Unit - 6

International Trade

Q1) What are the assumptions of H-O theory?

A1) The following assumptions:

Q2) What do you understand by the terms Factor Intensity and Factor Abundance?

A2) (A) Factor Intensity

In our two-country commodity model, commodity Y is capital intensive if the capital-labour ratio (K/L) in the production of Y is greater than K/L used in the proportion of X. To explain with an example, if commodity Y requires 2 units of capital (2K) and 2 units of labour (2L), the capital-labour ratio (K/L) for producing commodity Y is 2/2 = 1. For commodity X, if the required inputs are 1K and 4L, the capital-labour (K/L) ratio ¼.

The ratios can be stated as:

For commodity Y, the K/L = 2K /2L = 1

For commodity X, the K/L = 1K/4L =1/4

Here commodity Y is capital intensive and X is labour intensive

Commodity | Capital | Labour | K/L Ratio |

Y X | 2 3 | 2 12 | 1 1/4 |

Capital or labour intensity is not measured in absolute terms but by the ratio i.e., units of capital per labour or units of labour per capital. In our example, K/L ratio for Y is 1 and for X is ¼.

Instead, if units of capital and labour used in the production of Y are 2K and 2L where as for X, 3K and 12L, commodity Y still remains capital intensive through X requires more capital in absolute terms i.e., 3K. capital used per labour in the production of X is 3K/2L i.e., 3/12 = ¼. Whereas for Y it is 2K/2L = 1 as shown in table.

Commodity | Capital | Labour | K/L Ratio |

Y X | 2 3 | 2 12 | 1 1/4 |

Factor intensity, therefore is measured by the factor ratios and not by absolute units.

In our example of two commodities, two factors and two countries, we say commodity Y is capital intensive if capital-labour ratio (K/L) of Y is greater than the K/L ratio of X. to illustrate the point let us say that production of one unit of Y requires two units of capital (2K) and 2-unit labour (2L). The capital-labour ratio (K/L) of Y is2/2 =1. Similarly, if the production of X requires 3K and 12L, the capital-labour ratio of X is ¼. Here we say Y is capital intensive and X is labour intensive.

It is to be noted that goods are not be noted categorized based on absolute quantity or units of capital and labour used in the production of a unit of good Y or X but the ratio of capital-labour of each c6K and 24L, here good X requires more capital in absolute number than Y. Yet in terms of ratio, it is Y which is capital intensive (5/5 =1) where as X is labour intensive (6/24 = ¼).

(B) Factor Abundance

Factor Abundance in Physical Terms

Nations differ in factor endowments. Some have more natural resources, some have more of labour and others more of capital. A given county’s factor abundance can be defined either in physical terms or in terms of relative factor prices. In our two-country model, country I is capital abundant, if in physical terms the ratio of total amount of capital (TK) to the total amount of labour (TL) that is (TK/TL) in nation 1 is greater than nation 2 i.e.,  >

> . It should be noted that it is not the absolute amount of capital and labour but the ratio of the total amount of capital to the total amount of labour. Country 1 may have a lesser quantity of capital than country 2, yet country 1 will be capital abundant if TK to TL in country 1 is greater than in country 2.

. It should be noted that it is not the absolute amount of capital and labour but the ratio of the total amount of capital to the total amount of labour. Country 1 may have a lesser quantity of capital than country 2, yet country 1 will be capital abundant if TK to TL in country 1 is greater than in country 2.

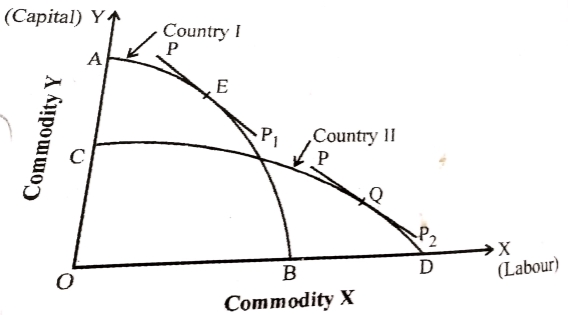

Factor abundance in physical terms can also be explained with the help of production possibility curve OR production frontier, as shown in fig.

In the diagram below, country I is capital abundant, therefore, its production possibility curve is skewed towards Y-axis. Country II is labour abundant, accordingly its production possibility curve is skewed towards X-axis.

Country I can produce OA of Y i.e., CA quantity more than country II. Similarly, country II can produce OD of X, i.e., BD quantity more than country I. country II can produce more of X which is labour intensive because it is capital intensive due to its abundant capital.

The domestic price lines are PP1 and PP2 in countries I and II. The points E and Q are the respective equilibrium points of production and consumption. The price lines P1 and P2 indicate that commodity Y is cheaper in country I and X in country II, providing the basis for trade.

Q3) Explain Leontief paradox.

A3) In the early 1950s, Russian-born American economist Wassily W. Leontief closely studied the American economy and noted that the United States was abundant in capital and, therefore, should export goods intensive. However, his research using real data showed the opposite: the United States imported more capital-intensive goods. In 1953, Wassily Leontief published the results of experiential surveys mainly renowned in economics, attempt to test the reliability of the HO model with U.S. commercial models. According to the theory of factor proportions, the United States should have imported labor-intensive goods, but instead, it was effectively exporting them, and its analysis became known as the Leontief paradox because that this was the reverse of what was expected by factor proportion theory. This econometric research is the result of Wassily W. Leontief's attempt to empirically test the Heckscher-Ohlin theory ("HO theory"). measured that a country will be required to export the products which intensively use its many factors of manufacture and to import those which intensively use its inadequate issue.

Q4) Write the objectives of Leontief paradox.

A4) Leontief's objectives were: to prove that the H-O model was correct; and to show that US exports were capital intensive. Leontief developed an input-output table for the United States in 1947 to establish the capital-labor ratios used in the production of American exports and imports. In one of the most widely discussed tests of factor proportion theory, Leontief attempted to expose the structure of the relative factor proportions of the United States' contribution to international trade. He found that U.S. exports used a capital-labor ratio of $ 13,991 per man-year, while import substitutes used a ratio of $ 18,184 per man-year. In the following years, economists historically noted at this time that labor in the United States was available in constant and more productive quantities than in many other countries; it therefore made sense to export labor-intensive goods. Over the decades, many economists have used theories and data to explain and downplay the impact of the paradox. The general consensus is that the United States is the only country that is most abundantly capable of capital. Therefore, one would expect the United States to export complete assets and import labor-intensive goods.

Q5) What do you understand by trade?

A5) Trade is the fundamental state of business activity it includes sale and purchase of the goods or services. It involves the exchange or transfer of goods or services. The producers build the goods, then it transfers to the whole seller, then to a retailer and finally reached to the consumer.

Q6) What is gross barter terms of trade?

A6) This concept of the gross terms of trade was introduced by F.W. Taussig and in his view this is often an improvement over the concept of net barter terms of trade because it directly takes into account the volume of trade. Accordingly, the gross barter terms of trade ask the relation of the volume of imports to the volume of exports. Thus,

Tg = Qm/Qx

Where

Tg = gross barter terms of trade,

Qm = quantity of imports

Qx = quantity of exports

To compare the change within the trade situation over a period of your time, the subsequent ratio is employed

Qm1/Qx1: Qm0/Qx0

Where the subscript 0 denotes the base year and therefore the subscript I denotes the current year.

It is obvious that the gross barter terms of trade for a country will rise (i.e., will improve) if more imports may be obtained for a given volume of exports. it's important to notice that when the balance of trade is in equilibrium (that is, when value of exports is adequate to the value of imports), the gross barter terms of trade amount to an equivalent thing as net barter terms of trade.

This can be shown as under:

Value of imports = price of imports x quantity of imports = Pm. Qm

Value of exports = Price of exports x quantity of exports = Px. Qx

Therefore, THE balance of trade is in equilibrium.

Px. Qx = Pm. Qm

Px. Qm = Pm Qx

However, when balance of trade is not its equilibrium, the gross barter terms of trade would differ from net barter terms of trade.

Gross barter terms of trade include all the items in the balance of payments thus making its wider and comprehensive than net terms of trade. The gross barter terms of trade differ from the net barter terms of trade as the former include unilateral transfers.

Q7) What are the limitations of gross barter terms of trade?

A7) Limitations of gross barter terms of trade are:

Taussig's concept of gross barter terms of trade has been criticised on the grounds

(a) It expresses the terms of trade in terms of quantity instead of prices. For analytical as well as practical purposes terms of trade expressed in value or price are more relevant.

(b) It includes payments such as unilateral payments which do not depend on trade but on factors mostly unrelated to the trade.

(c) Gross barter terms of trade explain the changes in balance of trade/payments rather than the changes in export-import prices.

(d) A favourable GBTT need not necessarily indicate higher welfare as welfare depends on many factors other than more imports that is favourable GBTT

Q8) What are the limitations of Income terms of trade?

A8) The limitations of income terms of trade are:

i) The income terms of trade, however, do not measure precisely the gain or loss from the trade. More imports may be at the cost of higher exports which involve larger amount of domestic resources which could have been used for domestic consumption.

ii) Increase in exports may be due to a decline in prices. With import prices remaining the same, the capacity of the country to import increases. It is, however, possible that additional income is due to increase in exports at a lower price. This situation, however makes commodity terms of trade deteriorate.

iii) Income terms of trade takes into account the import capacity of a country based on export receipts only but neglects foreign exchange receipts from other sources. It is argued that a country s capacity to import does not depend only on export receipts but on total foreign exchange receipts.

(iv) The concept of income terms of trade fails to consider the welfare aspects of trade. More exports involve more resources to produce those goods. These resources could have been used to produce goods for domestic consumption which have increased the economic welfare of the people.

Q9) What are the factors that affect the terms of trade?

A9) Terms of trade of a country are favourable or not, depend on a number of factors. The important of them are:

1. Changes in Factor Endowments: Availability of factors of production in a country may increase or decrease over a period of time. An increase may enable a country to export more and a decrease may lead to increase in imports resulting in changes in terms of trade.

2. Reciprocal Demand: The intensity of demand for other country's goods changes the terms of trade. If India's demand for goods from China is strong and increasing compared to China's demand for Indian goods, then the terms of trade will be adverse to India.

3. Improvement in Technology: It may lead to reduction in cost of production, requirement of raw materials and other associated changes which may improve the terms of trade. i Developing countries which export raw materials may experience a deterioration in terms of trade due to decline in demand as a result of such changes.

4. Changes in Tastes: Demand for goods may increase or decrease whenever tastes change. Change in taste may include changes in fashion and habits. For example, a change in taste for tea and coffee may affect the terms of trade of those countries which export these items. Declining habit of smoking throughout world may affect the terms of trade of tobacco exporting countries.

5. Tariffs: A country imposes tariffs on its imports to influence its terms of trade in its favour as imports may decline or prices of imports may be reduced by the countries who export these goods.

6. Economic Development: In the process of development an economy experiences dynamic changes leading to the changes in composition and direction of its trade. Besides, changes in quality of inputs, technology and work culture may lead to changes in terms of trade. Some of the developing countries specially emerging market economies are experiencing these changes resulting in positive changes in their terms of trade.

7. Nature of Commodities: The nature and type of goods traded differ from country to country. Developed countries exports mainly comprise capital goods and manufactures. They have a strong demand from the developing countries. Higher cost of production combined with less elastic demand result in high prices for these goods. The developing and poor countries, specially whose exports are mainly primary goods (with some exceptions like crude oil) command less price. The main reasons may be low cost and elastic demand for primary goods. Therefore, it is argued that the developing countries suffer from adverse terms of trade.

Q10) What is trade barrier?

A10) A trade barrier is any obstacle that limits the movement of trade flows between countries. Generally, the purpose of this measure is to protect the domestic economy.

Q11) What are the types of trade barriers?

A11) There are four types of trade barriers that can be implemented by countries. They are Voluntary Export Restraints, Regulatory Barriers, Anti-Dumping Duties, and Subsidies

Q12) What is WTO?

A12) The World Trade Organization (WTO) is the only global international organization dealing with the rules of trade between nations. At its heart are the WTO agreements, negotiated and signed by the bulk of the world’s trading nations and ratified in their parliaments. The goal is to ensure that trade flows as smoothly, predictably and freely as possible.

Q13) What are the objectives of WTO?

A13) Objectives of WTO

Q14) What are the limitations of Double factoral terms of trade?

A14) The limitations of double factoral terms of trade are:

i) It is highly difficult to construct the productivity index.

ii) It involves comparison of changes in efficiency in productivity in export and import countries, which is impractical as socio economic and political conditions differ.

iii) Changes in productivity is less important for trading countries than the price and quantity involved in trade.

(iv) Prof. Kindleberger criticised this concept by stating that the exporting country is interested in its gain rather than the improvement in productivity in importing country.

Of all types of terms of trade, only net barter terms of trade, income terms of trade and single factoral terms of trade are made use of for practical purposes. Even from these, it is the net barter terms of trade which are used for all official purposes while measuring terms of trade and changes therein.

Q15) What is Single Factorial Terms of Trade?

A15) Single Factorial Terms of Trade:

To overcome the limitations of commodity terms of trade, Prof. Viner developed the concept of single factoral terms of trade. This concept admits changes in productivity of factors involved in producing exports. The single factoral terms of trade can be expressed as

Ts = (Px/Pm) Zx

where, Ts = Single factoral terms of trade

Px/Pm= Commodity terms of trade (Tc)

Zx= Productivity index of the export sector

Thus, the single factoral terms of trade (Ts) measures the amount of imports the nation gets per unit of domestic factors of production embodied in its exports.

For example, if Tc= 95/110 and the productivity in our export sector rose from 100 in 2015 to 125 in 2019, then our single factoral terms of trade will be

Ts = (95/110) 125 = (0.8636) 125 =107.95

Here the exporting country received 7.95 percent more imports per unit of domestic factors embodied in its exports than what it received in 2015.