UNIT II

Final Accounts

PART A

Question Bank:

Q1) State with reasons whether the following statements are ‘True’ or ‘False’. (8 marks)

(1) Overhaul expenses of second-hand machinery purchased are Revenue Expenditure.

(2) Money spent to reduce working expenses is Revenue Expenditure.

(3) Legal fees to acquire property are Capital Expenditure.

(4) Amount spent as lawyer’s fee to defend a suit claiming that the firm’s factory site belonged to the plaintiff’s land is Capital Expenditure.

(5) Amount spent for replacement of worn-out part of machine is Capital Expenditure.

(6) Expense incurred on the repairs and white washing for the first time on purchase of an old building are Revenue Expenses.

(7) Expenses in connection with obtaining a license for running the cinema are Capital Expenditure.

(8) Amount spent for the construction of temporary huts, which were necessary for construction of the Cinema House and were demolished when the cinema house was ready, is Capital Expenditure.

A1)

(1) False: Overhaul expenses are incurred to put second-hand machinery in working condition to derive endurable long-term advantage. So it should be capitalized.

(2) False: It may be reasonably presumed that money spent for reducing revenue expenditure would have generated long-term benefits to the entity. It becomes part of intangible fixed assets if it is in the form of technical know-how and tangible fixed assets if it is in the form of additional replacement of any of the existing tangible fixed assets. So, this is capital expenditure.

(3) True: Legal fee paid to acquire any property is part of the cost of that property. It is incurred to possess the ownership right of the property and hence a capital expenditure.

(4) False: Legal expenses incurred to defend a suit claiming that the firm’s factory site belongs to the plaintiff are maintenance expenditure of the asset. By this expense, neither any endurable benefit can be obtained in future in addition to that what is presently available nor will the capacity of the asset be increased. Maintenance expenditure in relation to an asset is revenue expenditure.

(5) False: Amount spent for replacement of any worn-out part of a machine is revenue expense since it is part of its maintenance cost.

(6) False: Repairing and white washing expenses for the first time of an old building are incurred to put the building in usable condition. These are the part of the cost of building. Accordingly, these are capital expenditure.

(7) True: The Cinema Hall could not be started without license. Expenditure incurred to obtain the license is pre-operative expense which is capitalized. Such expenses are amortized over a period of time.

(8) True: Cost of temporary huts constructed which were necessary for the construction of the cinema house is part of the construction cost of the cinema house. Therefore, such costs are to be capitalized.

Q2) State with reasons whether the following are Capital or Revenue Expenditure:( 5 marks)

(1) Expenses incurred in connection with obtaining a license for starting the factory for Rs. 10,000.

(2) Rs. 1,000 paid for removal of Inventory to a new site.

(3) Rings and Pistons of an engine were changed at a cost of Rs. 5,000 to get fuel efficiency.

(4) Money paid to Mahanagar Telephone Nigam Ltd. (MTNL) Rs. 8,000 for installing telephone in the office.

(5) A factory shed was constructed at a cost of Rs. 1,00,000. A sum of Rs. 5,000 had been incurred in the construction of temporary huts for storing building material.

A2)

(1) Money paid Rs. 10,000 for obtaining license to start a factory is a capital expenditure. This is an item of expenditure incurred to acquire the right to carry on business.

(2) Rs. 1,000 paid for removal of Inventory to a new site is revenue expenditure. This is neither bringing enduring benefit nor enhancing the value of the asset.

(3) Rs. 5,000 spent in changing Rings and Pistons of an engine to get fuel efficiency is capital expenditure. This is an expenditure on improvement of a fixed asset. It results in increasing profit-earning capacity of the business by cost reduction.

(4) Money deposited with MTNL for installation of telephone in office is not expenditure. This is treated as an asset and the same is adjusted over a period of time against actual telephone bills.

(5) Cost of construction of building including cost of temporary huts is capital expenditure. Building is fixed asset which will generate enduring benefit to the business over more than one accounting period. Construction of temporary huts is incidental to the main construction. Such cost is also capitalized with the cost of building.

Q3) Good Pictures Ltd., constructs a cinema house and incurs the following expenditure during the first year ending 31st March, 2016. ( 5 marks)

1. Second-hand furniture worth Rs. 9,000 was purchased; repainting of the furniture costs Rs. 1,000. The furniture was installed by own workmen, wages for this being Rs. 200.

2. Expenses in connection with obtaining a license for running the cinema worth Rs. 20,000. During the course of the year the cinema company was fined Rs. 1,000, for contravening rules. Renewal fee Rs. 2,000 for next year also paid.

3. Fire insurance, Rs. 1,000 was paid on 1st October, 2015 for one year.

4. Temporary huts were constructed costing Rs. 1,200. They were necessary for the construction of the cinema. They were demolished when the cinema was ready.

Point out how you would classify the above items.

A3)

1. The total cost of the furniture should be treated as Rs. 10,200 i.e., all the amounts mentioned should be capitalized since without such expenditure the furniture would not be available for use. If Rs. 1,000 and Rs. 200 have been respectively debited to the Repairs Account and the Wages Account, these accounts will be credited to the Furniture Account.

2. License for running the cinema house is necessary, hence its cost should be capitalized. But the fine of Rs. 1,000 is revenue expenditure. The renewal fee for the next year is also revenue expenditure but pertains to the next year; hence, it is a prepaid expense.

3. Half of the insurance premium pertains to the year beginning on 1st April, 2016. Hence such amount should be treated as prepaid expense. The remaining amount is revenue expense for the current year.

4. Since the temporary huts were necessary for the construction, their cost should be added to the cost of the cinema hall and thus capitalized.

Q4) State with reasons whether the following are capital or revenue expenditures:( 5 marks)

(i) A new machine is purchased for ₹ 60,000, ₹ 800 were spent on its carriage and ₹ 1,500 were paid as wages for its installation.

(ii) A sum of ₹ 10,000 was spent on painting the new factory.

(iii) ₹ 5,000 paid for the erection of a new machine.

(iv) ₹ 2,000 were spent on repairs before using a second-hand generator purchased recently.

(v) ₹ 1,500 were spent on the repair of machinery.

(vi) ₹ 10,000 was paid as brokerage on the issue of shares and other expenses of the issue were ₹ 25,000.

A4) The reasons are.

(i) New machinery purchase is a capital expenditure that increases the earning function of a firm. Here, the installation cost is capitalized as it is used before the machine is put into operation.

(ii) As the new factory is painted it is categorized as a capital expenditure.

(iii) New machine erection cost will be capitalized as it is used before equipment is put into operation.

(iv) As 2nd hand generator are repaired before it is put into function, so it is a capital expenditure

(v) Since, repairs are done regularly, therefore, it is considered as revenue expenditure.

(vi) Brokerage and other expenses issue are capital in nature; therefore, it is a capital expenditure.

Q5) State whether the following expenditure are Capital, Revenue or Deferred Revenue. Give reasons ( 5 marks)

(i) Furniture of the book value of ₹ 10,000 was sold off at ₹ 2,500 and new furniture of the value of ₹ 6,000 was acquired, cartage on purchase ₹ 50.

(ii) Temporary was constructed costing ₹25,000. These are necessary for the construction of the new building and were demolished when the buildings were ready.

(iii) Replacement of old machine by a new one. Damages paid by a transport company to its passengers injured in an accident.

(iv) ₹40,000 was spent is dismantling the removing the machinery from old sites to a more suitable site.

(v) Removal of stock from the old site to new site cost 420,000. The new site is more favorably located.

A5)

(i) ₹7,500 loss in the furniture sale is revenue expenditure and ₹ 6,050 purchase + cartage will be capital expenditure.

(ii) It is considered as capital expenditure as registration and a legal fee is given to obtain the asset.

(iii) A purchase of a new machine is a capital expenditure which will enhance the firm’s earning space. Since accidents and damages payments do not increase the earning size of a business, so it is a revenue expenditure.

(iv) The new construction will increase the earning capacity of a firm. So, it is a capital expenditure,

(v)It is a deferred expenditure.

Q6) State with reasons whether the following receipts would be treated as Capital or Revenue: -( 8 marks)

(a) ₹ 5,000 received from a customer whose account was previously written off as bad.

(b) ₹ 20,000 received from the sale of an old machine.

(c) ₹ 2,60,000 received from the sale of stock-in-trade.

(d) ₹ 5,00,000 is contributed by a partner as capital.

(e) Took a loan of ₹ 10 Lac from Punjab National Bank.

(f) Received ₹ 4 Lac as subsidy from State Government.

(g) Received ₹ 8 Lac as a grant from State Government for the construction of quarters for the staff.

A6)

(a) The account previously written off as bad is a revenue receipt as it is the normal function of a business.

(b) Sale of an old machine is considered as a capital receipt as by selling the machine it will gain the capital.

(c) Sale of a stock is termed as revenue receipt as the company will receive the capital over an exchange of goods.

(d) Contribution os a partner is a capital receipt because it will enhance the financial status of a firm.

(e) A loan is a capital receipt as it will intensify the production of a business.

(f) A subsidy is a revenue receipt because it is received on a regular basis from the government.

(g) Grants received for construction is a capital receipt as it will increase the firm’s earning capacity.

Q7) Describe how to prepare an income statement for a manufacturing company.

Question: Companies that provide services, such as Ernst & Young (accounting) and Accenture LLP (consulting), do not sell goods and therefore have no inventory. The accounting process and income statement for service companies are relatively simple. Merchandising companies (also called retail companies) like Macy’s and Home Depot buy and sell goods but typically do not manufacture goods. Since merchandising companies must account for the purchase and sale of goods, their accounting systems are more complex than those of service companies. Manufacturing companies, such as Johnson & Johnson and Honda Motor Company, produce and sell goods. Such companies require an accounting system that goes well beyond accounting solely for the purchase and sale of goods. Why are accounting systems more complex for manufacturing companies?

A7) Accounting systems are more complex for manufacturing companies because they need a system that tracks manufacturing costs throughout the production process to the point at which goods are sold. Since income statements for manufacturing companies tend to be more complex than for service or merchandising companies, we devote this section to income statements for manufacturing companies. Understanding income statements in a manufacturing setting begins with the inventory cost flow equation.

Q8) How do companies use the cost flow equation to calculate unknown balances? (5 marks)

A8) We can use the basic cost flow equation to calculate unknown balances for just about any balance sheet account (e.g., cash, accounts receivable, and inventory). The equation is as follows:

Key Equation

Beginning balance (BB) + Transfers in (TI) – Ending balance (EB) = Transfers out (TO)

We will apply this equation to the three inventory asset accounts discussed earlier (raw materials, work in process, and finished goods) to calculate the cost of raw materials used in production, cost of goods manufactured, and cost of goods sold.

Raw materials used in production shows the cost of direct and indirect materials placed into the production process. Cost of goods manufactured represents the cost of goods completed and transferred out of work-in-process (WIP) inventory into finished goods inventory. Cost of goods sold represents the cost of goods that are sold and transferred out of finished goods inventory into cost of goods sold.

Accountants need all these amounts—raw materials placed in production, cost of goods manufactured, and cost of goods sold—to prepare an income statement for a manufacturing company. We describe how to calculate these amounts using three formal schedules in the following order:

(a) Schedule of raw materials placed in production

(b) Schedule of cost of goods manufactured

(c) Schedule of cost of goods sold

Q9) Give a summary of important adjustments that are typically made at the end of the accounting period. (8 marks)

A9) Summary as follows:

Sr No | Adjustment | Effect 1 | Effect 2 |

1 | Closing Stock- Raw Materials | Less from RC- MFG A/c | BS- Asset Side |

| Closing Stock- Work in Progress | MFG A/c- Cr Side | BS- Asset Side |

| Closing Stock- Finished Goods | Trading A/c- Cr Side | BS- Asset Side |

2 | Outstanding Expenses or Payable | Add to Expense | BS- Liability Side |

3 | Prepaid Expense | Less from Expenses | BS- Asset Side |

4 | Outstanding Income or Receivable | Add to Income | BS- Asset Side |

5 | Income received in Advance | Less from Income | BS- Liability Side |

6 | Depreciation on Assets used in MFG | Less from Asset in BS | MFG A/c Dr Side |

| Depreciation on Office Assets | Less from Asset in BS | P/L A/c Dr Side |

7 | Interest on Capital | P & L A/c Dr Side | Add to Capital in BS |

8 | Interest on Drawings | P & L A/c Cr Side | Less from Capital in BS |

9 | Bad or Doubtful Debts | P & L Dr Side (Formula) | Less From Debtors |

10 | Provision/Reserve for Doubtful Debts (RDD) | P & L Dr Side (Formula) | Less From Debtors |

11 | Provision for Discount on Debtors | Add to Discount (P & L Dr Side) | Less From Debtors |

12 | Provision for Discount on Creditors | Add to Discount (P & L Cr Side) | Less From Creditors |

13 | Unrecorded Sales | Add to Debtors | Add to Sales |

14 | Unrecorded Purchases | Add to Creditors | Add to Purchases |

15 | Uninsured Goods lost by Fire/theft | P & L Dr Side | Trading A/c Cr Side |

16 | Insured Goods lost by Fire/theft | P & L Dr Side- Actual Loss Amount

BS Asset Side - Insurance Claim Receivable | Trading A/c Cr Side- Amount of Goods Lost |

17 | Goods Distributed as Free Samples | P & L Dr Side | Trading A/c Cr Side |

18 | Goods taken for Personal use by proprietor | Add to Drawings | Trading A/c Cr Side |

19 | Bills Receivable Dishonored | Less from Bills Receivable | Add to Debtors |

20 | Bills Payable Dishonored | Less from Bills Payable | Add to Creditors |

21 | Interest on Loan Payable | Add to Loan Liability Side | P & L Dr Side |

22 | Interest on Investment Receivable | Add to Investment Asset Side | P & L Cr Side |

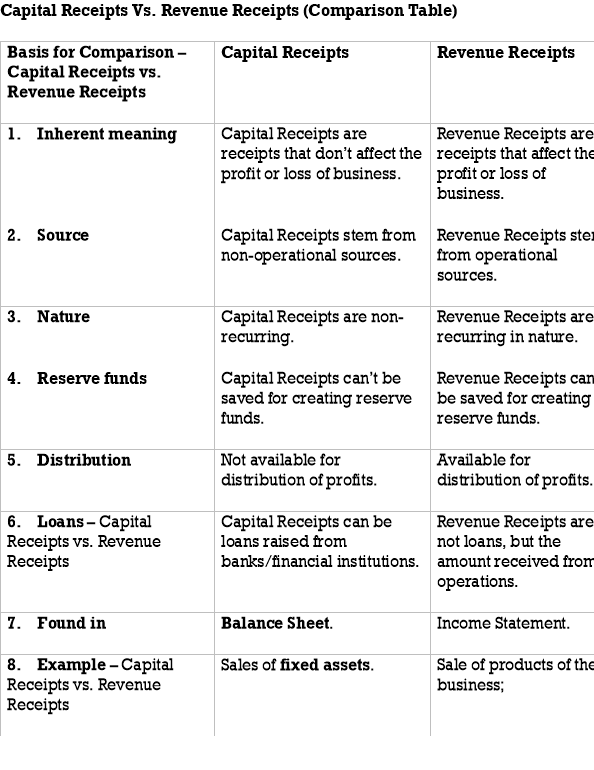

Q10) What is the difference between Capital and Revenue Receipts? ( 8 marks)

A10)

PART B

Question Bank

Q11) Mr. Amit runs a factory which produces soaps. Following details were available in respect of his manufacturing activities for the year ended on 31.3.2016: (8 marks)

Opening Work-in-Process (10,000 units) | 16,000 |

Closing Work-in-Process (12,000 units) | 20,000 |

Opening inventory of Raw Materials | 1,70,000 |

Closing inventory of Raw Materials | 1,90,000 |

Purchases | 8,20,000 |

Hire charges of machine @ 0.60 per unit manufactured |

|

Hire charges of factory | 2,20,000 |

Direct wages-Contracted @ 0.80 per unit manufactured and @ 0.40 per unit of Closing W.I.P. |

|

Repairs and Maintenance | 1,80,000 |

Units produced – 5,00,000 units |

|

Required: Prepare a Manufacturing Account of Mr. Amit for the year ended 31.3.2016.

A1)

In the books of Mr. Amit

Manufacturing Account for the year ended 31.3.2016

Particulars | Units | Amount | Amount | Particulars | Units | Amount | Amount |

To Opening W.I.P | 10000 |

| 16000 | By Closing W.I.P | 12000 |

| 20000 |

To Raw Materials consumed |

|

|

|

|

|

|

|

Opening Inventory |

| 170000 |

| By Trading A/c | 500000 |

| 1900800 |

Add: Purchases |

| 820000 |

| (Cost of Finished Goods transferred) |

|

|

|

|

| 990000 |

|

|

|

|

|

Less: Closing Inventory |

| (190000) | 800000 |

|

|

|

|

To Direct Wages (WN 1) |

|

| 404800 |

|

|

|

|

To Direct Expenses |

|

|

|

|

|

|

|

Hire Charges on Machinery (WN 2) |

|

| 300000 |

|

|

|

|

To Indirect Expenses |

|

|

|

|

|

|

|

Hire Charges of Factory Shed |

|

| 220000 |

|

|

|

|

Repairs & Maintenance |

|

| 180000 |

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

| 1920800 | Total |

|

| 1920800 |

Working Note:

- Direct Wages

500000 units x Rs. 0.80 4,00,000

12000 units x Rs. 0.40 4,800

4,04,800

2. Hire Charges on Machinery = 500000 units x Rs. 0.60 3,00,000

Q12) Mr. Dharmesh runs a factory which produces motor spares of export quality. The following details were obtained about his manufacturing expenses for the year ended on 31.3.2016.

| Rs. | |

W.I.P. | - Opening | 3,90,000 |

| - Closing | 5,07,000 |

Raw Materials | - Purchases | 12,10,000 |

| - Opening | 3,02,000 |

| - Closing | 3,10,000 |

| - Returned | 18,000 |

| - Indirect material | 16,000 |

Wages | - Direct | 2,10,000 |

| - Indirect | 48,000 |

Direct Expenses | - Royalty on Production | 1,30,000 |

| - Repairs & maintenance | 2,30,000 |

| - Depreciation on Factory Shed | 40,000 |

| - Depreciation on Plant | 60,000 |

By Product at Selling Price | 20,000 | |

Required: Prepare a Manufacturing Account of Mr. Dharmesh for the year ended 31.3.2016. (8 marks)

A2)

In the books of Mr. Dharmesh

Manufacturing Account for the year ended 31.3.2016

Particulars | Amount | Amount | Particulars | Amount | Amount |

To Opening W.I.P |

| 3,90,000 | By Closing W.I.P |

| 5,07,000 |

To Raw Materials consumed |

|

| By By-Products |

| 20,000 |

Opening Inventory | 3,02,000 |

| By Trading A/c |

| 17,81,000 |

Add: Purchases | 12,10,000 |

| (Cost of Finished Goods transferred) |

|

|

| 15,12,000 |

|

|

|

|

Less: Returns | (18,000) |

|

|

|

|

| 14,94,000 |

|

|

|

|

Less: Closing Inventory | (3,10,000) | 11,84,000 |

|

|

|

To Direct Wages |

| 2,10,000 |

|

|

|

To Direct Expenses |

|

|

|

|

|

Royalty |

| 1,30,000 |

|

|

|

To Manufacturing Overheads |

|

|

|

|

|

Indirect Material | 16,000 |

|

|

|

|

Indirect Wages | 48,000 |

|

|

|

|

Repairs & Maintenance | 2,30,000 |

|

|

|

|

Depreciation on Factory Shed | 40,000 |

|

|

|

|

Depreciation on Plant | 60,000 | 3,94,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

| 23,08,000 | Total |

| 23,08,000 |

Q13) Mr. Arun runs a factory which produces soaps. Following details were available in respect of his manufacturing activities for the year ended on 31.3.2016:

Opening Work-in-Process | 16,000 |

Closing Work-in-Process | 20,000 |

Opening inventory of Raw Materials | 1,70,000 |

Closing inventory of Raw Materials | 1,90,000 |

Purchases of Raw Materials | 8,20,000 |

Hire charges of machine | 3,00,000 |

Hire charges of factory | 2,20,000 |

Direct wages | 4,04,800 |

Repairs and Maintenance | 1,80,000 |

Purchases of Finished Goods | 3,00,000 |

Sales of Finished Goods | 30,00,000 |

Opening Stock of Finished Goods | 3,00,000 |

Office Expenses | 40,000 |

Printing & Stationery | 20,000 |

Office Furniture | 5,00,000 |

Plant & Machinery | 5,00,000 |

Cash in Hand | 50,000 |

Cash at Bank | 1,00,000 |

Sundry Debtors | 80,000 |

Sundry Creditors | 50,000 |

Bank Loan | 1,00,000 |

Capital | 7,70,800 |

|

|

Additional Information

- Closing Stock: Work-in-Process 20,000

Raw Materials 1,90,000

Finished Goods 7,00,000

2. Depreciation on Office Furniture @ 10%

3. Bad Debts amounted to Rs. 2,000

Required: Prepare a Manufacturing Account, Trading & Profit & Loss Account of Mr. Arun for the year ended 31.3.2016 and balance sheet as on that date. (12 marks)

A3.

In the books of Mr. Arun

Manufacturing Account for the year ended 31.3.2016

Particulars | Amount | Amount | Particulars | Amount | Amount |

To Opening W.I.P |

| 16,000 | By Closing W.I.P |

| 20,000 |

To Raw Materials consumed |

|

|

|

|

|

Opening Inventory | 1,70,000 |

| By Trading A/c |

| 19,00,800 |

Add: Purchases | 8,20,000 |

| (Cost of Finished Goods transferred) |

|

|

| 9,90,000 |

|

|

|

|

Less: Closing Inventory | (1,90,000) | 8,00,000 |

|

|

|

To Direct Wages |

| 4,04,800 |

|

|

|

To Direct Expenses |

|

|

|

|

|

Hire Charges on Machinery |

| 3,00,000 |

|

|

|

To Indirect Expenses |

|

|

|

|

|

Hire Charges of Factory Shed |

| 2,20,000 |

|

|

|

Repairs & Maintenance |

| 1,80,000 |

|

|

|

|

|

|

|

|

|

Total |

| 19,20,800 | Total |

| 19,20,800 |

Trading, Profit & Loss Account for the year ended 31.3.2016

Particulars | Amount | Amount | Particulars | Amount | Amount |

To Opening Stock of Finished Goods |

| 3,00,000 | By Sales of Finished Goods |

| 30,00,000 |

To Cost of Goods trf from Manufacturing A/c |

| 19,00,800 | By Closing Stock of Finished Goods |

| 7,00,000 |

To Purchases of FG |

| 3,00,000 |

|

|

|

|

|

|

|

|

|

To Gross Profit c/d |

| 11,99,200 |

|

|

|

Total |

| 37,00,000 | Total |

| 37,00,000 |

|

|

|

|

|

|

|

|

| By Gross Profit b/d |

| 11,99,200 |

To Office Expenses |

| 40,000 |

|

|

|

To Printing & Stationery |

| 20,000 |

|

|

|

To Depreciation on Office Furniture |

| 50,000 |

|

|

|

To Bad Debts |

| 2,000 |

|

|

|

|

|

|

|

|

|

To Net Profit trf to Balance Sheet |

| 11,67,200 |

|

|

|

Total |

| 11,99,200 | Total |

| 11,99,200 |

Balance Sheet as on 31st March 2016

Liabilities | Amount | Amount | Assets | Amount | Amount |

|

|

|

|

|

|

Capital | 7,70,800 |

| Plant & Machinery |

| 5,00,000 |

Add: Net Profit | 11,67,200 | 19,38,000 |

|

|

|

|

|

| Office Furniture | 5,00,000 |

|

Sundry Creditors |

| 50,000 | Less: Depreciation @ 10% | 50,000 | 4,50,000 |

Bank Loan |

| 1,00,000 |

|

|

|

|

|

| Sundry Debtors | 80,000 |

|

|

|

| Less: Bad Debts | 2,000 | 78,000 |

|

|

|

|

|

|

|

|

| Cash in Hand |

| 50,000 |

|

|

| Cash at Bank |

| 1,00,000 |

|

|

|

|

|

|

|

|

| Closing Stock |

|

|

|

|

| Raw Materials | 1,90,000 |

|

|

|

| Work In Progress | 20,000 |

|

|

|

| Finished Goods | 7,00,000 | 9,10,000 |

|

|

|

|

|

|

Total |

| 20,88,000 | Total |

| 20,88,000 |

Q14) From the following Trial Balance of Laxman, Enterprises prepare Manufacturing Account, Trading and Profit & Loss Account for the year ended 31st December, 2006 and Balance Sheet as on that date. (12 marks)

| Debit Rs. | Credit Rs. |

Opening Stock – Raw Materials Opening Stock – Finished Goods Purchases of Raw Material Carriage Wages Salaries Power / Lighting Insurance: Machinery Sales Returns Outward Returns Inward Scrap Sold Interest Conveyance Professional Fees Stationery Electricity Capital Drawings Bank Balance Creditors 10% Investment (01st January, 2006) Debtors Furniture Machinery Cash in Hand | 18,000 3,500 95,800 12,000 18,000 14,000 4,500 2,000

3,500

9,500 6,000 3,750 1,250

30,000

15,000 54,000 30,000 45,000 200 |

2,03,500 2,500

8,500 1,000

62,500

27,000 61,000 |

| 3,66,000 | 3,66,000 |

Adjustments:

a) Closing stock – Raw Materials Rs. 28,000.

b) Closing stock – Furnished Goods Rs. 2,300.

c) ⅓ of carriage is for sale of goods and ⅔ is for purchase of raw materials.

d) Depreciate Plant / Machinery and Furniture by 10% p.a.

e) Create provision of 10% for bad and doubtful debts.

f) In fire, finished goods costing Rs. 5,000 were destroyed but Insurance Company admitted the claim of Rs. 3,000 only.

A4)

In the books of Mr. Laxman

Manufacturing Account for the year ended 31.12.2006

Particulars | Amount | Amount | Particulars | Amount | Amount |

|

|

|

|

|

|

To Raw Materials consumed |

|

| By Sale of Scrap |

| 8,500 |

Opening Inventory | 18,000 |

| By Trading A/c |

| 1,07,300 |

Add: Purchases | 95,800 |

| (Cost of Finished Goods transferred) |

|

|

| 1,13,800 |

|

|

|

|

Less: Return Outwards | (2,500) |

|

|

|

|

| 1,11,300 |

|

|

|

|

Less: Closing Inventory | (28,000) | 83,300 |

|

|

|

To Carriage Inwards (2/3 x 12000) |

| 8,000 |

|

|

|

To Wages |

| 18,000 |

|

|

|

To Power/Lighting |

| 4,500 |

|

|

|

To Insurance (Machinery) |

| 2,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

| 1,15,800 | Total |

| 1,15,800 |

Trading, Profit & Loss Account for the year ended 31.12.2006

Particulars | Amount | Amount | Particulars | Amount | Amount |

To Opening Stock of Finished Goods |

| 3,500 | By Sales of Finished Goods Less: Return Inwards | 2,03,500

(3,500) | 2,00,000 |

To Cost of Goods trf from Manufacturing A/c |

| 1,07,300 | By Goods lost (Fire) |

| 5,000 |

|

|

| By Closing Stock of Finished Goods |

| 2,300 |

To Gross Profit c/d |

| 96500 |

|

|

|

|

|

|

|

|

|

Total |

| 2,07,300 | Total |

| 2,07,300 |

|

|

|

|

|

|

To Carriage Outwards (1/3 x 12000) |

| 4,000 | By Gross Profit b/d |

| 96,500 |

To Depreciation |

|

| By Interest Income | 1,000 |

|

On Plant & Machinery | 4,500 |

| Add: Interest Receivable | 500 | 1,500 |

On Office Furniture | 3,000 | 7,500 | (10% on 15000 i.e 1500-1000) |

|

|

To R.D.D (New) |

| 5,400 |

|

|

|

To Loss by Fire |

| 2,000 |

|

|

|

To Salaries |

| 14,000 |

|

|

|

To Conveyance |

| 9,500 |

|

|

|

To Professional Fees |

| 6,000 |

|

|

|

To Stationery |

| 3,750 |

|

|

|

To Electricity |

| 1,250 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To Net Profit trf to Balance Sheet |

| 44,600 |

|

|

|

Total |

| 98,000 | Total |

| 98,000 |

Balance Sheet as on 31.12.2006

Liabilities | Amount | Amount | Assets | Amount | Amount |

|

|

|

|

|

|

Capital | 62,500 |

| Plant & Machinery | 45,000 |

|

Less: Drawings | (30,000) |

| Less: Depreciation @ 10% | 4,500 | 40,500 |

| 32,500 |

| Furniture | 30,000 |

|

Add: Net Profit | 44,600 | 77,100 | Less: Depreciation @ 10% | 3,000 | 27,000 |

Bank Overdraft |

| 27,000 |

|

|

|

Sundry Creditors |

| 61,000 | Sundry Debtors | 54,000 |

|

|

|

| Less: R.D.D @ 10% | 5,400 | 48,600 |

|

|

| 10% Investment | 15,000 |

|

|

|

| Add: Interest Receivable | 500 | 15,500 |

|

|

| Cash in Hand |

| 200 |

|

|

| Insurance Claim receivable |

| 3,000 |

|

|

| Closing Stock |

|

|

|

|

| Raw Materials | 28,000 |

|

|

|

| Finished Goods | 2,300 | 30,300 |

|

|

|

|

|

|

|

|

|

|

|

|

Total |

| 1,65,100 | Total |

| 1,65,100 |

Q15) A company imported transistor radios from Britain, however, the radios must be modified to meet Hong Kong specifications with the help of some equipment. The trial balance at year end 31st December, 1993 is as follows:

| $ | $ |

Sales |

| 12000 |

Purchases | 4500 |

|

Radios | 3000 |

|

Carriage inwards | 200 |

|

Carriage outwards | 300 |

|

Returns inwards | 600 |

|

Returns outwards |

| 500 |

Wages for modifications | 400 |

|

Motor vans | 10 000 |

|

Equipment | 2 000 |

|

Selling expenses | 500 |

|

Capital | _ | 9 000 |

| 21 500 | 21 500 |

It is the company's policy to depreciate fixed assets at 10% p.a. And increase the stock held by 10% each year. Prepare the Trading and Profit and Loss Account for the year ended 31st December 1993. (8 marks)

Trading and profit and loss account for the year ended 31-12-1993 | |||

| |||

Sales |

| 12000 |

|

Less: Returns Inwards |

| 600 | |

Net Sales |

|

| 11400 |

Less: Cost of goods sold | |||

Opening stock |

| 3000 |

|

Less: Purchases | 4500 |

|

|

Less: Returns Outwards | 500 | ||

Net Purchases | 4000 |

|

|

Add: Carriage inwards | 200 | 4200 | |

7200 | |||

Less: Closing stock |

| 3300 | |

3900 | |||

Add: Wages for modifications | 400 |

|

|

Depreciation expense on equipment | 200 | 600 | 4500 |

A5)

Gross Profit |

| 6900 |

| ||

Less: Expenses | ||

Carriage outwards | 300 |

|

Selling expenses | 500 |

|

Depreciation expense on motor van | 1000 | 1800 |

Net Profit |

| 5100 |

Q16) The goods are transferred from factory to sales office at 10% mark up.

Show the balance sheet (extract) at the beginning and the end of the year and also the provision for unrealized profit on stock account. (5 marks)

Cost of production for the year |

$10 000 |

Finished goods, at cost: |

|

At the beginning of year | 6 000 |

At the end of year | 2 000 |

A6)

Balance Sheet (Extract) | |||

Beginning | Ending | ||

Finished goods |

| 6600 | 2200 |

Less: Provision for unrealized profit | 600 | 200 | |

6000 | 2000 | ||

Provision for unrealized profit | |||

Profit and Loss | 400 | Balance b/d | 600 |

Balance c/d | 200 |

| |

Q17) Prepare the trading account if:

i) There was a normal loss of damaged stock of $10, and

Ii) There was a fire during the year and the loss amounted to $2 000. (8 marks)

Beginning stock | $10 000 |

Purchases | 5 000 |

Ending stock (after stock loss) | 7 000 |

Sales | 12 000 |

A7)

| |||

(i) Trading | |||

Beginning stock | 10000 | Sales | 12000 |

Add: Purchases | 5000 |

| |

15000 |

| ||

Less: Ending stock | 7000 |

| |

Cost of goods sold | 8000 |

| |

Gross profit | 4000 |

| |

12000 | 12000 | ||

|

| ||

Beginning stock + Purchases = Ending Stock + Cost of goods sold + Stock Loss | |||

10000 5000 7000 7990 10 | |||

| |||

(ii) Trading | |||

Beginning stock | 10000 | Sales | 12000 |

Add: Purchases | 5000 |

| |

15000 |

| ||

Less: Ending stock | 7000 |

| |

Stock loss | 2000 |

| |

Cost of goods sold | 6000 |

| |

Gross profit | 6000 |

| |

12000 | 12000 | ||

| |||

Stock loss due to fire | 2000 | Gross profit | 6000 |

| |||

| |||

Beginning stock + Purchases = Ending Stock + Cost of goods sold + Stock Loss | |||

10000 5000 7000 6000 2000 | |||

| |||

Dr. Profit and Loss: stock loss due to fire 2000 | |||

Cr. Trading account: Stock loss 2000 | |||

Q18) Prepare the extract of the manufacturing account and the journal entry for the stock stolen.(5marks)

Beginning raw material | $ 10 000 |

Purchases of raw material | 10 000 |

Ending raw material | 5 000 |

Raw materials stolen | 6 000 |

A8)

Manufacturing account | |||

Beginning raw material | 10000 | Transferred to trading | 9000 |

Add: Purchases | 10000 |

| |

20000 |

| ||

Less: Ending raw material | 5000 |

| |

Raw materials stolen | 6000 |

| |

Cost of raw material consumed | 9000 | 9000 | |

|

| ||

Dr. Profit and Loss ~ Loss due to theft 6000 | |||

Cr. Manufacturing ~ Loss due to theft 6000 | |||

| |||

Manufacturing account | |||

Beginning raw material | 10000 | Transferred to trading | 15000 |

Add: Purchases | 10000 |

| |

20000 |

| ||

Less: Ending raw material | 5000 |

| |

Cost of raw material consumed | 15000 | 15000 | |

|

| ||

Not true and fair view |

| ||

Q19) From the following information prepare the manufacturing, trading and profit and loss accounts for the year ending 31 December 2019 and the balance sheet as at 31 December 2019 for the firm of J. Jones. (12 marks)

| Rs | Rs |

Purchase of raw materials | 258,000 |

|

Fuel and light | 21,000 |

|

Administration salaries | 17,000 |

|

Factory wages | 59,000 |

|

Carriage outwards | 4,000 |

|

Rent and rates | 21,000 |

|

Sales |

| 482,000 |

Returns inward | 7,000 |

|

General office expenses | 9,000 |

|

Repairs to plant and machinery | 9,000 |

|

Stock at 1 January 2019 |

|

|

Raw materials | 21,000 |

|

Work in progress | 14,000 |

|

Finished goods | 23,000 |

|

Sundry creditors |

| 37,000 |

Capital account |

| 457,000 |

Freehold premises | 410,000 |

|

Plant and machinery | 80,000 |

|

Debtors | 20,000 |

|

Provision for depreciation on plant and |

|

|

Machinery at 1 January 2019 |

| 8,000 |

Cash in hand | 11,000 |

|

| 984,000 | 984,000 |

Make provision for the following:

(a) Stock in hand at 31 December 2019

Raw materials Rs 25,000 Work in progress 11,000

Finished goods 26,000

(b) Depreciation of 10% on plant and machinery – straight line method

(c) 80% of fuel and light and 75% of rent and rates to be charged to manufacturing

(d) Doubtful debts provision – 5% of sundry debtors

(e) RS4,000 outstanding for fuel and light

(f) Rent and rates paid in advance – Rs 5,000

(g) Market value of finished goods – Rs 382,000

A9)

| |||||

| |||||

Manufacturing A/C for the yr. Ended 31-12-2019 | |||||

$ | $ | ||||

Beginning stock |

| 21,000 | Goods transferred at market value | 382,000 | |

Add: Purchases |

| 258,000 |

| ||

279,000 |

| ||||

Less: ending stock |

| 25,000 |

| ||

Cost of materials consumed |

| 254,000 |

| ||

Factory Overhead |

| 59,000 |

| ||

Prime cost |

| 313,000 |

| ||

Fuel & light | 20,000 |

|

| ||

Rent & Rates | 12,000 |

|

| ||

Repairs to plant | 9,000 |

|

| ||

Depreciation | 8,000 | 49000 |

| ||

362,000 |

| ||||

Add: Work-in-progress |

| 14,000 |

| ||

376,000 |

| ||||

Less: Work-in-progress |

| 11,000 |

| ||

365,000 |

| ||||

Manufacturing profit |

| 17,000 |

| ||

Market value of goods Manufactured |

| 382,000 | 382,000 | ||

| |||||

Trading & Profit & Loss A/C for the year Ended 31-12-2019 | |||||

Beginning stock |

| 23,000 | Sales | 482,000 | |

Add: Production cost |

| 382,000 | Less: Sales Returns | 7,000 | |

405,000 | Net Sales |

| 475,000 | ||

Less: ending stock |

| 26,000 |

| ||

Cost of sales |

| 379,000 |

| ||

Gross profit |

| 9,6000 |

| ||

4,75,000 | 475,000 | ||||

Fuel and light |

| 5,000 | Gross profit |

| 96,000 |

Rent & Rates |

| 4,000 | Manufacturing profit |

| 17,000 |

Administration salaries |

| 17,000 |

| ||

Carriage outwards |

| 4,000 |

| ||

General office expenses |

| 9,000 |

| ||

Provision for Bad Debts |

| 1,000 |

| ||

Net Profit |

| 73,000 |

| ||

1,13,000 | 1,13,000 | ||||

Balance Sheet as at 31-12-19-6 | ||||||

Fixed Assets | Capital | 457,000 |

| |||

Freehold premises |

| 410,000 |

| Add: Net Profit | 73,000 | |

Plant & Machinery | 80,000 |

|

| 530,000 | ||

Less: Depreciation | 16,000 | 64,000 | 474,000 |

| ||

|

| |||||

Current Assets | Current liabilities | |||||

Stock- raw materials |

| 25,000 |

| Creditors | 37,000 |

|

- Work-in-progress |

| 11,000 |

| Accruals | 4,000 | 41,000 |

- Finished goods |

| 26,000 |

|

| ||

Debtors | 20,000 |

|

|

| ||

Less: Provision for B.D. | 1,000 | 19000 |

|

| ||

Prepayment |

| 5,000 |

|

| ||

Cash in hand |

| 11,000 | 97,000 |

| ||

571,000 | 571,000 | |||||

Q20) John Cormack started in business on 1st January 1980 as a manufacturer of gaming machines. The following figures are extracted from his records on 31st December 1980. (12 marks)

Sales (30,000 machines at £30 each) | 900,000 |

Plant and machinery (bought 1st January 1980) | 80,000 |

Motor vans (bought 1st January 1980) | 10,000 |

Administrative wages | 18,000 |

Loose tools bought | 6,400 |

Light and power | 40,000 |

Building repairs | 20,000 |

Raw materials bought | 273,400 |

Salesmen’s salaries | 29,000 |

Driver’s wages | 24,000 |

Motor van expenses | 5,000 |

Direct wages | 302,000 |

General administration expenses | 6,000 |

Indirect wages | 54,000 |

Repairs to machinery | 11,000 |

Rates and insurance | 10,000 |

The following information is also made available to you:

(a) The work in progress on 31st December 1980, valued at production cost was £55,000.

(b) The closing stocks on 31st December 1980 were: Raw materials £13,400, Loose tools £

2,400.

(c) Depreciate motor vans 20%, plant and machinery 10%.

(d) Allocate expenses as follows:

| Factory | Administration |

Light and power Building repairs Rates and insurance | 9/10 3/5 4/5 | 1/10 2/5 1/5 |

(e) A manufacturing profit of 25% on production cost was added for the purpose of transferring finished goods to the trading account.

(f) During the year 40,000 machines were completed. Value the 10,000 machines in stock at the average cost of production (subject to provision for unrealized profit).

You are required to draw up the manufacturing, trading and profit and loss account for the year ended 31st December 1980. Show clearly the figures of prime cost and production cost of goods completed.

A10)

Manufacturing & Trading & Profit & Loss account for the year ended 31-12-80 | ||||

Purchases |

| 273,400 | Goods transferred at market value | 800,000 |

Less: ending stock |

| 13,400 |

| |

Cost of materials consumed |

| 260,000 |

| |

Direct wages |

| 302,000 |

| |

Prime cost |

| 562,000 |

| |

Factory Overhead |

| |||

Depreciation | 8,000 |

|

| |

Loose tools (6400-2400) | 4,000 |

|

| |

Light & power | 36,000 |

|

| |

Building repairs | 12,000 |

|

| |

Rates & Insurance | 8,000 |

|

| |

Indirect wages | 54,000 |

|

| |

Repairs to machinery | 11,000 | 133,000 |

| |

695,000 |

| |||

Less: work-in-progress |

| 55,000 |

| |

640,000 |

| |||

Manufacturing profit |

| 160,000 |

| |

Market value of goods manufactured |

| 800,000 | 800,000 | |

|

| |||

Market value of goods manufactured |

| 800,000 | Sales | 900,000 |

Less: closing stock |

| 200,000 |

| |

Cost of sales |

| 600,000 |

| |

Gross profit |

| 300,000 |

| |

900,000 | 900,000 | |||

Depreciation |

| 2,000 | Gross profit | 300,000 |

Administrative wages |

| 18,000 | Manufacturing profit | 160,000 |

Light & power |

| 4,000 |

| |

Building repairs |

| 8,000 |

| |

Rates & Insurance |

| 2,000 |

| |

Salaries |

| 29,000 |

| |

Drivers’ wages |

| 24,000 |

| |

Motor van expenses |

| 5,000 |

| |

General expenses |

| 6,000 |

| |