Unit II

Business Income

Question Bank

Q1) Create a balance account for the same period from the following balance accounts for the year ending March 31, 2017 at People's Club.

Receipt and Payment Account

Dr. Cr.

Expenditure | Rs. | Income

| Rs. |

Balance c / d bank Subscription: 2015 6,750.00 2016 45,000.00 2017 2,250.00 Donations Hall rent Interest on bank deposits Admission fee

Total

| 1,12,500.00

54,000.00 9,000.00 1,350.00 2,025.00 4,500.00

1,83,375.00

| Purchasing Furniture Salary Telephone Bill Electric Bill Shipping and Stationery Book Purchase Expense Entertainment 5% Government Purchase Paper Miscellaneous Expenses Balance C / D Cash Bank

Total | 22,500.00 9,000.00 1,350.00 2,700.00 675.00 11,250.00 4,050.00 36,000.00 2,700.00

1,350.00 91,800.00

1,83,375.00 |

The following information is available:

Expenditure | Rs. | Income

| Rs. |

Salary 9,000 Add: Unprocessed 6,750 Telephone bill electric bill Shipping and stationery Entertainment fee 4,052.00 Add: Unprocessed 2,250.00 Miscellaneous expenses Furniture miscellaneous expenses on Depreciation expenses Surplus

Total

|

15,750.00 1,350.00 2,700.00 675.00

6,302.00 6,300.00 2,700.00

1,687.50 31,837.50

63,000.00 | Subscription Donations Admission fee (50% of 4500) Bank interest 2,025 Added: Unpaid interest 675 Interest in investment Hall rent

Total | 46,800.00 9,000 2,250.00

2,700.00 900 1,350

63,000.00 |

A1)

Income and Expenditure A/C

Balance sheet overview

Balance preparation for non-trade or non-profit concerns is the same as balance sheet preparation for trading companies. You have all the liabilities and assets as of the date the organization created the balance sheet. Excess assets that exceed liabilities are called capital funds or general funds. Creating a balance sheet for non-profits.

Q2) How do you view your subscription amount on your non-profit balance sheet from the following Receipt and Payment accounts and additional information?

Receipt | Rs. | Payment

| Rs. |

To subscription

| 25,000 |

|

|

Additional Information:

A2)

Start of Balance Sheet

Liabilities | Rs. | Assets

| Rs. |

Pre-subscription (previous year) out. | 1,000

1,000 ________ 2,000 | Subscription (previous year)

| 2,000

________ 2,000 |

Closing the Balance Sheet

Liabilities | Rs. | Assets

| Rs. |

Advanced Subscription (Next Year)

|

1,200

1,200 | Unprocessed Subscription (This Year) Unpaid subscription (previous year)

|

1,500

2,000

3,500 |

Q3) Calculate sports material debited to Income & Expenditure a / c. Yearly. It ended on March 31, 2007, based on the following information. The amount paid for sports material during the year. It was Rs.19,000

Details Inventory of sports materials Creditors of sports materials | 1 = 4 = 2006 (Rs.)

7,500

200 | 31.3.2007 (Rs.)

6,400

2,600 |

A3)

Option 2. Rs. 20,700

Description: Amount debited to income and expenditure as consumption of sports materials = payment amount + starting inventory-ending inventory-starting creditor + ending creditor. Amount debited to income and expenses = 19000 + 7500-6400-2000 + 2600 = Rs. 20,700

Q4) The non-profit has received Rs.10,000 as an admission fee for new members. If 20% of the fee needs to be capitalized, what is the amount of the fee that needs to be displayed in the balance account?

A4) Option 2 Rs.8000

Description: These are the fees collected from all members upon enrolment in membership. Once you become a member of society or a club, you will only be paid once by new entrants. It is treated in two ways: -when capitalized, it appears on the debt side's balance sheet. -If it is considered a receipt for income, it will be displayed in the income and expenditure account on the income side. Therefore, Rs. 20% means Rs. 2000 (10,000 * 20%) appears on the balance sheet on the debt side and the balance of Rs. 8000 is displayed in the income and expenditure account on the income side.

Q5) Prize Rs.10000, Prize Investment Interest Rs.1000, Prize Payment Rs.2000, Prize Investment Rs.8000. What will happen to that treatment?

A5) Option 4. Rs.9000, Rs on the debt side. 8000 on the asset side

Description: The balance sheet calculation looks like this: -Prize-9000 Addition: -Interest 1000 deduction for prize investment: -Prize payment 2000 Debt side amount = Rupee. 9000 prize investment Rs. 8000 is displayed on the asset side.

Q6) Bell, a non-governmental non-profit organization, received special pledged funding from a donor to another non-governmental non-profit medical organization during its annual campaign. How does Bell need to record these funds?

A6) Option 2. Increased assets and increased liabilities

Description: Bell, a non-governmental NPO, is responsible for the funds for the annual campaign and is recorded on the balance sheet. And if the organization pledges this fund to another non-governmental NPO, it becomes a property of the Bernon government. Organization recorded on the asset side of the balance sheet.

Q7) From the information below, we will calculate the amount of stationery that will be posted to the Income and Expenditure account of the Cultural Association of India for the year ending March 31, 2018.

Details Stationery inventory Stationery creditors | 1.4.2017 (Rs.) 21,000 11,000 | 31.3.2018 (Rs.) 18,000 23,000 |

Stationery purchased in the year ended March 31, 2018 was Rs 75,000. Also, please present relevant items on the social balance sheet as of March 31, 2018.

A7)

Stationery Account

| Dr. |

| Cr.

|

Details | Rs. | Details | Rs. |

To Balance b / d | 21,000 | By income and expenditure in balance A / c | 78,000 |

To Bank balance | 75,000 | Balancing figure |

|

|

| By balance c / d

| 18,000

|

| 96,000 |

| 96,000 |

Balance sheet as of March 31, 2018

Liabilities | Amount | Assets | Amount |

Stationery Creditors | 23,000 | Stationery Inventory | 18,000 |

Q8) From the information below, we will calculate the amount of the subscription that will be credited to the 2007-2008 balance account.

Amount | |

Subscriptions received for year | 50,000 |

Outstanding subscriptions on March 31, 2007 | 20,000 |

Unprocessed subscriptions on March 31, 2008 | 6,000 |

Subscriptions pre-received on March 31, 2007 | 8,000 |

Subscriptions received in advance on March 31, 2008. The 2006-07 delinquency is still 1,500. | 9,000

|

A8)

Particulars | Amount |

Subscriptions received for year | 50,000 |

(+) March 31, 2008 Unprocessed Subscriptions (6,000 – 1,500) | 4,500 |

(+) Subscriptions received in advance on March 31, 2007 | 8,000 |

(-) Subscription received in advance on March 31, 2008 | (9,000) |

(-) Unprocessed subscriptions on March 31, 2007 (20,000 – 1,500) | (18,500)

|

Revenue from 2007-08 subscription | 35,000 |

Q9) Find out the cost of drugs consumed in 2015-16 from the following information:

Particulars | Amount (Rs) |

Purchase price of medicine | 3,70,000 |

Creditors of purchased medicines April 1, 2015 March 31, 2016 | 25,000 17,000 |

Drug inventory April 1, 2015 March 31, 2016 |

62,000 54,000 |

Pre-pharmaceutical supplier April 1, 2015 March 31, 2016 |

11,500 18,200 |

A9)

Particulars | Amount |

Payment for drug purchase | 3,70,000 |

(-) Decrease in drug creditors in 2016 (25,000 – 17,000) | (8,000) |

(-) Increase in drug advance payments in 2016 (18,200 – 11,500) | (6,700) |

2016 drug purchase | 3,55,300 |

(+) Starting inventory of pharmaceutical products on April 1, 2015 (-) End of stock of pharmaceutical products on March 31, 2016 | 62,000 (54,000) |

= Medicines consumed in 2016 | 3,63,000 |

Q10) From the following receipt and payment accounts for the Cricket Club and the additional information provided, prepare the balance sheet for the year ending December 31, 2018 and the balance sheet for that date.

Receipt and Payment Accounts

Year ending December 31, 2018

To bal b/d | Rs. |

| Rs. |

- Cash | 3,520 | By Maintenance | 6,820 |

-Bank | 27,380 | By tableware | 2,650 |

-Time deposit @ 6% | 30,000 | By Match cost | 13,240

|

To subscription (2017 including Rs 6000) | 40,000 | By salary

| 11,000 |

To admission | 2,750 | By Transportation | 820 |

To Donation | 5,010 | By maintaining the lawn | 4,240 |

To Interested in time deposit | 900 | By Stamps | 1,050 |

To Tournament Fund | 20,000 | By purchasing cricket products | 9,720 |

To Sale of tableware (book value Rs. 1200) | 2,000 | By Miscellaneous expenses

| 2,000 |

|

| By Investment | 5,700 |

|

| By Tournament costs | 18,800 |

|

| By Balance c / d: -Cash -Bank |

2,200 23,320 |

|

| Time deposit | 30,000 |

| 1,31,560 |

| 1,31,560

|

Additional Information:

A10)

Cricket Club Income and Expenditure Account

Year ended December 31, 2018

Expenditure | Rs. | Income | Rs. | |

To Maintenance | 6,820 | By Subscription 40,000 |

| |

To transport | 820 | less: Rec. Last year 6,000 |

| |

To Lawn Maintenance | 4,240 | Add: untreated this year 8,000 | 42,000 | |

To match cost | 13,240 | By Admission fee | 2,750 | |

To Salary 11,000 |

| By Donations | 5,010 | |

Add: Outstanding 1,000 |

12,000 | By Interest on time deposits 900 |

| |

To Postage stamps: |

| Added: Unpaid due 900 | 1,800 | |

Balance at the beginning 750 |

| By Gain on sale of tableware (2000-1200) |

800 | |

Add: Purchase 1,050 |

|

|

| |

Less: Closing Inventory (900) |

900 |

|

| |

To cricket goods: |

|

|

| |

Beginning balance 3210 Added: Buy 9720 Less: Closing price (2800) |

10,130 |

|

| |

To miscellaneous expenses | 2,000 |

|

| |

To income that exceeds expenditure (Bal Fig) |

2,210

|

|

| |

| 52,360 |

| 52,360 | |

Balance sheet

As of December 31, 2018

Liabilities | Amount | Assets | Amount | |

Tournament Fund Less: Tournament costs | 20,000

18,800 |

1,200 | Cash Bank Time deposit Investment

| 2,200 23,320 30,000 5,700 |

Unpaid salary |

| 1,000 | Crockery

| 2,650 |

Capital (balance Fig) Added: Surplus | 72,660

2,210 |

74,870 | Interest accrued on time deposit | 900 |

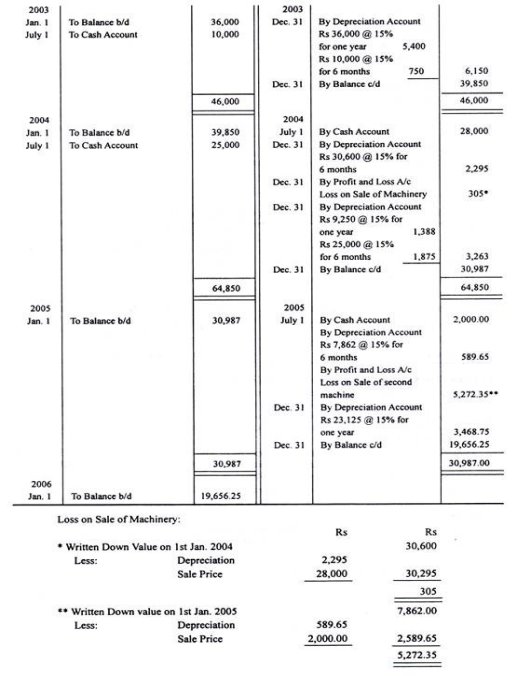

Q11) On July 1, 2008, a company bought a machine for Rs 3,90,000 and spent Rs 10,000 on its installation. We have decided to provide depreciation at 15% per year using the write-down method. On November 30, 2011, the machine was dismantled at a cost of 5,000 rupees and then sold for 1,00,000 rupees.

On December 1, 2011, the company acquired a new machine and put it into operation at a total cost of Rs 7,60,000. The new machine was depreciated on the same basis as the previous machine. The company closes its books on March 31st each year.

A11)

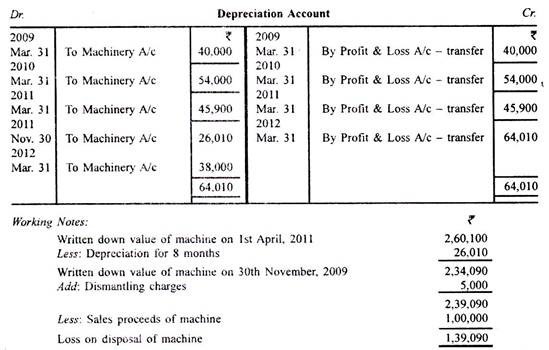

Q12) The cost of the machine used by the company on April 1, 2011 was Rs 250,000, while the depreciation cost for that day was Rs 1,05,000. The company provided depreciation at 10% of the reduced value.

Two machines purchased on December 31, 2011 and October 1, 2008, Rs. 15,000 and Rs. 12,000, respectively, were discarded due to damage and replaced with two new machines, Rs. 20,000 and Rs. 15,000, respectively. I had to.

One of the discarded machines sold for Rs 8,000. On the other hand, the Rs 3,000 was expected to be feasible.

Shows the accounts related to the company's ledger for the year ended March 31, 2012.

A12)

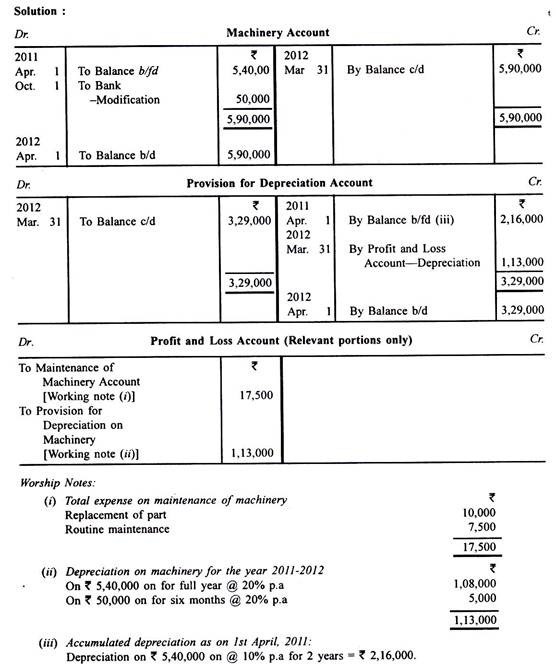

Q13) Metropol Ltd. purchased the machine on April 1, 2009 for Rs 5,40,000. Depreciation is billed at an annual rate of 20% on a straight-line basis.

On October 1, 2011, a change was made to improve technical efficiency at a cost of 50,000 rupees, which was expected to extend the useful life of the machine by two years. At the same time, important components of the machine were replaced at a cost of 10,000 rupees due to excessive wear.

The cost of regular maintenance during the fiscal year ending March 31, 2012 is Rs 7,500.

Shows for the year ending March 31, 2012:

(I) Machine account

(II) Reserve for depreciation account and

(III) The relevant part of the income statement showing the revenue and expense associated with the machine.

A13)

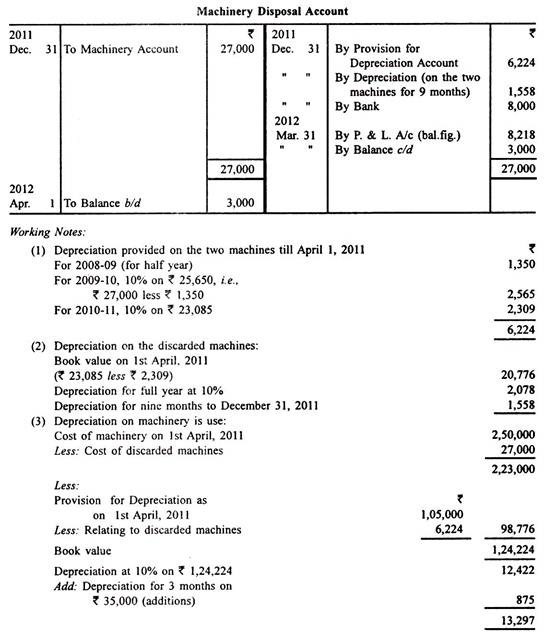

Q14) X Co. Ltd. purchased the machine on April 1, 2008 for Rs 1,60,000. On October 1, 2009, another machine was acquired. for Rs 1,40,000. On October 1, 2010, the first machine sold for Rs 1,20,000. On the same day, another machine was purchased for Rs 1,00,000. On October 1, 2011, the second machine sold for Rs 92,000.

The depreciation rate on March 31 was 10% of the original cost. On March 31, 2011, the depreciation billing method was changed to the depreciation method, with a rate of 15%.

Prepare machine accounts for the years ending March 31, 2009, 2010, 2011, and 2012.

A14)

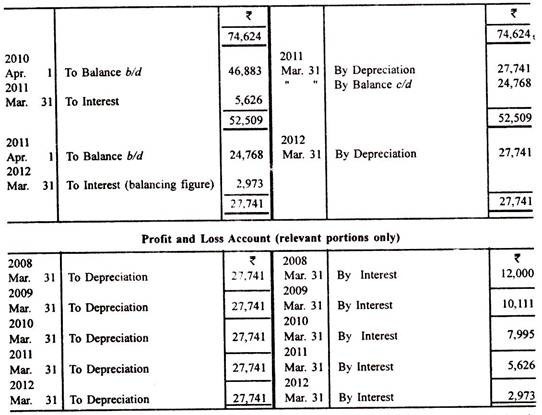

Q15) The lease will be purchased on April 1, 2007 for 5 years at a cost of Rs 1,00,000. It is proposed to depreciate the lease by the pension law, which charges 12% interest. Shows the 5-year lease account and related entries in the P & L account.

A15) A reference to the pension table indicates that Re will be depreciated. Under the 15-year pension law, you must claim 12% interest and amortize the total of Re. 0.277410. To amortize Rs 1,00,000, you need to amortize Rs 1,00,000 x 0.277410, or Rs 27,741 each year.

From the Q above, you can see that the amount depreciated as depreciation is higher than in the straight-line or instalment payments, but because of the interest, it does not ultimately affect the income statement. Assets that are debited are credited to the income statement. Therefore, the pension law only pays attention to the amount of money spent on the use of assets: lost costs and interest.

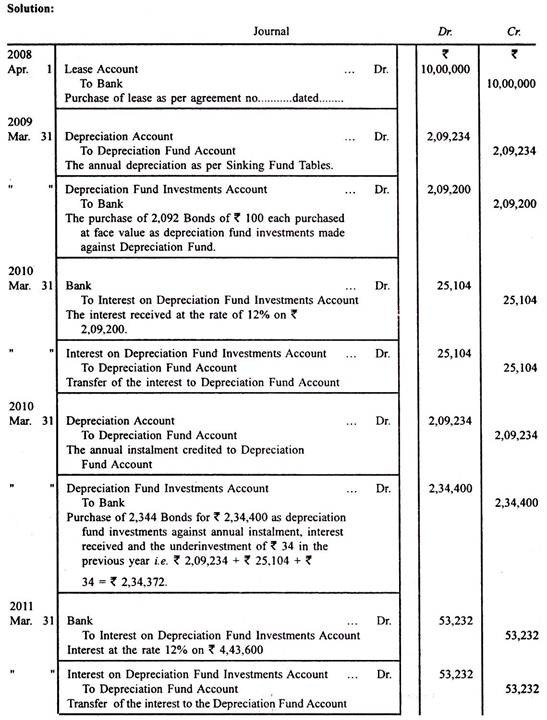

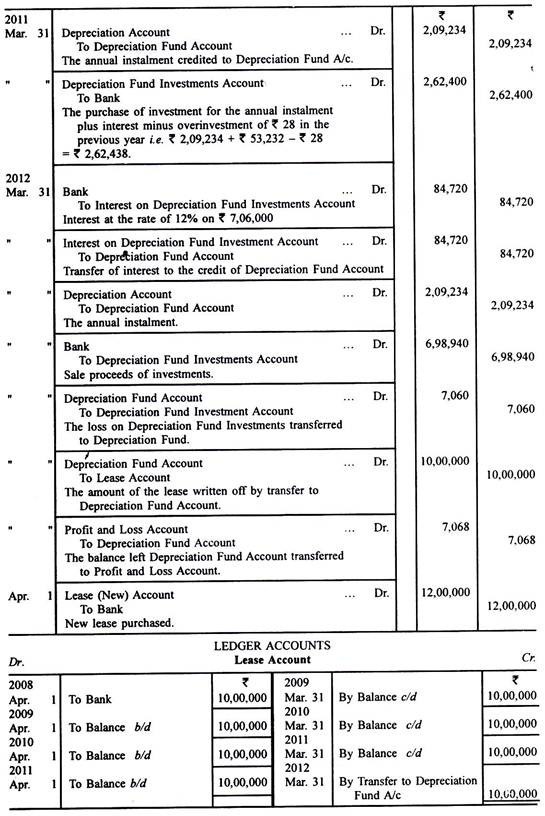

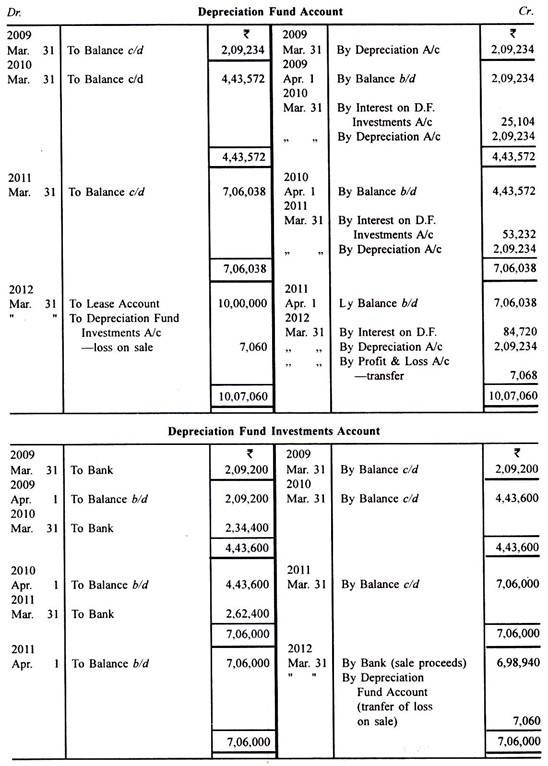

Q16) A company purchased a four-year lease for Rs 10,00,000 on April 1, 2008. By establishing a depreciation fund, it has been decided to offer a lease exchange at the end of four years. The investment is expected to be of interest at 12%. The table of the sinking fund is Re. Investing 0.209234 each year will generate Re. 12% per year at the end of 4 years 1. The investment was made in a 12% bond of Rs 100 available at par. Interest was received on March 31st of each year.

On March 31, 2012, the investment was sold for Rs 6,98,940. On April 1, 2012, the same lease was renewed for another four years with a payment of Rs 12,00,000.

View journals and specify important ledger accounts to record the above.

A16)

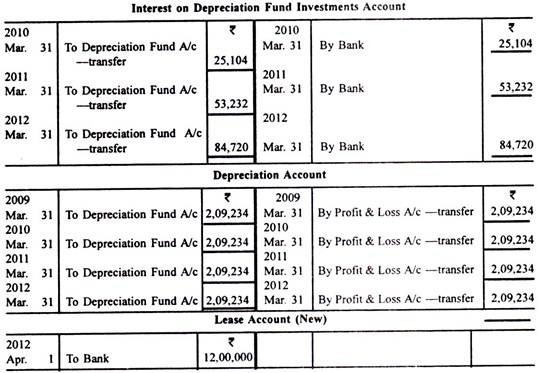

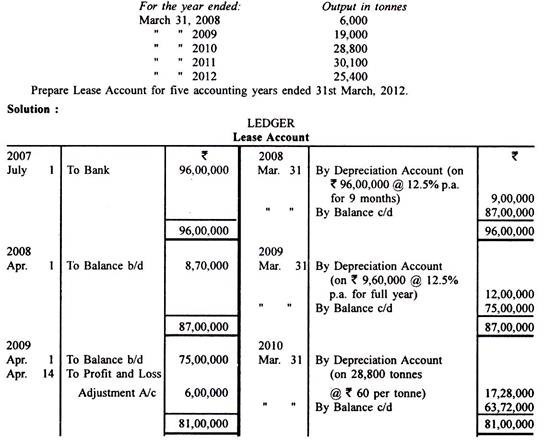

Q17) A company bought a three-year lease on April 1 for Rs 3,000,000. In 2009, we decided to offer a replacement under an insurance policy of Rs 3,000,000. The annual premium is 89,500 rupees.

On April 1, 2012, the lease will be renewed for another 3 years at Rs 330,000. Display the required ledger accounts.

A17)

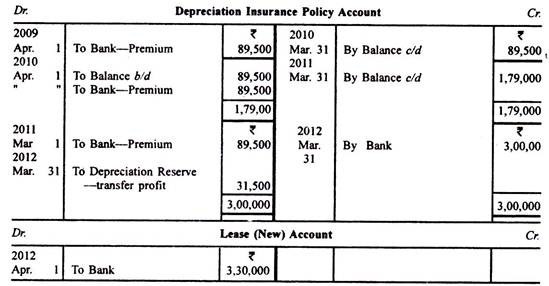

Q18) Experts estimated that the mine contained a total of 160,000 tonnes of minerals. On July 1, 2007, P leased the mine for eight years and paid the owner Rs 96,00,000 with the above estimate in mind.

P has decided to offer depreciation at an annual rate of 12.5% on a straight-line basis. However, in April 2009, we decided to switch to the depreciation method because we thought it would be more appropriate. He passed the required adjustment entry on April 14, 2009.

The output for the first five fiscal years of the lease is as follows:

A18)

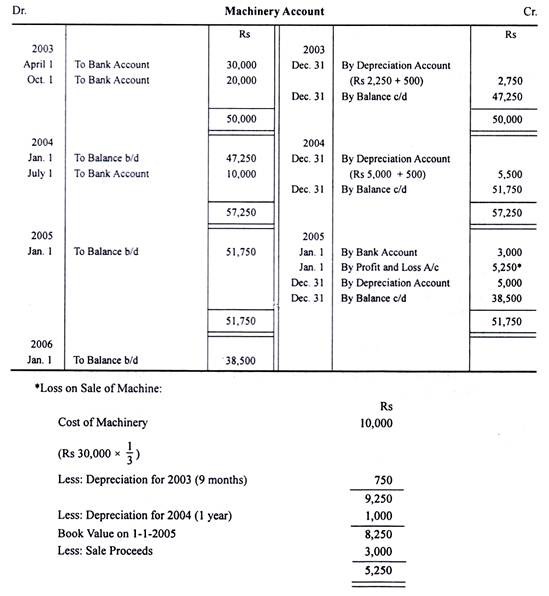

Q19) Companies whose financial year purchased on April 1, 2003 may be a civil year. the worth of the machine is 30,000 rupees.

I bought another machine for 20,000 rupees on October 1, 2003 and 10,000 rupees on Dominion Day, 2004.

One-third of the machines installed on January 1, 2005 and April 1, 2003 were abolished and sold for Rs 3,000.

Shows how machine accounts appear within the company's books. The machine may be a fixed instalment method @ 10% p.a. Depreciated by.

A19)

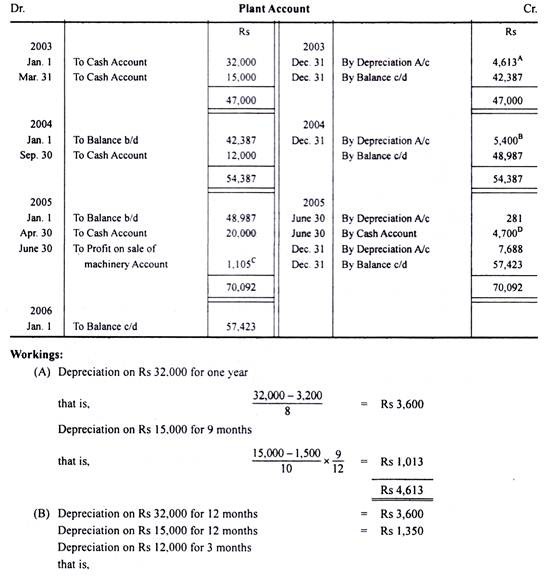

Q20) The 32,000-rupee plant purchased on January 1, 2003 has an estimated lifespan of 8 years.

Further purchases of plants are:

1. As of March 31, 2003, the value of the plant is 15,000 rupees and therefore the estimated life is 10 years.

2. On September 30, 2004, the factory cost is 12,000 rupees and therefore the estimated life is 6 years.

3. On April 30, 2005, the factory cost is 20,000 rupees and therefore the estimated life is 8 years.

Of the first plant acquired on January 1, 2003, one machine of Rs 5,000 was sold for Rs 4,700 on June 30, 2005.

The residual value of every asset is 10% of the first cost.

Prepare a plant account for the primary three years.

A20)

Q21) The balance of the plant and machinery accounts on New Year's Eve , 2003 was Rs 19,515 after depreciation for the year. (The total cost of the plant was 35,800 rupees and eight ,900 rupees including the plant purchased in 1995.)

In January 2004, a substitute factory was purchased at a price of Rs 2,950, and in 1980 a machine costing Rs 550 was sold as scrap of Rs 35.

In January 2005, there was an addition of 1,800 rupees, and in 2001 a 700-rupee machine was sold for 350 rupees.

You need to make machine accounts for 2004 and 2005. All calculations are displayed.

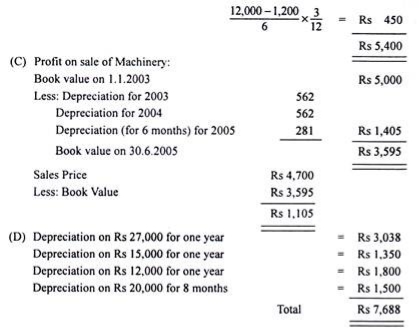

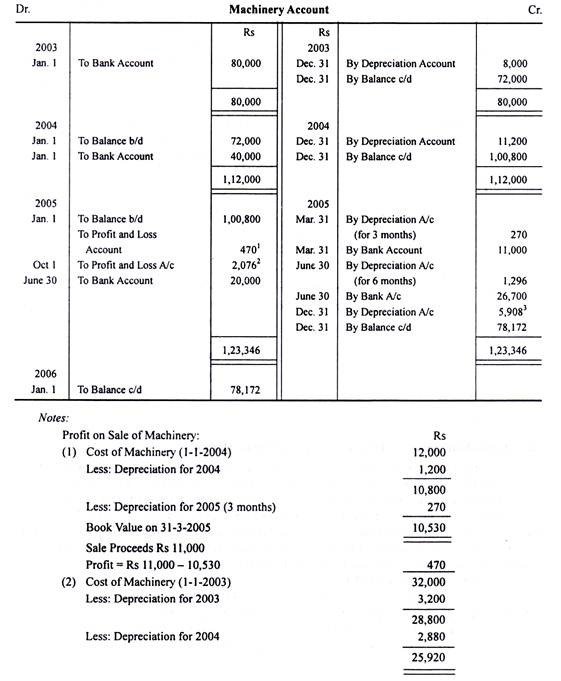

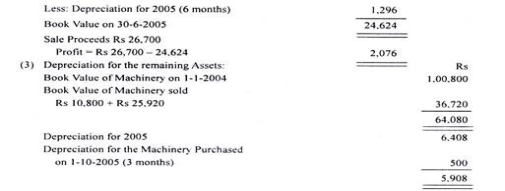

On January 1, 2003, the machine was purchased for Rs 80,000. On January 1, 2004, a machine of 40,000 rupees was added. On March 31, 2005, a machine of Rs 12,000 purchased on January 1, 2004 was sold for Rs 11,000 and 32,000 purchased on June 30, 2005 on January 1, 2003. The rupee machine was sold for 26,700 rupees. On October 1, 2005, an amount of Rs 20,000 was added. Depreciation was provided at an annual rate of 10%. About the reduction balance method.

Shows machine accounts for the three years from 2003 to New Year's Eve, 2005.

A21)

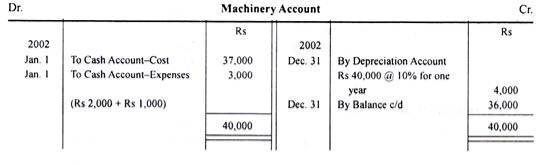

Q22) A company bought a second hand machine for Rs 37,000 on January 1, 2002 and immediately spent Rs 2,000 for repairs and Rs 1,000 for construction. I bought another machine for Rs 10.000 on Dominion Day, 2003 and sold the primary machine I bought in 2002 on Dominion Day, 2004 for Rs 28,000. On an equivalent day, I bought the machine for 25,000 rupees. The second machine, which was purchased for 10,000 rupees, was also sold for 2,000 rupees on Dominion Day, 2005.

Depreciation was provided to the machine on December 31st annually at a rate of 10% of the first cost. However, in 2003, we changed the depreciation method and adopted a depreciation method with a rate of depreciation of 15%.

We will offer you a machine account for 4 years from January 1, 2002.

A22)