Unit 2

The Indian Partnership Act, 1932

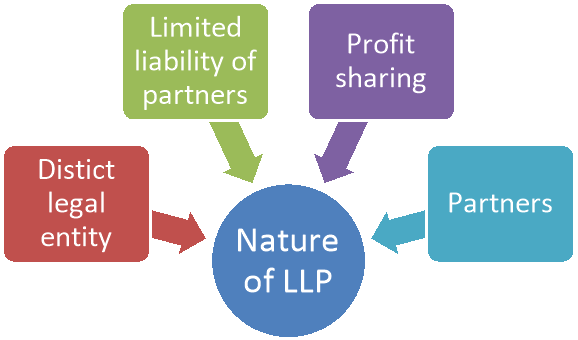

Q1) Define LLP. State the nature of LLP. 2017 5

A1) Limited Liability Partnerships (LLPs) are commercial vehicles which combine the features of partnership and company form of business .The concept of Limited Liability Partnership (LLP) has been introduced in India by way of Limited Liability Partnership Act, 2008 (notified on 31st March 2009).

A Limited Liability Partnership combines the advantages of both the Company and Partnership into a single form of organization. In an LLP one partner is not responsible or liable for another partner’s misconduct or negligence. In an LLP, all partners have limited liability for each individual’s protection within the partnership, similar to that of the shareholders of a limited company. However, unlike the company shareholders, the partners have the right to manage the business directly. An LLP also limits the personal liability of a partner for the errors, omissions, incompetence, or negligence of the LLP’s employees or other agents.

The Limited Liability Partnership consists of the features mentioned below:

Figure: Nature of LLP

1. Distinct Legal Entity

The Limited Liability Partnerships, unlike the traditional partnership firms, are considered as separate legal entities. LLPs may own assets and incur the liabilities in their names. Also, they can enter into the contracts and can sue and be sued in their names.

2. Limited Liability of the Partners Involved

The liabilities of the partners in an LLP are limited and separate. Their personal assets are not liable to the attachment if the LLP is suffering or winding up legal consequences of debt or repayments. However, the liability of the partners could become unlimited in certain offensive cases like frauds, illegal and wrongful acts, or commission of offences

2. Profit Sharing

All the partners of the Limited Liability Partnership would share business profit similar to the partners of the traditional firms. However, they are free to decide the profit ratios amongst themselves.

3. Partners of Limited Liability Partnerships

The partners of the LLPs can be either body corporations or individuals. Also, an individual cannot be a partner in an LLP in case he or she is insolvent or does not have a sound mind.

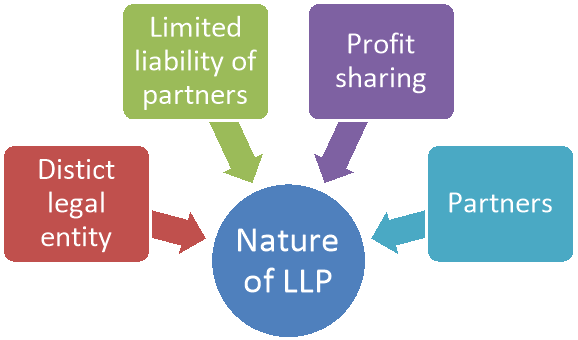

Q2) Explain the nature and advantages of LLP. 2017 8

A2) Advantages of LLP

There are numerous benefits to be had from trading through an LLP -

- Limited liability protects the member’s personal assets from the liabilities of the business. LLP’s are a separate legal entity to the members.

- Flexibility. The operation of the partnership and distribution of profits is determined by written agreement between the members. This may allow for greater flexibility in the management of the business.

- The LLP is deemed to be a legal person. It can buy, rent, lease, own property, employ staff, enter into contracts, and be held accountable if necessary.

- Corporate ownership. LLP’s can appoint two companies as members of the LLP. In an LTD company at least one director must be a real person.

- Designate and non-designate members. You can operate the LLP with different levels of membership.

- Protecting the partnership name. By registering the LLP at Companies House you prevent another partnership or company from registering the same name.

Nature of LLP

The Limited Liability Partnership consists of the features mentioned below:

Figure: Nature of LLP

1. Distinct Legal Entity

The Limited Liability Partnerships, unlike the traditional partnership firms, are considered as separate legal entities. LLPs may own assets and incur the liabilities in their names. Also, they can enter into the contracts and can sue and be sued in their names.

2. Limited Liability of the Partners Involved

The liabilities of the partners in an LLP are limited and separate. Their personal assets are not liable to the attachment if the LLP is suffering or winding up legal consequences of debt or repayments. However, the liability of the partners could become unlimited in certain offensive cases like frauds, illegal and wrongful acts, or commission of offences

4. Profit Sharing

All the partners of the Limited Liability Partnership would share business profit similar to the partners of the traditional firms. However, they are free to decide the profit ratios amongst themselves.

5. Partners of Limited Liability Partnerships

The partners of the LLPs can be either body corporations or individuals. Also, an individual cannot be a partner in an LLP in case he or she is insolvent or does not have a sound mind.

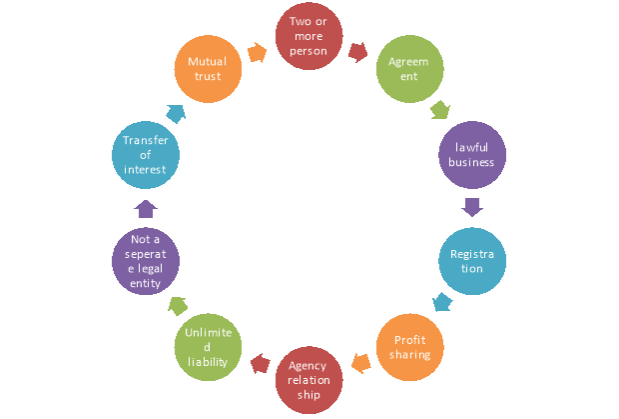

Q3) Discuss the features of partnership firm. 2018 10

A3) The general features of partnership are discussed below-

Figure: Features of partnership

1. Two or More Persons:

At least two persons must pool resources to start a partnership firm. The Partnership Act, 1932 does not specify any maximum limit on the number of partners. However, the Companies Act, 1956 lays down that any partnership or association of more than 10 persons in case of banking business and 20 persons in other types of business is illegal unless registered as a joint stock company.

2. Agreement:

A partnership comes into being through an agreement between persons who are competent to enter into a contract (e.g. Minors, lunatics, insolvents etc. not eligible). The agreement may be oral, written or implied. It is, however, to put everything in black and white and clear the fog surrounding all knotty issues.

3. Lawful Business:

The partners can take up only legally blessed activities. Any illegal activity carried out by partners does not enjoy the legal sanction.

4. Registration:

Under the Act, registration of a firm is not compulsory. (In most states in India, registration is voluntary). However, if the firm is not registered, certain legal benefits cannot be obtained. The effects of non-registration are- (i) the firm cannot take any action in a court of law against any other parties for settlement of claims and (ii) in case of a dispute among partners, it is not possible to settle the disputes through a court of law.

5. Profit Sharing:

The partnership agreement must specify the manner of sharing profits and losses among partners. A charitable hospital, educational institution run jointly by like-minded persons is not to be viewed as partnership since there is no sharing of profits or losses. However, mere sharing of profits is not a conclusive proof of partnership. In this sense, employees or creditors who share profits cannot be called partners unless there is an agreement between the partners.

6. Agency Relationship:

Generally speaking, every partner is considered to be an agent of the firm as well as other partners. Partners have an agency relationship among themselves. The business can be carried out jointly run by one nominated partner on behalf of all. Any acts done by a nominated partner in good faith and on behalf of the firm are binding on other partners as well as the firm.

7. Unlimited Liability:

All partners are jointly and severally responsible for all activities carried out by the partnership. In other words in all cases where the assets of the firm are not sufficient to meet the obligations of creditors of the firm, the private assets of the partners can also be attached. The creditors can get hold one any one partner —who is financially sound-and get their claims satisfied.

8. Not a Separate Legal Entity:

The firm does not have a personality of its own. The business gets terminated in case of death, bankruptcy or lunacy of any one of the partners.

9. Transfer of Interest:

A partner cannot transfer his interest in the firm to outsiders unless all other partners agree unanimously. A partner is an agent of the firm and is ineligible to transfer his interest unilaterally to outsiders.

10. Mutual Trust and Confidence:

A partnership is built around the principle of mutual trust, confidence and understanding between partners. Each partner is supposed to act for the benefit of all. If trust is broken and partners work at cross purposes, the firm will get crushed under its own weight.

Q4) Distinguish between the “partnership firm” and “LLP”. 2018, 2019 5

A4) The distinctions between LLP and partnership firm are highlighted below-

Sl no | LLP | Partnership firm |

| It is governed under the Limited Liability Partnerships Act, 2018 | It is governed under the Partnership Act, 1932. |

2. Separate entity | There exist separate legal entity between partners and partnership firm. | There is no separate legal entity between partners and partnership firm. |

3. Liability of partners | Partners have limited liability. | Partners have unlimited liability. |

4. Number of partners | Minimum 2, maximum is unlimited | Minimum 2, maximum 50 |

5. Registration | Registration is mandatory. | Registration is optional. |

6. Ownership of asset | A firm can own assets in its own name. | Only partners of the partnership can own the assets of the firm |

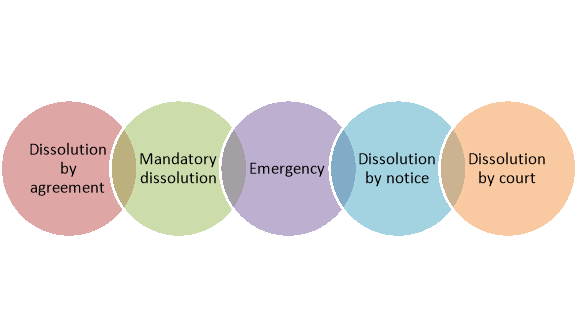

Q5) What is dissolution of partnership firm? Explain modes of its dissolution. 2019 5

A5) Dissolution of partnership firm means a process by which the relationship between the partners is terminated. The partnership firm becomes wound up and comes to an end and all the assets, shares, accounts and liabilities are disposed of and settled.

Dissolution of a firm takes place in any of the following ways/modes:

Figure: Modes of dissolution of firm

- Dissolution by Agreement:

An enterprise is dissolved:

- With the consent of all the partners

- In accordance with an agreement between the partners

6. Mandatory Dissolution:

An enterprise is dissolved mandatorily in the below mentioned cases:

- When all the partners or one partner, become bankrupt, rendering them incapable to sign an agreement

- When the business concern of the enterprise is illegal

- When some occurrence has taken place which makes it illegitimate for the partners to take over and carry on the business concern of the enterprise in partnership, for example, when a partner who is a citizen of a nation becomes an alien antagonist because of the allegated declaration of war with his nation and India

3. On the occurrence of certain emergencies:

Subject to agreement between the partners, an enterprise is dissolved:

- If established for a steady period, by the expiry of that time frame

- If established to carry out one or more deals, by the accomplishment thereon

- When the fellow partner is deceased

- By the judgment of a partner as a bankrupt

4. Dissolution by Notice:

If the partnership is at will, the enterprise may be dissolved if one of the partners furnishes a notice in written proof to the other fellow partners, bespeaking his motive of pursuing dissolution of the enterprise

5. Dissolution by Court:

At the suit of a partner, the court may order a partnership enterprise to be dissolved in any of the following mentioned aspects:

- When a fellow partner turns out to be a mentally ill person

- When a partner becomes ineffective in performing his responsibilities

- When a partner is found guilty of misconduct or unethical behaviour which sceptically influence the business concern of the enterprise.

Q6) Define the term “company” and “Limited liability partnership”. 2019 8

A6) The difference between LLP and company are highlighted below-

Sl no | LLP | Company |

| It is registered under the Limited Liability partnership Act 2008 | It is registered under the Companies Act 2013 |

2. Number of directors | Minimum designated partner-2 Maximum designated partner – not applicable | Minimum -2 |

3. Members required | Minimum -2 Maximum-no limit | Minimum -2 |

4. Minimum capital required | No minimum share capital required. | No minimum share capital required. |

5. Statutory audit | Not required unless partners contribution exceeds 25 lakhs and annual turnover exceeds 40 lakhs. | Statutory audit is mandatory. |

6. Compliances | Less legal compliances | High legal compliances |

7. Reliability | It is less reliable | It is more confidential. |

8. Investment | There is no cap or criteria for the investment by any third party. | Companies has to go through with sections 73 and any other provisions and rules made their under.

|

Q7) Define in detail the rights of partners under the Partnership Act, 1932. 2018 12

A7) Rights of partners

- Right to take part in the conduct of the Business [Section 12(a)]

All the partners of a partnership firm have the right to take part in the business conducted by the firm as a partnership business is a business of the partners, and their management powers are generally coextensive. If the management power of a particular partner is interfered with and the individual has been wrongfully precluded from participating, the Court of Law can intervene under such circumstances. The Court can, and will, restrain the other partner from doing so by injunction. Other remedies are a suit for dissolution, a suit for accounts without seeking dissolution and so on for a partner who has been wrongfully deprived of the right to participate in the management.

2. Right to be consulted [Section 12(c)]

When a difference of any sorts arises between the partners of a firm concerning the business of the firm, it shall be decided by the views of the majority among the partners. Every partner in the firm shall have the right to express his opinion before the decision is made. However, there can be no changes like the business of the firm without the consent of all the partners involved. As a routine matter, the opinion of the majority of the partners will prevail. Although, the majority rule would not apply when there is a change like the firm itself. In such situations, the unanimous consent of the partners is required.

3. Right to remuneration [Section 13(a)]

No partner of the firm is entitled to receive any remuneration along with his share in the profits of the business by the firm as a result of taking part in the business of the firm. Although, this rule may always vary by an express agreement, or by a course of dealings, in which case the partner will be entitled to remuneration. Thus, a partner may claim remuneration even in the absence of a contract, when such remuneration is payable under the continued usage of the firm. In simpler words, where it is customary to pay remuneration to a partner for conducting the business of the partnership firm, the partner may claim it even in the absence of a contract for the payment of the same. It is common for partners to agree that a managing partner will receive over and above his share, salary or commission for the trouble that he will take while conducting the business of the firm.

4. Right to share profits [Section 13(b)]

Partners are entitled to share all the profits earned in the business equally. Similarly, the losses sustained by the partnership firm are also equally contributed. The amount of a partner’s share must be ascertained by inquiring whether there is an agreement in that behalf among the partners. If there is no agreement, then it can be presumed that the share of profit is equal and the burden of proving that the shares are unequal, will lie on the party alleging the same.

5. Interest on capital [Section 13(c)]

If a partner subscribes interest on capital is payable to the partner under the partnership deed, then the interest will be payable out of the profits only in such a case. In a general rule, the interest on a capital subscribes by partners is not permitted unless there is an agreement or a usage to that effect. The underlying principle in this provision of law is that with concern to the capital brought by a partner in the business, the partner is not a creditor of the firm but an adventurer.

6. Interest on advances [Section 13(d)]

If a partner makes an advance to the partnership firm in addition to the amount of capital to be contributed by him, the partner is entitled to claim interest thereon at 6 per cent per annum. While the interest on capital account ceases to run on dissolution, the interest on advances keeps running even after dissolution and up to the date of payment. It can be noted that the Partnership Act makes a distinction between the capital contribution of a partner and the advance made by him to the firm. The advance by the partner is regarded as loans which should bear interest while the capital interest takes interest only when there is an agreement to this effect.

7. Right to be indemnified [Section 13(e)]

All the partners of the firm have the right to be repaid by the firm in respect of the payments made and the liabilities incurred by him in the ordinary and proper conduct of the business of the firm. This also includes the performance of an act in an emergency for protecting the firm from a loss, if the payments, liability and action are such as a prudent man would make, incur or perform in his case, under similar circumstances.

8. Right to stop the admission of a new partner [Section 31]

All the partners of a partnership firm have the right to prevent the introduction of a new partner in the firm without the consent of all the existing partners.

9. Right to retire [Section 32(1)]

Every partner of a partnership firm has the right to withdraw from the business with the consent of all the other partners. In the case of a partnership formed at will, this may be done by giving a notice to that effect to all the other partners.

10. Right not to be expelled [Section 33]

Every partner of a partnership firm has the right to continue in the business. A partner cannot be dismissed from the firm by any majority of the partners unless conferred by a partnership agreement and exercised in good faith and for the advantage of the partnership firm.

11. Right of outgoing partner to carry on a competing business [Section 36(1)]

A partner outgoing from the partnership firm may carry on a business competing with that of the firm. The partner may even advertise such activity but has to do so without using the firm’s name or representing himself as carrying on the business of the firm or soliciting the clients who were dealing with the firm before the partner ceased to be a part of the partnership firm.

12. Right of outgoing partner to share subsequent profits [Section 37]

If a partner has passed away or ceased to be a partner and the existing partners carry on the business of the firm with the property of the firm without any final settlement of accounts as between them and the outgoing partner or his estate, the outgoing partner or his estate has, at his or his representative’s option, the right to such share of profit made since he ceased to be a partner as may be attributable to the use of his share of the property of the firm or interest at 6 per cent per annum on the amount of the partner’s share in the property of the firm.

13. Right to dissolve the firm [Section 40]

A partner of a partnership firm has the right to dissolve the partnership with the consent of all the other partners. However, where the partnership is at will, the firm may be dissolved by any partner by giving notice in writing to all the other partners of his intention to dissolve the firm.

Q8) Discuss in brief the duties of partners of a partnership firm. 2018, 5

A8) The following are the duties of a partner in a partnership firm.

- General duties of a partner [Section 9]

Partners are legally bound to carry on the business of the partnership firm. The general responsibilities of a partner are listed below.

- A partner is required to carry on the business to the highest common advantage.

- A partner is required to be just and faithful to each other

- A partner has to render to any other partner or his legal representative about the true account and all the information of all the things affecting the partnership firm.

2. To indemnify for fraud [Section 10]

According to Section 10, a partner of the partnership firm is liable to compensate the firm for any damages caused to its business or the firm because of a partner’s fraud in the conduct of the business of the firm.

3. To indemnify for wilful neglect [Section 13(f)]

According to the Section, a partner of a partnership firm must compensate the firm for any damages or loss caused to it by wilful neglect in the conduct of the business of the firm.

4. To attend duties diligently without remuneration [Section 12(b) & Section 13(a)]

According to Section 12(b) of the Indian Partnership Act, every partner is legally bound to attend to his duties diligently to his duties relating to the conduct of the firm’s business. Moreover, Section 13(a) enumerates that a partner is not, however, generally entitled to remuneration for participating in the conduct of the business. A partner is also bound to let his partners have the advantage of his knowledge and skill.

5. To share losses [Section 13(b)]

All the partners of a partnership firm are liable to contribute equally to the injury sustained by the firm.

6. To account for any profit [Section 16(a)]

If a partner of a partnership firm derives any profit for himself for any transaction of the firm or from the use of the property or business connection of the firm or firm’s name, then the partner is bound to account for that profit and refund it to the firm.

7. To account and pay for profits of competing for business [Section 16(b)]

If a partner carries on a company of the same nature as the firm and competes with that of the firm, the partner must be accountable for and pay to the firm all the profits made in the business by the partner. The partnership firm will not be held liable for any losses caused in the business.

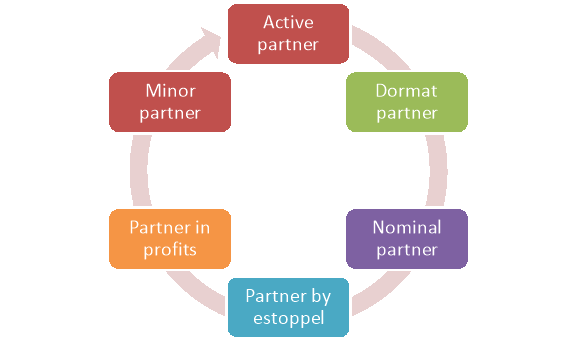

Q9) Explain in brief different types of partners. 5

A9) According to the nature of activities performed by partners, they are classified into different categories. Such types of partners are discussed below-

Figure: Types of partner

1] Active Partner/Managing Partner

An active partner is also known as Ostensible Partner. As the name suggests he takes active participation in the firm and the running of the business. He carries on the daily business on behalf of all the partners. This means he acts as an agent of all the other partners on a day to day basis and with regards to all ordinary business of the firm.

2] Dormant/Sleeping Partner

This is a partner that does not participate in the daily functioning of the partnership firm, i.e. he does not take an active part in the daily activities of the firm. He is however bound by the action of all the other partners. He will continue to share the profits and losses of the firm and even bring in his share of capital like any other partner. If such a dormant partner retires he need not give a public notice of the same.

3] Nominal Partner

This is a partner that does not have any real or significant interest in the partnership. So, in essence, he is only lending his name to the partnership. He will not make any capital contributions to the firm, and so he will not have a share in the profits either. But the nominal partner will be liable to outsiders and third parties for acts done by any other partners.

4] Partner by Estoppel

If a person holds out to another that he is a partner of the firm, either by his words, actions or conduct then such a partner cannot deny that he is not a partner. This basically means that even though such a person is not a partner he has represented himself as such, and so he becomes partner by estoppel or partner by holding out.

5] Partner in Profits Only

This partner will only share the profits of the firm, he will not be liable for any liabilities. Even when dealing with third parties he will be liable for all acts of profit only, he will share none of the liabilities.

6] Minor Partner

A minor cannot be a partner of a firm according to the Contract Act. However, a partner can be admitted to the benefits of a partnership if all partner gives their consent for the same. He will share profits of the firm but his liability for the losses will be limited to his share in the firm.

Q10) Write a brief note on registration of firm. 5

A10) Partnership firm registration is required when two or more parties sign a formal agreement to manage and operate a business and share both the profits and losses. Registering a Partnership is the right choice for small enterprises as the formation is straightforward and there are minimal regulatory compliances. The Partnership Act has been in existence in India since 1932, making partnerships one of the oldest types of business entities in India. A partnership firm can even be registered after it is formed. There are as such no penalties for non-Registration of a Partnership firm. But unregistered Partnership firms are denied certain rights under section 69 of the Partnership Act that majorly deals with the effects of non-Registration of Partnership firms.

The process of registration of partnership firm are discussed below-

Figure: Registration of procedure of partnership firm

Step 1: Application for Registration

An application form has to be filed to the Registrar of Firms of the State in which the firm is situated along with prescribed fees. The registration application has to be signed and verified by all the partners or their agents. The application can be sent to the Registrar of Firms through post or by physical delivery, which contains the following details:

- The name of the firm.

- The principal place of business of the firm.

- The location of any other places where the firm carries on business.

- The date of joining of each partner.

- The names and permanent addresses of all the partners.

- The duration of the firm.

Step 2: Selection of Name of the Partnership Firm

Any name can be given to a partnership firm. But certain conditions need to be followed while selecting the name:

- The name should not be too similar or identical to an existing firm doing the same business.

- The name should not contain words like emperor, crown, empress, empire or any other words which show sanction or approval of the government.

Step 3: Certificate of Registration

If the Registrar is satisfied with the registration application and the documents, he will register the firm in the Register of Firms and issue the Registration Certificate. The Register of Firms contains up-to-date information on all firms, and anybody can view it upon payment of certain fees. An application form along with fees is to be submitted to the Registrar of Firms of the State in which the firm is situated. The application has to be signed by all partners or their agents.

Documents for Registration of Partnership

The documents required to be submitted to Registrar for registration of a Partnership Firm are:

- Application for registration of partnership (Form 1)

- Certified original copy of Partnership Deed.

- Specimen of an affidavit certifying all the details mentioned in the partnership deed and documents are correct.

- PAN Card and address proof of the partners.

- Proof of principal place of business of the firm (ownership documents or rental/lease agreement).

If the registrar is satisfied with the documents, he will register the firm in the Register of Firms and issue a Certificate of Registration.

Register of Firms contains up-to-date information on all firms and can be viewed by anybody upon payment of certain fees.

Q11) Write a brief note on incorporation of LLP. 5

A11) A limited liability partnership (LLP) is a partnership in which some or all partners (depending on the jurisdiction) have limited liabilities. It therefore can exhibit elements of partnerships and corporations. In an LLP, each partner is not responsible or liable for another partner's misconduct or negligence.

Steps for the Incorporation of an LLP

- Reserving the name for the LLP: The applicant first files the e-Form 1 to check the availability of the name and then register the name of the LLP. Once the name gets approved by the Ministry, it is reserved for the applicant for a duration of 90 days. If the LLP fails to be incorporated within the given frame of time, they let go of the reservation and make it available for other applicants.

- Incorporating a new LLP: After the reservation of the name for the LLP, the applicant has to file e-Form 2 for the incorporation of the LLP. It carries all the details of the LLP proposed, plus all the details of the partners and the designated partners.

- The partners and the designated partners have to give their consent to act in the respective decided roles.

- Filing of the LLP Agreement has to be done with the Registrar in e-Form 3 within 30 days from the incorporation of the LLP. Execution of the LLP Agreement is mandatory as per Section 23 of the LLP Act, 2008.

- The LLP Incorporation process is complete after obtaining the approval of the LLP Agreement.

Q12) State the provisions related to financial disclosure of LLPs. 8

A12) The provisions related to financial disclosure under the LLP act, 2008 are discussed below-

Maintenance of books of account, other records and audit, etc (Section 34)

(1) The limited liability partnership shall maintain such proper books of account as may be prescribed relating to its affairs for each year of its existence on cash basis or accrual basis and according to double entry system of accounting and shall maintain the same at its registered office for such period as may be prescribed.

(2) Every limited liability partnership shall, within a period of six months from the end of each financial year, prepare a Statement of Account and Solvency for the said financial year as at the last day of the said financial year in such form as may be prescribed, and such statement shall be signed by the designated partners of the limited liability partnership.

(3) Every limited liability partnership shall file within the prescribed time, the Statement of Account and Solvency prepared pursuant to sub-section (2) with the Registrar every year in such form and manner and accompanied by such fees as may be prescribed.

(4) The accounts of limited liability partnerships shall be audited in accordance with such rules as may be prescribed: Provided that the Central Government may, by notification in the Official Gazette, exempt any class or classes of limited liability partnerships from the requirements of this sub-section.

(5) Any limited liability partnership which fails to comply with the provisions of this section shall be punishable with fine which shall not be less than twenty-five thousand rupees but which may extend to five lakh rupees and every designated partner of such limited liability partnership shall be punishable with fine which shall not be less than ten thousand rupees but which may extend to one lakh rupees.

Annual return (section 35)

(1) Every limited liability partnership shall file an annual return duly authenticated with the Registrar within sixty days of closure of its financial year in such form and manner and accompanied by such fee as may be prescribed.

(2) Any limited liability partnership which fails to comply with the provisions of this section shall be punishable with fine which shall not be less than twenty-five thousand rupees but which may extend to five lakh rupees.

(3) If the limited liability partnership contravenes the provisions of this section, the designated partner of such limited liability partnership shall be punishable with fine which shall not be less than ten thousand rupees but which may extend to one lakh rupees.

Inspection of documents kept by Registrar (Section 36)

The incorporation document, names of partners and changes, if any, made therein, Statement of Account and Solvency and annual return filed by each limited liability partnership with the Registrar shall be available for inspection by any person in such manner and on payment of such fee as may be prescribed.

Penalty for false statement (section 38)

If in any return, statement or other document required by or for the purposes of any of the provisions of this Act, any person makes a statement—

(a) which is false in any material particular, knowing it to be false; or

(b) which omits any material fact knowing it to be material, he shall, save as otherwise expressly provided in this Act, be punishable with imprisonment for a term which may extend to two years, and shall also be liable to fine which may extend to five lakh rupees but which shall not be less than one lakh rupees.

Power of Registrar to obtain information (Section 38)

(1) In order to obtain such information as the Registrar may consider necessary for the purposes of carrying out the provisions of this Act, the Registrar may require any person including any present or former partner or designated partner or employee of a limited liability partnership to answer any question or make any declaration or supply any details or particulars in writing to him within a reasonable period.

(2) In case any person referred to in sub-section (1) does not answer such question or make such declaration or supply such details or particulars asked for by the Registrar within a reasonable time or time given by the Registrar or when the Registrar is not satisfied with the reply or declaration or details or particulars provided by such person, the Registrar shall have power to summon that person to appear before him or an inspector or any other public officer whom the Registrar may designate, to answer any such question or make such declaration or supply such details, as the case may be.

(3) Any person who, without lawful excuse, fails to comply with any summons or requisition of the Registrar under this section shall be punishable with fine which shall not be less than two thousand rupees but which may extend to twenty-five thousand rupees.

Compounding of offences (Section 39)

The Central Government may compound any offence under this Act which is punishable with fine only, by collecting from a person reasonably suspected of having committed the offence, a sum which may extend to the amount of the maximum fine prescribed for the offence.

Destruction of old records (Section 40)

The Registrar may destroy any document filed or registered with him in physical form or in electronic form in accordance with such rules as may be prescribed.

Enforcement of duty to make returns, etc. (Section 41)

(1) If any limited liability partnership is in default in complying with—

(a) any provisions of this Act or of any other law which requires the filing in any manner with the Registrar of any return, account or other document or the giving of notice to him of any matter; or

(b) any request of the Registrar to amend or complete and resubmit any document or to submit a fresh document, and fails to make good the default within fourteen days after the service on the limited liability partnership of a notice requiring it to be done, the Tribunal may, on application by the Registrar, make an order directing that limited liability partnership or its designated partners or its partners to make good the default within such time as specified in the order.

(2) Any such order may provide that all the costs of and incidental to the application shall be borne by that limited liability partnership. (3) Nothing in this section shall limit the operation of any other provision of this Act or any other law imposing penalties in respect of any default referred to in this section on that limited liability partnership.

Contributions (Section 32)

The provisions related to contributions are stated below-

Form of contribution (Section 32)

(1) A contribution of a partner may consist of tangible, movable or immovable or intangible property or other benefit to the limited liability partnership, including money, promissory notes, other agreements to contribute cash or property, and contracts for services performed or to be performed.

(2) The monetary value of contribution of each partner shall be accounted for and disclosed in the accounts of the limited liability partnership in the manner as may be prescribed.

Obligation to contribute (Section 33)

(1) The obligation of a partner to contribute money or other property or other benefit or to perform services for a limited liability partnership shall be as per the limited liability partnership agreement. (2) A creditor of a limited liability partnership, which extends credit or otherwise acts in reliance on an obligation.