UNIT IV

Accounting for Hire Purchase

Question Bank

PART A

Q1) What is Hire Purchase" System? (8 marks)

A1) If you buy your TV in cash, you pay, for example, Rs. 15,000. But if you want to pay in instalments of Rs, for example. You may need to pay 3,000 or Rs in 4 instalments each year. A total of 20,000. Extra amount of Rs. 3,000 are interested. If you choose the latter payment method, you will need to debit Rs. 5,000 to treat with interest in television as rated by Rs. 15,000 (not Rs. 20,000). For installment payments, there are two types of arrangements. Each installment may be treated as an "employment" in which the purchaser becomes the owner only if the purchaser has paid all the instalments. In other words, no property is passed to him, even if one installment remains unpaid. The seller reserves the right to take away the goods in case of default with respect to any installation. This is known as the "Hire Purchase" System.

Another arrangement may be that the property passes at the same time as the contract is signed. If the installment payment is not paid, the seller does not have the right to retrieve the item. His right is to sue the buyer for the amount to be paid. This is known as an Installment Payment System.

Definition: The Hire Purchase System is a system in which an employer (employee purchaser) purchases goods from a seller (employment vendor) but does not pay the full amount at one time. However, the down payment will be made in one lump sum and the balance will be paid in instalments by the employer. It's kind of like an installment plan, but the big difference between the installment plan and the hiring purchase plan is when the ownership is transferred.

Rental purchase systems are generally imposed on products with high resale value in the market. Therefore, if the job purchaser does not pay in instalments, the job vendor has the option of re-owning and reselling the asset in the market to recover costs and rates of return.

Parties involved in the employment purchase system

1. Hirer: In general terms, "Hirer" means the purchaser of an item, or the owner or person who acquires an item from a seller under an employment purchase system.

2. Rental Vendor: A "rental vendor" is the owner or seller of a product that delivers the product to the rental company based on the rental purchase system.

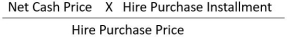

Formula

1. To calculate the Rental Purchase Price

2. How to calculate Cash Price Instalments

Hire Purchase Contract

The Employment Purchase Agreement contains conditions under which the Buyer and Seller mutually agree to hire the goods. This agreement contains the following terms:

The vendor or seller grants ownership of the goods to the employer or employment purchaser, provided that ownership is transferred only when the employer pays the final installment payment.

Hirer has the option to terminate the contract at any time if the asset is not needed or if additional instalments cannot be paid. Instalments paid by that date are considered rent to use the asset and the employer must return the asset to the vendor upon termination of the contract.

Contents of Employment Purchase Contract

According to the Employment Purchase Act of 1972 (Section 4), the Employment Purchase Agreement must include the following:

- Product description.

- The selling price of the sold product.

- The actual cash price of the item sold.

- Date and time of contract start.

- The amount and number of instalments paid by the employer along with the interest rate.

- The last day until all instalments are paid off.

- The name of the person eligible for the installment payment.

Q2) What are the features of Hire Purchase System? ( 5 marks)

A2) Hire Purchase System: Hire Purchase System is a system of retail business under which the seller agrees to sell the article on the condition that the buyer shall pay the purchase price by a fixed number of installments. Here the article is not legally sold out to the buyer and hence the ownership in the goods does not pass on to the buyer. The purchaser becomes the owner only on payment of the last installment.

Features of Hire Purchase System

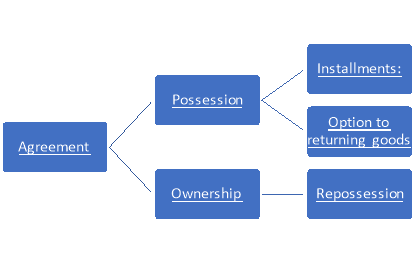

1. Agreement: There is an agreement between the seller and the purchaser.

2. Possession: The possession of goods immediately passes from the seller to the buyer on signing the agreement.

3. Installments: The buyer will make payment in installments over a period of time.

4. Ownership: The ownership of the goods will remain with the seller and passes to the buyer on the payment of last installment.

5. Constituents of Hire Purchase: Each installment is treated as hire charge till the last installment is paid.

6. Option to returning goods: The buyer has an option to return the goods to the seller has a right to repossess the goods sold on hire purchase and forfeit the amount already received either as down payment or in installments.

7. Repossession: If there is any default in payment of any installment, the seller has a right to repossess the goods sold on hire purchase and forfeit the amount already received either as down payment or in installments.

Q3) What is Installment purchase system? What are its features? ( 5 marks)

A3) Installment Purchase System: In Installment Purchase System, the possession as well as ownership passes from the seller to the buyer immediately on entering the agreement but the buyer agrees to pay the total price in installments. If the buyer makes any default in the payment of any installment, the seller has no right to repossess the goods. The seller can file a suit in the court of law for recovery of the price.

Features of Installment Purchase System

1. There is an agreement between the seller and the buyer.

2. The buyer is required to pay the total price in installments.

3. The buyer gets the possession and ownership of goods immediately on signing the agreement.

4. If there is any default in the payment of any installment, the seller has no right to repossess the goods. He can go to the court and sue the purchaser for unpaid balance.

5. As the purchaser is the owner of goods, he can dispose of the goods in any manner he likes.

Q4) Write short notes on: ( 8 marks)

1. Charging of depreciation in Hire Purchase System

2. Termination of Hire Purchase Agreement

3. Complete Repossession & Partial Repossession

4. Financial Lease

1. Charging of depreciation in Hire Purchase System

In Hire Purchase System, depreciation is allowed to be charged on the assets used by the Hire Buyer. The basic logic is that the Hire Purchaser has the intention to own the asset till the payment of the last installment and use it for earning revenue in his business. Therefore, it is necessary to provide depreciation on the asset so as to arrive at a correct profit. Basically, the charging of depreciation is done by either of the method:

a. Straight line method or original cost method.

Or

b. Written down value method or Diminishing Balance method or Reducing balance method.

2. Termination of Hire Purchase Agreement

The Hire Purchaser may, at any time, termination the hire purchase agreement after giving the owner at least 14 days’ notice in writing. He has to redeliver the goods to the owner and pay any installment of hire which might have become due before the termination. With a view to safeguarding the interest of the hirer, the Act has made the following provisions:

a. Where the sum total of the amount due in respect of the hire purchase price immediately before the termination, exceeds one-half of the hire purchase price, the hirer shall not be liable to pay the sum stated in the agreement;

b. Where the sum total of the amount paid and the amount due in respect of the hire purchase price immediately preceding the termination of the agreement does not exceed one-half of the hire purchase price, the hirer shall be liable to pay the difference between the said sum total and the said one-half, or the sum stated and the agreement whichever is lower.

3. Complete Repossession & Partial Repossession

When the hire purchaser makes default in the payment of installment, the hire vendor has a right to repossess the goods sold under hire purchase system. The essence of a hire purchase transaction is to transfer the ownership of goods to the hire purchaser only on the payment of last installment by him. On committing default in the payment of any installment, the hire vendor reserves the right to repossess the goods and the hire purchaser has to forfeit the installment already paid. The hire vendor repossesses either all the goods hired out or only a few of them. Repossession of all the goods is known as complete repossession and repossession a part or few of the goods is known as partial repossession.

4. Financial Lease:

Financial lease is a long-term lease usually coinciding with the economic life of the asset and is non-cancellable. It operates as a long-term debt financing and is usually full-payout as is contrast to operating lease; it is usually a single lease repaying the cost of the asset. They pay a major role in financing of building and equipment to industries.

Q5) How is interest calculated in Hire Purchase System with an example? (8 marks)

A5) In either case (employment purchase or installment payment), interest must be separated from the principal. Payments will continue for more than two fiscal years, so you will need to calculate the interest for each year separately. Information about cash prices and interest rates is usually available. This will make it easier to calculate interest. Simply set up one party's account on a regular line and charge interest on your unpaid balance. Suppose A purchases from machine B with a cash price of Rs on January 1, 2000. 15,000; Rs. 5,000 rupees will be paid at the time of signing the contract, and 4,000 rupees will be paid at the end of each year for three years. The interest rate is 10% per annum. If you create B's account (memo-based) in A's book, you'll see the annual interest.

Dr. |

|

| B’s Account |

| Cr. |

|

| Rs. |

|

| Rs. |

2000 |

|

| 2000 |

|

|

Jan.1 | To Cash | 5,000 | Jan.1 | By Machinery A/c | 15,000 |

Dec.31 | To Cash | 4,000 | Dec.31 | By Interest A/c | 1,000 |

’’ | To balance c/d | 7,000 |

| (10% on Rs. 10,000) |

|

|

| 16,000 |

|

| 16,000 |

2001 |

|

| 2001 |

|

|

Dec.31 | To Cash | 4,000 | Jan.1 | By Balance b/d | 7,000 |

| To Balance c/d | 3,700 | Dec.31 | By Interest A/c |

|

|

|

|

| (10% on Rs. 7,000) | 700 |

|

| 7,700 |

|

| 7,700 |

2002 |

|

| 2002 |

|

|

Dec.31 | To Cash | 4,000 | Jan.1 | By Balance b/d | 3,700 |

|

|

| Dec.31 | By Interest A/c* | 300 |

|

| 4,000 |

|

| 4,000 |

Since this is the final year of instalments, the interest amount will be the difference between the outstanding balance and the actual instalments. [Students note that if they calculate last year's interest at a given percentage of the O / S amount (3700 x 10% = 370), the total payment will be (3700 + 370 = 4070), which is more than the installment payment. Please give me. Paid. So, there is Rs again. 70 will be paid even after the last installment has been paid.

If no interest rate is specified, the interest for each year is proportional to the amount unpaid for each year. In the above example, the total amount paid is Rs. 17,000 rupees 5,000 will be paid immediately. This leaves Rs. 12,000 unpaid in the first year and Rs at the end. 4,000 will be paid. In the second year Rs. 8,000 is outstanding and in the third year it is Rs. There is a deadline of 4,000. The total interest is rupees. 2,000. That is, Rs. 17,000. Minus Rs. 15,000. Interest must be allocated to the unpaid ratio, or Rs, over a three-year period. 12,000; Rs. 8,000 rupees 4,000 or 3: 2: 1 ratio. The interest in the first year is Rs.1,000, in the second year he is Rs.670, and in the third year he is Rs.333. Please note that the interest rate cannot be the same as the specified amount.

To check cash prices, interest rates and instalments. Cash prices may not be listed. Assets cannot be debited beyond the cash price and must be confirmed. The process is to first take last year and separate interest from principal from the total amount to be paid. In the above example, Rs. 4,000 will be paid at the end of 2002. The interest rate is 10%. If Rs.100 is paid at the beginning of 2001, Rs.10 will be added and Rs.110 will be paid at the end of 2002. Therefore, one eleventh of the total paid at the end of the year is interest. The rest are principals. In this way, we can proceed year by year.

Thus: —

| Rs. |

Amount due on 31-12-2001 | 4,000 |

Interest @ 1/11 | 364 |

Amount due on 1-1-2002 or 31-12-2001 | 3,636 |

Paid on 31-12-2001 | 4,000 |

Total amount due on 31-12-2001 | 7,636 |

Interest @ 1/11 | 694 |

Amount due on 1-1-96 or 31-12-2000 | 6,942 |

Paid on 31-12-2000 | 4,000 |

Total amount due on 31-12-2000 | 10,942 |

Interest @ 1/11 | 995 |

Amount due on 1-1-2000 | 9,947 |

Paid Cash down on 1-1-2000 | 5,000 |

Cash Price | 14,947 |

The interest for three years is Rs.995, Rs.694 and Rs.364 respectively. | |

Q6) Write down the Journal entry with Actual Cash Price Payment Method. (8 marks)

A6) Below are the various accounting entries in the books of hiring buyers and hiring vendors.

| Case | In the Books of Hire Purchaser |

| In the Books of Hire Vendor |

| Amount with which debited or credited |

| ||||||

A. | On making down payment due | Asset A/c To Hire Vendor’s A/c | Dr. | Hire Purchaser’s A/c To Hire Purchase Sales A/c | Dr. | (With the amount of down payment) |

B. | On making Down Payment | Hire Vendor’s A/c To Bank A/c | Dr. | Bank A/c To Hire Purchaser’s A/c | Dr. | (With the amount of down payment) |

C. | On making principal part of the instalment due | Asset A/c To Hire Vendor’s A/c | Dr. | Hire Purchaser’s A/c To Hire Purchase Sales A/c | Dr. | (With the amount of principal part of the instalment) |

D. | On making Interest due on Unpaid balance | Interest A/c To Hire Vendor’s A/c | Dr. | Hire Purchaser’s A/c To Interest A/c | Dr. | (With the interest Due on unpaid Balance) |

E. | On making payment of instalment | To Hire Vendor’s A/c To Bank A/c | Dr. | Bank A/c To Hire Purchaser’s A/c | Dr. | (With the amount of instalment) |

F. | On providing Depreciation | Depreciation A/c To Asset A/c | Dr. | No Entry |

| (With the amount of (depreciation) |

G. | On closure of Depreciation A/c | Profit & Loss A/c To Depreciation A/c | Dr. | No entry |

| (With the amount Of depreciation) |

H. | On closure of Interest A/c | Profit & Loss A/c To Interest A/c | Dr. | Interest A/c To Profit & Loss A/c | Dr. | (With the amount Of interests) |

Note: Depreciation is charged on full cash price of the asset and Interest is calculated on total outstanding balance.

Q7) Explain the difference between hire-purchase system and instalment payment system. Under instalment payment system, which accounts are prepared in the books of buyer and seller? (8 marks)

A7) Though Hire-Purchase System and Instalment Payment Systems seem similar as they both involve periodical payments to the vendor, but they are fundamentally different. The main points of difference between the two systems are as follows:

(A) Legal Differences

1. Nature of Contract: Hire-purchase system is an agreement of hiring whereas instalment payment system is an agreement of sale.

2. Property in Goods: Under hire-purchase system, the property in the goods remains vested in the seller until the last instalment has been paid off whereas under instalment payment system, the property in the goods passes to the buyer immediately on signing the agreement of sale.

3. Bailee: Under hire-purchase system, the purchaser is a bailee but under instalment system, the purchaser is the owner from the very beginning.

4. Right of Return of Goods: Under hire-purchase system, the buyer can return the goods to the vendor if he does not want to pay rest of the instalments but under instalment payment system, goods cannot be returned unless some default has been committed by the seller.

5. Right of Disposal of Goods: Under hire-purchase system, the buyer cannot dispose of the goods, unless the last instalment is paid but under instalment payment system, he can do so.

6. Good Title: Under hire-purchase system, the buyer cannot give good title to others before the last instalment is paid but under instalment system, the purchaser can give good title to any bonafide purchaser.

7. Right of Repossession of Goods: Under hire-purchase system, the seller has the right to woods if the buyer makes default in payment of any instalment but under instalment le seller cannot repossess the goods but he can only sue for the unpaid balance.

8. Realisation of Outstanding Instalments: Under hire-purchase system, on default by the purchaser, the vendor has the right to claim for the ander has the right to claim for the recovery of outstanding balances besides the right of repossession of goods but under instalment system, the seller can the seller can only sue for the recovery of outstanding instalments.

9. Repair of the Goods: Under hire-purchase system, till the final instalment is realized, the seller takes the responsibility of repair of the article sold because till then, he is the real owner but under Instalment system, unless a clear contract is made, the seller is not liable for the repair of the goods

10. Risk: Under hire-purchase system, until the last instalment is paid, loss occurring to goods ha to be borne by the seller, if the buyer has taken reasonable care of the goods expected from a bailee but under instalment payment system, any such loss will be borne by the buyer.

(B) Accounting Differences

1. In the Books of the Buyer

(a) Accounting Method: Under hire-purchase system, entries can be made by either asset accrual method or credit purchase method but under instalment payment system, usually interest suspense method is adopted.

(b) Balance Sheet: Under hire-purchase system, amount outstanding at the end of the year is shown in the buyer’s balance sheet as deduction from the hire-purchase asset on the asset side whereas under installment payment system, amount outstanding to vendor is shown on the liabilities side of the balance sheet after deducting from it, the balance of Interest Suspense Account.

2. In the Books of the Seller

(a) Entry of Goods Sold: When goods are sold on hire-purchase, ‘Hire-sales account is credited with the cash value of the goods sold but when goods are sold on instalment payment system, ‘Sales account is credited.

(b) Outstanding Balances: Under the hire-purchase system, instalments outstanding and not due at the end of an accounting period are regarded as ‘stock’ whereas under instalment system, they are regarded as ‘debtors’.

(c) Provision for Bad Debts: Under instalment payment system, it is essential to make adequate provision for bad debts resulting from non-payment of future instalment whereas under Hire Purchase System, no such provision is required as here the seller can repossess the goods in case of default.

Accounts Prepared in the Books of Buyer under Instalment Payment System: The accounts prepared in the books of buyer under instalment payment system are as follows:

1. Asset’s account.

2. Vendor account.

3. Interest suspense account.

4. Interest account.

Accounts Prepared in the Books of Purchaser under Instalment Payment System: The accounts prepared in the books of purchaser under instalment payment system is as follows:

1. Purchaser account.

2. Interest suspense account.

3. Interest account.

Q8) Mention the journal entries necessary in the books of the hire-purchaser as well as the hire vendor under hire-purchase system. ( 5 marks)

A8) Accounting Treatment in the Books of Hirer-purchaser

Books of buyer or hirer-purchaser legally speaking the hire-purchaser may not be treated as the owner of goods purchased till the last due (instalment) is paid by him. But in accounting treatment this view is ignored and the hire-purchase is treated as other ordinary transaction. Only accountants emphasise is to add the term ‘Hire-purchase’ to assets purchased under system, to distinguish from the assets purchased by full payment of cash.

There are two methods of recording transactions in the book of buyer or hirer-purchaser:

First Method: The asset account is debited with the cash price included in each instalment. The down payment is fully towards cash price (the main drawback of this method is t near in the balance sheet at proper value).

Second Method: At the time of signing contract, the asset account

Me of signing contract, the asset account is debited with total cash transaction, accounting treatment is more or less similar.

Under the first method, vendor’s account shows nil balance after every payment.

Whereas under the second method the vendor’s account will be a running account and nil only after last payment.

The accounting entries are shown for both the methods in tabular form as given below

Note:

1. Whenever instalment amount becomes due, transactions, 3, 4.5 and 6 are to be repeated.

2. In case instalments are not annual, then 5 and 6 are to be recorded once, i.e. at the time of closing book.

Book,

3. However in this book, only the second method is used most widely. The first method here is discussed purely from academic interest only as far as this book is concerned.

4. Regarding depreciation, students are asked to provide depreciation on the assets purchased under hire-purchase system in the same way as other assets bought for ‘Cash or Credit’ (ignore the controversy on depreciation whether depreciation is to be charged or not). As such, depreciation must be provided on full cash price.

Q9) Discuss the important terms and contents of Hire-Purchase Agreements.

(8 marks)

A9) Hire Purchase System is a system of retail business under which the seller agrees to sell the article on the condition that the buyer shall pay the purchase price by a fixed number of instalments. Here the article is not legally sold out to the buyer and hence the ownership in the goods does not pass on to the buyer. The purchaser becomes the owner only on payment of the last installment.

To understand this hire-purchase system properly, the following terms should be understood prior, we proceed further:

1. Hirer: A ‘hirer’ means a person who obtains or has obtained possession of the goods from an owner under a hire-purchase agreement.

2. Owner or Hire-vendor : Hire-vendor means a person who delivers or has delivered the possession of goods to the hirer under a hire-purchase agreement.

3. Down Payment or Option Amount or Initial Payment: All the terms denote the same meaning that the sum of money paid by the hirer at the time of taking possession of the property (goods), 1.0.0 the time of entering into a hire-purchase agreement.

4. Hire: It means the sum payable periodically by the hirer under a hire-purchase agreement.

5. Cash Price: It means the total price payable at the time of purchase. It is composed of costo owner plus profit margin.

6. Net Cash Price: It means the cash price of the goods comprised in a hire-purchase agree less any deposit.

7. Cash Price Instalment: Cash price instalment = Net cash price Hire-purchase instalment 8. Hire-purchase Price: It can be understood easily in the form of equation.

9. Hire-purchased Charges: It means the difference between hire-purchase ed in hire-purchase agreement.

10. Hire-purchase Agreement: It includes an agreement under which,

(a) Possession of goods is delivered by the owner to a person who pays the agreed amount in periodical installation.

(b) The property in goods is to pass to such a person on payment. Such a person on payment. Such a person has the right to terminate the agreement at any time before the property so passe.

(c) Such person has right to terminate the agreement at any time beto cerminate the agreement at any time before the property so passes.

Contents of Hire-purchase Agreement

As per Section 4 of the Hire-purchase Act, 1972, every hire-purchase agreement should have the following contents:

1. The hire-purchase price of the goods.

2. The cash price of goods.

3. The date of commencement of agreement.

4. The Number of instalments by which the hire-purchase is to be paid, the amount of each of those instalments, the date upon which it is payable, the person to whom and the place where it is payable.

Q10) What are the conditions of hire purchase transactions? ( 5 marks)

A10) Sale and purchase of goods and services under hire purchase system are subject to certain conditions. The important conditions are (in addition to a few more presented under the head ‘Important Terms in Hire Purchase Accounting’) are identified and presented below.

(1) The hire vendor delivers the goods or asset to the hire purchaser at the time of agreement i.e., after singing agreement.

(2) The hire purchaser has the right to use the goods delivered to him by the hire vendor under hire purchase system.

(3) The purchase price of the goods acquired under hire purchase system is paid in instalments.

(4) Each instalment (paid by the hire purchaser) is treated as the hire charges for allowing the hirer to use the goods.

(5) If all instalments are paid by the hirer in accordance with the Provisions of the agreement, the title to the goods (i.e., legal ownership) is transferred by the hire vendor to the hire purchaser. Besides, the hirer has the right to buy the goods (purchased on hire purchase system) at any time before the payment of last instalment. In this case, the hirer is expected to give at least 14 days’ notice to the hire vendor and he is eligible for the rebate calculated as shown below. That means, the hirer has to pay the hire vendor only hire purchase price or the balance thereof as reduced by the rebate as shown below.

Rebate] = [2 × Number of Instalments Due × Hire Purchase]

3 Total Number of Instalments Charges

If there is a default in the payment of any of the instalments, the hire vendor has the right take back the goods from the possession of the hire purchaser without refunding him any amount received earlier in the form of instalments. Similarly, the hirer has the right to terminate the hire purchase agreement for valid reasons any time before the payment of last instalment.

PART B

Question Bank

Q11) (Cash Price, Rate of Interest and Amount of Installments are given)

Om Ltd. Purchased a machine on hire purchase basis from Kumar Machinery Co. Ltd. On the following terms:

- Cash price Rs. 80,000

- Down payment at the time of signing the agreement on 1.1.2011 Rs. 21,622.

- 5 annual instalments of Rs. 15,400, the first to commence at the end of twelve months from the date of down payment.

- Rate of interest is 10% p.a.

You are required to calculate the total interest and interest included in cash instalment. (8 marks)

A1)

Calculation of interest

| Total (Rs.) | Interest in each instalment (1) | Cash price in each instalment (2) |

Cash Price Less: Down Payment Balance due after down payment Interest/Cash Price of 1st instalment

Less: Cash price of 1st instalment Balance due after 1st instalment Interest/cash price of 2nd instalment

Less: Cash price of 2nd instalment Balance due after 2nd instalment Interest/Cash price of 3rd instalment

Less: Cash price of 3rd instalment Balance due after 3rd instalment Interest/Cash price of 4th instalment

Less: Cash price of 4th instalment Balance due after 4th instalment Interest/Cash price of 5th instalment

Less: Cash price of 5th instalment Total | 80,000 (21,622) 58,378 -

(9,562) 48,816 -

(10,518) 38,298 -

(11,570) 26,728

-

(12,728) 14,000 -

(14,000) Nil |

Nil

Rs. 58,378 x10/100 = Rs. 5,838

Rs. 48,816 x 10/100 = Rs. 4,882

Rs. 38,298x10/100 = Rs. 3,830

Rs. 26,728 x10/100 = Rs. 2,672

Rs. 14,000 x10/100 =Rs. 1,400

Rs. 18,622 |

Rs. 21,622

Rs. 15,400 – Rs. 5,838 = Rs. 9,562

Rs. 15,400 - Rs. 4,882 = Rs. 10,518

Rs. 15,400 - Rs. 3,830 = Rs. 11,570

Rs. 15,400 - Rs. 2,672 = Rs. 12,728

Rs. 15400 – Rs. 1,400 = 14,000

Rs. 80,000 |

Total interest can also be calculated as follow:

(Down payment + instalments) – Cash Price = Rs. [21,622+(15400 x 5)] – Rs. 80,000 = Rs. 18,622

Q12) (Cash Price and Amount of Installments are given; Rate of Interest is not given)

Happy Valley Florists Ltd. Acquired a delivery van on hire purchase on 01.04.2011 from Ganesh Enterprises. The terms were as follows:

Particulars | Amount (Rs.) |

Hire Purchase Price | 180,000 |

Down Payment | 30,000 |

1st installment payable after 1 year | 50,000 |

2nd installment after 2 years | 50,000 |

3rd installment after 3 years | 30,000 |

4th installment after 4 years | 20,000 |

Cash price of van Rs. 1,50,000. You are required to calculate Total Interest and Interest included in each instalment. ( 8 marks)

A2)

Calculation of total Interest and Interest included in each installment Hire Purchase Price (HPP) = Down Payment + instalments = 30,000 + 50,000 + 50,000 + 30,000 + 20,000 = 1,80,000

Total Interest = 1,80,000 – 1,50,000 = 30,000

Computation of IRR (considering two guessed rates of 6% and 12%)

Year | Cash Flow | DF @6% | PV | DF @12% | PV |

0 | 30,000 | 1.00 | 30,000 | 1.00 | 30,000 |

1 | 50,000 | 0.94 | 47,000 | 0.89 | 44,500 |

2 | 50,000 | 0.89 | 44,500 | 0.80 | 40,000 |

3 | 30,000 | 0.84 | 25,200 | 0.71 | 21,300 |

4 | 20,000 | 0.79 | 15,800 | 0.64 | 12,800 |

|

| NPV | 1,62,500 | NPV | 1,48,600 |

Interest rate implicit on lease is computed below by interpolation:

Interest rate implicit on lease= 6% + 1,62,500-1,50,000 x (12-6) = 11.39%

1,62,500-1,48,600

Thus, repayment schedule and interest would be as under:

Installment no. | Principal at beginning | Interest included in each Installment | Gross amount | Installment | Principal at end |

Cash down | 1,50,000 |

| 1,50,000 | 30,000 | 1,20,000 |

1 | 1,20,000 | 13,668 | 1,33,668 | 50,000 | 83,668 |

2 | 83,668 | 9,530 | 93,198 | 50,000 | 43,198 |

3 | 43,198 | 4,920 | 48,118 | 30,000 | 18,118 |

4 | 18,118 | 2,064 | 20,182 | 20,000 | 182* |

|

| 30,182* |

|

|

|

* the difference is on account of approximations. | |||||

Q13) On January 1, 2011 HP M/s acquired a Pick-up Van on hire purchase from FM M/s. The terms of the contract were as follows:

(a) The cash price of the van was Rs. 1,00,000.

(b) Rs. 40,000 were to be paid on signing of the contract.

(c) The balance was to be paid in annual instalments of Rs. 20,000 plus interest.

(d) Interest chargeable on the outstanding balance was 6% p.a.

(e) Depreciation at 10% p.a. Is to be written-off using the straight-line method.

You are required to:

(a) Give Journal Entries and show the relevant accounts in the books of HP M/s from January 1, 2011 to December 31, 2013; and

(b) Show the relevant items in the Balance Sheet of the purchaser as on December 31, 2011 to 2013. ( 12 marks)

A3)

Journal Entries in the books of HP M/s

Date | Particulars | Dr. | Cr. | |

2011 |

| Rs. | Rs. | |

Jan. 31 | Pick-up Van A/c To FM M/S A/c (Being the purchase of a pick-up van on hire purchase From FM M/s) | Dr. | 1,00,000 |

|

|

|

| 1,00,000 | |

“ | FM M/S A/c To Bank A/c (Being the amount paid on signing the H.P. Contract) | Dr. | 40,000 |

|

|

|

| 40,000 | |

Dec. 31 | Interest A/c To FM M/s A/c (Being the interest payable @ 6% on Rs. 60,000) | Dr. | 3,600 |

|

|

|

| 3,600 | |

“ | FM M/s A/c (Rs. 20,000+Rs. 3,600) To Bank A/c (Being the payment of 1st instalment along with interest) | Dr. | 23,600 |

|

|

|

| 23,600 | |

“ | Depreciation A/c To Pick-up Van A/c (Being the depreciation charged @ 10% p.a. On Rs. 1,00,000) | Dr. | 10,000 |

|

|

|

| 10,000 | |

“ | Profit & Loss A/c To Depreciation A/c To Interest A/c (Being the depreciation and interest transferred to Profit and Loss Account) | Dr. | 13,600 |

|

|

|

| 10,000 3,600 | |

2012 Dec. 31 | Interest A/c To FM M/s A/c (Being the interest payable @ 6% on Rs. 40,000) | Dr. | 2,400 |

2,400 |

“ | FM M/s A/c (Rs. 20,000 + Rs. 2,400) To Bank A/c (Being the payment of 2nd instalment along with interest) | Dr. | 22,400 |

|

|

|

| 22,400 | |

“ | Depreciation A/c To Pick-up Van A/c (Being the depreciation charged @ 10% p.a.) | Dr. | 10,000 |

|

|

|

| 10,000 | |

“ | Profit & Loss A/c To Depreciation A/c To Interest A/c (Being the depreciation and interest charged to Profit And Loss Account) | Dr. | 12,400 |

|

|

|

| 10,000 2,400 | |

2013 Dec. 31 | Interest A/c To FM M/s A/c (Being the interest payable @ 6% on Rs. 20,000) | Dr. | 1,200 |

1,200 |

“ | FM M/s A/c (Rs. 20,000 + Rs. 1,200) To Bank A/c (Being the payment of final instalment along with Interest) | Dr. | 21,200 |

|

|

|

| 21,200 | |

“ | Depreciation A/c To Pick-up Van A/c (Being the depreciation charged @ 10% p.a. On Rs. 1,00,000) | Dr. | 10,000 |

|

|

|

| 10,000 | |

“ | Profit & Loss A/c To Depreciation A/c To Interest A/c (Being the interest and depreciation charged to Profit And Loss Account) | Dr. | 11,200 |

|

|

|

| 10,000 1,200 |

Ledgers in the books of HP M/s

Pick-up Van Account

Date | Particulars | Rs. | Date | Particulars | Rs. |

1.1.2011 | To FM M/s A/c | 1,00,000 | 31.12.2011 | By Depreciation A/c | 10,000 |

|

|

| 31.12.2011 | By Balance c/d | 90,000 |

|

| 1,00,000 |

|

| 1,00,000 |

1.1.2012 | To Balance b/d | 90,000 | 31.12.2012 | By Depreciation A/c | 10,000 |

|

|

| 31.12.2012 | By Balance c/d | 80,000 |

|

| 90,000 |

|

| 90,000 |

1.1.2013 | To Balance b/d | 80,000 | 31.12.2013 | By Depreciation A/c | 10,000 |

|

|

| 31.12.2013 | By Balance c/d | 70,000 |

|

| 80,000 |

|

| 80,000 |

FM M/s Account

Date | Particulars | Rs. | Date | Particulars | Rs. |

1.1.2011 | To Bank A/c | 40,000 | 1.1.2011 | By Pick-up Van A/c | 1,00,000 |

31.12.2011 | To Bank A/c | 23,600 | 31.12.2011 | By Interest c/d | 3,600 |

31.12.2011 | To Balance c/d | 40,000 |

|

|

|

|

| 1,03,600 |

|

| 1,03,600 |

31.12.2012 | To Bank A/c | 22,400 | 1.1.2012 | By Balance b/d | 40,000 |

31.12.2012 | To Balance c/d | 20,000 | 31.12.2012 | By Interest A/c | 2,400 |

|

| 42,400 |

|

| 42,400 |

31.12.2013 | To Bank A/c | 21,200 | 1.1.2013 | By Balance b/d | 20,000 |

|

|

| 31.12.2013 | By Interest A/c | 1,200 |

|

| 21,200 |

|

| 21,200 |

Depreciation Account

Date | Particulars | Rs. | Date | Particulars | Rs. |

31.12.2011 | To Pick-up Van A/c | 10,000 | 31.12.2011 | By Profit & Loss A/c | 10,000 |

31.12.2012 | To Pick-up Van A/c | 10,000 | 31.12.2012 | By Profit & Loss A/c | 10,000 |

31.12.2013 | To Pick-up Van A/c | 10,000 | 31.12.2013 | By Profit & Loss A/c | 10,000 |

Interest Account

Date | Particulars | Rs. | Date | Particulars | Rs. |

31.12.2011 | To FM M/s A/c | 3,600 | 31.12.2011 | By Profit & Loss A/c | 3,600 |

31.12.2012 | To FM M/s A/c | 2,400 | 31.12.2012 | By Profit & Loss A/c | 2,400 |

31.12.2013 | To FM M/s A/c | 1,200 | 31.12.2013 | By Profit & Loss A/c | 1,200 |

Balance Sheet of HP M/s as at 31st December, 2011

Liabilities | Rs. | Assets | Rs. |

FM M/s | 40,000 | Pick-up Van | 90,000 |

Balance Sheet of HP M/s as at 31st December, 2012

Liabilities | Rs. | Assets | Rs. |

FM M/s | 20,000 | Pick-up Van | 80,000 |

Balance Sheet of HP M/s as at 31st December, 2013

Liabilities | Rs. | Assets | Rs. |

|

| Pick-up Van | 70,000 |

Q14) 1st January, 2000 Mr. A purchase from Mr. B machinery whose cash price is Rs. 15,000; Rs. 5,000 is to be paid down, that is on signing of the contract, and Rs. 4,000 is to be paid at the end of each year for 3 years. Rate of interest is 10% p.a. Prepare B’s account in the books of Mr. A. (5 marks)

A3)

A’s Books

Dr. |

|

| B’s Account |

| Cr. |

|

| Rs. |

|

| Rs. |

2000 |

|

| 2000 |

|

|

Jan.1 | To Cash | 5,000 | Jan.1 | By Machinery A/c | 15,000 |

Dec.31 | To Cash | 4,000 | Dec.31 | By Interest A/c | 1,000 |

’’ | To balance c/d | 7,000 |

| (10% on Rs. 10,000) |

|

|

| 16,000 |

|

| 16,000 |

2001 |

|

| 2001 |

|

|

Dec.31 | To Cash | 4,000 | Jan.1 | By Balance b/d | 7,000 |

| To Balance c/d | 3,700 | Dec.31 | By Interest A/c |

|

|

|

|

| (10% on Rs. 7,000) | 700 |

|

| 7,700 |

|

| 7,700 |

2002 |

|

| 2002 |

|

|

Dec.31 | To Cash | 4,000 | Jan.1 | By Balance b/d | 3,700 |

|

|

| Dec.31 | By Interest A/c* | 300 |

|

| 4,000 |

|

| 4,000 |

Q15) Based on particulars given below calculate Interest under the hire purchase system

X & Co.—purchaser Y & Co.-Seller Date of purchase—Jan. 1, 1999, Cash price—Rs. 74,500.

Installments Rs. 20,000 on signing of the agreement. Rest in three instalments of Rs. 20,000 each. Rate of Interest—5%. Depreciation 10% on the diminishing Balance. ( 8 marks)

A4)

Calculation of Interest | ||

|

| Rs. |

Jan.1, 1999 | Cash Price | 74,500 |

| Less-Cash down | 20,000 |

| Balance Due | 54,500 |

| Interest @ 5% for 1999 | 2,725 |

Dec.31, 1999 | Total | 57,225 |

| Amount paid | 20,000 |

Jan.1, 2000 | Balance Due | 37,225 |

| Interest for 2000 @ 5% | 1,861 |

Dec.31, 2000 | Total | 39,086 |

| Amount paid | 20,000 |

Jan.1,2001 | Balance due 2001 | 19,086 |

| Interest for (balancing figure) 2001 | 914 |

Jan.1,2002 | Amount paid | 20,000 |

Q16) Based on particulars given below calculate Interest under the hire purchase system

X & Co.—purchaser Y & Co.-Seller Date of purchase—Jan. 1, 1999, Cash price—Rs. 74,500. Installments Rs. 20,000 on signing of the agreement. Rest in three instalments of Rs. 20,000 each. Depreciation 10% on the diminishing Balance. ( 5 marks)

A5)

Calculation of interest when the rate of interest is not given:

Hire Purchase Price | 80,000 | ||||

Cash Price | 74,500 | ||||

Total interest | 5,500 | ||||

|

|

|

|

|

|

Year | Amount Outstanding | Ratio | Interest | Rs. | |

1 | 60,000 |

| 3 | 3/6 x 5,500 | 2,750 |

2 | 40,000 |

| 2 | 2/6 x 5,500 | 1,833 |

3 | 20,000 |

| 1 | 1/6 x 5,500 | 917 |

Q17) Based on particulars given below calculate Interest under the hire purchase system

X & Co.—purchaser Y & Co.-Seller Date of purchase—Jan. 1, 1999, Installments Rs. 20,000 on signing of the agreement. Rest in three instalments of Rs. 20,000 each. Rate of Interest—5%. Depreciation 10% on the diminishing Balance.( 5 marks)

A6)

Calculation of cash price, rate of interest being given:

Instalment | Amount due at the end of the year (after payment of Installment) | Instalment Paid | Total amount due at the end of the Year (before payment of instalment) | Interest @ 1/21 | Principal due in the beginning | |

| Rs. | Rs. |

| Rs. | Rs. | Rs. |

3 | Nil | 20,000 |

| 20,000 | 952 | 19,408 |

2 | 19,048 | 20,000 |

| 39,048 | 1,859 | 37,189 |

1 | 37,189 | 20,000 |

| 57,189 | 2,723 | 54,466 |

|

|

|

|

| 5,534 |

|

Cash Price: 54,466 + cash down, Rs. 20,000 or Rs. 74,466.

Q18) Y & Co. Sold machinery whose cash price is Rs. 74,500. To X and Co., on hire purchase basis on 1st January, 2000. Payment was to be made as Rs. 20,000 down and Rs. 20,000 every year for three years. Rate of interest was 5% & Co. Charged depreciation @ 10% p.a. On the diminishing balance. Give ledger accounts in the books of Y & Co. ( 8 marks)

A7)

Ledger of Y & Co. | |||||

Dr. |

|

| X & Co. |

| Cr. |

|

| Rs. |

|

| Rs. |

2000 |

|

| 2000 |

|

|

Jan.1 | To Sales | 74,500 | Jan.1 | By Cash | 20,000 |

Dec.31 | To Interest A/c |

| Dec.31 | By Cash | 20,000 |

| (5% on Rs. 54,500) | 2,725 |

| By Balance c/d | 37,225 |

|

| 77,225 |

|

| 77,225 |

2001 |

|

| 2001 |

|

|

Jan.1 | To Balance b/d | 37,225 | Dec.31 | By Cash | 20,000 |

Dec.31 | To Interest A/c | 1,861 |

| By Balance c/d | 19,086 |

|

| 39,086 |

|

| 39,086 |

2002 |

|

| 2002 |

|

|

Jan.1 | To Balance b/d | 19,086 | Dec.31 | By Cash | 20,000 |

Dec.31 | To Interest A/c | 914 |

|

|

|

|

| 20,000 |

|

| 20,000 |

Dr. | Sales Account | Cr. | ||

|

| 2000 |

|

|

|

| Jan. 1 | By X & Co. | Rs. 15,000. |

Interest Account | ||||

Dr. |

|

|

| Cr. |

2000 |

| 2000 |

|

|

Dec.31 to P & L A/c | 2,725 | Dec.31 | By X & Co. | 2,725 |

2001 |

| 2001 |

|

|

Dec.31 to P & L A/c | 1,861 | Dec.31 | By X & Co. | 1,861 |

2002 |

| 2002 |

|

|

Dec.31 to P & L A/c | 914 | Dec.31 | By X & Co. | 914 |

Q19) Y & Co. Sold machinery whose cash price is Rs. 74,500. To X and Co., on hire purchase basis on 1st January, 2000. Payment was to be made as Rs. 20,000 down and Rs. 20,000 every year for three years. Rate of interest was 5% & Co. Charged depreciation @ 10% p.a. On the diminishing balance. Give Journal Entries & ledger accounts in the books of X & Co. ( 12 marks)

A8)

Journal of X & Co.

|

|

| Debit (Rs) | Credit (Rs) | ||||

2000 |

|

|

|

| ||||

Jan.1 | Machinery Account | Dr. | 20,000 | |||||

| To Y & Co. |

| 20,000 | |||||

| (Amount due to Y & Co. As down payment for purchase of machinery on hire purchase basis.) |

|

| |||||

|

|

|

| |||||

Jan.1 | Y & Co. | Dr. | 20,000 | |||||

| To Bank Account |

| 20,000 | |||||

| (Payment made to Y & Co. Down) |

|

| |||||

|

|

|

| |||||

Dec.31 | Machinery Account | Dr. | 17,275 | |||||

| Interest Account | Dr. | 2,725 | |||||

| To Y & Co. |

| 20,000 | |||||

| (The amount due to Y & Co. Under the hire purchase Contract for interest (and debited as such) and the balance treated as payment for machinery) |

|

| |||||

| ||||||||

Dec.31 | Y & Co. | Dr. | 20,000 | |||||

| To Bank A/c |

| 20,000 | |||||

| (Payment made to Y & Co.) |

|

| |||||

|

|

|

| |||||

Dec.31 | Depreciation Account | Dr. | 7,450 | |||||

| To Machinery Account |

| 7,450 | |||||

| (Depreciation for 1st year-10% on Rs. 74,500) |

|

| |||||

|

|

|

| |||||

Dec 31 | Profit & Loss Account | Dr. | 10,175 | |||||

| To Interest Account |

| 2,725 | |||||

| To Depreciation Account |

| 7,450 | |||||

| (Being interest and depreciation transferred to P/L A/c) |

|

| |||||

2001 | ||||||||

Dec.31 | Machinery Account | Dr. | 18,139 | |||||

| Interest Account | Dr. | 1,861 | |||||

| To Y & Co. |

| 20,000 | |||||

| (Amount due to Y & Co. For interest the balance charged to Machinery A/c.) |

|

| |||||

| ||||||||

Dec.31 | Y & Co. | Dr. | 20,000 | |||||

| To Bank Account |

| 20,000 | |||||

| (Payment made to Y & Co.) |

|

| |||||

|

|

|

| |||||

Dec. 31 | Depreciation | Dr. | 6,705 | |||||

| To Machinery Account |

| 6,705 | |||||

| (Depreciation for the second year 10% on Rs. 67,050; i.e. Rs. 74,500 - Rs. 7,450). |

|

| |||||

|

|

|

| |||||

Dec 31 | Profit & Loss Account | Dr. | 8,566 | |||||

| To Interest Account |

| 1,861 | |||||

| To Depreciation Account |

| 6,705 | |||||

| (Being interest and depreciation transferred to P/L A/c) |

|

| |||||

2002 | ||||||||

Dec.31 | Machinery Account | Dr. | 19,086 | |||||

| Interest Account | Dr. | 914 | |||||

| To Y & Co. |

| 20,000 | |||||

| (Amount due to Y & Co. In respect of interest and the principal sum.) |

|

| |||||

| ||||||||

Dec.31 | Y & Co. | Dr. | 20,000 | |||||

| To Bank Account |

| 20,000 | |||||

| (Payment made to Y & Co.) |

|

| |||||

|

|

|

| |||||

Dec.31 | Depreciation Account | Dr. | 6,035 | |||||

| To Machinery Account |

| 6,035 | |||||

| (Depreciation @ 10% of the diminishing balance charged for the third years). |

|

| |||||

|

|

|

| |||||

Dec 31 | Profit & Loss Account | Dr. | 6,949 | |||||

| To Interest Account |

| 914 | |||||

| To Depreciation Account |

| 6,035 | |||||

| (Being interest and depreciation transferred to P/L A/c) |

|

| |||||

Ledger Accounts | ||||||||

Dr. |

| Machinery Account |

| Cr. | ||||

2000 |

| Rs. | 2000 |

| Rs. | |||

Jan.1 | To Y & Co. | 20,000 | Dec.31 | By Depreciation | 7,450 | |||

Dec.31 | To Y & Co. |

| Dec.31 | By Balance c/d | 29,825 | |||

| (20,000—2,725) | 17,275 |

|

|

| |||

|

| 37,275 |

|

| 37,275 | |||

2001 |

|

| 2001 |

|

| |||

Jan.1 | To balance b/d | 29,825 | Dec.31 | By Depreciation A/c | 6,705 | |||

Dec.31 | To Y & Co. |

| Dec.31 | By Balance c/d | 41,259 | |||

| (20,000—1,861) | 18,139 |

|

|

| |||

|

| 47,964 |

|

| 47,964 | |||

2002 |

|

| 2002 |

|

| |||

Jan.1 | To Balance b/d | 41,259 | Dec.31 | By Depreciation A/c | 6,035 | |||

Dec.31 | To Y & Co. | 19,086 | Dec.31 | By Balance c/d | 54,310 | |||

|

| 60,345 |

|

| 60,345 | |||

2003 |

|

|

|

|

| |||

Jan.1 | To Balance b/d | 54,310 |

|

|

| |||

Dr. |

| Interest Account | Cr. | ||

2000 |

| Rs. | 2000 |

| Rs. |

Dec.31 | To Y & Co. | 2,725 | Dec.31 | By P & L A/c | 2,725 |

2001 |

|

| 2001 |

|

|

Dec.31 | To Y & Co. | 1,861 | Dec.31 | By P & L A/c | 1,861 |

2002 |

|

| 2002 |

|

|

Dec.31 | To Y & Co. | 914 | Dec.31 | By P & L A/c | 914 |

Dr. |

|

| Y & Co. |

|

| Cr. |

2000 |

| Rs. |

| 2000 |

| Rs. |

Jan.1 | To Bank A/c | 20,000 | Jan.1 | By Machinery A/c | 20,000 | |

Dec.31 | To Bank A/c | 20,000 | Dec.31 | By Sundries— |

|

|

|

|

|

| Machinery | 17,275 |

|

|

|

|

| Interest | 2,725 | 20,000 |

|

| 40,000 |

|

| 40,000 | |

2001 |

|

| 2001 |

|

|

|

Dec.31 | To Bank A/c | 20,000 | Dec.31 | By Machinery A/c | 18,139 | |

|

|

|

| By Interest A/c | 1,861 | |

|

| 20,000 |

|

| 20,000 | |

2002 |

|

| 2002 |

|

| |

Dec.31 | To Bank A/c | 20,000 | Dec.31 | By Machinery A/c | 19,086 | |

|

|

|

| By Interest A/c | 914 | |

|

| 20,000 |

|

| 20,000 | |

Depreciation Account

2000 |

| Rs. | 2000 |

| Rs. |

Dec.31 | To Machinery A/c | 7,450 | Dec.31 | By P & L A/c | 7,450 |

2001 |

| 2001 |

|

| |

Dec.31 | To machinery A/c | 6,705 | Dec.31 | By P & L A/c | 6,705 |

2002 |

| 2002 |

|

| |

Dec.31 | To Machinery A/c | 6,035 | Dec.31 | By P & L A/c | 6,035 |

Q20) On 1 January 2016, Scooter Ltd., sold a scooter on hire purchase basis for 1,00,000 to be paid as follows.

On signing the agreement 12,000

At the end of first year 17,000

At the end of second year 16,000

At the end of the third year 55,000

Interest included in 1,00,000 being charged on cash value at 10% per annum. You are required to,

(1) Ascertain cash value of the scooter.

(2) Pass journal entries in the books of the hire purchaser. ( 8 marks)

A9) It is known that, Instalment Amount = (Instalment Cash Price + Instalment Interest). And the instalment interest is charged on the unpaid cash price balance at the beginning of instalment. Therefore,

(1) If instalment cash price is 100, then the instalment interest works out to 10 (as the rate of interest is 10%).

(2) Instalment Amount = (Instalment Cash Price, 100 + Instalment Interest, 10) = 110. Therefore,

It may be noted here that instalment interest is computed on the unpaid cash price at the beginning of the instalment. And reverse method (i.e., starting from last instalment) is used to ascertain the cash price or cash value of the scooter. In this background, cash price of scooter is computed and presented below.

Calculation of Instalment Interest and Instalment Cash Price

Instal -ment Num- ber | Amount () | ||||||

Instal- ment | Instalment -end Balance |

(Instalment) Interest | (Instalment) Cash Price (= Instalment Amount – Instalment Interest) | ||||

III | 55,000 | 55,000 | [ 55,000 × (10 ÷ 110)] = | 5,000 | ( 55,000 – 5,000) = | 50,000 | |

II | 16,000 | 66,0001 | [ 66,000 × (10 ÷ 110)] = | 6,000 | ( 16,000 – 6,000) = | 10,000 | |

I | 17,000 | 77,0002 | [ 77,000 × (10 ÷ 110)] = | 7,000 | ( 17,000 – 7,000) = | 10,000 | |

DP3 | 12,000 | - |

| - |

| 12,000 | |

| 1,00,000 |

|

| 18,000 |

| 82,000 | |

From the above, it is obvious that the cash price or cash value of scooter = 82,000 and total interest = 18,000. Hence, total hire purchase price = 1,00,000.

In the Books of Hire Purchaser (Credit Purchase with Interest Method)

Journal Entries

Date | Particulars | L F | Amount () | ||

Debit | Credit | ||||

01-01-2016 | Scooter’s A/c To Scooter Ltd.’s A/c (Being the cash price of scooter purchased on hire purchase basis) | Dr. |

| 82,000 |

|

|

| 82,000 | |||

01-01-2016 | Scooter Ltd.’s A/c To Bank A/c (Being down payment made) | Dr. | 12,000 |

| |

|

| 12,000 | |||

31-12-2016 | Interest A/c To Scooter Ltd’s A/c (Being the amount of instalment interest due) | Dr. |

| 7,000 |

|

|

| 7,000 | |||

31-12-2016 | Scooter Ltd’s A/c To Bank A/c (Being first instalment paid) | Dr. | 17,000 |

| |

|

| 17,000 | |||

31-12-2016 | Profit and Loss A/c To Interest A/c (Being the amount of interest transferred to Profit and Loss A/c) | Dr. | 7,000 |

| |

|

| 7,000 | |||

31-12-2017 | Interest A/c To Scooter Ltd’s A/c (Being the amount of instalment interest due) | Dr. | 6,000 |

| |

|

| 6,000 | |||

31-12-2017 | Scooter Ltd’s A/c To Bank A/c (Being second instalment paid) | Dr. | 16,000 |

| |

|

| 16,000 | |||

31-12-2017 | Profit and Loss A/c To Interest A/c (Being the amount of interest transferred to Profit and Loss A/c) | Dr. | 6,000 |

| |

|

| 6,000 | |||

31-12-2018 | Interest A/c To Scooter Ltd’s A/c (Being instalment interest due) | Dr. | 5,000 |

| |

|

| 5,000 | |||

31-12-2018 | Scooter Ltd’s A/c To Bank A/c (Being third instalment paid) | Dr. | 55,000 |

| |

|

| 55,000 | |||

31-12-2018 | Profit and Loss A/c To Interest A/c (Being interest amount transferred to P & L A/c) | Dr. | 5,000 |

| |

|

| 5,000 |

Working Notes:

(1) Unpaid Balance at the beginning of second Instalment = ( 50,000 Unpaid balance of cash price at the beginning of last instalment + 16,000 Second instalment).

(2) Unpaid Balance at the beginning of first Instalment = ( 50,000 cash price of last instalment + 10,000 cash price of second instalment + 17,000 First instalment).

(3) Down payment. Interest is not calculated on down payment as it (i.e., interest) is calculated only on outstanding amount after making the down payment.

(4) As there is no information about depreciation, necessary (depreciation-related) entries are not passed.

Q21) Mr. Shashi bought a refrigerator under hire purchase system for a cash price of

15,675 with the following terms.

(a) 4,500 to be paid on signing the agreement.

(b) Balance to be paid in three equal instalments of 4,500 at the end of each year.

(c) The rate of interest charged for the hire purchase is 10% per annum.

Calculate the amount of hire purchase interest showing all necessary working notes supporting your answer. ( 8 marks)

A10)

Cash Price, Instalment Interest and Instalment Cash Price

Instalment Number | Amount () | |||

Instalment Amount | Unpaid Cash Price balance at the beginning Of the instalment (year) |

Interest | Cash Price | |

DP1 | 4,5001 | 0a | 0a | 4,500a |

I | 4,500 | 11,175b | 1,118c | 3,382d |

II | 4,500 | 7,793e | 779f | 3,721g |

III | 4,500 | 4,072h | 428i | 4,072i |

Total | 18,000 |

| 2,325 | 15,675 |

Working Notes:

(a) DP = Down payment. In the case of down payment, entire amount is towards cash price of the asset acquired under hire purchase system. This is for the reason that the unpaid cash price balance at the time of signing the agreement is zero and therefore, interest is also zero.

(b) Unpaid Cash Price Balance at the beginning of first Instalment = (Cash price,

15,675 – Down payment, 4,500) = 11,175.

(c) First Instalment Interest = (Unpaid cash price balance at the beginning of first instalment, 11,175 × Rate of interest, 10%) = 1,117.5 ≈ 1,118.

(d) First Instalment Cash Price = (First instalment, 4,500 – First instalment interest,

1,118) = 3,382.

(e) Unpaid Cash Price Balance at the beginning of second Instalment = (Unpaid cash price balance at the beginning of first instalment, 11,175 – First instalment cash price, 3,382) = 7,793.

(f) Second Instalment Interest = (Unpaid cash price balance at the beginning of second instalment, 7,793 × Rate of interest, 10%) = 779.3 ≈ 779.

(g) Second Instalment Cash Price = (Second instalment, 4,500 – Second instalment interest, 779) = 3,721.

(h) Unpaid Cash Price Balance at the beginning of last Instalment = (Unpaid cash price balance at the beginning of second instalment, 7,793 – Second instalment cash price, 3,721) = 4,072.

(i) Last Instalment Interest = (Last instalment, 4,500 – Unpaid cash price balance at the beginning of last instalment, 4,072) = 428.