Unit II

Investment Theory

Q1) Explain Mercantilism.

A1)

Mercantilism, economic theory and practice common in Europe from the 16th to the 18th century that promoted governmental regulation of a nation’s economy for the purpose of augmenting state power at the expense of rival national powers. It was the economic counterpart of political absolutism. Its 17th-century publicists—most notably Thomas Mun in England, Jean-Baptiste Colbert in France, and Antonio Serra in Italy—never, however, used the term themselves; it was given currency by the Scottish economist Adam Smith in his Wealth of Nations (1776).

Mercantilism is an economic theory that advocates government regulation of international trade to generate wealth and strengthen national power. Merchants and the government work together to reduce the trade deficit and create a surplus. Mercantilism—a form of economic nationalism—funds corporate, military, and national growth.1 It advocates trade policies that protect domestic industries.

In mercantilism, the government strengthens the private owners of the factors of production. These four factors of production are:

a) Entrepreneurship.

b) Capital goods.

c) Natural resources.

d) Labor.

Mercantilism establishes monopolies, grants tax-free status, and grants pensions to favored industries. It imposes tariffs on imports. It also prohibits the emigration of skilled labor, capital, and tools. It doesn't allow anything that could help foreign companies.

In return, businesses funnel the riches from foreign expansion back to their governments. Its taxes pay for increase national growth and political power.

Later, mercantilism was severely criticized. Advocates of laissez-faire argued that there was really no difference between domestic and foreign trade and that all trade was beneficial both to the trader and to the public. They also maintained that the amount of money or treasure that a state needed would be automatically adjusted and that money, like any other commodity, could exist in excess. They denied the idea that a nation could grow rich only at the expense of another and argued that trade was in reality a two-way street. Laissez-faire, like mercantilism, was challenged by other economic ideas.

Factors Shaping Mercantilism:

Some economic, political, religious and cultural factors were responsible for the emergence of mercantilism.

1. Economic Factors:

Towards the end of the 15th century changes were taking place in the economic life of the people. Domestic economy was giving way to an exchange economy. Agriculture was giving place to industry. Trade became very important and it changed the foundation of socio-economic set-up of the middle ages.

Trade necessitated the use of money which was available in the form of gold and silver. Along with the expansion of commerce there were improvements in transport, agriculture, population, etc., so the Mercantilist thought was the outcome of these developments.

2. Political Factors:

Towards the end of the middle ages nationalism became the strong force. Europe changed greatly due to Renaissance. As a result, there was a fundamental political change. It resulted in the emergence of strong nations like England, France, Spain, etc., Feudalism came to an end and the King became more powerful. Each nation wanted to preserve its independence and considered other nations as enemies. In order to create a strong and powerful state the Mercantilists tried to regulate the political and economic activities of the people.

3. Religious Factors:

The Reformation Movement was revolt against Roman Catholic Church. It challenged the authority of Pope. Initially the Roman Catholic Church controlled the political and economic activities of the nation. But after the Reformation the authority of the Pope was challenged.

4. Cultural Factors:

Culturally also Europe was undergoing a sharp change. Renaissance gave a new light of learning to the people. People were made to realise that this worldly life was more important than the heavenly life. As a result, money came to occupy an important place in human activities.

5. Scientific Factors:

In the field of science and technology great improvements and inventions were made. The discoveries of compass and printing press were of great importance, with the help of compass navigation became easier and it led to the discovery of new countries. Thus new countries opened the gates to a variety of raw materials and markets. The invention of printing press helped the spread of new ideas and knowledge.

Q2) Explain Complimentary trade theories – stopler – Samuelson theorem.

A2)

The H-O theory determined that the labour- abundant country specialises in the export of labour- intensive commodity while capital-abundant country specialises in the export of capital-intensive commodity. The factor price equalisation theory suggested that the trade would lead towards such movements in the factor prices that the factor price differentials would get reduced and ultimately eliminated.

In what way the international trade and relative changes in the factor prices would affect the distribution of income, was worked out by W.F. Stopler and Paul Samuelson on the basis of the H-O theory. The theorem developed by these writers stated that commencement of free international trade would benefit the relatively abundant factor and hurt the relatively scarce factor of production.

Assumption-

The H-O theory determined that the labour- abundant country specialises in the export of labour- intensive commodity while capital-abundant country specialises in the export of capital-intensive commodity. The factor price equalisation theory suggested that the trade would lead towards such movements in the factor prices that the factor price differentials would get reduced and ultimately eliminated.

In what way the international trade and relative changes in the factor prices would affect the distribution of income, was worked out by W.F. Stopler and Paul Samuelson on the basis of the H-O theory. The theorem developed by these writers stated that commencement of free international trade would benefit the relatively abundant factor and hurt the relatively scarce factor of production.

Assumptions of the Stopler-Samuelson Theorem:

(i) One of the two trading countries, considered for analysis, produces two commodities—cloth and steel, and employs only two factors—labour and capital.

(ii) The production function for each of the two commodities is homogenous of first degree. It implies that the production is governed by constant returns to scale.

(iii) Both labour and capital are fully employed.

(iv) The two factors of production are fixed in supply.

(v) The conditions of perfect competition exist both in the product and factor markets.

(vi) The given country is labour-abundant and capital-scarce.

(vii) The cloth is labour-intensive good while steel is capital-intensive good.

(viii) The international terms of trade are fixed.

(ix) Neither commodity is the input in the production of the other commodity.

(x) Both the factors are mobile between two industries or sectors but these are not mobile between the two countries.

(xi) There is an absence of transport costs.

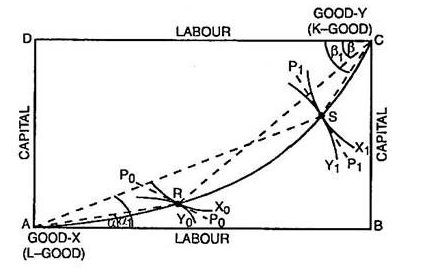

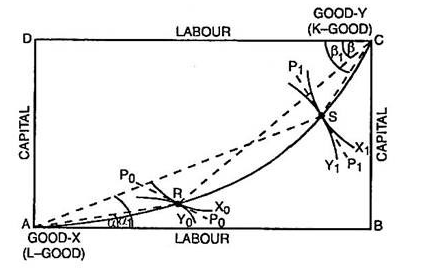

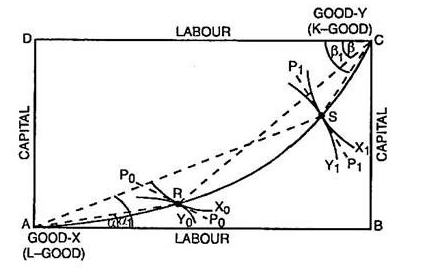

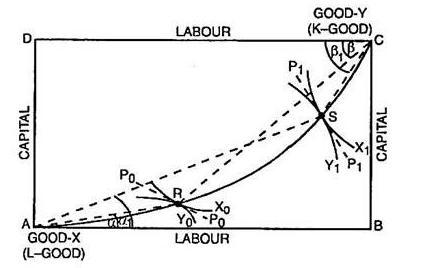

Given the above assumptions, the Stopler- Samuelson Theorem can be explained through Edgeworth Box shown in the below figure.

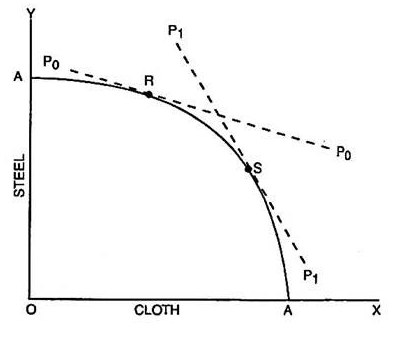

The Edgeworth box shows that the given country is labour-abundant and capital-scarce. A is the origin for labour-intensive goods—cloth and C is the point of origin for the capital-intensive good—steel. AC is the non-linear contract curve sagging below. In the absence of trade, production takes place at R, which is the point of tangency of isoquant X0 of cloth, isoquant Y0 of steel and the factor price line P0P0.

K-L Ratio in cloth at R = Slope of line AR = Tan α

K-L Ratio in steel at R = Slope of line RC = Tan β

When trade commences, this labour-surplus country expands the production of cloth (L- good) and reduces the production of steel (K-good). The production now takes place at S, which is the point of tangency of higher isoquant X1 of cloth, lower isoquant Y1 of steel and the factor price line P1P1.

K-L Ratio in cloth at S = Slope of line AS = Tan α1

K-L Ratio in cloth at S = Slope of line SC = Tanβ1

Since Tan α1 > Tan α and Tan β1 > Tan β, the K-L ratio rises in both the commodities in this country. The factor price line P1P1 is more steep than the original factor price line P0P0. It signifies that the price of labour rises relative to the price of capital.

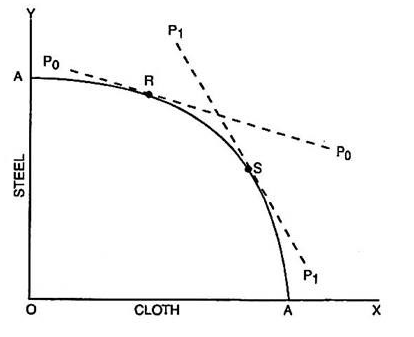

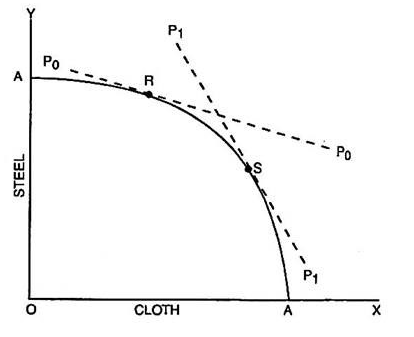

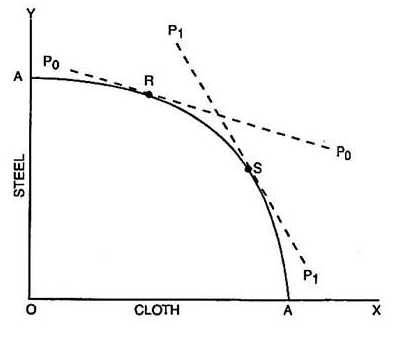

As the production of exportable commodity cloth expands, the resources are diverted from the steel industry to the cloth industry. The increased production of cloth and resource diversion to this industry will cause a rise in the price of cloth relative to that of steel. It may be shown through below fig.

The fig measures L-good cloth along the horizontal scale and K-good steel along the vertical scale. AA is the production possibility curve. Its slopes indicates that this country is labour-abundant and capital-scarce. In the absence of trade (i.e., autarchy), the production takes place at R. This point corresponds with point R in the first fig.

As the production of cloth is expanded after the commencement of trade, production takes place at S. This point corresponds with point S in the first figure. The slope of the production possibility curve at S is greater than its slope at R. This is represented by more steepness of price line P1 P1 than P0P0.

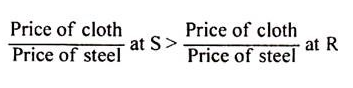

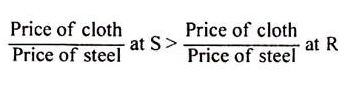

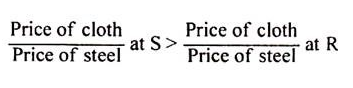

From this it follows that:

It signifies that price of cloth increases while that of steel falls.

Such relative changes in the prices of two commodities promote greater diversion of resources from steel industry to the cloth industry. The expanding cloth industry wants to employ more workers than are being released by the contracting steel industry. This results in the bidding up of the price of labour. At the same time, the steel industry releases capital which the cloth industry can absorb only at the lower price of capital.

The increased employment of labour along with the higher price of labour (wage rate) implies that the absolute income share of labour in the national income rises. On the other hand, the reduced employment of capital along with a fall in its price (rate of interest) lowers the absolute share of capital. From it follows the conclusion of Stopler-Samuelson Theorem that international trade would benefit the abundant factor and hurt the scarce factor.

Q3) Explain International Product life Cycles.

A3)

The international product lifecycle (IPL) is an abstract model briefing how a company evolves over time and across national borders. This theory shows the development of a company’s marketing program on both domestic and foreign platforms. International product lifecycle includes economic principles and standards like market development and economies of scale, with product lifecycle marketing and other standard business models.

The four key elements of the international product lifecycle theory are −

a) The layout of the demand for the product.

b) Manufacturing the product.

c) Competitions in international market.

d) Marketing strategy.

The marketing strategy of a company is responsible for inventing or innovating any new product or idea. These elements are classified based on the product’s stage in the traditional product lifecycle. These stages are introduction, growth, maturity, saturation, and decline

IPL Stages

The lifecycle of a product is based on sales volume, introduction and growth. These remain constant for marketing internationally and involves the effects of outsourcing and foreign production. The different stages of the lifecycle of a product in the international market are given below –

1) Introduction:

In this stage, a new product is launched in a target market where the intended consumers are not well aware of its presence. Customers who acknowledge the presence of the product may be willing to pay a higher price in the greed to acquire high quality goods or services. With this consistent change in manufacturing methods, production completely relies on skilled laborers.

Competition at international level is absent during the introduction stage of the international product lifecycle. Competition comes into picture during the growth stage, when developed markets start copying the product and sell it in the domestic market. These competitors may also transform from being importers to exporters to the same country that once introduced the product.

2) Growth:

An effectively marketed product meets the requirements in its target market. The exporter of the product conducts market surveys, analyze and identify the market size and composition. In this stage, the competition is still low. Sales volume grows rapidly in the growth stage. This stage of the product lifecycle is marked by fluctuating increase in prices, high profits and promotion of the product on a huge scale.

3) Maturity:

In this level of the product lifecycle, the level of product demand and sales volumes increase slowly. Duplicate products are reported in foreign markets marking a decline in export sales. In order to maintain market share and accompany sales, the original exporter reduces prices. There is a decrease in profit margins, but the business remains tempting as sales volumes soar high.

4) Saturation:

In this level, the sales of the product reach the peak and there is no further possibility for further increase. This stage is characterized by Saturation of sales. (at the early part of this stage sales remain stable then it starts falling). The sales continue until substitutes enter into the market. Marketer must try to develop new and alternative uses of product.

5) Decline:

This is the final stage of the product lifecycle. In this stage sales volumes decrease and many such products are removed or their usage is discontinued. The economies of other countries that have developed similar and better products than the original one export their products to the original exporter's home market. This has a negative impact on the sales and price structure of the original product. The original exporter can play a safe game by selling the remaining products at discontinued items prices.

Q4) Explain International Business Strategies.

A4)

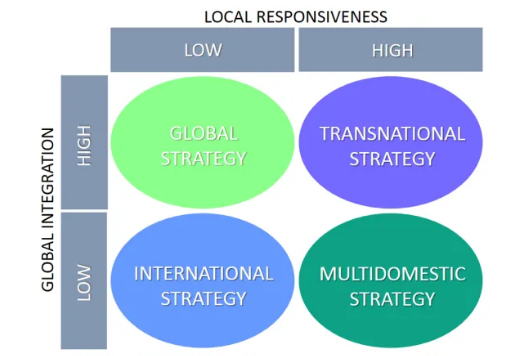

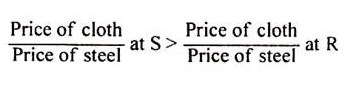

A major concern for managers deciding on a global business strategy is the tradeoff between global integration and local responsiveness. Global integration is the degree to which the company is able to use the same products and methods in other countries. Local responsiveness is the degree to which the company must customize their products and methods to meet conditions in other countries. The two dimensions result in four basic global business strategies: export, standardization, multidomestic, and transnational. These are shown in the figure below.

Multidomestic: Low Integration and High Responsiveness

Companies with a multidomestic strategy have as aim to meet the needs and requirements of the local markets worldwide by customizing and tailoring their products and services extensively. In addition, they have little pressure for global integration. Consequently, multidomestic firms often have a very decentralized and loosely coupled structure where subsidiaries worldwide are operating relatively autonomously and independent from the headquarter.

Global: High Integration and Low Responsiveness

Global companies are the opposite of multidomestic companies. They offer a standarized product worldwide and have the goal to maximize efficiencies in order to recude costs as much as possible. Global companies are highly centralized and subsidiaries are often very dependent on the HQ. Their main role is to implement the parent company’s decisions and to act as pipelines of products and strategies. This model is also known as the hub-and-spoke model.

Transnational: High Integration and High Responsiveness

The transnational company has characteristics of both the global and multidomestic firm. Its aim is to maximize local responsiveness but also to gain benefits from global integration. Even though this seems impossible, it is actually perfectly doable when taking the whole value chain into considerations. Transnational companies often try to create economies of scale more upstream in the value chain and be more flexible and locally adaptive in downstream activities such as marketing and sales.

International: Low Integration and Low Responsiveness

An international strategy is used when a company is primarily focused on its domestic operations. It does not intend to expand globally but does export some products to take advantage of international opportunities. It does not attempt to customize its products for international markets. It is not interested in either responding to unique conditions in other countries or in creating an integrated global strategy.

Q5) Explain International Human Resource Management.

A5)

International Human Resource Management (IHRM) can be defined as a set of activities targeting human resource management at the international level. It strives to meet organizational objectives and achieve competitive advantage over competitors at national and international level.

IHRM comprises of typical HRM functions such as recruitment, selection, training and development, performance appraisal and dismissal done at the international level and additional exercises such as global skills management, expatriate management and so on.

In short, IHRM is concerned with handling the human resources at Multinational Companies (MNCs) and it includes managing three types of employees −

1) Home country employees − Employees residing in the home country of the company where the corporate head quarter is situated, for example, an Indian working in India for some company whose headquarters are in India itself.

2) Host country employees − Employees residing in the nation in which the subsidiary is located, for example, an Indian working as an NRI in some foreign country.

3) Third country employees − These are the employees who are not from home country or host country but are employed at the additional or corporate headquarters.

Objectives-

Q6) Explain Mercantilism; Complimentary trade theories – stopler – Samuelson theorem.

A6)

Mercantilism

Mercantilism, economic theory and practice common in Europe from the 16th to the 18th century that promoted governmental regulation of a nation’s economy for the purpose of augmenting state power at the expense of rival national powers. It was the economic counterpart of political absolutism. Its 17th-century publicists—most notably Thomas Mun in England, Jean-Baptiste Colbert in France, and Antonio Serra in Italy—never, however, used the term themselves; it was given currency by the Scottish economist Adam Smith in his Wealth of Nations (1776).

Mercantilism is an economic theory that advocates government regulation of international trade to generate wealth and strengthen national power. Merchants and the government work together to reduce the trade deficit and create a surplus. Mercantilism—a form of economic nationalism—funds corporate, military, and national growth.1 It advocates trade policies that protect domestic industries.

In mercantilism, the government strengthens the private owners of the factors of production. These four factors of production are:

a) Entrepreneurship.

b) Capital goods.

c) Natural resources.

d) Labor.

Mercantilism establishes monopolies, grants tax-free status, and grants pensions to favored industries. It imposes tariffs on imports. It also prohibits the emigration of skilled labor, capital, and tools. It doesn't allow anything that could help foreign companies.

In return, businesses funnel the riches from foreign expansion back to their governments. Its taxes pay for increase national growth and political power.

Later, mercantilism was severely criticized. Advocates of laissez-faire argued that there was really no difference between domestic and foreign trade and that all trade was beneficial both to the trader and to the public. They also maintained that the amount of money or treasure that a state needed would be automatically adjusted and that money, like any other commodity, could exist in excess. They denied the idea that a nation could grow rich only at the expense of another and argued that trade was in reality a two-way street. Laissez-faire, like mercantilism, was challenged by other economic ideas.

Factors Shaping Mercantilism:

Some economic, political, religious and cultural factors were responsible for the emergence of mercantilism.

1. Economic Factors:

Towards the end of the 15th century changes were taking place in the economic life of the people. Domestic economy was giving way to an exchange economy. Agriculture was giving place to industry. Trade became very important and it changed the foundation of socio-economic set-up of the middle ages.

Trade necessitated the use of money which was available in the form of gold and silver. Along with the expansion of commerce there were improvements in transport, agriculture, population, etc., so the Mercantilist thought was the outcome of these developments.

2. Political Factors:

Towards the end of the middle ages nationalism became the strong force. Europe changed greatly due to Renaissance. As a result, there was a fundamental political change. It resulted in the emergence of strong nations like England, France, Spain, etc., Feudalism came to an end and the King became more powerful. Each nation wanted to preserve its independence and considered other nations as enemies. In order to create a strong and powerful state the Mercantilists tried to regulate the political and economic activities of the people.

3. Religious Factors:

The Reformation Movement was revolt against Roman Catholic Church. It challenged the authority of Pope. Initially the Roman Catholic Church controlled the political and economic activities of the nation. But after the Reformation the authority of the Pope was challenged.

4. Cultural Factors:

Culturally also Europe was undergoing a sharp change. Renaissance gave a new light of learning to the people. People were made to realise that this worldly life was more important than the heavenly life. As a result, money came to occupy an important place in human activities.

5. Scientific Factors:

In the field of science and technology great improvements and inventions were made. The discoveries of compass and printing press were of great importance, with the help of compass navigation became easier and it led to the discovery of new countries. Thus new countries opened the gates to a variety of raw materials and markets. The invention of printing press helped the spread of new ideas and knowledge.

Complimentary trade theories – Stopler – Samuelson theorem

The H-O theory determined that the labour- abundant country specialises in the export of labour- intensive commodity while capital-abundant country specialises in the export of capital-intensive commodity. The factor price equalisation theory suggested that the trade would lead towards such movements in the factor prices that the factor price differentials would get reduced and ultimately eliminated.

In what way the international trade and relative changes in the factor prices would affect the distribution of income, was worked out by W.F. Stopler and Paul Samuelson on the basis of the H-O theory. The theorem developed by these writers stated that commencement of free international trade would benefit the relatively abundant factor and hurt the relatively scarce factor of production.

Assumption

The H-O theory determined that the labour- abundant country specialises in the export of labour- intensive commodity while capital-abundant country specialises in the export of capital-intensive commodity. The factor price equalisation theory suggested that the trade would lead towards such movements in the factor prices that the factor price differentials would get reduced and ultimately eliminated.

In what way the international trade and relative changes in the factor prices would affect the distribution of income, was worked out by W.F. Stopler and Paul Samuelson on the basis of the H-O theory. The theorem developed by these writers stated that commencement of free international trade would benefit the relatively abundant factor and hurt the relatively scarce factor of production.

Assumptions of the Stopler-Samuelson Theorem:

(i) One of the two trading countries, considered for analysis, produces two commodities—cloth and steel, and employs only two factors—labour and capital.

(ii) The production function for each of the two commodities is homogenous of first degree. It implies that the production is governed by constant returns to scale.

(iii) Both labour and capital are fully employed.

(iv) The two factors of production are fixed in supply.

(v) The conditions of perfect competition exist both in the product and factor markets.

(vi) The given country is labour-abundant and capital-scarce.

(vii) The cloth is labour-intensive good while steel is capital-intensive good.

(viii) The international terms of trade are fixed.

(ix) Neither commodity is the input in the production of the other commodity.

(x) Both the factors are mobile between two industries or sectors but these are not mobile between the two countries.

(xi) There is an absence of transport costs.

Given the above assumptions, the Stopler- Samuelson Theorem can be explained through Edgeworth Box shown in the below figure.

The Edgeworth box shows that the given country is labour-abundant and capital-scarce. A is the origin for labour-intensive goods—cloth and C is the point of origin for the capital-intensive good—steel. AC is the non-linear contract curve sagging below. In the absence of trade, production takes place at R, which is the point of tangency of isoquant X0 of cloth, isoquant Y0 of steel and the factor price line P0P0.

K-L Ratio in cloth at R = Slope of line AR = Tan α

K-L Ratio in steel at R = Slope of line RC = Tan β

When trade commences, this labour-surplus country expands the production of cloth (L- good) and reduces the production of steel (K-good). The production now takes place at S, which is the point of tangency of higher isoquant X1 of cloth, lower isoquant Y1 of steel and the factor price line P1P1.

K-L Ratio in cloth at S = Slope of line AS = Tan α1

K-L Ratio in cloth at S = Slope of line SC = Tanβ1

Since Tan α1 > Tan α and Tan β1 > Tan β, the K-L ratio rises in both the commodities in this country. The factor price line P1P1 is more steep than the original factor price line P0P0. It signifies that the price of labour rises relative to the price of capital.

As the production of exportable commodity cloth expands, the resources are diverted from the steel industry to the cloth industry. The increased production of cloth and resource diversion to this industry will cause a rise in the price of cloth relative to that of steel. It may be shown through below fig.

The fig measures L-good cloth along the horizontal scale and K-good steel along the vertical scale. AA is the production possibility curve. Its slopes indicates that this country is labour-abundant and capital-scarce. In the absence of trade (i.e., autarchy), the production takes place at R. This point corresponds with point R in the first fig.

As the production of cloth is expanded after the commencement of trade, production takes place at S. This point corresponds with point S in the first figure. The slope of the production possibility curve at S is greater than its slope at R. This is represented by more steepness of price line P1 P1 than P0P0.

From this it follows that:

It signifies that price of cloth increases while that of steel falls.

Such relative changes in the prices of two commodities promote greater diversion of resources from steel industry to the cloth industry. The expanding cloth industry wants to employ more workers than are being released by the contracting steel industry. This results in the bidding up of the price of labour. At the same time, the steel industry releases capital which the cloth industry can absorb only at the lower price of capital.

The increased employment of labour along with the higher price of labour (wage rate) implies that the absolute income share of labour in the national income rises. On the other hand, the reduced employment of capital along with a fall in its price (rate of interest) lowers the absolute share of capital. From it follows the conclusion of Stopler-Samuelson Theorem that international trade would benefit the abundant factor and hurt the scarce factor.

Q7) Explain Factors Shaping Mercantilism.

A7)

Mercantilism

Mercantilism, economic theory and practice common in Europe from the 16th to the 18th century that promoted governmental regulation of a nation’s economy for the purpose of augmenting state power at the expense of rival national powers. It was the economic counterpart of political absolutism. Its 17th-century publicists—most notably Thomas Mun in England, Jean-Baptiste Colbert in France, and Antonio Serra in Italy—never, however, used the term themselves; it was given currency by the Scottish economist Adam Smith in his Wealth of Nations (1776).

Mercantilism is an economic theory that advocates government regulation of international trade to generate wealth and strengthen national power. Merchants and the government work together to reduce the trade deficit and create a surplus. Mercantilism—a form of economic nationalism—funds corporate, military, and national growth.1 It advocates trade policies that protect domestic industries.

In mercantilism, the government strengthens the private owners of the factors of production. These four factors of production are:

a) Entrepreneurship.

b) Capital goods.

c) Natural resources.

d) Labor.

Mercantilism establishes monopolies, grants tax-free status, and grants pensions to favored industries. It imposes tariffs on imports. It also prohibits the emigration of skilled labor, capital, and tools. It doesn't allow anything that could help foreign companies.

In return, businesses funnel the riches from foreign expansion back to their governments. Its taxes pay for increase national growth and political power.

Later, mercantilism was severely criticized. Advocates of laissez-faire argued that there was really no difference between domestic and foreign trade and that all trade was beneficial both to the trader and to the public. They also maintained that the amount of money or treasure that a state needed would be automatically adjusted and that money, like any other commodity, could exist in excess. They denied the idea that a nation could grow rich only at the expense of another and argued that trade was in reality a two-way street. Laissez-faire, like mercantilism, was challenged by other economic ideas.

Factors Shaping Mercantilism:

Some economic, political, religious and cultural factors were responsible for the emergence of mercantilism.

1. Economic Factors:

Towards the end of the 15th century changes were taking place in the economic life of the people. Domestic economy was giving way to an exchange economy. Agriculture was giving place to industry. Trade became very important and it changed the foundation of socio-economic set-up of the middle ages.

Trade necessitated the use of money which was available in the form of gold and silver. Along with the expansion of commerce there were improvements in transport, agriculture, population, etc., so the Mercantilist thought was the outcome of these developments.

2. Political Factors:

Towards the end of the middle ages nationalism became the strong force. Europe changed greatly due to Renaissance. As a result, there was a fundamental political change. It resulted in the emergence of strong nations like England, France, Spain, etc., Feudalism came to an end and the King became more powerful. Each nation wanted to preserve its independence and considered other nations as enemies. In order to create a strong and powerful state the Mercantilists tried to regulate the political and economic activities of the people.

3. Religious Factors:

The Reformation Movement was revolt against Roman Catholic Church. It challenged the authority of Pope. Initially the Roman Catholic Church controlled the political and economic activities of the nation. But after the Reformation the authority of the Pope was challenged.

4. Cultural Factors:

Culturally also Europe was undergoing a sharp change. Renaissance gave a new light of learning to the people. People were made to realise that this worldly life was more important than the heavenly life. As a result, money came to occupy an important place in human activities.

5. Scientific Factors:

In the field of science and technology great improvements and inventions were made. The discoveries of compass and printing press were of great importance, with the help of compass navigation became easier and it led to the discovery of new countries. Thus new countries opened the gates to a variety of raw materials and markets. The invention of printing press helped the spread of new ideas and knowledge.

Q8) Explain assumption stopler – Samuelson theorem.

A8)

The H-O theory determined that the labour- abundant country specialises in the export of labour- intensive commodity while capital-abundant country specialises in the export of capital-intensive commodity. The factor price equalisation theory suggested that the trade would lead towards such movements in the factor prices that the factor price differentials would get reduced and ultimately eliminated.

In what way the international trade and relative changes in the factor prices would affect the distribution of income, was worked out by W.F. Stopler and Paul Samuelson on the basis of the H-O theory. The theorem developed by these writers stated that commencement of free international trade would benefit the relatively abundant factor and hurt the relatively scarce factor of production.

Assumption-

The H-O theory determined that the labour- abundant country specialises in the export of labour- intensive commodity while capital-abundant country specialises in the export of capital-intensive commodity. The factor price equalisation theory suggested that the trade would lead towards such movements in the factor prices that the factor price differentials would get reduced and ultimately eliminated.

In what way the international trade and relative changes in the factor prices would affect the distribution of income, was worked out by W.F. Stopler and Paul Samuelson on the basis of the H-O theory. The theorem developed by these writers stated that commencement of free international trade would benefit the relatively abundant factor and hurt the relatively scarce factor of production.

Assumptions of the Stopler-Samuelson Theorem:

(i) One of the two trading countries, considered for analysis, produces two commodities—cloth and steel, and employs only two factors—labour and capital.

(ii) The production function for each of the two commodities is homogenous of first degree. It implies that the production is governed by constant returns to scale.

(iii) Both labour and capital are fully employed.

(iv) The two factors of production are fixed in supply.

(v) The conditions of perfect competition exist both in the product and factor markets.

(vi) The given country is labour-abundant and capital-scarce.

(vii) The cloth is labour-intensive good while steel is capital-intensive good.

(viii) The international terms of trade are fixed.

(ix) Neither commodity is the input in the production of the other commodity.

(x) Both the factors are mobile between two industries or sectors but these are not mobile between the two countries.

(xi) There is an absence of transport costs.

Given the above assumptions, the Stopler- Samuelson Theorem can be explained through Edgeworth Box shown in the below figure.

The Edgeworth box shows that the given country is labour-abundant and capital-scarce. A is the origin for labour-intensive goods—cloth and C is the point of origin for the capital-intensive good—steel. AC is the non-linear contract curve sagging below. In the absence of trade, production takes place at R, which is the point of tangency of isoquant X0 of cloth, isoquant Y0 of steel and the factor price line P0P0.

K-L Ratio in cloth at R = Slope of line AR = Tan α

K-L Ratio in steel at R = Slope of line RC = Tan β

When trade commences, this labour-surplus country expands the production of cloth (L- good) and reduces the production of steel (K-good). The production now takes place at S, which is the point of tangency of higher isoquant X1 of cloth, lower isoquant Y1 of steel and the factor price line P1P1.

K-L Ratio in cloth at S = Slope of line AS = Tan α1

K-L Ratio in cloth at S = Slope of line SC = Tanβ1

Since Tan α1 > Tan α and Tan β1 > Tan β, the K-L ratio rises in both the commodities in this country. The factor price line P1P1 is more steep than the original factor price line P0P0. It signifies that the price of labour rises relative to the price of capital.

As the production of exportable commodity cloth expands, the resources are diverted from the steel industry to the cloth industry. The increased production of cloth and resource diversion to this industry will cause a rise in the price of cloth relative to that of steel. It may be shown through below fig.

The fig measures L-good cloth along the horizontal scale and K-good steel along the vertical scale. AA is the production possibility curve. Its slopes indicates that this country is labour-abundant and capital-scarce. In the absence of trade (i.e., autarchy), the production takes place at R. This point corresponds with point R in the first fig.

As the production of cloth is expanded after the commencement of trade, production takes place at S. This point corresponds with point S in the first figure. The slope of the production possibility curve at S is greater than its slope at R. This is represented by more steepness of price line P1 P1 than P0P0.

From this it follows that:

It signifies that price of cloth increases while that of steel falls.

Such relative changes in the prices of two commodities promote greater diversion of resources from steel industry to the cloth industry. The expanding cloth industry wants to employ more workers than are being released by the contracting steel industry. This results in the bidding up of the price of labour. At the same time, the steel industry releases capital which the cloth industry can absorb only at the lower price of capital.

The increased employment of labour along with the higher price of labour (wage rate) implies that the absolute income share of labour in the national income rises. On the other hand, the reduced employment of capital along with a fall in its price (rate of interest) lowers the absolute share of capital. From it follows the conclusion of Stopler-Samuelson Theorem that international trade would benefit the abundant factor and hurt the scarce factor.

Q9) Explain International Business Strategies, International Human Resource Management.

A9)

International Business Strategies:

A major concern for managers deciding on a global business strategy is the tradeoff between global integration and local responsiveness. Global integration is the degree to which the company is able to use the same products and methods in other countries. Local responsiveness is the degree to which the company must customize their products and methods to meet conditions in other countries. The two dimensions result in four basic global business strategies: export, standardization, multidomestic, and transnational. These are shown in the figure below.

Multidomestic: Low Integration and High Responsiveness

Companies with a multidomestic strategy have as aim to meet the needs and requirements of the local markets worldwide by customizing and tailoring their products and services extensively. In addition, they have little pressure for global integration. Consequently, multidomestic firms often have a very decentralized and loosely coupled structure where subsidiaries worldwide are operating relatively autonomously and independent from the headquarter.

Global: High Integration and Low Responsiveness

Global companies are the opposite of multidomestic companies. They offer a standarized product worldwide and have the goal to maximize efficiencies in order to recude costs as much as possible. Global companies are highly centralized and subsidiaries are often very dependent on the HQ. Their main role is to implement the parent company’s decisions and to act as pipelines of products and strategies. This model is also known as the hub-and-spoke model.

Transnational: High Integration and High Responsiveness

The transnational company has characteristics of both the global and multidomestic firm. Its aim is to maximize local responsiveness but also to gain benefits from global integration. Even though this seems impossible, it is actually perfectly doable when taking the whole value chain into considerations. Transnational companies often try to create economies of scale more upstream in the value chain and be more flexible and locally adaptive in downstream activities such as marketing and sales.

International: Low Integration and Low Responsiveness

An international strategy is used when a company is primarily focused on its domestic operations. It does not intend to expand globally but does export some products to take advantage of international opportunities. It does not attempt to customize its products for international markets. It is not interested in either responding to unique conditions in other countries or in creating an integrated global strategy.

International Human Resource Management-

International Human Resource Management (IHRM) can be defined as a set of activities targeting human resource management at the international level. It strives to meet organizational objectives and achieve competitive advantage over competitors at national and international level.

IHRM comprises of typical HRM functions such as recruitment, selection, training and development, performance appraisal and dismissal done at the international level and additional exercises such as global skills management, expatriate management and so on.

In short, IHRM is concerned with handling the human resources at Multinational Companies (MNCs) and it includes managing three types of employees −

Objectives

Q10) Explain International Product life Cycles, International Business Strategies.

A10)

International Product life Cycles:

The international product lifecycle (IPL) is an abstract model briefing how a company evolves over time and across national borders. This theory shows the development of a company’s marketing program on both domestic and foreign platforms. International product lifecycle includes economic principles and standards like market development and economies of scale, with product lifecycle marketing and other standard business models.

The four key elements of the international product lifecycle theory are −

a) The layout of the demand for the product.

b) Manufacturing the product.

c) Competitions in international market.

d) Marketing strategy.

The marketing strategy of a company is responsible for inventing or innovating any new product or idea. These elements are classified based on the product’s stage in the traditional product lifecycle. These stages are introduction, growth, maturity, saturation, and decline

IPL Stages

The lifecycle of a product is based on sales volume, introduction and growth. These remain constant for marketing internationally and involves the effects of outsourcing and foreign production. The different stages of the lifecycle of a product in the international market are given below −

Introduction-

In this stage, a new product is launched in a target market where the intended consumers are not well aware of its presence. Customers who acknowledge the presence of the product may be willing to pay a higher price in the greed to acquire high quality goods or services. With this consistent change in manufacturing methods, production completely relies on skilled laborers.

Competition at international level is absent during the introduction stage of the international product lifecycle. Competition comes into picture during the growth stage, when developed markets start copying the product and sell it in the domestic market. These competitors may also transform from being importers to exporters to the same country that once introduced the product.

Growth

An effectively marketed product meets the requirements in its target market. The exporter of the product conducts market surveys, analyze and identify the market size and composition. In this stage, the competition is still low. Sales volume grows rapidly in the growth stage. This stage of the product lifecycle is marked by fluctuating increase in prices, high profits and promotion of the product on a huge scale.

Maturity

In this level of the product lifecycle, the level of product demand and sales volumes increase slowly. Duplicate products are reported in foreign markets marking a decline in export sales. In order to maintain market share and accompany sales, the original exporter reduces prices. There is a decrease in profit margins, but the business remains tempting as sales volumes soar high.

Saturation

In this level, the sales of the product reach the peak and there is no further possibility for further increase. This stage is characterized by Saturation of sales. (at the early part of this stage sales remain stable then it starts falling). The sales continue until substitutes enter into the market. Marketer must try to develop new and alternative uses of product.

Decline

This is the final stage of the product lifecycle. In this stage sales volumes decrease and many such products are removed or their usage is discontinued. The economies of other countries that have developed similar and better products than the original one export their products to the original exporter's home market. This has a negative impact on the sales and price structure of the original product. The original exporter can play a safe game by selling the remaining products at discontinued items prices.

International Business Strategies

A major concern for managers deciding on a global business strategy is the tradeoff between global integration and local responsiveness. Global integration is the degree to which the company is able to use the same products and methods in other countries. Local responsiveness is the degree to which the company must customize their products and methods to meet conditions in other countries. The two dimensions result in four basic global business strategies: export, standardization, multidomestic, and transnational. These are shown in the figure below.

Multidomestic: Low Integration and High Responsiveness

Companies with a multidomestic strategy have as aim to meet the needs and requirements of the local markets worldwide by customizing and tailoring their products and services extensively. In addition, they have little pressure for global integration. Consequently, multidomestic firms often have a very decentralized and loosely coupled structure where subsidiaries worldwide are operating relatively autonomously and independent from the headquarter.

Global: High Integration and Low Responsiveness

Global companies are the opposite of multidomestic companies. They offer a standarized product worldwide and have the goal to maximize efficiencies in order to recude costs as much as possible. Global companies are highly centralized and subsidiaries are often very dependent on the HQ. Their main role is to implement the parent company’s decisions and to act as pipelines of products and strategies. This model is also known as the hub-and-spoke model.

Transnational: High Integration and High Responsiveness

The transnational company has characteristics of both the global and multidomestic firm. Its aim is to maximize local responsiveness but also to gain benefits from global integration. Even though this seems impossible, it is actually perfectly doable when taking the whole value chain into considerations. Transnational companies often try to create economies of scale more upstream in the value chain and be more flexible and locally adaptive in downstream activities such as marketing and sales.

International: Low Integration and Low Responsiveness

An international strategy is used when a company is primarily focused on its domestic operations. It does not intend to expand globally but does export some products to take advantage of international opportunities. It does not attempt to customize its products for international markets. It is not interested in either responding to unique conditions in other countries or in creating an integrated global strategy.

Q11) Explain stages of IPL.

A11)

International Product life Cycles

The international product lifecycle (IPL) is an abstract model briefing how a company evolves over time and across national borders. This theory shows the development of a company’s marketing program on both domestic and foreign platforms. International product lifecycle includes economic principles and standards like market development and economies of scale, with product lifecycle marketing and other standard business models.

The four key elements of the international product lifecycle theory are −

a) The layout of the demand for the product.

b) Manufacturing the product.

c) Competitions in international market.

d) Marketing strategy.

The marketing strategy of a company is responsible for inventing or innovating any new product or idea. These elements are classified based on the product’s stage in the traditional product lifecycle. These stages are introduction, growth, maturity, saturation, and decline

IPL Stages

The lifecycle of a product is based on sales volume, introduction and growth. These remain constant for marketing internationally and involves the effects of outsourcing and foreign production. The different stages of the lifecycle of a product in the international market are given below −

Introduction

In this stage, a new product is launched in a target market where the intended consumers are not well aware of its presence. Customers who acknowledge the presence of the product may be willing to pay a higher price in the greed to acquire high quality goods or services. With this consistent change in manufacturing methods, production completely relies on skilled laborers.

Competition at international level is absent during the introduction stage of the international product lifecycle. Competition comes into picture during the growth stage, when developed markets start copying the product and sell it in the domestic market. These competitors may also transform from being importers to exporters to the same country that once introduced the product.

Growth

An effectively marketed product meets the requirements in its target market. The exporter of the product conducts market surveys, analyze and identify the market size and composition. In this stage, the competition is still low. Sales volume grows rapidly in the growth stage. This stage of the product lifecycle is marked by fluctuating increase in prices, high profits and promotion of the product on a huge scale.

Maturity

In this level of the product lifecycle, the level of product demand and sales volumes increase slowly. Duplicate products are reported in foreign markets marking a decline in export sales. In order to maintain market share and accompany sales, the original exporter reduces prices. There is a decrease in profit margins, but the business remains tempting as sales volumes soar high.

Saturation

In this level, the sales of the product reach the peak and there is no further possibility for further increase. This stage is characterized by Saturation of sales. (at the early part of this stage sales remain stable then it starts falling). The sales continue until substitutes enter into the market. Marketer must try to develop new and alternative uses of product.

Decline

This is the final stage of the product lifecycle. In this stage sales volumes decrease and many such products are removed or their usage is discontinued. The economies of other countries that have developed similar and better products than the original one export their products to the original exporter's home market. This has a negative impact on the sales and price structure of the original product. The original exporter can play a safe game by selling the remaining products at discontinued items prices.

Q12) Explain stopler – Samuelson theorem.

A12)

The H-O theory determined that the labour- abundant country specialises in the export of labour- intensive commodity while capital-abundant country specialises in the export of capital-intensive commodity. The factor price equalisation theory suggested that the trade would lead towards such movements in the factor prices that the factor price differentials would get reduced and ultimately eliminated.

In what way the international trade and relative changes in the factor prices would affect the distribution of income, was worked out by W.F. Stopler and Paul Samuelson on the basis of the H-O theory. The theorem developed by these writers stated that commencement of free international trade would benefit the relatively abundant factor and hurt the relatively scarce factor of production.

Assumption

The H-O theory determined that the labour- abundant country specialises in the export of labour- intensive commodity while capital-abundant country specialises in the export of capital-intensive commodity. The factor price equalisation theory suggested that the trade would lead towards such movements in the factor prices that the factor price differentials would get reduced and ultimately eliminated.

In what way the international trade and relative changes in the factor prices would affect the distribution of income, was worked out by W.F. Stopler and Paul Samuelson on the basis of the H-O theory. The theorem developed by these writers stated that commencement of free international trade would benefit the relatively abundant factor and hurt the relatively scarce factor of production.

Assumptions of the Stopler-Samuelson Theorem:

(i) One of the two trading countries, considered for analysis, produces two commodities—cloth and steel, and employs only two factors—labour and capital.

(ii) The production function for each of the two commodities is homogenous of first degree. It implies that the production is governed by constant returns to scale.

(iii) Both labour and capital are fully employed.

(iv) The two factors of production are fixed in supply.

(v) The conditions of perfect competition exist both in the product and factor markets.

(vi) The given country is labour-abundant and capital-scarce.

(vii) The cloth is labour-intensive good while steel is capital-intensive good.

(viii) The international terms of trade are fixed.

(ix) Neither commodity is the input in the production of the other commodity.

(x) Both the factors are mobile between two industries or sectors but these are not mobile between the two countries.

(xi) There is an absence of transport costs.

Given the above assumptions, the Stopler- Samuelson Theorem can be explained through Edgeworth Box shown in the below figure.

The Edgeworth box shows that the given country is labour-abundant and capital-scarce. A is the origin for labour-intensive goods—cloth and C is the point of origin for the capital-intensive good—steel. AC is the non-linear contract curve sagging below. In the absence of trade, production takes place at R, which is the point of tangency of isoquant X0 of cloth, isoquant Y0 of steel and the factor price line P0P0.

K-L Ratio in cloth at R = Slope of line AR = Tan α

K-L Ratio in steel at R = Slope of line RC = Tan β

When trade commences, this labour-surplus country expands the production of cloth (L- good) and reduces the production of steel (K-good). The production now takes place at S, which is the point of tangency of higher isoquant X1 of cloth, lower isoquant Y1 of steel and the factor price line P1P1.

K-L Ratio in cloth at S = Slope of line AS = Tan α1

K-L Ratio in cloth at S = Slope of line SC = Tanβ1

Since Tan α1 > Tan α and Tan β1 > Tan β, the K-L ratio rises in both the commodities in this country. The factor price line P1P1 is more steep than the original factor price line P0P0. It signifies that the price of labour rises relative to the price of capital.

As the production of exportable commodity cloth expands, the resources are diverted from the steel industry to the cloth industry. The increased production of cloth and resource diversion to this industry will cause a rise in the price of cloth relative to that of steel. It may be shown through below fig.

The fig measures L-good cloth along the horizontal scale and K-good steel along the vertical scale. AA is the production possibility curve. Its slopes indicates that this country is labour-abundant and capital-scarce. In the absence of trade (i.e., autarchy), the production takes place at R. This point corresponds with point R in the first fig.

As the production of cloth is expanded after the commencement of trade, production takes place at S. This point corresponds with point S in the first figure. The slope of the production possibility curve at S is greater than its slope at R. This is represented by more steepness of price line P1 P1 than P0P0.

From this it follows that:

It signifies that price of cloth increases while that of steel falls.

Such relative changes in the prices of two commodities promote greater diversion of resources from steel industry to the cloth industry. The expanding cloth industry wants to employ more workers than are being released by the contracting steel industry. This results in the bidding up of the price of labour. At the same time, the steel industry releases capital which the cloth industry can absorb only at the lower price of capital.

The increased employment of labour along with the higher price of labour (wage rate) implies that the absolute income share of labour in the national income rises. On the other hand, the reduced employment of capital along with a fall in its price (rate of interest) lowers the absolute share of capital. From it follows the conclusion of Stopler-Samuelson Theorem that international trade would benefit the abundant factor and hurt the scarce factor.