Basis of Difference | Single Entry System | Double Entry System |

Overview | In the Single Entry system of bookkeeping, only one effect of the transaction is recorded which is related to our business. | In Double Entry system of bookkeeping, only both or all effects of the transaction is recorded in the books of accounts. |

Object | To know or remember the cash, debtors and creditor balance only. | To know every financial term of the business entity. |

Type of Recording | It is an incomplete system of recording the transactions. | It is the complete system of recording the transactions. |

Fraud | In this system, here is very easy to record fraud entry of transactions Because you are not showing the second affected account by the same transaction. | In this system, here is difficult to record fraud entry of transactions Because you are showing the second affected account by the same transaction. |

Error | It is very hard to identify the error in the books. | It is easy to identify the error in the books. |

Accounts Included | Only account related to persons and cash are included. | All accounts are considered in this method. Like the person, real and nominal. |

Acceptance by Taxation department | It is not accepted by the taxation department. | It is accepted. |

Profit/Loss for the year | It requires a lot of labour and time to calculate the Profit/loss for the year. | It is easy to find out the Profit and Loss for the Year. |

Suitable | This system is suitable for only a very small business. | It is suitable for all type of business. |

Cost of Implementation | This system does not require any cost of implementation | This system does require any cost of implementation. |

Users | Only Owner of the Business can use this system because it is not maintained on the particular standard. | All related Parties can use this system because all books are maintained on the standard formats. |

Reconciliation of accounts | Reconciliations of accounts are not possible. | Reconciliations of accounts are possible. |

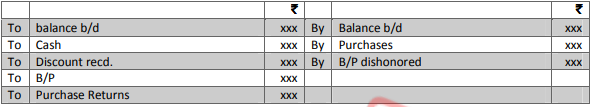

| Rs. |

Capital at the end of the year | Xxx |

Add: Drawings during the year | xxx |

|

|

Less: Flesh Capital introduced | xxx |

Less: Capital in the beginning of the year | Xxx |

Profit during the year | xxxx |

|

|

|

|

|