BL

Unit -VThe Negotiable Instruments Act 1881 Q1) What is the meaning and characteristics of Negotiable Instruments.A1) The Negotiable Instruments Act was enacted, in India, in 1881. Prior to its enactment, the supply of the English negotiable instrument Act were applicable in India, and therefore the present Act is additionally based on English Act with certain modifications. It extends to the entire of India except the State of Jammu and Kashmir. The Act operates subject to the provisions of Sections 31 and 32 of the reserve banks of India Act, 1934. NEGOTIABLE INSTRUMENTS• Negotiable means transferable. • The negotiation that goes on refers to the transfer of the instrument between two people, or from one bank to a different, or maybe from one country to a different. What is an instrument? • In the broadest sense, almost any agreed-upon medium of exchange could be considered a negotiable instrument. • In day-to-day banking, a negotiable instrument usually refers to checks, drafts, bills of exchange, and a few sorts of promissory notes.According to Section 13 (1) of the Negotiable Instruments Act, 1881“A negotiable instrument means a promissory note, bill of exchange, or cheque payable either to order or to bearer”. “A negotiable instrument may be made payable to two or more payees jointly, or it may be made payable within the alternative to one of two, or one or some of several payees” [Section 13(2)].FORMS OF NEGOTIABLE INSTRUMENTS • A negotiable instrument may be a written, order promising to pay a sum of money. • A document becomes negotiable when it contains an unconditional promise to pay money and is payable to a bearer or payable on demand.FEATURES OF A NEGOTIABLE INSTRUMENT • It may be a written document by which certain rights are created and or/ transferred to a particular person. • It must be signed by the maker or the drawer as the case may be. • There must exist the unconditional order or promise to pay. • There must be a time mentioned for such payment. • In particular cases, the drawer’s name should be specifically mentioned. Sorts of negotiable instrument 1. Promissory note2. Cheque3. Bills of exchange Q2) What are promissory notes and its characteristics?A2) PROMISSORY NOTES Section 4 of the Act defines, “A promissory note is an instrument in writing (promissory note being a bank-promissory note or a currency promissory note) containing an unconditional undertaking, signed by the maker, to pay a certain sum of money to or to the order of a certain person, or to the bearer of the instruments.” The one that makes the promissory note and promises to pay is named the maker. The person to whom the payment is to be made is named the payee. Examples: A Signs instruments within the following terms A) I promise to pay B or order Rs.500." b) I promise to pay B Rs.500 which shall flow from to him.CHARACTERISTICS OF A PROMISSORY NOTE • It is an Instrument in Writing • It may be a Promise to Pay • Signed by the Maker • Other Formalities • Definite and Unconditional Promise • Promise to Pay Money Only • Maker must be a particular Person • Payee must be sure • Sum Payable must be sure • It could also be Payable on Demand or after a particular Period of time • It can't be Made Payable to Bearer on Demand PARTIES TO A PROMISSORY NOTE • Maker: Maker is that the one that promises to pay the quantity stated within the promissory note. • Payee:Payee is that the person to whom the quantity of the promissory note is payable. • Holder:He is either the payee or the person to whom the promissory note may are endorsed. ESSENTIALS OF PROMISSORY NOTEPromissory notes must contain the following essentials elements;It should be in written shape. It must contain a guarantee to give money. The promise to give money must be unconditional. It must be signed by the maker. The maker should be a certain person. The payee must also be a certain person. The amount must be certain. Payment should be of money only. Time or period of payment should be fixed. Q3) What do you understand by bill of exchange? What are the essential elements of bills of exchange?A3) BILL OF EXCHANGEAccording to Section 5 of the act, A bill of exchange is “an instrument in writing containing an unconditional order signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of, a particular person or to the bearer of the instrument”. It’s also called a Draft. SPECIAL BENEFITS OF BILL OF EXCHANGE: • A bill of exchange may be a double secured instrument. • In case of immediate requirement, a Bill could also be discounted with a bank. ESSENTIAL ELEMENTS OF BILL OF EXCHANGE• It must be in Writing• Order to pay • Drawee • Signature of the Drawer • Unconditional Order • Parties • Certainty of Amount• Payment in a similar way isn't Valid • Stamping • Cannot be made Payable to Bearer on Demand PARTIES TO A BILL OF EXCHANGE • Drawer:The maker of a bill of exchange is named the drawer. • Drawee:The person directed to pay the money by the drawer is named the drawee.• Payee: The person named within the instrument, to whom or to whose order the money are directed to be paid by the instruments are called the payee. KINDS OF BILLS OF EXCHANGE 1. Inland2. Foreign bills1. Inland bill:• It is drawn in India on an individual residing in India, whether payable in or outside India, or • It is drawn in India on person residing outside India but payable in India.The following are the inland bills: a) A bill is drawn by a merchant in Delhi on a merchant in Chennai. It’s payable in Mumbai the bill is a draft. b) A bill is drawn by a Delhi merchant on an individual in London but is formed payable in2. Foreign draft• A bill drawn outside India & made payable in India. • A bill drawn outside India on a person residing outside India. • A bill drawn in India on an individual residing outside India and made payable outside India.CLASSIFICATION OF BILL OF EXCHANGE Inland and Foreign BillsInland Bill: • It is drawn in India on an individual residing in India whether payable in or outside India; or • It is drawn in India on an individual residing outside India but payable in India. ◦ Foreign Bill: • A bill drawn in India on an individual residing outside India and made payable outside India. • Drawn upon an individual who is that the resident of a far-off country. Time and Demand Bills: Time Bill: A bill payable after a hard and fast time is termed as a time draft. A bill payable “after date” may be a time draft. ◦Demand Bill: A bill payable at sight or on demand is termed as a requirement bill. Trade and Accommodation Bills: Trade Bill: A bill drawn and accepted for a real trade transaction is termed as “trade bill”. Accommodation Bill: A bill drawn and accepted not for a real trade transaction but only to supply financial help to some party is termed as an “accommodation bill”. Q4) What is the difference between bill of exchange and cheque?A4)

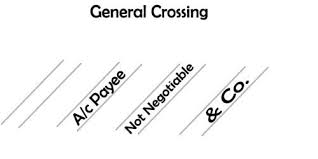

Q5) What is cheque? What are the essential elements of cheque?A5) CHEQUEConsistent with Section 6 of the act, A cheque is “a bill of exchange drawn on a specified banker and not expressed to be payable otherwise than on demand”. A cheque is additionally, therefore, a bill of exchange with two additional qualifications: • It is usually drawn on a specified banker. • It is usually payable on demand. Special Benefits of bill of exchange:• A bill of exchange may be a double secured instrument. • In case of immediate requirement, a Bill could also be discounted with a bank. ESSENTIAL ELEMENTS OF A CHEQUE • In writing • Express Order to Pay • Definite and Unconditional Order• Signed by the Drawer • Order to Pay Certain Sum • Order to Pay Money Only • Certain Three Parties • Drawn upon a Specified Banker • Payable on Demand PARTIES TO A CHEQUE • Drawer:Drawer is that the one that draws the cheque. • Drawee/Banker:Drawee is that the drawer’s banker on whom the cheque has been drawn. • Payee:Payee is that the one that is entitled to receive the payment of a cheque.CROSSING OF CHEQUES • It may be a direction given by the customer to the banker that payment shouldn't be made across the counter. • Crossing is suffering from drawing two parallel transverse lines with or without particular abbreviations. • A cheque that's not crossed is an open cheque. • It is a measure of safety against theft or loss of cheques in transit. Q6) Explain Holder and Holder in due course.A6) HOLDER MEANINGAccording to sec. 8, Holder of a negotiable instrument is that the person: Who is entitled in his own name to the possession of the instrument?Who has the proper to receive, or recover the quantity due thereon from the parties thereto? In case the instrument (promissory note, bill or cheque) is lost or destroyed, the one that has entitled in his own name to the possession of it or to receive or recover the quantity due thereon from the parties thereto is that the holder ofWho is often a Holder? • Payee:The payee is typically the first holder of an instrument. He remains holder till he endorses the instrument. • Endorsee:The person to whom an instrument is endorsed becomes holder of in situ of the endorser. An instrument, when endorsed and delivered, the endorsee becomes the holder. • Bearer:In the case of a bearer instrument, the person to whom the instrument is delivered becomes the holder. But every bearer of an instrument cannot become the holder.Example: a thief or a finder of a bearer instrument or a servant possessing an instrument on behalf of his employer cannot become holder. • Legal representative or heir- a legal representative or heir of a deceased person can become holder by operation of law albeit he's not the payee or the bearer or the endorsee of the instrument. HOLDER IN DUE COURSE:Holder in due course may be a one that came into possession of the instrument on payment of consideration and without knowledge of the very fact that the erstwhile owner had a defective title. The holder in due course features a better title than the holder. Therefore, consistent with sec. 9 of the negotiable instrument Act, holder in due course mans a person who for consideration became the possessor of a note, bill of exchange or cheque if payable to bearer, or the payee or endorsee thereof, if payable to order before the quantity mentioned in it became payable, and without having sufficient cause to believe that any defect existed within the title of the person from whom he derived his title.[sec. 9]. PRIVILEGES OF A HOLDER IN DUE COURSE • He can sue every prior party to the negotiable instrument if the instrument isn't duly satisfied. • When the holder endorses such instrument further, the new owner features a good title unless he's party to fraud. • The burden of proving his title doesn't lie upon the holder in due course. Q7) What is negotiation and modes of negotiation?A7) According to section 14 of the Act, ‘when a promissory note, bill of exchange or cheque is transferred to a person so on constitute that person the holder thereof, the instrument is claimed to be negotiated.’ the most purpose and essence of negotiation is to form the transferee of a promissory note, a bill of exchange or a cheque the holder there of. Negotiation thus requires two conditions to be fulfilled, namely: • There must be a transfer of the instrument to a different person.• The transfer must be made in such a fashion on constitute the transferee the holder of the instrument. MODES OF NEGOTIATION 1. Negotiation by delivery (Sec. 47): Where a promissory note or a bill of exchange or a cheque is payable to a bearer, it's going to be negotiated by delivery thereof. Example: A the holder of a negotiable instrument payable to bearer, delivers it to B’s agent to stay it for B. The instrument has been negotiated. 2. Negotiation by endorsement and delivery (Sec. 48): A promissory note, a cheque or a bill of exchange payable to order are often negotiated only be endorsement and delivery. Unless the holder signs his endorsement on the instrument and delivers it, the transferee doesn't become a holder. If there are more payees than one, all must endorse it. ENDORSEMENT [SECTION 15] The word ‘endorsement’ in its literal sense means, writing on the back of an instrument. But under the Negotiable Instruments Act it means, the writing of one’s name on the rear of the instrument or any paper attached thereto with the intention of transferring the rights therein. Thus, endorsement is signing a negotiable instrument for the aim of negotiation. The one that effects an endorsement is named an ‘endorser’, and therefore the person to whom negotiable instrument is transferred by endorsement is named the ‘endorsee’. Q8) Explain Endorsement and kinds of Endorsement.A8) ENDORSEMENT Essentials of a legitimate Endorsement: • It must get on the rear or face of instrument or on an error of paper annexed thereto. • It must be signed by the endorser. • It must be completed by the delivery of the instrument• It must be made by the holder of the instrument. Kinds of Endorsement: • Blank or General Endorsement• Full or Special Endorsement • Partial Endorsement • Restrictive Endorsement• Conditional Endorsement KINDS OF ENDORSEMENT 1. Blank endorsement: If the endorser signs his name only, the endorsement is claimed to be in blank and it becomes payable to bearer e.g. Mahbubul Haq. 2. Special or Full endorsement: An endorsement “in full” or a special endorsement is one where the endorser not only puts his signature on the instrument but also writes the name of an individual to whom or to whose order the payment is to be made.3. Conditional endorsement: In conditional endorsement the endorser puts his signature under such an article which makes the transfer of title subject to fulfillment of some conditions of the happening of some events.Example: Pay to Mr.Sarwar Jahan or order after his marriage- Sd/Badrul Kamal4. Restrictive endorsement: An endorsement is named restrictive when the endorser restricts or prohibits further negotiation. Example: “Pay to Miss. / A. Pereira only” Sd/HosneAra.5. Partial endorsement: In Partial endorsement only a part of the quantity of the bill is transferred or the quantity of the bill is transferred to 2 or more endorsees severally. This doesn't separate as a negotiation of the instrument. The law lies down that an endorsement must relate to the entire instrument. Q9 What is crossing of cheque? What are the types of crossing?A9 Cheque crossing is recognized in the Negotiable Instruments Act of 1881.Crossing a cheque means drawing two parallel transverse lines between the lines on the cheque with or without additional words such as “& CO.” or “Account Payee” or “Not Negotiable.”Types of CrossingThe way a cheque is crossed specified the banker on how the funds are to be handled, to protect it from fraud and forgery. Primarily, it ensures that the funds must be transferred to the bank account only and not to encash it right away upon the receipt of the cheque. There are several types of crossingGeneral Crossing: When across the face of a cheque two transverse parallel lines are drawn at the top left corner, along with the words & Co., between the two lines, with or without using the words “not negotiable”. When a cheque is crossed in this way, it is called a general crossing.

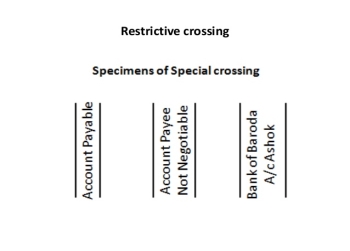

2. Restrictive Crossing: When in between the two transverse parallel lines, the words ‘A/c payee’ is written across the face of the cheque, then such a crossing is called restrictive crossing or account payee crossing. In this case, the cheque can be credited to the account of the stated person only, making it a non-negotiable instrument.

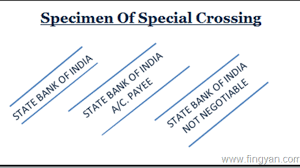

3. Special Crossing: A cheque in which the name of the banker is written, across the face of the cheque in between the two transverse parallel lines, with or without using the word ‘not negotiable’. This type of crossing is called a special crossing. In a special crossing, the paying banker will pay the sum only to the banker whose name is stated in the cheque or to his agent. Hence, the cheque will be honored only when the bank mentioned in the crossing orders the same.

4. Not Negotiable Crossing: When the words not negotiable is mentioned in between the two transverse parallel lines, indicating that the cheque can be transferred but the transferee will not be able to have a better title to the cheque.

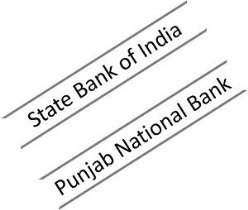

5. Double Crossing: Double crossing is when a bank to whom the cheque crossed specially, further submits the same to another bank, for the purpose of collection as its agent, in this situation the second crossing should indicate that it is serving as an agent of the prior banker, to whom the cheque was specially crossed.

The crossing of a cheque is done to ensure the safety of payment. It is a well-known mechanism used to protect the parties to the cheque, by making sure that the payment is made to the right payee. Hence, it reduces fraud and wrong payments, as well as it protects the instrument from getting stolen or en-cashed by any unscrupulous individual. Q10) Explain bouncing of cheque.A10) FFA situation of cheque bounce is basically a term used to define the unsuccessful processing of a dispensed cheque due to several reasons. Non-sufficient funds (NSF) in the issuer’s account are one of the primary reasons for a bounced cheque. The banks return or dishonour the cheques, also known as rubber checks, in addition to imposing a particular charge. Further, the passing of bad cheques can be illegal, and this crime can be aggravated depending on the amount and whether this action involves crossing state boundaries.There are various reasons for bouncing of cheques:Insufficient funds Date not mentioned properly or scribbled figures Signature mismatch Difference in numbers and words Damaged Cheque Overwriting on Cheque

Basis of difference | Bills of exchange | Cheque |

Person/firm | A bill of exchange usually drawn on some person or firm | A cheque is always drawn on bank |

Acceptance | It is essential that a bill of exchange must be accepted before its payment can be claimed | A cheque does not require any such acceptance |

Payable on demand | The B.O.E. may be drawn payable on demand | A cheque can only be drawer payable on demand |

Grace of days | Three days are allowed in case of B.O.E. | In case cheque no grace of days are allowed |

Notice of dishonor | It is necessary in B.O.E. | No. such notice is required |

Crossing | No crossing of bills of exchange | A cheque may be crossed |

Stamp | It must be properly stamped | No stamp is required |

|

|

3. Special Crossing: A cheque in which the name of the banker is written, across the face of the cheque in between the two transverse parallel lines, with or without using the word ‘not negotiable’. This type of crossing is called a special crossing. In a special crossing, the paying banker will pay the sum only to the banker whose name is stated in the cheque or to his agent. Hence, the cheque will be honored only when the bank mentioned in the crossing orders the same.

|

|

|

The crossing of a cheque is done to ensure the safety of payment. It is a well-known mechanism used to protect the parties to the cheque, by making sure that the payment is made to the right payee. Hence, it reduces fraud and wrong payments, as well as it protects the instrument from getting stolen or en-cashed by any unscrupulous individual. Q10) Explain bouncing of cheque.A10) FFA situation of cheque bounce is basically a term used to define the unsuccessful processing of a dispensed cheque due to several reasons. Non-sufficient funds (NSF) in the issuer’s account are one of the primary reasons for a bounced cheque. The banks return or dishonour the cheques, also known as rubber checks, in addition to imposing a particular charge. Further, the passing of bad cheques can be illegal, and this crime can be aggravated depending on the amount and whether this action involves crossing state boundaries.There are various reasons for bouncing of cheques:

0 matching results found