The credit-granting decision is critical for the seller since credit-granting has economic value to buyers and buyers’ decision on purchase is directly affected by this policy. For instance, if the credit eligibility terms reject a particular customer and requires the customer to make cash purchase, the customer may not buy the product from the company and may look forward to someone who is agreeable to grant credit. Nevertheless, Management of Inventory it may not be desirable to grant credit to all customers. It may instead analyse each potential buyer before deciding whether to grant credit or not based on the attributes of that particular buyer. While the earlier two terms of credit policy viz. Credit period and discount rate are not changed frequently in order to maintain consistency in the policy, credit eligibility is periodically reviewed. For instance, an entry of new customer would warrant a review of credit eligibility of existing customers.

Q9) What is Credit Limit?

A9) If a customer falls within the desired limit of credit worthiness, the next issue is fixing the credit amount. This is something similar to banks fixing overdraft limit for the account holders. If a customer is new, normally the credit limit is fixed at the lowest level initially and expanded over the period based on the performance of the customer in meeting the liability. Credit limit may undergo a change depending on the changes in the credit worthiness of the customer and changes in the performance of customer’s industry.

Q10) What is Credit policy?

A10) Designing credit policy is the first step in receivables management. In designing credit policy, the management can follow two broad approaches. Firstly, the policy can be designed under the assumption of unlimited production/sales and funds available for investment in receivables. If credit policy is designed under this assumption and subsequently some constraints are experienced on sales or funds available for receivables, then managers have to restrict the credit at the time of implementing the credit policy. But this may cause certain difficulties to customers because of deviation from the announced credit policy. For example, if a company announces that credit will be unlimited to certain categories of customers based on unlimited funds assumption and subsequently refuse to grant credit due to limited funds available for investment in receivables, it will create hardship to the customer. Under the second approach, the credit policy could be designed keeping in mind the limitations on production/sales volume and funds available for investment in receivables. This is aimed to achieve optimum utilisation of production capacity and funds available for receivables. It also ensures consistency of credit policy.

Q11) What are the components of the credit policy?

A11) The credit policy consists of the following components:

a) Credit Period

b) Discount

c) Credit Eligibility

d) Credit Limit

Q12) What are the two important components of the credit terms?

A12) The two important components of the credit terms are:

- Credit period: The term credit period refers to the time duration for which credit is extended to the customers. It is generally expressed in terms of “net days”.

- Cash discount: Most firms offer cash discount to their customers for encouraging them to pay their dues before the expiry of the credit period. The terms of the cash discounts indicate the rate of discount as well as the period for which the discount has been offered.

Q13) How level of sales affect investment in receivables?

A13) This is the most important factor in determining the size of accounts receivable. Generally, in the same industry, a firm having a large volume of sales will be having a larger level of receivables as compared to a firm with a small volume of sales.

Sales level can also be used for forecasting change in accounts receivable.

Q14) How credit policies affect investment in receivables?

A14) The term credit policy refers to those decision variables that influence the amount of trade credit, i.e., the investment in receivables. These variables include the quantity of trade accounts to be accepted, the length of the credit period to be extended, the cash discount to be given and any special terms to be offered depending upon particular circumstances of the firm and the customer. A firm’s credit policy, as a matter of fact, determines the amount of risk the firm is willing to undertake in its sales activities. If a firm has a lenient or a relatively liberal credit policy, it will experience a higher level of receivables as compared to a firm with a more rigid or stringent credit policy.

This is because of two reasons:

- A lenient credit policy encourages even the financially strong customers to make delays in payments resulting in increasing the size of the accounts receivables;

- Lenient credit policy will result in greater defaults in payments by financially weak customers thus resulting in increasing the size of receivables.

Q15) How terms of trade affect investment in receivables?

A15) The size of the receivables is also affected by terms of trade (or credit terms) offered by the firm.

The two important components of the credit terms are:

- Credit period: The term credit period refers to the time duration for which credit is extended to the customers. It is generally expressed in terms of “net days”.

- Cash discount: Most firms offer cash discount to their customers for encouraging them to pay their dues before the expiry of the credit period. The terms of the cash discounts indicate the rate of discount as well as the period for which the discount has been offered.

Q16) How Formulation of Credit Policy helps in the scope of receivables management?

A16) Receivable management is the one which formulates and implements an effective credit policy in an organization. Credit policies are decided as per the capabilities of an organization. A company may either follow a liberal policy or stringent credit policy for providing credit facilities to its customers.

Q17) How Credit Evaluation helps in the scope of receivables management?

A17) Credit evaluation involves examining the credit worthiness of customer before approving any credit amount. Proper investigation of customer’s information lowers the risk of bad debts. Receivable management acquire all credentials of client for determining their borrowing capacity and repaying ability.

Q18) How Credit Control helps in the scope of receivables management?

A18) Receivable management implement a proper structure for monitoring all credit functions of business. It records credit sales with proper documents on a daily basis. Invoices are raised immediately after goods get dispatch and amount are collected soon as they become due for payment.

Q19) How Maximize Profit is the scope of receivables management?

A19) It plays an efficient role in maximizing the profit of organizations. Receivable management helps in boosting the sales volume by providing credit facilities to customers. More and more people are able to purchase goods on credit which maximizes the overall profit level.

Q20) How better Competition is the scope of receivables management?

A20) Efficient account receivable management helps business in facing the strong competition in market. It enables in providing credit facilities to customers as per their needs and capabilities. Receivable management analyses the credit strategies adopted by competitors and according frame policy for an organization. It attracts more and more customers by offering them credit facilities at convenient rates.

Unit 3

Management of Receivables

Q1) What are Receivables?

A1) Receivables, also regarded as accounts receivable, are debts owed to a firm by its customers for goods or services used or delivered but not yet paid for.

Receivables are created by expanding the line of credit to customers and are listed as current assets on the company's balance sheet. They are considered as liquid assets since they can be used as collateral to secure a loan to help meet short-term obligations.

Receivables are part of the working capital of a company. Effectively handling receivables means promptly following up with any consumers who have not paid and eventually reviewing payment plans if necessary. This is critical as it provides additional capital to fund operations and reduces the net debt of the organisation.

Receivables are assets accounts representing amounts owed to the firm as a result of sale of goods / services in the ordinary course of business.

They, therefore, represent the claims of a firm against its customers and are carried to the “assets side” of the balance sheet under titles such as accounts receivables, customer receivables or book debts. They are, as stated earlier, the result of extension of credit facility to then customers a reasonable period of time in which they can pay for the goods purchased by them.

Q2) What are the nature of Receivables?

A2) The nature of receivable management is discussed below-

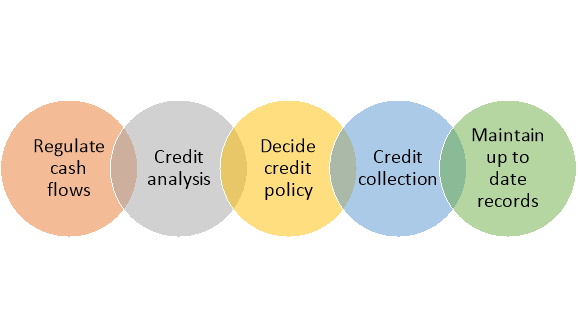

Figure: Nature of receivable management

- Regulate Cash Flow

Receivable management regulates all cash flows in an organization. It controls all inflow and outflow of funds and ensures that an efficient amount of cash is always available. Proper management of receivables enables organizations in efficient functioning at all the times.

2. Credit Analysis

It performs proper analysis of customer credentials for determining their credit ratings. Monitoring and scanning of customers before provide them any credit facility helps in minimizing the credit risk.

3. Decide Credit Policy

Receivable management decides the credit policy and standards as per which credit facility should be extended to customers. A company may have a lenient credit policy where customer credit-worthiness is not at all considered or a stringent policy where credit-worthiness is considered for providing credit.

4. Credit Collection

Receivable management focuses on efficient and timely collection of business payments from its customers. It works towards reducing the time gap in between the moments when bills are raised and payment is collected.

5. Maintain Up-To-Date Records

Receivable management maintains a systematic record of all business transactions on a regular basis. All transactions are maintained fairly in the form of proper billing and invoices which helps in avoiding any confusion or settling of disputes arising later.

Q3) What are the benefits of Receivables?

A3) The benefits of receivables are-

- Evaluates Customer Credit Ratings

Receivable management evaluates its customers borrowing capacity and repaying ability for determining their credit ratings. It approves any credit facility to its customers after analysing their information both qualitatively and quantitatively. Proper investigation of client details helps in reducing the credit risk.

2. Minimizes Investment in Receivables

It reduces investment in receivable by ensuring optimum funds are available within organization at all the times. Receivable management decides proper credit limit and credit period for avoiding any bankruptcy situations. Attempts are made to collect account receivable as soon as they become due for payment which reduces the overall investment in receivables.

3. Optimize Sales

Efficient receivable management assist business in raising their sales volume. Business is able to attract more and more customers by providing them credit facilities. They are able to properly decide and monitor credit facilities with the help of a receivable management.

4. Reduce Risk of Bad Debts

It takes all steps to avoid any instances of bad debts. Receivable management notify all customers for the payment as soon as the amount gets due. It charges interest on delay payments and aims at optimum collection of all payment timely.

5. Maintain Efficient Cash

Maintenance of efficient cash is crucial for the survival of every organization. Receivables management properly records all cash inflows and outflows of a business. All credit facilities are extended after analysing the capability of organization and due payments are collected timely. This results in steady cash flow within the organization.

6. Lower Cost of Credit

Receivable management helps business in lowering its cost of credit by limiting the credit amount and credit period for its customers. It performs all processes such as acquiring credit information of clients and collecting all due payments in an efficient way which lower the overall cost associated with credit facilities.

Q4) What are the meaning of Receivables management?

A4) Account receivables refer to the outstanding invoices or money which is yet to be paid by your customers. Until it is paid, such invoices or money is accounted as accounts receivables. It is also known as bills receivables. Business need cash all the time to keep the business running smoothly and ensuring the accounts receivables are paid on time is essential to manage cash flow efficiently. Management of the accounts receivable is called receivable management. Basically, the entire process of defining the credit policy, setting payment terms, sending payment follow ups and timely collection of the due payments can be defined as receivables management. Management of Receivables is also known as:

1.Payment Collection

2.Collection Management

3. Accounts Receivables

Q5) What are Control of Receivables?

A5) Managing receivables does not end with granting of credit as dictated by the credit policy. It is necessary to ensure that customers make payment as per the credit term and in the event of any deviation, corrective actions are required. Thus, monitoring the payment behaviour of the customers assumes importance. There are several possible reasons for customers to deviate from the payment terms. Three of these possible reasons and their implications in credit management are discussed below:

1.Changing Customer Business Characteristics: The customers, who have earlier agreed to make payment within a certain period of time, may deviate from their acceptance and delay the payment. For example, economic slowdown or slowdown in the industry of the customers business may force the customers to delay the payment. In fact, the bills payable become discretionary cash outflow item in economic recession. Thus, a close watch on the performance of customer’s industry is required.

2. Inaccurate Policy Forecasts: A wide deviation from the credit terms and actual flow of cash flows show inaccurate forecast and defective credit policy. It is quite possible that a firm uses defective credit rating model or wrongly assesses the credit variable. For example, it is quite possible to overestimate the collateral value and then lend more credit. If this is the reason for wide deviation, it requires updating the model or training the employees.

3.Improper Policy Implementation: Often wide deviation is noticed in practice while implementing credit policy. This may not be intentional but frequently in the form of accommodating special requests of the customers. For example, a customer may not be eligible for credit or higher credit as per the model in force. The customer may personally see the concerned manager and request her/him to relax the credit restriction. If there is no policy in place to deal with these types of request and ad hoc decisions are made, then wide deviation is possible. Often these deviations become costly for the firm. Intervention of top officials and ad hoc decisions are cited as major reasons for widespread defaults in many public financial institutions. Thus, it is necessary to ensure that policies are implemented in letter and spirit. Monitoring provides signals of deviation from expectations. There are several 17 monitoring techniques available to the credit managers. The monitoring system begins with aggregate analysis and then move down to account-specific analysis.

Q6) What is Credit Period?

A6) Decision on credit period is determined by several factors. It is important to check the credit period given by other firms in the industry. It would be difficult to sustain by adopting a completely different credit policy as compared to that of industry. For example, if the industry practice is 30 days of credit period, a firm which offers 120 days credit would certainly attract more business but the cost associated with managing longer credit period also increases simultaneously. On the other hand, if the firm reduces the credit period to 10 days, it would certainly reduce the cost of carrying receivables but volume would also decline because many customers would prefer other firms, which offer 30 days credit. In other words, granting trade credit is an aspect of price. The time that the buyer gets before payment is due, is one of the dimensions of the product (like quality, service, etc.) which determine the attractiveness of the product. Like other aspects of price, the firm’s terms of credit affect its volume. All other things being equal, longer credit period and more liberal credit-granting policies increase sales, while shorter credit period and more stringent credit granting policies decrease sales. These policies also affect the level and timing of certain costs. Evaluation of credit policy changes must compare with the changes in sales and additional revenues generated by the sales as a result of this policy change and costs effects. While additional volume and revenue associated with such additional volume are clear and measurable, the cost effects require further analysis.

Q7) What is Discount?

A7) When a firm pursues aggressive credit policy, it affects cash flows in the form of delayed collection and bad debts. Discounts are offered to the customers, who purchased the goods on credit, as an incentive to give up the credit period and pay much earlier. For example, suppose the terms of credit is “3/10 net 60”. It means if the customer, who gets 60 days credit period can pay within 10 days from the date of purchase and get a discount of 3% on the value of order. Since the customer uses the opportunity cost of funds and availability of cash in taking decision, the cash discount should be set attractive. The discount quantum should be greater than interest rate of short-term borrowings.

Q8) What is Credit Eligibility?

A8) Having designed credit period and discount rate, the next logical step is to define the customers, who are eligible for the credit terms. The credit-granting decision is critical for the seller since credit-granting has economic value to buyers and buyers’ decision on purchase is directly affected by this policy. For instance, if the credit eligibility terms reject a particular customer and requires the customer to make cash purchase, the customer may not buy the product from the company and may look forward to someone who is agreeable to grant credit. Nevertheless, Management of Inventory it may not be desirable to grant credit to all customers. It may instead analyse each potential buyer before deciding whether to grant credit or not based on the attributes of that particular buyer. While the earlier two terms of credit policy viz. Credit period and discount rate are not changed frequently in order to maintain consistency in the policy, credit eligibility is periodically reviewed. For instance, an entry of new customer would warrant a review of credit eligibility of existing customers.

Q9) What is Credit Limit?

A9) If a customer falls within the desired limit of credit worthiness, the next issue is fixing the credit amount. This is something similar to banks fixing overdraft limit for the account holders. If a customer is new, normally the credit limit is fixed at the lowest level initially and expanded over the period based on the performance of the customer in meeting the liability. Credit limit may undergo a change depending on the changes in the credit worthiness of the customer and changes in the performance of customer’s industry.

Q10) What is Credit policy?

A10) Designing credit policy is the first step in receivables management. In designing credit policy, the management can follow two broad approaches. Firstly, the policy can be designed under the assumption of unlimited production/sales and funds available for investment in receivables. If credit policy is designed under this assumption and subsequently some constraints are experienced on sales or funds available for receivables, then managers have to restrict the credit at the time of implementing the credit policy. But this may cause certain difficulties to customers because of deviation from the announced credit policy. For example, if a company announces that credit will be unlimited to certain categories of customers based on unlimited funds assumption and subsequently refuse to grant credit due to limited funds available for investment in receivables, it will create hardship to the customer. Under the second approach, the credit policy could be designed keeping in mind the limitations on production/sales volume and funds available for investment in receivables. This is aimed to achieve optimum utilisation of production capacity and funds available for receivables. It also ensures consistency of credit policy.

Q11) What are the components of the credit policy?

A11) The credit policy consists of the following components:

a) Credit Period

b) Discount

c) Credit Eligibility

d) Credit Limit

Q12) What are the two important components of the credit terms?

A12) The two important components of the credit terms are:

- Credit period: The term credit period refers to the time duration for which credit is extended to the customers. It is generally expressed in terms of “net days”.

- Cash discount: Most firms offer cash discount to their customers for encouraging them to pay their dues before the expiry of the credit period. The terms of the cash discounts indicate the rate of discount as well as the period for which the discount has been offered.

Q13) How level of sales affect investment in receivables?

A13) This is the most important factor in determining the size of accounts receivable. Generally, in the same industry, a firm having a large volume of sales will be having a larger level of receivables as compared to a firm with a small volume of sales.

Sales level can also be used for forecasting change in accounts receivable.

Q14) How credit policies affect investment in receivables?

A14) The term credit policy refers to those decision variables that influence the amount of trade credit, i.e., the investment in receivables. These variables include the quantity of trade accounts to be accepted, the length of the credit period to be extended, the cash discount to be given and any special terms to be offered depending upon particular circumstances of the firm and the customer. A firm’s credit policy, as a matter of fact, determines the amount of risk the firm is willing to undertake in its sales activities. If a firm has a lenient or a relatively liberal credit policy, it will experience a higher level of receivables as compared to a firm with a more rigid or stringent credit policy.

This is because of two reasons:

- A lenient credit policy encourages even the financially strong customers to make delays in payments resulting in increasing the size of the accounts receivables;

- Lenient credit policy will result in greater defaults in payments by financially weak customers thus resulting in increasing the size of receivables.

Q15) How terms of trade affect investment in receivables?

A15) The size of the receivables is also affected by terms of trade (or credit terms) offered by the firm.

The two important components of the credit terms are:

- Credit period: The term credit period refers to the time duration for which credit is extended to the customers. It is generally expressed in terms of “net days”.

- Cash discount: Most firms offer cash discount to their customers for encouraging them to pay their dues before the expiry of the credit period. The terms of the cash discounts indicate the rate of discount as well as the period for which the discount has been offered.

Q16) How Formulation of Credit Policy helps in the scope of receivables management?

A16) Receivable management is the one which formulates and implements an effective credit policy in an organization. Credit policies are decided as per the capabilities of an organization. A company may either follow a liberal policy or stringent credit policy for providing credit facilities to its customers.

Q17) How Credit Evaluation helps in the scope of receivables management?

A17) Credit evaluation involves examining the credit worthiness of customer before approving any credit amount. Proper investigation of customer’s information lowers the risk of bad debts. Receivable management acquire all credentials of client for determining their borrowing capacity and repaying ability.

Q18) How Credit Control helps in the scope of receivables management?

A18) Receivable management implement a proper structure for monitoring all credit functions of business. It records credit sales with proper documents on a daily basis. Invoices are raised immediately after goods get dispatch and amount are collected soon as they become due for payment.

Q19) How Maximize Profit is the scope of receivables management?

A19) It plays an efficient role in maximizing the profit of organizations. Receivable management helps in boosting the sales volume by providing credit facilities to customers. More and more people are able to purchase goods on credit which maximizes the overall profit level.

Q20) How better Competition is the scope of receivables management?

A20) Efficient account receivable management helps business in facing the strong competition in market. It enables in providing credit facilities to customers as per their needs and capabilities. Receivable management analyses the credit strategies adopted by competitors and according frame policy for an organization. It attracts more and more customers by offering them credit facilities at convenient rates.

Unit 3

Management of Receivables

Q1) What are Receivables?

A1) Receivables, also regarded as accounts receivable, are debts owed to a firm by its customers for goods or services used or delivered but not yet paid for.

Receivables are created by expanding the line of credit to customers and are listed as current assets on the company's balance sheet. They are considered as liquid assets since they can be used as collateral to secure a loan to help meet short-term obligations.

Receivables are part of the working capital of a company. Effectively handling receivables means promptly following up with any consumers who have not paid and eventually reviewing payment plans if necessary. This is critical as it provides additional capital to fund operations and reduces the net debt of the organisation.

Receivables are assets accounts representing amounts owed to the firm as a result of sale of goods / services in the ordinary course of business.

They, therefore, represent the claims of a firm against its customers and are carried to the “assets side” of the balance sheet under titles such as accounts receivables, customer receivables or book debts. They are, as stated earlier, the result of extension of credit facility to then customers a reasonable period of time in which they can pay for the goods purchased by them.

Q2) What are the nature of Receivables?

A2) The nature of receivable management is discussed below-

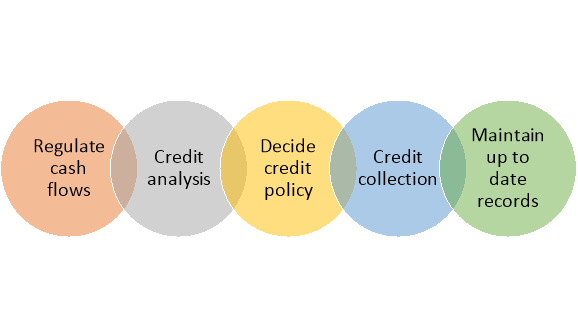

Figure: Nature of receivable management

- Regulate Cash Flow

Receivable management regulates all cash flows in an organization. It controls all inflow and outflow of funds and ensures that an efficient amount of cash is always available. Proper management of receivables enables organizations in efficient functioning at all the times.

2. Credit Analysis

It performs proper analysis of customer credentials for determining their credit ratings. Monitoring and scanning of customers before provide them any credit facility helps in minimizing the credit risk.

3. Decide Credit Policy

Receivable management decides the credit policy and standards as per which credit facility should be extended to customers. A company may have a lenient credit policy where customer credit-worthiness is not at all considered or a stringent policy where credit-worthiness is considered for providing credit.

4. Credit Collection

Receivable management focuses on efficient and timely collection of business payments from its customers. It works towards reducing the time gap in between the moments when bills are raised and payment is collected.

5. Maintain Up-To-Date Records

Receivable management maintains a systematic record of all business transactions on a regular basis. All transactions are maintained fairly in the form of proper billing and invoices which helps in avoiding any confusion or settling of disputes arising later.

Q3) What are the benefits of Receivables?

A3) The benefits of receivables are-

- Evaluates Customer Credit Ratings

Receivable management evaluates its customers borrowing capacity and repaying ability for determining their credit ratings. It approves any credit facility to its customers after analysing their information both qualitatively and quantitatively. Proper investigation of client details helps in reducing the credit risk.

2. Minimizes Investment in Receivables

It reduces investment in receivable by ensuring optimum funds are available within organization at all the times. Receivable management decides proper credit limit and credit period for avoiding any bankruptcy situations. Attempts are made to collect account receivable as soon as they become due for payment which reduces the overall investment in receivables.

3. Optimize Sales

Efficient receivable management assist business in raising their sales volume. Business is able to attract more and more customers by providing them credit facilities. They are able to properly decide and monitor credit facilities with the help of a receivable management.

4. Reduce Risk of Bad Debts

It takes all steps to avoid any instances of bad debts. Receivable management notify all customers for the payment as soon as the amount gets due. It charges interest on delay payments and aims at optimum collection of all payment timely.

5. Maintain Efficient Cash

Maintenance of efficient cash is crucial for the survival of every organization. Receivables management properly records all cash inflows and outflows of a business. All credit facilities are extended after analysing the capability of organization and due payments are collected timely. This results in steady cash flow within the organization.

6. Lower Cost of Credit

Receivable management helps business in lowering its cost of credit by limiting the credit amount and credit period for its customers. It performs all processes such as acquiring credit information of clients and collecting all due payments in an efficient way which lower the overall cost associated with credit facilities.

Q4) What are the meaning of Receivables management?

A4) Account receivables refer to the outstanding invoices or money which is yet to be paid by your customers. Until it is paid, such invoices or money is accounted as accounts receivables. It is also known as bills receivables. Business need cash all the time to keep the business running smoothly and ensuring the accounts receivables are paid on time is essential to manage cash flow efficiently. Management of the accounts receivable is called receivable management. Basically, the entire process of defining the credit policy, setting payment terms, sending payment follow ups and timely collection of the due payments can be defined as receivables management. Management of Receivables is also known as:

1.Payment Collection

2.Collection Management

3. Accounts Receivables

Q5) What are Control of Receivables?

A5) Managing receivables does not end with granting of credit as dictated by the credit policy. It is necessary to ensure that customers make payment as per the credit term and in the event of any deviation, corrective actions are required. Thus, monitoring the payment behaviour of the customers assumes importance. There are several possible reasons for customers to deviate from the payment terms. Three of these possible reasons and their implications in credit management are discussed below:

1.Changing Customer Business Characteristics: The customers, who have earlier agreed to make payment within a certain period of time, may deviate from their acceptance and delay the payment. For example, economic slowdown or slowdown in the industry of the customers business may force the customers to delay the payment. In fact, the bills payable become discretionary cash outflow item in economic recession. Thus, a close watch on the performance of customer’s industry is required.

2. Inaccurate Policy Forecasts: A wide deviation from the credit terms and actual flow of cash flows show inaccurate forecast and defective credit policy. It is quite possible that a firm uses defective credit rating model or wrongly assesses the credit variable. For example, it is quite possible to overestimate the collateral value and then lend more credit. If this is the reason for wide deviation, it requires updating the model or training the employees.

3.Improper Policy Implementation: Often wide deviation is noticed in practice while implementing credit policy. This may not be intentional but frequently in the form of accommodating special requests of the customers. For example, a customer may not be eligible for credit or higher credit as per the model in force. The customer may personally see the concerned manager and request her/him to relax the credit restriction. If there is no policy in place to deal with these types of request and ad hoc decisions are made, then wide deviation is possible. Often these deviations become costly for the firm. Intervention of top officials and ad hoc decisions are cited as major reasons for widespread defaults in many public financial institutions. Thus, it is necessary to ensure that policies are implemented in letter and spirit. Monitoring provides signals of deviation from expectations. There are several 17 monitoring techniques available to the credit managers. The monitoring system begins with aggregate analysis and then move down to account-specific analysis.

Q6) What is Credit Period?

A6) Decision on credit period is determined by several factors. It is important to check the credit period given by other firms in the industry. It would be difficult to sustain by adopting a completely different credit policy as compared to that of industry. For example, if the industry practice is 30 days of credit period, a firm which offers 120 days credit would certainly attract more business but the cost associated with managing longer credit period also increases simultaneously. On the other hand, if the firm reduces the credit period to 10 days, it would certainly reduce the cost of carrying receivables but volume would also decline because many customers would prefer other firms, which offer 30 days credit. In other words, granting trade credit is an aspect of price. The time that the buyer gets before payment is due, is one of the dimensions of the product (like quality, service, etc.) which determine the attractiveness of the product. Like other aspects of price, the firm’s terms of credit affect its volume. All other things being equal, longer credit period and more liberal credit-granting policies increase sales, while shorter credit period and more stringent credit granting policies decrease sales. These policies also affect the level and timing of certain costs. Evaluation of credit policy changes must compare with the changes in sales and additional revenues generated by the sales as a result of this policy change and costs effects. While additional volume and revenue associated with such additional volume are clear and measurable, the cost effects require further analysis.

Q7) What is Discount?

A7) When a firm pursues aggressive credit policy, it affects cash flows in the form of delayed collection and bad debts. Discounts are offered to the customers, who purchased the goods on credit, as an incentive to give up the credit period and pay much earlier. For example, suppose the terms of credit is “3/10 net 60”. It means if the customer, who gets 60 days credit period can pay within 10 days from the date of purchase and get a discount of 3% on the value of order. Since the customer uses the opportunity cost of funds and availability of cash in taking decision, the cash discount should be set attractive. The discount quantum should be greater than interest rate of short-term borrowings.

Q8) What is Credit Eligibility?

A8) Having designed credit period and discount rate, the next logical step is to define the customers, who are eligible for the credit terms. The credit-granting decision is critical for the seller since credit-granting has economic value to buyers and buyers’ decision on purchase is directly affected by this policy. For instance, if the credit eligibility terms reject a particular customer and requires the customer to make cash purchase, the customer may not buy the product from the company and may look forward to someone who is agreeable to grant credit. Nevertheless, Management of Inventory it may not be desirable to grant credit to all customers. It may instead analyse each potential buyer before deciding whether to grant credit or not based on the attributes of that particular buyer. While the earlier two terms of credit policy viz. Credit period and discount rate are not changed frequently in order to maintain consistency in the policy, credit eligibility is periodically reviewed. For instance, an entry of new customer would warrant a review of credit eligibility of existing customers.

Q9) What is Credit Limit?

A9) If a customer falls within the desired limit of credit worthiness, the next issue is fixing the credit amount. This is something similar to banks fixing overdraft limit for the account holders. If a customer is new, normally the credit limit is fixed at the lowest level initially and expanded over the period based on the performance of the customer in meeting the liability. Credit limit may undergo a change depending on the changes in the credit worthiness of the customer and changes in the performance of customer’s industry.

Q10) What is Credit policy?

A10) Designing credit policy is the first step in receivables management. In designing credit policy, the management can follow two broad approaches. Firstly, the policy can be designed under the assumption of unlimited production/sales and funds available for investment in receivables. If credit policy is designed under this assumption and subsequently some constraints are experienced on sales or funds available for receivables, then managers have to restrict the credit at the time of implementing the credit policy. But this may cause certain difficulties to customers because of deviation from the announced credit policy. For example, if a company announces that credit will be unlimited to certain categories of customers based on unlimited funds assumption and subsequently refuse to grant credit due to limited funds available for investment in receivables, it will create hardship to the customer. Under the second approach, the credit policy could be designed keeping in mind the limitations on production/sales volume and funds available for investment in receivables. This is aimed to achieve optimum utilisation of production capacity and funds available for receivables. It also ensures consistency of credit policy.

Q11) What are the components of the credit policy?

A11) The credit policy consists of the following components:

a) Credit Period

b) Discount

c) Credit Eligibility

d) Credit Limit

Q12) What are the two important components of the credit terms?

A12) The two important components of the credit terms are:

- Credit period: The term credit period refers to the time duration for which credit is extended to the customers. It is generally expressed in terms of “net days”.

- Cash discount: Most firms offer cash discount to their customers for encouraging them to pay their dues before the expiry of the credit period. The terms of the cash discounts indicate the rate of discount as well as the period for which the discount has been offered.

Q13) How level of sales affect investment in receivables?

A13) This is the most important factor in determining the size of accounts receivable. Generally, in the same industry, a firm having a large volume of sales will be having a larger level of receivables as compared to a firm with a small volume of sales.

Sales level can also be used for forecasting change in accounts receivable.

Q14) How credit policies affect investment in receivables?

A14) The term credit policy refers to those decision variables that influence the amount of trade credit, i.e., the investment in receivables. These variables include the quantity of trade accounts to be accepted, the length of the credit period to be extended, the cash discount to be given and any special terms to be offered depending upon particular circumstances of the firm and the customer. A firm’s credit policy, as a matter of fact, determines the amount of risk the firm is willing to undertake in its sales activities. If a firm has a lenient or a relatively liberal credit policy, it will experience a higher level of receivables as compared to a firm with a more rigid or stringent credit policy.

This is because of two reasons:

- A lenient credit policy encourages even the financially strong customers to make delays in payments resulting in increasing the size of the accounts receivables;

- Lenient credit policy will result in greater defaults in payments by financially weak customers thus resulting in increasing the size of receivables.

Q15) How terms of trade affect investment in receivables?

A15) The size of the receivables is also affected by terms of trade (or credit terms) offered by the firm.

The two important components of the credit terms are:

- Credit period: The term credit period refers to the time duration for which credit is extended to the customers. It is generally expressed in terms of “net days”.

- Cash discount: Most firms offer cash discount to their customers for encouraging them to pay their dues before the expiry of the credit period. The terms of the cash discounts indicate the rate of discount as well as the period for which the discount has been offered.

Q16) How Formulation of Credit Policy helps in the scope of receivables management?

A16) Receivable management is the one which formulates and implements an effective credit policy in an organization. Credit policies are decided as per the capabilities of an organization. A company may either follow a liberal policy or stringent credit policy for providing credit facilities to its customers.

Q17) How Credit Evaluation helps in the scope of receivables management?

A17) Credit evaluation involves examining the credit worthiness of customer before approving any credit amount. Proper investigation of customer’s information lowers the risk of bad debts. Receivable management acquire all credentials of client for determining their borrowing capacity and repaying ability.

Q18) How Credit Control helps in the scope of receivables management?

A18) Receivable management implement a proper structure for monitoring all credit functions of business. It records credit sales with proper documents on a daily basis. Invoices are raised immediately after goods get dispatch and amount are collected soon as they become due for payment.

Q19) How Maximize Profit is the scope of receivables management?

A19) It plays an efficient role in maximizing the profit of organizations. Receivable management helps in boosting the sales volume by providing credit facilities to customers. More and more people are able to purchase goods on credit which maximizes the overall profit level.

Q20) How better Competition is the scope of receivables management?

A20) Efficient account receivable management helps business in facing the strong competition in market. It enables in providing credit facilities to customers as per their needs and capabilities. Receivable management analyses the credit strategies adopted by competitors and according frame policy for an organization. It attracts more and more customers by offering them credit facilities at convenient rates.

Unit 3

Management of Receivables

Q1) What are Receivables?

A1) Receivables, also regarded as accounts receivable, are debts owed to a firm by its customers for goods or services used or delivered but not yet paid for.

Receivables are created by expanding the line of credit to customers and are listed as current assets on the company's balance sheet. They are considered as liquid assets since they can be used as collateral to secure a loan to help meet short-term obligations.

Receivables are part of the working capital of a company. Effectively handling receivables means promptly following up with any consumers who have not paid and eventually reviewing payment plans if necessary. This is critical as it provides additional capital to fund operations and reduces the net debt of the organisation.

Receivables are assets accounts representing amounts owed to the firm as a result of sale of goods / services in the ordinary course of business.

They, therefore, represent the claims of a firm against its customers and are carried to the “assets side” of the balance sheet under titles such as accounts receivables, customer receivables or book debts. They are, as stated earlier, the result of extension of credit facility to then customers a reasonable period of time in which they can pay for the goods purchased by them.

Q2) What are the nature of Receivables?

A2) The nature of receivable management is discussed below-

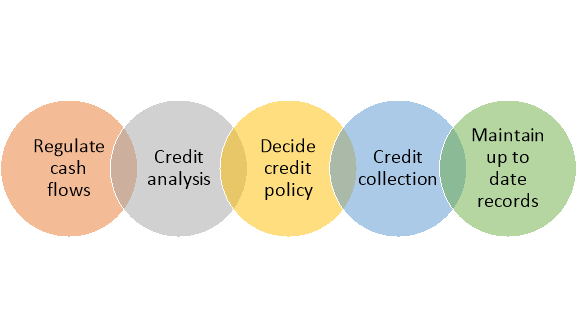

Figure: Nature of receivable management

- Regulate Cash Flow

Receivable management regulates all cash flows in an organization. It controls all inflow and outflow of funds and ensures that an efficient amount of cash is always available. Proper management of receivables enables organizations in efficient functioning at all the times.

2. Credit Analysis

It performs proper analysis of customer credentials for determining their credit ratings. Monitoring and scanning of customers before provide them any credit facility helps in minimizing the credit risk.

3. Decide Credit Policy

Receivable management decides the credit policy and standards as per which credit facility should be extended to customers. A company may have a lenient credit policy where customer credit-worthiness is not at all considered or a stringent policy where credit-worthiness is considered for providing credit.

4. Credit Collection

Receivable management focuses on efficient and timely collection of business payments from its customers. It works towards reducing the time gap in between the moments when bills are raised and payment is collected.

5. Maintain Up-To-Date Records

Receivable management maintains a systematic record of all business transactions on a regular basis. All transactions are maintained fairly in the form of proper billing and invoices which helps in avoiding any confusion or settling of disputes arising later.

Q3) What are the benefits of Receivables?

A3) The benefits of receivables are-

- Evaluates Customer Credit Ratings

Receivable management evaluates its customers borrowing capacity and repaying ability for determining their credit ratings. It approves any credit facility to its customers after analysing their information both qualitatively and quantitatively. Proper investigation of client details helps in reducing the credit risk.

2. Minimizes Investment in Receivables

It reduces investment in receivable by ensuring optimum funds are available within organization at all the times. Receivable management decides proper credit limit and credit period for avoiding any bankruptcy situations. Attempts are made to collect account receivable as soon as they become due for payment which reduces the overall investment in receivables.

3. Optimize Sales

Efficient receivable management assist business in raising their sales volume. Business is able to attract more and more customers by providing them credit facilities. They are able to properly decide and monitor credit facilities with the help of a receivable management.

4. Reduce Risk of Bad Debts

It takes all steps to avoid any instances of bad debts. Receivable management notify all customers for the payment as soon as the amount gets due. It charges interest on delay payments and aims at optimum collection of all payment timely.

5. Maintain Efficient Cash

Maintenance of efficient cash is crucial for the survival of every organization. Receivables management properly records all cash inflows and outflows of a business. All credit facilities are extended after analysing the capability of organization and due payments are collected timely. This results in steady cash flow within the organization.

6. Lower Cost of Credit

Receivable management helps business in lowering its cost of credit by limiting the credit amount and credit period for its customers. It performs all processes such as acquiring credit information of clients and collecting all due payments in an efficient way which lower the overall cost associated with credit facilities.

Q4) What are the meaning of Receivables management?

A4) Account receivables refer to the outstanding invoices or money which is yet to be paid by your customers. Until it is paid, such invoices or money is accounted as accounts receivables. It is also known as bills receivables. Business need cash all the time to keep the business running smoothly and ensuring the accounts receivables are paid on time is essential to manage cash flow efficiently. Management of the accounts receivable is called receivable management. Basically, the entire process of defining the credit policy, setting payment terms, sending payment follow ups and timely collection of the due payments can be defined as receivables management. Management of Receivables is also known as:

1.Payment Collection

2.Collection Management

3. Accounts Receivables

Q5) What are Control of Receivables?

A5) Managing receivables does not end with granting of credit as dictated by the credit policy. It is necessary to ensure that customers make payment as per the credit term and in the event of any deviation, corrective actions are required. Thus, monitoring the payment behaviour of the customers assumes importance. There are several possible reasons for customers to deviate from the payment terms. Three of these possible reasons and their implications in credit management are discussed below:

1.Changing Customer Business Characteristics: The customers, who have earlier agreed to make payment within a certain period of time, may deviate from their acceptance and delay the payment. For example, economic slowdown or slowdown in the industry of the customers business may force the customers to delay the payment. In fact, the bills payable become discretionary cash outflow item in economic recession. Thus, a close watch on the performance of customer’s industry is required.

2. Inaccurate Policy Forecasts: A wide deviation from the credit terms and actual flow of cash flows show inaccurate forecast and defective credit policy. It is quite possible that a firm uses defective credit rating model or wrongly assesses the credit variable. For example, it is quite possible to overestimate the collateral value and then lend more credit. If this is the reason for wide deviation, it requires updating the model or training the employees.

3.Improper Policy Implementation: Often wide deviation is noticed in practice while implementing credit policy. This may not be intentional but frequently in the form of accommodating special requests of the customers. For example, a customer may not be eligible for credit or higher credit as per the model in force. The customer may personally see the concerned manager and request her/him to relax the credit restriction. If there is no policy in place to deal with these types of request and ad hoc decisions are made, then wide deviation is possible. Often these deviations become costly for the firm. Intervention of top officials and ad hoc decisions are cited as major reasons for widespread defaults in many public financial institutions. Thus, it is necessary to ensure that policies are implemented in letter and spirit. Monitoring provides signals of deviation from expectations. There are several 17 monitoring techniques available to the credit managers. The monitoring system begins with aggregate analysis and then move down to account-specific analysis.

Q6) What is Credit Period?

A6) Decision on credit period is determined by several factors. It is important to check the credit period given by other firms in the industry. It would be difficult to sustain by adopting a completely different credit policy as compared to that of industry. For example, if the industry practice is 30 days of credit period, a firm which offers 120 days credit would certainly attract more business but the cost associated with managing longer credit period also increases simultaneously. On the other hand, if the firm reduces the credit period to 10 days, it would certainly reduce the cost of carrying receivables but volume would also decline because many customers would prefer other firms, which offer 30 days credit. In other words, granting trade credit is an aspect of price. The time that the buyer gets before payment is due, is one of the dimensions of the product (like quality, service, etc.) which determine the attractiveness of the product. Like other aspects of price, the firm’s terms of credit affect its volume. All other things being equal, longer credit period and more liberal credit-granting policies increase sales, while shorter credit period and more stringent credit granting policies decrease sales. These policies also affect the level and timing of certain costs. Evaluation of credit policy changes must compare with the changes in sales and additional revenues generated by the sales as a result of this policy change and costs effects. While additional volume and revenue associated with such additional volume are clear and measurable, the cost effects require further analysis.

Q7) What is Discount?

A7) When a firm pursues aggressive credit policy, it affects cash flows in the form of delayed collection and bad debts. Discounts are offered to the customers, who purchased the goods on credit, as an incentive to give up the credit period and pay much earlier. For example, suppose the terms of credit is “3/10 net 60”. It means if the customer, who gets 60 days credit period can pay within 10 days from the date of purchase and get a discount of 3% on the value of order. Since the customer uses the opportunity cost of funds and availability of cash in taking decision, the cash discount should be set attractive. The discount quantum should be greater than interest rate of short-term borrowings.

Q8) What is Credit Eligibility?

A8) Having designed credit period and discount rate, the next logical step is to define the customers, who are eligible for the credit terms. The credit-granting decision is critical for the seller since credit-granting has economic value to buyers and buyers’ decision on purchase is directly affected by this policy. For instance, if the credit eligibility terms reject a particular customer and requires the customer to make cash purchase, the customer may not buy the product from the company and may look forward to someone who is agreeable to grant credit. Nevertheless, Management of Inventory it may not be desirable to grant credit to all customers. It may instead analyse each potential buyer before deciding whether to grant credit or not based on the attributes of that particular buyer. While the earlier two terms of credit policy viz. Credit period and discount rate are not changed frequently in order to maintain consistency in the policy, credit eligibility is periodically reviewed. For instance, an entry of new customer would warrant a review of credit eligibility of existing customers.

Q9) What is Credit Limit?

A9) If a customer falls within the desired limit of credit worthiness, the next issue is fixing the credit amount. This is something similar to banks fixing overdraft limit for the account holders. If a customer is new, normally the credit limit is fixed at the lowest level initially and expanded over the period based on the performance of the customer in meeting the liability. Credit limit may undergo a change depending on the changes in the credit worthiness of the customer and changes in the performance of customer’s industry.

Q10) What is Credit policy?

A10) Designing credit policy is the first step in receivables management. In designing credit policy, the management can follow two broad approaches. Firstly, the policy can be designed under the assumption of unlimited production/sales and funds available for investment in receivables. If credit policy is designed under this assumption and subsequently some constraints are experienced on sales or funds available for receivables, then managers have to restrict the credit at the time of implementing the credit policy. But this may cause certain difficulties to customers because of deviation from the announced credit policy. For example, if a company announces that credit will be unlimited to certain categories of customers based on unlimited funds assumption and subsequently refuse to grant credit due to limited funds available for investment in receivables, it will create hardship to the customer. Under the second approach, the credit policy could be designed keeping in mind the limitations on production/sales volume and funds available for investment in receivables. This is aimed to achieve optimum utilisation of production capacity and funds available for receivables. It also ensures consistency of credit policy.

Q11) What are the components of the credit policy?

A11) The credit policy consists of the following components:

a) Credit Period

b) Discount

c) Credit Eligibility

d) Credit Limit

Q12) What are the two important components of the credit terms?

A12) The two important components of the credit terms are:

- Credit period: The term credit period refers to the time duration for which credit is extended to the customers. It is generally expressed in terms of “net days”.

- Cash discount: Most firms offer cash discount to their customers for encouraging them to pay their dues before the expiry of the credit period. The terms of the cash discounts indicate the rate of discount as well as the period for which the discount has been offered.

Q13) How level of sales affect investment in receivables?

A13) This is the most important factor in determining the size of accounts receivable. Generally, in the same industry, a firm having a large volume of sales will be having a larger level of receivables as compared to a firm with a small volume of sales.

Sales level can also be used for forecasting change in accounts receivable.

Q14) How credit policies affect investment in receivables?

A14) The term credit policy refers to those decision variables that influence the amount of trade credit, i.e., the investment in receivables. These variables include the quantity of trade accounts to be accepted, the length of the credit period to be extended, the cash discount to be given and any special terms to be offered depending upon particular circumstances of the firm and the customer. A firm’s credit policy, as a matter of fact, determines the amount of risk the firm is willing to undertake in its sales activities. If a firm has a lenient or a relatively liberal credit policy, it will experience a higher level of receivables as compared to a firm with a more rigid or stringent credit policy.

This is because of two reasons:

- A lenient credit policy encourages even the financially strong customers to make delays in payments resulting in increasing the size of the accounts receivables;

- Lenient credit policy will result in greater defaults in payments by financially weak customers thus resulting in increasing the size of receivables.

Q15) How terms of trade affect investment in receivables?

A15) The size of the receivables is also affected by terms of trade (or credit terms) offered by the firm.

The two important components of the credit terms are:

- Credit period: The term credit period refers to the time duration for which credit is extended to the customers. It is generally expressed in terms of “net days”.

- Cash discount: Most firms offer cash discount to their customers for encouraging them to pay their dues before the expiry of the credit period. The terms of the cash discounts indicate the rate of discount as well as the period for which the discount has been offered.

Q16) How Formulation of Credit Policy helps in the scope of receivables management?

A16) Receivable management is the one which formulates and implements an effective credit policy in an organization. Credit policies are decided as per the capabilities of an organization. A company may either follow a liberal policy or stringent credit policy for providing credit facilities to its customers.

Q17) How Credit Evaluation helps in the scope of receivables management?

A17) Credit evaluation involves examining the credit worthiness of customer before approving any credit amount. Proper investigation of customer’s information lowers the risk of bad debts. Receivable management acquire all credentials of client for determining their borrowing capacity and repaying ability.

Q18) How Credit Control helps in the scope of receivables management?

A18) Receivable management implement a proper structure for monitoring all credit functions of business. It records credit sales with proper documents on a daily basis. Invoices are raised immediately after goods get dispatch and amount are collected soon as they become due for payment.

Q19) How Maximize Profit is the scope of receivables management?

A19) It plays an efficient role in maximizing the profit of organizations. Receivable management helps in boosting the sales volume by providing credit facilities to customers. More and more people are able to purchase goods on credit which maximizes the overall profit level.

Q20) How better Competition is the scope of receivables management?

A20) Efficient account receivable management helps business in facing the strong competition in market. It enables in providing credit facilities to customers as per their needs and capabilities. Receivable management analyses the credit strategies adopted by competitors and according frame policy for an organization. It attracts more and more customers by offering them credit facilities at convenient rates.