UNIT 3

Trade Policy

Q1) Explain free trade policy arguments for and against?

A1) Free trade may be defined as a policy of a government which does not discriminate against imports or interfere with trade by applying tariffs (to imports) or subsidies (to exports). In other words it is the unrestricted purchase and sale of goods and services between countries without the imposition of constraints such as tariffs, duties and quotas. Free trade enables nations to focus on their core competitive advantages, thereby maximizing economic output and fostering income growth for their citizens. The idea that free trade is welfare enhancing is one of the most fundamental doctrines in modern economics dating back at least to Adam Smith (1776) and David Ricardo (1816). But the policy of free trade has been in controversy all the time because the countries were not taking choice between free trade and autarky (no trade). They always choose one policy from among a spectrum of free trade regimes with varying degrees of liberalization.

Arguments for free trade policy

- The theory of comparative advantage - This explains that by specializing and trading goods in which countries have a lower opportunity cost or greater comparative advantage, there can be an increase in economic welfare for all countries. Free trade enables countries to specialize in those goods where they have a comparative advantage. Free trade in lines of comparative advantage is expected to mutually benefit the countries engaged in free trade.

2. Trade as a vent for surplus- Trade is identified as a vent for surplus output of an economy. The dictum is related to Adam smith who identified the importance of division of labour. Smith also maintained that the division of labour is limited by the size of the market. Hence division of labour is expected to raise the domestic production. A deficiency in Aggregate demand may reduce the domestic prices. Here trade can act as a vent for surplus production brought forth through technology and division of labour. Free trade is expected to smoothen this process.

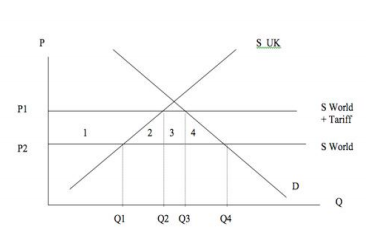

3. Reducing Tariff barriers leads to trade creation Trade creation occurs when consumption switches from high cost producers to low cost producers. Reducing the tariff barriers with an objective to bring about free trade in an economy may help countries for trade creation. The following diagram explains the above idea.

The removal of tariffs leads to lower prices for consumers and an increase in consumer surplus of areas 1 + 2 + 3 + 4

Imports will increase from Q3-Q2 to Q4-Q1

The government will lose tax revenue of area 3

Domestic firms producing this good will sell less and lose producer surplus equal to area 1

However overall there will be an increase in economic welfare of 2+4 (1+2+3+4 – (1+3) The magnitude of this increase depends upon the elasticity of supply and demand. If demand elastic consumers will have a big increase in welfare

4. Economies of Scale- If countries can specialize in certain goods they can benefit from economies of scale and lower average costs. Economies of scale refer to the capacity of firms to change their output more than proportionately to changes in inputs. This is especially true in industries with high fixed costs or that require high levels of investment. The benefits of economies of scale will ultimately lead to lower prices for consumers. Lowering of trade restrictions enhances this outcome.

5. Increased Competition- With more trade domestic firms will face more competition from abroad. As a result of this there will be more incentives to cut costs and increase efficiency. It may prevent domestic monopolies from charging too high prices.

6. Trade is an engine of growth- World trade has increased by an average of 7% since the 1945, causing this to be one of the big contributors to economic growth.

7. Make use of surplus raw materials- Middle Eastern counties such as Qatar are very rich in reserves of oil but without trade there would be not much benefit in having so much oil. Japan on the other hand has very few raw material without trade it would be very poor.

8. Tariffs encourage inefficiency- If an economy protects its domestic industry by increasing tariffs industries may not have any incentives to cut costs. Trade liberalization is often justified in terms of the efficient market outcome and efficient price fixation through a competitive price fixing mechanism.

Arguments against Free Trade

- Infant Industry Argument: Governments are sometimes urged to support the development of infant industries, protecting home industries in their early stages, usually through subsidies or tariffs. Subsidies may be indirect, as in when import duties are imposed or some prohibition against the import of a raw or finished material is imposed. If developing countries have industries that are relatively new, then at the moment these industries would struggle against international competition. However if they invested in the industry then in the future they may be able to gain Comparative Advantage.

2. The Senile industry argument: If industries are declining and inefficient they may require large investment to make them efficient again. Protection for these industries would act as an incentive to for firms to invest and reinvent themselves. However protectionism could also be an excuse for protecting inefficient firms

3. To diversify the economy: Many developing countries rely on producing primary products in which they currently have a comparative advantage. However relying on agricultural products has several disadvantages. One of the most important determinants of Agricultural Prices is the environmental factors. Hence they can fluctuate with climatic changes. Agricultural commodities have a low income and price elasticity of demand. Therefore with proportionate rise in economic growth will lead to less than proportionate rise in demand. Agricultural commodities have relatively low price elasticity of supply. A proportionate rise in prices will lead to less than proportionate rise in supply of agricultural commodities. This is because of the time lag involved in the production of agricultural goods. This is given by the fact that the production of agricultural goods at time t is determined by the prices prevailing in time‘t-1’.

4. Raise revenue for the govt: Import taxes and tariffs can be used to raise money for the government.

5. Help the Balance of Payments: Reducing imports can help the current account. However in the long term this is likely to lead to retaliation

6. Cultural Identity: This is not really an economic argument but more political and cultural. Many countries wish to protect their countries from what they see as an Americanization or commercialization of their countries

7. Protection against dumping: The EU sold a lot of its food surplus from the CAP at very low prices on the world market. This caused problems for world farmers because they saw a big fall in their market prices 8. Environmental: It is argued that free trade can harm the environment because Developing countries may use up natural reserves of raw materials to produce exportable commodities. Also countries with strict pollution controls may find consumers import the goods from other countries where legislation is lax and pollution allowed.

Q2) Explain protection policy argument for and against?

A2) Trade protection is the deliberate attempt to limit imports or promote exports by putting up barriers to trade. Despite the arguments in favour of free trade and increasing trade openness, protectionism is still widely practiced.

Protectionism refers to government policies that restrict international trade to help domestic industries. Protectionist policies are usually implemented with the goal to improve economic activity within a domestic economy but can also be implemented for safety or quality concerns.

Arguments for Protection:

1. Infant Industries:

Many developing countries, like India, Pakistan, Sri Lanka and Bangladesh have the conditions necessary to compete successfully in the international market, but they lack experience and expertise which take time to acquire.

The infant industry argument suggests that new industries should be given temporary protection in order to enable them to build up this experience. This argument applies where the industry is small and young, and where costs are high but fall as the industry grows.

According to this argument, there are some industries in which a country would really have comparative advantages if and only if it could get them started. If faced with foreign competition, such infant (young and growing) industries would not be able to pass the initial period of experiment and financial stresses.

But given protection for a short period, they can be expected to develop economies of mass production and they would ultimately be able to face foreign competition without protection. So, at the infant stage such industries should be protected for a period till they can face competition independently.

2. Diversification of Industries Argument:

A policy of production is also advocated to diversify a developing country’s industrial structure. A country cannot rely on one or a few industries only; it is necessary that a large number of industries of diverse varieties develop in the long run. This strategy will reduce the risk of losing foreign markets; for, in case of failure to export one commodity, other goods may be exported.

3. Employment Protection:

The dynamics of the world economy mean that at any time some industries will be in decline. If those industries were responsible for a significant amount of employment in a country in the past, their decline would cause problems of regional unemployment. There s justification for a country to protect a contracting industry to slow down its rate of decline so that time is given for people to find jobs elsewhere in the economy.

4. Employment Creation:

Protection to home industries may create employment opportunities in the country, and thus reduce the magnitude of unemployment. But this argument is also fallacious; for protection may create employment in some home industries, but by reducing imports it reduces employment opportunities in the foreign countries.

5. Balance of Trade:

Some countries experience imbalance in their trade with the rest of the world. If they are importing too many goods they may correct a temporary problem by imposing tariffs on imports. A suitable tariff policy can create and maintain a favourable balance of trade.

The restrictions on imports for the purpose of protection will create a surplus in the balance of trade of the country. But this argument is wrong. If all countries simultaneously follow this policy, none would find foreign buyers for the sale of goods and so none would gain. However, Sir Arthur Lewis has put forward a counter argument here.

6. Dumping to Reflect Low Marginal Cost of Production:

Dumping is a problem which confronts many countries. It is an example of price discrimination at the international level. By following the practice of dumping foreign sellers try to capture the home market by selling their goods at low prices.

Protection of home industries is necessary to resist such a policy. It refers to the selling of products on overseas markets at prices below those prevailing on domestic markets. The danger here is that the dumping of products could cause prices to drop drastically.

This could benefit the consumers in the short run. But, in the long run, domestic producers could be forced out of business making room for the foreign suppliers in the future. Producers may be off-loading products on foreign markets to keep prices up in their home markets. The price of a Japanese camera, for example, is higher in Tokyo than in New York. Therefore, the effects of dumping are undesirable and, if it can be detected, some protection against its adverse effects is justified.

7. Improving the Terms of Trade:

Countries can improve their position when they are the sole (or dominant) buyer of a commodity. This is rare, but if American importers of tea agreed with one another to restrict imports’ then the world price would fall. Of course, this would lower the incomes received by the producers of tea and so might be thought undesirable as they are mostly poor countries.

8. Retaliation:

Protecting an industry as a retaliation for protection introduced by other countries is questionable. It was used by the USA when it felt that the European Union was using hidden subsidies to lower the price of steel exported to the USA.

Fallacious Arguments:

The following arguments for protection are found to be fallacious:

1. Keeping Money at Home Argument:

According to Abraham Lincon, protection prevents the purchase of foreign goods and thereby keeps money at home. But this argument loses much of its weight when we observe that owing to protection the people of the country are to pay higher prices for home-produced goods.

2. Home Market Argument:

It is argued by Henry Clay and other American protectionists that the restriction on the imports of foreign goods will create a wide domestic market for the products of the home industries. But this argument is also fallacious because protection, by curtailing imports, will reduce exports’ too. It is true that home industries will lose the foreign markets if the same policy is pursued by foreigners.

3. National Defence Argument:

Industries which are essential for the defence (e.g., arms and ammunitions, military equipment, etc.) of the country are to be protected to preserve the national independence of a country. The policy of discriminating protection as adopted in India also in 1949-50 prescribed protection for defence industries at any cost.

4. National Self-Sufficiency Argument:

Protection is also advocated to attain self-sufficiency in essential goods. The industries which are essential for national self-sufficiency are to be protected. This is really a convincing argument for protection in developing countries like India. In fact, national interest is the sole criterion for granting protection to industries in such countries.

Arguments Against Protection:

The policy of protection is also criticised on various grounds:

(a) It creates obstacles or barriers to free multinational trade. Due to high tariffs imposed by other countries, a country is not allowed to produce goods in which it has cost advantages. So, protection reduces world production and consumption of internationally traded goods,

(b) Owing to higher tariff on imports, the consumers are compelled to buy home goods, often of inferior quality and often at higher prices,

(c) Protection gives shelter to weak home industries. If it is permanent, home industries would not get any incentive to compete freely with their foreign counterparts. There would be need for continuation of protection for an indefinite period,

(d) Protection may lead to trade wars and international conflicts among trading nations,

(e) Protection give rise to such abuse as ‘wire-pulling’ in political quarters, vested interest in the protected sector, etc.

Q3) Explain free trade policy arguments.

A3) Free trade may be defined as a policy of a government which does not discriminate against imports or interfere with trade by applying tariffs (to imports) or subsidies (to exports). In other words it is the unrestricted purchase and sale of goods and services between countries without the imposition of constraints such as tariffs, duties and quotas. Free trade enables nations to focus on their core competitive advantages, thereby maximizing economic output and fostering income growth for their citizens. The idea that free trade is welfare enhancing is one of the most fundamental doctrines in modern economics dating back at least to Adam Smith (1776) and David Ricardo (1816). But the policy of free trade has been in controversy all the time because the countries were not taking choice between free trade and autarky (no trade). They always choose one policy from among a spectrum of free trade regimes with varying degrees of liberalization.

Arguments for free trade policy

- The theory of comparative advantage - This explains that by specializing and trading goods in which countries have a lower opportunity cost or greater comparative advantage, there can be an increase in economic welfare for all countries. Free trade enables countries to specialize in those goods where they have a comparative advantage. Free trade in lines of comparative advantage is expected to mutually benefit the countries engaged in free trade.

2. Trade as a vent for surplus- Trade is identified as a vent for surplus output of an economy. The dictum is related to Adam smith who identified the importance of division of labour. Smith also maintained that the division of labour is limited by the size of the market. Hence division of labour is expected to raise the domestic production. A deficiency in Aggregate demand may reduce the domestic prices. Here trade can act as a vent for surplus production brought forth through technology and division of labour. Free trade is expected to smoothen this process.

3. Reducing Tariff barriers leads to trade creation Trade creation occurs when consumption switches from high cost producers to low cost producers. Reducing the tariff barriers with an objective to bring about free trade in an economy may help countries for trade creation. The following diagram explains the above idea.

- The removal of tariffs leads to lower prices for consumers and an increase in consumer surplus of areas 1 + 2 + 3 + 4

- Imports will increase from Q3-Q2 to Q4-Q1

- The government will lose tax revenue of area 3

- Domestic firms producing this good will sell less and lose producer surplus equal to area 1

- However overall there will be an increase in economic welfare of 2+4 (1+2+3+4 – (1+3) The magnitude of this increase depends upon the elasticity of supply and demand. If demand elastic consumers will have a big increase in welfare

4. Economies of Scale- If countries can specialize in certain goods they can benefit from economies of scale and lower average costs. Economies of scale refer to the capacity of firms to change their output more than proportionately to changes in inputs. This is especially true in industries with high fixed costs or that require high levels of investment. The benefits of economies of scale will ultimately lead to lower prices for consumers. Lowering of trade restrictions enhances this outcome.

5. Increased Competition- With more trade domestic firms will face more competition from abroad. As a result of this there will be more incentives to cut costs and increase efficiency. It may prevent domestic monopolies from charging too high prices.

6. Trade is an engine of growth- World trade has increased by an average of 7% since the 1945, causing this to be one of the big contributors to economic growth.

7. Make use of surplus raw materials- Middle Eastern counties such as Qatar are very rich in reserves of oil but without trade there would be not much benefit in having so much oil. Japan on the other hand has very few raw material without trade it would be very poor.

8. Tariffs encourage inefficiency- If an economy protects its domestic industry by increasing tariffs industries may not have any incentives to cut costs. Trade liberalization is often justified in terms of the efficient market outcome and efficient price fixation through a competitive price fixing mechanism.

Q4) Explain free trade policy arguments against free trade.

A4) Free trade may be defined as a policy of a government which does not discriminate against imports or interfere with trade by applying tariffs (to imports) or subsidies (to exports). In other words it is the unrestricted purchase and sale of goods and services between countries without the imposition of constraints such as tariffs, duties and quotas. Free trade enables nations to focus on their core competitive advantages, thereby maximizing economic output and fostering income growth for their citizens. The idea that free trade is welfare enhancing is one of the most fundamental doctrines in modern economics dating back at least to Adam Smith (1776) and David Ricardo (1816). But the policy of free trade has been in controversy all the time because the countries were not taking choice between free trade and autarky (no trade). They always choose one policy from among a spectrum of free trade regimes with varying degrees of liberalization.

Arguments against Free Trade

- Infant Industry Argument: Governments are sometimes urged to support the development of infant industries, protecting home industries in their early stages, usually through subsidies or tariffs. Subsidies may be indirect, as in when import duties are imposed or some prohibition against the import of a raw or finished material is imposed. If developing countries have industries that are relatively new, then at the moment these industries would struggle against international competition. However if they invested in the industry then in the future they may be able to gain Comparative Advantage.

2. The Senile industry argument: If industries are declining and inefficient they may require large investment to make them efficient again. Protection for these industries would act as an incentive to for firms to invest and reinvent themselves. However protectionism could also be an excuse for protecting inefficient firms

3. To diversify the economy: Many developing countries rely on producing primary products in which they currently have a comparative advantage. However relying on agricultural products has several disadvantages. One of the most important determinants of Agricultural Prices is the environmental factors. Hence they can fluctuate with climatic changes. Agricultural commodities have a low income and price elasticity of demand. Therefore with proportionate rise in economic growth will lead to less than proportionate rise in demand. Agricultural commodities have relatively low price elasticity of supply. A proportionate rise in prices will lead to less than proportionate rise in supply of agricultural commodities. This is because of the time lag involved in the production of agricultural goods. This is given by the fact that the production of agricultural goods at time t is determined by the prices prevailing in time‘t-1’.

4. Raise revenue for the govt: Import taxes and tariffs can be used to raise money for the government.

5. Help the Balance of Payments: Reducing imports can help the current account. However in the long term this is likely to lead to retaliation

6. Cultural Identity: This is not really an economic argument but more political and cultural. Many countries wish to protect their countries from what they see as an Americanization or commercialization of their countries

7. Protection against dumping: The EU sold a lot of its food surplus from the CAP at very low prices on the world market. This caused problems for world farmers because they saw a big fall in their market prices 8. Environmental: It is argued that free trade can harm the environment because Developing countries may use up natural reserves of raw materials to produce exportable commodities. Also countries with strict pollution controls may find consumers import the goods from other countries where legislation is lax and pollution allowed.

Q5) explain argument for protection policy.

A5) Trade protection is the deliberate attempt to limit imports or promote exports by putting up barriers to trade. Despite the arguments in favour of free trade and increasing trade openness, protectionism is still widely practiced.

Protectionism refers to government policies that restrict international trade to help domestic industries. Protectionist policies are usually implemented with the goal to improve economic activity within a domestic economy but can also be implemented for safety or quality concerns.

Arguments for Protection:

1. Infant Industries:

Many developing countries, like India, Pakistan, Sri Lanka and Bangladesh have the conditions necessary to compete successfully in the international market, but they lack experience and expertise which take time to acquire.

The infant industry argument suggests that new industries should be given temporary protection in order to enable them to build up this experience. This argument applies where the industry is small and young, and where costs are high but fall as the industry grows.

According to this argument, there are some industries in which a country would really have comparative advantages if and only if it could get them started. If faced with foreign competition, such infant (young and growing) industries would not be able to pass the initial period of experiment and financial stresses.

But given protection for a short period, they can be expected to develop economies of mass production and they would ultimately be able to face foreign competition without protection. So, at the infant stage such industries should be protected for a period till they can face competition independently.

2. Diversification of Industries Argument:

A policy of production is also advocated to diversify a developing country’s industrial structure. A country cannot rely on one or a few industries only; it is necessary that a large number of industries of diverse varieties develop in the long run. This strategy will reduce the risk of losing foreign markets; for, in case of failure to export one commodity, other goods may be exported.

3. Employment Protection:

The dynamics of the world economy mean that at any time some industries will be in decline. If those industries were responsible for a significant amount of employment in a country in the past, their decline would cause problems of regional unemployment. There s justification for a country to protect a contracting industry to slow down its rate of decline so that time is given for people to find jobs elsewhere in the economy.

4. Employment Creation:

Protection to home industries may create employment opportunities in the country, and thus reduce the magnitude of unemployment. But this argument is also fallacious; for protection may create employment in some home industries, but by reducing imports it reduces employment opportunities in the foreign countries.

5. Balance of Trade:

Some countries experience imbalance in their trade with the rest of the world. If they are importing too many goods they may correct a temporary problem by imposing tariffs on imports. A suitable tariff policy can create and maintain a favourable balance of trade.

The restrictions on imports for the purpose of protection will create a surplus in the balance of trade of the country. But this argument is wrong. If all countries simultaneously follow this policy, none would find foreign buyers for the sale of goods and so none would gain. However, Sir Arthur Lewis has put forward a counter argument here.

6. Dumping to Reflect Low Marginal Cost of Production:

Dumping is a problem which confronts many countries. It is an example of price discrimination at the international level. By following the practice of dumping foreign sellers try to capture the home market by selling their goods at low prices.

Protection of home industries is necessary to resist such a policy. It refers to the selling of products on overseas markets at prices below those prevailing on domestic markets. The danger here is that the dumping of products could cause prices to drop drastically.

This could benefit the consumers in the short run. But, in the long run, domestic producers could be forced out of business making room for the foreign suppliers in the future. Producers may be off-loading products on foreign markets to keep prices up in their home markets. The price of a Japanese camera, for example, is higher in Tokyo than in New York. Therefore, the effects of dumping are undesirable and, if it can be detected, some protection against its adverse effects is justified.

7. Improving the Terms of Trade:

Countries can improve their position when they are the sole (or dominant) buyer of a commodity. This is rare, but if American importers of tea agreed with one another to restrict imports’ then the world price would fall. Of course, this would lower the incomes received by the producers of tea and so might be thought undesirable as they are mostly poor countries.

8. Retaliation:

Protecting an industry as a retaliation for protection introduced by other countries is questionable. It was used by the USA when it felt that the European Union was using hidden subsidies to lower the price of steel exported to the USA.

Fallacious Arguments:

The following arguments for protection are found to be fallacious:

1. Keeping Money at Home Argument:

According to Abraham Lincon, protection prevents the purchase of foreign goods and thereby keeps money at home. But this argument loses much of its weight when we observe that owing to protection the people of the country are to pay higher prices for home-produced goods.

2. Home Market Argument:

It is argued by Henry Clay and other American protectionists that the restriction on the imports of foreign goods will create a wide domestic market for the products of the home industries. But this argument is also fallacious because protection, by curtailing imports, will reduce exports’ too. It is true that home industries will lose the foreign markets if the same policy is pursued by foreigners.

3. National Defence Argument:

Industries which are essential for the defence (e.g., arms and ammunitions, military equipment, etc.) of the country are to be protected to preserve the national independence of a country. The policy of discriminating protection as adopted in India also in 1949-50 prescribed protection for defence industries at any cost.

4. National Self-Sufficiency Argument:

Protection is also advocated to attain self-sufficiency in essential goods. The industries which are essential for national self-sufficiency are to be protected. This is really a convincing argument for protection in developing countries like India. In fact, national interest is the sole criterion for granting protection to industries in such countries.

Q6) Explain argument against protection policy.

A6) Trade protection is the deliberate attempt to limit imports or promote exports by putting up barriers to trade. Despite the arguments in favour of free trade and increasing trade openness, protectionism is still widely practiced.

Protectionism refers to government policies that restrict international trade to help domestic industries. Protectionist policies are usually implemented with the goal to improve economic activity within a domestic economy but can also be implemented for safety or quality concerns.

Arguments Against Protection:

The policy of protection is also criticised on various grounds:

(a) It creates obstacles or barriers to free multinational trade. Due to high tariffs imposed by other countries, a country is not allowed to produce goods in which it has cost advantages. So, protection reduces world production and consumption of internationally traded goods,

(b) Owing to higher tariff on imports, the consumers are compelled to buy home goods, often of inferior quality and often at higher prices,

(c) Protection gives shelter to weak home industries. If it is permanent, home industries would not get any incentive to compete freely with their foreign counterparts. There would be need for continuation of protection for an indefinite period,

(d) Protection may lead to trade wars and international conflicts among trading nations,

(e) Protection give rise to such abuse as ‘wire-pulling’ in political quarters, vested interest in the protected sector, etc.

Q7) Explain types of protection.

A7) Protectionism is the practice of following protectionist trade policies. A protectionist trade policy allows the government of a country to promote domestic producers, and thereby boost the domestic production of goods and services by imposing tariffs or otherwise limiting foreign goods and services in the marketplace.

Protectionist policies also allow the government to protect developing domestic industries from established foreign competitors.

Types of Protectionism

Protectionist policies come in different forms, including:

1. Tariffs

The taxes or duties imposed on imports are known as tariffs. Tariffs increase the price of imported goods in the domestic market, which, consequently, reduces the demand for them.

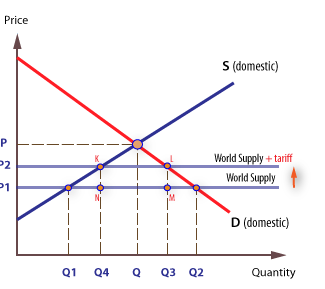

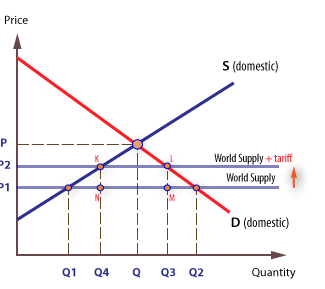

The impact of tariffs

The imposition of tariffs leads to the following:

Higher prices

Domestic consumers face higher prices, which also means that there is a loss of consumer surplus. However, there is a gain in domestic producer surplus as producers are protected from cheap imports, and receive a higher price than they would have without the tariff. However, it is likely that there is an overall net welfare loss.

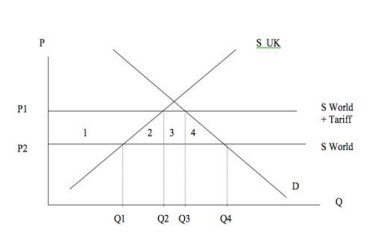

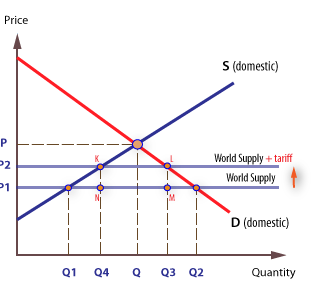

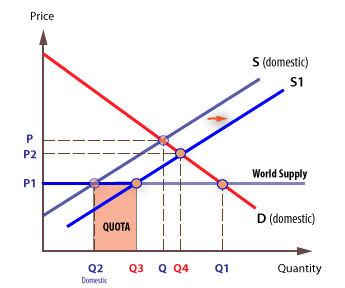

Without trade, the domestic price and quantity are P & Q.

If a country opens up to world supply, price falls to P1, and output increases from Q to Q2. As a result, domestic producers’ share falls to Q1 and imports now dominate, with the quantity imported Q1 to Q2.

The imposition of a tariff shifts up the world supply curve to World Supply + Tariff.

The price rises to P2, and the new output is at Q3. Domestic producers share of the market rise to Q4, and imports fall to Q4 to Q3. The result is that domestic producers have been protected from cheaper imports from the rest of the World.

Given that domestic consumers face higher prices, they also suffer a loss of consumer surplus. In contrast, domestic producers increase their producer surplus as they receive a higher price than they would have without the tariff.

Increased market share also means that jobs will be protected in the domestic economy.

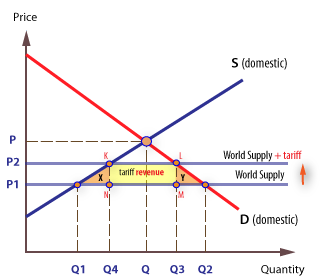

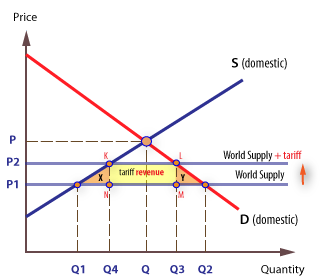

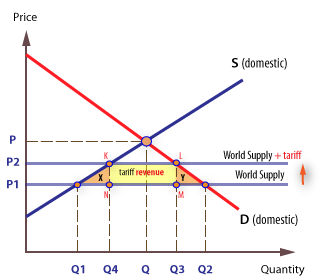

Welfare loss

However, the reduction in consumer surplus is greater than the increase in producer surplus. Even when adding the tariff revenue (area K,L,M,N) there is still a net loss. The net welfare loss is represented by the triangles X and Y.

Distortion

There is a potential distortion of the principle of comparative advantage, whereby a tariff alters the cost advantage that countries may have built up through specialisation.

Retaliation

There is the likelihood of retaliation from exporting countries, which could trigger a costly trade war.

However, in the short run tariffs may protect jobs, infant and declining industries, and strategic goods. Tariffs may also help conserve a non-renewable scarce resource. Selective tariffs may also help reduce a trade deficit, and reduce consumption.

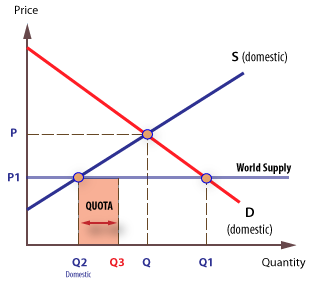

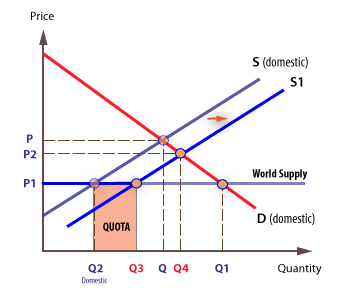

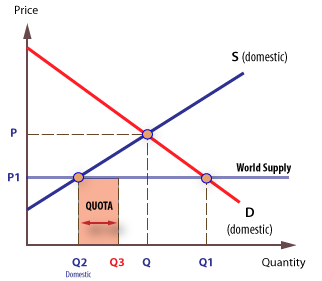

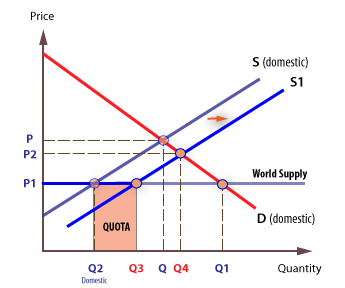

2. Quotas

Quotas are restrictions on the volume of imports for a particular good or service over a period of time. Quotas are known as a “non-tariff trade barrier.” A constraint on the supply causes an increase in the prices of imported goods, reducing the demand in the domestic market.

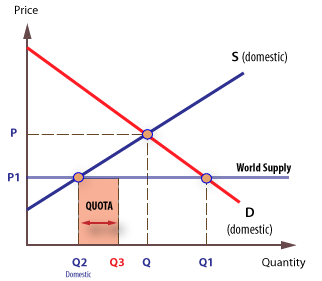

A quota is a limit to the quantity coming into a country.

With no trade, equilibrium market price in the country will exist at the price which equates domestic demand and domestic supply, at P, and with output at Q. However, the world price is likely to be lower, at P1, than the price in a country that does not trade. If the country is opened up to free trade from the rest of the world, the world supply curve will be perfectly elastic at the world price, P1.

The new equilibrium price is P1 and output is Q1. The domestic share of output is now Q2,compared with Q, the self-sufficient quantity. The amount imported is the distance Q2 to Q1.

Imposing a quota

In an attempt to protect domestic producers, a quota of Q2 to Q3 may be imposed on imports.

This enables the domestic share of output to rise to 0 to Q2, plus Q3 to Q4.

The quota creates a relative shortage and drives the price up to P2, with total output falling to Q4. The amount imported falls to the quota level. It is this price rise that provides an incentive for less efficient domestic firms to increase their output.

3. Subsidies

Subsidies are negative taxes or tax credits that are given to domestic producers by the government. They create a discrepancy between the price faced by consumers and the price faced by producers.

4. Standardization

The government of a country may require all foreign products to adhere to certain guidelines. For instance, the UK Government may demand that all imported shoes include a certain proportion of leather. Standardization measures tend to reduce foreign products in the market.

Q8) Explain meaning and types of protection.

A8) Protectionism is the practice of following protectionist trade policies. A protectionist trade policy allows the government of a country to promote domestic producers, and thereby boost the domestic production of goods and services by imposing tariffs or otherwise limiting foreign goods and services in the marketplace.

Protectionist policies also allow the government to protect developing domestic industries from established foreign competitors.

Types of Protectionism

Protectionist policies come in different forms, including:

1. Tariffs

The taxes or duties imposed on imports are known as tariffs. Tariffs increase the price of imported goods in the domestic market, which, consequently, reduces the demand for them.

The impact of tariffs

The imposition of tariffs leads to the following:

Higher prices

Domestic consumers face higher prices, which also means that there is a loss of consumer surplus. However, there is a gain in domestic producer surplus as producers are protected from cheap imports, and receive a higher price than they would have without the tariff. However, it is likely that there is an overall net welfare loss.

Without trade, the domestic price and quantity are P & Q.

If a country opens up to world supply, price falls to P1, and output increases from Q to Q2. As a result, domestic producers’ share falls to Q1 and imports now dominate, with the quantity imported Q1 to Q2.

The imposition of a tariff shifts up the world supply curve to World Supply + Tariff.

The price rises to P2, and the new output is at Q3. Domestic producers share of the market rise to Q4, and imports fall to Q4 to Q3. The result is that domestic producers have been protected from cheaper imports from the rest of the World.

Given that domestic consumers face higher prices, they also suffer a loss of consumer surplus. In contrast, domestic producers increase their producer surplus as they receive a higher price than they would have without the tariff.

Increased market share also means that jobs will be protected in the domestic economy.

Welfare loss

However, the reduction in consumer surplus is greater than the increase in producer surplus. Even when adding the tariff revenue (area K,L,M,N) there is still a net loss. The net welfare loss is represented by the triangles X and Y.

Distortion

There is a potential distortion of the principle of comparative advantage, whereby a tariff alters the cost advantage that countries may have built up through specialisation.

Retaliation

There is the likelihood of retaliation from exporting countries, which could trigger a costly trade war.

However, in the short run tariffs may protect jobs, infant and declining industries, and strategic goods. Tariffs may also help conserve a non-renewable scarce resource. Selective tariffs may also help reduce a trade deficit, and reduce consumption.

2. Quotas

Quotas are restrictions on the volume of imports for a particular good or service over a period of time. Quotas are known as a “non-tariff trade barrier.” A constraint on the supply causes an increase in the prices of imported goods, reducing the demand in the domestic market.

A quota is a limit to the quantity coming into a country.

With no trade, equilibrium market price in the country will exist at the price which equates domestic demand and domestic supply, at P, and with output at Q. However, the world price is likely to be lower, at P1, than the price in a country that does not trade. If the country is opened up to free trade from the rest of the world, the world supply curve will be perfectly elastic at the world price, P1.

The new equilibrium price is P1 and output is Q1. The domestic share of output is now Q2,compared with Q, the self-sufficient quantity. The amount imported is the distance Q2 to Q1.

Imposing a quota

In an attempt to protect domestic producers, a quota of Q2 to Q3 may be imposed on imports.

This enables the domestic share of output to rise to 0 to Q2, plus Q3 to Q4.

The quota creates a relative shortage and drives the price up to P2, with total output falling to Q4. The amount imported falls to the quota level. It is this price rise that provides an incentive for less efficient domestic firms to increase their output.

3. Subsidies

Subsidies are negative taxes or tax credits that are given to domestic producers by the government. They create a discrepancy between the price faced by consumers and the price faced by producers.

4. Standardization

The government of a country may require all foreign products to adhere to certain guidelines. For instance, the UK Government may demand that all imported shoes include a certain proportion of leather. Standardization measures tend to reduce foreign products in the market.

Q9) Explain tariffs.

A9)

The taxes or duties imposed on imports are known as tariffs. Tariffs increase the price of imported goods in the domestic market, which, consequently, reduces the demand for them.

The impact of tariffs

The imposition of tariffs leads to the following:

Higher prices

Domestic consumers face higher prices, which also means that there is a loss of consumer surplus. However, there is a gain in domestic producer surplus as producers are protected from cheap imports, and receive a higher price than they would have without the tariff. However, it is likely that there is an overall net welfare loss.

Without trade, the domestic price and quantity are P & Q.

If a country opens up to world supply, price falls to P1, and output increases from Q to Q2. As a result, domestic producers’ share falls to Q1 and imports now dominate, with the quantity imported Q1 to Q2.

The imposition of a tariff shifts up the world supply curve to World Supply + Tariff.

The price rises to P2, and the new output is at Q3. Domestic producers share of the market rise to Q4, and imports fall to Q4 to Q3. The result is that domestic producers have been protected from cheaper imports from the rest of the World.

Given that domestic consumers face higher prices, they also suffer a loss of consumer surplus. In contrast, domestic producers increase their producer surplus as they receive a higher price than they would have without the tariff.

Increased market share also means that jobs will be protected in the domestic economy.

Welfare loss

However, the reduction in consumer surplus is greater than the increase in producer surplus. Even when adding the tariff revenue (area K,L,M,N) there is still a net loss. The net welfare loss is represented by the triangles X and Y.

Distortion

There is a potential distortion of the principle of comparative advantage, whereby a tariff alters the cost advantage that countries may have built up through specialisation.

Retaliation

There is the likelihood of retaliation from exporting countries, which could trigger a costly trade war.

However, in the short run tariffs may protect jobs, infant and declining industries, and strategic goods. Tariffs may also help conserve a non-renewable scarce resource. Selective tariffs may also help reduce a trade deficit, and reduce consumption.

Q10) Explain quote.

A10) Quotas are restrictions on the volume of imports for a particular good or service over a period of time. Quotas are known as a “non-tariff trade barrier.” A constraint on the supply causes an increase in the prices of imported goods, reducing the demand in the domestic market.

A quota is a limit to the quantity coming into a country.

With no trade, equilibrium market price in the country will exist at the price which equates domestic demand and domestic supply, at P, and with output at Q. However, the world price is likely to be lower, at P1, than the price in a country that does not trade. If the country is opened up to free trade from the rest of the world, the world supply curve will be perfectly elastic at the world price, P1.

The new equilibrium price is P1 and output is Q1. The domestic share of output is now Q2,compared with Q, the self-sufficient quantity. The amount imported is the distance Q2 to Q1.

Imposing a quota

In an attempt to protect domestic producers, a quota of Q2 to Q3 may be imposed on imports.

This enables the domestic share of output to rise to 0 to Q2, plus Q3 to Q4.

The quota creates a relative shortage and drives the price up to P2, with total output falling to Q4. The amount imported falls to the quota level. It is this price rise that provides an incentive for less efficient domestic firms to increase their output.

Q11) Explain dumping.

A11) Dumping is international price discrimination. Price discrimination is usually practiced by a monopolist, and refers to charging different prices to same commodity for different people. A firm may charge higher price for domestic consumers and a lower price for foreign consumers. This may be considered as a trade barrier.

Two necessary conditions for price discrimination and dumping are:

(i) The markets should be subdivided and the division should be so effective that the goods sold in one market needs to be resold in another market.

(ii) The price elasticity demand should be different in each market.

Dumping is of different types. The following are the important types of dumping.

(i) Persistent Dumping It is a continuous tenancy of a domestic monopolist to maximize total profits by selling the commodity at a higher price in the domestic markets than foreign market.

(ii) Predatory Dumping It is the ‘temporary sale’ of a commodity at a lower price (may be low cost) in abroad in order to drive foreign producers out of business.

(iii) Sporadic Dumping Sporadic Dumping is the occasional sale of a commodity at below cost at a lower price abroad than domestically in order to unload an unforeseen and temporary surplus of the commodity without having to reduce domestic prices.

Q12) Explain dumping and its effects.

A12)

Dumping is international price discrimination. Price discrimination is usually practiced by a monopolist, and refers to charging different prices to same commodity for different people. A firm may charge higher price for domestic consumers and a lower price for foreign consumers. This may be considered as a trade barrier.

Two necessary conditions for price discrimination and dumping are:

(i) The markets should be subdivided and the division should be so effective that the goods sold in one market needs to be resold in another market.

(ii) The price elasticity demand should be different in each market.

Dumping is of different types. The following are the important types of dumping.

(iv) Persistent Dumping It is a continuous tenancy of a domestic monopolist to maximize total profits by selling the commodity at a higher price in the domestic markets than foreign market.

(v) Predatory Dumping It is the ‘temporary sale’ of a commodity at a lower price (may be low cost) in abroad in order to drive foreign producers out of business.

(vi) Sporadic Dumping Sporadic Dumping is the occasional sale of a commodity at below cost at a lower price abroad than domestically in order to unload an unforeseen and temporary surplus of the commodity without having to reduce domestic prices.

Effects of Dumping:

Dumping affects both the importer and exporter countries in the following ways:

1. Effects on Importing Country:

The effects of dumping on the country, in which a monopolist dumps his commodity, depend on whether dumping is for a short period or a long period and what are the nature of the product and the aim of dumping.

1. If a producer dumps his commodity abroad for a short period, then the industry of the importing country is affected for a short while. Due to the low price of the dumped commodity, the industry of that country has to incur a loss for some time because less quantity of its commodity is sold.

2. Dumping is harmful for the importing country if it continues for a long period. This is because it takes time for changing production in the importing country and its domestic industry is not able to bear competition. But when cheap imports stop or dumping does not exist, it becomes difficult to change the production again.

3. If the dumped commodity is a consumer good, the demand of the people in the importing country will change for the cheap goods. When dumping stops, this demand will reverse, thereby changing the tastes of the people which will be harmful for the economy.

4. If the dumped commodities are cheap capital goods, they will lead to the setting up of a now industry. But when the imports of such commodities stop, this industry will also be shut down. Thus ultimately, the importing country will incur a loss.

5. If the monopolist dumps the commodity for removing his competitors from the foreign market, the importing country gets the benefit of cheap commodity in the beginning. But after competition ends and he sells the same commodity at a high monopoly price, the importing country incurs a loss because now it has to pay a high price.

6. If a tariff duty is imposed to force the dumper to equalise prices of the domestic and imported commodity, it will not benefit the importing country.

7. But a lower fixed tariff duty benefits the importing country if the dumper delivers the commodity at a lower price.

2. Effects on Exporting Country:

Dumping affects the exporting country in the following ways:

1. When domestic consumers have to buy the monopolistic commodity at a high price through dumping, there is loss in their consumers’ surplus. But if a monopolist produces more commodities in order to dump it in another country, consumers benefit. This is because with more production of the commodity, the marginal cost falls. As a result, the price of the commodity will be less than the monopoly price without dumping.

But this lower price than the monopoly price depends upon the law of production under which the industry is operating. If the industry is producing under the law of diminishing returns, the price will not fall because costs will increase and so will the price increase.

The consumers will be losers and the monopolist will profit. There will be no change in price under fixed costs. It is only when costs fall under the law of increasing returns that both the consumers and the monopolist will benefit from dumping.

2. The exporting country also benefits from dumping when the monopolist produces more commodity. Consequently, the demand for the required inputs such as raw materials, etc. for the production of that commodity increases, thereby expanding the means of employment in the country.

3. The exporting country earns foreign currency by selling its commodity in large quantity in the foreign market through dumping. As a result, its balance of trade improves.