UNIT 4

Terms of Trade

Q1) Explain meaning and importance of international trade.

A1) Meaning

By terms of trade, is meant terms or rates at which the products of one country are exchanged for the products of the other. It is known to us that every country has got its own money. The currency of one country is not legal tender in the other country. So every country has to export commodities in order to import goods. "The rate at which given volume of exports Is exchanged for a given quantity of imports is called the commodity terms of trade". The rate of exchange or the term of exchange depends upon the elasticities of the demand of each country for the products of the other. For instance, if Pakistan's demand for Indian's wheat is much more intense than Indian's demand for Pakistan's cotton, the terms of trade will be more favorable to India than to Pakistan. This is because Pakistan's demand for India's wheat is highly inelastic while India's demand for Pakistan's cotton is highly elastic.

The country which is more eager to sell or purchase stands at disadvantage in the bargain. In the words of Taussing: That country gains more from international trade whose exports are more in demand and which itself has little demand for the things it imports, i.e., for the exports of the other countries, that country gains least which has the most insistent demand for the products of the other country

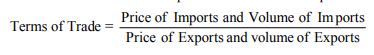

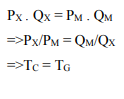

That terms of trade are measured by the ratio of import prices to export prices. The terms of trade will be favorable to a country when the export prices are high relatively to import prices. This is because the products of one unit of domestic resources will exchange against the product of more than one unit of foreign exchange. If, on the other hand, the prices of its imports rise relatively to the prices of its exports, the terms of trade will be unfavorable to the country.

Formula

The terms of trade are of economic significance to a country. If they are favorable to a country, it will be gaining more from international trade and if they are unfavorable, the loss will be occurring to it. When the country's goods are in high demand from abroad, i.e., when its terms of trade are favorable, the level of money income increases. Conversely, when the terms of trade are unfavorable, the level of money income falls.

Importance

The terms of trade is most often defined as a ratio of an index of export prices to an index of import prices. An increase in this ratio — a rising terms of trade — means that any given volume of export sales will now exchange for a larger volume of imports. In this circumstance, the nation’s real income and living standard increase because an improved terms of trade allows the economy to expend fewer resources for export production, yet command the same volume of imports. These freed resources can be used to produce more domestic goods or buy more imports. Either way the volume of goods available to the economy for a given level of resource use is now larger. A sustained trend of improvement of the terms of trade could make a significant contribution to the long-term growth of economic welfare. Similarly, a decrease in the ratio of export prices to import prices — a falling terms of trade — raises the export cost of acquiring imports and reduces real income and the domestic living standard. The decrement to economic well-being occurs because the economy must allocate more resources to the production of exports and reduce the production of domestic output to command the same volume of imports. In this case, the total volume of goods available for consumption for a given level of resource expenditure must fall.

Q2) Explain importance of international trade.

A2) Meaning

By terms of trade, is meant terms or rates at which the products of one country are exchanged for the products of the other. It is known to us that every country has got its own money. The currency of one country is not legal tender in the other country. So every country has to export commodities in order to import goods. "The rate at which given volume of exports Is exchanged for a given quantity of imports is called the commodity terms of trade". The rate of exchange or the term of exchange depends upon the elasticities of the demand of each country for the products of the other. For instance, if Pakistan's demand for Indian's wheat is much more intense than Indian's demand for Pakistan's cotton, the terms of trade will be more favorable to India than to Pakistan. This is because Pakistan's demand for India's wheat is highly inelastic while India's demand for Pakistan's cotton is highly elastic.

The country which is more eager to sell or purchase stands at disadvantage in the bargain. In the words of Taussing: That country gains more from international trade whose exports are more in demand and which itself has little demand for the things it imports, i.e., for the exports of the other countries, that country gains least which has the most insistent demand for the products of the other country

That terms of trade are measured by the ratio of import prices to export prices. The terms of trade will be favorable to a country when the export prices are high relatively to import prices. This is because the products of one unit of domestic resources will exchange against the product of more than one unit of foreign exchange. If, on the other hand, the prices of its imports rise relatively to the prices of its exports, the terms of trade will be unfavorable to the country.

Formula

The terms of trade are of economic significance to a country. If they are favorable to a country, it will be gaining more from international trade and if they are unfavorable, the loss will be occurring to it. When the country's goods are in high demand from abroad, i.e., when its terms of trade are favorable, the level of money income increases. Conversely, when the terms of trade are unfavorable, the level of money income falls.

Importance

The terms of trade is most often defined as a ratio of an index of export prices to an index of import prices. An increase in this ratio — a rising terms of trade — means that any given volume of export sales will now exchange for a larger volume of imports. In this circumstance, the nation’s real income and living standard increase because an improved terms of trade allows the economy to expend fewer resources for export production, yet command the same volume of imports. These freed resources can be used to produce more domestic goods or buy more imports. Either way the volume of goods available to the economy for a given level of resource use is now larger. A sustained trend of improvement of the terms of trade could make a significant contribution to the long-term growth of economic welfare. Similarly, a decrease in the ratio of export prices to import prices — a falling terms of trade — raises the export cost of acquiring imports and reduces real income and the domestic living standard. The decrement to economic well-being occurs because the economy must allocate more resources to the production of exports and reduce the production of domestic output to command the same volume of imports. In this case, the total volume of goods available for consumption for a given level of resource expenditure must fall.

Q3) Explain gross barter terms of trade.

A3) The gross barter term of trade is a ratio of total physical quantities of imports to the total physical quantities of exports of a given country.

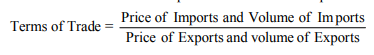

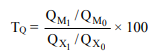

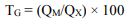

Given the above definition, the gross barter terms of trade in case of particular commodities can be measured at a point of time through the formula given below:

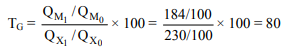

Here TG is gross barter terms of trade, QM is aggregate quantity of imports and QX is the aggregate quantity of exports. Higher the magnitude of TG over 100, better are the gross barter terms of trade. It implies that the country can import larger quantities from abroad for the given quantities exported to other countries. On the opposite, if the magnitude of TG is less than 100, it means the gross barter terms of trade are unfavourable to a given country and it can import smaller quantity of goods from abroad for the same quantity of exports.

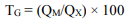

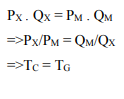

If the balance of trade of a country is in a state of balance and the total receipts from export of goods are exactly equal to the payments for import of goods, the net barter terms of trade will be equal to the gross barter terms of trade

Total Receipts from Exports = Total Payments for Imports

When there is a deficit or surplus in trade balance, the gross barter and net barter terms of trade will differ from each other (TC < > TG).

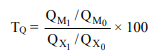

When trade involves a large number of commodities and changes in terms of trade have to be compared between two periods, the gross barter terms of trade are a ratio of indices of quantities imported and the quantities exported.

In such a case, the gross barter terms of trade can be determined as:

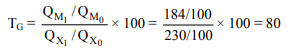

Here QM1 and QM0 are the quantity indices of imports in the current year (1) and base year (0) respectively. QX1 and QX0 are the quantity indices of exports in the current year (1) and base year (0) respectively.

Given the quantity indices of imports and exports as 100 each in the base year 2010 and 184 and 230 respectively in the current year 2015, the gross barter terms of trade have turned unfavourable for the given country.

Criticisms:

(i) Aggregation of Goods, Services and Capital Transactions: The gross barter terms of trade attempted to remove the deficiency of the net barter terms of trade by aggregating all exports of goods, services and capital in the index of export quantities. Similarly, the imports of goods, services and capital were aggregated in the index of quantities imported. The lumping together of these nonhomogeneous quantities was both unreal and impractical. It was because of this reason that this concept of terms of trade came to be rejected at the hands of economists like Jacob Viner and Haberler

(ii) Faulty Index of Welfare: A higher ratio of quantity index of imports to the quantity index of exports is sometimes regarded as an index of a higher level of welfare from trade because the country obtains larger quantity of importable good per unit of exportable goods. But this is not necessarily true. If there are such changes in tastes and habits of a people that even a smaller quantity of imports yields greater satisfaction, the community may derive greater welfare despite an unfavourable gross barter terms of trade.

(iii) Neglect of Productivity: It is possible that a country has unfavourable gross barter terms of trade but that is caused by increased factor productivity in the export sector. The increased factor productivity still indicates the gain from the point of view of the exporting country. The impact of improvement in productivity has been overlooked in this measure of terms of trade.

(iv) Neglect of Qualitative Changes: The gross barter terms of trade ratio undoubtedly takes into account the physical quantities of imports and exports but ignores the fact that there might have been qualitative improvements in production in the exporting and importing countries. Such changes can have very significant effect on the welfare, yet these are not reflected through the gross barter terms of trade.

(v) Neglect of Capital Movements: The international capital movements have quite important influence on the balance of payments and general economic condition of a country. This vital factor, however, has not found proper expression in the measurement of gross barter terms of trade.

Q4) Explain Net Barter Terms of Trade.

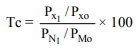

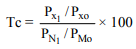

A4) In the contemporary world, the concept of net barter terms of trade was introduced by F.W. Taussig. This concept was called as commodity terms of trade by Jacob Viner.It is defined as ratio of export prices to import prices. It can be expressed as:

Here TC = commodity terms of trade or net barter terms of trade, PX = export price, PM = import price.

If the net barter terms of trade are to be applied to more than one export and import commodities and the changes in terms of trade over a given period are to be computed, the index numbers of export and import prices rather than prices of individual commodities are taken into account.

In such situations, the net barter terms of trade can be measured as below:

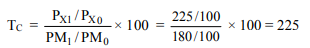

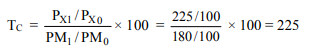

Here, Px1 and Px0 are the export price indices of current year (1) and last year(o) respectively. PM1 and PM0 on the import price indium of current year (1) and base year (o) respectively.

Given the price indius of exports and imports for the base year (say, 2010) as 100 each and its price indices of imports and exports an 180 and 225 is 2015, the net barter terms of trade is:

If means the commodity terms of trade in 2015 compared worth 2010 has improved by 25 percent.

Criticisms:

Even though the concept of net barter terms of trade has been widely accepted as a useful measure of short-term changes in the trade position of a country, yet it suffers from certain limitations because of which it has been subjected to criticism.

The main objections against it are as follows:

(i) Problems in the Construction of Index Numbers: This concept involves the use of index numbers of export and import prices. The construction of index numbers is beset with several problems related to the choice of commodities, obtaining of price quotations, choice of base year, use of appropriate weights and the method for computing index numbers.

(ii) Neglect of Qualitative Changes: The net barter terms of trade are based on indices of export and import prices. These can measure the relative changes in prices between the current and base period. If there are qualitative changes in output in the two trading countries during a given period, they remain neglected. In such a situation, net barter terms of trade cannot measured exactly the changes in welfare due to foreign trade in general and terms of trade in particular.

(iii) Misleading: If the export price index of a country falls, the import price index remaining the same, there is worsening of the net barter terms of trade. As export prices are lower than the import prices, the country will be able to get a smaller quantity of import in exchange of the goods exported. The conclusion may be derived that the economic position of the country has deteriorated. It is possible that the fall in export prices has resulted from a fall in costs of producing export goods. If the productivity in export sector increases at a greater rate than the worsening of net barter terms of trade, the country actually does not suffer due to trade, it rather gains. From this it follows that the net barter terms of trade can sometimes result in misleading conclusions.

(iv) Inappropriate for Explaining Distribution of Gains from Trade: The concept of net barter terms of trade is an inappropriate criterion for explaining the distribution of gains from trade between two countries one of which is advanced and the other is less developed. Suppose the import price index has risen relatively less than the export price index in the latter. It signifies an improvement in the terms of trade and the conclusion is derived that the less developed country gains from trade. However, if the profits from foreign investments rise large enough to off-set the increase in export prices, the LDC may not derive any gain from trade. Similarly, if the export prices fall but there is also an equivalent fall in the profits of foreign investments, the position of the country is not worse off even though the net barter terms of trade are unfavourable. It is, therefore, evident that the distribution of gains from trade cannot be rightly decided on the basis of changes just in the net barter terms of trade.

(v) Faulty Index of Gain from Trade: It is often claimed that the net barter terms of trade provide an index of gains from trade for a country. In this connection, Taussig pointed out that the net barter terms of trade could be an appropriate measure of gains from trade, if the balance of payments of the country included only the receipts and payments on account of exchange of goods and services. However, if balance of payments includes also the capital transactions and unilateral transfers, the gain from trade cannot be determined through the ratio of export and import prices.

(vi) Period of Time: The net barter terms of trade are based upon the relative changes in export and import prices over some period between the base year and the current year. If this time interval is too short, there may not be any significant change in the terms of trade. On the contrary, if this duration is too long, there is the possibility of some major changes in the structure of production and demand in the countries such that comparisons on the basis of export and import prices are rendered irrelevant.

(vii) Neglect of Factors Affecting Prices: The net barter terms of trade concentrate only upon the indices of export and import prices. There is absolute neglect of the factors, which cause variation in these prices. The export and import prices are affected by changes in productivity, costs, wages, general business conditions and reciprocal demand in the trading countries. Any conclusion concerning the economic position of a country exclusively on the basis of commodity terms of trade cannot be valid.

(viii) Capacity to Import: The improvement or worsening of the commodity terms of trade cannot give any definite conclusion about the capacity of a country to import. An appropriate measure of the capacity to import can be the income terms of trade rather than the net barter terms of trade. In order to overcome the deficiencies of the net barter terms of trade, Taussig introduced the concept of gross barter terms of trade.

Q5) Explain Income Terms of Trade.

A5) The income terms of trade was given by G.S.Dorrance in 1948. It is the index of the value of exports divided by the price index for imports multiplied by quantity index of experts. In other words, it is the net barter terms of trade of a country multiplied by its exports – volume index.

T = (Px / Pm )

Where, Px = Price index of exports Pm = Price index of imports Qx = Quantity

It is the desire of every country that it should earn the maximum of income out of international exchange by taking permanent favorable terms of trade. In order to secure maximum gain, the country will try to increase the volume and value of exports and reduce the volume of imports and buy it also from the cheapest market. If the country is having a monopoly in the supply of a commodity and the demand for products is inelastic, then it can fetch more income. In case the terms of trade move against the country, then there will be drain of national income, the commodity terms of trade depend upon the following factors:

(i) Ratio of import prices to export prices.

(ii) The volume and value of exports and imports.

(iii) The condition attached to export and import such as insurance charges, supply of machinery and shipping, etc.

If the terms of trade are favorable which may be due to monopolistic supply or inelastic demand or cheap and better kind of exports, etc., the terms of trade will be favorable and the national income will rise. In case of terms of trade are unfavorable over a period of time, the national income will fall.

Q6) Explain Single Factorial Terms of Trade.

A6) The concept of income terms of trade attempted — a correction in the net barter terms of trade for changes in the volume of exports. Jacob Viner made another modification over the net barter or commodity terms of trade. He corrected the commodity terms of trade for changes in factor productivity in the production of export goods.

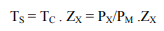

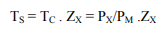

The concept of terms of trade developed by him is called as the ‘Single Factoral Terms of Trade’. It is determined by multiplying the commodity terms of trade with the productivity index in the domestic export sector. The single factoral terms of trade imply a ratio of the export price index and import price index adjusted for changes in the productivity of factors used in the production of export goods. It can be stated as:

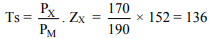

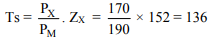

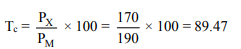

Where Tsis the ----- factoral terms of trade, Tc is the commodity terms of trade and Zx is the export productivity index.

If Px = 100, Pm = 100 and Zx = 100 in the base year may 2010, the single factoral terms of trade is 100

TS = PX/PM. ZX = 100 × 100/100 = 100

If in the current year 2015, Px = 170, PM = 190 and ZX = 152, then

It signifies that there is an improvement in the single factorial terms of trade even though the commodity terms of trade have worsened.

From the above illustration, it is clear that change in the export productivity index can have highly significant effect on the terms of trade of a country. If the increase in productivity in the export sector causes such a substantial decline in costs that export prices have declined by a marked extent, it is possible that the commodity terms of trade become unfavourable even when the single factoral terms of trade have improved.

Criticism

(i) Difficulty in the Measurement of Productivity: The exact measurement of productivity and changes therein is quite difficult, as factor productivity depends upon some non-quantifiable psychological and technical factors. The productivity of a factor unit differs not only from one export industry to another but also from one plant to another. That causes serious complication in the computation of productivity index and changes in it over different periods.

(ii) Not a Reliable Index of Gain from Trade: The terms of trade are supposed to be an index of gains from international trade of a country. It is possible that increase in productivity index makes the single factoral terms of trade favourable but the rise in productivity in export sector and consequent fall in production costs and export price index can transfer the gain from higher productivity and trade to the foreign country. The productivity increase may occur in the exporting country but the productivity and trade gains go to the importing country.

(iii) Increase in Global Inequalities: The increased productivity in the export sectors of the advanced countries like U.S.A., Japan and the West European countries has brought about considerable improvement in their single factoral terms of trade while keeping their net barter terms of trade also favourable for them. However, the improvement in productivity in the export sectors in the LDC’s has made both commodity terms of trade and single factoral terms of trade unfavourable.

Q7) Explain Factors affecting Terms of Trade.

A7) The terms of trade of a country are influenced by a number of factors which are discussed as under:

1. Reciprocal Demand:

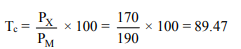

The terms of trade of a country depend upon reciprocal demand, i.e. “the strength and elasticity of each country’s demand for the other country’s product”. Suppose there are two countries, Germany and England, which produce linen and cloth respectively.

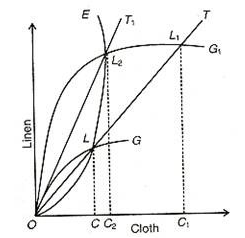

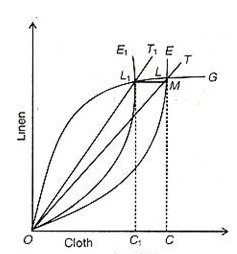

If Germany’s demand for England’s cloth becomes more intense (inelastic), the price of cloth rises more than the price of linen, the commodity terms of trade will move against Germany and in favour of England. On the other hand, if England’s demand for Germany’s linen becomes more intense, the price of linen will rise more than the price of cloth, and the commodity terms of trade will move in favour of Germany and against England. This is explained diagrammatically in Fig. Below (A) and (B) where England’s offer curve and OG is the offer curve of Germany. The point A where the two offer curves intersect each other is the equilibrium point at which ОС of cloth is traded by England for OL linen of Germany. The terms of trade are represented by the slope of the ray ОТ.

Suppose England’s demand for Germany’s linen increases. England will be prepared to sell more cloth for Germany’s linen. The increase in England’s demand is shown by the shifting of its offer curve to the right as OE1 which intersects Germany’s offer curve OG at A, in Panel (A).

Now the new terms of trade are represented by the ray OT1 whereby England exports OC1 units of cloth for OL1 units of linen. The terms of trade have deteriorated for England and improved for Germany.

This is evident from the fact that England exports CC, more units of cloth in exchange for LL, units of linen. CC, is greater than LL1.

Similarly, in Panel (B), if Germany’s demand for England’s cloth increases, Germany’s offer curve shifts to the left as OG, which intersects England’s initial offer curve OE at A2. Now Germany exports OL2 units of linen for OC-, units of cloth. The new terms of trade, as shown by the slope of ray OT2 indicate that they have deteriorated for Germany and improved for England. This is evident from the fact that Germany exports LL, more linen in exchange for CC2 less cloth.

But the terms of trade will depend upon the elasticity of demand of the offer curve of each country.

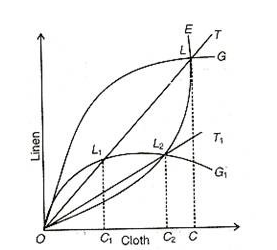

2. Changes in Factor Endowments:

Changes in factor endowments of a country affect its terms of trade. Changes in factor endowments may increase exports or reduce them. With tastes remaining unchanged, they may lead to changes in the terms of trade. This is explained with the help of Fig. Below where OE is the offer curve of England and OG is the offer curve of Germany. Before any change in factor endowments, the terms of trade of England and Germany are settled at point L where they trade ОС of cloth for CL of linen. Suppose there is an increase in the supply of Germany’s factors of production. As a result, the new offer curve of Germany is OG1. At the old terms of trade ОТ, Germany would be at point L, where it would export more linen C1L1 and import English cloth ОС1.

But England may not be willing to trade with Germany at the old terms of trade because of its inability to produce so much cloth as its factor endowments and tastes remain unchanged. Thus the terms of trade will settle on the new terms of trade line ОT1 where England’s offer curve OE intersects Germany’s new offer curve OG, at point LT At L2, Germany exports C2L2 of linen in exchange for OC2 of cloth from England. Thus the terms of trade have moved against Germany from L to L2, with change in its factor endowments because it exports more linen (C2L2) than before (CL).

3. Changes in Technology:

Technological changes also affect the terms of trade of a country. The effect of technological change on terms of trade is illustrated in Fig below. Suppose there is change in technology in Germany. Before technological change the terms of trade between Germany and England are settled at point L on the ОТ ray where Germany exports CL of linen for ОС of England cloth. With technological change, Germany’s new offer curve is OG, which cuts the terms of trade line ОТ at L1. At this point, Germany would like to export less linen (C1L1) and import less cloth (ОС1) than England wants to exchange at the terms of trade ОТ. So Germany’s terms of trade improve when its new offer curve OG, intersects England’s unchanged offer curve OE at L, where the new terms of trade are settled on the line OT1. At L2, Germany is better off because it exports less linen for more of England’s cloth, i.e. C2L2 < ОС2. Its terms of trade have improved with technological change.

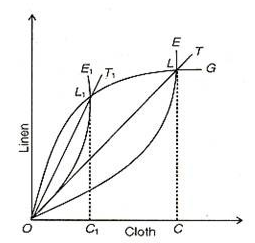

4. Changes in Tastes:

Changes in tastes of the people of a country also influence its terms of trade with another country. Suppose England’s tastes shift from Germany’s linen to its own cloth. In this situation, England would export less cloth to Germany and its demand for Germany’s linen would also fall. Thus England’s terms of trade would improve. On the contrary, a change in England’s taste for Germany’s linen would increase its demand and hence the terms of trade would deteriorate for England. The first case of an improvement in the terms of trade of England is depicted in Fig. Below. When England’s tastes change from Germany’s linen to its own cloth, its offer curve shifts up to OE1 and intersect Germany’s unchanged offer curve OG at L1. As a result, England exports only OC1 of cloth in exchange for C1L1 of Germany’s linen. Obviously, England’s terms of trade have improved for now it exchanges less cloth (ОС1) for more linen of Germany (C1L1) i.e. OC1 < C1L1.

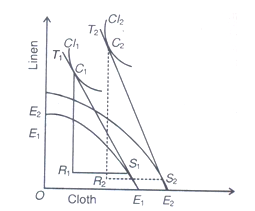

5. Economic Growth:

Economic growth is another important factor which affects the terms of trade. The raising of a country’s national product or income over time is called economic growth. Given the tastes and technology in a country, an increase in its productive capacity may affect favourably or adversely its terms of trade.

This is illustrated in Fig. Below in terms of the production possibility curves and the community indifference curves of a country which experience economic growth. E1E1 is the production possibility curve of England before growth where the slope of T1 shows its terms of trade.

Before growth, it is producing at S, and consuming at C, on the community indifference curve C1. Thus England is exporting R1S1 of cloth and importing R1C1 of linen for Germany. When growth takes place, the production possibility curves E2E2, shifts outward as E2E2. The new terms of trade after growth, as represented by the slope of the line T2, show an improvement when production takes place at point S2 on the production possibility curve E2E1 and consumption at point C, of the community indifference curve CI2. As a result of the improvement in England’s terms of trade, it exports less cloth to Germany in exchange for more linen than in the pre-growth situation. It exports R2S2, which is less than R1S1 and imports R2C2, which is greater than R1C1.

6. Tariff:

An import tariff improves the terms of trade of the imposing country. This is explained with the help of Fig. 79.8 where the offer curves of England and Germany before the imposition of tariff are OE and OG respectively. The initial terms of trade are given by the line ОТ. England is exporting ОС of cloth and importing CL of linen from Germany. Suppose a tariff is imposed on Germany’s linen by England. It shifts the offer curve of England from OE to OE1. These changes the terms of trade ОТ to OT1 in favour of England. Now England exports ОС, of cloth in exchange for C1L1 of linen from Germany. It now exports CC1 = (ML1) less of cloth than before and imports ML less of linen. Since the quantity of exports reduced as a result of tariff by England is greater than the quantity of imports reduced by Germany (ML1 < ML), the terms of trade have definitely moved in favour of England.

7. Devaluation:

Devaluation raises the domestic price of imports and reduces the foreign price of exports of a country devaluing its currency in relation to the currency of another country.

The effects of devaluation on the terms of trade have been much debated among economists. According to Prof. Machlup, “Devaluation is supposed to improve the balance of trade. A reduction in the physical volume of imports in relation to the physical volume of exports constitutes an adverse change in the gross barter terms of trade.”

Thus devaluation will be successful only if the gross barter term becomes adverse. Prof. Robertson favours the use of the concept of the commodity terms of trade to assess the effects of devaluation. To him, if this concept is used, devaluation will lead to rise in the prices of imports and fall in the prices of exports in foreign currency, and hence deteriorate the commodity terms of trade. But Prof. Hirch suggests that the right procedure should be to study price movements in exports and imports in the same currency in order to assess the true effects of devaluation. Both exports and imports prices normally rise in the home currency and fall in the foreign currency

Q8) Explain Causes of Unfavourable Terms of Trade to Developing Countries.

A8) 1. Low capacity to import: As the prices of exported primary products have remained lower relative to prices of manufactured product, the capacity of the developing countries to import goods per unit of the exported capacity has become less and less.

2. Balance of payments deficits:The deteriorating terms of trade of the developing countries have enlarged the gap between their export earnings and import bills. As a consequenc, most of the LDC’s countries have been facing mounting balanve of payments deficits.

3. Enforcement of stiff borrowing conditions:The adverse terms of trade and consequent balance of payments deficit have led to the increasing dependence of the developing countries upon the borrowings from the advanced countries and the international financial institutions. The borrowings from the financial institutions are made available under increasingly stiff conditionality. These include the adjustment in exchange rate of home currency, borrowing from commercial banks in advanced countries, liberalization of structure of tariff, larger imports from advanced countries, internal monetary and tax adjustments, changes in plan and development priorities etc. Such conditions, imposed under the pressure of advanced countries are likely to have adverse economic and other consequences for the developing countries.

4. Debt trap: The continuous deterioration in the terms of trade has landed many a developing country in a state of debt trap. The burden of international borrowing upon some of the countries such as Brazil and Mexico has increased to such a large extent that the export receipts are insufficient to pay for debt servicing. The external debt burden in case of India too has reached an alarming level. While in 1989-90, the external borrowings of India were 75-90 billion U.S. Dollars and debt servicing accounted for 31.8 percent of the current receipts of that year, the amount of foreign debt soared to 97.86 billions U.S. Dollars at the end of Sept., 2000 and the debt servicing stood at 16 percent of the current receipts in 1999-2000. While most of the developing countries are perilously close to the debt trap, where fresh obligations, no satisfactory multilateral debt relief arrangement has so far been evolved because of inflexible attitude of the advanced countries.

5. Adverse effect on growth:The persistent BOP deficits, decline in the capacity to import, mounting external debt and increasing restrictions on the inflow of capital in the wake of deteriorating terms of trade have serious depressing effect upon the growth process in the developing countries.

Q9) Explain gross and net barter terms of trade.

A9) A) Gross Barter Terms of Trade

The gross barter term of trade is a ratio of total physical quantities of imports to the total physical quantities of exports of a given country.

Given the above definition, the gross barter terms of trade in case of particular commodities can be measured at a point of time through the formula given below:

Here TG is gross barter terms of trade, QM is aggregate quantity of imports and QX is the aggregate quantity of exports. Higher the magnitude of TG over 100, better are the gross barter terms of trade. It implies that the country can import larger quantities from abroad for the given quantities exported to other countries. On the opposite, if the magnitude of TG is less than 100, it means the gross barter terms of trade are unfavourable to a given country and it can import smaller quantity of goods from abroad for the same quantity of exports.

If the balance of trade of a country is in a state of balance and the total receipts from export of goods are exactly equal to the payments for import of goods, the net barter terms of trade will be equal to the gross barter terms of trade

Total Receipts from Exports = Total Payments for Imports

When there is a deficit or surplus in trade balance, the gross barter and net barter terms of trade will differ from each other (TC < > TG).

When trade involves a large number of commodities and changes in terms of trade have to be compared between two periods, the gross barter terms of trade are a ratio of indices of quantities imported and the quantities exported.

In such a case, the gross barter terms of trade can be determined as:

Here QM1 and QM0 are the quantity indices of imports in the current year (1) and base year (0) respectively. QX1 and QX0 are the quantity indices of exports in the current year (1) and base year (0) respectively.

Given the quantity indices of imports and exports as 100 each in the base year 2010 and 184 and 230 respectively in the current year 2015, the gross barter terms of trade have turned unfavourable for the given country.

Criticisms:

(vi) Aggregation of Goods, Services and Capital Transactions: The gross barter terms of trade attempted to remove the deficiency of the net barter terms of trade by aggregating all exports of goods, services and capital in the index of export quantities. Similarly, the imports of goods, services and capital were aggregated in the index of quantities imported. The lumping together of these nonhomogeneous quantities was both unreal and impractical. It was because of this reason that this concept of terms of trade came to be rejected at the hands of economists like Jacob Viner and Haberler

(vii) Faulty Index of Welfare: A higher ratio of quantity index of imports to the quantity index of exports is sometimes regarded as an index of a higher level of welfare from trade because the country obtains larger quantity of importable good per unit of exportable goods. But this is not necessarily true. If there are such changes in tastes and habits of a people that even a smaller quantity of imports yields greater satisfaction, the community may derive greater welfare despite an unfavourable gross barter terms of trade.

(viii) Neglect of Productivity: It is possible that a country has unfavourable gross barter terms of trade but that is caused by increased factor productivity in the export sector. The increased factor productivity still indicates the gain from the point of view of the exporting country. The impact of improvement in productivity has been overlooked in this measure of terms of trade.

(ix) Neglect of Qualitative Changes: The gross barter terms of trade ratio undoubtedly takes into account the physical quantities of imports and exports but ignores the fact that there might have been qualitative improvements in production in the exporting and importing countries. Such changes can have very significant effect on the welfare, yet these are not reflected through the gross barter terms of trade.

(x) Neglect of Capital Movements: The international capital movements have quite important influence on the balance of payments and general economic condition of a country. This vital factor, however, has not found proper expression in the measurement of gross barter terms of trade.

B) Net Barter Terms of Trade

In the contemporary world, the concept of net barter terms of trade was introduced by F.W. Taussig. This concept was called as commodity terms of trade by Jacob Viner.It is defined as ratio of export prices to import prices. It can be expressed as:

Here TC = commodity terms of trade or net barter terms of trade, PX = export price, PM = import price.

If the net barter terms of trade are to be applied to more than one export and import commodities and the changes in terms of trade over a given period are to be computed, the index numbers of export and import prices rather than prices of individual commodities are taken into account.

In such situations, the net barter terms of trade can be measured as below:

Here, Px1 and Px0 are the export price indices of current year (1) and last year(o) respectively. PM1 and PM0 on the import price indium of current year (1) and base year (o) respectively.

Given the price indius of exports and imports for the base year (say, 2010) as 100 each and its price indices of imports and exports an 180 and 225 is 2015, the net barter terms of trade is:

If means the commodity terms of trade in 2015 compared worth 2010 has improved by 25 percent.

Criticisms:

Even though the concept of net barter terms of trade has been widely accepted as a useful measure of short-term changes in the trade position of a country, yet it suffers from certain limitations because of which it has been subjected to criticism.

The main objections against it are as follows:

(ix) Problems in the Construction of Index Numbers: This concept involves the use of index numbers of export and import prices. The construction of index numbers is beset with several problems related to the choice of commodities, obtaining of price quotations, choice of base year, use of appropriate weights and the method for computing index numbers.

(x) Neglect of Qualitative Changes: The net barter terms of trade are based on indices of export and import prices. These can measure the relative changes in prices between the current and base period. If there are qualitative changes in output in the two trading countries during a given period, they remain neglected. In such a situation, net barter terms of trade cannot measured exactly the changes in welfare due to foreign trade in general and terms of trade in particular.

(xi) Misleading: If the export price index of a country falls, the import price index remaining the same, there is worsening of the net barter terms of trade. As export prices are lower than the import prices, the country will be able to get a smaller quantity of import in exchange of the goods exported. The conclusion may be derived that the economic position of the country has deteriorated. It is possible that the fall in export prices has resulted from a fall in costs of producing export goods. If the productivity in export sector increases at a greater rate than the worsening of net barter terms of trade, the country actually does not suffer due to trade, it rather gains. From this it follows that the net barter terms of trade can sometimes result in misleading conclusions.

(xii) Inappropriate for Explaining Distribution of Gains from Trade: The concept of net barter terms of trade is an inappropriate criterion for explaining the distribution of gains from trade between two countries one of which is advanced and the other is less developed. Suppose the import price index has risen relatively less than the export price index in the latter. It signifies an improvement in the terms of trade and the conclusion is derived that the less developed country gains from trade. However, if the profits from foreign investments rise large enough to off-set the increase in export prices, the LDC may not derive any gain from trade. Similarly, if the export prices fall but there is also an equivalent fall in the profits of foreign investments, the position of the country is not worse off even though the net barter terms of trade are unfavourable. It is, therefore, evident that the distribution of gains from trade cannot be rightly decided on the basis of changes just in the net barter terms of trade.

(xiii) Faulty Index of Gain from Trade: It is often claimed that the net barter terms of trade provide an index of gains from trade for a country. In this connection, Taussig pointed out that the net barter terms of trade could be an appropriate measure of gains from trade, if the balance of payments of the country included only the receipts and payments on account of exchange of goods and services. However, if balance of payments includes also the capital transactions and unilateral transfers, the gain from trade cannot be determined through the ratio of export and import prices.

(xiv) Period of Time: The net barter terms of trade are based upon the relative changes in export and import prices over some period between the base year and the current year. If this time interval is too short, there may not be any significant change in the terms of trade. On the contrary, if this duration is too long, there is the possibility of some major changes in the structure of production and demand in the countries such that comparisons on the basis of export and import prices are rendered irrelevant.

(xv) Neglect of Factors Affecting Prices: The net barter terms of trade concentrate only upon the indices of export and import prices. There is absolute neglect of the factors, which cause variation in these prices. The export and import prices are affected by changes in productivity, costs, wages, general business conditions and reciprocal demand in the trading countries. Any conclusion concerning the economic position of a country exclusively on the basis of commodity terms of trade cannot be valid.

Capacity to Import: The improvement or worsening of the commodity terms of trade cannot give any definite conclusion about the capacity of a country to import. An appropriate measure of the capacity to import can be the income terms of trade rather than the net barter terms of trade. In order to overcome the deficiencies of the net barter terms of trade, Taussig introduced the concept of gross barter terms of trade.

Q10) Explain income and single factorial terms of trade.

A10) Income Terms of Trade

The income terms of trade was given by G.S.Dorrance in 1948. It is the index of the value of exports divided by the price index for imports multiplied by quantity index of experts. In other words, it is the net barter terms of trade of a country multiplied by its exports – volume index.

T = (Px / Pm )

Where, Px = Price index of exports Pm = Price index of imports Qx = Quantity

It is the desire of every country that it should earn the maximum of income out of international exchange by taking permanent favorable terms of trade. In order to secure maximum gain, the country will try to increase the volume and value of exports and reduce the volume of imports and buy it also from the cheapest market. If the country is having a monopoly in the supply of a commodity and the demand for products is inelastic, then it can fetch more income. In case the terms of trade move against the country, then there will be drain of national income, the commodity terms of trade depend upon the following factors:

(i) Ratio of import prices to export prices.

(ii) The volume and value of exports and imports.

(iii) The condition attached to export and import such as insurance charges, supply of machinery and shipping, etc.

If the terms of trade are favorable which may be due to monopolistic supply or inelastic demand or cheap and better kind of exports, etc., the terms of trade will be favorable and the national income will rise. In case of terms of trade are unfavorable over a period of time, the national income will fall.

Single Factorial Terms of Trade

The concept of income terms of trade attempted — a correction in the net barter terms of trade for changes in the volume of exports. Jacob Viner made another modification over the net barter or commodity terms of trade. He corrected the commodity terms of trade for changes in factor productivity in the production of export goods.

The concept of terms of trade developed by him is called as the ‘Single Factoral Terms of Trade’. It is determined by multiplying the commodity terms of trade with the productivity index in the domestic export sector. The single factoral terms of trade imply a ratio of the export price index and import price index adjusted for changes in the productivity of factors used in the production of export goods. It can be stated as:

Where Tsis the ----- factoral terms of trade, Tc is the commodity terms of trade and Zx is the export productivity index.

If Px = 100, Pm = 100 and Zx = 100 in the base year may 2010, the single factoral terms of trade is 100

TS = PX/PM. ZX = 100 × 100/100 = 100

If in the current year 2015, Px = 170, PM = 190 and ZX = 152, then

It signifies that there is an improvement in the single factorial terms of trade even though the commodity terms of trade have worsened.

From the above illustration, it is clear that change in the export productivity index can have highly significant effect on the terms of trade of a country. If the increase in productivity in the export sector causes such a substantial decline in costs that export prices have declined by a marked extent, it is possible that the commodity terms of trade become unfavourable even when the single factoral terms of trade have improved.

Criticism

(i) Difficulty in the Measurement of Productivity: The exact measurement of productivity and changes therein is quite difficult, as factor productivity depends upon some non-quantifiable psychological and technical factors. The productivity of a factor unit differs not only from one export industry to another but also from one plant to another. That causes serious complication in the computation of productivity index and changes in it over different periods.

(ii) Not a Reliable Index of Gain from Trade: The terms of trade are supposed to be an index of gains from international trade of a country. It is possible that increase in productivity index makes the single factoral terms of trade favourable but the rise in productivity in export sector and consequent fall in production costs and export price index can transfer the gain from higher productivity and trade to the foreign country. The productivity increase may occur in the exporting country but the productivity and trade gains go to the importing country.

(iii) Increase in Global Inequalities: The increased productivity in the export sectors of the advanced countries like U.S.A., Japan and the West European countries has brought about considerable improvement in their single factoral terms of trade while keeping their net barter terms of trade also favourable for them. However, the improvement in productivity in the export sectors in the LDC’s has made both commodity terms of trade and single factoral terms of trade unfavourable.

Q11) Write the objections of net barter terms of trade.

A11)

- Problems in the Construction of Index Numbers: This concept involves the use of index numbers of export and import prices. The construction of index numbers is beset with several problems related to the choice of commodities, obtaining of price quotations, choice of base year, use of appropriate weights and the method for computing index numbers.

(i) Neglect of Qualitative Changes: The net barter terms of trade are based on indices of export and import prices. These can measure the relative changes in prices between the current and base period. If there are qualitative changes in output in the two trading countries during a given period, they remain neglected. In such a situation, net barter terms of trade cannot measured exactly the changes in welfare due to foreign trade in general and terms of trade in particular.

(ii) Misleading: If the export price index of a country falls, the import price index remaining the same, there is worsening of the net barter terms of trade. As export prices are lower than the import prices, the country will be able to get a smaller quantity of import in exchange of the goods exported. The conclusion may be derived that the economic position of the country has deteriorated. It is possible that the fall in export prices has resulted from a fall in costs of producing export goods. If the productivity in export sector increases at a greater rate than the worsening of net barter terms of trade, the country actually does not suffer due to trade, it rather gains. From this it follows that the net barter terms of trade can sometimes result in misleading conclusions.

(iii) Inappropriate for Explaining Distribution of Gains from Trade: The concept of net barter terms of trade is an inappropriate criterion for explaining the distribution of gains from trade between two countries one of which is advanced and the other is less developed. Suppose the import price index has risen relatively less than the export price index in the latter. It signifies an improvement in the terms of trade and the conclusion is derived that the less developed country gains from trade. However, if the profits from foreign investments rise large enough to off-set the increase in export prices, the LDC may not derive any gain from trade. Similarly, if the export prices fall but there is also an equivalent fall in the profits of foreign investments, the position of the country is not worse off even though the net barter terms of trade are unfavourable. It is, therefore, evident that the distribution of gains from trade cannot be rightly decided on the basis of changes just in the net barter terms of trade.

(iv) Faulty Index of Gain from Trade: It is often claimed that the net barter terms of trade provide an index of gains from trade for a country. In this connection, Taussig pointed out that the net barter terms of trade could be an appropriate measure of gains from trade, if the balance of payments of the country included only the receipts and payments on account of exchange of goods and services. However, if balance of payments includes also the capital transactions and unilateral transfers, the gain from trade cannot be determined through the ratio of export and import prices.

(v) Period of Time: The net barter terms of trade are based upon the relative changes in export and import prices over some period between the base year and the current year. If this time interval is too short, there may not be any significant change in the terms of trade. On the contrary, if this duration is too long, there is the possibility of some major changes in the structure of production and demand in the countries such that comparisons on the basis of export and import prices are rendered irrelevant.

(vi) Neglect of Factors Affecting Prices: The net barter terms of trade concentrate only upon the indices of export and import prices. There is absolute neglect of the factors, which cause variation in these prices. The export and import prices are affected by changes in productivity, costs, wages, general business conditions and reciprocal demand in the trading countries. Any conclusion concerning the economic position of a country exclusively on the basis of commodity terms of trade cannot be valid.

(vii) Capacity to Import: The improvement or worsening of the commodity terms of trade cannot give any definite conclusion about the capacity of a country to import. An appropriate measure of the capacity to import can be the income terms of trade rather than the net barter terms of trade. In order to overcome the deficiencies of the net barter terms of trade, Taussig introduced the concept of gross barter terms of trade.

Q12) Write the objection of gross barter terms of trade.

A12) Criticisms:

(i) Aggregation of Goods, Services and Capital Transactions: The gross barter terms of trade attempted to remove the deficiency of the net barter terms of trade by aggregating all exports of goods, services and capital in the index of export quantities. Similarly, the imports of goods, services and capital were aggregated in the index of quantities imported. The lumping together of these nonhomogeneous quantities was both unreal and impractical. It was because of this reason that this concept of terms of trade came to be rejected at the hands of economists like Jacob Viner and Haberler

(ii) Faulty Index of Welfare: A higher ratio of quantity index of imports to the quantity index of exports is sometimes regarded as an index of a higher level of welfare from trade because the country obtains larger quantity of importable good per unit of exportable goods. But this is not necessarily true. If there are such changes in tastes and habits of a people that even a smaller quantity of imports yields greater satisfaction, the community may derive greater welfare despite an unfavourable gross barter terms of trade.

(iii) Neglect of Productivity: It is possible that a country has unfavourable gross barter terms of trade but that is caused by increased factor productivity in the export sector. The increased factor productivity still indicates the gain from the point of view of the exporting country. The impact of improvement in productivity has been overlooked in this measure of terms of trade.

(iv) Neglect of Qualitative Changes: The gross barter terms of trade ratio undoubtedly takes into account the physical quantities of imports and exports but ignores the fact that there might have been qualitative improvements in production in the exporting and importing countries. Such changes can have very significant effect on the welfare, yet these are not reflected through the gross barter terms of trade.

(v) Neglect of Capital Movements: The international capital movements have quite important influence on the balance of payments and general economic condition of a country. This vital factor, however, has not found proper expression in the measurement of gross barter terms of trade.