Unit 3

Trade Cycle

Q1) Explain trade cycle.

A1) A trade cycle refers to fluctuations in economic activities especially in employment, output and income, prices, profits etc. it's been defined differently by different economists. Consistent with Mitchell, “Business cycles are of fluctuations within the economic activities of organized communities. The adjective ‘business’ restricts the concept of fluctuations in activities which are systematically conducted on commercial basis.

The noun ‘cycle’ bars out fluctuations which don't occur with a measure of regularity”. Consistent with Keynes, “A trade cycle consists of periods of excellent trade characterised by inflation/ rise in prices and low unemployment percentages altering with periods of bad trade characterised by falling prices and high unemployment percentages”.

Q2) Explain characteristic of trade cycle.

A2) Features of a Trade Cycle:

1. A trade cycle is synchronic. When cyclical fluctuations start in one sector it spreads to other sectors.

2. During a trade cycle, a period of prosperity is followed by a period of depression. Hence trade cycle may be a wave like movement.

3. Trade cycle is recurrent and rhythmic; prosperity is followed by depression and the other way around.

4. A trade cycle is cumulative and self-reinforcing. Each phase feeds on itself and creates further movement within the same direction.

5. A trade cycle is asymmetrical. The prosperity phase is slow and gradual and therefore the phase of depression is rapid.

6. The trade cycle isn't periodical. Some trade cycles last for 3 or four years, while others last for 6 or eight or maybe more years.

7. The impact of a trade cycle is differential. It affects different industries in numerous ways.

8. A trade cycle is international in character. Through international trade, booms and depressions in one country are passed to other countries.

Q3) Explain meaning and characteristic of trade cycle.

A3) A trade cycle refers to fluctuations in economic activities especially in employment, output and income, prices, profits etc. it's been defined differently by different economists. Consistent with Mitchell, “Business cycles are of fluctuations within the economic activities of organized communities. The adjective ‘business’ restricts the concept of fluctuations in activities which are systematically conducted on commercial basis.

The noun ‘cycle’ bars out fluctuations which don't occur with a measure of regularity”. Consistent with Keynes, “A trade cycle consists of periods of excellent trade characterised by inflation/ rise in prices and low unemployment percentages altering with periods of bad trade characterised by falling prices and high unemployment percentages”.

Features of a Trade Cycle:

1. A trade cycle is synchronic. When cyclical fluctuations start in one sector it spreads to other sectors.

2. During a trade cycle, a period of prosperity is followed by a period of depression. Hence trade cycle may be a wave like movement.

3. Trade cycle is recurrent and rhythmic; prosperity is followed by depression and the other way around.

4. A trade cycle is cumulative and self-reinforcing. Each phase feeds on itself and creates further movement within the same direction.

5. A trade cycle is asymmetrical. The prosperity phase is slow and gradual and therefore the phase of depression is rapid.

6. The trade cycle isn't periodical. Some trade cycles last for 3 or four years, while others last for 6 or eight or maybe more years.

7. The impact of a trade cycle is differential. It affects different industries in numerous ways.

8. A trade cycle is international in character. Through international trade, booms and depressions in one country are passed to other countries.

Q4) Explain phase of trade cycle.

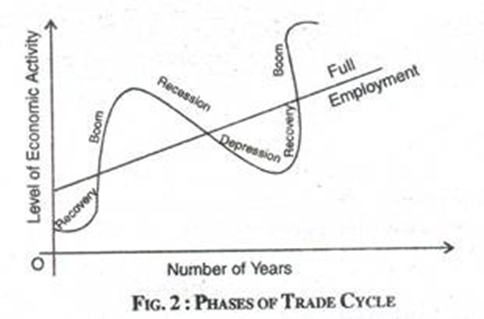

A4) The four important features of trade cycle are (i) Recovery, (ii) Boom, (iii) Recession, and (iv) Depression.

The trades cycle or trade cycle are cyclical fluctuations of an economy. A full trade cycle possesses four phases: (i) Recovery, (ii) Boom, (iii) Recession, and (iv) depression. The upward phase of a business cycle or prosperity is split into two stages—recovery and boom, and therefore the downward phase of a trade cycle is additionally divided into two stages—recession and depression.

Phases of Trade Cycle:

The phases of trade cycle are explained with a diagram:

(1) Recovery:

In the early period of recovery, entrepreneurs increase the extent of investment which successively increases employment and income. Employment increases purchasing power and this results in a rise in demand for commodity .

As a result, demand for goods will press upon their supply and it shall, thereby, cause an increase in prices. The demand for consumer’s goods shall encourage the demand for producer’s goods.

The rise in prices shall rely upon the gestation of investment. The longer the period of investment, the upper shall be the price rise. the increase of prices shall cause a change within the distribution of income. Rent, wages, interest don't rise within the same proportion as prices.

Consequently, the margin of profit improves. The wholesale prices rise quite retail prices. the prices of raw materials rise over the prices of semi-finished goods and therefore the prices of semi-finished goods use over the prices of finished goods.

(2) Boom:

The rate of investment increases still further. because of the spread of a wave of optimism in business, the amount of production increases and therefore the boom gathers momentum. More investment is feasible only through credit creation. During a period of boom, the economy surpasses the extent of full employment and enters a stage of over full employment.

(3) Recession:

The orders for raw materials are reduced on the onset of a recession. the rate of investment in producers’ goods industries and housing construction declines. Liquidity preference rises in society and due to a contraction of money supply, the prices falls. A wave of pessimism spreads in business and those markets which were sometime before sellers markets become buyer’s markets now.

(4) Depression:

The main feature of a depression may be a general fall in economic activity. Production, employment and income decline. the prices fall and therefore the main factor accountable for it is, a fall in the purchasing power.

The distribution of national income changes,because the costs are rigid in nature, the margin of profit declines. Machines aren't accustomed their full capacity in factories, because effective demand is far less. the prices of finished goods fall but the prices of raw materials.

Q5) Explain control of trade cycle.

A5) Economic stabilization: Monetary Policy, fiscal policy and Direct Controls.

Economic stabilisation is one among the most remedies to effectively control or eliminate the periodic trade cycles which plague capitalist economy. Economic stabilisation, it should be noted, isn't merely confined to one individual sector of an economy but embraces all its facts. so as to ensure economic stability, variety of economic measures need to be devised and implemented.

In modem times, a programme of economic stabilisation is typically directed towards the attainment of three objectives: (i) controlling or moderating cyclical fluctuations; (ii) encouraging and sustaining economic growth at full employment level; and (iii) maintaining the value of money through price stabilisation. Thus, the goal of economic stability are often easily resolved into the dual objectives of sustained full employment and therefore the achievement of a degree of price stability.

The following instruments are wont to attain the objectives of economic stabilisation, particularly control of trade cycles, relative price stability and attainment of economic growth:

(1) Monetary policy

(2) Fiscal policy; and

(3) Direct controls.

1. Monetary Policy:

The most commonly advocated policy of solving the matter of fluctuations is monetary policy. Monetary policy pertains to banking and credit, availability of loans to firms and households, interest rates, public debt and its management, and monetary management.

However, the basic problem of monetary policy in reference to trade cycles is to regulate and regulate the quantity of credit in such a way as to attain economic stability. During a depression, credit must be expanded and through an inflationary boom, its flow must be checked.

Monetary management is that the function of the commercial banking system, and thru it, its effects are primarily exerted the economy as an entire . Monetary management directly affects the volume of cash reserves of banks, regulates the availability of money and credit within the economy, thereby influencing the structure of interest rates and availability of credit.

Both these factors affect the components of aggregate demand (consumption plus investment) and therefore the flow of expenditures within the economy. it's obvious that an expansion in bank credit causes an increasing flow of expenditure (in terms of money) and contraction in bank credit reduces it.

In the armoury of the central bank, there are quantitative also as qualitative weapons to control the credit- creating activity of the banking system. they're bank rate, open market operations and reserve ratios. These are interrelated to tools which operate the reserves of member banks which influence the ability and willingness of the banks to expand credit. Selective credit controls are applied to control the extension of credit for particular purposes.

We shall now briefly discuss the implications of those weapons.

Bank Rate Policy:

Due to various reasons, the bank rate policy is comparatively an ineffective weapon of credit control. However, from the point of view of contra cyclical monetary policy, bank rate policy is typically interpreted as an evidence of monetary authority’s judgement regarding the contribution of the current flow of money and bank credit to general economic stability.

That is to mention, an increase in the bank rate indicates that the central bank considers that liquidity within the banking system possesses an inflationary potential. It implies that the flow of money and credit is very much in excess of the actual productive capacity of the economy and thus, a restraint on the expansion of money supply through dear money policy is desirable.

On the opposite hand, a reduction in the bank rate is usually interpreted as an evidence of a shift within the direction of monetary policy towards an inexpensive and expansive money policy. a reduction in bank rate then is more significant as an emblem of an easy money policy than anything . However, the bank rate is most effective as an instrument of restraint.

Effectiveness of bank rate Policy in Expansion:

According to Estey, the subsequent difficulties usually arise in the way of an efficient discount policy in expansion:

1. During high prosperity, the demand for credit by businessmen could also be interest-inelastic.

2. The rising of bank rate and a consequent rise within the market rates of interest may attract loanable funds from the financial intermediaries within the money market and assist in counteracting undesired effects.

3. Though the quantity of money is also controlled by the banking system, the velocity of its circulation isn't directly under the influence of banks. Banking policy may determine how much credit there should be but it's the trade which decides how much and the way fast it'll be used. Thus, if the velocity of the movement is contrary to the volume of credit, banking policy is rendered ineffective.

4. There's also the difficulty of proper timing within the application of banking policy. Brakes must be applied at the proper time and within the right quarter. If they're applied timely , they must bring expansion to an end with factors of production not fully employed. And when applied too late, there could be a runaway monetary expansion and inflation, completely out of control.

Open Market Operations:

The technique of open market operations refers to the purchase and sale of securities by the central bank. A selling operation reduces commercial banks’ reserves and their lending power.

However, because of the need to maintain the government securities market, the central bank is totally free to sell government securities when and in what amounts it wishes so as to influence commercial banks’ reserve position. Thus, when an outsized public debt is outstanding, by expanding the securities market, monetary policy and management of the public debt become inseparably intertwined.

Reserve Ratios:

The monetary authorities have at their disposal another best way of influencing reserves and activities of commercial banks which weapon may be a change in cash reserve ratios. Changes within the reserve ratios become effective at a pre-announced date.

Their immediate effect is to change the liquidity position in the banking system. When the cash reserve ratio is raised commercial banks find their existing level of cash reserves inadequate to hide deposits and need to raise funds by disposing liquid assets in the monetary market. The reverse are the case when the reserve ratio is lowered. Thus, changes within the reserve ratios can influence directly the cash volume and therefore the lending capacity of the banks.

It appears that the bank rate policy, open market operations and changes in reserve ratios exert their influence on the cost, volume and availability of bank reserves through reserves, on the money supply.

Selective Controls:

Selective controls or qualitative credit control is used to divert the flow of credit into and out of particular segments of the credit market. Selective controls aim at influencing the aim of borrowing. They regulate the extension of credit for particular purposes. The rationale for the use of selective controls is that credit may be deemed excessive in some sectors at a time when a general credit control would be contrary to the maintenance of economic stability.

It goes without saying that these various means of credit controls are to be co-ordinated to attain the goal of economic stability.

Effectiveness of Monetary Control:

Monetary policy is far more effective in curbing a boom than in helping to bring the economy out of a depressionary state. it's long been recognised that monetary management can always contract the money supply sufficiently to finish any boom, but it's little capacity to finish a contraction.

This is because the actions of monetary management don't directly enter the income-expenditure stream because the best contra-cyclical weapon, for his or her first impact is on the asset structure of monetary institutions, and during this process of altering the assets structure, rate of interest, volume of credit and therefore the income-expenditure flow could also be altered.

All these operate more significantly in restraining the income stream during expansion than in inducing a rise during contraction. However, the best advantage of monetary policy is its flexibility. Monetary management makes decisions about the rate of change within the money supplies that are consistent with economic stability and growth on a judgement of given quantitative and qualitative evidences.

But, whether now of monetary policy will prove its effectiveness or not depends on its exact timing. Manipulation of bank rate and open market dealings by the central bank should be reasonably effective if applied quickly and continuously in preventing booms from developing and consequently, into a depression.

To sum up, monetary policy may be a necessary a part of the stabilisation programme but it alone isn't sufficient to attain the specified goal. Monetary policy, if used as a tool of economic stabilisation, in some ways , is a complement of fiscal policy.

It is strong, whereas fiscal policy is weak. it's flexible and capable of quick alternations to suit the measure of pressures of the time and wishes . However, it's to be co-ordinated with economic policy . A wrong monetary policy may seriously endanger and even destroy the effectiveness of fiscal policy. Thus, monetary policy and fiscal policy, each reinforcing and supplementing the opposite , are the essential elements in devising an economic stabilisation programme.

2. Fiscal Policy:

Today, foremost among the techniques of stabilisation is fiscal policy. fiscal policy as a tool of economic stability, however, has received its due importance under the influence of Keynesian economies only since Depression years of the 1930s.

The term ‘‘fiscal policy” embraces the tax and expenditure policies of the govt . Thus, fiscal policy operates through the control of state expenditures and tax receipts. It encompasses two separate but related decisions: public expenditures and level and structure of taxes. the quantity of public outlay, the inducement and effects of taxation and therefore the relation between expenditure and revenue exert a major impact upon the free enterprise economy.

Broadly speaking, the taxation policy of the govt relates to the programme of curbing private spending. The expenditure policy, on the opposite hand, deals with the channels by which government spending on new goods and services directly raise aggregate demand and indirectly income through the secondary spending which takes place on account of the multiplier effect.

Taxation, on the opposite hand, operates to scale back the level of personal spending (on both consumption and investment) by reducing the income and therefore the resulting savings within the community. Hence, under the budgetary phenomenon, public expenditure and revenue are often combined in various ways to realize the specified stimulating or deflationary effect on aggregate demand.

Thus, fiscal policy has quantitative also as qualitative aspect changes in tax rates, the structure of taxation and its incidence influence the volume and direction or private spending in economy. Similarly, changes in government’s expenditures and its structure of allocations also will have quantitative and redistributive effects on time, consumption and aggregate demand of the community.

As a matter of fact, all government spending is an inducement to extend the aggregate demand (both volume and components) and has an inflationary bias within the sense that it releases funds for the private economy which are then available to be used in trade and business.

Similarly, a discount in government spending features a deflationary bias and it reduces the aggregate demand (its volume and relative components during which the expenditure is curtailed). Thus, the composition of public expenditures and public revenue not only help to mould the economic structure of the country but also exert certain effects on the economy.

For maximum effectiveness, fiscal policy should be planned on both long-run and short-run basis. Long- run fiscal policy obviously cares with the long- run trends in government income and spendings. Within the framework of such a long-range plan of fiscal operations, the budget is often made to vary cyclically so as to moderate the short-run economic fluctuations.

Basically two sets of techniques are often employed for planning the specified flexibility within the relation between tax income and expenditure: (1) built-in flexibility or automatic stabilisers, and (2) discretionary action.

Built -in Flexibility:The operation of a fiscal policy is usually confronted with the matter of timing and forecast. A fiscal policy administrator has always to face the question: When to do what? But it's a really difficult and complicated question to answer. Thus, so as to minimise the difficulties that arise from uncertainties of forecasting and timing of fiscal operations, an automatic stabiliser programme is usually advocated.

Automatic stabiliser programme implies that during a given framework of expenditure and revenue relation during a budgetary policy, there exist factors which give automatically corrective influences on movements in national income, employment, etc. this is often what's called built-in flexibility. It refers to a passive budgetary policy.

The essence of built-in flexibility is that (i) with a given set of tax rates tax yields will vary directly with national income, and (ii) there are certain lines of government expenditures which tend to vary inversely with movements in national income.

Thus, when the national income rises, the present structure of taxes and expenditures tend to automatically increase public revenue relative to expenditure, and to increase expenditures relative to revenue when the value falls. These changes tend to mitigate or offset inflation or depression a minimum of partially. Thus, a progressive tax structure seems to be the simplest automatic stabiliser.

Likewise, certain sorts of government expenditure schemes like unemployment compensation programmes, government subsidies or price-support programmes also offset changes in income by varying inversely with movements in national income.

However, automatic stabilisers aren't a panacea for economic fluctuations, since they operate only as a partial offset to changes in national income, but provide a force to reverse the direction of the change within the income.

They slow down the rate of decline in aggregate income but contain no provision for restoring income to its former level. Thus, they ought to be recognised as a really useful device of fiscal operations but not the sole device. Simultaneously, there should be scope for discretionary policies because the circumstances will involve .

Discretionary Action:

Quite often, it becomes absolutely necessary to possess fiscal operations with a tool kit of discretionary policies consisting of measures for putting into effect with a minimum delay, the changes in government expenditures. This calls for a skeleton of structure projects providing for administrative discretion to use them and therefore the funds to place them into effect.

It calls for a budgetary manipulation an active budget policy constituting flexible tax rates and expenditures. There are often 3 ways of discretionary changes in tax rates and expenditures: changing expenditure with constant tax rates; changing tax rates and constant expenditure; and a mixture of changing tax rates and changing expenditures.

In general, the primary method is perhaps superior to the second during a depression. that's to mention, to increase expenditures with the level of taxes remaining unchanged is beneficial in pushing up the aggregate spending and effective demand within the economy. However, the second method will convince be superior to the primary during inflation.

That is to mention , inflation might be checked effectively by increasing the tax rates with a given expenditure programme. But it's easy to ascertain that the third method is far simpler during inflation also as deflation than the opposite two.

Inflation would, of course, be more effectively curbed when taxes are enhanced and public expenditure is additionally simultaneously reduced. Similarly, during a depression, the spending rate of personal economy are going to be quickly lifted up if taxes are reduced simultaneously with the increasing public expenditure.

However, the most difficulty with most discretionary policies is their proper timing. Delay in discretion and implementation will aggravate the problem and therefore the programme might not prove to be effective in solving the issues .

Thus, many economists fear that discretionary government actions are likely to do more harm than good, due to the uncertainty of government actions and therefore the political pressures to favour vested interests. that's why reliance on built-in stabilisers, as far as possible, has been advocated.

3. Direct Controls:

Broadly speaking, direct controls are imposed by government which expressly forbid or restricts certain types of investment or economic activity. Sometimes, direct government controls over prices and wages as a measure against inflation are advocated and implemented.

During world war II, price-wage controls were employed in conjunction with consumer rationing and materials allocation to curb generalised total excess demand and to direct productive resources into channels desired by the govt . Monetary-fiscal controls is also used to curb excess demand generally but direct controls are often more useful once they are applied to specific scarcity areas.

Direct controls have the subsequent advantages:

1. They can be introduced or changed quickly and easily: hence the consequences of those can be rapid.

2. Direct controls are often more discriminatory than monetary and fiscal controls.

3. There can be variation within the intensity of the operations of controls from time to time in several sectors.

In a peace-time economy, however, there are serious philosophical and political objections to direct economic controls as a stabilisation device Objections are raised to such controls on the subsequent counts:

1. Direct controls suppress individual initiative and enterprise.

2. they tend to inhibit innovations, like new techniques of production, new products etc.

3. Direct controls may breed or induce speculation which can have destabilising effects. as an example , if it's expected that a commodity X, say steel, is to be rationed due to scarcity, people may attempt to hoard large stocks of it, which aggravates its shortage. It, thus, encourages the creation of artificial scarcity through large-scale hoarding;.

4. Direct controls need a cumbersome, honest and efficient administrative organisation if they're to work effectively.

5. Gross disturbances reappear as soon as controls are removed.

In short, direct controls are to be used only in extraordinary circumstances like emergencies, but not during a peace-time economy.

Q6) Explain monetary measures.

A6) 1. Monetary Policy:

The most commonly advocated policy of solving the matter of fluctuations is monetary policy. Monetary policy pertains to banking and credit, availability of loans to firms and households, interest rates, public debt and its management, and monetary management.

However, the basic problem of monetary policy in reference to trade cycles is to regulate and regulate the quantity of credit in such a way as to attain economic stability. During a depression, credit must be expanded and through an inflationary boom, its flow must be checked.

Monetary management is that the function of the commercial banking system, and thru it, its effects are primarily exerted the economy as an entire . Monetary management directly affects the volume of cash reserves of banks, regulates the availability of money and credit within the economy, thereby influencing the structure of interest rates and availability of credit.

Both these factors affect the components of aggregate demand (consumption plus investment) and therefore the flow of expenditures within the economy. it's obvious that an expansion in bank credit causes an increasing flow of expenditure (in terms of money) and contraction in bank credit reduces it.

In the armoury of the central bank, there are quantitative also as qualitative weapons to control the credit- creating activity of the banking system. they're bank rate, open market operations and reserve ratios. These are interrelated to tools which operate the reserves of member banks which influence the ability and willingness of the banks to expand credit. Selective credit controls are applied to control the extension of credit for particular purposes.

We shall now briefly discuss the implications of those weapons.

Bank Rate Policy:

Due to various reasons, the bank rate policy is comparatively an ineffective weapon of credit control. However, from the point of view of contra cyclical monetary policy, bank rate policy is typically interpreted as an evidence of monetary authority’s judgement regarding the contribution of the current flow of money and bank credit to general economic stability.

That is to mention, an increase in the bank rate indicates that the central bank considers that liquidity within the banking system possesses an inflationary potential. It implies that the flow of money and credit is very much in excess of the actual productive capacity of the economy and thus, a restraint on the expansion of money supply through dear money policy is desirable.

On the opposite hand, a reduction in the bank rate is usually interpreted as an evidence of a shift within the direction of monetary policy towards an inexpensive and expansive money policy. a reduction in bank rate then is more significant as an emblem of an easy money policy than anything . However, the bank rate is most effective as an instrument of restraint.

Effectiveness of bank rate Policy in Expansion:

According to Estey, the subsequent difficulties usually arise in the way of an efficient discount policy in expansion:

1. During high prosperity, the demand for credit by businessmen could also be interest-inelastic.

2. The rising of bank rate and a consequent rise within the market rates of interest may attract loanable funds from the financial intermediaries within the money market and assist in counteracting undesired effects.

3. Though the quantity of money is also controlled by the banking system, the velocity of its circulation isn't directly under the influence of banks. Banking policy may determine how much credit there should be but it's the trade which decides how much and the way fast it'll be used. Thus, if the velocity of the movement is contrary to the volume of credit, banking policy is rendered ineffective.

4. There's also the difficulty of proper timing within the application of banking policy. Brakes must be applied at the proper time and within the right quarter. If they're applied timely , they must bring expansion to an end with factors of production not fully employed. And when applied too late, there could be a runaway monetary expansion and inflation, completely out of control.

Open Market Operations:

The technique of open market operations refers to the purchase and sale of securities by the central bank. A selling operation reduces commercial banks’ reserves and their lending power.

However, because of the need to maintain the government securities market, the central bank is totally free to sell government securities when and in what amounts it wishes so as to influence commercial banks’ reserve position. Thus, when an outsized public debt is outstanding, by expanding the securities market, monetary policy and management of the public debt become inseparably intertwined.

Reserve Ratios:

The monetary authorities have at their disposal another best way of influencing reserves and activities of commercial banks which weapon may be a change in cash reserve ratios. Changes within the reserve ratios become effective at a pre-announced date.

Their immediate effect is to change the liquidity position in the banking system. When the cash reserve ratio is raised commercial banks find their existing level of cash reserves inadequate to hide deposits and need to raise funds by disposing liquid assets in the monetary market. The reverse are the case when the reserve ratio is lowered. Thus, changes within the reserve ratios can influence directly the cash volume and therefore the lending capacity of the banks.

It appears that the bank rate policy, open market operations and changes in reserve ratios exert their influence on the cost, volume and availability of bank reserves through reserves, on the money supply.

Selective Controls:

Selective controls or qualitative credit control is used to divert the flow of credit into and out of particular segments of the credit market. Selective controls aim at influencing the aim of borrowing. They regulate the extension of credit for particular purposes. The rationale for the use of selective controls is that credit may be deemed excessive in some sectors at a time when a general credit control would be contrary to the maintenance of economic stability.

It goes without saying that these various means of credit controls are to be co-ordinated to attain the goal of economic stability.

Effectiveness of Monetary Control:

Monetary policy is far more effective in curbing a boom than in helping to bring the economy out of a depressionary state. it's long been recognised that monetary management can always contract the money supply sufficiently to finish any boom, but it's little capacity to finish a contraction.

This is because the actions of monetary management don't directly enter the income-expenditure stream because the best contra-cyclical weapon, for his or her first impact is on the asset structure of monetary institutions, and during this process of altering the assets structure, rate of interest, volume of credit and therefore the income-expenditure flow could also be altered.

All these operate more significantly in restraining the income stream during expansion than in inducing a rise during contraction. However, the best advantage of monetary policy is its flexibility. Monetary management makes decisions about the rate of change within the money supplies that are consistent with economic stability and growth on a judgement of given quantitative and qualitative evidences.

But, whether now of monetary policy will prove its effectiveness or not depends on its exact timing. Manipulation of bank rate and open market dealings by the central bank should be reasonably effective if applied quickly and continuously in preventing booms from developing and consequently, into a depression.

To sum up, monetary policy may be a necessary a part of the stabilisation programme but it alone isn't sufficient to attain the specified goal. Monetary policy, if used as a tool of economic stabilisation, in some ways , is a complement of fiscal policy.

It is strong, whereas fiscal policy is weak. it's flexible and capable of quick alternations to suit the measure of pressures of the time and wishes . However, it's to be co-ordinated with economic policy . A wrong monetary policy may seriously endanger and even destroy the effectiveness of fiscal policy. Thus, monetary policy and fiscal policy, each reinforcing and supplementing the opposite , are the essential elements in devising an economic stabilisation programme.

Q7) Explain fiscal measures.

A7) Fiscal Policy:

Today, foremost among the techniques of stabilisation is fiscal policy. fiscal policy as a tool of economic stability, however, has received its due importance under the influence of Keynesian economies only since Depression years of the 1930s.

The term ‘‘fiscal policy” embraces the tax and expenditure policies of the govt . Thus, fiscal policy operates through the control of state expenditures and tax receipts. It encompasses two separate but related decisions: public expenditures and level and structure of taxes. the quantity of public outlay, the inducement and effects of taxation and therefore the relation between expenditure and revenue exert a major impact upon the free enterprise economy.

Broadly speaking, the taxation policy of the govt relates to the programme of curbing private spending. The expenditure policy, on the opposite hand, deals with the channels by which government spending on new goods and services directly raise aggregate demand and indirectly income through the secondary spending which takes place on account of the multiplier effect.

Taxation, on the opposite hand, operates to scale back the level of personal spending (on both consumption and investment) by reducing the income and therefore the resulting savings within the community. Hence, under the budgetary phenomenon, public expenditure and revenue are often combined in various ways to realize the specified stimulating or deflationary effect on aggregate demand.

Thus, fiscal policy has quantitative also as qualitative aspect changes in tax rates, the structure of taxation and its incidence influence the volume and direction or private spending in economy. Similarly, changes in government’s expenditures and its structure of allocations also will have quantitative and redistributive effects on time, consumption and aggregate demand of the community.

As a matter of fact, all government spending is an inducement to extend the aggregate demand (both volume and components) and has an inflationary bias within the sense that it releases funds for the private economy which are then available to be used in trade and business.

Similarly, a discount in government spending features a deflationary bias and it reduces the aggregate demand (its volume and relative components during which the expenditure is curtailed). Thus, the composition of public expenditures and public revenue not only help to mould the economic structure of the country but also exert certain effects on the economy.

For maximum effectiveness, fiscal policy should be planned on both long-run and short-run basis. Long- run fiscal policy obviously cares with the long- run trends in government income and spendings. Within the framework of such a long-range plan of fiscal operations, the budget is often made to vary cyclically so as to moderate the short-run economic fluctuations.

Basically two sets of techniques are often employed for planning the specified flexibility within the relation between tax income and expenditure: (1) built-in flexibility or automatic stabilisers, and (2) discretionary action.

Built -in Flexibility:The operation of a fiscal policy is usually confronted with the matter of timing and forecast. A fiscal policy administrator has always to face the question: When to do what? But it's a really difficult and complicated question to answer. Thus, so as to minimise the difficulties that arise from uncertainties of forecasting and timing of fiscal operations, an automatic stabiliser programme is usually advocated.

Automatic stabiliser programme implies that during a given framework of expenditure and revenue relation during a budgetary policy, there exist factors which give automatically corrective influences on movements in national income, employment, etc. this is often what's called built-in flexibility. It refers to a passive budgetary policy.

The essence of built-in flexibility is that (i) with a given set of tax rates tax yields will vary directly with national income, and (ii) there are certain lines of government expenditures which tend to vary inversely with movements in national income.

Thus, when the national income rises, the present structure of taxes and expenditures tend to automatically increase public revenue relative to expenditure, and to increase expenditures relative to revenue when the value falls. These changes tend to mitigate or offset inflation or depression a minimum of partially. Thus, a progressive tax structure seems to be the simplest automatic stabiliser.

Likewise, certain sorts of government expenditure schemes like unemployment compensation programmes, government subsidies or price-support programmes also offset changes in income by varying inversely with movements in national income.

However, automatic stabilisers aren't a panacea for economic fluctuations, since they operate only as a partial offset to changes in national income, but provide a force to reverse the direction of the change within the income.

They slow down the rate of decline in aggregate income but contain no provision for restoring income to its former level. Thus, they ought to be recognised as a really useful device of fiscal operations but not the sole device. Simultaneously, there should be scope for discretionary policies because the circumstances will involve .

Discretionary Action:

Quite often, it becomes absolutely necessary to possess fiscal operations with a tool kit of discretionary policies consisting of measures for putting into effect with a minimum delay, the changes in government expenditures. This calls for a skeleton of structure projects providing for administrative discretion to use them and therefore the funds to place them into effect.

It calls for a budgetary manipulation an active budget policy constituting flexible tax rates and expenditures. There are often 3 ways of discretionary changes in tax rates and expenditures: changing expenditure with constant tax rates; changing tax rates and constant expenditure; and a mixture of changing tax rates and changing expenditures.

In general, the primary method is perhaps superior to the second during a depression. that's to mention, to increase expenditures with the level of taxes remaining unchanged is beneficial in pushing up the aggregate spending and effective demand within the economy. However, the second method will convince be superior to the primary during inflation.

That is to mention , inflation might be checked effectively by increasing the tax rates with a given expenditure programme. But it's easy to ascertain that the third method is far simpler during inflation also as deflation than the opposite two.

Inflation would, of course, be more effectively curbed when taxes are enhanced and public expenditure is additionally simultaneously reduced. Similarly, during a depression, the spending rate of personal economy are going to be quickly lifted up if taxes are reduced simultaneously with the increasing public expenditure.

However, the most difficulty with most discretionary policies is their proper timing. Delay in discretion and implementation will aggravate the problem and therefore the programme might not prove to be effective in solving the issues .

Thus, many economists fear that discretionary government actions are likely to do more harm than good, due to the uncertainty of government actions and therefore the political pressures to favour vested interests. that's why reliance on built-in stabilisers, as far as possible, has been advocated.

Q8) Explain characteristic and phase of trade cycle.

A8) A trade cycle refers to fluctuations in economic activities especially in employment, output and income, prices, profits etc. it's been defined differently by different economists. Consistent with Mitchell, “Business cycles are of fluctuations within the economic activities of organized communities. The adjective ‘business’ restricts the concept of fluctuations in activities which are systematically conducted on commercial basis.

The noun ‘cycle’ bars out fluctuations which don't occur with a measure of regularity”. Consistent with Keynes, “A trade cycle consists of periods of excellent trade characterised by inflation/ rise in prices and low unemployment percentages altering with periods of bad trade characterised by falling prices and high unemployment percentages”.

Features of a Trade Cycle:

1. A trade cycle is synchronic. When cyclical fluctuations start in one sector it spreads to other sectors.

2. During a trade cycle, a period of prosperity is followed by a period of depression. Hence trade cycle may be a wave like movement.

3. Trade cycle is recurrent and rhythmic; prosperity is followed by depression and the other way around.

4. A trade cycle is cumulative and self-reinforcing. Each phase feeds on itself and creates further movement within the same direction.

5. A trade cycle is asymmetrical. The prosperity phase is slow and gradual and therefore the phase of depression is rapid.

6. The trade cycle isn't periodical. Some trade cycles last for 3 or four years, while others last for 6 or eight or maybe more years.

7. The impact of a trade cycle is differential. It affects different industries in numerous ways.

8. A trade cycle is international in character. Through international trade, booms and depressions in one country are passed to other countries.

Phases of Trade Cycle

The four important features of trade cycle are (i) Recovery, (ii) Boom, (iii) Recession, and (iv) Depression.

The trades cycle or trade cycle are cyclical fluctuations of an economy. A full trade cycle possesses four phases: (i) Recovery, (ii) Boom, (iii) Recession, and (iv) depression. The upward phase of a business cycle or prosperity is split into two stages—recovery and boom, and therefore the downward phase of a trade cycle is additionally divided into two stages—recession and depression.

Phases of Trade Cycle:

The phases of trade cycle are explained with a diagram:

(1) Recovery:

In the early period of recovery, entrepreneurs increase the extent of investment which successively increases employment and income. Employment increases purchasing power and this results in a rise in demand for commodity .

As a result, demand for goods will press upon their supply and it shall, thereby, cause an increase in prices. The demand for consumer’s goods shall encourage the demand for producer’s goods.

The rise in prices shall rely upon the gestation of investment. The longer the period of investment, the upper shall be the price rise. the increase of prices shall cause a change within the distribution of income. Rent, wages, interest don't rise within the same proportion as prices.

Consequently, the margin of profit improves. The wholesale prices rise quite retail prices. the prices of raw materials rise over the prices of semi-finished goods and therefore the prices of semi-finished goods use over the prices of finished goods.

(2) Boom:

The rate of investment increases still further. because of the spread of a wave of optimism in business, the amount of production increases and therefore the boom gathers momentum. More investment is feasible only through credit creation. During a period of boom, the economy surpasses the extent of full employment and enters a stage of over full employment.

(3) Recession:

The orders for raw materials are reduced on the onset of a recession. the rate of investment in producers’ goods industries and housing construction declines. Liquidity preference rises in society and due to a contraction of money supply, the prices falls. A wave of pessimism spreads in business and those markets which were sometime before sellers markets become buyer’s markets now.

(4) Depression:

The main feature of a depression may be a general fall in economic activity. Production, employment and income decline. the prices fall and therefore the main factor accountable for it is, a fall in the purchasing power.

The distribution of national income changes,because the costs are rigid in nature, the margin of profit declines. Machines aren't accustomed their full capacity in factories, because effective demand is far less. the prices of finished goods fall but the prices of raw materials.

Q9) explain meaning and phase of trade cycle

Solution

A trade cycle refers to fluctuations in economic activities especially in employment, output and income, prices, profits etc. it's been defined differently by different economists. Consistent with Mitchell, “Business cycles are of fluctuations within the economic activities of organized communities. The adjective ‘business’ restricts the concept of fluctuations in activities which are systematically conducted on commercial basis.

The noun ‘cycle’ bars out fluctuations which don't occur with a measure of regularity”. Consistent with Keynes, “A trade cycle consists of periods of excellent trade characterised by inflation/ rise in prices and low unemployment percentages altering with periods of bad trade characterised by falling prices and high unemployment percentages”.

Phases of Trade Cycle

The four important features of trade cycle are (i) Recovery, (ii) Boom, (iii) Recession, and (iv) Depression.

The trades cycle or trade cycle are cyclical fluctuations of an economy. A full trade cycle possesses four phases: (i) Recovery, (ii) Boom, (iii) Recession, and (iv) depression. The upward phase of a business cycle or prosperity is split into two stages—recovery and boom, and therefore the downward phase of a trade cycle is additionally divided into two stages—recession and depression.

Phases of Trade Cycle:

The phases of trade cycle are explained with a diagram:

(1) Recovery:

In the early period of recovery, entrepreneurs increase the extent of investment which successively increases employment and income. Employment increases purchasing power and this results in a rise in demand for commodity .

As a result, demand for goods will press upon their supply and it shall, thereby, cause an increase in prices. The demand for consumer’s goods shall encourage the demand for producer’s goods.

The rise in prices shall rely upon the gestation of investment. The longer the period of investment, the upper shall be the price rise. the increase of prices shall cause a change within the distribution of income. Rent, wages, interest don't rise within the same proportion as prices.

Consequently, the margin of profit improves. The wholesale prices rise quite retail prices. the prices of raw materials rise over the prices of semi-finished goods and therefore the prices of semi-finished goods use over the prices of finished goods.

(2) Boom:

The rate of investment increases still further. because of the spread of a wave of optimism in business, the amount of production increases and therefore the boom gathers momentum. More investment is feasible only through credit creation. During a period of boom, the economy surpasses the extent of full employment and enters a stage of over full employment.

(3) Recession:

The orders for raw materials are reduced on the onset of a recession. the rate of investment in producers’ goods industries and housing construction declines. Liquidity preference rises in society and due to a contraction of money supply, the prices falls. A wave of pessimism spreads in business and those markets which were sometime before sellers markets become buyer’s markets now.

(4) Depression:

The main feature of a depression may be a general fall in economic activity. Production, employment and income decline. the prices fall and therefore the main factor accountable for it is, a fall in the purchasing power.

The distribution of national income changes,because the costs are rigid in nature, the margin of profit declines. Machines aren't accustomed their full capacity in factories, because effective demand is far less. the prices of finished goods fall but the prices of raw materials.

Q10) explain moneytary and fiscal measures

Solution

1. Monetary Policy:

The most commonly advocated policy of solving the matter of fluctuations is monetary policy. Monetary policy pertains to banking and credit, availability of loans to firms and households, interest rates, public debt and its management, and monetary management.

However, the basic problem of monetary policy in reference to trade cycles is to regulate and regulate the quantity of credit in such a way as to attain economic stability. During a depression, credit must be expanded and through an inflationary boom, its flow must be checked.

Monetary management is that the function of the commercial banking system, and thru it, its effects are primarily exerted the economy as an entire . Monetary management directly affects the volume of cash reserves of banks, regulates the availability of money and credit within the economy, thereby influencing the structure of interest rates and availability of credit.

Both these factors affect the components of aggregate demand (consumption plus investment) and therefore the flow of expenditures within the economy. it's obvious that an expansion in bank credit causes an increasing flow of expenditure (in terms of money) and contraction in bank credit reduces it.

In the armoury of the central bank, there are quantitative also as qualitative weapons to control the credit- creating activity of the banking system. they're bank rate, open market operations and reserve ratios. These are interrelated to tools which operate the reserves of member banks which influence the ability and willingness of the banks to expand credit. Selective credit controls are applied to control the extension of credit for particular purposes.

We shall now briefly discuss the implications of those weapons.

Bank Rate Policy:

Due to various reasons, the bank rate policy is comparatively an ineffective weapon of credit control. However, from the point of view of contra cyclical monetary policy, bank rate policy is typically interpreted as an evidence of monetary authority’s judgement regarding the contribution of the current flow of money and bank credit to general economic stability.

That is to mention, an increase in the bank rate indicates that the central bank considers that liquidity within the banking system possesses an inflationary potential. It implies that the flow of money and credit is very much in excess of the actual productive capacity of the economy and thus, a restraint on the expansion of money supply through dear money policy is desirable.

On the opposite hand, a reduction in the bank rate is usually interpreted as an evidence of a shift within the direction of monetary policy towards an inexpensive and expansive money policy. a reduction in bank rate then is more significant as an emblem of an easy money policy than anything . However, the bank rate is most effective as an instrument of restraint.

Effectiveness of bank rate Policy in Expansion:

According to Estey, the subsequent difficulties usually arise in the way of an efficient discount policy in expansion:

1. During high prosperity, the demand for credit by businessmen could also be interest-inelastic.

2. The rising of bank rate and a consequent rise within the market rates of interest may attract loanable funds from the financial intermediaries within the money market and assist in counteracting undesired effects.

3. Though the quantity of money is also controlled by the banking system, the velocity of its circulation isn't directly under the influence of banks. Banking policy may determine how much credit there should be but it's the trade which decides how much and the way fast it'll be used. Thus, if the velocity of the movement is contrary to the volume of credit, banking policy is rendered ineffective.

4. There's also the difficulty of proper timing within the application of banking policy. Brakes must be applied at the proper time and within the right quarter. If they're applied timely , they must bring expansion to an end with factors of production not fully employed. And when applied too late, there could be a runaway monetary expansion and inflation, completely out of control.

Open Market Operations:

The technique of open market operations refers to the purchase and sale of securities by the central bank. A selling operation reduces commercial banks’ reserves and their lending power.

However, because of the need to maintain the government securities market, the central bank is totally free to sell government securities when and in what amounts it wishes so as to influence commercial banks’ reserve position. Thus, when an outsized public debt is outstanding, by expanding the securities market, monetary policy and management of the public debt become inseparably intertwined.

Reserve Ratios:

The monetary authorities have at their disposal another best way of influencing reserves and activities of commercial banks which weapon may be a change in cash reserve ratios. Changes within the reserve ratios become effective at a pre-announced date.

Their immediate effect is to change the liquidity position in the banking system. When the cash reserve ratio is raised commercial banks find their existing level of cash reserves inadequate to hide deposits and need to raise funds by disposing liquid assets in the monetary market. The reverse are the case when the reserve ratio is lowered. Thus, changes within the reserve ratios can influence directly the cash volume and therefore the lending capacity of the banks.

It appears that the bank rate policy, open market operations and changes in reserve ratios exert their influence on the cost, volume and availability of bank reserves through reserves, on the money supply.

Selective Controls:

Selective controls or qualitative credit control is used to divert the flow of credit into and out of particular segments of the credit market. Selective controls aim at influencing the aim of borrowing. They regulate the extension of credit for particular purposes. The rationale for the use of selective controls is that credit may be deemed excessive in some sectors at a time when a general credit control would be contrary to the maintenance of economic stability.

It goes without saying that these various means of credit controls are to be co-ordinated to attain the goal of economic stability.

Effectiveness of Monetary Control:

Monetary policy is far more effective in curbing a boom than in helping to bring the economy out of a depressionary state. it's long been recognised that monetary management can always contract the money supply sufficiently to finish any boom, but it's little capacity to finish a contraction.

This is because the actions of monetary management don't directly enter the income-expenditure stream because the best contra-cyclical weapon, for his or her first impact is on the asset structure of monetary institutions, and during this process of altering the assets structure, rate of interest, volume of credit and therefore the income-expenditure flow could also be altered.

All these operate more significantly in restraining the income stream during expansion than in inducing a rise during contraction. However, the best advantage of monetary policy is its flexibility. Monetary management makes decisions about the rate of change within the money supplies that are consistent with economic stability and growth on a judgement of given quantitative and qualitative evidences.

But, whether now of monetary policy will prove its effectiveness or not depends on its exact timing. Manipulation of bank rate and open market dealings by the central bank should be reasonably effective if applied quickly and continuously in preventing booms from developing and consequently, into a depression.

To sum up, monetary policy may be a necessary a part of the stabilisation programme but it alone isn't sufficient to attain the specified goal. Monetary policy, if used as a tool of economic stabilisation, in some ways , is a complement of fiscal policy.

It is strong, whereas fiscal policy is weak. it's flexible and capable of quick alternations to suit the measure of pressures of the time and wishes . However, it's to be co-ordinated with economic policy . A wrong monetary policy may seriously endanger and even destroy the effectiveness of fiscal policy. Thus, monetary policy and fiscal policy, each reinforcing and supplementing the opposite , are the essential elements in devising an economic stabilisation programme.

2. Fiscal Policy:

Today, foremost among the techniques of stabilisation is fiscal policy. fiscal policy as a tool of economic stability, however, has received its due importance under the influence of Keynesian economies only since Depression years of the 1930s.

The term ‘‘fiscal policy” embraces the tax and expenditure policies of the govt . Thus, fiscal policy operates through the control of state expenditures and tax receipts. It encompasses two separate but related decisions: public expenditures and level and structure of taxes. the quantity of public outlay, the inducement and effects of taxation and therefore the relation between expenditure and revenue exert a major impact upon the free enterprise economy.

Broadly speaking, the taxation policy of the govt relates to the programme of curbing private spending. The expenditure policy, on the opposite hand, deals with the channels by which government spending on new goods and services directly raise aggregate demand and indirectly income through the secondary spending which takes place on account of the multiplier effect.

Taxation, on the opposite hand, operates to scale back the level of personal spending (on both consumption and investment) by reducing the income and therefore the resulting savings within the community. Hence, under the budgetary phenomenon, public expenditure and revenue are often combined in various ways to realize the specified stimulating or deflationary effect on aggregate demand.

Thus, fiscal policy has quantitative also as qualitative aspect changes in tax rates, the structure of taxation and its incidence influence the volume and direction or private spending in economy. Similarly, changes in government’s expenditures and its structure of allocations also will have quantitative and redistributive effects on time, consumption and aggregate demand of the community.

As a matter of fact, all government spending is an inducement to extend the aggregate demand (both volume and components) and has an inflationary bias within the sense that it releases funds for the private economy which are then available to be used in trade and business.

Similarly, a discount in government spending features a deflationary bias and it reduces the aggregate demand (its volume and relative components during which the expenditure is curtailed). Thus, the composition of public expenditures and public revenue not only help to mould the economic structure of the country but also exert certain effects on the economy.

For maximum effectiveness, fiscal policy should be planned on both long-run and short-run basis. Long- run fiscal policy obviously cares with the long- run trends in government income and spendings. Within the framework of such a long-range plan of fiscal operations, the budget is often made to vary cyclically so as to moderate the short-run economic fluctuations.

Basically two sets of techniques are often employed for planning the specified flexibility within the relation between tax income and expenditure: (1) built-in flexibility or automatic stabilisers, and (2) discretionary action.

Built -in Flexibility:The operation of a fiscal policy is usually confronted with the matter of timing and forecast. A fiscal policy administrator has always to face the question: When to do what? But it's a really difficult and complicated question to answer. Thus, so as to minimise the difficulties that arise from uncertainties of forecasting and timing of fiscal operations, an automatic stabiliser programme is usually advocated.

Automatic stabiliser programme implies that during a given framework of expenditure and revenue relation during a budgetary policy, there exist factors which give automatically corrective influences on movements in national income, employment, etc. this is often what's called built-in flexibility. It refers to a passive budgetary policy.

The essence of built-in flexibility is that (i) with a given set of tax rates tax yields will vary directly with national income, and (ii) there are certain lines of government expenditures which tend to vary inversely with movements in national income.

Thus, when the national income rises, the present structure of taxes and expenditures tend to automatically increase public revenue relative to expenditure, and to increase expenditures relative to revenue when the value falls. These changes tend to mitigate or offset inflation or depression a minimum of partially. Thus, a progressive tax structure seems to be the simplest automatic stabiliser.

Likewise, certain sorts of government expenditure schemes like unemployment compensation programmes, government subsidies or price-support programmes also offset changes in income by varying inversely with movements in national income.

However, automatic stabilisers aren't a panacea for economic fluctuations, since they operate only as a partial offset to changes in national income, but provide a force to reverse the direction of the change within the income.

They slow down the rate of decline in aggregate income but contain no provision for restoring income to its former level. Thus, they ought to be recognised as a really useful device of fiscal operations but not the sole device. Simultaneously, there should be scope for discretionary policies because the circumstances will involve .

Discretionary Action:

Quite often, it becomes absolutely necessary to possess fiscal operations with a tool kit of discretionary policies consisting of measures for putting into effect with a minimum delay, the changes in government expenditures. This calls for a skeleton of structure projects providing for administrative discretion to use them and therefore the funds to place them into effect.

It calls for a budgetary manipulation an active budget policy constituting flexible tax rates and expenditures. There are often 3 ways of discretionary changes in tax rates and expenditures: changing expenditure with constant tax rates; changing tax rates and constant expenditure; and a mixture of changing tax rates and changing expenditures.

In general, the primary method is perhaps superior to the second during a depression. that's to mention, to increase expenditures with the level of taxes remaining unchanged is beneficial in pushing up the aggregate spending and effective demand within the economy. However, the second method will convince be superior to the primary during inflation.

That is to mention , inflation might be checked effectively by increasing the tax rates with a given expenditure programme. But it's easy to ascertain that the third method is far simpler during inflation also as deflation than the opposite two.

Inflation would, of course, be more effectively curbed when taxes are enhanced and public expenditure is additionally simultaneously reduced. Similarly, during a depression, the spending rate of personal economy are going to be quickly lifted up if taxes are reduced simultaneously with the increasing public expenditure.

However, the most difficulty with most discretionary policies is their proper timing. Delay in discretion and implementation will aggravate the problem and therefore the programme might not prove to be effective in solving the issues .

Thus, many economists fear that discretionary government actions are likely to do more harm than good, due to the uncertainty of government actions and therefore the political pressures to favour vested interests. that's why reliance on built-in stabilisers, as far as possible, has been advocated.