|

Particulars | X | Y | Particulars | X | Y |

To Bank A/C (Capital Withdraw) To Balance c/f

|

|

| By Balance b/f By Bank A/C (Introduction of further capital) |

|

|

|

|

|

|

Particulars | X | Y | Particulars | X | Y |

To Drawings A/C To Interest on drawings A/C To P/L Appropriation A/C (Share of loss) To Balance c/f

|

|

| By Balance b/f By interest on Capital A/C By Partners’ Salary A/C By Partners’ Commission A/c By P/L Appropriation A/c (Share of Profit) |

|

|

|

|

|

|

Particulars | X | Y | Particulars | X | Y |

To Drawings A/C To Bank A/C (Capital withdrawn) To Interest on drawings A/C To P/L Appropriation A/C (Share of loss) To Balance c/f

|

|

| By Balance b/f By Bank A/C (Introduction of further capital) By interest on Capital A/C By Partners’ Salary A/C By Partners’ Commission A/c By P/L Appropriation A/c (Share of Profit) |

|

|

|

|

|

| ||

| |||||

|

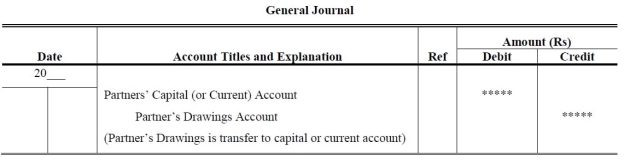

(2) Interest on Drawings Journal Entry

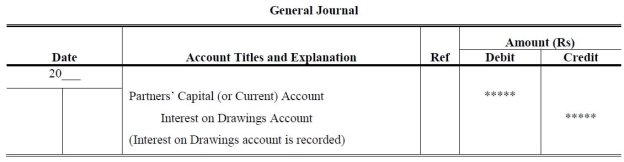

(2) Interest on Drawings Journal Entry (3) Fresh Capital Introduce Journal Entry

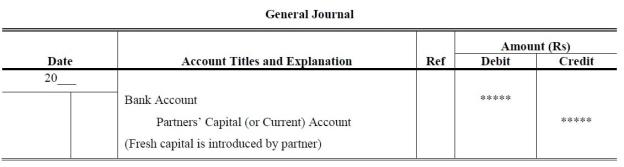

(3) Fresh Capital Introduce Journal Entry (4) Excess Capital withdrawal Journal Entry

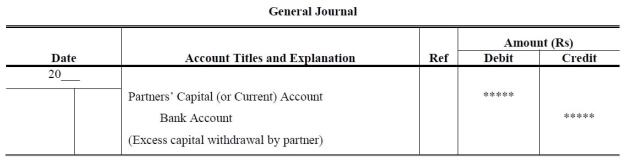

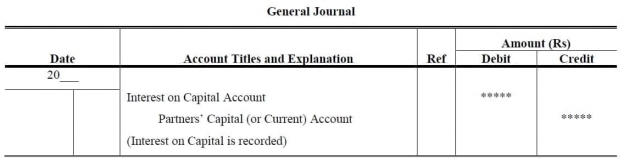

(4) Excess Capital withdrawal Journal Entry (5) Interest on Capital Journal Entry

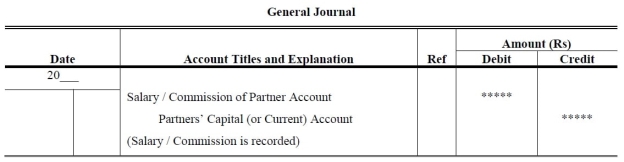

(5) Interest on Capital Journal Entry (6) Salary / Commission Journal Entry

(6) Salary / Commission Journal Entry Q3) Explain difference Capital & Current accountA3)

Q3) Explain difference Capital & Current accountA3)Difference | Capital account | Current account |

Need | Capital account is maintained in all the cases, whether following Fixed Capital Account Method or Fluctuating Account Method. | Current Account is maintained when Fixed Capital Account is followed. |

Balance of payment | Capital Account will always have a Credit Balance when the Fixed Capital Method is followed. In Fluctuating Capital Account Method, it may have either debit or credit balance. | Balance of Current Account may have a Debit or Credit balance. |

Nature | In case of Fixed Capital, Capital account balance generally remains unchanged from year to year. It changes when further capital is introduced or capital is withdrawn by the partners. | The balance of Current Account changes every year as the all the adjustments are done in this account. |

Capital contribution | The capital contributed by partners is shown in this account. | This account does not show the capital contribution. |

Transactions | Capital Account records the transactions such as Opening capital, Additional capital and Withdrawal of capital. | Current account records the transactions such as Drawings, Interest on Capital, Interest on Drawings, Salary, Commission, Profit or Loss, etc. |

3. Guarantee by Other Partners but Deficiency is Borne in a Specified Ratio - Under this case, the deficiency of profit is borne by other partners in a pre-determined ratio (not the remaining profit sharing ratio).

Q5) Durai and Velan entered into a partnership agreement on 1st April 2018, Durai contributing rs 25,000 and Velan rs 30,000 as capital. The agreement provided that: a) Profits and losses to be shared in the ratio 2:3 as between Durai and Velan.b) Partners to be entitled to interest on capital @ 5% p.a.c) Interest on drawings to be charged Durai: rs 300 Velan: rs 450d) Durai to receive a salary of rs 5,000 for the year, ande) Velan to receive a commission of rs 2,000During the year, the firm made a profit of rs 20,000 before adjustment of interest, salary and commission. Prepare the Profit and loss appropriation account.A5)

|

|

Q8) Rohit and Mohit are partners sharing profit in the ratio of 3 : 2. They admit Sumit as a new partner for 1/5 share in profit. Calculate the new profit sharing ratio and sacrificing ratio.A8) Calculation of new profit sharing ratio:Let total Profit = 1New partner’s share = 1/5Remaining share = 1 – 1/5 = 4/5Rohit’s new share = 3/5 of 4/5 = 12/25Mohit’s new share = 2/5 of 4/5 = 8/25Sumit’s Share = 1/5The new profit sharing ratio of Rohit, Mohit and Sumit is:= 12/25 : 8/25 : 1/5= 12/25 : 8/25 : 5/25= 12 : 8 : 5Calculation of Sacrificing RatiosRohit Sacrificed = 3/5 – 12/25 = 15 – 12/25 = 3/25Mohit Sacrificed = 2/5 – 8/25 = 10 – 8/25 = 2/25Sacrificing Ratio = 3 : 2 Q9) Explain Adjustment Regarding Revaluation of Assets and Liabilities at the time of admissionA9) At the time of admission of a new partner, it is always desirable to ascertain whether the assets of the firm are shown in books at their current values. In case the assets are overstated or understated, these are revalued. Similarly, a reassessment of the liabilities is also done so that these are brought in the books at their correct values. At times there may be some unrecorded assets with the business, these are also recorded and similarly if there is any unrecorded liability which the firm has to pay, the same is also recorded. For revaluation of assets and recording of unrecorded assets and for the reassessment of liabilities and recording of unrecorded liabilities the firm prepares an account in its book called Revaluation Account. Any gain or loss on revaluation of assets and reassessment of liabilities is transferred to the capital accounts of the old partners in their old profit sharing ratio. The revaluation account is credited with increase in the value of assets and decrease in the value of liabilities because it is a gain. Similarly, decrease of assets and increase in the value of liabilities is debited to revaluation account because it is a loss. Unrecorded assets are credited and unrecorded liabilities are debited in the revaluation account. If the revaluation account shows a credit balance then it indicates gain and if there is a debit balance then it indicates loss. Gain on revaluation or loss on revaluation will be transferred to the capital accounts of the old partners in old ratio.The following journal entries are recorded on revaluation of assets and reassessment of liabilities.(i) For increase in the value of AssetsAsset A/c Dr.To Revaluation A/c(Increase in the value of Assets)(ii) For decrease in the value of AssetRevaluation A/c Dr.To Asset A/c(Decrease in the value of Assets)(iii) For increase in the value of LiabilitiesRevaluation A/c Dr.To Liabilities A/c(Increase in the value of Liabilities) (iv) For decrease in the value of Liabilities Liabilities A/c Dr.To Revaluation A/c(Decrease in the value of Liabilities)(v) For unrecorded AssetsAsset A/c [unrecorded] Dr.To Revaluation A/c(Unrecorded asset recorded at actual value)(vi) For unrecorded LiabilityRevaluation A/c Dr.To Liability A/c [unrecorded](Unrecorded Liability recorded at actual value)(vii) For transfer of gain on revaluationRevaluation A/c Dr.To Existing Partner’s Capital/Current A/c(Profit on revaluation transferred to capital account in existing ratio)(viii) For transfer of loss on revaluationExisting Partner’s Capital/Current A/c Dr.To Revaluation A/c(Loss on revaluation transferred to capital account in existing ratio) Q10) Explain revaluation of assets and liabilities at the time of retirementA10) In case of retirement or death of a partner the assets and liabilities of the firm should be revalued in the same way as at the time of admission of a partner. At the time of retirement/death some of the assets or liabilities may not have been shown at their current values. To ascertain the net profit and loss on revaluation of assets and liabilities Revaluation A/c is prepared.The following journal entries are passed for the revaluation of assets and liabilities:(i) For increase in the value of AssetsAsset A/c Dr.To Revaluation A/c(Increase in the value of assets)(ii) For decrease in the value of AssetRevaluation A/c Dr.To Asset A/c(Decrease in the value of assets)(iii) For increase in the value of LiabilitiesRevaluation A/c Dr.To Liabilities A/c(Increase in the value of Liabilities)(iv) For decrease in the value of LiabilitiesLiabilities A/c Dr.To Revaluation A/c(Decrease in the value of Liabilities)(v) For unrecorded AssetsAsset A/c [unrecorded] Dr.To Revaluation A/c(Unrecorded asset recorded at actual value) (vi) For unrecorded Liability NotesRevaluation A/c Dr.To Liability A/c [unrecorded](Unrecorded Liability recorded at actual value)(vii) For transfer of gain on revaluation:Revaluation A/c Dr.To All Partner’s Capital A/c (Old ratio)(Profit on revaluation transferred to capital account in old profit sharing ratio)(viii) For transfer of loss on revaluation:All Partner’s Capital Dr.To Revaluation A/c(Loss on revaluation transferred to capital account in existing ratio)