UNIT 3

Introduction of Banking Company

Q1) From the following information, prepare Profit and Loss Account of South Bank Ltd. as on 31st March 2020.

Particulars | (in ‘000) |

Interest and Discounts | 3045 |

Income from Investments | 115 |

Interest on Balances with RBI | 820 |

Commission, Exchange and Brokerage | 110 |

Profit on Sale of Investments | 1225 |

Interest on Deposits Interest to RBI | 161 |

Payment to and Provision for Employees | 1044 |

Rent, Taxes and Lighting | 210 |

Printing and Stationery | 180 |

Advertisement and Publicity | 95 |

Depreciation | 92 |

Director’s Fees | 220 |

Auditor’s Fees | 120 |

Law Charges | 20 |

Postage, Telegram and Telephones | 70 |

Insurance | 56 |

Repairs and Maintenance | 48 |

Other Information:

(i) Interest and discount mentioned above is after adjustment for the following:

Particulars | (‘000) |

Tax provision for the year | 2,20 |

Provision during the year for doubtful debts | 1,02 |

Loss on sale of investments | 12 |

Rebate on bills discounted | 58 |

(ii) 20% of profit is transferred to Statutory Reserves. 5% of profit is transferred to Revenue Reserve. Profit brought forward from last year 16,000.

A1)

In the books of South Bank

Profit and Loss Account for the year ended 31st March 2020

Profit and Loss Account for the year ended 31st March 2020

Particulars | Schedule No. | As on 31.3.2020 Current Year |

2. Expenditure Interest Expended Operating Expenses Provision and Contingencies

3. Profit/Loss Net Profit for the year Profit brought forward Total 4. Appropriations Transfer to Statutory Reserve ( 5,19 × 20/100) Transfer to Revenue Reserve ( 5,19 × 5/100) Balance carried over to Balance Sheet Total |

13 |

37,32 |

14 | 9,18 | |

| 46,50 | |

15 | 13,86 | |

16 | 23,65 | |

| 3,80* | |

|  41,31 | |

| 5,19 | |

| 16 | |

|  5,35 | |

| 1,04 | |

| 26 | |

| 4,05 | |

| 5,35 |

* 380 (i.e., 220 + 102 + 58)

SCHEDULE 13 – INTEREST AND DISCOUNT

Particulars | As on 31.3.2020 Current Year |

Interest and Discount | 34,37 |

Income on Investment | 1,15 |

Interest on RBI Deposit | 1,80 |

Others | Nil |

| 37,32 |

SCHEDULE 14 – OTHER INCOME

Particulars | As on 31.3.2020 Current Year |

Commission, Exchange | 8,20 |

And Brokerage |

|

Profit on Sale of Investment | 98 |

(Net) (1,10 – 12) |

|

| 9,18 |

SCHEDULE 15 – INTEREST EXPENDED

Particulars | As on 31.3.2020 Current Year |

Interest paid on Deposits | 12,25 |

Interest to RBI | 1,61 |

| 13,86 |

Q2) From the following information, prepare a Balance Sheet with necessary Schedules of the Citizen Bank Ltd. as on 31st March 2020 and ascertain Cash Reserves and Statutory Liquid Reserves required:

( in Lakhs)

Particulars | Dr. | Cr. |

Share Capital: 20,00,000 Shares of 10 each |

| 200.00 |

Statutory Reserves |

| 230.00 |

Net Profit before Appropriation |

| 150.00 |

Profit and Loss Account |

| 410.00 |

Fixed Deposit Accounts |

| 520.00 |

Saving Deposit Accounts |

| 450.00 |

Current Accounts |

| 520.00 |

Bills Payable | 30.00 | 1.00 |

Cash Credit |

| 110.00 |

Borrowing from other Banks | 813.00 |

|

Cash in hand | 160.00 |

|

Cash with RBI | 40.00 |

|

Cash with other Banks | 156.00 |

|

Money at call and Short Notice | 210.00 |

|

Gold | 55.00 |

|

Government Securities | 110.00 |

|

Premises | 156.00 |

|

Furniture | 70.00 |

|

Term Loan | 791.00 |

|

| 2,591.00 | 2,591.00 |

Additional Information:

Particulars | |

Bills for collection | 20,00,000 |

Acceptances and endorsements | 15,00,000 |

Claims against the bank not acknowledged as debts | 60,000 |

Depreciation charges: Premises | 1,00,000 |

Furniture | 80,000 |

50% of the Term Loan is secured by Government Guarantees. 10% of Cash Credit is unsecured.

A2)

Particulars | As on 31.3.2020 Current Year Lakhs |

For Other Bank: |

|

Authorized Capital: …… | — |

Shares of 10 each |

|

Subscribed Called-up and |

|

Paid-up capital: |

|

20,00,000 shares of 10 each | 200.00 |

| 200.00 |

SCHEDULE 1: CAPITAL

SCHEDULE 2: RESERVES & SURPLUS

Particulars | As on 31.3.2020 Current Year Lakhs |

Add: Additions during the year (20% of 150 lakh) Less: Deduction during the year

II. Capital Reserves III. Share Premium IV. Revenue and Other Reserves V. Balance in Profit and Loss A/c |

230.00 30.00 |

260.00 Nil | |

260.00 — — 530.00 | |

790.00 |

SCHEDULE 3: DEPOSITS

Particulars | As on 31.3.2020 Current Year Lakhs |

II. Saving Bank Deposits III. Term Deposits, i.e., Fixed Deposit Account Total | 520.00

450.00 520.00 |

1490.00 |

SCHEDULE 4: BORROWINGS

Particulars | As on 31.3.2020 Current Year Lakhs |

(i) Reserve Bank of India (ii) Other Bank (iii) Other Institutions and Agencies II. Borrowings Outside India Total |

— 110.00 —

— |

SCHEDULE 5: CASH AND BALANCES WITH RBI

Particulars | As on 31.3.2020 Current Year Lakhs |

Total | 160.00 40.00 |

200.00 |

SCHEDULE 6: BALANCE WITH BANKS AND MONEY AT CALL AND SHORT NOTICE

Particulars | As on 31.3.2020 Current Year Lakhs |

(i) Balance with Bank (i.e., Cash with other Banks) (ii) Money at Call and Short Notice II. Borrowings Outside India Total |

156.00

210.00 — |

366.00 |

SCHEDULE 7: INVESTMENTS

Particulars | As on 31.3.2020 Current Year Lakhs |

(i) Govt. Securities (ii) Other, i.e., Gold II. Borrowings Outside India Total | — 110.00 55.00 — |

165.00 |

SCHEDULE 8: ADVANCES

Particulars | As on 31.3.2020 Current Year Lakhs |

II. Cash Credit, Overdrafts and Loans Payable on Demand: Cash Credits Overdrafts III. Term Loans Total B. I. Secured by Tangible Assets (90% of 813 + 50% of 791) II. Covered by Bank/Govt. Guarantors (50% of 791) III. Unsecured (10% of 813 + 100% of 30) Total |

813.00 |

30.00 | |

791.00 | |

1,634.00 | |

1,127.20 | |

395.50 | |

111.30 |

SCHEDULE 9: FIXED ASSETS

SCHEDULE 9: FIXED ASSETS

Particulars | As on 31.3.2020 Current Year Lakhs |

Total | 156.00

70.0.0 |

226.00 |

SCHEDULE 10: OTHER ASSETS

Particulars | As on 31.3.2020 Current Year Lakhs |

Total | — — —

— — — |

— |

SCHEDULE 11: CONTIGENT LIABILITIES

Particulars | As on 31.3.2020 Current Year Lakhs |

Total | 0.60

15.00 |

15.60 |

Notes: (i) Net Profit to be transferred to Statutory Reserve as per Sec. 17: 20% of Net Profit, i.e., 150 lakhs

× 20/100 = 30 lakhs. Thus, the Balance of Profit and Loss Account which is transferred to Balance Sheet:

= Opening Balance + Net Profit – Statutory Reserve

= 410 + 150 – 30 lakhs

= 530 lakhs

(ii) It has been assumed that 90% of the Cash Credit and 50% of the Term Loans are fully secured by tangible assets.

Q3) From the following particulars, prepare the final accounts of Barnali Bank Ltd.:

Balance Sheet as on 31st March 2020

Particulars | Dr. | Cr. |

Share Capital: |

|

|

1,00,000 Shares of 10 each, 5 paid up |

| 5,00,000 |

Reserve Fund |

| 10,00,000 |

Fixed Deposits |

| 20.00,000 |

Savings Bank Deposits |

| 30,00,000 |

Current Accounts |

| 70,00,000 |

Borrowed from Bank |

| 2,00,000 |

Investments | 30,00,000 |

|

Premises | 12,00,000 |

|

Cash in hand | 60,000 |

|

Cash at bank | 28,00,000 |

|

Money at Call and Short Notice | 3.00,000 |

|

Interest Accrued and Paid | 2,00,000 |

|

Salaries | 80,000 |

|

Rent | 30,000 |

|

Profit and Loss Account (1.4.08) |

| 1,60,000 |

Gross Profit for the year |

| 4,50,000 |

Bills Discounted | 5,00,000 |

|

Bills Payable |

| 8,00,000 |

Loans, Advances, Overdrafts and Cash Credits | 70,00,000 |

|

Unclaimed Dividend |

| 30,000 |

Sundry Creditors |

| 30,000 |

| 1,51,70,000 | 1,51,70,000 |

The Bank has the bills for 14,00,000 as collection for its constituents and also acceptances and endorsements for them amounting to 4,00,000.

A3)

In the Books of Barnali Bank Ltd.

Profit & Loss Account for the year ended 31st March 2020

Particulars | Schedule No. | As on 31.3.14 Current Year | |

I. Income |

|

|

|

Interest Earned |

| 13 | 4,50,000 |

Other Incomes |

| 14 | — |

| Total |

|  4,50,000 |

II. Expenditure |

|

|  |

Interest Expended |

| 15 | 2,00,000 |

Operating Expenses |

| 16 | 1,10,000 |

Provision and Contingencies |

| — | Nil |

| Total |

|  3,10,000 |

III. Profit/Loss |

|

|

|

Net Profit/Loss for the Year (I – II) |

|

| 1,40,000 |

Profit/Loss brought forward |

|

| 1,60,000 |

| Total |

|  3,00,000 |

IV. Appropriations |

|

|  |

Transfer to Statutory |

|

| 28,000 |

Reserve (20% of Net Profit) |

|

|

|

Balance carried over to Balance Sheet |

|

| 2,72,000 |

| Total |

|  3,00,000 |

Balance Sheet of Barnali Bank Ltd. as at 31st March 2020

Balance Sheet of Barnali Bank Ltd. as at 31st March 2020

Particulars | Schedule No. | As on 31.3.14 Current Year Lakhs |

Capital and Liabilities |

|

|

Capital | 1 | 5,00,000 |

Reserves and Surplus | 2 | 13,00,000 |

Deposits | 3 | 1,20,00,000 |

Borrowings | 4 | 2,00,000 |

Other Liabilities and Provisions | 5 | 8,60,000 |

Total |

|  1,48,60,000 |

Assets |

|  |

Cash and Balance with RBI | 6 | 60,000 |

Balance with another Bank | 7 | 31,00,000 |

And Money at Call and Short Notice |

|

|

Investments | 8 | 30,00,000 |

Advances | 9 | 75,00,000 |

Fixed Assets |

| 10 | 12,00,000 |

Other Assets |

|

| — |

| Total |

|  1,48,60,000 |

Contingent Liabilities |

| 11 |  4,00,000 |

Bills for Collection |

| 12 | 4,50,000 |

SCHEDULE 1: CAPITAL

Particulars | As on 31.3.2020 Current Year Lakhs | |

Authorized Capital: |

|

|

…… Shares of 10 each |

|

|

Called-up Capital |

| 5,00,000 |

1,00,000 Shares of 10 each, 5 paid-up |

|

|

| Total | 5,00,000 |

SCHEDULE 2: RESERVES & SURPLUS

Particulars | As on 31.3.2020 Current Year Lakhs |

Statutory Reserve: | 10,00,000 |

Opening Balance |

|

Add: Transfer from current year’s |

|

Profit | 28,000 |

Capital Reserve | — |

Profit & Loss Account | 2,72,000 |

Total | 13,00,000 |

SCHEDULE 4: BORROWINGS

Particulars | As on 31.3.2020 Current Year Lakhs | |

Borrowings in India: |

|

|

(1) RBI |

| — |

(2) Others |

| — |

Borrowings outside India |

| 2,00,000 |

| Total | 2,00,000 |

SCHEDULE 5: OTHER LIABILITIESAND PROVISIONS

Particulars | As on 31.3.2020 Current Year Lakhs |

Bills Payable Others (including Provisions): Sundry Creditors Unclaimed Dividends Total | 8,00,000

30,000 30,000 |

8,60,000 |

SCHEDULE 6: CASHAND BALANCE WITH RBI

SCHEDULE 6: CASHAND BALANCE WITH RBI

Particulars | As on 31.3.2020 Current Year Lakhs | |

Demand Deposits: |

|

|

(1) From Banks |

| 70,00,000 |

(2) From Others |

| — |

Savings Bank Deposits |

|

|

Term Deposits: |

|

|

(1) From Banks |

| 30,00,000 |

(2) From Others |

| 20,00,000 |

| Total | 1,20,00,000 |

SCHEDULE 7: BALANCE WITH BANK AND MONEY AT CALL AND SHORT NOTICE

SCHEDULE 7: BALANCE WITH BANK AND MONEY AT CALL AND SHORT NOTICE

Particulars | As on 31.3.2020 Current Year Lakhs |

In India (i) Balances with bank (a) in Current Accounts (b) in Other Deposit Accounts (ii) Money at Call and Short Notice Outside India Total |

28,00,000 — — 3,00,000 — |

31,00,000 |

SCHEDULE 8: INVESTMENTS

Particulars | As on 31.3.2020 Current Year Lakhs | |

Investment in India |

| 30,00,000 |

Investment outside India |

| — |

| Total | 30,00,000 |

SCHEDULE 9: ADVANCES

Particulars | As on 31.3.2020 Current Year Lakhs |

Bills Discounted and Purchased |

|

Cash Credits, Overdrafts and Loans | 5,00,000 |

Payable on demand | 70,00,000 |

Term Loans | — |

75,00,000 | |

Total |

SCHEDULE 10: FIXED ASSETS

Particulars | As on 31.3.2020 Current Year Lakhs | |

1. Premises |

| 12,00,000 |

2. Other Fixed Assets |

| — |

| Total | 12,00,000 |

SCHEDULE 11: CONTINGENTLIABILITIES

Particulars | As on 31.3.2020 Current Year Lakhs |

Acceptances, Endorsements and Other Obligations Total |

4,00,000 |

4,00,000 |

SCHEDULE 12: INTEREST EARNED

Particulars | As on 31.3.2020 Current Year Lakhs |

Bills Discounted and Purchased Interest and Discount Received Total |

4,50,000 |

4,50,000 |

SCHEDULE 13: INTEREST EXPENDED

Particulars | As on 31.3.2020 Current Year Lakhs | |

Interest on Deposits |

| — |

Interest on RBI/Inter-bank |

| 2,00,000 |

Borrowings |

|

|

Others |

| — |

| Total | 2,00,000 |

SCHEDULE 14: OPERATING EXPENSES

SCHEDULE 14: OPERATING EXPENSES

Particulars | As on 31.3.2020 Current Year Lakhs |

Bills Discounted and Purchased |

|

Payment to and Provision for Employees |

80,000 |

Rent, Taxes and Lighting | 30,000 |

Total | 1,10,000 |

Q4)

From the following information, prepare the Profit and Loss A/c of Trinity Bank Ltd. for the year ended 31st March 2020.

Particulars | |

Interest on Loan | 25,90,000 |

Interest on Fixed Deposits | 27,50,000 |

Rebate on Bills Discounted | 4,90,000 |

Commission | 82,000 |

Establishment Charges | 5,40,000 |

Discount on Bills Discounted (Net) | 14,60,000 |

Interest on Cash Credits | 22,30,000 |

Interest on Current Account | 4,20,000 |

Rent and Rates | 1,80,000 |

Interest on Overdraft | 15,40,000 |

Director’s Fees | 30,000 |

Auditor’s Fees | 12,000 |

Interest on Saving Bank Deposits | 6,80,000 |

Postage and Telegrams | 14,000 |

Printing and Stationery | 29,000 |

Sundry Charges | 17,000 |

(A) Bad debts to be written off amounted to 4,00,000

(B) Provision for taxation may be made at 55% of net profit. Show your workings.

A4)

Form B

Profit and Loss Account for the year ended 31st March 2020

Profit and Loss Account for the year ended 31st March 2020

Particulars | Schedule | ||

II. Expenditure Interest Expended Operating Expenses Provisions and Contingencies

III. Profit: Net profit for the year

IV. Appropriations: Transfer to Statutory Reserve (20%) Transfer to other Reserves Proposed Dividend Balance carried over to Balance Sheet |

Total

Total

Total

Total |

13 |

73,30,000 |

14 | 82,000 | ||

|  74,12,000 | ||

15 | 38,50,000 | ||

| 12,22,000 | ||

| 12,87,000 | ||

| 63,59,000 | ||

| 10,53,000 | ||

| 10,53,000 | ||

| 2,10,600 | ||

| — | ||

| — | ||

| 8,42,400 | ||

|  10,53,000 | ||

Note: As particulars given in the question are not balances, it has been assumed that Rebate on Bills discounted is yet to be adjusted and hence it has been deducted from discount on bills discounted.

Note: As particulars given in the question are not balances, it has been assumed that Rebate on Bills discounted is yet to be adjusted and hence it has been deducted from discount on bills discounted.

SCHEDULE 13: INTEREST EARNED

Particulars | |

Interest Discount (Refer to W.N.) Total | 73,30,000 |

73,30,000 |

SCHEDULE 14: OTHER INCOME

Particulars | |

Commission, Exchange and Brokerage Total | 82,000 |

82,000 |

SCHEDULE 15: INTEREST EXPENDED

Particulars | |

Total | 5,40,000 1,80,000 30,000 12,000 14,000 29,000 17,000 4,00,000 12,22,000 |

Working Notes:

- Interest/Discount is calculated as follows

Particulars | |

Interest on Loans | 25,90,000 |

Interest on Cash Credit | 22,30,000 |

Interest on Overdraft | 15,40,000 |

Discount on Bills (Net) | 14,60,000 |

|  78,20,000 |

Less: Rebate on Bills Discounted | 4,90,000 |

Total |  73,30,000 |

|

|

II. Provision for taxation at 55% is calculated as follows

= 74,12,000 – 50,72,000 = 23,40,000

Tax provision = 23,40,000 × 55/100 = 12,87,000/-

Q5) From the following details, prepare the profit and loss account of Triveni Bank Ltd. for the year ended 31st March, 2020.

Particulars | |

Interest paid on deposits, borrowings etc. | 79,26,660 |

Interest and discount | 1,83,74,725 |

Rentals received | 78,000 |

Net profit on sale of investments | 2,27,000 |

Salaries, allowances, bonus and provident fund

| 97,79,925 |

(Including remuneration of the Chairman and |

|

Managing Director) |

|

Commission and brokerage | 42,00,000 |

Law charges | 72,000 |

Rates and taxes | 46,300 |

Postage and telegrams | 3,26,070 |

Audit fees | 60,000 |

Director’s fees | 36,000 |

Printing and stationery | 2,92,000 |

Depreciation on Bank’s property | 8,20,000 |

Miscellaneous receipts | 40,006 |

Miscellaneous expenditure | 1,65,406 |

Repairs to property | 32,400 |

Telephones and stamps | 4,83,200 |

Advertisement | 2,76,000 |

Insurance and lighting | 3,45,000 |

Bad debts written off | 72,700 |

Unexpired discount (1st April, 2019) | 5,70,000 |

Provision for bad debts (1st April, 2019) | 16,10,000 |

Provision for taxation (1st April, 2019) | 24,00,000 |

During the year Income Tax proceedings of the previous years were concluded and the liability on this account worked out to 22,40,000

The Bank has made an evaluation at the end of the year of the recoverability of its advances and finds itself in the following position:

(a) Unsecured advances to the extent of 60,000 would be full irrecoverable.

(b) Unsecured loans to the extent of 40,00,000 would be doubtful of recovery to the extent of 40%.

(c) Cash credit accounts to the extent of 25,00,000 have been left without the margin due to fall in the value of securities and the accounts to the extent of 10% are likely to become bad.

It is the Bank’s policy to provide fully against the contingency of bad debts. Provision for taxation to remain at 55% of the current profits.

Unexpired discount and interest on bills discounted as on 31st March, 2020 was 7,25,000.

A5)

In the Books of Triveni Bank

Profit and Loss A/c for the year ended 31st March 2020

Profit and Loss A/c for the year ended 31st March 2020

Particulars | Schedule No. | Year ended 31-3-2020 | |

Interest Earned Other Income

II. Expenditure Interest Expended Operating Expenses Provisions of Contingencies

III. Profit/Loss Net Profit/Loss (-) for the year Profit/Loss (-) brought forward |

Total

Total

Total |

13 |

1,82,19,725 |

14 | 45,45,006 | ||

| 2,27,64,731 | ||

15 | 79,26,660 | ||

16 | 1,27,34,301 | ||

| 11,64,789 | ||

| 2,18,25,750 | ||

| 9,38,981 | ||

| 10,00,000 | ||

| 19,38,981 | ||

Q6)

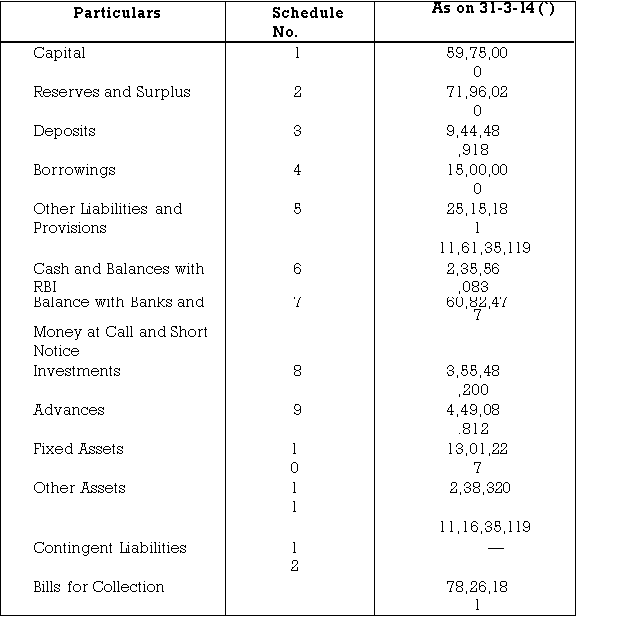

After writing up the Profit and Loss Account, the General Ledger Balances of S.S. Bank Ltd. as on 31st March, 2020 were as under:

Particulars | |

Share Capital | 59,75,000 |

Bills for Collection | 78,26,181 |

Cash in hand | 1,05,30,783 |

Machinery acquired in satisfaction of a claim | 45,600 |

Cash with RBI | 1,30,25,300 |

Cash with SBI | 50,11,837 |

Equity Shares of ACC Ltd. | 3,81,700 |

4% Govt. Of India Loan, 2007-08 of face value 3,00,000 | 2,40,90,000 |

Bengal Govt. Loan Bonds, 2003 of the face value 75,00,000 | 70,30,400 |

Punjab Govt. Loan Bonds, 2010 of the face value 38,00,000 | 39,56,100 |

Interest accrued on Investments | 1,80,720 |

Profit for the year | 11,30,240 |

Reserve Fund as on 1st April, 2013 | 57,75,000 |

Unpaid dividend | 30,700 |

Debenture | 90,000 |

Borrowings from other Banks | 15,00,000 |

Fixed Deposits | 3,00,60,520 |

Saving Bank Deposits | 2,60,97,616 |

Current Deposits | 3,82,90,782 |

Provision for Taxation | 10,00,000 |

Provision for Doubtful Debts | 5,00,000 |

Balances with other Banks in Current A/c | 10,70,640 |

Loans, Cash Creditors, Overdrafts | 3,96,70,682 |

Bills Payable | 4,77,679 |

Staff Provident Fund | 9,60,785 |

Sundry Creditors | 25,607 |

Unexpired Discount | 20,410 |

Bills Discounted and Purchased | 57,70,577 |

Building | 11,70,577 |

Furniture | 1,30,650 |

Dividend Recoverable | 12,000 |

Profit and Loss A/c credit balance brought forward from the previous year was 12,60,780 out of which appropriations made were 3,58,000 for dividend and 6,12,000 for taxes paid.

The following further information is relevant:

(a) The Authorized Share Capital of the Bank was 1,00,00,000 divided into shares of 100 each, out of which 75,000 shares were issued and subscribed with 80 per share called up.

(b) During the year, additions of 1,20,077 were made to building and 29,620 to furniture, while 7,600 realized on sale of a part of furniture (Book value 7,600). Depreciation on furniture to 31st March 1998 was 30,600 and that on Building was 1,40,500.

Prepare the Balance Sheet of the Banks as on 31st March 2020.

A6)

S.S. Bank Ltd.

Balance Sheet as on 31st March 2020

Balance Sheet as on 31st March 2020

SCHEDULE 1: CAPITAL

Particulars | As on 31.3.2020 |

Authorized Capital (1,00,000 shares |

|

Of 100/- each) |

|

Issued, Subscribed and Called-up Capital | 1,00,00,000 |

75,000 shares of 100/- | 60,00,000 |

Each 80/- called up |

|

Less: Calls in Arrears | 25,000 |

Total | 59,75,000 |

SCHEDULE 2: RESERVESAND SURPLUS

Particulars | As on 31.3.2020 |

Add: Additions during the year (i.e., 20% of 11,3,240) II. Balance in Profit and Loss A/c Total |

57,75,000 2,26,048 60,01,048 11,94,972 |

SCHEDULE 3: DEPOSITS

Particulars | As on 31.3.2020 |

Total | 3,00,60,520 2,60,97,616 3,82,90,782 |

9,44,48,918 |

SCHEDULE 4: BORROWINGS

Particulars | As on 31.3.2020 |

Borrowings from other Banks Total | 15,00,000 |

15,00,000 |

SCHEDULE 5: OTHER LIABILITIES AND PROVISIONS

Particulars | As on 31.3.2020 | |

Bills Payable |

| 4,77,679 |

Staff Provident Fund |

| 9,60,785 |

Sundry Creditors |

| 25,607 |

Unexpired Discounts |

| 20,410 |

Unpaid Dividend |

| 30,700 |

Provision for Taxation |

| 10,00,000 |

| Total | 25,15,181 |

SCHEDULE 6: CASH AND BALANCES WITH RBI

Particulars | As on 31.3.2020 |

Total | 1,05,30,783 1,30,25,300 |

2,35,56,083 |

SCHEDULE 7: BALANCES WITH BANKS AND MONEY AT CALL AND SHORT NOTICE

Particulars | As on 31.3.2020 |

Total | 50,11,837 NIL

10,70,640 |

60,82,477 |

SCHEDULE 8: INVESTMENTS

Particulars | As on 31.3.2020 |

Total | 3,81,700

2,40,90,000

70,30,400

39,56,100 90,000 |

3,55,48,2000 |

SCHEDULE 9: ADVANCES

Particulars | As on 31.3.2020 |

Total | 3,91,70,682 57,38,130 |

SCHEDULE 10: FIXED ASSETS

Particulars | As on 31.3.2020 |

Building At Cost as on 31-3-97 Add: Addition during the year Less: Depreciation Furniture As Cost as on 31-3-97 Add: Addition during the year

Less: Sales Depreciation

Total |

11,91,000 |

1,20,077 | |

13,11,077 | |

1,40,500 | |

11,70,577 | |

1,39,230 | |

29,620 | |

1,68,850 | |

7,600 | |

30,600 | |

1,30,650 | |

13,01,227 |

SCHEDULE 11: OTHER ASSETS

Particulars | As on 31.3.2014 |

Total | 1,80,720 12,000 45,600 |

2,38,320 |

Working Notes

Particulars |

Profit and Loss A/c 12,60,780 |

Profit as per last Balance Sheet 3,58,000 |

Less: Dividends 6,21,000 |

Tax 2,90,780 |

11,30,240 |

Add: Current Year Profit 14,21,020 |

Less: 20% of Current Year’s profit 2,26,048 |

Total 11,94,972 |

Q7) From the following balances extracted from the books of Tushar Bank Ltd., Akola, prepare the Profit and Loss Account for the year ended 31st March 2015 and the Balance Sheet as on that date.

Particulars | Rs. |

Current accounts | 1,60,00,000 |

Savings Accounts | 60,00,000 |

Fixed and time deposits | 19,00,000 |

Acceptances | 4,00,000 |

Unclaimed dividend | 60,000 |

Dividend 2013-2014 | 1,00,000 |

Profit and Loss A/c (Credit) on 1-4-2015 | 4,20,000 |

Reserve fund | 7,00,000 |

Share Capital: 20,000 shares of Rs. 50 each. | 10,00,000 |

Interest and discount received | 15,00,000 |

Interest paid | 4,00,000 |

Borrowings from other banks | 14,00,000 |

Money at call | 6,00,000 |

Investments (Market value Rs. 62,00,000) | 60,00,000 |

Premises (After depreciation upto 31-3-2014 Rs. 2,00,000) |

24,00,000 |

Sundry creditors | 60,000 |

Bills payable | 16,00,000 |

Bills for collection | 2,80,000 |

Salaries | 1,60,000 |

Rent and taxes | 40,000 |

Audit fee | 4,000 |

Printing | 10,000 |

General expenses | 6,000 |

Cash in hand | 1,20,000 |

Cash with R.B.I. | 30,00,000 |

Cash with other banks | 26,00,000 |

Bills discounted and purchased | 12,00,000 |

Loans, overdrafts and cash credits | 1,40,00,000 |

Adjustments :

1) Authorised share capital is Rs. 20,00,000 divided into 40,000 shares of Rs. 50 each.

2) Rebate on bills discounted amounted to Rs. 10,000.

3) Create a provision for taxation Rs. 2,00,000.

4) Provision for bad and doubtful debts is required to be made at Rs. 60,000.

5) Provide 5% depreciation on the original amount of premises.

A7) Tushar bank Ltd. Profit and Loss Account For the year ended 31st March 2015

Particulars | Schedule No. | Current Year | Previous Year | |

I. Income |

|

|

|

|

Interest earned |

| 13 | 14,90,000 | |

Other Income |

| 14 | Nil | |

| Total |

| 14,90,000 |

|

II. Expenditure |

|

|

|

|

Interest expended |

| 15 | 4,00,000 | |

Operating expenses |

| 16 | 3,50,000 | |

Provision (tax) |

|

| 2,00,000 | |

Other provisions |

|

| 60,000 | |

|

|

|

|

|

| Total |

| 10,10,000 |

|

Working Details :

Schedule No. 1 : Capital

Particulars | Current Year | Previous Year |

Authorised Capital 40,000 shares of Rs. 50 each Issued Capital 20,000 shares of Rs. 50 each fully paid Total |

20,00,000

10,00,000 |

|

10,00,000 |

|

Schedule No. 2 : Reserve and Surplus

Particulars | Current Year | Previous Year | |

Reserve Fund | 7,00,000 |

|

|

Add 20% addition | 96,000 | 7,96,000 | |

Balance of P & L Appropriation A/c. |

| 7,04,000 | |

| Total | 15,00,000 |

|

Schedule No. 3 : Deposits

Schedule No. 3 : Deposits

Particulars | As on 31-3-....... (Current Year) | Previous Year | |

Current Accounts |

| 1,60,00,000 |

|

Saving Account |

| 60,00,000 | |

Fixed and time deposits |

| 19,00,000 | |

| Total | 2,39,00,000 |

|

Schedule No. 4 : Borrowings

Particulars | As on 31-3-....... (Current Year) | Previous Year |

Borrowing from other Banks Total | 14,00,000 |

|

14,00,000 |

| |

|

|

Schedule No. 5 : Other Liabilities and Provisions

Particulars | Current Year | Previous Year | |

Unclaimed dividend |

| 60,000 |

|

Sundry Creditors |

| 60,000 | |

Bills payables |

| 16,00,000 | |

Rebate on bills discounted |

| 10,000 | |

Provision for taxation |

| 2,00,000 | |

| Total | 19,30,000 |

|

Schedule No. 6 : Cash in hand and with R.B.I.

Particulars | Current Year | Previous Year | |

Cash in hand |

| 1,20,000 |

|

Cash with R.B.I. |

| 30,00,000 | |

| Total | 31,20,000 |

|

|

|

|

|

Schedule No. 7

Balance with other Banks, Money at call & Short Notice.

Particulars | Current Year | Previous Year | |

Money at call |

| 6,00,000 |

|

Cash with other Banks |

| 26,00,000 | |

| Total | 32,00,000 |

|

|

|

|

|

Schedule No. 8 : Investments

Particulars | Current Year | Previous Year |

Investments (Market Value Rs. 6,20,000) Total | 60,00,000 |

|

60,00,000 |

| |

|

|

Schedule No. 9 : Advances

Particulars | Current Year | Previous Year |

Loans overdrafts & cash credits 1,40,00,000 Less : provision 60,000 Bills discounted and purchased Total |

1,39,40,000 12,00,000 |

|

1,51,40,000 |

|

Schedule No. 10 : Fixed Assets

Premises 24,00,000 Less : Depreciation 1,30,000 (5% on original cost) Total |

22,70,000 |

|

22,70,000 |

|

Schedule No. 11 : Other Assets

Total | Nil |

|

NIL |

|

Schedule No. 12 : Contingent Liabilities

Acceptances on behalf of customer Total | 4,00,000 |

|

4,00,000 |

|

Schedule No. 13 : Interest earned

Interest and Discount 15,00,000 Less Rebate on bill discount 10,000 Total |

14,90,000 |

|

14,90,000 |

|

Schedule No. 14 : Other Incomes

Total | Nil |

|

Nil |

|

Schedule No. 15 : Interest Expended

Interest Paid Total | 4,00,000 |

|

4,00,000 |

|

III. Profit/ Loss Profit brought forward Net profit for the year |

|

4,20,000 4,80,000 |

|

Total IV. Appropriations Transfer to Reserve fund Dividend for last year Balance C/d. Total |

| 9,00,000 |

|

|

96,000 1,00,000 7,04,000 |

| |

| 9,00,000 |

|

Form ‘A’

Balance Sheet of Tushar Bank Ltd.

As on 31-3-2015

Particulars | Schedule No. | Current Year | Previous Year |

Capital and Liabilities Capital Reserve and surplus Deposits Borrowings Other liabilities and provisions Total Assets Cash in hand and with R.B.I. Balance with other banks, money at call and short notice Investments Advances Fixed Assets Other Assets Total Contingent Liabilities Bills for collection |

1 |

10,00,000 |

|

2 | 15,00,000 | ||

3 | 2,39,00,000 | ||

4 | 14,00,000 | ||

5 | 19,30,000 | ||

| 2,97,30,000 |

| |

6 |

31,20,000 |

| |

7 | 32,00,000 | ||

8 | 60,00,000 | ||

9 | 1,51,40,000 | ||

10 | 22,70,000 | ||

11 | Nil | ||

| 2,97,30,000 |

| |

12 | 4,00,000 |

| |

-- | 2,80,000 |

Schedule No. 16 : Operating Expenses

Particulars | Current Year | Previous Year | |

Salaries |

| 1,60,000 |

|

Rentals Taxes |

| 40,000 | |

Audit Fees |

| 4,000 | |

Printing |

| 10,000 | |

General Expenses |

| 6,000 | |

Depreciation on Premises |

| 1,30,000 | |

| Total | 3,50,000 |

|

Q8) From the following balances of Mahindra Bank Ltd., as on 31st March 2015, prepare Profit and Loss A/c for the year ended 31st march 2008 and Balance sheet as on that date.

Particulars Equity share capital of Rs. 100 each | Rs. | |

Rs. 50 paid up (Authorised and Issued 40,000 shares) | 20,00,000 | |

Profit and Loss A/c (Cr. On 1-4-2014) | 8,00,000 | |

Current Deposit A/c | 68,20,000 | |

Fixed Deposit A/c | 78,00,000 | |

Saving Bank A/c | 51,30,000 | |

Director’s fees | 90,000 | |

Audit fees | 20,000 | |

Furniture (Cost Rs. 20,00,000) | 17,40,000 | |

Interest and discount received | 42,00,000 | |

Commission and exchange | 20,00,000 | |

Reserve fund | 7,00,000 | |

Printing and Stationery | 80,000 | |

Salary (including Manager’s Rs. 4,00,000) | 14,00,000 | |

Building (Cost Rs. 60,00,000) | 45,00,000 | |

Cash in hand | 3,20,000 | |

Cash with RBI | 70,00,000 | |

Cash with Other Bank | 65,00,000 | |

Law charges | 30,000 | |

Investment at cost | 24,00,000 | |

Loans, cash credit and overdraft | 60,00,000 | |

Bills discounted and purchased | 28,00,000 | |

Interest paid | 30,00,000 | |

Borrowing from Laxmi Bank Ltd. | 40,00,000 | |

Branch Adjustment A/c(Cr.) | 26,00,000 | |

Rent and Taxes | 1,70,000 | |

Following additional information is available:

1) The Bank has accepted on behalf of the customers bills worth Rs. 30,00,000 against the securities or Rs. 38,00,000 lodged with the Bank.

2) Rebate on bills discounted to Rs. 1,10,000

3) Provide depreciation on building by 10% and on furniture by 5% on cost.

4) Provide Rs. 30,000 for bad and doubtful debts.

A8)

Mahindra Bank Ltd.

Profit and Loss Account

For the year ended 31st March 2015

Particulars | Schedule No. | Current Year | Previous Year | |

Income |

|

|

|

|

Interest earned |

| 13 | 40,90,000 | |

Other Income |

| 14 | 20,00,000 | |

| Total |

| 60,90,000 |

|

Expenditure |

|

|

|

|

Interest expended |

| 15 | 30,00,000 | |

Operating expenses |

| 16 | 24,90,000 | |

Provisions |

|

| 30,000 | |

Other provisions |

|

|

| |

| Total |

| 55,20,000 |

|

Prof it /Loss Profit brought forward Net profit for the year |

|

8,00,000 5,70,000 |

|

Total Appropriations Transfer to Reserve fund Balance C/d. Total |

| 13,70,000 |

|

|

1,14,000 12,56,000 |

| |

| 13,70,000 |

|

Form ‘A’

Balance Sheet of Mahindra Bank Ltd.

As on 31-3-2015

Particulars | Schedule No. | Current Year | Previous Year | |

Capital and Liabilities Capital Reserve and surplus Deposits Borrowings Other liabilities and provisions

Assets Cash in hand and with R.B.I. Balance with other banks, money at call and short notice Investments Advances Fixed Assets Other Assets

Contingent Liabilities Bills for collection |

Total

Total |

1 |

20,00,000 |

|

2 | 20,70,000 | |||

3 | 1,97,50,000 | |||

4 | 40,00,000 | |||

5 | 27,10,000 | |||

| 3,05,30,000 |

| ||

6 |

73,20,000 |

| ||

7 |

65,00,000 | |||

8 | 24,00,000 | |||

9 | 87,70,000 | |||

10 | 55,40,000 | |||

11 | Nil | |||

| 3,05,30,000 |

| ||

12 | 30,00,000 |

| ||

--- | --- | |||

Working Details

Schedule No. 1 : Capital

Particulars | Current Year | Previous Year |

Authorised Capital 40000 shares of Rs. 1 00 each Issued and Paid up Capital 40000 shares of Rs. 1 00 each Rs. 50 paid Total |

40,00,000

20,00,000 |

|

20,00,000 |

| |

|

|

Schedule No. 2 : Reserve and Surplus

Particulars | Current Year | Previous Year | |

Reserve Fund Add 20% addition Balance of P & L Appropriation A/c. | 7,00,000 1,14,000 |

8,14,000 12,56,000 |

|

Total | |||

20,70,000 |

| ||

Schedule No. 3 : Deposits

Particulars | Current Year | Previous Year | |

Current Deposits A/c |

| 68,20,000 |

|

Fixed Deposit A/c |

| 78,00,000 | |

Saving Bank A/c |

| 51,30,000 | |

| Total | 1,97,50,000 |

|

Schedule No. 4 : Borrowings

Particulars | Current Year | Previous Year |

Borrowing from Laxmi Bank Ltd.

Total | 40,00,000 |

|

40,00,000 |

| |

|

|

Schedule No. 5 : Other Liabilities and Provisions

Particulars | Current Year | Previous Year | |

Branch Adjustment |

| 26,00,000 |

|

Rebate on bills discounted |

| 1,10,000 | |

| Total | 27,10,000 |

|

Schedule No. 6 : Cash in hand and with R.B.I.

Particulars | Current Year | Previous Year | |

Cash in hand |

| 3,20,000 |

|

Cash with R.B.I. |

| 70,00,000 | |

| Total | 73,20,000 |

|

Schedule No. 7

Balance with other Banks, Money at call & Short Notice.

Particulars | Current Year | Previous Year |

Cash with other Banks Total | 65,00,000 |

|

65,00,000 |

|

Schedule No. 8 : Investments

Particulars | Current Year | Previous Year |

Investments at Cost Total | 24,00,000 |

|

24,00,00 |

| |

|

|

Schedule No. 9 : Advances

Particulars | Current Year | Previous Year | |

Loan Cash Credit and overdrafts |

60,00,000 |

|

|

Less : Provision | 30,000 | 59,70,000 | |

Bills discounted and purchased |

Total | 28,00,000 | |

| 87,70,000 |

| |

|

| ||

Schedule No. 10 : Fixed Assets

Particulars | Current Year | Previous Year | |

Furniture at cost | 20,00,000 |

|

|

Less : Depreciation upto date Building at cost | 3,60,000 | 16,40,000 | |

60,00,000 | |||

Less Dep. Upto date | 21,00,000 | 39,00,000 | |

| Total | 55,40,000 |

|

Schedule No. 11 : Other Assets

Particulars | Current Year | Previous Year |

Total | Nil |

|

Nil |

|

Schedule No. 12 : Contingent Liabilities

Particulars | Current Year | Previous Year |

Acceptances on behalf of customers Total | 30,00,000 |

|

30,00,000 |

|

Schedule No. 13 : Interest earned

Particulars | Current Year | Previous Year | |

Interest and Discount Received 42,00,000 Less Rebate on bill discounted 1,10,000 |

40,90,000 |

| |

| Total | 40,90,000 |

|

Schedule No. 14 : Other Incomes

Particulars | Current Year | Previous Year |

Commission and Exchange Total | 20,00,000 |

|

20,00,000 |

|

Schedule No. 15 : Interest Expended

Particulars | Current Year | Previous Year |

Interest Paid Total | 30,00,000 |

|

30,00,000 |

|

Schedule No. 16 : Operating Expenses

Particulars | Current Year | Previous Year | |

Directors fees |

| 90,000 |

|

Audit fees |

| 20,000 | |

Printing and Stationery |

| 80,000 | |

Managers Salary |

| 4,00,000 | |

Staff Salary |

| 10,00,000 | |

Law Charges |

| 30,000 | |

Rent and Taxes |

| 1,70,000 | |

Depreciation on Furniture |

| 1,00,000 | |

Depreciation on Building |

| 6,00,000 | |

| Total | 24,90,000 |

|

Q9) The following is the Trial Balance of Lalu Bank Ltd.,

As on March 31st 2015

Particulars | Rs. | Particulars | Rs. |

Loans, cash credits |

| Share Capital : 50,000 equity shares of Rs. 100 each fully paid Reserve Fund Current Deposit Fixed Deposit Savings Bank Deposit Profit & Loss A/c (1-4-2014) Interest and Discount Recurring Deposits |

|

And Overdrafts | 28,50,000 |

| |

Premises | 5,00,000 |

| |

Indian Government Securities | 41,70,000 | 50,00,000 | |

Salaries | 2,80,000 | 25,00,000 | |

General Expenses | 2,74,000 | 10,00,000 | |

Rent, Rates and Taxes | 23,000 | 12,50,000 | |

Director’s Fees | 18,000 | 5,00,000 | |

Stock of Stationery | 85,000 |

| |

Bill Purchased and Discounted | 4,60,000 | 1,60,000 | |

Shares | 5,00,000 | 12,80,000 | |

Cash in hand and with |

| 2,00,000 | |

Reserve Bank | 19,30,000 |

| |

Money at call and short notice | 8,00,000 |

| |

| 1,18,90,000 |

| 1,18,90,000 |

The following information should be considered :

a) Provision for bad and doubtful debts is required, amounting to Rs. 50,000

b) Interest accrued on investments was Rs. 80,000

c) Unexpired discount amounts of Rs. 3,800

d) Endorsement made on behalf of customers totalled Rs. 11,50,000

e) Authorised capital was 80,000 equity shares of Rs. 100 each,

f) Rs. 1,00,000 were added to the premises during the year. Depreciation at 5% on the opening balance is required,

g) Market Value of Indian Government Securities was Rs. 39,00,000 Prepare Profit and Loss Account for the year ended 31st March 2015 and

Balance Sheet as on that date in the prescribed form.

A9) Lalu Bank Ltd.

Profit and Loss Account

For the year ended 31st March 2015

Particulars | Schedule No. | Current Year | Previous Year | |

I. Income |

|

|

|

|

Interest earned |

| 13 | 13,56,200 | |

Other Income |

| 14 | Nil | |

| Total |

| 13,56,200 |

|

Expenditure |

|

|

|

|

Interest expended |

| 15 | Nil | |

Operating expenses |

| 16 | 6,15,000 | |

Provisions |

|

| 50,000 | |

Other provisions |

|

| -- | |

| Total |

| 6,65,000 |

|

Profit and Loss |

|

|

|

|

Profit brought forward |

| 1,60,000 | ||

Net profit for the year |

| 6,91,200 | ||

| Total |

| 8,51,200 |

|

Appropriations |

|

|

|

|

Transfer to Reserve fund |

| 1,38,240 | ||

Balance C/d. |

| 7,12,960 | ||

| Total |

| 8,51,200 |

|

Form ‘A’

Balance Sheet of Lalu Bank Ltd.

For the year ended on 31st March, 2015

Particulars | Schedule No. | Current Year | Previous Year |

Capital and Liabilities Capital Reserve and surplus Deposits Borrowings Other liabilities and provisions Total Assets Cash in hand and with R.B.I. Balance with other banks, money at call and short notice Investments Advances Fixed Assets Other Assets Total Contingent Liabilities Bills for collection |

1 |

50,00,000 |

|

2 | 33,51,200 | ||

3 | 29,50,000 | ||

4 | Nil | ||

5 | 3,800 | ||

| 1,13,05,000 |

| |

6 |

19,30,000 |

| |

7 |

8,00,000 | ||

8 | 46,70,000 | ||

9 | 32,60,000 | ||

10 | 4,80,000 | ||

11 | 1,65,000 | ||

| 1,13,05,000 |

| |

12 | 11,50,000 |

| |

--- | --- |

Working Details

Schedule No. 1 : Capital

Particulars | Current Year | Previous Year |

Authorised Capital |

|

|

80000 shares of Rs. 100 each | 80,00,000 | |

Issued and Paid up Capital |

| |

50000 shares of Rs. 1 00 each Fully paid | 50,00,000 | |

Total | 50,00,000 |

|

|

|

|

Schedule No. 2 : Reserve and Surplus

Particulars | Current Year | Previous Year | |

Reserve Fund | 25,00,000 |

|

|

Add 20% addition | 1,38,240 | 26,38,240 | |

Balance of P & L Appropriation A/c. |

| 7,12,960 | |

| Total | 33,51,200 |

|

Schedule No. 3 : Deposits

Particulars | Current Year | Previous Year | |

Current Deposits A/c |

| 10,00,000 |

|

Fixed Deposit A/c |

| 12,50,000 | |

Saving Bank A/c |

| 5,00,000 | |

Recurring Deposits |

| 2,00,000 | |

| Total | 29,50,000 |

|

Schedule No. 4 : Borrowings

Total | Nil |

|

Nil |

|

Schedule No. 5 : Other Liabilities and Provisions

Particulars | Current Year | Previous Year |

Unexpired Discount Total | 3,800 |

|

3,800 |

|

Schedule No. 6 : Cash in hand and with R.B.I.

Particulars | Current Year | Previous Year |

Cash in hand and with R.B.I. Total | 19,30,000 |

|

19,30,000 |

|

Schedule No. 7

Balance with other Banks. Money at call & Short Notice.

Particulars | Current Year | Previous Year |

Money at call and short notice Total | 8,00,000 |

|

8,00,000 |

|

Schedule No. 8 : Investments

Particulars | Current Year | Previous Year |

Indian Government securities (Market value 39, 00, 000) Shares Total |

41,70,000 5,00,000 |

|

46,70,000 |

|

Schedule No. 9 : Advances

Loan Cash Credit and overdrafts | 28,50,000 |

|

|

Less : Provision | 50,000 | 28,00,000 | |

Bills discounted and purchased |

| 4,60,000 | |

| |||

| Total | 32,60,000 |

|

Schedule No. 10 : Fixed Assets

Premises Opening bal. Add : Addition during year | 4,00,000 1,00,000 |

4,80,000 |

|

Less : Dep.on Op. Baol. 5% | 5,00,000 20,000 | ||

| Total | 4,80,000 |

|

Schedule No. 11 : Other Assets

Stock of Stationery Interest accrued on Investment Total | 85,000 80,000 |

|

1,65,000 |

|

Schedule No. 12 : Contingent Liabilities

Endorsement on behalf of customers Total | 11,50,000 |

|

11,50,000 |

|

Schedule No. 13 : Interest earned

Interest and Discount | 12,80,000 |

|

|

Less : Unexpired Discount | 3,800 | 12,76,200 | |

Interest on Investment |

| 80,000 | |

| Total | 13,56,200 |

|

Schedule No. 14 : Other Incomes

Particulars | Current Year | Previous Year |

Total | Nil |

|

Nil |

|

Schedule No. 15 : Interest Expended

Particulars | Current Year | Previous Year |

Total | Nil |

|

Nil |

|

Schedule No. 16 : Operating Expenses

Particulars | Current Year | Previous Year | |

Depreciation on Premises |

| 20,000 |

|

Salaries |

| 2,80,000 | |

General Expenses |

| 2,74,000 | |

Rent. Rate and Taxes |

| 23,000 | |

Director Fees |

| 18,000 | |

| Total | 6,15,000 |

|

Q10) From the following balances extracted from the books of Karodpati Bank Ltd, Solapur prepare the Profit & Loss Account for the year ended 31st March, 2015 and the Balance Sheet as on that date.

Particulars Salaries and allowances (including remuneration to General Manager Rs. 9,00,000 and Director’s Fees | Rs. | ||

Rs. 1,00,000) | 25,00,000 | ||

Sundry expenses | 1,50,000 | ||

Interest paid on deposits | 21,25,000 | ||

Commission, exchange (credit) | 17,00,000 | ||

Interest and discount received | 48,00,000 | ||

Statutory Reserved fund | 20,00,000 | ||

Deposits : | a) Fixed | 87,50,000 | |

| b) Savings | 60,00,000 | |

| c) Current | 90,00,000 | |

Loans, cash-credits and over drafts | 2,30,00,000 | ||

Bills discounted and purchased | 15,00,000 | ||

Investment fluctuation fund | 5,00,000 | ||

Cash in hand | 17,50,000 | ||

Cash with RBI | 25,00,000 | ||

Cash with Vijay Bank Ltd. | 2,50,000 | ||

4% Government securities | 60,00,000 | ||

Silver | 5,00,000 | ||

Gold | 21,00,000 | ||

Bills for collection | 10,00,000 | ||

Interest accrued on investments | 3,00,000 | ||

Acceptances, endorsements and other obligations | 20,00,000 | ||

Profit and Loss account (credit balance on 1-4-2007) | 30,00,000 | ||

Shares in Telco Co. Ltd. | 10,00,000 | ||

Interim divided paid | 3,00,000 | ||

Drafts payable | 8,00,000 | ||

Share capital (authorised and issued) 2,00,000 shares or Rs. 100 each Rs. 50 paid |

10,00,000 | ||

Rent and taxes paid | 2,00,000 | ||

Premises | 25,00,000 | ||

Furniture and fixtures | 7,50,000 | ||

Provident fund | 8,00,000 | ||

Rebate on bills discounted | 75,000 | ||

Unclaimed dividend | 1,00,000 | ||

Adjustments :

- Provide Rs. 4,00,000 for taxation and Rs. 2,50,000 for bad and doubtful debts.

- Rebate on bills discounted is over calculated by Rs. 25,000

- An interim dividend declared was at 4% actual.

- The market value of 4% Govt. Securities on 31-3-2008 was Rs. 58,25,000 and was to be shown at this figure in the B/S.

- Current Accounts include Rs. 4,00,000 debits balance being overdraft.

A10)

Karodpati bank Ltd.

Profit and Loss Account

For the year ended 31st March 2008

Particulars | Schedule No. | Current Year | Previous Year | |

Income |

|

|

|

|

Interest earned |

| 13 | 48,25,000 | |

Other Income |

| 14 | 17,00,000 | |

| Total |

| 65,25,000 |

|

Expenditure |

|

|

|

|

Interest expended |

| 15 | 21,25,000 | |

Operating expenses |

| 16 | 28,50,000 | |

Provisions |

|

| 2,50,000 | |

Other provisions |

|

| 4,00,000 | |

| Total |

| 56,25,000 |

|

Profit /Loss |

|

|

|

|

Profit brought forward |

| 30,00,000 | ||

Net profit for the year |

| 9,00,000 | ||

| Total |

| 39,00,000 |

|

Appropriations |

|

|

|

|

Transfer to Reserve fund |

| 1,80,000 | ||

Interim Dividend | 3,00,000 |

| ||

Add : outstanding | 1,00,000 | 4,00,000 | ||

Balance C/d. |

| 33,20,000 | ||

| Total |

| 39,00,000 |

|

|

|

|

|

|

Form ‘A’

Balance Sheet of Lalu Bank Ltd.

As on 31-3-2015

Particulars | Schedule No. | Current Year | Previous Year | |

Capital and Liabilities Capital Reserve and surplus Deposits Borrowings Other liabilities and provisions

Assets Cash in hand and with R.B.I. Balance with other banks, Money at call and short notice Investments Advances Fixed Assets Other Assets

Contingent Liabilities Bills for collection |

Total

Total |

1 |

100,00,000 |

|

2 | 58,25,000 | |||

3 | 2,41,50,000 | |||

4 | Nil | |||

5 | 21,50,000 | |||

| 4,21,25,000 |

| ||

6 |

42,500,000 |

| ||

7 |

2,50,000 | |||

8 | 89,25,000 | |||

9 | 2,46,50,000 | |||

10 | 32,50,000 | |||

11 | 8,00,000 | |||

| 4,21,25,000 |

| ||

12 | 20,00,000 |

| ||

-- | 10,00,000 | |||

Working Details

Schedule No. 1 : Capital

Particulars | Current Year | Previous Year |

Authorised Capital |

|

|

2,00,000sharesof Rs. 100each | 2,00,00,000 | |

Issued and Paid up Capital |

| |

200000 shares of Rs. 1 00 each Rs. 50 paid | 1,00,00,000 | |

Total | 1,00,00,000 |

|

Schedule No. 2 : Reserve and Surplus

Particulars | Current Year | Previous Year | |

Statutory Reserve Fund Add : 20% transfer Investment flaction fund Less : loss on revaluation of Investment? Balance of P&L Appropriation A/c | 20,00,000 |

|

|

1,80,000 | 21,80,000 | ||

5,00,000 |

| ||

1,75,000 |

3,25,000 | ||

| 33,20,000 | ||

Total | 58,25,000 |

| |

Schedule No. 3 : Deposits

Particulars | Current Year | Previous Year | |

Fixed Deposits |

| 87,50,000 |

|

Saving Deposits |

| 60,00,000 | |

Current Deposits | 90,00,000 |

| |

Add overdrawn | 4,00,000 | 94,00,000 | |

| Total | 2,41,50,000 |

|

|

|

| |

Schedule No. 4 : Borrowings

Total | Nil |

|

Nil |

| |

|

|

Schedule No. 5 : Other Liabilities and Provisions

Particulars | Current Year | Previous Year | |

Drafts Payable |

| 8,00,000 |

|

Provident Fund |

| 8,00,000 | |

Rebate on bills discounted | 75,000 |

| |

Less over calculated | 25,000 | 50,000 | |

Provision for tax |

| 4,00,000 | |

Unclaimed Dividend |

| 1,00,000 | |

| Total | 21,50,000 |

|

|

|

|

|

Schedule No. 6 : Cash in hand and with R.B.I.

Particulars | Current Year | Previous Year | |

Cash in hand |

| 17,50,000 |

|

Cash with R.B.I. |

| 25,00,000 | |

| Total | 42,50,000 |

|

Schedule No. 7

Balance with other Banks, Money at call & Short Notice.

Particulars | Current Year | Previous Year |

Cash with millions Bank Total | 2,50,000 |

|

2,50,000 |

|

Schedule No. 8 : Investments

Particulars | Current Year | Previous Year | |

4% Govt. Securities Less loss on revaluation Gold Shares in Ltd. Co. | 60,00,000 1,75,000 |

58,25,000 21,00,000 10,00,000 |

|

Total | |||

89,25,000 |

| ||

Schedule No. 9 : Advances

Loan Cash Credit and overdrafts Less Provision | 2,30,00,000 2,50,000 |

2,31,50,000 15,00,000 |

|

Add overdrawn Current A/c. Bills purchased and discounted | 2,27,50,000 4,00,000 | ||

Total | |||

| 2,46,50,000 |

|

Schedule No. 10 : Fixed Assets

Premises Furniture and fixtures Total | 25,00,000 7,50,000 |

|

32,50,000 |

|

Schedule No. 11 : Other Assets

Particulars | Current Year | Previous Year | |

Silver |

| 5,00,000 |

|

Interest accrued on Investment |

| 3,00,000 | |

| Total | 8,00,000 |

|

Schedule No. 12 : Contingent Liabilities

Acceptance, endorsement and other obligations Total |

20,00,000 |

|

20,00,000 |

|

Schedule No. 13 : Interest earned

Interest and discount received 48,00,000 Add over calculated rebate 25,000 Total |

48,25,000 |

|

48,25,000 |

|

Schedule No. 14 : Other Incomes

Commission Exchange Total | 17,00,000 |

|

17,00,000 |

|

Schedule No. 15 : Interest Expended

Interest paid on deposits Total | 21,25,000 |

|

21,25,000 |

|

Schedule No. 16 : Operating Expenses

General managers remuneration |

| 9,00,000 |

|

Directors fees |

| 1,00,000 | |

Staff salaries and allowances |

| 15,00,000 | |

Sundry Expenses |

| 1,50,000 | |

Rent and taxes paid |

| 2,00,000 | |

| Total | 28,50,000 |

|