UNIT 2

Theories of International Trade

Q1) Explain theory of Absolute Cost Advantage?

A1)

The Scottish economist Adam Smith developed the trade theory of absolute advantage in 1776 through his legendary book “An Enquiry into the Nature and Causes of Wealth of Nations”. He developed the theory as an attack against the then prevailing mercantilist view of restrictive trade with the slogan ‘free trade’. Smith's argument was that the wealth of nations depends upon the goods and services available to their citizens, rather than the gold reserves held by the nation. Maximizing this availability depends primarily on fuller utilization of resources and then, on the ability

- To obtain goods and services from where they are produced most cheaply (because of “natural” or “acquired” advantages), and

- To pay for them by production of the goods and services produced most cheaply in the country,

Human skill up gradation, division of labour and specialization and the economies of scale are the sources of acquired advantage for cheaper production. Natural advantages may emerge out of natural factors.

As the name indicates this theory proposes that a country should engage in the production and exchange of those commodities where it has an absolute advantage. Such a country produces greater output of a good or service than other countries using the same amount of resources. Absolute advantage is defined as the ability to produce more of a good or service than competitors, using the same amount of resources. Smith stated that tariffs and quotas should not restrict international trade; it should be allowed to flow according to market forces. Contrary to mercantilism Smith argued that a country should concentrate on production of goods in which it holds an absolute advantage. No country would then need to produce all the goods it consumed. The theory of absolute advantage destroys the mercantilist idea that international trade is a zero- sum game. According to the absolute advantage theory, international trade is a positive-sum game, because there are gains for both countries to an exchange.

Assumptions

- There are two countries and two commodities

- One country has absolute advantage in one commodity and the second country has advantage in another commodity

- Technology is assumed to be constant

- Labour is the only factor of production

- Labour is homogeneous, that means each unit of labour produces same level of output value of a commodity is measured in terms of its labour content

- There is no technological improvement

- Labour is perfectly mobile within the country but perfectly immobile between the countries. It means that workers are free to move between industries within the nation but migration to other countries is impossible.

- A system of barter prevails

- Zero transportation cost

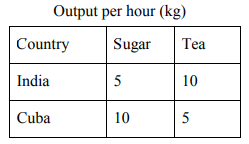

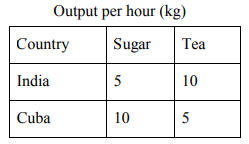

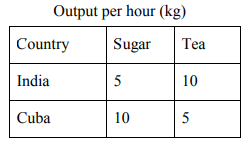

Based on these assumptions the theory can be explained with an example. Suppose there are two countries- India and Cuba producing tea and sugar. By employing a worker for one hour India can produce either 10kilograms of tea or 5 kilograms of sugar. Similarly if a Cuban worker is employed she is capable of producing 10 kilograms of sugar or 5 kilograms of tea.

From the table it is clear that by spending an hour’s labour India is capable of producing twofold of tea than Cuba similarly in the case of sugar Cuba is able to generate double the production in India. In short Cuba has absolute advantage in sugar and India in tea. In this situation by concentrating on the respective absolute advantageous areas both nations can benefit by fully channelizing their resources to absolutely advantageous commodity.

Since there is perfect factor mobility within a country, India can channelize labourers into tea sector and Cuba into sugar industry. If India transfer one labour from sugar to tea sector sugar production may fall by 5 kilograms but can produce 10 more kilograms of tea. By exchanging this one unit effort India is capable of purchasing 10 kilograms of sugar from Cuba. So it is beneficial for India. If India goes for domestic exchange, due to the increased cost it will not benefit India. The same is true for Cuba in the case of sugar.

There is a potential problem with absolute advantage. If there is one country that does not have an absolute advantage in the production of any product, will there still be benefit to trade, and will trade even occur? The answer may be found in the extension of absolute advantage, the theory of comparative advantage.

Q2) Explain theory of Comparative Cost Advantage?

A2)

The most basic concept in the whole of international trade theory is the principle of comparative advantage, first introduced by David Ricardo in 1817. It remains a major influence on much international trade policy and is therefore important in understanding the modern global economy. Comparative advantage is the ability of a firm or individual to produce goods and/or services at a lower opportunity cost than other firms or individuals. A comparative advantage gives a company the ability to sell goods and services at a lower price than its competitors and realize stronger sales margins. David Ricardo stated in his theory of comparative advantage that a country should specialize in producing and exporting products in which it has a comparative advantage and it should import goods in which it has a comparative disadvantage. Out of such specialization, it will accrue greater benefit for all.

Assumptions

- There are two countries and two commodities

- One country has absolute advantage in both commodities and the second country has in another commodity

- Technology is assumed to be constant

- Labour is the only factor of production

- Labour is homogeneous, that means each unit of labour produces same level of output

- Technology is assumed to be constant

- Value of a commodity is measured in terms of its labour content

- There is no technological improvement

- Labour is perfectly mobile within the country but perfectly immobile between the countries. It means that workers are free to move between industries within the nation but migration to other countries is impossible.

- A system of barter prevails

- Zero transportation cost

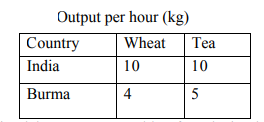

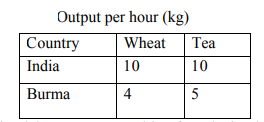

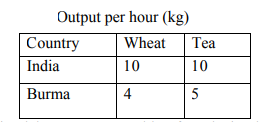

Example

In this example Indian labourers are capable of producing both wheat and tea in absolute advantage. Burma is disadvantageous in both cases. But still there is a possibility for trade. Burma has fewer disadvantages in tea than wheat. So it is its comparative advantage. If India concentrates in wheat it is capable of producing more than two fold wheat, but in tea it can produce only two fold than Burma. Although India has an absolute advantage in the production of both tea and wheat, India has a comparative advantage only in the production of wheat. This is because its advantage in wheat is comparatively greater than its advantage in tea. In this situation India can concentrate on wheat and Burma on tea and both can benefit from trade.

In this theory there are several assumptions that limit the real-world application. The assumption that countries are driven only by the maximization of production and consumption and not by issues out of concern for workers or consumers is a mistake.

Q3) Explain theory of Factor Endowment (Heckscher-Ohlin)?

A3) In the early 20th century, Swedish economists Eli Heckscher and Bertil Ohlin identified the role of labor and capital, so-called factor endowments, as a determinant of advantage. In 1979 Ohlin was awarded Nobel Prize jointly with James Meade for his work in international trade theory. The Heckscher-Ohlin proposition maintains that countries tend to export goods whose production uses intensively the factor of production that is relatively abundant in the country. Countries well endowed with capital—such as factories and machinery—should export capitalintensive products, while those well endowed with labor should export labor-intensive products. According to Bertil Ohlin, trade arises due to the differences in the relative prices of different goods in different countries. The difference in commodity price is due to the difference in factor prices (i.e. costs). Factor prices differ because endowments (i.e. capital and labour) differ in countries. Hence, trade occurs because different countries have different factor endowments.

The Heckscher Ohlin theorem states that countries which are rich in labour will export labour intensive goods and countries which are rich in capital will export capital intensive goodsHeckscher-Ohlin's theory explains the modern approach to international trade on the basis of following assumptions :-

1. There are two countries involved.

2. Each country has two factors (labour and capital).

3. Each country produce two commodities or goods (labour intensive and capital intensive).

4. There is perfect competition in both commodity and factor markets.

5. All production functions are homogeneous of the first degree i.e. production function is subject to constant returns to scale.

6. Factors are freely mobile within a country but immobile between countries.

7. Two countries differ in factor supply.

8. Each commodity differs in factor intensity.

9. The production function remains the same in different countries for the same commodity.

For e.g. If commodity A requires more capital in one country then same is the case in other country.

10. There is full employment of resources in both countries and demand are identical in both countries.

11. Trade is free i.e. there are no trade restrictions in the form of tariffs or non tariff barriers.

12. There are no transportation costs.

Give these assumptions, Heckscher and Ohlin contend that the immediate cause of international trade is the difference in relative commodity prices caused of differences in relative demand and supply of factor (factor prices) as a result of differences in factor endowments between the two countries. Fundamentally, the relative scarcity of factor-the shortage of supply in relation to demand is essential for trade between two regions. Commodities which use large quantities of scarce factors are imported because their prices are high while those using abundant factors are exported because their prices are low.

The H.O. Theorem is explained in terms of two definitions: (I) factor abundance (or scarcity) in terms of the price criterion; and (2) factor abundance (or scarcity) in terms of physical criterion. We discuss these on by one below:

1. Factor Abundance in Terms of Factor Prices. Heckscher-Ohlin explain richness in factor endowment in terms of factor prices. According to their definition, country A is abundant in capital if (Pc/POne0c/P0a, where Pc and PL refer to prices of capital and labour, and the subscripts A and B denote the two countries. In other countries. In other words, if capital is relatively cheap in country A, the country is abundant in capital, and if labour is relatively cheap in country B, the country is abundant in labour. Thus country A will produce and export the capital-intensive-good and important the labour-intensive good and country B will produce and export the labour-intensive good and import the capital intensive good. This establishes the H.O. Theorem that the capital abundant country will export the relatively cheap capital-intensive commodity, and the labour 'abundant country will export the relatively cheap labour-intensive commodity.

2. Factor Abundance in Physical Terms. Another way to explain the 11.0. Theorem is in physical terms of factor abundance. According to this criterion, a country is relatively capital abundant if it is endowed with a higher proportion of capital and labour, than the other. If country A is relatively capital abundant and country B is relatively labour-abundant, then measured in, physical amounts CA/LA> CB/1.43, where CA and LA are the total amounts of capital and labour respectively in country B. The H.O. Theorem in terms of physical criterion will be valid only if tastes (demand or consumption preferences) for each commodity in the two countries arc identical.

Its Superiority over the classical theory of international trade inpany aspects.

1. International Trade A Special Case. The 1-1.0. Theory is superior to the classical theory in that it regards international trade as ,a Special case of interregional or inter local trade as distinct from the classical theory which considers international trade totally different from domestic trade.

2. General Equilibrium Theory. The H.O. Analysis is cast within the framework of the realistic general equilibrium theory of value. It frees the classical theory from the defunct and unrealistic labour theory of value.'

3. Two Factors of Production. The H.O. Model takes two factors-labour and capital-as against the one factor(labour) of the classical model, and is thus superior to the latter.

4. Differences in Factor Supplies. The H.O. Theory is superior to the Ricardian theory in that it regards differences in factor supplies as basic for determining the pattern of international trade while the Ricardian theory takes no notice of it.

5. Relative Prices of Factors. The H.O. Model is realistic because it is based on the relative price of goods, while the Ricardian theory considers the relative prices of good only.

6. Relative Productivities of Factors. The H.O. Theory considers differences in relative productivities of labour and capital as the basis of international trade, while the classical theory takes the productivity of labour alone. Hence the former is more realistic than the letter.

7. Differences in Factor Endowments. The H.O. Model is based on differences in factor endowments in different countries as against the quality of one factor labour in the classical theory. Thus the former is superior because it lays emphasis not only on the quality but also on the quantity of factors in determining international values.

8. Cause of Differences in Comparative Costs. According to Samuelson, the Ricardian theory could not explain the causes of difference in comparative advantage. The merit of 11.0 theory lies in explaining the same satisfactorily

9. Positive Theory. The classical theory demonstrates the gains from trade between the two countries. This is related to the welfare theory. On the other hand, the H.O. Model is scientific and concentrates on the basis of trade. It, thus partakes of the positive theory.

10. Location Theory. According to Haberler, the H.O. Theory is a location theory which highlights the importance of the space factor in international trade while classical theory regards the different countries as space less markets. Thus the former theory is superior to the latter.

11. Production function of Two Countries. The H.O. Theorem is explicitly based on the assumption of production functions of the two countries. On the other hand, the classical theory is based on difference in the production of the trading countries.

12. Complete Specialisation. The H.O. Model is more realistic than the classical theory in that the fanner leads to complete specialisation in the production of one commodity by one country and of the other commodity by the second country when they enter into trade with each other. By contrast, the trade between two countries may not lead to incomplete specialisation in the classical theory.

13. Future of Trade. According to Lancaster, the HO. Theory is superior to the classical theory because it refer to the future of trade. In the classical theory, difference in comparathe costs between two countries arc due to difference in the efficiency of labour. If, in future, labour becomes equally efficient in both the countries, there will be no trade between them. But in the 1-1.0. theory trade will not cease even if labour becomes equally efficient, in ilia two countries because the basis of trade is difference in factor endowments and prices.

Critical Evaluation of Modern Theory

1. It lakes into consideration all the cost and not only the labour cost and not .only the labour cost as in classical theory.

2. This theory introduced the economies of large scale production rind claimed that these economics created an additional basis for international trade.

3. The classical economists felt the need of a separate ;incl.distinct theory of international trade while Ohlin was of the opinion that there was no need or a separate theory. The difference between the two was one of the degree, not of kind.

4. Modern theory of emphasizes the differences in factor endowments.

5. The classical theory does not explain why there are differences in comparative cost but modern theory is able to do so.

6. The classical theory is unrealistic where as modern theory is realistic.

Q4) Explain Leontief Paradox?

A4) In 1953, Wassily Leontief published a study named, "Domestic production and foreign trade: the American capital position re-examined" where he tested the validity of the Heckscher- Ohlin theory. Using data available from the 1947 input-output (I-O) model of the US economy, Leontief calculated the K and L requirements for the production of $1 million of US exports and $1 million of US production in import-competing industries. He found that the former required a higher proportion of L than the latter. The study showed that the U.S was more abundant in capital compared to other countries, therefore the U.S would export capital- intensive goods and import labour-intensive goods. Leontief found out that the U.S's export was less capital intensive than import. Hecksher-Ohlin's theory of factor endowments stressed that a country should produce and export goods that require resources (factors) that are abundant in the home country. Leontief tested the Hecksher-Ohlin theory in the U.S. And found that it was not applicable in the U.S.

Possible explanations of the Leontief paradox

- US demand for K-intensive products outstripped its capacity to provide them domestically. So there was no other alternative than imports.

2. "Factor-intensity reversal" — Leontief had no idea of the input mix for manufacturing in other countries; he measured the K-intensity of US production in import-competing industries, not of US imports. If L is expensive in the US, then US industries facing import competition would have to reduce their use of L, by substituting K. However, this would mean that production functions (i.e., input mix; technology) vary for the same products in different places, which renders the Heckscher-Ohlin theorem nearly useless.

3. Perhaps international trade flows were not rationalized according to comparative advantage in 1947, immediately after the destruction and disruption of World War 2. After all, comparative advantage is a normative concept. 4. The US imported natural-resource commodities whose extraction is K-intensive, but in which other nations have an absolute advantage.

4. "Human-skills theory" — L is a heterogeneous factor, and should be analyzed as separate factors according to skills levels. Perhaps the US is actually skilled- and technical-L rich, and therefore has a comparative advantage in production that requires much skilled or technical L. H- O formulations should be expanded to allow for more than one L factor. [Difficult to test, but can be added to the H-O theorem]. Related to this is the recognition of international differences in factor productivity. US labor is more productive than the labor of most countries (because of skills, work organization, capital/worker, and technology), and is paid more per hour; this helps explain why US labor looms larger as a cost in US exports.

5. Technology itself is a nation-specific factor of production, rather than being a universal attribute of production. Furthermore, technology is a factor that is produced within a given nation (much like a commodity), but is not perfectly mobile or tradable. This kind of thinking has led to "neo-technology theories of trade").

6. The US Government and private companies lent (or otherwise invested) so much capital in particular sectors of particular foreign economies, that these enclaves became, essentially, capital rich.

Q5) Explain new trade theory?

A5)

New trade theory (NTT) suggests that a critical factor in determining international patterns of trade are the very substantial economies of scale and network effects that can occur in key industries.

These economies of scale and network effects can be so significant that they outweigh the more traditional theory of comparative advantage. In some industries, two countries may have no discernible differences in opportunity cost at a particular point in time. But, if one country specialises in a particular industry then it may gain economies of scale and other network benefits from its specialisation.

Another element of new trade theory is that firms who have the advantage of being an early entrant can become a dominant firm in the market. This is because the first firms gain substantial economies of scale meaning that new firms can’t compete against the incumbent firms. This means that in these global industries with very large economies of scale, there is likely to be limited competition, with the market dominated by early firms who entered, leading to a form of monopolistic competition.

Monopolistic competition is an important element of New Trade Theory, it suggests that firms are often competing on branding, quality and not just simple price. It explains why countries can both export and import designer clothes.

This means that the most lucrative industries are often dominated in capital-intensive countries, who were the first to develop these industries. Therefore, being the first firm to reach industrial maturity gives a very strong competitive advantage. (some may say unfair advantage)

New trade theory also becomes a factor in explaining the growth of globalisation.

It means that poorer, developing economies may struggle to ever develop certain industries because they lag too far behind the economies of scale enjoyed in the developed world. This is not due to any intrinsic comparative advantage, but more the economies of scale the developed firms already have.

Paul Krugman was a leading academic in developing New Trade Theory. He was awarded a Nobel Prize (2008) in economics for his contributions in modelling these ideas. “for his analysis of trade patterns and location of economic activity”.

Examples of New Trade Theory

- Specialisation of IT in Silicon Valley – the US. Hewlett and Packard started their computer business. Success attracted more IT firms to that area. Not because of any particular intrinsic benefit but new firms start to get the network benefits of being around other IT setups.’

- Globalisation has led to increased variety for consumers. The proliferation of brand clothing labels. Firms competing in the model of monopolistic competition and heavy branding. Neither UK or Italy has a particular comparative advantage in producing clothes, but consumers are attracted to brand image of Italian and British fashion labels.

New Trade Theory and Government regulation

New trade theory suggests that governments might have a role to play in promoting new industries and supporting the growth of key industries. Some point to the Japanese car industry in the 1950s, which received substantial government support. Other S.E. Asian economies also had some government protection and support.

A developing economy may need tariff protection and domestic subsidy to encourage the creation of capital-intensive industries. If the industry gets support for a few years, it will be able to exploit economies of scale and then be competitive without government support. This is similar to earlier arguments surrounding infant industries.

Q6) Explain product lifecycle theory.

A6) Raymond Vernon, a Harvard Business School professor, developed the product life cycle theory in the 1960s. Products come into the market and steadily depart all over again. According to Raymond Vernon, each manufactured goods has a definite life cycle that begins with its expansion and ends with its decline. Product Life Cycle is defined as, “the sequence through which every product goes through from introduction to removal or ultimate downfall.”

The theory, originating in the field of marketing, stated that a Product life cycle has three distinct stages:

- New product,

- A maturing product, and

- Standardized product.

(A) New product

In this stage, a firm in a developed or developing country will innovate or manufacture a fresh product for their customers. The market for these manufactured goods will be little and sales will be comparatively small as a result. The firm’s marketing executives have to strongly observe buyer reactions to ensure that the new product satisfies customer needs. Characteristics of this stage include:

- Vast promotional costs are compulsory to enhance the consciousness of customers.

- A marketer has to undertake procedural and manufacture troubles.

- The sale is low and growing at a lesser rate.

- There is a loss or an insignificant profit.

(B) Maturity Stage

In the maturity stage of the Product Life Cycle, the manufactured goods are generally known and are bought by many customers. The innovating firm builds new factories to enlarge its competence and convince home and overseas demand for the products. Characteristics of this stage include:

- Sales enlarge at a decreasing rate.

- Profits initiate to decline.

- Marginal competitors put down the market.

- Customer preservation is given more prominence.

(C) Standardized product stage

The market for manufactured goods stabilizes. The product becomes more of a commodity, and firms are pressured to lesser their industrialized costs as much as probable by shifting production to facilities in countries with small labor costs. Characteristics of this stage include:

- Sales reduce quickly.

- Profits reduce more quickly than sales.

- Steadily, the company prefers to move resources to new products.

- Most of the sellers remove from the market.

Q7) Explain New Trade Theory (Zeala- Harrison) and Product Life Cycle Theory (Vernon)

A7)

New trade theory

New trade theory (NTT) suggests that a critical factor in determining international patterns of trade are the very substantial economies of scale and network effects that can occur in key industries.

These economies of scale and network effects can be so significant that they outweigh the more traditional theory of comparative advantage. In some industries, two countries may have no discernible differences in opportunity cost at a particular point in time. But, if one country specialises in a particular industry then it may gain economies of scale and other network benefits from its specialisation.

Another element of new trade theory is that firms who have the advantage of being an early entrant can become a dominant firm in the market. This is because the first firms gain substantial economies of scale meaning that new firms can’t compete against the incumbent firms. This means that in these global industries with very large economies of scale, there is likely to be limited competition, with the market dominated by early firms who entered, leading to a form of monopolistic competition.

Monopolistic competition is an important element of New Trade Theory, it suggests that firms are often competing on branding, quality and not just simple price. It explains why countries can both export and import designer clothes.

This means that the most lucrative industries are often dominated in capital-intensive countries, who were the first to develop these industries. Therefore, being the first firm to reach industrial maturity gives a very strong competitive advantage. (some may say unfair advantage)

New trade theory also becomes a factor in explaining the growth of globalisation.

It means that poorer, developing economies may struggle to ever develop certain industries because they lag too far behind the economies of scale enjoyed in the developed world. This is not due to any intrinsic comparative advantage, but more the economies of scale the developed firms already have.

Paul Krugman was a leading academic in developing New Trade Theory. He was awarded a Nobel Prize (2008) in economics for his contributions in modelling these ideas. “for his analysis of trade patterns and location of economic activity”.

Examples of New Trade Theory

- Specialisation of IT in Silicon Valley – the US. Hewlett and Packard started their computer business. Success attracted more IT firms to that area. Not because of any particular intrinsic benefit but new firms start to get the network benefits of being around other IT setups.’

- Globalisation has led to increased variety for consumers. The proliferation of brand clothing labels. Firms competing in the model of monopolistic competition and heavy branding. Neither UK or Italy has a particular comparative advantage in producing clothes, but consumers are attracted to brand image of Italian and British fashion labels.

New Trade Theory and Government regulation

New trade theory suggests that governments might have a role to play in promoting new industries and supporting the growth of key industries. Some point to the Japanese car industry in the 1950s, which received substantial government support. Other S.E. Asian economies also had some government protection and support.

A developing economy may need tariff protection and domestic subsidy to encourage the creation of capital-intensive industries. If the industry gets support for a few years, it will be able to exploit economies of scale and then be competitive without government support. This is similar to earlier arguments surrounding infant industries.

Product lifecycle theory

Raymond Vernon, a Harvard Business School professor, developed the product life cycle theory in the 1960s. Products come into the market and steadily depart all over again. According to Raymond Vernon, each manufactured goods has a definite life cycle that begins with its expansion and ends with its decline. Product Life Cycle is defined as, “the sequence through which every product goes through from introduction to removal or ultimate downfall.”

The theory, originating in the field of marketing, stated that a Product life cycle has three distinct stages:

- New product,

- A maturing product, and

- Standardized product.

(A) New product

In this stage, a firm in a developed or developing country will innovate or manufacture a fresh product for their customers. The market for these manufactured goods will be little and sales will be comparatively small as a result. The firm’s marketing executives have to strongly observe buyer reactions to ensure that the new product satisfies customer needs. Characteristics of this stage include:

- Vast promotional costs are compulsory to enhance the consciousness of customers.

- A marketer has to undertake procedural and manufacture troubles.

- The sale is low and growing at a lesser rate.

- There is a loss or an insignificant profit.

(B) Maturity Stage

In the maturity stage of the Product Life Cycle, the manufactured goods are generally known and are bought by many customers. The innovating firm builds new factories to enlarge its competence and convince home and overseas demand for the products. Characteristics of this stage include:

- Sales enlarge at a decreasing rate.

- Profits initiate to decline.

- Marginal competitors put down the market.

- Customer preservation is given more prominence.

(C) Standardized product stage

The market for manufactured goods stabilizes. The product becomes more of a commodity, and firms are pressured to lesser their industrialized costs as much as probable by shifting production to facilities in countries with small labor costs. Characteristics of this stage include:

- Sales reduce quickly.

- Profits reduce more quickly than sales.

- Steadily, the company prefers to move resources to new products.

- Most of the sellers remove from the market.

Q8) Explain theory of absolute and comparative cost advantage?

A8) Theory of Absolute Cost Advantage

The Scottish economist Adam Smith developed the trade theory of absolute advantage in 1776 through his legendary book “An Enquiry into the Nature and Causes of Wealth of Nations”. He developed the theory as an attack against the then prevailing mercantilist view of restrictive trade with the slogan ‘free trade’. Smith's argument was that the wealth of nations depends upon the goods and services available to their citizens, rather than the gold reserves held by the nation. Maximizing this availability depends primarily on fuller utilization of resources and then, on the ability

- To obtain goods and services from where they are produced most cheaply (because of “natural” or “acquired” advantages), and

- To pay for them by production of the goods and services produced most cheaply in the country,

Human skill up gradation, division of labour and specialization and the economies of scale are the sources of acquired advantage for cheaper production. Natural advantages may emerge out of natural factors.

As the name indicates this theory proposes that a country should engage in the production and exchange of those commodities where it has an absolute advantage. Such a country produces greater output of a good or service than other countries using the same amount of resources. Absolute advantage is defined as the ability to produce more of a good or service than competitors, using the same amount of resources. Smith stated that tariffs and quotas should not restrict international trade; it should be allowed to flow according to market forces. Contrary to mercantilism Smith argued that a country should concentrate on production of goods in which it holds an absolute advantage. No country would then need to produce all the goods it consumed. The theory of absolute advantage destroys the mercantilist idea that international trade is a zero- sum game. According to the absolute advantage theory, international trade is a positive-sum game, because there are gains for both countries to an exchange.

Assumptions

- There are two countries and two commodities

- One country has absolute advantage in one commodity and the second country has advantage in another commodity

- Technology is assumed to be constant

- Labour is the only factor of production

- Labour is homogeneous, that means each unit of labour produces same level of output value of a commodity is measured in terms of its labour content

- There is no technological improvement

- Labour is perfectly mobile within the country but perfectly immobile between the countries. It means that workers are free to move between industries within the nation but migration to other countries is impossible.

- A system of barter prevails

- Zero transportation cost

Based on these assumptions the theory can be explained with an example. Suppose there are two countries- India and Cuba producing tea and sugar. By employing a worker for one hour India can produce either 10kilograms of tea or 5 kilograms of sugar. Similarly if a Cuban worker is employed she is capable of producing 10 kilograms of sugar or 5 kilograms of tea.

From the table it is clear that by spending an hour’s labour India is capable of producing twofold of tea than Cuba similarly in the case of sugar Cuba is able to generate double the production in India. In short Cuba has absolute advantage in sugar and India in tea. In this situation by concentrating on the respective absolute advantageous areas both nations can benefit by fully channelizing their resources to absolutely advantageous commodity.

Since there is perfect factor mobility within a country, India can channelize labourers into tea sector and Cuba into sugar industry. If India transfer one labour from sugar to tea sector sugar production may fall by 5 kilograms but can produce 10 more kilograms of tea. By exchanging this one unit effort India is capable of purchasing 10 kilograms of sugar from Cuba. So it is beneficial for India. If India goes for domestic exchange, due to the increased cost it will not benefit India. The same is true for Cuba in the case of sugar.

There is a potential problem with absolute advantage. If there is one country that does not have an absolute advantage in the production of any product, will there still be benefit to trade, and will trade even occur? The answer may be found in the extension of absolute advantage, the theory of comparative advantage.

Theory of Comparative Cost Advantage

The most basic concept in the whole of international trade theory is the principle of comparative advantage, first introduced by David Ricardo in 1817. It remains a major influence on much international trade policy and is therefore important in understanding the modern global economy. Comparative advantage is the ability of a firm or individual to produce goods and/or services at a lower opportunity cost than other firms or individuals. A comparative advantage gives a company the ability to sell goods and services at a lower price than its competitors and realize stronger sales margins. David Ricardo stated in his theory of comparative advantage that a country should specialize in producing and exporting products in which it has a comparative advantage and it should import goods in which it has a comparative disadvantage. Out of such specialization, it will accrue greater benefit for all.

Assumptions

- There are two countries and two commodities

- One country has absolute advantage in both commodities and the second country has in another commodity

- Technology is assumed to be constant

- Labour is the only factor of production

- Labour is homogeneous, that means each unit of labour produces same level of output

- Technology is assumed to be constant

- Value of a commodity is measured in terms of its labour content

- There is no technological improvement

- Labour is perfectly mobile within the country but perfectly immobile between the countries. It means that workers are free to move between industries within the nation but migration to other countries is impossible.

- A system of barter prevails

- Zero transportation cost

Example

In this example Indian labourers are capable of producing both wheat and tea in absolute advantage. Burma is disadvantageous in both cases. But still there is a possibility for trade. Burma has fewer disadvantages in tea than wheat. So it is its comparative advantage. If India concentrates in wheat it is capable of producing more than two fold wheat, but in tea it can produce only two fold than Burma. Although India has an absolute advantage in the production of both tea and wheat, India has a comparative advantage only in the production of wheat. This is because its advantage in wheat is comparatively greater than its advantage in tea. In this situation India can concentrate on wheat and Burma on tea and both can benefit from trade.

In this theory there are several assumptions that limit the real-world application. The assumption that countries are driven only by the maximization of production and consumption and not by issues out of concern for workers or consumers is a mistake.

Q9) What are the Possible explanations of the Leontief paradox?

A9) Possible explanations of the Leontief paradox

- US demand for K-intensive products outstripped its capacity to provide them domestically. So there was no other alternative than imports.

2. "Factor-intensity reversal" — Leontief had no idea of the input mix for manufacturing in other countries; he measured the K-intensity of US production in import-competing industries, not of US imports. If L is expensive in the US, then US industries facing import competition would have to reduce their use of L, by substituting K. However, this would mean that production functions (i.e., input mix; technology) vary for the same products in different places, which renders the Heckscher-Ohlin theorem nearly useless.

3. Perhaps international trade flows were not rationalized according to comparative advantage in 1947, immediately after the destruction and disruption of World War 2. After all, comparative advantage is a normative concept. 4. The US imported natural-resource commodities whose extraction is K-intensive, but in which other nations have an absolute advantage.

4. "Human-skills theory" — L is a heterogeneous factor, and should be analyzed as separate factors according to skills levels. Perhaps the US is actually skilled- and technical-L rich, and therefore has a comparative advantage in production that requires much skilled or technical L. H- O formulations should be expanded to allow for more than one L factor. [Difficult to test, but can be added to the H-O theorem]. Related to this is the recognition of international differences in factor productivity. US labor is more productive than the labor of most countries (because of skills, work organization, capital/worker, and technology), and is paid more per hour; this helps explain why US labor looms larger as a cost in US exports.

5. Technology itself is a nation-specific factor of production, rather than being a universal attribute of production. Furthermore, technology is a factor that is produced within a given nation (much like a commodity), but is not perfectly mobile or tradable. This kind of thinking has led to "neo-technology theories of trade").

6. The US Government and private companies lent (or otherwise invested) so much capital in particular sectors of particular foreign economies, that these enclaves became, essentially, capital rich.

Q10) Explain absolute cost advantage with examples?

A10) The Scottish economist Adam Smith developed the trade theory of absolute advantage in 1776 through his legendary book “An Enquiry into the Nature and Causes of Wealth of Nations”. He developed the theory as an attack against the then prevailing mercantilist view of restrictive trade with the slogan ‘free trade’. Smith's argument was that the wealth of nations depends upon the goods and services available to their citizens, rather than the gold reserves held by the nation. Maximizing this availability depends primarily on fuller utilization of resources and then, on the ability

- To obtain goods and services from where they are produced most cheaply (because of “natural” or “acquired” advantages), and

- To pay for them by production of the goods and services produced most cheaply in the country,

Human skill up gradation, division of labour and specialization and the economies of scale are the sources of acquired advantage for cheaper production. Natural advantages may emerge out of natural factors.

As the name indicates this theory proposes that a country should engage in the production and exchange of those commodities where it has an absolute advantage. Such a country produces greater output of a good or service than other countries using the same amount of resources. Absolute advantage is defined as the ability to produce more of a good or service than competitors, using the same amount of resources. Smith stated that tariffs and quotas should not restrict international trade; it should be allowed to flow according to market forces. Contrary to mercantilism Smith argued that a country should concentrate on production of goods in which it holds an absolute advantage. No country would then need to produce all the goods it consumed. The theory of absolute advantage destroys the mercantilist idea that international trade is a zero- sum game. According to the absolute advantage theory, international trade is a positive-sum game, because there are gains for both countries to an exchange.

Assumptions

- There are two countries and two commodities

- One country has absolute advantage in one commodity and the second country has advantage in another commodity

- Technology is assumed to be constant

- Labour is the only factor of production

- Labour is homogeneous, that means each unit of labour produces same level of output value of a commodity is measured in terms of its labour content

- There is no technological improvement

- Labour is perfectly mobile within the country but perfectly immobile between the countries. It means that workers are free to move between industries within the nation but migration to other countries is impossible.

- A system of barter prevails

- Zero transportation cost

Based on these assumptions the theory can be explained with an example. Suppose there are two countries- India and Cuba producing tea and sugar. By employing a worker for one hour India can produce either 10kilograms of tea or 5 kilograms of sugar. Similarly if a Cuban worker is employed she is capable of producing 10 kilograms of sugar or 5 kilograms of tea.

From the table it is clear that by spending an hour’s labour India is capable of producing twofold of tea than Cuba similarly in the case of sugar Cuba is able to generate double the production in India. In short Cuba has absolute advantage in sugar and India in tea. In this situation by concentrating on the respective absolute advantageous areas both nations can benefit by fully channelizing their resources to absolutely advantageous commodity.

Since there is perfect factor mobility within a country, India can channelize labourers into tea sector and Cuba into sugar industry. If India transfer one labour from sugar to tea sector sugar production may fall by 5 kilograms but can produce 10 more kilograms of tea. By exchanging this one unit effort India is capable of purchasing 10 kilograms of sugar from Cuba. So it is beneficial for India. If India goes for domestic exchange, due to the increased cost it will not benefit India. The same is true for Cuba in the case of sugar.

There is a potential problem with absolute advantage. If there is one country that does not have an absolute advantage in the production of any product, will there still be benefit to trade, and will trade even occur? The answer may be found in the extension of absolute advantage, the theory of comparative advantage.

Q11) Explain comparative cost advantage with example?

A11) The most basic concept in the whole of international trade theory is the principle of comparative advantage, first introduced by David Ricardo in 1817. It remains a major influence on much international trade policy and is therefore important in understanding the modern global economy. Comparative advantage is the ability of a firm or individual to produce goods and/or services at a lower opportunity cost than other firms or individuals. A comparative advantage gives a company the ability to sell goods and services at a lower price than its competitors and realize stronger sales margins. David Ricardo stated in his theory of comparative advantage that a country should specialize in producing and exporting products in which it has a comparative advantage and it should import goods in which it has a comparative disadvantage. Out of such specialization, it will accrue greater benefit for all.

Assumptions

- There are two countries and two commodities

- One country has absolute advantage in both commodities and the second country has in another commodity

- Technology is assumed to be constant

- Labour is the only factor of production

- Labour is homogeneous, that means each unit of labour produces same level of output

- Technology is assumed to be constant

- Value of a commodity is measured in terms of its labour content

- There is no technological improvement

- Labour is perfectly mobile within the country but perfectly immobile between the countries. It means that workers are free to move between industries within the nation but migration to other countries is impossible.

- A system of barter prevails

- Zero transportation cost

Example

In this example Indian labourers are capable of producing both wheat and tea in absolute advantage. Burma is disadvantageous in both cases. But still there is a possibility for trade. Burma has fewer disadvantages in tea than wheat. So it is its comparative advantage. If India concentrates in wheat it is capable of producing more than two fold wheat, but in tea it can produce only two fold than Burma. Although India has an absolute advantage in the production of both tea and wheat, India has a comparative advantage only in the production of wheat. This is because its advantage in wheat is comparatively greater than its advantage in tea. In this situation India can concentrate on wheat and Burma on tea and both can benefit from trade.

In this theory there are several assumptions that limit the real-world application. The assumption that countries are driven only by the maximization of production and consumption and not by issues out of concern for workers or consumers is a mistake.