Unit-III

Hire Purchase System

Question Bank

Q1) (Cash Price, Rate of Interest and Amount of Installments are given)

Om Ltd. purchased a machine on hire purchase basis from Kumar Machinery Co. Ltd. on

the following terms:

You are required to calculate the total interest and interest included in cash instalment.

A1)

Calculation of interest

| Total (Rs.) | Interest in each instalment (1) | Cash price in each instalment (2) |

Cash Price Less: Down Payment Balance due after down payment Interest/Cash Price of 1st instalment

Less: Cash price of 1st instalment Balance due after 1st instalment Interest/cash price of 2nd instalment

Less: Cash price of 2nd instalment Balance due after 2nd instalment Interest/Cash price of 3rd instalment

Less: Cash price of 3rd instalment Balance due after 3rd instalment Interest/Cash price of 4th instalment

Less: Cash price of 4th instalment Balance due after 4th instalment Interest/Cash price of 5th instalment

Less: Cash price of 5th instalment Total | 80,000 (21,622) 58,378 -

(9,562) 48,816 -

(10,518) 38,298 -

(11,570) 26,728

-

(12,728) 14,000 -

(14,000) Nil |

Nil

Rs. 58,378 x10/100 = Rs. 5,838

Rs. 48,816 x 10/100 = Rs. 4,882

Rs. 38,298x10/100 = Rs. 3,830

Rs. 26,728 x10/100 = Rs. 2,672

Rs. 14,000 x10/100 =Rs. 1,400

Rs. 18,622 |

Rs. 21,622

Rs. 15,400 – Rs. 5,838 = Rs. 9,562

Rs. 15,400 - Rs. 4,882 = Rs. 10,518

Rs. 15,400 - Rs. 3,830 = Rs. 11,570

Rs. 15,400 - Rs. 2,672 = Rs. 12,728

Rs. 15400 – Rs. 1,400 = 14,000

Rs. 80,000 |

Total interest can also be calculated as follow:

(Down payment + instalments) – Cash Price = Rs. [21,622+(15400 x 5)] – Rs. 80,000 = Rs. 18,622

Q2) (Cash Price and Amount of Installments are given; Rate of Interest is not given)

Happy Valley Florists Ltd. acquired a delivery van on hire purchase on 01.04.2011 from Ganesh Enterprises. The terms were as follows:

Particulars | Amount (Rs.) |

Hire Purchase Price | 180,000 |

Down Payment | 30,000 |

1st installment payable after 1 year | 50,000 |

2nd installment after 2 years | 50,000 |

3rd installment after 3 years | 30,000 |

4th installment after 4 years | 20,000 |

Cash price of van Rs. 1,50,000. You are required to calculate Total Interest and Interest included in each instalment.

A2) Calculation of total Interest and Interest included in each installment Hire Purchase Price (HPP) = Down Payment + instalments = 30,000 + 50,000 + 50,000 + 30,000 + 20,000 = 1,80,000

Total Interest = 1,80,000 – 1,50,000 = 30,000

Computation of IRR (considering two guessed rates of 6% and 12%)

Year | Cash Flow | DF @6% | PV | DF @12% | PV |

0 | 30,000 | 1.00 | 30,000 | 1.00 | 30,000 |

1 | 50,000 | 0.94 | 47,000 | 0.89 | 44,500 |

2 | 50,000 | 0.89 | 44,500 | 0.80 | 40,000 |

3 | 30,000 | 0.84 | 25,200 | 0.71 | 21,300 |

4 | 20,000 | 0.79 | 15,800 | 0.64 | 12,800 |

|

| NPV | 1,62,500 | NPV | 1,48,600 |

Interest rate implicit on lease is computed below by interpolation:

Interest rate implicit on lease= 6% + 1,62,500-1,50,000 x (12-6) = 11.39%

1,62,500-1,48,600

Thus, repayment schedule and interest would be as under:

Installment no. | Principal at beginning | Interest included in each installment | Gross amount | Installment | Principal at end |

Cash down | 1,50,000 |

| 1,50,000 | 30,000 | 1,20,000 |

1 | 1,20,000 | 13,668 | 1,33,668 | 50,000 | 83,668 |

2 | 83,668 | 9,530 | 93,198 | 50,000 | 43,198 |

3 | 43,198 | 4,920 | 48,118 | 30,000 | 18,118 |

4 | 18,118 | 2,064 | 20,182 | 20,000 | 182* |

|

| 30,182* |

|

|

|

* the difference is on account of approximations. | |||||

Q3) On January 1, 2011 HP M/s acquired a Pick-up Van on hire purchase from FM M/s. The

terms of the contract were as follows:

(a) The cash price of the van was Rs. 1,00,000.

(b) Rs. 40,000 were to be paid on signing of the contract.

(c) The balance was to be paid in annual instalments of Rs. 20,000 plus interest.

(d) Interest chargeable on the outstanding balance was 6% p.a.

(e) Depreciation at 10% p.a. is to be written-off using the straight-line method.

You are required to:

(a) Give Journal Entries and show the relevant accounts in the books of HP M/s from January 1, 2011 to December 31, 2013; and

(b) Show the relevant items in the Balance Sheet of the purchaser as on December 31, 2011 to 2013.

A3)

Journal Entries in the books of HP M/s

Date | Particulars | Dr. | Cr. | |

2011 |

| Rs. | Rs. | |

Jan. 31 | Pick-up Van A/c To FM M/S A/c (Being the purchase of a pick-up van on hire purchase from FM M/s) | Dr. | 1,00,000 |

|

|

|

| 1,00,000 | |

“ | FM M/S A/c To Bank A/c (Being the amount paid on signing the H.P. contract) | Dr. | 40,000 |

|

|

|

| 40,000 | |

Dec. 31 | Interest A/c To FM M/s A/c (Being the interest payable @ 6% on Rs. 60,000) | Dr. | 3,600 |

|

|

|

| 3,600 | |

“ | FM M/s A/c (Rs. 20,000+Rs. 3,600) To Bank A/c (Being the payment of 1st instalment along with interest) | Dr. | 23,600 |

|

|

|

| 23,600 | |

“ | Depreciation A/c To Pick-up Van A/c (Being the depreciation charged @ 10% p.a. on Rs. 1,00,000) | Dr. | 10,000 |

|

|

|

| 10,000 | |

“ | Profit & Loss A/c To Depreciation A/c To Interest A/c (Being the depreciation and interest transferred to Profit and Loss Account) | Dr. | 13,600 |

|

|

|

| 10,000 3,600 | |

2012 Dec. 31 | Interest A/c To FM M/s A/c (Being the interest payable @ 6% on Rs. 40,000) | Dr. | 2,400 |

2,400 |

“ | FM M/s A/c (Rs. 20,000 + Rs. 2,400) To Bank A/c (Being the payment of 2nd instalment along with interest) | Dr. | 22,400 |

|

|

|

| 22,400 | |

“ | Depreciation A/c To Pick-up Van A/c (Being the depreciation charged @ 10% p.a.) | Dr. | 10,000 |

|

|

|

| 10,000 | |

“ | Profit & Loss A/c To Depreciation A/c To Interest A/c (Being the depreciation and interest charged to Profit and Loss Account) | Dr. | 12,400 |

|

|

|

| 10,000 2,400 | |

2013 Dec. 31 | Interest A/c To FM M/s A/c (Being the interest payable @ 6% on Rs. 20,000) | Dr. | 1,200 |

1,200 |

“ | FM M/s A/c (Rs. 20,000 + Rs. 1,200) To Bank A/c (Being the payment of final instalment along with interest) | Dr. | 21,200 |

|

|

|

| 21,200 | |

“ | Depreciation A/c To Pick-up Van A/c (Being the depreciation charged @ 10% p.a. on Rs. 1,00,000) | Dr. | 10,000 |

|

|

|

| 10,000 | |

“ | Profit & Loss A/c To Depreciation A/c To Interest A/c (Being the interest and depreciation charged to Profit and Loss Account) | Dr. | 11,200 |

|

|

|

| 10,000 1,200 |

Ledgers in the books of HP M/s

Pick-up Van Account

Date | Particulars | Rs. | Date | Particulars | Rs. |

1.1.2011 | To FM M/s A/c | 1,00,000 | 31.12.2011 | By Depreciation A/c | 10,000 |

|

|

| 31.12.2011 | By Balance c/d | 90,000 |

|

| 1,00,000 |

|

| 1,00,000 |

1.1.2012 | To Balance b/d | 90,000 | 31.12.2012 | By Depreciation A/c | 10,000 |

|

|

| 31.12.2012 | By Balance c/d | 80,000 |

|

| 90,000 |

|

| 90,000 |

1.1.2013 | To Balance b/d | 80,000 | 31.12.2013 | By Depreciation A/c | 10,000 |

|

|

| 31.12.2013 | By Balance c/d | 70,000 |

|

| 80,000 |

|

| 80,000 |

FM M/s Account

Date | Particulars | Rs. | Date | Particulars | Rs. |

1.1.2011 | To Bank A/c | 40,000 | 1.1.2011 | By Pick-up Van A/c | 1,00,000 |

31.12.2011 | To Bank A/c | 23,600 | 31.12.2011 | By Interest c/d | 3,600 |

31.12.2011 | To Balance c/d | 40,000 |

|

|

|

|

| 1,03,600 |

|

| 1,03,600 |

31.12.2012 | To Bank A/c | 22,400 | 1.1.2012 | By Balance b/d | 40,000 |

31.12.2012 | To Balance c/d | 20,000 | 31.12.2012 | By Interest A/c | 2,400 |

|

| 42,400 |

|

| 42,400 |

31.12.2013 | To Bank A/c | 21,200 | 1.1.2013 | By Balance b/d | 20,000 |

|

|

| 31.12.2013 | By Interest A/c | 1,200 |

|

| 21,200 |

|

| 21,200 |

Depreciation Account

Date | Particulars | Rs. | Date | Particulars | Rs. |

31.12.2011 | To Pick-up Van A/c | 10,000 | 31.12.2011 | By Profit & Loss A/c | 10,000 |

31.12.2012 | To Pick-up Van A/c | 10,000 | 31.12.2012 | By Profit & Loss A/c | 10,000 |

31.12.2013 | To Pick-up Van A/c | 10,000 | 31.12.2013 | By Profit & Loss A/c | 10,000 |

Interest Account

Date | Particulars | Rs. | Date | Particulars | Rs. |

31.12.2011 | To FM M/s A/c | 3,600 | 31.12.2011 | By Profit & Loss A/c | 3,600 |

31.12.2012 | To FM M/s A/c | 2,400 | 31.12.2012 | By Profit & Loss A/c | 2,400 |

31.12.2013 | To FM M/s A/c | 1,200 | 31.12.2013 | By Profit & Loss A/c | 1,200 |

Balance Sheet of HP M/s as at 31st December, 2011

Liabilities | Rs. | Assets | Rs. |

FM M/s | 40,000 | Pick-up Van | 90,000 |

Balance Sheet of HP M/s as at 31st December, 2012

Liabilities | Rs. | Assets | Rs. |

FM M/s | 20,000 | Pick-up Van | 80,000 |

Balance Sheet of HP M/s as at 31st December, 2013

Liabilities | Rs. | Assets | Rs. |

|

| Pick-up Van | 70,000 |

Q4) 1st January, 2000 Mr. A purchases from Mr. B machinery whose cash price is Rs. 15,000; Rs. 5,000 is to be paid down, that is on signing of the contract, and Rs. 4,000 is to be paid at the end of each year for 3 years. Rate of interest is 10% p.a. Prepare B’s account in the books of Mr. A

A4)

A’s Books

Dr. |

|

| B’s Account |

| Cr. |

|

| Rs. |

|

| Rs. |

2000 |

|

| 2000 |

|

|

Jan.1 | To Cash | 5,000 | Jan.1 | By Machinery A/c | 15,000 |

Dec.31 | To Cash | 4,000 | Dec.31 | By Interest A/c | 1,000 |

’’ | To balance c/d | 7,000 |

| (10% on Rs. 10,000) |

|

|

| 16,000 |

|

| 16,000 |

2001 |

|

| 2001 |

|

|

Dec.31 | To Cash | 4,000 | Jan.1 | By Balance b/d | 7,000 |

| To Balance c/d | 3,700 | Dec.31 | By Interest A/c |

|

|

|

|

| (10% on Rs. 7,000) | 700 |

|

| 7,700 |

|

| 7,700 |

2002 |

|

| 2002 |

|

|

Dec.31 | To Cash | 4,000 | Jan.1 | By Balance b/d | 3,700 |

|

|

| Dec.31 | By Interest A/c* | 300 |

|

| 4,000 |

|

| 4,000 |

Q5) Based on particulars given below calculate Interest under the hire purchase system. X & Co.—purchaser Y & Co.-Seller Date of purchase—Jan. 1, 1999, Cash price—Rs. 74,500.

Installments Rs. 20,000 on signing of the agreement. Rest in three instalments of Rs. 20,000 each. Rate of Interest—5%. Depreciation 10% on the diminishing Balance.

A5)

Calculation of Interest | ||

|

| Rs. |

Jan.1, 1999 | Cash Price | 74,500 |

| Less-Cash down | 20,000 |

| Balance Due | 54,500 |

| Interest @ 5% for 1999 | 2,725 |

Dec.31, 1999 | Total | 57,225 |

| Amount paid | 20,000 |

Jan.1, 2000 | Balance Due | 37,225 |

| Interest for 2000 @ 5% | 1,861 |

Dec.31, 2000 | Total | 39,086 |

| Amount paid | 20,000 |

Jan.1,2001 | Balance due 2001 | 19,086 |

| Interest for (balancing figure) 2001 | 914 |

Jan.1,2002 | Amount paid | 20,000 |

Q6) Based on particulars given below calculate Interest under the hire purchase system. X & Co.—purchaser Y & Co.-Seller Date of purchase—Jan. 1, 1999, Cash price—Rs. 74,500.

Installments Rs. 20,000 on signing of the agreement. Rest in three instalments of Rs. 20,000 each. Depreciation 10% on the diminishing Balance.

A6)

Calculation of interest when the rate of interest is not given:

Hire Purchase Price | 80,000 | ||||

Cash Price | 74,500 | ||||

Total interest | 5,500 | ||||

|

|

|

|

|

|

Year | Amount Outstanding | Ratio | Interest | Rs. | |

1 | 60,000 |

| 3 | 3/6 x 5,500 | 2,750 |

2 | 40,000 |

| 2 | 2/6 x 5,500 | 1,833 |

3 | 20,000 |

| 1 | 1/6 x 5,500 | 917 |

Q7) Based on particulars given below calculate Interest under the hire purchase system

X & Co.—purchaser Y & Co.-Seller Date of purchase—Jan. 1, 1999, Installments Rs. 20,000 on signing of the agreement. Rest in three instalments of Rs. 20,000 each. Rate of Interest—5%. Depreciation 10% on the diminishing Balance.

A7)

Calculation of cash price, rate of interest being given:

Instalment | Amount due at the end of the year (after payment of Installment) | Instalment paid | Total amount due at the end of the Year (before payment of instalment) | Interest @ 1/21 | Principal due in the beginning | |

| Rs. | Rs. |

| Rs. | Rs. | Rs. |

3 | Nil | 20,000 |

| 20,000 | 952 | 19,408 |

2 | 19,048 | 20,000 |

| 39,048 | 1,859 | 37,189 |

1 | 37,189 | 20,000 |

| 57,189 | 2,723 | 54,466 |

|

|

|

|

| 5,534 |

|

Cash Price: 54,466 + cash down, Rs. 20,000 or Rs. 74,466.

Q8) Y & Co. sold machinery whose cash price is Rs. 74,500. to X and Co., on hire purchase basis on 1st January, 2000. Payment was to be made as Rs. 20,000 down and Rs. 20,000 every year for three years. Rate of interest was 5% & Co. charged depreciation @ 10% p.a. on the diminishing balance. Give ledger accounts in the books of Y & Co.

A8)

Ledger of Y & Co. | |||||

Dr. |

|

| X & Co. |

| Cr. |

|

| Rs. |

|

| Rs. |

2000 |

|

| 2000 |

|

|

Jan.1 | To Sales | 74,500 | Jan.1 | By Cash | 20,000 |

Dec.31 | To Interest A/c |

| Dec.31 | By Cash | 20,000 |

| (5% on Rs. 54,500) | 2,725 |

| By Balance c/d | 37,225 |

|

| 77,225 |

|

| 77,225 |

2001 |

|

| 2001 |

|

|

Jan.1 | To Balance b/d | 37,225 | Dec.31 | By Cash | 20,000 |

Dec.31 | To Interest A/c | 1,861 |

| By Balance c/d | 19,086 |

|

| 39,086 |

|

| 39,086 |

2002 |

|

| 2002 |

|

|

Jan.1 | To Balance b/d | 19,086 | Dec.31 | By Cash | 20,000 |

Dec.31 | To Interest A/c | 914 |

|

|

|

|

| 20,000 |

|

| 20,000 |

Dr. | Sales Account | Cr. | ||

|

| 2000 |

|

|

|

| Jan. 1 | By X & Co. | Rs. 15,000. |

Interest Account | ||||

Dr. |

|

|

| Cr. |

2000 |

| 2000 |

|

|

Dec.31 to P & L A/c | 2,725 | Dec.31 | By X & Co. | 2,725 |

2001 |

| 2001 |

|

|

Dec.31 to P & L A/c | 1,861 | Dec.31 | By X & Co. | 1,861 |

2002 |

| 2002 |

|

|

Dec.31 to P & L A/c | 914 | Dec.31 | By X & Co. | 914 |

Q9) Y & Co. sold machinery whose cash price is Rs. 74,500. to X and Co., on hire purchase basis on 1st January, 2000. Payment was to be made as Rs. 20,000 down and Rs. 20,000 every year for three years. Rate of interest was 5% & Co. charged depreciation @ 10% p.a. on the diminishing balance. Give Journal Entries & ledger accounts in the books of X & Co.

A9)

Journal of X & Co.

|

|

| Debit (Rs) | Credit (Rs) | |||||||

2000 |

|

|

|

| |||||||

Jan.1 | Machinery Account | Dr. | 20,000 | ||||||||

| To Y & Co. |

| 20,000 | ||||||||

| (Amount due to Y & Co. as down payment for purchase of machinery on hire purchase basis.) |

|

| ||||||||

|

|

|

| ||||||||

Jan.1 | Y & Co. | Dr. | 20,000 | ||||||||

| To Bank Account |

| 20,000 | ||||||||

| (Payment made to Y & Co. down) |

|

| ||||||||

|

|

|

| ||||||||

Dec.31 | Machinery Account | Dr. | 17,275 | ||||||||

| Interest Account | Dr. | 2,725 | ||||||||

| To Y & Co. |

| 20,000 | ||||||||

| (The amount due to Y & Co. under the hire purchase Contract for interest (and debited as such) and the balance treated as payment for machinery) |

|

| ||||||||

| |||||||||||

Dec.31 | Y & Co. | Dr. | 20,000 | ||||||||

| To Bank A/c |

| 20,000 | ||||||||

| (Payment made to Y & Co.) |

|

| ||||||||

|

|

|

| ||||||||

Dec.31 | Depreciation Account | Dr. | 7,450 | ||||||||

| To Machinery Account |

| 7,450 | ||||||||

| (Depreciation for 1st year-10% on Rs. 74,500) |

|

| ||||||||

|

|

|

| ||||||||

Dec 31 | Profit & Loss Account | Dr. | 10,175 | ||||||||

| To Interest Account |

| 2,725 | ||||||||

| To Depreciation Account |

| 7,450 | ||||||||

| (Being interest and depreciation transferred to P/L A/c) |

|

| ||||||||

2001 | |||||||||||

Dec.31 | Machinery Account | Dr. | 18,139 | ||||||||

| Interest Account | Dr. | 1,861 | ||||||||

| To Y & Co. |

| 20,000 | ||||||||

| (Amount due to Y & Co. for interest the balance charged to Machinery A/c.) |

|

| ||||||||

| |||||||||||

Dec.31 | Y & Co. | Dr. | 20,000 | ||||||||

| To Bank Account |

| 20,000 | ||||||||

| (Payment made to Y & Co.) |

|

| ||||||||

|

|

|

| ||||||||

Dec. 31 | Depreciation | Dr. | 6,705 | ||||||||

| To Machinery Account |

| 6,705 | ||||||||

| (Depreciation for the second year 10% on Rs. 67,050; i.e. Rs. 74,500 - Rs. 7,450). |

|

| ||||||||

|

|

|

| ||||||||

Dec 31 | Profit & Loss Account | Dr. | 8,566 | ||||||||

| To Interest Account |

| 1,861 | ||||||||

| To Depreciation Account |

| 6,705 | ||||||||

| (Being interest and depreciation transferred to P/L A/c) |

|

| ||||||||

2002 | |||||||||||

Dec.31 | Machinery Account | Dr. | 19,086 | ||||||||

| Interest Account | Dr. | 914 | ||||||||

| To Y & Co. |

| 20,000 | ||||||||

| (Amount due to Y & Co. in respect of interest and the principal sum.) |

|

| ||||||||

| |||||||||||

Dec.31 | Y & Co. | Dr. | 20,000 | ||||||||

| To Bank Account |

| 20,000 | ||||||||

| (Payment made to Y & Co.) |

|

| ||||||||

|

|

|

| ||||||||

Dec.31 | Depreciation Account | Dr. | 6,035 | ||||||||

| To Machinery Account |

| 6,035 | ||||||||

| (Depreciation @ 10% of the diminishing balance charged for the third years). |

|

| ||||||||

|

|

|

| ||||||||

Dec 31 | Profit & Loss Account | Dr. | 6,949 | ||||||||

| To Interest Account |

| 914 | ||||||||

| To Depreciation Account |

| 6,035 | ||||||||

| (Being interest and depreciation transferred to P/L A/c) |

|

| ||||||||

Ledger Accounts | |||||||||||

Dr. |

| Machinery Account |

| Cr. | |||||||

2000 |

| Rs. | 2000 |

| Rs. | ||||||

Jan.1 | To Y & Co. | 20,000 | Dec.31 | By Depreciation | 7,450 | ||||||

Dec.31 | To Y & Co. |

| Dec.31 | By Balance c/d | 29,825 | ||||||

| (20,000—2,725) | 17,275 |

|

|

| ||||||

|

| 37,275 |

|

| 37,275 | ||||||

2001 |

|

| 2001 |

|

| ||||||

Jan.1 | To balance b/d | 29,825 | Dec.31 | By Depreciation A/c | 6,705 | ||||||

Dec.31 | To Y & Co. |

| Dec.31 | By Balance c/d | 41,259 | ||||||

| (20,000—1,861) | 18,139 |

|

|

| ||||||

|

| 47,964 |

|

| 47,964 | ||||||

2002 |

|

| 2002 |

|

| ||||||

Jan.1 | To Balance b/d | 41,259 | Dec.31 | By Depreciation A/c | 6,035 | ||||||

Dec.31 | To Y & Co. | 19,086 | Dec.31 | By Balance c/d | 54,310 | ||||||

|

| 60,345 |

|

| 60,345 | ||||||

2003 |

|

|

|

|

| ||||||

Jan.1 | To Balance b/d | 54,310 |

|

|

| ||||||

Dr. |

| Interest Account | Cr. | ||

2000 |

| Rs. | 2000 |

| Rs. |

Dec.31 | To Y & Co. | 2,725 | Dec.31 | By P & L A/c | 2,725 |

2001 |

|

| 2001 |

|

|

Dec.31 | To Y & Co. | 1,861 | Dec.31 | By P & L A/c | 1,861 |

2002 |

|

| 2002 |

|

|

Dec.31 | To Y & Co. | 914 | Dec.31 | By P & L A/c | 914 |

Dr. |

|

| Y & Co. |

|

| Cr. |

2000 |

| Rs. |

| 2000 |

| Rs. |

Jan.1 | To Bank A/c | 20,000 | Jan.1 | By Machinery A/c | 20,000 | |

Dec.31 | To Bank A/c | 20,000 | Dec.31 | By Sundries— |

|

|

|

|

|

| Machinery | 17,275 |

|

|

|

|

| Interest | 2,725 | 20,000 |

|

| 40,000 |

|

| 40,000 | |

2001 |

|

| 2001 |

|

|

|

Dec.31 | To Bank A/c | 20,000 | Dec.31 | By Machinery A/c | 18,139 | |

|

|

|

| By Interest A/c | 1,861 | |

|

| 20,000 |

|

| 20,000 | |

2002 |

|

| 2002 |

|

| |

Dec.31 | To Bank A/c | 20,000 | Dec.31 | By Machinery A/c | 19,086 | |

|

|

|

| By Interest A/c | 914 | |

|

| 20,000 |

|

| 20,000 | |

Depreciation Account

2000 |

| Rs. | 2000 |

| Rs. |

Dec.31 | To Machinery A/c | 7,450 | Dec.31 | By P & L A/c | 7,450 |

2001 |

| 2001 |

|

| |

Dec.31 | To machinery A/c | 6,705 | Dec.31 | By P & L A/c | 6,705 |

2002 |

| 2002 |

|

| |

Dec.31 | To Machinery A/c | 6,035 | Dec.31 | By P & L A/c | 6,035 |

Q10) A purchased from B two machines of Rs.15,000. each on hire purchase system. The payment was to be made Rs.6,000 down and the remainder in three equal instalments of Rs.5,000 each together with interest. A writes off depreciation at 10% on written down value. A could not pay the second instalment. It was agreed that the vendor would leave one machine with the purchaser, adjusting the value of the other against due, treating the machines at 20% depreciation on W.D. value

Show machines A/c and B’s A/c in the books of A.

Show machines A/c and B’s A/c in the books of A.

A10)

Machines A/c

Machines A/c

Beginning of 1 Year |

To b’s A/c |

21,000 |

End of yr. |

By Depreciation |

2,100 |

|

|

|

| By Balance c/d | 18,900 |

|

| 21,000 |

|

| 21,000 |

Beginning |

|

| End of II yr. | By Depreciation | 1,890 |

of II yr. | To Balance b/d | 18,900 | End of II yr. | By B’s A/c | 6,720 |

|

|

| End of II yr. | By P & L A/c (Bal Fig.) | 1,785 |

|

|

|

| By Bal. c/d | 8,505 |

|

| 18,900 |

|

| 18,900 |

|

|

|

B’s A/c |

|

|

|

| Rs. |

|

| Rs. |

1 yr. | To Cash | 6,000 | End of I yr. | By Machine | 21,000 |

End of I yr. | To Cash | 5,750 | End of I yr. | By Interest | 750 |

| To Balance c/d | 10,000 |

|

|

|

|

| 21,750 |

|

| 21,750 |

End of II yr. | To Machine | 6,720 | Beginning of I yr. | By Balance c/d | 10,000 |

| To Balance c/d | 3,780 | End of II yr. | By Interest | 500 |

|

| 10,500 |

|

| 10,500 |

Working Notes Value of which machine is taken over by B |

|

| Rs. |

Cost of one machine | 10,500 |

Less 20% dep. for I year. | 2,100 |

| 8,400 |

Less 20% dep. for next year | 1,680 |

| Rs. 6,720 |

W.D.V. of machines left with A |

|

Cash price of one machine | Rs. 10,500 |

Less dep. for I year | 1,050 |

| 9,450 |

Less dep. for II year | 945 |

| 8,505 |

Q11) On 1st January 20XI, Ashok acquired furniture on the hire purchase system from Real Aids Ltd., agreeing to pay four semi-annual instalments of Rs.800, each commencing on 30th June 20XI. The cash price of the furniture was Rs.3,010 and interest of 5% per annum at half yearly rest was chargeable. On 30th September 20XI, Ashok expresses his inability to continue and Real Aids seized the property. It was agreed that Ashok would pay the due proportion of the instalment up to the date of seizure and also a further sum of Rs.200 towards depreciation. At the time of repossession, Real Aids valued the furniture at Rs.1,500. The company after incurring Rs.200 towards repairs of the furniture, sold the items for Rs.1,800 on 15th October 20XI. Prepare the Ledger accounts in the books of the Vendor and the Purchaser presuming that the purchaser charges depreciation @ 10% p.a.

A11)

: |

|

|

|

|

|

Books of Ashok : | |||||

Dr. |

| Furniture Account | Cr. | ||

Date | Particulars | Rs. P. | Date | Particulars | Rs. P. |

01.01.XI | To Real Aids Ltd. | 3,010.00 | 30.09.XI | By Depreciation A/c (10% | 225.75 |

|

|

|

| on Rs.3,000 for 9 months) |

|

|

|

|

| By Real aids Ltd. | 1,713.82 |

|

|

|

| By Profit & Loss a/c (Loss) | 1,070.43 |

|

| 3,010.00 |

|

| 3,010.00 |

Dr. |

| Real Aids Ltd.’s Account | Cr. | ||

Date | Particulars | Rs. P. | Date | Particulars | Rs. P. |

30.06.XI | To Cash A/c | 800.00 | 01.01.XI | By Furniture A/c | 3,010.00 |

30.09.XI | To Cash A/c | 600.00 | 30.06.XI | By Interest A/c | 75.25 |

| (Rs. 400 + Rs.200) |

| 30.09.XI | By Interest (on Rs. | 28.57 |

|

|

|

| 2,285.25 @ 5% p.a.) |

|

30.09.XI | To Furniture A/c | 1713.82 |

|

|

|

|

| 3,113.82 |

|

| 3,113.82 |

Interest Account

Interest Account

Date | Particulars | Rs.P. | Date | Particulars | Rs.P. |

30.06.XI | To Real Aids | 75.25 |

| By Profit & Loss A/c | 103.82 |

30.09.XI | To Real Aids Ltd. | 28.57 |

|

|

|

|

| 103.82 |

|

| 103.82 |

Dr. | An Extract of Profit and Loss Account of Ashok | Cr. | |||

Particulars |

| Rs. P. | Particulars |

| Rs.P. |

To Interest |

| 103.82 |

|

|

|

To Loss on seizure of goods | 1070.43 |

|

|

| |

To Depreciation on Furniture | 225.75 |

|

|

| |

| 1,400.00 |

|

|

| |

Books of Real Aids Ltd. : | |||||

Dr. |

| Ashok’s Account | Cr. | ||

Date | Particulars | Rs. P. | Date | Particulars | Rs. P. |

01.01.XI | To Hire Purchase | 3,010.00 | 30.06.XI | By Bank A/c | 800.00 |

| Sales A/c |

| 30.06.XI | By Bank A/c | 600.00 |

30.06.XI | To Interest A/c | 75.25 | 30.09.XI | By Profit And Loss A/c (Loss | 213.82 |

| (on Rs.3,010) |

|

| on valuation of goods |

|

30.09.XI | To Interest A/c | 28.57 |

| repossessed) |

|

| (on Rs.2,285.25) |

| 30.09.XI | By H.P. Goods Repossessed | 1,500.00 |

|

|

|

| A/c |

|

|

| 3,113.82 |

|

| 3,113.82 |

Dr. | Hire Purchase Goods Repossessed Account | Cr. | |||

Date | Particulars | Rs. P. | Date | Particulars | Rs. P. |

30.09.XI | To Ashok | 1,500 | 15.10.XI | By Cash A/c (Sales) | 1,800 |

30.09.XI | To Cash (Expenses) | 200 |

|

|

|

15.10.XI | To Profit and Loss A/c | 100 |

|

|

|

| (profit on sale of |

|

|

|

|

| repossessed goods) | 1,800 |

|

| 1,800 |

Dr. An Extract of Profit and Loss account of Real Aids Ltd. Cr.

Dr. An Extract of Profit and Loss account of Real Aids Ltd. Cr.

Particulars | Rs. P. | Particulars | Rs. P. |

To Loss on valuation of goods | 213.82 | By Interest on H.P. Sales | 103.82 |

repossessed |

| By Hire Purchase Goods Repossessed A/c (Profit) | 100.00 |

Q12) X purchased from Y three cars costing Rs.1,00,000 each on hire purchase system. Payment was to be made; Rs.60,000 down and balance in three equal instalments together with interest at 15% per annum. X provides depreciation at 20% per annum on diminishing balance method. X paid the first instalment at the end of the first year but could not pay the second instalment, Y took possession of all the three cards. He spent Rs.18,000. on repairs and sold them for Rs.1,50,000.

Show the necessary ledger account in the books of both the parties.

A12)

In the books of Hire Purchaser.

In the books of Hire Purchaser.

|

| 1. | Cars Account |

| |

Date | Particulars | Rs. | Date | Particulars | Rs. |

I yr.1.1 | To Hire Vendor A/c | 3,00,000 | I yr.31.12 | By Depreciation | 60,000 |

|

|

|

| By balance c/d | 2,40,000 |

|

| 3,00,000 | II yr. |

| 3,00,000 |

II yr. 1.1 | To Balance b/d | 2,40,000 | 31.12 | By Depreciation | 48,000 |

|

|

|

| By Hire Vendor A/c | 1,84,000 |

|

|

|

| By P & L A/c (Loss on sale) | 8,000 |

|

| 2,40,000 |

|

| 2,40,000 |

| 2. | Hire Vendor Account |

|

| |

Date | Particulars | Rs. | Date | Particulars | Rs. |

I yr. |

|

| I yr. |

|

|

1.1 | To Cash A/c | 60,000 | 1.1 | By Cars A/c | 3,00,000 |

| To Cash A/c (80,000 + 36,000) | 1,16,000 | 31.12 | By Interest A/c | 36,000 |

| To Balance c/d | 1,60,000 |

|

|

|

|

| 3,36,000 |

|

| 3,36,000 |

II yr. |

|

|

|

| II yr. |

|

|

1.1 | To Cars A/c |

| 1,84,000 | 31.12 | By Balance b/d |

| 1,60,000 |

|

|

|

| 31.12 | By Interest A/c |

| 24,000 |

|

|

| 1,84,000 |

|

|

| 1,84,000 |

In the books of Hire Vendor | |||||||

Hire Purchaser A | |||||||

Date | Particulars | Rs. | Date | Particulars |

|

| Rs. |

I yrs.1.1 |

|

| I yr. |

|

|

|

|

1.1 | To Cars A/c | 3,00,000 | 1.1 | By Cash A/c | 60,000 | ||

31.12. | To Interest A/c | 36,000 | 31.12 | By Cash A/c | 1,16,000 | ||

|

|

|

| By Balance c/d | 1,60,000 | ||

|

| 3,36,000 |

|

|

|

| 3,36,000 |

II yr. |

|

| II. yr. |

|

|

|

|

1.1 | To Balance b/d | 1,60,000 | 31.12 | By Goods | Repossessed A/c |

| 1,84,000 |

| To Interest | 24,000 |

|

|

|

|

|

|

| 1,84,000 |

|

|

|

| 1,84,000 |

|

|

Goods |

Repossessed Account |

|

|

| |

Date | Particulars | Rs. | Date | Particulars |

|

| Rs. |

II yr. |

|

| II yr. |

|

|

|

|

31.12 | To Hire Purchase A/c 1,84,000 | 31.12 | By Cash (Sale) | 1,50,000 | |||

| To Cash (Repairs) | 18,000 |

| By Profit & Loss A/c (Loss) | 52,000 | ||

|

| 2,02,000 |

|

| 2,02,000 | ||

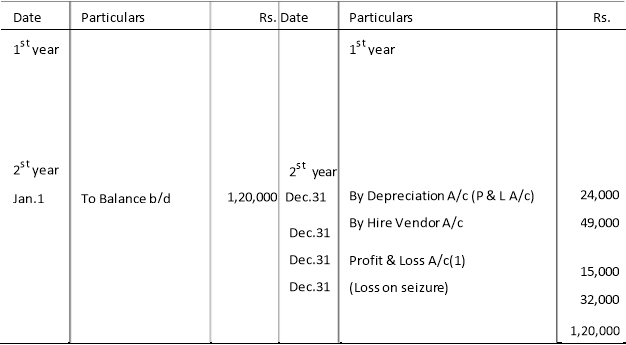

Q13) Kanpur Transport Ltd. purchased from Delhi Motors three trucks costing Rs.50,000 each on the hire purchase system. Payment was to be made Rs.30,000 down and the remainder in three equal instalments together with interest @ 9%.

Q13) Kanpur Transport Ltd. purchased from Delhi Motors three trucks costing Rs.50,000 each on the hire purchase system. Payment was to be made Rs.30,000 down and the remainder in three equal instalments together with interest @ 9%.

Kanpur Transport Ltd. Wrote off depreciation @ 20% on the diminishing balance. It paid the instalment due at the end of the first year but could not pay the next. Delhi Motors agreed to leave one truck with the purchaser, adjusting the value of the other two trucks against the amounts due. The trucks were valued on the basis of 30% depreciation (diminishing value) annually. Show the necessary accounts in the books of Kanpur transport Ltd. for two years.

A13)

In the books of Kanpur Transport Ltd.

Trucks Account

Trucks Account

Jan.1 | To Hire Vendor A/c | 1,50,000 | Dec.31 | By Depreciation A/c (P & L A/c) | 30,000 |

|

|

| Dec.31 | By Balance c/d | 1,20,000 |

|

| 1,50,000 |

|

| 1,50,000 |

Delhi Motors Ltd. Account

Delhi Motors Ltd. Account

Date | Particulars | Rs. | Date | Particulars |

| Rs. |

1st year |

|

| 1st year |

|

|

|

Jan.1 | To Cash A/c | 30,000 | Jan.1 | By Trucks A/c |

| 1,50,000 |

Dec.31 | To Cash A/c | 50,800 | Dec.31 | By Interest A/c |

| 10,800 |

| To balance c/d | 80,000 |

|

|

|

|

|

| 1,60,800 |

|

|

| 1,60,800 |

2st year |

|

| 2st year |

|

|

|

Dec.31 | To Trucks A/c | 49,000 | Jan.1 | By Balance b/d |

| 80,000 |

| To Balance c/d |

| Dec.31 | By Interest A/c |

| 7,200 |

| (31,000 + 7,200) | 38,200 |

|

|

|

|

|

| 87,200 |

|

|

| 87,200 |

Working Notes: | ||||||

1. | Revised price of 2 seized trucks: |

|

|

| Rs. | |

| Cash price 50,000 each for 2 |

|

|

| 1,00,000 | |

| (–) Depreciation @ 30% for Ist year |

|

| 30,000 | ||

|

|

|

|

|

| 70,000 |

| (–) Depreciation for | 2nd year |

|

|

| 21,000 |

|

|

|

|

|

| 49,000 |

2. | Balance outstanding for retained truck : |

|

| Rs. | ||

| Cash price for all 3 trucks |

|

|

| 1,50,000 | |

| (–) Cash paid at the signing |

| Rs. 30,000 |

|

| |

| instalment |

|

| 40,000 |

|

|

| Revised price of 2 seized trucks |

| 49,000 |

| 1,19,000 | |

|

|

|

|

|

| 31.000 |

3. | Depreciation of the retained truck: |

|

| Rs. | ||

| Cash price |

|

|

|

| 50,000 |

| (–) Depreciation for Ist year |

|

|

| 10,000 | |

| W.D.V. |

|

|

| 40,000 | |

| (–) Depreciation for 2nd year @ 20% |

|

| 8,000 | ||

| Valued at the end of 2nd year |

|

|

| 32,000 | |

In the books of Kanpur Transport Ltd. - Second method based on Actual Payments.

Q14) Suri is having his Head office at Mumbai and Branch Office at Nasik. Prepare the branch Account in the books of the Head Office from the following transaction with the branch:

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

Opening Balance at Branch: |

| Amounts remitted to the Branch for: |

|

- Petty Cash | 1,000 | - Petty Cash Expenses | 4,000 |

- Stock | 39,500 | - Salary | 12,000 |

- Debtors | 21,000 | - Rent and Taxes | 3,500 |

Goods Supplied to Branch during the year | 3,10,000 | Closing balances ay Branch: |

|

Amounts remitted by the branch |

| - Petty | 950 |

- Cash Sales | 1,13,200 | - Debtors | 53,000 |

- Realisation from Debtors | 2,30,300 | - Stock | 26,500 |

A14)

IN THE BOOKS OF H.O.

Dr. NASIK BRANCH ACCOUNT. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Balance b/d |

| By Bank (Remittance): |

|

Branch petty cash | 1,000 | - Petty Cash Expenses | 4,000 |

Branch Stock | 39,500 | - Salary | 12,000 |

Branch Debtors | 21,000 | - Rent and Taxes | 3,500 |

To Goods sent to Branch | 3,10,000 | Closing balance at Branch |

|

To cash remitted for: |

| - Petty Cash | 950 |

Petty Cash Expenses | 4,000 | - Debtors | 53,000 |

Salary | 12,000 | - Stock | 26,500 |

Rent | 3,500 |

|

|

To General P&L (Bal Fig) | 32,950 |

|

|

TOTAL | 4,23,950 | TOTAL | 4,23,950 |

Q15) D of Delhi have a branch at Madras. Goods are sent by the Head Office at Invoice Price which is at the Profit of 25% on Cost Price. All the Expenses of the branch are paid by the Head Office. From the following particulars, prepare Branch Account in Head Office Books

BALANCES | OPENING | CLOSING |

Stock at invoice | 11,000 | 13,000 |

Debtors | 1,700 | 2,000 |

Petty Cash | 100 | 25 |

TOTAL | 12,800 | 15,025 |

Goods sent to branch at invoice price Rs. 20,000.

Expenses made by head office: -Rent Rs.600, Wages Rs.200, Salaries Rs.900

Remittance made to Head Office: - Cash Sales Rs. 2,650, Cash collected from debtors Rs. 21,000

Goods Returned by Branch at Invoice Price Rs.400

A15)

IN THE BOOKS OF HEAD OFFICE

Dr. MADRAS BRANCH A/c. Cr.

PARTICULARS | AMOUNT | AMOUNT | PARTICULARS | AMOUNT | AMOUNT |

To Balance b/d |

|

| By Stock Reserve A/c b/d(Load on OP. Stock 11,000 X 25/125) |

| 2,200 |

Stock (IP) |

| 11,000 | By Bank |

|

|

Debtors |

| 1,700 | Cash Sales | 2,650 |

|

Petty Cash |

| 100 | Cash collected from Debtors | 21,000 | 23,650 |

To Goods sent to Branch (IP) |

| 20,000 | By Goods sent to branch (Returns at IP) |

| 400 |

To Bank (Expenses): |

|

| By Goods sent to branch (19,600 X 25/125; net Loading) |

| 3,920 |

Rent | 600 |

| By Balance c/d |

|

|

Wages | 200 |

| Stock (IP) | 13,000 |

|

Salaries | 900 | 1,700 | Debtors | 2,000 |

|

To Stock Reserve A/c c/d(Load on Cl. Stock 13,000 X 25/125) |

| 2,600 | Petty Cash | 25 | 15,025 |

To Net Profit tfd to general P&L (Bal Fig) |

| 8,095 |

|

|

|

TOTAL |

| 45,195 | TOTAL |

| 45,195 |

Note: Goods are sent by Head Office at @ 25% on Cost Price.

So, Cost + Profit = Invoice Price

100 + 25 = 125

Profit charged by Head Office is 1/5 or 20% of Invoice Price.

Q16) One M.P. Head Office has a branch at Berhampur to which goods are invoiced at cost plus 20%. from the following particulars prepare the Branch Account in the Head Office Books:

PARTICULARS | AMOUNT |

Goods sent to Branch at invoice Price | 2,11,872 |

Total Sales | 2,06,400 |

Cash Sales | 1,10,400 |

Cash received from Branch Debtors | 88,000 |

Branch Debtors at commencement | 24,000 |

Branch Stock at commencement at Invoice price | 7,680 |

Branch Stock at Close of the period at Invoice Price | 13,440 |

A16)

IN THE BOOKS OF M.P. HEAD OFFICE

Dr. BERHAMPUR BRANCH ACCOUNT. Cr.

PARTICULARS | AMOUNT | AMOUNT | PARTICULARS | AMOUNT | AMOUNT |

To Balance b/d |

|

| By Stock Reserve A/c b/d(Load on OP. Stock) |

| 1,280 |

Stock (IP) |

| 7,680 | By Bank |

|

|

Debtors |

| 24,000 | Cash Sales | 1,10,400 |

|

To Goods sent to Branch (IP) |

| 2,11,872 | Cash collected from Debtors | 88,000 | 1,98,400 |

To Stock Reserve A/c c/d(Load on Cl. Stock) |

| 2,240 | By Goods sent to branch (2,11,872 X 20/120; net Loading) |

| 35,312 |

To Net Profit tfd to general P&L (Bal Fig) |

| 34,640 | By Balance c/d |

|

|

|

|

| Stock (IP) | 13,440 |

|

|

|

| Debtors | 32,000 | 45,440 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

| 2,80,432 | TOTAL |

| 2,80,432 |

Working Note:

Dr. BERHAMPUR BRANCH DEBTORS ACCOUNT. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Balance b/d | 24,000 | By Cash | 88,000 |

To Credit Sales | 96,000 | By balance c/d (balancing figure) | 32,000 |

TOTAL | 1,20,000 | TOTAL | 1,20,000 |

(2)

Total Sales =2,06,400

Less: - Cash Sales =1,10,400

Credit Sales =96,000

(3)

Goods are sent by Head Office at @ 20% on Cost Price.

So, Cost + Profit = Invoice Price

100 + 20 = 120

Profit charged by Head Office is 1/6 of Invoice Price.

Q17) The Canada commercial company invoiced goods to its Jaipur Branch at cost. The head office paid all the branch expenses from its bank except petty cash expenses which were Paid by the branch. From the following details relating to the branch, prepare

(1): Branch Stock A/c

(2) Branch Debtors A/c

(3) Branch Expenses A/c

(4) Branch P&L A/c

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

Stock (Opening) | 21,000 | Discount to Customer | 4,200 |

Debtors (Opening) | 37,800 | Bad Debts | 1,800 |

Petty Cash(Opening) | 600 | Goods returned by customers to branch | 1,500 |

Goods sent to H.O. | 78,000 | Salaries | 18,600 |

Goods returned to H.O. | 3,000 | Rent | 3,600 |

Cash Sales | 52,500 | Debtors(Closing) | 29,400 |

Advertisement | 2,400 | Petty Cash (Closing) | 300 |

Cash received from debtors | 85,500 | Credit Sales | 85,200 |

Stock(Closing) | 19,500 |

|

|

Allowances to Customer | 600 |

|

|

|

|

|

|

A17)

Dr. BRANCH STOCK A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Balance b/d | 21,000 | By Branch Cash | 52,500 |

To Goods sent to sent Branch | 78,000 | By Goods sent to Branch | 3,000 |

To Branch Debtors | 1,500 | By Branch Debtors | 85,200 |

To Branch P&L (Transfer) | 59,700 | By Balance c/d | 19,500 |

TOTAL | 1,60,200 | TOTAL | 1,60,200 |

Dr. BRANCH DEBTORS A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Balance b/d | 37,800 | By Branch Cash | 85,500 |

To Branch Stock (Credit Sales) | 85,200 | By Branch expenses Bad Debts 1,800 Allowances 600 Discount 4,200

| 6,600 |

|

| By Branch Stock (Returns) | 1,500 |

|

| By Balance c/d | 29,400 |

TOTAL | 1,23,000 | TOTAL | 1,23,000 |

Dr. BRANCH EXPENSES A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Branch Debtors | 6,600 | By Branch P&L | 31,500 |

To Bank Advertisement 2,400 Salaries 18,600 Rent 3,600 | 24,600 |

|

|

To Petty Expenses (600-300) | 300 |

|

|

|

|

|

|

TOTAL | 31,500 | TOTAL | 31,500 |

Dr. BRANCH PROFIT & LOSS A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Branch Expenses | 31,500 | By Branch Stock | 59,700 |

To General P&L (Bal Fig) | 28,200 |

|

|

TOTAL | 59,700 | TOTAL | 59,700 |

Q18) The following are the details of ‘Indore Branch’ for the year 2018

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

Opening stock | 6,000 | Salaries | 2,000 |

Opening Petty Cash | 500 | Rent | 1,500 |

Opening Debtors | 8,000 | Closing Stock | 8,000 |

Goods sent to Branch | 24,000 | Cash sent to Branch | 2,200 |

Goods returned by Branch | 800 | Discount Allowed | 100 |

Remittance from Branch | 33,500 | Bad Debts | 150 |

Returns from Debtors | 2,000 | Commission Paid | 750 |

Collection from Debtors | 34,000 | Closing Petty Cash | 450 |

Cash Sales | 1,500 | Closing Debtors | 9,000 |

Prepare: (1) Branch Stock A/c (2) Branch Debtors A/c (3) Branch Expenses A/c

(4) Branch P&L A/c (5) Branch Cash (6) Goods sent to Branch A/c

A18)

Dr. BRANCH STOCK A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Balance b/d | 6,000 | By Branch Cash (Cash Sales) | 1,500 |

To Goods sent to sent Branch | 24,000 | By Goods sent to Branch | 800 |

To Branch Debtors(Return Inwards) | 2,000 | By Branch Debtors(Credit Sales) | 37,250 |

To Branch P&L (Transfer) | 15,550 | By Balance c/d | 8,000 |

TOTAL | 47,550 | TOTAL | 47,550 |

Dr. BRANCH DEBTORS A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Balance b/d | 8,000 | By Branch Cash (Received from Debtors) | 34,000 |

To Branch Stock (Credit Sales) (Bal Fig) | 37,250 | Branch expenses Bad Debts 150 Discount 100 | 250 |

|

| By Branch Stock (Returns) | 2,000 |

|

| By Balance c/d | 9,000 |

TOTAL | 45,250 | TOTAL | 45,250 |

Dr. BRANCH CASH A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Balance (Petty Cash) | 500 | By Branch Expenses Salaries 2,000 Rent 1,500 Commission 750 | 4,250 |

To Bank (Remittance) | 2,200 | By Bank (Remittance from Branch) | 33,500 |

To Branch stock (Cash Sales) | 1,500 | By Balance (Petty Cash) | 450 |

To Branch Debtors (Received) | 34,000 |

|

|

|

|

|

|

TOTAL | 38,200 | TOTAL | 38,200 |

Dr. BRANCH EXPENSES A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Branch Debtors | 6,600 | By Branch P&L | 31,500 |

To Bank Advertisement 2,400 Salaries 18,600 Rent 3,600

| 24,600 |

|

|

To Petty Expenses (600-300) | 300 |

|

|

|

|

|

|

TOTAL | 31,500 | TOTAL | 31,500 |

Dr. BRANCH EXPENSES A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Branch Debtors | 250 | By Branch P&L (Balance Transferred) | 4,500 |

To Branch Cash | 4,250 |

|

|

|

|

|

|

|

|

|

|

TOTAL | 4,500 | TOTAL | 4,500 |

Dr. GOODS SENT TO BRANCH A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Branch Stock | 800 | By Branch Stock | 24,000 |

To Purchase | 23,200 |

|

|

|

|

|

|

|

|

|

|

TOTAL | 24,000 | TOTAL | 24,000 |

Dr. BRANCH PROFIT & LOSS A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Branch Expenses | 4,500 | By Branch Stock (Gross Profit) | 15,550 |

To General P&L (Bal Fig) | 11,050 |

|

|

TOTAL | 15,550 | TOTAL | 15,550 |

Q19) Mumbai Textile Mills Ltd. Has branch at Agra. Goods are invoiced to branch at cost plus 50%. Branch remits all cash received to the head office and all expenses are met by head office. From the following particulars, prepare the necessary accounts under the Stock and Debtors system to Show the Profit Earned at the Branch:

PARTICULARS | AMOUNT |

Stock on the 1st April,2013 (Invoice Price) | 93,000 |

Debtors on 1st April,2013 | 68,000 |

Goods Invoiced to Branch (Cost) | 3,40,000 |

Sales at Branch: |

|

Cash | 2,50,100 |

Credit | 3,10,000 |

Cash Collected from Debtors | 3,04,000 |

Goods Returned by Debtors | 12,000 |

Goods Returned by Branch to head office | 1,500 |

Shortage of Stock | 4,500 |

Discount Allowed to Customer | 2,000 |

Expenses at Branch | 54,000 |

A19)

Dr. BRANCH STOCK A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Balance b/d | 93,000 | By Branch Cash (Cash Sales) | 2,50,100 |

To Goods sent to sent Branch (3,40,000 X 150%) | 5,10,000 | By Branch Debtors(Credit Sales) | 3,10,000 |

To Branch Debtors | 12,000 | By Goods sent to Branch | 1,500 |

|

| By Branch Adjustment (Shortage) | 4,500 |

|

| By Balance c/d | 48,900 |

TOTAL | 6,15,000 | TOTAL | 6,15,000 |

Dr. BRANCH ADJUSTMENT A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Branch Stock(Shortage) | 4,500 | By Stock Reserve(Loading on Opening Stock) | 31,000 |

To Goods Sent to Branch | 500 | By Goods Sent to Branch | 1,70,000 |

To Gross Profit c/d | 1,79,700 |

|

|

To Stock Reserve(Loading on Closing Stock) | 16,300 |

|

|

TOTAL | 2,01,000 | TOTAL | 2,01,000 |

Dr. BRANCH PROFIT & LOSS A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Branch Expenses | 54,000 | By Branch Stock (Gross Profit) | 1,79,700 |

To Discount | 2,000 |

|

|

To General P&L (Bal Fig) | 1,23,700 |

|

|

TOTAL | 1,79,700 | TOTAL | 1,79,700 |

Dr. GOODS SENT TO BRANCH A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Branch Stock | 1,500 | By Branch Stock | 5,10,000 |

To Branch Adjustment | 1,70,000 | By Branch Adjustment | 500 |

To Trading A/c(Bal Fig) | 3,39,000 |

|

|

|

|

|

|

TOTAL | 5,10,500 | TOTAL | 5,10,500 |

Dr. BRANCH DEBTORS A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Balance b/d | 68,000 | By Branch Cash (Received from Debtors) | 3,04,000 |

|

| By Branch expenses (Discount) | 2,000 |

To Branch Stock (Credit Sales) | 3,10,000 | By Branch Stock (Returns) | 12,000 |

|

| By Balance c/d | 60,000 |

TOTAL | 3,78,000 | TOTAL | 3,78,000 |

Dr. BRANCH CASH A/c. Cr.

PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

To Sales | 2,50,100 | By Head Office Cash | 5,54,100 |

To Debtors | 3,04,000 | (Sent to HO) |

|

TOTAL | 5,54,100 | TOTAL | 5,54,100 |

Q20) A Ltd. has a branch in Calcutta. Goods are invoiced at cost plus 25%. | |

Opening Balance | 2002 |

Stock | 3,200 |

Debtors | 1,300 |

Goods sent to Branch (Invoice price) | 75,000 |

Sales at Calcutta |

|

Cash Sales | 32,000 |

Credit Sales | 38,000 |

Cash collected from Debtors | 33,400 |

Discount allowed | 400 |

Bad Debts written off | 250 |

Cash sent to Branch for expenses | 5,500 |

Stock at end | 7,900 |

A20)

BRANCH STOCK A/C | |||

To Balance b/d | 3,200 | To Cash Sales | 32,000 |

To Goods Sent to Branch A/c |

| By Branch Debtors | 38,000 |

| 75,000 | By Branch Adjustment A/c | 300 |

|

| By Balance c/d | 7,900 |

| 78,200 |

| 78,200 |

GOODS SENT TO BRANCH A/C | |||

To br. Adjustment A/c (loading) | 15,000 | By Br. Stock A/c | 75,000 |

To Trading A/c (Transfer) | 60,000 |

|

|

| 75,000 |

| 75,000 |

BRANCH STOCK RESERVE A/C

To Br. Adjustment A/c | 640 | By Balance b/d | 640 | |||

To balance c/d | 1,580 | By Branch Adj. A/c | 1,580 | |||

| 2,220 |

| 2,220 | |||

BRANCH DEBTORS A/C | ||||||

To Balance b/d | 1,300 | By Cash | 33,400 | |||

To Branch Stock (Cr. Sales) | 38,000 | By Branch Exp. A/c |

| |||

|

| Discount | 400 |

| ||

|

| Bad Debts | 250 | 650 | ||

|

| By Bal. c/d | 5,250 | |||

| 39,300 |

| 39,300 | |||

BRANCH ADJUSTMENT A/C | ||||||

To Branch Stock Reserve |

|

| ||||

(closing stock) A/c | 1,580 | By Stock Reserve (opening stock) | 640 | |||

To br. Stock A/c (shortage) | 300 |

|

| |||

To Br. Exp. A/c | 7,150 | By Goods sent to br. A/c | 15,000 | |||

To P & L A/c | 6,610 |

|

| |||

| 15,640 |

| 15,640 | |||

BRANCH EXPENSES A/C | ||||||

To Cash | 6,500 | By Branch Adjustment A/c | 7,150 | |||

To branch Dr.s A/c |

|

|

| |||

| Discount | 400 |

|

|

| |

| Bad Debts | 250 | 650 |

|

| |

| 7,150 |

| 7,150 | |||

Q21) From the following Trial Balance, prepare Departmental Trading and Profit and Loss Account for the year ended 31.12.2013 and a Balance Sheet as at the date in the books of Sri S. Maity:

Particulars | Dr. Rs. | Cr. Rs. |

Stock (1.1.2013): Dept. A Dept. B Purchases: Dept. A Dept. B Sales: Dept. A Dept. B Wages: Dept. A Dept. B Rent Salaries Lighting and Heating Discount Allowed Discount Received Advertising Carriage Inward Furniture and Fittings Plant and Machinery Sundry Debtors Sundry Creditors Capital Drawings Cash in hand Cash at Bank |

5,400 4,900

9,800 7,350

1,340 240 1,870 1,320 420 441

738 469 600 4,200 1,820

900 32 1,980 |

16,900 13,520

133

3,737 9,530 |

43,820 | 43,820 |

The following information is also provided:Rent and Lighting and Heating are to be allocated between Factory and Office in the ratio of 3:2. Rent, Lighting and Heating, Salaries and Depreciation are to be apportioned to A and B Depts. as 2:1. Other expenses and incomes are to be apportioned to A and B Depts. on suitable basis.

The following adjustments are to be made: Rent Prepaid Rs 370; Lighting and Heating outstanding Rs 180; Depreciation of Furniture and Fittings @ 10% p.a. and Plant and Machinery @ 10% p.a.

The Stock at 31.12.2012: Dept. A Rs 2,748; Dept. B Rs 2,401.

A21)

In the books of Sri S. Maity

Departmental Trading and Profit & Loss Account for the year ended 31.12.2013

Dr. Cr.

Particulars | Dept. A Rs | Dept. B Rs | Total Rs | Particulars | Dept. A Rs | Dept. B Rs | Total Rs |

To Opening Stock | 5,400 | 4,900 | 10,300 | By Sales ,, Closing Stock

By Gross Profit b/d

,, Dis. Received (4 :3) ,, Net Loss | 16,900 | 13,520 | 30,420 |

,, Purchase | 9,800 | 7,350 | 17,150 | 2,748 | 2,401 | 5,149 | |

,, Wages | 1,340 | 240 | 1,580 |

|

|

| |

,, Carriage Inwards (4:3) | 268 | 201 | 4691 |

|

|

| |

,, Rent | 600 | 300 | 9006 |

|

|

| |

,, Lighting and Heating | 240 | 120 | 3602 |

|

|

| |

,, Gross Profit c/d | 2,000 | 2,810 | 4,810 |

|

|

| |

| 19,648 | 15,921 | 35,569 | 19,648 | 15,921 | 35,569 | |

To Rent |

400 |

200 |

6006 |

2,000 |

2,810 |

4,810 | |

,, Advertisement | 410 | 328 | 7384 |

|

|

| |

,, Salaries (2:1) | 880 | 440 | 1,3205 |

|

|

| |

,, Lighting and Heating | 160 | 80 | 2402 | 76 | 57 | 1337 | |

,, Discount Allowed |

|

|

| 339 | --- | --- | |

(on Sales) | 245 | 196 | 4413 |

|

|

| |

,, Dep. On (2:1) |

|

|

|

|

|

| |

Plant & Machinery | 280 | 140 | 420 |

|

|

| |

Furniture & Fixture | 40 | 20 | 60 |

|

|

| |

,, Net Profit | --- | 1,463 | 1,124 |

|

|

| |

| 2,415 | 2,867 | 4,943 | 2,415 | 2,867 | 4,943 |

Balance Sheet as at 31.12.2013

Liabilities | Amount Rs | Amount Rs | Assets | Amount Rs | Amount Rs |

Capital | 9,530 |

| Plant and Machinery | 4,200 |

|

Add: Net Profit | 1,124 |

| Less: Depreciation | 420 | 3,780 |

| 10,654 |

| Furniture and Fittings | 600 |

|

Less: Drawings | 900 | 9,754 | Less: Depreciation | 60 | 540 |

Sundry Creditors |

| 3,737 |

|

|

|

Outstanding Liabilities: |

|

| Closing Stock: |

|

|

Lighting and Heating |

| 180 | Dept. A | 2,748 |

|

|

|

| Dept. B | 2,401 | 5,149 |

|

|

| Sundry Debtors |

| 1,820 |

|

|

| Prepaid Rent |

| 370 |

|

|

| Cash at Bank |

| 1,980 |

|

|

| Cash in Hand |

| 32 |

|

| 13,671 |

|

| 13,671 |

Workings:

Allocation of Expenses and Incomes

Sl. No. | Expense/Income | Basis | Dept. A | Dept. B |

1 | Carriage Inward | Purchase (4:3) | =Rs 469 x 4/7 = Rs 268 | = Rs 469 x 3/7 = Rs 201 |

2 | Lighting & Heating (Rs 420 + Rs 180) Factory part = 600 x 3/5 Office part = 600 x 2/5 | Rs 600 (Given)

360 240 |

= Rs 360 x 2/3 = Rs 240 = Rs 240 x 2/3 = Rs 160 |

= Rs 360 x 1/3 = Rs 120 = Rs 240 x 1/3 = Rs 80 |

3 | Discount Allowed | = Sales | = Rs 441 x (16900/30420) = Rs 245 | = Rs 441 x (13520/30420) = Rs 196 |

4 | Advertisement | = Sales | = Rs 738 x (16900/30420) = Rs 410 | = Rs 738 x (13520/30420) = Rs 328 |

5 | Salaries | 2 : 1 | = Rs 1,320 x (2/3) = Rs 880 | = Rs 1,320 x (1/3) = Rs 440 |

6 | Rent Rs 1,500 = (Rs 1,870 – Rs 370) Factory part = 1,500 x 3/5 = 900 Office part = 1,500 x 2/5 =600 | 2 : 1

2 : 1 |

= Rs 900 x (2/3) = Rs 600 = Rs 600 x (2/3) = Rs 400 |

= Rs 900 x (1/3) = Rs 300 = Rs 600 x (1/3) = Rs 200 |

7 | Discount Received | Purchase (4:3) | = Rs 133 x (4/7) = Rs 76 | = Rs 133 x (3/7) = Rs 57 |

Q22) The Trading and Profit & Loss Account of Bindas Ltd. for the year ended 31st March is as under:

Particulars | Amount Rs | Particulars | Amount Rs | ||

Purchases |

|

| Sales |

|

|

Transistors | (A) | 1,60,000 | Transistors | (A) | 1,75,000 |

Tape Recorders | (B) | 1,25,000 | Tape Recorders | (B) | 1,40,000 |

Spare parts for Servicing and |

|

| Servicing and Repair Jobs | (C) | 35,000 |

Repair Job | (C) | 80,000 | Stock on 31st March |

|

|

|

|

| Transistors | (A) | 60,100 |

Salaries and wages |

| 48,000 | Tape Recorders | (B) | 20,300 |

Rent |

| 10,800 | Spare parts for servicing & |

|

|

Sundry Expenses |

| 11,000 | repair jobs | (C) | 44,600 |

Net Profit |

| 40,200 |

|

|

|

|

| 4,75,000 |

|

| 4,75,000 |

Prepare Departmental Accounts for each of the three Departments A, B and C mentioned above after taking into consideration the following :

A22)

Departmental P&L Accounts for the year ended 31st March (Amount in Rs)

Dr. Cr.

Particulars | A Rs | B Rs | C Rs | Particulars | A Rs | B Rs | C Rs |

To Purchases |

| 1,25,000 | — | By Sales | 1,75,000 | 1,40,000 | — |

To Spares | — | — | 80,000 | By Services | — | — | 35,000 |

To Salary & Wages | 12,000 | 24,000 | 12,000 | By Closing Stock | 60,100 | 20,300 | 44,600 |

To Rent | 2,400 | 2,400 | 6,000 | By Net Loss | — | — | 19,500 |

To Sundry Expenses* | 5,500 | 4,400 | 1,100 |

|

|

|

|

To Net Profit | 55,200 | 4,500 |

|

|

|

|

|

| 2,35,100 | 1,60,300 | 99,100 |

| 2,35,100 | 1,60,300 | 99,100 |

Note : Sundry Expenses are apportioned in the ratio of Turnover (5 : 4 : 1) i.e. 1,75,000 : 1,40,000 : 35,000.

Inter Departmental Transfer

Transfer made by one department to another may be recorded either:

At Cost Price

When transfers are made, Recipient Department should be debited at cost price and Transferring Department should be credited at Cost Price.

Q23) Make an appropriate entry for inter transfer of goods from one department to another. Department A transferred goods for Rs 30,000 to Department B.

A23)

In the Books of...

Journal

Date | Particulars | L/F | Debit Rs | Credit Rs |

| Department Trading (B) A/c Dr. To Department Trading (A) A/c (Goods are transferred to Department B from Department A.) |

| 30,000 |

30,000 |

At Invoice Price i.e., Provision for unrealized Profit.

In case of goods transfer from one department to another, no problem arises if all goods are sold within the year. On the other hand, problem arises where all goods are not sold. Under the circumstances, appropriate adjustments must be made against the unsold stock for ascertaining the correct profit or loss. As such, provision to be made for both opening stock and closing stock. The entries for this purpose are:

For Opening Stock Reserve:

Opening Stock Reserve A/c Dr.

To General Profit and Loss A/c

For Closing Stock Reserve:

General Profit and Loss A/c Dr.

To Closing Stock Reserve A/c

Trucks Account

Trucks Account

Date | Particulars | Amount | Date | Particulars | Amount | ||

|

| Rs. |

|

|

|

| Rs. |

1st year |

|

| 1st | year |

|

|

|

Jan.1 | To delhi Motors | 30,000 | Dec.31 | By Depreciation |

| ||

Dec.31 | To Delhi Motors | 40,000 |

|

| 20% on 1,50,000 | 30,000 | |

|

| Dec.31 | By Balance c/d | 40,000 | |||

|

| 70,000 |

|

|

|

| 70,000 |

2st year |

| 2st | year |

|

|

| |

Jan.1 | To Balance b/d | 40,000 | Dec.31 | By Depreciation |

| ||

| To Delhi Motors(2) | 31,000 |

|

| (20% on Rs.1,20,000) | 24,000 | |

|

|

| Dec.31 | By P & L A/c (Loss on seizure) |

| ||

|

|

|

|

| (Balancing figure) | 15,000 | |

|

|

| Dec.31 | By Balance c/d (3) | 32,000 | ||

|

| 71,000 |

|

|

|

| 71,000 |

|

|

| Delhi | Motors |

|

| |

Date | Particulars |

| Rs. | Date |

| Particulars | Rs. |

1st year |

|

|

| 1st year |

|

| |

Jan.1 | To Cash A/c |

| 30,000 | Jan.1 |

| By Trucks A/c | 30,000 |

Dec.31 | To Cash A/c |

| 40,000 | Dec.31 | By Trucks A/c | 40,000 | |

| To Cash A/c |

| 10,000 | Dec.31 | By Interest A/c@ 9% p.a. | 10,800 | |

|

|

| 80,000 |

|

|

| 80,000 |

2st year |

|

|

| 2st year |

|

| |

Dec.31 | To Balance (31,000+7,200) | 38,200 | Dec.31 | By Interest @ 9% p.a. | 7,200 | ||

|

|

|

| By Trucks A/c (2) | 31,000 | ||

|

| 38,200 |

|

| 38,200 | ||