Unit 4

Public Finance

Q1) Explain meaning and scope of public finance.

A1) Public finance is the study of income and expenditure or receipt and payment of government. Public finance refers to how government raises its resources to meet the growing expenditure. Thus, in public finance we study the finances of government. The terms ‘finance’ is money resource i.e. coins. And public is collected name for individual within an administrative territory and finance. Thus public finance in this manner can be said the science of the income and expenditure of the government.

Definition:

According to prof. Dalton “public finance is one of those subjects that lie on the border lie between economics and politics. It is concerned with income and expenditure of public authorities and with the mutual adjustment of one another. The principal of public finance are the general principles, which may be laid down with regard to these matters.

According to Adam Smith “public finance is an investigation into the nature and principles of the state revenue and expenditure”

The scope of public finance is not just to find out about the composition of public income and public expenditure. It covers a full discussion of the have an impact on of government fiscal operations on the stage of typical activity, employment, costs and increase system of the financial device as a whole.

According to Musgrave, the scope of public finance embraces the following three functions of the government’s budgetary coverage limited to the fiscal department:

(i) the allocation branch,

(ii) the distribution branch, and

(iii) the stabilisation branch.

These refer to three goals of finances policy, i. E., the use of fiscal instruments:

(i) to impenetrable adjustments in the allocation of resources,

(ii) to impenetrable changes in the distribution of income and wealth, and

(iii) to achieve financial stabilisation.

Thus, the function of the allocation department of the fiscal branch is to decide what changes in allocation are needed, who shall endure the cost, what income and expenditure policies to be formulated to fulfill the desired objectives.

The characteristic of the distribution department is to decide what steps are needed to carry about the favored or equitable nation of distribution in the economy and the stabilization branch shall confine itself to the choices as to what ought to be carried out to tightly closed charge steadiness and to keep full employment level.

Further, modern public finance has two aspects:

(i) positive aspect and (ii) normative aspect.

In its advantageous aspect, the study of public finance is concerned with what are sources of public revenue, gadgets of public expenditure, constituents of budget, and formal as nicely as tremendous incidence of the fiscal operations.

In its normative aspect, norms or standards of the government’s monetary operations are laid down, investigated, and appraised. The simple norm of modern finance is normal economic welfare. On normative consideration, public finance turns into a skillful art, whereas in its nice aspect, it remains a fiscal science.

Q2) Explain scope of public finance.

A2) The scope of public finance is not just to find out about the composition of public income and public expenditure. It covers a full discussion of the have an impact on of government fiscal operations on the stage of typical activity, employment, costs and increase system of the financial device as a whole.

According to Musgrave, the scope of public finance embraces the following three functions of the government’s budgetary coverage limited to the fiscal department:

(i) the allocation branch,

(ii) the distribution branch, and

(iii) the stabilisation branch.

These refer to three goals of finances policy, i. E., the use of fiscal instruments:

(i) to impenetrable adjustments in the allocation of resources,

(ii) to impenetrable changes in the distribution of income and wealth, and

(iii) to achieve financial stabilisation.

Thus, the function of the allocation department of the fiscal branch is to decide what changes in allocation are needed, who shall endure the cost, what income and expenditure policies to be formulated to fulfill the desired objectives.

The characteristic of the distribution department is to decide what steps are needed to carry about the favored or equitable nation of distribution in the economy and the stabilization branch shall confine itself to the choices as to what ought to be carried out to tightly closed charge steadiness and to keep full employment level.

Further, modern public finance has two aspects:

(i) positive aspect and (ii) normative aspect.

In its advantageous aspect, the study of public finance is concerned with what are sources of public revenue, gadgets of public expenditure, constituents of budget, and formal as nicely as tremendous incidence of the fiscal operations.

In its normative aspect, norms or standards of the government’s monetary operations are laid down, investigated, and appraised. The simple norm of modern finance is normal economic welfare. On normative consideration, public finance turns into a skillful art, whereas in its nice aspect, it remains a fiscal science.

Q3) Explain importance of public finance.

A3) 1. Increasing the growth rate of Economy – The role of public expenditure in economic development lies in increasing the growth rate of the economy, providing more employment opportunities, raising incomes and standard of living, reducing inequalities of income and wealth, encouraging private initiative and enterprise and bringing about regional balance in the economy. All these are achieved by spending on public works, agriculture: industry, transport and communications, power, financial and banking institutions, social services etc. The government is able to increase public expenditure through a budget deficit.

2. Emergence of Social Services – The importance of public finance as also increased due to emergence of social services which can be performed more conveniently, efficiently and also at the minimum cost as against individual. Such services are education, health, social security and protection from certain uncertainties. The need for such social services is increasing day by day and with them is increasing the importance of public finance.

3. Reduction in Economic Inequalities – Public finance can play a vital role in reducing economic inequalities which is the source of dissatisfaction, class-struggles, poverty etc. The state can levy heavy taxes on richer sections of the society and thereby spend the income so received on providing food, cheap housing, free medical aid etc. for the poorer sections of the society. Similarly, heavy taxes can be imposed on the use of harmful commodities, such as harmful drugs, wine, opium, hashish etc.

4. Increases Employment – Public finance can play vital role in increasing employment which is the burning problem of almost all the countries of the world, The Governments these days establish, give grants, subsidies, grant exemption from excise duty, sales tax etc. to employment-oriented cottage and small-scale industries. Unbalanced budget is also an indispensable measure of increasing volume of employment during depression.

5. Capital Formation – The economic development, as is well known, depends upon the rate of capital-formation in the country. Public finance can play a vital role in increasing the rate of capital-formation in the economy. It can be managed in such a manner as to step up the rate of saving and investment in the economy. For example, the tax system can be so managed as to discourage the consumption of non-essential goods and thereby release the resources for being invested in more productive industries. Further, the tax system can be employed to increase the rate of private saving which in turn, can be used as the basis for an increase in public investment.

6. Industrial Development – The governments these days give subsidies and grants to different industries to enable them to increase the production of essential goods in the country. These subsidies and grants have special place in the government expenditure of underdeveloped and backward countries .

Q4) Explain types of tax.

A4) Prevalence of a number sorts of taxes is found in India. Taxes in India can be both direct and indirect. However, the kinds of taxes even depend on whether a precise tax is being levied by the central or the kingdom authorities or any other municipalities. Following are some of the predominant Indian taxes:

Direct Taxes-

It is names so because it is directly paid to the Union Government of India. As per a survey, the Republic of India has witnessed a steady upward jab in the collection of such taxes over a period of previous years. The seen growth in these tax collections as well as the rate of taxes displays a healthful within your budget boom of India. Besides that, it even portrays the compliance of high tax alongside with higher administration of taxation. To title a few of the direct taxes, which are imposed with the aid of the Indian Government are:

• Banking Cash Transaction Tax

• Corporate Tax

• Capital Gains Tax

• Double Tax Avoidance Treaty

• Fringe Benefit Tax

• Securities Transaction Tax

• Personal Income Tax

• Tax Incentives

Indirect Taxes

As hostile to the direct taxes, such a tax in the nation is normally levied on some specific services or some unique goods. An indirect tax is no longer levied on any specific organization or an individual. Almost all the activities, which fall within the periphery of the indirect taxation, are protected in the range beginning from manufacturing items and transport of offerings to those that are supposed for consumption.

Apart from these, the different things to do and services, which are associated to import buying and selling etc. are even covered inside this range. This large range results in the involvement as well as implementation of some or other oblique tax in all lines of business.

Usually, the oblique taxation in the Indian Republic is a complicated process that involves legal guidelines and regulations, which are interconnected to every other.

These taxation guidelines even consist of some laws that are specific to some of the states of the country. The regime of indirect taxation encompasses distinctive sorts of taxes. The groups provide offerings in all or most of the associated fields, some of which are as follows:

• Anti-Dumping Duty

• Custom Duty

• Excise Duty

• Sales Tax

• Service Tax

• Value Added Tax or V. A. T.

Taxation Types:

(i) Proportional taxes,

(ii) Progressive taxes,

(iii) Regressive taxes and

(iv) Digressive taxes.

Proportional Taxes:

Taxes in which the price of tax stays constant, even though the tax base changes, are called proportional taxes.

Here, the tax base may also be income, cash cost of property, wealth, or items etc. Income is, however, viewed as the fundamental tax base, because it is the determinant of taxable capability of a person.

In a proportional tax system, thus, taxes fluctuate in direct share to the change in income. If earnings are doubled, the tax quantity is additionally doubled. Thus, a proportional tax extracts a regular share of rising income.

Progressive Taxes:

Taxes in which the price of tax increases are known as innovative taxes. Thus, in a innovative tax, the quantity of tax paid will increase at a greater price than the amplify in tax base or income, for the taxation quantity is the product of multiplying the base through the charge and both these expand in a revolutionary tax.

Regressive Taxes:

When the charge of tax decreases as the tax base increases, the taxes are known as regressive taxes.

It must be referred to that in regressive taxation, although the whole quantity of tax increase on a greater earnings in the absolute sense, in the relative sense, the tax rate declines on a greater income. As such, highly a heavier burden (sacrifice involved) falls upon the negative than on the rich. Generally, taxes on necessaries are regressive as they take away a higher percentage of lower incomes as compared to greater incomes.

Thus, regressive taxation is unjust and inequitable. It does no longer comply with the canon of equity. It tends to accentuate inequalities of earnings in the community.

Digressive Taxes:

Taxes which are mildly progressive, consequently now not very steep, so that excessive earnings earners do not make a due sacrifice on the foundation of equity, are known as digressive.

In digressive taxation, thus, the tax payable increases solely at a diminishing rate.

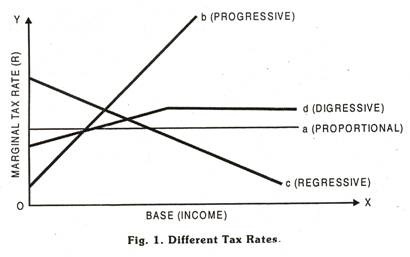

Diagrammatically, differences in progressive, proportional, regressive and digressive taxation are shown in Fig. 1.

Fig. 1 depicts the percentage of profits taken away in taxation under special tax rates. Tax line a represents a revolutionary tax rate, tax line b represents a proportional tax rate, tax line с suggests a regressive tax rate and tax line denotes a digressive tax rate.

The proportional tax charge has a regular slope, graphically ,whilst the revolutionary tax rate has a rising fine slope.

The steeper the slope of the tax line, the modern the tax regime. The regressive tax charge line has a declining negative slope. The steeper the negative slope of the tax line, the more regressive the taxation. The digressive tax price line has a rising slope initially, but it turns into constant after a point.

Q5) Explain public expenditure causes.

A5) Public expenditure refers to the expenses incurred by the government for the maintenance of the government and to preserve the welfare of society as a whole. In other words, it refers to the expenses made by the public authorities, i.e. Central Government, State Government and Local bodies to satisfy the common wants of the people. Public expenditure is not merely a financial mechanism but it also aims at securing social objectives.

Prof. Dalton classified the aims and objectives of public expenditure into two parts: (a) Security of human life against the external aggression and internal disorder and injustice. (b) Promoting maximum social welfare of the community

Causes of increasing public expenditure

2. To meet the Defense Needs- Every country pays greater attention to its defense preparedness against foreign attacks. The manufacture of modern nuclear weapons, training and planning of army is a very costly affair. As Adam Smith also said long ago, “Defense is better than opulence.” So public expenditure on defense is essential.

3. Development of Agriculture and Industries- In developing countries like India, the development of agriculture and small-scale industries is the key factor of the progress of the economy. Every year, government spend huge amount for the disbursement of loans, providing subsidized fertilizers and pesticides on minimum prices to farmers. In addition to it, government also takes measure to provide consumer goods and services at reduced cost. This led naturally to a greater share for public expenditure.

4. Rising Population- The increase in population account for better health and medical facilities resulting in increase public expenditure on roads, railways, hospitals, schools, colleges, etc. Apart from that, the state also has to bear additional responsibility of solving problems such as food, unemployment, housing, sanitation etc.

5. Urbanization- With the growth of population, there is migration of population from rural to urban areas in search of employment. Existing cities expand and new cities come up. These require huge public expenditure in providing civic amenities like water, lighting, roads, transport, schools, parks, houses, etc. Simultaneously, the expenditure on civil administration also increases.

6. Public debt and interest charges - The state borrows both internally and externally to meet its ever increasing public expenditure. This further raises public expenditure in the form of repayment of loans and interest charges.

7. Price Rise- In modern times, prices have a tendency to rise continuously with the increase in the growth rate of the economy. As a result, the government expenditure on goods and services increases. The rise in the cost of living further exaggerates the government expenditure.

8. Burden of Democracy - Modern governments are democratic in nature. Countries are run on a multi-party system with elections after four or five years. This tends to increase public expenditure. Further, there are “pressure groups” and “interest groups” within the parliament which want allocation of government funds for providing public services in their constituencies.

9. Development Schemes and projects - Modern government incurs huge amount for the development of both rural and urban folks, apart from gender equity. Schemes, such as, Digital India, Make in India, Ayushman Bharat, PM-KISAN, PM Garib Kalyan Yojana (PMGKY) have rendered huge expenditure on the part of the government.

10. Economic Development- Modern governments are engaged in the development of their economies. They spend large sums on infrastructural facilities, on research and development in various fields, development of public sector, increasing national income, uplifting marginalized section etc. This has led to the increase in public expenditure.

Q6) Explain public debt.

A6) Public debt is the total amount borrowed by the government of a country to meet its operational and development expenditure. It is also referred as total liability of the government which the public income fails to meet. The different form of borrowing includes market loans, special bearer bonds, treasury bills and special loans and securities issued by the Reserve Bank. It also includes external debt. In the Indian context, public debt includes the total liabilities of the Union government that have to be paid from the Consolidated Fund of India.

The state borrows to meet the following expenditures

Q7) Explain importance of public debt.

A7) Public debt is the total amount borrowed by the government of a country to meet its operational and development expenditure. It is also referred as total liability of the government which the public income fails to meet. The different form of borrowing includes market loans, special bearer bonds, treasury bills and special loans and securities issued by the Reserve Bank. It also includes external debt. In the Indian context, public debt includes the total liabilities of the Union government that have to be paid from the Consolidated Fund of India.

The state borrows to meet the following expenditures

IMPORTANCE

2. Deficit budget – Sometimes the situation becomes such that the current revenue cannot meet the proposed expenditure unless they are supplemented by additional taxes and borrowing. But tax collection takes longer time. In such a situation, to meet its requirement immediately, the government may resort to borrowing from the public.

3. Waging wars- Modern war is so costly that the normal income through taxation falls short of the actual war expenditure. War expenditures are so huge that they cannot be met by taxing people alone. Governments, therefore, have to borrow extensively from individuals and institutions towards war financing.

4. Facing natural calamities- Natural calamities such as floods, famines earthquakes, tsunami etc. lend to increase the government expenditure in order to provide relief to the victims. This requires huge public borrowing by the government.

5. Fighting depression- Borrowing is anti-cyclical. Public debt creation is considered as a very significant remedy to depression. Depression is the effect of fall in effective demand. The government can create effective demand by pumping that is by injecting money into the income stream. This involves huge amounts of money which the government may mobilise by borrowing the surplus of the country.

6. To curb inflation- Public borrowing may be regarded as a means to relieve the pressure of inflationary spiral in the economy, as by raising public loans, the government absorbs the excessive purchasing power in the hands of the people and check prices from rising.

7. Public enterprises and utilities- Public borrowing is necessary to promote public enterprises and utilities like railways, post and telegraph, power generation, etc. Promotion of this public corporation requires huge financial resources. The current revenues cannot afford it. The government can meet them only through public borrowing rather than by taxation.

8. Unpopularity of Taxation- People generally do not like to pay taxes to the government 'taxation, whether new or old is always unpopular with the public. The people generally oppose the enhancement of existing rates of taxes and the imposition of additional taxes. To get over this public opposition, the modern governments adopt the easy method of resorting to public debt.

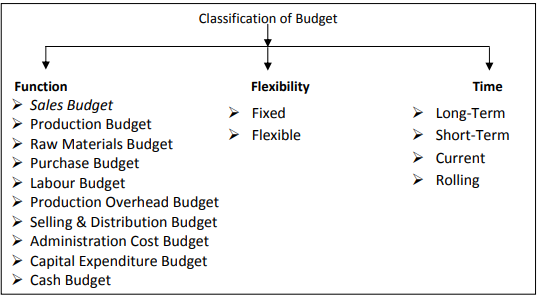

Q8) Explain types of budget.

A8) Government has several policies to implement in the overall task of performing its functions to meet the objectives of social & economic growth. For implementing these policies, it has to spend huge amount of funds on defence, administration, and development, welfare projects & various other relief operations. It is therefore necessary to find out all possible sources of getting funds so that sufficient revenue can be generated to meet the mounting expenditure.

Planning process of assessing revenue & expenditure is termed as Budget.

The term budget is derived from the French word "Budgette" which means a "leather bags; or a "wallet". It is a statement of the financial plan of the government. It shows the income & expenditure of the government during a financial year, which runs generally from 1st April to 31st March.

Definitions of Budget:

According to Tayler, "Budget is a financial plan of government r a definite period".

According to Rene, "A budget is a document containing a preliminary approved plan of public revenues and expenditure".’

Functional Classification:

2. PRODUCTION BUDGET: The production budget is prepared on the basis of estimated production for budget period. Usually, the production budget is based on the sales budget. At the time of preparing the budget, the production manager will consider the physical facilities like plant, power, factory space, materials and labour, available for the period. Production budget envisages the production program for achieving the sales target. The budget may be expressed in terms of quantities or money or both. Production may be computed as follows: Units to be produced = Desired closing stock of finished goods + Budgeted sales – Beginning stock of finished goods.

3. PRODUCTION COST BUDGET: This budget shows the estimated cost of production. The production budget demonstrates the capacity of production. These capacities of production are expressed in terms of cost in production cost budget. The cost of production is shown in detail in respect of material cost, labour cost and factory overhead. Thus production cost budget is based upon Production Budget, Material Cost Budget, Labour Cost Budget and Factory overhead.

4. RAW‐MATERIAL BUDGET: Direct Materials budget is prepared with an intention to determine standard material cost per unit and consequently it involves quantities to be used and the rate per unit. This budget shows the estimated quantity of all the raw materials and components needed for production demanded by the production budget.

5. PURCHASE BUDGET: Strategic planning of purchases offers one of the most important areas of reduction cost in many concerns. This will consist of direct and indirect material and services. The purchasing budget may be expressed in terms of quantity or money.

6. LABOUR BUDGET: Human resources are highly expensive item in the operation of an enterprise. Hence, like other factors of production, the management should find out in advance personnel requirements for various jobs in the enterprise. This budget may be classified into labour requirement budget and labour recruitment budget. The labour necessities in the various job categories such as unskilled, semi‐skilled and supervisory are determined with the help of all the head of the departments. The labour employment is made keeping in view the requirement of the job and its qualifications, the degree of skill and experience required and the rate of pay.

7. PRODUCTION OVERHEAD BUDGET: The manufacturing overhead budget includes direct material, direct labour and indirect expenses. The production overhead budget represents the estimate of all the production overhead i.e. fixed, variable, semi‐variable to be incurred during the budget period.

8. SELLING AND DISTRIBUTION COST BUDGET: The Selling and Distribution Cost budget is estimating of the cost of selling, advertising, delivery of goods to customers etc. throughout the budget period. This budget is closely associated to sales budget in the logic that sales forecasts significantly influence the forecasts of these expenses. Nevertheless, all other linked information should also be taken into consideration in the preparation of selling and distribution budget. The sales manager is responsible for selling and distribution cost budget.

9. ADMINISTRATION COST BUDGET: This budget includes the administrative costs for non‐manufacturing business activities like directors fees, managing directors’ salaries, office lightings, heating and air condition etc. Most of these expenses are fixed so they should not be too difficult to forecast. There are semi‐variable expenses which get affected by the expected rise or fall in cost which should be taken into account. Generally, this budget is prepared in the form of fixed budget.

10. CAPITAL‐ EXPENDITURE BUDGET: This budget stands for the expenditure on all fixed assets for the duration of the budget period. This budget is normally prepared for a longer period than the other functional budgets. It includes such items as new buildings, land, machinery and intangible items like patents, etc. This budget is designed under the observation of the accountant which is supported by the plant engineer and other functional managers.

11. CASH BUDGET: The cash budget is a sketch of the business estimated cash inflows and outflows over a specific period of time. Cash budget is one of the most important and one of the last to be prepared. It is a detailed projection of cash receipts from all sources and cash payments for all purposes and the resultants cash balance during the budget. It is a mechanism for controlling and coordinating the fiscal side of business to ensure solvency and provides the basis for forecasting and financing required to cover up any deficiency in cash. Cash budget thus plays avital role in the financing management of a business undertaken.

FIXED AND FLEXIBLE BUDGET:

2. FLEXIBLE BUDGET: This is a dynamic budget. In comparison with a fixed budget, a flexible budget is one “which is designed to change in relation to the level of activity attained.” The underlying principle of flexibility is that a budget is of little use unless cost and revenue are related to the actual volume of production. The statistics range from the lowest to the highest probable percentages of operating activity in relation to the standard operating performance. Flexible budgets are a part of the feed advance process and as such are a useful part of planning. An equally accurate use of the flexible budgets is for the purposes of control.

TIME BUDGET-

(a) Long term Budget: These budgets are prepared on the basis of long‐term projection and portray a long range planning. These budgets generally cover plans for three to ten years. In this regard it is mostly prepared in terms of physical quantities rather than in monetary values.

(b) Short term Budget: In this budget forecasts and plans are given in respect of its operations for a period of about one to five years. They are generally prepared in monetary units and are more specific than long term budgets.

(c) Current Budgets: These budgets cover a very short period, may be a month or a quarter or maximum one year. The preparation of these budgets requires adjustments in short term budgets to current conditions.

(d) Rolling Budgets: A few companies follow the practice of preparing a rolling or progressive budget. In this case companies prepare the budget for a year in advance. A new budget is prepared after the end of each month or quarter for a full year in advance. The figures for the month or quarter which has rolled down are dropped and the statistics for the next month or quarter are added.

MASTER BUDGET-

The master budget is a review budget which combines all functional budgets and it may take the form of Financial Statements at the end of budget period. It is also called the operating budget. It embraces the impact of both operating decisions and financing decisions. It provides the necessary plan for operations during the period when all detailed budgets have been completed. A master budget becomes a principal document for the operations of the industry during the period it covers.

Q9) Explain functional classification of budget.

A9) Functional Classification:

2. PRODUCTION BUDGET: The production budget is prepared on the basis of estimated production for budget period. Usually, the production budget is based on the sales budget. At the time of preparing the budget, the production manager will consider the physical facilities like plant, power, factory space, materials and labour, available for the period. Production budget envisages the production program for achieving the sales target. The budget may be expressed in terms of quantities or money or both. Production may be computed as follows: Units to be produced = Desired closing stock of finished goods + Budgeted sales – Beginning stock of finished goods.

3. PRODUCTION COST BUDGET: This budget shows the estimated cost of production. The production budget demonstrates the capacity of production. These capacities of production are expressed in terms of cost in production cost budget. The cost of production is shown in detail in respect of material cost, labour cost and factory overhead. Thus production cost budget is based upon Production Budget, Material Cost Budget, Labour Cost Budget and Factory overhead.

4. RAW‐MATERIAL BUDGET: Direct Materials budget is prepared with an intention to determine standard material cost per unit and consequently it involves quantities to be used and the rate per unit. This budget shows the estimated quantity of all the raw materials and components needed for production demanded by the production budget.

5. PURCHASE BUDGET: Strategic planning of purchases offers one of the most important areas of reduction cost in many concerns. This will consist of direct and indirect material and services. The purchasing budget may be expressed in terms of quantity or money.

6. LABOUR BUDGET: Human resources are highly expensive item in the operation of an enterprise. Hence, like other factors of production, the management should find out in advance personnel requirements for various jobs in the enterprise. This budget may be classified into labour requirement budget and labour recruitment budget. The labour necessities in the various job categories such as unskilled, semi‐skilled and supervisory are determined with the help of all the head of the departments. The labour employment is made keeping in view the requirement of the job and its qualifications, the degree of skill and experience required and the rate of pay.

7. PRODUCTION OVERHEAD BUDGET: The manufacturing overhead budget includes direct material, direct labour and indirect expenses. The production overhead budget represents the estimate of all the production overhead i.e. fixed, variable, semi‐variable to be incurred during the budget period.

8. SELLING AND DISTRIBUTION COST BUDGET: The Selling and Distribution Cost budget is estimating of the cost of selling, advertising, delivery of goods to customers etc. throughout the budget period. This budget is closely associated to sales budget in the logic that sales forecasts significantly influence the forecasts of these expenses. Nevertheless, all other linked information should also be taken into consideration in the preparation of selling and distribution budget. The sales manager is responsible for selling and distribution cost budget.

9. ADMINISTRATION COST BUDGET: This budget includes the administrative costs for non‐manufacturing business activities like directors fees, managing directors’ salaries, office lightings, heating and air condition etc. Most of these expenses are fixed so they should not be too difficult to forecast. There are semi‐variable expenses which get affected by the expected rise or fall in cost which should be taken into account. Generally, this budget is prepared in the form of fixed budget.

10. CAPITAL‐ EXPENDITURE BUDGET: This budget stands for the expenditure on all fixed assets for the duration of the budget period. This budget is normally prepared for a longer period than the other functional budgets. It includes such items as new buildings, land, machinery and intangible items like patents, etc. This budget is designed under the observation of the accountant which is supported by the plant engineer and other functional managers.

11. CASH BUDGET: The cash budget is a sketch of the business estimated cash inflows and outflows over a specific period of time. Cash budget is one of the most important and one of the last to be prepared. It is a detailed projection of cash receipts from all sources and cash payments for all purposes and the resultants cash balance during the budget. It is a mechanism for controlling and coordinating the fiscal side of business to ensure solvency and provides the basis for forecasting and financing required to cover up any deficiency in cash. Cash budget thus plays a vital role in the financing management of a business undertaken.

Q10) Explain fixed and flexible budget.

A10) FIXED AND FLEXIBLE BUDGET:

2. FLEXIBLE BUDGET: This is a dynamic budget. In comparison with a fixed budget, a flexible budget is one “which is designed to change in relation to the level of activity attained.” The underlying principle of flexibility is that a budget is of little use unless cost and revenue are related to the actual volume of production. The statistics range from the lowest to the highest probable percentages of operating activity in relation to the standard operating performance. Flexible budgets are a part of the feed advance process and as such are a useful part of planning. An equally accurate use of the flexible budgets is for the purposes of control.