Unit I

Accounting

Q1) Define AIS.

A1) Another definition of the American Institute of Certified Public Accountants (AICPA) is: Interpret the result. "

Accounting includes recording, classifying, and summarizing business transactions. This is the process of identifying, measuring, and communicating economic information, including four interrelated phases. They are outlined here:

First, the first phase is intended to record economic events or transactions called journals-recording them in chronological books in chronological order as they occur. This process is known as journaling. Next is the ledger posting phase. This is the process by which all transactions are synthesized for each account and the cumulative balance for each of those accounts can be determined. The ledger posting process is very important because it helps you see the net effect of various transactions over a particular time period. The next step is to prepare a trial balance that includes aggregating all ledger accounts into debit and credit balances. This activity allows you to see if the total debit is equal to the total credit. Finally, there is the stage of preparing financial statements. This phase aims to close the account by measuring the profit and loss account at the end of the accounting period and creating a balance sheet.

Accounting information has different users, who can be inside or outside your organization. Accounting information is economic information because it relates to the financial or economic activity of a corporate organization. Because numerous people use accounting information for therefore many diverse purposes, the aim of monetary statements is that the needs of users who may lead them to form better financial decisions. Is to respond to. Users can be categorized as internal users and external users.

Q2) Who are the primary users of AIS?

A2) The internal or primary users of accounting information are:

Management-Accounting information is very useful for managing planning, management, and decision-making processes. In addition, management needs accounting information to assess an organization's performance and status and can take the necessary steps to improve performance. What's more, accounting information helps managers make their jobs better.

Employees-Employees use accounting information to study the financial position, sales, and profitability of their business to determine employment stability, future compensation potential, severance pay, and employment opportunities.

Owner – The owner uses accounting information to analyze the feasibility and profitability of an investment. Accounting information allows owners to assess the ability of a business organization to pay dividends. It also guides you in deciding on future course of action.

The external or secondary users of accounting information are:

Creditors – Creditors are interested in accounting information because they can determine the creditworthiness of their business. Credit terms and standards are set based on the financial position of the business, which helps you analyse with accurate information. Creditors include financial suppliers and lenders such as banks. Trade creditors are generally more interested in accounting information in a shorter period of time than lenders.

Investor – We need information because we are interested in the risks and returns inherent in our investment. It is important to assess the feasibility of investing in a company and should be analysed before funding the company.

Customers – Customers are interested in accounting information to assess the financial position of their business. This is because you can maintain a stable business source, especially if you are involved in the long term.

Regulators – Accounting information is needed to ensure that it complies with rules and regulations and protects the interests of stakeholders who depend on such information.

General-purpose financial statements provide much of the knowledge needed by external users of monetary accounting. These financial statements are formal reports that provide information about the company's financial position, cash inflows and outflows, and operating results. Many companies publish these statements in their annual reports, also known as 10-K or 10-Q (quarterly reports). The annual report contains the opinion of the independent auditor on the fairness of the financial statements and information on the company's activities, products and plans. The best place to find these reports for public companies is usually the investor public relations section of your website. Financial statements used by external entities are prepared using generally accepted accounting principles (GAAP). The GAAP language will be discussed in more detail in a later section.

Government / IRS

Government agencies that track and use taxes are interested in a company's financial story. They want to know if a company pays taxes according to current tax law. The language in which tax-related financial statements are produced is called the IRC or the Internal Revenue Service. Tax preparation is outside the scope of this ours.

Q3) What are the qualitative features of AIS?

A3) The qualitative features that have been found to be widely accepted and recognized in the accounting literature are:

1. Relevance:

Relevance is closely and directly associated with the concept of useful information. Relevance means that you need to report all information items that may help users make decisions and forecasts. In general, the more important information in decision making is more relevant.

In particular, it is the ability of information to make a difference that identifies it as relevant to decision making. The Commission, which prepares a statement on the basic accounting theory of the American Accounting Society, describes relevance as "a primary standard and influences actions designed to facilitate information or outcomes that are desired to be generated. Or need to be usefully associated. "

2. Reliability:

Confidence is described as one of the two main qualities (relevance and credibility) that make accounting information useful for decision making. Reliable information is needed to make decisions about a company's profitability and financial position. Reliability varies from item to item.

Some of the information contained in the annual report is more reliable than the others. For example, information about plants and machinery may be less reliable than certain information about current assets due to differences in realization uncertainty. Reliability is the quality that allows users of data to rely on it with confidence as a representative of what the data is trying to represent.

The FASB Concept No. 2 concludes that:

To be useful information, it can only be trusted. There must be no relevance. You need to be aware of the degree of reliability. There are few black or white issues, but it is a high or low reliability issue. Reliability is verified by accounting explanations or measurements. It is possible, expressively faithful and dependent to some extent. Information neutrality also interacts with these two elements of reliability and affects the usefulness of information. "

3. Intelligibility:

Intelligibility is the quality of information that enables users to recognize its importance. You can increase the benefits of information by making it easier to understand and helping more users.

Presenting information that only sophisticated users can understand and others cannot understand creates a bias that contradicts proper disclosure standards. The presentation of information should not only facilitate understanding, but also avoid misinterpretation of financial statements. Therefore, easy-to-understand financial accounting information presents data that is understandable to the user of the information and is expressed in a format and terminology that fits the user's understanding.

4. Comparability:

To make an economic decision, you need to choose from possible course of action. When making a decision, the decision maker makes a comparison between the alternatives. This is facilitated by financial information. Comparability means that they are reported in the same way and in different ways.

FASB (USA) Concept No. 2 defines comparability as follows: Obviously, a valid comparison is only possible if the measurements (quantities or ratios) used are certain to represent the characteristics to be compared.

Comparable financial accounting information shows similarities and differences that result from the fundamental similarities and differences of a company or its transactions, as well as differences in the treatment of financial accounting.

The information, when comparable, helps decision makers determine relative financial strengths and weaknesses, as well as future prospects, between two or more companies, or between periods of one company.

5. Consistency:

Consistency of the method over a period of time is a valuable quality that makes accounting numbers more useful.

If the investor knows which method is being followed and it is guaranteed that it is being followed consistently each year, then what exact rules and practices are used by the investor to report their earnings. It doesn't really matter if you adopt. Inconsistency creates a lack of comparability. The value of business-to-business comparisons is significantly reduced if significant differences in revenue are caused by fluctuations in accounting practices.

6. Neutrality:

Neutrality is also known as "freedom from prejudice" or the quality of objectivity. Neutrality means that the main concern in developing or implementing a standard should be the relevance and credibility of the resulting information, not the impact of the new rules on a particular interest or user. Means neutral choices between accounting options are not biased towards given results. The purpose of (general purpose) financial reporting serves many different information users with different interests, and one given result may not fit the interests and purposes of all users.

Therefore, accounting facts and practices should be fairly determined and reported without the purpose of intentionally biasing users or groups of users. If there is no bias in the choice of reported accounting information, then one set of profits cannot be said to have an advantage over another. In fact, it may support a particular interest, because the information points to it that way.

7. Importance:

The concept of materiality pervades the entire field of accounting and auditing. The concept of materiality means that all financial information needs to or should not be communicated in accounting reports-only important information should be reported. Information that is not important may be omitted and should probably be omitted. Information that may affect your financial decisions should be disclosed in your annual report. Information that meets this requirement is important.

8. Timeliness:

Timeliness means making information available to decision makers before they lose their ability to influence decisions. Timeliness is an auxiliary aspect of relevance. Future action, if information is not available when needed or becomes available long after the reported event and is not worth it, is irrelevant and of little or no use. Timeliness alone cannot make information relevant, but lack of timeliness can rob you of relevant information that you might otherwise have.

Obviously, there is a degree of timeliness, and some reports need to be produced quickly, such as in the case of takeover bids or strikes. In other situations, such as regular reporting of annual performance by operators, long delays in reporting information can have a significant impact on relevance and thus the usefulness of the information. However, to achieve the increased relevance that accompanies the increased timeliness, other desirable properties of the information must be sacrificed, which can result in an overall increase or decrease in usefulness.

For example, it may be desirable to sacrifice accuracy for timeliness. This is because quickly-produced estimates are often more useful than accurate information reported after longer delays.

9. Verifiability:

Verification does not guarantee the suitability of the method used and does not guarantee the accuracy of the resulting measurements. It conveys some assurance that the measurement rules used, whatever they are, have been carefully applied to the measurer's side with personal prejudice.

It is a means to deal with some measurement problems more than other measurement problems.

Verification of accounting information does not guarantee that the information has a high degree of representational fidelity, and a highly verifiable measurement is a decision that is intended to be useful. Not necessarily related. "

10. Conservatism:

There are places of custom such as conservatism. This is a scrutiny of financial accounting and reporting as business and economic activity is surrounded by uncertainty, but it should be applied with caution.

Conservatism in financial reporting should no longer mean a deliberate, consistent and unobtrusive representation of net worth and profits.

Therefore, conservatism dictates the use of non-optimistic estimates when two estimates of the amount to be received or paid in the future can occur in much the same way. However, if the two amounts are not equal, conservatism is not necessarily the most likely amount and does not dictate the use of a more pessimistic amount.

Q4) Difference between cash and anticipation.

A4) The difference between cash accounting and accrual accounting lies in the timing at which sales and purchases are recorded in your account. Cash accounting recognizes revenues and expenses only when money changes, while accrual accounting recognizes revenues when revenues are earned and expenses when billed (but pays).

Cash basis accounting

Accounting cash basis recognizes revenue when you receive cash and costs when you pay. Accounts receivable and accounts payable are not recognized this way.

Many small businesses choose to use accounting cash basis because it is easy to maintain. You can easily determine when a transaction occurred (whether the money is in or out of the bank) and you don't need to track receivables or payables.

The cash method is also beneficial in that it tracks the amount of cash the business actually has at a given point in time. You can look at your bank balance and understand the exact resources you have at your disposal.

Also, since transactions are not recorded until you receive or pay cash, your company's income is not taxed until you enter the bank.

Accrual accounting

Accrual accounting is an accounting method that records when income and expenses are earned, regardless of when the money is actually received or paid. For example, record revenue when a project is completed, not when you receive payment.

The advantage is that accrual accounting provides a more realistic idea of income and expenses over a period of time, thus providing a long-term picture of the business that cash accounting cannot provide.

The downside is that accrual accounting cannot recognize cash flows. Even though you actually have an empty bank account, your business can seem very profitable.

Q5) What does "record a transaction" mean?

A5) So far, we've covered a lot about recording transactions in books and how cash and accruals decide when to do it.

What is recording of transaction?

Every company needs to record all financial transactions in its ledger. This is also known as bookkeeping. If you request a tax credit at the end of the year, you need to do this. And you need one central place to sum up all your income and expenses (you'll need this information to file your taxes). If you want someone else to do the bookkeeping, check out the bench.

Q6) State the Impact of cash and accrual accounting.

A6) It's important to understand the difference between cash accounting and accrual accounting, but it's also necessary to look at the direct effects of each method and put this in context.

Let's look at an example of how cash and accrual accounting affect revenue differently.

Suppose you want to execute the following transaction in a month's business.

Invoiced for a web design project completed this month for $ 5,000

Received a $ 1,000 invoice for developer fees for work done this month

I paid a $ 75 fee for the bill I received last month

Received $ 1,000 from a client for a project billed last month

Impact on cash flow

Using the cash-based method, this month's profit is $ 925 ($ 1,000 in income minus $ 75 in commission).

Using accrual accounting, this month's profit is $ 4,000 ($ 5,000 in revenue minus $ 1,000 in developer fees).

This example shows how the flow of revenue and the appearance of cash flows are affected by the accounting process used.

Tax impact

Now imagine that the above example happened between November and December 2017. One of the differences between cash accounting and accrual accounting is that it affects which tax year is recorded in profit or loss.

In cash-basis accounting, income is recorded when it is received, whereas in accrual accounting, income is recorded when it is received.

Following the example above, if you use accrual accounting to charge your client $ 5,000 in December 2017, you will record the transaction as part of your 2017 income, even if you receive a payment (thus I will pay the tax). January 2018.

Q7) Do SMEs Need to Use Cash or Accrual Accounting?

A7) If your business is a company with an average total revenue of over $ 25 million over the last three years (excluding S corporations), the IRS requires you to use accrual accounting.

If your business does not meet these criteria, you can use the cash method.

That said, the cash method is usually suitable for small businesses that do not have inventory. For high-inventory businesses, accountants probably recommend accrual accounting.

To change the accounting method, you must submit Form 3115 for approval from the IRS.

Q8. State the difference between Cash and Accrual basis of Accounting.

A8)

Basis for Comparison |

| Cash Accounting |

| Accrual Accounting |

Meaning |

| In cash accounting, incomes and expenses are only recognized through cash. |

| In accrual accounting, incomes and expenses are recognized when they are done (on the mercantile basis). |

Includes |

| Only cash expenses, cash incomes. |

| All expenses and all incomes; |

Nature |

| Simple and easy to understand. |

| Complex and difficult to understand. |

Recognized by |

| Not recognized by Companies Act. |

| Recognized by Companies Act. |

How is accounting done? |

| When cash is received or paid; |

| When revenue is earned, or loss is incurred. |

Focus |

| Liquidity. |

| Revenue/Expense/Profit/Loss. |

Why useful? |

| We can quickly get how much cash the business generated (i.e., net cash flow). |

| We can understand how much profit or loss a business has made during a particular period. |

Holistic in approach |

| No, because it only talks about cash. |

| Yes, because it includes all of the transactions. |

Which one is more accurate? |

| Accuracy of cash accounting is doubtful since it doesn’t take every transaction into accounting. |

| It is a more accurate method of accounting. |

Q9) What are the basic concepts of Accounting?

A9) The basic accounting concept is as follows:

The concept of an entity assumes that its financial statements and other accounting information belong to a particular company that is different from its owner. Therefore, an analysis of business transactions, including costs and revenues, is expressed in terms of changes in the company's financial position.

Similarly, the assets and liabilities devoted to business activities are the assets and liabilities of the entity. The company's transaction is reported, not the company's owner's transaction. Therefore, this concept allows accountants to distinguish between personal and commercial transactions. This concept applies to sole proprietorships, partnerships, businesses, and small businesses. It may also apply to multiple companies, such as when a segment of a company, such as a department, or an interrelated company is merged.

2. Going Concern Concept:

An entity is considered to be in business unless there is evidence of opposition. Because companies are relatively permanent, financial accounting is designed with the assumption that the business will survive indefinitely in the future.

The Going Concern concept justifies the valuation of assets on a non-clearing basis and requires the use of acquisition costs for many valuations. In addition, fixed and intangible assets are amortized over their useful lives, rather than in shorter periods, in the hope of early liquidation.

This further means that the data transmitted is tentative and that the current statement should disclose adjustments to the statement over the past year revealed by more recent developments.

3. Money measurement concept:

A unit of exchange and measurement is required to uniformly account for a company's transactions. The common denominator chosen in accounting is the currency unit. Money is the lowest common denominator for measuring the exchangeability of goods and services such as labor, natural resources and capital.

The concept of monetary measurement considers accounting to be a process of measuring and communicating financially measurable company activity. Obviously, the financial statements should show the money spent.

The concept of measuring money means two limitations of accounting. First, accounting is limited to the generation of information expressed in monetary units. It does not record and convey other relevant but non-monetary information. Second, the concept of monetary measurement concerns the limitation of the monetary unit itself as a unit of measurement.

There are concerns about purchasing power, which is the main characteristic of currency units, or the amount of goods and services that money can obtain. Traditionally, financial accounting has addressed this issue by stating that the concept assumes that the purchasing power of a currency unit is stable over the long term or that price changes are not significant. Although still accepted in current financial reporting, the concept of stable monetary units is subject to continuous and permanent criticism.

4. Accounting period concept:

Financial accounting provides information about a company's economic activity over a specific period of time that is shorter than the company's lifespan. The periods are usually the same length for ease of comparison.

The period is specified in the financial statements. The period is usually 12 months. Quarterly or semi-annual statements may also be issued. These are considered provisional and differ from the annual report. Statements that cover shorter periods of time, such as months or weeks, may also be created for administrative use.

5. Cost concept:

The concept of cost is that the asset should be recorded at the exchange price, that is, the acquisition cost or the acquisition cost. Acquisition costs are recognized as an appropriate valuation criterion for recognizing the acquisition of all goods and services, costs, expenses and capital.

For accounting purposes, business transactions are usually measured in terms of the particular price or cost at which the transaction occurred. That is, financial accounting measurements are based on exchange prices, where economic resources and obligations are exchanged. Therefore, the quantity of an asset listed during a company's account doesn't indicate what the asset could also be sold for.

The concept of acquisition cost means there's little point in revaluing an asset to reflect its current value, because the company has no plans to sell its asset. Additionally, for practical reasons, accountants like better to report actual costs over market values that are difficult to verify.

6. Dual aspect concept:

This concept is at the guts of the whole accounting process. Accountants record events that affect the wealth of a specific entity. The question is which aspect of this wealth is vital. Accounting entities are artificial creations, so it's essential to understand who their resources belong to or what purpose they serve.

It's also important to understand what sorts of resources you manage, like cash, buildings, and land. Therefore, the accounting record system was developed to point out two main things: (a) the source of wealth and (b) the shape it takes. Suppose Mr. X decides to line up a business and transfers Rs. 100,000 from his personal checking account to a different business account.

He may record this event as follows:

Obviously, the source of wealth must be numerically adequate to the shape of wealth. S (source) must be adequate to F (form) because they're simply different aspects of an equivalent thing, that is, within the sort of equations.

In addition, transactions or events that affect a company's wealth got to record two aspects so as to take care of equality on each side of the accounting equation.

According to the Financial Accounting Standards Board (USA):

"Accrual accounting is that the financial impact of transactions and other events and situations that affect a corporation on cash, not only during the amount during which it had been received, but also during the amount during which those transactions, events and situations occur. Accrual accounting is paid to the corporate as more (or perhaps less) cash spent on resources and activities, also because the start and end of the method. it's associated with the method of being returned. We recognize that purchases, production, sales, other operations, and other events that affect a company's performance during a period often do not match the receipt or payment of cash for that period. "

Realization and matching concepts are central to accrual accounting. Accrual accounting measures revenue for a period of time as the difference between the revenues recognized during that period and the costs that match those incomes. In accrual accounting, the period revenue is usually not the same as the period cash receipt from the customer, and the period cost is usually not the same as the period cash payment.

2. Cash Basis Accounting:

In cash-basis accounting, sales are not recorded until the period in which they are received in cash. Similarly, costs are deducted from sales during the period in which the cash payment was made. Therefore, neither realization nor matching concepts apply to cash basis accounting.

In reality, "pure" cash-basis accounting is rare. This is because the pure cash basis approach requires the acquisition of inventory to be treated as a reduction in profit when paying the acquisition cost, not when selling the inventory. Similarly, the cost of acquiring plant and equipment items is treated as a reduction in profit if these long-lived items are paid in cash rather than after they have been used.

Obviously, such a pure cash basis approach would result in a balance sheet and income statement with limited usefulness. Therefore, what is commonly referred to as cash-basis accounting is actually a mixture of cash-basis for some items (especially cost of goods sold and period costs) and accrual-based for others (especially product costs and long-term assets). This mix is sometimes referred to as modified cash-basis accounting to distinguish it from the pure cash-basis method.

Cash-basis accounting is most often seen in small businesses that do not have large inventories because they provide services. Examples include restaurants, hairdressers, hairdressers, and income tax filing companies.

Most of these establishments do not provide credit to their customers, so cash-basis profits may not differ dramatically from accrual income. Nevertheless, cash basis accounting is not permitted by GAAP for any type of entity.

3. Conservatism concept:

This trait can be considered a reactive version of the Minimax management philosophy. That is, it minimizes the potential for maximum loss.

The concept of accounting conservatism suggests that accounting should be cautious and cautious until the opposite evidence emerges, where and when uncertainty and risk exposure are legitimate. Accounting conservatism does not mean intentionally underestimating income and assets. It applies only to situations where there is reasonable doubt. For example, inventories are valued at the lower end of cost or market value.

In its application to the income statement, conservatism encourages recognition of all losses incurred or may occur, but does not recognize profits until they are actually realized. Early depreciation of intangible assets and restrictions on recording asset valuations have also been motivated, at least to some extent, by conservatism. Not recognizing revenue until the sale is made is another sign of conservatism.

4. Matching concept:

The concept of matching in financial accounting is the process of matching (associating) performance or revenue (measured at the selling price of goods and services offered) with labour or expense (measured at the cost of goods and services used) over a specific period of time. is. Targets for which income has been determined.

This concept emphasizes which item of expense in a particular accounting period is expense. That is, expenses are reported as expenses for the accounting period in which revenue related to those expenses is reported. For example, if the sales of some products are reported as revenue for one year, the costs for those products are reported as expenses for the same year.

The concept of matching only needs to be met after the accountant has completed the concept of realization. First measure the revenue according to the concept of realization, then associate the costs with these revenues. Cost matches revenue, but not the other way around.

Therefore, the reconciliation process requires significant cost allocation in acquisition cost accounting. Past (history) costs are investigated and steps are taken to assign a cost element that is considered to have expired service potential or to match it with the associated revenue.

The remaining component of the cost, which is considered to have continued potential for future services, is carried over to the past balance sheet and is called an asset. Therefore, the balance sheet is just a report of unallocated past costs waiting for the estimated future service potential to expire before it matches the appropriate revenue.

5. Realization or Cognitive concept:

The concept of realization or recognition indicates the amount of revenue that should be recognized from a particular sale. Realization rules help accountants determine if revenues or expenses have been incurred. This allows accountants to measure, record, and report on financial reports.

Realization refers to the inflow of cash or cash charges (accounts receivable, accounts receivable, etc.) resulting from the sale of goods or services. Therefore, if the customer purchases Rs. If you pay 500 worth of goods in cash at a grocery store, the store will realize Rs. 500 from the sale.

If the clothing store sells Rs suits. 3,000, if the buyer agrees to pay within 30 days, the store will realize Rs. From sale to 3,000 (accounts receivable) (conservative concept), provided the buyer has a good credit record and the payment is reasonably secure.

The concept of realization states that the amount perceived as revenue is reasonably certain to be realized, that is, reasonably certain to be paid by the customer. Of course, there is room for difference in judgment as to whether or not it is "reasonably certain."

However, this concept explicitly acknowledges that the perceived revenue amount is lower than the selling price of the goods and services sold. The obvious situation is the discounted sale of goods at a price lower than the normal selling price. In such cases, the revenue will be recorded at a lower price rather than the normal price.

6. Consistency concept:

In this concept, once an organization has decided on one method, it should be used for all subsequent transactions and events of the same nature unless there is a good reason to change it. Frequent changes in accounting methods make it difficult to compare financial statements for one period with financial statements for another period.

Consistent use of accounting methods and procedures over the long term checks income statement and balance sheet distortions, and possible operations on these statements. Consistency is needed to help external users compare the financial statements of a particular company over time and make sound economic decisions.

7. Materiality concept:

The law has a doctrine called de minimis non curat lex. This means that the court does not consider trivial issues. Similarly, accountants do not attempt to record events that are not so important that the task of recording them is not justified by the usefulness of the results.

The concept of materiality means that transactions and events that have a non-significant or non-significant impact must not be recorded and reported in the financial statements. Recording of non-essential events is claimed to be unjustifiable in terms of their low usefulness to subsequent users.

For example, conceptually, a brand-new paper pad is an asset of an entity. Each time someone writes on the pad's page, some of this asset is exhausted and retained earnings are reduced accordingly. Theoretically, it is possible to see how many partially used pads the company owns at the end of the accounting period and display this amount as an asset.

However, the cost of such efforts is clearly unreasonable, and accountants are not willing to do this. The accountant took a simpler action, albeit inaccurate, that the asset was exhausted (expenditure) when the pad was purchased or when the pad was issued to the user from the consumable inventory. Treat as.

Unfortunately, there is no consensus on what it means to be important and the exact line that distinguishes between important and non-important events. Decisions depend on judgment and common sense. The accounting creator is meant to interpret what is important and what is not.

Perhaps the importance of an event or transaction can be determined in terms of financial position, performance, changes in an organization's financial position, and its impact on user evaluations or decisions.

8. Full disclosure concept:

The concept of full disclosure requires companies to provide all relevant information to external users for the purpose of sound economic decisions. This concept means that information that is substantive or of interest to the average investor is not omitted or hidden from a company's financial statements.

Q10) Define Accounting standards with its features.

A10) Meaning of accounting standards:

Accounting standards are written statements consisting of rules and guidelines issued by accounting institutions for the preparation of unified and consistent financial statements and other disclosures that affect different users of accounting information. is.

Accounting standards set the conditions for accounting policies and practices with codes, guidelines, and adjustments that facilitate the interpretation of items contained in financial statements and even their handling in the books.

Nature of accounting standards:

Based on the discussion above, accounting standards can be said to be guides, dictators, service providers, and harmonizers in the field of accounting processes.

Accounting standards serve accountants as a guide to the accounting process. They provide the basis for the account to be prepared. For example, they provide a way to value inventory.

2. Act as a dictator:

Accounting standards act as a dictator in the field of accounting. In some areas, like dictators, accountants have no choice but to choose practices other than those listed in accounting standards. For example, the cash flow statement must be prepared in the format specified by accounting standards.

3. Act as a service provider:

Accounting standards constitute the scope of accounting by defining specific terms, presenting accounting issues, specifying standards, and explaining numerous disclosures and implementation dates. Therefore, accounting standards are descriptive in nature and act as a service provider.

4. Functions as a harmonizer.

There is no bias in accounting standards and there is uniformity in accounting methods. They remove the effects of various accounting practices and policies. Accounting standards often develop and provide solutions to specific accounting problems. Therefore, whenever there is a contradiction in the accounting problem, it is clear that the accounting standard acts as a harmonizer and facilitates the accountant's solution.

Q11) Define Double entry system

A11) Double entry system of accounting deals with two aspects of every business transaction. In other words, every transaction has two effects. For ex, a person buys a cold drink from a store and in return pays the money to shopkeeper for the cold drink. This transaction has two effects in terms of both buyer and seller. Buyer cash balance will decrease by the cost of purchase on the other hand he will acquire a cold drink. Seller will have one drink short but his cash balance will increase.

Accounting attempts to record both effect of transaction in the financial statement. This refers to double entry concept. Under this every transaction involves two parties, one party gives the benefit and other party receives it. It is also called dual entity of transaction.

Accounting records the two affects which are known as Debit (Dr) and Credit (Cr). Accounting system is based on the duality principal that for every Debit entry, there will always be an equal Credit entry.

Debit entries are ones that account for the following effects:

Credit entries are ones that account for the following effects:

Accounting equation recorded in double entry are

Assets – Liabilities = Capital

Any increase in expense (Dr) will be offset by a decrease in assets (Cr) or increase in liability or equity (Cr) and vice-versa. The accounting equation will still be in equilibrium.

Q12) Give examples with characteristics of Double Entry System.

A12) Examples of Double Entry System.

Machine account debited (increase in assets)

Cash account credited (decrease in assets)

2. Payment of utility bills

Utility expenses account debited (increase in expenses)

Cash account credited (decrease in assets)

3. Receipt of bank loans

Cash account credited (increase in assets)

Bank loan account credited (increase in liability)

Characteristic of double entry system

Q13) Explain the classification of Accounts.

A13) The classification can be explained as follows.

A business concern may be to maintain business relationships with all of the above personal accounts in order to purchase, sell, rent, or rent goods from them. Therefore, they are either debtors or creditors.

The capital and drawing accounts of the individual owner are also personal accounts.

2. Non-personal accounts: All accounts that are not personal accounts. This can be further divided into two types. Real and nominal accounts.

Q14) What are the golden rules of Accounting?

A14) Golden Rules of Accounting

1.Personal Accounts | – | Debit the receiver Credit the giver |

2.Real Accounts | – | Debit what comes in Credit what goes out |

3.Nominal Accounts | – | Debit all expenses and losses Credit all incomes and gains |

Q15) Define Accounting cycle and explain its phases.

A15) When complete sequence of accounting procedure is done which happens frequently and repeated in same directions during an accounting period, the same is called an accounting cycle.

Steps/Phases of Accounting Cycle

The steps or phases of accounting cycle can be developed as under:

Financial Statements: Financial statement can now be easily prepared which will exhibit the true financial position and operating results.

Q16) What do you mean by journals?

A16) Original entry book

The book in which the transaction is recorded for the first time from the source document is called the Books of Original Entry or Prime Entry. The journal is one of the original entry books in which transactions were originally recorded in chronological order (daily) according to the principle of double-entry bookkeeping.

Journal

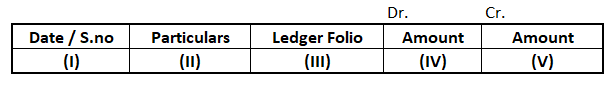

The journal is a dated record of all transactions, including debited and credited account details and the amount of each transaction.

Proforma of a Journal

Description:

1. Date: The date of the transaction is entered in the first column. The year and month are written only once until they change. The date and month order must be strictly maintained.

2. Details: Each transaction affects two accounts, one of which is debited and the other of which is credited. The name of the account to be debited is first written in the immediate vicinity of the row of details column, Dr. Is also written at the end of a particular column. On the second line, the name of the credited account begins with the word "To", a few spaces away from the margins of the detail column to distinguish it from a debit account.

3. Narration: After each entry, a brief description of the transaction and the required details are displayed in a detail column in parentheses called narration. The words "For" or "Being" are used before you start writing the narration. Currently, you don't have to use the word "For" or "Being".

4. Ledger Folio (L.F): All entries in the journal are later posted to the ledger account. The ledger page numbers or folio numbers posted from the journal are recorded in the L.F column of the journal. Until such time, this column remains blank.

5. Debit Amount: This column contains the amount of the account to be debited.

6. Credit Amount: This column will contain the amount of the account to be credited.

Q17) What are the benefits of ledger?

A17)

Utility:

A utility ledger may be a principal or main ledger that contains all accounts to which transactions recorded within the original entry's books are transferred. Ledgers also are referred to as "final entry books" or "secondary entry books" because transactions are eventually incorporated into the ledger. the benefits of the ledger are:

All transactions associated with your account are collected in one place in your ledger. By watching the balance of that account, you'll see at a look the collective effect of all such transactions.

2. Arithmetic Accuracy

With the assistance of your ledger balance, you'll prepare an attempt balance to understand the arithmetic accuracy of your account.

3. Business Performance

Makes it easy to make a final accounting to know business performance and therefore the financial position of the business.

4. Accounting Information

Data provided by various ledger accounts is summarized, analyzed, and interpreted to get various accounting information.

Description

In other words, posting means grouping all transactions associated with a specific account in one place. All journals must be posted to different accounts in your ledger because postings assist you understand internet impact of various transactions over a specific period on a specific account.

Q18) How does trial balance work?

A18) The trial balance is the statement of all debits and credits. Business man prepares trial balance at the end of the reporting period regularly to ensure that the entries are mathematically correct in the books of account. The total of trial balance should be equal. In case the debit and credit does not match it means there is an error. For example, the accountant may have recorded an account or classified a transaction incorrectly.

Preparation of trial balance

Q19) Draw the Performa of Trial Balance.

A19) A trial balance looks like

All the account title is the closing balance of ledger account

ABC LTD - Trial Balance as at 31 December 2019 | ||

| Debit | Credit |

Account Title | Rs | Rs |

Share Capital | - | 15,000 |

Furniture & Fixture | 5,000 | - |

Building | 10,000 | - |

Creditor | - | 5,000 |

|

|

|

Debtors | 3,000 | - |

Cash | 2,000 | - |

Sales | - | 10,000 |

Cost of sales | 8,000 | - |

General and Administration Expense | 2,000 | - |

Total | 30,000 | 30,000 |